Advisory Desk

May 16, 2012

Cravatex

BUY

Cravatex Ltd. (Cravatex) is a market leader in providing fitness equipment

CMP

`655

distribution under its brand Proline Fitness and represents the 100-year old Italian

Target Price

`800

brand, FILA, in India. Cravatex has recently acquired sub-license to distribute the

Investment Period

12 Months

products of FILA in the United Kingdom (UK) and Ireland. The company has also

been forming strategic partnerships with various health club chains in India such as

Talwalkars and Gold Gym in the fitness equipment segment. Cravatex is trading at

an attractive 9.8x PE and 0.5x EV/Sales on FY2014E. We recommend Buy on

Cravatex with a target price of `800, based on target PE of 12x and implied

EV/Sales of 0.6x for FY2014E

Investment rationale

Strategic partnership and organic growth to drive 45% growth

Owing to robust organic growth and strategic partnerships the net revenue for the

fitness equipment segment is expected to grow at 45% CAGR over FY2011-14E.

Cravatex is a market leader in fitness equipment distribution and operates through

a wide network of 51 retail stores across India. The company has recently entered

into strategic partnership with reputed health club chains in India such as

Talwalkars and Gold Gym to provide them with high-quality equipment and

customer service.

Sportswear segment to grow at 67% CAGR

On the back of acquisition of subsidiary, M/s BB (UK) Ltd, Cravatex aims to acquire

sub-license for certain distribution channels for FILA in the UK and Ireland. The

subsidiary will design, develop and supply FILA apparel to other markets in Europe.

The acquisition is expected to deliver potential annual revenue of around £10mn

for the next two years. Overall revenue from the sportswear segment is therefore

expected to grow at CAGR of 67% over FY2011-14E.

Strong parentage of FILA

FILA is a 100-year old Italian sportswear brand with a strong parentage in sports

apparel, sports accessories and sports footwear industry. The brand plans to set up

60-70 stores across India by 2014. FILA has plans to be present in almost all large

retail formats such as Shoppers Stop, Westside and Lifestyle. Kim Clijsters, US open

singles champion is the brand ambassador for FILA.

Outlook and valuation

Cravatex’ net revenue is expected to grow at a 58% CAGR over FY2011-14E.

EBITDA for the company is expected to grow from `6.9cr in FY2011 to `21cr in

FY2014E, at a 45% CAGR. Net profit of the company is expected to grow from

`6.4cr in FY2011 to `17.2cr in FY2014E. At the CMP of `655, the stock is trading

at PE of 9.8x and EV/Sales of 0.5x of FY2014E. We recommend Buy on Cravatex

with a target price of `800, offering an upside of 22% from current levels.

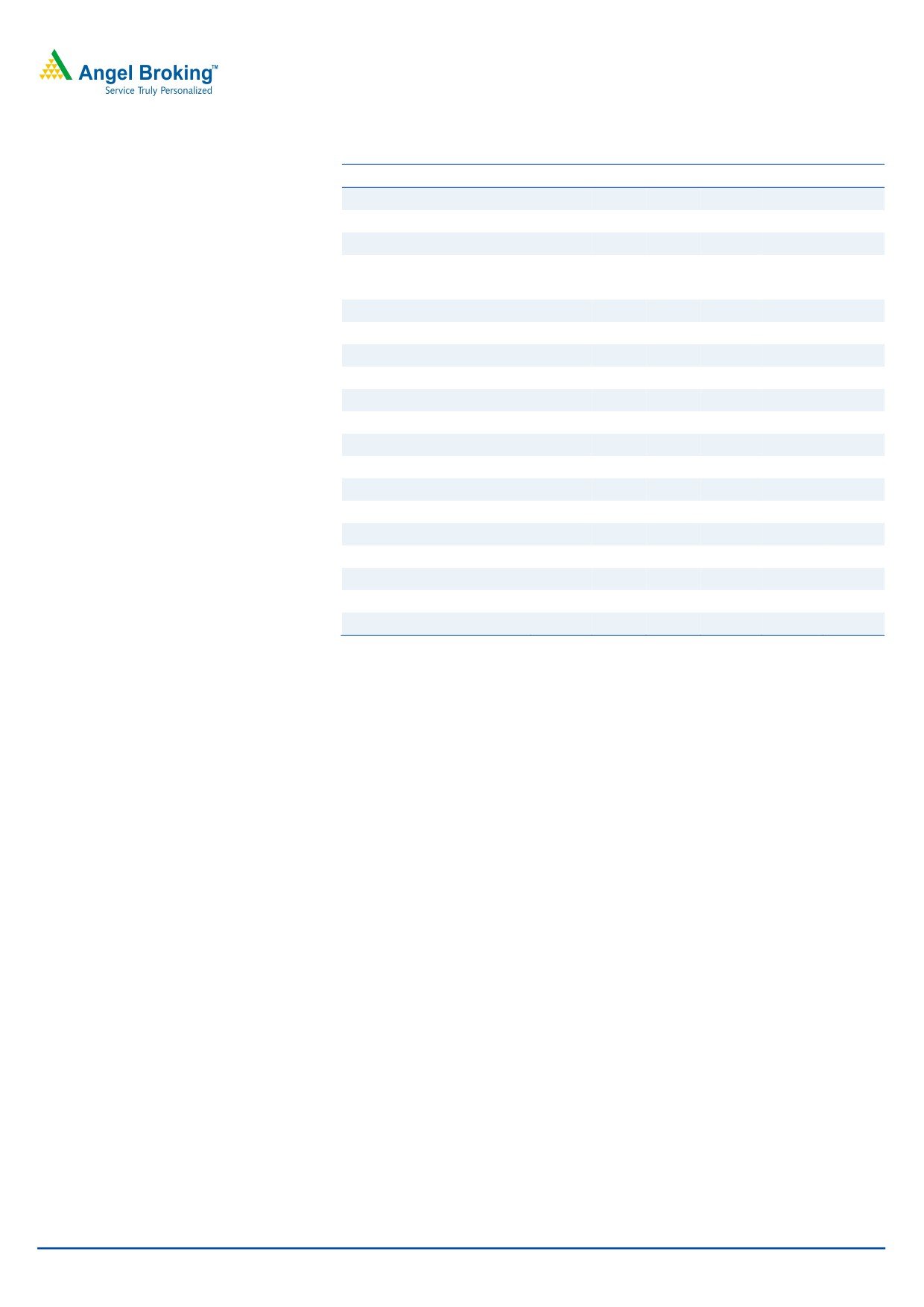

Key financials

Cravatex Net sales OPM PAT

EPS ROIC

P/E P/BV EV/ EBITDA EV/ Sales

(` cr)

(%)

(` cr)

(`)

(%)

(x)

(x)

(x)

(x)

FY2011

93

7.4

6

25

15

26.5

7.1

27.1

2.0

FY2012E

230

5.7

9

36

21

18.1

5.3

14.7

0.8

FY2013E

301

4.3

11

42

18

15.5

4.0

14.9

0.6

Twinkle Gosar

Tel: 022- 3935 7800 Ext: 6848

FY2014E

361

5.8

17

67

24

9.8

2.9

9.1

0.5

Source: Company, Angel Research

Please refer to important disclosures at the end of this report

1

Advisory Desk

Cravatex

Investment arguments

Strategic partnership and organic growth to drive 45% growth

Cravatex is a market leader in fitness equipment distribution through its brand

Proline Fitness. The company distributes products of Johnson Health Tech, the third

largest fitness company in the world. Cravatex operates through a wide network of

51 retail stores across India.

