Please refer to important disclosures at the end of this report

1

Angel Top Picks – November 2022

October witnessed stability – After a strong recovery in month of July and August of

cumulative 12.5%, the Indian markets witnessed profit booking in September and

October months, posting negative returns. More importantly, the FIIs remained net

sellers in October month and MFs continued to remain net buyers. The markets

continued to correct in in the first half of October but in the second half it was nearing

its all-time high levels post cautious commentary regarding the inflation and the

measures to tackle it. Going ahead, we believe that the FIIs will return owing to strong

growth outlook compared to other global nations.

Hawkish commentary by US Fed members led to increased volatility in October– At

the latest FOMC meeting, Federal Reserve Chair, Jerome Powell said that the

FOMC’s primary focus right now is to bring inflation back down to 2%. At the most

recent meeting in November, the FED raised the target range for the federal funds

rate by 75bps to 3.75% - 4.00% and it further intends to increase it to 4.40% by end

of this year.

India's growth recovery continues –Although India’s Q1FY23 YoY GDP growth of

13.5% appears low owing to the impact of the second wave in the base quarter

(Q1FY22), it is pertinent to note that the economy has crossed the pre-pandemic

level. As per data, economic activity is showing signs of broadening and the overall

demand environment is improving leading to moderation in inflation further boosting

positive sentiments. As for high frequency indicators, the PMI Manufacturing was

observed at 55.1 in Sept’22, which continued to remain in line with the last 12-month

average reading. GST collections at ₹1.52 lakh crores in Oct’22, marked the 8th

consecutive month of ₹1.40 lakh crore+ collections.

Falling crude/commodity prices to provide relief – We believe that the current

scenario of a weaker global economic outlook due to recession fears lowers the

chances of a significant spike in crude oil prices which have corrected ~24% over

the period of April’22 to Sept’22. So, the falling crude oil prices are to certainly

benefit the Indian companies which were impacted heavily on the margin front over

the past few quarters. Going ahead, this cooling of commodity prices would not only

prove to be tailwinds but also aid in containing overall inflation and spur demand.

Maintain a positive view from a longer-term perspective – We believe that India is in

a relatively stronger position vs. other Advanced and Emerging economies that are

experiencing high inflation and lower growth. A lower devaluation of our currency

compared to other emerging nation’s currency is also a sign of strength and

resilience in our economy. Moreover, our strong fundamentals and external position

are expected to drive further investments and cushion us from external shocks,

respectively. At current levels, the Nifty is trading at a P/E multiple of 18.5x (Source:

Bloomberg) on rolling one-year consensus earnings, which is near its 5-year average

of 17.2x. Though the upside may be limited in the near term, the long-term prospects

remain intact given the low corporate leverage levels, the better position of financial

institutions, and the revival of the investment cycle in India.

Top Picks Performance

Return Since Inception (30th Oct, 2015)

Top Picks Return

188.10%

BSE 100

111.20%

Outperformance

76.90%

Source: Company, Angel Research

Top Picks

Company

CMP (`)

TP (`)

Auto

Sona BLW Precis.

460

843

Ramkrishna Forg.

238

256

Suprajit Engg.

332

485

Banking

Federal Bank

137

155

HDFC Bank

1509

1850

AU Small Finance

616

848

Chemical

P I Industries

3297

3700

Jubilant Ingrev.

535

700

IT

HCL Technologies

1047

1192

Others

Stove Kraft

623

805

Sobha

630

850

Amber Enterp.

2013

3850

Oberoi Realty

932

1150

Devyani Intl.

186

255

Marico

505

600

Source: Company, Angel Research

Note: Closing price as on 07

th

Nov, 2022

Research Analyst:

Purves Choudhari

(purves.chaudhari@angelbroking.com)

November 9, 2022

2

Angel Top Picks – November 2022

Top Picks

November 9, 2022

3

Angel Top Picks – November 2022

Federal Bank

Federal bank is one of India's largest old generation private sector banks.

At the end of Q1 FY’23 the bank had advances of `1.51 lakh cr. And

deposits of `1.83 lakh cr. The bank predominantly has a secured lending

book, which helped limit asset quality issues during the Covid 19

pandemic.

Federal Bank has posted a good set of numbers for Q1FY23 as NII and

Advances increased by 13.1%/16.9% YoY. Provisioning for the quarter

was down by 74% YoY because of which PAT was up by 64% YoY. GNPA

and NNPA ratio improved to 2.69% and 0.94% while restructuring

remained stable sequentially at 2.6% of advances.

Overall asset quality for the quarter improved in Q1FY23, which was in

line with our expectations. We expect asset quality to improve further in

FY2023 given normalization of the economy. We expect the Federal bank

to post NII/PPOP/PAT CAGR of 24.9%/29.1%/42.7% between FY2022-

24 and remain positive on the bank.

Key Finance

Y/E

NII

NIM

PAT

EPS

ABV

ROA

ROE

P/E

P/ABV

March

(` cr)

(%)

(` cr)

(`)

(`)

(%)

(%)

(x)

(x)

FY2023E

7,532

3.1

3,127.6

14.9

97.2

1.3

15.4

9.2

1.1

FY2024E

9,301

3.2

3,846.2

18.3

114.0

1.3

16.1

7.5

1.0

Source: Company, Angel Research

HDFC Bank

HDFC bank is India's largest private sector bank with a loan book of ₹ 13.95

lakh crore in Q1FY2023 and deposit base of ₹ 16.04 lakh crore. The Bank

has a very well spread-out book with wholesale constituting ~57% of the

asset book while retail accounted for the remaining ~44% of the loan book.

Q1FY2022 numbers were below expectations due to change in portfolo mix

towards corporate which resulted in contraction in NIM by 10bps YoY to

4.0%. Moreover, higher opex dragged down PPOP growth. The bank posted

NII/PPOP growth of 14.5%/1.5% for the quarter on the back of loan growth

of 21.6% YoY.

While operating numbers were below expectations, the bank posted an

improvement in asset quality as GNPA/ NNPA reduced by 19/13bps YoY to

1.28% and 0.35% of advances. Restructured advances at the end of the

quarter stood at 0.76% of advances. Given best in class asset quality,

expected rebound in retail credit growth we are positive on the bank given

reasonable valuations at 2.3xFY24, adjusted book which is at a discount to

historical averages.

