Angel Top Picks - September 2019

Top Picks

FPI outflows continue unabated for the second month in a row - The Government

Company

CMP (`)

TP (`)

in the Union Budget proposed to increase surcharge on Individuals and trusts

Banking/NBFC

earning more than `2 cr. and `5 cr. Though the Government has rolled back the

ICICI Bank

410

490

surcharge on equity investments FII selling continued unabated in August also as

HDFC Bank

2229

2620

they pulled out `17,592 cr. during the month after pulling out `12,419 cr. in

RBL Bank

327

540

Jul’19. FII flows for calendar year 2019 now stands at `47,311 cr.

Shriram Transport Finance

966

1385

Rate cut, dividend and one time surplus transfer by RBI to help revive Government

Consumption

spending - The RBI announced a 35bps rate cut in it’s monetary policy meet on

Amber Enterprises

825

910

the 7th of Aug’19 and maintained it’s accommodative stance which indicates more

Blue Star

721

1061

rate cuts during the year. The RBI also accepted the recommendations of the Bimal

Safari Industries

560

646

Jalan committee report and announced a dividend of `1.23lakh cr along with a

TTK Prestige

5740

6638

one-time surplus transfer of `52,640 cr. to the Government. Adjusting for the

Media/Automobiles

interim dividend already paid to the Government in March the RBI has transferred

Maruti Suzuki

6,122

7783

a total of `1.48 lakh cr. to the Government against a budgeted `90,000 cr. for

M&M

529

724

FY20. The additional transfer of `58,000 cr. would go a long way in boosting

Real Estate/Infra/Logistics/Power

Government spending which had been lacking for the past two quarters.

GMM Pfaudler

1,479

1,570

Q1FY20 GDP number of 5.0% probably the bottom in terms of growth rate - Rate

Jindal Steel

97

250

cuts and large transfer by the RBI, Improving monsoon situation along with relief

KEI Industries

471

556

for FPI’s from additional surcharge should help in reversing sentiments going

Pharmaceutical

forward. The Q1FY20 GDP growth number at 5.0% probably marks the bottom in

Aurobindo Laboratories

601

890

terms of growth rate. Hence we believe that the worst is over and growth rates

Source: Angel Research;

should start improving from Q2 onwards driven by Government spending while

Note: CMP as of August 30, 2019

private spending is expected to pick up from the second half of FY20.

Escalating US-China trade war is key risk going forward - The trade war between

US and China escalated further with the US President proposing tariffs on

additional Chinese goods worth USD 300bn which would be implemented in two

steps. In the first round the US imposed tariffs of 15% on goods worth UD 112bn

from the 1st of Sep’19. Tariffs on the balance USD 188bn worth of goods will be

imposed from the 15th of Dec’19. Furthermore, tariffs are to be raised from 25% to

30% on the existing USD 250 billion worth of Chinese goods from the 1st of

Oct’19. Post the recent round of escalation in the US China trade war the US yield

curve has inverted with the US 10 year G-Sec currently trading below 1.6% as

compared to the Fed target rate of 2.0-2.25%. The inversion of the yield curve has

raised concerns about possible slowdown in the US economy down the line.

Top pick’s overview

We recommend our top picks as it has outperformed the benchmark BSE 100

since inception. We believe that consumer (both discretionary and non

discretionary) space and private sector banks (both corporate and retail) offers

good growth opportunity going forward despite volatile market environment.

