Daily Technical Report

June 07, 2012

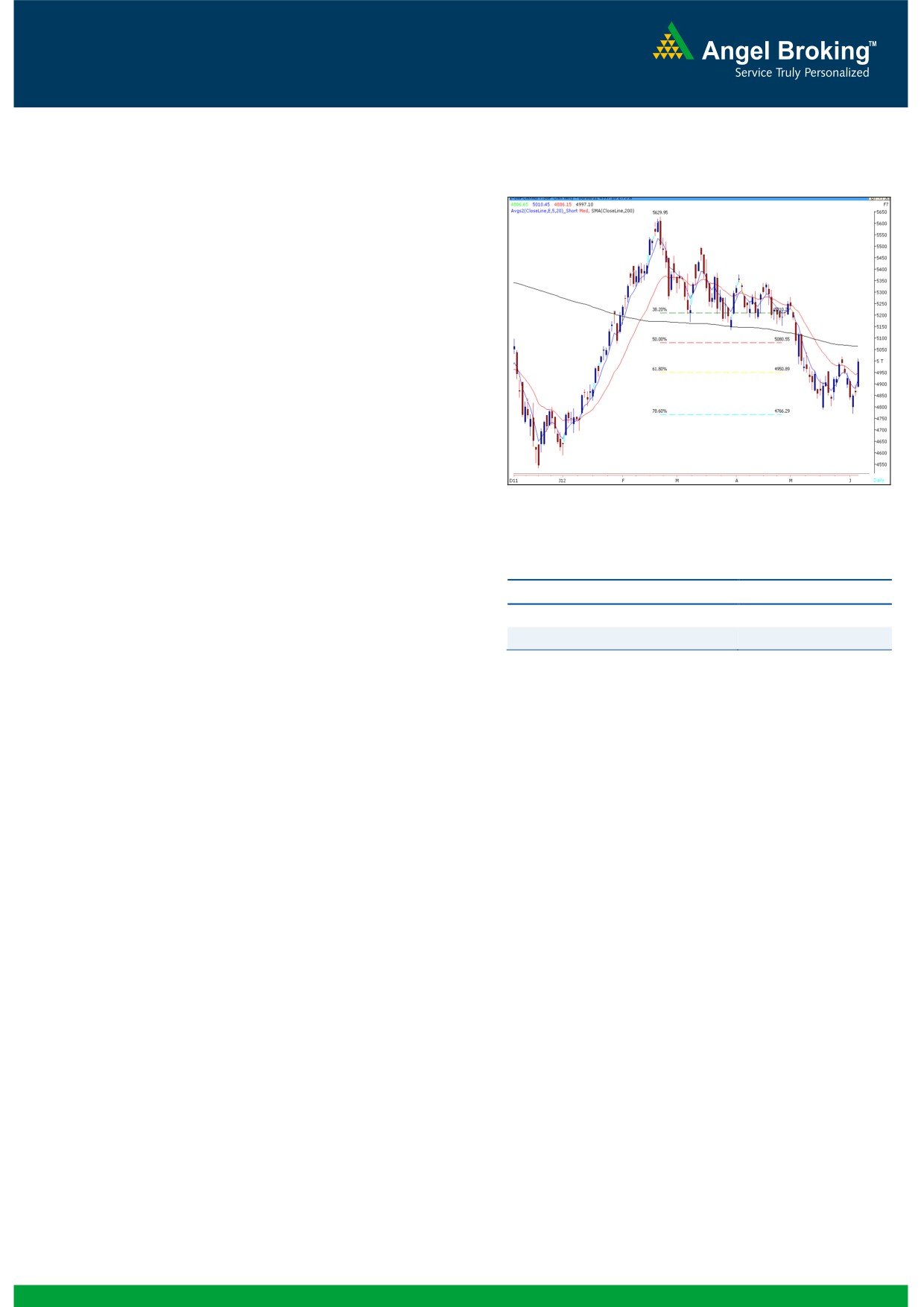

Exhibit 1: Nifty Daily Chart

Sensex (16454) / NIFTY (4997)

After immense volatility on Tuesday’s session,

yesterday our benchmark indices opened on a higher

note in-line with positive clues from other Asian

bourses. Subsequently, strong buying interest among

market participants resulted in a strong intraday rally

of nearly 3%. On sectoral front, Auto, Capital Goods,

Power and Banking counters contributed heavily in

yesterday’s huge rally. There was no sector in the

negative territory. The advance to decline ratio was in

favor of advancing counters (A=1847 D=894)

Formation

Source: Falcon

The 200-day SMA (Simple Moving Average) and

20-day EMA (Exponential Moving Average) have

now shifted to 16800 / 5070 and 16360 /

Actionable points:

4960, respectively.