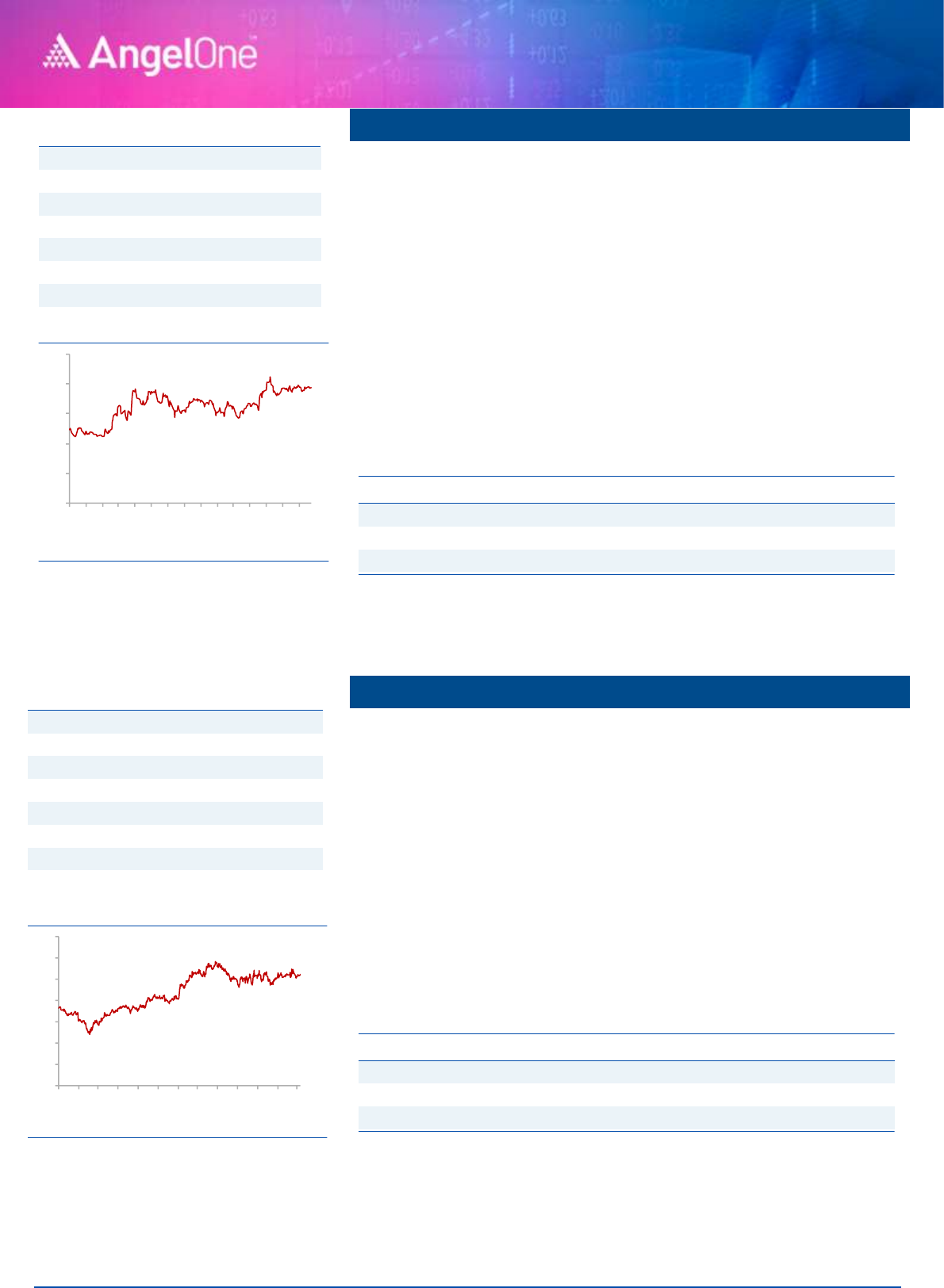

Stock Info

CMP

137

TP

155

Upside

13%

Sector

Banking

Market Cap (` cr)

