Initiating coverage | Credit Rating

January 10, 2010

CRISIL

BUY

CMP

`5,979

Well Rated

Target Price

`7,584

CRISIL is the largest credit rating agency with a market share of around 65% and is

Investment Period

12 Months

one of the biggest research houses in India. With the recent acquisition of Pipal

Sector

Credit R ating

Research Corp. (Pipal), robust credit demand and strong infrastructure-spend, we

Market Cap (` cr)

4,245

expect strong growth across all the segments of the company. The company has

Beta

0.3

also recently finished a buyback of 1.3lakh shares worth `80cr at an average price

of `6,200. We Initiate Coverage on the stock with a Buy rating.

52 Week High / Low

6350/4290

Avg. Daily Volume

1,198

Acquisition of Pipal to boost research revenue: Pipal is a strong player providing

Face Value (`)

10

offshore research services to the corporate sector, while CRISIL's Irevna is a leading

offshore research provider to the financial sector. The synergy between the two

BSE Sensex

19,224

firms will help CRISIL to service its clients better and further expand its client base,

Nifty

5,763

resulting in strong growth going ahead. Post the acquisition with the combined

R euters Code

CR S L.BO

strength of the two firms we expect a 22% CAGR in the research segment's revenue

Bloomberg Code

CR ISIL@IN

over CY2010-12.

Robust growth in credit ratings to continue on strong credit demand: We believe

credit demand will continue to grow at a faster rate than India's nominal GDP as

Shareholding P attern (% )

financial depth continues to increase. The need for large capital formation of 30-

P romoters

52.4

35% of GDP for sustaining 8%+ GDP growth in India is well acknowledged;

MF / B anks / Indian Fls

19.4

hence, we expect credit demand to witness

20% CAGR over CY2010-14,

considering the actual and latent credit demand in India. CRISIL has been growing

F II / NR Is / OCBs

10.4

at ~2x India's credit growth since CY2005. Further, the company will continue to

Indian P ublic / Others

17.8

benefit from Basel-II norms, as a large number of entities are still to be rated.

CRISIL, being the market leader with 65% market share in credit rating and 50%

share in bank loan rating (BLR), will continue to benefit greatly from India's strong

Abs . (% )

3m 1yr

3yr

credit growth. We conservatively expect the segment to register 21% revenue CAGR

Sensex

(5.1)

9.6

(6.6)

over CY2010-12.

CR IS IL

0.8

24.3

70.8

Outlook and valuation: We expect CRISIL to post 21.5% CAGR in revenues over

CY2010-12 and continue to maintain its leadership position. CRISIL benefits from

its asset-light business model, which is high on intellectual assets (employee cost-

to-sales is around 40%). Further, the company is debt free and has 40% plus RoE.

Additionally, CRISIL enjoys strong parentage (Standard and Poor's). Currently, the

stock is available at 17.3x CY2012E earnings, which is at the lower end of its

historical range of 16.4-29.9x one-year forward EPS. We Initiate Coverage on the

stock with a Buy rating and a Target Price of `7,584, valuing it at its five-year

median of 22x CY2012E earnings and implying an upside of 27%.

Key financials (Consolidated)

Y/E Dec. (` cr)

CY2009 CY2010E CY2011E CY2012E

Net sales

537

629

767

927

% chg

4.4

17.0

22.0

20.0

Adj. Net profit

161

157

200

245

% chg

14.4

(2.5)

27.7

22.3

FDEPS (`)

223

284

282

345

EBITDA margin (%)

37.1

33.3

34.3

34.8

P/E (x)

26.9

21.0

21.2

17.3

RoE (%)

40.6

37.2

44.9

46.8

RoCE (%)

46.6

44.6

53.6

56.8

P/BV (x)

10.0

10.4

8.8

7.6

Sharan Lillaney

EV/Sales (x)

7.6

6.6

5.3

4.3

022- 3935 7800 Ext.: 6811

EV/EBITDA (x)

20.5

20.0

15.6

12.4

Source: Company, Angel Research

Please refer to important disclosures at the end of this report

1

CRISIL | Initiating coverage

Investment arguments

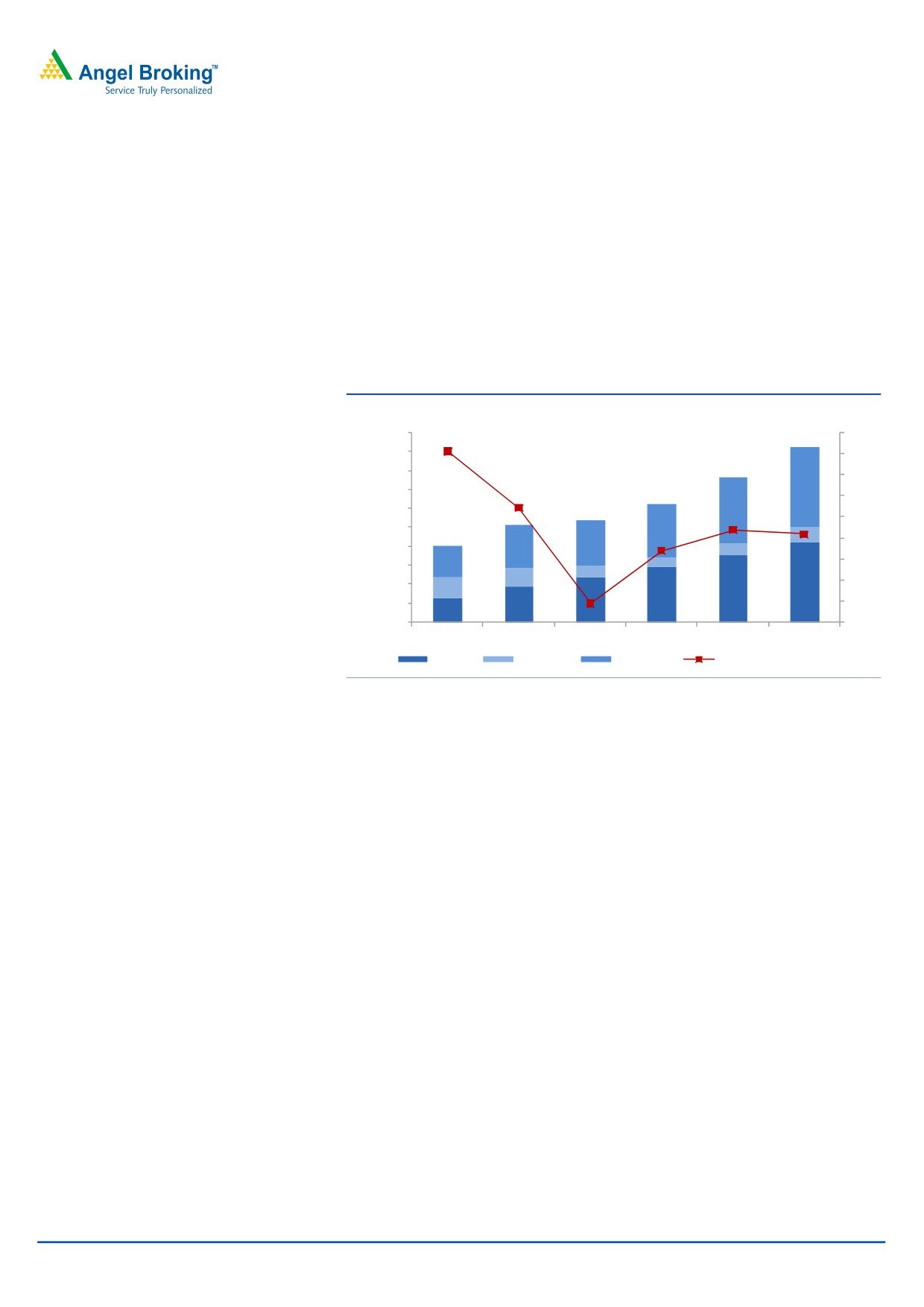

CRISIL witnessed robust growth in the first three quarters of CY2010 on the back of

strong credit growth and global economic recovery, which going ahead is

expected to further improve. The company recently acquired Pipal Research, which

will lend to a boost to their research portfolio and result in robust growth in the

ensuing years. The advisory segment is expected to revert to high growth

tracjectory on the back of the strong infra spends. Overall, we expect all the

segments of the company to register high growth and conservatively expect total

revenues to register 21.5% CAGR over CY2010-12.

