IPO Note | Pharmaceuticals

14-Jun-17

Eris Lifesciences Limited

SUBSCRIBE

sue Open: June 16, 2017

Is

Strong fundamentals leading to growth rewards

Issue Close: June 20, 2017

Eris Lifesciences is an Ahmedabad based pharma company. It manufactures and

sells branded pharmaceutical products in the chronic and acute therapeutic areas

Issue Details

and has 100% domestic focus. The company’s 66% revenue contribution is from

the chronic segment, while 34% is from the acute segment. It has a formulations

Face Value: `1

facility located in Guwahati.

Present Eq. Paid up Capital: `13.75cr

Focus on niche therapeutic segments: Since its inception, the company has been

focusing on chronic and specialty acute therapeutic segments. This strategy has

Offer for Sale: 2.89cr Shares

played well for the company, as it has gained market share in most of the

Fresh issue: Nil

therapeutic segments of its focus. This has also helped the company to become

Post Eq. Paid up Capital: `13.75cr

32nd largest company by revenue in domestic pharma industry within a decade.

Issue size (amount): *`1,732cr -**1,741 cr.

100% domestic branded generic player: The business of Eris is 100% domestic

and the company has no intention to start exports. This, we believe is a

Price Band: `600-603

differentiated strategy, as it insulates the company form the risk of foreign

Lot Size: 24 shares and in multiple thereafter

regulator as well as higher expenses in terms of R&D. This bodes well in the times

of heightened regulatory issues in the sector.

Post-issue implied mkt. cap:

*`8,250cr

-

**`8,591cr

Strong track record of growth and profitability: Eris has exhibited a growth CAGR

Promoters holding Pre-Issue: 59.2%

of 16.5% in the top-line over the last five years. Company also has a good

EBITDA margin profile, 37% in FY2017, much better than its Indian and MNC

Promoters holding Post-Issue: 55.93%

peers. Moreover, the margins have seen consistent expansion owing to which, its

*Calculated on lower price band

bottom-line CAGR works out to be 42.6% over the last five years (4.1x growth).

** Calculated on upper price band

Company has strong RoE and RoIC ratios as compared to peers, and we believe

that with its specialty focus and marketing & selling capability, it will be able to

Book Building

maintain healthy financial profile going ahead.

QIBs

75% of issue

Outlook and Valuation: On FY2017 EPS of `17.6, the issue is priced at P/E of

Non-Institutional

15% of issue

34.25x, which is at par with its MNC peers but higher than domestic peer, Alkem

Labs. Considering that Eris’ faster growth, superior returns, debt free status, and

Retail

10% of issue

specialty play, we believe that this is a fair valuation. We believe that Eris is likely

to continue growing faster than its competitors owing to its marketing capability,

higher operating leverage and growing market share of its mother brands. While

most pharma companies are currently facing issues on several fronts, this

Post Issue Shareholding Pattern

business model looks attractive with no USFDA concerns and pricing pressure.

Promoters Group

55.9

Considering the company’s superior growth, better margin profile and high return

ratios, we rate this IPO as SUBSCRIBE.

DIIs/FIIs/Public & Others

44.1

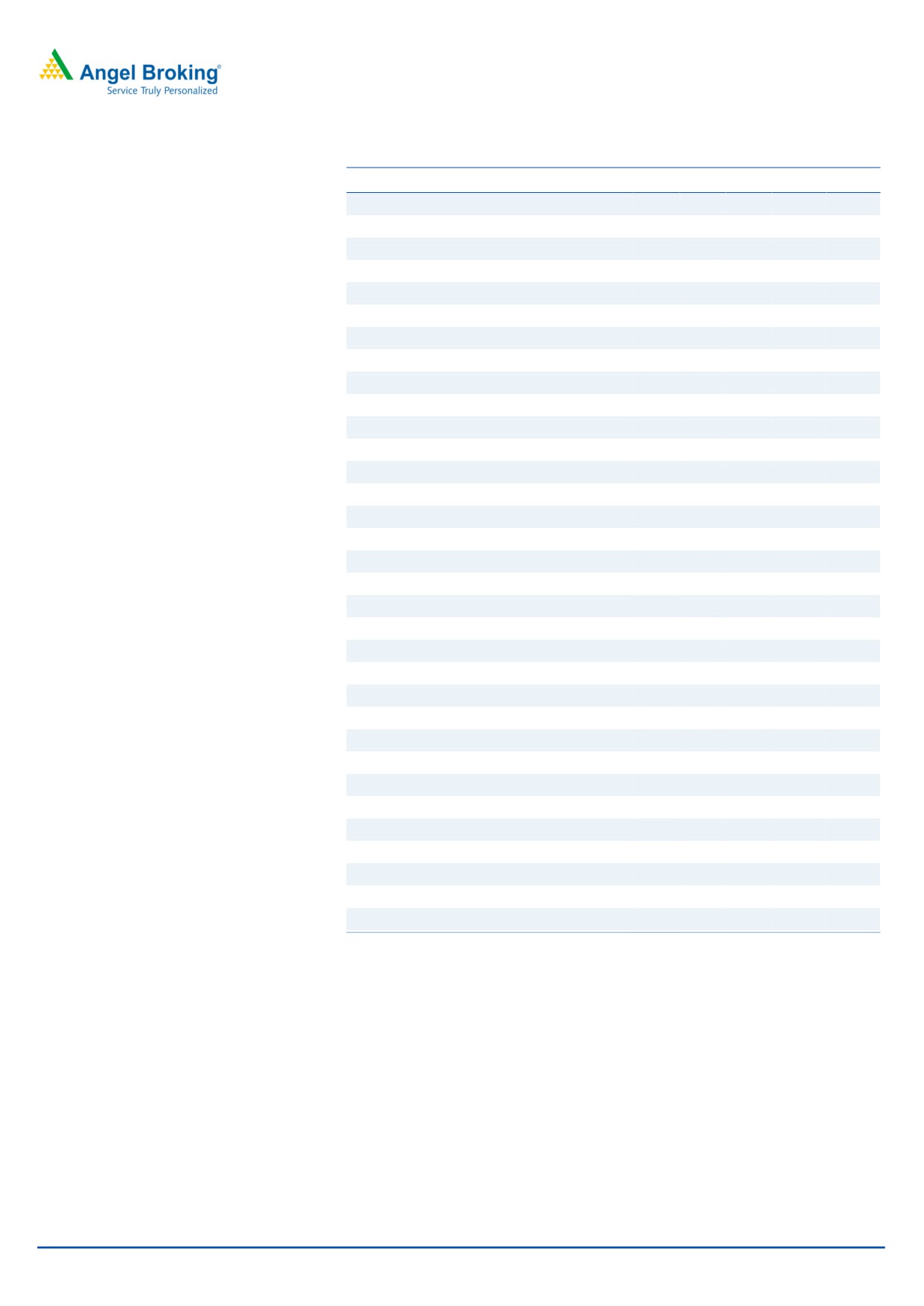

Key Financials

Y/E March (` cr)

FY14

FY15

FY16

FY17

Net Sales

509

546

597

725

% chg

29.5

7.2

9.4

21.4

Net Profit

70

89

134

242

% chg

21.0

26.7

49.7

81.2

OPM (%)

19.4

22.3

28.7

37.1

EPS (Rs)

5.1

6.5

9.7

17.6

P/E (x)

117.7

92.9

62.1

34.3

P/BV (x)

47.0

31.2

27.7

15.4

RoE (%)

39.9

33.6

44.6

44.8

Shrikant Akolkar

RoCE (%)

49.2

38.7

46.4

44.2

+91 22 39357800 Ext: 6846

EV/Sales (x)

16.1

14.9

13.6

11.1

EV/EBITDA (x)

83.0

66.9

47.3

29.9

Source: Company, Angel Research

Please refer to important disclosures at the end of this report

1

Eris Lifesciences| IPO Note

Company background

Eris Lifesciences is a Gujarat based Pharma Company. It was started in 2007 by

Mr. Amit Bakshi and in the short period of ten years, it has become one of the

fastest growing companies in the domestic pharma space. It has also ascended to

the 32nd position in terms of market share during this short period. Company

develops, manufactures and commercializes branded pharmaceutical products in

select therapeutic areas within the chronic and acute categories, such as

cardiovascular, anti-diabetics, vitamins, gastroenterology, and anti-infective. Its

primary focus has been on developing products in the super specialties in the

chronic and acute category, which are linked to lifestyle related disorders.

Company has a formulation facility located in Guwahati (Assam), which

contributed 60% of FY2017 revenues (FY2016 - 51.56%). Its manufacturing

partner Sozin Flora Pharma constituted 28.16% of its revenue in FY2016 and

18.67% in FY2017. The rest came from third party manufacturing.