29,171

Beta

1.2

52 Week High / Low

139/79

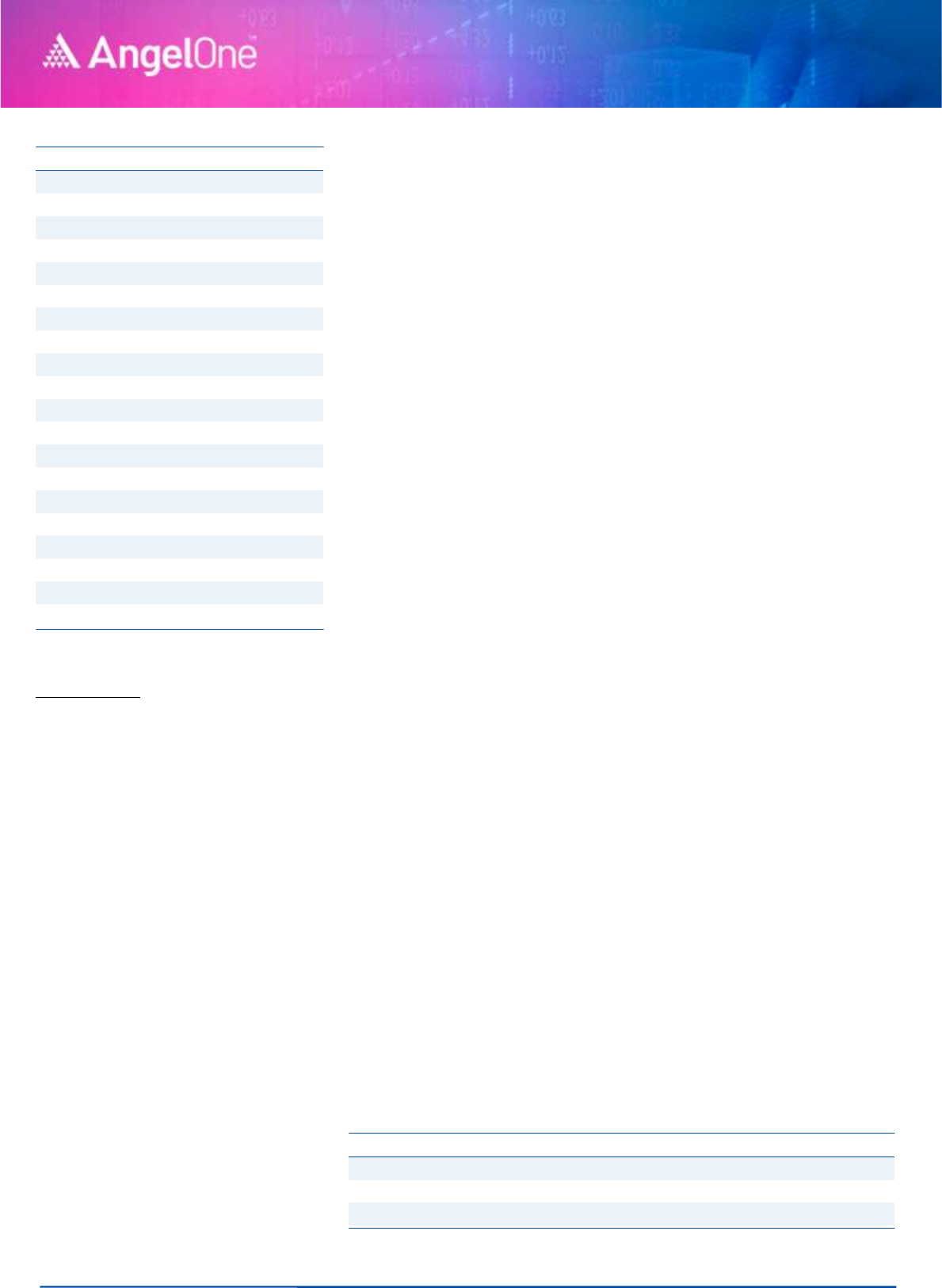

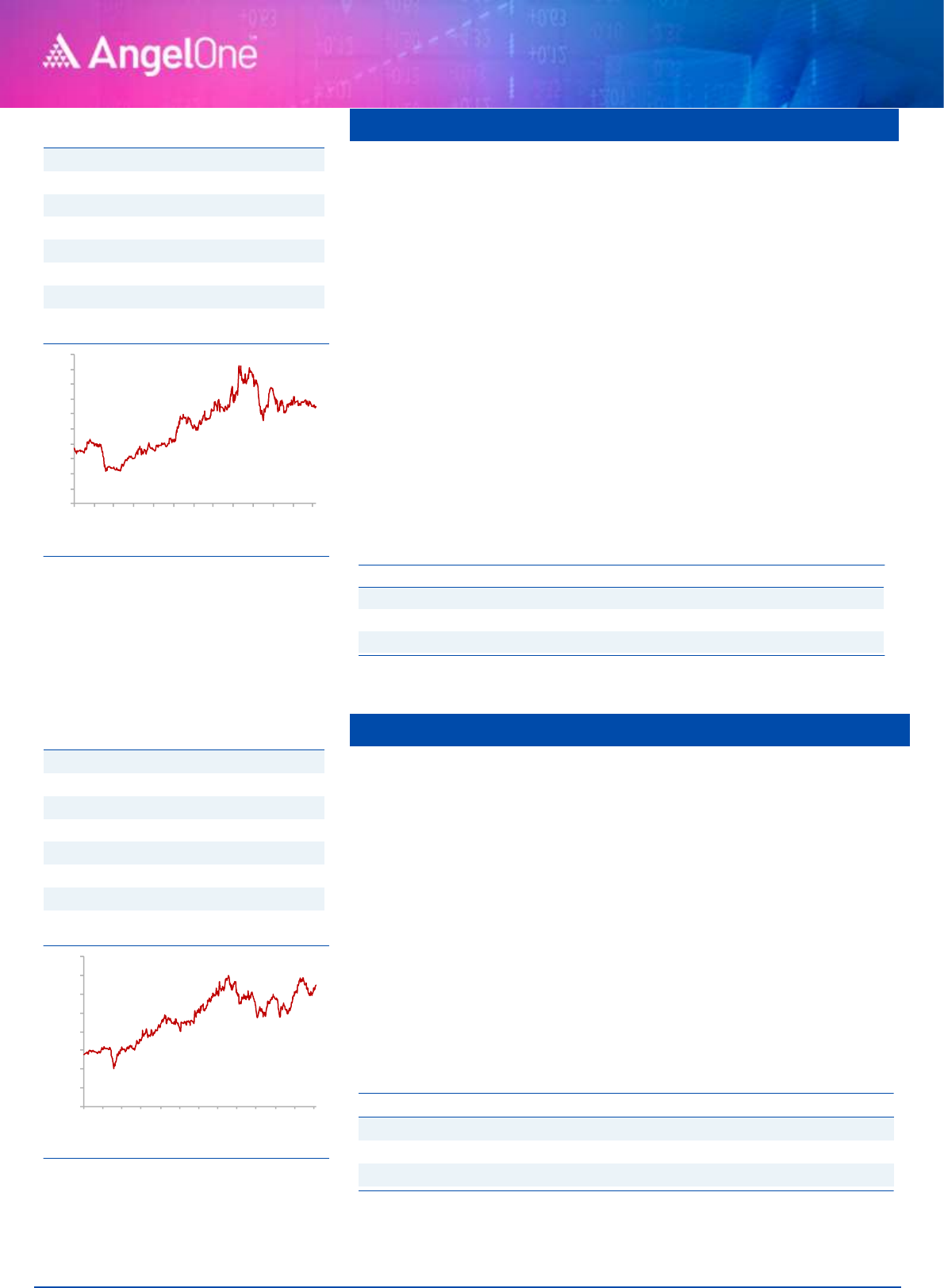

3-Year-Chart

-

20

40

60

80

100

120

140

160

Nov-19

Feb-20

May-20

Jul-20

Oct-20

Jan-21

Apr-21

Jul-21

Oct-21

Jan-22

Apr-22

Jul-22

Oct-22

Source: Company, Angel Research

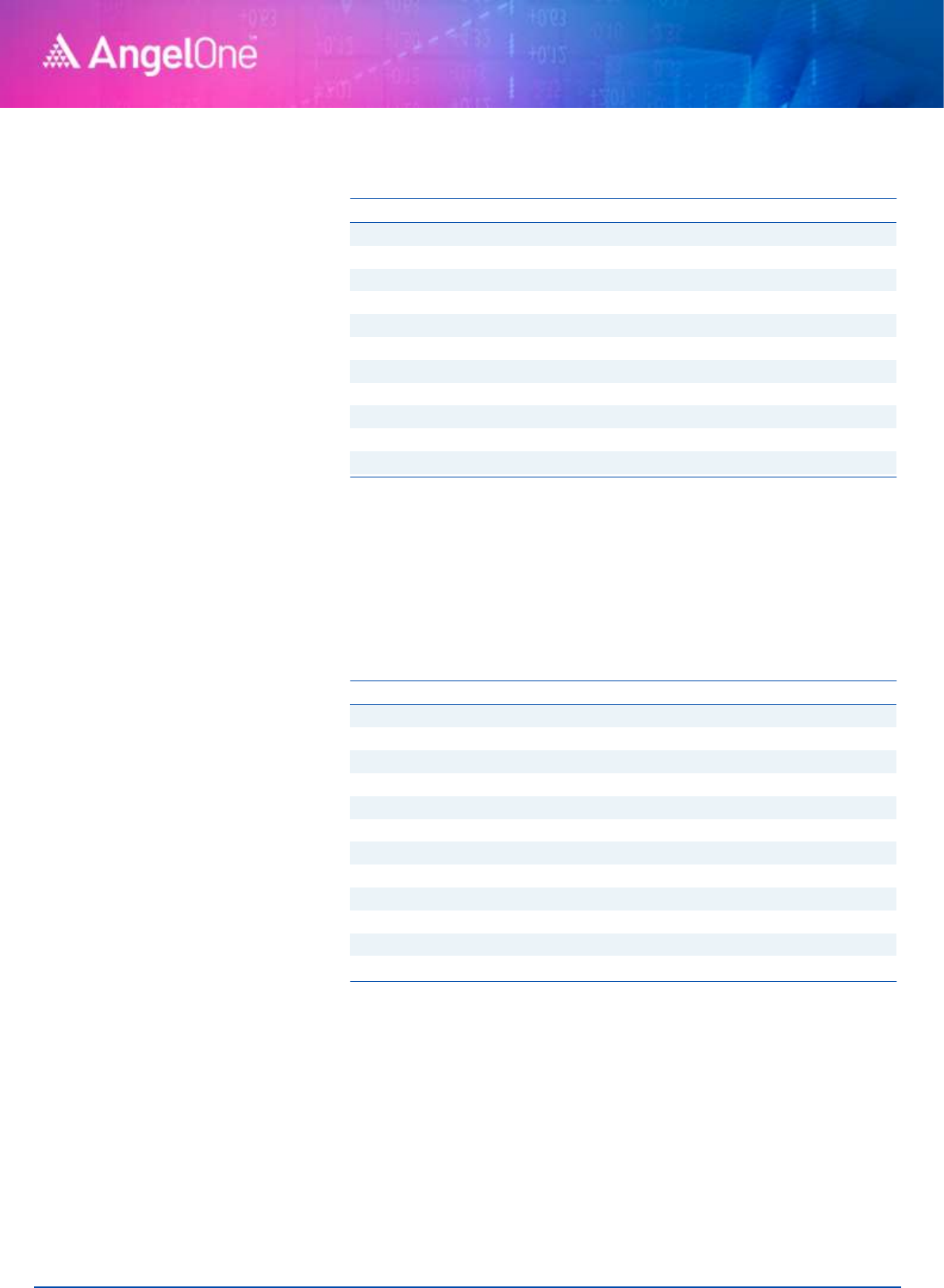

Stock Info

CMP

1509

TP

1850

Upside

23%

Sector

Banking

Market Cap (` cr)

