Initiating coverage | Capital Goods

June 29, 2015

Bharat Earth Movers (BEML)

BUY

CMP

`1,218

Metro + Mining Equip. + Defense = All triggers in place...

Target Price

`1,414

Metro: The Metro investment cycle in the country is to pick up with over `15,000cr

Investment Period

12 Months

worth of Rolling Stock to be awarded during FY2016-20E. BEML being a low cost

player (vis-a-vis Bombardier and Alstom India), is well positioned to gain the most

Stock Info

from this opportunity.

Sector

Capital Goods

Mining Equipment: 70-80% of BEML’s mining equipment sales come from Coal

Market Cap (` cr)

5,038

India (CIL) and other PSUs. We envisage strong mining equipment award activity

Net debt (` cr)

448

from CIL (as per CIL’s internal projections, it intends to procure 5,263 equipments during

Beta

1.3

FY2016-20E) and other PSUs (SAIL, NMDC) which are on a capex spree. This augurs well

52 Week High / Low

1,289/515

for growth prospects of BEML’s Mining & Construction Equipment (MCE) segment.

Avg. Daily Volume

75,345

Defense: BEML has a monopolistic position for supplying Tatra trucks to the

Face Value (`)

10

Indian Army. Removal of ban on Tatra trucks coupled with higher budgetary

BSE Sensex

27,812

allocations towards the Defense sector indicate strong growth prospects for

Nifty

8,381

BEML’s Defense segment.

Reuters Code

BEML.BO

Poised to report strong growth; some early signs already visible: Higher Budgetary

Bloomberg Code

BEML@IN

allocations towards urban infrastructure (especially metros) and defense sector,

coupled with recent mining sector announcements, strengthen our view that good

times are ahead for BEML. We expect BEML to post a 19% top-line CAGR during

Shareholding Pattern (%)

FY2015-17E to `4,006cr. Demand recovery, strong market positioning (almost

Promoters

54.0

virtual monopoly), coupled with execution of cost cutting initiatives, strengthen our

MF / Banks / Indian Fls

20.1

view that BEML would experience strong margin recovery. Accordingly, EBITDA

FII / NRIs / OCBs

6.8

margins are expected to expand from 2.5% in FY2015 to 8.9% in FY2017E. With

Management highlighting that it does not foresee any major capex for FY2016-

Indian Public / Others

19.1

17E, we expect entire benefits of EBITDA margin expansion to flow down to PAT

level (PAT margins would grow from 0.2% in FY2015 to 6.7% in FY2017E).

Abs. (%)

3m 1yr 3yr

Valuations: At the current market price of `1,218/share, BEML is trading at

Sensex

2.3

10.8

63.9

FY2017E P/E multiple of 19.0x. Historically, since Feb-2001, BEML’s stock has

BEML

31.0

50.9

221.3

traded at 1-year forward P/E multiple of 27x (excluding the time when BEML

made losses). On assigning P/E multiple of 22.0x to our FY2017E EPS estimate of

`64/share, we arrive at price target of `1,414, estimating 19% top-line and 529%

3-Year Daily price chart

bottom-line CAGR during FY2015-17E. Alternatively, BEML’s stock at `1,218 is trading

1400

at FY2017E EV/sales of 1.3x. At the implied price target of `1,414/share, BEML would

1200

1000

trade at FY2017E EV/sales of 1.5x, which is at ~12% discount to its long-term average.

800

Given the 16% upside from current levels, we initiate coverage on BEML with Buy rating.

600

400

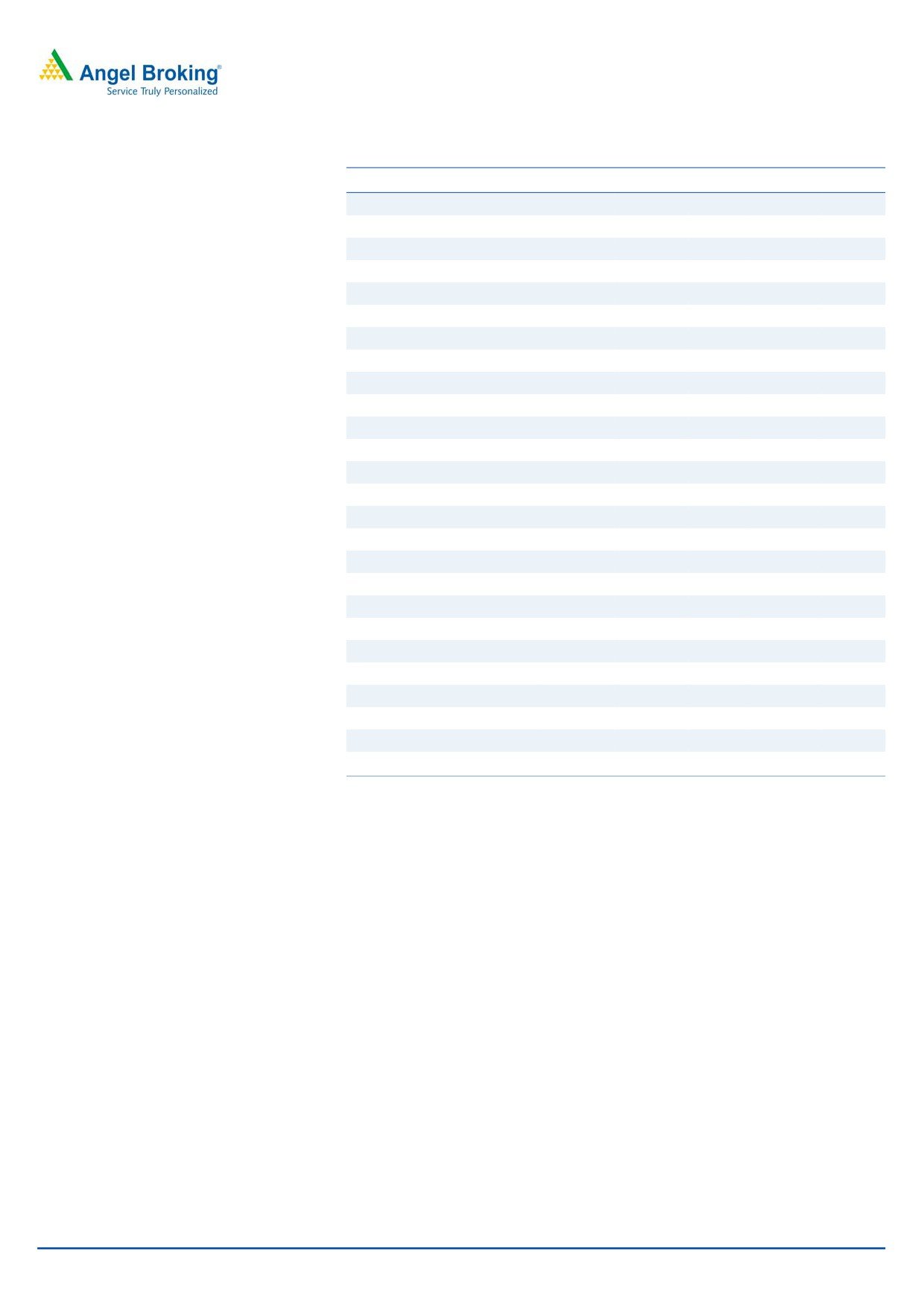

Key Financials

200

Y/E March (` cr)

FY13

FY14

FY15P

FY16E

FY17E

0

Net Sales

2,809

2,912

2,809

3,277

4,006

% chg

3.0

3.7

(3.5)

16.7

22.2

Net Profit

(80)

5

7

122

268

Source: Company, Angel Research

% chg

NMF

NMF

44.8

1699.6

120.0

EBITDA (%)

(1.6)

3.9

2.5

6.0

8.9

EPS (`)

(19.2)

1.1

1.6

29.2

64.3

P/E (x)

NMF

NMF

NMF

41.7

19.0

P/BV (x)

2.4

2.4

2.4

2.3

2.1

RoE (%)

(4.3)

0.4

0.3

5.7

11.7

RoCE (%)

(2.8)

1.8

0.6

4.9

10.2

Yellapu Santosh

EV/Sales (x)

2.2

2.1

2.0

1.6

1.3

022 - 3935 7800 Ext: 6811

EV/EBITDA (x)

NMF

52.7

79.0

27.3

14.4

Source: Company, Angel Research; Note: NMF- Not Meaningful, CMP as of June 26, 2015

Please refer to important disclosures at the end of this report

1

Initiating coverage | BEML

Rail & Metro- massive growth opportunity

With Metro investment cycle likely to see uptick, BEML being a low cost

manufacturer (vis-a-vis Bombardier and Alstom India, the only two other players

having Rolling Stock plants in India) is likely to gain the most. We estimate BEML to

report 18% revenue and 383% EBIT CAGR during 2015-17E.

Strong growth outlook for domestic Metro Industry

Considering the government’s increased thrust towards Metros in urban areas, we

are of the view that we are at the beginning of a multi-year investment cycle in

Metro projects, the first indicator being 36% higher allocation towards Urban

Metro Projects in the last budget to `8,193cr vs `6,019cr in FY2014-15.

Exhibit 1: Budgetary Allocation towards Urban Metro

(` in cr)

Actual 2013-2014

Budget 2014-2015

Revised 2014-2015

Budget 2015-2016

Plan

Non-Plan Total Plan Non-Plan Total Plan Non-Plan Total Plan Non-Plan Total

Delhi Metro Rail Corp.

2,485

0

2,485

3,324

0

3,324

3,073

0

3,073

4,134

0

4,134

Bangalore Metro Rail Corp.

845

0

845

948

0

948

1,372

0

1,372

996

0

996

Kolkata Metro Rail Corp.

10

0

10

20

0

20

0

0

0

30

0

30

Chennai Metro Rail Ltd.

1,992

0

1,992

1,866

0

1,866

1,007

0

1,007

1,024

0

1,024

Mumbai Metro

0

0

0

876

0

876

0

0

0

109

0

109

Jaipur Metro

0

0

0

234

0

234

0

0

0

421

0

421

Kochi Metro

125

0

125

462

0

462

541

0

541

599

0

599

Ahmedabad Metro

0

0

0

50

0

50

0

0

0

427

0

427

Pune Metro

0

0

0

0

0

0

0

0

0

127

0

127

Lucknow Metro

0

0

0

50

0

50

15

0

15

173

0

173

Vizag Metro

0

0

0

10

0

10

1

0

1

6

0

6

Vijayawada Metro

0

0

0

10

0

10

1

0

1

6

0

6

Nagpur Metro

0

0

0

0

0

0

10

0

10

144

0

144

Investment in Public Enterprises

5,457

0

5,457

7,850

0

7,850

6,019

0

6,019

8,193

0

8,193

Source: Budget Docs, Angel Research

In addition to the above mentioned (Exhibit 1) Metro projects, which are at various

stages of execution, Detailed Project Report (DPR) and preliminary studies have

also been prepared/ conducted across Thiruvananthapuram, Kozhikode, Varanasi,

Agra, Meerut, Patna and Kanpur.

New Orders from existing Metro projects to be awarded

Of the total ongoing works across 9 Metro projects, 2 of them are at very early

stages of implementation. Of the remaining 7 ongoing Metro projects, we expect

6 of them to come-up with the next round of Rolling Stock orders during

FY2016-18E.

June 29, 2015

2

Initiating coverage | BEML

Exhibit 2: Ongoing Metro Project Details

Total Project

Metro Project details

Comments

Cost (` cr)

Phase I and II are completed (total cost of `29,600cr); Phase III at cost of `35,000cr

is under construction (66% works done; to be completed by Dec-2016); 486 train

Delhi Metro Rail Corp. (Phase I-III)

64,600

coaches worth `4,000cr were awarded to Hyundai Rotem (120 coaches to be made

in South Korea and 366 coaches in Bengaluru);

Phase I is partly operational; 38.3km of the total 42.3km to be finished by Dec-

2015; Phase II with outlay of `26,405cr (on FY2012 no’s) is under planning;

Bangalore Metro Rail Corp. (Phase I-II)

40,300

Rolling stock for Phase I has been awarded; Phase II is yet to be awarded (worth

`918cr).

Phase I is operational; Phase II-IV are under various stages of implementation;

Phase II (only)

Kolkata Metro Rail Corp. (Phase I-IV)

Rolling stock for Phase II has been procured from CAF-Melco JV; Rolling stock for

5,000

Phase III worth `714cr is yet to be ordered.

TPC for Phase I is at `20,000cr; DPR for Phase II has been submitted, with

estimated project cost of `36,000cr; Commissioner of Railway Safety checked trial

Phase II (only)-

Chennai Metro Rail Ltd. (Phase I only)

runs for Phase I; First set of Phase I operations to start in H1FY2016E; Of the total

20,000

42 trains (worth `1,478cr) ordered- 9 from Brazil and 12 from Sri City have been

procured; for the remaining, work is in progress.

Phase I is operational, Phase II is under planning stages and Phase III tenders for

Phase II & III-

Mumbai Metro (Phase I-III)

underground structure/ Car depot have been floated; final selection of construction

34,136

firm is awaited; Rolling stock worth `3,755cr is to be awarded for Phase II & III.