Exhibit 1: Revenue mix based on manufacturing facilities

Manufacturer

FY16

FY17

Guwahati (Captive)

52%

59%

Sozin Flora Pharma (partner) - until August 2016

28%

19%

Third Party Manufacturers

20%

22%

Total

100%

100%

Source: Company, Angel Research

Eris is a 100% domestic branded generic player and has no intent to start

exporting. Recently, in July 2016, company acquired Amay Pharma’s trademarks

of 40 brands in cardiovascular and anti-diabetics space for `32.9cr. Eris has also

purchased 75.5% stake in a musculoskeletal disorder focused pharma company

Kinedex for `77.2cr. Company has indicated that it will foray in neurological pain,

dermatology and gynecology. Eris’ top 10 brands have leading market share

positions, while 10 mother brands represent 72.5% of its revenues. Company had

total 1,501 medical representatives as of March 2017.

Botticelli, ChrysCapital’s investment arm purchased 16.25% equity stake in the

company for `87.27 per share (total `195cr), which is seeking exit from the

company through this IPO.

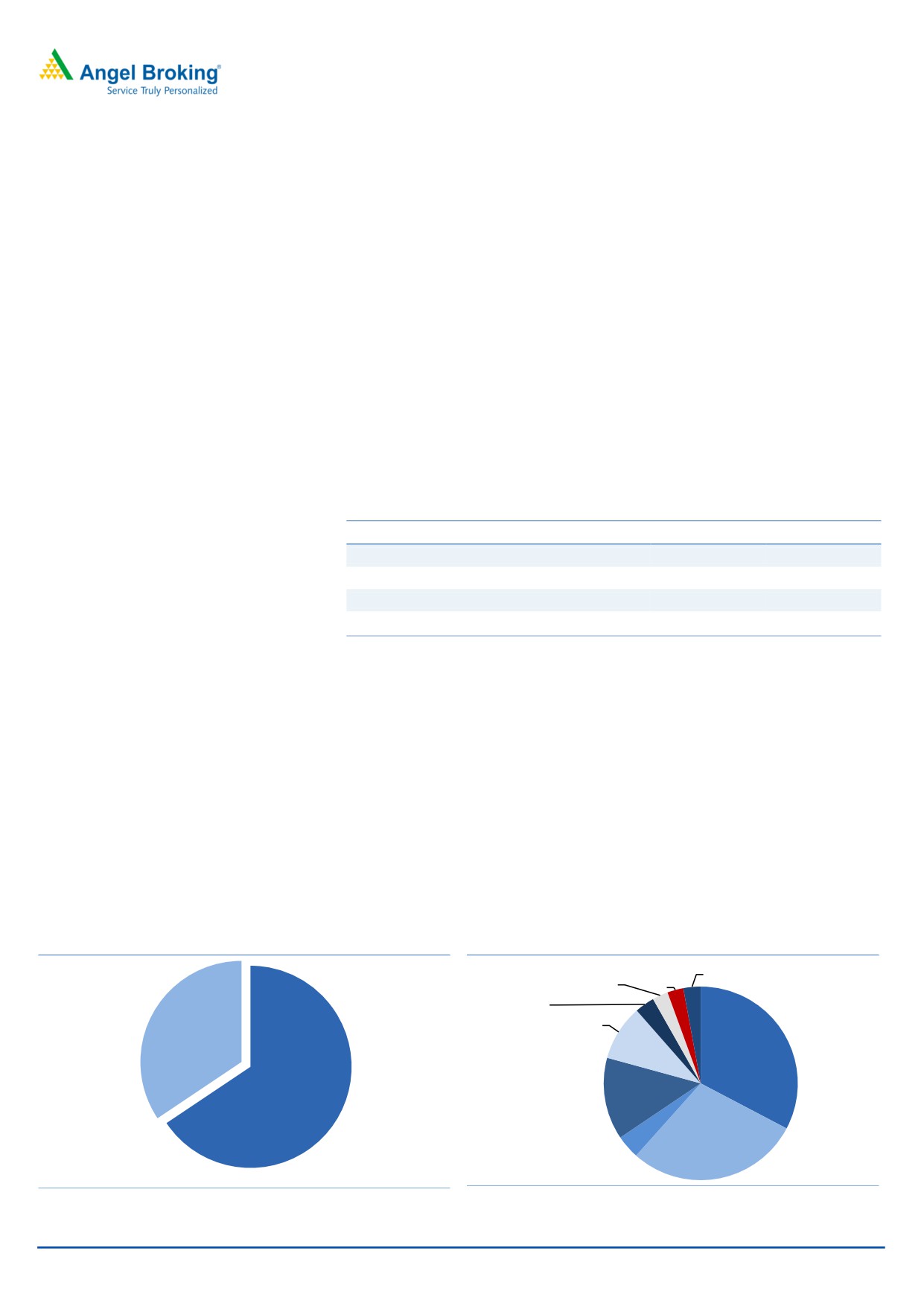

Exhibit 2: Revenue mix (%)

Exhibit 3: Therapeutic segment mix (%)

Gynaecology,

Others - Acute,

Anti-infectives:,

3%

3%

Acute pain-

3%

analgesics, 3%

Gastroenterolo

Acute, 34%

gy, 9%

Cardiovascular

, 33%

Chronic, 66%

Vitamins, 14%

Anti-diabetics,

Others -

29%

Chronic, 4%

Source: Company, Angel Research

Source: Company, Angel Research

June 14, 2017

2

Eris Lifesciences| IPO Note

Issue details

Through this IPO, existing shareholders i.e. ChrysCapital is selling its entire

16.25% shareholding from the company. Promoters are also selling some of their

shares in this IPO. This is a 100% OFS issue and no fresh shares will be issued by

the company.

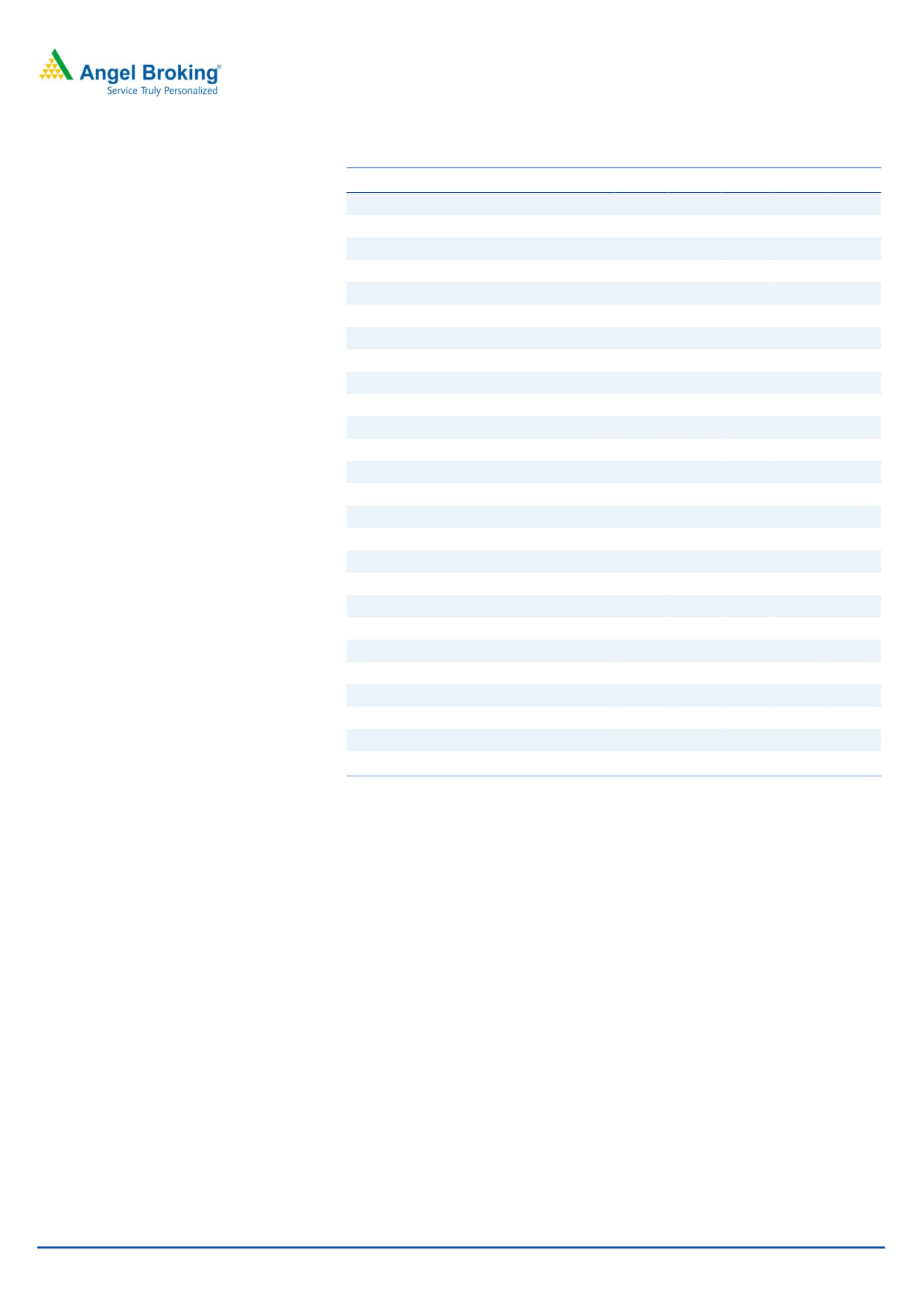

Exhibit 4: Pre and Post-IPO shareholding of selling shareholders

Selling shareholders

Pre-issue shares held

Percentage of pre-issue capital

Post issue

Percentage of post- issue capital

Amit Indubhushan Bakshi

54,959,000

40.0%

54,271,500

39.5%

Himanshu Jayantbhai Shah

6,972,000

5.1%

6,284,500

4.6%

Inderjeet Singh Negi

6,971,000

5.1%

5,939,833

4.3%

Kaushal Kamlesh Shah

5,500,000

4.0%

4,468,833

3.3%

Mr. Rajendrakumar Rambhai Patel

6,971,000

5.1%

5,939,834

4.3%

Botticelli (ChrysCapital)