The company has recently entered into strategic partnership with reputed health

club chains in India such as Talwalkars and Gold Gym to provide them with high-

quality equipment and customer service. Talwalkars’ expectation of around 30%

growth in its business provides growth visibility for Cravatex.

Owing to robust organic growth and strategic partnerships the net revenue for the

fitness equipment segment is expected to grow at 45% CAGR over FY2011-14E.

Healthy lifestyle and underpenetration provide growth visibility

The base for people using fitness equipment or enrolling for fitness programs is

expanding rapidly, with an increase in the standard of living of people and

increased awareness about fitness.

In 2010, ~39% of India’s total population of 1.2bn was in the 20-44 years age

group. According to Planning Commission of India, the country’s population is

expected to increase to 1.3bn by 2020. Thus, the company will also have a

significant base of potential consumers - even if a modest 1% of the country’s

population aged 20-44 years is concerned about fitness.

The Indian fitness industry is highly underpenetrated compared to developed

countries, with only 0.4% population compared to 16% in the US possessing

membership in fitness clubs in 2008 (as per The IHRSA Asia Pacific Market Report

2008). This provides a potential opportunity to the company.

Increased urban disposable income

According to Mckinsey Global Institute’s recent research study, India’s urban

population is expected to rise from 340mn in 2008 to 590 mn in 2030,

urbanization rate of 40% (lower than seen in most Asian countries due to strict

definition of Indian Census).The average household disposable income in urban

areas is expected to grow at CAGR of 6.4% from ~`60,000 in 2008 to

~`239,000 in

2030 with an overall growth rate of

6.1% to

~`136,000

considering the GDP growth rate of 7.4%. Thus, with such a rise in disposable

income it provides strong growth visibility for the company’s fitness segment.

Sportswear segment to grow at 67% CAGR

Cravatex has acquired 100% of M/s BB (UK) Ltd., which is its wholly owned

subsidiary with effect from February 2011. Through this subsidiary, Cravatex aims

to acquire sub-license for certain distribution channels for FILA in the UK and

Ireland. The subsidiary will design, develop and supply FILA apparel to other

markets in Europe. The acquisition is expected to deliver potential annual revenue

of around £10mn for the next two years. Overall revenue from the sportswear

segment is therefore expected to grow at CAGR of 67% over FY2011-14E.

May 16, 2012

2

Advisory Desk

Cravatex

Strong parentage of FILA

FILA is a 100-year old Italian sportswear brand with a strong parentage in sports

apparel, sports accessories and sports footwear industry. The brand plans to set up

60-70 stores across India by 2014. FILA has plans to be present in almost all large

retail formats such as Shoppers Stop, Westside and Lifestyle. Kim Clijsters, US open

singles champion is the brand ambassador for FILA.

Sports events to provide growth opportunities

The Indian sportswear industry is at a nascent stage with increasing organized

retail space. Increasing number of sports events and activities such as CWG and

IPL are also providing scope and growth opportunities for players in the industry.

Thus, on the back of mounting popularity of sports with increasing number of

events the sportswear industry is expected to grow at a CAGR 15% over 2011-14

as per the company’s estimation.

May 16, 2012

3

Advisory Desk

Cravatex

Financials

Key assumptions

Revenue from the sportswear segment is expected to grow at a CAGR of 67% over

FY2011-14E, owing to acquisition of the sub-license for distribution through

specified channels in the UK and Ireland. It is also expected that the retail-led

approach of FILA along with government’s reform to allow up to 51% FDI in the

retail sector will together enhance the company’s earnings.

In case of the fitness equipment segment, revenue is expected to grow at a CAGR

of 45% over FY2011-14E on the back of expansion plans of health club chains

such as Talwalkars and Gold Gym, with whom the company has signed strategic

partnerships. Also, Cravatex plans to expand its existing network of retail stores,

which will provide it greater visibility among retail consumers.