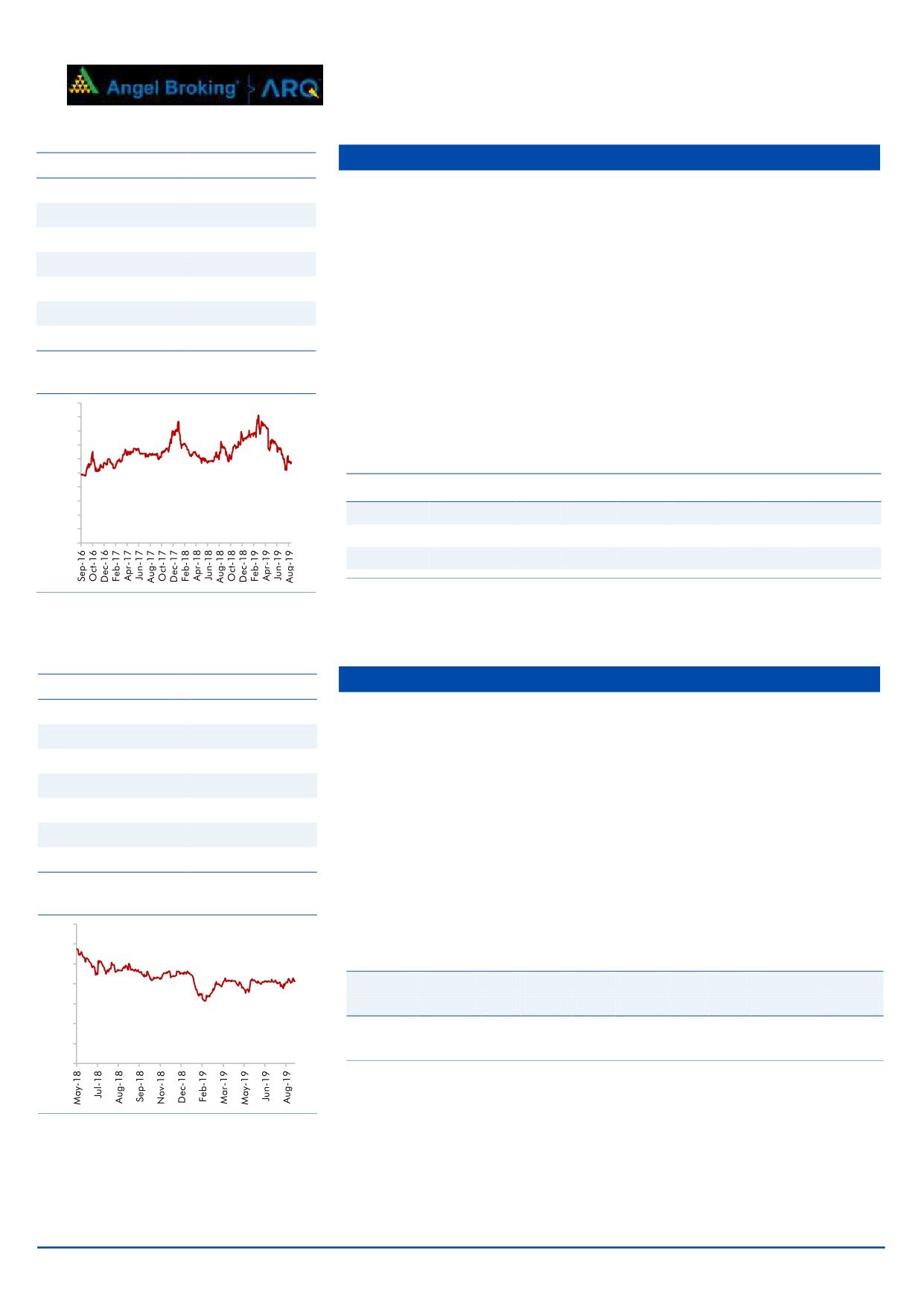

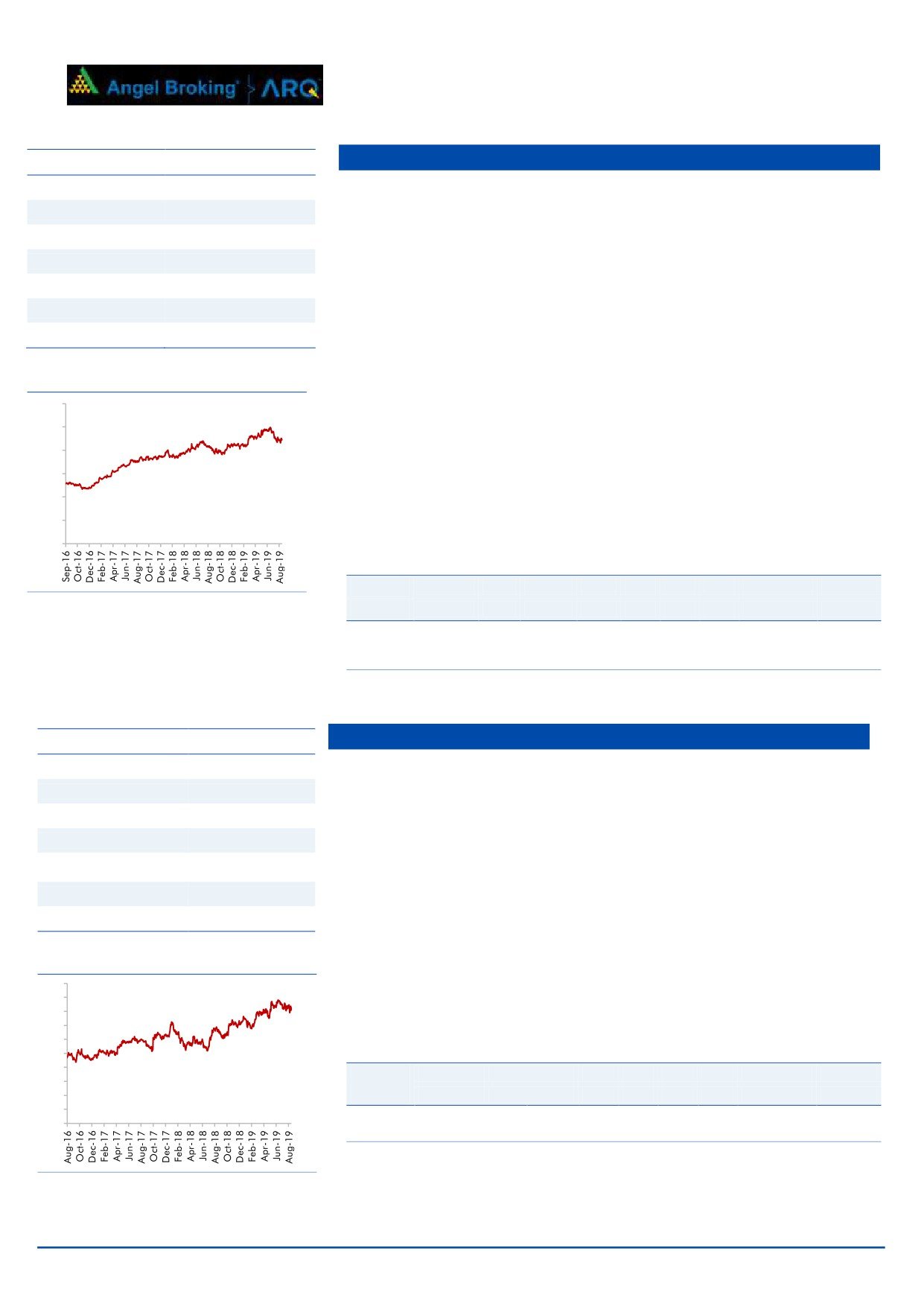

Exhibit 1: Top Picks Performance

Return Since Inception (30th Oct, 2015)

Top Picks Return

37.0%

BSE 100

36.0%

Outperformance

1.0%

Source: Company, Angel Research

Please refer to important disclosures at the end of this report

1

Angel Top Picks | September 2019

Top Picks

September 7, 2019

2

Angel Top Picks | September 2019

TTK Prestige

Stock Info

CMP

5740

TTK Prestige (TTK) is the leading brands in kitchen appliances with 40%+

TP

6638

market share in organized market. It has successfully transformed from a

single product company to a multi product company offering an entire gamut

Upside

15.7%

of kitchen and home appliances (600+ products).

Sector

Houseware

Market Cap (` cr)

7,956

It has also launched an economy range - ‘Judge Cookware’ to capture the

untapped demand especially at the bottom end of the pyramid. It is expecting

Beta

0.44

good growth in cleaning solution.

52 Week High / Low

7742/4584

It expects to double its revenue in the next five years backed by revival in

3 year-Chart

consumption demand, inorganic expansion and traction in exports.

10,000

9,000

8,000

7,000

6,000

Key Financials

5,000

4,000

Y/E

Sales

OPM PAT

EPS

ROE P/E P/BV EV/Sales

3,000

2,000

March

(` cr)

(%)

(` cr)

(`)

(%)

(x)

(x)

(x)