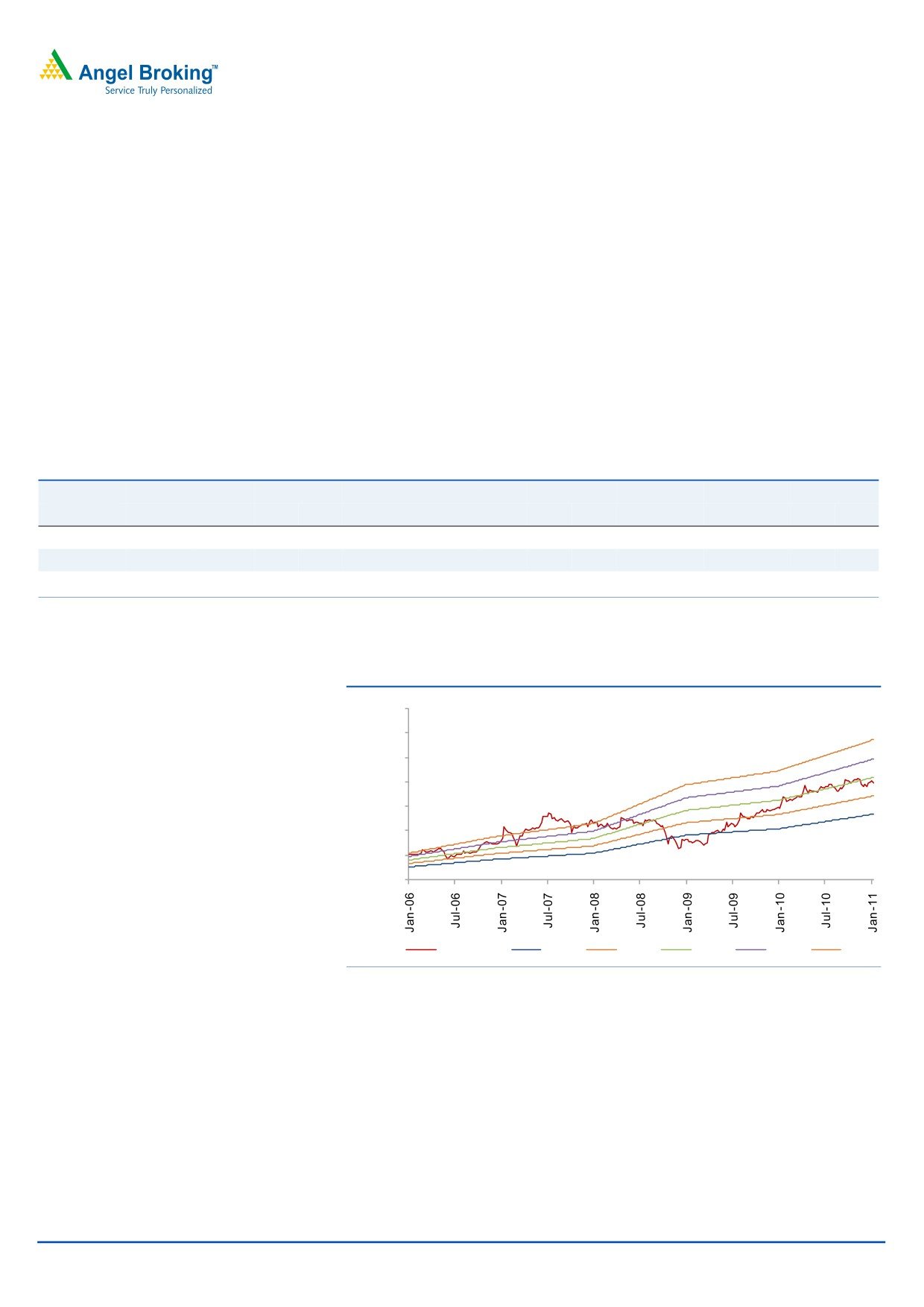

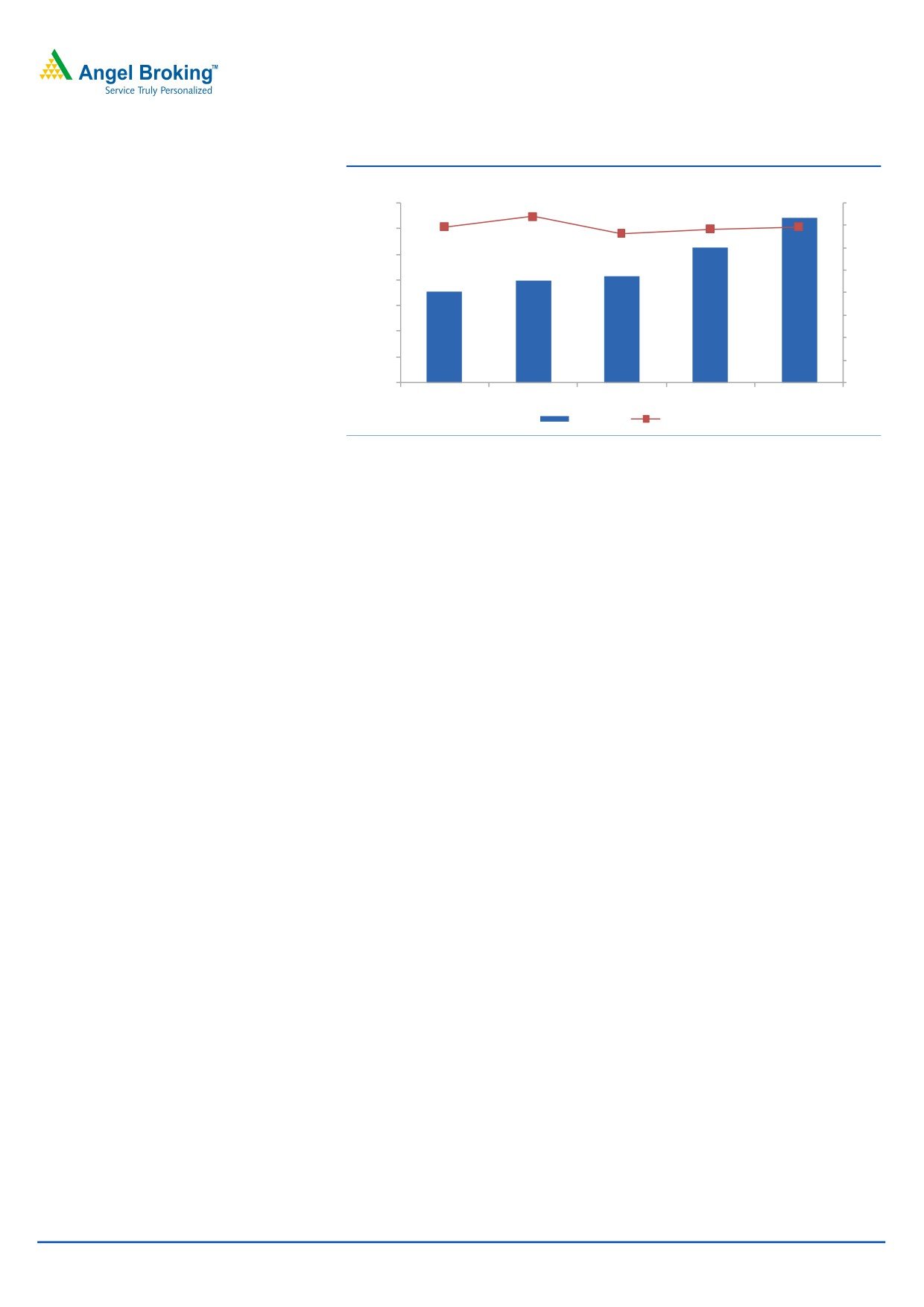

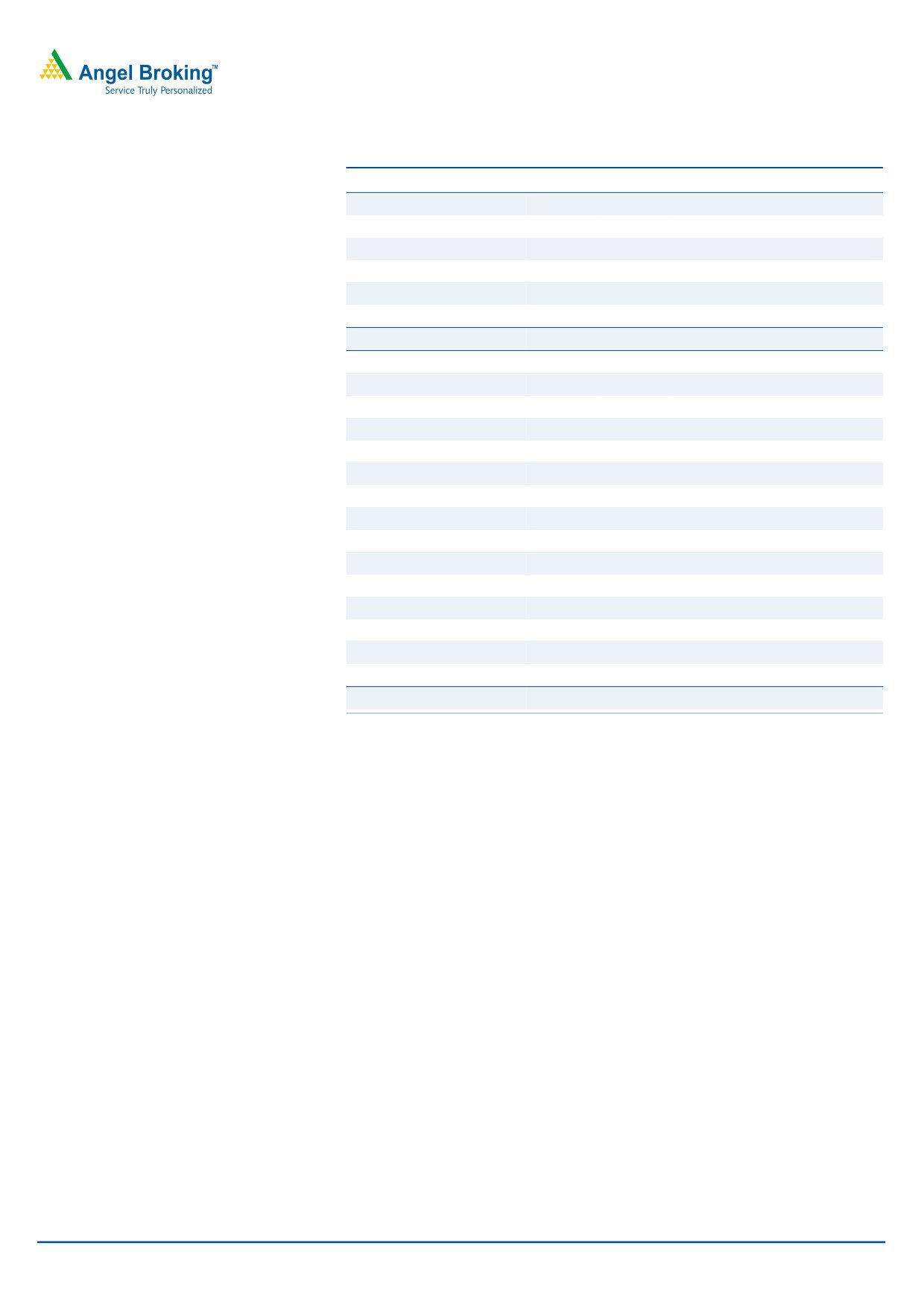

Exhibit 1: Segmental revenue breakup

(` cr)

(%)

1,000

45

900

40

800

35

700

427

30

600

352

25

500

286

75

20

400

226

238

62

168

51

15

300

60

100

10

200

425

107

353

292

239

5

100

189

130

0

0

CY07

CY08

CY09

CY10E

CY11E

CY12E

Rating

Advisory

Research

Total Revenue Growth

Source: Company, Angel Research

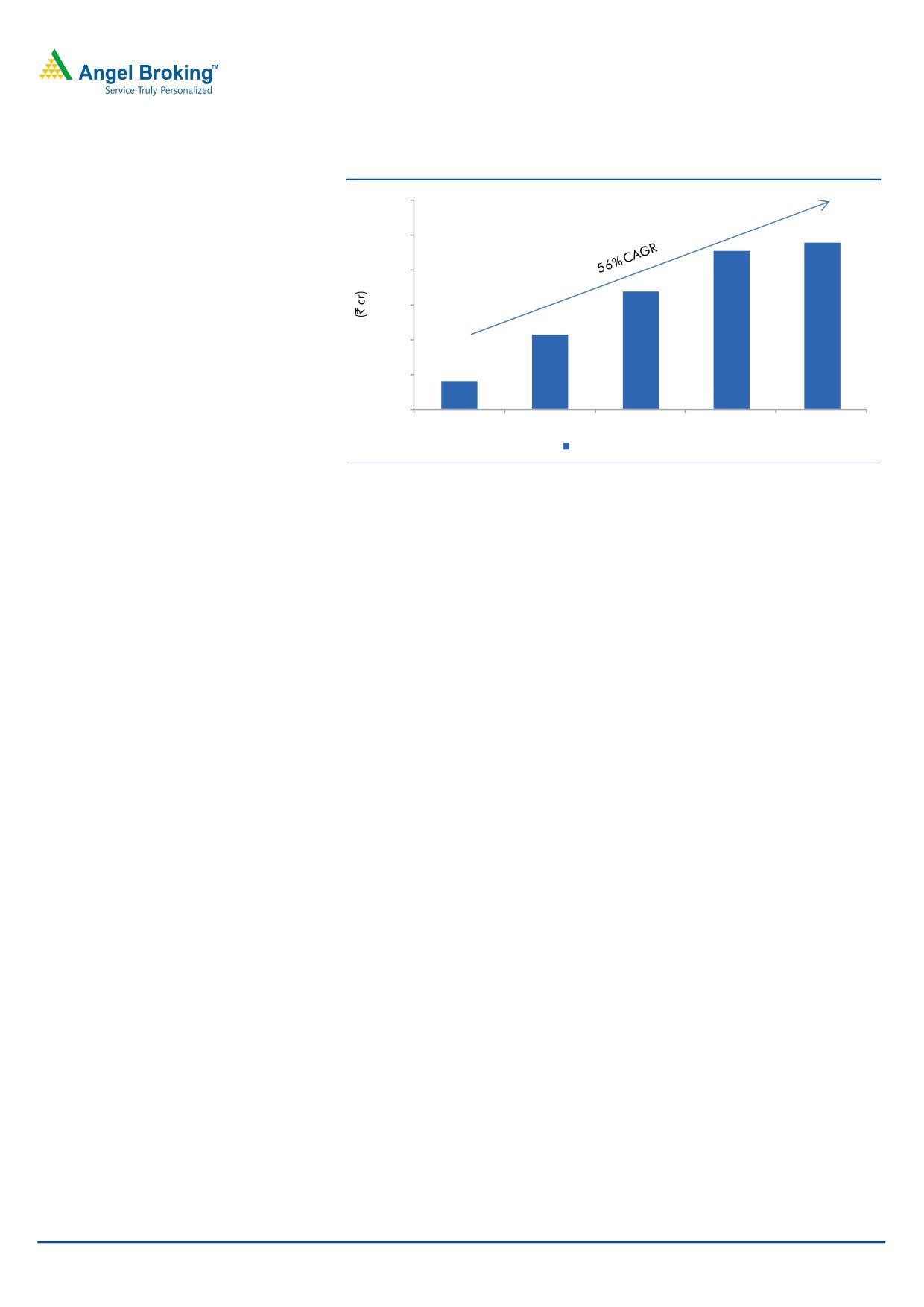

Strong growth to continue on the back of acquisition Pipal

CRISIL has a history of acquiring small companies and scaling their operations by

leveraging their strong clientele, skills and processes. CRISIL acquired Irevna in

CY2005 for `73.1cr, which was valued at ~2.2x EV/Sales (`33.1cr sales). Post the

acquisition, CRISIL’s research segment’s revenue increased from `41cr in CY2005

to `238cr in CY2009, witnessing a 55.7% CAGR in revenue over CY2005-09,

contributing nearly 45% to the total revenue in CY2009 from 29% in CY2005.

In CY2009, Datamonitor’s The Black Book of Outsourcing for Financial Research

ranked Irevna as the number one research house in the country.

January 10, 2010

2

CRISIL | Initiating coverage

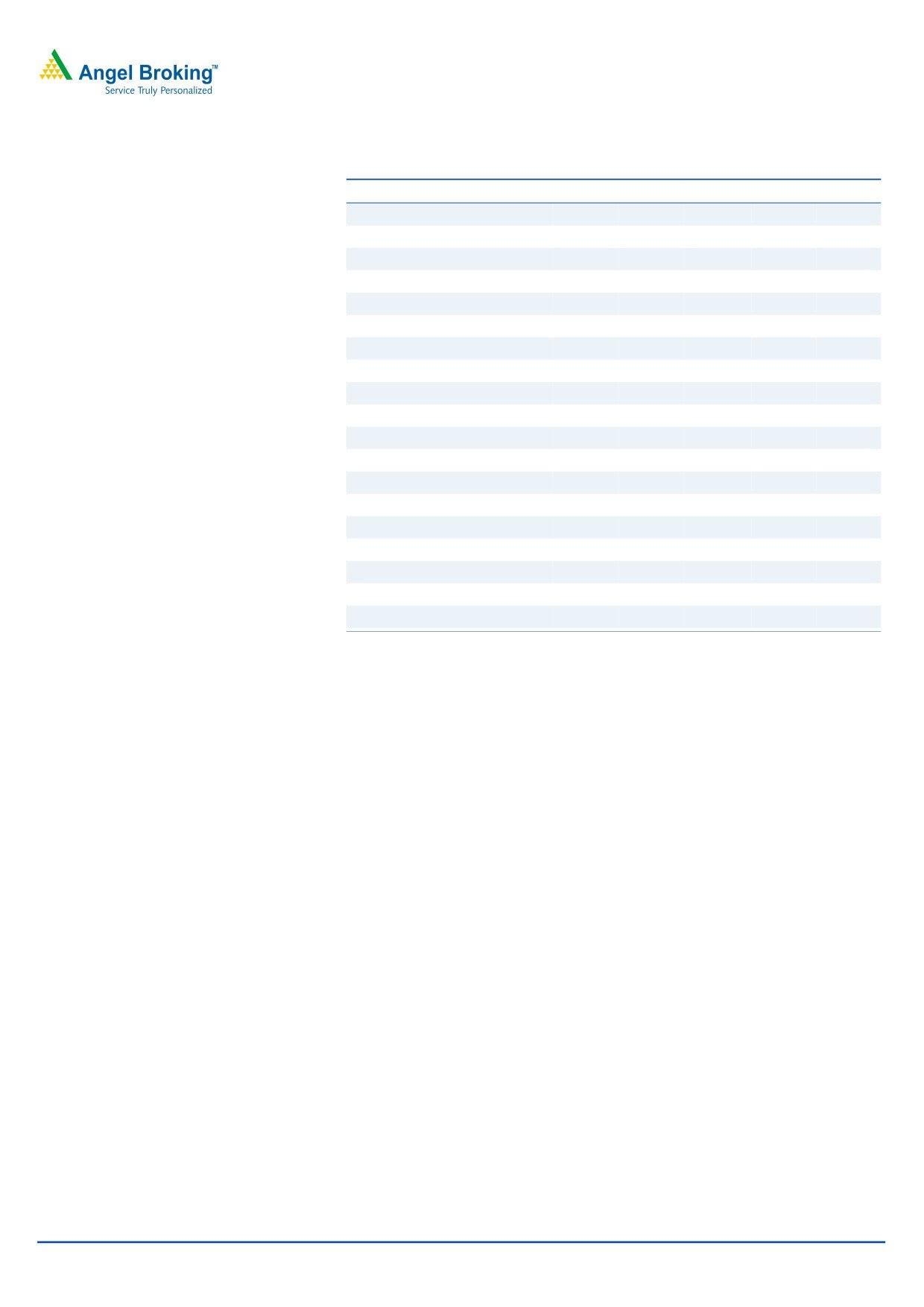

Exhibit 2: Strong revenue growth post Irevna’s acquisition

300

250

200

150

100

50

41

107

168

226

238

0

CY05

CY06

CY07

CY08

CY09

Research Revenue

Source: Company, Angel Research

CRISIL recently acquired Chicago-based Pipal Research Corp., one of the leading

players in the knowledge process outsourcing (KPO) industry, from First Source

Solution for US $12.75mn (around `58cr), at 1.6x EV/Sales . Pipal has a strong

presence in the corporate sector mainly in North America and Europe and

reported revenue of US $8.1mn (around `37cr) in FY2010. Pipal’s client base

includes leading telecommunications, technology, consumer packaged goods and

industrial companies.

