Daily Technical Report

May 07, 2012

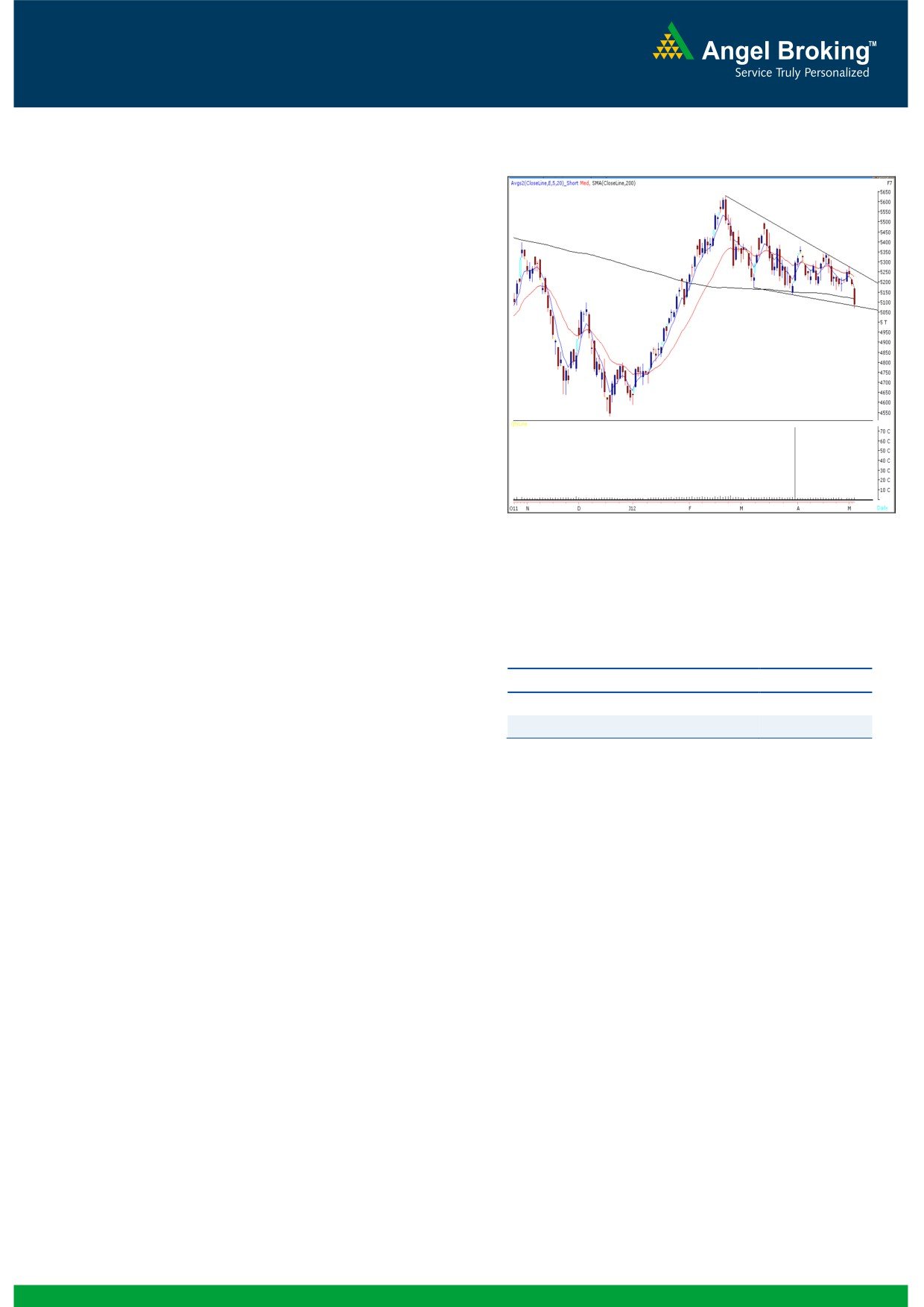

Exhibit 1: Nifty Daily Chart

Sensex (16831) / NIFTY (5087)

On Friday, our benchmark indices opened with a

downside gap and traded with negative bias

throughout the day to close with a loss of almost 2%.

