1QFY2019 Result Update | Pharmaceutical

August 10, 2018

Aurobindo Pharma

BUY

CMP

`601

Performance Highlights

Target Price

`780

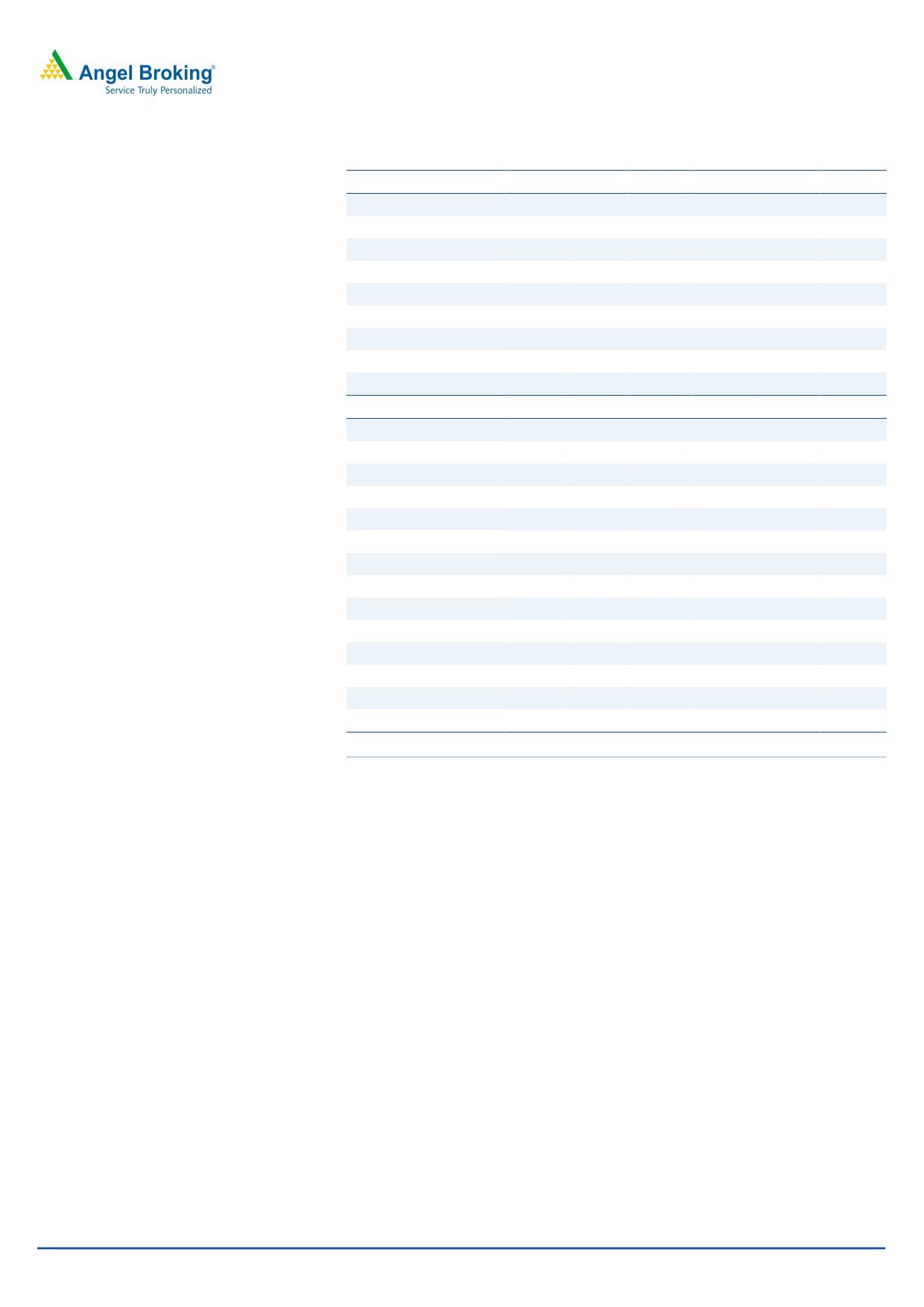

Y/E march (` cr)

1QFY19

4QFY18

% chg (QoQ)

1QFY18

% chg (yoy)

Investment Period

12 months

Net sales

4,182

3,989

4.8

3,621

15.5

Other income

112

105

7.2

81

38.6

Stock Info

Operating profit

710

746

(4.7)

784

(9.4)

Sector

Pharmaceutical

Interest

98

41

140.4

25

298.3

Market Cap (` cr)

35,207

Adj. Net profit

456

529

(13.8)

518

(12.1)

Net debt (` cr)

3,277

Source: Company, Angel Research

Beta

1.1

52 Week High / Low

809/527

For 1QFY2019, Aurobindo Pharma (APL) posted decent set of numbers on

Avg. Daily Volume

54,388

topline. On sales front, the company posted sales of `4,182cr v/s. `3,621cr in

Face Value (`)

1

1QFY2018, a yoy growth of 15.5%. On the operating front, the EBITDA margin

BSE Sensex

38,024

at 17.0% v/s. 21.6% in 1QFY2018.Consequently, the Adj. PAT came in at

Nifty

11,471

`456cr v/s. `518cr in 1QFY2018, a yoy de-growth of 12.1%. We maintain our

Reuters Code

ARBN.BO

Buy rating on the stock.