844,328

Beta

1.1

52 Week High / Low

1722/1272

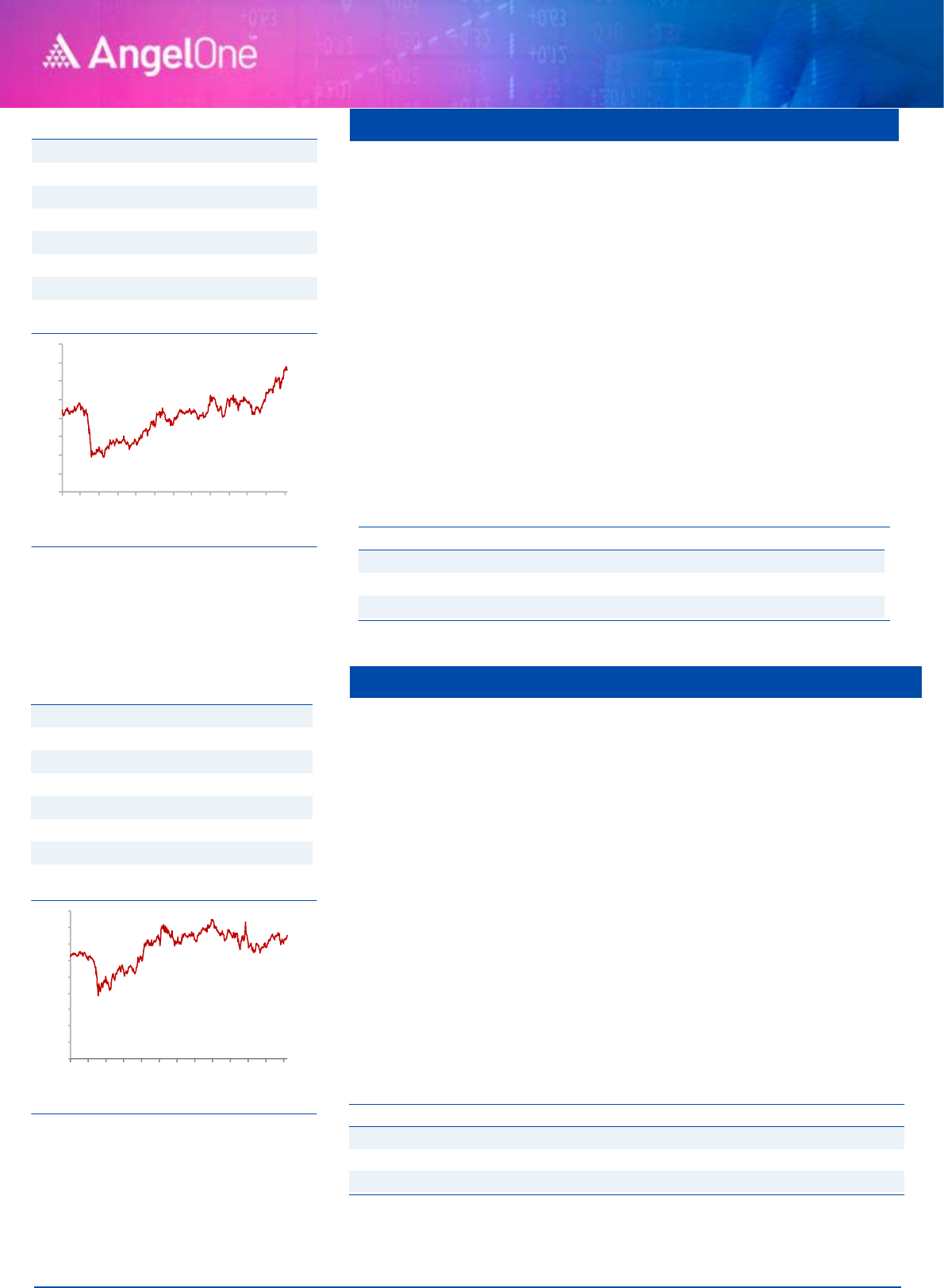

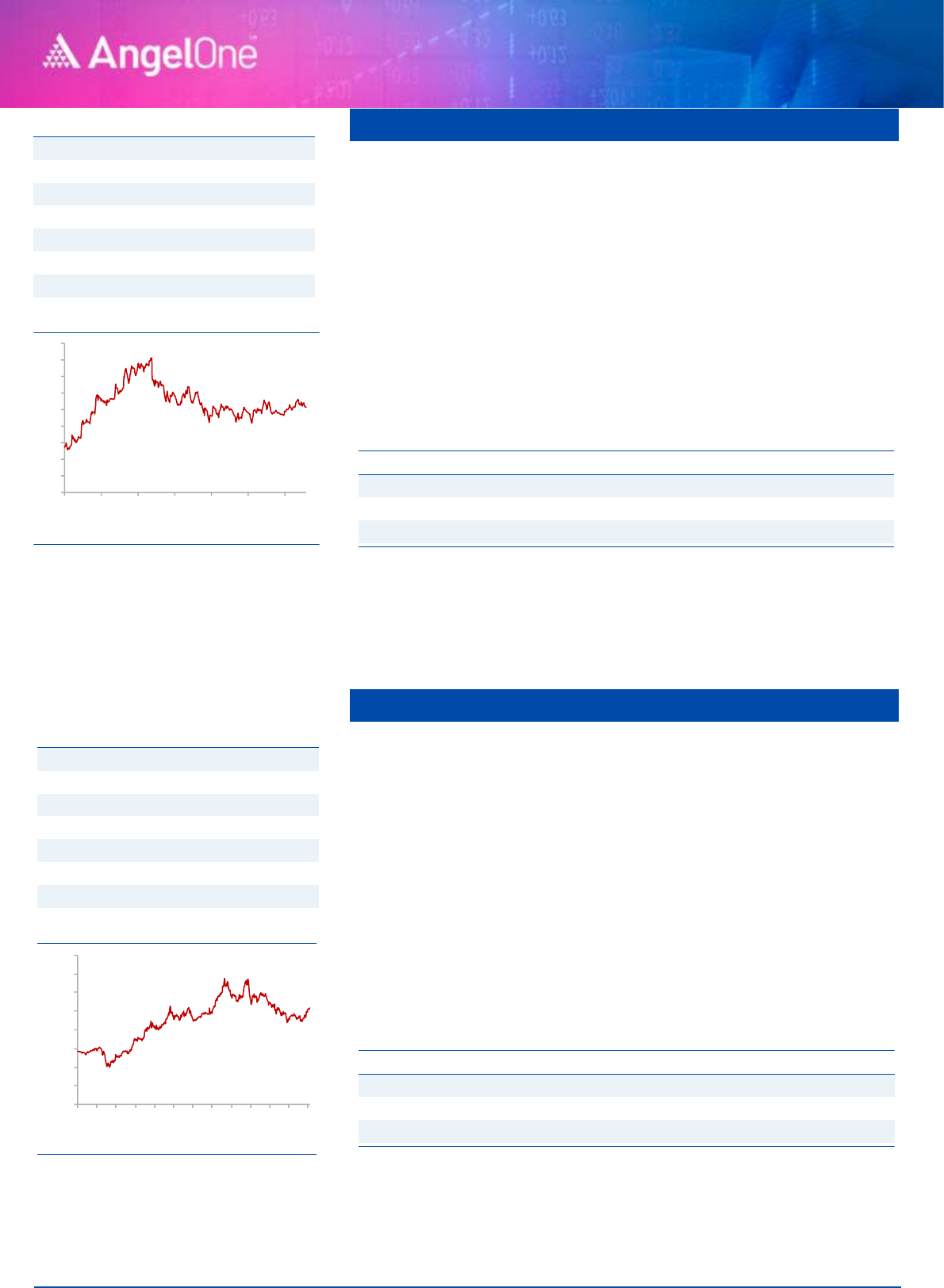

3-Year-Chart

-

200

400

600

800

1,000

1,200

1,400

1,600

1,800

Nov-19

Feb-20

May-20

Jul-20

Oct-20

Jan-21

Apr-21

Jul-21

Oct-21

Jan-22

Apr-22

Jul-22

Oct-22

Source: Company, Angel Research

Key Finance

Y/E

NII

NIM

PAT

EPS

ABV

ROA

ROE

P/E

P/ABV

March

(` cr)

(%)

(` cr)

(`)

(`)

(%)

(%)

(x)

(x)

FY2023E

85,512

4.0

46630

84.1

499.0

2.1

18.2

17.9

2.9

FY2024E

108,523

4.1

59845

107.9

606.0

2.2

19.4

14.0

2.4

Source: Company, Angel Research

November 9, 2022

4

Angel Top Picks – November 2022

AU Small Finance Bank

AU Small Finance Bank is one of the leading small finance banks with Total

Loan AUM of ~50,161Cr. at the end of Q1FY2023. It has a well-diversified

geographical presence across India. AU has a very high exposure to high

margin retail business, which accounted for 90% of its loan book as of

Q1FY2023.

AU continued to report very strong numbers in Q1FY2023 as GNPA/ NNPA

reduced by 243/170bps YoY to 1.96% and 0.56% of advances.

Restructured advances at the end of the quarter also declined to 2.1% from

2.5% of advances sequentially. The bank posted NII growth of 34.8% for

the quarter on the back of strong advances growth of 43.3% YoY while

NIMs for the quarter stood at 5.9%.

We expect AU SFB to post robust NII/PPOP/ PAT CAGR of

31.2%/31.9%/38.8% between FY2022-24 on the back of AUM CAGR of

32%. Reducing cost of funds will also help NIM expansion going forward.

We believe that the worst is over for the bank and expect continued

improvement in asset quality in FY2023, which should lead to a rerating.

Key Finance

Y/E

NII

NIM

PAT

EPS

ABV

ROA

ROE

P/E

P/ABV

March

(` cr)

(%)

(` cr)

(`)

(`)

(%)

(%)

(x)

(x)

FY2023E

4,517

5.5

1701

54.0

263.5

2.1

20.3

11.4

2.5

FY2024E

5,913

5.4

2174

69.0

332.5

2.0

21.1

8.9

1.9

Source: Company, Angel Research

Stock Info

CMP

616

TP

848

Upside

38%

Sector

Banking

Market Cap (` cr)

