IPO Note | FMCG

September 19, 2017

Prataap Snacks Limited

NEUTRAL

sue Open: September 22, 2017

Is

IPO Note

Issue Close: September 26, 2017

Prataap Snacks is one of the top snack food companies in India and with 27%

revenue CAGR between FY13-FY17, it is also one of the fastest growing

Issue Details

companies in its sector. It has three product lines i.e. Extruded Snacks, Chips and

Namkeen and has brands such as Chulbule and Yellow Diamond. It has 3

Face Value: `5

manufacturing facilities, 218 distributors and 3,500 super stockists.

Present Eq. Paid up Capital: `10.7cr

Fastest growing organized snacks player: Prataap Snacks has seen a strong

revenue growth since inception and from FY13-FY17 its revenue grew at a CAGR

Offer for Sale: 30lakh Shares (*`279-

**282cr)

of 27% vs. organized snack food industry growth of 14% (2010-16). This has

been due to its strong distribution network and acquisition of Yellow Diamond

Fresh issue: *21.5 lakh -**21.3 lakh shares

brand which is doing well. With the focus on growth, company has gained 8%

(`200cr)

and 3% market share in organized extruded snacks and chips market respectively.

Post Eq. Paid up Capital: `11.7cr

Company is foraying in chocolate-based confectionary products which will benefit

Issue size (amount): *`479.5cr -**481.9 cr

Prataap to report above industry growth rate going ahead.

Price Band: `930-938

Inconsistent profitability: With the focus on gaining the market share, its

profitability has remained inconsistent. The gross margins (GM) during FY13-17

Lot Size: 15 shares and in multiple thereafter

have been between 26-31% which is weak compared to its peer DFM Foods’

Post-issue implied mkt. cap:

*`2,183cr

-

which made GM of ~40% in FY17. With weak GM and higher depreciation,

**`2,200cr

company’s EBITDA margins have been consistently weak and have come down

Promoters holding Pre-Issue: 92.7%

from 8% in FY13 to 4.5% in FY17. PAT margins have also shrunk to just 1% in

Promoters holding Post-Issue: 71.4%

FY17 from 4.3% in FY13 due to the potato crop related issues.

*Calculated on lower price band

Weak return ratios: With the poor profitability, company has also seen poor set of

** Calculated on upper price band

return ratios. The highest of RoE in the last five years has been 12.6% in FY16

which declined to just 4.2% in FY17. This is weaker than its peer DFM Foods (20%

Book Building

in FY17). Its ROCE has also been lower than cost of capital during this period.

QIBs

50% of issue

Valuations and outlook: At 202x of its FY17 earnings, the issue is richly valued at

upper end of its price band i.e. `938. Ignoring its lower profitability in FY17 and

Non-Institutional

15% of issue

valuating the issue on FY16 EPS still yields a high P/E of 73.0x. FMCG companies

Retail

35% of issue

commanding such high P/Es have a very strong profitability and returns profile

such as Britannia (which is not an exact peer due to size and product portfolio). Its

peer in exactly same industry i.e. DFM Foods, also has good margins (10% in

FY17) and handsome return profile (~20%). For Prataap to justify this high

Post Issue Shareholding Pattern

valuation, remarkable improvement in profitability is required which may come at

the cost of lower growth. Considering this, we rate Prataap Snacks as Neutral.

Promoters Group

71.4

Key Financials

DIIs/FIIs/Public & Others

28.6

Y/E March (` cr)

FY2014

FY2015

FY2016

FY2017

Net Sales

445.6

558.8

757.2

903.9

% chg

29.6

25.4

35.5

19.4

Net Profit

5.4

9.9

27.4

9.9

% chg

(63.8)

84.1

176.4

(63.9)

OPM (%)

4.5

6.1

7.5

4.5

EPS (Rs)

2.5

4.6

12.8

4.6

P/E (x)

371.8

202.0

73.1

202.2

P/BV (x)

11.3

10.5

9.2

8.4

RoE (%)

3.0

5.2

12.6

4.2

RoCE (%)

3.9

8.4

14.6

5.2

EV/Sales (x)

5.0

4.0

3.0

2.5

Shrikant Akolkar

EV/EBITDA (x)

110.0

65.8

39.7

55.2

+91 22 39357800 Ext: 6846

Source: Company, Angel Research

Please refer to important disclosures at the end of this report

1

Prataap Snacks| IPO Note

Company background

Prataap Snacks is one of the top six Indian snack food companies in terms of

revenues in 2016, and features among the fastest growing companies in the

Indian organized snack market between 2010 and 2016. Company has three

product lines i.e. Extruded Snacks (potato or cereal based snacks) Chips (fried,

sliced chips or crisps made from potatoes, hummus, lentils etc) and Namkeen

(traditional savoury Indian snack such as moong dal, masala or fried nuts, sev and

bhujia). Company operates brands such as Chulbule, Yellow Diamond, etc.

Extruded snacks, Potato Chips and Namkeen represented 63%, 24%, and 12%, of

its total revenue in FY17.

Company owns and operates 3 manufacturing facilities, one located at Indore,

and two in Assam. The total capacity of these three facilities is 80,500 MTPA. It has

also engaged in two facilities on contract manufacturing basis, located at

Bengaluru, and at Kolkata. Its distribution network included 218 super stockists

and over 3,500 distributors. Prataap is one of the leading players in the East Zone

with a strong presence in the North and West Zones and it is also increasing

penetration in the South Zone. Company has appointed Salman Khan, a popular

Hindi movie actor, as its brand ambassador.

Its Potato Chips, Rings, Chulbule and Namkeen products currently generate

revenues of over ₹100cr each. Company also has a subsidiary named Pure N Sure

which intends to foray in chocolate-based confectionary snacks by setting up a

manufacturing facility.