Phase IA (Mansarovar-Chandpole station) has commenced operations; `1,126cr

for Phase IB has been spent towards civil works, depot, rolling stock (`100cr), sub-

Jaipur Metro (Phase IA & IB)

4,175

stations and systems; BEML was awarded `318cr of Rolling Stock (including order

for Phase IB worth `100cr); BEML expects another follow-on order worth `60cr.

51% of the civil works at stretch 1A and 17% of the civil works at stretch IB have

been executed; Stretch IA of Phase I to commence operations from early 2016E;

Kochi Metro (Phase I)

5,189

Alstom was awarded the project to supply rolling stock (worth `630cr); Contract

with Alstom also includes the option to supply another 25 train sets.

J Kumar was awarded `278cr order for works across Vastral-Apparel park stretch

of Phase I; First 6km route of Tahltej-Vastral Phase I to be completed by Sep-2016

Ahmedabad Metro (Phase I)

10,773

at a cost of `611cr; Phase I to get commissioned by 2018; Already `565cr spent till

May 30, 2014 for Phase I works; Rolling stock worth `960cr to be awarded.

Works between Airport-Charbagh station have started; In Dec-2014, global tenders

Lucknow Metro

8,000

for coaches were floated; DPR assumes rolling stock cost at `1,200cr; Tenders for

80 rolling stock have been floated, these are to open anytime.

Total Investment in Metro Projects

133,037

Source: Company, Metro DPRs, pib.nic.in

With more announcements expected towards Greenfield Metros, we expect the

opportunity from Metros to get bigger during FY2016-20E.

Over `15,000cr of Rolling stock orders in pipeline…

Based on a report by BB&J Consulting and our internal assessment of domestic

Metros’ DPRs, we are of the view that Rolling stock cost as % of the Total Project

Cost (TPC) stands at somewhere between 15-25%.

Based on the DPRs prepared and the budgeted allocations towards Rolling stock,

we are of conservative view that award activity for over `15,000cr worth of Rolling

stock would be made during FY2016-20E.

June 29, 2015

3

Initiating coverage | BEML

Exhibit 3: Rolling Stock cost as % of Metro Project Cost

Sl.

Rolling Stock as %

International Metro's

No.

of Project Cost

1

Mexico City Line B

36.2

2

Caracas Line 3

15.7

3

Santiago Line 5

24.8

4

Santiago Line 5 Extension

21.4

5

Delhi Metro (Phase I and II)

24.2

6

Madrid Extension (excl. Arganda)

15.4

Source: BB&J Consult (2000), Angel Estimates

BEML enjoys ‘lowest cost maker’ tag….well positioned to gain

Currently, there are only 3 major players Rolling Stock manufacturers for Metros in

India, with yearly capacity of ~660 units, namely, BEML, Bombardier and Alstom

India. BEML has tied-up with Hyundai-Rotem for technology part to manufacture

AC Metro coaches.

Exhibit 4: Metro Industry- Competitive Analysis

Installed

Capacity

Orders

Rolling Stock

Sl. No.

Plant Location

Capacity

Utilized

Booked

Ongoing projects & Comments

Manufacturers

(p.a.)

(p.a.)

for (yrs.)

Bengaluru,

Over 2

Delhi Metro Projects ongoing; BEML has one of

1

BEML

190

190

Karnataka

years

the lowest cost/ unit vs. peers, at `8-8.5cr/unit;

Supply 450 units to Australia; Exports to Australia

from India to begin from CY15-end; Working on

Bombardier

Savli,

Over 2

2

350

350

projects from Brazil & Saudi Arabia; Currently

India

Gujarat

years

working on the supply of 72 rakes for Mumbai's

Sub-Urban Rail Network

To supply 135 units to Australia; On Single shift

basis, on shifting to double shift installed capacity

could increase to 250 units; In next 2-3 yrs,

SriCity,

Over 2

Alstom plans to export 50%+ of domestically

3

Alstom India

120

120

Andhra Pradesh

years

manufactured Rolling Stock to Australia, APAC

and Americas; Some part of the Kochi Metro

Order has been sub-contracted to Faiveley

Transport

Source: BEML, Alstom India, Media Articles (published in CY2015), Angel Research

In addition to these 3 players, BEML also faces competition from international

players like Siemens, Mitsubishi, Kawasaki, and Band Changchun, who do not

have any manufacturing presence in India.

Based on our channel checks and Management commentary, the cost of

manufacturing a Metro coach ranges from

`8cr-12cr. Amongst the three

companies, BEML with higher indigenization, enjoys the most favorable cost

structure. Also, these MNCs have lower indigenization component and their inputs

comprise of relatively higher proportion of imports; going forward the unfavorable

June 29, 2015

4

Initiating coverage | BEML

rupee movement against the dollar may force them to bid at higher quotes vs

BEML’s quotes. Both the MNC players are also using their Indian subsidiaries to

execute their global orders. This, coupled with their current higher plant utilization

suggests that they may not bid aggressively for upcoming projects in near-term.

Recent order wins give order book and revenue growth visibility

BEML, in recent times, has reported 2 Rolling stock orders from Delhi Metro Rail

Corp. (DMRC). The first order is worth `570cr to supply 70 cars, and the second

order is worth `645cr to supply 74 cars.

BEML, as of FY2015-end, was sitting on strong order book of `1,588cr, executable

over next 12-18 months. Strong market positioning, coupled with improvement in

the award activity environment, gives strong revenue growth visibility for next few

years.

On a whole….Rail & Metro segment poised for strong growth

At the backdrop of emerging opportunity for Rolling Stock coaches, coupled with

BEML’s strong market positioning, indicates that BEML is likely to emerge as one of

the beneficiaries from revival in Indian Railway (IR) and Metro award activity.

Considering BEML’s outstanding order book of `1,588cr and strong execution, we

expect BEML’s Rail & Metro segment (35% of FY2015 revenues) to report 18% top-

line and

383% EBIT CAGR during FY2015-17E to

`1,371cr and

`70cr,

respectively.

June 29, 2015

5

Initiating coverage | BEML

Defense- removal of Tatra ban to drive earnings

With removal of ban on Tatra trucks and BEML being the only supplier of Tatra

trucks to Indian Army, we believe BEML’s Defense segment is well positioned to

report 105% revenue CAGR and turnaround in its EBIT during 2015-17E.

Removal to Tatra trucks ban…positive for the company

BEML’s Defense segment derives a major chunk of its revenues from (1) Tatra

vehicles which are used for carrying various types of missiles and rocket launchers

and (2) Armored Recovery Vehicles. Since 1986, BEML has supplied close to 7,000

Tatra trucks to the Indian Army. Currently, BEML is the only domestic player

eligible to procure/make Tatra trucks in India, thereby giving it a monopolistic

position.

In 4QFY2015, BEML was allowed to supply spare parts as well as Tatra trucks to

Indian Army on fulfillment of key conditions, such as, no direct dealing with any of

the banned entities. The removal of ban in a monopolistic scenario augurs well for

the growth prospects of BEML’s Defense segment. Given BEML’s higher

dependency on Tatra trucks, the lifting of ban should lead to strong revival in the

Defense business, going forward.

Recent announcements hint at govt. increasing Defense spending

The government in recent times has made positive announcements, which indicate

revival in Defense investment cycle. To encourage domestic manufacturing, the

government has (1) increased the FDI cap in the Defense sector (from 26% to

49%), (2) launched ‘Make in India’ theme, where greater emphasis has been laid

on procurement of locally made parts/ machines/ equipments, and (3) increased

budgetary allocation towards the Defense sector by 15.4% yoy to `94,588cr. Also,

in order to encourage better technical know-how, the government is applying for

permanent membership in the Missile Technology Control Regime (MTCR).

Defense Order book of `2,483cr, gives better revenue visibility

BEML, as of FY2015-end, is sitting on an order book of `2,483cr, executable over

the next 18-24 months. With an almost virtual monopoly, coupled with removal of

ban on Tatra trucks, gives better revenue visibility for FY2016-17E.

On a whole….Defense segment to see strong business recovery

Higher budgetary allocations coupled with surge in bid pipeline indicate that

higher Defense spending by government is real and likely to pan-out. Given that

Tatra vehicles are used for carrying various missiles and rocket launchers, uptick in

Defense spending by government would also reflect higher spending towards Tatra

vehicles and Armored Recovery Vehicles (ARVs). On a whole, we expect the

Defense segment (accounted for 6% of FY2015 revenues) to report 105% top-line

CAGR over FY2015-17E to `678cr. Further, we expect turn-around in Defense

segment EBIT in FY2016E to `21cr, which should further increase to `41cr in

FY2017E.

June 29, 2015

6

Initiating coverage | BEML

Mining & Con. Equip. segment - growth & margins to

revive

Coal India (CIL) and other PSUs account for 70-80% of BEML’s mining equipment

sales. Any revival in capex cycle at CIL augurs well for the growth prospects of

BEML’s MCE segment. We expect the MCE segment to report 9% revenue and 25%

EBIT CAGR during 2015-17E.

CIL’s increased production target to spur Mining Equip. ordering

The government in recent times (1) set an ambitious 1bn tonne output target for

CIL by 2020, (2) auctioned coal mines (Schedule I and II done, Schedule III to be

awarded) to private players, and (3) shared clarity on e-auction of various minerals

and metals. All these initiatives are a precursor to accelerate the Mining sector,

which in turn should revive the demand for mining equipments.

Exhibit 5: Coal India Machinery Procurement plans (for FY2016-20E)

2014

2015

2016E

2017E

2018E

2019E

2020E

Coal Prod. Act./ Guidance (mn tn)

462

494

548

598

661

774

908

Incremental Production (mn tn)

10

32

54

50

63

113

134

Shovel (5-42 m3)

715

732

Replacement & New demand

159

175

193

156

178

Dumper (35-240 T)

3,109

2,977

Replacement & New demand

520

992

1,082

329

521

Crawler Dozer (320-850 hp)

972

977

Replacement & New demand

123

121

149

70

46

Grader (280-500 hp)

Replacement & New demand

1

9

5

5

12

SDL (1.5 m3 to 3.5 m3)

669

668

Replacement & New demand

45

110

44

14

42

LHD (1.5 m3 to 3.5 m3)

342

340

Replacement & New demand

19

22

22

21

32

Continuous Miner (4.8 m )

8

8

Replacement & New demand

22

9

7

6

2

Total Equipments (o/s at CIL)

5,815

5,702

Replacement & New demand

889

1,438

1,502

601

833

Source: CIL, Angel Research

In order to attain its FY2020 output target, CIL in its presentation to the Power

Ministry in Jan-2015 highlighted that it has started focusing on strategies to

improve its efficiency, like switching from current low capacity to high capacity

mining equipments, and implement new mining technologies. In this regard CIL,

along with its subsidiaries, has outlined higher capex outlay (intends to procure

5,263 Mining equipments). Exhibit 5 highlights capex outlay for various key types

of mining equipments, CIL intends to purchase during FY2016-20E.

Pent-up demand from CIL to come-up for awarding…

CIL during FY2013-15 has increased its production by 42mn tonne to 494mn

tonne. Based on our analysis, Mining Equipment outstanding at CIL during the

June 29, 2015

7

Initiating coverage | BEML

period has been on a declining trend (total Mining Equipments in use declined

from 6,012 units in FY2013 to 5,815 units in FY2014 and 5,702 units in FY2015).

This disconnect in number of Mining Equipments used to increase production

numbers, indicates that demand for new Mining Equipments has been postponed

for some time now. This coupled with CIL’s ambitious growth plans (to increase the

production from 494mn tonne in FY2015 to 1bn tonne by 2020), along with its

cash balance of `53,092cr (as of FY21015 end), indicate that awarding of new

mining equipments by CIL is inevitable. Accordingly, we expect tenders for this

pent-up demand to come-up in FY2016-17E, which translates to strong demand

uptick for BEML’s Mining Equipments.

PSUs too pursuing the next round of capex…

In addition to CIL, SAIL and NMDC are also on an expansion spree, which indicate

higher capex outlay towards Mining Equipment. This can be seen from the point

that SAIL intends to expand its hot metal installed capacity from 14.4mn tonne in

FY2015 to 20.2mn tonne by FY2017E. Whereas, NMDC on the other hand,

intends to increase its Iron ore installed capacity from 31.0mn tonne in FY2015 to

37.9mn tonne by FY2017E.

Well leveraging on its existing client relationships..

BEML has well leveraged on its relationship with CIL and other PSUs, by setting-up

9 spare parts regional depots and 5 district offices, situated at client premises for

after-sales service support. This post sale support network, has led CIL to be highly

dependent on BEML (>75% of CIL’s mining equipments are procured from BEML).

This strategy helps CIL in cutting down any cost overruns and time delays, arising

due to machinery break-down. Also BEML stands to gain by understanding the

client requirements and encash on them. Notably, no other private player as of

now has set up spare part depot/ after sales service office on CIL premises.