View

Bullish Above 5020

The ‘20-Week EMA’ is placed at 16840 / 5100

Resistance Levels

5050 - 5090

level.

Support Levels

4947 - 4925

Indices have taken a support near 15860 /

4766 level, which is the

78.6% Fibonacci

Retracement level of the rise from 15135 / 4531

Hence, indices are likely to test their recent swing

(Low on December 23, 2011) to 18524 / 5630

high of 16544 / 5020. A sustainable move beyond

(High on February 22, 2012).

this level may push indices higher to test '200-day

SMA' resistance zone of 16780 - 16840 / 5050 -

The weekly ‘RSI’ momentum oscillator is

5090. Conversely, 16290 - 16220 / 4947 - 4925

signaling a positive crossover.

levels may provide a decent support for the markets.

Trading strategy:

Yesterday, after a gap opening, we witnessed a

strong rally on the back rumors that the Fed will resort

to Quantitative Easing (QE3) in the near future. On

the charts, positive divergence observed in daily 'RSI'

momentum oscillator helped the bulls to make

significant gains. Indices have now closed

convincingly above '20-day EMA'. In addition, the

weekly RSI oscillator is now signaling a positive

crossover. This technical indication would get

confirmed if indices give a weekly closing around

5000 mark. Going forward, considering yesterday's

sharp rally and a closing above 20-day EMA, we

expect a positive opening for the markets.