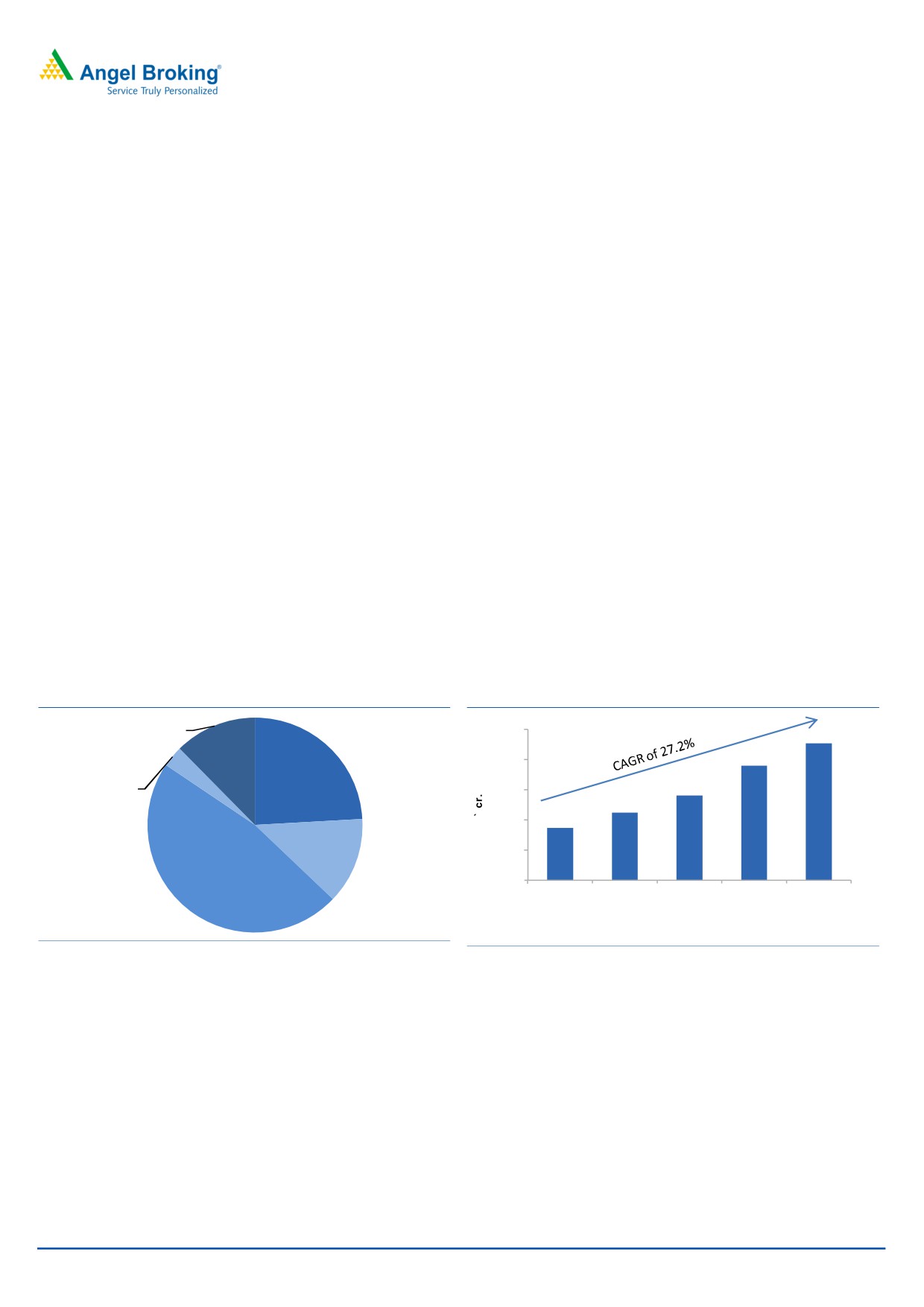

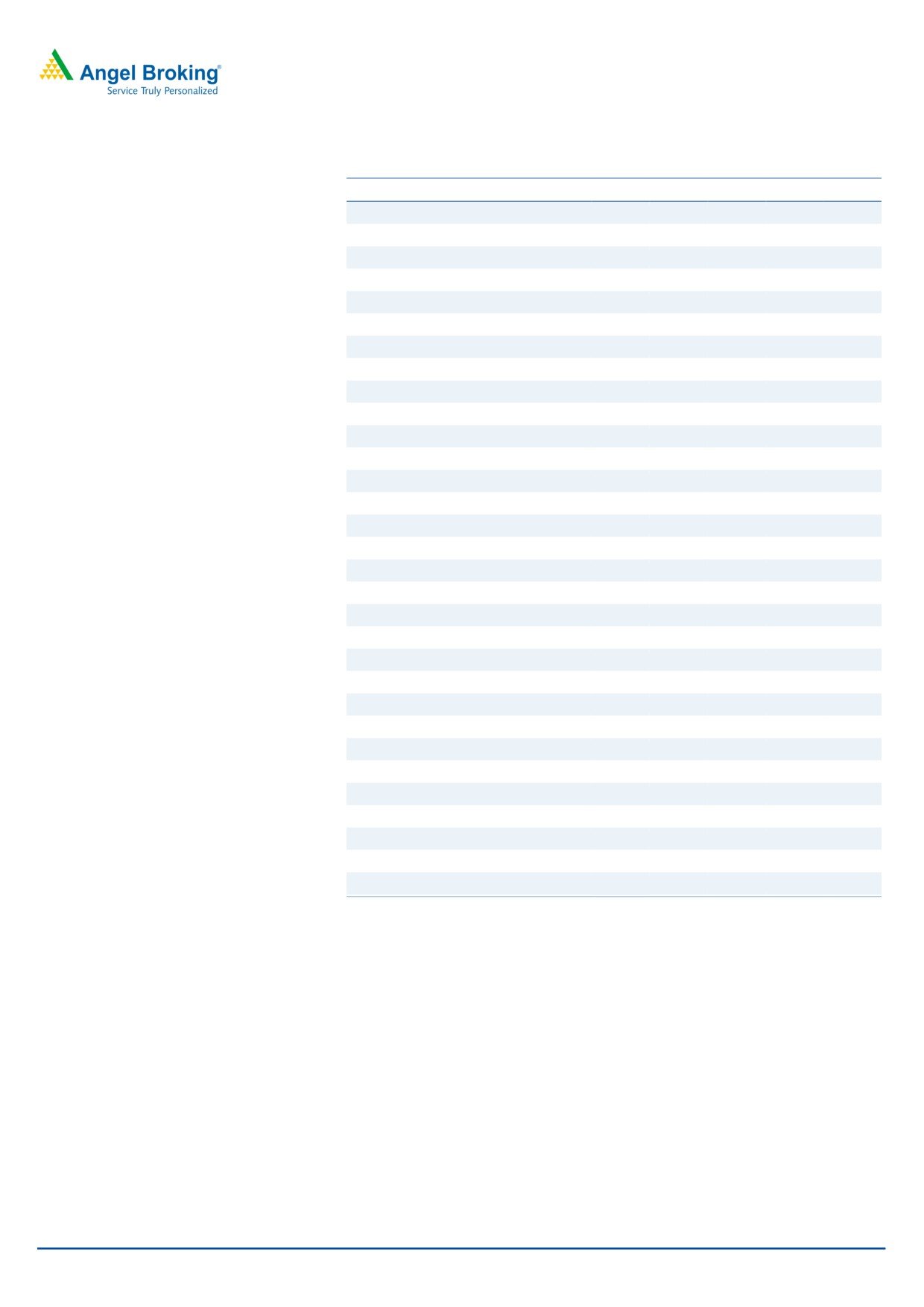

Exhibit 1: Revenue mix FY17

Exhibit 2: FY13-FY17 revenue CAGR at 27%

Namkeen,

1,000

908

12.3%

760

Potato

800

Chips,

Pellets,

562

24.1%

600

3.2%

449

347

400

Chulbule,

200

13.0%

Puff and

Rings,

0

47.3%

FY13

FY14

FY15

FY16

FY17

Source: Company, Angel Research

Source: Company, Angel Research

September 19, 2017

2

Prataap Snacks| IPO Note

Issue details

The IPO consists of OFS (~`282cr) and a fresh issue (`200cr). Through this IPO,

Sequoia Capital as well as some founders are selling some part of their shares

from the company. Before the IPO, Sequoia Capital held majority i.e. ~62% stake

in the company, this was bought by Sequoia in 2011. After the IPO, Sequoia

Capital’s stake would come down to 48.4%. The founders of the company hold the

31.1% stake in the company which will also come down to 23%. The company has

raised `50cr before the IPO at the price of `938 per share.

Exhibit 3: Selling shareholders and pre and post IPO shareholding pattern

Shareholder

Percentage of pre-issue capital

Shares sold

Percentage of post- issue capital

Sequoia Capital

61.6%

1,780,810

48.4%

Rajesh Mehta

4.9%

361,920

2.9%

Naveen Mehta

4.9%

139,200

3.9%

Arvind Mehta

3.5%

183,740

2.4%

Arun Mehta

3.3%

139,200

2.4%

Kanta Mehta

1.4%

66,820

1.0%

Rita Mehta

1.5%

0

1.4%

Premlata Kumat

3.0%

77,950

2.4%

