IPO Note | Logistics

October 30, 2017

Mahindra Logistics Limited

SUBSCRIBE

sue Open: October 31, 2017

Is

Asset light model backed by heavy growth

Issue Close: November 02, 2017

Mahindra Logistics Limited (MLL) is a part of Mahindra & Mahindra group and

works as a 3rd party logistics services provider. MLL was incorporated in 2007 and

Issue Details

has become one of largest 3rd party logistics solutions providers in India. MLL

follows an asset light business model in which most assets (vehicles and

Face Value: `10

warehouses) are owned /provided by its business partners. The company operates

in two business segments i.e. Supply Chain Management (SCM) and corporate

Present Eq. Paid up Capital: `71.1cr

People Transport Solutions (PTS).

Offer for Sale: *1.9cr shares (*`821.62cr -

**`829.36cr)

Operating in an attractive industry: Domestic logistics industry, valued at

`6.4trillion, is expected to grow by ~13% to reach `9.2trillion by 2020. Within the

Fresh issue:Nil

industry, the 3rd party logistics segment is expected to witness a growth of ~21%.

Post Eq. Paid up Capital: `71.1cr

The industry is highly fragmented and post GST implementation, organized large

Issue size (amount): *`821.62cr -**`829.36cr

players are expected to see improved cost structure and gain market share. We

believe that MLL is operating in an industry with tailwinds.

Price Band: `425-429

Impressive growth in non-Mahindra revenues: MLL was dependent on its parent

Lot Size: 34 shares and in multiple thereafter

Mahindra and Mahindra to derive its revenue. In the last few years however,

Post-issue implied mkt. cap:

*`3,023cr

-

company has successfully diversified its business and 45% of its revenues are

**`3,052cr

derived by non-Mahindra clients. Company has hired global consultant McKinsey

Promoter and promoter group holding Pre-

to devise its sales strategy which has clearly helped the company to diversify and

Issue: 74.64%

report a healthy growth rate of 17.5% in the top-line over last three years.

Employee

reservation:

1.25

lakh

Strong return profile: While MLL reported EBITDA margins of 2.9% in FY2017 and

shares(*`5.3cr - **`5.4cr)

5 year PAT CAGR of 17.2%, the adjusted numbers show a different picture with

Promoter and promoter group holding Post-

3.2% EBITDA margins and PAT CAGR of 25.2%. FY2017 adjusted ROE and ROIC

Issue: 61.05%

also work out to be 17.3% and 40% respectively, far better than its peers.

*Calculated on lower price band

** Calculated on upper price band

Outlook and valuation: At the upper end of the price band (`425-`429), the issue

is priced at 66.2x and 50.8x of its reported and adj. FY2017 earnings. Due to its

asset light model, there is no exact comparable peer; however, the thumb rule for

Book Building

any investment is growth and returns. MLL has exhibited CAGR of 15% and 25%

QIBs

50% of issue

in top-line and adj. bottom-line respectively, which is better than its players i.e.

VRL logistics and Transport Corporation of India. In terms of returns, company

Non-Institutional

15% of issue

has shown a better return profile (ROE & ROIC of 17.3% and 40% v/s. peer

Retail

35% of issue

group avg. - 13% & 14% respectively). Based on its growth story, diversification

strategy, strong parent repute and post GST attractiveness of the logistics sector,

we assign Subscribe rating to the issue.

**Post Issue Shareholding Pattern

Key Financials

Y/E March (` cr)

FY2014

FY2015

FY2016

FY2017

Promoters Group

61.05

Net Sales

1,751

1,931

2,064

2,667

% chg

14.3

10.3

6.9

29.2

DIIs/FIIs/Public & Others

38.95

Net Profit

37

39

36

46

% chg

49.9

5.2

(6.6)

28.1

OPM (%)

2.9

3.0

2.5

2.9

EPS (Rs)

5.9

6.6

5.3

6.6

P/E (x)

83.4

79.2

84.9

66.2

P/BV (x)

24.5

11.5

10.1

8.8

Adj. RoE (%)

29.4

15.2

13.2

17.3

RoCE (%)

38.7

19.0

13.5

16.4

Shrikant Akolkar

EV/Sales (x)

1.7

1.6

1.5

1.1

+91 22 39357800 Ext: 6846

EV/EBITDA (x)

57.8

52.7

58.3

39.7

Source: Company, Angel Research

Please refer to important disclosures at the end of this report

1

Mahindra Logistics| IPO Note

Company background

Mahindra Logistics Limited (MLL) is a part of Mahindra & Mahindra group and

works as a third party logistics services provider (3PL). MLL was incorporated in

2007 and has become one of largest 3rd party logistics solutions providers in

India. MLL follows an asset light business model in which most assets (vehicles and

warehouses) are owned /provided by its business partners. The company operates

in two business segments, Supply Chain Management (SCM) and corporate People

Transport Solutions (PTS). MLL is a 3PL company involved into logistics, ware-

house management, inbound and outbound activities, etc.