Currently, CRISIL is a leader in the high-end KPO space. With this acquisition,

CRISIL, which provides services from Chennai, Mumbai, Buenos Aires and

Wroclaw (Poland), will now have presence in Gurgaon, Noida, Bangalore and

Chicago. The acquisition will also strengthen its position in the market. Pipal has

strong presence in the corporate sector, while Irevna’s strong presence lies in the

financial sector. The synergy between the two firms will help the company to

service clients better and expand its client base, which will result in a strong

platform for growth in the coming years.

Going ahead, we expect CRISIL’s research segment to grow further, as it did post

the acquisition of Irevna, registering a 22% CAGR over CY2010-12E.

January 10, 2010

3

CRISIL | Initiating coverage

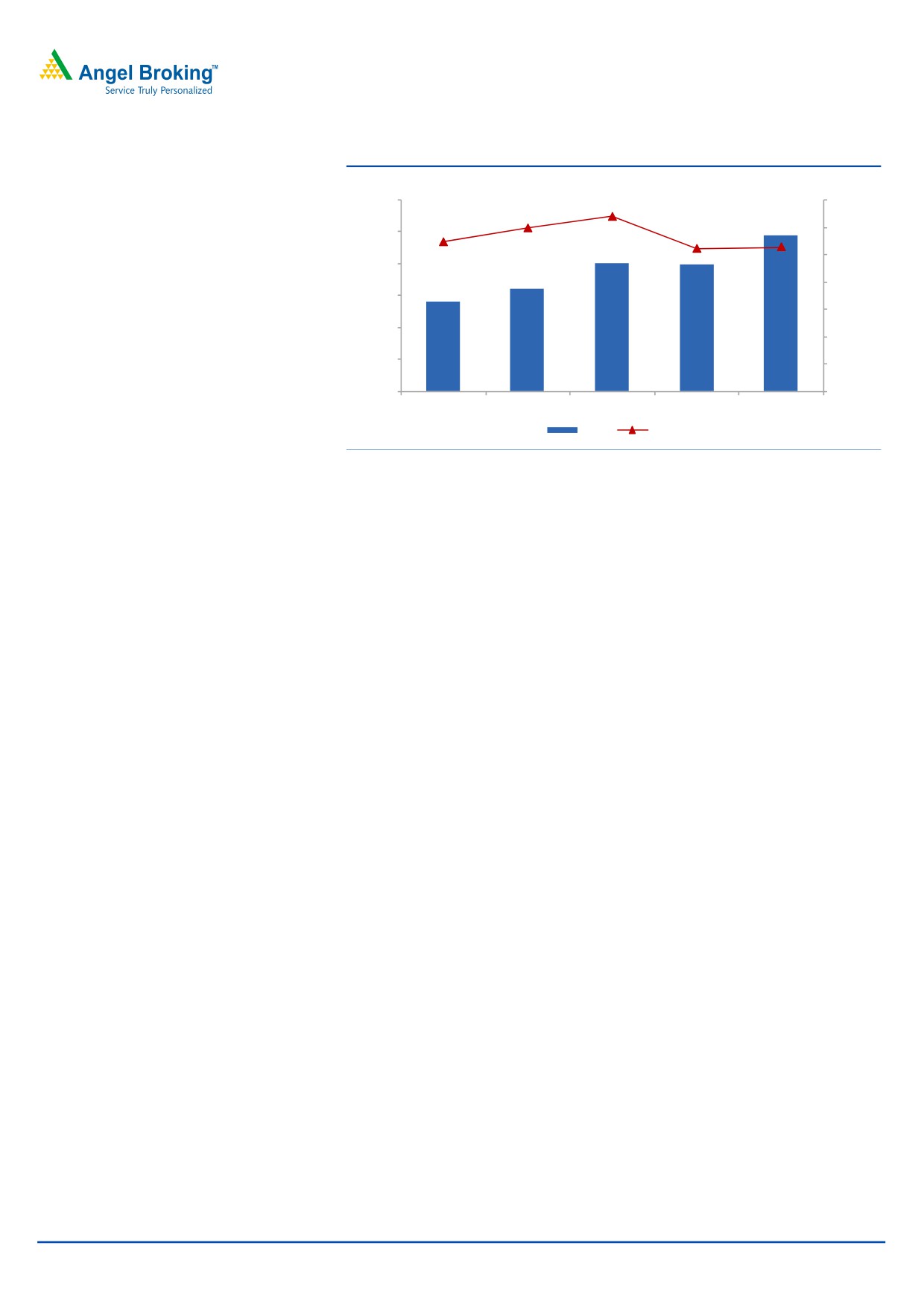

Exhibit 3: Robust growth to continue post Pipal’s acquisition

(`

cr)

(%)

450

23

25

21

400

19

350

20

300

15

250

200

10

150

5

100

5

50

238

285

350

424

-

-

CY09

CY10E

CY11E

CY12E

Research Revenue

Growth (yoy)

Source: Company, Angel Research

Robust growth in credit ratings to continue on strong credit demand

The Indian economy is on the cusp of an upturn in its capex cycle, and early signs

of a pronounced capex upswing are already emerging. GDP growth has averaged

at about 8% over the last five years and is expected to grow at 8-9% over the next

few years.

We believe macro indicators such as huge project announcements, improving

utilisation levels, improved business confidence, increasing end-product prices and

expectation of significant demand improvement will lead to growth in the capex

cycle. Funds raised by companies grew by 20.5% in FY2010 compared to 18% in

FY2009. The capex cycle, which started in 2004, took a breather between 2008

and 2009 as the world faced liquidity constraints.

After the interruption seen over the last two years, the capex cycle has resumed

and is expected to further improve going ahead. Rising economic growth

momentum, improving domestic demand prospects and growing capacity

utilisation since FY2009 have translated into recent growth in capacity expansion

plans as well as in actual project implementation. Moreover, the continuous flow of

investment announcements reflects the confidence of industries in sustaining the

current upsurge in demand. More importantly, the current investment boom is not

triggered by the government but by companies that are optimistic about the

economy’s growth potential and are investing willingly. This is evident from the fact

that the share of private sector in outstanding investment has been rising steadily

from 39% in 2004 to 58% in 2010.

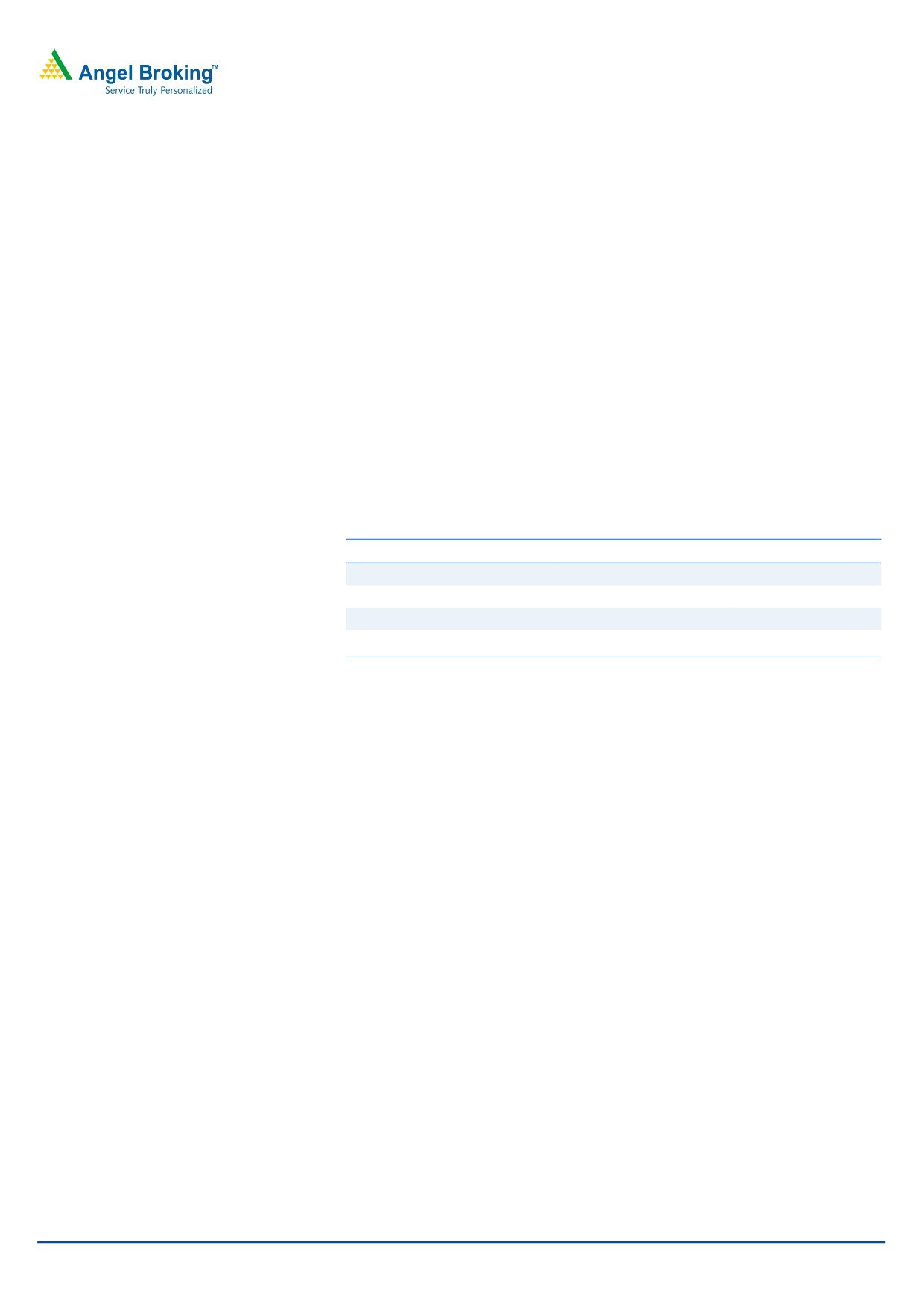

We believe credit demand will continue to grow at a faster rate than India's

nominal GDP as financial depth continues to increase. The need for large capital

formation of 30-35% of GDP for sustaining 8%+ GDP growth in India is well

acknowledged; hence, we expect credit demand to witness a 20% CAGR over

CY2010-14, considering the actual and latent credit demand in India.

CRISIL has been growing at ~2x India's credit growth since CY2005. Further, the

company will continue to benefit from Basel II norms, as the number of entities to

be rated will increase further. CRISIL, being the market leader with 65% market

January 10, 2010

4

CRISIL | Initiating coverage

share in credit rating, will continue to benefit greatly from India's strong credit

growth. As of September 30, 2010, CRISIL had more than 10,941 ratings

(including 6030 SMEs) outstanding. We conservatively expect the rating business to

register 21% revenue CAGR over CY2010-12.

