1

Please refer to important disclosures at the end of this report

1

1

Angel Top Picks – September 2020

Indian equities rally for the third month in a row driven by FPI flows – Indian

equities closed in the green for the third month in arrow with the benchmark Nifty

up by 2.8% for the month driven by FII flows. FII flows for the month stood at

`47,080 crore which is the highest during the calendar year. Markets were also

supported by better than expected Q1FY2021 numbers along with continued

improvement in underlying economic conditions.

Current phase of global rally led by improvement in economic activities - Global

markets have recovered sharply from the lows in March with the S&P 500 at all

time highs with the S&P 500 closing the month at 3,500 which was 8.5% higher

than its Jan closing levels. While the initial phase of the rally from the March lows

was led by fed induced liquidity the second phase of the rally from July was driven

by improvement in the global economy.

Domestic economy too continued improving in August – The economy continued to

improve in August which was reflected in high frequency data like Auto sales and

PMI numbers. Auto companies reported another month of strong sequential

growth with Maruti Suzuki reporting a 17.1% yoy increase in August domestic sales

as compared to a 1.1% growth in July while Hero Motocorp reported a 6.5% yoy

growth in motorcycle sales. The manufacturing PMI for August also pointed to

continued improvement as it improved to 52.0 from 46.0 in July.

Easing of restrictions post unlock 4.0 to provide further impetus to the economy -

Post Unlock 1.0 in June there had been a significant improvement in economic

activities from May till the third week of July. However state Governments imposing

localized lockdowns in July let to tapering off growth from the last week of July.

Due to lockdowns in April and May there is pent up demand which along with

inventory buildup prior to the festive season and further opening up of the

economy under unlock 4.0 should lead to improvement in economic activities.

We expect recovery theme to gather strength while sectors with revenue visibility

will continue doing well – We expect the rural, essential and digital theme to

continue playing out over the next few quarters given revenue visibility and strong

growth prospects. We therefore continue to maintain our positive outlook on

sectors like Agrochemicals, IT, Telecom, Two wheelers and tractors. However we

also expect the recovery theme to gather strength in the near future due to

continued improvement in the economy. Within the recovery theme we believe that

sectors like low ticket consumer durables, cement, hotels and multiplexes should

do well.

Key risks which can derail the recovery rally are 1) Surge in infections as the

economy is opened up further 2) Delay in vaccine production as compared to

timelines expected by markets 3) Growth faltering significantly as compared to

market expectations post festive season.

Top Picks Performance

Return Since Inception (30th Oct, 2015)

Top Picks Return

69.0%

BSE 100

40.1%

Outperformance

28.9%

Source: Company, Angel Research

Top Picks

Company

CMP (`)

TP (`)

Auto

Endurance Technologies

1,062

1,297

Swaraj Engines

1,610

1,891

Banking/NBFC

Cholamandalam Inv.

234

280

IDFC First Bank

32

36

Consumer Durables

Hawkins cooker

4,842

5,682

VIP Industries

285

348

FMCG

Britannia Industries

3,706

4,220

IT

Persistent Systems

990

1,276

Zensar Technologies

171

204

Pharma & Healthcare

Metropolis Healthcare

1,787

2,156

Telecom/ Others

Chalet Hotels

154

200

Hind. Aeronautics

911

1,125

Inox Leisure

290

350

JK Lakshmi cement

264

328

Reliance Industries

2,077

2,366

Source: Company, Angel Research

Note: Closing price as on 4th September,2020

2

Error!

Refer

ence

sourc

Angel Top Picks | September 2020

September 5, 2020

2

Top Picks

3

Error!

Refer

ence

sourc

Angel Top Picks | September 2020

September 5, 2020

3

Chalet Hotel

Part of the K. Raheja Corp, CHL is an owner, developer and asset manager of

high-end hotels in key metro cities in India. The Company’s hotel comprises

six operating hotels in the key Indian cities of Mumbai, Hyderabad, Bengaluru

and Pune representing 2,554 key.

All the hotels are branded with globally recognized brands, such as JW

Marriott, Westin, Marriott, Marriott Executive Apartments, Renaissance, Four

Points by Sheraton and Novotel, which are held by Marriott Group and the

Accor Group

Post sharp drop in occupancy in the month of April the company has reported

strong pick up in occupancy for June through August. We expect further

improvement in business post the festive season and normalization of

operations in FY22.

Hawkins Cooker

HCL operates in two segments i.e. Pressure Cookers and Cookware. Over the

last two years, the company has outperformed TTK Prestige (market leader) in

terms of sales growth ~13% vs. ~4% in Cookers & Cookware segment.

Cooking gas (LPG) penetration has increased from 56% in FY2014 to 95% in

FY2020, which would drive higher growth for Cookers & Cookware compared

to past.

Increase demand for Kitchen product post Covid-19.

Strong balance sheet along with free cash flow and higher profitability.

Key Financials

Y/E

Sales

OPM

PAT

EPS

ROE

P/E

P/BV

EV/Sales

March

(` cr)

(%)

(` cr)

(`)

(%)

(x)

(x)

(x)

FY2021E

575

13.0

51

96.7

32.5

49.6

16.1

4.3

FY2022E

728

15.1

77

145.7

42.4

32.9

14.0

3.4

Source: Company, Angel Research

Stock Info

CMP

154

TP

200

Upside

29.9%

Sector

Others

Market Cap (` cr)