Bloomberg Code

ARBP.IN

OPM under pressure: On sales front, the company a yoy growth of 15.5%.The

formulation sales (`3,501cr) posted a yoy growth of 14.7%, while API (`748cr)

posted a yoy growth of 19.7%. Europe (`1,199cr) posted a yoy growth of 30.7%,

Shareholding Pattern (%)

while company’s key market USA (`1,890cr) posted a growth of 11.5% yoy. The

Promoters

51.9

business accounted for 28.2% of revenues. In Euro terms, sales grew by 16.0%

MF / Banks / Indian Fls

17.8

yoy. On the operating front, the EBITDA margin at 17.0% v/s. 21.6% in

FII / NRIs / OCBs

15.8

1QFY2018, mainly on back of drop in gross margins, which came in at 54.4%

Indian Public / Others

14.5

V/s 58.6% in 1QFY2018. Profitability was impacted largely due to certain one-off

product related provisions; which amounted to `100cr. Consequently, the PAT

Abs. (%)

3m 1yr

3yr

came in at `456cr, a yoy de-growth of 12.1%.

Sensex

#

19.6

35.3

Outlook and valuation: We expect Aurobindo to report net revenue CAGR of

Aurobindo

#

(12.2)

(22.8)

~16% & net profit to grow at ~9% CAGR during FY2018-20E, due to increased

R&D expenditure. However, valuations of the company are cheap V/s its peers

and own fair multiples of 17-18x. We recommend a Buy rating with a target

price of `780.