1

Daily Technical Report

June 07, 2012

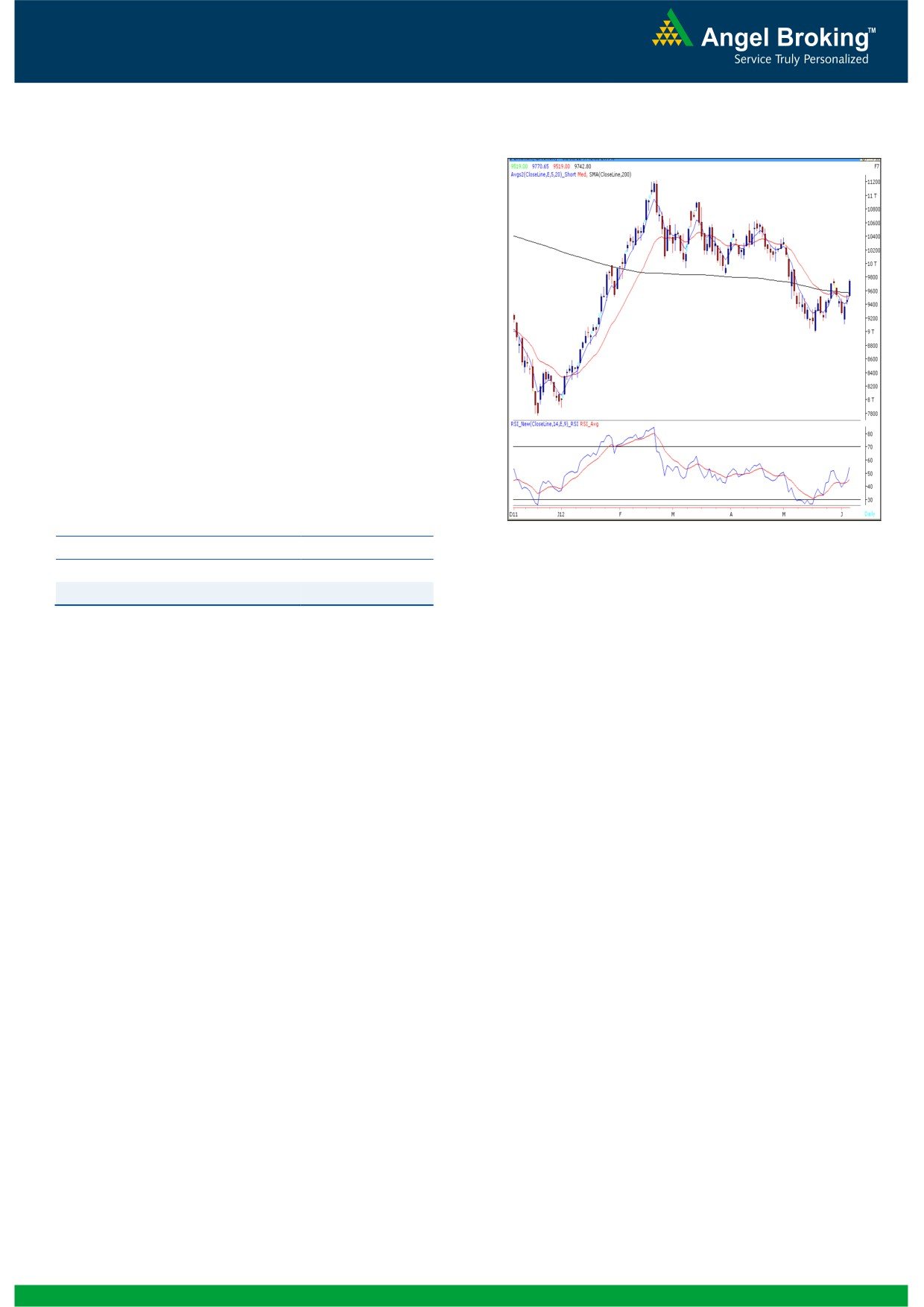

Exhibit 2: Bank Nifty Daily Chart

Bank Nifty Outlook - (9743)

Yesterday, Bank Nifty opened on an optimistic note

and gained momentum as the day progressed to

close near the highest point of the day. As mentioned

in our previous report we witnessed accelerated

momentum above 9545 level and the index almost

achieved the mentioned “Inverted Head & Shoulder”

target of 9800. The momentum oscillators on the

daily chart continue with their buy signals. However

the momentum oscillators on the hourly chart are

placed in extreme overbought territory and thus a

minor pullback or consolidation, post today’s gap up

opening, cannot be ruled out. On the upside a move

beyond 9783 level is likely to push the indices further

to test 9871 - 10030 levels.

Actionable points:

Source: Falcon

View

Bullish above 9783

Expected targets

9871 - 10030

Support Levels

9540 - 9480

2

Daily Technical Report

June 07, 2012

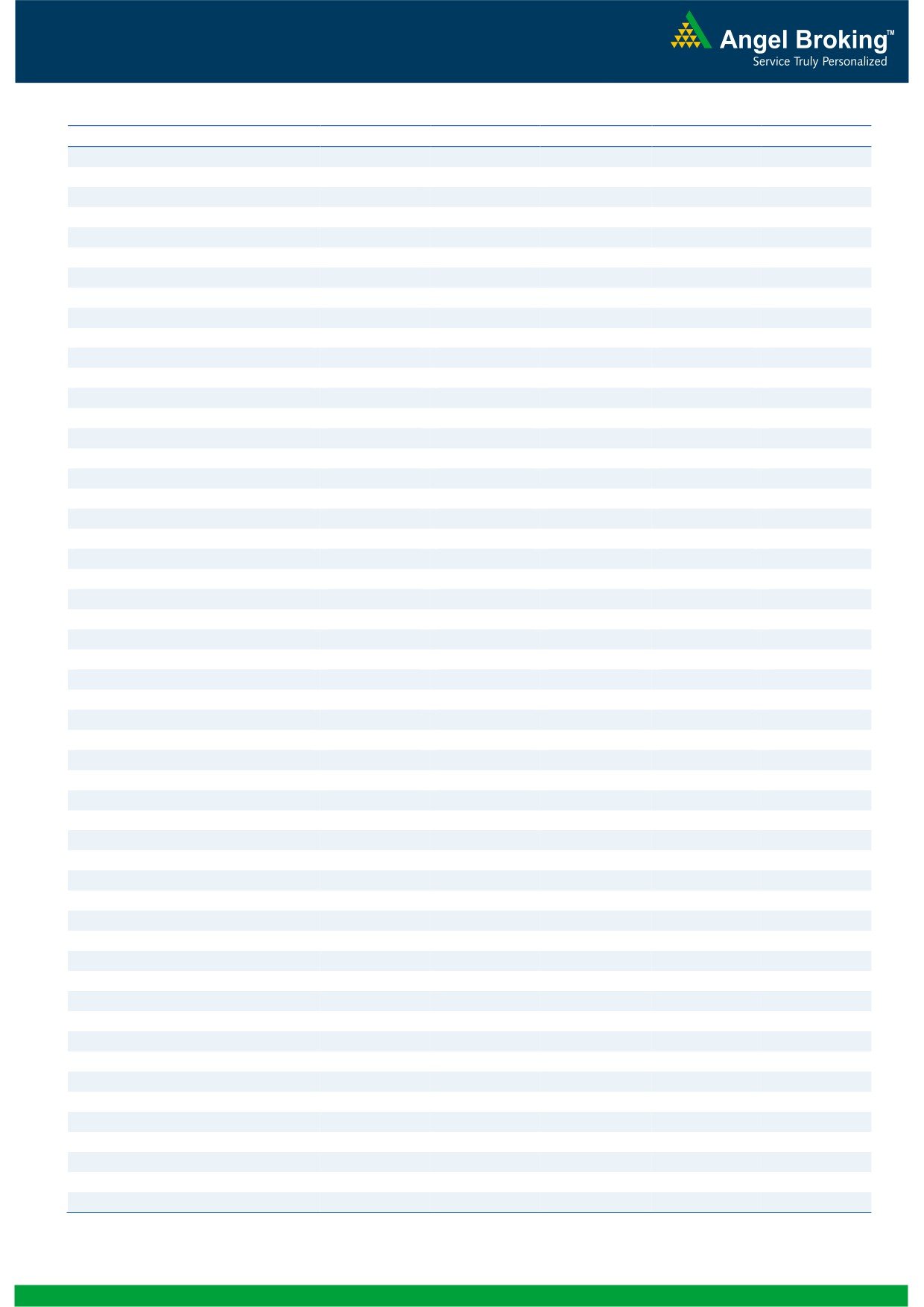

Daily Pivot Levels for Nifty 50 Stocks

SCRIPS

S2

S1

PIVOT

R1

R2

SENSEX

15,956

16,205

16,350

16,599

16,744

NIFTY

4,840

4,919

4,965

5,043

5,089

BANKNIFTY

9,426

9,584

9,677

9,836

9,929

ACC

1,118

1,138

1,152

1,172

1,186

AMBUJACEM

144

148

151

156

158

ASIANPAINT

3,712

3,768

3,806

3,862

3,900

AXISBANK

985

1,003

1,015

1,033

1,045

BAJAJ-AUTO

1,478

1,509

1,530

1,561

1,582

BANKBARODA

688

704

714

730

740

BHARTIARTL

280

289

294

303

308

BHEL

209

213

215

218

221

BPCL

690

698

704

712

719

CAIRN

314

318

321

325

328

CIPLA

305

307

310

312

314

COALINDIA

314

318

321

325

327

DLF

183

185

187

190

192

DRREDDY

1,581

1,598

1,619

1,636

1,656

GAIL

319

323

326

330

333

GRASIM

2,249

2,291

2,321

2,363

2,393

HCLTECH

491

497

502

507

512

HDFC

641

646

649

654

657

HDFCBANK

496

508

515

527

535

HEROMOTOCO

1,843

1,899

1,937

1,992

2,030

HINDALCO

117

119

120

122

123

HINDUNILVR

402

411

418

427

435

ICICIBANK

791

800

805

814

820

IDFC

122

125

127

131

133

INFY

2,378

2,397

2,415

2,434

2,452

ITC

221

228

232

239

244

JINDALSTEL

407

419

428

440

449

JPASSOCIAT

63

65

66

67

68

KOTAKBANK

544

556

563

574

581

LT

1,192

1,230

1,251

1,288

1,309

M&M

650

662

669

682

688

MARUTI

1,061

1,084

1,100

1,124

1,139

NTPC

145

149

151

155

157

ONGC

250

255

259

264

268

PNB

744

757

764

777

784

POWERGRID

104

107

109

112

114

RANBAXY

469

481

492

504

514

RELIANCE

691

704

711

723

730

RELINFRA

447

459

466

478

485

SAIL

92

93

94

95

96

SBIN

2,069

2,114

2,141

2,186

2,213

SESAGOA

173

177

181

185

188

SIEMENS

644

655

665

676

685

STER

89

91

93

95

96

SUNPHARMA

547

561

569

583

592

TATAMOTORS

218

226

231

239

245

TATAPOWER

88

90

91

93

95

TATASTEEL

398

404

408

414

417

TCS

1,213

1,232

1,248

1,267

1,283

WIPRO

396

403

408

415

420

3

Daily Technical Report

June 07, 2012

Research Team Tel: 022 - 39357800

DISCLAIMER

This document is solely for the personal information of the recipient, and must not be singularly used as the basis of any investment

decision. Nothing in this document should be construed as investment or financial advice. Each recipient of this document should make

such investigations as they deem necessary to arrive at an independent evaluation of an investment in the securities of the companies

referred to in this document (including the merits and risks involved), and should consult their own advisors to determine the merits and

risks of such an investment.

Angel Broking Limited, its affiliates, directors, its proprietary trading and investment businesses may, from time to time, make