Swati Bapna

1.1%

22,270

0.9%

Apoorva Kumat

3.1%

116,930

2.3%

Amit Kumat

3.3%

116,930

2.5%

Sandhya Kumat

0.6%

0

0.6%

Rakhi Kumat

0.5%

0

0.5%

Public

7.3%

28.6%

Total shares

100.0%

3,005,770

100.0%

Source: Company, Angel Research, Sequoia Capital = Sequoia Capital GFIV Mauritius Investments + SCI Growth Investments II + Sequoia Capital India

Growth Investment Holdings I

Objects of the offer

Partial / full repayment/pre-payment, of certain borrowings

Modernization of existing facilities and setting up of a new production line and

construction of a building

Investment in its subsidiary, Pure N Sure, towards enabling the repayment/pre-

payment of certain borrowings

Marketing and brand-building activities

General corporate purposes

September 19, 2017

3

Prataap Snacks| IPO Note

Investment Rationale

Fastest growing organized snacks player: Prataap Snacks has seen a strong

revenue growth since inception and from FY13-FY17 its revenue grew at a CAGR

of 27% vs. organized snack food industry growth of 14% (2010-16). This has been

due to its strong distribution network and acquisition of Yellow Diamond brand

which is doing well. With the focus on growth, company has gained 8% and 3%

market share in organized extruded snacks and chips market respectively.

Company is foraying in chocolate-based confectionary products which will benefit

Prataap to report above industry growth rate going ahead.

