Banco Products (India) | Auto Ancillary

July 1, 2014

Banco Products (India)

BUY

CMP

`120

Initiating coverage with a BUY recommendation

Target Price

`172

Banco Products (India) (Banco) is among the leading manufacturers of radiators

Investment Period

12 months

and gaskets in the country with five manufacturing units. In July 2010, the

company acquired 51% stake in Lake Cement (a cement manufacturer), a

Stock Info

diversification into unrelated business which led to sharp correction in the stock

Sector

Auto Ancillary

price. In May, 2014, the company exited the cement business at ~52% premium

Market Cap (` cr)

859

for US$17.7mn and is now expected to use the proceeds for acquisition in auto

Net debt (` cr)

(46)

component related business in Europe which will further strengthen its foothold in

Beta

0.2

global auto component market. Additionally, the commercial vehicle (CV) industry

52 Week High / Low

117/ 33

which contributes ~80% to the company’s domestic revenue is also witnessing

revival, which poses a huge growth potential for the company.

Avg. Daily Volume

35,585

Face Value (`)

2

Recovery in global economy & revival in domestic CV industry to aid growth

BSE Sensex

25,414

The company is a leading exporter of aftermarket radiators to Europe, with a

Nifty

7,611

growing presence in the America, Middle East and African markets. The global

economy which witnessed couple of difficult years is now showing recovery signs

Reuters Code

BNCO.BO

(U.N. forecasts global economic growth of 3% in 2014 and 3.3% in 2015). Also,

Bloomberg Code

BNCO IN

the IHS Automotive predicts global auto sales to reach 85mn in 2014 and 100mn

in 2018 from 82.8mn in 2013. Further, production in the domestic CV industry

(contributes ~80% to domestic revenue) is to grow at a CAGR of 11% over

Shareholding Pattern (%)

FY2012-21E to 23.5lakh units. We expect these factors to aid the company’s

Promoters

67.9

revenue, which is expected to grow at a CAGR of 12.0% over FY2014-16E to

MF / Banks / Indian Fls

7.8

`1,457cr in FY2016E.

FII / NRIs / OCBs

4.8

Exit from Lake Cement - No further unrelated acquisitions

Indian Public / Others

19.5

In order to focus on the core business, the company has divested its entire stake in

Lake Cement for US$17.7mn, which is at an approximate premium of 52%. It is

expected that the company will use the proceeds from the sale of Lake Cement

Abs.(%)

3m 1yr

3yr

(US$17.7mn) for acquisitions related to the core business. We believe this will

Sensex

13.5

29.8

34.9

help the company in strengthening its core business and enable it to make related

Banco

67.9

240.9

68.3

acquisitions in Europe, which will enable it to fortify its presence in the global

market.

Outlook and valuation: We expect Banco to register a revenue CAGR of 12.0%

over FY2014-16E to `1,457cr with an operating margin of 15.2% in FY2016E.

The profit is expected to grow at a CAGR of 23.2% over the same period to

`136cr in FY2016E. At the CMP, the company is trading at a PE of 6.3x FY2016E

earnings. On account of growth potential with revival in CV industry and potential

acquisition plans, we initiate coverage on the company with a Buy

recommendation with a target price of `172 on a target PE of 9.0x FY2016E

earnings.

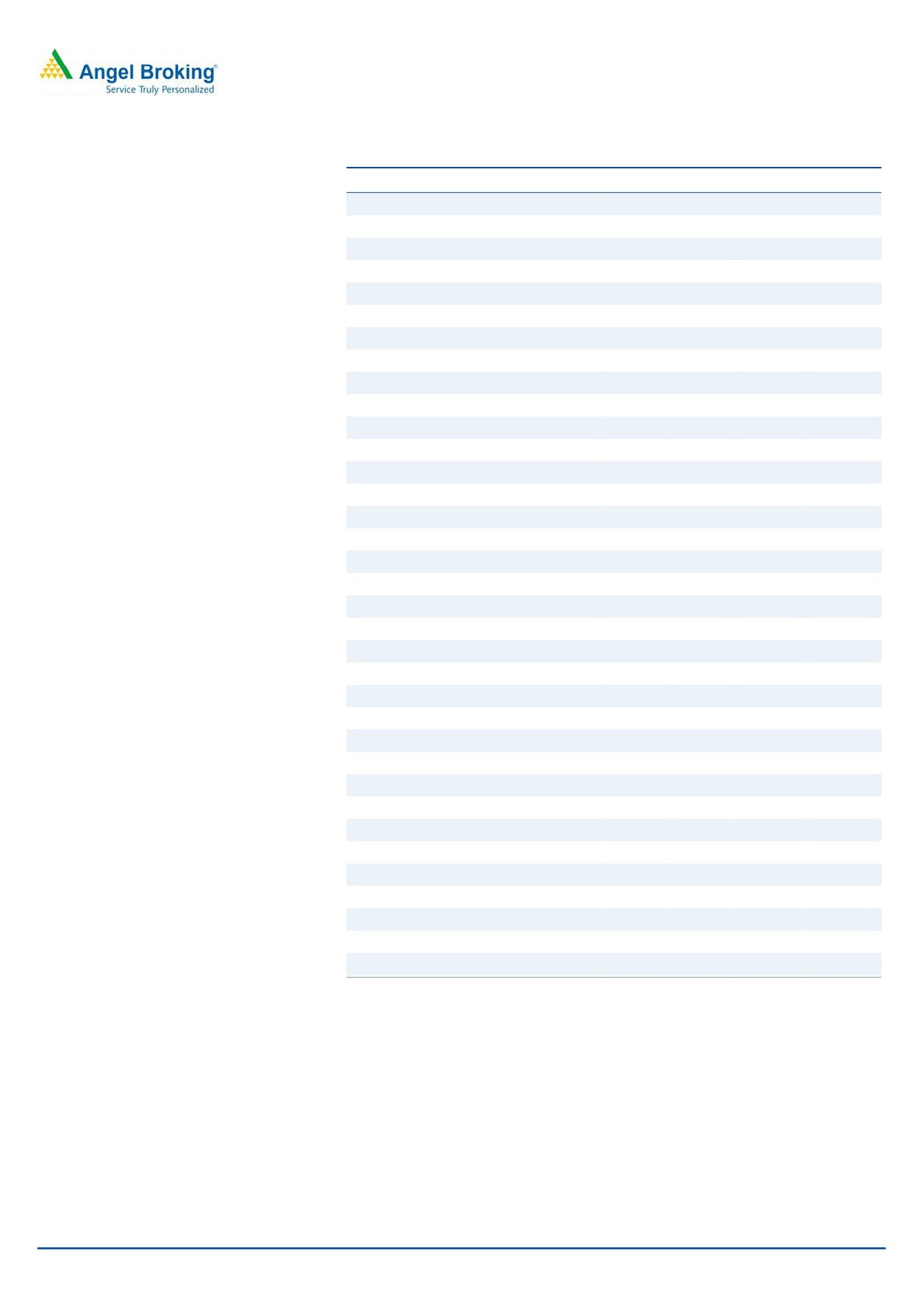

Financials (Consolidated)

Y/E

Sales OPM PAT EPS RoE P/E P/BV

EV/BITDA

EV/Sales

March

(` cr)

(%)

(` cr)

(`)

(%) (x)

(x)

(x)

(x)

Tejashwini Kumari

FY2015E

1,278

14.8

111

15.5

18.1

7.7

1.3

4.7

0.7

022-39357800 Ext: 6856

FY2016E

1,457

15.2

136

19.1

19.6

6.3

1.1

3.8

0.6

Source: Company, Angel Research; Note: CMP as of June 30, 2014

Please refer to important disclosures at the end of this report

1

Banco Products (India) | Initiating Coverage

Investment arguments

Improving global activities to aid growth in auto industry

The company is a leading exporter of aftermarket radiators to Europe, with a

growing presence in the North American, Middle Eastern, African and South

American markets. It has also started supplying OEMs in Europe. The company’s

performance was adversely affected because of the slowdown in global economy

in FY2013 with stagnant exports from the standalone business. However, in

FY2014 it has witnessed recovery as the global economies started showing

recovery signs. Also, there was a ~18.9% growth in the exports to `157cr (on

standalone basis).

