Please refer to important disclosures at the end of this report

1

CMS Info System is India’s largest cash management company based on number of

ATM points and number of retail pick-up points as of March 31, 2021. Its’ business

includes installing, maintaining and managing assets and technology solutions on

end-to-end outsourced basis for banks under long-term contracts. Company caters to

broad set of outsourcing requirements for banks, financial institutions, and organized

retail and e-commerce companies in India.

Positives: (a) Leading market player with strong fundamentals. (b) Strong Pan-India

network of 3,965 cash vans and 238 branches and offices. (c) Longstanding customer

relationships with increased business opportunities. (d) Integrated business platform

offering a range of products and services.

Investment concerns: (a) A decrease in the use of cash as the predominant mode of

payment in India. (b) Highly dependent on the banking sector in India. (c) Adversely

affected by the COVID-19 type pandemic. (d) Significant expenses in relation to

employee benefits and cash vans and transportation. (e) Derive a substantial portion

of revenue from a limited number of customers.

Outlook & Valuation: CMS Infosystems derives majority of its revenues by providing

various services to the banking sector. There is no comparable company in the listed

space which is exclusively engaged in the portfolio of business similar to the company.

However, SIS Ltd. provides cash management services, among other services, through

its joint ventures. At the higher end of the price band CMS would be trading at P/E

multiple of 19x FY21 EPS of `11.4 which would be at a slight premium to SIS.

Moreover CMS is primarily dependent upon the banking sector for most of its

revenues and has high client concentration with top three customers accounting for

44.6% of revenues for the first five months of FY2022. Moreover the company’s

business would be impacted in case we witness a third Covid wave in India. Given the

dependence on a single sector, high client concentration and possible impact on

business due to a third Covid wave we have a NEUTRAL recommendation on the IPO.