In order to maintain CIL’s dependency for its mining equipment and leaving no

space for competition to step in, BEML is proactively trying to fulfill CIL’s machinery

needs. Attempting to do so, it has gone a step ahead by adopting measures like

(1) establishing training centers at Nagpur, KGF and Mysore to impart training to

O&M staff of coal mining companies, (2) signed “model depot agreement” with

NCL, Singrauli, where detailed advance annual coal projections along with

requirement for genuine spare parts are shared, (3) Offer MARC/ GPCC/ Cost

Cap contracts for higher output (leading to more equipments being taken up), (4)

regularly launch new product variants, which are efficient and technologically

advanced, and (5) widen product offerings to cater to client requirements (started

sale of underground mining equipments). These initiatives in our view are an

attempt by BEML to service CIL better and avert any competition. BEML almost

enjoys a virtual monopoly in providing operating mining machinery to CIL, with no

other noteworthy player competing.

June 29, 2015

8

Initiating coverage | BEML

Exhibit 6: BEML- After Sale & Parts Support network at CIL

CIL

Regional

District

Consignment

Service

Subsidiary

Office

Office

Store

Centre

Singrauli

NCL

Singrauli

with Parts Depot

Bilaspur

SECL

Bilaspur

with Parts Depot

Chandrapur

Nagpur Service-

WCL

Nagpur

with Parts Depot

HQ

Sambalpur

MCL

Bilaspur

with Parts Depot

Ranchi

CCL

with Parts Depot

Dhanbad

BCCL

Kolkata

with Parts Depot

Asansol

ECL

Kolkata

Rajmahal

with Parts Depot

Kothagudem

SCCL

Hyderabad

Ramagundam

Hyderabad

NLC

Chennai

Neyveli

Source: CIL, BEML, Angel Research

Not easy for MNCs to encroach into BEML’s market share…

Even though CIL depends heavily on BEML for its mining equipment requirement,

international players like, Komatsu, Caterpillar, Hyundai, and Volvo have shown

interest in being allowed to supply mining equipments to CIL and PSUs. MNCs lack

the bid criterions in most cases, hence are not qualified to supply equipments to

CIL and other PSUs. While comparing BEML’s products with its international peers,

BEML lags behind international players on some of the Equipment efficiency

parameters, whereas on the other hand, BEML enjoys better pricing and post sale

support network, over its international peers.

Also, CIL and PSU manpower needs to be trained to operate MNC players’

equipments. This aspect, in our view, could act as a deterrent for CIL and PSUs to

switch to using MNCs’ mining equipments.

A strong case for business recovery in sight for MCE segment….

Considering uptick in overall Mining sector (especially demand emanating from

CIL and its subsidiaries), we expect BEML’s MCE segment revenues to report 9%

top-line and 25% EBIT CAGR during FY2015-17E to `1,919cr and `188cr,

respectively. Our growth estimates capture the longer duration of CIL’s tendering

cycle and possible loss of market share to international peers.

June 29, 2015

9

Initiating coverage | BEML

Investment Rationale

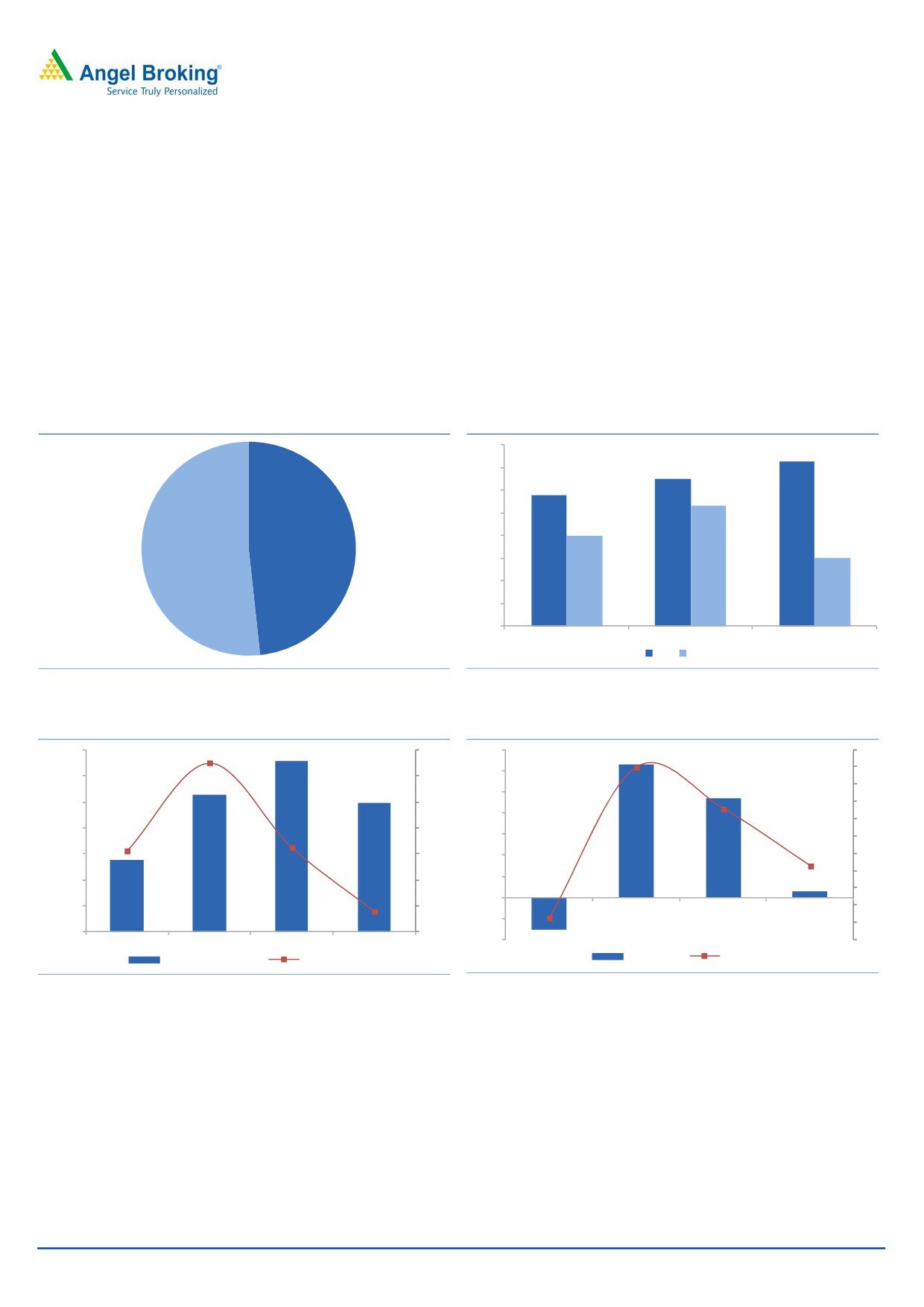

Order book set to expand…

As of FY2015-end, BEML is sitting on an order book of `5,633cr, which gives

revenue visibility for 18+ months. Further, if we look into order book details, a

major chunk of it is from the Defense segment (28% of total order book), followed

by Rail & Metro segment (44% of total order book), and Mining segment (28% of

total order book).