3,162

Beta

0.7

52 Week High / Low

395 /99

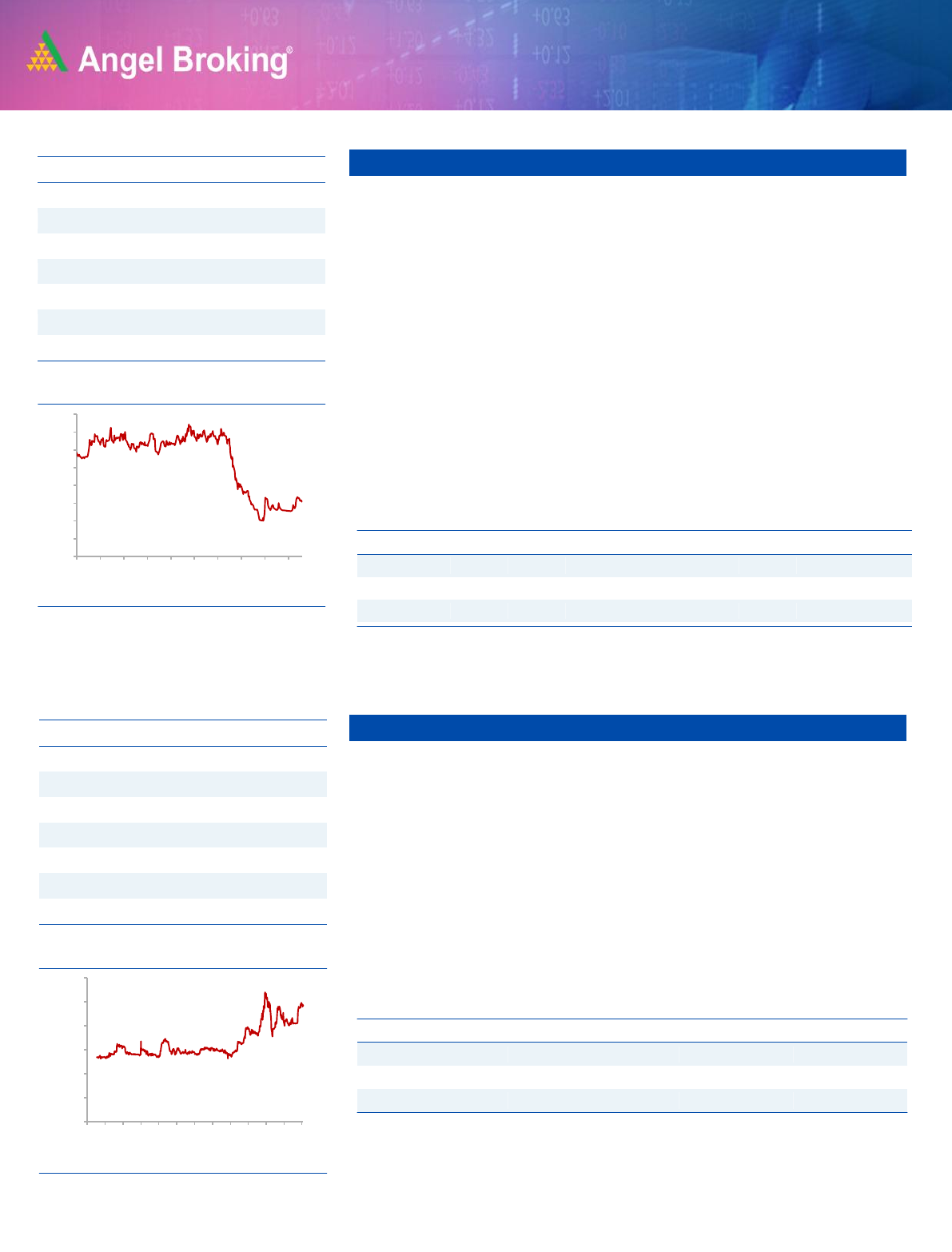

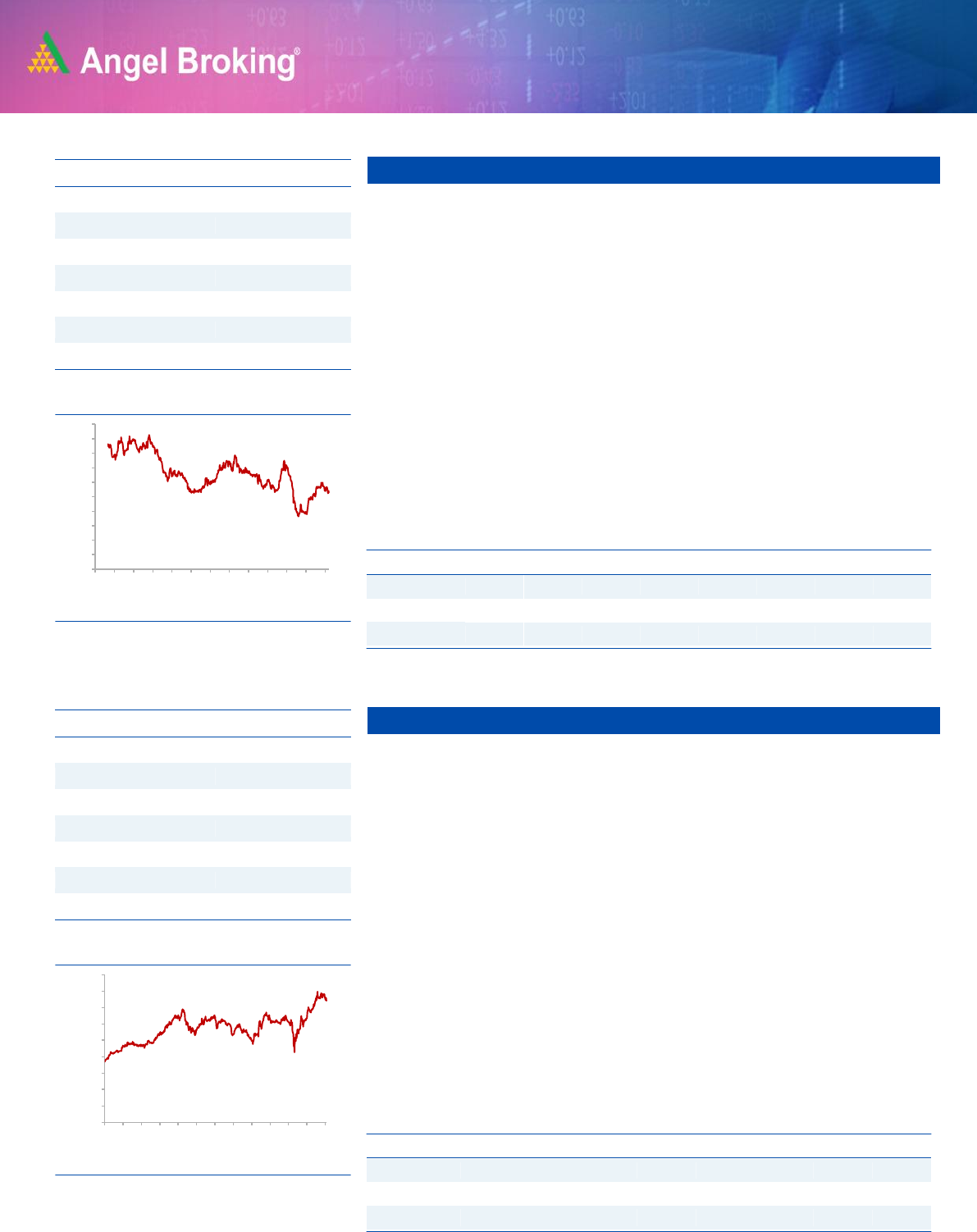

3 year-Chart

Source: Company, Angel Research

Key Financials

Y/E

Sales

OPM

PAT

EPS

ROE

P/E

P/BV

EV/Sales

March

(` cr)

(%)

(` cr)

(`)

(%)

(x)

(x)

(x)

FY2021E

484

34.6

-73

0.0

0.0

NA

3.1

14.3

FY2022E

995

40.7

83

4.0

0.0

38.3

2.9

7.2

Source: Company, Angel Research

-

50

100

150

200

250

300

350

400

Feb-19

Apr-19

Jun-19

Aug-19

Oct-19

Dec-19

Feb-20

Apr-20

Jun-20

Aug-20

Stock Info

CMP

4,842

TP

5,682

Upside

17.3%

Sector

Durable

Market Cap (` cr)

2,561

Beta

0.6

52 Week High / Low

5,539 /2,865

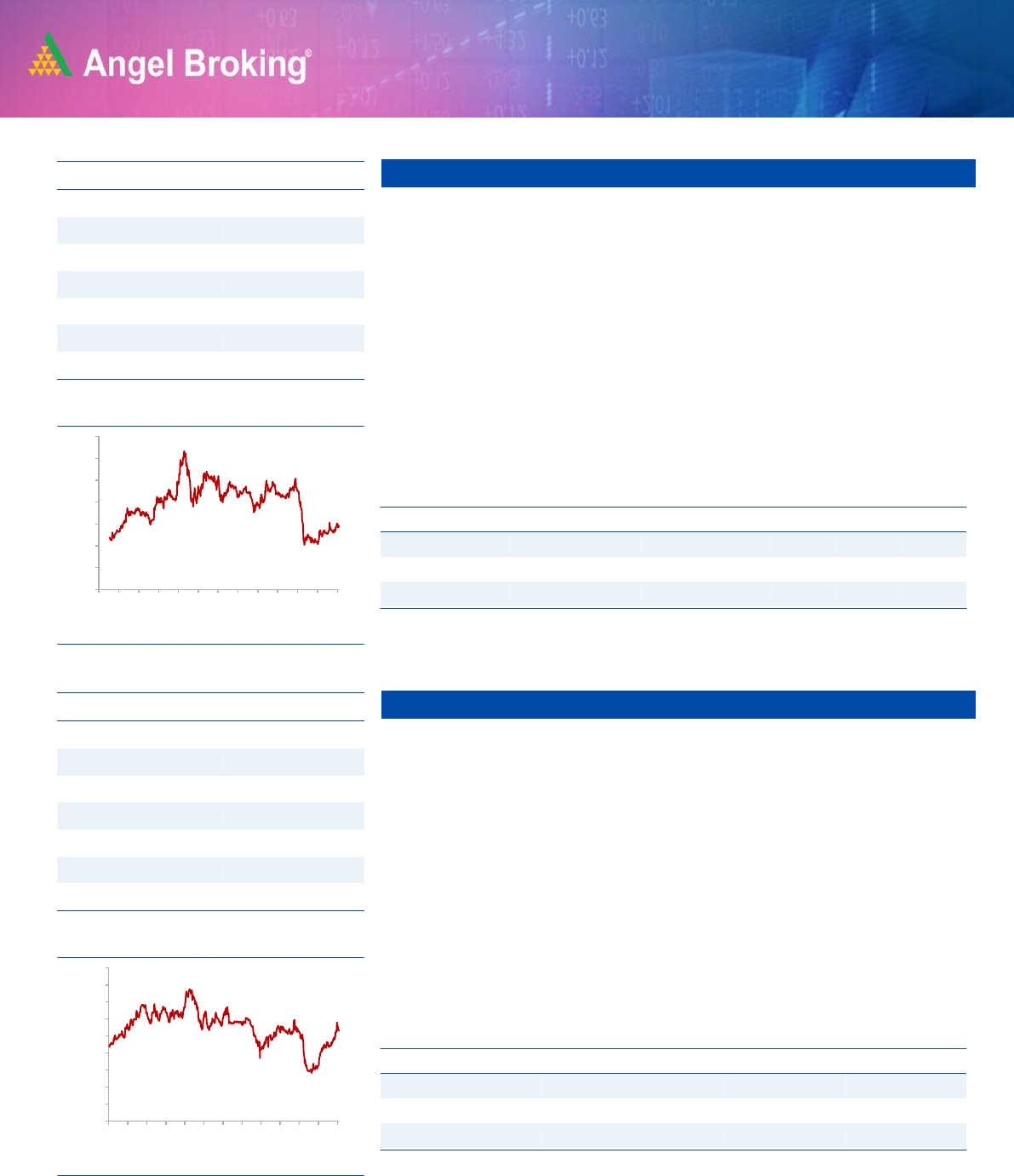

3 year-Chart

Source: Company, Angel Research

-

1,000

2,000

3,000

4,000

5,000

6,000

Jul-17

Oct-17

Jan-18

Apr-18

Jul-18

Nov-18

Feb-19

May-19

Aug-19

Nov-19

Feb-20

May-20

Aug-20

4

Error!