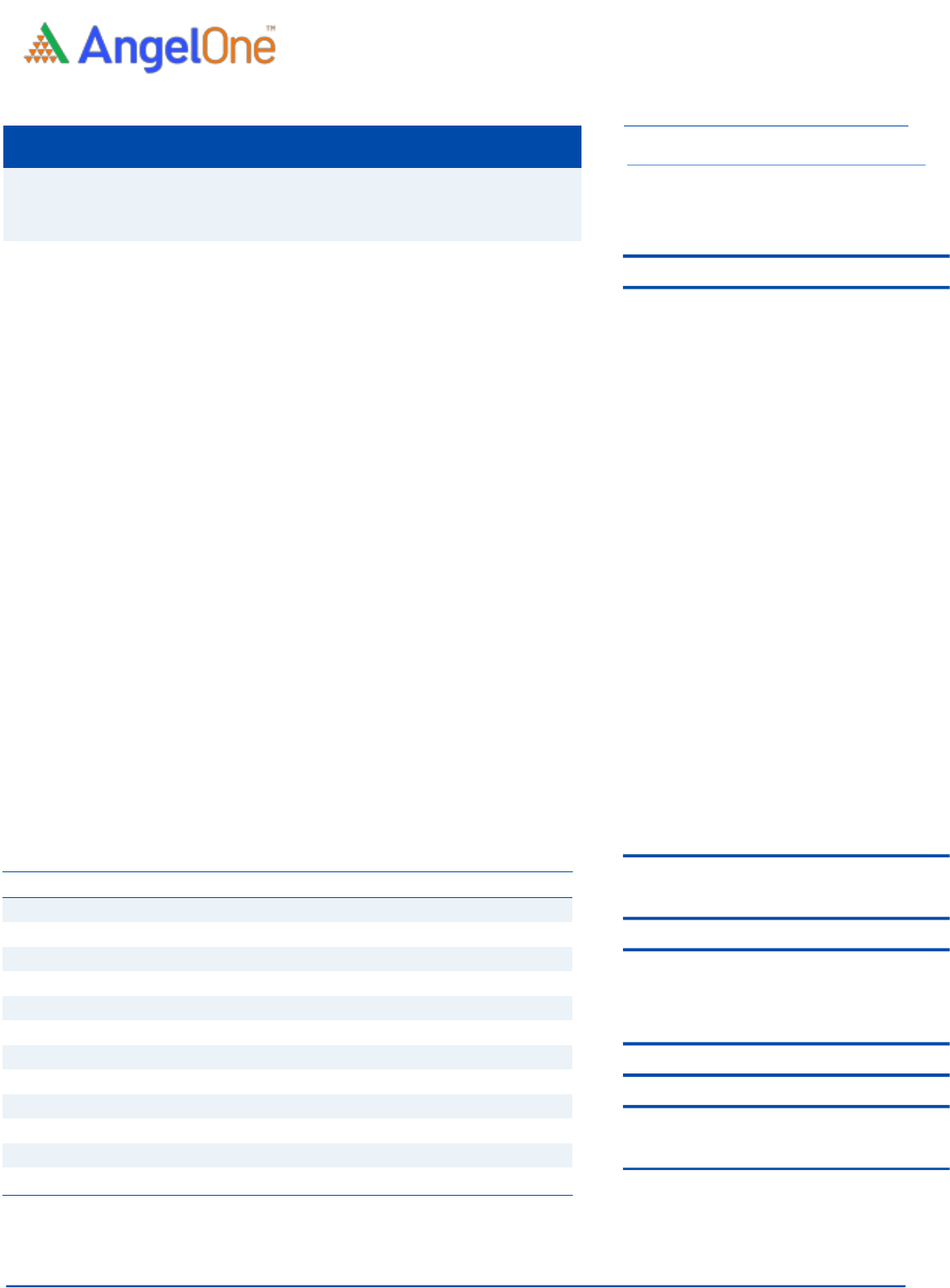

Key Finance

Y/E March (` cr)

FY2019

FY2020

FY2021

5MFY22

Net Sales

1,146.2

1,383.2

1,306.1

626.3

% chg

-

20.7

-5.6

-

Net Profit

96.1

134.7

168.5

84.5

% chg

-

40.1

25.1

-

EBITDA (%)

17.3

18.4

22.5

23.9

EPS (Rs)

6.5

9.1

11.4

-

P/E (x)

33.3

23.7

19.0

-

P/BV (x)

4.3

3.8

3.2

-

ROE (%)

12.9

15.8

17.1

-

ROCE (%)

13.5

16.4

17.7

-

EV/EBITDA

15.4

11.6

9.8

-

EV/Sales

2.7

2.1

2.2

-

Source: Company, Angel Research

NEUTRAL

Issue Open: Dec 21, 2021

Issue Close: Dec 23, 2021

Offer for Sale: `1,100 cr

QIBs 50% of issue

Non-Institutional 15% of issue

Retail 35% of issue

Promoters 65.6%

Others 34.4%

Fresh issue: NA

Issue Details

Face Value: `10

Present Eq. Paid up Capital: `148 cr

Post Issue Shareholding Pattern

Post Eq. Paid up Capital: `148 cr

Issue size (amount): `1,100 cr

Price Band: ₹205 - ₹216

Lot Size: 69 shares and in multiple thereafter

Post-issue mkt. cap: * `3,034 cr - ** `3,196 cr

Promoters holding Pre-Issue: 100%

Promoters holding Post-Issue: 65.59%

*Calculated on lower price band

** Calculated on upper price band

Book Building

CMS Info Systems Limited

IPO NOTE

CMS Info Systems Limited

December 20, 2021

CMS Info Systems Limited | IPO Note

December 20, 2021

2

Company background

CMS Info Systems Limited (“CMS”) was incorporated on March 26, 2008. CMS is

India’s largest cash management company based on number of ATM points and

number of retail pick-up points, as well as one of the largest ATM cash

management companies worldwide based on number of ATM points as of March

31, 2021. It operates mainly in three business segments that are Cash

management service includes end-to-end ATM replenishment services, Managed

services includes banking automation product sales, deployment and associated

annual maintenance; and Other services includes end-to-end financial cards

issuance and management for banks and card personalization service.