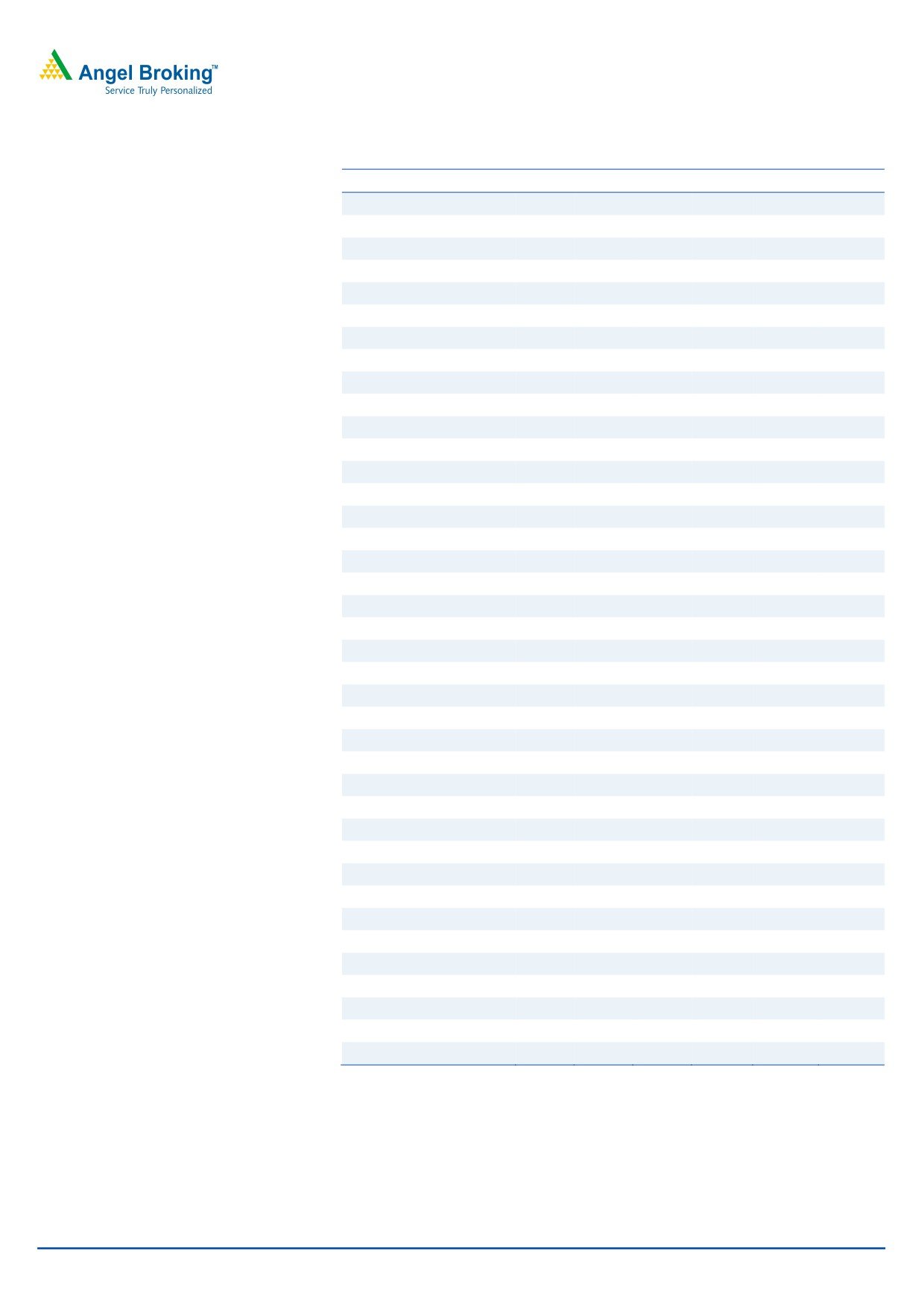

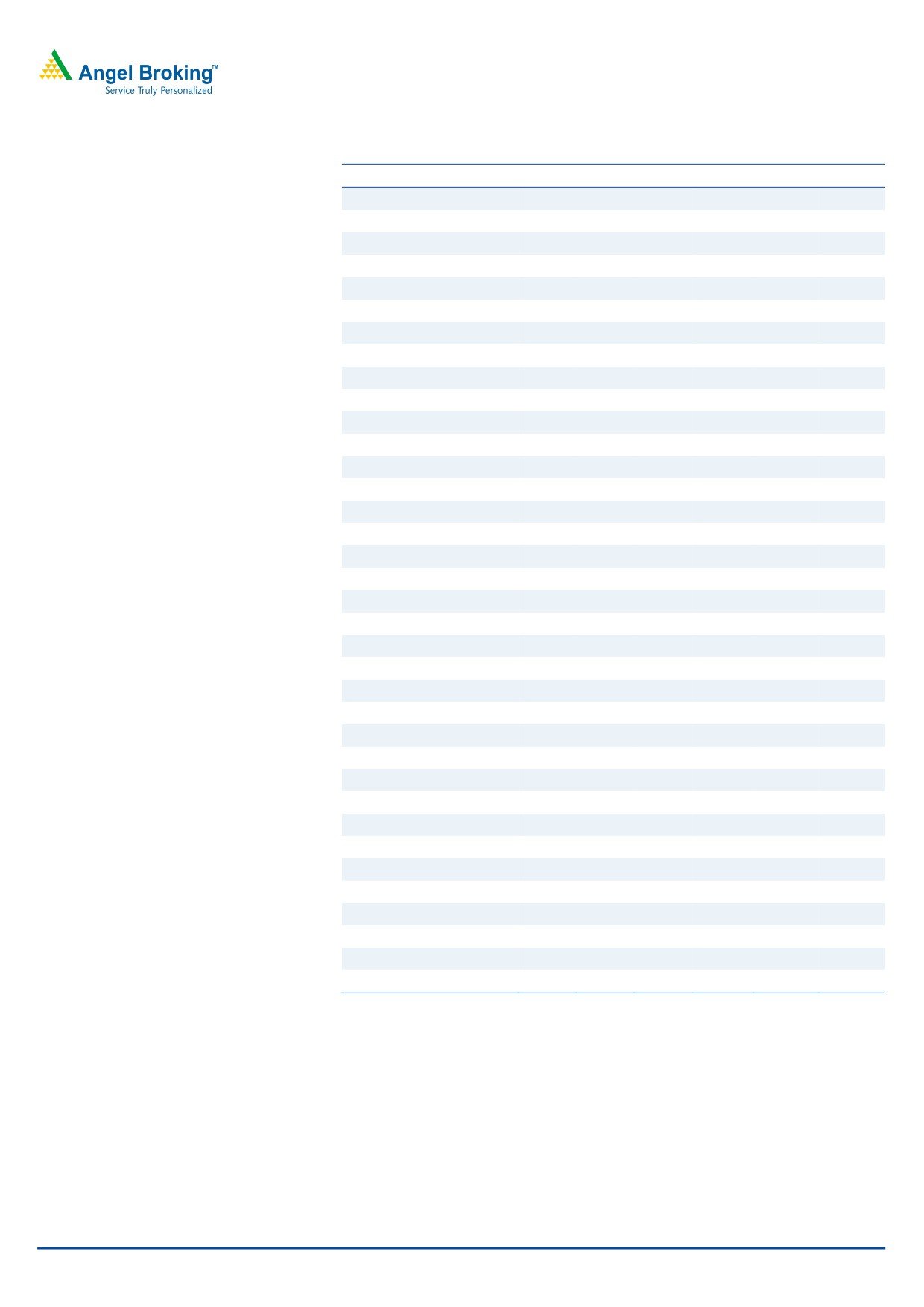

Exhibit 1: Key assumptions

Particulars

FY2010 FY2011 FY2012E FY2013E FY2014E

Total revenue growth (%)

32.2

58.4

148.5

30.7

20.2

Sportswear segment

Volume growth (%)

66.1

49.0

125.0

5.0

5.0

Change in price/unit (%)

49.5

33.4

22.2

33.4

14.3

Revenue growth (%)

148.2

98.8

175.0

40.0

20.0

Fitness equipment segment

Volume growth (%)

(10.2)

12.8

90.0

10.0

14.0

Change in price/unit (%)

5.1

7.9

10.5

7.3

7.9

Revenue growth (%)

(5.6)