Refer

ence

sourc

Angel Top Picks | September 2020

September 5, 2020

4

Hindustan Aeronautics

HAL is one of the premier defense PSU in India along with BRL and has over

the years showcased research, design and development capabilities with the

successful development of military aircraft and helicopters such as the Ajeet,

Marut, HPT-32, Kiran and Advanced Light Helicopter.

Indigenous aircraft and helicopters HAL has also manufactured aircrafts under

license from such foreign companies including the MiG 21FL/M/BIS, MiG-27,

Dornier 228, Su-30 MkI, Hawk Mk 132 aircraft etc.

Currently the company has an order backlog of ~Rs. 52,000 cr which is

expected increase substantially over the next few years as the company is likely

to get many new orders including orders for 83 LCA Mark 1A worth ` 39,000

cr which is expected to go for cabinet approval very soon.The company also

has various other projects in the pipeline including Light Utility Helicopter

(LUH) and the company is likely to fetch some orders for the same in FY2021.

Key Financials

Y/E

Sales

OPM

PAT

EPS

ROE

P/E

P/BV

EV/Sales

March

(` cr)

(%)

(` cr)

(`)

(%)

(x)

(x)

(x)

FY2021E

21293

24.5%

2961

88.6

23.3

10.3

2.2

1.7

FY2022E

25552

25%

3791

113.4

24

8

2.1

1.5

Source: Company, Angel Research

Persistent System

Persistent Systems has a very strong presence in Hi tech, manufacturing and

life science segments which ware amongst the least impacted sectors due to

Covid-19.

Company has posted a very strong set of numbers for Q1FY21 with dollar

revenue growth of 3.1% qoq. Company has also reported improvement in

margins due to tight cost control. Company has won a large deal during the

quarter which will ramp up over the next few quarters.

We expect the company to post revenue/EBITDA/PAT growth of

11.6%/21.4%/19.7% between FY20-FY22 given negligible impact of Covid-

19 on FY21 numbers, strong deal wins, ramp up of existing projects along

with margin expansion.

Key Financials

Y/E

Sales

OPM

PAT

EPS

ROE

P/E

P/BV

EV/Sales

March

(` cr)

(%)

(` cr)

(`)

(x)

(%)

(%)

(x)

FY2021E

4,159

15.3

415

54.3

15.4

18.2

2.8

1.4

FY2022E

4,756

15.3

488

63.8

15.9

15.5

2.5

1.2

Source: Company, Angel Research

Stock Info

CMP

990

TP

1,276

Upside

28.9%

Sector

IT

Market Cap (` cr)