As on August 31, 2021, company has pan-India fleet of 3,965 cash vans and the

network of 238 branches and offices. Company is supported by its’ Promoter-Sion

Investment Holdings Pte. Ltd, who acquired the company in 2015

Issue details

The IPO is made up of offer for sale upto ₹1,100.00 Cr by promoter with no fresh

issue.

No of shares

(Pre-issue)

%

(Post-issue)

%

Promoter

148,000,000

100%

97,074,074

66%

Public (others)

0

0%

50,925,926

34%

Total

148,000,000

100%

148,000,000

100%

Objectives of the Offer

To carry out an offer for sale of equity shares by promotors aggregating

upto Rs. 1,100 Cr.

To achieve the benefits of listing the equity shares on the stock exchanges.

Key Management Personnel

Shyamala Gopinath is the Chairperson of the Company and an Independent

Director of the company. . In the past, she has served as the Deputy Governor of

the RBI, chairperson of the advisory board on Bank, Commercial and Financial

Frauds and part-time non-executive director of HDFC Bank Ltd.

Rajiv Kaul is the Executive Vice Chairman, Whole Time Director and CEO of the

company. He has been associated with the company since July 1, 2009. He has

over 24 years of experience across technology, private equity and cash

management industry.

Jimmy Lachmandas Mahtani is the Non-Executive Director of the company. He has

over 21 years of experience in private equity and investment banking. He has been

associated with Baring Private Equity Asia (BPEA) since 2006 and currently serves

as a managing director of private equity investment team in India.

Ashish Agrawal is the Non-Executive Director of the company. He has been

associated with the company since August 27, 2015. He has over 24 years of

experience in private equity and investment banking. He currently serves as the

CMS Info Systems Limited | IPO Note

December 20, 2021

3

managing director of Baring Private Equity Asia, Mumbai. Prior to that, he was

associated with Lehman Brothers in Mumbai as a senior vice president and with

Bank of America in Chicago as a vice president.