1,000

FY2020E

2,307.4

13.9

210.4

170.2

15.9

37.6

6.1

3.3

-

FY2021E

2,556.8

13.9

234.9

152.7

15.6

33.7

5.4

3

Source: Company, Angel Research

Source: Company, Angel Research

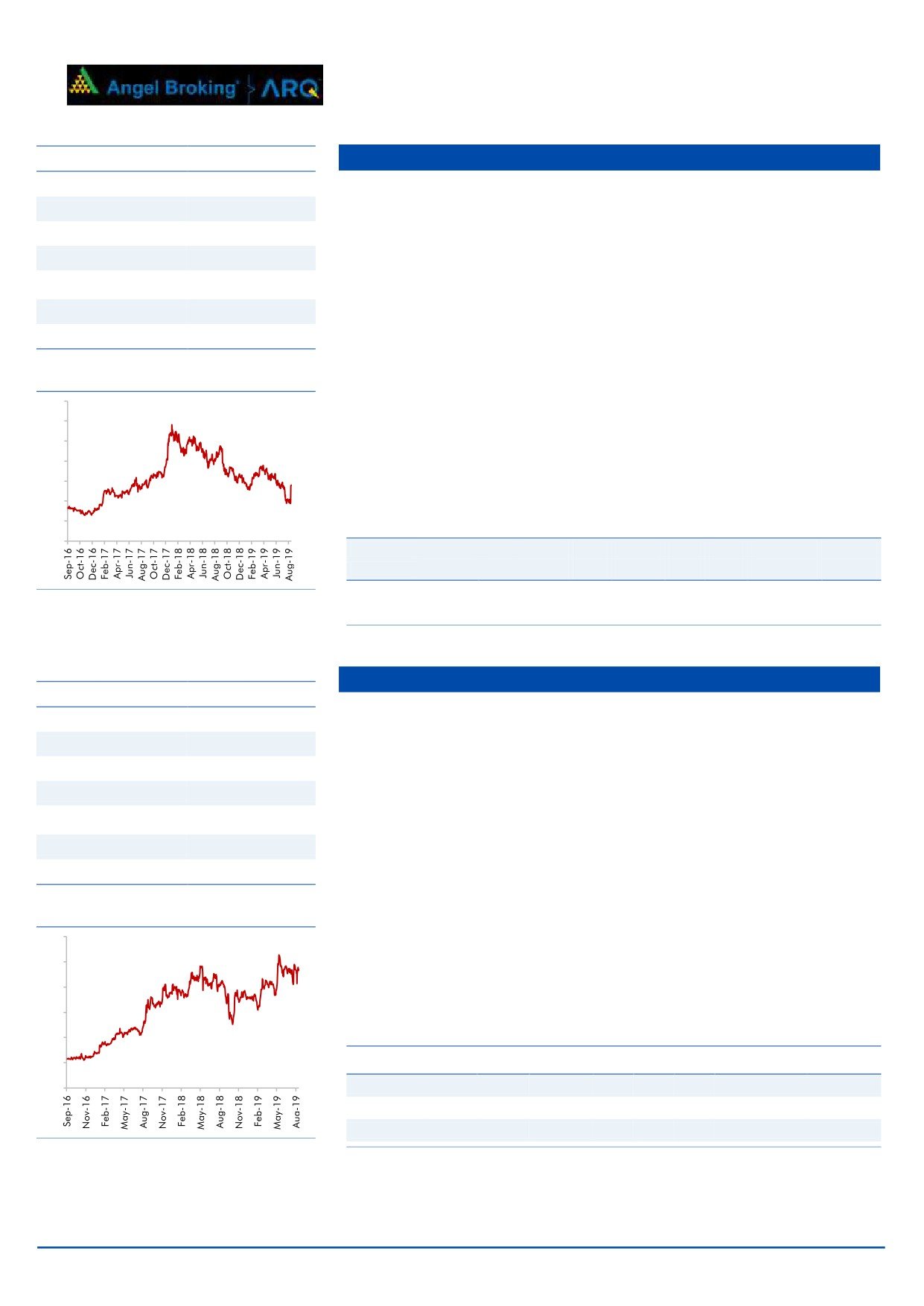

Amber Enterpries

Stock Info

CMP

Amber Enterprises India Ltd. (Amber) is the market leader in the room air

825

TP

910

conditioners (RAC) outsourced manufacturing space in India. It is a one-stop

solutions provider for the major brands in the RAC industry and currently

Upside

10.3%

serves eight out of the ten top RAC brands in India.

Sector

Electronics

In line with its strategy to capture more wallet share, it has made 2 acquisitions

Market Cap (` cr)

2,593

in the printed circuit board (PCB) manufacturing space over the last 1 year

Beta

0.88

which will boost its manufacturing capabilities.

52 Week High / Low

1121/622

We expect Amber to report consolidated revenue/PAT CAGR of 20%/27%

respectively over FY2019-21E. Its growing manufacturing capabilities and

1 year-Chart

scale put it in a sweet spot to capture the underpenetrated RAC market in

1,400

India.

1,200

1,000

Key Financials

800

Y/E

Sales

OPM

PAT

EPS

ROE

P/E

P/BV

EV/EBITDA

EV/Sales

600

March

(` cr)

(%)

(` cr)

(`)

(%)

(x)

(x)

(x)

(x)