7,564

Beta

0.5

52 Week High / Low

1,128/420

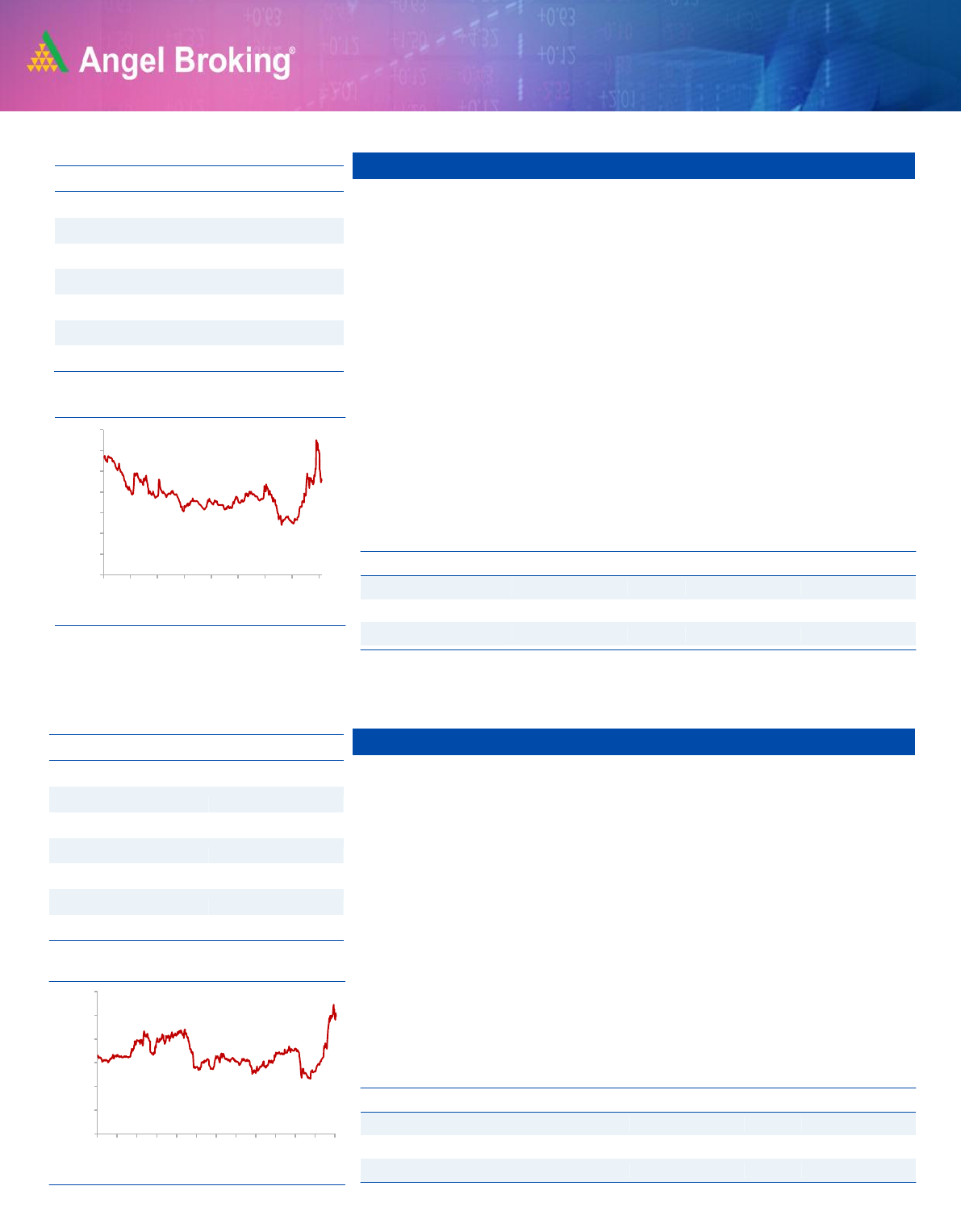

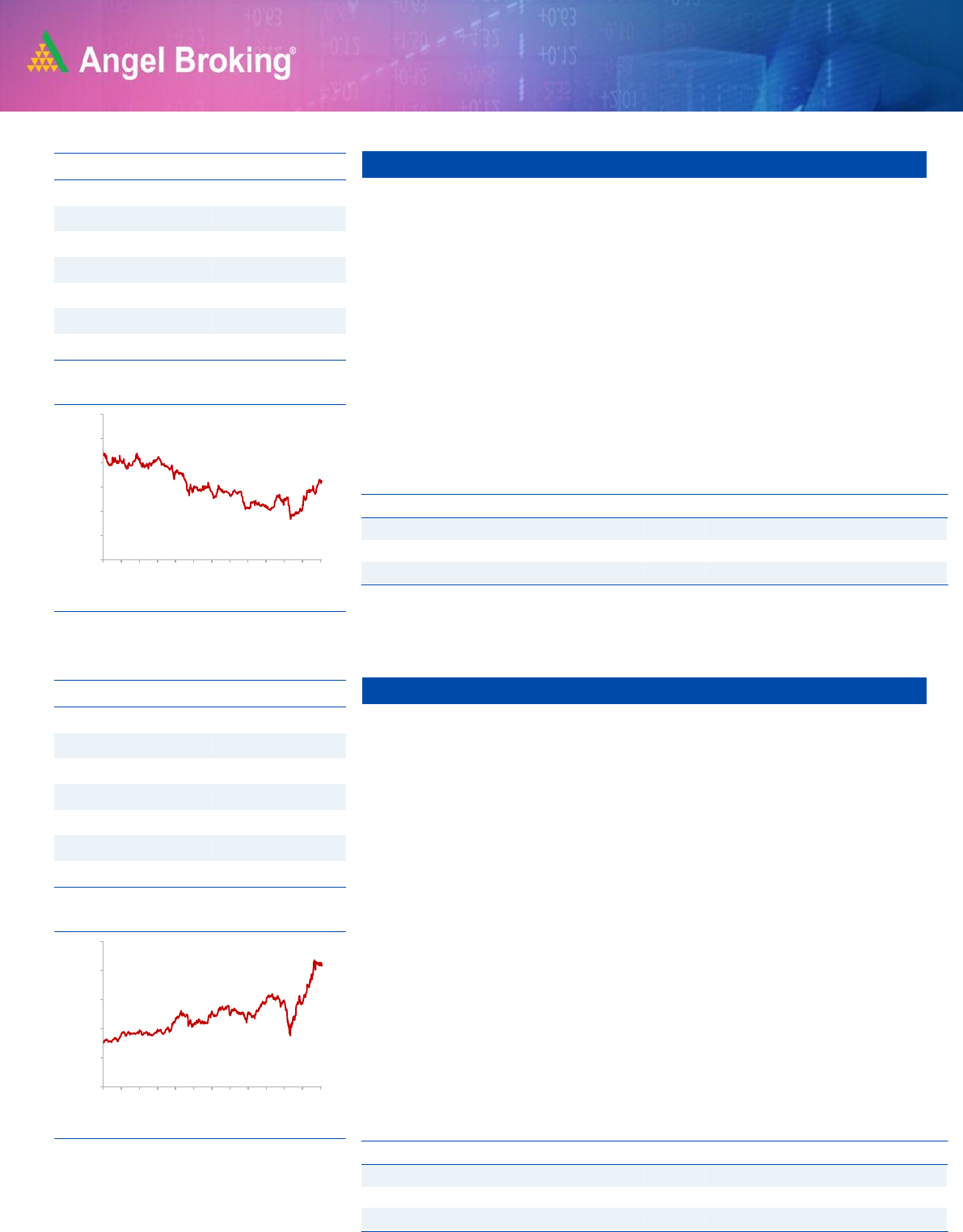

3 year-Chart

Source: Company, Angel Research

-

200

400

600

800

1,000

1,200

Jul-17

Oct-17

Jan-18

Apr-18

Aug-18

Nov-18

Feb-19

May-19

Aug-19

Nov-19

Feb-20

May-20

Aug-20

Stock Info

CMP

911

TP

1,125

Upside

23.4%

Sector

Defence

Market Cap (` cr)

30,454

Beta

0.5

52 Week High / Low

1,423/448

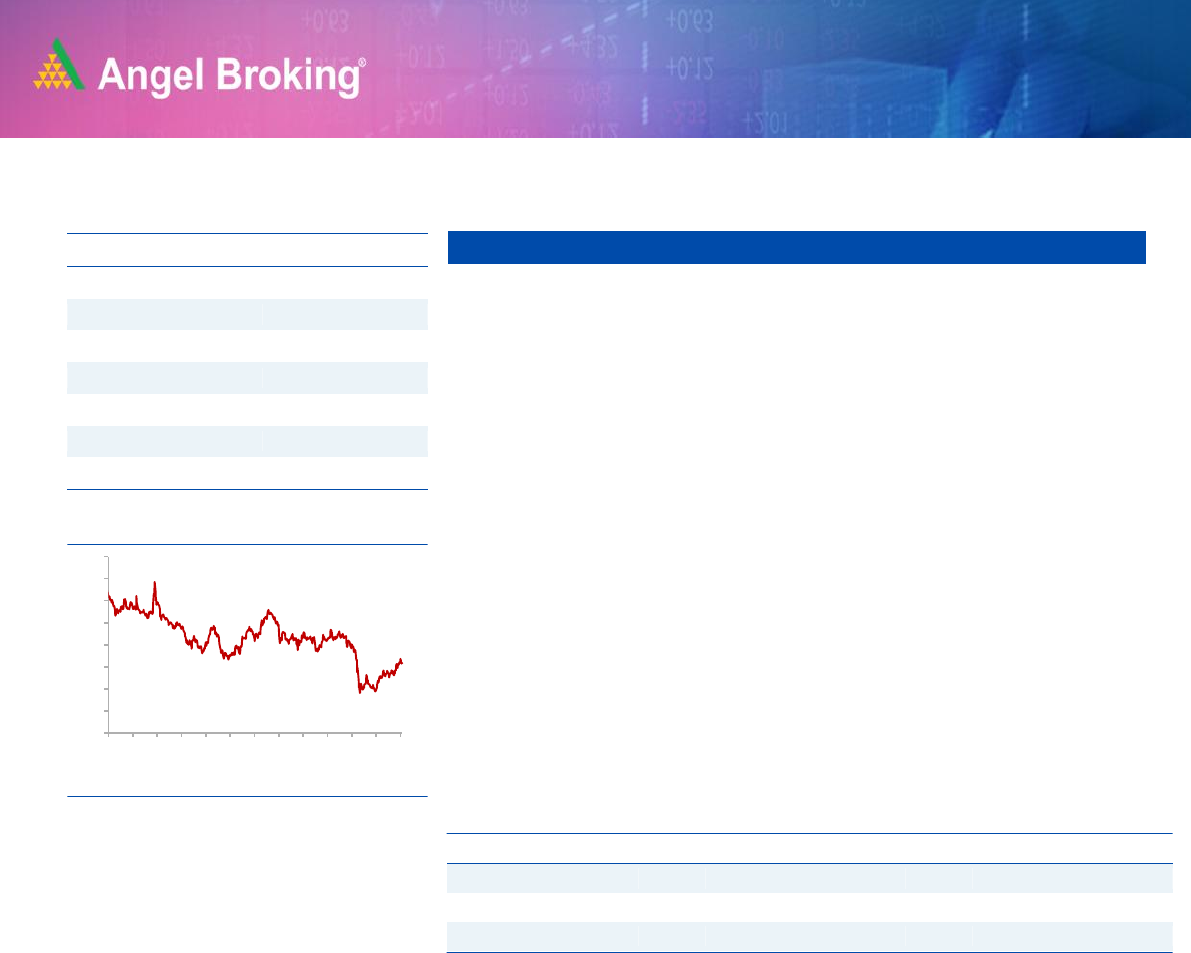

3 year-Chart

Source: Company, Angel Research

-

200

400

600

800

1,000

1,200

1,400

Mar-18

Jul-18

Nov-18

Feb-19

Jun-19

Sep-19

Jan-20

May-20

Aug-20

5

Error!

Refer

ence

sourc

Angel Top Picks | September 2020

September 5, 2020

5

Inox Leisure

Inox Leisure is the second largest multiplex company in India after PVR and

operates more than 600 screens across India.

Multiplex screens are gaining ground in India at the expense of single screens.

According to FICCI, multiplex screens share have increased from ~26% in

CY16 to ~33.5% in CY19, which will continue to increase.

Share prices have corrected ~40% as all theatres are closed down due to

covid-19 issue. Although, long term fundamentals are intact. Covid-19 can

lead to further consolidation in the industry.

We are positive on the prospects of the company given that has strong

balance sheet, increasing market share of multiplexes and also increasing

appetite for Hollywood and smaller budget movies which is expected to reduce

volatility in earnings due to lower dependency on big Bollywood movies

Key Financials:

Y/E

Sales

OPM

PAT

EPS

ROE

P/E

P/BV

EV/Sales

March

(` cr)

(%)

(` cr)

(`)

(%)

(x)

(x)

(x)

FY2021E

628

-8.6

-146

-14.2

-15.0

0.0

4.7

4.7

FY2022E

2153

17.0

162

15.8

14.5

18.4

2.7

1.5

Source: Company, Angel Research (Above table is ex Ind AS 116).

Zensar Technologies

Zensar Technologies is one of the leading IT service providers to the High tech

verticals. The company has a very strong presence in Hi tech and

manufacturing which ware amongst the least impacted sectors due to Covid-

19.

Company was adversely impacted between FY18-20 due to ramp down in the

retail and consumer group segment share of which has gone down from

27.1% of revenues in FY2018 to 20.7% of revenues in FY2020. The consumer

group segment further degrew to 12.0% of revenues in Q1FY2021.

Company has won deals worth USD 150mn during the quarter and

management has said that deal pipeline is very strong at USD 1.5bn as

compared to USD 1.0bn a quarter ago.

We expect the company to post revenue/EBITDA/PAT growth of

4.5%/17.8%/19.7% between FY20-FY22 given that the worst is over for the

company in terms of client ramp downs.