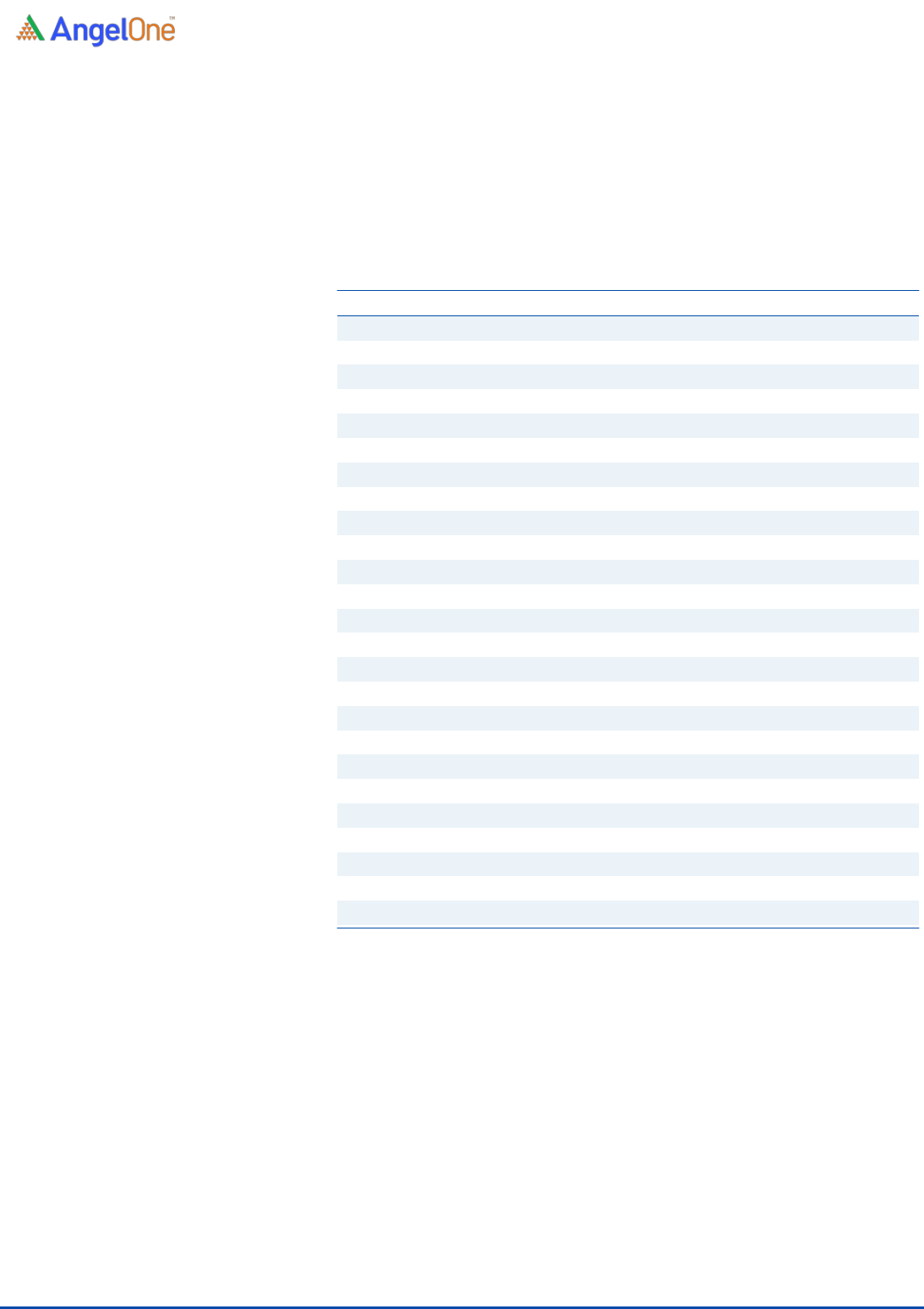

Exhibit 1: Consolidated Profit & Loss Account

Y/E March (` cr)

FY2019

FY2020

FY2021

5MFY22

Total operating income

1,146.2

1,383.2

1,306.1

626.3

% chg

-

20.7

-5.6

-52.0

Total Expenditure

948.2

1,129.3

1,012.5

476.6

Purchase of traded goods

100.6

181.5

207.0

43.3

Decrease / (Increase) in inventories

-11.4

9.9

-27.3

28.0

Employee benefit expenses

213.5

219.4

201.6

90.5

Other expenses

645.6

718.7

631.3

314.9

EBITDA

197.9

253.9

293.6

149.7

% chg

-

28.3

15.6

-49.0

(% of Net Sales)

17.3

18.4

22.5

23.9

Depreciation& Amortisation

53.7

56.6

63.5

34.6

EBIT

144.2

197.3

230.2

115.1

% chg

-

36.8

16.6

-50.0

(% of Net Sales)

12.6

14.3

17.6

18.4

Finance costs

7.4

7.3

8.2

5.1

Other income

13.2

5.1

15.8

3.4

(% of Sales)

1.1

0.4

1.2

0.5

Recurring PBT

149.9

195.1

237.8

113.4

% chg

-

30.1

21.9

-52.3

Exceptional item

-

-

-

-

Tax

53.8

60.4

69.2

29.0

PAT

96.1

134.7

168.5

84.5

% chg

-

39.1

26.1

-49.8

(% of Net Sales)

8.4

9.7

12.9

13.5

Basic & Fully Diluted EPS (Rs)