400

FY2019

3,433.7

8.5

123.2 39.2

11.3

21.1

2.4

9.4

0.8

200

FY2020E

3,988.0

8.6

151.6 48.2

12.5

17.1

2.1

7.8

0.7

-

Source: Company, Angel Research

Source: Company, Angel Research

September 7, 2019

3

Angel Top Picks | September 2019

Stock Info

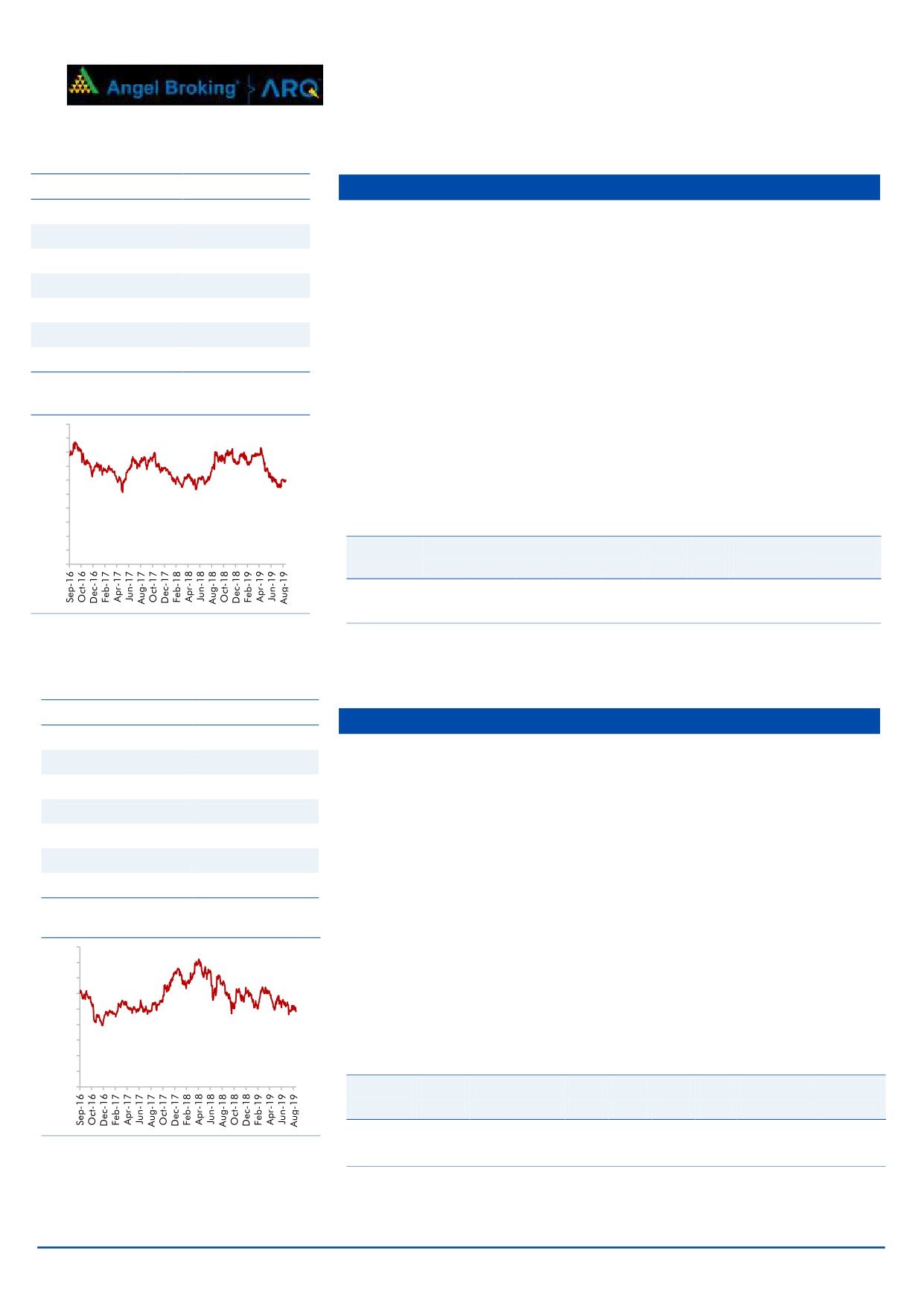

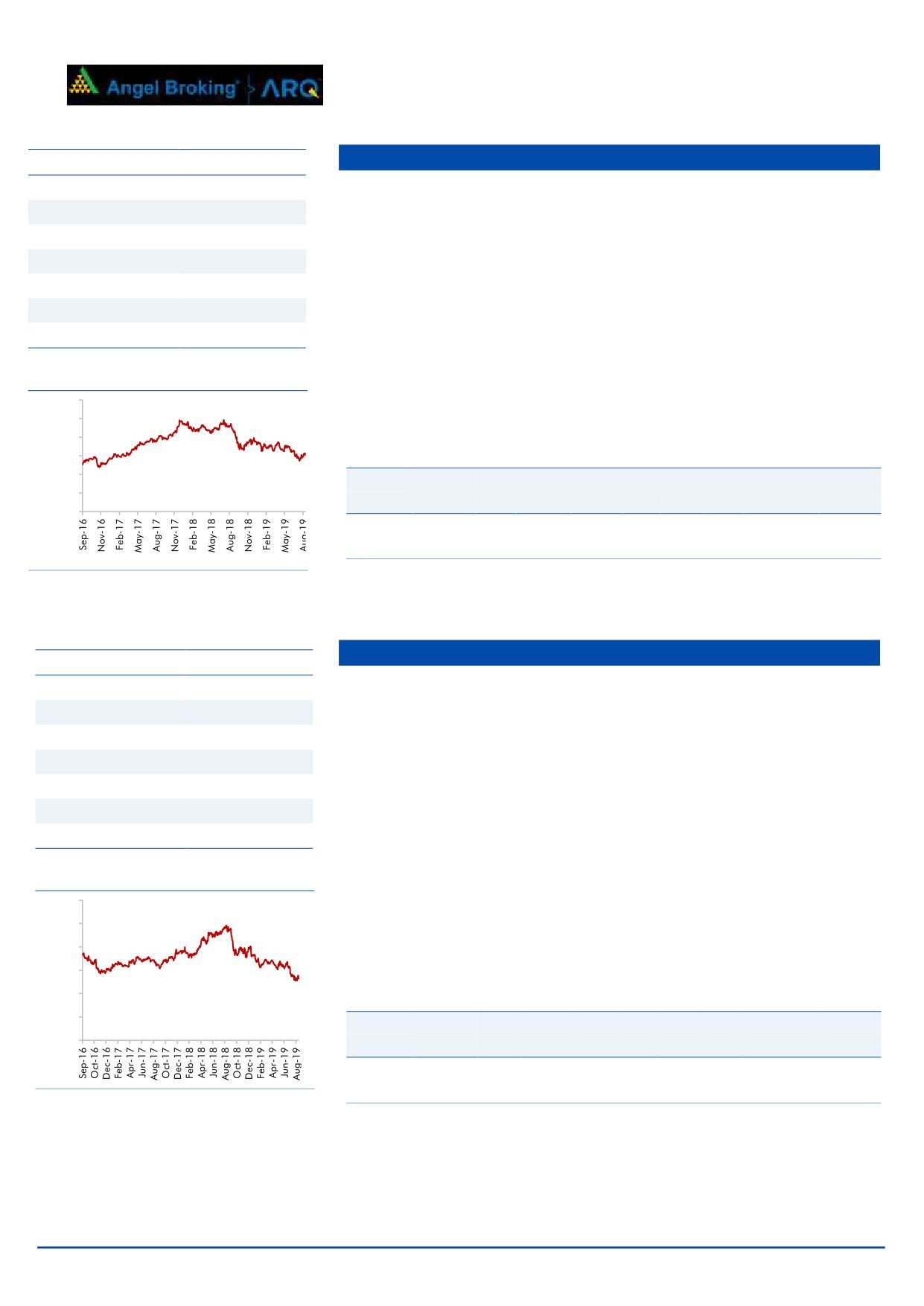

Aurobindo Pharma

CMP

601

Aurobindo Pharmaceuticals is an India-based leading global generic

TP

890

company. It’s predominately formulations Export Company, with USA &

Upside

48.2%

Europe contributing ~80% of sales (FY2018).

Sector

Pharmaceuticals

Recently it acquired dermatology and oral solids businesses from Sandoz Inc.,

USA. With this acquisition, Aurobindo adds sales of US$0.9bn and would

Market Cap (` cr)

35,197

become the 2nd largest generic player in the US by number of prescriptions.

Beta

0.88

52 Week High / Low

838/537

Aurobindo has a robust pipeline (has filed 519 ANDA’s; second highest

amongst Indian companies) & is investing to enhance its foray into complex

3 year-Chart

generic (mainly injectables, ophthalmic etc.) & biosimilar, which will drive its

1,000

next leg of growth.

900

800

We expect Aurobindo to report net revenue CAGR of ~22% & net profit to

700

600

grow at ~19% CAGR during FY2018-20E, aided by acquisitions. Valuations of

500

the company are cheap V/s its peers and own fair multiples of 17-18x.