Key Financials

Y/E

Sales

OPM

PAT

EPS

ROE

P/E

P/BV

EV/Sales

March

(` cr)

(%)

(` cr)

(`)

(%)

(x)

(x)

(x)

FY2021E

4,059

14.7

319

14.2

13.5

12.0

1.6

0.8

FY2022E

4,558

15.0

384

17.0

14.3

10.0

1.4

0.6

Source: Company, Angel Research

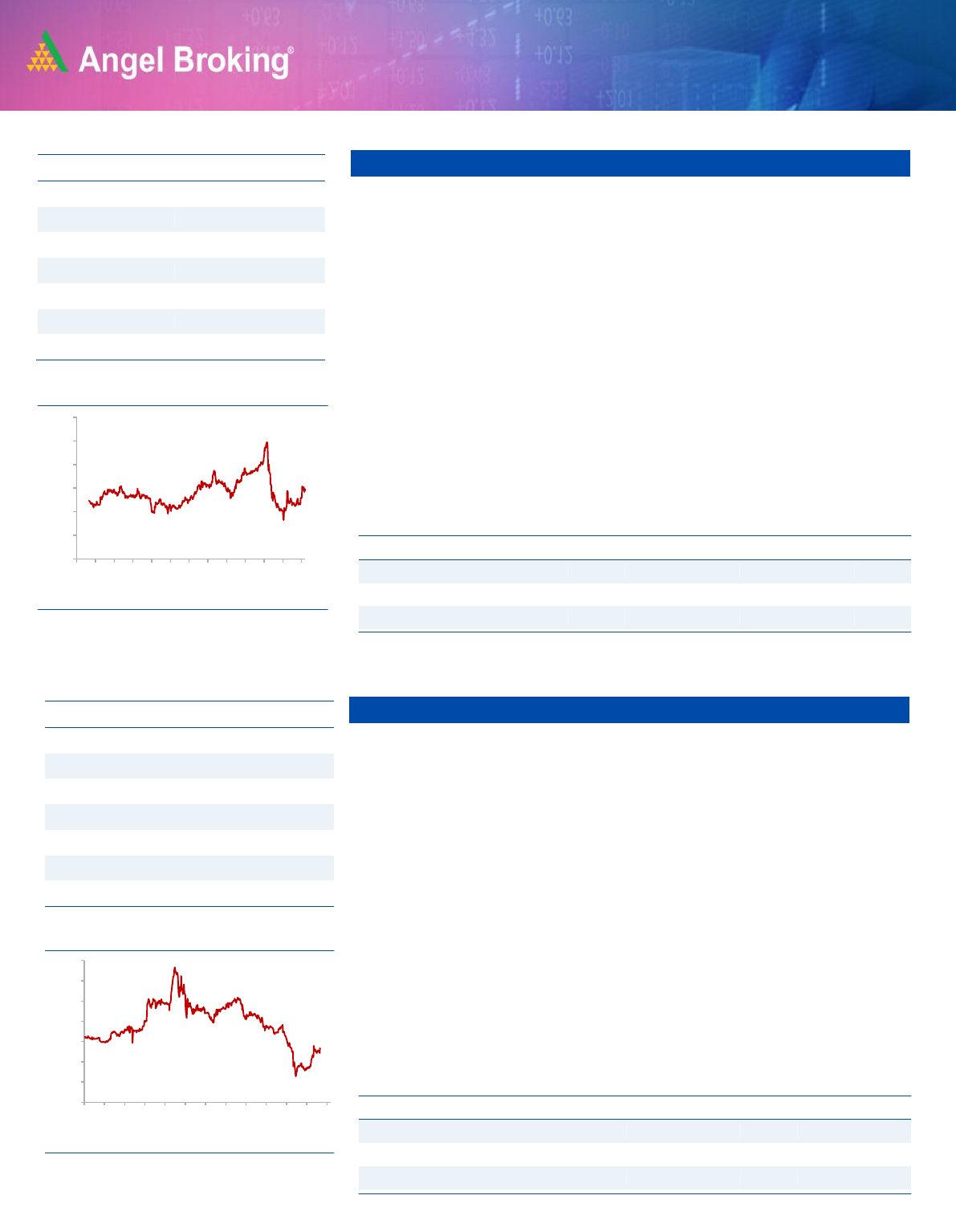

Stock Info

CMP

171

TP

204

Upside

19.3%

Sector

IT

Market Cap (` cr)

3,846

Beta

0.6

52 Week High / Low

230 /64

3 year-Chart

Source: Company, Angel Research

-

50

100

150

200

250

300

350

Jul-17

Oct-17

Jan-18

Apr-18

Jul-18

Oct-18

Jan-19

Apr-19

Aug-19

Nov-19

Feb-20

May-20

Aug-20

Stock Info

CMP

290

TP

350

Upside

20.6%

Sector

Media & Entertainment

Market Cap (` cr)

2,984

Beta

0.7

52 Week High / Low

510 /158

3 year-Chart

Source: Company, Angel Research

-

100

200

300

400

500

600

Jul-17

Oct-17

Jan-18

Apr-18

Jul-18

Oct-18

Jan-19

Apr-19

Aug-19

Nov-19

Feb-20

May-20

Aug-20

6

Error!

Refer

ence

sourc

Angel Top Picks | September 2020

September 5, 2020

6

Metropolis Healthcare

Metropolis is a leading Pathology centre in India. Company has an asset light

model with a strong Balance sheet having cash and cash equivalents to the

tune of ₹235cr as on 30st June, 2020.

Currently, the diagnostic industry is dominated by standalone centers (~48%)

followed by hospital based labs (~37%) and diagnostic chains (~15%)

From 62.6% revenue de-growth (including covid testing) YoY in April'20, the

Company has registered mid double digit revenue growth in July'20 as covid

revenue is making up for the losses in non-covid revenue. We expect non-

covid business to be back to normal from Q3FY21 onwards.

We are positive on the long term prospects of the Company given expected

long term growth rates of ~15% CAGR, stable margins profile and

moderating competitive intensity.

Key Financials

Y/E

Sales

OPM

PAT

EPS

ROE

P/E

P/BV

EV/Sales

March

(` cr)

(%)

(` cr)

(`)

(x)

(%)

(%)

(x)

FY2021E

920

25.0

145

28.7

23.1

62.1

14.4

9.6

FY2022E

1156

28.4

222

43.9

27.8

40.6

11.3

7.5

Source: Company, Angel Research

Cholamandalam Inv. Fin. Com.

The CIFC has one of the most diversified AUMs in terms of product mix and

geographical presence. None of its product segments account for over 26% of

overall AUM. The maximum geographic zonal exposure in terms of AUM is

27% (south).

Management has a stress-tested book and guided for lower incremental

provision requirement. The final provision for FY21 would be similar to FY20.

Hence, we believe existing COVID provision is adequate.

A diversified product mix will help capture growth in the LCV, tractor, and 2W

segment. Adequate capital adequacy (20%+) and declined trend in The cost

of funds and strong parentage provide comfort. The company will benefit

significantly from stabilization in the operating environment.

Key Financials

Y/E

NII

NIM

PAT

EPS

ABV

ROA

ROE

P/E

P/ABV

March

(` cr)

(%)

(` cr)

(`)

(`)

(%)

(%)

(x)

(x)