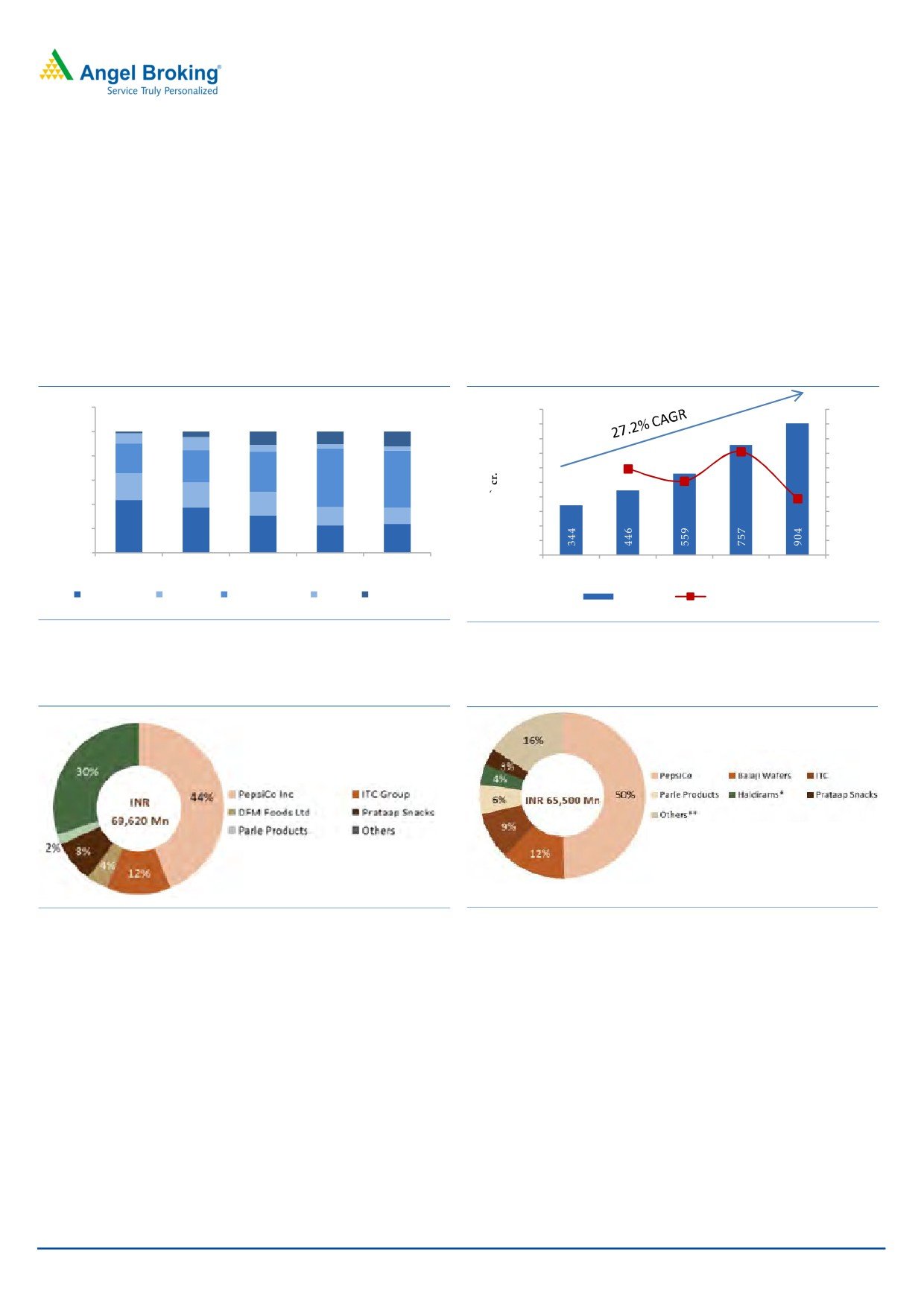

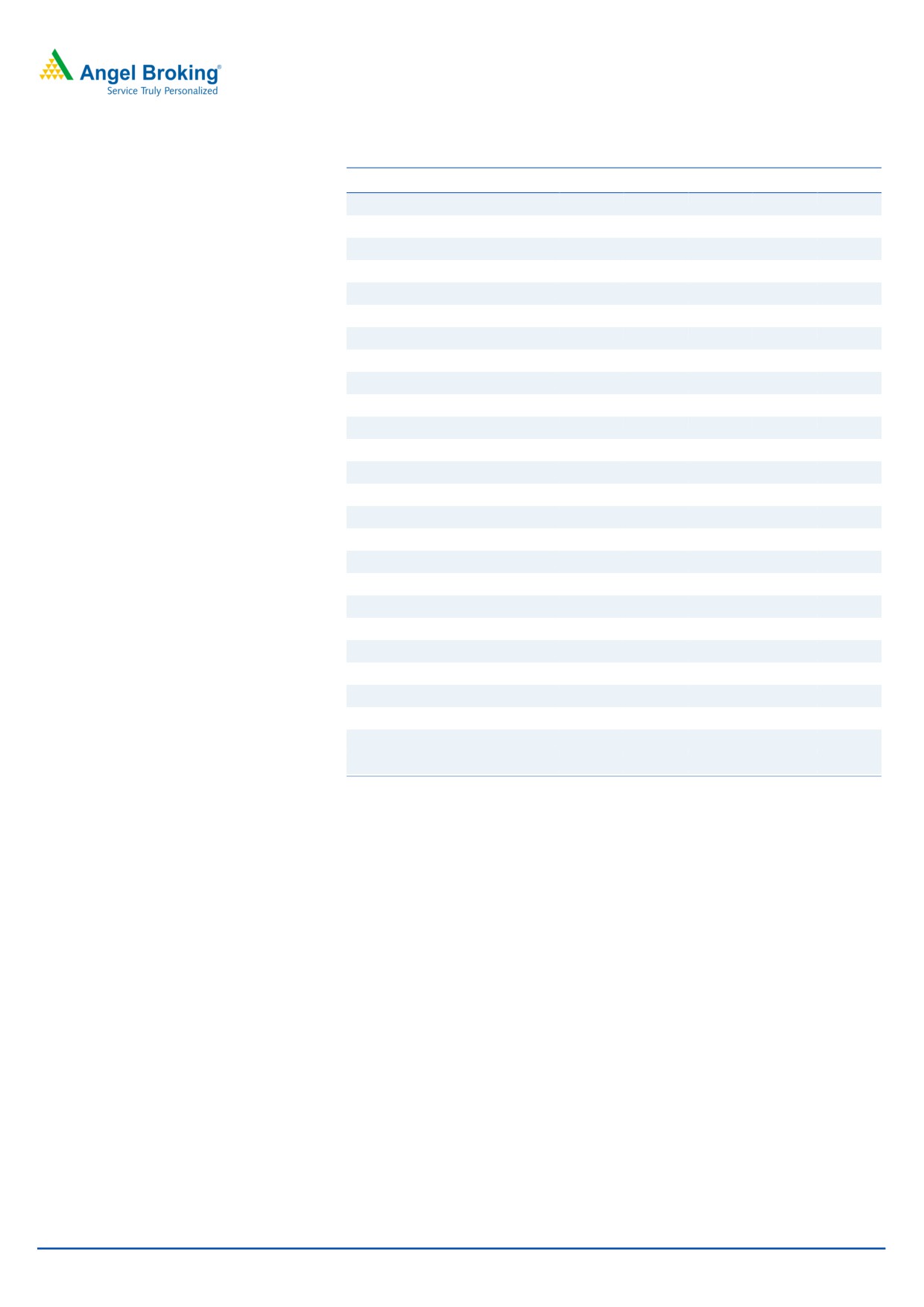

Exhibit 4: Evolution of its business mix

Exhibit 5: 27% CAGR in revenue between FY13-FY17

120.0%

1,000

50.0%

1.7%

4.6%

12.3%

900

45.0%

11.0%

10.5%

100.0%

800

35.5%

40.0%

80.0%

700

35.0%

24.6%

29.6%

26.9%

600

25.4%

30.0%

33.2%

60.0%

48.3%

47.3%

21.8%

500

19.4%

25.0%

20.5%

400

20.0%

40.0%

19.4%

300

15.0%

15.1%

13.0%

20.0%

43.7%

37.4%

200

10.0%

30.9%

22.7%

24.1%

100

5.0%

0.0%

0

0.0%

FY13

FY14

FY15

FY16

FY17

FY13

FY14

FY15

FY16

FY17

Potato Chips

Chulbule

Puff and Rings

Pellets

Namkeen

Net sales

YoY Growth

Source: DRHP, Angel Research

Source: DRHP, Angel Research

Exhibit 6: 8% market share in organized extruded snacks

Exhibit 7: 3% in market share in organized chips

Source: DRHP, Angel Research

Source: DRHP, Angel Research

Inconsistent profitability: With the focus on gaining the market share, its

profitability has remained inconsistent. The gross margins (GM) during FY13-17

have been between 26-31% which is weak compared to its peer DFM Foods’

which made GM of ~40% in FY17. With weak GM and higher depreciation,

company’s EBITDA margins have been consistently weak and have come down

from 8% in FY13 to 4.5% in FY17. PAT margins have also shrunk to just 1% in

FY17 from 4.3% in FY13 due to the potato crop related issues.