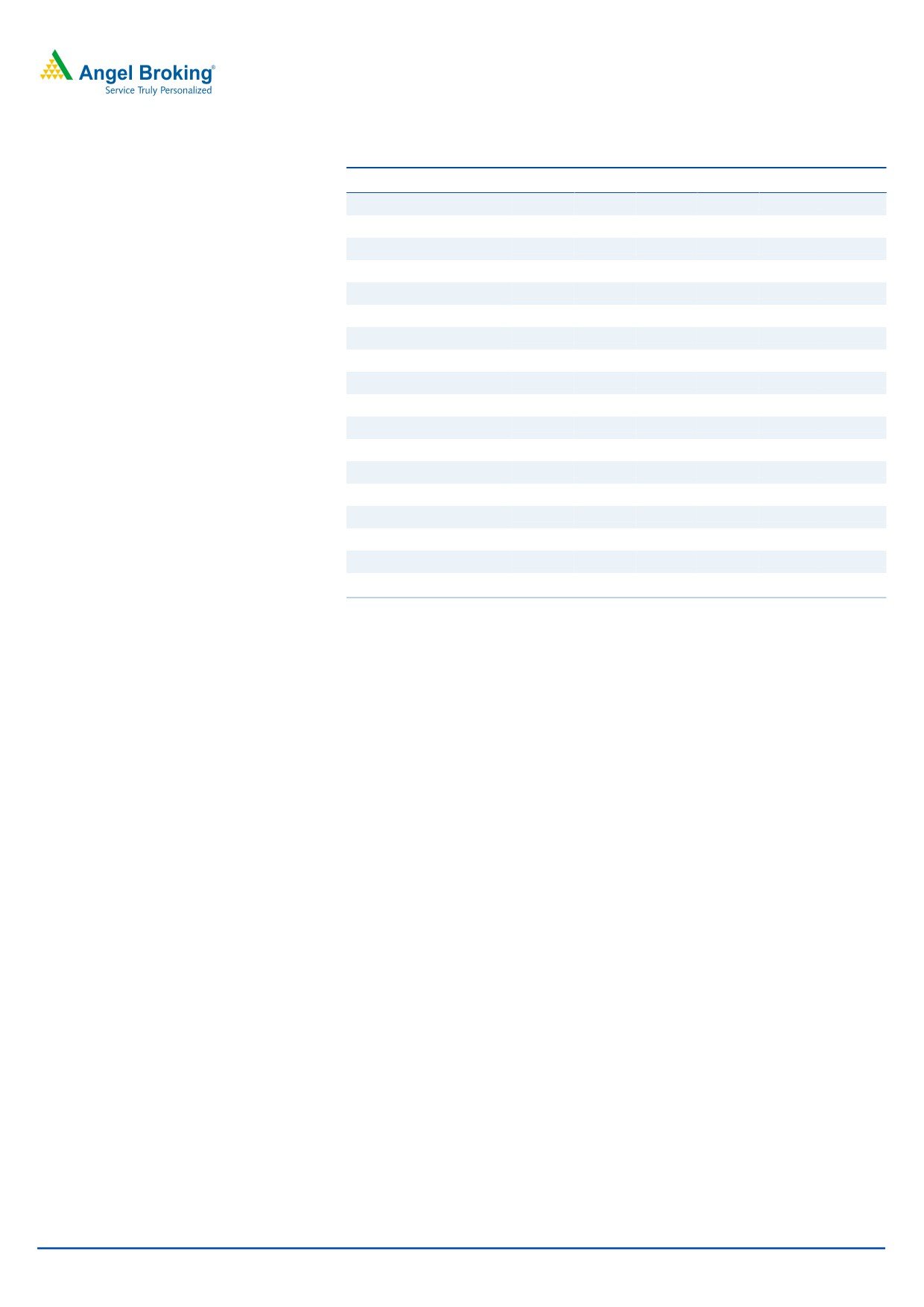

Key financials (Consolidated)

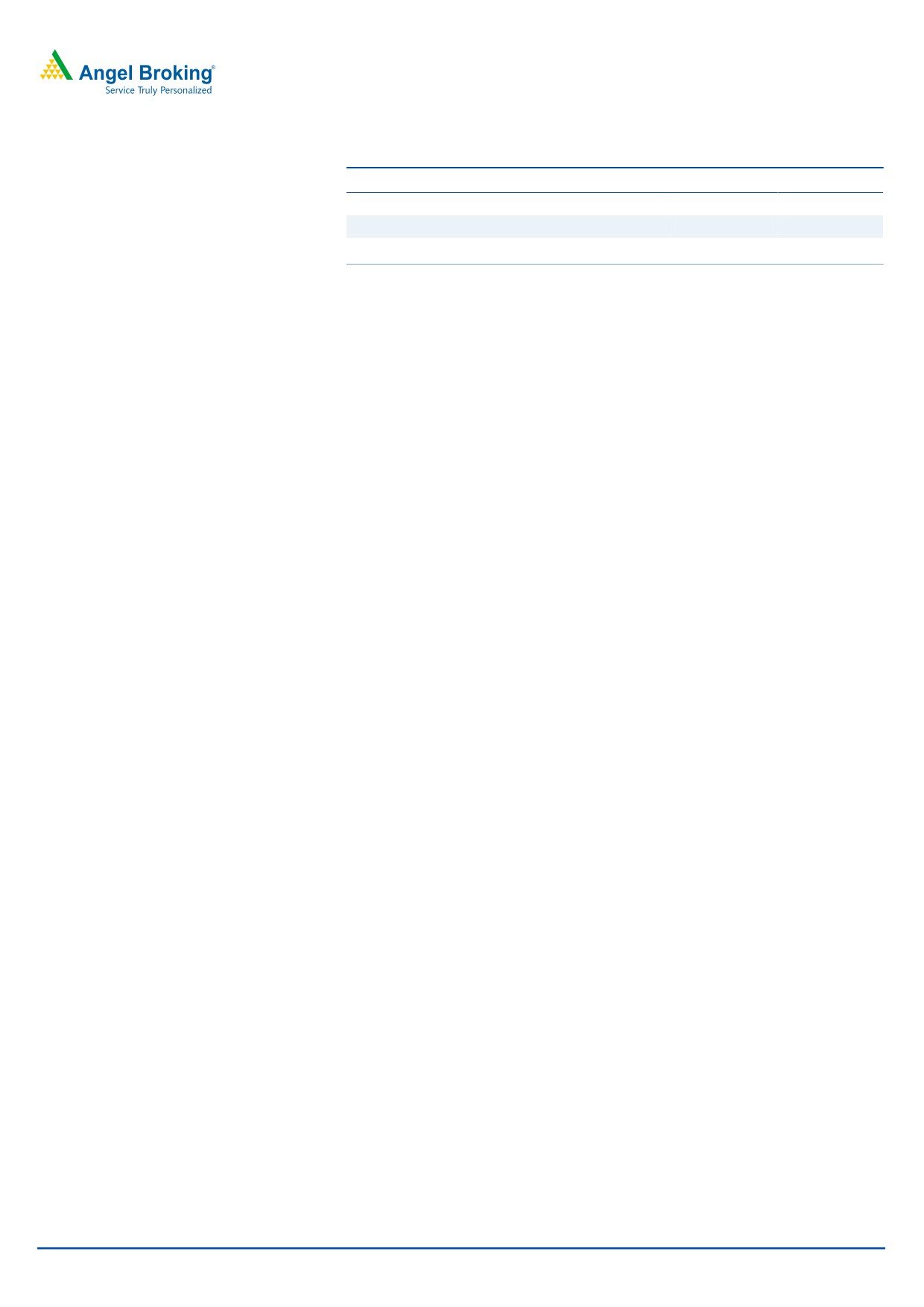

3-year daily price chart

Y/E March (` cr)