6.5

9.1

11.4

5.7

Source: Company, Angel Research

CMS Info Systems Limited | IPO Note

December 20, 2021

4

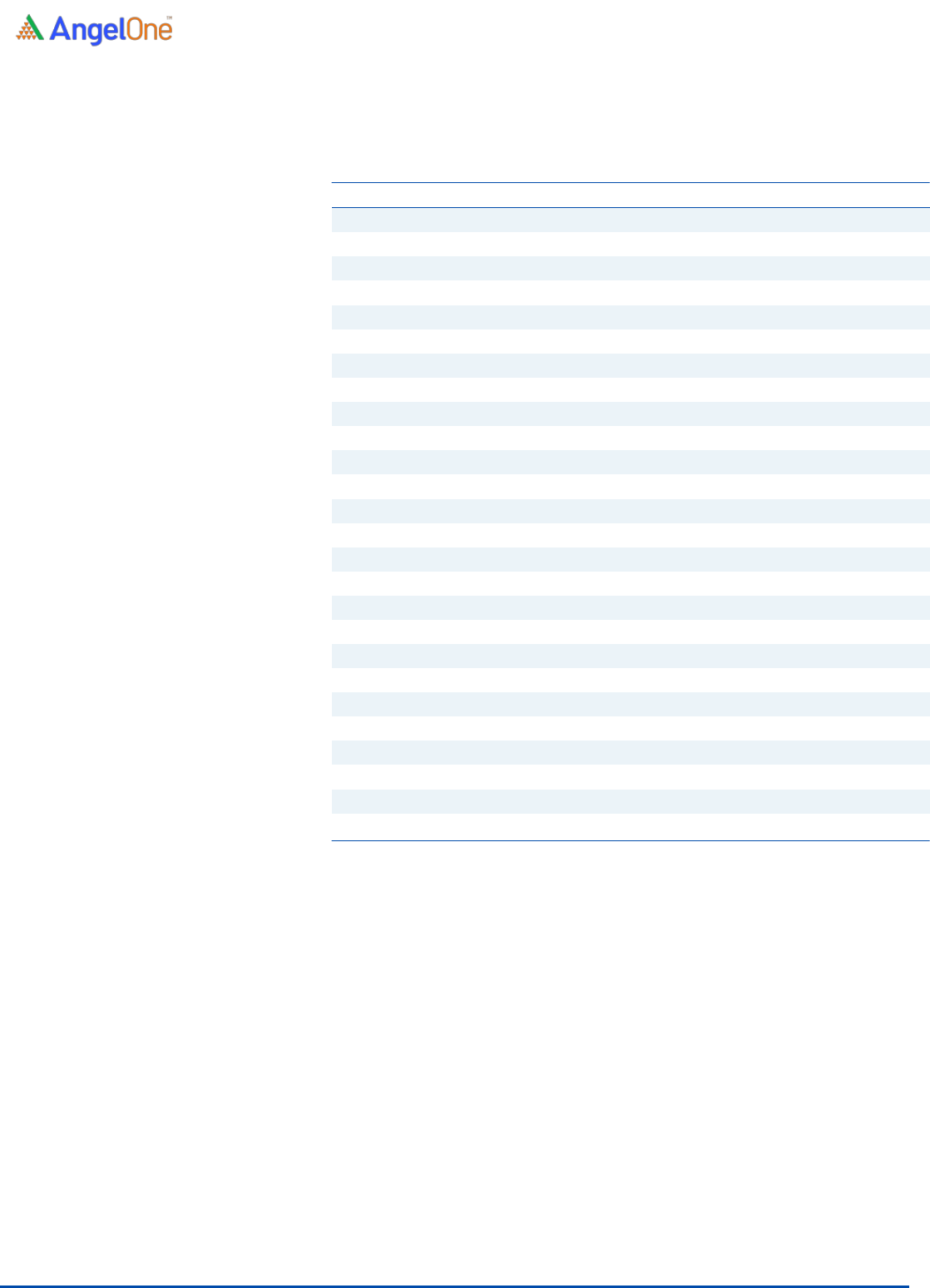

Exhibit 2: Consolidated Balance Sheet

Y/E March (` cr)