21.7

110.0

18.0

23.0

Source: Angel Research

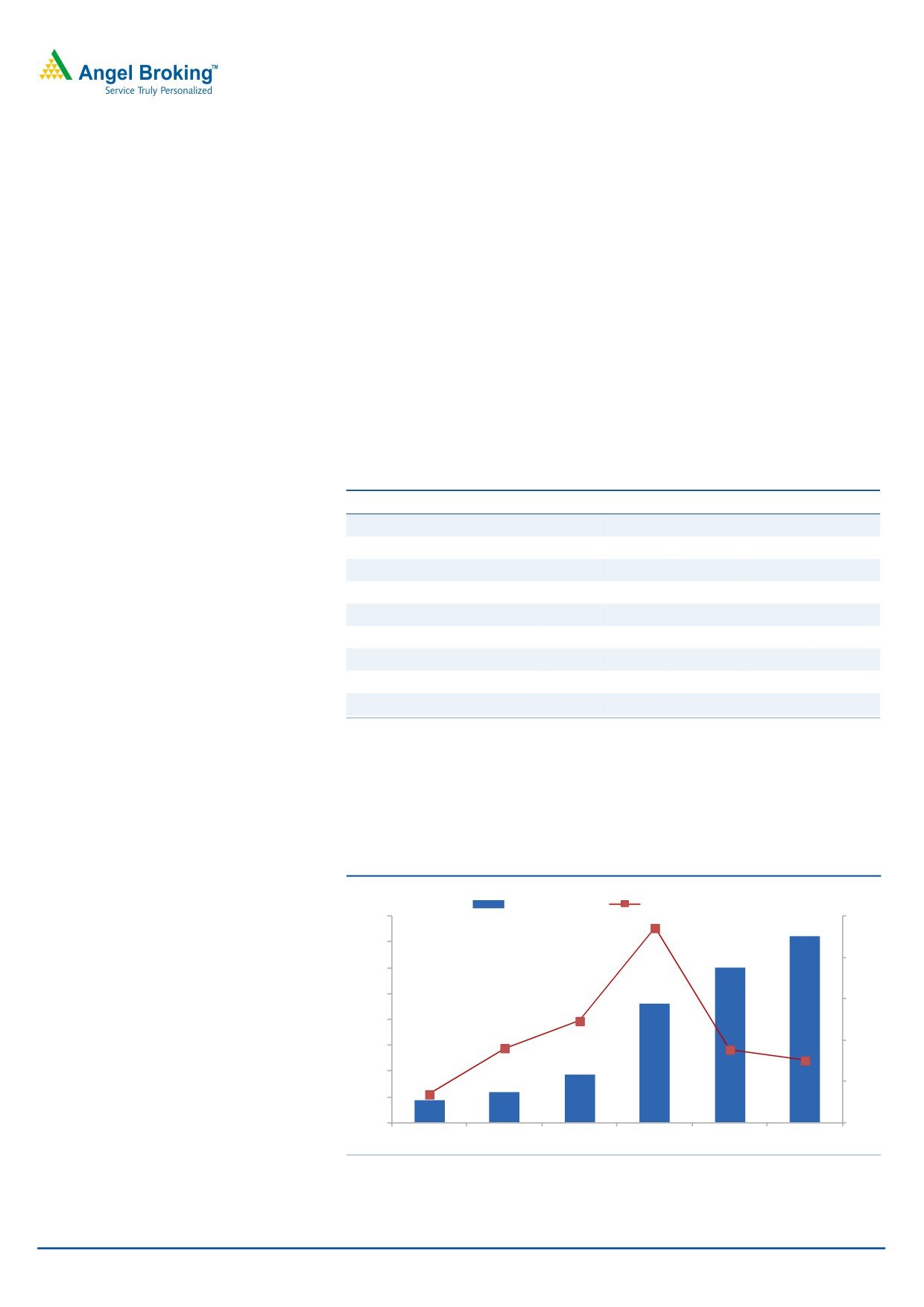

Net sales to grow at 58% CAGR over FY2011-14E

We expect the company’s net sales to register a CAGR of 58% over FY2011-14E,

increasing from `93cr in FY2011 to `361cr in FY2014E.

Exhibit 2: Net sales and net sales growth

(`cr)

(%)

Net sales (LHS)

Net sales growth (RHS)

400

160

350

120

300

250

80

200

40

150

100

0

50

0

(40)

FY2009

FY2010

FY2011

FY2012E FY2013E FY2014E

Source: Company, Angel Research

May 16, 2012

4

Advisory Desk

Cravatex

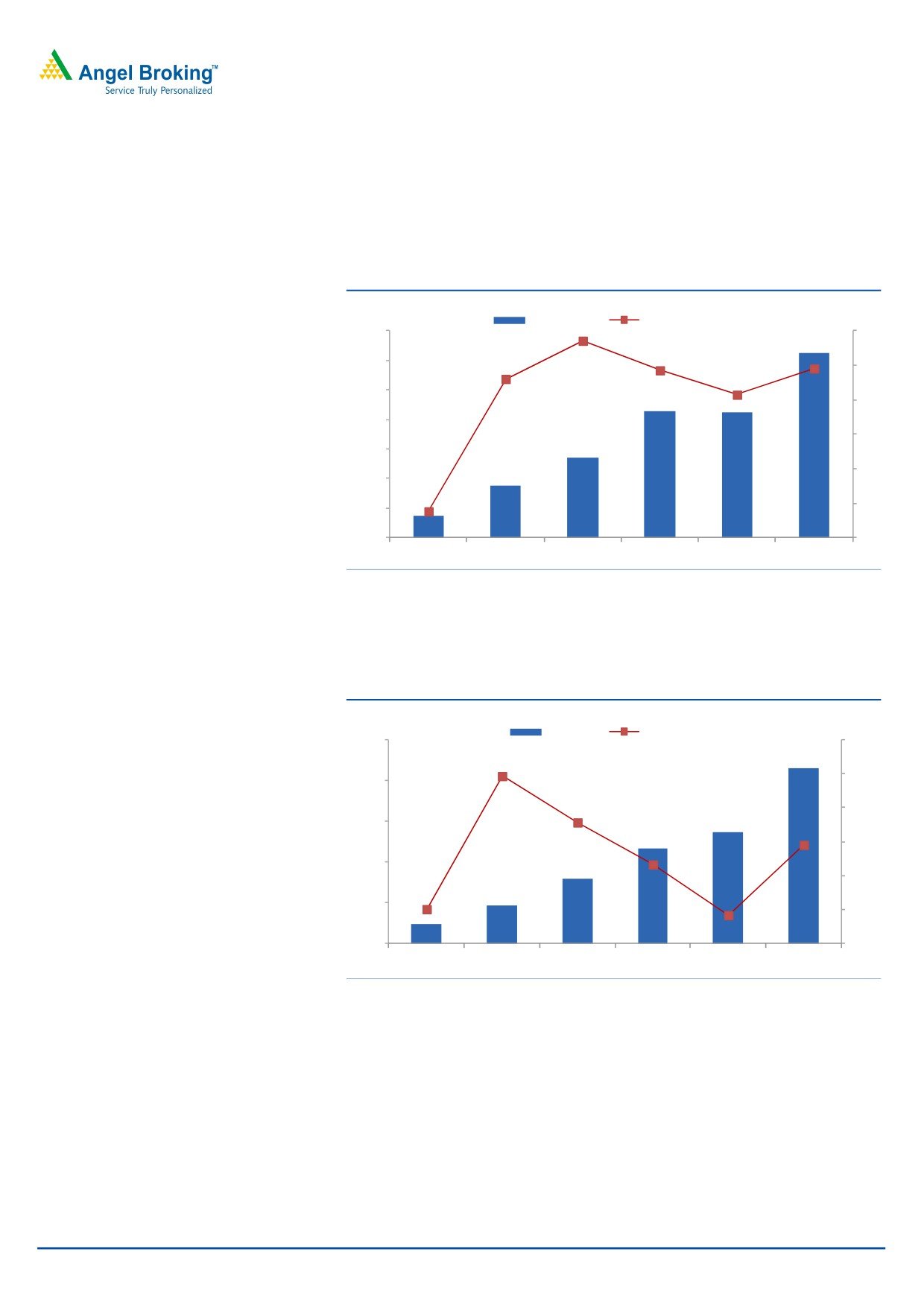

EBITDA to grow at a CAGR 45% over FY2011-14E

On the back of robust top-line growth of 58%, the company’s EBITDA is expected

to grow at a CAGR of 45% over FY2011-14E, from `6.9cr in FY2011 to `21cr in

FY2014E.