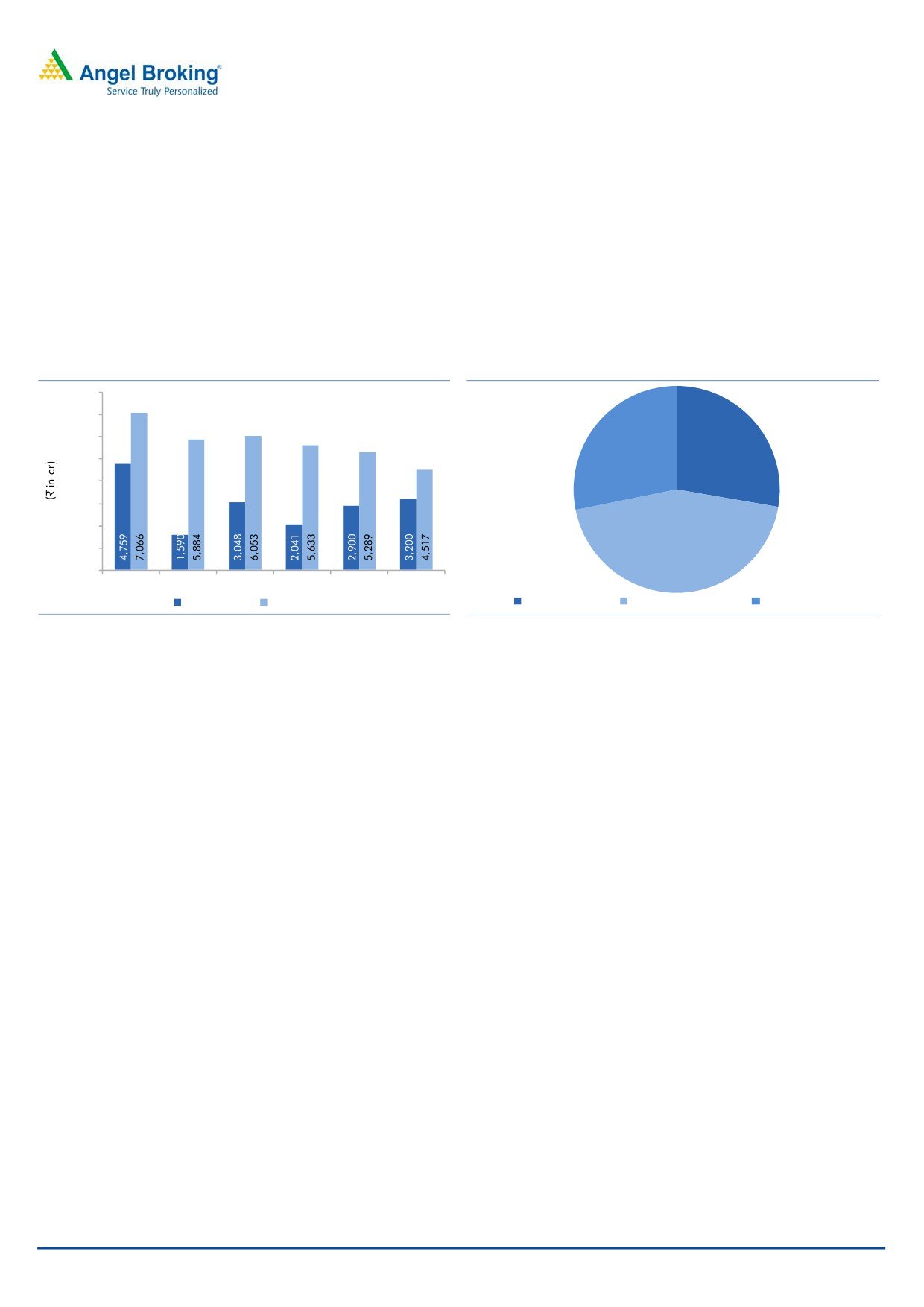

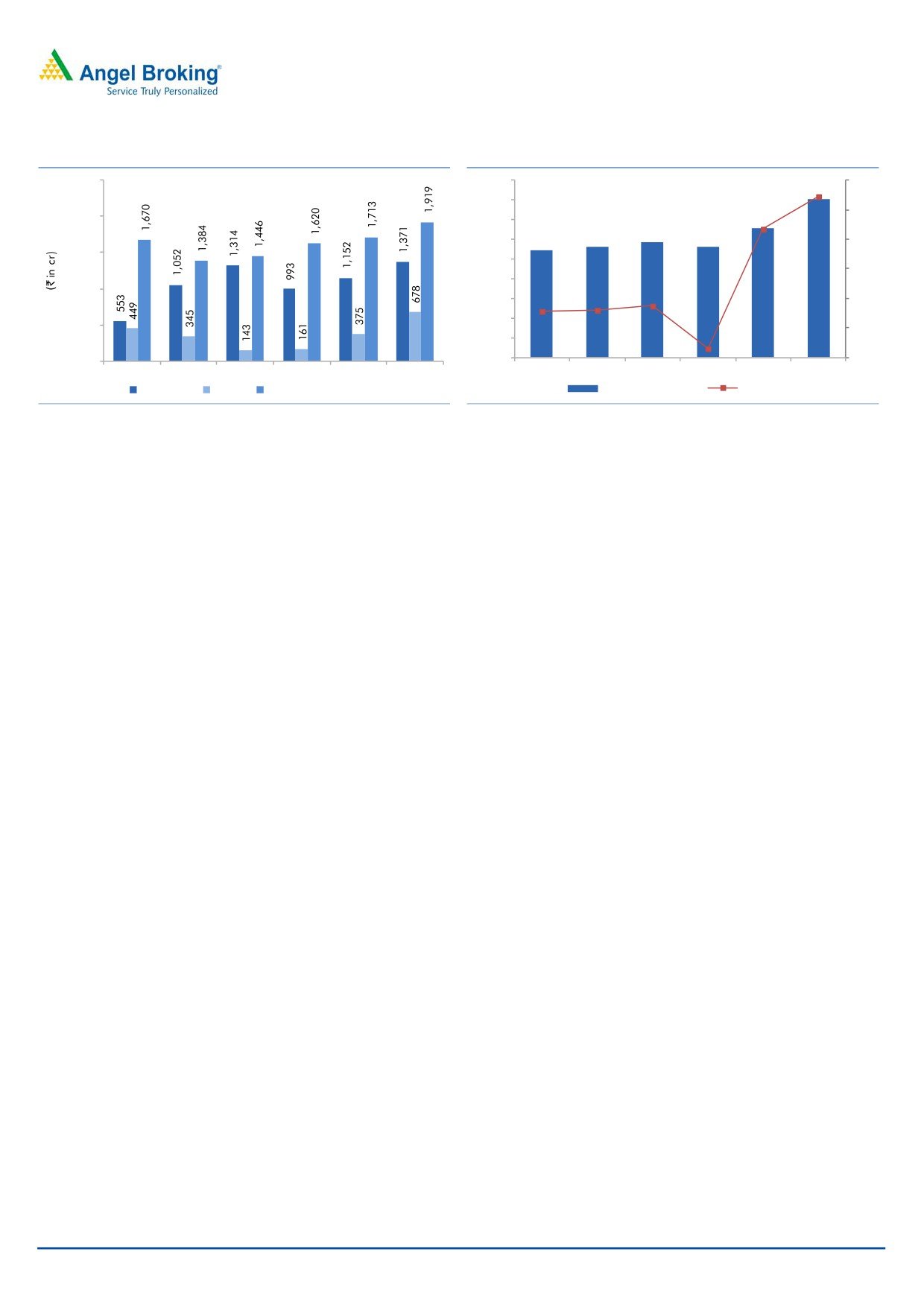

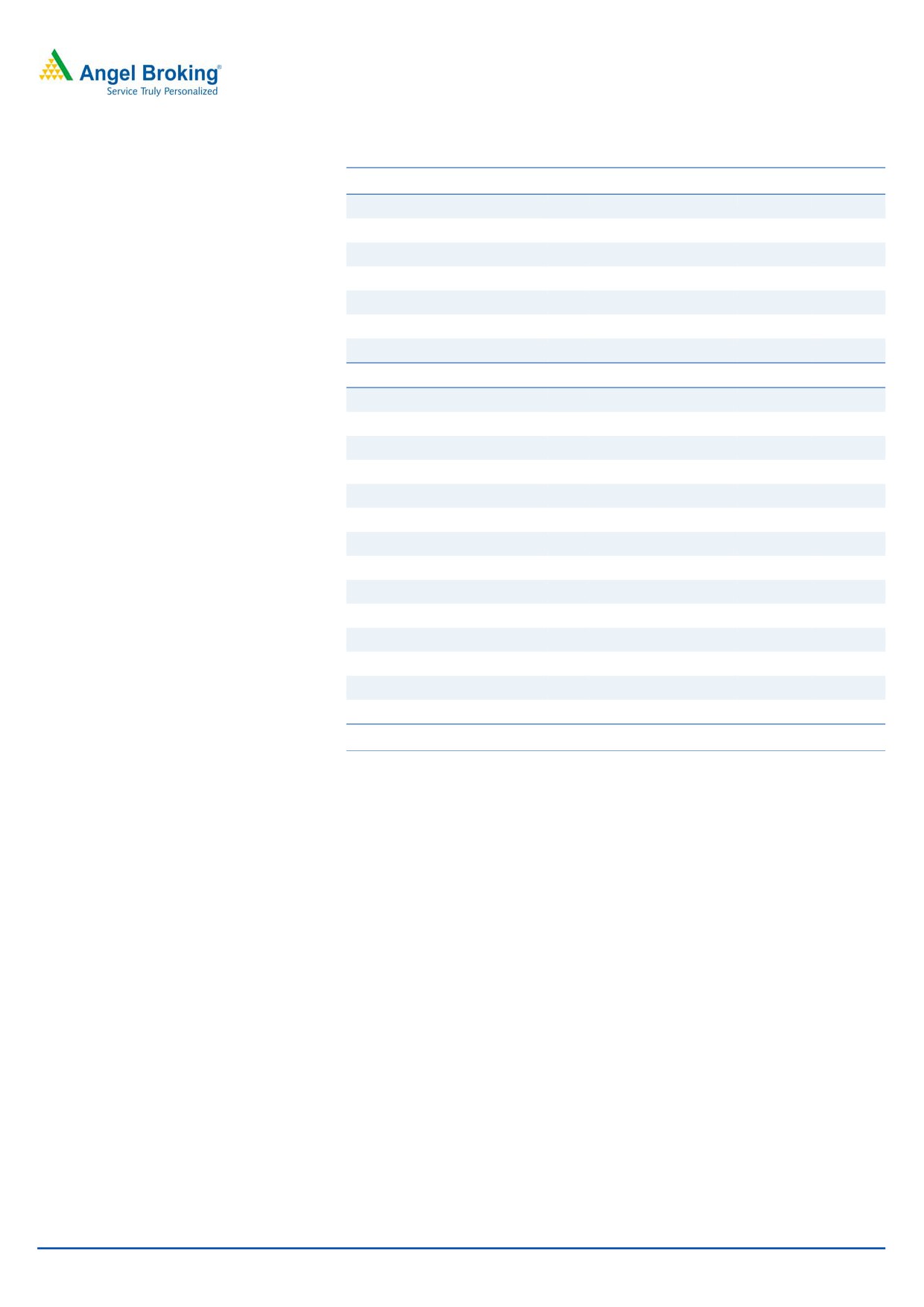

Exhibit 7: Order Inflow & Order Book movement

Exhibit 8: Order Book split (segment-wise)

8,000

7,000

6,000

28%

28%

5,000

4,000

3,000

2,000

1,000

0

44%

FY12

FY13

FY14

FY15

FY16E

FY17E

Order Inflows

Order Book

Mining segment

Rail & Metro segment

Defense segment

Source: Company, Angel Research

Source: Company, Angel Research

The government’s increased thrust towards Mining, Defense and Metro amongst

other verticals, when coupled with BEML’s strong market positioning across the

segments, strengthens our view that BEML should report 25% CAGR in its order

inflow during FY2015-17E to `3,200cr. This, on the back of strong execution,

strengthens our view that the order book would de-grow by 11% CAGR during

FY2015-17E to `4,517cr.

Expect strong 19% top-line CAGR during FY2015-17E…

At the backdrop of strong revival in the order inflow environment (across all the

three business segments), we expect BEML to ramp-up its execution, going

forward. We expect BEML to report strong growth across two of its business

segments, ie Rail & Metro and Defense, which have been under pressure in the last

2-3 years (on lower revenue base). The government’s thrust towards Metro

development and expansion across 15+cities will create huge demand for Rolling

stock, which in turn should benefit BEML the most, with it being one of the low cost

Metro coach manufacturers. We expect the Rail & Metro segment of the company

to report 18% top-line CAGR during FY2015-17E to `1,371cr. Further, with the

removal of ban on Tatra trucks, growth prospects for BEML’s Defense segment

look strong. We expect the Defense segment to report 105% top-line CAGR during

FY2015-17E to `678cr. Our view of strong growth in the Defense segment is

owing to (1) higher budgetary allocation made towards the Defense sector and

(2) considering that BEML is the single supplier of Tatra trucks to Indian defense.

Also, their MCE segment is expected to report

9% top-line CAGR during

FY2015-17E to `1,919cr. Growth across the MCE division would be driven by

strong new equipment demand and replacement demand emanating from CIL,

SAIL and NMDC’s capex cycle (as all of them are pursuing strong capex).

June 29, 2015

10

Initiating coverage | BEML

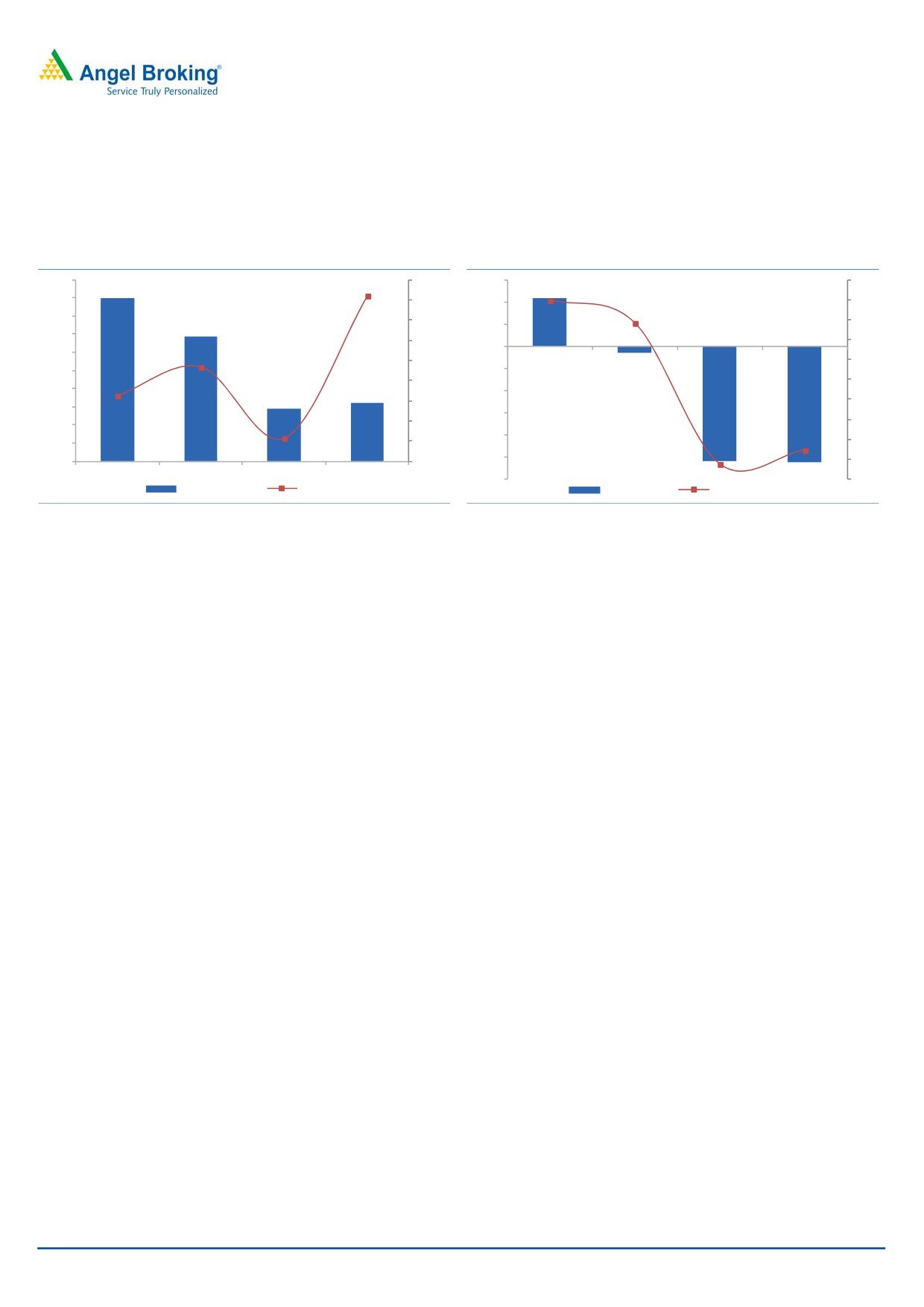

Exhibit 9: Segment-wise Revenue movement

Exhibit 10: Revenue & yoy growth

2,500

4,500

25%

4,006

4,000

22%

20%

2,000

3,500

3,277

2,912

2,809

2,809

3,000

2,727

15%

17%

1,500

2,500

10%

2,000

1,000

1,500

5%

1,000

500

4%

3%

3%

-4%

0%

500

(0)

-5%

(0)

FY12

FY13

FY14

FY15

FY16E

FY17E

FY12

FY13

FY14

FY15

FY16E

FY17E

Rail & Metro Defense Construction & Mining

Revenues (` in cr)

yoy growth (%)