42,538

Beta

1.2

52 Week High / Low

733/468

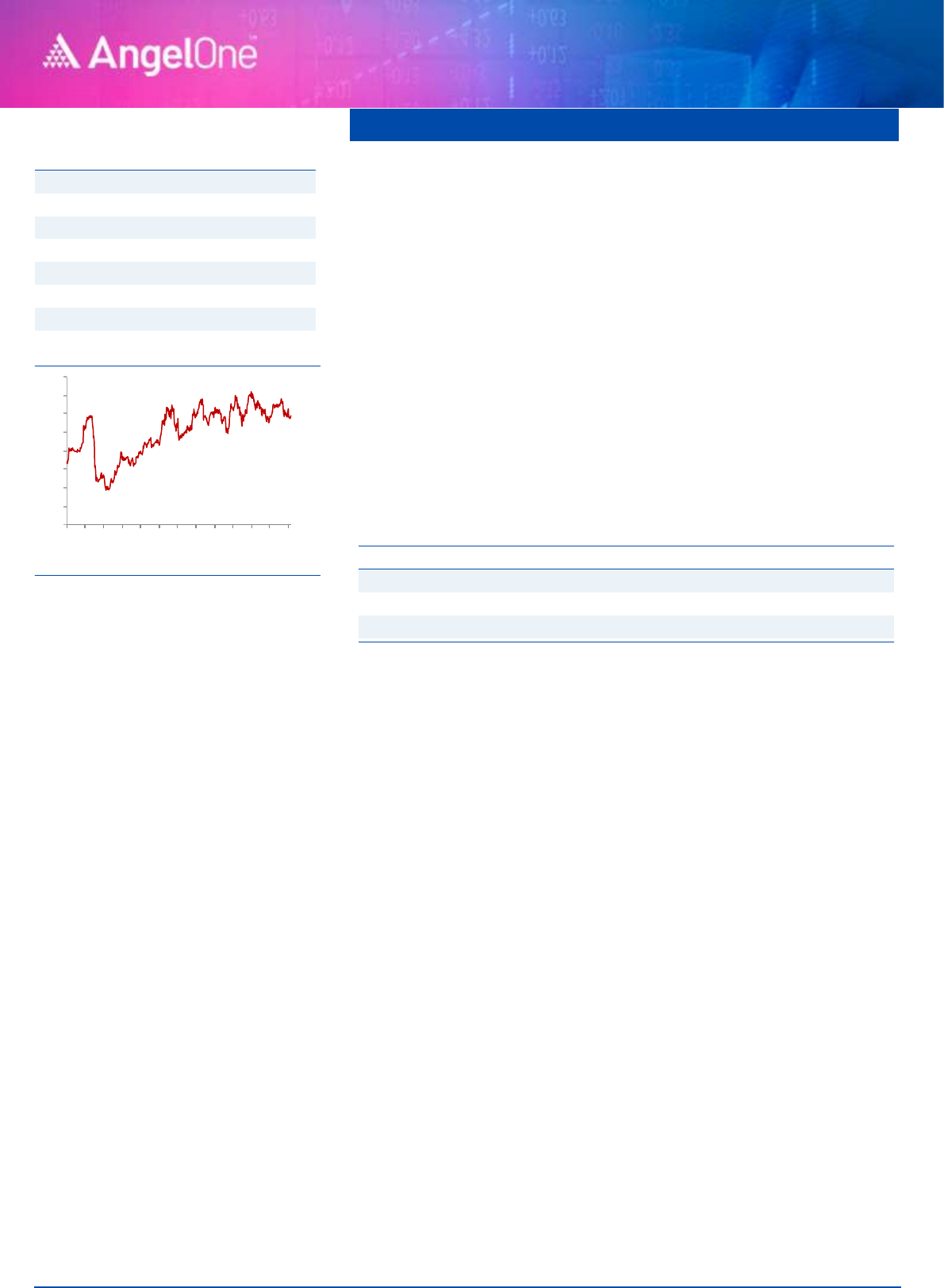

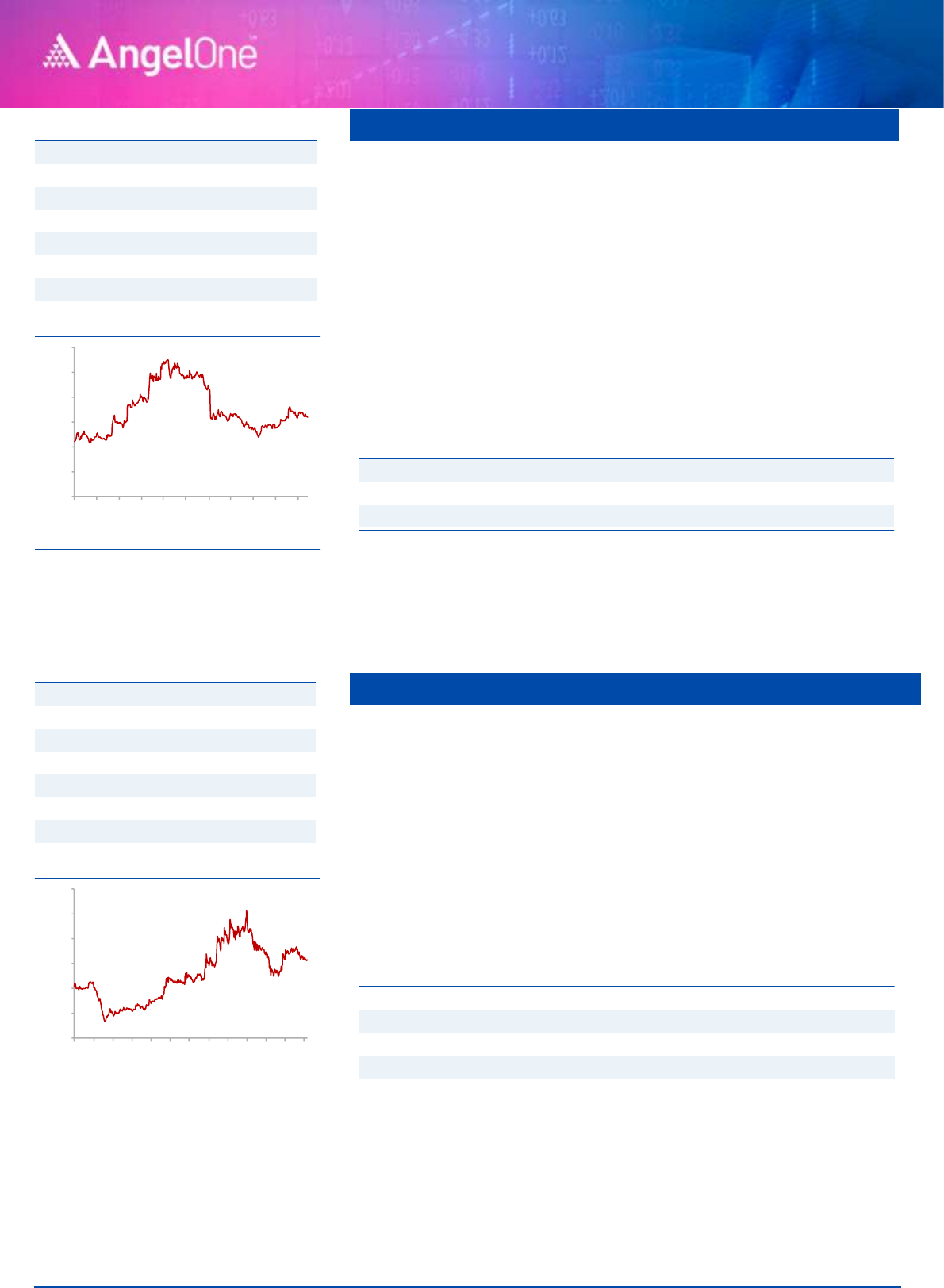

3-Year-Chart

-

100

200

300

400

500

600

700

800

Nov-19

Feb-20

May-20

Jul-20

Oct-20

Jan-21

Apr-21

Jul-21

Oct-21

Jan-22

Apr-22

Jul-22

Oct-22

Source: Company, Angel Research

November 9, 2022

5

Angel Top Picks – November 2022

Sona BLW Precis.

Sona BLW, one of India's leading automotive technology companies,

derives ~50% of its revenues from Battery Electric Vehicles (BEV) and

Hybrid Vehicles and stands to benefit from the global electrification trend.

Sona BLW has a strong positioning in the Indian Differential Gears market

across PV, CV, and tractor OEMs and it continues to gain market share

globally aided by its combined motor and driveline capabilities. Focus on

R&D is yielding results in new product development, which is likely to aid

further growth.

Sona BLW continues to add new customers and win new orders and its

order book stands at `20,600 Cr which along with its strong financial

profile and expected ~45% earnings CAGR over FY22-24E justifies the

premium multiples of ~45x FY24E EPS.

Key Finance

Y/E

Sales

OPM

PAT

EPS

ROE

P/E

P/BV

EV/Sales

March

(` cr)

(%)

(` cr)

(`)

(%)

(x)

(x)

(x)

FY2023E

2,915

26.5

451

7.7

21.1

59.7

14.7

11.5

FY2024E

4,066

29.2

739

12.6

29.7

36.5

12.3

8.2

Source: Company, Angel Research

Ramakrishna forg.

Ramkrishna Forgings (RKFL), a leading forging player in India and among

a select few having heavy press, stands to benefit from a favorable

demand outlook for the Medium & Heavy Commercial Vehicle (M&HCV)

industry in domestic and other key geographies in the near term.

The company has phased out its CAPEX over the past few years during

which it was impacted by industry slowdown in certain periods. With the

end to the CAPEX cycle, the favorable outlook in the medium term, and

sufficient capacity in place, we believe RKFL volumes would be able to

post a volume CAGR of 14% over FY22-24E.

RKFL has been able to add new products which have higher value

addition. Better mix along with operating leverage aided ~520 bps YoY

improvement in EBITDA margins in FY22 and are expected to sustain

going ahead.

Key Finance

Y/E

Sales

OPM

PAT

EPS

ROE

P/E

P/BV

EV/Sales

March

(` cr)

(%)

(` cr)

(`)

(%)

(x)

(x)

(x)

FY2023E

2,688

23.5

261

16.3

19.7

14.5

2.0

1.3

FY2024E

3,074

24.1

339

21.2

21.0

11.2

1.6

1.1

Source: Company, Angel Research

Stock Info

CMP

460

TP

843

Upside

83%

Sector

Auto

Market Cap (` cr)