FY2017

FY2018

FY2019E

FY2020E

1,000

Net sales

14,845

16,233

18,701

21,829

800

% chg

8.3

9.4

15.2

16.7

2,302

2,423

2,753

2,877

600

Adj. Net profit

13.7

5.3

13.6

4.5

% chg

400

EPS (`)

39.4

41.5

47.1

49.3

200

EBITDA margin (%)

21.5

21.6

21.7

19.6

15.2

14.5

12.7

12.2

-

P/E (x)

RoE (%)

27.6

23.0

21.4

18.7

RoCE (%)

23.1

20.6

20.1

19.6

P/BV (x)

3.9

3.2

2.6

2.2

Source: Company, Angel Research

EV/Sales (x)

2.7

2.5

2.1

1.8

EV/EBITDA (x)

12.4

11.4

9.7

9.0

Source: Company, Angel Research; Note: CMP as of August 09, 2018

Sarabjit Kour Nangra

+91 22 3935 7800 Ext: 6806

Please refer to important disclosures at the end of this report

1

Aurobindo Pharma | 1QFY2019 Result Update

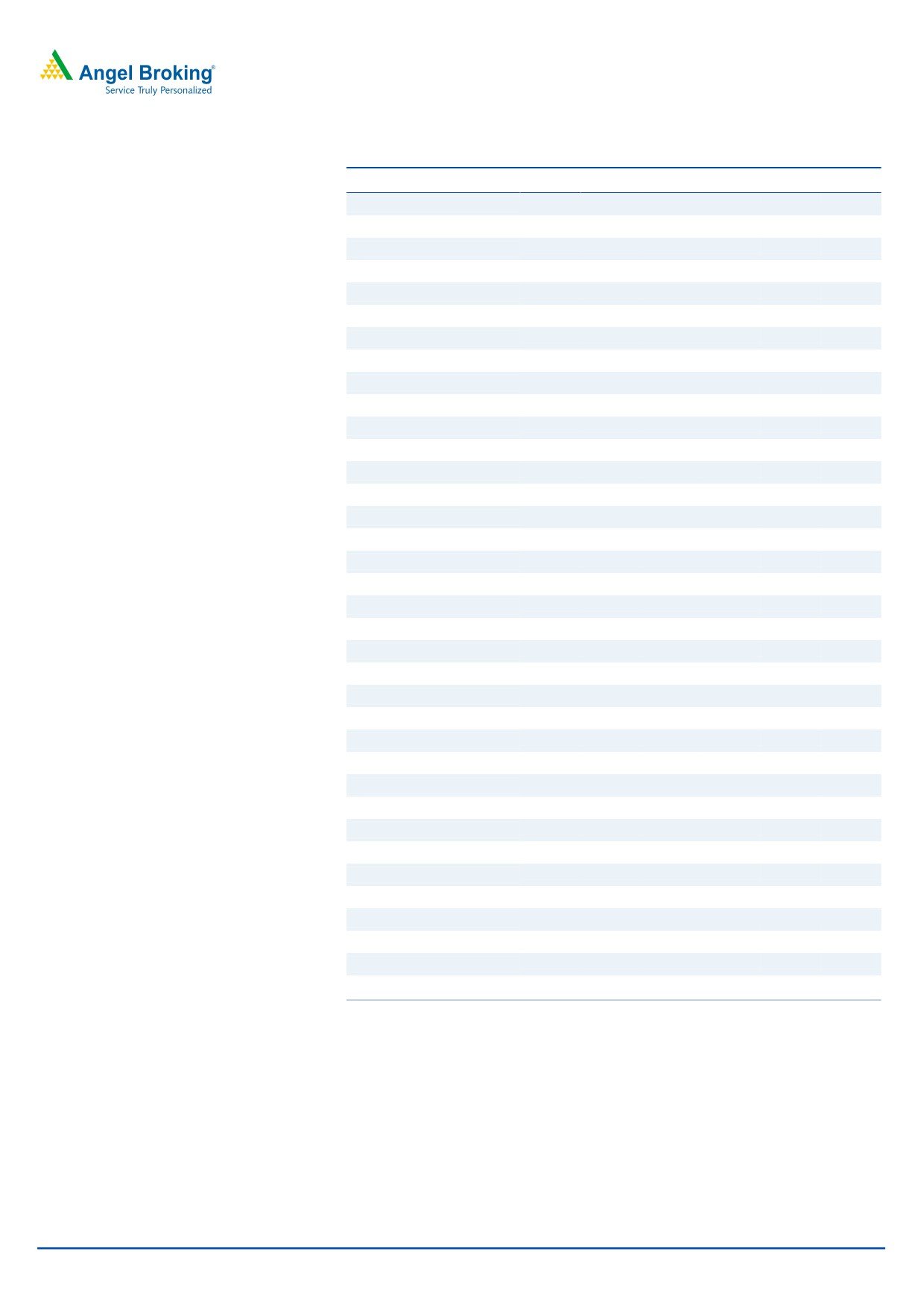

Exhibit 1: 1QFY2019 performance (Consolidated)

% chg

Y/E March (` cr)

1QFY2019

4QFY2018

1QFY2018

% chg (yoy)

FY2018

FY2017

% chg (yoy)

(QoQ)

Net sales

4,182

3,989

4.8

3,621

15.5

16,233

14,845

9.4

Other income

112

105

7.2

81

38.6

372

366

1.7

Total income

4,294

3,712

15.7

3,702

16.0

16,605

15,211

9.2

Gross profit

2,274

2,319

(1.9)

2,123

7.1

9,480

8,411

12.7

Gross margins

54.4

58.1

58.6

58.4

56.7

Operating profit

710

746

(4.7)

784

(9.4)

3,522

3,189

10.4

OPM (%)

17.0

18.7

(9.1)

21.6

21.7

21.5

Interest

98

41

140.4

25

298.3

94

67

41.6

Dep & amortization

155

157

(1.3)

131

17.8

558

428

30.5

PBT

571

651

(12.4)

709

(19.5)

3,241

3,061

5.9

Provision for taxation

116

122

(5.6)

191

(39.5)

818

760

7.7

Net profit

455

529

(13.9)

518

(12.2)

2,423

2,301

5.3

Less : Exceptional items (gains)/loss

-

-

-

-

-

-

MI & share in associates

0

(0)

(0)

(0)

(0)

-

PAT after Exceptional items

456

529

(13.8)

518

(12.1)

2,423

2,301

5.3

Adjusted PAT

456

529

(13.8)

518

(12.1)

2,423

2,301

5.3

EPS (`)

7.8

9.0

8.8

41.3

39.3

Source: Company, Angel Research