September 19, 2017

4

Prataap Snacks| IPO Note

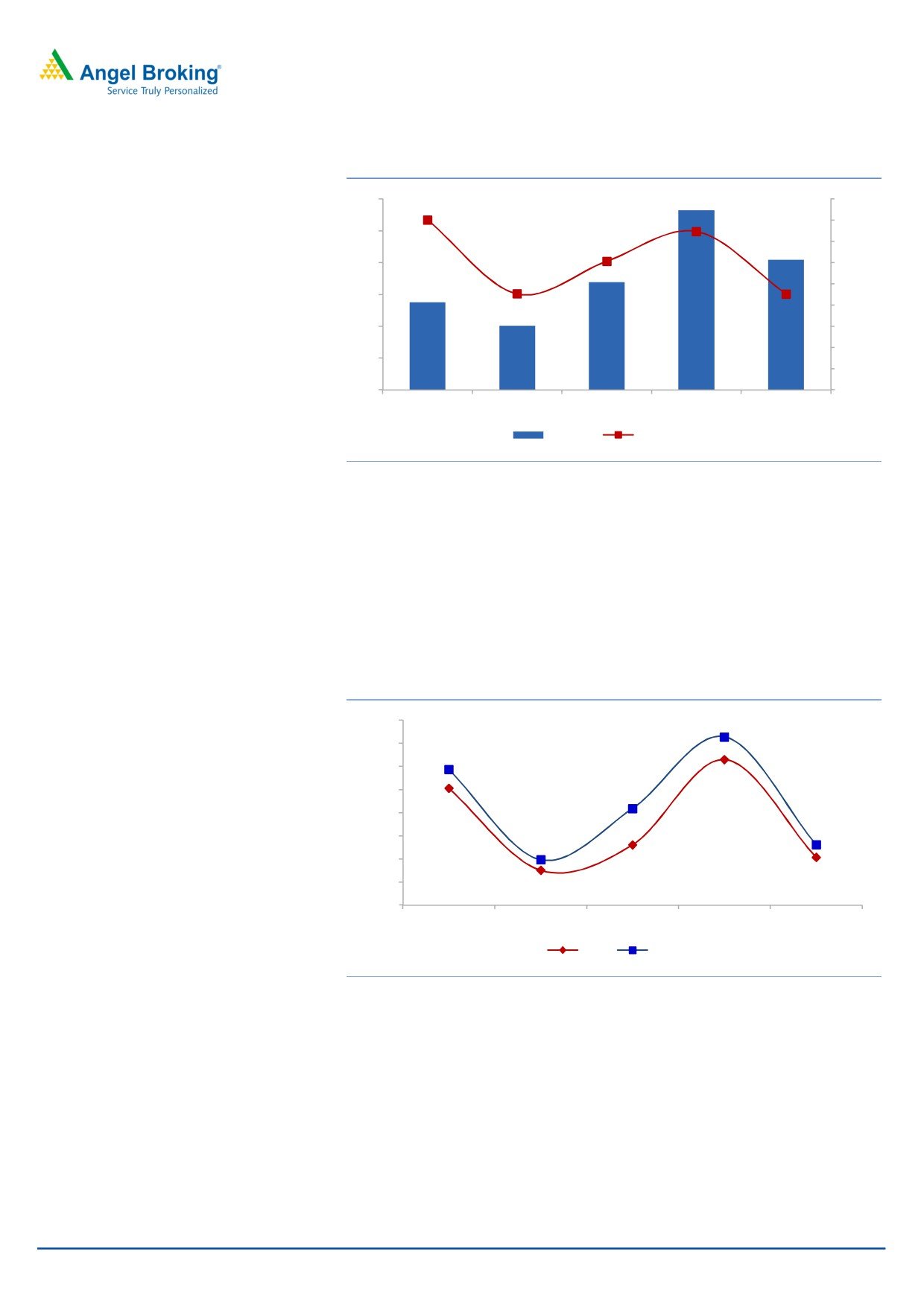

Exhibit 8: Inconsistent EBITDA margins

60

9.0%

8.0%

8.0%

50

7.5%

7.0%

40

6.1%

6.0%

5.0%

30

4.5%

4.5%

4.0%

20

3.0%

2.0%

10

1.0%

0

0.0%

FY13

FY14

FY15

FY16

FY17

EBITDA

EBITDA Margin

Source: DRHP, Angel Research

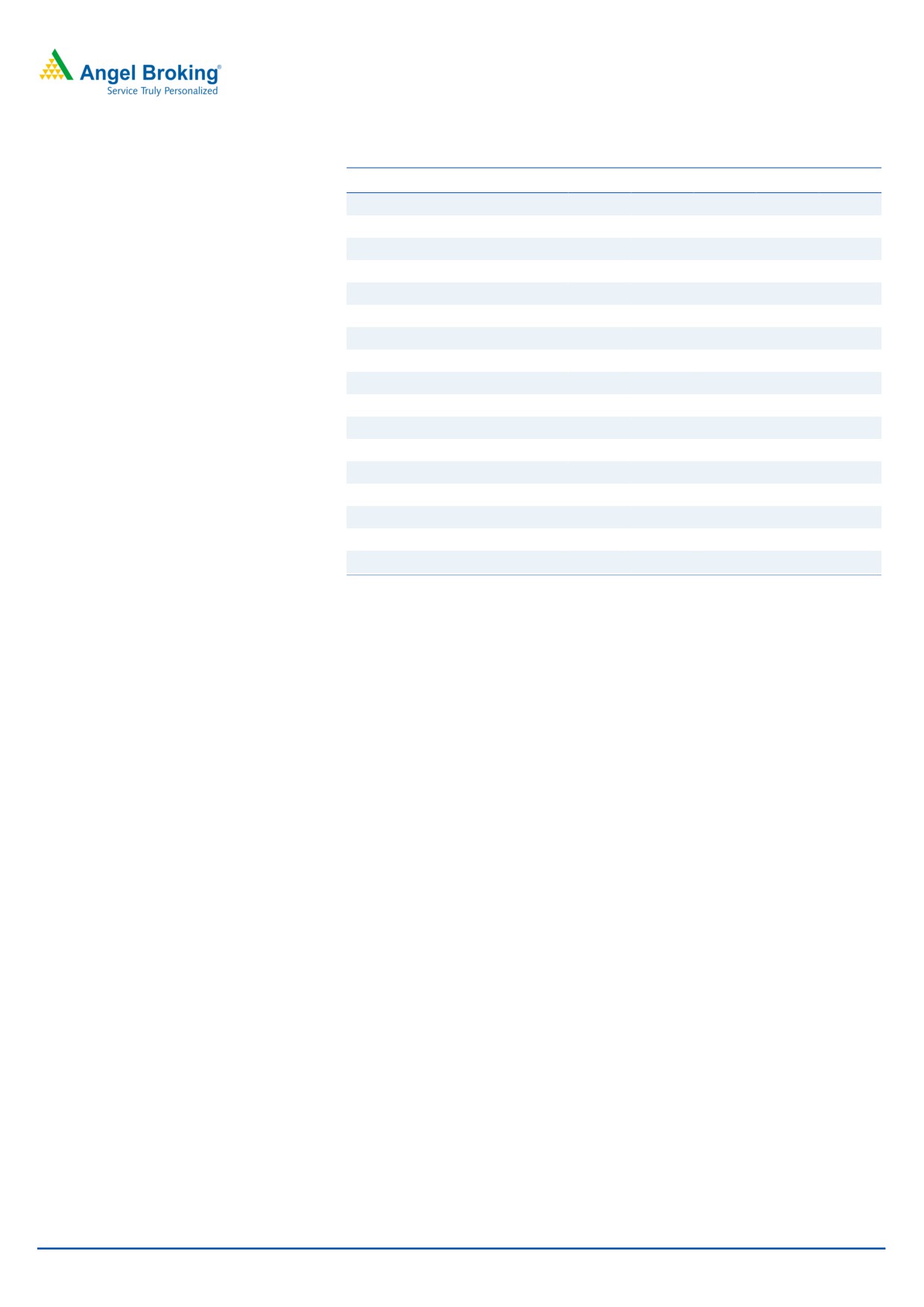

Weak return ratios: Due to the poor profitability, company has seen weak return

ratios. The higher RoE that company has seen was 12.6% in FY16 which declined

to just 4.2% in FY17 vs. DFM Foods’ RoE of ~20% in FY17.