Exhibit 3: EBITDA and EBITDA margin

(` cr)

(%)

EBITDA (LHS)

EBITDA margin (RHS)

24

8

20

6

16

4

12

2

8

0

4

(2)

0

(4)

(4)

FY2009

FY2010

FY2011

FY2012E FY2013E FY2014E

Source: Company, Angel Research

Net profit of the company is expected to grow at a CAGR of

39% over

FY2011-14E, from `6.4cr in FY2011 to `17.2cr in FY2014E.

Exhibit 4: PAT and PAT growth

(` cr)

(%)

PAT (LHS)

PAT growth (RHS)

20

120

100

16

80

12

60

8

40

4

20

0

0

FY2009

FY2010

FY2011

FY2012E FY2013E FY2014E

Source: Company, Angel Research

May 16, 2012

5

Advisory Desk

Cravatex

Risks

High cost of equipment

India does not have quality equipment manufacturers due to which majority of the

equipment are been imported (largely from USA). The duty structure on imported

equipment is around 23%. Thus, considering the original cost of fitness equipment,

imports duty inflates their cost, which further leads to higher fixed cost for

consumers both individuals and institutions.

Euro slowdown

Subsidiary in UK which, Cravatex has recently acquired is expected to deliver

potential annual revenue of around £10mn for coming two years. This revenue

potential may be adversely impacted due to recent slowdown in Euro zone.

Currency Impact

Cravatex imports most of its equipment from outside country. Rupee depreciation

will make the imports expensive and increase the cost of acquiring the equipment.

High procurement cost will thereby impact the margins of the company.

Lack of government focus

Unlike most developed countries, the fitness equipment and sportswear sectors in

India lack industry status. Consequently, the government’s focus to enhance

awareness regarding fitness and sports-related products is quite low.

Inflation to impact growth

Rising inflation has caused the RBI to continue interest rate hikes and, thereby,

sacrifice growth to stabilize inflation. Higher inflation, rising interest rates and a

weak economic environment are expected to hold up consumers’ disposable

income and, thereby, impact growth.

May 16, 2012

6

Advisory Desk

Cravatex

Fitness equipment industry

The fitness equipment industry is witnessing significant growth as Indians are

increasingly becoming conscious about their health and fitness and since only a

fraction of urban India practices regular workout sessions. The industry is presently

estimated to reach `63.3bn by 2012 and grow by 25% for at least next five years

as quoted by Stag International. The end-user segment includes individuals using

fitness equipment at home and institutions such as health clubs and corporate

houses.

The Indian fitness industry is highly underpenetrated as compared to developed

and several developing countries in the world. For instance, 16% of the population

in the US possesses fitness club membership compared to mere 0.4% (considering

the top seven cities) in India.

In 2010, ~39% of India’s total population of 1.2bn was in the 20-44 years age

group. According to Planning Commission of India, the country’s population is

expected to increase to 1.3bn by 2020. Thus, the company will also have a

significant base of potential consumers - even if a modest 1% of the country’s

population aged 20-44 years is concerned about fitness.

The fitness industry in India continues to grow at a rapid pace on the back of

expansion of health club chains such as Talwalkars and Gold’s Gym and entry of

foreign fitness chains/clubs in the country. Penetration of these brands is creating

awareness about healthy lifestyles among people. The key trends identified include

health chains entering the equipment retail market, introduction of innovative

products and emergence of new distribution channels.

Foreign brands are known for their quality and durability in the Indian market.

Therefore, a large share of fitness equipment is imported from the US and Europe.

Various government policies such as FDI and franchise route of market entry in

India have a significant impact on the development of the fitness equipment

industry in India.

Key challenges identified in the industry include:

Lack of R&D facilities in the country

Lack of consumer confidence in Indian equipment

Lack of good trainers

Lack of space in residential complexes

May 16, 2012

7

Advisory Desk

Cravatex

Sportswear industry

The sportswear industry in India includes sports apparel, sports footwear and

accessories. The market for premium sports apparel and footwear industry in India

is currently worth `2,500cr as specified by the management. On the back of

mounting popularity of sports, higher disposable income and changing lifestyle

and consumer preferences, the sports apparel and footwear industry is expected to

grow at 15% CAGR over FY2011-14 as per the company’s estimations.

Increasing number of sports events and activities such as CWG and IPL are

providing scope and growth opportunities for players in the industry. The Indian

sportswear industry is at a nascent stage with increasing organized retail space.

Moreover, the trend of sportswear brand endorsements by prominent celebrities is

helping in boosting awareness among people. However, the industry has to cope

with price-conscious customers, extensive competition and limited channels for

distribution. Key challenges identified in the sportswear industry include poor state

of sports infrastructure in the country, imposition of excise duty and competition

from unorganized players. Further, competition from organized, international

players such as Nike, Adidas, FILA and Reebok continues to grab the industry share

of players in the Indian sportswear industry.

May 16, 2012

8

Advisory Desk

Cravatex

Company background

Cravatex mainly operates in two segments a) distribution of fitness equipment and

b) distribution of sports footwear and apparel of the brand FILA. Contribution from

the sportswear segment to the company’s revenue has increased from 24% of the

total revenue in FY2007 to 56% in FY2011, while contribution of the fitness

segment has reduced from 49% in FY2007 to 40% in FY2011.

Cravatex has recently issued bonus shares in the ratio of 1:1 by capitalizing the

subsequent amount from the General Reserve account of the company.