Exhibit 2: Sales break-up (Consolidated)

(` cr)

1QFY2019

4QFY2018

% chg (QoQ)

1QFY2018

% chg (yoy)

FY2018

FY2017

% chg

Formulations

3,501

3,249

7.8

3051

14.8

13,533

12,045

12.4

US

1890

1739

8.7

1694

11.5

7442

6827

9.0

Europe & ROW

1456

1361

6.9

1112

31.0

5252

4033

30.2

ARV

156

149

4.7

245

(36.4)

840

1185

(29.2)

API

748

800

(6.5)

625

19.7

2,962

3,042

(2.6)

SSP

492

533

(7.7)

409

20.3

1992

204

(2.5)

Cephs

256

267

(4.0)

216

18.5

970

999

(2.9)

Total Sales

4,249

4,048

5.0

3,678

15.5

16,495

15,088

9.3

Source: Company, Angel Research

Result Takeaways

US has witnessed 11.5% yoy during 1QFY2019; on

like-to-like basis, the

growth in the business sales grew by 7%; and accounted for 44.5% of sales.

US Injectable (sales of US$210mn); will post a growth of 30% yoy, backed by

launch of 10-12 pdts. For 1QFY2019, the sales of Injectable business is

around US$36mn.

R&D as a percent of sales to be 4.0% of sales in 1QFY2019; expected to be

5% of sales in FY2019E.

Profitability was impacted largely due to certain one-off product related

provisions; which amounted to `100cr on the gross margins front. Thus, gross

margins will move back to 58% in 2QFY2019.

August 10,2018

2

Aurobindo Pharma | 1QFY2019 Result Update

The company filed 7 ANDAs, including 3 ANDAs for injectable with USFDA

during the quarter. Received final approval for 13 ANDAs and tentative

approval for 3 ANDAs during the quarter.

As on 30 th Jun 2018, on a cumulative basis, the company filed 487 ANDAs

with USFDA and received approval for 375 ANDAs including 33 tentative*

approvals.

Sales from EU formulations in 1QFY18-19 witnessed a strong growth of

30.7% at `1,199cr, driven by strong growth in some of the key markets. The

business accounted for 28.2% of revenues. In Euro terms, sales grew by 16.0%

yoy.

Capex was US$70mn for 1QFY2019; capex guided at US$170mn in FY2019.