Its ROCE has also been weak during FY13-FY17. The return on capital has been

significantly less than cost of capital for the last five years in row, while cost of

capital has been ~16-17%; the ROCE in the last five years has averaged at 8.8%

indicating that the company is not generating enough returns.

Exhibit 9: Inconsistent return ratios and ROCE below cost of capital

16.0%

14.6%

14.0%

11.7%

12.0%

12.6%

10.0%

8.4%

10.1%

8.0%

5.2%

6.0%

3.9%

4.0%

5.2%

4.2%

2.0%

3.0%

0.0%

FY13

FY14

FY15

FY16

FY17

ROE

ROCE

Source: DRHP, Angel Research

September 19, 2017

5

Prataap Snacks| IPO Note

Outlook and Valuation:

At 202x of its FY17 earnings, the issue is richly valued at upper end of its price

band i.e. `938. Ignoring its lower profitability in FY17 and valuating the issue on

FY16 EPS still yields a high P/E of 73.0x. FMCG companies commanding such

high P/Es have a very strong profitability and returns profile such as Britannia

(which is not an exact peer due to size and product portfolio). Its peer in exactly

same industry i.e. DFM Foods, also has good margins (10% in FY17) and

handsome return profile (~20%). For Prataap to justify this high valuation,

remarkable improvement in profitability is required which may come at the cost of

lower growth. Considering this, we rate Prataap Snacks as Neutral.

Exhibit 10: Valuation matrix

Parameter

DFM foods Britannia Industries

Prataap Snacks

EBITDA margins

9.9%

14.1%

4.5%

RoE

19.6%

32.9%

4.2%

ROCE

14.9%

41.1%

5.2%

P/E

86

59

202

EV/EBITDA

43

41

50

Source: Capitaline, Angel Research, Comparison based on latest reported annual numbers

Upside risks

Faster growth in the sales: The company has grown as a CAGR of >30% between

FY13-16 however in FY17, growth rate slowed to below 20% on yoy basis. With

the funds raised through fresh issue in the IPO company intends to invest in the

new manufacturing facilities to foray in the new range of products which may lead

to increase in the growth rates and this can take the growth rate back to ~30%

yoy.

Improvement in the margins: Prataap has seen an inconsistent profitability over the

last five years which has also impacted its return ratios. Improvement in the

profitability would improve its return ratios.

September 19, 2017

6

Prataap Snacks| IPO Note

Income statement

Y/E March (` cr)

FY2013

FY2014

FY2015

FY2016

FY2017

Total operating income

344

446

559

757

904

% chg

29.6

25.4

35.5

19.4

Total Expenditure

316

425

525

701

863

Raw Material Consumed

241

328

404

522

637

Personnel Expenses

5

9

14

19

25

Others Expenses

70

88

107

160

201

EBITDA

28

20

34

57

41

% chg

(% of Net Sales)

8.0

4.5

6.1

7.5

4.5

Depreciation& Amortisation

7

12

15

18

25

EBIT

21

8

19

39

16

% chg

(% of Net Sales)

6.0

1.9

3.3

5.1

1.8

Interest & other Charges

3

3

6

11

3

Recurring PBT

18

5

13

28

13

% chg

Extraordinary Expense/(Inc.)

-

-

-

-

-

PBT (reported)

18

5

13

28

13

Tax

3

(0)

3

0

3

(% of PBT)

16.6

(7.9)

23.8

0.7

23.5

PAT before MI

15

5

10

27

10

Minority Interest (after tax)

-

-

-

-

-

Profit/Loss of Associate Company

-

-

-

-

-

PAT after MI(reported)

15

5

10

27

10

Exceptional Items

-

-

-

-

-

Reported PAT

15

5

10

27

10

% chg

(63.8)

84.1

176.4

(63.9)

(% of Net Sales)

4.3

1.2

1.8

3.6

1.1

Basic EPS (`)

7

3

5

13

5

Fully Diluted EPS (`)

7

3

5

13

5

% chg

(63.8)

84.1

176.4

(63.9)

Source: DRHP, Angel Research

September 19, 2017

7

Prataap Snacks| IPO Note

Balance Sheet

Y/E March (` cr)

FY2013

FY2014

FY2015

FY2016

FY2017

SOURCES OF FUNDS

Equity Share Capital

1

1

1

1

3

Reserves& Surplus

146

176

188

216

235

Shareholders’ Funds

147

177

190

217

238

Minority Interest

0

0

-

-

-

Total Loans

30

38

32

47

66

Other long term liabilities

Long-term provisions

0

0

1

1

2

Deferred Tax Liability

3

3

6

6

9

Total Liabilities

180

219

228

271

314

APPLICATION OF FUNDS

Gross Block

136

165

194

221

267

Less: Acc. Depreciation

11

22

37

53

74

Net Block

125

143

157

168

193

Intangible assets

0

0

0

0

8

Capital Work in Progress

3

15

24

30

52

Other non current assets

12

28

31

40

47

Current Assets

82

93

86

102

128

Inventories

42

52

58

69

79

Sundry Debtors

4

12

14

18

20

Cash

29

22

4

6

11

Loans & Advances

6

7

10

8

12

Other Assets

1

1

1

2

6

Current liabilities

42

61

71

70

113

Net Current Assets

40

32

15

32

15

Total Assets

180

219

228

271

314

Source: DRHP, Angel Research

September 19, 2017

8

Prataap Snacks| IPO Note

Cash Flow Statement

Y/E March (` cr)