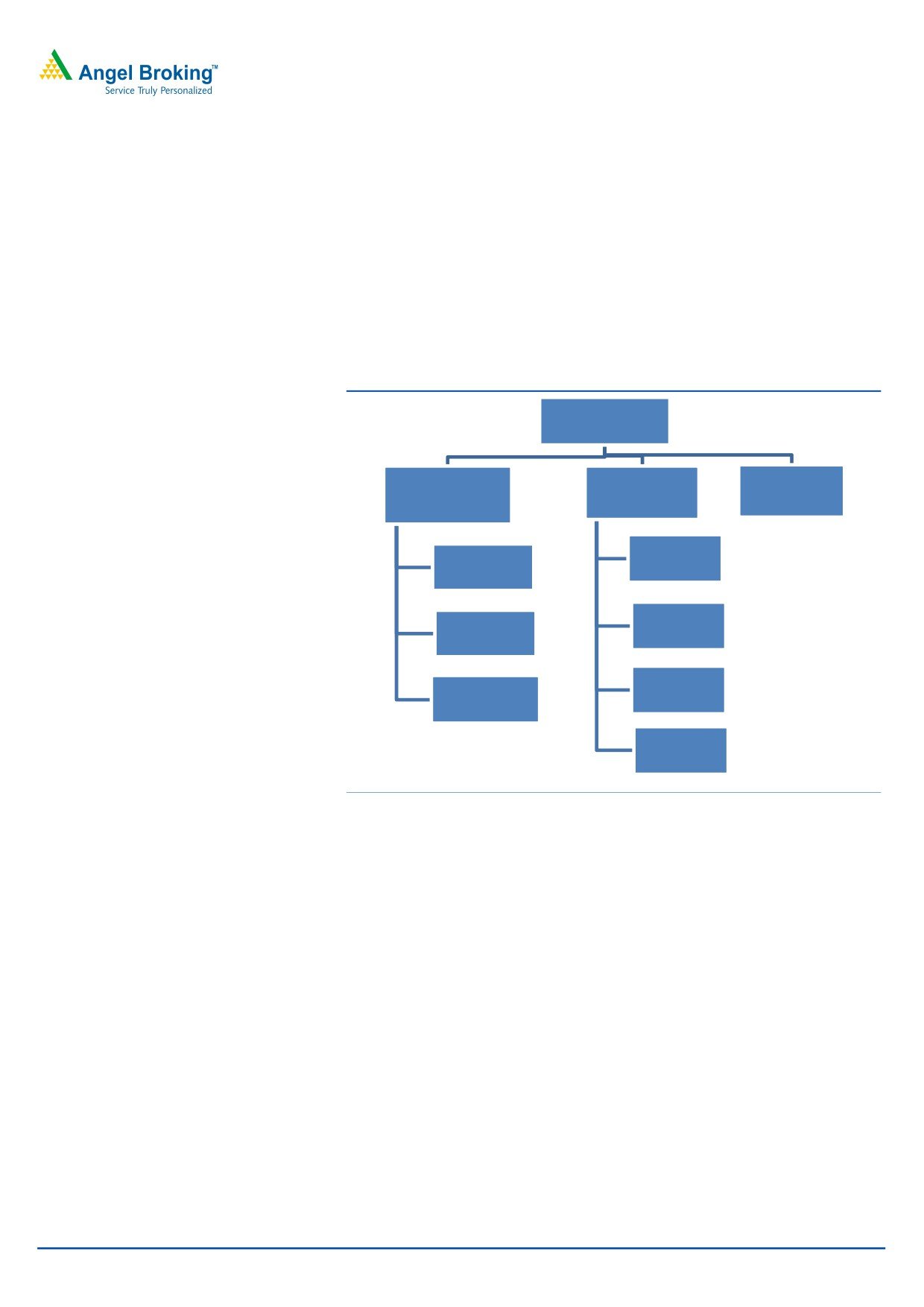

Exhibit 5: Revenue streams

Total Revenue

(92.6cr for FY2011)

Sportswear

Other Services

Fitness Equipment

Segment (56%)

(4%)

Segment (40%)

Distributors

Proline Fitness

Health club

Franchisee

chains

Home use

Shop-in-shops

equipments

MBO's

Source: Company, Angel Research

Distribution of fitness equipment

Cravatex is a market leader in fitness equipment distribution through its brand

Proline Fitness. The company distributes products of several international brands

like Johnson Health Tech (the third largest fitness company in the world), Horizon,

Vision, Body Solid and Magnum. Cravatex is the only ISO certified public listed

company dealing with fitness equipments.

In context to fitness at home, Proline Fitness has created the retail network of

around 51 stores with a complete range of home-use fitness equipment. The

company is also concentrating retail expansion by opening more stores and

maintaining a competitive product mix.

The company has been continuously forming strategic partnerships with various

health club chains such as Talwalkars and Gold Gym and is providing them with

high-quality equipment and customer service. Talwalkars, which has a presence in

nearly 50 cities including metros, mini metros and tier II and tier III cities with over

100 health clubs on a consolidated basis, provides promising growth visibility to

the company.

May 16, 2012

9

Advisory Desk

Cravatex

Distribution of sports footwear and apparel

In the sports apparel and footwear industry, Cravatex represents the 100-year old

Italian brand FILA. In India, FILA has entered by opening four retail stores this year

and plans a more retail-led approach in the coming years. The company is present

in over 1,135 footwear stores, 105 apparel stores and 200 shop-in-shops stores in

large retail formats. FILA aims to have a market share of 12-15% in next 2-3

years, with a yoy growth rate of

25-30% as quoted by the company’s

management.

Sports footwear: On the global front, Cravatex has acquired 100% of M/s BB (UK)

Ltd., which is its wholly owned subsidiary with effect from February 2011. Through

its subsidiary, Cravatex aims to acquire sub-license for certain distribution channels

for FILA in the UK and Ireland. The subsidiary will design, develop and supply FILA

apparel to other markets in Europe. The acquisition is expected to deliver revenue

of around £10mn in the next two years.

Founded in Italy in 1926, FILA is one of the most famous fashion sports shoes in

the world. Kim Clijsters, US open singles champion is the brand ambassador for

FILA.

Sports apparel: FILA entered India in 2009 and is now focusing on increasing its

presence by expanding its product portfolio and retail stores. The brand has

launched its sports apparel range and plans to set up 60-70 stores across India by

2014.

Cravatex management quotes that the sports apparel industry in India is growing

at a healthy rate of 15-18% per year. In large retail formats, as per availability of

space, the brand is present in shop-in-shops stores and expects to be present in all

large retail formats such as Shoppers Stop, Westside and Lifestyle. Starting with

metros and then mini metros and smaller towns, the company is also looking

forward to penetrate tier II-III cities. The company may opt for a franchise

depending on its location and store size.