22,344,000

16.3%

Nil

Nil

Bhikhabhai Chimanlal Shah

12,429,000

9.0%

11,054,000

8.0%

Hetal Rasiklal Shah

5,500,000

4.0%

4,812,500

3.5%

Total

121,646,000

88.5%

92,771,000

67.5%

Source: Company, Angel Research

Objects of the offer

Achieve the benefits of listing of the equity shares on the stock exchanges

Sale of up to 28,875,000 Equity Shares by the Selling Shareholders

June 14, 2017

3

Eris Lifesciences| IPO Note

Investment Rationale

Chronic segment focus, a right strategy since inception: Since its incorporation,

company has maintained its focus on bringing products primarily focused on

therapeutic areas, which require the intervention of specialists and super

specialists. This means focus on chronic segments like cardiology, diabetology, etc.

The company is also focused on the acute therapeutic segments, which are linked

to the lifestyle diseases such as, Gynecology, gastroenterology, etc. This has

proved beneficial for the company, as it has differentiated itself by focusing on the

segments in which it can use its sales and marketing expertise.

The strategy to focus on the chronic and lifestyle related acute therapies is a right

strategy, as most pharma companies in Indian market are also focusing on the

chronic segment. The Indian Pharma Market (IPM) is also witnessing this change.

While acute is the largest segment in IPM, the growth of this segment has been

slower (10.40%) than that of chronic segment (17.70%) from 2011 to 2016. Due

to the faster growth, share of chronic therapies is going up in the IPM. It is believed

that by 2021, chronic therapies will contribute 37% of IPM revenues v/s. 34% in

2016 and 27% in 2011.

Chronic diseases like cancer, diabetes, cardiovascular, etc. are caused due to the

change in the lifestyle and sometimes they are also not curable. These types of

diseases also require prolonged medication. On the other hand, acute diseases

are the ones where the market is competitive and they are mainly treated by

general practitioners (GPs) and consulting physicians (CPs). Some indications from

acute therapies are also moving to the OTC segment, where the already

established brands have better chance to perform. The chronic therapies, however,

are complex and need special attention by the specialists. This means that

companies with strong relationship with doctors are better placed to benefit from

pricing advantage and can fare better than others.