FY2019

FY2020

FY2021

5MFY22

SOURCES OF FUNDS

Equity Share Capital

148.0

148.0

148.0

148.0

Other equity (Retained Earning)

597.9

702.4

836.5

911.4

Shareholders’ Funds

745.9

850.4

984.5

1,059.4

Total Loans

-

-

-

-

Other liabilities

76.7

82.5

113.6

130.1

Total Liabilities

822.6

932.9

1,098.1

1,189.4

APPLICATION OF FUNDS

Property, plant and equipment

80.4

120.6

189.7

222.1

Capital work-in-progress

0.4

2.9

22.7

18.8

Right-of- use assets

81.3

83.9

121.1

140.1

Goodwill

203.4

203.4

203.4

203.4

Other Intangible assets

16.4

18.3

19.0

16.2

Intangible assets under development

2.1

1.0

0.5

0.2

Current Assets

616.2

819.7

980.3

889.2

Inventories

41.6

43.0

89.5

56.5

Investments

11.6

56.6

112.3

61.5

Trade receivables

390.6

448.6

500.7

555.4

Cash and cash equivalents

122.0

159.1

133.5

89.8

Bank balances other than above

17.2

31.4

61.0

40.7

Other financial assets

1.8

2.8

4.1

5.9

Other current assets

31.4

78.1

79.2

79.4

Current Liability

270.1

399.9

513.7

388.6

Net Current Assets

346.1

419.8

466.6

500.6

Other Non-Current Asset

92.6

83.0

75.2

88.2

Total Assets

822.6

932.9

1,098.1

1,189.4

Source: Company, Angel Research

CMS Info Systems Limited | IPO Note

December 20, 2021

5

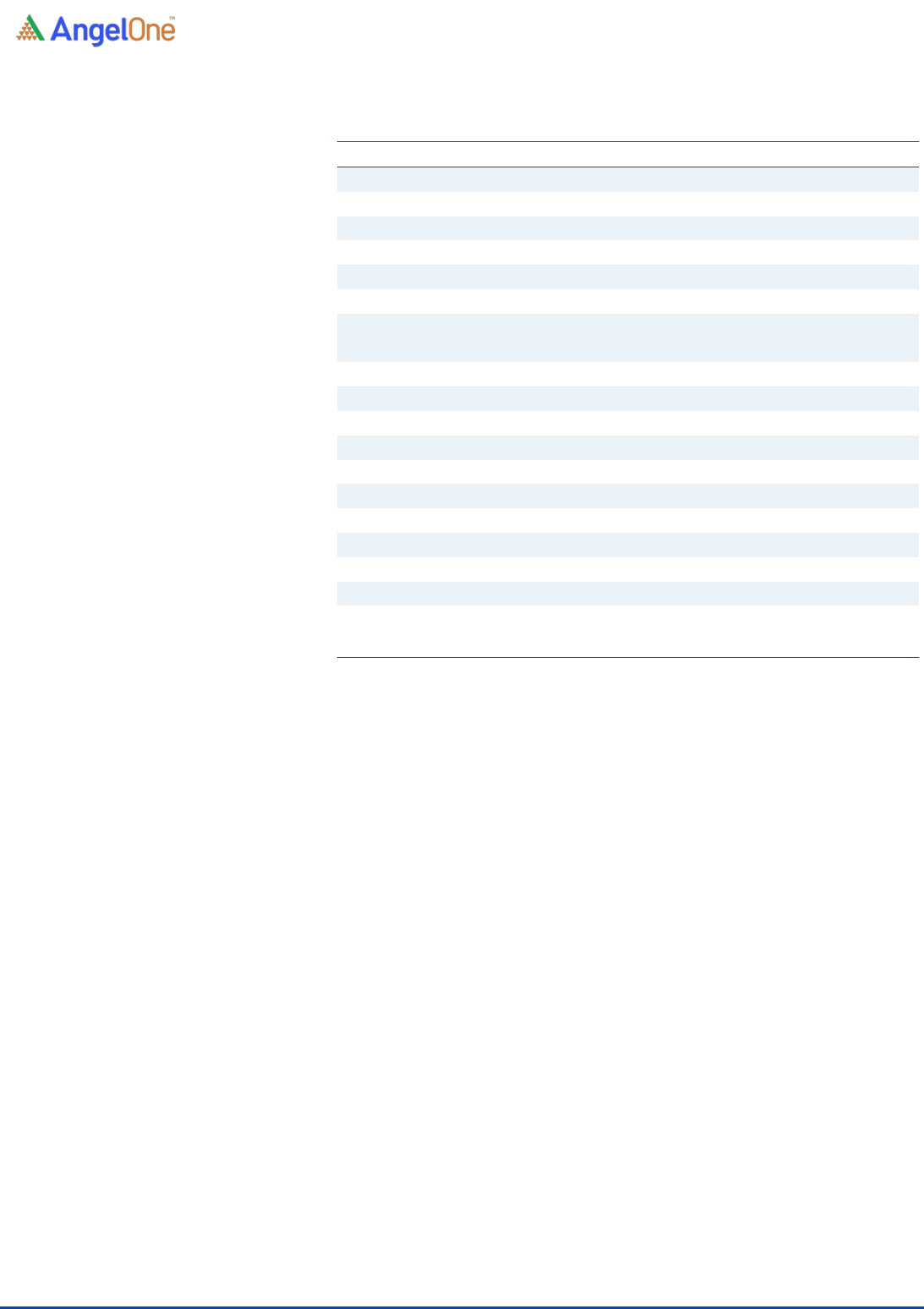

Exhibit 3: Consolidated Cash Flow Statement

Y/E March (`cr)

FY2019

FY2020

FY2021