Source: Company, Angel Research

Source: Company, Angel Research

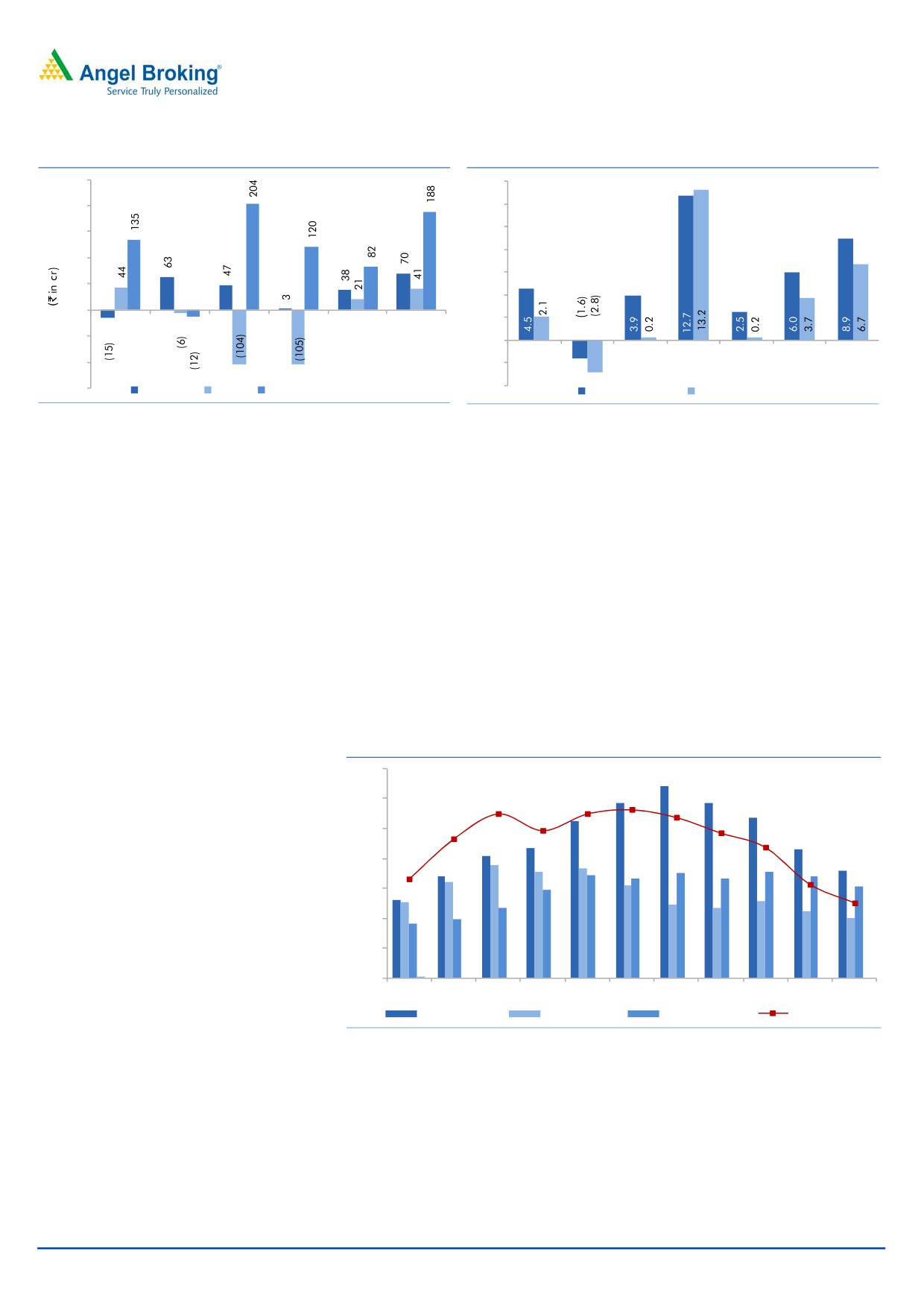

Strong execution to fuel the much required turnaround…

Higher fixed cost base across business segments and almost stagnated revenue

base has put BEML in a tough spot. BEML reported negative EBITDA margins in

FY2013 (-1.6%) and 1HFY2015 (-10.3%); margins for 1HFY2015 are the worst in

the company’s recent history. But on the back of stronger execution, 2HFY2015

witnessed a turn-around.

Further, if we look into segment-wise details, Defense segment reported margins in

red during FY2015 (reflecting weak execution). Also, Mining Equipment and Rail &

Metro segments witnessed margin contraction on account of higher fixed cost

base.

Led by revival across business segments (as highlighted above), we expect BEML to

report a strong 19% top-line CAGR during FY2015-17E to `4,006cr. BEML at

FY2015-end had 10,328 employees. Considering revenue growth potential during

FY2016-17E, when coupled with (1) ~800 employees retiring during the same

period, (2) control over admin. and marketing expenses, (3) cost control initiatives

at the shop floor level, and (4) next pay commission hike coming in to effect from

Jan-2018 only, we are of the view that BEML would be well positioned to absorb

fixed costs, which in turn should translate into margin expansion. We expect BEML

to extend its FY2015 EBITDA level turnaround to FY2016 (at 6.0%) and further

expand margins during FY2017E (to 8.9%).

June 29, 2015

11

Initiating coverage | BEML

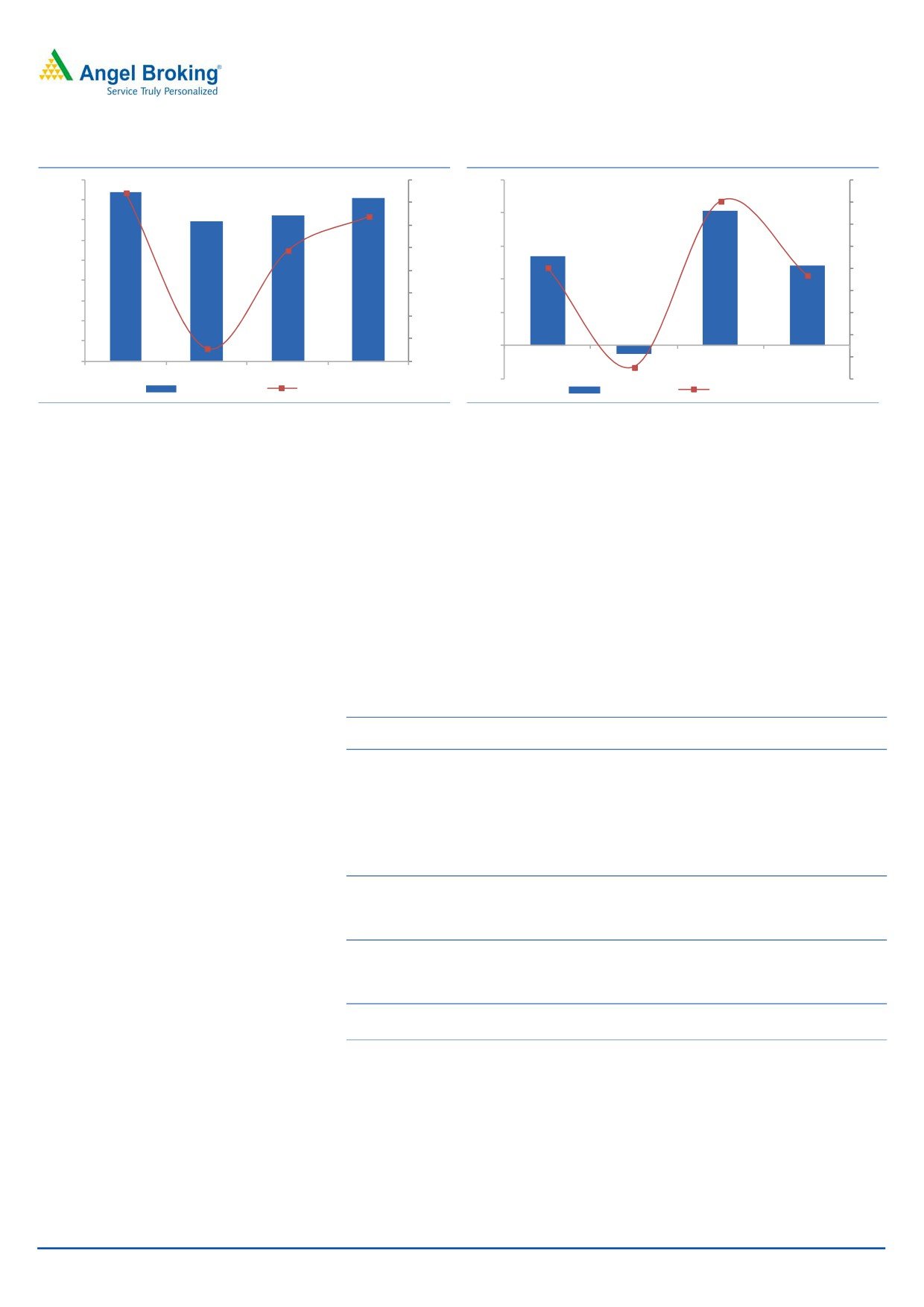

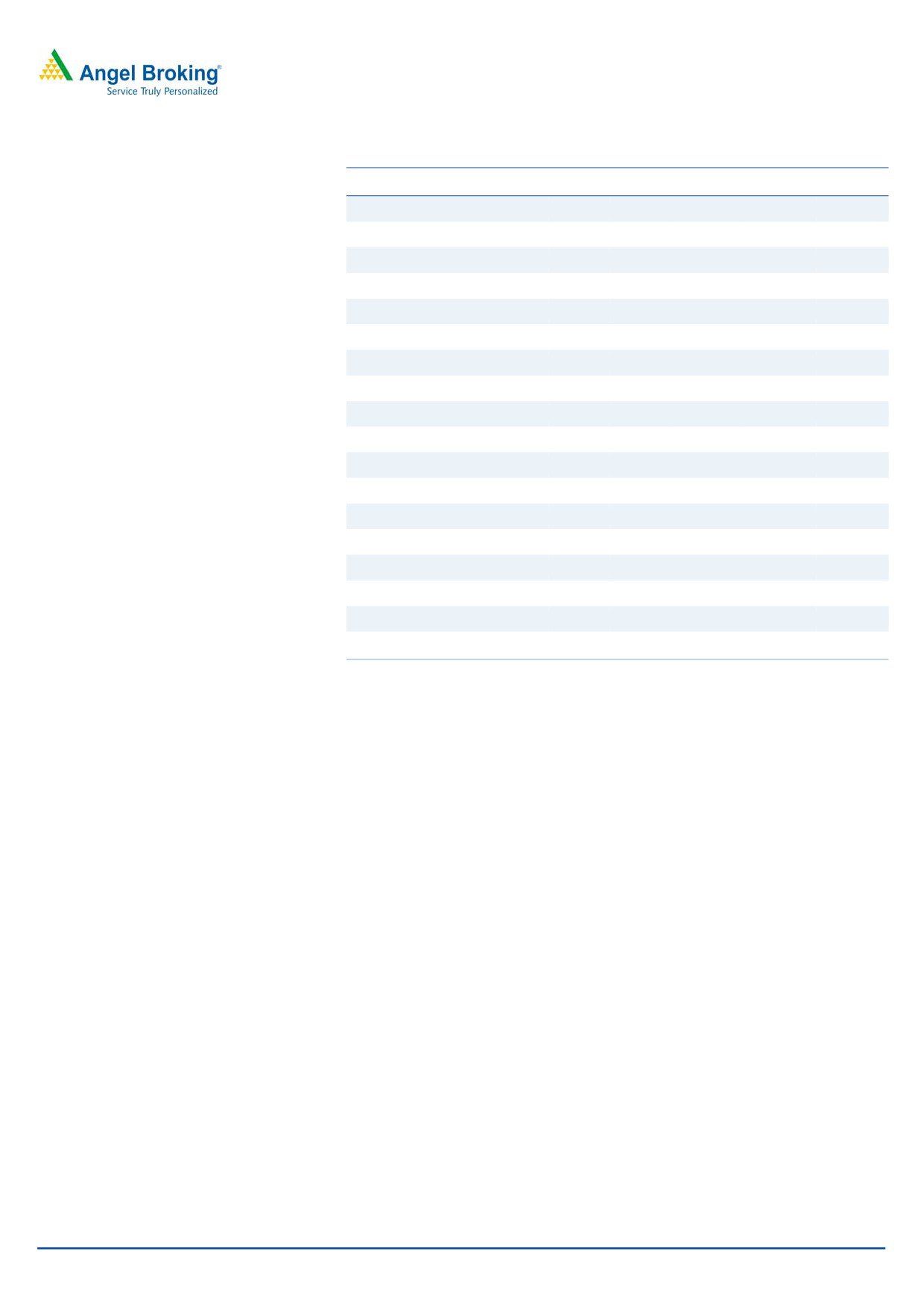

Exhibit 11: Segment-wise EBIT

Exhibit 12: Company level EBITDA & PAT Margins

250

14.0

200

12.0

10.0

150

8.0

100

6.0

50

4.0

0

2.0

FY12

FY13

FY14

FY15

FY16E

FY17E

(50)

0.0

FY12

FY13

FY14

4QFY15

FY15

FY16E

FY17E

(100)

(2.0)

(150)

(4.0)

Rail & Metro Defense Construction & Mining

EBITDA Margins (%) PAT Margins (%)

Source: Company, Angel Research

Source: Company, Angel Research

With EBITDA level turnaround already seen, we expect the entire benefits to flow

down to PAT level. This, when coupled with ease in working capital cycle and lower

interest rate cycle, should help BEML report PAT level margin expansion. On the

whole, we expect PAT margins to improve from 0.2% in FY2015 to 6.7% in

FY2017 (reflecting sharp PAT growth from `7cr in FY2015 to `268cr in FY2017E.

Working Capital cycle to ease going forward…

BEML is well geared to capitalize on the emerging opportunities across its business

segments. Slowdown in the capex cycle across business segments had taken a toll

on the company’s growth prospects. Anticipation of sharp demand from MCE

segment led BEML build higher inventories, which contributed majorly to the stretch

in the Net Working Capital (NWC) cycle.

Exhibit 13: Decline in Inventory days to ease NWC cycle...