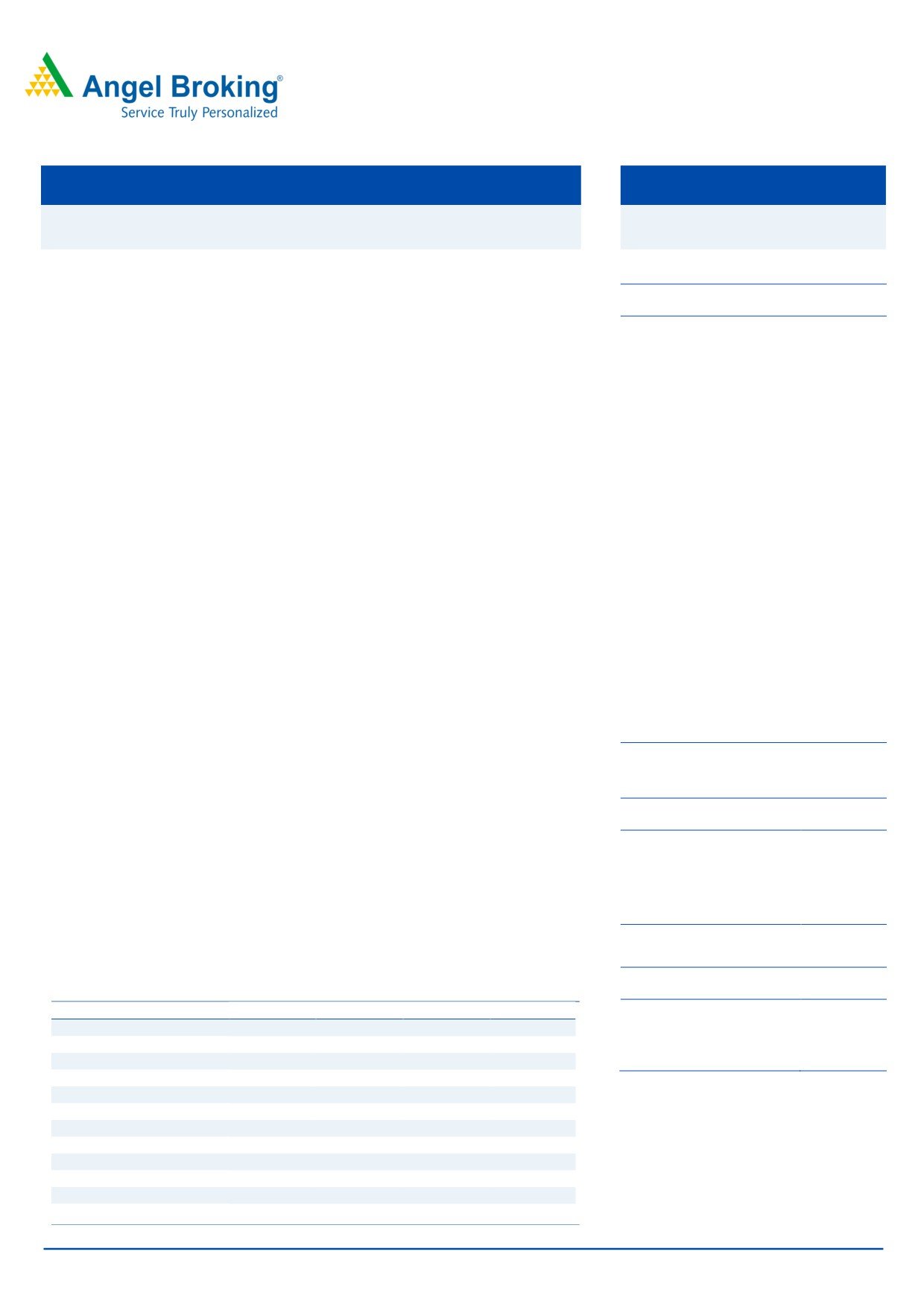

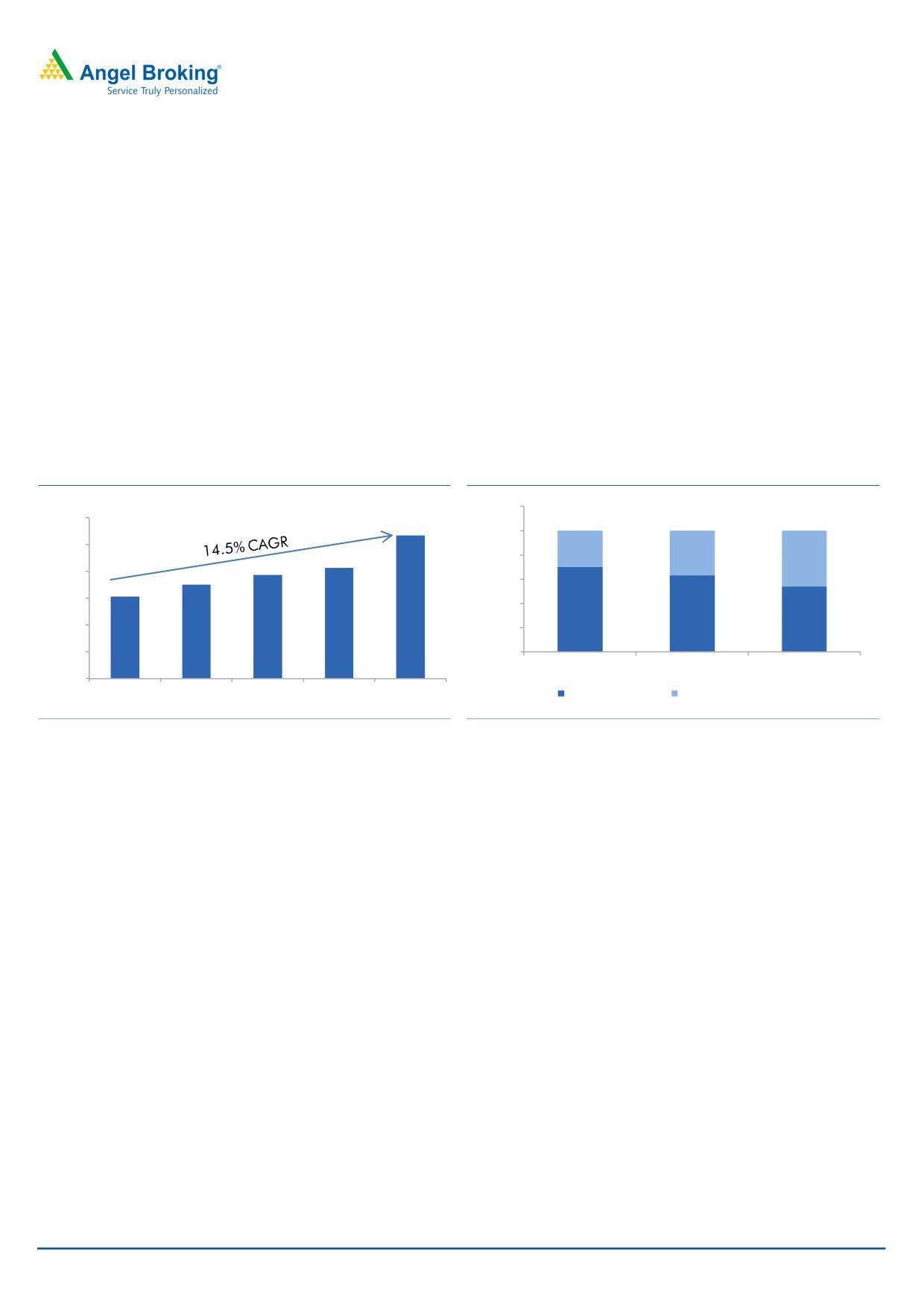

Exhibit 1: Business mix (FY17)