400

300

Key Financials

200

100

Y/E

Sales

OPM

PAT

EPS

ROE

P/E

P/BV

EV/EBITDA

EV/Sales

-

March

(` cr)

(%)

(` cr)

(`)

(%)

(x)

(x)

(x)

(x)

FY2019

18,799

19.6

2,575

44.0

20.1

13.7

2.5

10.3

2.0

FY2020E

24,234

21.9

3,438

58.7

22.2

10.2

2.1

7.0

1.5

Source: Company, Angel Research

Source: Company, Angel Research

Stock Info

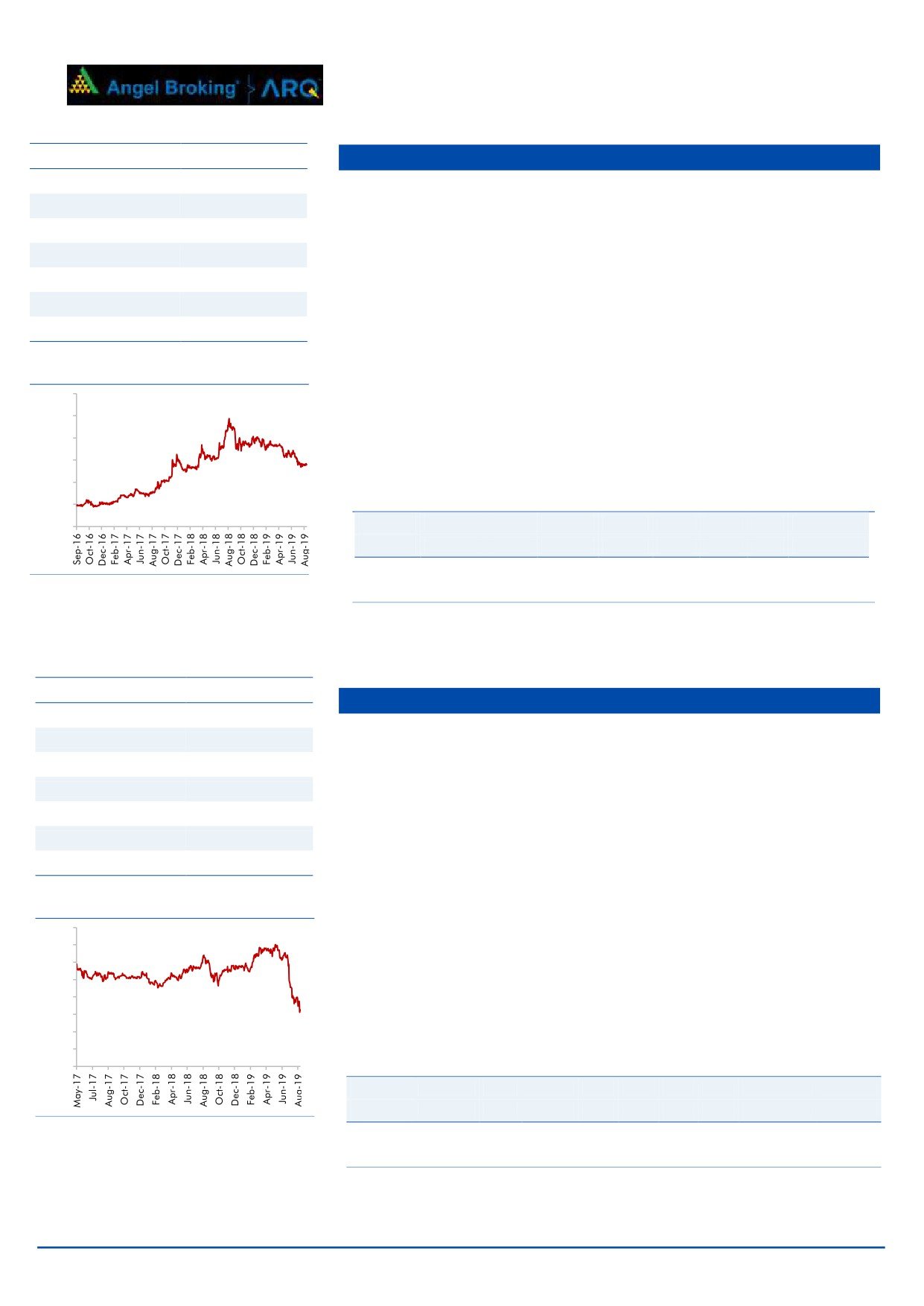

Shriram Transport Finance

CMP

966

SHTF's primary focus is on financing pre-owned commercial vehicles. We

TP

1385

expect AUM to grow at CAGR of 13% over FY2019-21E led by pick up in

Upside

43.3%

infra/ construction Post 2019 elections, macro revival and Ramping up in rural

Sector

Financials

distribution.

Market Cap (` cr)

21,921

Beta

1.43

In last three year SHTF, GNPA and credit cost has been increased primarily

due to the transition of NPA recognition from 180DPD to 90DPD (Q4FY18).

52 Week High / Low

1367/904

Q1FY19 onwards asset quality started witnessing steady improvement, and we

expect this trend to continue.

3 year-Chart

1,800

We expect STFC to report RoA/RoE to 2.7%/17.6% in FY2021E respectively. At

1,600

1,400

CMP, the stock is trading at 1.2x FY2021E ABV and 6x FY2021E EPS, which

1,200

we believe is reasonable for differentiated business model with return ratios.

1,000

800

600

400

Key Financials

200

-

Y/E

NII

NIM

PAT

EPS

ABV

ROA

ROE

P/E

P/ABV

March

(` cr)

(%)

(` cr)

(`)

(`)

(%)

(%)

(x)

(x)

FY2020E

8,681

8.1

2,868

126

812

2.6

16.7

7.7

1.4

Source: Company, Angel Research

FY2021E

9,946

8.3

3,405

150

946

2.7

17.1

6.5

1.2

Source: Company, Angel Research

September 7, 2019

4

Angel Top Picks | September 2019

Stock Info

Blue Star

CMP

721

BSL is one of the largest air-conditioning companies in India. With a mere 3%

TP

1061

penetration level of ACs vs 25% in China, the overall outlook for the room air-

Upside

47.2%

conditioner (RAC) market in India is favorable.

Sector

Cons.Durable

BSL's RAC business has been outgrowing the industry by ~10% points over the

Market Cap (` cr)

6,942

last few quarters, resulting in the company consistently increasing its market

share. This has resulted in the Cooling Products Division (CPD)'s share in

Beta

0.72

overall revenues increasing from~23% in FY2010 to ~43% in FY2019

52 Week High / Low

825/508

(expected to improve further). With strong brand equity and higher share in

split ACs, we expect the CPD to continue to drive growth.

3 year-Chart

Going Aided by increasing contribution from the Unitary Products, we expect

900

the overall top-line to post revenue CAGR of ~11% over FY2019-21E and

800

700

margins to improve from 5.7% in FY2018 to 6.8% in FY2021E.

600

500

Key Financials

400

300

Y/E

Sales

OPM

PAT

EPS

ROE

P/E

P/BV

EV/EBITDA

EV/Sales

200

March

(` cr)

(%)

(` cr)

(`)

(%)

(x)

(x)

(x)

(x)

100

-

FY2020E

5,711

6.5

207

21.5

22.3

33.5

7.5

19.0

1.2

FY2021E

6,397

6.8

245

25.5

23.9

28.3

6.7

16.2

1.1

Source: Company, Angel Research

Source: Company, Angel Research

GMM Pfaudler Ltd.

Stock Info

GMM Pfaudler Limited (GMM) is the Indian market leader in glass-lined (GL)

CMP

1479

steel equipment used in corrosive chemical processes of agrochemicals,

TP

1570

specialty chemical and pharma sector. The company is seeing strong order

Upside

6.2%

inflow from the user industries which is likely to provide 20%+ growth outlook

for next couple of years.