The U.N. forecasts global economic growth of 3% in 2014 and 3.3% in 2015. The

advanced economies are gaining momentum and driving the pick-up in global

growth with investment and trade shooting up again. The US GDP growth is

projected to grow by 2.6% in 2014 and 3.5% in 2015; Euro area is expected to

witness positive growth after three years of contraction, with a GDP growth of 1.2%

in 2014 and 1.7% in 2015. The GDP growth for the BRIICS is projected at 5.3%

and 5.7% in 2014 & 2015 respectively.

We believe that the recovery in the major economies and revival in investment and

falling level of unemployment will aid the recovery path for the global automobile

industry and thereby the auto component industry. The IHS Automotive predicts

global auto sales to reach 85mn in 2014 and steadily increase to 100mn in 2018

from 82.8mn in 2013. We expect the improvement in the global auto industry to

provide huge potential to the company, including huge export potential from the

standalone business, in the global auto component market.

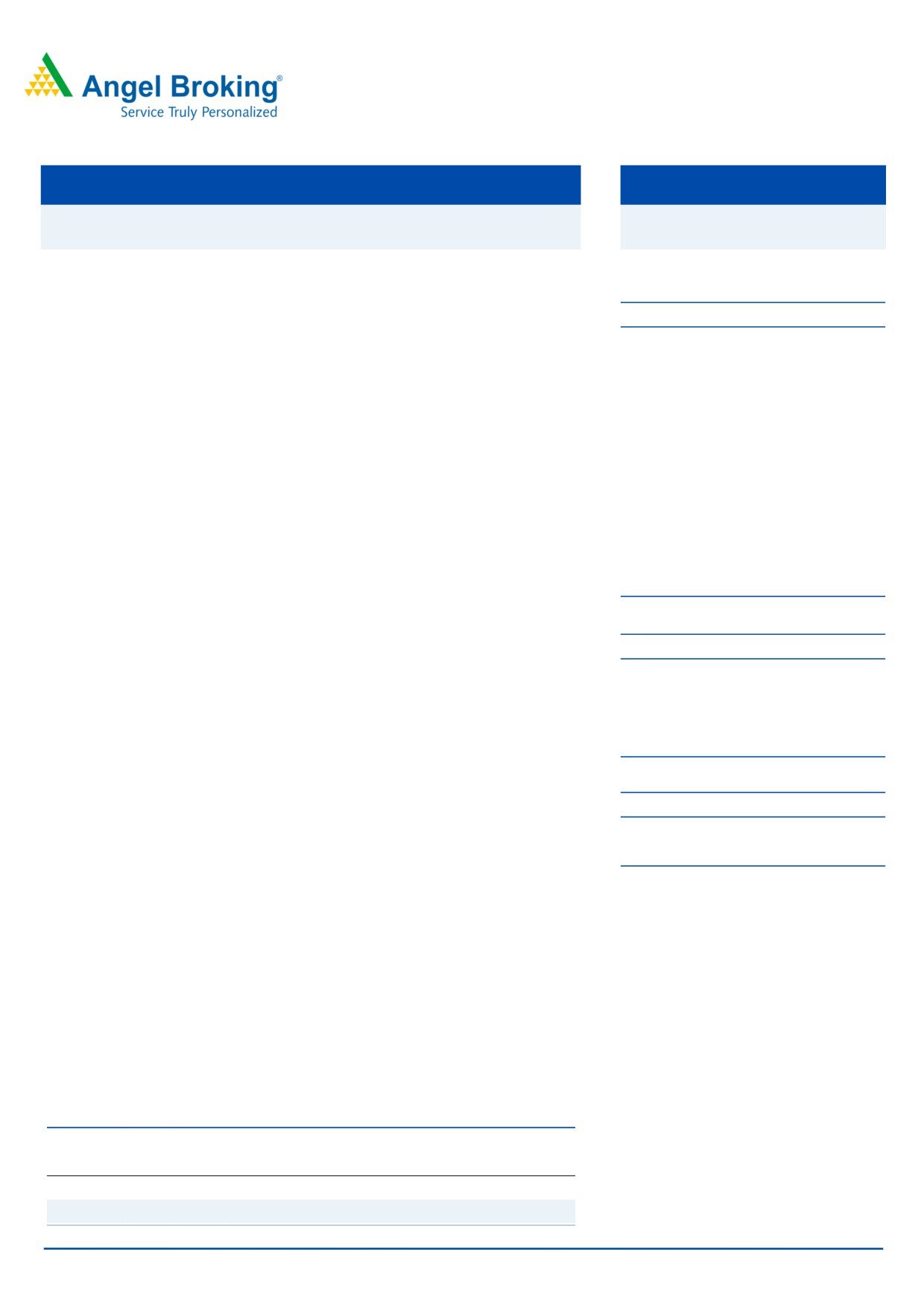

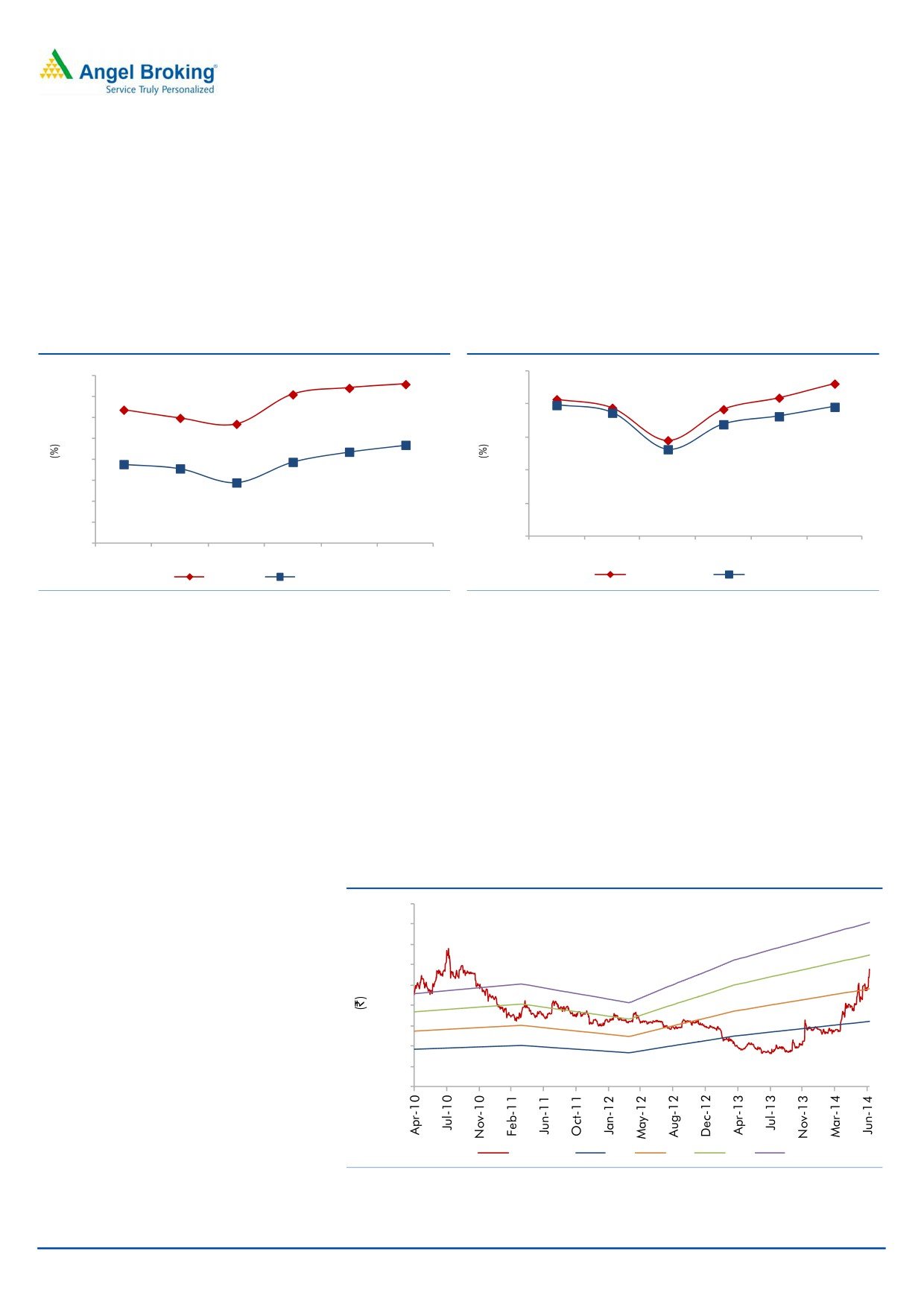

Exhibit 1: Export trend on standalone basis

Exhibit 2: Total vehicle sales in major export markets

180

30.0

40

24.7

157

160

25.0

35

132

18.9

140

135

128

131

20.0

30

120

108

15.0

25

100

7.5

10.0

20

80

2.3

0.8

5.0

15

60

0.0

10

40

20

(5.0)

5

0

(10.0)

0

FY2009

FY2010

FY2011

FY2012

FY2013

FY2014E

2007

2008

2009

2010

2011

2012

2013

Export Sales

yoy growth (RHS)

Europe America Asia/Oceania/Middle East

Source: Company, Angel Research

Source: OICA, Angel Research

Expected improvement in domestic CV industry to aid radiator demand

The company has a domestic installed capacity of

2.1mn aluminum and

copper-brass automotive heat exchangers and

4,000 large industrial heat

exchangers per annum (presently producing ~1000 varieties of heat exchangers,

ie radiators, charge air coolers and oil coolers).

July 1, 2014

2

Banco Products (India) | Initiating Coverage

The CV industry contributed ~80.0% to the company’s domestic standalone sales

in FY2014. According to ACMA, the production in domestic CV industry grew at a

CAGR of 22% over FY2008-12 and is expected to grow at a CAGR of 11% over

FY2012-21E to 23.5lakh units. Also, the new government’s thrust is on higher

infrastructure investment and development. We believe availability of infrastructure

provides good prospects for growth in CVs across the country, thus providing

Banco a strong growth opportunity domestically. In addition, it enjoys diverse

clients, which includes non-automotive companies in infrastructure, railways and

farm equipment segments. The major customers include companies like Tata

Motors, Ashok Leyland, Mahindra & Mahindra, Koel, BEML, TAFE, JCB and Indian

Railways. On the back of expected growth in domestic CV industry, we expect the

revenue for the standalone business to grow at a CAGR of 11.0% over FY2014-

16E to `551cr in FY2016E.