FY2021E

3,783

5.8

987

12

102

1.5

11.5

19.3

2.3

FY2022E

3,962

5.7

1,346

17

105

2.0

14.1

14.1

2

Source: Company, Angel Research

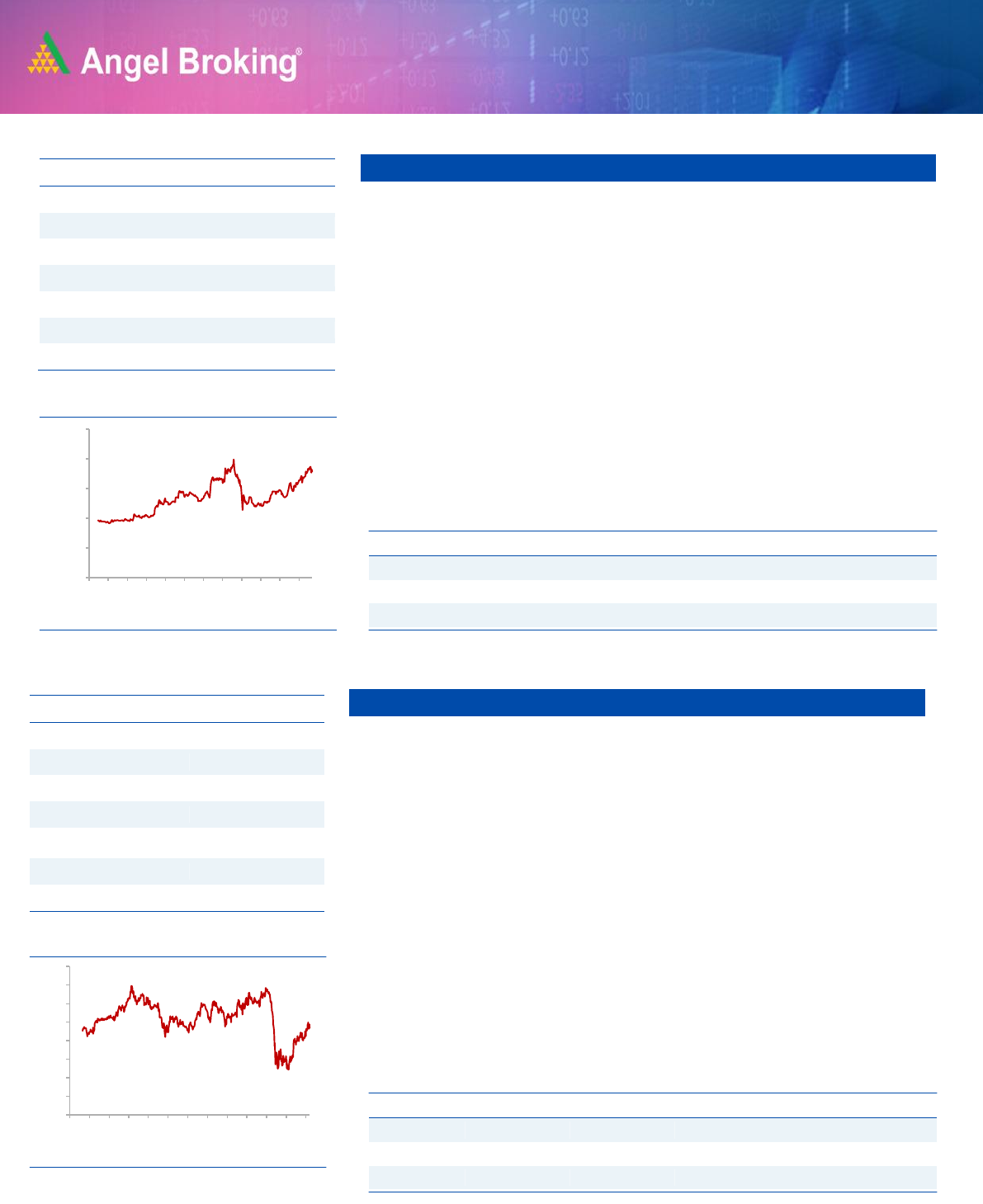

Stock Info

CMP

234

TP

280

Upside

17.7%

Sector

Financials

Market Cap (` cr)

19,195

Beta

1.6

52 Week High / Low

349 /117

3 year-Chart

Source: Company, Angel Research

-

50

100

150

200

250

300

350

400

Jul-17

Oct-17

Jan-18

Apr-18

Jul-18

Oct-18

Jan-19

Apr-19

Aug-19

Nov-19

Feb-20

May-20

Aug-20

Stock Info

CMP

1,787

TP

2,156

Upside

20.6%

Sector

Healthcare

Market Cap (` cr)

9,101

Beta

0.8

52 Week High / Low

2,110/994

3 year-Chart

Source: Company, Angel Research

-

500

1,000

1,500

2,000

2,500

Mar-19

May-19

Jun-19

Aug-19

Sep-19

Nov-19

Dec-19

Feb-20

Mar-20

May-20

Jun-20

Aug-20

7

Error!

Refer

ence

sourc

Angel Top Picks | September 2020

September 5, 2020

7

J.K. Lakshmi Cement

JK Lakshmi promoted by Singhania group is a predominantly north India

cement company with capacity of 13.3 Mn Mt.

Currently, north India is favorable location for the cement industry as it is

consolidated to a large extent as well as demand and supply outlook is better

compared to other locations. Q1FY21 numbers of the Company were better

compared to its peers due to favorable regional presence.

Freight and power & fuel are important line items of cost for cement

companies. Fall in crude prices will help to reduce cost/tonne for the

company.

It is also trading at a significant discount compared to other north based

cement company such as JK Cement as well as historical valuation.

Britannia Industries

Britannia Industries (BRIT)’s principal activity is manufacture and sale of

biscuits, bread, rusk, cakes and dairy products.

BRIT has brands like Tiger, Good-Day, and 50:50 under its fold with an

estimated market share of 33% in the Indian biscuits industry. Biscuits

contribute more than 80% of the company’s turnover.

BRIT has an overall distribution reach of 5.5 million outlets. With consistent

focus on distribution expansion, BRIT has narrowed the gap with the No. 1

player. The gap with largest distributed brand is now just 0.8 million outlets.

In Q1FY21 BRIT have outperformed other companies in FMCG space in both

top-line and bottom line front. Going ahead in near term, food industry is

witnessing a shift from dining out/ street food to home consumption. BRIT

being a low price product with trusted brands is well positioned to cater the

shift.

Stock info

CMP

264

TP

328

Upside

24.4%

Sector

Cement

Market Cap (` cr)

3,102

Beta

0.7

52 Week High / Low

390 /180

3 year-Chart

Source: Company, Angel Research

Key Financials

Y/E

Sales

OPM

PAT

EPS

ROE

P/E

P/BV

EV/Sales

March

(` cr)

(%)

(` cr)

(`)

(%)

(x)

(x)

(x)

FY2021E

3793

16.9

223

19.0

12.3

14.9

1.7

1.1

FY2022E

4452

16.2

278

23.6

13.7

12.0

1.5

0.9

Source: Company, Angel Research (Standalone nos.)

Stock Info

CMP

3,706

TP

4,220

Upside

13.9%

Sector

FMCG

Market Cap (` cr)

89,208

Beta

0.8

52 Week High / Low

4,015/2,100

3 year-Chart

Source: Company, Angel Research

Key Financials

Y/E

Sales

OPM

PAT

EPS

ROE

P/E

P/BV

EV/Sales

March

(` cr)

(%)

(` cr)

(`)

(%)

(x)

(x)

(x)

FY2021E

13,269

17.6

1712.0

71.2

29.5

52.1

20.3

6.7

FY2022E

14,624

16.5

1753.0

72.9

28.6

50.9

18.0

6.0

Source: Company, Angel Research

-

50

100

150

200

250

300

350

400

450

500

Jul-17

Oct-17

Jan-18

Apr-18

Jul-18

Oct-18

Jan-19

Apr-19

Aug-19

Nov-19

Feb-20

May-20

Aug-20

-

500

1,000

1,500

2,000

2,500

3,000

3,500

4,000

4,500

Jul-17

Oct-17

Jan-18

Apr-18

Jul-18

Nov-18

Feb-19

May-19

Aug-19

Nov-19

Feb-20

May-20

Aug-20

8

Error!

Refer

ence

sourc

Angel Top Picks | September 2020

September 5, 2020

8

VIP Industries

VIP Industries Ltd (VIP) is engaged in the manufacturing of hard and soft

luggage both. VIP's brands include Carlton, VIP Bags, Skybags, Aristocrat, Alfa

and Caprese.

Shift in trend towards the organized sector to propel growth. Substantial brand

visibility with a wide distribution network. VIP has a well diversified product

bouquet, which caters to consumers from all income groups

The recent correction has given the investors an opportunity to invest in a

market leader with a strong brand & wide distribution network.

Endurance Tech.

It mainly caters to two and three-wheeler OEMs in India and supplies

aluminum casting products to four-wheeler OEMs in Europe.

The company operates 17 plants in India, 9 plants overseas and 4 R&D sites

Post Covid19, evolving consumer preference for lower ticket priced means of

private transport amid pressurized incomes & awareness around social

distancing are expected to act as tailwinds for domestic 2-Ws in India, 4-Ws

across developed nations.

Going ahead, given the company’s ability to gain new businesses & market

share across categories; we recommend a buy for Endurance.