Debt as on June’2018 was ~`5,298cr & cash is around `1,387cr.

Recommendation rationale

Well placed for challenging times in USA: Aurobindo has a robust pipeline

(has filed 487 ANDA’s; second highest amongst Indian companies) & is

investing to enhance its foray into complex generic (mainly injectables,

ophthalmic etc.) & biosimilar, which will drive its next leg of growth. In the

current price competitive market, company is well placed; given it’s vertically

integrated with 70% of raw material requirements being meet through

internally. In addition, almost no single product of the company contributes

than 3% of sales; unlike others peers, who have high product concentration.

This is also evident from the performance of the company in USA in

FY2018. Company expects pricing pressure to stabilize at +/- 5% yoy over

the medium term. The company expects to launch ~30-40 products in the

US, over the next six months, which will aid growth in the US business.

Overall USA will grow at 15.7% CAGR over FY2018-20E.

Europe to grow steady, while ARV could provide extra boost: Europe, which

is another key region for the company, is expected to post CAGR of 20.0%

during FY2018-20E, while ROW is expected to post a CAGR of 18.0%

during same period. However, growth during the period would be more

predominate in the ARV segment, where company has confirmed tenders of

US$80-100mn to be executed over next two years.

Outlook and valuation

We expect Aurobindo to report net revenue CAGR of ~16% & net profit to grow at

~9% CAGR during FY2018-20E, due to increased R&D expenditure. However,

valuations of the company are cheap V/s its peers and own fair multiples of 17-

18x.We maintain our Buy rating on the stock.

August 10,2018

3

Aurobindo Pharma | 1QFY2019 Result Update

Exhibit 3: Key assumptions

FY2019E

FY2020E

Sales Growth (%)

15.2

16.7

Operating Margins (%)

21.7

19..6

Capex (`cr)

1,388

1,200

Source: Company, Angel Research

Company background

Aurobindo Pharma manufactures generic pharmaceuticals and APIs. The

company’s manufacturing facilities are approved by several leading regulatory

agencies like the USFDA, UK MHRA, WHO, Health Canada, MCC South Africa

and ANVISA Brazil among others. The company’s robust product portfolio is

spread over six major therapeutic/product areas encompassing antibiotics,

antiretrovirals, CVS, CNS, gastroenterological, and anti-allergics.

August 10,2018

4

Aurobindo Pharma | 1QFY2019 Result Update

Profit & loss statement (Consolidated)

Y/E March (` cr)

FY2015

FY2016

FY2017

FY2018

FY2019E

FY2020E

Gross sales

12,221

13,937

15,084

16,493

18,986

22,162

Less: Excise duty

178

227

239

260

285

332

Net Sales

12,043

13,710

14,845

16,233

18,701

21,829

Other operating income

77

245

245

267

267

267

Total operating income

12,121

13,955

15,090

16,500

18,968

22,096

% chg

49.6

15.1

8.1

9.3

15.0

16.5

Total Expenditure

9,557

10,931

11,656

12,728

14,650

17,546

Net Raw Materials

5,506

6,162

6,434

6,753

7,761

9,277

Other Mfg costs

1,204

1,371

1,484

1,623

1,870

2,183

Personnel

1,302

1,543

1,768

2,131

2,450

2,818

Other

1,115

1,386

1,426

1,555

1,710

1,881

R&D

430

470

543

667

858

1,386

EBITDA

2,486

2,779

3,189

3,505

4,051

4,284

% chg

20.1

11.8

14.8

9.9

15.6

5.7

(% of Net Sales)

20.6

20.3

21.5

21.6

21.7

19.6

Depreciation& Amortization

333

392

428

558

678

769

EBIT

2,154

2,386

2,762

2,947

3,373

3,515

% chg

22.5

10.8

15.7

6.7

14.5

4.2

(% of Net Sales)

17.9

17.4

18.6

18.2

18.0

16.1

Interest & other Charges

84

93

67

78

75

50

Other Income

81

205

121

105

105

105

(% of PBT)

3.6

7.5

4.0

3.2

2.9

2.7

Share in profit of Associates

-

-

-

-

-

-

Recurring PBT

2,227

2,744

3,061

3,241

3,670

3,837

% chg

28.4

23.2

11.5

5.9

13.2

4.5

Extraordinary Expense/(Inc.)

