Daily Technical Report

July 02, 2012

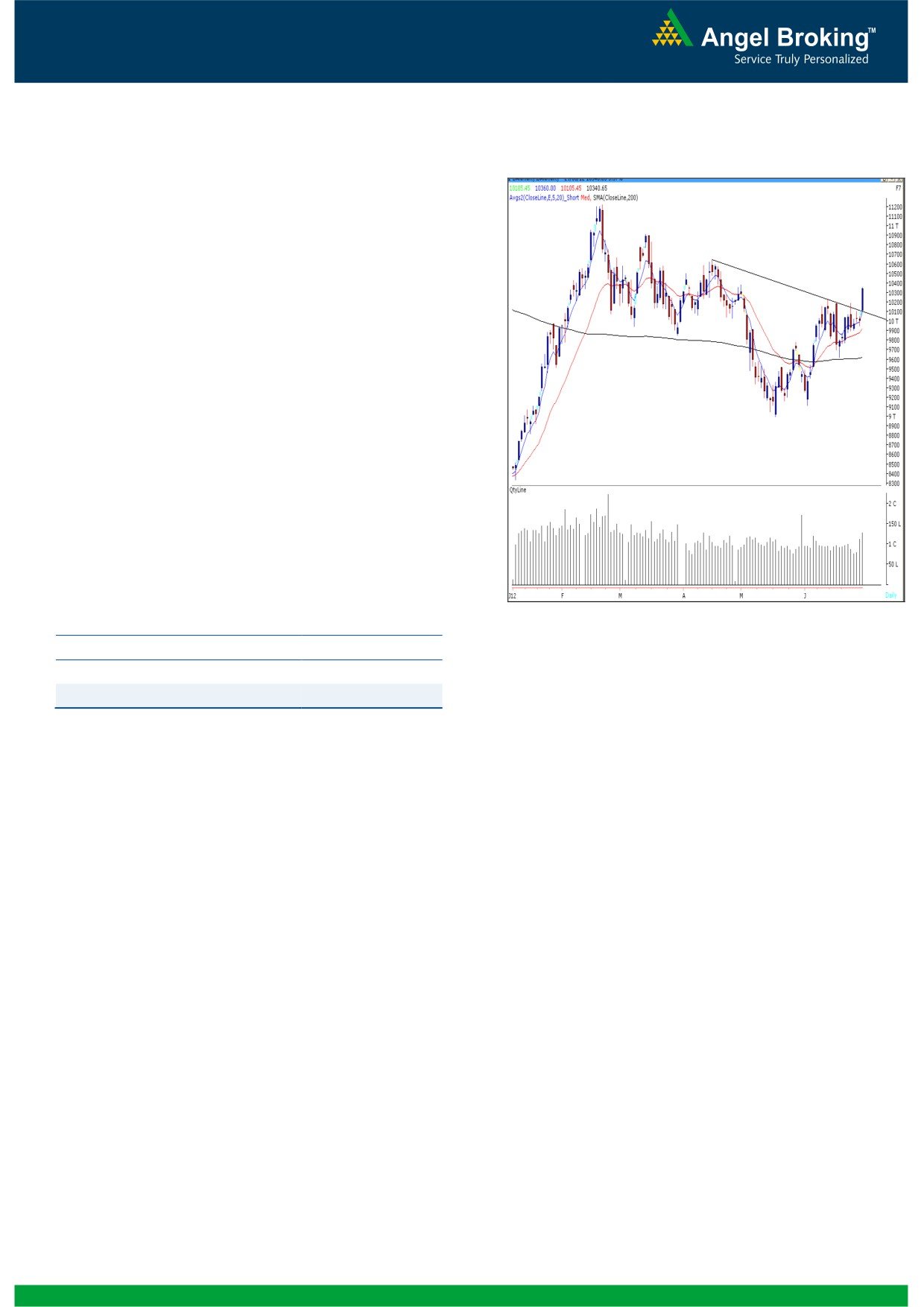

Exhibit 1: Nifty Daily Chart

Sensex (17430) / NIFTY (5279)

During Friday’s session, our benchmark indices closed

at a two-month high on the back of positive global

cues with gains of almost 2.5%. On sectoral front, all

the sectors contributed to the rally where Consumer

Goods, Power and Banking counters were among the

major gainers. The advance to decline ratio was

strongly in favor of advancing counters (A=1864

Formation

The 200-day SMA (Simple Moving Average) is

placed at 16810/ 5078 level.