Indices have broken the major support level of 16920

/5135 and have closed below the same, which is sign

of further weakness. On sectoral front, most of the

sectors contributed in Friday’s selloff, where Capital

Goods, Banking and Metal counter were among the

major losers. The advance to decline ratio was

strongly in favor of declining counters (A=744

Formation

The 200-day SMA (Simple Moving Average) and

Source: Falcon

20-day EMA (Exponential Moving Average) have

now shifted to 17100 / 5120 and 17220 /

5225, respectively.

The ‘20-Week EMA’ is placed at 17200 / 5200

level.

Actionable points:

We are now witnessing a negative crossover in

View

Bearish

weekly ‘5 & 20 EMA’.

Support Levels

5000 - 4950

We are observing a continuation pattern which

Resistance Levels

5110 - 5165

resembles a ‘Falling Wedge’.

Indices have now tested 16830 / 5080 which is

However it must be noted that at present markets are

the 50% Fibonacci Retracement level of the rise

hovering around the

50% Fibonacci Retracement

from 15135 / 4531 (Low on December 23,

level of the steep rise from 15135 / 4531 to 18524 /

2011) to 18524 / 5630 (High on February,

5630. The mentioned level is at 16830 / 5080 and

2012).

considered as a decent technical support. In addition,

Trading strategy:

we are observing that markets are moving in a

continuation pattern called as ‘Falling Wedge’ (Refer

We have been mentioning a trading range of 17530

Exhibit 1). The break out from the said pattern will

to 16920 / 5345 to 5135 in the last couple of reports.

be confirmed only if indices close above the upper

Markets have now closed below ‘200-day SMA’ and

trend line level of 17300 / 5230. This may boost the

’20-week EMA’ level on account of selling on Friday’s

buying interest among market participants and

session. We are now observing a negative crossover

eventually indices may rally higher to test 17530 -

in weekly ‘5 & 20 EMA’. The impact of this technical

17664 - 17871 / 5342 - 5380 - 5445 levels.

signal would be witnessed if indices sustain below

Market participants are advised to take positions post

Friday’s low of 16776 / 5080. In this scenario, selling

clarification of the GAAR issue as it would have a

pressure may persist and indices are likely to drift

significant impact on trader sentiment.

lower to test 16600 - 16430 / 5000 - 4950 levels.