May 16, 2012

10

Advisory Desk

Cravatex

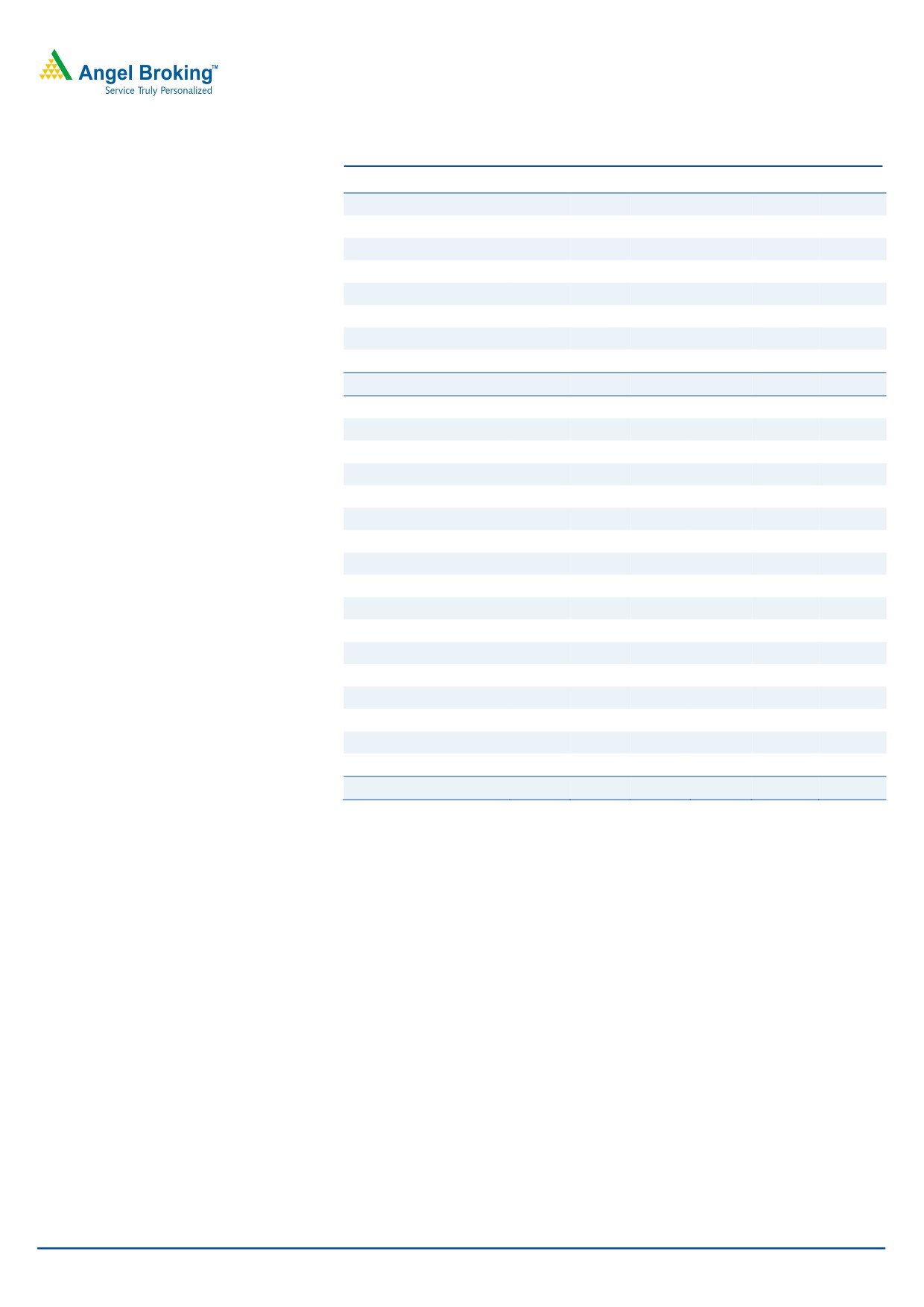

Profit and loss statement (Standalone)

Y/E March (` cr)

FY2009

FY2010

FY2011

FY2012E

FY2013E

FY2014E

Gross sales

44

58

93

230

301

361

Less: Excise duty

-

-

-

-

-

-

Net Sales

44

58

93

230

301

361

Other operating income

-

-

-

-

-

-

Total operating income

44

58

93

230

301

361

% chg

(12.6)

32.2

58.4

148.5

30.7

20.2

Net Raw Materials

28

33

51

148

194

227

(% of Net Sales)

62.2

56.8

54.9

64.5

64.4

62.9

Other Mfg costs

1

1

3

6

8

10

% chg

48.9

(25.4)

159.0

148.7

30.7

20.2

Personnel

4

5

9

18

29

34

% chg

0.5

19.3

84.5

109.1

55.2

20.2

Other

12

16

23

44

57

69

% chg

2.2

31.9

42.9

86.1

30.7

20.2

Total Expenditure

45

55

86

217

288

340

EBITDA

(1)

3

7

13

13

21

% chg

(138.1)

(378.9)

125.7

91.1

(1.7)

62.8

(% of Net Sales)

(2.5)

5.2

7.4

5.7

4.3

5.8

Depreciation & Amortization

1

1

1

1

1

1

EBIT

(2)

2

6

12

12

20

% chg

(202.1)

(218.4)

160.2

100.9

(1.8)

67.4

(% of Net Sales)

(4.4)

4.0

6.5

5.3

3.9

5.5

Interest & other charges

1

1

2

3

2

3

Other Income

6

6

5

4

6

8

(% of Net Sales)

13.2

9.5

5.2

1.7

2.1

2.1

Extraordinary Expense/(Inc.)

(0)

(0)

-

-

-

-

PBT (reported)

3

7

9

13

16

25

Tax

1

3

3

4

5

7

(% of PBT)

31.2

47.5

31.4

30.0

30.0

30.0

PAT (reported)

2

4

6

9

11

17

PAT after MI (reported)

2

4

6

9

11

17

ADJ. PAT

2

4

6

9

11

17

% chg

20.3

98.7

71.4

46.6

16.7

58.1

(% of Net Sales)

4.2

6.4

6.9

4.1

3.6

4.8

Basic EPS (`)

7

14

25

36

42

67

Fully Diluted EPS (`)

7

14

25

36

42

67

% chg

20.3

98.7

71.4

46.6

16.7

58.1

Dividend

0

1

1

1

1

1

Retained Earning

1

3

6

8

10

16

May 16, 2012

11

Advisory Desk

Cravatex

Balance sheet (Standalone)

Y/E March (` cr)

FY2009

FY2010

FY2011

FY2012E

FY2013E

FY2014E

SOURCES OF FUNDS

Equity Share Capital

1

1

1

1

1

1

Preference Capital

-

-

-

-

-

-

Reserves& Surplus

14

17

22

31

41

57

Shareholders’ Funds

15

18

24

32

42

58

Minority Interest

-

-

-

-

-

-

Total Loans

11

13

18

25

25

25

Deferred Tax Liability

3.4

3.4

3.4

3.4

3.4

3.4

Total Liabilities

29

35

45

60

70

86

APPLICATION OF FUNDS

Gross Block

20

20

21

24

26

28

Less: Acc. Depreciation

9

8

9

10

11

12

Net Block

11

11

12

13

15

16

Capital Work-in-Progress

1

1

-

-

-

-

Lease adjustment

-

-

-

-

-

-

Goodwill

0

0

-

-

-

-

Investments

2

2

0

0

0

0

Current Assets

27

41

60

108

137

167

Cash

3

2

1

1

2

3

Loans & Advances

11

12

13

23

25

31

Inventory

7

12

21

39

50

61

Debtors

7

16

25

46

60

72

Current liabilities

13

21

27

62

82

97

Net Current Assets

15

20

32

47

55

70

Misc. Exp. not written off

-

-

-

-

-

-

Deferred Tax Asset

0

0

0

0

0

0

Total Assets

29

35

45

60

70

86

May 16, 2012

12

Advisory Desk

Cravatex

Cash flow statement (Standalone)