26,902

Beta

1.3

52 Week High / Low

839/453

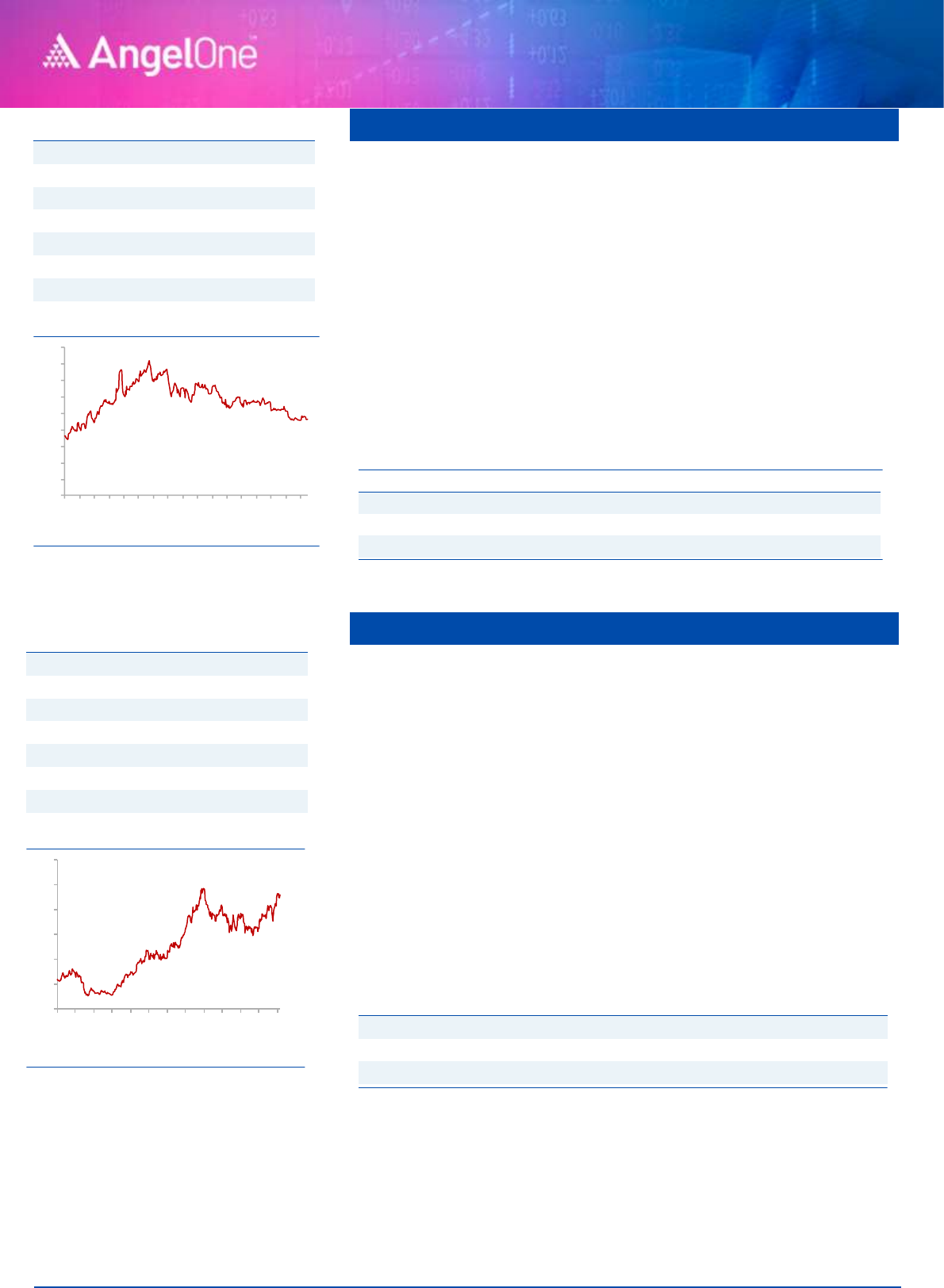

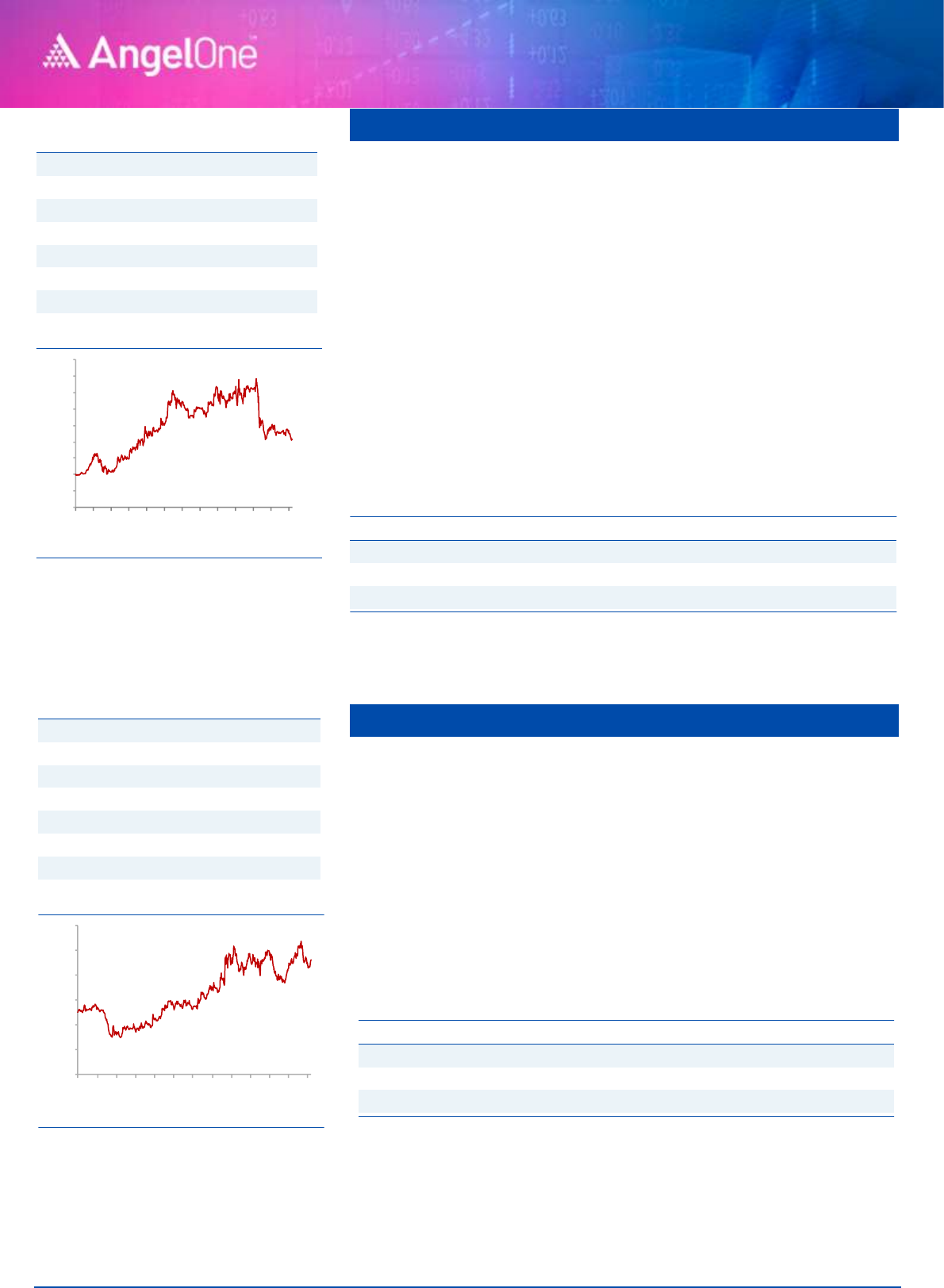

14-Month-Chart

-

100

200

300

400

500

600

700

800

900

Jun-21

Jul-21

Aug-21

Sep-21

Oct-21

Nov-21

Dec-21

Jan-22

Feb-22

Mar-22

Apr-22

May-22

Jun-22

Jul-22

Aug-22

Sep-22

Oct-22

Source: Company, Angel Research

Stock Info

CMP

238

TP

256

Upside

8%

Sector

Auto

Market Cap (` cr)

3,832

Beta

1.2

52 Week High / Low

244/146

3-Year-Chart

-

50

100

150

200

250

300

Nov-19

Feb-20

May-20

Jul-20

Oct-20

Jan-21

Apr-21

Jul-21

Oct-21

Jan-22

Apr-22

Jul-22

Oct-22

Source: Company, Angel Research

November 9, 2022

6

Angel Top Picks – November 2022

Suprajit Eng.

Suprajit Engineering (SEL) is the largest supplier of automotive cables to

the domestic OEMs with a presence across both 2Ws and PVs. Over the

years, SEL has evolved from a single product/client company in India to

have a diversified exposure which coupled with its proposition of low-cost

player has enabled it to gain market share and more business from

existing customers.

SEL overall has outperformed the Indian Auto industry in recent years

aided by market share gains as well as commercialization of new

products. The company believes that consolidation of vendors and new

client additions would help in maintaining the trend of market/wallet

share gains.

SEL has grown profitably over the years and as a result, it boasts a strong

balance sheet (net cash). We believe SEL is a prime beneficiary of a ramp-

up in production by OEMs and its newly developed products for EVs would

support revenues due to higher kit value. Its premium valuations are

justified in our opinion owing to its strong outlook and top-grade quality

of earnings.