350

282

300

275

275

269

247

243

233

250

219

200

166

157

150

126

100

50

0

FY07

FY08

FY09

FY10

FY11

FY12

FY13

FY14

FY15

FY16E FY17E

Inventory (in days)

Debtors (in days)

CL & Prov. (in days)

NWC (in days)

Source: Company, Angel Research

However, with early indications of capex cycle revival across Mining sector, mainly

led by Coal India, we are optimistic that BEML should be able to further lower its

NWC days (from 282 days in FY2012 to 126 days in FY2017E).

Ease in the NWC cycle of BEML, in our view would lead to decline in the overall

debt levels of the company. As a result, the debt of BEML would decline from

`592cr (as of FY2015-end) to `317cr by FY2017E. Simultaneously, the Net D/E

ratio would decline from 0.2x as of FY2015-end to 0.0x by FY2017-end.

June 29, 2015

12

Initiating coverage | BEML

Upcoming business phase to see strong CFO generation…

BEML is well geared to capitalize on the emerging opportunities across its business

segments. Slowdown in the capex cycle across business segments in the past

couple of years had taken a toll on the company’s growth prospects.

Currently, all of the 9 assembly units/ plants are unable to absorb the higher fixed

cost base. At the backdrop of demand uptick across all the business segments, and

improvement in WC cycle (in terms of no. of days) when coupled with minimal

capex outlay requirements (except for maintenance capex part), lead to our view

getting strengthened that BEML is expected to report strong cash flow from

operations (CFO), going forward. We expect BEML to generate `1,140cr of cash

flow from operations during FY2015-17E, which could be used to either reinvest

back into the business or reward shareholders with higher dividend.

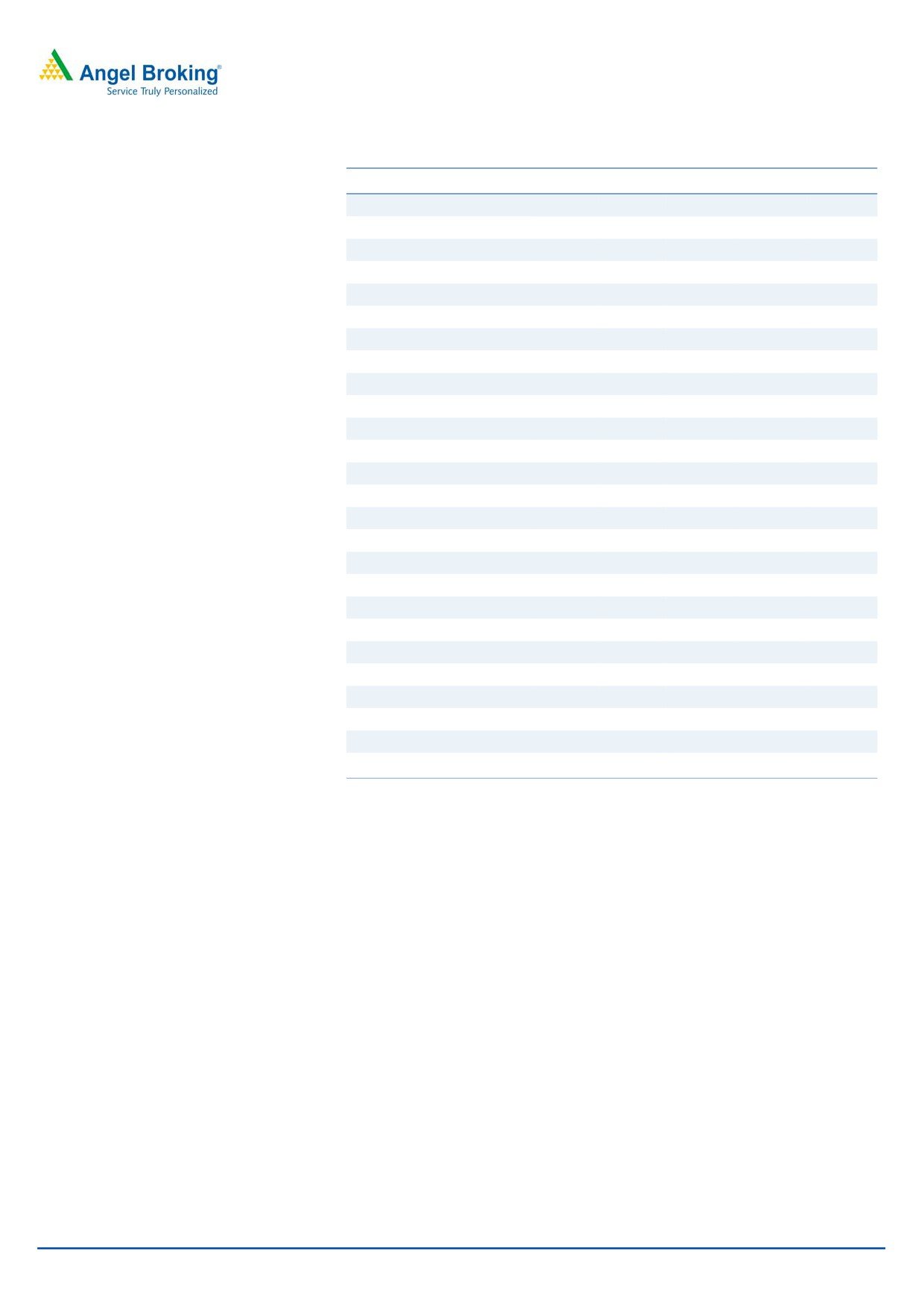

Exhibit 14: Cash flow from Operations

Exhibit 15: OCF Yield

600

25

500

20

400

15

300

10

200

5

100

0

0

FY13

FY14

FY15

FY16E

FY17E

FY13

FY14

FY15

FY16E

FY17E

(100)

(5)

(200)

(10)

Source: Company, Angel Research

Source: Company, Angel Research

BEML’s yield on Operating Cash Flows (OCF) for FY2015 stood at 21.2%, which is

very impressive. We expect BEML to report OCF yield of 11.2% and 13.3% for

FY2016E and FY2017E, which again is noteworthy.

June 29, 2015

13

Initiating coverage | BEML

About the Company

BEML is a Mini-Ratna Category-1 public sector undertaking (PSU) under the control

of Ministry of Defence (MoD), operating in three distinct business segments

namely, Mining & Construction Equipment, Defence, and Rail & Metro.

Having commenced operations in 1964, with the transfer of Railway Coach

Manufacturing facilities from Hindustan Aeronautics Ltd, BEML has over the years

diversified into manufacturing various types of mining and construction

equipments, Metro coaches and specialised defence vehicles/ products.

Exhibit 16: Business Segment Details

Business Segments

Production/ Assembling of

Mining & Construction Equip.

Dumpers, Bulldozers, Hydraulic Excavators, Rope Shovels,

(MCE)

Hydraulic Excavators, Wheel/ Backhoe Loaders, Tyre Handlers

Integrated Rail Coaches, Electrical Multiple Units (EMUs), Main

Rail & Metro

Line Electrical Multiple Units (MEMUs), Stainless Steel EMU

Tatra Trucks, Armored Recovery Vehicles, Ammunization

Defense Products

Loader Vehicles, Bheema

Source: Company, Angel Research

In the back-drop of down cycle seen across MCE and Rail & Metro segments, and

ban on Tatra Trucks affecting the Defense segment performance, BEML reported a

flat top-line CAGR during FY2013-15 to `2,809cr. Shift in mix, and recent cost

cutting initiatives led BEML report a turn-around from `80cr of net loss in FY2013

to `7cr of net profit in FY2015.

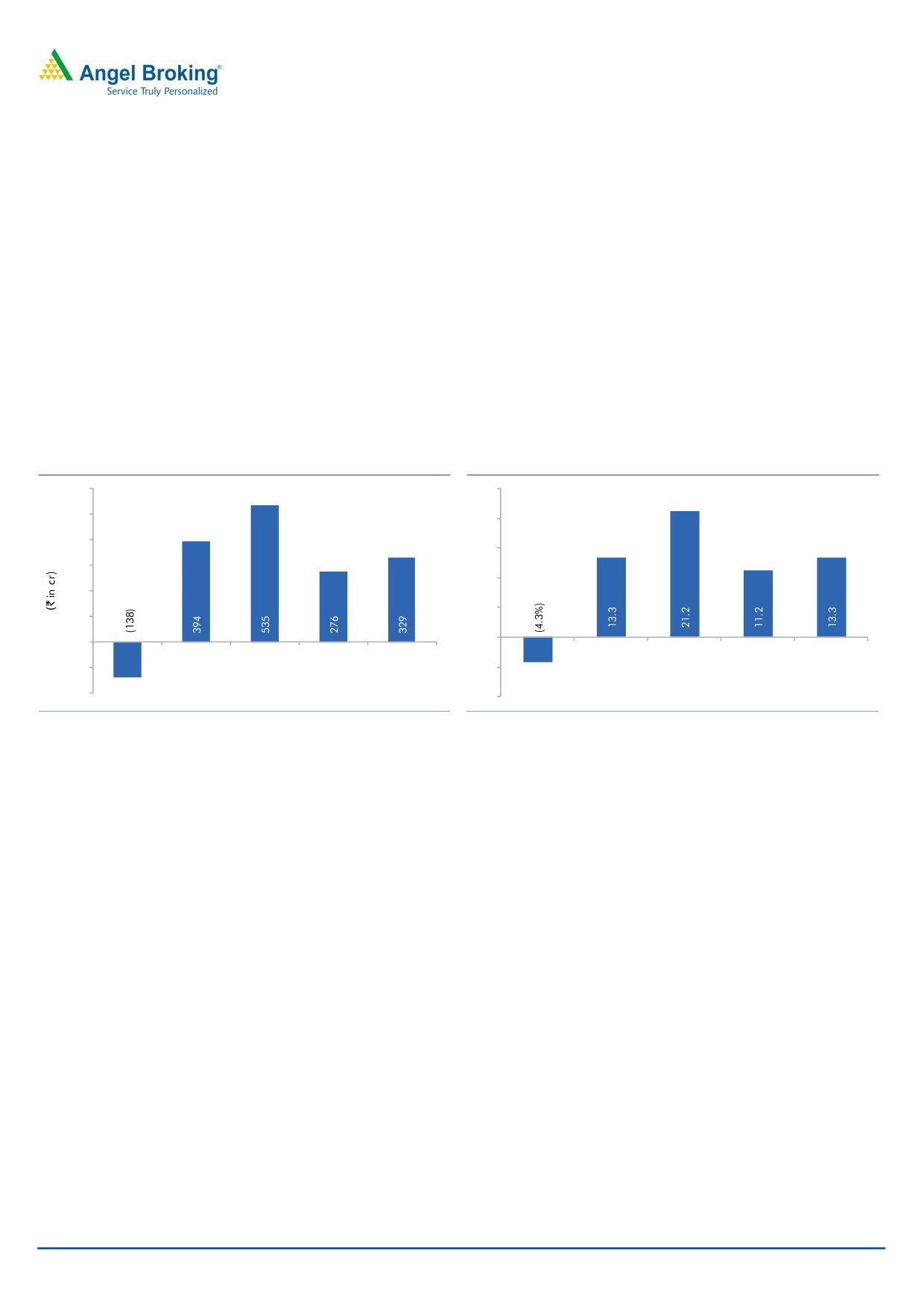

Exhibit 17: Revenue mix (segment-wise; FY15)

Exhibit 18: EBIT mix (segment-wise; FY15)

150

6%

120

100

50

36%

3

0

58%

Const. & Mining Equip.

Rail & Metro

Defense

(50)

(100)

(105)

Const. & Mining Equip.

Rail & Metro

Defense

(150)

Source: Company, Angel Research

Source: Company, Angel Research

Noticeably, BEML has witnessed a turn-around in the last quarters’ results, mainly

driven by recent cost cutting initiatives at the shop floor level, lower dependency on

imports, and cut in admin and marketing expenses.

June 29, 2015

14

Initiating coverage | BEML

(A) Metro & Railways segment under pain

Poor Wagon ordering affected the Railways sub-segment

For wagon supplies, BEML only bids for Indian Railways (IR)’ tenders. Prior to

FY2013, IR annually procured ~600-700 rail coaches from BEML. However,

during FY2014/15, BEML only made 130/145 coaches for IR. Decline in BEML’s

railways business was owing to (1) lower tendering by IR with ~25,000 wagons

tendered during FY2012-15 vs annual procurement activity of ~18,000-20,000

wagons during FY2009-12 in a highly crowded market (industry capacity stands at

~30,000 wagons annually), and with (2) BEML intentionally abstaining from

tendering for wagons, given that wagon works are highly labor intensive.