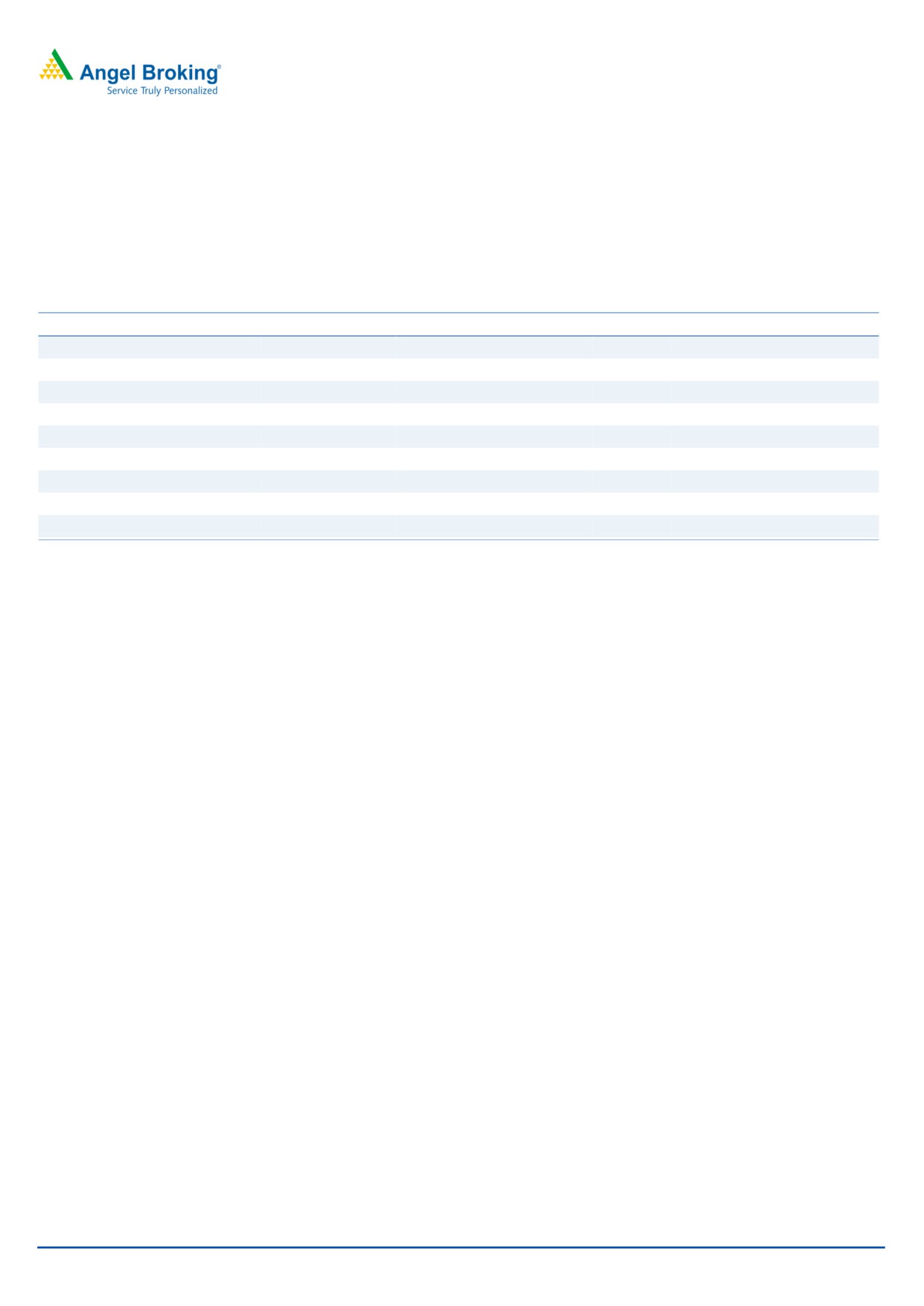

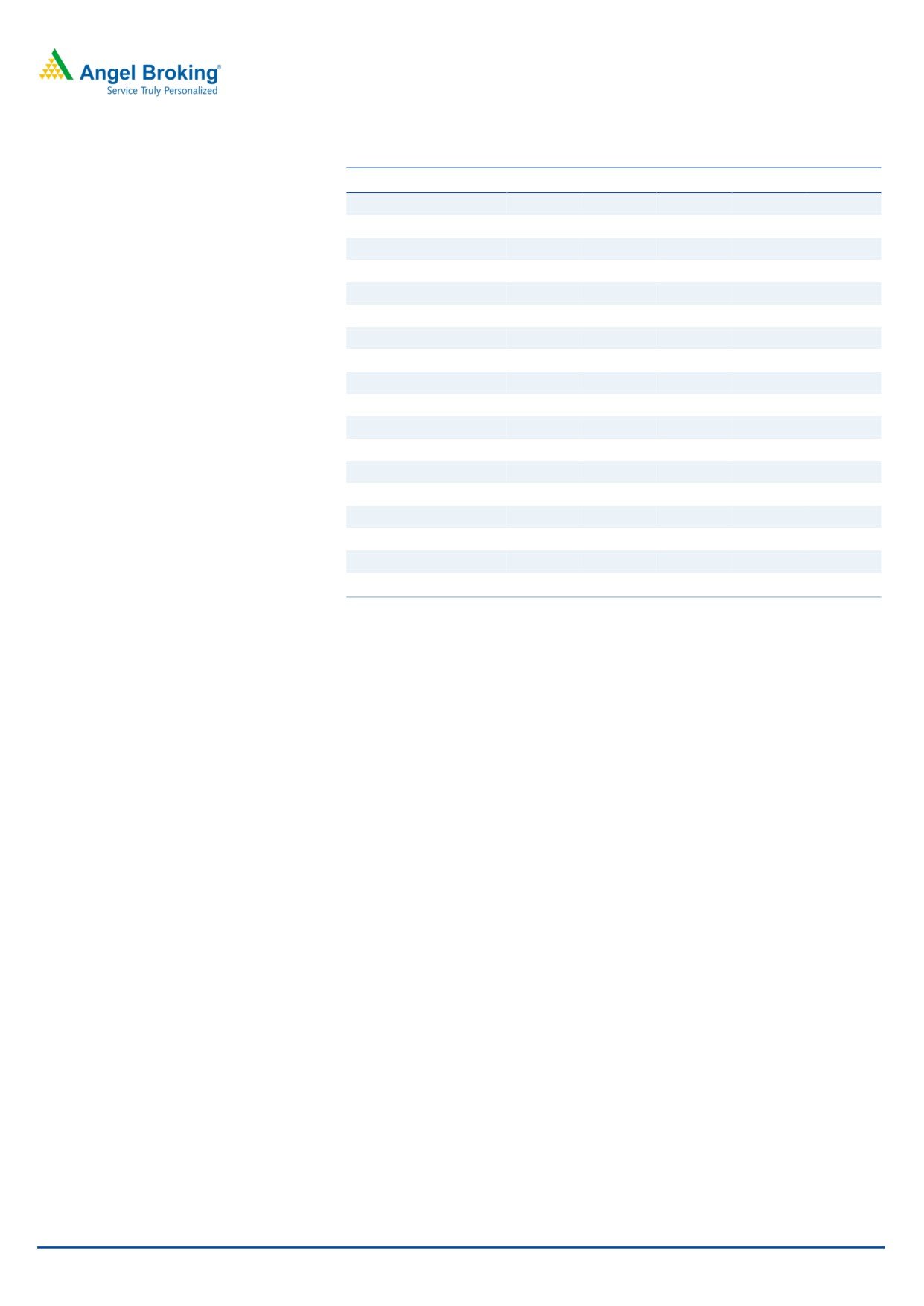

Exhibit 5: Chronic therapies to grow faster...

Exhibit 6: ...shifting IPM revenue mix

20.00%

120%

100%

15.00%

27%

80%

34%

37%

10.00%

60%

40%

73%

5.00%

66%

63%

20%

10%

18%

10%

14%

0.00%

0%

2011-16

2016-21

2011

2016

2021

Acute Chornic

Acute Chornic

Source: Company, Angel Research

Source: Company, Angel Research

June 14, 2017

4

Eris Lifesciences| IPO Note

Strong track record of growth: Eris’ portfolio is tilted more towards the chronic

segment, which represents 66% of its sales. The revenue from the chronic segment

has grown at a CAGR of 29% over FY2013-17. The acute segment revenue

represents the rest 34% business mix and has grown at a CAGR of 12% during the

same period. Due to the higher contribution from the high growth chronic

segment, company has been able to outperform the IPM growth so far. Eris’ top-

line has grown at a CAGR of

21.7% over FY2013-17, giving a strong

outperformance v/s. IPM growth of ~12% during this period.

While the chronic play has benefitted the company, the promoter’s experience in

pharma marketing has also paid the company richly.