Exhibit 2: Revenue growth and margin profile

3,000

3.5%

PTS Mahindra

2.9%

3.0%

2.9%

SCM Non-

1%

3.0%

2,500

2.5%

Mahindra

2.4%

36%

2.5%

2,000

2.0%

PTS Non-

1,500

Mahindra

1.5%

10%

1,000

1.0%

500

0.5%

SCM Mahindra

0

0.0%

53%

FY13

FY14

FY15

FY16

FY17

Net sales

EBITDA margins

Source: Company, Angel Research, #JVs are not consolidated

Source: Company, Angel Research

Exhibit 3: Evolution of MLL’s business

Year

Milestone

2000

Set-up of the logistics business as a separate division of Mahindra & Mahindra

2009

Logistics business transferred by M&M to MLL

2011

Achieves `1,000cr turnover

Investment by Private equity players Normandy and Kedaara AIF

2014

Enters Ecommerce business

2015

Acquisition of Lords and JV with IVC to for 2X2 Logistics

2017

Achieves `2,500cr turnover

Source: Company, Angel Research

Business segments

Supply Chain Management business (SCM): This segment offers customized and

end-to-end logistics solutions and services including transportation and

distribution, warehousing, in-factory logistics and value added services to clients. It

has a pan-India network comprising 24 city offices and over 350 client and

operating locations as on May 2017. It has a large network of over 1,000 business

partners providing vehicles, warehouses and other assets and services for the SCM

business. Key clients in this business are Volkswagen India Private Limited,

Vodafone India Limited, Thermax Limited, JSW Steel Limited, Ashok Leyland

Limited, Siemens Limited, Bosch Limited, BMW India Private Limited, 3M India

Limited, and Mercedes-Benz India Private Limited.

October 30, 2017

2

Mahindra Logistics| IPO Note

People Transport Solutions (PTS): This segment provides technology enabled

people transportation solutions and services across India to over 100 domestic and

multinational companies operating in the IT, BPOs, KPOs, financial services,

consulting and manufacturing industries. It offers services through a fleet of

vehicles provided by a large network of over 500 business partners. As on May

2017, the company operated PTS business in 12 cities and over 120 client

operating locations across India. Key clients in India for the PTS business include

Tech Mahindra Limited, AXISCADES Engineering Technologies Limited and ANZ

Support Services India Private Limited.

MLL operates two subsidiaries named 2X2 Logistics Private Limited and Lords

Freight (India) Private Limited.

October 30, 2017

3

Mahindra Logistics| IPO Note

Issue details

This is a 100% offer for sale (OFS) issue. Through this IPO, the promoter i.e.

Mahindra and Mahindra will sell total 96.7 lakh shares (`411cr on the lower band

and `415cr on the upper band) while equal no. of shares will be offloaded by PE

investors i.e. Normandy Holdings and Kedaara AIF (Kedaara Capital Alternative

Investment Fund). Normandy Holdings is a fully owned subsidiary of Kedaara

Capital. Promoter, Mahindra and Mahindra’s stake would come down to 58.77%

after the IPO.

Kedara Capital had bought 22.99% stake in the company for `200cr in 2014

(implying the then market cap of `870cr). Kedaara Capital continues to hold

22.99% stake in MLL (pre issue), however after it sells 13.59% stake in the

company through IPO, Kedaara capital’s stake would come down to 9.4%.

Exhibit 4: Selling shareholders and pre and post IPO shareholding pattern

Pre issue

Post-issue

Entity name

Shares offered

No of shares held

% of total shares

No of shares held

% of total shares

Mahindra & Mahindra Limited (Promoter)

51,478,330

72.36%

9,666,173

41,812,157

58.77%

Partners’ Enterprise (Promoter group)

1,622,147

2.28%

nil

1,622,147

2.28%

Promoter and Promoter group

53,100,477

74.64%

9,666,173

43,434,304

61.05%

Normandy

15,686,263

22.05%

9,271,180

6,415,083

9.02%

Kedaara AIF

668,304

0.94%

394,993

273,311

0.38%

Public

1,686,880

2.37%

nil

21,019,226

29.55%

Source: Company, Angel Research

Objects of the fresh issue

Achieve the benefits of listing the Equity Shares on the Stock Exchanges

Enhance visibility and brand image and provide liquidity to the Shareholders

Offer for sale for partial exit of existing shareholders

October 30, 2017

4

Mahindra Logistics| IPO Note

Investment Rationale

Logistics industry to grow at a CAGR of 13% over the next three years: India’s

logistics industry is estimated at `6.4 trillion in FY2017 and it is expected to grow

at a CAGR of 13% to `9.2 trillion in FY2020. The logistics industry is dominated by

transportation (~88% share of the logistics industry), which is expected to remain

high over the next 3-4 years. Large segment of the industry is fragmented, hence

dominated by the unorganized players. In warehousing too, there is scarcity of

quality warehouses. The 3rd party logistics market (3PL) is valued at `325bn in

2017 (~5% of the total logistics sector), which is expected to grow at a CAGR of

~21% to reach to `570bn in 2020 (~6% of the total domestic logistic sector). 3PL

companies are like one stop shop for the companies which can focus on the core

tasks such as manufacturing by outsourcing their logistics operations to the 3PL

companies. This growth push will be offered by sectors such as automobiles, e-

commerce, consumer goods, organized retail and engineering.