Sector

Machinery

Market Cap (` cr)

2,161

GMM has also increased focus on the non-GL business, which includes mixing

Beta

0.76

equipment, filtration and drying equipment for the chemical processing

industry. It is expecting to increase its share of non-GL business to 50% by

52 Week High / Low

1523/878

2020.

3 year-Chart

GMM is likely to maintain the 20%+ growth trajectory over FY19-21 backed

1,600

by capacity expansion and cross selling of non-GL products to its clients.

1,400

1,200

Key Financials

1,000

Y/E

Sales

OPM

PAT

EPS

ROE

P/E

P/BV

EV/EBITDA

EV/Sales

800

600

March

(` cr)

(%)

(` cr)

(`)

(%)

(x)

(x)

(x)

(x)

400

FY2020E

665

17.5

77.2

52.9

22.2

28.0

6.2

17.3

3.0

200

FY2021E

767

17.5

98.9

67.8

22.9

21.8

5.0

14.6

2.6

-

Source: Company, Angel Research

Source: Company, Angel Research

September 7, 2019

5

Angel Top Picks | September 2019

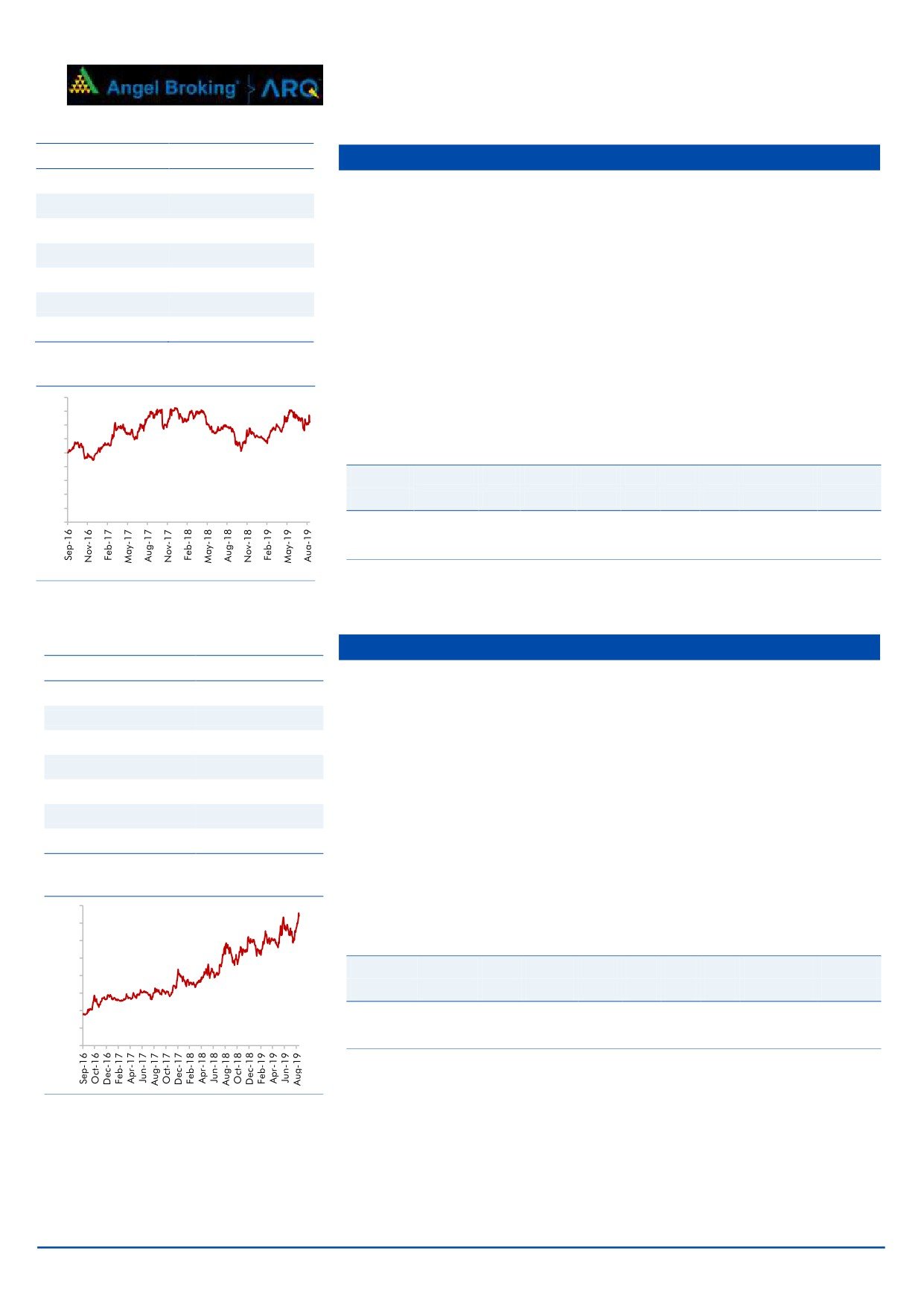

HDFC Bank

Stock Info

CMP

2229

Bank has planned to improve business with digital platform and engaging with

TP

2620

mid market client. Banks next leg of growth road map 1) increasing branch

Upside

17.5%

opening number from 300 current to 600 annually in non urban area. 2)

Increase point of sale (POS) 4x to 4mn by FY21 and double the virtual

Sector

Banking

relationship manager client in 3 years.

Market Cap (` cr)

6,09,441

Asset Strong and steady NIM of 4.4% on the back of lower cost of funds and

Beta

0.83

lower credit cost will ensure healthy return ratios for the company. Despite

52 Week High / Low

2503/1885

strong growth, the company has maintained stable asset quality (GNPA/NPA -

1.3%/0.4%).

3 year-Chart

HDFC bank’s subsidiaries, HDB Financial Services (HDBFS) and HDFC

3,000

Securities continue to contribute well to the banks overall growth. Strong loan

2,500

book, well-planned product line and clear customer segmentation aided this

2,000

growth.

1,500

We expect the company’s loan growth to remain 20% over next two years and

1,000

earnings growth is likely to be more than 20%.

500

-

Key Financials

Y/E

NII

NIM

PAT

EPS

ABV

ROA

ROE

P/E

P/ABV

Source: Company, Angel Research

March

(` cr)

(%)

(` cr)

(`)

(`)

(%)

(%)

(x)

(x)

FY2020E

57,795

4.4

24,915

91

619

1.8

17.1

24.4

3.6

FY2021E

68,500

4.4

30,149

110

711

1.9

16.3

20.2

3.1

Source: Company, Angel Research

ICICI Bank

Stock Info

CMP

410

ICICI bank has taken a slew of steps to strengthen its balance sheet. Measures

TP

490

such as Incremental lending to higher rated corporate, reducing concentration

in few stressed sectors and building up the retail loan book. The share of retail

Upside

19.4%

loans in overall loans increased to 61.4% (Q1FY20) from 38% in FY12.