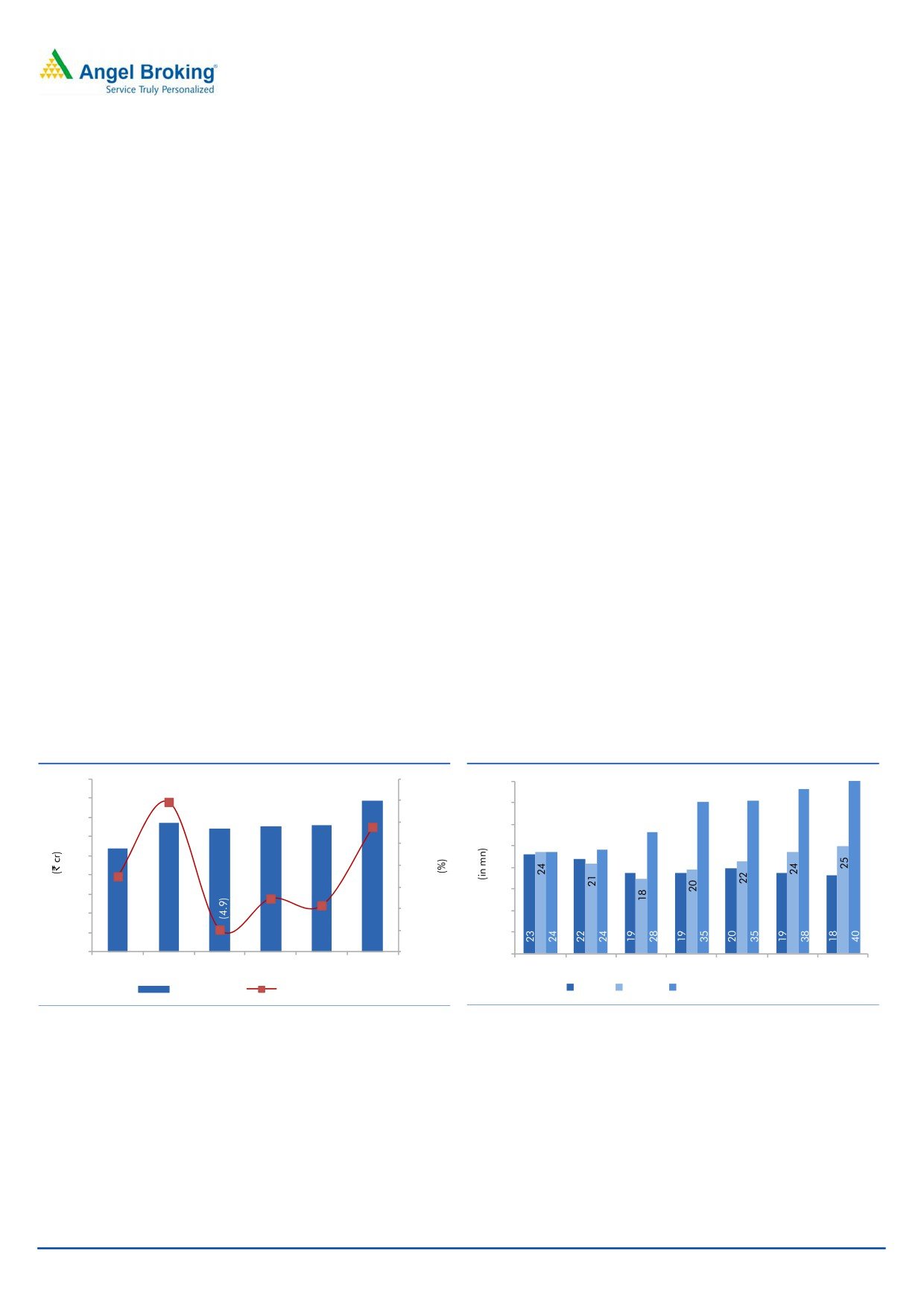

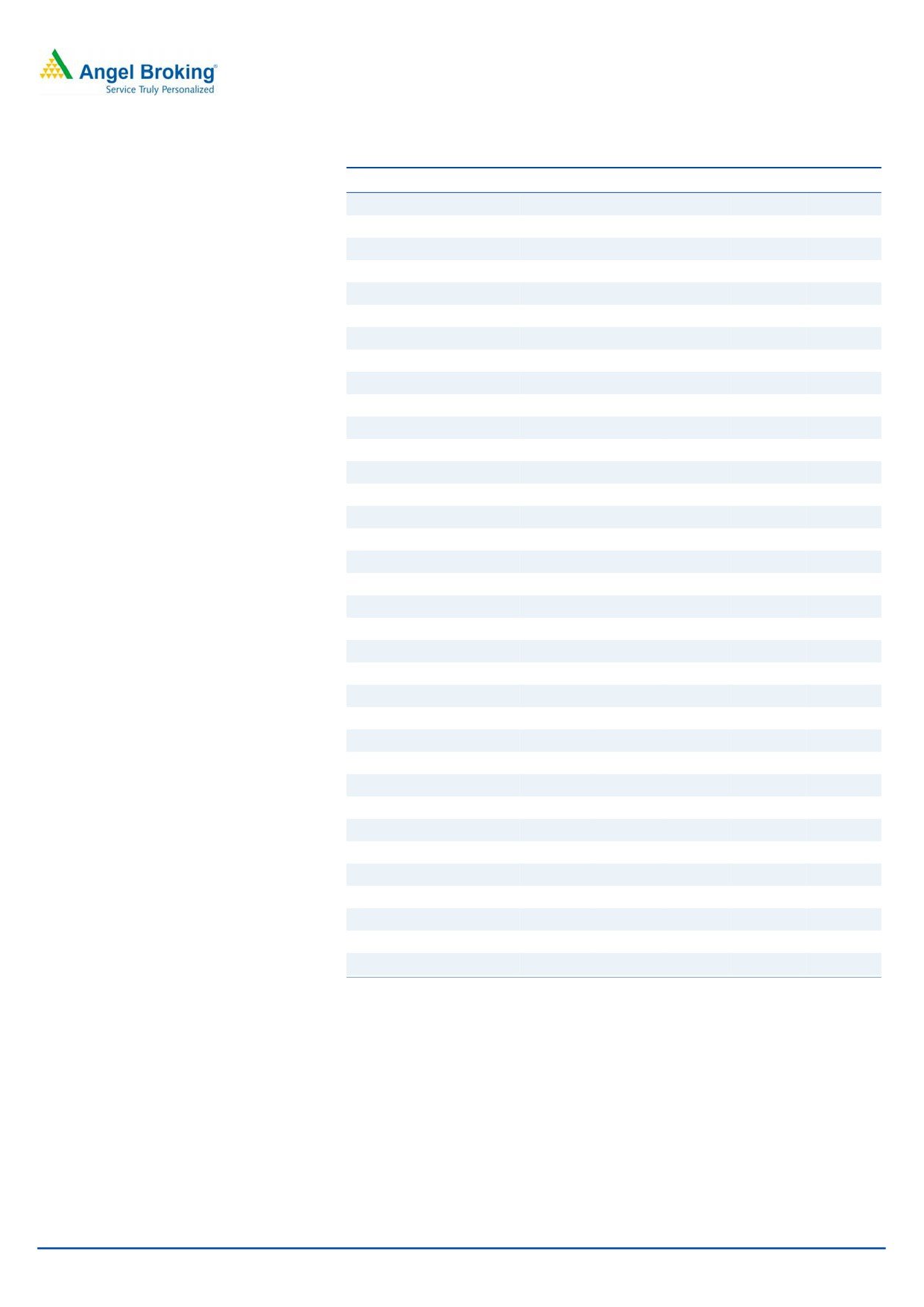

Exhibit 3: Domestic and Export sales break up

Exhibit 4: Indian CV industry

100.0

100

50.0

35.8

90.0

90

32.8

40.0

80.0

80

21.1

30.0

70.0

70

20.0

60.0

60

50.0

50

10.0

40.0

40

0.0

42

(8.8)

4.8

30

30.0

(16.0)

(10.0)

20.0

20

(23.5)

10

(20.0)

10.0

55

57

75

91

83

70

0

(30.0)

0.0

FY2008 FY2009 FY2010 FY2011 FY2012 FY2013 FY2014

FY2008

FY2009

FY2010

FY2011

FY2012

FY2013

FY2014

Export Sales

Domestic sales

CV Production

yoy growth

Source: Company, Angel Research

Source: Company, Angel Research

Exit from Lake Cement leads focus on the core business

As a part of diversification, Banco had acquired a 51% stake in Lake Cement,

Tanzania, in July 2010. The project included limestone-mining, clinker & cement

production and packing. However, in order to continue focus on the core business,

Banco, with its subsidiaries (Banco Products sold its entire 3,721 equity shares for

US$0.4mn and its subsidiaries - Lake Minerals (Mauritius) Ltd and Nederlandse

Radiateuren Banco Products divested their combined 1,74,875 equity shares for

US$17.3mn) has exited the venture by selling off the entire stake for US$17.7mn,

an approximate premium of 52% (as per the media reports). We believe that

exiting the unrelated diversification will help the company in strengthening the core

segments.

No further unrelated diversification

The company’s performance was adversely affected post the unrelated

diversification in the cement business. The stock price plunged sharply after the

acquisition of stake in Lake Cement. The company has now taken a step to

consolidate its presence in the auto related segment by selling off the entire stake