Exhibit 19: Rail & Metro Segment Revenue split

Exhibit 20: Rail & Metro Wagon/ Coach Sale volumes

160

145

140

130

115

120

106

100

80

80

Metro, 48%

60

Railways, 52%

60

40

20

(0)

FY13

FY14

FY15

Rail

Metro

Source: Company, Angel Research

Source: Company, Angel Research

Exhibit 21: Rail & Metro Segment Revenue

Exhibit 22: Rail & Metro Segment EBIT

1,400

90.2

100

70

7

6

60

1,200

80

6.0

5

50

1,000

60

4

40

3

800

40

3.6

24.9

993

22.3

30

2

0.3

600

20

20

1

0

400

0

10

(15)

63

47

3

(1)

(24.4)

0

200

(20)

(2)

FY12

FY13

FY14

FY15

553

1,052

1,314

(10)

(3)

(0)

(40)

(20)

(2.7)

(4)

FY12

FY13

FY14

FY15

EBIT (` in cr)

EBIT Margin (%)

Revenues (` in cr)

yoy growth

Source: Company, Angel Research

Source: Company, Angel Research

Muted award activity led to poor execution at Metro business

Having entered the Metro space in 2009, BEML to-date has delivered ~800 Metro

coaches for Jaipur, Bengaluru and Delhi Metro projects. In addition to the 3 above

mentioned projects, given the limited award activity in Metro space during

FY2013-15, BEML witnessed revenue decline in this sub-segment.

In the back-drop of weak award activity and higher fixed cost base, Rail and Metro

segment reported negative 3% revenue and negative 78% EBIT CAGR during

FY2013-15.

June 29, 2015

15

Initiating coverage | BEML

(B) Defense segment adversely impacted since Tatra Scam..

Since the Tatra scam broke-out in 2012, Defense segment revenues have been on

a declining trend (from the highs of `717cr in FY2011 to `161cr in FY2015).

Exhibit 23: Defense Segment Revenue

Exhibit 24: Defense Segment EBIT

500

12.2

20.0

60

20

9.7

450

10.0

10

40

(1.6)

400

0.0

0

20

350

44

(10.0)

(10)

0

300

(23.2)

(20.0)

FY12

FY13

FY14

FY15

(20)

250

(20)

(37.4)

(30.0)

(6)

(30)

200

(40)

(104)

(105)

(40.0)

(40)

150

(60)

(58.4)

(50.0)

(50)

100

(80)

(65.4)

(60.0)

(60)

50

449

345

143

161

(72.3)

0

(70.0)

(100)

(70)

FY12

FY13

FY14

FY15

(120)

(80)

Revenues (` in cr)

yoy growth

EBIT (` in cr)

EBIT Margin (%)

Source: Company, Angel Research

Source: Company, Angel Research

Historically, BEML derives a major chunk of the Defense segment revenues from

(1) Tatra Vehicles, which are used for carrying various types of missiles and rocket

launchers), and (2) Armored Recovery Vehicles. BEML has played an important role

in integrated guided missile development projects by supplying ground support

vehicles. It has also manufactured aggregates for Akash missile, and designed and

manufactured Armored Repair and Recovery Vehicle (ARRV) for Combat Vehicles

Research & Development Establishment (CVRDE). Since 1986, BEML has supplied

over 7,000 Tatra trucks to the Indian Army.

The Defense segment reported negative 32% revenue CAGR during FY2013-15 to

`161cr. The segment level EBIT losses widened from `6cr in FY2013 to `105cr in

FY2015, reflecting inability to absorb higher fixed costs.

(C) Spare sales & Servicing support MCE segment growth

BEML derives

70-80% of MCE segment revenues from Coal India (and

subsidiaries), SAIL and NMDC, indicating high dependency on Mining Equipment

sub-segment and less on the Construction Equipments. Again within Mining

Equipments, a major chunk of revenues are from the sale of Dozers and Dumpers

which account for ~500-650 units of the total ~600-850 units of equipments sold

annually.

Issues disconcerting the Mining cycle have adversely impacted the MCE segment of

the company in the last few years. During the years FY2011-15, the segment sales

have been hovering at ~1,700cr, where every year, loss of equipment sales have

been compensated by either higher exports, equipment servicing, or spare part

sales. Also, it is to be noted that mining companies tend to club their requirements

of several years and invite periodic tenders for mining equipments, which further

take several months to process. Often the actual delivery of machines spans over a

number of years. Therefore sales in any particular year do not necessarily

represent that year’s demand, so market growth is best interpreted over a longer

time horizon only.

June 29, 2015

16

Initiating coverage | BEML

Exhibit 25: MCE segment Revenue

Exhibit 26: MCE segment EBIT

1,800

20.0

250

16

14.1

17.2

1,600

12.0

15.0

14

200

1,400

10.0

12

4.5

1,200

8.1

5.0

150

7.4

10

1,000

0.0

8

800

100

(5.0)

6

600

(17.1)

(10.0)

50

4

400

(0.9)

204

135

120

2

200

(15.0)

1,670

1,384

1,446

1,620

0

(12)

0

(20.0)

FY12

FY13

FY14

FY15

0

FY12

FY13

FY14

FY15

(50)

(2)

Revenues (` in cr)

yoy growth

EBIT (` in cr)

EBIT Margin (%)

Source: Company, Angel Research

Source: Company, Angel Research

Despite issues grappling the Mining sector during FY2013-15, focus on spare part

sales and equipment servicing helped the MCE segment to report 8% revenue

CAGR during FY2013-15 to `1,620cr. Shift in mix towards high margin exports

and spare part sales helped BEML report turn-around in its segment level EBIT

from loss of `12cr in FY2013 to profit of `120cr in FY2015.

Details of Manufacturing Plants

BEML has 9 manufacturing units located across Kolar Gold Field (KGF), Bangalore,

Palakkad and Mysore, which are into manufacturing products for the Mining

Equipment, Rail & Metro and Defense business segments.

Exhibit 27: Details of Manufacturing facilities

Production Facilities

Segments Production details

Bulldozers, Hydraulic Excavators, Wheel Loaders,

Kolar Gold Field

Dozers, Pipe Layers, Tyre Handlers, Hydraulic Cranes,

MCE

(KGF) Complex

Walking Dragline, Electric Rope Shovels, Engineering

Mine Ploughs

R&M

Rail Coach & Wagon components & aggregates

Defense Armored Recovery Vehicles, Transmissions, Axles

Rail coaches, AC EMUs, DEMU's, SS EMU's, MEMUs,

Bangalore Complex

R&M

OHE Cars, Stainless Steel Metro Cars

Milrail Coaches, Ejector & Air Cleaner assemblies, and

Defense

Military Wagons

Palakkad Complex

R&M

Rail Coach parts & aggregates

Tatra Heavy duty Trucks, Sarvatra Bridge Systems,

Defense

Heavy Recovery Vehicles

Rear Dump Trucks, Motor Graders, Water Sprinklers,

Mysore Complex

MCE

Engines for all their product offerings

Source: Company, Angel Research

June 29, 2015

17

Initiating coverage | BEML

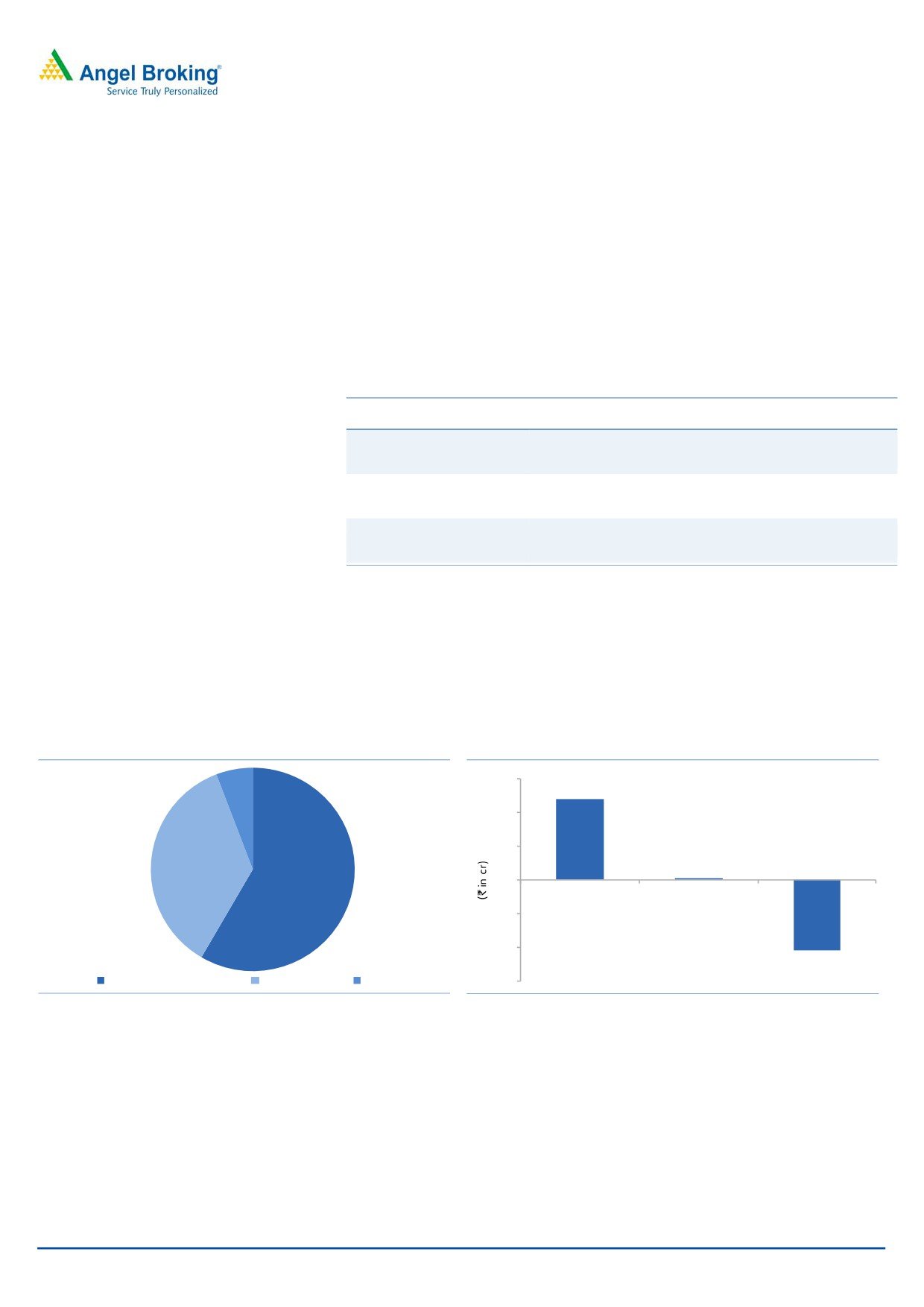

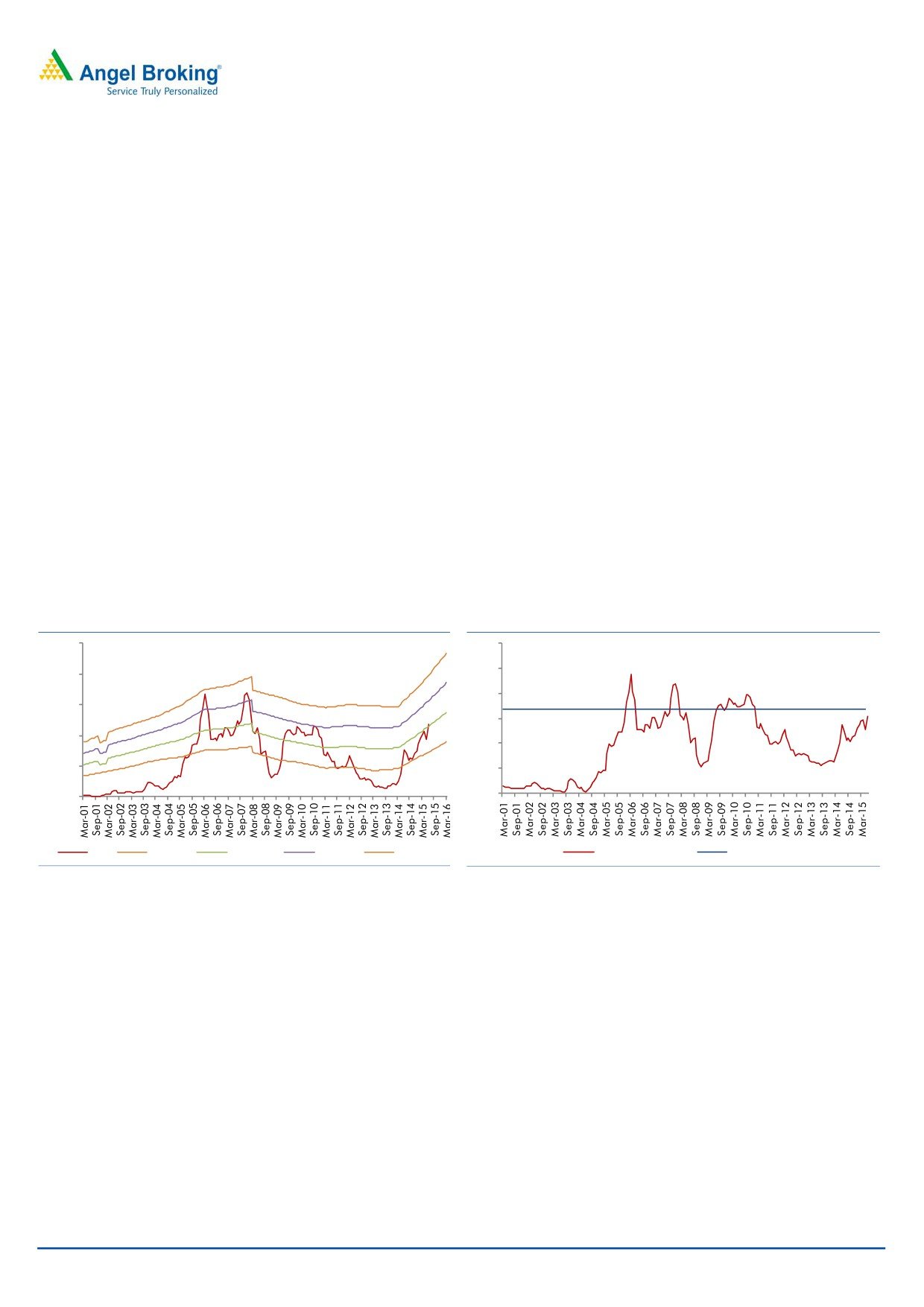

Valuation

At the current market price of `1,218/share, BEML is trading at FY2016E and

FY2017E P/E multiple of 41.7x and 19.0x, respectively. Historically, since Feb-

2001, BEML’s stock has traded at a 1-year forward P/E multiple of 27x (excluding

when BEML made losses). Earnings growth of the company has been very volatile

since FY2013. We expect BEML to report 19% top-line and 529% bottom-line

CAGR during FY2015-17E, with such strong growth expected to sustain beyond

FY2017 as well. We expect BEML to continue to enjoy premium valuations on

account of strong long-term growth outlook and low competitive threat across all

the business segment in which it operates.