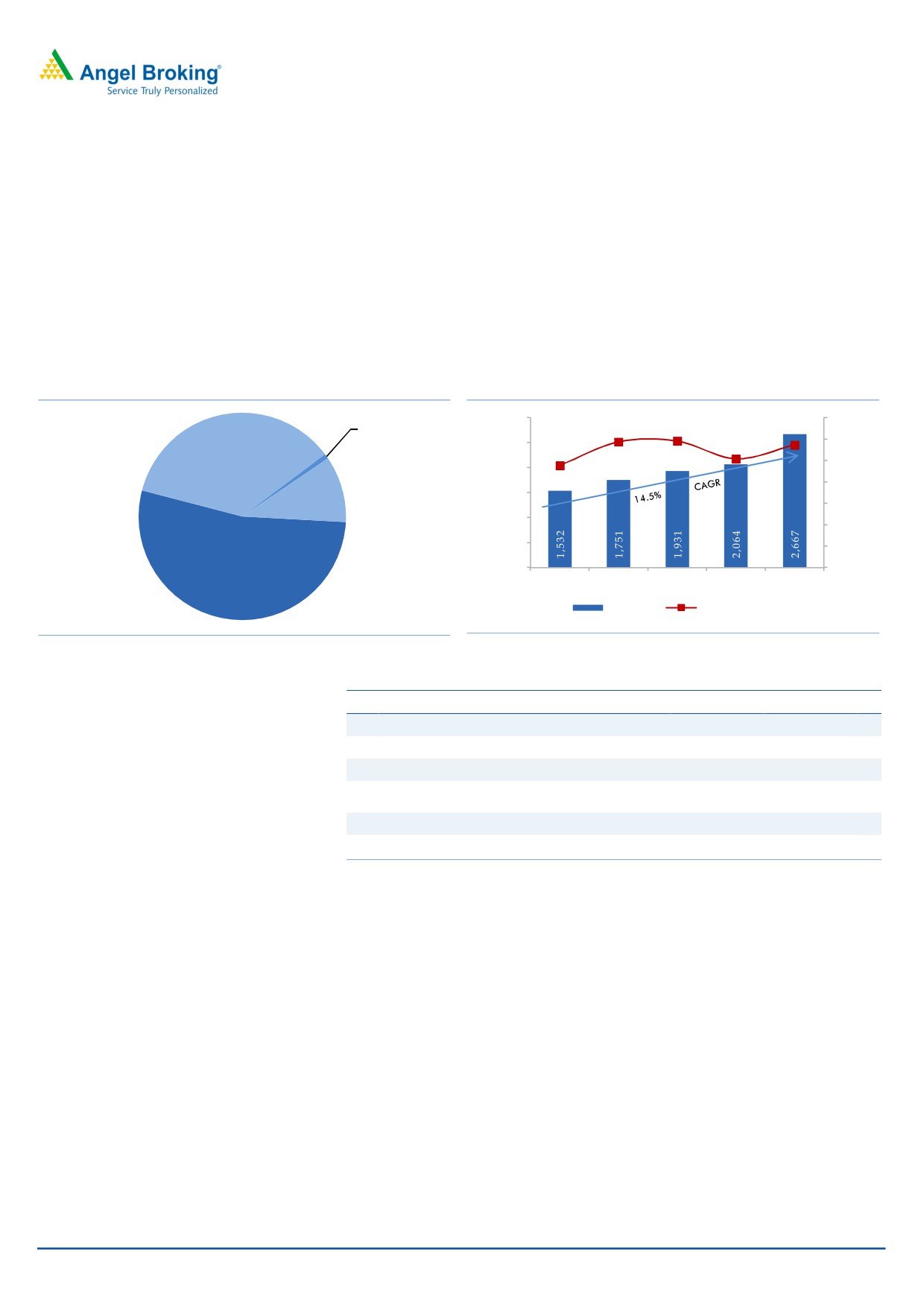

Exhibit 5: Break-up of the domestic logistics sector

Exhibit 6: 3PL to grow faster than logistics industry

25%

FY2017-20 CAGR

21%

Coastal

20%

freight, 1%

Rail freight,

15%

13%

16%

Cold chain,

10%

Road freight,

4%

71%

Wearehousing,

5%

7%

0%

CFS/ICD, 1%

Logistics sector

3PL sector

Source: Company, Angel Research

Source: Company, Angel Research

GST - Game changer for logistics sector: As the sector is largely fragmented, the

share of the unorganized players is very high in this sector. The GST

implementation in July 2017 is expected to help the manufacturing companies to

aggregate state based warehouses into one large, regional warehouse that would

offer cost and operational efficiency in large markets. As logistical inefficiency and

primary transport costs decline, the hub-and-spoke model is expected to

proliferate, which is expected to result in improved serviced levels. Implementation

of GST will result in most business decisions being focused on supply chain

efficiency and not on state-wise tax benefits. Many businesses have already started

considering a complete redesign of their supply chain network. This will be a boon

to the logistics sector and to the large organized players in the sector.