59.6

-

-

-

-

-

PBT (reported)

2,168

2,744

3,061

3,241

3,670

3,837

Tax

596.6

720.7

759.6

818.3

917.5

959.2

(% of PBT)

27.5

26.3

24.8

25.2

25.0

25.0

PAT (reported)

1,571

2,024

2,301

2,423

2,753

2,878

PAT after MI (reported)

1,576

2,025

2,302

2,423

2,753

2,877

Basic EPS (Rs)

27.7

34.6

39.3

41.4

47.1

49.2

% chg

21.5

25.1

13.7

5.3

13.6

4.5

August 10,2018

5

Aurobindo Pharma | 1QFY2019 Result Update

Balance sheet (Consolidated)

Y/E March (` cr)

FY2015

FY2016

FY2017

FY2018

FY2019E FY2020E

SOURCES OF FUNDS

Equity Share Capital

29

59

59

59

59

59

Share Application Money

-

-

-

-

-

-

Reserves & Surplus

5,127

7,229

9,313

11,622

14,053

16,594

Shareholders Funds

5,156

7,287

9,372

11,680

14,112

16,652

26

3

2

2

1

1

Minority Interest

Long-term provisions

24

23

22

56

56

56

Total Loans

3,864

4,415

3,084

4,483

3,000

2,000

Deferred Tax Liability

211

(182)

(118)

76

76

76

9,280

11,546

12,362

16,297

17,189

18,730

Total Liabilities

APPLICATION OF FUNDS

Gross Block

6,095

6,093

7,625

8,998

10,386

11,586

Less: Acc. Depreciation

1,794

2,186

2,614

3,172

3,850

4,619

Net Block

3,752

3,907

5,011

5,826

6,535

6,966

Capital Work-in-Progress

310

310

310

310

310

310

64

812

971

1,968

1,968

1,968

Goodwill

Investments

20

123

246

312

312

312

Long-term loans and adv.

486

269

338

343

343

395

Current Assets

8,279

10,294

9,206

12,188

13,078

15,031

Cash

469

834

513

1,262

492

342

8

831

409

10

10

10

Loans & Advances

Other

7,802

8,629

8,284

10,916

12,576

14,679

Current liabilities

3,634

4,168

3,720

4,649

5,356

6,252

Net Current Assets

4,645

6,127

5,487

7,539

7,722

8,779

9,280

11,546

12,362

16,297

17,189

18,730

Total Assets

August 10,2018

6

Aurobindo Pharma | 1QFY2019 Result Update

Cash flow statement (Consolidated)

Y/E March (` cr)

FY2015

FY2016

FY2017

FY2018

FY2019E FY2020E

Profit before tax

2,168

2,744

3,061

3,241

3,670

3,837

Depreciation

333

392

428

558

678

769

(Inc)/Dec in Working Capital

(757)

(1,333)

388

(1,298)

(953)

(1,155)

Less: Other income

81

205

121

105

105

105

Direct taxes paid

(597)

(721)

(760)

(818)

(918)

(959)

Cash Flow from Operations

1,066

877

2,996

1,577

2,373

2,386

(Inc.)/Dec.in Fixed Assets

(1,989)

3

(1,532)

(1,374)

(1,388)

(1,200)

(Inc.)/Dec. in Investments

-

103

123

66

-

-

Other income

81

205

121

105

105

105

Cash Flow from Investing

(1,908)

311

(1,288)

(1,203)

(1,282)

(1,095)

Issue of Equity

-

-

-

-

-

-

Inc./(Dec.) in loans

94

552

(1,331)

1,398

(1,483)

(1,000)

Dividend Paid (Incl. Tax)

(171)

(171)

(171)

(171)

(322)

(337)

Others

1,209

(1,204)

(527)

(854)

(56)

(91)

Cash Flow from Financing

1,133

(823)

(2,030)

373

(1,861)

(1,428)

Inc./(Dec.) in Cash

291

365

(321)

748

(770)

(137)

Opening Cash balances

179

469

834

513

1,262

492

Closing Cash balances

469

834

513

1,262

492

342

August 10,2018

7

Aurobindo Pharma | 1QFY2019 Result Update

Key ratios

Y/E March

FY2015

FY2016

FY2017

FY2018 FY2019E FY2020E

Valuation Ratio (x)

P/E (on FDEPS)

21.7

17.4

15.3

14.5

12.8

12.2

P/CEPS

9.2

14.5

12.9

11.8

10.2

9.6

P/BV

3.4

4.8

3.8

3.0

2.5

2.1

0.7

0.4

0.4

0.4

0.8

0.8

Dividend yield (%)

EV/Sales

1.7

2.8

2.5

2.4

2.0

1.7

EV/EBITDA

8.4

14.0

11.8

11.0

9.3

8.6

EV / Total Assets

2.3

3.4

3.1

2.4

2.2

2.0

Per Share Data (`)

EPS (Basic)

27.7

34.6

39.3

41.4

47.1

49.2

EPS (fully diluted)