Stock Info

CMP

285

TP

348

Upside

22.1%

Sector

Durable

Market Cap (` cr)

4,030

Beta

0.8

52 Week High / Low

520 /187

3 year-Chart

Source: Company, Angel Research

Key Financials

Y/E

Sales

OPM

PAT

EPS

ROE

P/E

P/BV

EV/Sales

March

(` cr)

(%)

(` cr)

(`)

(x)

(%)

(%)

(x)

FY2021E

800

NA

-136

-9.6

NA

-29.6

7.6

2.4

FY2022E

1650

16.5

108

7.6

19.5

37.3

6.7

0.2

Source: Company, Angel Research

Stock Info

CMP

1,062

TP

1,297

Upside

22.1%

Sector

Others

Market Cap (` cr)

14,940

Beta

0.6

52 Week High / Low

1,201/562

3 year-Chart

Source: Company, Angel Research

Key Financials

Y/E

Sales

OPM

PAT

EPS

ROE

P/E

P/BV

EV/Sales

March

(` cr)

(%)

(` cr)

(`)

(%)

(x)

(x)

(x)

FY2021E

5884

14.0

281.0

20.0

8.7

53.2

4.6

1.9

FY2022E

7465

15.8

608.0

43.2

16.2

24.6

3.6

1.7

Source: Company, Angel Research

-

100

200

300

400

500

600

700

Jul-17

Oct-17

Jan-18

Apr-18

Jul-18

Nov-18

Feb-19

May-19

Aug-19

Nov-19

Feb-20

May-20

Aug-20

-

200

400

600

800

1,000

1,200

1,400

1,600

1,800

Jul-17

Oct-17

Jan-18

Apr-18

Jul-18

Nov-18

Feb-19

May-19

Aug-19

Nov-19

Feb-20

May-20

Aug-20

9

Error!

Refer

ence

sourc

Angel Top Picks | September 2020

September 5, 2020

9

Swaraj Engines

Swaraj Engines is engaged in the business of manufacturing diesel engines

and hi-tech engine components. Diesel Engines are specifically designed for

tractor application.

Going forward, we expect recovery in tractor industry (due to robust Rabi crop

production, hike in MSP & the forecast of a normal monsoon) will benefit

player like Swaraj Engines.

The company has healthy balance sheet along with free cash flow and higher

profitability. The company is trading at reasonably lower valuations

Reliance Industries

Reliance Industries Ltd. (RIL) is India’s largest company with dominant

presence in Refining, Petrochemicals, Telecom and Retail businesses.

RIL has built up a dominant telecom business and has already attained market

leader status with 38.3 cr. subscribers at the end of Q4FY20. Telecom

business to witness robust growth over next few years due to tariff hikes and

shift of subscribers from Vodafone Idea to other telecom players

RIL has also built a very strong retail business which is the largest organized

retailing company in India. We expect the retail business to be a key value

driver for Reliance over the long run though there would be some impact on

business in FY21 due to the Covid 9 outbreak.

The company has raised INR 1.52lakh cr. from marquee investors like

Facebook, General Atlantic, KKR, Intel etc reaffirms our conviction in the

company’s potential transformation to a digital play from a pure brick and

mortar company.

Stock Info

CMP

1,610

TP

1,891

Upside

17.5%

Sector

Others

Market Cap (` cr)

1,953

Beta

0.3

52 Week High / Low

1,700/808

3 year-Chart

Source: Company, Angel Research

Key Financials

Y/E

Sales

OPM

PAT

EPS

ROE

P/E

P/BV

EV/Sales

March

(` cr)

(%)

(` cr)

(`)

(%)

(x)

(x)

(x)

FY2021E

711

16.7

64

53.0

16.2

30.4

5.2

2.9

FY2022E

899

17.0

86

71.2

17.1

22.6

4.1

2.3

Source: Company, Angel Research

Stock Info

CMP

2,077

TP

2,366

Upside

13.9%

Sector

Diversified

Market Cap (` cr)

1,367,284

Beta

1.1

52 Week High / Low

2,198 /867

3 year-Chart

Source: Company, Angel Research

Key Financials

Y/E

Sales

OPM

PAT

EPS

ROE

P/E

P/BV

EV/Sales

March

(` cr)

(%)

(` cr)

(`)

(%)

(x)

(x)

(x)

FY2021E

3,34,223

12.7

26,360

41.6

5.7

50.0

2.8

7.9

FY2022E

4,24,086

14.0

42,035

66.3

8.7

31.3

2.7

6.2

Source: Company, Angel Research

-

500

1,000

1,500

2,000

2,500

3,000

Jul-17

Oct-17

Jan-18

Apr-18

Jul-18

Nov-18

Feb-19

May-19

Aug-19

Nov-19

Feb-20

May-20

Aug-20

-

500

1,000

1,500

2,000

2,500

Jul-17

Oct-17

Jan-18

Apr-18

Jul-18

Nov-18

Feb-19

May-19

Aug-19

Nov-19

Feb-20

May-20

Aug-20

10

Error!

Refer

ence

sourc

Angel Top Picks | September 2020

September 5, 2020

10

IDFC First Bank

The Ability to raise sufficient liquidity at Low cost would be The Key criteria for

banks to navigate the current situation, as asset side inflow would be limited.

IDFC Fist Bank, Post management change has clearly outperformed in

building liability franchise and retail lending.

Since new management took charge, every qtr. liability franchise has been

strengthened. CASA ratio improved from 10.4% in Q3FY19 to 33.7% In

Q1FY21. NIM has improved to 4.53% in Q1FY21 as compared to 4.24% in

Q4 FY20 and 2.89% in Q3FY19. Retail advance mix is continuously

improving.

The Bank had raised Rs. 2,000 crores of fresh equity capital during Q1FY21.

Post the capital raise, the Capital Adequacy Ratio will be 15.03% with CET-1

Ratio of 14.58%.

We believe efforts to build a liability franchise, fresh capital infusion, and

provision taken on the wholesale books will help to tide over this difficult time.

The IDFC First Bank is trading (1.0x FY22ABV) at a significant discount to

historical average valuations.

Stock Info

CMP

32

TP

36

Upside

12.5%

Sector

Banking

Market Cap (` cr)

17,981

Beta

1.2

52 Week High / Low

48 /18

3 year-Chart

Source: Company, Angel Research

Key Financials

Y/E

NII

NIM

PAT

EPS

ABV

ROA

ROE

P/E

P/ABV

March

(` cr)

(%)

(` cr)

(`)

(`)

(%)

(%)

(x)

(x)

FY2021E

6,939

4.8

90

0.2

29

0.1

1

202

1.1

FY2022E

8,121

5.3

1,530

2.7

31

0.9

8

12

1.0

Source: Company, Angel Research

-

10

20

30

40

50

60

70

80

Jul-17

Oct-17

Jan-18

Apr-18

Jul-18

Nov-18

Feb-19

May-19

Aug-19

Nov-19

Feb-20

May-20

Aug-20

11

Error!