5MFY22

Operating profit before changes

234.0

320.8

340.2

180.4

Net changes in working capital

-72.1

-57.3

-97.9

-152.2

Cash generated from operations

161.9

263.5

242.4

28.3

Direct taxes paid (net of refunds)

-60.1

-49.3

-56.9

-20.1

Net cash flow operating activities

101.8

214.2

185.4

8.2

Proceeds from sale of property

0.4

0.4

4.9

0.2

Purchase of property, plant and equipment

-31.3

-83.6

-55.1

-99.0

Purchase consideration

-39.1

-

-

-13.0

Investment in mutual funds

-281.4

-383.0

-335.7

-221.5

Proceeds from redemption of mutual funds

364.6

339.7

281.2

273.5

Others

-7.1

7.1

-44.7

32.7

Cash Flow from Investing

6.2

-119.4

-149.3

-27.1

Dividend paid

-28.5

-32.1

-36.3

-9.2

Finance costs

-0.4

-0.6

-0.9

-

Finance costs on lease liability

-6.9

-6.7

-7.3

-5.1

Payment of principal portion)

-16.5

-18.2

-17.2

-10.5

Cash Flow from Financing

-52.4

-57.6

-61.7

-24.8

Inc./(Dec.) in Cash

55.6

37.1

-25.6

-43.7

Opening Cash balances

66.46

122.03

159.13

133.51

Closing Cash balances

122.0

159.1

133.5

89.8

Source: Company, Angel Research

CMS Info Systems Limited | IPO Note

December 20, 2021

6

Exhibit 4: Key Ratios

Y/E March

FY2019

FY2020

FY2021

Valuation Ratio (x)

P/E (on FDEPS)

33.3

23.7

19.0

P/CEPS

21.3

16.7

13.8

P/BV

4.3

3.8

3.2

EV/Sales

2.7

2.1

2.2

EV/EBITDA

15.4

11.6

9.8

Per Share Data (Rs)