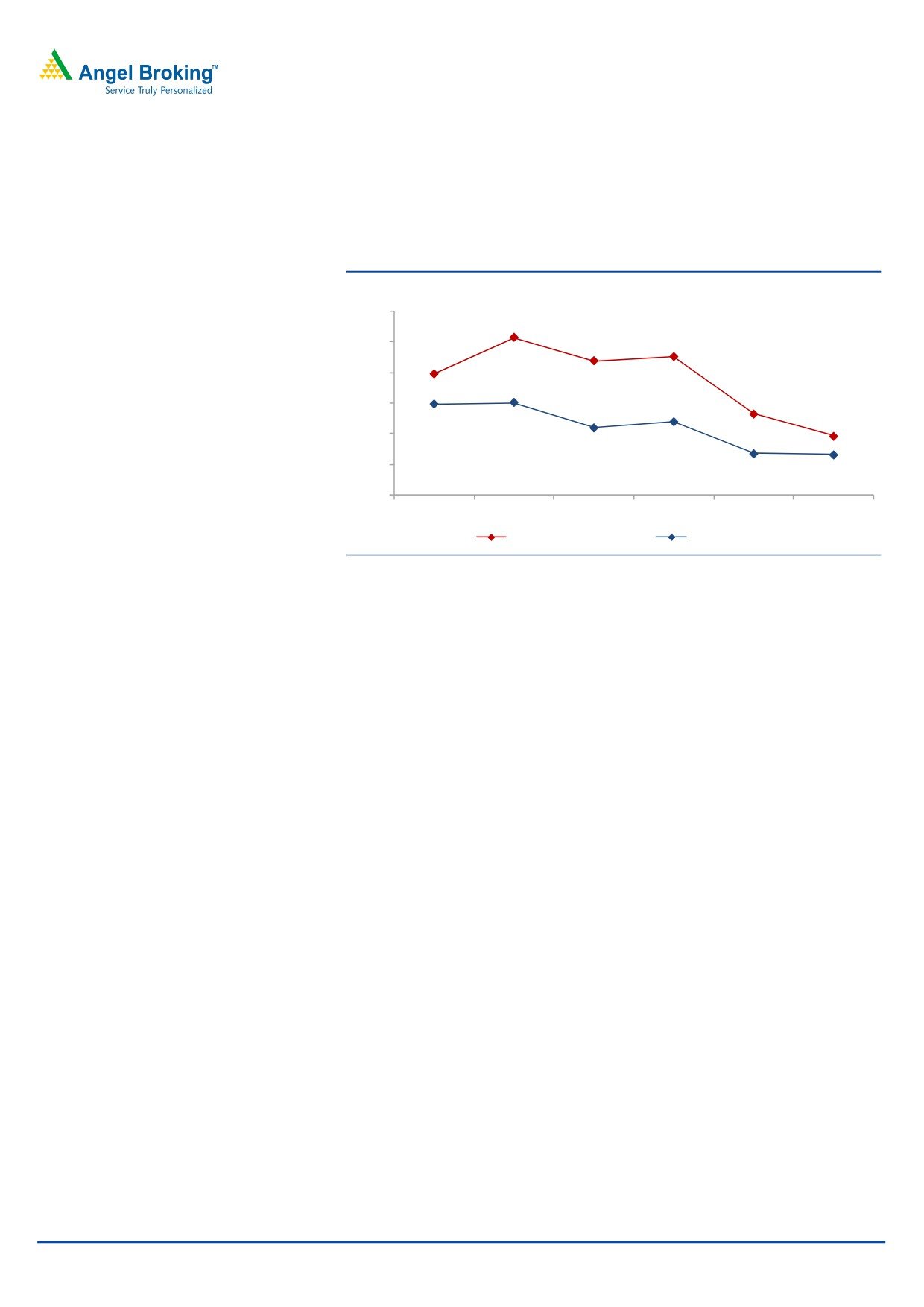

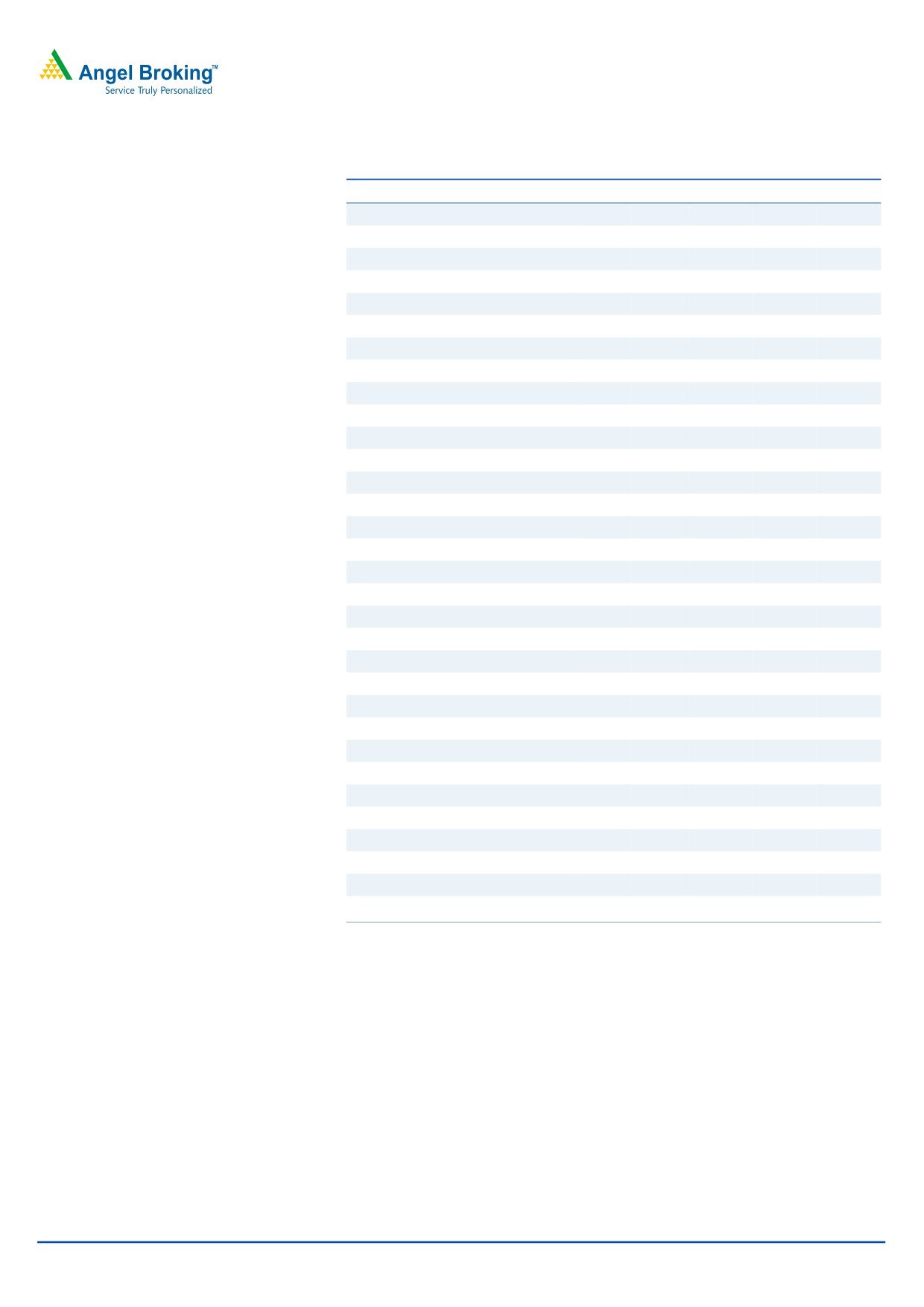

Exhibit 4: Credit rating business growing on the back of credit growth

(%)

60

51

50

44

45

40

40

27

30

30

30

19

20

24

22

10

14

13.3

-

CY05

CY06

CY07

CY08

CY09

9MCY10

Crisil Ratings Growth

Indian Credit Growth

Source: Company, Angel Research

Robust growth in BLR to continue post Basel II

Post Basel II, CRISIL has seen strong growth in its credit rating segment due to a

boost in bank loan rating (BLR). The company’s credit rating segment witnessed a

38.2% CAGR in revenue over CY2006-09. Till 3QCY2010, CRISIL had 5,017

BLRs, making it the market leader with a market share of 50%.

The BLR market is a much larger market compared to the bond market given the

wide reach of banks and large funds at their disposal vis-à-vis the capital market

participants. There are several incentives for entities to get rated, as they can avail

loans at cheaper rates based on their ratings. On the other hand, banks also stand

to benefit, as they now only need to hold capital reserves to the extent of the risks

they are exposed to, in turn freeing vital capital and reducing costs. Thus, given the

large size of the SME sector and high number of unrated entities under Base II

norms, we believe that the BLR market presents a strong growth opportunity.

January 10, 2010

5

CRISIL | Initiating coverage

Exhibit 5: Potential savings in interest rates on getting rated

Rating

Basel I

Basel II

Capital

Capital

PBT required by

PBT required by bank

Potential reduction

Risk

required

Risk

required

bank

due to lower risk weight

in interest rates

weight (%)

(` cr)

weight (%)

(` cr)

(% to assets)

AAA

100

9

20

1.8

1.4

0.3

1.1

AA

100

9

30

2.7

1.4

0.4

1.0

A

100

9

50

4.5

1.4

0.7

0.7

BBB

100

9

100

9.0

1.4

1.4

-

BB and below/

100

9

150

13.5

1.4

2.1

(0.7)

or unrated exposure

Source: RBI, Note1: Calculations made assuming a bank would like to make a profit of `1cr on a `100cr loan i.e. 1% RoA. Note 2: Unrated exposure above

`10cr will attract 150% risk weight on full transition to Basel II, irrespective of an entity’s actual creditworthiness.

Post 2014, the RBI may shift to the advanced internal ratings methodology under

Basel II norms, where banks can themselves rate entities. However, it is better for

an entity to get rated from a single, well-accepted external agency than getting

rated by multiple banks and increase its cost of rating. Hence, CRISIL being the

market leader will benefit the most from the growing BLR market.

India’s bond issuance growth to fuel further growth in ratings

Bond rating is one of the major contributors to the company’s ratings segment.

India’s corporate bond market is relatively underpenetrated compared to major

developed countries and emerging markets, as corporates in India prefer bank

credit over bonds. However, with the growing capex cycle and infra spends in the

recent years, corporate bond issuance has increased, as it is a cheaper way to

raise money compared to bank loans or equity dilution.

For India to expand at 8-9% in the coming decade, huge capex and infra spends

are required. As per the XIIth Five-Year Plan, the government has announced

US $1tn infrastructure spending. Accordingly, we expect bonds to become a major

source for corporates to raise money to fuel such a huge amount of spending.

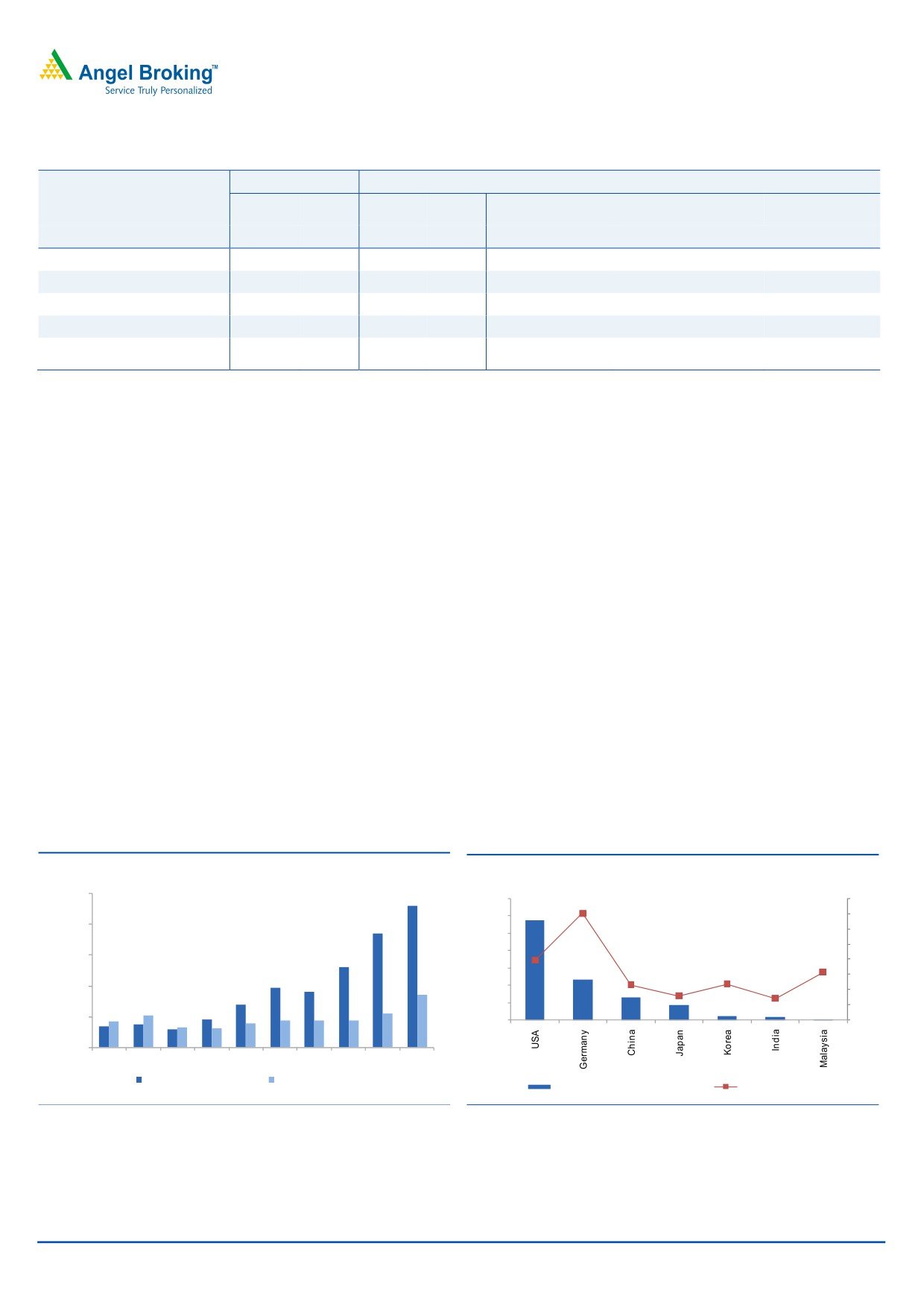

Exhibit 6: Indian corporate bond market showing robust growth

Exhibit 7: Largely underpenetrated corporate bond market

(` '00 cr)

(US$ bn)

2,000

1,831

1,400

16

1,200

14

1,600

1,477

12

1,000

10

800

1,200

1,033

8

600

1,150

775

6

719

800

400

4

547

200

464

2

301

359

267

172

47

41

14

400

263

234

0

-

338

411

256

244

309

348

344

346

437

678

0

CY01

CY02

CY03

CY04

CY05

CY06

CY07

CY08

CY09

CY10

Bond Issue Size (` '00 cr)

No. Of Bonds Issued

Annual Bond Issuance (US $CY10)

Corporate Debt/GDP (%)

Source: Bloomberg, Angel Research

Source: IMF, Bloomberg, Angel Research

January 10, 2010

6

CRISIL | Initiating coverage

Infra & advisory services to benefit from huge infra spend

CRISIL’s infrastructure advisory segment provides practical and innovative solutions

to governments, donor-funded agencies and leading organisations, where the

company helps to improve infrastructure service delivery, transform performance of

public institutions and design and strengthen reform programs to catalyse private

sector participation.