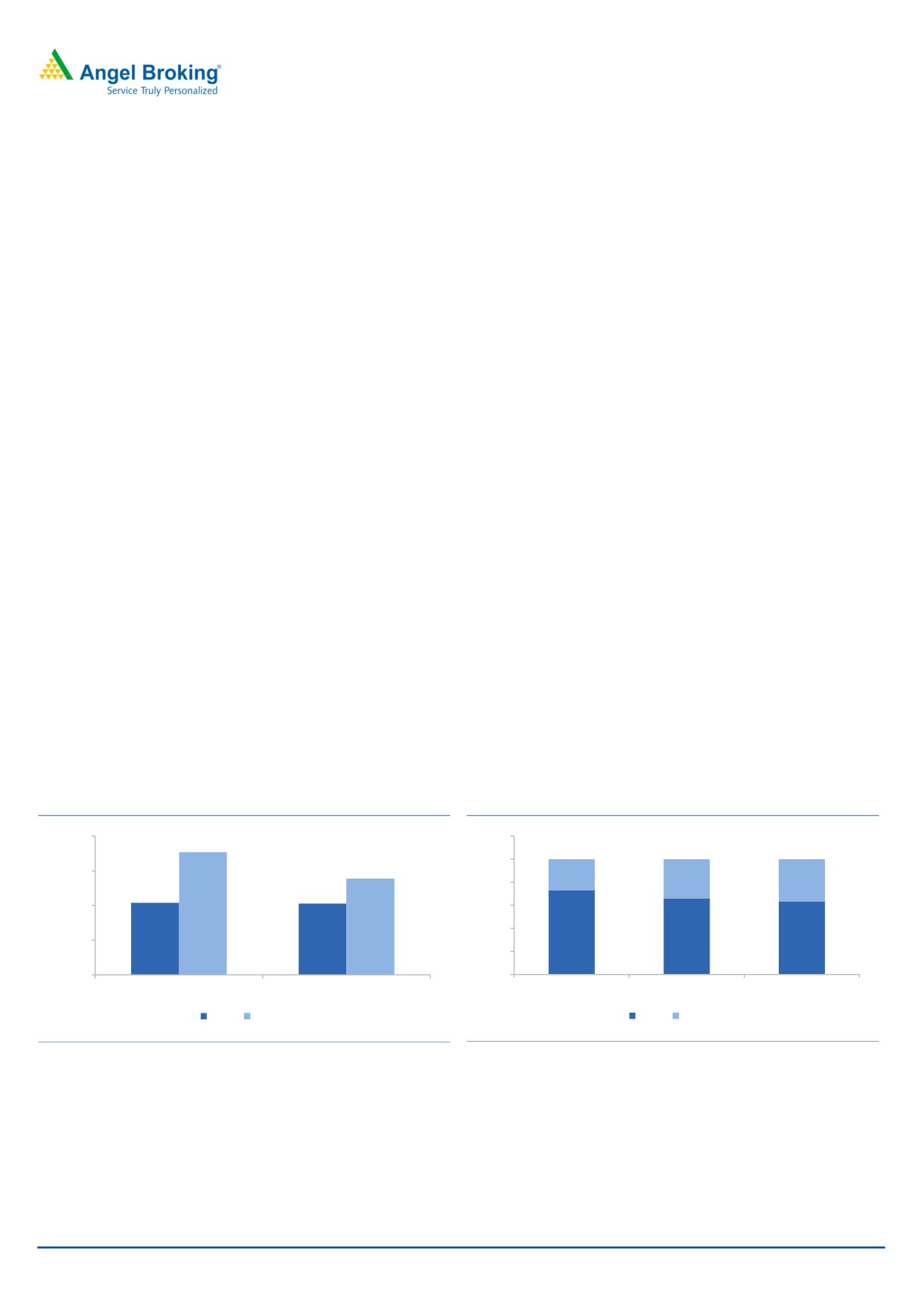

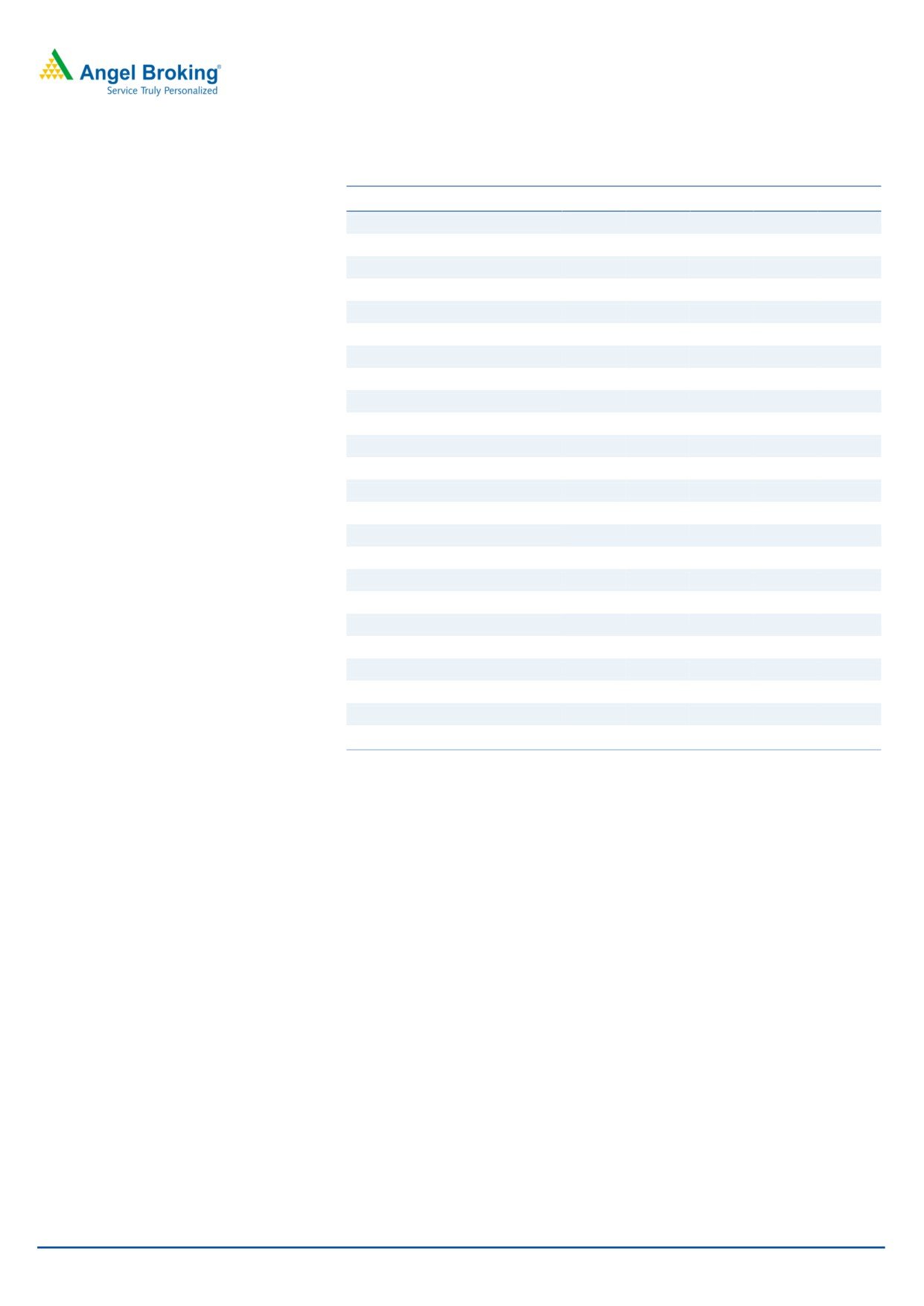

Exhibit 7: Eris’ fastest growing segment - Chronic

Exhibit 8: Rising contribution of Chronic in revenue mix

35.00%

120%

28.89%

30.00%

100%

25.00%

80%

44%

40%

37%

34%

48%

20.00%

60%

15.00%

12.02%

40%

10.00%

63%

66%

52%

56%

60%

5.00%

20%

0.00%

0%

Chronic category

Acute category

FY13

FY14

FY15

FY16

FY17

FY13 - FY17 - CAGR

Chronic category

Acute category

Source: Company

Source: Company

Foray in new chronic therapies to help gain further market share: As per IMS

report, IPM largely remains volume growth market than price growth. In FY2015

and FY2016, domestic pharma market grew by 5.6% and 5.8% respectively, in

volume terms, while in pricing terms it grew by 1.7% and 3.6% each. The new

drug launches have also contributed meaningful 6.1% in FY2015 and 5% each in

FY2016 and FY2017. We believe that the companies launching new drugs and

keeping competitive prices will be successful in domestic pharma.

Exhibit 9: India Pharma Market (IPM) - Key growth drivers

16.00

14.4

13.4

12.00

5.00

6.10

9.2

8.00

3.60

1.70

5.00

4.00

1.60

5.60

5.80

2.60

0.00

FY15

FY16

FY17

Volume Growth (%)

Price Growth (%)

New launches (%)

Total

Source: Company, Angel Research, data for FY17

Eris, while consolidating its presence in existing therapeutic areas, intends to focus

on pursuing opportunities in other therapeutic areas such as, chronic neurological

pain, dermatology and gynecology. These, we believe are significantly meaningful

June 14, 2017

5

Eris Lifesciences| IPO Note

opportunities and if the company is able to replicate its success in existing

therapies in these, it will be able to sustain the current growth rate trajectory, and

while doing so, it would also gain market share and rise in the ranks in IPM at a

faster pace.

Exhibit 10: Foray in the new therapies with meaningful market size

Segment

Market size (` cr.) FY13-17 CAGR Current revenue Strategy

Neurology

6,884

12.20%

167.5

Focus on chronic neuropathic pain

Dermatology

7,993

18.20%

NA

New launches

Gynecology

5,571

9.90%

0

Focus on female infertility and endocrine disorders

Osteoarthritis and

1,042

10.70%

0

leverage on Kinedex acquisition

musculoskeletal

Source: Company, Angel Research, data for FY17

Acquisitions in specialty therapeutic segments: Eris has also sought an inorganic

growth route owing to the growth opportunities in the specialty therapies and its

cash rich balance sheet.

Exhibit 11: Recent acquisitions

Company Description

75.48% stake acquired in 2016 for `77.2cr

Rosiflex is the largest brand with `39.6cr sales in FY2017

Kinedex

Major focus on mobility related disorders like musculoskeletal therapies, acquisition likely to help company in gaining market share in

this specialty segment

Acquired 40 brands from Aprica Pharma (erstwhile Amay) in 2016 for `37.9cr.

Aprica

Total revenue `19.3cr in FY2017

Pharma

Major focus on cardiovascular and anti-diabetics, acquisition is likely to consolidate its current position in the CV and anti-diabetic

segments

Source: Company, Angel Research

Most brands of Eris are gaining market share: Eris, since launching its products,

has seen strong growth traction in its mother brands. The DRHP speaks of 15 such

mother brand groups, which represent 85% of its total business. In their respective

categories, these mother brands have seen growth traction. Mother brands

representing

~55% of its business have exhibited a strong growth rate,

outperforming the segment growth. While old brands feature in the top 5 in their

respective categories, recently launched brands like Metital (Gynac) and Cyblex

and Tendia (anti-diabetic) have also quickly gained market share.

Exhibit 12:

Mother brand

Launch year

Market Share

Revenue (` cr.)

CAGR FY13-17

Prescription rank

% of revenue

Glimisave

2007

5.50%

171

29.00%

3

20%

Eritel

2008

5.30%

102

28.50%

4

12%

Olmin

2010

6.80%

49

36.10%

3

6%

LN Bloc

2012

10.80%

36

168.4

2

4%

Tendia

2015

7.20%

29

NA

3

3%

Crevast

2010

2.50%

23

20.40%

6

3%

Cyblex

2014

4.20%

22

NA

6

3%

Marzon

2011

57.00%

19

7.60%

1

2%

Metital

2014

19.70%

12

NA

1

1%

Source: Company, Angel Research, data for FY17

June 14, 2017

6

Eris Lifesciences| IPO Note

Two of its brands, Glimisave (Anti-diabetics) and Eritel (Hypertension), which

represent 31% of FY2017 sales, have seen a growth CAGR of ~29%. This we

believe is an indication that these brands can further go on gaining market share.

Also, going by the track record, there is also a probability that more brands will

gain further market share in future implying that Eris’ branded generics business

has strong potential.