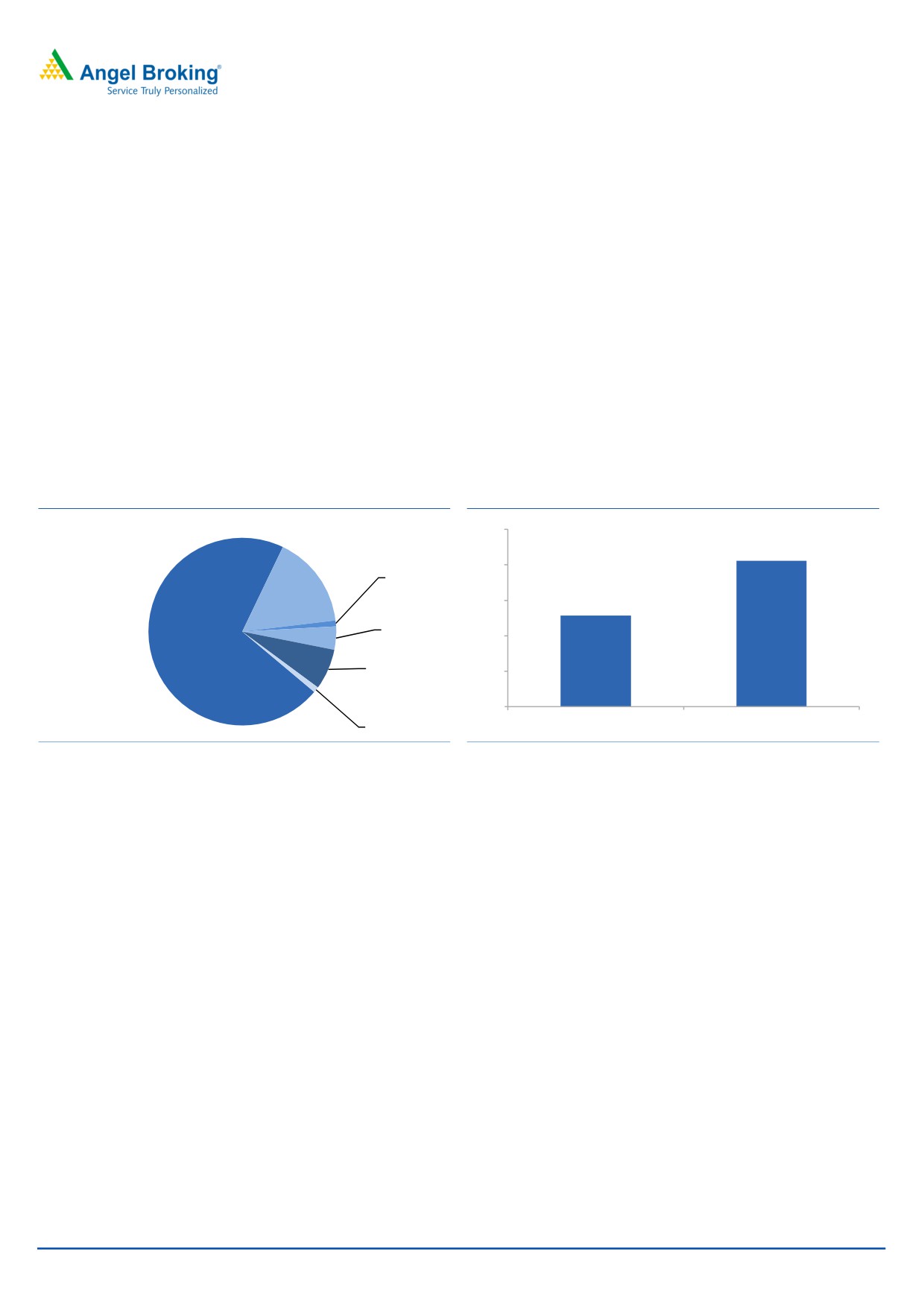

MLL an integrated player with pan India reach: MLL offers end-to-end logistics

solutions and services such as transportation, distribution, warehousing, inbound

and outbound logistics, etc. to its clients. In its SCM business it has a pan-India

network comprising 24 city offices and over 350 client and operating locations as

on May 2017. It has a large network of over 1,000 business partners providing

vehicles, warehouses and the other assets and services for the SCM business. In its

PTS business, company has over 100 domestic and MNC clients and offers

services through a fleet of vehicles provided by a large network of over 500

business partners.

October 30, 2017

5

Mahindra Logistics| IPO Note

Exhibit 7: MLL’s pan India network

Source: Company, Angel Research

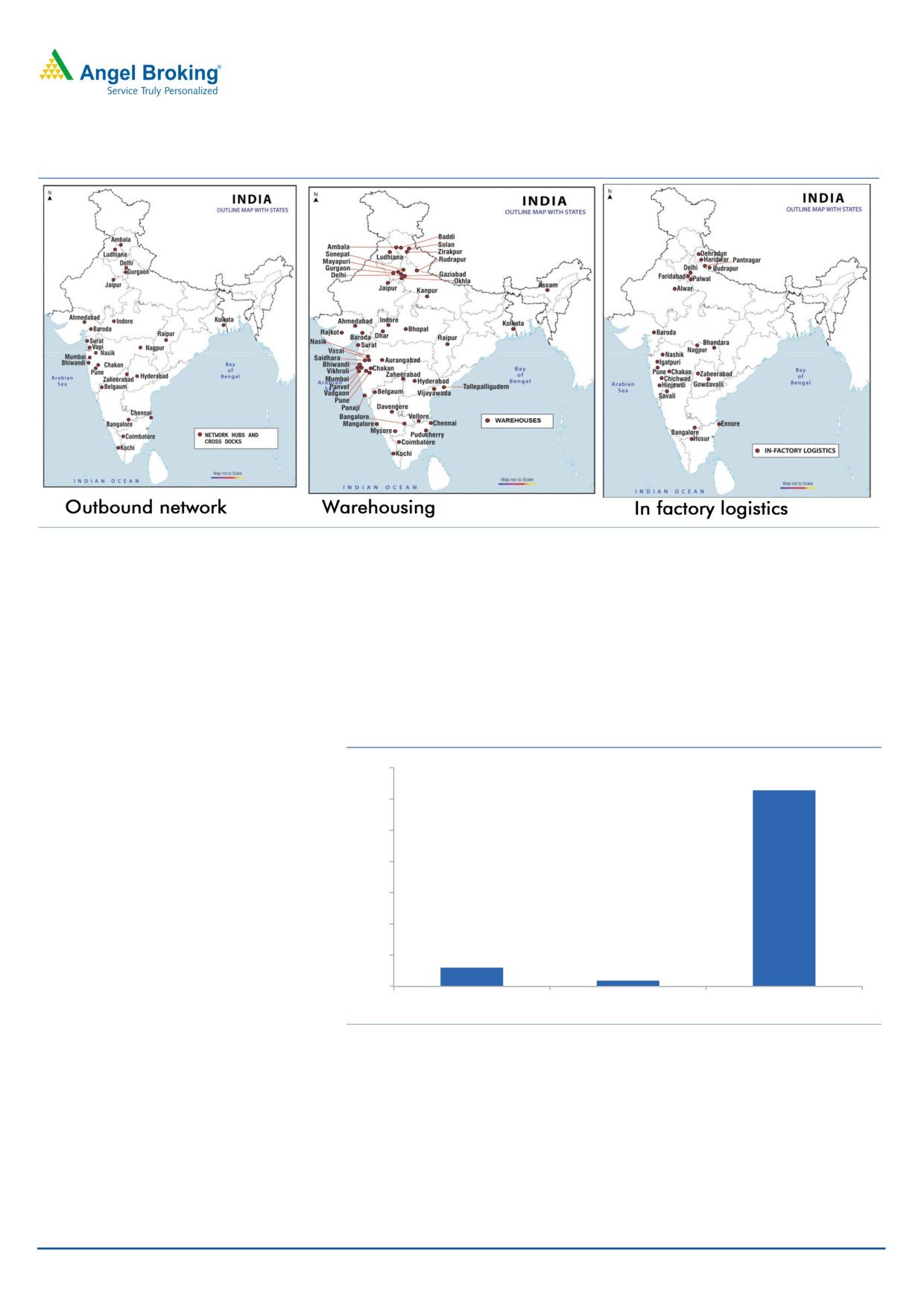

An asset light model: Unlike other players in the logistics industry, MLL operates an