Refer

ence

sourc

Angel Top Picks | September 2020

September 5, 2020

11

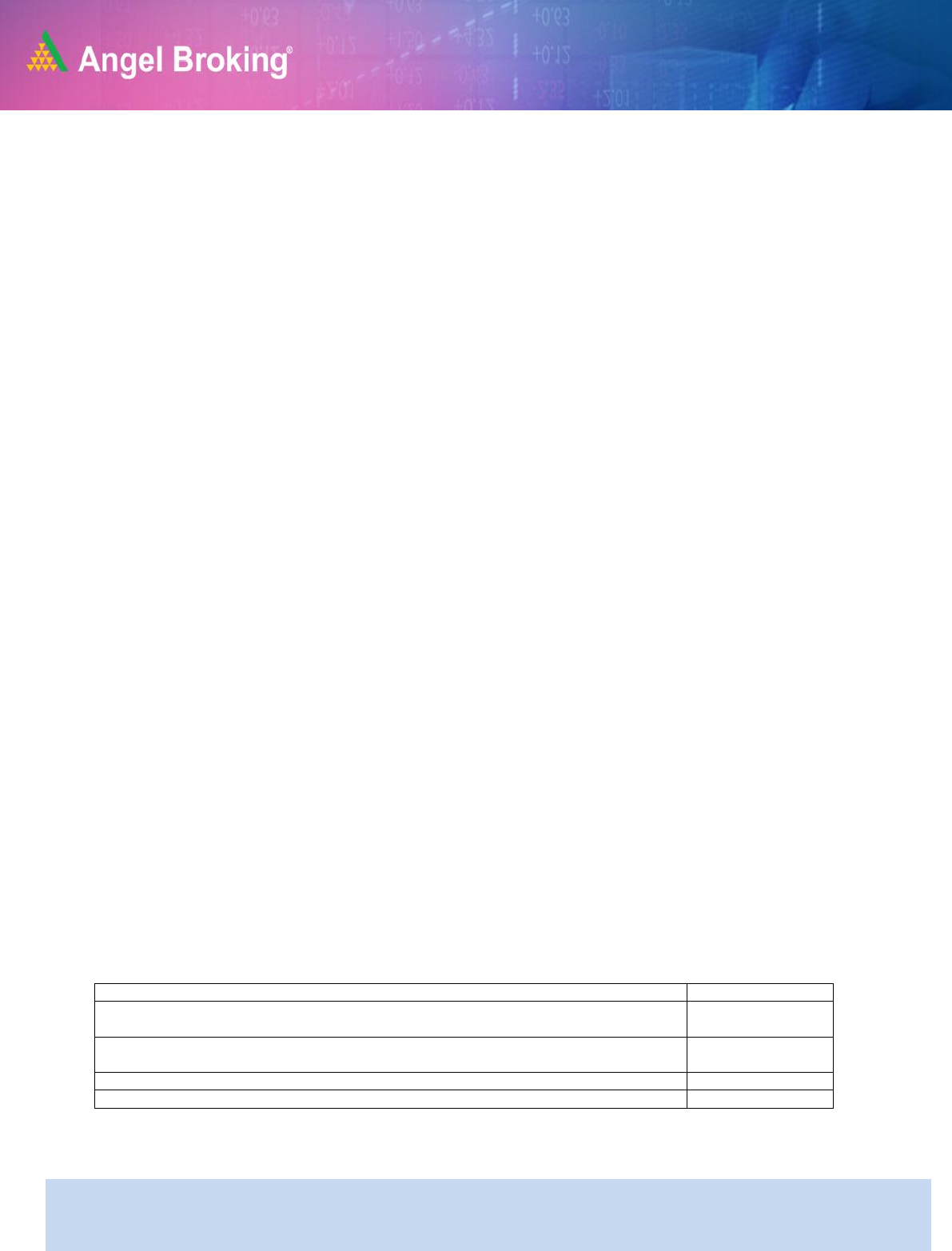

Changes in Recommendation

Exhibit 1: Stocks bought in last 6-months

Stock Name

Buy Call Date

Buy Price

Dr Lal Pathlabs

01-04-2020

1,384

P & G Hygiene

01-04-2020

10,161

Ipca Labs.

01-04-2020

1,398

Bharti Airtel

01-04-2020

421

Dabur India

16-04-2020

498

L & T Infotech

16-04-2020

1,493

Infosys

16-04-2020

626

Britannia Inds.

16-04-2020

2,832

Alkem Lab

17-04-2020

2,688

Reliance Inds.

17-04-2020

1,189

P I Inds.

24-04-2020

1,507

Galaxy Surfact.

24-04-2020

1,394

Aarti Inds.

24-04-2020

929

Dhanuka Agritech

07-05-2020

438

Hind. Unilever

08-05-2020

2,056

Dr Reddy's Labs

28-05-2020

3,877

H D F C

01-06-2020

1,740

Larsen & Toubro

01-06-2020

951

Escorts

01-06-2020

970

ICICI Bank

01-06-2020

345

Axis Bank

03-06-2020

424

Bajaj Fin.

03-06-2020

2,477

Can Fin Homes

03-06-2020

316

Endurance Tech.

08-06-2020

838

Swaraj Engines

08-06-2020

1,290

Persistent Sys

29-07-2020

885

Zensar Tech.

29-07-2020

155

Alembic Pharma

04-08-2020

1,023

J.K. Lakshmi Cement

24-08-2020

287

Cholamandalam Inv & Fin Comp

24-08-2020

232

VIP Industries

27-08-2020

303

Hawkins Cookers

27-08-2020

4,918

Inox Leisure

28-08-2020

304

Chalet Hotel

28-08-2020

165

Metropolis Healthcare

28-08-2020

1,832

Hindustan Aeronautics

03-09-2020

926

Source: Company, Angel Research

12

Error!

Refer

ence

sourc

Angel Top Picks | September 2020

September 5, 2020

12

Exhibit 2: Stocks sold in last 6-months

Stock Name

Sell Date

Sell Price

Dr Lal Pathlabs

09-04-2020

1,462

RBL Bank

15-04-2020

121

Shriram Trans.

15-04-2020

685

KEI Inds.

16-04-2020

279

Safari Inds.

16-04-2020

402

Amber Enterp.

16-04-2020

1,116

UltraTech Cem.

21-04-2020

3,409

Inox Wind

24-04-2020

27

Hind. Unilever

04-05-2020

2,121

ICICI Bank

05-05-2020

341

Dabur India

06-05-2020

450

Asian Paints

07-05-2020

1,610

Hawkins Cookers

22-05-2020

4,235

Bata India

26-05-2020

1,265

GMM Pfaudler

26-05-2020

3,732

Alkem Lab

27-05-2020

2,425

Dhanuka Agritech

27-05-2020

573

Nestle India

08-06-2020

17,160

P & G Hygiene

08-06-2020

10,150

Infosys

08-06-2020

708

Hind. Unilever

08-07-2020

2,161

Avenue Suparmart

13-07-2020

2,210

Axis Bank

14-07-2020

423

Bajaj Finance

21-07-2020

3,255

Larsen & Toubro

28-07-2020

913

Colgate-Palmolive

29-07-2020

1,413

Escorts

03-08-2020

1,110

Ipca Lab

11-08-2020

2,037

Aarti Industries

13-08-2020

1,012

Galaxy Surfactants

13-08-2020

1,751

L&T Infotech

13-08-2020

2,504

HDFC Ltd.

14-08-2020

1,813

ICICI Bank

17-08-2020

359

Dr. Reddy Lab

20-08-2020

4,481

Jindal Steel

24-08-2020

224

Bharti Airtel

24-08-2020

520

PI Industries

31-08-2020

1,920

Alembic Pharma

02-09-2020

921

Source: Company, Angel Research

13

Error!

Refer

ence

sourc

Angel Top Picks | September 2020

September 5, 2020

13

Research Team Tel: 022 - 39357800 E-mail: [email protected] Website: www.angelbroking.com

DISCLAIMER

Angel Broking Limited (hereinafter referred to as “Angel”) is a registered Member of National Stock Exchange of India Limited, Bombay

Stock Exchange Limited, Metropolitan Stock Exchange Limited, Multi Commodity Exchange of India Ltd and National Commodity &

Derivatives Exchange Ltd It is also registered as a Depository Participant with CDSL and Portfolio Manager and Investment Adviser with

SEBI. It also has registration with AMFI as a Mutual Fund Distributor. Angel Broking Limited is a registered entity with SEBI for Research

Analyst in terms of SEBI (Research Analyst) Regulations, 2014 vide registration number INH000000164. Angel or its associates has not

been debarred/ suspended by SEBI or any other regulatory authority for accessing /dealing in securities Market. Angel or its

associates/analyst has not received any compensation / managed or co-managed public offering of securities of the company covered

by Analyst during the past twelve months.

This document is solely for the personal information of the recipient, and must not be singularly used as the basis of any investment

decision. Nothing in this document should be construed as investment or financial advice. Each recipient of this document should

make such investigations as they deem necessary to arrive at an independent evaluation of an investment in the securities of the

companies referred to in this document (including the merits and risks involved), and should consult their own advisors to determine

the merits and risks of such an investment.

Reports based on technical and derivative analysis center on studying charts of a stock's price movement, outstanding positions and

trading volume, as opposed to focusing on a company's fundamentals and, as such, may not match with a report on a company's

fundamentals. Investors are advised to refer the Fundamental and Technical Research Reports available on our website to evaluate the

contrary view, if any

The information in this document has been printed on the basis of publicly available information, internal data and other reliable

sources believed to be true, but we do not represent that it is accurate or complete and it should not be relied on as such, as this

document is for general guidance only. Angel Broking Limited or any of its affiliates/ group companies shall not be in any way

responsible for any loss or damage that may arise to any person from any inadvertent error in the information contained in this report.

Angel Broking Limited has not independently verified all the information contained within this document. Accordingly, we cannot testify,

nor make any representation or warranty, express or implied, to the accuracy, contents or data contained within this document. While

Angel Broking Limited endeavors to update on a reasonable basis the information discussed in this material, there may be regulatory,

compliance, or other reasons that prevent us from doing so.

This document is being supplied to you solely for your information, and its contents, information or data may not be reproduced,

redistributed or passed on, directly or indirectly.

Neither Angel Broking Limited, nor its directors, employees or affiliates shall be liable for any loss or damage that may arise from or in

connection with the use of this information.

Disclosure of Interest Statement

Top Picks

1. Financial interest of research analyst or Angel or his Associate or his relative

No

2. Ownership of 1% or more of the stock by research analyst or Angel or associates or

relatives

No

3. Served as an officer, director or employee of the company covered under Research

No

4. Broking relationship with company covered under Research

No

Ratings (Based on Expected Returns: Buy (> 15%) Accumulate (5% to 15%) Neutral (-5 to 5%)

Over 12 months investment period) Reduce (-5% to -15%) Sell (< -15%)

Hold (Fresh purchase not recommended)