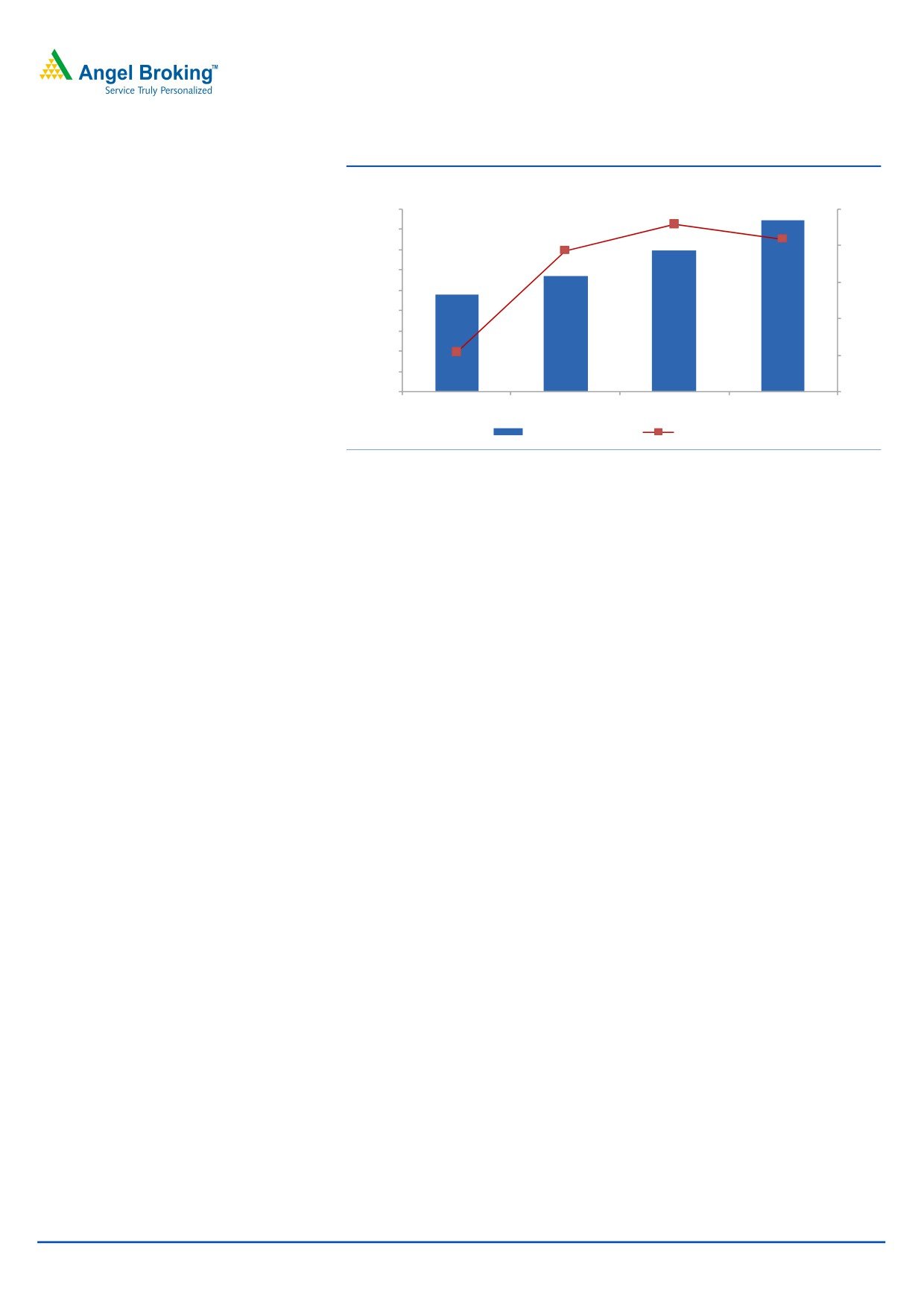

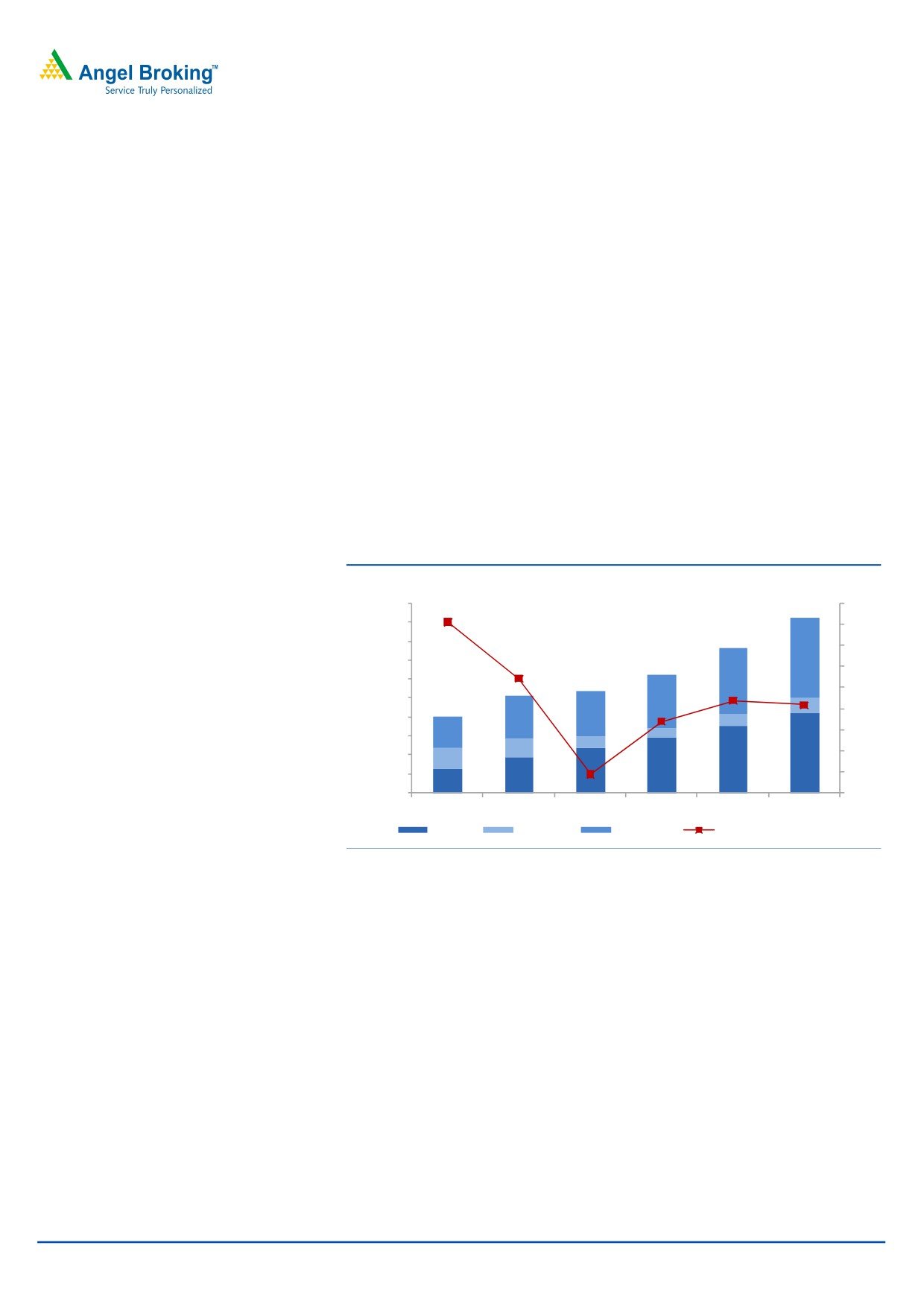

Over CY2007-09, CRISIL’s infra and risk advisory segment took a hit due to the

ongoing liquidity crisis. Consequently, the segment’s revenue declined from `107cr

in CY2007 to `60cr in CY2009. However, post the crisis, we expect the segment to

recover at a fast pace and register revenue close to its CY2007 revenue.

CRISIL is set to benefit from the estimated US $800bn spend on infrastructure from

FY2010-14E (US $1tn in the XIIth Five-Year Plan), as it will provide a huge

opportunity to the company to expand its infra and risk advisory services segment.

Accordingly, CRISIL has undertaken aggressive hiring across hierarchy and will

expand its customer base going ahead.