asset light model. It has a large network of over 1,000 business partners who offer

vehicles, warehouses and the other assets and services. Company has over 10.0

million square feet of pan India warehousing space. Company also operates in-

factory stores and line-feed at over 35 manufacturing locations. All the assets are

owned by its large business partners hence, company does not require investing in

the large capex expansion unlike other industry players.

Exhibit 8: MLL’s fixed asset T/O (x) is far higher than its peers

35.0

31.4

30.0

25.0

20.0

15.0

10.0

3.0

5.0

0.9

0.0

Transport Corp.

Sical

MLL

Source: Company, Angel Research, Capitaline, # based on FY17 numbers

This asset light model has given the company capabilities to serve over

200

domestic and multinational companies operating in several industry verticals in

India. The asset light model offers considerable benefits such as improved

scalability and flexibility of offerings to suit varied sectors and customers. With the

advent of GST, the asset light model looks better placed as it has been tested with

great success in the pre-GST era. We believe that asset light model is scalable and

hence, large organized service providers like MLL will be better positioned to

acquire a larger share of the logistics market in the long term.

October 30, 2017

6

Mahindra Logistics| IPO Note

MLL has exhibited a track record of faster growth - MLL, despite having a high

dependence on its strong parent, has shown a faster revenue growth due to its

diversification in other industries. The company’s emphasis has been to grow the

non-Mahindra business, which has clearly helped it to grow faster than the industry

and within a few years of operations, the company has become one of the largest

players in the industry (B2B logistics).

While the other industry players were growing at the rate less than 10%, MLL has

managed to grow at the rate of 15% between FY2013-17. The company hired

global consultant McKinsey in 2015 to scale up its business, especially that of the

non-Mahindra segment and results are clearly visible with the 17.5% top-line

CAGR between FY2015-17. During this period, its non-Mahindra revenue in SCM

business grew at 64.5% CAGR. In FY2015, Mahindra group contributed 70% of its

business, which has changed to 54% by FY2017.