1

Daily Technical Report

May 07, 2012

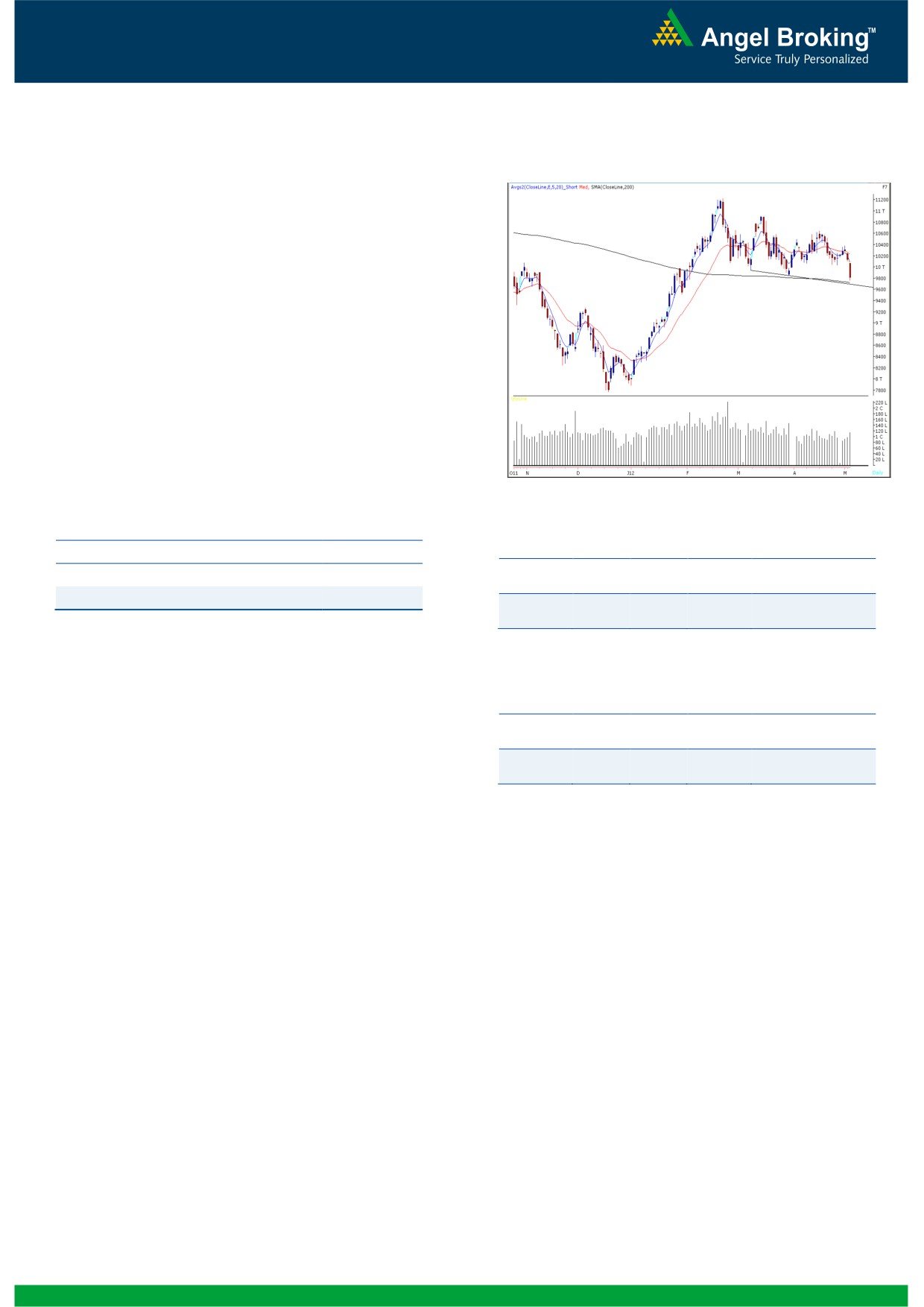

Bank Nifty Outlook - (9802)

Exhibit 2: Bank Nifty Daily Chart

On Friday, Bank Nifty for the second consecutive

session opened with a downside gap in line with our

benchmark indices and selling pressure was seen

throughout the day. At this juncture, index has taken

support near it “200 - day SMA” which coincides with

the trend line support formed by joining the lows of

March 7th, 2012 and March 29th, 2012. However,

we are witnessing a confirmation of “Lower Top and

Lower Bottom” formation on daily chart. Going

forward a breach and close below the “200 - day

SMA” will result in further selling pressure and the

index may test 9579 level. On the upside 10000 -

10070 are likely to act as resistance in coming

trading session.

Source: Falcon

Actionable points:

View

Neutral

Positive Bias:

Stock

Positive Expected

Resistance Levels

10000 -10070

CMP

Remarks

Name

Above

Target

Support Levels

9699 -9579

View will be

CIPLA

326

330

358

negated below 315

Negative Bias:

Stock

Negative Expected

CMP

Remarks

Name

Below

Target

Ambuja

View will be

142.3

141

130

Cement

negated above 146

2

Daily Technical Report

May 07, 2012

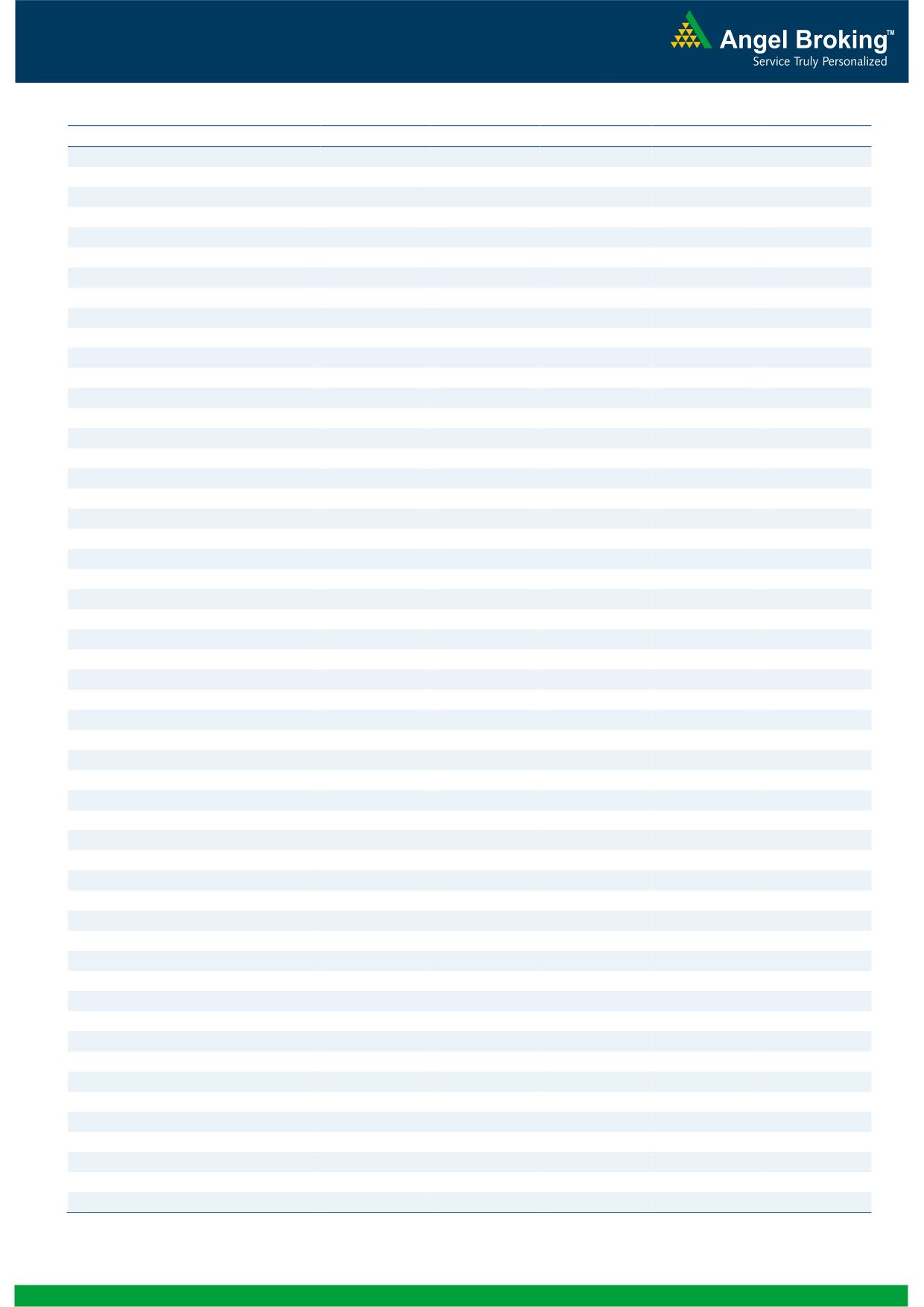

Daily Pivot Levels for Nifty 50 Stocks

SCRIPS

S2

S1

PIVOT

R1

R2

SENSEX

16,565

16,698

16,910

17,043

17,254

NIFTY

5,005

5,046

5,112

5,153

5,218

BANKNIFTY

9,565

9,684

9,876

9,995

10,187

ACC

1,184

1,196

1,209

1,221

1,234

AMBUJACEM

138

140

143

145

148

ASIANPAINT

3,545

3,580

3,615

3,650

3,685

AXISBANK

968

989

1,020

1,040

1,071

BAJAJ-AUTO

1,451

1,477

1,518

1,544

1,585

BANKBARODA

644

666

703

724

762

BHARTIARTL

307

309

312

315

318

BHEL

203

208

217

223

232

BPCL

635

643

656

665

678

CAIRN

321

327

337

343

353

CIPLA

314

320

325

331

335

COALINDIA

322

326

332

336

343

DLF

175

179

182

186

189

DRREDDY

1,721

1,734

1,748

1,762

1,776

GAIL

310

316

321

326

331

GRASIM

2,359

2,388

2,432

2,461

2,505

HCLTECH

501

507

515

521

528

HDFC

650

655

663

668

675

HDFCBANK

523

530

542

549

561

HEROMOTOCO

1,909

1,943

2,000

2,034

2,091

HINDALCO

112

114

116

118

121

HINDUNILVR

428

431

435

438

441

ICICIBANK

796

815

834

853

872

IDFC

110

112

114

117

119

INFY

2,380

2,411

2,454

2,486

2,529

ITC

233

235

240

243

248

JINDALSTEL

463

474

487

498

510

JPASSOCIAT

69

70

71

72

73

KOTAKBANK

548

556

567

575

586

LT

1,096

1,122

1,158

1,183

1,219

M&M

670

678

690

699

711

MARUTI

1,247

1,264

1,278

1,295

1,308

NTPC

152

153

156

157

160

ONGC

252

256

262

266

272

PNB

767

785

814

833

861

POWERGRID

105

106

107

108

110

RANBAXY

489

494

500

505

511

RELIANCE

711

719

729

737

747

RELINFRA

477

486

500

508

522

SAIL

90

92

94

96

98

SBIN

1,934

1,965

2,017

2,048

2,100

SESAGOA

176

178

183

185

189

SIEMENS

730

740

755

764

779

STER

98

100

102

103

105

SUNPHARMA

591

596

602

607

613

TATAMOTORS

292

297

300

305

309

TATAPOWER

97

99

100

102

103

TATASTEEL

418

425

436

443

453

TCS

1,246

1,261

1,278

1,294

1,311

WIPRO

407

411

415

419

424

3

Daily Technical Report

May 07, 2012

Research Team Tel: 022 - 39357800

DISCLAIMER

This document is solely for the personal information of the recipient, and must not be singularly used as the basis of any investment

decision. Nothing in this document should be construed as investment or financial advice. Each recipient of this document should make

such investigations as they deem necessary to arrive at an independent evaluation of an investment in the securities of the companies

referred to in this document (including the merits and risks involved), and should consult their own advisors to determine the merits and

risks of such an investment.

Angel Broking Limited, its affiliates, directors, its proprietary trading and investment businesses may, from time to time, make