in the Lake Cement. It is expected that Banco will use the proceeds from the sale of

Lake Cement (US$17.7mn) for auto component related acquisitions in Europe as it

now plans to diversify only in the core business. We believe that this will further

strengthen the company’s presence in the global market.

July 1, 2014

3

Banco Products (India) | Initiating Coverage

Consolidated Financials

Exhibit 5: Revenue and profit break up

(in ` cr)

FY2014E

FY2015E

FY2016E

Revenue

Banco Gaskets (India)

100

110

123

Kilimanjaro Biochem

55

61

68

Nederlandse Radiateuren Fabriek BV

555

611

702

Standalone

447

492

551

Less: Inter-company

(5)

(5)

(13)

Consolidated

1,162

1,278

1,457

PAT

Banco Gaskets (India)

4

5

6

Kilimanjaro Biochem

6

7

9

Nederlandse Radiateuren Fabriek BV

47

59

72

Standalone

66

75

88

Less: Inter-company

34

34

39

Consolidated

90

111

136

Source: Angel Research

Recovery in Global economy & domestic CV industry to aid growth

The company is a leading exporter of aftermarket radiators to Europe, with a

growing presence in the America, Middle East and African markets. The global

economy which witnessed couple of difficult years is now showing recovery signs

(U.N. forecasts global economic growth of 3% in 2014 and 3.3% in 2015). Also,

the IHS Automotive predicts global auto sales to reach 85mn in 2014 and 100mn

in 2018 from 82.8mn in 2013.

The current installed capacity of the company is 2.1mn aluminum and copper-

brass automotive heat exchangers and 4,000 large industrial heat exchangers per

annum with ~1,000 varieties. On the back of recovery trends visible in the

global economy and domestic CV industry and the company’s strong relationship

with its customers, we expect the revenue for the company to grow at a CAGR of

12.0% over FY2014-16E to `1,457cr.