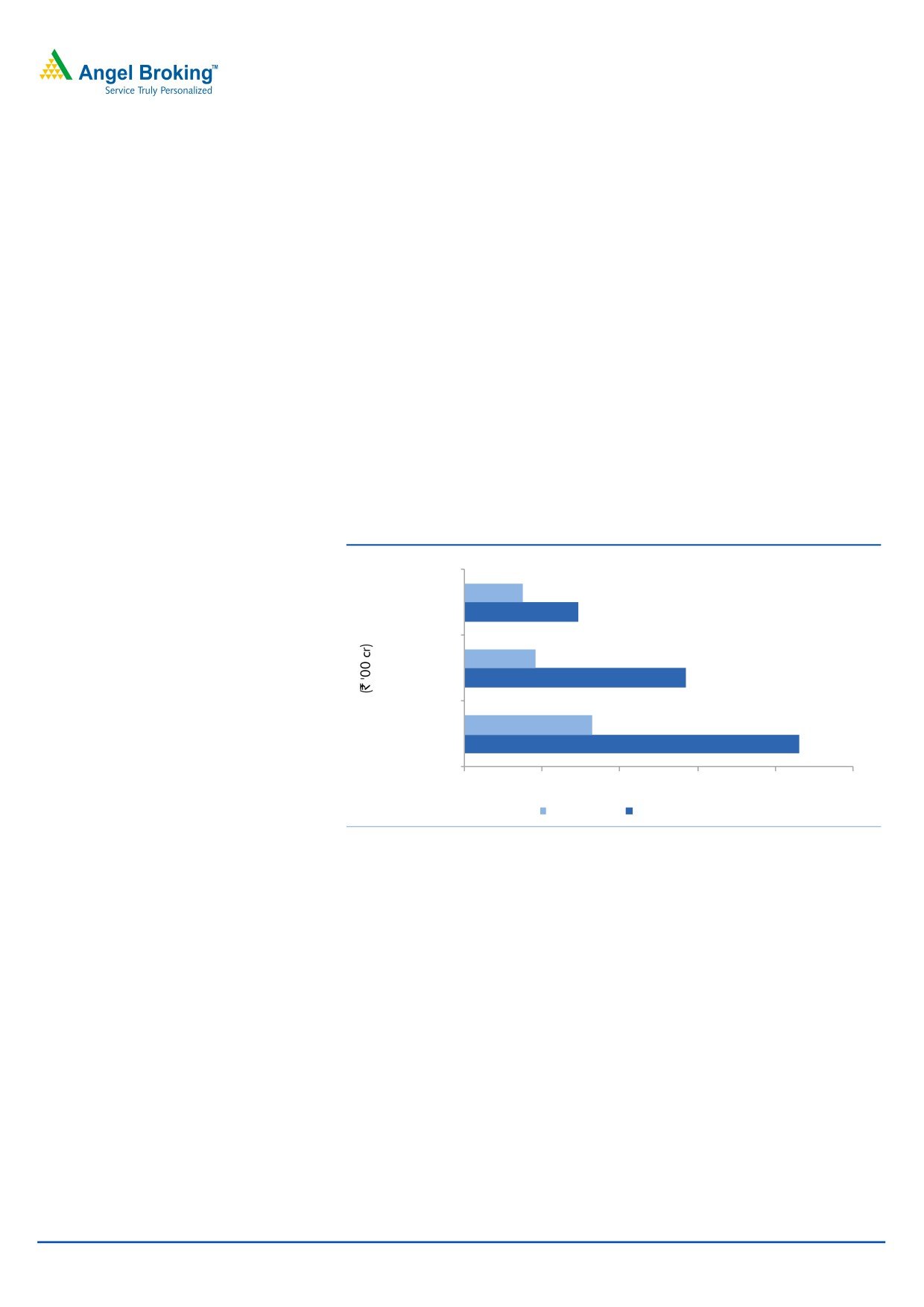

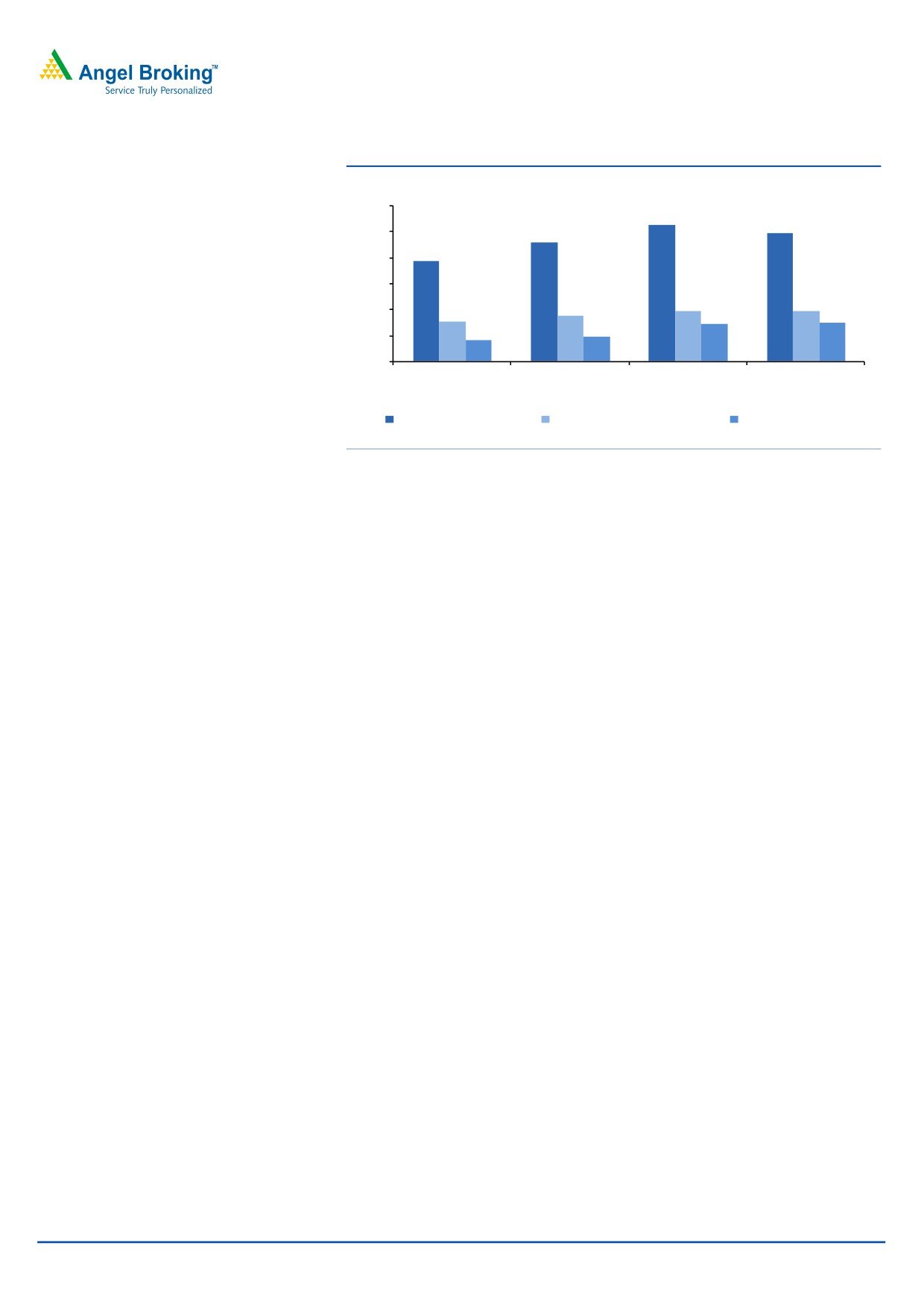

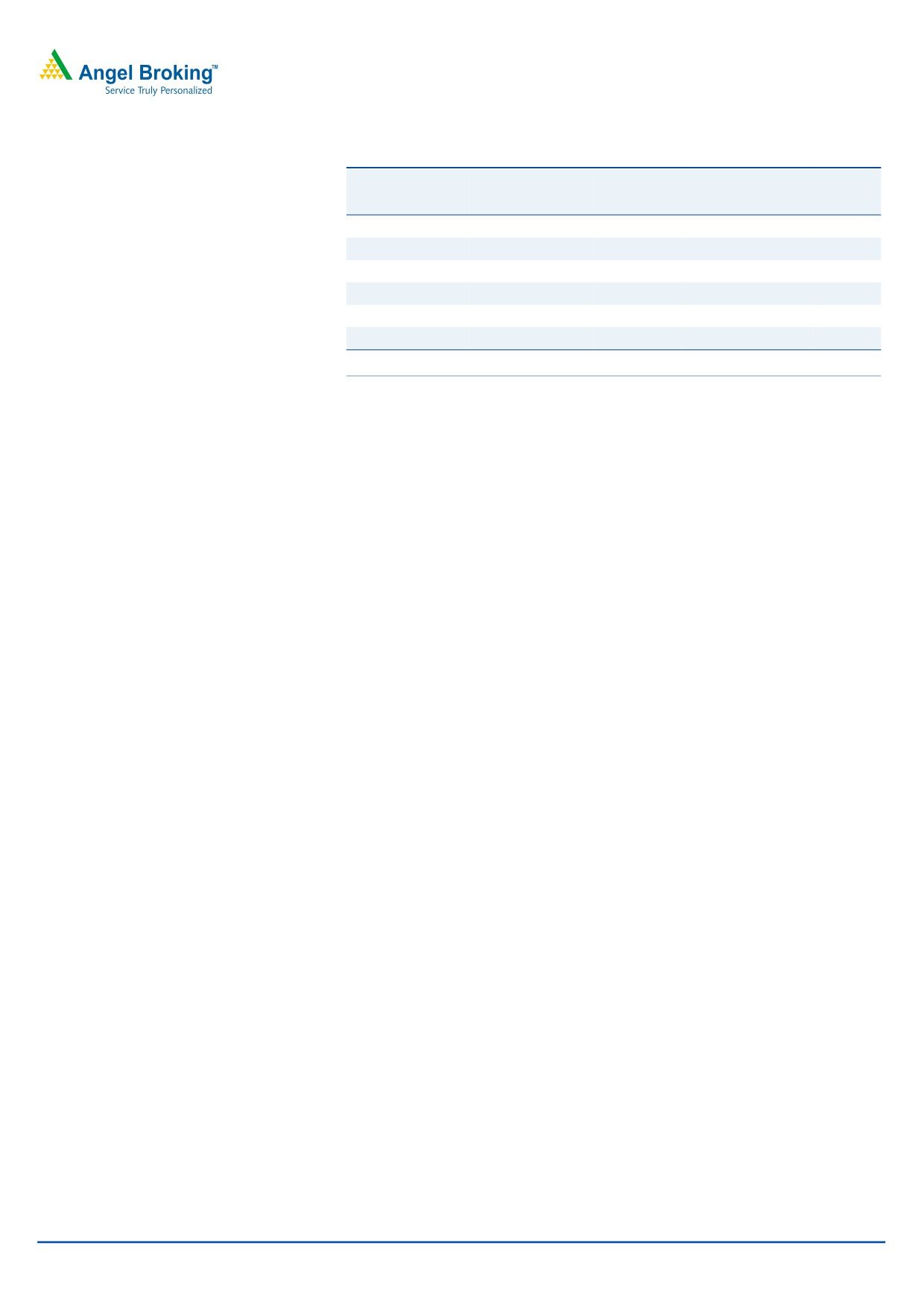

Exhibit 8: Estimated infra and industrial spending

7,415

Industrial

14,642

9,008

Infrastructure

28,349

16,423

Total Investments

42,991

0

10,000

20,000

30,000

40,000

50,000

FY2006-10 FY2011-15E

Source: CRISIL Research, Angel Research

Hence, we expect CRISIL's infra and risk advisory services segment to conservatively

report a 21.7% CAGR over CY2010-12E on account of low revenue base. Despite

such strong growth, the advisory segment is expected to report revenue of `75cr in

CY2012, which will be less than its CY2007 revenue of `107cr. Thus, there could

be significant upside to our estimates.

January 10, 2010

7

CRISIL | Initiating coverage

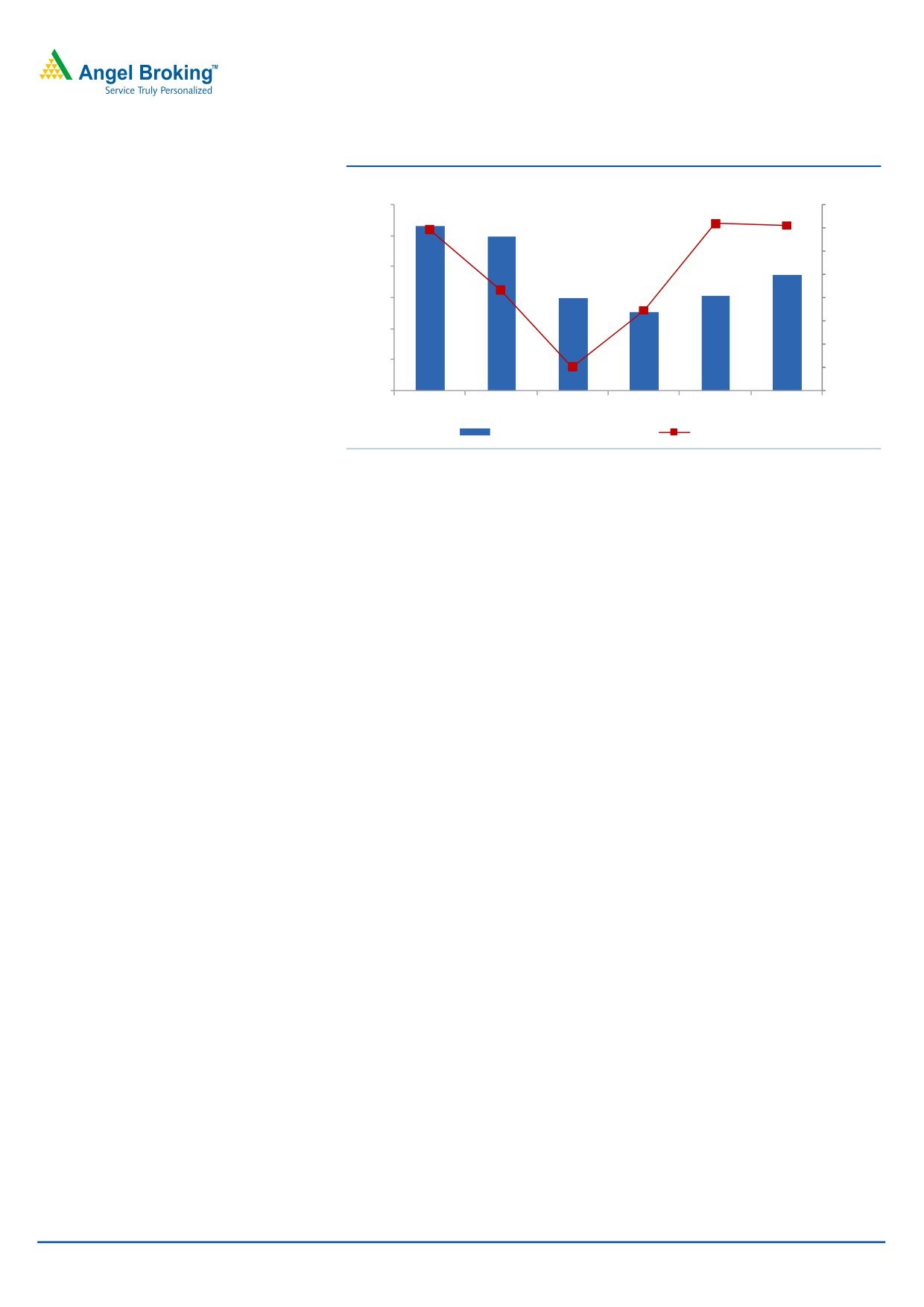

Exhibit 9: Advisory division to recover due to strong infra spends

(` cr)

120

30.0

107

100

20.0

100

10.0

75

80

-

60

62

60

51

(10.0)

(20.0)

40

(30.0)

20

(40.0)

0

(50.0)

CY07

CY08

CY09

CY10E

CY11E

CY12E

Advisory Revenue

Growth (yoy)

Source: Company, Angel Research

Strong cash reserves to result in buyback, acquisitions and

higher dividends

CRISIL, with its strong cash reserves of `158cr, initiated a buyback of ~1.3lakh

shares worth `80cr for an average price of `6,200/share in CY2010. The

company also purchased Pipal for `58cr. In CY2010, apart from the `75/share

dividend, CRISIL gave a special dividend of `100/share.

Going ahead, we expect this trend to continue with the company paying higher

dividend with payout ratio above 50% in CY2011-12. Also, the company can

initiate another round of buyback in CY2011, as it will have `142cr of cash

reserve post an estimated dividend payout of `150/share in CY2011. CRISIL has

historically taken up many inorganic growth opportunities to fuel its growth and

can easily accept another inorganic growth prospect, given its strong cash reserve

of `242cr by CY2012E.

January 10, 2010

8

CRISIL | Initiating coverage

Outlook and valuation

We expect CRISIL to register a 21.5% CAGR in revenue over CY2010-12E and

continue to maintain its leadership position, with robust growth across all its

segments. The company benefits from its asset-light business model, which is high

on intellectual assets (employee cost-to-sales is around 40%). Further, the company

is debt free and has 40% plus RoE. Additionally, the company enjoys strong

parentage (Standard and Poor's).

Currently, the stock is available 17.3x CY2012E earnings, which is at the lower

end of its historical range of 16.4-29.9x one-year forward EPS, which makes it

attractive. We Initiate Coverage on the stock with a Buy rating and a Target Price

of `7,584, valuing it at its five-year median of 22x CY2012E earnings and

implying an upside of 27%.

Exhibit 10: Peer comparison

Target Price Mkt. Cap.

Sales

Sales Growth (%)

OPM (%)

EPS (`)

EPS Growth (%)

PER (x)

RoE (%)

(` cr)

(`)

CY11E CY12E CY12E (yoy) CY11E CY12E CY11E CY12E CY12E (yoy) CY11E CY12E CY11E CY12E

CRISIL Angel

7,584

4,245

767

927

20.0

34.3

34.8

282.0

344.7

22.3

21.2

17.3

44.9

46.8

CRISIL Blmberg

N/A

4,245

785

958

22.0

36.5

37.7

282.8

372.9

31.9

21.1

16.0

50.5

53.9

ICRA* Blmberg

N/A

1,165

247

295

19.4

39.0

39.0

72.7

89.2

22.7

16.0

13.1

26.2

26.3

Source: Company, Angel Research, Bloomberg, *FY2012-13E

Exhibit 11: One-year forward P/E band

10,500

9,000

7,500

6,000

4,500

3,000

1,500

0

Price (`)

14x

18x

22x

26x

30x

Source: Company, Angel Research

January 10, 2010

9

CRISIL | Initiating coverage

Concerns

Slowdown in economic growth

CRISIL’s rating business depends on growth in credit demand, which is closely

linked to the economy’s growth. A major part of research revenue is generated

through outsourcing research services to foreign corporate and institution, which

may be affected if economic crisis continues in the near future.

Competition from other players

CRISIL enjoys the highest market share in industry. However, growing competition

from players such as ICRA, CARE, Fitch Rating and Brickwork has seen erosion in

its market share as seen in the case of BLR where CRISIL’s market share has

dipped to 50% in 3QCY2010 from 55% in CY2009. Going forward, this could

result in declining growth and have negative impact on the company’s profitability.

Nonetheless, CRISIL being the market leader since inception is well-placed to fend

off such competition, which we believe is there to stay.