Y/E March (` cr)

FY2009 FY2010 FY2011 FY2012E FY2013E FY2014E

Profit Before Tax

3

7

9

13

16

25

Depreciation

1

1

1

1

1

1

Other Income

(6)

(6)

(5)

(4)

(6)

(8)

Change in WC

2

(6)

(13)

(14)

(7)

(14)

Direct taxes paid

(1)

(3)

(3)

(4)

(5)

(7)

Others

6

5

5

-

-

-

Cash Flow from Operations

5

(2)

(6)

(8)

(2)

(3)

(Inc.)/ Dec. in Fixed Assets

0

1

(2)

(2)

(2)

(3)

(Inc.)/Dec. In Investments

(2)

0

2

0

0

0

Other Income

6

6

5

4

6

8

Others

(6)

(7)

(4)

-

-

-

Cash Flow from Investing

(2)

(1)

1

2

4

5

Issue of Equity/Preference

0

0

0

0

0

0

Inc./(Dec.) in Debt

(1)

3

4

7

0

0

Dividend Paid (Incl. Tax)

(0)

(1)

(1)

(1)

(1)

(1)

Others

0

0

0

-

-

-

Cash Flow from Financing

(2)

2

4

6

(1)

(1)

Inc./(Dec.) In Cash

1

(1)

(1)

0

1

1

Opening Cash balance

2

3

2

1

1

2

Closing cash balance

3

2

1

1

2

3

May 16, 2012

13

Advisory Desk

Cravatex

Key ratios

Y/E March

FY2009

FY2010

FY2011

FY2012E

FY2013E

FY2014E

Valuation Ratio (x)

P/E (on FDEPS)

90.4

45.5

26.5

18.1

15.5

9.8

P/CEPS

61.9

38.0

23.4

16.3

14.2

9.2

P/BV

11.3

9.4

7.1

5.3

4.0

2.9

Dividend yield (%)

0.3

0.3

0.4

0.6

0.6

0.6

EV/Net sales

4.0

3.1

2.0

0.8

0.6

0.5

EV/EBITDA

(160.4)

58.7

27.1

14.7

14.9

9.1

EV / Total Assets

6.0

5.1

4.2

3.2

2.7

2.2

Per Share Data (`)

EPS (Basic)

7

14

25

36

42

67

EPS (fully diluted)

7

14

25

36

42

67

Cash EPS

11

17

28

40

46

71

DPS

2

2

3

3

3

3

Book Value

58

69

92

124

162

225

DuPont Analysis

EBIT margin

(4.4)

4.0

6.5

5.3

3.9

5.5

Tax retention ratio

0.7

0.5

0.7

0.7

0.7

0.7

Asset turnover (x)

2.3

2.2

2.3

3.9

4.4

4.3

ROIC (Post-tax)

(6.9)

4.7

10.2

14.3

12.2

16.7

Cost of Debt (Post Tax)

7.9

3.3

6.0

7.7

7.0

7.7

Leverage (x)

0.4

0.5

0.7

0.7

0.5

0.4

Operating ROE

(12.7)

5.4

13.2

19.2

15.1

20.1

Returns (%)

ROCE (Pre-tax)

(6.7)

6.6

13.4

20.1

16.9

23.0

Angel ROIC (Pre-tax)

(10.0)

8.9

14.9

20.5

17.5

23.9

ROE

12.5

20.7

26.9

29.2

26.0

29.6

Turnover ratios (x)

Asset TO (Gross Block)

2.2

3.0

4.3

9.8

11.6

12.7

Inventory / Net sales (days)

61

59

63

61

61

62

Receivables (days)

67

70

81

72

72

72

Payables (days)

99

110

103

104

104

104

WC cycle (ex-cash) (days)

108

95

99

97

64

68

Solvency ratios (x)

Net debt to Equity

0.4

0.5

0.7

0.7

0.5

0.4

Net debt to EBITDA

(5.4)

3.1

2.5

1.8

1.7

1.0

Int. Coverage (EBIT/ Int.)

(1.6)

2.7

3.9

4.4

4.8

7.3

May 16, 2012

14

Advisory Desk

Cravatex

Advisory Team Tel: (91) (022) 39500777

DISCLAIMER

This document is solely for the personal information of the recipient, and must not be singularly used as the basis of any investment

decision. Nothing in this document should be construed as investment or financial advice. Each recipient of this document should make

such investigations as they deem necessary to arrive at an independent evaluation of an investment in the securities of the companies

referred to in this document (including the merits and risks involved), and should consult their own advisors to determine the merits and

risks of such an investment.

Angel Broking Limited, its affiliates, directors, its proprietary trading and investment businesses may, from time to time, make

investment decisions that are inconsistent with or contradictory to the recommendations expressed herein. The views contained in this

document are those of the analyst, and the company may or may not subscribe to all the views expressed within.

Reports based on technical and derivative analysis center on studying charts of a stock's price movement, outstanding positions and

trading volume, as opposed to focusing on a company's fundamentals and, as such, may not match with a report on a company's

fundamentals.

The information in this document has been printed on the basis of publicly available information, internal data and other reliable

sources believed to be true, but we do not represent that it is accurate or complete and it should not be relied on as such, as this

document is for general guidance only. Angel Broking Limited or any of its affiliates/ group companies shall not be in any way

responsible for any loss or damage that may arise to any person from any inadvertent error in the information contained in this report.

Angel Broking Limited has not independently verified all the information contained within this document. Accordingly, we cannot testify,

nor make any representation or warranty, express or implied, to the accuracy, contents or data contained within this document. While

Angel Broking Limited endeavors to update on a reasonable basis the information discussed in this material, there may be regulatory,

compliance, or other reasons that prevent us from doing so.

This document is being supplied to you solely for your information, and its contents, information or data may not be reproduced,

redistributed or passed on, directly or indirectly.

Angel Broking Limited and its affiliates may seek to provide or have engaged in providing corporate finance, investment banking or

other advisory services in a merger or specific transaction to the companies referred to in this report, as on the date of this report or in

the past.

Neither Angel Broking Limited, nor its directors, employees or affiliates shall be liable for any loss or damage that may arise from or in

connection with the use of this information.

Note: Please refer to the important `Stock Holding Disclosure' report on the Angel website (Research Section). Also, please refer to the

latest update on respective stocks for the disclosure status in respect of those stocks. Angel Broking Limited and its affiliates may have

investment positions in the stocks recommended in this report.

Disclosure of Interest Statement

Cravatex

1. Analyst ownership of the stock

No

2. Angel and its Group companies ownership of the stock

No

3. Angel and its Group companies' Directors ownership of the stock

No

4. Broking relationship with company covered

No

Note: We have not considered any Exposure below ` 1 lakh for Angel, its Group companies and Directors

Ratings (Returns):

Buy (> 15%)

Accumulate (5% to 15%)

Neutral (-5 to 5%)

Reduce (-5% to 15%)

Sell (< -15%)

May 16, 2012

15