27.7

34.6

39.3

41.4

47.1

49.2

Cash EPS

65.4

41.3

46.6

50.9

58.6

62.3

DPS

4.5

2.5

2.5

2.5

4.7

4.9

Book Value

176.6

124.5

160.1

199.6

241.1

284.6

Dupont Analysis

EBIT margin

17.9

17.4

18.6

18.2

18.0

16.1

Tax retention ratio

72.5

73.7

75.2

74.8

75.0

75.0

Asset turnover (x)

1.5

1.4

1.3

1.2

1.2

1.3

ROIC (Post-tax)

19.2

18.3

18.7

16.7

16.2

15.2

Cost of Debt (Post Tax)

1.6

1.7

1.3

1.5

1.5

1.5

Leverage (x)

0.8

0.6

0.4

0.3

0.2

0.1

Operating ROE

33.4

27.9

25.4

20.8

19.5

17.1

Returns (%)

ROCE (Pre-tax)

25.3

22.9

23.1

20.6

20.1

19.6

Angel ROIC (Pre-tax)

27.6

26.5

27.4

25.3

24.8

23.0

ROE

36.4

32.5

27.6

23.0

21.4

18.7

Turnover ratios (x)

Asset Turnover (Gross Block)

2.4

2.3

2.2

2.0

2.0

2.0

Inventory / Sales (days)

90

100

101

113

105

104

Receivables (days)

93

107

89

65

65

65

Payables (days)

98

126

119

114

114

111

WC cycle (ex-cash) (days)

119

124

124

124

130

129

Solvency ratios (x)

Net debt to equity

0.7

0.5

0.3

0.3

0.2

0.1

Net debt to EBITDA

1.4

1.3

0.8

0.9

0.6

0.4

Interest Coverage (EBIT / Int.)

25.5

25.8

41.4

37.9

45.1

70.3

August 10,2018

8

Aurobindo Pharma | 1QFY2019 Result Update

Research Team Tel: 022 - 39357800

DISCLAIMER

Angel Broking Private Limited (hereinafter referred to as “Angel”) is a registered Member of National Stock Exchange of India Limited,

Bombay Stock Exchange Limited and Metropolitan Stock Exchange Limited. It is also registered as a Depository Participant with CDSL

and Portfolio Manager with SEBI. It also has registration with AMFI as a Mutual Fund Distributor. Angel Broking Private Limited is a

registered entity with SEBI for Research Analyst in terms of SEBI (Research Analyst) Regulations, 2014 vide registration number

INH000000164. Angel or its associates has not been debarred/ suspended by SEBI or any other regulatory authority for accessing

/dealing in securities Market. Angel or its associates/analyst has not received any compensation / managed or co-managed public

offering of securities of the company covered by Analyst during the past twelve months.

This document is solely for the personal information of the recipient, and must not be singularly used as the basis of any investment

decision. Nothing in this document should be construed as investment or financial advice. Each recipient of this document should

make such investigations as they deem necessary to arrive at an independent evaluation of an investment in the securities of the

companies referred to in this document (including the merits and risks involved), and should consult their own advisors to determine

the merits and risks of such an investment.

Reports based on technical and derivative analysis center on studying charts of a stock's price movement, outstanding positions and

trading volume, as opposed to focusing on a company's fundamentals and, as such, may not match with a report on a company's

fundamentals. Investors are advised to refer the Fundamental and Technical Research Reports available on our website to evaluate the

contrary view, if any.

The information in this document has been printed on the basis of publicly available information, internal data and other reliable

sources believed to be true, but we do not represent that it is accurate or complete and it should not be relied on as such, as this

document is for general guidance only. Angel Broking Pvt. Limited or any of its affiliates/ group companies shall not be in any way

responsible for any loss or damage that may arise to any person from any inadvertent error in the information contained in this report.

Angel Broking Pvt. Limited has not independently verified all the information contained within this document. Accordingly, we cannot

testify, nor make any representation or warranty, express or implied, to the accuracy, contents or data contained within this document.

While Angel Broking Pvt. Limited endeavors to update on a reasonable basis the information discussed in this material, there may be

regulatory, compliance, or other reasons that prevent us from doing so.

This document is being supplied to you solely for your information, and its contents, information or data may not be reproduced,

redistributed or passed on, directly or indirectly.

Neither Angel Broking Pvt. Limited, nor its directors, employees or affiliates shall be liable for any loss or damage that may arise from

or in connection with the use of this information.

Disclosure of Interest Statement

Aurobindo Pharma

1. Financial interest of research analyst or Angel or his Associate or his relative

No

2. Ownership of 1% or more of the stock by research analyst or Angel or associates or relatives

No

3. Served as an officer, director or employee of the company covered under Research

No

4. Broking relationship with company covered under Research

No

Ratings (Based on expected returns

Buy (> 15%)

Accumulate (5% to 15%)

Neutral (-5 to 5%)

over 12 months investment period):

Reduce (-5% to -15%)

Sell (< -15)

August 10,2018

9