Considering the strong earnings growth, which is likely to stretch beyond FY2017,

we have assigned a 1-year forward P/E multiple of 22.0x (~19% discount to its

long-term historical average). Our target multiple of 22.0x captures, (1) strong

business recovery in FY2016/17E, which is expected to last for another 3-5 years,

(2) strong margin recovery from here-on, considering the market positioning within

relatively lesser competitive business areas (guarded by structural advantage BEML

enjoys given its PSU status). On assigning 22.0x P/E multiple to our FY2017E EPS

estimate of `64/share, we arrive at a price target of `1,414.

Exhibit 28: 1-year forward EV/ Sales band (x)

Exhibit 29: 1-year forward Avg. EV/Sales band (x)

2,500

3.0

2.5

2,000

2.0

1,500

1.5

1,000

1.0

500

0.5

0

0.0

Price

EV/Sales-1

EV/Sales-1.5

EV/Sales-2

EV/Sales2.5

Price

EV/Sales-1.5

Source: Angel Research

Source: Angel Research

We did an alternate check to assess whether the assigned target P/E multiple

justifies our price target. BEML’s stock at `1,218/share would be trading at FY2016E

and FY2017E, EV/sales multiple of 1.6x and 1.3x, respectively. At the implied price target of

`1,414/share, BEML’s share would be still trading at FY2017 EV/sales of 1.5x, which is at

~12% discount to its long-term average. Given the 16% upside from current levels, we

initiate coverage on BEML stock with Buy rating.

June 29, 2015

18

Initiating coverage | BEML

Risks to our Estimates

Delays in MCE and Metro capex cycle recovery from here-on could be a big

risk to our estimates.

Significant loss of market share vs. our assumption of slight loss of market

share, across MCE segment could be a risk to our assumptions.

Any sharp appreciation in the Rupee (INR) could make MCE segment imports

competitive, which again could be a risk to our market share assumptions and

be a threat to our earnings growth estimates.

June 29, 2015

19

Initiating coverage | BEML

Profit and Loss Statement

Y/E March (` cr)

FY13

FY14

FY15

FY16E

FY17E

Net Sales

2,809

2,912

2,809

3,277

4,006

% Chg

3.0

3.7

(3.5)

16.7

22.2

Total Expenditure

2,854

2,798

2,739

3,082

3,649

Cost of Raw Materials Con.

1,645

1,711

1,583

1,846

2,311

Purchase of Stock-in-trade

9

3

0

1

0

Employee benefits Expense

739

717

769

787

805

Other Expenses

460

367

387

448

532

EBITDA

(45)

113

70

196

357

% Chg

NMF

NMF

(38.2)

179.8

82.7

EBIDTA %

(1.6)

3.9

2.5

6.0

8.9

Depreciation

50

54

52

55

59

EBIT

(95)

60

18

141

298

% Chg

NMF

NMF

(70.2)

693.0

111.8

Interest & Financial Charges

141

110

71

51

34

Other Income

104

63

60

66

79

PBT

(132)

13

7

156

343

Exceptional Items

10

16

0

0

0

Prior Period Adjustments

0

(19)

0

0

0

Tax

(42)

4

0

34

75

% of PBT

32.1

35.2

2.2

22.0

22.0

PAT

(80)

5

7

122

268

% Chg

NMF

NMF

44.8

1,699.6

120.0

PAT %

(2.8)

0.2

0.2

3.7

6.7

Basic EPS

(19.2)

1.1

1.6

29.2

64.3

Diluted EPS

(19.2)

1.1

1.6

29.2

64.3

% Chg

NMF

NMF

44.8

1699.6

120.0

Note: NMF- Not Meaningful

June 29, 2015

20

Initiating coverage | BEML

Balance Sheet

Y/E March (` cr)

FY13

FY14

FY15

FY16E

FY17E

Sources of Funds

Equity Capital

42

42

42

42

42

Reserves Total

2,038

2,038

2,035

2,135

2,356

Networth

2,080

2,080

2,077

2,177

2,398

Total Debt

1,214

905

592

528

317

Other Long-term Liabilities

406

379

317

337

355

Long-term Provisions

149

136

164

184

199

Total Liabilities

3,850

3,500

3,150

3,226

3,269

Application of Funds

Gross Block

1,184

1,201

1,253

1,316

1,385

Accumulated Depreciation

653

702

754

809

868

Net Block

531

499

499

507

518

Capital WIP & Intan. under Dev.

142

173

162

145

144

Investments

4

4

3

3

3

Deferred Tax Assets (net)

105

100

101

101

101

Inventories

2,456

2,152

1,921

1,920

1,959

Sundry Debtors

862

977

992

987

1,088

Cash and Bank Balance

77

16

144

256

246

Loans & Advances

603

532

400

406

448

Current Liabilities

1,366

1,261

1,441

1,511

1,678

Net Current Assets

2,632

2,417

2,017

2,057

2,063

Other Assets

436

308

368

413

440

Total Assets

3,850

3,500

3,150

3,226

3,269

June 29, 2015

21

Initiating coverage | BEML

Cash Flow Statement

Y/E March (` cr)

FY13

FY14

FY15P

FY16E

FY17E

Profit before tax

(122)

9

7

156

343

Depreciation

53

55

52

55

59

Other Adjustments

96

(35)

(28)

(18)

(18)

Change in Working Capital

(275)

282

434

66

(10)

Interest & Financial Charges

141

110

71

51

34

Direct taxes paid

(31)

(26)

(0)

(34)

(75)

Cash Flow from Operations

(138)

394

535

275

333

(Inc)/ Dec in Fixed Assets

(170)

(53)

(42)

(45)

(69)

(Inc)/ Dec in Invest. & Int. received

38

25

22

18

18

Cash Flow from Investing

(132)

(28)

(20)

(27)

(51)

Inc./ (Dec.) in Borrowings

303

(306)

(312)

(64)

(211)

Issue/ (Buy Back) of Equity

0

0

0

0

0

Dividend Paid (Incl. Tax)

(24)

(12)

(5)

(21)

(47)

Finance Cost

(124)

(109)

(71)

(51)

(34)

Cash Flow from Financing

155

(427)

(388)

(137)

(292)

Inc./(Dec.) in Cash

(116)

(61)

128

112

(10)

Opening Cash balances

192

77

16

144

256

Closing Cash balances

77

16

144

256

246

June 29, 2015

22

Initiating coverage | BEML

Key Ratios

Y/E March

FY13

FY14

FY15P

FY16E

FY17E

Valuation Ratio (x)

P/E (on FDEPS)

NMF

NMF

NMF

41.7

19.0

P/CEPS

NMF

87.1

86.1

28.8

15.5

Dividend yield (%)

0.2

0.1

0.1

0.4

0.8

EV/Sales

2.2

2.1

2.0

1.6

1.3

EV/EBITDA

NMF

52.7

79.0

27.3

14.4

EV / Total Assets

1.6

1.7

1.8

1.7

1.6

Per Share Data (`)

EPS (Basic)

(19.2)

1.1

1.6

29.2

64.3

EPS (fully diluted)

(19.2)

1.1

1.6

29.2

64.3

Cash EPS

(7.1)

14.0

14.1

42.3

78.4

DPS

2.5

1.0

1.0

4.4

9.6

Book Value

499.5

499.4

498.7

522.8

575.8

Returns (%)

RoCE (Pre-tax)

(2.8)

1.8

0.6

4.9

10.2

Angel RoIC (Pre-tax)

(2.9)

2.0

0.7

5.2

11.0

RoE

(4.3)

0.4

0.3

5.7

11.7

Turnover ratios (x)

Asset Turnover (Gross Block) (x)

2.4

2.4

2.3

2.6

3.0

Inventory / Sales (days)

321

292

268

216

180

Receivables (days)

123

117

129

111

100

Payables (days)

175

166

178

170

154

WC days

269

243

219

157

126

Leverage Ratios (x)

D/E ratio (x)

0.5

0.4

0.2

0.1

0.0

Interest Coverage Ratio (x)

NMF

0.5

0.3

2.8

8.8

Note: NMF- Not Meaningful

June 29, 2015

23

Initiating coverage | BEML

Research Team Tel: 022 - 39357800

DISCLAIMER

Angel Broking Private Limited (hereinafter referred to as “Angel”) is a registered Member of National Stock Exchange of India Limited,

Bombay Stock Exchange Limited and MCX Stock Exchange Limited. It is also registered as a Depository Participant with CDSL and

Portfolio Manager with SEBI. It also has registration with AMFI as a Mutual Fund Distributor. Angel Broking Private Limited is a

registered entity with SEBI for Research Analyst in terms of SEBI (Research Analyst) Regulations, 2014 vide registration number

INH000000164. Angel or its associates has not been debarred/ suspended by SEBI or any other regulatory authority for accessing

/dealing in securities Market. Angel or its associates including its relatives/analyst do not hold any financial interest/beneficial

ownership of more than 1% in the company covered by Analyst. Angel or its associates/analyst has not received any compensation /

managed or co-managed public offering of securities of the company covered by Analyst during the past twelve months. Angel/analyst

has not served as an officer, director or employee of company covered by Analyst and has not been engaged in market making activity

of the company covered by Analyst.

This document is solely for the personal information of the recipient, and must not be singularly used as the basis of any investment

decision. Nothing in this document should be construed as investment or financial advice. Each recipient of this document should

make such investigations as they deem necessary to arrive at an independent evaluation of an investment in the securities of the

companies referred to in this document (including the merits and risks involved), and should consult their own advisors to determine

the merits and risks of such an investment.

Reports based on technical and derivative analysis center on studying charts of a stock's price movement, outstanding positions and

trading volume, as opposed to focusing on a company's fundamentals and, as such, may not match with a report on a company's

fundamentals.

The information in this document has been printed on the basis of publicly available information, internal data and other reliable

sources believed to be true, but we do not represent that it is accurate or complete and it should not be relied on as such, as this

document is for general guidance only. Angel Broking Pvt. Limited or any of its affiliates/ group companies shall not be in any way

responsible for any loss or damage that may arise to any person from any inadvertent error in the information contained in this report.

Angel Broking Pvt. Limited has not independently verified all the information contained within this document. Accordingly, we cannot

testify, nor make any representation or warranty, express or implied, to the accuracy, contents or data contained within this document.

While Angel Broking Pvt. Limited endeavors to update on a reasonable basis the information discussed in this material, there may be

regulatory, compliance, or other reasons that prevent us from doing so.

This document is being supplied to you solely for your information, and its contents, information or data may not be reproduced,

redistributed or passed on, directly or indirectly.

Neither Angel Broking Pvt. Limited, nor its directors, employees or affiliates shall be liable for any loss or damage that may arise from

or in connection with the use of this information.

Note: Please refer to the important ‘Stock Holding Disclosure' report on the Angel website (Research Section). Also, please refer to the

latest update on respective stocks for the disclosure status in respect of those stocks. Angel Broking Pvt. Limited and its affiliates may

have investment positions in the stocks recommended in this report.

Disclosure of Interest Statement

BEML

1. Analyst ownership of the stock

No

2. Angel and its Group companies ownership of the stock

No

3. Angel and its Group companies' Directors ownership of the stock

No

4. Broking relationship with company covered

No

Note: We have not considered any Exposure below ` 1 lakh for Angel, its Group companies and Directors

Ratings (Based on expected returns

Buy (> 15%)

Accumulate (5% to 15%)

Neutral (-5 to 5%)

over 12 months investment period):

Reduce (-5% to -15%)

Sell (< -15)

June 29, 2015

24