Sector

Banking

ICICI bank’s slippages remained high during FY18 and hence GNPA went up

Market Cap (` cr)

2,64,975

to 8.8% vs. 5.8% in FY16. We expect addition to stress assets to reduce and

Beta

1.28

credit costs to further decline owing to incremental lending to higher rated

52 Week High / Low

444/295

corporate and faster resolution in Accounts referred to NCLT under IBC.

The gradual improvement in recovery of bad loans would reduce credit costs

3 year-Chart

that would help to improve return ratio. The strength of the liability franchise,

500

shift in loan mix towards retail assets and better rated companies, and

450

400

improvement in bad loans would be a key trigger for multiple expansion.

350

300

250

Key Financials

200

Y/E

Op. Inc

NIM

PAT

EPS

ABV

ROA

ROE

P/E

P/ABV

150

100

March

(` cr)

(%)

(` cr)

(`)

(`)

(%)

(%)

(x)

(x)

50

FY2020E

31,732

3.4

12,250

19

169

1.2

10.8

21.6

2.4

-

FY2021E

37,135

3.5

16,518

26

189

1.4

13.2

16

2.2

Source: Company, Angel Research

Source: Company, Angel Research

September 7, 2019

6

Angel Top Picks | September 2019

Stock Info

Jindal Steel & Power Ltd.

CMP

97

The company has increased its crude steel capacity more than double in last

TP

250

five years from 3.6 MTPA to 8.6 MTPA and currently running at ~65%

Upside

158.8%

utilization.

Owing to continuous demand of steel from infrastructure, housing and auto

Sector

Steel & Power

sectors along with limited addition of steel capacity in near term and favorable

Market Cap (` cr)

9,853

government policies augur well for JSPL to perform well going forward, we

Beta

1.84

expect JSPL’s utilization to improve to 80-85% by FY20 along with reduction in

52 Week High / Low

246/92

debt led by improving in profitability.

From April 2019, power segment has seen improvement in PLF and now

3 year-Chart

producing 1,700 megawatts, up from the average 1,400 megawatts, this will

350

lead improvement in PLF from 34% to 50%.

300

Expect 515MW of PPA from NHPC currently, JPL emerged as L1 bidder.

250

200

JSPL is trading at attractive valuation to its peer, we value the stock based on

150

asset based approach of Steel segment on EV/Tone basis and Power segment

100

on EV/MW basis.

50

Key Financials

-

Y/E

Sales

OPM

PAT

EPS

ROE

P/E

P/BV

EV/EBITDA

EV/Sales

March

(` cr)

(%)

(` cr)

(`)

(%)

(x)

(x)

(x)

(x)

FY2020E

45,561

22.4

2,076

21.4

6.9

4.5

0.3

3.9

0.9

Source: Company, Angel Research

FY2021E

47,450

24.1

3,239

33.5

9.4

2.9

0.3

3.1

0.8

Source: Company, Angel Research

KEI Industries

Stock Info

CMP

KEI’s current order book (OB) stands at `4,414cr (segmental break-up: out

471

which EPC is around `2,210cr and balance from cables, substation & EHV). Its

TP

556

OB grew strongly in the last 3 years due to strong order inflows from State

Upside

18.2%

Electricity Boards, Power grid, etc.

Sector

Cable

KEI’s consistent effort to increase its retail business from 30-32% of revenue in

Market Cap (` cr)

3,713

FY18 to 40-45% of revenue in the next 2-3 years on the back of strengthening

Beta

1.29

distribution network (currently 926 which is expect to increase ~1,500 by

52 Week High / Low

533/249

FY20) and higher ad spend.

KEI’s export (FY19 - 16% of revenue) is expected to reach a level 20% in next

3 year-Chart

two years with higher order execution from current OB and participation in

600

various international tenders. We expect KEI to report net revenue CAGR of

500

~15% to ~`5,632cr and net profit CAGR of ~22% to `269cr over FY2019-

400

21E.

300

200

Key Financials

100

Y/E

Sales

OPM

PAT

EPS ROE P/E

EV/EBITDA

EV/Sales

-

March

(` cr)

(%)

(` cr)

(`)

(%)

(x)

(x)

(x)

FY2020E

4,897

10.5

223

28.9

3.7

16.3

7.6

0.8

FY2021E

5,632

10.5

269

34.8

21.9

13.5

6.5

0.7

Source: Company, Angel Research

Source: Company, Angel Research

September 7, 2019

7

Angel Top Picks | September 2019

Maruti Suzuki

Stock Info

CMP

6122

Maruti Suzuki continues to hold ~52% market share in the passenger vehicles.

TP

7783

The launch of exciting models has helped the company to ride on the

Upside

27.1%

premiumization wave that is happening in the country. In the last two years,

Sector

Automobile

company has seen improvement in the business mix with the pie of the utility

vehicles.

Market Cap (` cr)

1,84,921

Beta

1.26

Well place to capture any revival in industry due to overall refreshment of

52 Week High / Low

9400/5447

portfolio (Already more than 50% of portfolio launched based on BS6

compliance like Alto, Wagon, Baleno, Dzire, Swift. Launching new product in

3 year-Chart

august which has potential to contribute Signiant on Top-line - MPV - XL6.)

12,000

10,000

8,000

6,000

Key Financials

4,000

Y/E

Sales

OPM

PAT

EPS

ROE

P/E

P/BV

EV/EBITDA

EV/Sales

2,000

March

(` cr)

(%)

(` cr)

(`)

(%)

(x)

(x)

(x)

(x)

-

FY2020E

84,277

11.9

6,443

213.3

12.9

28.7

3.7

14.4

1.7

FY2021E

90,201

12.6

7,126

235.9

13.5

25.9

3.5

12.4

1.6

Source: Company, Angel Research

Source: Company, Angel Research

Mahindra & Mahindra Ltd.

Stock Info

CMP

M&M is an India-based company, operating in nine segments: automotive,

529

farm equipment, IT services, financial services, steel trading & processing,

TP

724

infrastructure, hospitality, Systech and Others (comprising logistics, after-

Upside

36.9%

market, two wheelers and investment).

Sector

Automobile

IMD has predicted a near normal monsoon for 2019 for the third consecutive

Market Cap (` cr)

65,752

year, which would help the tractor sales growth. In our view, healthy growth in

Beta

1.39

tractor industry would benefit M&M the most due to strong brand recall and

52 Week High / Low

992/503

leadership position in farm tractor.

We expect M&M to report healthy top-line and bottom-line growth over long

3 year-Chart

period mainly due to healthy growth in automobile segment like Utility

1,200

Vehicles (on the back of new launches and facelift of some models) and

1,000

healthy growth in Tractors segment driven by strong brand recall and

800

improvement in rural sentiment.