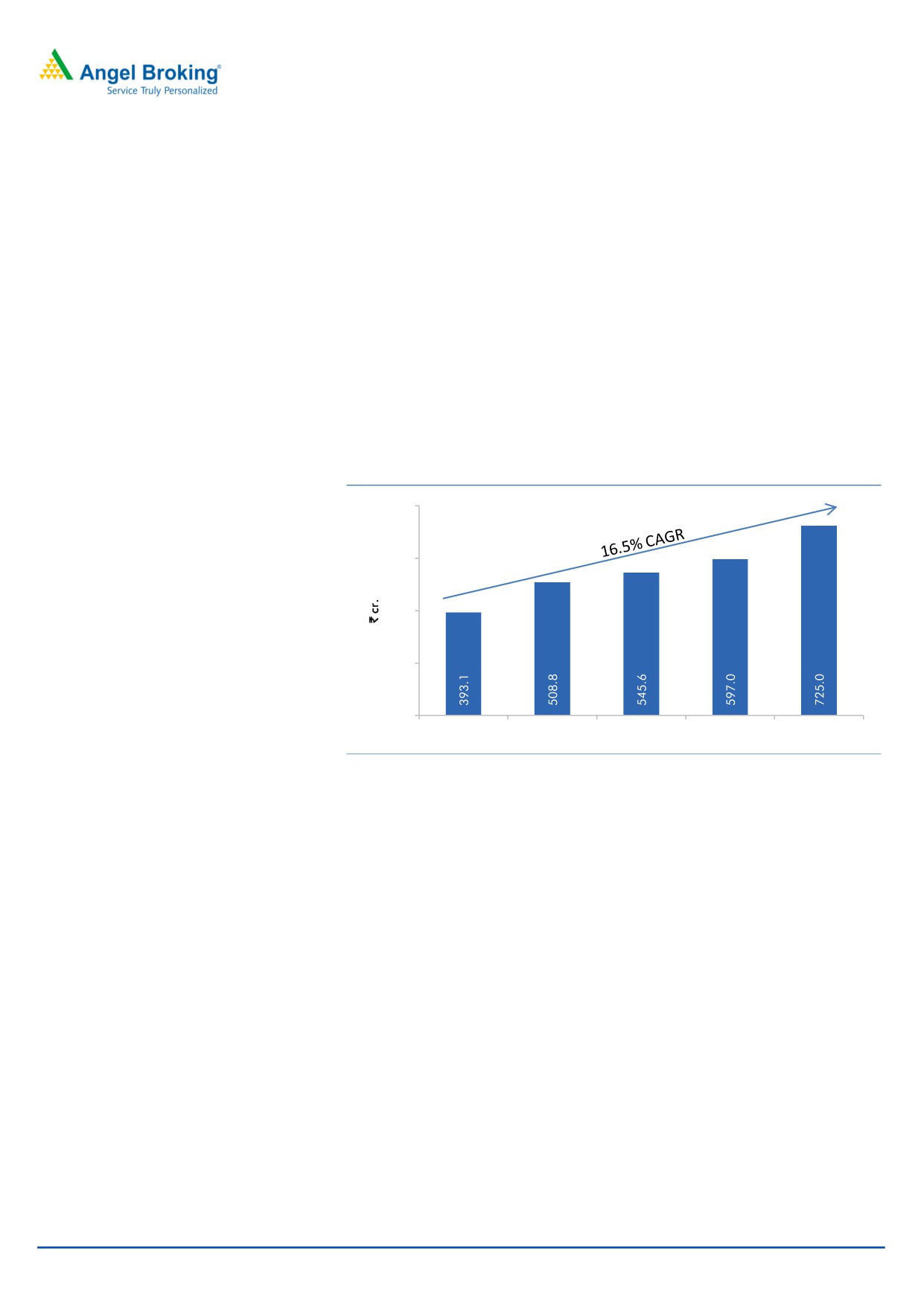

Eris is one of the fastest growing pharma companies in IPM: With its strong

marketing and sales capabilities and strategy to focus on only specialty segments,

company has been able to grow faster than its competitors. With 16.5% CAGR

over FY2013-17, Eris has gained 0.7% market share and it is now ranked as 32nd

company in IPM. During this period, top 35 companies in IPM grew by 12.1%. In

the chronic category, Eris is ranked at 20th position with 1.4% market share and it

is the fastest growing company in the top 25 companies in this category.

Exhibit 13: Net sales CAGR of 16.5% in the last 5 years

800

600

400

200

0

FY13

FY14

FY15

FY16

FY17

Source: Company, Angel research

Superior financials vis-à-vis peers: Owing to its superior growth, low cost strategies

and focus on niche therapeutic segments, Eris has exhibited strong record in

profitability and returns. Between FY2014-17, company has consistently seen

improvement in its margins and returns. The EBITDA margins increased from

19.4% in FY2014 to 37.1% in FY2017. This margin profile is far superior to its

peers, who have highest domestic exposure like Alkem labs or MNC pharma

companies.