Indices have taken support near 15860 / 4766

level, which is the 78.6% Fibonacci Retracement

level of the rise from 15135 / 4531 (Low on

December 23, 2011) to 18524 / 5630 (High on

February 22, 2012).

Source: Falcon

The weekly ‘RSI-Smoothened’ oscillator and ‘5 &

20 EMA’ are now signaling a positive crossover.

Actionable points:

Markets have taken support at the Monthly

‘Upward Sloping Trend Line’ and have formed a

View

Bullish Above 5290

‘Bullish Engulfing’ Pattern.

Expected Target

5340

Support Levels

5234 - 5189

Trading strategy:

The said pattern is a reversal pattern and will get

The much-awaited breakout above 5200 mark took

confirmed only if prices sustain above last month’s

place on Friday’s session, mainly on the back of

high of 17449 / 5287. Considering these technical

extremely positive news flow from global cues. As

evidences, we revise our targets for the previously

expected, the breakout resulted in enhanced buying

recommended long positions and expect higher

by market participants and indices rallied significantly

levels of 17687 - 18041 / 5386 - 5500 in the

after the gap-up opening to close marginally below

coming weeks. We continue to remain optimistic on

5300 mark. Although markets have reached our

the markets and advise traders to use every dip as a

immediate target of 17400 / 5270, we still expect

buying opportunity. Conversely, 17131 / 5195 will

higher levels mainly due to the following technical

now act as a strong support level for the markets.

evidences. The weekly ‘RSI-Smoothened’ oscillator

Only a breach of 16800 / 5090 level may result in

and ‘5 & 20 EMA’ are now signaling a positive

loss of this short-term positive momentum.

crossover, which signifies enormous strength in this

rally. We are also observing that markets have taken

support at the Monthly ‘Upward Sloping Trend Line’

drawn by joining two monthly lows of October 2008

and December 2011 and have formed the ‘Bullish

Engulfing’ Pattern. This pattern has more significance

as it is formed near the strong support zone of

Upward Sloping Trend Line as well as

78.6%

Fibonacci Retracement Level of 15860 / 4760.

1

Daily Technical Report

July 02, 2012

Exhibit 2: Bank Nifty Daily Chart

Bank Nifty Outlook - (10340)

On Friday, Bank Nifty opened with an upside gap

and gained strength as the day progressed to close

near the highest point of the day. The index managed

to breakout outside the trading range of 9760 -

10230. We are now witnessing a breakaway gap

which indicates bullishness in the short term time

frame. The positive crossover in “5 & 20 EMA” on the

weekly chart has been confirmed as the index

managed to close above the

10230 level. The

momentum oscillators on the daily and weekly chart

are positively poised. Thus if the index manages to

sustain above Friday’s high of 10360 then it is likely

to rally towards 10501 - 10555 levels. On the

downside the gap area of 10150 - 10050 is likely to

act as support in coming trading session. Positional

traders holding long positions can further trail their

stop loss to the 10050 mark (Closing basis) on Bank

Nifty spot.

Actionable points:

Source: Falcon

View

Bullish Above 10360

Resistance Levels

10055 - 10110

Support Levels

9900 - 9870

2

Daily Technical Report

July 02, 2012

Daily Pivot Levels for Nifty 50 Stocks

SCRIPS

S2

S1

PIVOT

R1

R2

SENSEX

17,024

17,227

17,338

17,541

17,652

NIFTY

5,154

5,217

5,251

5,314

5,349

BANKNIFTY

10,014

10,177

10,269

10,432

10,523

ACC

1,211

1,240

1,257

1,285

1,302

AMBUJACEM

170

172

174

176

177

ASIANPAINT

3,723

3,806

3,853

3,936

3,983

AXISBANK

976

996

1,007

1,027

1,038

BAJAJ-AUTO

1,546

1,560

1,569

1,583

1,592

BANKBARODA

718

725

730

737

742

BHARTIARTL

300

302

305

308

310

BHEL

220

226

230

236

239

BPCL

733

739

746

752

759

CAIRN

293

301

310

317

326

CIPLA

306

311

315

320

323

COALINDIA

337

342

348

353

359

DLF

195

197

198

200

202

DRREDDY

1,608

1,628

1,641

1,661

1,673

GAIL

341

347

351

356

361

GRASIM

2,540

2,590

2,626

2,677

2,713

HCLTECH

456

466

472

482

488

HDFC

645

649

652

656

659

HDFCBANK

547

555

560

568

573

HEROMOTOCO

2,068

2,109

2,134

2,175

2,200

HINDALCO

115

117

119

121

123

HINDUNILVR

447

451

457

461

467

ICICIBANK

857

878

891

913

926

IDFC

133

135

136

137

138

INFY

2,459

2,484

2,501

2,527

2,544

ITC

249

254

257

262

265

JINDALSTEL

419

445

460

485

500

JPASSOCIAT

72

73

73

74

75

KOTAKBANK

570

581

588

599

605

LT

1,341

1,370

1,385

1,414

1,429

M&M

693

700

706

714

720

MARUTI

1,126

1,148

1,162

1,184

1,198

NTPC

157

158

159

161

162

ONGC

276

280

283

288

290

PNB

789

799

804

814

819

POWERGRID

109

111

113

115

117

RANBAXY

482

486

492

496

502

RELIANCE

719

728

735

744

750

RELINFRA

539

549

555

564

570

SAIL

89

90

90

91

92

SBIN

2,109

2,134

2,152

2,177

2,195

SESAGOA

186

189

190

193

195

SIEMENS

707

721

730

744

753

STER

98

100

102

104

105

SUNPHARMA

606

621

633

648

660

TATAMOTORS

237

240

243

246

249

TATAPOWER

97

101

103

107

109

TATASTEEL

428

435

439

446

451

TCS

1,252

1,265

1,276

1,289

1,300

WIPRO

391

396

403

407

414

3

Daily Technical Report

July 02, 2012

Research Team Tel: 022 - 39357800

DISCLAIMER

This document is solely for the personal information of the recipient, and must not be singularly used as the basis of any investment

decision. Nothing in this document should be construed as investment or financial advice. Each recipient of this document should make

such investigations as they deem necessary to arrive at an independent evaluation of an investment in the securities of the companies

referred to in this document (including the merits and risks involved), and should consult their own advisors to determine the merits and

risks of such an investment.

Angel Broking Limited, its affiliates, directors, its proprietary trading and investment businesses may, from time to time, make

investment decisions that are inconsistent with or contradictory to the recommendations expressed herein. The views contained in this

document are those of the analyst, and the company may or may not subscribe to all the views expressed within.

Reports based on technical and derivative analysis center on studying charts of a stock's price movement, outstanding positions and

trading volume, as opposed to focusing on a company's fundamentals and, as such, may not match with a report on a company's

fundamentals.

The information in this document has been printed on the basis of publicly available information, internal data and other reliable

sources believed to be true, but we do not represent that it is accurate or complete and it should not be relied on as such, as this

document is for general guidance only. Angel Broking Limited or any of its affiliates/ group companies shall not be in any way

responsible for any loss or damage that may arise to any person from any inadvertent error in the information contained in this report.

Angel Broking Limited has not independently verified all the information contained within this document. Accordingly, we cannot testify,

nor make any representation or warranty, express or implied, to the accuracy, contents or data contained within this document. While

Angel Broking Limited endeavours to update on a reasonable basis the information discussed in this material, there may be regulatory,

compliance, or other reasons that prevent us from doing so.

This document is being supplied to you solely for your information, and its contents, information or data may not be reproduced,

redistributed or passed on, directly or indirectly.

Angel Broking Limited and its affiliates may seek to provide or have engaged in providing corporate finance, investment banking or

other advisory services in a merger or specific transaction to the companies referred to in this report, as on the date of this report or in

the past.

Neither Angel Broking Limited, nor its directors, employees or affiliates shall be liable for any loss or damage that may arise from or in

connection with the use of this information.

Note: Please refer to the important `Stock Holding Disclosure' report on the Angel website (Research Section). Also, please refer to the

latest update on respective stocks for the disclosure status in respect of those stocks. Angel Broking Limited and its affiliates may have

investment positions in the stocks recommended in this report.

Research Team

Shardul Kulkarni

-

Head - Technicals

Sameet Chavan

-

Technical Analyst

Sacchitanand Uttekar

-

Technical Analyst

Mehul Kothari

-

Technical Analyst

Ankur Lakhotia

-

Technical Analyst

Angel Broking Pvt. Ltd.

Registered Office: G-1, Ackruti Trade Centre, Rd. No. 7, MIDC, Andheri (E), Mumbai - 400 093.

Corporate Office: 6th Floor, Ackruti Star, MIDC, Andheri (E), Mumbai - 400 093. Tel: (022) 3952 6600

Sebi Registration No: INB 010996539

4