investment decisions that are inconsistent with or contradictory to the recommendations expressed herein. The views contained in this

document are those of the analyst, and the company may or may not subscribe to all the views expressed within.

Reports based on technical and derivative analysis center on studying charts of a stock's price movement, outstanding positions and

trading volume, as opposed to focusing on a company's fundamentals and, as such, may not match with a report on a company's

fundamentals.

The information in this document has been printed on the basis of publicly available information, internal data and other reliable

sources believed to be true, but we do not represent that it is accurate or complete and it should not be relied on as such, as this

document is for general guidance only. Angel Broking Limited or any of its affiliates/ group companies shall not be in any way

responsible for any loss or damage that may arise to any person from any inadvertent error in the information contained in this report.

Angel Broking Limited has not independently verified all the information contained within this document. Accordingly, we cannot testify,

nor make any representation or warranty, express or implied, to the accuracy, contents or data contained within this document. While

Angel Broking Limited endeavours to update on a reasonable basis the information discussed in this material, there may be regulatory,

compliance, or other reasons that prevent us from doing so.

This document is being supplied to you solely for your information, and its contents, information or data may not be reproduced,

redistributed or passed on, directly or indirectly.

Angel Broking Limited and its affiliates may seek to provide or have engaged in providing corporate finance, investment banking or

other advisory services in a merger or specific transaction to the companies referred to in this report, as on the date of this report or in

the past.

Neither Angel Broking Limited, nor its directors, employees or affiliates shall be liable for any loss or damage that may arise from or in

connection with the use of this information.

Note: Please refer to the important `Stock Holding Disclosure' report on the Angel website (Research Section). Also, please refer to the

latest update on respective stocks for the disclosure status in respect of those stocks. Angel Broking Limited and its affiliates may have

investment positions in the stocks recommended in this report.

Research Team

Shardul Kulkarni

-

Head - Technicals

Sameet Chavan

-

Technical Analyst

Sacchitanand Uttekar

-

Technical Analyst

Mehul Kothari

-

Technical Analyst

Ankur Lakhotia

-

Technical Analyst

Angel Broking Pvt. Ltd.

Registered Office: G-1, Ackruti Trade Centre, Rd. No. 7, MIDC, Andheri (E), Mumbai - 400 093.

Corporate Office: 6th Floor, Ackruti Star, MIDC, Andheri (E), Mumbai - 400 093. Tel: (022) 3952 6600

Sebi Registration No: INB 010996539

4