June 14, 2017

7

Eris Lifesciences| IPO Note

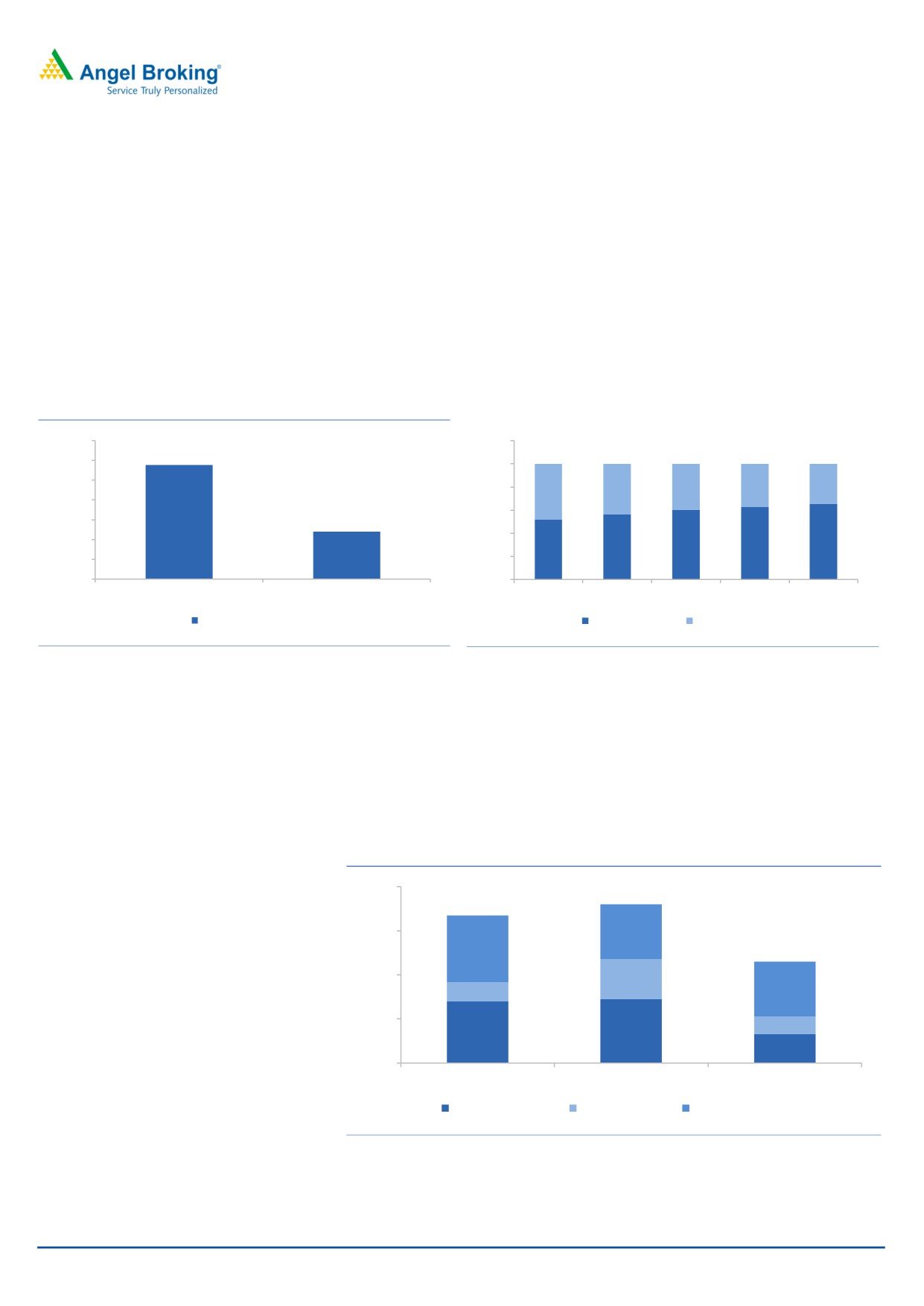

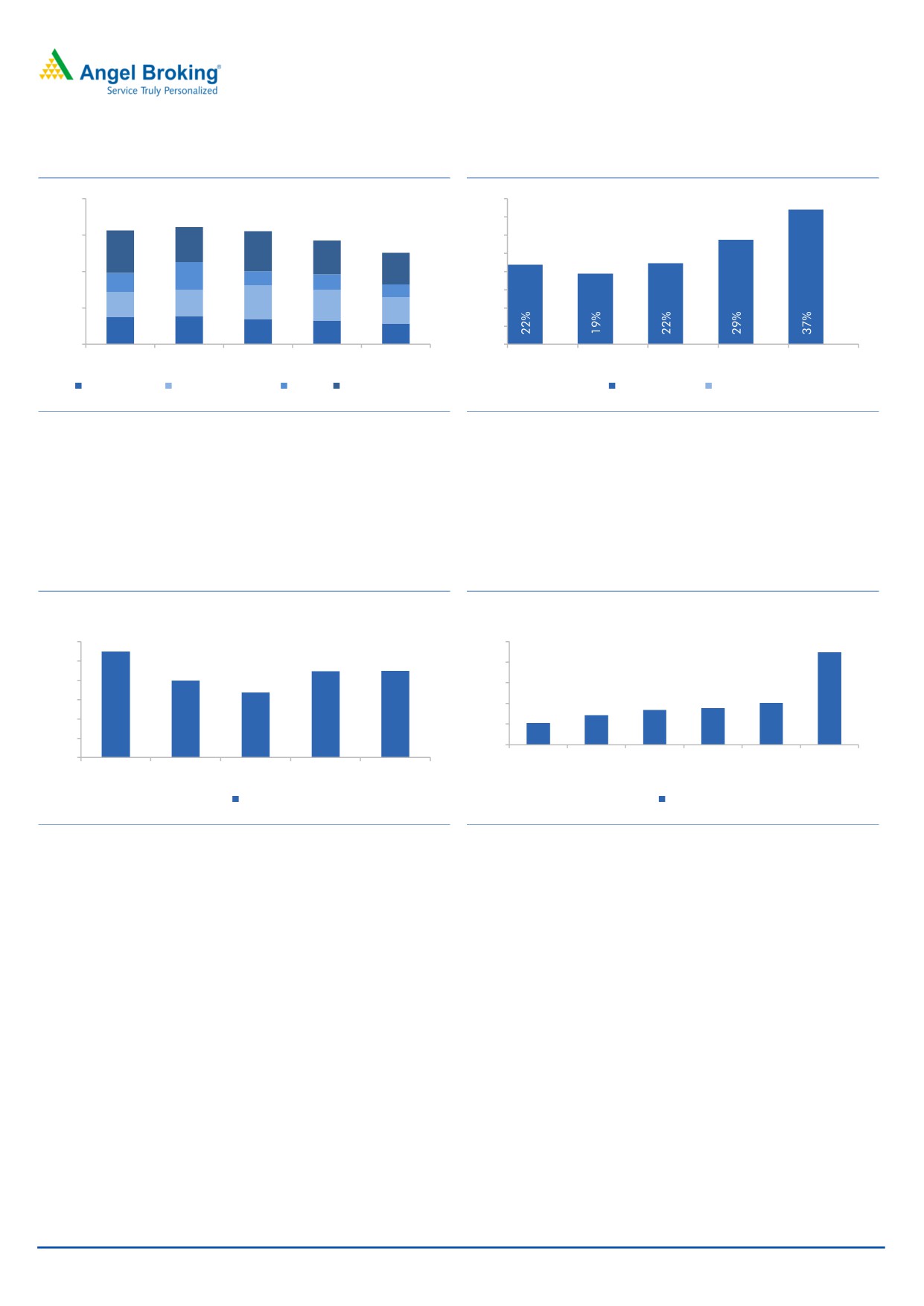

Exhibit 14: Consistent decline in operating costs...

Exhibit 15: ...helping to improve EBITDA margins

100%

40%

35%

75%

30%

24%

29%

28%

25%

23%

50%

22%

20%

19%

10%

13%

11%

9%

15%

17%

18%

23%

25%

21%

18%

10%

5%

19%

19%

17%

16%

14%

0%

0%

FY13

FY14

FY15

FY16

FY17

FY13

FY14

FY15

FY16

FY17

Raw Materials

Employee expenses

SG&A Other expenses

EBITDA margins

FY13

Source: Company, Angel Research

Source: Company, Angel Research

Healthy return ratios: Owing to the superior margin profile, company has

consistently seen return on equity greater than 30% in the last five years. In the last

two years, RoE has been healthy at 44% v/s. its MNC peers having RoE of 10%-

18%.

Exhibit 16: More than 30% ROE for last five years...

Exhibit 17: ...and superior than its peers

RoE

ROE

60.0

50.0

50.0

40.0

40.0

30.0

30.0

20.0

20.0

10.0

10.0

0.0

0.0

Pfizer

GSK

Abbott India Sanofi

Alkem

Eris

FY13

FY14

FY15

FY16

FY17

pharma

RoE

ROE

Source: Company, Angel Research

Source: Company, Angel Research

Eris is a debt free company and has been investing its cash flows in the liquid

investments. So far, management has refrained from fund raising, expect the one

that was raised from ChrysCapital. We believe that the strong cash flows so far

have been the prime reason that the management has taken a conservative

approach. Lately, with two acquisitions, we see some change in the approach and

we see this as a positive change. Moreover, the company has also paid dividends

in the last two years, and if this goes on, ratios are likely to improve further.

The company has a liquid balance sheet, in FY2017, 42% of its total assets were

held in liquid instruments (cash and investments) v/s. 50% in FY2016. Due to this,

we believe that RoIC is a good measure of calculating shareholders returns. Eris’

average RoIC works out to be more than 100% over FY2013-17 v/s. peers RoIC of

<30%. On the return ratios, Eris shows a far superior performance than its peers,

which we like.

June 14, 2017

8

Eris Lifesciences| IPO Note

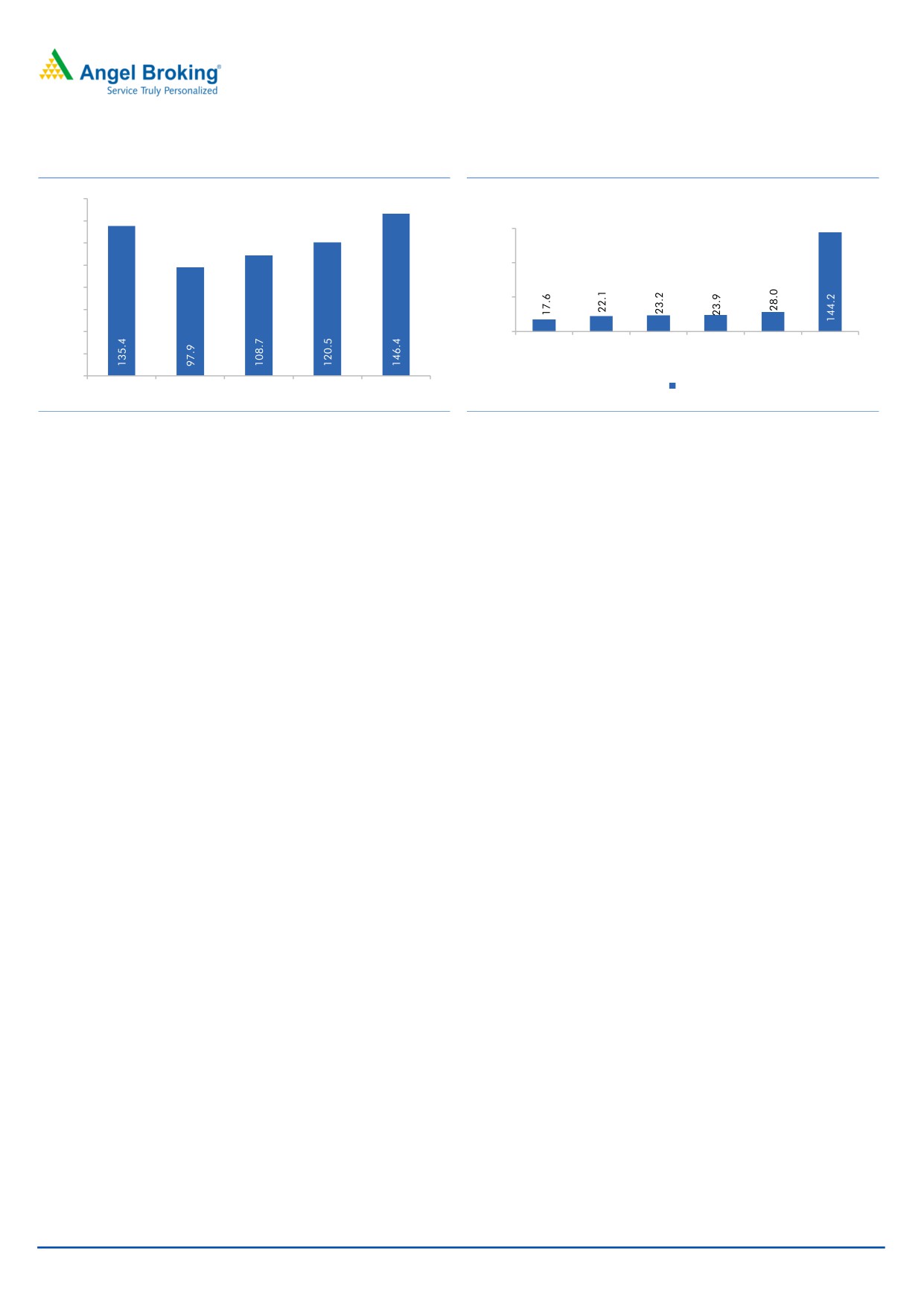

Exhibit 18: Average ~100% ROIC in last five years...

Exhibit 19: ...and leader amongst its peers

160.0

140.0

150.0

120.0

100.0

100.0

80.0

50.0

60.0

40.0

0.0

Pfizer

Alkem

Abbott

Sanofi

GSK

Eris

20.0

India

pharma

0.0

FY13

FY14

FY15

FY16

FY17

Source: Company, Angel Research

Source: Company, Angel Research

Overall we believe that this is a high RoE business and with its major thrust to third

party manufacturing, and consolidating its position in the existing therapeutic

segments, we expect Eris to maintain the same in the near future.

Outlook and Valuation:

On FY2017 EPS of `17.6, the issue is priced at P/E of 34.25x, which is at par with

its MNC peers but higher than domestic peer, Alkem Labs. Considering that Eris’

faster growth, superior returns, debt free status, and specialty play, we believe that

this is a fair valuation. We believe that Eris is likely to continue growing faster than

its competitors owing to its marketing capability, higher operating leverage and

growing market share of its mother brands. While most pharma companies are

currently facing issues on several fronts, this business model looks attractive with

no USFDA concerns and pricing pressure. Considering the company’s superior

growth, better margin profile and high return ratios, we rate this IPO as

SUBSCRIBE.