Exhibit 12: Market share still highest amidst intensifying competition

Quarter

Ratings Announced

Market Share (%)

CY2007

15

42

CY2008

842

46

CY2009

2,268

55

3QCY2010

5,017

50

Source: Company, Angel Research

Margins at risk due to fluctuations in forex

CRISIL derives ~53% of its revenue from foreign clients. Thus, the company has a

large exposure to foreign currency and any major fluctuation in forex can lead to

losses, thus affecting margins and profitability.

Wage inflation and attrition rate cause of concern

CRISIL has been facing attrition in excess of 15% over the years. In the face of it,

the company has been incurring significant costs towards acquiring and training

qualified manpower. Also, in its efforts to retain talent, CRISIL has seen an increase

in cost per employee due to inflationary effects. However, it may be noted that it

has been able to increase its profit and revenue per employee over the years

exhibiting strong capability to pass on additional expenses. Overall, we believe

that being a market leader with a strong brand, the company will be able to

manage such pressures and sustain its margins going ahead.

January 10, 2010

10

CRISIL | Initiating coverage

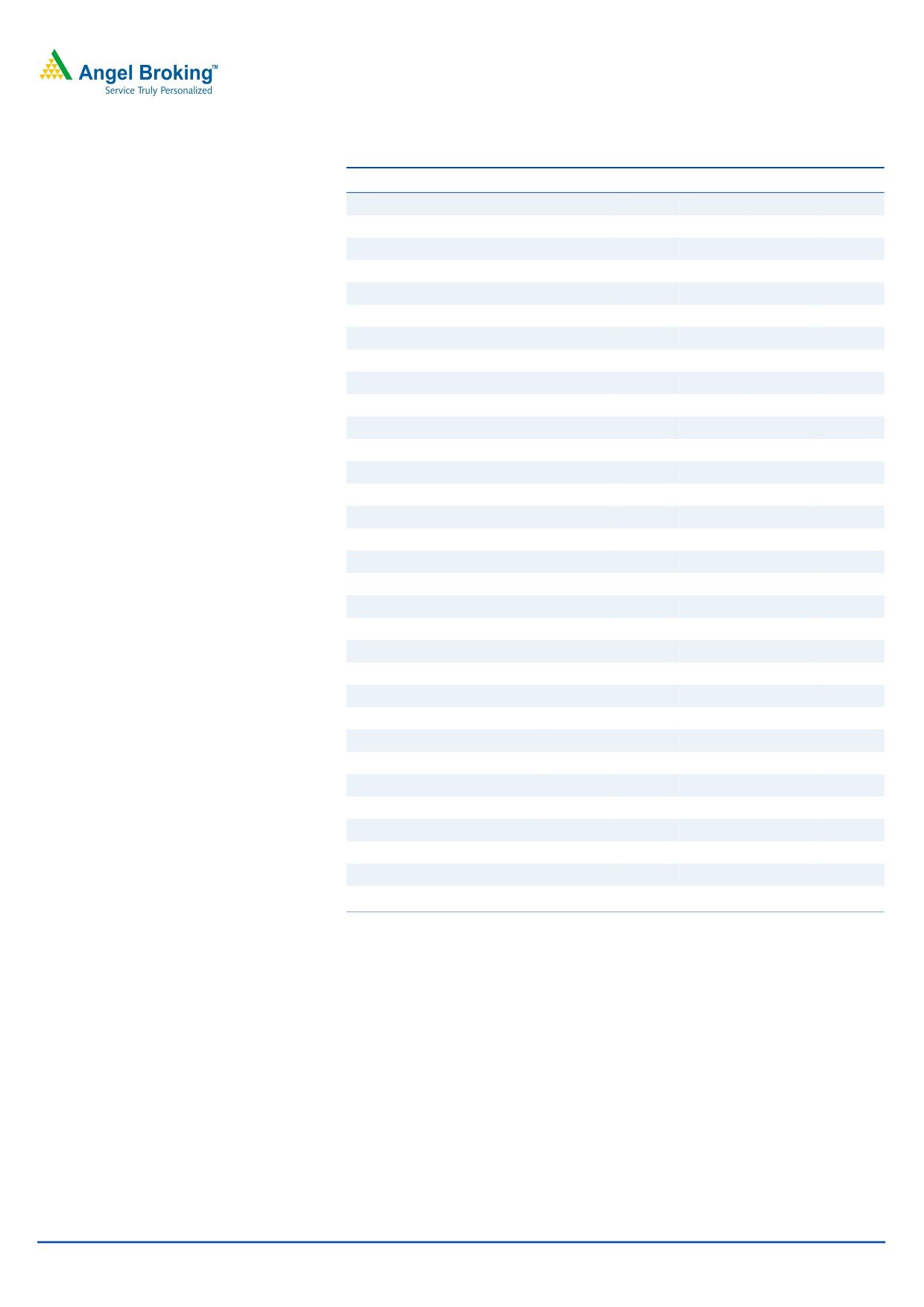

Exhibit 13: Revenue per employee rising despite wage inflation

(` lakh)

30

26.3

24.8

23.1

25

19.4

20

15

9.8

9.6

8.7

10

7.7

7.2

7.4

4.1

4.8

5

0

CY2006

CY2007

CY2008

CY2009

Revenue/Employee Staff expense/Employee Profit/Employee

Source: Company, Angel Research

January 10, 2010

11

CRISIL | Initiating coverage

Financial overview

In CY2009, CRISIL registered mediocre growth of 4.4% yoy in revenue, largely due

to the slowdown in capital expenditure during the economic downturn. However,

on the back of a revival in the economy, the company registered robust 16% yoy

growth in revenue for 9MCY2009 to `453.7cr from `391.7cr, aided by strong

growth in the credit rating and research segments.

For 4QCY2010E, we expect strong growth across all segments as the economy is

back on track, with an estimated GDP growth of around 8.5%. For CY2010, we

expect strong top-line growth of `91cr (17%) yoy to `629cr compared to `537cr in

CY2009, largely due to strong growth in the credit rating and research segments,

which are expected to post 22% and 20% yoy growth, respectively. Further, we

expect all segments to register strong growth on the back of robust credit demand,

acquisition of Pipal and strong infrastructure spend in the coming years.

Going ahead, we expect the company's top line to register a 21.5% CAGR over

CY2010-12E, increasing to `767cr in CY2011 and `927cr in CY2012.

Exhibit 14: Strong turnaround in growth due to economic recovery

(` cr)

(%)

1,000

45

900

40

800

35

700

427

30

600

352

25

500

286

75

20

400

226

238

62

168

51

15

300

60

100

10

200

425

107

353

292

239

5

100

189

130

0

0

CY07

CY08

CY09

CY10E

CY11E

CY12E

Rating

Advisory

Research

Total Revenue Growth

Source: Company, Angel Research

EBITDA margins to remain in line

During CY2009, CRISIL’s operating margin improved to 37.1% (34.8%), largely on

the back of cost cutting, which resulted in other expenses coming down to 14% of

revenue in CY2009 versus 18% in CY2008. However, for 9MCY2010, the

operating margin reduced marginally by 4.3% to 32.8% yoy due to higher

employee cost and other expenses, which included forex losses of `7.3cr for

9MCY2010.

CRISIL’s margins, which took a hit in the first two quarters of CY2010, improved to

35.3% in 3QCY2010 due to lower other expenses. For 4QCY2010E, we believe

the company’s EBITDA margin will be at around 34.4%. For CY2010E, we

estimate EBITDA margin of 33.3%, which is expected to come back to its CY2008

levels going ahead and gradually increase to 34.3% and 34.8% in CY2011E and

CY2012E, respectively. EBITDA is estimated to increase from `199cr in CY2009 to

`323cr in FY2012E on the back of strong revenue growth.

January 10, 2010

12

CRISIL | Initiating coverage

Exhibit 15: EBITDA margins expected to remain stable

(` cr)

(%)

350

37.1

40

34.8

34.3

34.8

33.3

300

35

30

250

25

200

20

323

150

263

15

100

199

209

179

10

50

5

0

0

CY08

CY09

CY10E

CY11E

CY12E

EBITDA

Margin

Source: Company, Angel Research

Net profit to register 15% CAGR over CY2009-12E

In CY2009 CRISIL's net profit margin increased by 261bp to 29.9% (27.3%),

primarily because of higher operating margins. For CY2010, we estimate net profit

margin to increase substantially to 32.1% (29.9%) on the back of higher other

income arising from sale of property and investments. For 9MCY2010, net profit

surged 32.6% yoy to `155cr from `117cr due to the 306% yoy spike in other

income. Thus, in CY2010 net profit is expected to increase to `202cr from `161cr

in CY2009.

CRISIL derives a major part of its revenue from exports, which is tax-exempted till

FY2011 under the Software Technology Parks of India’s (STPI) regulations. Going

ahead, this exemption will seize and, thus, the company has started taking

necessary steps such as transferring business to its existing SEZ units, where the

company can continue to avail tax exemption. Management has guided that tax

exemption may be extended till FY2012 under the STPI. If tax exemptions under the

STPI are not extended till FY2012, we expect the company’s tax rate to increase by

~2% in CY2012. For CY2011 and CY2012, we estimate net profit margin to

decline to 26.1% and 26.4% to `200cr and `245cr, respectively, due to lower

other income in CY2011 and CY2012 and higher tax rate in CY2012.

January 10, 2010

13

CRISIL | Initiating coverage

Exhibit 16: PAT margins to come back to historical levels

(` cr)

(%)

300

32.1

35.0

29.9

27.3

26.4

30.0

250

26.1

25.0

200

20.0

150

15.0

100

10.0

50

5.0

141

161

202

200

245

-

-

CY08

CY09

CY10E

CY11E

CY12E

PAT

Margin

Source: Company, Angel Research

January 10, 2010

14

CRISIL | Initiating coverage

Company background

CRISIL was incorporated in 1987 as India’s first credit rating agency. Over the

years, the company has evolved to become the industry leader with a market share

of around 65% and has diversified into research and infrastructure risk and policy

advisory services. The company is currently one of the largest research houses in

the country, providing research to over 65 industries and 150 corporates in India.

The company also provides high-end offshore research and analytical services

mainly to top financial institutions (including six of the world’s top 10 investment

banks), insurance companies and asset management firms.

Credit rating segment

CRISIL is the largest credit rating agency in India. CRISIL pioneered ratings in India

more than 20 years ago and is today the undisputed business leader, with the

largest number of rated entities and products. Over the years, CRISIL has also

developed several structured ratings for multinational entities based on guarantees

from the parent as well as standby letter of credit arrangements from bankers. The

rating agency has also developed a methodology for credit enhancement of

corporate borrowing programmes through the use of partial guarantees. CRISIL is

uniquely placed in its experience in understanding the extent of credit

enhancement arising out of such structures. CRISIL’s comprehensive offerings

include ratings for long-term instruments such as debentures/bonds and

preference shares, structured obligations (including asset-backed securities) and

fixed deposits. The company also rates short-term instruments such as commercial

paper programmes and short-term deposits.

Bank Loan Ratings (Basel II)

CRISIL commenced rating bank loans post the RBI’s guidelines on capital

adequacy for banks in 2007. Basel II guidelines, as they are called, require banks

to provide capital on credit exposure as per credit ratings assigned by approved

external credit assessment institutions (ECAIs), such as CRISIL. Basel II is a

recommendatory framework for banking supervision issued by the Basel

Committee on Banking Supervision in June 2004. The objective of Basel II is to

bring about international convergence of capital measurement and standards in

the banking system. The revised framework for capital adequacy has been effective

from March 31, 2008, for all Indian banks with an operational presence outside

India (12 public sector banks and five private sector banks) and for all foreign

banks operating in India. It has been applicable to all other commercial banks

(except local area banks and regional rural banks) from March 31, 2009.

CRISIL rates the maximum number of companies for their bank loans in India. As

of September 30, 2010, CRISIL had rated 5,017 entities, representing over 50% of

all the companies, which have their bank loans rated in India; CRISIL has rated

bank facilities of all types: term loans, project loans, corporate loans, general

purpose loans, working capital demand loans, cash credit facilities and non-fund-

based facilities, such as letters of credit and bank guarantees.

January 10, 2010

15

CRISIL | Initiating coverage

Exhibit 17: Distribution of Bank Loan Ratings by loan size

Loan Size

No. of ratings upto

% of total

No. of ratings upto

% of total

(` cr)

1QCY2009

2008

1QCY2010

2009

<10

70

5

503

13

10-25

270

19

1,232

32

25-50

234

17

764

20

50-250

553

40

977

26

250-500

112

8

161

4

>500

161

12

188

5

Total

1,400

100

3,825

100

Source: Company, Angel Research, Data available only till 1QCY2010, 5017 entities rated till

3QCY2010.

SME Ratings

CRISIL pioneered the concept of ratings for the SME sector in India and, presently,

within a span of just five years, has the largest number of ratings on the SME sector

in the world. As of September 30, 2010, CRISIL had assigned ratings to over

14,500 SMEs. CRISIL's SME ratings are affordable and tailor-made services

designed for SMEs.

Real Estate Ratings

Housing and real estate form the backbone of the country's infrastructure and are

critical drivers of economic development. With government policies emphasising

faster economic growth, the real estate sector is attracting large investments from

both domestic and foreign investors. Investors and customers, however, need to

exercise caution in their exposure, as the sector is largely unorganised.

Given the risk factors and volatility inherent in the real estate business, it is critical

to judge the performance ability of developers to deliver good quality projects.

Towards this end, CRISIL provides third-party opinion through two specialised

products: National Developer Ratings and Real Estate Star Ratings.

Research

CRISIL Research: CRISIL’s research segment is India’s leading independent,

integrated research house. Through constant innovation and comprehensive

research offerings covering the economy, industry and companies, CRISIL Research

meets the requirements of more than 750 Indian and global clients. Apart from

off-the-shelf research reports, CRISIL provides incisive, customised research.

Through its IPO grading initiative, CRISIL Research has also established a presence

in the equity research domain and is poised to significantly expand its presence in

this area.