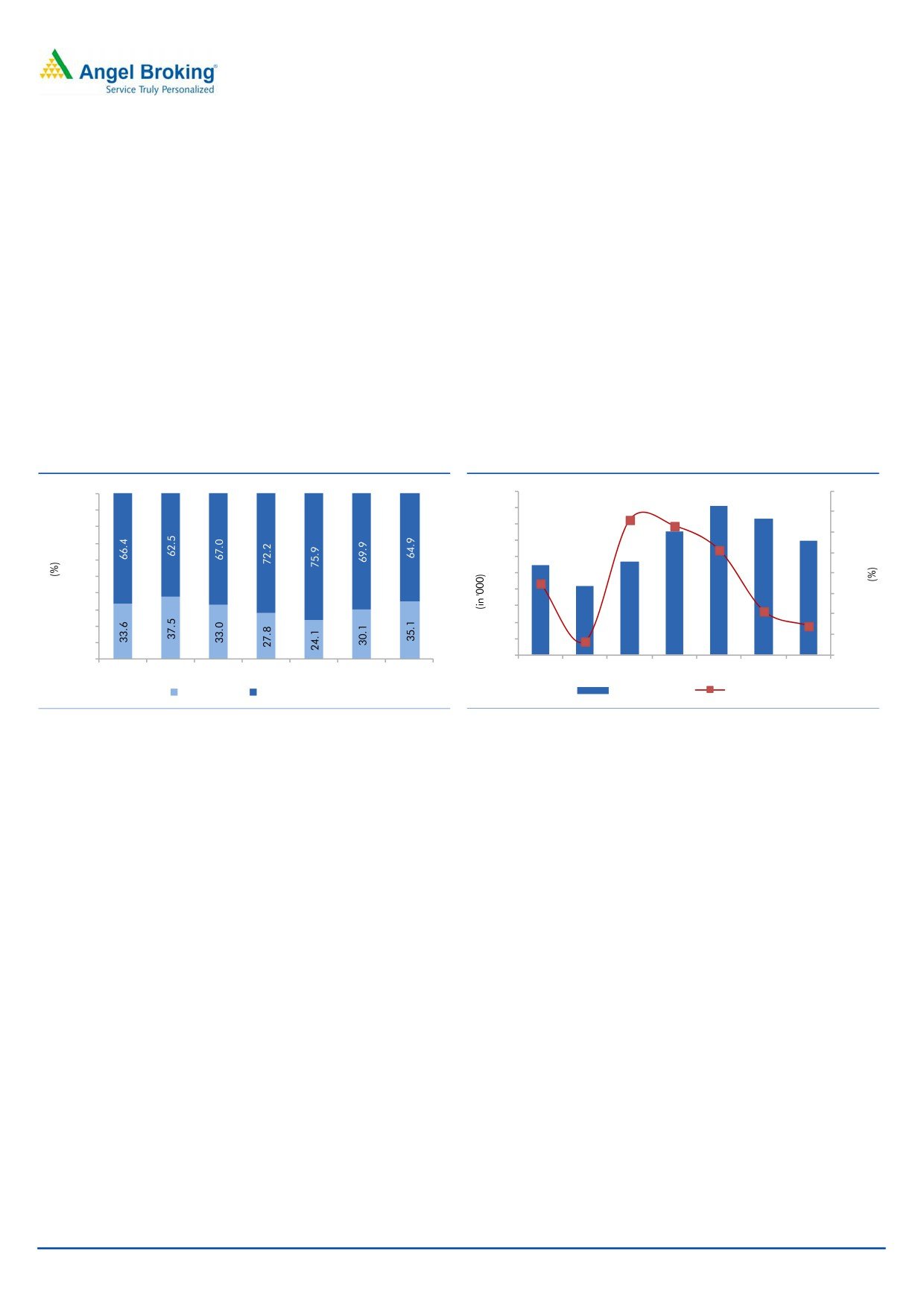

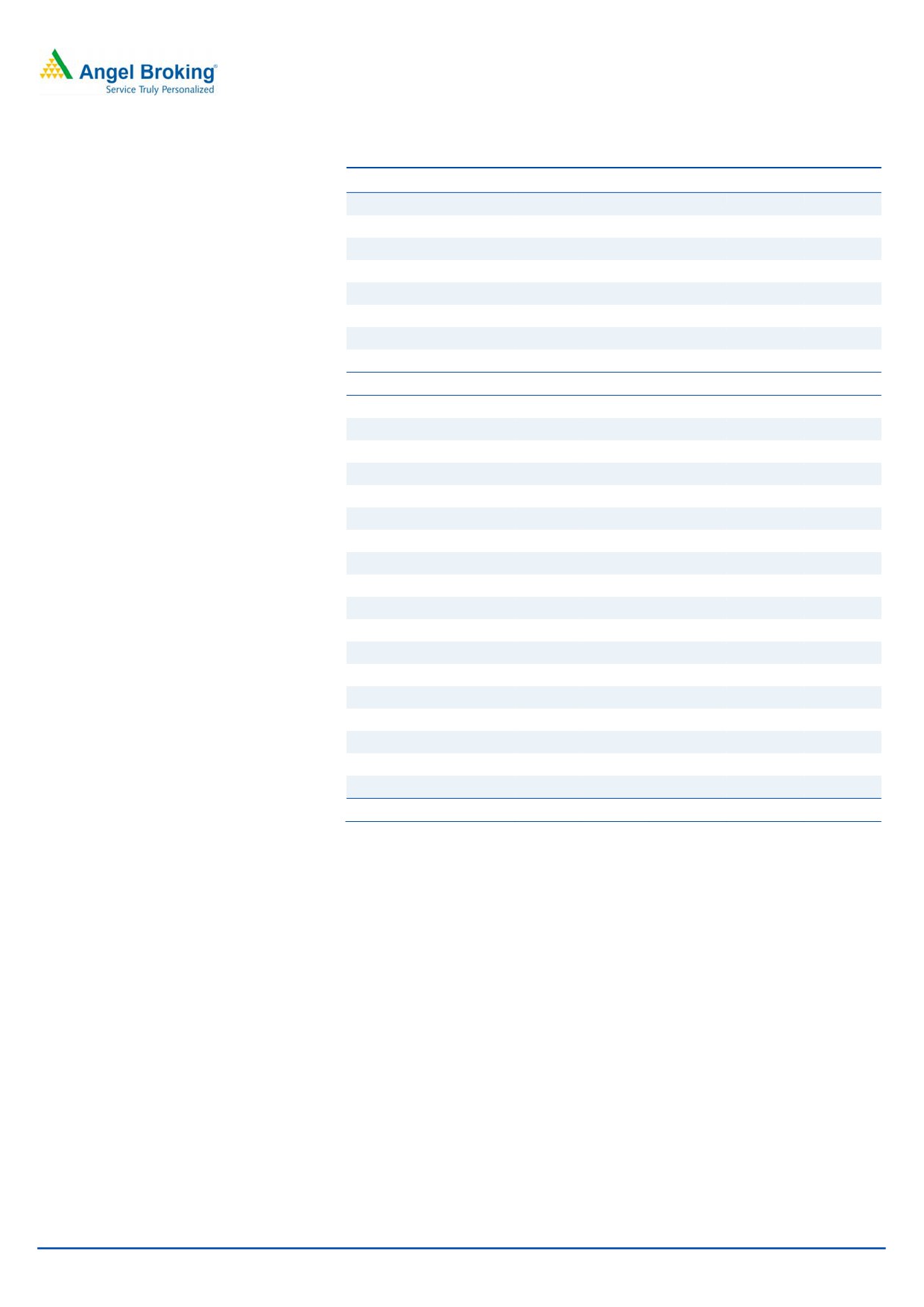

Exhibit 6: Improving CV sales to drive volume

Exhibit 7: EBITDA margin to improve by 98bps over FY2014-16E

1,600

89.1

100

250

15.2

16

14.8

90

1,400

14.2

15

80

200

1,200

14

70

12.7

1,000

60

13

150

11.9

800

50

11.4

12

40

100

600

11

30

400

16.8

13.4

14.0

10

10.0

20

50

200

9

0.5

10

0

0

0

8

FY2011

FY2012

FY2013

FY2014

FY2015E FY2016E

FY2011

FY2012

FY2013

FY2014

FY2015E FY2016E

Revenue (LHS)