EPS (Basic)

6.5

9.1

11.4

EPS (fully diluted)

6.5

9.1

11.4

Cash EPS

10.1

12.9

15.7

Book Value

50.4

57.5

66.5

Returns (%)

ROE

12.9

15.8

17.1

ROCE

13.5

16.4

17.7

Turnover ratios (x)

Receivables (days)

124

118

140

Inventory (days)

13

11

25

Payables (days)

52

70

86

Working capital cycle (days)

85

59

79

Source: Company, Angel Research

CMS Info Systems Limited | IPO Note

December 20, 2021

7

Research Team Tel: 022 - 40003600 E-mail: [email protected] Website: www.angelone.in

DISCLAIMER

Angel Broking Limited (hereinafter referred to as “Angel”) is a registered Member of National Stock Exchange of India Limited, Bombay

Stock Exchange Limited and Metropolitan Stock Exchange Limited. It is also registered as a Depository Participant with CDSL and Portfolio

Manager and investment advisor with SEBI. It also has registration with AMFI as a Mutual Fund Distributor. Angel Broking Limited is a

registered entity with SEBI for Research Analyst in terms of SEBI (Research Analyst) Regulations, 2014 vide registration number

INH000000164. Angel or its associates has not been debarred/ suspended by SEBI or any other regulatory authority for accessing /dealing

in securities Market.

This document is solely for the personal information of the recipient, and must not be singularly used as the basis of any investment

decision. Nothing in this document should be construed as investment or financial advice. Each recipient of this document should make

such investigations as they deem necessary to arrive at an independent evaluation of an investment in the securities of the companies

referred to in this document (including the merits and risks involved), and should consult their own advisors to determine the merits and

risks of such an investment.

Angel or its associates or research analyst or his relative may have actual/beneficial ownership of 1% or more in the securities of the subject

company at the end of the month immediately preceding the date of publication of the research report. Neither Angel or its associates nor

Research Analysts or his relative has any material conflict of interest at the time of publication of research report.

Angel or its associates might have received any compensation from the companies mentioned in the report during the period preceding

twelve months from the date of this report for services in respect of managing or co-managing public offerings, corporate finance,

investment banking or merchant banking, brokerage services or other advisory service in a merger or specific transaction in the normal

course of business. Angel or its associates did not receive any compensation or other benefits from the companies mentioned in the report

or third party in connection with the research report. Neither Angel nor its research analyst entity has been engaged in market making

activity for the subject company.

Reports based on technical and derivative analysis center on studying charts of a stock's price movement, outstanding positions and trading

volume, as opposed to focusing on a company's fundamentals and, as such, may not match with a report on a company's fundamentals.

Investors are advised to refer the Fundamental and Technical Research Reports available on our website to evaluate the contrary view, if

any.

The information in this document has been printed on the basis of publicly available information, internal data and other reliable sources

believed to be true, but we do not represent that it is accurate or complete and it should not be relied on as such, as this document is for

general guidance only. Angel Broking Limited or any of its affiliates/ group companies shall not be in any way responsible for any loss or

damage that may arise to any person from any inadvertent error in the information contained in this report. Angel Broking Limited has not

independently verified all the information contained within this document. Accordingly, we cannot testify, nor make any representation or

warranty, express or implied, to the accuracy, contents or data contained within this document. While Angel Broking Limited endeavors to

update on a reasonable basis the information discussed in this material, there may be regulatory, compliance, or other reasons that prevent

us from doing so.

This document is being supplied to you solely for your information, and its contents, information or data may not be reproduced,

redistributed or passed on, directly or indirectly.

Neither Angel Broking Limited, nor its directors, employees or affiliates shall be liable for any loss or damage that may arise from or in

connection with the use of this information. Angel or its associates or Research Analyst or his relative might have financial interest in the

subject company. Research analyst has not served as an officer, director or employee of the subject company.