FY2013

FY2014

FY2015

FY2016

FY2017

Profit before tax

18

5

13

28

13

Depreciation

7

12

15

18

25

Change in Working Capital

(13)

(5)

(0)

(6)

5

Interest / Dividend (Net)

3

4

6

11

4

Direct taxes paid

(3)

(3)

(1)

(7)

(5)

Cash Flow from Operations

11

13

33

43

43

(Inc.)/ Dec. in Fixed Assets

(67)

(50)

(41)

(52)

(59)

(Inc.)/ Dec. in Investments

(25)

12

12

6

(11)

Cash Flow from Investing

(92)

(38)

(29)

(47)

(70)

Issue of Equity

30.0

25.0

2.4

-

11.2

Inc./(Dec.) in loans

42.0

8.4

(5.6)

9.3

26.1

Dividend Paid (Incl. Tax)

-

-

-

-

-

Interest / Dividend (Net)

(2.8)

(4.2)

(6.2)

(4.5)

(5.0)

Cash Flow from Financing

69

29

(9)

5

32

Inc./(Dec.) in Cash

(11)

4

(5)

2

5

Opening Cash balances

14

3

7

1

3

Closing Cash balances

3

7

1

3

8

Source: DRHP, Angel Research

September 19, 2017

9

Prataap Snacks| IPO Note

Key Ratios

Key Ratios

Y/E March

FY2013

FY2014

FY2015

FY2016

FY2017

Valuation Ratio (x)

P/E (on FDEPS)

134.5

371.8

202.0

73.1

202.2

P/CEPS

92.2

117.3

79.2

44.1

57.3

P/BV

13.6

11.3

10.5

9.2

8.4

Dividend yield (%)

0.0

0.0

0.0

0.0

0.0

EV/Sales

6.4

5.0

4.0

3.0

2.5

EV/EBITDA

79.9

110.0

65.8

39.7

55.2

EV / Total Assets

9.9

7.9

7.4

6.6

5.3

Per Share Data (`)

EPS (Basic)

7.0

2.5

4.6

12.8

4.6

EPS (fully diluted)

7.0

2.5

4.6

12.8

4.6

Cash EPS

10.2

8.0

11.8

21.3

16.4

DPS

0.0

0.0

0.0

0.0

0.0

Book Value

68.9

83.1

88.9

101.9

111.8

Returns (%)

ROCE

11.7

3.9

8.4

14.6

5.2

Angel ROIC (Pre-tax)

14.3

4.7

9.6

16.9

6.8

ROE

10.1

3.0

5.2

12.6

4.2

Turnover ratios (x)

Asset Turnover (Gross Block)

2.5

2.7

2.9

3.4

3.4

Inventory / Sales (days)

45

43

38

33

32

Receivables (days)

4

9

9

9

8

Payables (days)

25

33

32

27

31

Working capital cycle (ex-cash) (days)

24

20

14

15

9

Solvency ratios (x)

Net debt to equity

0.0

0.1

0.1

0.2

0.2

Net debt to EBITDA

0.0

0.8

0.8

0.7

1.3

Interest Coverage (EBIT / Interest)

7.2

2.4

3.4

3.5

5.4

Source: DRHP, Angel Research

September 19, 2017

10

Prataap Snacks| IPO Note

Research Team Tel: 022 - 39357800

DISCLAIMER

Angel Broking Private Limited (hereinafter referred to as “Angel”) is a registered Member of National Stock Exchange of India Limited,

Bombay Stock Exchange Limited and Metropolitan Stock Exchange Limited. It is also registered as a Depository Participant with CDSL

and Portfolio Manager with SEBI. It also has registration with AMFI as a Mutual Fund Distributor. Angel Broking Private Limited is a

registered entity with SEBI for Research Analyst in terms of SEBI (Research Analyst) Regulations, 2014 vide registration number

INH000000164. Angel or its associates has not been debarred/ suspended by SEBI or any other regulatory authority for accessing

/dealing in securities Market. Angel or its associates/analyst has not received any compensation / managed or co-managed public

offering of securities of the company covered by Analyst during the past twelve months.

This document is solely for the personal information of the recipient, and must not be singularly used as the basis of any investment

decision. Nothing in this document should be construed as investment or financial advice. Each recipient of this document should

make such investigations as they deem necessary to arrive at an independent evaluation of an investment in the securities of the

companies referred to in this document (including the merits and risks involved), and should consult their own advisors to determine

the merits and risks of such an investment.

Reports based on technical and derivative analysis center on studying charts of a stock's price movement, outstanding positions and

trading volume, as opposed to focusing on a company's fundamentals and, as such, may not match with a report on a company's

fundamentals. Investors are advised to refer the Fundamental and Technical Research Reports available on our website to evaluate the

contrary view, if any.

The information in this document has been printed on the basis of publicly available information, internal data and other reliable

sources believed to be true, but we do not represent that it is accurate or complete and it should not be relied on as such, as this

document is for general guidance only. Angel Broking Pvt. Limited or any of its affiliates/ group companies shall not be in any way

responsible for any loss or damage that may arise to any person from any inadvertent error in the information contained in this report.

Angel Broking Pvt. Limited has not independently verified all the information contained within this document. Accordingly, we cannot

testify, nor make any representation or warranty, express or implied, to the accuracy, contents or data contained within this document.

While Angel Broking Pvt. Limited endeavors to update on a reasonable basis the information discussed in this material, there may be

regulatory, compliance, or other reasons that prevent us from doing so.

This document is being supplied to you solely for your information, and its contents, information or data may not be reproduced,

redistributed or passed on, directly or indirectly.

Neither Angel Broking Pvt. Limited, nor its directors, employees or affiliates shall be liable for any loss or damage that may arise from

or in connection with the use of this information.

September 19, 2017

11