Outsourcing (Irevna and Pipal): CRISIL’s outsourcing department consists of Irevna

and the recently acquired Pipal. Irevna was one of the pioneers of offshore

investment research for some of the world’s leading investment banks and

financial institutions. It is one of the most experienced and diversified provider of

analytical services to the financial services industry, supporting equity research,

equity strategy, credit research, securitisation research, and derivatives IT and

January 10, 2010

16

CRISIL | Initiating coverage

structuring. Irevna has offices across the world in the US, the UK, Poland,

Argentina and Hong Kong and its Indian offices are at Mumbai and Chennai.

Pipal is a leading custom research firm, delivering financial and business research

and quantitative analytics to organisations worldwide. Founded in 2001 by a team

of management professionals, Pipal created a name for itself as a knowledge

vendor of choice.

January 10, 2010

17

CRISIL | Initiating coverage

Advisory

CRISIL Infrastructure Advisory: CRISIL’s infrastructure advisory segment provides

practical and innovative solutions to governments, donor-funded agencies and

leading organisations in over 20 emerging economies across the world. It has

widely acknowledged policy advisory expertise and specialises in commercial and

contractual issues in the areas of energy, urban infrastructure and public-private

partnerships. CRISIL Infrastructure Advisory has built a unique position for itself in

these domains and is the preferred consultant to governments, multilateral lending

agencies and private sector clients.

CRISIL Risk: This segment provides risk solutions for banks, financial institutions,

mutual funds and corporates. It also provides risk management services,

consulting and software products in the areas of credit, market and operational

risk. It partners closely with leading public and private sector banks and entities in

the financial services and insurance sectors, implementing enterprise-wide risk

management solutions.

January 10, 2010

18

CRISIL | Initiating coverage

Profit & Loss Statement (Consolidated)

Y/E Dec.

CY2008

CY2009

CY2010E

CY2011E

CY2012E

Net Sales

515

537

629

767

927

% chg

27.3

4.4

17.0

22.0

20.0

Total Expenditure

335

338

419

504

605

Establishment Expenses

52

55

64

78

92

Other Expenses

93

75

94

115

138

Personnel

191

208

261

311

375

EBITDA

179

199

209

263

323

% chg

52.8

11.3

5.0

25.7

22.7

(% of Net Sales)

34.8

37.1

33.3

34.3

34.8

Depreciation& Amortisation

14

15

21

24

26

EBIT

165

184

188

239

297

% chg

63.0

11.5

1.9

27.0

24.4

(% of Net Sales)

32.1

34.3

29.9

31.1

32.0

Interest & other Charges

-

-

-

-

-

Other Income

22

23

72

20

27

(% of PBT)

11.6

11.1

27.8

7.6

8.3

Recurring PBT

187

207

260

258

324

% chg

69.1

10.9

25.4

(0.8)

25.5

PBT (reported)

187

207

260

258

324

Tax

46

47

59

58

79

(% of PBT)

24.8

22.5

22.5

22.5

24.5

PAT (reported)

141

161

202

200

245

% chg

68.0

14.4

25.4

(0.8)

22.3

Prior period items

-

-

-

-

-

PAT after MI (reported)

141

161

202

200

245

Extraordinary Income (post tax)

-

-

45

-

-

ADJ. PAT

141

161

157

200

245

% chg

68.0

14.4

(2.5)

27.7

22.3

(% of Net Sales)

27.3

29.9

24.9

26.1

26.4

Basic EPS (Rs)

194.6

222.5

284.2

282.0

344.7

Fully Diluted EPS (Rs)

194.6

222.5

284.2

282.0

344.7

% chg

68.0

14.4

27.7

(0.8)

22.3

January 10, 2010

19

CRISIL | Initiating coverage

Balance Sheet (Consolidated)

Y/E Dec.

CY2008 CY2009 CY2010E CY2011E CY2012E

SOURCES OF FUNDS

Equity Share Capital

7.2

7.2

7.1

7.1

7.1

Reserves& Surplus

350

427

401

476

555

Shareholders Funds

358

434

408

483

562

Total Loans

-

-

-

-

-

Deferred Tax Liability

-

-

-

-

-

Total Liabilities

358

434

408

483

562

APPLICATION OF FUNDS

Gross Block

190

192

300

324

330

Less: Acc. Depreciation

64

72

93

118

143

Net Block

126

120

207

206

187

Capital Work-in-Progress

4

64

14

-

-

Investments

118

118

118

118

118

Current Assets

261

323

255

370

507

Cash

129

158

64

142

242

Loans & Advances

53

62

68

75

82

Other Current Assets

2

11

12

12

13

Debtors

77

92

112

141

170

Other

-

-

-

-

-

Current liabilities

160

200

195

221

260

Net Current Assets

101

122

60

150

247

DEFERRED TAX ASSETS (Net)

8

10

10

10

10

Total Assets

358

434

408

483

562

January 10, 2010

20

CRISIL | Initiating coverage

Cash Flow (Consolidated)

Y/E Dec.

CY2008 CY2009 CY2010E CY2011E CY2012E

Profit before tax

187

207

260

258

324

Depreciation

14

15

21

24

26

Change in Working Capital

36

16

(25)

(4)

9

Less: Other income

22

23

72

20

27

Direct taxes paid

46

47

59

58

79

Cash Flow from Operations

169

169

126

201

253

Inc./ (Dec.) in Fixed Assets

0

(62)

(58)

(10)

(6)

Inc./ (Dec.) in Investments

(21)

1

-

-

-

Inc./ (Dec.) in loans and advances

(12)

(9)

(6)

(7)

(7)

Other income

22

23

72

20

27

Cash Flow from Investing

(11)

(47)

8

3

13

Issue/(Buy Back) of Equity

-

-

(79)

-

-

Inc./(Dec.) in loans

-

-

-

-

-

Dividend Paid (Incl. Tax)

(59)

(85)

(148)

(125)

(166)

Others

(12)

(9)

-

-

-

Cash Flow from Financing

(71)

(93)

(227)

(125)

(166)

Inc./(Dec.) in Cash

87

28

(94)

79

100

Opening Cash balances

42

129

158

64

142

Closing Cash balances

129

158

64

142

242

January 10, 2010

21

CRISIL | Initiating coverage

Key Ratios

Y/E Dec.

CY2008 CY2009

CY2010E CY2011E

CY2012E

Valuation Ratio (x)

P/E (on FDEPS)

30.7

26.9

21.0

21.2

17.3

P/BV

12.1

10.0

10.4

8.8

7.6

Dividend yield (%)

1.2

1.7

2.9

2.5

3.3

Market cap. / Sales

8.2

7.9

6.7

5.5

4.6

EV/Sales

8.0

7.6

6.6

5.3

4.3

EV/EBITDA

23.0

20.5

20.0

15.6

12.4

EV / Total Assets

11.5

9.4

10.2

8.5

7.1

Per Share Data (Rs)

EPS (Basic)

194.6

222.5

284.2

282.0

344.7

EPS (fully diluted)

194.6

222.5

284.2

282.0

344.7

Cash EPS

213.4

243.1

314.3

316.3

380.9

DPS

70.0

100.0

175.0

150.0

200.0

Book Value

494.8

600.4

574.9

681.3

791.8

Dupont Analysis (%)

EBIT margin

32.1

34.3

29.9

31.1

32.0

Tax retention ratio

75.2

77.5

77.5

77.5

75.5

Asset turnover (x)

4.2

4.0

3.3

3.4

4.4

ROIC (Post-tax)

100.9

106.4

75.5

82.1

105.2

Operating ROE

100.9

106.4

75.5

82.1

105.2

Returns (%)

ROCE (Pre-tax)

52.2

46.6

44.6

53.6

56.8

Angel ROIC (Pre-tax)

141.2

183.6

122.0

109.4

139.4

ROE

44.3

40.6

47.9

44.9

46.8

Turnover ratios (x)

Asset Turnover (Gross Block)

2.7

2.8

2.6

2.5

2.8

Asset Turnover (Net Block)

4.0

4.4

3.8

3.7

4.7

Asset Turnover (Total Assets)

1.6

1.4

1.5

1.7

1.8

Operating Income / Invested Capital

4.2

4.0

3.3

3.4

4.4

Receivables (days)

59

58

59

60

61

Payables (days)

104

122

115

99

95

Working capital cycle (ex-cash) (days)

(11)

(21)

(11)

1

2

January 10, 2010

22

CRISIL | Initiating coverage

Research Team Tel: 022 - 39357800

DISCLAIMER

This document is solely for the personal information of the recipient, and must not be singularly used as the basis of any investment

decision. Nothing in this document should be construed as investment or financial advice. Each recipient of this document should make

such investigations as they deem necessary to arrive at an independent evaluation of an investment in the securities of the companies

referred to in this document (including the merits and risks involved), and should consult their own advisors to determine the merits and

risks of such an investment.

Angel Broking Limited, its affiliates, directors, its proprietary trading and investment businesses may, from time to time, make

investment decisions that are inconsistent with or contradictory to the recommendations expressed herein. The views contained in this

document are those of the analyst, and the company may or may not subscribe to all the views expressed within.

Reports based on technical and derivative analysis center on studying charts of a stock's price movement, outstanding positions and

trading volume, as opposed to focusing on a company's fundamentals and, as such, may not match with a report on a company's

fundamentals.

The information in this document has been printed on the basis of publicly available information, internal data and other reliable

sources believed to be true, but we do not represent that it is accurate or complete and it should not be relied on as such, as this

document is for general guidance only. Angel Broking Limited or any of its affiliates/ group companies shall not be in any way

responsible for any loss or damage that may arise to any person from any inadvertent error in the information contained in this report.

Angel Broking Limited has not independently verified all the information contained within this document. Accordingly, we cannot testify,

nor make any representation or warranty, express or implied, to the accuracy, contents or data contained within this document. While

Angel Broking Limited endeavours to update on a reasonable basis the information discussed in this material, there may be regulatory,

compliance, or other reasons that prevent us from doing so.

This document is being supplied to you solely for your information, and its contents, information or data may not be reproduced,

redistributed or passed on, directly or indirectly.

Angel Broking Limited and its affiliates may seek to provide or have engaged in providing corporate finance, investment banking or

other advisory services in a merger or specific transaction to the companies referred to in this report, as on the date of this report or in

the past.

Neither Angel Broking Limited, nor its directors, employees or affiliates shall be liable for any loss or damage that may arise from or in

connection with the use of this information.

Note: Please refer to the important `Stock Holding Disclosure' report on the Angel website (Research Section). Also, please

refer to the latest update on respective stocks for the disclosure status in respect of those stocks. Angel Broking Limited and

Disclosure of Interest Statement

Crisil

1. Analyst ownership of the stock

No

2. Angel and its Group companies ownership of the stock

No

3. Angel and its Group companies' Directors ownership of the stock

No

4. Broking relationship with company covered

No

Note: We have not considered any Exposure below `1 lakh for Angel, its Group companies and Directors.

Ratings (Returns) :

Buy (> 15%)

Accumulate (5% to 15%)

Neutral (-5 to 5%)

Reduce (-5% to 15%)

Sell (< -15%)

January 10, 2010

23

CRISIL | Initiating coverage

6th Floor, Ackruti Star, Central Road, MIDC, Andheri (E), Mumbai- 400 093.

Tel: (022) 39357800

Research Team

Fundamental:

Sarabjit Kour Nangra

VP-Research, Pharmaceutical

Vaibhav Agrawal

VP-Research, Banking

Vaishali Jajoo

Automobile

Shailesh Kanani

Infrastructure

Rupesh Sankhe

Cement, Power

Param Desai

Real Estate, Logistics, Shipping

Sageraj Bariya

Fertiliser, Mid-cap

Paresh Jain

Metals & Mining

John Perinchery

Capital Goods

Srishti Anand

IT, Telecom

Jai Sharda

Mid-cap

Sharan Lillaney

Mid-cap

Naitik Mody

Mid-cap

Chitrangda Kapur

FMCG, Media

Amit Vora

Research Associate (Oil & Gas)

V Srinivasan

Research Associate (Cement, Power)

Mihir Salot

Research Associate (Logistics, Shipping)

Pooja Jain

Research Associate (Metals & Mining)

Yaresh Kothari

Research Associate (Automobile)

Shrinivas Bhutda

Research Associate (Banking)

Sreekanth P.V.S

Research Associate (FMCG, Media)

Hemang Thaker

Research Associate (Capital Goods)

Nitin Arora

Research Associate (Infra, Real Estate)

Ankita Somani

Research Associate (IT, Telecom)

Varun Varma

Research Associate (Banking)

Vasant Lohiya

Research Associate (Banking)

Technicals:

Shardul Kulkarni

Sr. Technical Analyst

Mileen Vasudeo

Technical Analyst

Derivatives:

Siddarth Bhamre

Head - Derivatives

Jaya Agarwal

Derivative Analyst

Institutional Sales Team:

Mayuresh Joshi

VP - Institutional Sales

Abhimanyu Sofat

AVP - Institutional Sales

Pranav Modi

Sr. Manager

Ganesh Iyer

Sr. Manager

Jay Harsora

Manager

Meenakshi Chavan

Dealer

Gaurang Tisani

Dealer

Production Team:

Bharathi Shetty

Research Editor

Simran Kaur

Research Editor

Bharat Patil

Production

Dilip Patel

Production

Angel Broking Ltd: BSE Sebi Regn No : INB 010996539 / CDSL Regn No: IN - DP - CDSL - 234 - 2004 / PMS Regn Code: PM/INP000001546 Angel Securities Ltd:BSE: INB010994639/INF010994639 NSE: INB230994635/INF230994635 Membership numbers: BSE 028/NSE:09946

Angel Capital & Debt Market Ltd: INB 231279838 / NSE FNO: INF 231279838 / NSE Member code -12798 Angel Commodities Broking (P) Ltd: MCX Member ID: 12685 / FMC Regn No: MCX / TCM / CORP / 0037 NCDEX : Member ID 00220 / FMC Regn No: NCDEX / TCM / CORP / 0302

January 10, 2010

24