Revenue growth (RHS)

EBITDA (LHS)

EBITDA Margin (RHS)

Source: Company, Angel Research

Source: Company, Angel Research

July 1, 2014

4

Banco Products (India) | Initiating Coverage

On the back of improved demand scenario and stabilized raw material costs, the

operating margin is expected to improve by 98bp over FY2014-16E at 15.2%. We

expect the company to reduce its debt to `111cr and `88cr in FY2015E and

FY2016E respectively, leading to a reduction in interest cost going forward. Also,

the company will have cash of `80cr and `107cr in FY2015E and FY2016E

respectively unless it plans out any expected acquisition. Consequently, we expect

the profit to grow at a CAGR of 23.2% over FY2014-16E to `136cr.

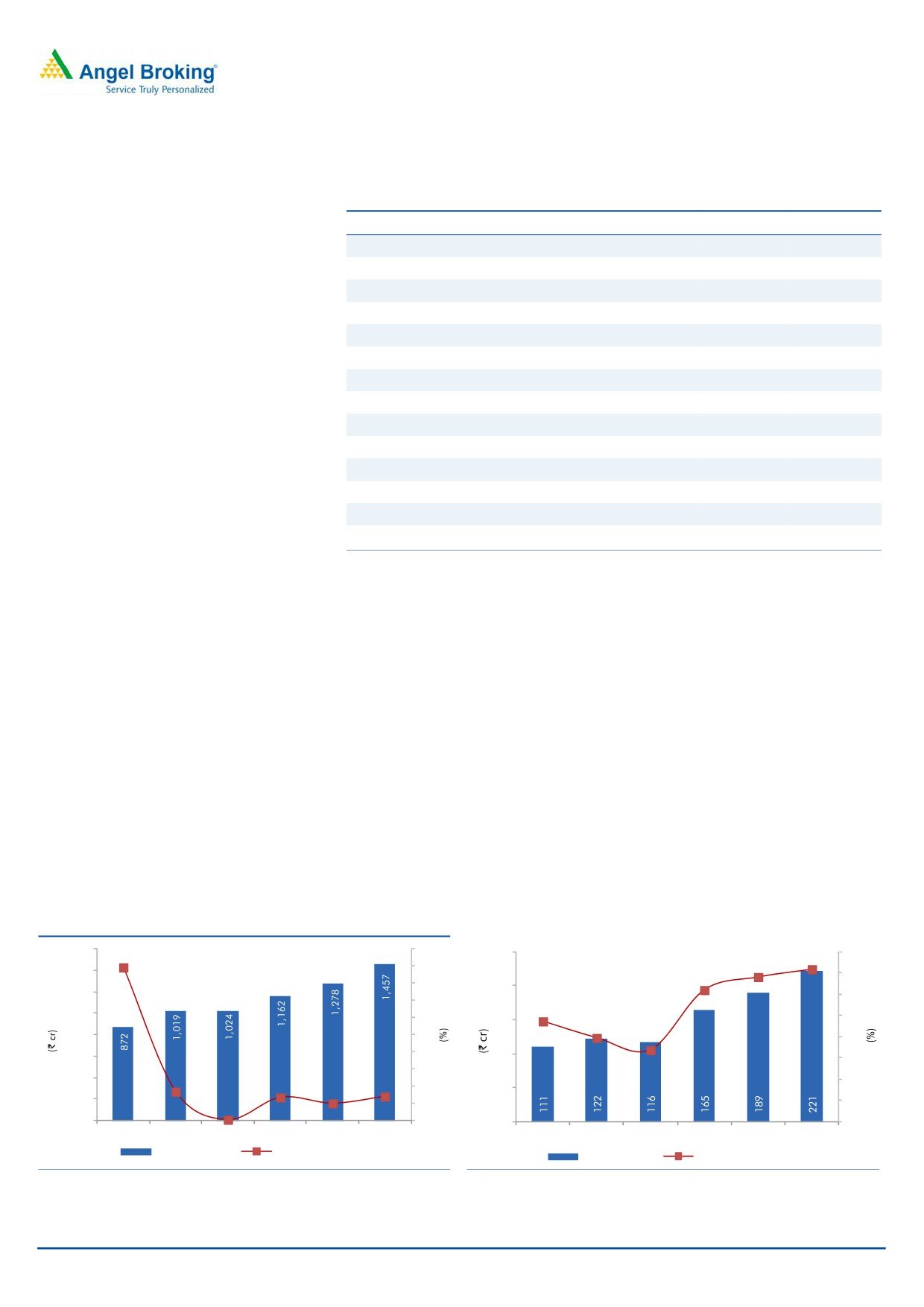

Exhibit 8: PATM to improve going forward...

Exhibit 9: ... leading to improvement in return ratios

14.8

15.2

25.0

23.1

16.0

14.2

20.7

20.9

12.7

19.4

19.2

14.0

11.9

20.0

11.4

12.0

19.8

14.5

19.6

9.4

18.7

10.0

8.7

15.0

18.1

7.5

7.7

16.9

7.1

8.0

5.8

13.2

10.0

6.0

4.0

5.0

2.0

0.0

0.0

FY2011

FY2012

FY2013

FY2014

FY2015E FY2016E

FY2011

FY2012

FY2013

FY2014

FY2015E FY2016E

EBITDAM

PATM

ROCE (Pre-tax)

ROE

Source: Company, Angel Research

Source: Company, Angel Research

Outlook and valuation: We expect Banco to register a revenue CAGR of 12.0%

over FY2014-16E to `1,457cr with an operating margin of 15.2% in FY2016E.

The profit is expected to grow at a CAGR of 23.2% over the same period to `136cr

in FY2016E. At the CMP, the company is trading at a PE of 6.3x FY2016E

earnings.

On account of growth potential with revival in CV industry, and potential

acquisition plans, we initiate coverage on the company with a Buy

recommendation with a target price of `172 on a target PE of 9.0x FY2016E

earnings.

Exhibit 10: One-year forward P/E band

180

160

140

120

100

80

60

40

20

0

Price (`)

4x

6x

8x

10x

Source: Company, Angel Research

July 1, 2014

5

Banco Products (India) | Initiating Coverage

Concerns

Continued slowdown in CV industry: The company earns its major revenue from

the CV industry, including the ones in the US and Europe. Any prolonged

slowdown in these economies can adversely affect the company’s performance.

Adverse movement in currency: Exports contribute ~30% to total standalone sales,

so any appreciation in domestic currency may adversely affect the company.

Fluctuations in raw material price: Any substantial fluctuation in the price of copper

and aluminum can lead to margin compression for the company as they form

22.1% and 41.4% of raw material consumption respectively.