600

400

Key Financials

200

Y/E

Sales

OPM

PAT

EPS

ROE

P/E

P/BV

EV/EBITDA

EV/Sales

-

March

(` cr)

(%)

(` cr)

(`)

(%)

(x)

(x)

(x)

(x)

FY2020E

54,213

11.7

4,167

35.0

11.1

15.1

1.7

6.9

0.8

FY2021E

57,752

12.0

4,627

38.9

11.3

13.6

1.5

6.1

0.7

Source: Company, Angel Research

Source: Company, Angel Research

September 7, 2019

8

Angel Top Picks | September 2019

Stock Info

Safari Industries

CMP

560

Safari Industries Ltd (Safari) is the third largest branded player in the Indian

TP

646

luggage industry. Post the management change in 2012, Safari has grown its

Upside

15.3%

revenue by 6x in the last 7 years. This has been achieved by foraying in many

Sector

Luggage

new categories like back pack, school bags (via acquisition of Genius and

Market Cap (` cr)

1,251

Genie) and improvement in distribution networks.

Beta

0.63

Its margins have more than doubled from 4.1% in FY2014 to 9.1% in FY2019,

52 Week High / Low

948/481

driven by launch of new product categories and business. We expect it to

maintain 9%+ margins from FY2018 onwards led by regular price hikes, shift

3 year-Chart

towards organized player and favorable industry dynamics.

1,200

1,000

We expect its revenue to grow by a CAGR of ~18%/23% in revenue/ earnings

800

over FY2018-20E on the back of growth in its recently introduced new

600

products.

400

200

Key Financials

-

Y/E

Sales

OPM

PAT

EPS

ROE

P/E

P/BV

EV/Sales

March

(` cr)

(%)

(` cr)

(`)

(%)

(x)

(x)

(x)

FY2020E

702.4

11.1

33.1

14.9

14.5

37.7

7.3

1.9

Source: Company, Angel Research

FY2021E

813.5

11.3

41.1

18.5

15.5

30.3

6.3

1.6

Source: Company, Angel Research

Stock Info

RBL Bank

CMP

327

TP

540

RBL Bank (RBK) has grown its loan book at healthy CAGR of 53% over FY10-

19. We expect it to grow at 27% over FY19-21E. With adequately diversified,

Upside

64.9%

well capitalised B/S, RBK is set to grab market share from corporate lenders

Sector

Banking

(esp.PSUs).

Market Cap (` cr)

14,093

Beta

1.42

The retail loan portfolio grew 62% YoY to `18,391cr and now constitutes 32%

of the loan book (18% share in 4QFY17).NIM has expanded to 4.23%, up

52 Week High / Low

717/292

19bps YoY, despite a challenging interest rate scenario on the back of a

changing portfolio mix. However, the management disclosed stressed asset

3 year-Chart

800

worth `1,000Cr which will increase GNPA to 2.25%. Management is confident

700

that it would normalise by Q1FY21.

600

500

RBL Bank currently trades at 1.5x its FY2021E price to book value, which we

400

believe is reasonable for a bank in a high growth phase with stable asset

300

quality.

200

100

-

Key Financials

Y/E

Op. Inc

NIM

PAT

EPS

ABV

ROA

ROE

P/E

P/ABV

March

(` cr)

(%)

(` cr)

(`)

(`)

(%)

(%)

(x)

(x)

Source: Company, Angel Research

FY2020E

3,270

3.7

1,018

24

190

1.1

12.8

13.7

1.7

FY2021E

4,226

3.8

1,503

35

216

1.3

16.6

9.3

1.5

Source: Company, Angel Research

September 7, 2019

9

Angel Top Picks | September 2019

Exhibit 2: Changes in Recommendation

Effective Date

Stock

CMP

Change in recommantaion

(`)

From

To

06-06-2019

Ashok Leyland

70

Buy

Hold

06-06-2019

GIC Housing

243

Buy

Hold

06-06-2019

Inox Wind

55

Buy

Hold

06-06-2019

Music Broadcast

46

Buy

Hold

06-06-2019 Siyaram Silk Mills

255

Buy

Hold

06-09-2019 Parag Food Milks

137

Buy

Hold

06-09-2019

Bata India

1545

Buy

Hold

06-09-2019 Aditya Birla Capital

93

Buy

Hold

Source: Angel Research

Hold - While we recommend to Hold on to existing positions at current level, we

would await for further data points before recommending any fresh purchases.

September 7, 2019

10

Angel Top Picks | September 2019

Research Team Tel: 022 - 39357800

DISCLAIMER

Angel Broking Limited (hereinafter referred to as “Angel”) is a registered Member of National Stock Exchange of India Limited, Bombay

Stock Exchange Limited and Metropolitan Stock Exchange Limited. It is also registered as a Depository Participant with CDSL and

Portfolio Manager and investment advisor with SEBI. It also has registration with AMFI as a Mutual Fund Distributor. Angel Broking

Private Limited is a registered entity with SEBI for Research Analyst in terms of SEBI (Research Analyst) Regulations, 2014 vide

registration number INH000000164. Angel or its associates has not been debarred/ suspended by SEBI or any other regulatory

authority for accessing /dealing in securities Market. Angel or its associates/analyst has not received any compensation / managed or

co-managed public offering of securities of the company covered by Analyst during the past twelve months.

This document is solely for the personal information of the recipient, and must not be singularly used as the basis of any investment

decision. Nothing in this document should be construed as investment or financial advice. Each recipient of this document should

make such investigations as they deem necessary to arrive at an independent evaluation of an investment in the securities of the

companies referred to in this document (including the merits and risks involved), and should consult their own advisors to determine

the merits and risks of such an investment.

Reports based on technical and derivative analysis center on studying charts of a stock's price movement, outstanding positions and

trading volume, as opposed to focusing on a company's fundamentals and, as such, may not match with a report on a company's

fundamentals. Investors are advised to refer the Fundamental and Technical Research Reports available on our website to evaluate the

contrary view, if any.

The information in this document has been printed on the basis of publicly available information, internal data and other reliable

sources believed to be true, but we do not represent that it is accurate or complete and it should not be relied on as such, as this

document is for general guidance only. Angel Broking Limited or any of its affiliates/ group companies shall not be in any way

responsible for any loss or damage that may arise to any person from any inadvertent error in the information contained in this report.

Angel Broking Limited has not independently verified all the information contained within this document. Accordingly, we cannot testify,

nor make any representation or warranty, express or implied, to the accuracy, contents or data contained within this document. While

Angel Broking Limited endeavors to update on a reasonable basis the information discussed in this material, there may be regulatory,

compliance, or other reasons that prevent us from doing so.

This document is being supplied to you solely for your information, and its contents, information or data may not be reproduced,

redistributed or passed on, directly or indirectly.

Neither Angel Broking Limited, nor its directors, employees or affiliates shall be liable for any loss or damage that may arise from or in

connection with the use of this information

Ratings (Based on expected returns

Buy (> 15%)

Accumulate (5% to 15%)

Neutral (-5 to 5%)

over 12 months investment period):

Reduce (-5% to -15%)

Sell (< -15)