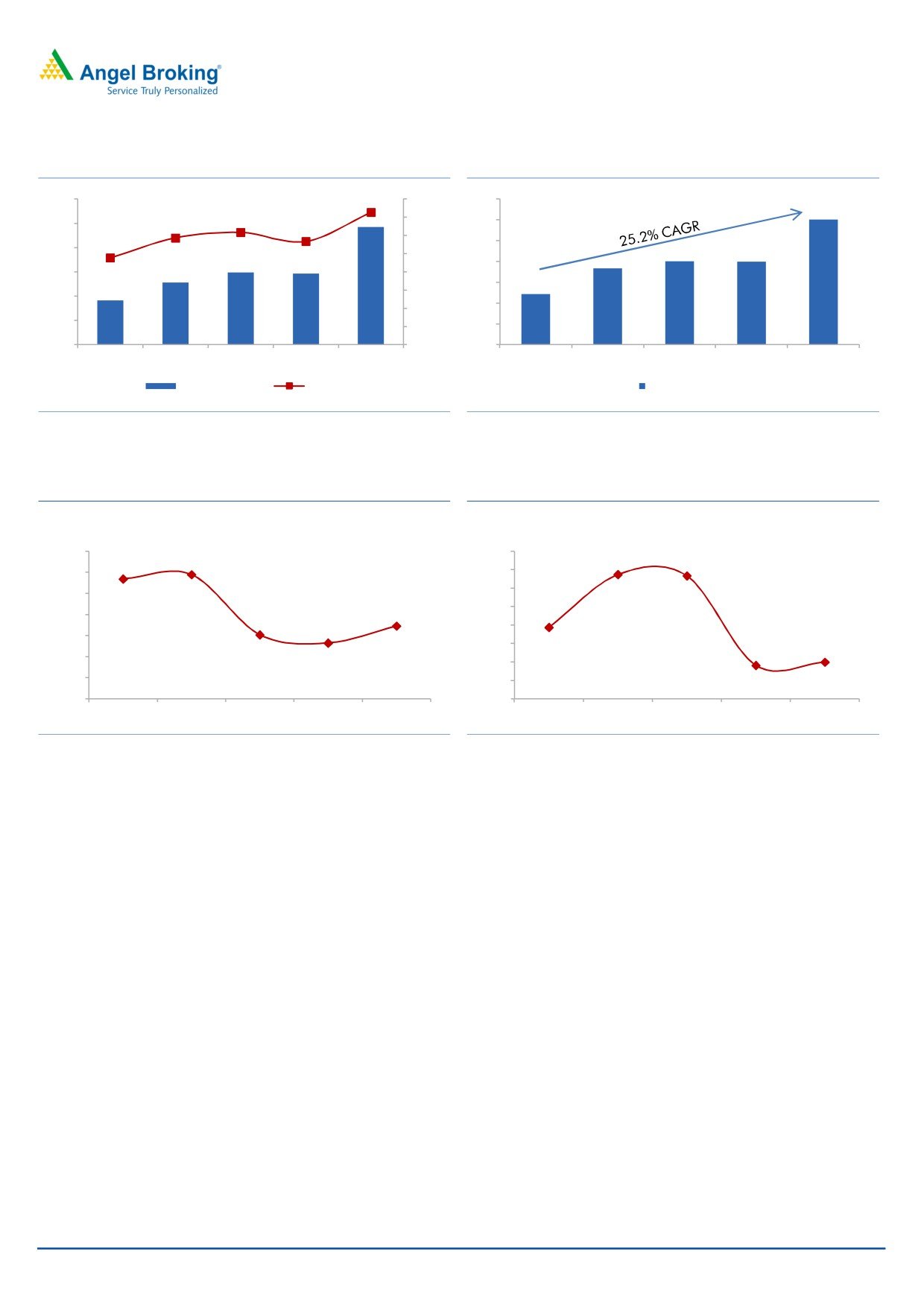

Exhibit 9: 14.5% revenue growth

Exhibit 10: Decreasing dependence on MnM

120.0%

3,000

100.0%

2,500

80.0%

29.9%

36.8%

46.0%

2,000

60.0%

1,500

40.0%

70.1%

63.2%

54.0%

1,000

20.0%

500

0.0%

FY15

FY16

FY17

0

FY13

FY14

FY15

FY16

FY17

Mahindra revenue

Non-Mahindra revenue

Source: Company, Angel Research

Source: Company, Angel Research

Financial performance: Owing to the diversification in the various industries and

growing non-Mahindra revenue, company reported 14.5% CAGR in the net sales

over FY2013-17. During this period, its peers grew by <10% rate, indicating that

asset light model garnered higher market share in the 3PL industry. On the

margins front, company saw margins improving from 2.4% in FY2013 to 2.9% in

FY2017. Adjusted for the consultant fees paid to McKinsey, the FY2017 EBITDA

margins work out to be 3.6%, indicating a 125bps appreciation in the EBITDA

margins since FY2013. The company’s PAT CAGR during this period works out to

be 17.2%, however adjusted PAT CAGR works out to be 25.2%.

October 30, 2017

7

Mahindra Logistics| IPO Note

Exhibit 11: 125bps expansion in adj. EBITDA margins

Exhibit 12: 25.2% CAGR in Adj. PAT

120

3.6%

4.0%

70

3.1%

3.5%

2.9%

60

100

2.8%

3.0%

2.4%

50

80

2.5%

40

60

2.0%

30

1.5%

40

20

1.0%

20

10

0.5%

36

51

60

58

97

24

37

40

40

60

0

0.0%

0

FY13

FY14

FY15

FY16

FY17

FY13

FY14

FY15

FY16

FY17

Adjusted EBITDA

Margins

Adjusted PAT

Source: Company, Angel Research

Source: Company, Angel Research

MLL

Exhibit 13: Adj. ROE

Exhibit 14: Adj. ROIC

Adj ROE

Adj. ROIC

35.0%

160%

29.4%

135%

133%

28.4%

30.0%

140%

120%

25.0%

17.3%

100%

77%

20.0%

15.2%

13.2%

80%

15.0%

60%

40%

36%

10.0%

40%

5.0%

20%

0.0%

0%

FY13

FY14

FY15

FY16

FY17

FY13

FY14

FY15

FY16

FY17

Source: Company, Angel Research

Source: Company, Angel Research

Outlook and Valuation:

At the upper end of the price band (`425-`429), the issue is priced at 66.2x and

50.8x of its reported and adj. FY2017 earnings. Due to its asset light model, there

is no exact comparable peer; however, the thumb rule for any investment is growth

and returns. MLL has exhibited CAGR of 15% and 25% in top-line and adj.

bottom-line respectively, which is better than its players i.e. VRL logistics and

Transport Corporation of India. In terms of returns, company has shown a better

return profile (ROE & ROIC of 17% and 40% v/s. peer group avg. - 13% & 14%

respectively). Based on its growth story, diversification strategy, strong parent

repute and post GST attractiveness of the logistics sector, we assign Subscribe

rating to the issue.

Downside risks

Slowdown in the parent’s business

Consolidation by mid-sized players in the sector

October 30, 2017

8

Mahindra Logistics| IPO Note

Income statement

Y/E March (` cr)

FY14

FY15

FY16

FY17

Net Sales

1,751

1,931

2,064

2,667

% chg

14.3

10.3

6.9

29.2

Total Expenditure

1,699

1,874

2,012

2,590

Personnel Expenses

88

123

151

188

Others Expenses

1,611

1,751

1,861

2,402

EBITDA

51

57

52

76

% chg

40.7

11.1

(8.1)

45.7

(% of Net Sales)

2.9

3.0

2.5

2.9

Depreciation& Amortisation

3

6

8

15

EBIT

48

51

44

62

% chg

44.0

5.9

(13.5)

39.9

(% of Net Sales)

2.7

2.6

2.1

2.3

Other income

6

9

13

10

Interest & other Charges

0

0

1

3

Recurring PBT

54

59

56

68

% chg

50.1

9.1

(5.5)

21.2

Exceptional Items

-

-

-

-

PBT (reported)

54

59

56

68

Tax

18

21

20

22

(% of PBT)

32.6

35.0

35.7

32.1

PAT before MI

37

39

36

46

Minority Interest (after tax)

-

-

-

-

PAT after MI(reported)

37

39

36

46

Exceptional Items

-

-

-

-

Reported PAT

37

39

36

46

% chg

49.9

5.2

(6.6)

28.1

(% of Net Sales)

2.1

2.0

1.7

1.7

Basic EPS (`)

6.3

6.6

5.4

6.7

Fully Diluted EPS (`)

5.9

6.6

5.3

6.6

% chg

45.2

12.5

(19.1)

24.4

Source: DRHP, Angel Research

October 30, 2017

9

Mahindra Logistics| IPO Note

Balance Sheet

Y/E March (` cr)