Company background

Banco is a manufacturer of radiators and gaskets that have applications in

automobiles, oil engines, compressors and locomotives. The company has a

technical collaboration with Japan Metal Gasket, Japan for manufacture of

gaskets. It has five manufacturing units, three in Baroda and one assembly plant at

Jamshedpur for supply to Tata Motors and one at Rudrapur. In the domestic

market, original equipment manufacturer (OEM) sales account for 80-85% and the

rest come from the replacement market. The company enjoys diverse clients, which

includes non-automotive companies in infrastructure, railways and farm equipment

segments. The major customers include companies like Tata Motors, Ashok

Leyland, Mahindra & Mahindra, Koel, BEML, TAFE, JCB and Indian Railways.

The company has three subsidiaries:

a) Banco Gaskets (India): a wholly owned subsidiary of the company with

effect from 31st March, 2012 involved in the manufacture of gaskets.

b) Kilimanjaro Biochem, Tanzania: a wholly owned subsidiary of the

company with effect from 1st February, 2011 involved in the manufacture

of potable alcohol in Tanzania.

c) Nederlandse Radiateuren Fabriek BV, Netherlands: a wholly owned

subsidiary of the company with effect from 23rd February, 2010 engaged

in the business of manufacturing and distribution of heat transfer

products.

Products

Cooling Systems/ radiators

Radiators are used as heat exchangers to transfer excess heat away from engine

and release it into environment. Banco is one of the leading manufacturers and

suppliers of original equipment for commercial vehicles, passenger vehicles and

industrial products with a total installed capacity of 2.1mn aluminum and copper-

brass automotive heat exchangers and 4,000 large industrial heat exchangers per

annum. The company has also started supplying OEMs in Europe. It is also India’s

leading exporter of aftermarket radiators to Europe, with a growing presence in

the North American, Middle Eastern, African and South American markets.

Application: Compressors, Motorcycles/ Micro cars, On highways bus/ trucks, Off

highway mining trucks, Tractor & forest machinery, Construction/ handling

equipment, Traction locomotives, Gensets, Wind mills, SUVs etc.

July 1, 2014

6

Banco Products (India) | Initiating Coverage

Gaskets

Gaskets are used for sealing two metal surfaces to prevent loss of pressure or heat.

Banco is among the leading manufacturers and development partners to OEM

companies, manufacturing diesel and petrol engines in India who are affiliated or

are subsidiaries of leading multinational companies from Europe, Japan and the

USA. The company has a technical collaboration with Japan Metal Gasket, Japan

for manufacture of gaskets.

Application: Heavy duty turbocharged diesel and CNG engines for buses and

trucks, Agricultural and Forestry equipment, High horsepower traction

Locomotives, Compressors, Smaller diesel engines for power generation

equipment, Passenger car petrol and diesel engines, Industrial gaskets for

chemical and process industries, motorcycles and scooters, water pumps and fuel

injection equipment.

The company had transferred the Gasket Manufacturing Division with its

manufacturing facility at Anakhi for `46cr by way of slump sale to Banco Gaskets

(India) Ltd (BGIL), a wholly owned subsidiary of the company with effect from 31st

March, 2012.

July 1, 2014

7

Banco Products (India) | Initiating Coverage

Profit and loss statement (Consolidated)

Y/E Mar. (` cr)

FY2012 FY2013 FY2014

FY2015E

FY2016E

Total operating income

1,019

1,024

1,162

1,278

1,457

% chg

16.8

0.5

13.4

10.0

14.0

Net Raw Materials

554

536

583

634

717

% chg

20.4

(3.3)

8.9

8.7

13.2

Power and Fuel

13

19

22

24

28

% chg

23.5

42.4

16.3

10.0

14.0

Personnel

124

138

158

173

198

% chg

12.5

10.7

14.4

10.0

14.0

Other

206

215

234

257

293

% chg

14.4

4.7

8.6

10.0

14.0

Total Expenditure

897

908

997

1089

1236

EBITDA

122

116

165

189

221

% chg

9.6

(4.3)

41.6

14.7

16.8

(% of Net Sales)

11.9

11.4

14.2

14.8

15.2

Depreciation

21

29

32

34

37

EBIT

101

88

132

155

184

% chg

9.6

(13.1)

51.3

16.9

19.0

(% of Net Sales)

9.9

8.5

11.4

12.1

12.6

Interest & other Charges

9

13

19

8

7

Other Income

10

8

9

10

15

(% of Net Sales)

1.0

0.8

0.7

0.8

1.0

Recurring PBT

92

74

113

146

178

% chg

11.4

(19.5)

52.5

29.5

21.2

PBT (reported)

102

83

122

157

192

Tax

26

21

32

45

56

(% of PBT)

25.1

25.8

26.2

29.0

29.0

PAT (reported)

77

61

90

111

136

Extraordinary Expense/(Inc.)

4

2

0

0

0

ADJ. PAT

72

59

90

111

136

% chg

10.4

(18.5)

52.3

23.8

22.6

(% of Net Sales)

7.1

5.8

7.7

8.7

9.4

Basic EPS (`)

10.1

8.2

12.6

15.5

19.1

Fully Diluted EPS (`)

10.1

8.2

12.6

15.5

19.1

% chg

10.4

(18.5)

52.3

23.8

22.6

Dividend

18

13

14

14

14

July 1, 2014

8

Banco Products (India) | Initiating Coverage

Balance sheet (Consolidated)

Y/E Mar. (` cr)

FY2012

FY2013

FY2014

FY2015E

FY2016E

SOURCES OF FUNDS

Equity Share Capital

14

14

14

14

14

Reserves& Surplus

409

458

574

623

743

Shareholders’ Funds

423

472

589

637

757

Total Loans

130

175

138

111

88

Other Long Term Liabilities

-

0

0

0

0

Long Term Provisions

2

2

2

2

2

Deferred Tax (Net)

17

20

22

22

22

Total liabilities

572

670

752

772

870

APPLICATION OF FUNDS

Gross Block

478

562

612

648

694

Less: Acc. Depreciation

277

329

362

396

433

Net Block

201

232

250

252

261

Capital Work-in-Progress

3

9

6

13

15

Goodwill

-

-

-

-

-

Investments

39

63

71

-

-

Long Term Loans and adv.

27

60

71

77

87

Other Non-current asset

-

-

-

-

-

Current Assets

453

491

547

636

744

Cash

36

20

27

80

107

Loans & Advances

24

16

32

26

29

Inventory

215

262

275

307

353

Debtors

178

193

214

224

255

Other current assets

-

-

-

-

-

Current liabilities

151

184

193

206

237

Net Current Assets

301

307

354

431

507

Misc. Exp. not written off

-

-

-

-

-

Total Assets

572

670

752

772

870

July 1, 2014

9

Banco Products (India) | Initiating Coverage

Cash flow statement (Consolidated)

Y/E Mar. (` cr)

FY2012 FY2013

FY2014 FY2015E FY2016E

Profit before tax

102

83

122

157

192

Depreciation

21

29

32

34

37

Change in Working Capital

6

(22)

(40)

(23)

(50)

Direct taxes paid

(26)

(21)

(32)

(45)

(56)

Others

5

29

(9)

(10)

(15)

Cash Flow from Operations

109

97

73

112

108

(Inc.)/Dec. in Fixed Assets

(61)

(89)

(47)

(44)

(47)

(Inc.)/Dec. in Investments

(36)

(23)

(8)

71

-

(Incr)/Decr In LT loans & adv.