investment decisions that are inconsistent with or contradictory to the recommendations expressed herein. The views contained in this

document are those of the analyst, and the company may or may not subscribe to all the views expressed within.

Reports based on technical and derivative analysis center on studying charts of a stock's price movement, outstanding positions and

trading volume, as opposed to focusing on a company's fundamentals and, as such, may not match with a report on a company's

fundamentals.

The information in this document has been printed on the basis of publicly available information, internal data and other reliable

sources believed to be true, but we do not represent that it is accurate or complete and it should not be relied on as such, as this

document is for general guidance only. Angel Broking Limited or any of its affiliates/ group companies shall not be in any way

responsible for any loss or damage that may arise to any person from any inadvertent error in the information contained in this report.

Angel Broking Limited has not independently verified all the information contained within this document. Accordingly, we cannot testify,

nor make any representation or warranty, express or implied, to the accuracy, contents or data contained within this document. While

Angel Broking Limited endeavours to update on a reasonable basis the information discussed in this material, there may be regulatory,

compliance, or other reasons that prevent us from doing so.

This document is being supplied to you solely for your information, and its contents, information or data may not be reproduced,

redistributed or passed on, directly or indirectly.

Angel Broking Limited and its affiliates may seek to provide or have engaged in providing corporate finance, investment banking or

other advisory services in a merger or specific transaction to the companies referred to in this report, as on the date of this report or in

the past.

Neither Angel Broking Limited, nor its directors, employees or affiliates shall be liable for any loss or damage that may arise from or in

connection with the use of this information.

Note: Please refer to the important `Stock Holding Disclosure' report on the Angel website (Research Section). Also, please refer to the

latest update on respective stocks for the disclosure status in respect of those stocks. Angel Broking Limited and its affiliates may have

investment positions in the stocks recommended in this report.

Research Team

Shardul Kulkarni

-

Head - Technicals

Sameet Chavan

-

Technical Analyst

Sacchitanand Uttekar

-

Technical Analyst

Mehul Kothari

-

Technical Analyst

Ankur Lakhotia

-

Technical Analyst

Angel Broking Pvt. Ltd.

Registered Office: G-1, Ackruti Trade Centre, Rd. No. 7, MIDC, Andheri (E), Mumbai - 400 093.

Corporate Office: 6th Floor, Ackruti Star, MIDC, Andheri (E), Mumbai - 400 093. Tel: (022) 3952 6600

Sebi Registration No: INB 010996539

4