Downside risks

High dependence on few suppliers and single manufacturing facility in Assam

Change in domestic regulations adverse to the branded generic companies

Increased competition in the chronic segments

June 14, 2017

9

Eris Lifesciences| IPO Note

Income Statement

Y/E March (Rs cr)

FY13

FY14

FY15

FY16

FY17

Total operating income

393

509

546

597

725

% chg

29.5

7.2

9.4

21.4

Total Expenditure

307

410

424

425

456

Cost of Materials

74

99

94

98

104

Personnel

67

91

126

125

132

Others Expenses

166

221

204

203

220

EBITDA

86

99

121

172

269

% chg

15.2

22.8

41.2

56.6

(% of Net Sales)

21.9

19.4

22.3

28.7

37.1

Depreciation& Amortisation

3

5

16

20

24

EBIT

82

94

106

151

245

% chg

14.3

12.5

42.7

62.0

(% of Net Sales)

21.0

18.5

19.4

25.3

33.8

Interest & other Charges

1

0

0

0

0

Other Income

1

4

3

3

19

(% of PBT)

1.7

4.5

3.2

2.2

7.2

Share in profit of Associates

-

-

-

-

-

Recurring PBT

83

98

109

154

264

% chg

18.3

11.3

41.2

70.8

Prior Period & Extraordinary Expense/(Inc.)

-

-

-

-

-

PBT (reported)

83

98

109

154

264

Tax

25

28

20

20

22

(% of PBT)

29.7

28.3

18.4

12.7

8.3

PAT (reported)

58.4

70.5

89.3

134.9

241.9

Add: Share of earnings of associate

-

-

-

-

-

Less: Minority interest (MI)

0

0

0

1

(0)

PAT after MI (reported)

58

70

89

134

242

ADJ. PAT

58.2

70.4

89.2

133.6

242.1

% chg

21.0

26.7

49.7

81.2

(% of Net Sales)

14.8

13.8

16.4

22.4

33.4

Basic EPS (Rs)

4.2

5.1

6.5

9.7

17.6

Fully Diluted EPS (Rs)

4.2

5.1

6.5

9.7

17.6

% chg

21.0

26.7

49.7

81.2

June 14, 2017

10

Eris Lifesciences| IPO Note

Balance Sheet

Y/E March (` cr)

FY13

FY14

FY15

FY16

FY17

SOURCES OF FUNDS

Equity Share Capital

0.1

0.1

0.1

0.1

13.8

Reserves& Surplus

106

176

266

299

526

Shareholder's Funds

106

177

266

299

540

Minority Interest

5

4

4

3

-

Total Loans

10

15

8

27

14

Deferred Tax Liability

-

-

-

-

-

Other long-term liabilities

2

1

1

2

4

Total Liabilities

122

197

279

332

558

APPLICATION OF FUNDS

Net Block

24

71

67

71

55

Capital Work-in-Progress

-

-

-

-

0

Intangibles

3

4

4

1

116

Investments

47

84

167

190

269

Other long-term assets

18

23

21

35

66

Current Assets

80

89

94

95

126

Inventories

43

45

58

48

56

Sundry Debtors

17

22

24

25

49

Cash

5

7

6

10

2

Loans & Advances

15

14

7

12

11

Other Assets

-

-

0

0

8

Current liabilities

50

74

78

66

83

Net Current Assets

30

15

16

29

43

Deferred Tax Asset

0

0

3

6

10

Mis. Exp. not written off

Total Assets

122

197

279

332

558

June 14, 2017

11

Eris Lifesciences| IPO Note

Cash Flow Statement

Y/E March (` cr)

FY13

FY14

FY15

FY16

FY17

Profit before tax

83

98

109

154

264

Depreciation

3

5

16

20

24

Change in Working Capital

(16)

21

(8)

(8)

(16)

Interest / Dividend (Net)

0

0

0

-

-

Direct taxes paid

(36)

(30)

(23)

(35)

(53)

Others

3

(4)

(3)

(0)

(18)

Cash Flow from Operations

38

90

90

131

200

(Inc.)/ Dec. in Fixed Assets

(8)

(52)

(13)

(24)

(50)

(Inc.)/ Dec. in Investments

(28)

(31)

(79)

(20)

(134)

Cash Flow from Investing

(36)

(83)

(92)

(44)

(184)

Issue of Equity

-

-

-

-

-

Inc./(Dec.) in loans

(2)

(2)

0

(1)

(7)

Finance costs

(1)

(0)

(0)

(0)

(0)

Others

-

-

-

(83)

(17)

Cash Flow from Financing

(3)

(2)

0

(84)

(24)

Inc./(Dec.) in Cash

(1)

5

(2)

4

(8)

Opening Cash balances

3

2

7

5

9

Closing Cash balances

2

7

5

9

2

June 14, 2017

12

Eris Lifesciences| IPO Note

Key Ratios

Y/E March

FY13

FY14

FY15

FY16

FY17

Valuation Ratio (x)

P/E (on FDEPS)

142.5

117.7

92.9

62.1

34.3

P/CEPS

133.9

110.1

79.1

53.4

31.2

P/BV

78.2

47.0

31.2

27.7

15.4

Dividend yield (%)

0.0

0.0

0.0

1.0

0.2

EV/Sales

21.0

16.1

14.9

13.6

11.1

EV/EBITDA

96.0

83.0

66.9

47.3

29.9

EV / Total Assets

48.02

30.36

22.75

20.43

12.53

Per Share Data (Rs)

EPS (Basic)

4.2

5.1

6.5

9.7

17.6

EPS (fully diluted)

4.2

5.1

6.5

9.7

17.6

Cash EPS

4.5

5.5

7.6

11.3

19.3

DPS

0.0

0.0

0.0

6.0

1.2

Book Value

7.7

12.8

19.3

21.8

39.3

Returns (%)

ROCE

71.3

49.2

38.7

46.4

44.2

Angel ROIC (Pre-tax)

135.4

97.9

108.7

120.5

146.4

ROE

54.9

39.9

33.6

44.6

44.8

Turnover ratios (x)

Asset Turnover (Net Block)

16.7

7.2

8.1

8.4

13.1

Inventory / Sales (days)

40

32

39

29

28

Receivables (days)

15

16

16

16

25

Payables (days)

20

27

25

15

19

Working capital cycle (ex-cash) (days)

35

21

30

30

33

June 14, 2017

13

Eris Lifesciences| IPO Note

Research Team Tel: 022 - 39357800

DISCLAIMER

Angel Broking Private Limited (hereinafter referred to as “Angel”) is a registered Member of National Stock Exchange of India Limited,

Bombay Stock Exchange Limited and Metropolitan Stock Exchange Limited. It is also registered as a Depository Participant with CDSL

and Portfolio Manager with SEBI. It also has registration with AMFI as a Mutual Fund Distributor. Angel Broking Private Limited is a

registered entity with SEBI for Research Analyst in terms of SEBI (Research Analyst) Regulations, 2014 vide registration number

INH000000164. Angel or its associates has not been debarred/ suspended by SEBI or any other regulatory authority for accessing

/dealing in securities Market. Angel or its associates/analyst has not received any compensation / managed or co-managed public

offering of securities of the company covered by Analyst during the past twelve months.

This document is solely for the personal information of the recipient, and must not be singularly used as the basis of any investment

decision. Nothing in this document should be construed as investment or financial advice. Each recipient of this document should

make such investigations as they deem necessary to arrive at an independent evaluation of an investment in the securities of the

companies referred to in this document (including the merits and risks involved), and should consult their own advisors to determine

the merits and risks of such an investment.

Reports based on technical and derivative analysis center on studying charts of a stock's price movement, outstanding positions and

trading volume, as opposed to focusing on a company's fundamentals and, as such, may not match with a report on a company's

fundamentals. Investors are advised to refer the Fundamental and Technical Research Reports available on our website to evaluate the

contrary view, if any.

The information in this document has been printed on the basis of publicly available information, internal data and other reliable

sources believed to be true, but we do not represent that it is accurate or complete and it should not be relied on as such, as this

document is for general guidance only. Angel Broking Pvt. Limited or any of its affiliates/ group companies shall not be in any way

responsible for any loss or damage that may arise to any person from any inadvertent error in the information contained in this report.

Angel Broking Pvt. Limited has not independently verified all the information contained within this document. Accordingly, we cannot

testify, nor make any representation or warranty, express or implied, to the accuracy, contents or data contained within this document.

While Angel Broking Pvt. Limited endeavors to update on a reasonable basis the information discussed in this material, there may be

regulatory, compliance, or other reasons that prevent us from doing so.

This document is being supplied to you solely for your information, and its contents, information or data may not be reproduced,

redistributed or passed on, directly or indirectly.

Neither Angel Broking Pvt. Limited, nor its directors, employees or affiliates shall be liable for any loss or damage that may arise from

or in connection with the use of this information.

June 14, 2017

14