Key Finance

Y/E

Sales

OPM

PAT

EPS

ROE

P/E

P/BV

EV/Sales

March

(` cr)

(%)

(` cr)

(`)

(%)

(x)

(x)

(x)

FY2023E

2,794

14.4

221

16.0

19.2

21.0

3.7

1.8

FY2024E

3,132

14.8

266

19.2

22.8

17.3

4.1

1.7

Source: Company, Angel Research

P I Industries

PI Industries is a leading player in providing Custom synthesis and

manufacturing solutions (CSM) to global agrochemical players. The CSM

business accounted for over 70% of the company's revenues in FY22 and is

expected to be the key growth driver for the company in future.

The company has been increasing it's share of high margin CSM business

driven by strong relationship with global agrochemical players. PI is

leveraging its chemistry skill sets and is looking to diversify its CSM portfolio

to electronic chemicals, Pharma API, fluoro chemicals, etc. which will help

drive business.

We expect PI Industries to post revenue/PAT CAGR of 17%/24% between

FY22-FY24 driven by 20% growth in the CSM business over the next 2-3

years. Moreover foray into new segments like electronic chemicals and APIs

will also help drive growth over next 3-4 years for the company.

Key Finance

Y/E

Sales

OPM

PAT

EPS

ROE

P/E

P/BV

EV/Sales

March

(` cr)

(%)

(` cr)

(`)

(%)

(x)

(x)

(x)

FY2023E

6,181

23.0

1064

70.0

15.0

47.1

5.7

6.2

FY2024E

7,194

23.8

1299

85.5

15.6

38.6

4.9

5.2

Source: Company, Angel Research

Stock Info

CMP

332

TP

485

Upside

46%

Sector

Auto

Market Cap (` cr)

4,608

Beta

1.3

52 Week High / Low

478/272

3-Year-Chart

-

50

100

150

200

250

300

350

400

450

500

Nov-19

Feb-20

May-20

Jul-20

Oct-20

Jan-21

Apr-21

Jul-21

Oct-21

Jan-22

Apr-22

Jul-22

Oct-22

Source: Company, Angel Research

Stock Info

CMP

3297

TP

3700

Upside

12%

Sector

Chemical

Market Cap (` cr)

56,013

Beta

0.9

52 Week High / Low

3699/2334

3-Year-Chart

-

500

1,000

1,500

2,000

2,500

3,000

3,500

4,000

Nov-19

Feb-20

May-20

Jul-20

Oct-20

Jan-21

Apr-21

Jul-21

Oct-21

Jan-22

Apr-22

Jul-22

Oct-22

Source: Company, Angel Research

November 9, 2022

7

Angel Top Picks – November 2022

Jubilant Ingrev.

Jubilant Ingrevia was formed by spinning off the chemical and life science

ingredients of Jubilant Life Sciences Ltd. The company has a vast array of

products across its three divisions and is one of the top two producers of

Pyridine - Beta and vitamin B3 globally.

The company derives 56% of its revenues from the life science chemicals

division while the specialty chemicals and nutrition & health solution

business account for 28% and 15% of revenues respectively.

At current levels the stock is trading at P/E multiple of ~13.5xFY24 EPS

which is at a significant discount to other chemical companies. Therefore,

we believe that there is value in the stock at current levels and hence rate

it a BUY.

Key Finance

Y/E

Sales

OPM

PAT

EPS

ROE

P/E

P/BV

EV/Sales

March

(` cr)

(%)

(` cr)

(`)

(%)

(x)

(x)

(x)

FY2023E

5,020

17.0

544

34.2

19.9

15.5

2.9

1.6

FY2024E

5,572

17.4

633

39.7

19.5

13.5

2.4

1.4

Source: Company, Angel Research

HCL Technologies

HCL Tech (HCLT) is amongst the top four IT services companies based out

of India and provides a vast gamut of services like ADM, Enterprise

solutions, Infrastructure management services, etc.

IT services growth of over 2.7% QoQ CC in Q1FY23 which largely broad-

based and due to recovery in Products which grew by 5.1% QoQ CC.

New deal TCV at USD 2.1bn was up by 23% YoY and included many

large deals. Strong deal wins will help drive growth in the services

business, which should make up for the continued softness in the product

business.

At CMP, the stock is trading at a significant discount to the other large-

cap IT companies like Infosys and TCS and offers tremendous value at

current levels given market leader status in Infrastructure management.

Key Finance

Y/E

Sales

OPM

PAT

EPS

ROE

P/E

P/BV

EV/Sales

March

(` cr)

(%)

(` cr)

(`)

(%)

(x)

(x)

(x)

FY2023E

98,316

22.0

14,028

52.3

21.9

20.0

4.1

2.4

FY2024E

1,08,179

22.6

16,017

59.6

23.7

17.6

3.8

2.2

Source: Company, Angel Research

Stock Info

CMP

535

TP

700

Upside

31%

Sector

Chemical

Market Cap (` cr)

8,850

Beta

1.7

52 Week High / Low

674/401

18-Months-Chart

-

100

200

300

400

500

600

700

800

900

Mar-21

Jun-21

Sep-21

Dec-21

Mar-22

Jun-22

Sep-22

Source: Company, Angel Research

-

200

400

600

800

1,000

1,200

1,400

1,600

Jul-19

Sep-19

Dec-19

Mar-20

Jun-20

Sep-20

Dec-20

Mar-21

Jun-21

Sep-21

Dec-21

Mar-22

Jun-22

Stock Info

CMP

1047

TP

1192

Upside

14%

Sector

IT

Market Cap (` cr)

286,275

Beta

0.8

52 Week High / Low

1359/876

3-Year-Chart

-

200

400

600

800

1,000

1,200

1,400

1,600

Nov-19

Feb-20

May-20

Jul-20

Oct-20

Jan-21

Apr-21

Jul-21

Oct-21

Jan-22

Apr-22

Jul-22

Oct-22

Source: Company, Angel Research

November 9, 2022

8

Angel Top Picks – November 2022

Stove Kraft

Stove Kraft Ltd (SKL) is engaged in the business of manufacturing & selling

Kitchen & Home appliances products like pressure cookers, LPG stoves, non-

stick cookware etc. under the brand name of 'Pigeon' and 'Gilma'.

In the Pressure Cookers and Cookware segment, over the last two years, the

company has outperformed Industry and its peers. Post Covid, organized

players are gaining market share from unorganized players which would

benefit the player like SKL.

Going forward, we expect SKL to report healthy top-line & bottom-line growth

on the back of new product launches, strong brand name and wide

distribution network.

Key Finance

Y/E

Sales

OPM

PAT

EPS

ROE

P/E

P/BV

EV/Sales

March

(` cr)

(%)

(` cr)

(`)

(%)

(x)

(x)

(x)

FY2023E

1,341

8.4

62.6

19.2

14.7

32.5

4.2

1.3

FY2024E

1,582

9.1

86.0

26.4

16.8

23.6

3.5

1.1

Source: Company, Angel Research

Sobha

Company operates in Residential & Commercial real-estate along with

Contractual business. Companies 64% of residential pre-sales come from the

Bangalore market, which is one of the IT hubs in India, we expect new hiring by

the IT industry will increase residential demand in the South India market.

Ready to move inventory and under construction inventory levels have moved

down to its lowest levels. Customers are now having preference towards the

branded players like Sobha Developers.

Company expected new projects/phase spread over 13.53mn sqft across 7

cities. Majority of launches will be coming from existing land banks. Company

having land bank of approx. 200mn Sqft of salable area.

Key Finance

Y/E

Sales

OPM

PAT

EPS

ROE

P/E

P/BV

EV/Sales

March

(` cr)

(%)

(` cr)

(`)

(%)

(x)

(x)

(x)

FY2023E

3,350

58.0

457.0

48.1

15.6

13.1

1.7

1.9

FY2024E

3,752

59.0

524.0

55.4

16.2

11.4

1.5

1.7

Source: Company, Angel Research

Stock Info

CMP

623

TP

805

Upside

29%

Sector

Others

Market Cap (` cr)

2,143

Beta

0.8

52 Week High / Low

1080/472

17-Months-Chart

-

200

400

600

800

1,000

1,200

Feb-21

Apr-21

Jun-21

Aug-21

Oct-21

Dec-21

Feb-22

Apr-22

Jun-22

Aug-22

Oct-22

Source: Company, Angel Research

Stock Info

CMP

630

TP

850

Upside

35%

Sector

Others

Market Cap (` cr)

5,956

Beta

1.2

52 Week High / Low

1045/480

3-Year-Chart

-

200

400

600

800

1,000

1,200

Nov-19

Feb-20

May-20

Jul-20

Oct-20

Jan-21

Apr-21

Jul-21

Oct-21

Jan-22

Apr-22

Jul-22

Oct-22

Source: Company, Angel Research

November 9, 2022

9

Angel Top Picks – November 2022

Amber Enterp.

Amber Enterprises India Ltd. (Amber) is the market leader in the room air

conditioners (RAC) outsourced manufacturing space in India. Amber would

outperform the industry due to dominant position in Room AC contract

manufacturer, increase in share of business in existing customers and new

client additions.