FY14

FY15

FY16

FY17

SOURCES OF FUNDS

Equity Share Capital

59

60

60

68

Reserves& Surplus

65

205

242

280

Shareholder's Funds

124

265

302

348

Minority Interest

-

4

3

5

Total Loans

-

4

24

28

Other long term liabilities

2

2

2

0

Long-term provisions

6

9

12

13

Deferred Tax Liability

-

0

-

-

Total Liabilities

133

283

342

394

APPLICATION OF FUNDS

Gross Block

19

30

61

85

Less: Acc. Depreciation

5

9

16

29

Net Block

14

21

45

56

Intangible assets

1

5

5

6

Investments

0

110

68

58

Capital Work in Progress

0

0

2

1

Other noncurrent assets

32

26

55

79

Current Assets

287

357

416

618

Sundry Debtors

153

199

245

412

Cash

87

52

24

50

Loans & Advances

-

10

27

25

Other Assets

47

95

120

130

Current liabilities

202

236

249

423

Net Current Assets

85

121

167

194

Total Assets

133

283

342

394

Source: DRHP, Angel Research

October 30, 2017

10

Mahindra Logistics| IPO Note

Cash Flow Statement

Y/E March (` cr)

FY14

FY15

FY16

FY17

Profit before tax

54

59

56

68

Depreciation

3

6

8

15

Change in Working Capital

5

(21)

(67)

(61)

Interest / Dividend (Net)

(6)

(7)

(10)

(4)

Direct taxes paid

(11)

(15)

(38)

(52)

Cash Flow from Operations

49

27

(48)

(29)

(Inc.)/ Dec. in Fixed Assets

(10)

(11)

(35)

(24)

(Inc.)/ Dec. in Investments

6

(154)

36

78

Cash Flow from Investing

(4)

(165)

1

53

Issue of Equity

1.8

101.2

-

1.4

Inc./(Dec.) in loans

-

2.0

19.6

4.4

Dividend Paid (Incl. Tax)

-

-

-

-

Interest / Dividend (Net)

(0.1)

(0.2)

(1.2)

(3.3)

Cash Flow from Financing

2

103

18

2

Inc./(Dec.) in Cash

46

(35)

(28)

27

Opening Cash balances

41

87

52

24

Closing Cash balances

87

52

24

50

Source: DRHP, Angel Research

October 30, 2017

11

Mahindra Logistics| IPO Note

Key Ratios

Valuation Ratio (x)

FY14

FY15

FY16

FY17

P/E (on FDEPS)

83.4

79.2

84.9

66.2

P/CEPS

76.6

68.5

69.0

50.3

P/BV

24.5

11.5

10.1

8.8

Dividend yield (%)

0.0

0.0

0.0

0.0

EV/Sales

1.7

1.6

1.5

1.1

EV/EBITDA

57.8

52.7

58.3

39.7

EV / Total Assets

8.8

5.8

5.2

3.7

Per Share Data (`)

EPS (Basic)

6.3

6.6

5.4

6.7

EPS (fully diluted)

6.3

6.6

5.4

6.7

Cash EPS

5.6

6.3

6.2

8.5

DPS

0.0

0.0

0.0

0.0

Book Value

17.5

37.2

42.4

48.9

Returns (%)

ROCE

38.7

19.0

13.5

16.4

Angel ROIC (Pre-tax) Adj.

134.7

133.3

36.3

39.8

ROE Adj.

29.4

15.2

13.2

17.3

Turnover ratios (x)

Asset Turnover (Gross Block)

91.5

63.6

33.9

31.4

Receivables (days)

32

38

43

56

Payables (days)

39

41

39

53

Working capital cycle (ex-cash) (days)

(8)

(4)

4

4

Solvency ratios (x)

Net debt to equity

(0.7)

(0.2)

(0.0)

(0.1)

Net debt to EBITDA

(1.7)

(0.8)

(0.0)

(0.3)

Interest Coverage (EBIT / Interest)

874.2

139.6

33.4

17.7

Source: DRHP, Angel Research, #ROIC is adjusted for consultancy charges in PL statement and

Income Tax Assets in BS

October 30, 2017

12

Mahindra Logistics| IPO Note

Research Team Tel: 022 - 39357800

DISCLAIMER

Angel Broking Private Limited (hereinafter referred to as “Angel”) is a registered Member of National Stock Exchange of India Limited,

Bombay Stock Exchange Limited and Metropolitan Stock Exchange Limited. It is also registered as a Depository Participant with CDSL

and Portfolio Manager and investment advisor with SEBI. It also has registration with AMFI as a Mutual Fund Distributor. Angel Broking

Private Limited is a registered entity with SEBI for Research Analyst in terms of SEBI (Research Analyst) Regulations, 2014 vide

registration number INH000000164. Angel or its associates has not been debarred/ suspended by SEBI or any other regulatory

authority for accessing /dealing in securities Market. Angel or its associates/analyst has not received any compensation / managed or

co-managed public offering of securities of the company covered by Analyst during the past twelve months.

This document is solely for the personal information of the recipient, and must not be singularly used as the basis of any investment

decision. Nothing in this document should be construed as investment or financial advice. Each recipient of this document should

make such investigations as they deem necessary to arrive at an independent evaluation of an investment in the securities of the

companies referred to in this document (including the merits and risks involved), and should consult their own advisors to determine

the merits and risks of such an investment.

Reports based on technical and derivative analysis center on studying charts of a stock's price movement, outstanding positions and

trading volume, as opposed to focusing on a company's fundamentals and, as such, may not match with a report on a company's

fundamentals. Investors are advised to refer the Fundamental and Technical Research Reports available on our website to evaluate the

contrary view, if any.

The information in this document has been printed on the basis of publicly available information, internal data and other reliable

sources believed to be true, but we do not represent that it is accurate or complete and it should not be relied on as such, as this

document is for general guidance only. Angel Broking Pvt. Limited or any of its affiliates/ group companies shall not be in any way

responsible for any loss or damage that may arise to any person from any inadvertent error in the information contained in this report.

Angel Broking Pvt. Limited has not independently verified all the information contained within this document. Accordingly, we cannot

testify, nor make any representation or warranty, express or implied, to the accuracy, contents or data contained within this document.

While Angel Broking Pvt. Limited endeavors to update on a reasonable basis the information discussed in this material, there may be

regulatory, compliance, or other reasons that prevent us from doing so.

This document is being supplied to you solely for your information, and its contents, information or data may not be reproduced,

redistributed or passed on, directly or indirectly.

Neither Angel Broking Pvt. Limited, nor its directors, employees or affiliates shall be liable for any loss or damage that may arise from

or in connection with the use of this information.

October 30, 2017

13