26

(32)

(11)

(6)

(11)

Others

(17)

41

54

(36)

15

Cash Flow from Investing

(88)

(104)

(13)

(14)

(43)

Issue of Equity

-

-

-

-

-

Inc./(Dec.) in loans

3

45

(37)

(28)

(22)

Dividend Paid (Incl. Tax)

(21)

(15)

(17)

(17)

(17)

Others

5

(40)

-

-

-

Cash Flow from Financing

(14)

(10)

(54)

(44)

(39)

Inc./(Dec.) in Cash

7

(16)

7

54

26

Opening Cash balances

29

36

20

27

80

Closing Cash balances

36

20

27

80

107

July 1, 2014

10

Banco Products (India) | Initiating Coverage

Key ratios (Consolidated)

Y/E Mar.

FY2012

FY2013

FY2014

FY2015E

FY2016E

Valuation Ratio (x)

P/E (on FDEPS)

11.9

14.6

9.6

7.7

6.3

P/CEPS

9.2

9.8

7.0

5.9

5.0

P/BV

2.0

1.8

1.5

1.3

1.1

EV/Net sales

0.9

0.9

0.8

0.7

0.6

EV/EBITDA

7.5

8.2

5.5

4.7

3.8

EV / Total Assets

1.6

1.5

1.2

1.2

1.0

Per Share Data (`)

EPS (Basic)

10.1

8.2

12.6

15.5

19.1

EPS (fully diluted)

10.1

8.2

12.6

15.5

19.1

Cash EPS

13.1

12.3

17.1

20.3

24.2

DPS

2.5

1.8

2.0

2.0

2.0

Book Value

59.2

66.1

82.3

89.1

105.8

DuPont Analysis

EBIT margin

9.9

8.5

11.4

12.1

12.6

Tax retention ratio

0.7

0.7

0.7

0.7

0.7

Asset turnover (x)

2.2

2.0

2.0

2.0

2.1

ROIC (Post-tax)

16.3

12.5

16.5

17.1

18.9

Cost of Debt (Post Tax)

4.9

6.5

9.1

4.8

4.8

Leverage (x)

0.1

0.2

0.1

0.0

(0.0)

Operating ROE

17.8

13.7

17.0

17.7

18.6

Returns (%)

ROCE (Pre-tax)

19.4

14.5

19.2

20.9

23.1

Angel ROIC (Pre-tax)

21.7

16.9

22.4

24.1

26.6

ROE

18.7

13.2

16.9

18.1

19.6

Turnover ratios (x)

Asset TO (Gross Block)

2.3

2.0

2.0

2.0

2.2

Inventory / Net sales (days)

75

85

84

83

83

Receivables (days)

62

66

64

64

64

Payables (days)

57

67

69

69

70

WC cycle (ex-cash) (days)

96

98

97

97

94

Solvency ratios (x)

Net debt to equity

0.1

0.2

0.1

0.0

(0.0)

Net debt to EBITDA

0.5

0.8

0.2

0.2

(0.1)

Int. Coverage (EBIT/ Int.)

11.8

6.6

6.8

18.4

27.4

July 1, 2014

11

Banco Products (India) | Initiating Coverage

Research Team Tel: 022 - 39357800

DISCLAIMER

This document is solely for the personal information of the recipient, and must not be singularly used as the basis of any investment

decision. Nothing in this document should be construed as investment or financial advice. Each recipient of this document should

make such investigations as they deem necessary to arrive at an independent evaluation of an investment in the securities of the

companies referred to in this document (including the merits and risks involved), and should consult their own advisors to determine

the merits and risks of such an investment.

Angel Broking Pvt. Limited, its affiliates, directors, its proprietary trading and investment businesses may, from time to time, make

investment decisions that are inconsistent with or contradictory to the recommendations expressed herein. The views contained in this

document are those of the analyst, and the company may or may not subscribe to all the views expressed within.

Reports based on technical and derivative analysis center on studying charts of a stock's price movement, outstanding positions and

trading volume, as opposed to focusing on a company's fundamentals and, as such, may not match with a report on a company's

fundamentals.

The information in this document has been printed on the basis of publicly available information, internal data and other reliable

sources believed to be true, but we do not represent that it is accurate or complete and it should not be relied on as such, as this

document is for general guidance only. Angel Broking Pvt. Limited or any of its affiliates/ group companies shall not be in any way

responsible for any loss or damage that may arise to any person from any inadvertent error in the information contained in this report.

Angel Broking Pvt. Limited has not independently verified all the information contained within this document. Accordingly, we cannot

testify, nor make any representation or warranty, express or implied, to the accuracy, contents or data contained within this document.

While Angel Broking Pvt. Limited endeavours to update on a reasonable basis the information discussed in this material, there may be

regulatory, compliance, or other reasons that prevent us from doing so.

This document is being supplied to you solely for your information, and its contents, information or data may not be reproduced,

redistributed or passed on, directly or indirectly.

Angel Broking Pvt. Limited and its affiliates may seek to provide or have engaged in providing corporate finance, investment banking

or other advisory services in a merger or specific transaction to the companies referred to in this report, as on the date of this report or

in the past.

Neither Angel Broking Pvt. Limited, nor its directors, employees or affiliates shall be liable for any loss or damage that may arise from

or in connection with the use of this information.

Note: Please refer to the important `Stock Holding Disclosure' report on the Angel website (Research Section). Also, please refer to the

latest update on respective stocks for the disclosure status in respect of those stocks. Angel Broking Pvt. Limited and its affiliates may

have investment positions in the stocks recommended in this report.

Disclosure of Interest Statement

Banco Products (India)

1. Analyst ownership of the stock

No

2. Angel and its Group companies ownership of the stock

No

3. Angel and its Group companies' Directors ownership of the stock

No

4. Broking relationship with company covered

No

Note: We have not considered any Exposure below ` 1 lakh for Angel, its Group companies and Directors

Ratings (Returns):

Buy (> 15%)

Accumulate (5% to 15%)

Neutral (-5 to 5%)

Reduce (-5% to -15%)

Sell (< -15%)

July 1, 2014

12

Banco Products (India) | Initiating Coverage

6th Floor, Ackruti Star, Central Road, MIDC, Andheri (E), Mumbai- 400 093. Tel: (022) 39357800

Research Team

Fundamental:

Sarabjit Kour Nangra

VP-Research, Pharmaceutical

Vaibhav Agrawal

VP-Research, Banking

Twinkle Gosar

Analyst

Tejashwini Kumari

Analyst

Tejas Vahalia

Research Editor

Technicals and Derivatives:

Siddarth Bhamre

Head - Technical & Derivatives

Sameet Chavan

Technical Analyst

Nagesh Arekar

Executive

Sneha Seth

Associates (Derivatives)

Institutional Sales Team:

Mayuresh Joshi

VP - Institutional Sales

Meenakshi Chavan

Dealer

Gaurang Tisani

Dealer

Production Team:

Dilip Patel

Production Incharge

CSO & Registered Office: G-1, Ackruti Trade Centre, Road No. 7, MIDC, Andheri (E), Mumbai - 93. Tel: (022) 3083 7700. Angel Broking Pvt. Ltd: BSE Cash: INB010996539 / BSE F&O: INF010996539, CDSL Regn. No.: IN - DP - CDSL - 234 - 2004, PMS Regn. Code: PM/INP000001546, NSE Cash: INB231279838 /

NSE F&O: INF231279838 / NSE Currency: INE231279838, MCX Stock Exchange Ltd: INE261279838 / Member ID: 10500. Angel Commodities Broking (P) Ltd.: MCX Member ID: 12685 / FMC Regn. No.: MCX / TCM / CORP / 0037 NCDEX: Member ID 00220 / FMC Regn. No.: NCDEX / TCM / CORP / 0302.

July 1, 2014

13