Amber plans to increase revenues from components (by increasing product

offerings, catering to newer geographies, adding new clients) and exports

(already started in the Middle east). In the past 2-3 year, Amber has acquired

companies like IL JIN Electronics, Ever and Sidwal Refrigeration Industries,

which would help in backward integration and also help the company to foray

in different segments like railway, metro and defense.

Going forward, we expect healthy profitability on back of foray into the

Commercial AC segment, entry into export markets, participation in the PLI

scheme.

Key Finances

Y/E

Sales

OPM

PAT

EPS

ROE

P/E

P/BV

EV/Sales

March

(` cr)

(%)

(` cr)

(`)

(%)

(x)

(x)

(x)

FY2023E

5,522

7.4

208

61.8

16.4

32.5

4.4

1.5

FY2024E

6,850

8.0

304

90.2

18.8

22.3

4.1

1.2

Source: Company, Angel Research

Oberoi Realty

Oberoi Realty is a real-estate company, focusing on the MMR region.

Company having business vertices of residential and commercial real-

estate.

Company has reported a strong set of numbers in Q4FY22, we expect

residential real-estate growth momentum to continue for the next couple of

quarters as in Q1FY23 company has launched Elysian Tower B in Goregon

along with this upcoming launch of Thane in current year.

We have seen good consolidation in across India towards top-10 players.

Top-10 players now holds 11.2% market share as compared to 5.4% in 2017.

We believes that top-10 players will continue to gain market share.

Key Finance

Y/E

Sales

OPM

PAT

EPS

ROE

P/E

P/BV

EV/Sales

March

(` cr)

(%)

(` cr)

(`)

(%)

(x)

(x)

(x)

FY2023E

3,621

59.0

1502

41.2

12.9

22.5

2.6

8.6

FY2024E

4,055

59.2

1550

42.6

13.1

21.9

2.6

8.2

Source: Company, Angel Research

Stock Info

CMP

2013

TP

3850

Upside

91%

Sector

Others

Market Cap (` cr)

6,815

Beta

0.5

52 Week High / Low

4024/1971

3-Year-Chart

-

500

1,000

1,500

2,000

2,500

3,000

3,500

4,000

4,500

Nov-19

Feb-20

May-20

Jul-20

Oct-20

Jan-21

Apr-21

Jul-21

Oct-21

Jan-22

Apr-22

Jul-22

Oct-22

Source: Company, Angel Research

Stock Info

CMP

932

TP

1150

Upside

23%

Sector

Others

Market Cap (` cr)

34,097

Beta

1.5

52 Week High / Low

1088/726

3-Year-Chart

-

200

400

600

800

1,000

1,200

Nov-19

Feb-20

May-20

Jul-20

Oct-20

Jan-21

Apr-21

Jul-21

Oct-21

Jan-22

Apr-22

Jul-22

Oct-22

Source: Company, Angel Research

November 9, 2022

10

Angel Top Picks – November 2022

Devyani Intl.

Devyani International Ltd. (DIL) is Yum! Brands’ largest franchisee in India,

with more than 800 stores including KFC, Pizza Hut and Costa Coffee.

Currently, DIL operates 339 KFC stores, 391 Pizza Hut stores, 50 Costa Coffee

stores in India and balance stores from other brands and from international

locations.

QSR industry is expected to grow ~23% CAGR over FY20-25 which would

benefit the player like DIL. Going ahead, We expect DIL would add 200 stores

per annum (at least 3-4 year) which would drive strong revenue growth.

Lower capex (shifted its strategy to smaller & delivery-focused stores) and

improving store-level economics would boost the operating margin going

ahead. Going forward, we expect DIL to report strong top-line growth &

improvement in operating on the back of aggressive store addition, improving

store unit economics and strong brand.

Key Finance

Y/E

Sales

OPM

PAT

EPS

ROE

P/E

P/BV

EV/Sales

March

(` cr)

(%)

(` cr)

(`)

(%)

(x)

(x)

(x)

FY2023E

2,990

23.0

258

2.4

27.3

77.4

20.5

5.9

FY2024E

3,947

23.4

410

3.9

30.3

47.7

14.3

5.2

Source: Company, Angel Research

Marico

Marico is one of the major FMCG companies present in hair oil, edible oil,

foods & personal care segment. Major brands include Parachute, Saffola,

Nihar, Hair & Care, Set Wet, Livon & Beardo.

Marico’s products have strong brand recall coupled with an extensive

distribution reach of more than 5mn outlets and direct reach of ~1 million

outlets. Parachut flagship brand gained market share by 170 bps in FY22 &

expected to performance better going ahead.

In the medium term, the company aspires to grow revenue at 13-15% with

8-10% volume growth. Marico has a strong balance sheet along with free cash

flow and higher profitability. We expect Marico to report healthy bottom-line

CAGR of ~11% over FY2022-24E due to better volume growth on the back

of strong brand, wide distribution network.

Key Finance

Y/E

Sales

OPM

PAT

EPS

ROE

P/E

P/BV

EV/Sales

March

(` cr)

(%)

(` cr)

(`)

(%)

(x)

(x)

(x)

FY2023E

10,368

17.9

1287

10.2

30.3

49.5

15.3

6.2

FY2024E

11,301

18.8

1478

11.7

28.0

43.2

12.3

5.6

Source: Company, Angel Research

Stock Info

CMP

186

TP

255

Upside

37%

Sector

Others

Market Cap (` cr)

22,306

Beta

1.4

52 Week High / Low

215/135

14-Month-Chart

-

50

100

150

200

250

Aug-21

Sep-21

Oct-21

Nov-21

Dec-21

Jan-22

Feb-22

Mar-22

Apr-22

May-22

Jun-22

Jul-22

Aug-22

Sep-22

Oct-22

Source: Company, Angel Research

Stock Info

CMP

505

TP

600

Upside

19%

Sector

Others

Market Cap (` cr)

65,015

Beta

1.2

52 Week High / Low

566/456

3-Year-Chart

-

100

200

300

400

500

600

700

Nov-19

Feb-20

May-20

Jul-20

Oct-20

Jan-21

Apr-21

Jul-21

Oct-21

Jan-22

Apr-22

Jul-22

Oct-22

Source: Company, Angel Research

November 9, 2022

11

Angel Top Picks – November 2022

Stock bought in last 12 Months

Stock

Date

Reco

Price

Marico

14-Jun-22

BUY

498.00

Devyani Intl.

9-Feb-22

BUY

175.00

Oberoi Realty

7-Jan-22

BUY

922

Jubilant Ingrev.

31-Dec-21

BUY

565

HCL Technologies

20-Dec-21

BUY

1,159

Ramkrishna Forg.

13-Oct-21

BUY

244

Whirlpool India

29-Sep-21

BUY

2,299

Lemon Tree Hotel

23-Sep-21

BUY

43.25

Sobha

22-Sep-21

BUY

729.00

Amber Enterp.

14-Sep-21

BUY

3243.00

P I Industries

9-Sep-21

BUY

3,420

Source: Company, Angel Research

Stock sold in last 12 Months

Stock

Date

Reco

Price

Ashok Leyland

5-Sep-22

EXIT

165

Carborundum Uni.

28-Feb-22

EXIT

813

Safari Inds.

10-Feb-22

EXIT

942.00

Lemon Tree Hotel

17-Dec-21

EXIT

47.25

Shri.City Union.

6-Dec-21

EXIT

2,066

Whirlpool India

3-Nov-21

EXIT

2,074

GNA Axles

19-Oct-21

EXIT

1,076

L & T Infotech

27-Sep-21

EXIT

5,950

Bajaj Electrical

24-Sep-21

EXIT

1,499

Dalmia BharatLtd

22-Sep-21

EXIT

2,143

Crompton Gr. Con

14-Sep-21

EXIT

484.00

Sobha

7-Sep-21

EXIT

780

Source: Company, Angel Research

November 9, 2022

12

Angel Top Picks – November 2022

Ratings (Based on Expected Returns: Buy (> 15%) Accumulate (5% to 15%) Neutral (-5 to 5%)

Over 12 months investment period) Reduce (-5% to -15%) Sell (< -15%)

Hold (Fresh purchase not recommended)

Research Team Tel: 022 - 40003600 E-mail: [email protected] Website: www.angelone.in

DISCLAIMER

Angel One Limited (hereinafter referred to as “Angel”) is a registered Member of National Stock Exchange of India Limited, Bombay Stock

Exchange Limited and Metropolitan Stock Exchange Limited. It is also registered as a Depository Participant with CDSL and Portfolio Manager

and investment advisor with SEBI. It also has registration with AMFI as a Mutual Fund Distributor. Angel One Limited is a registered entity with

SEBI for Research Analyst in terms of SEBI (Research Analyst) Regulations, 2014 vide registration number INH000000164. Angel or its

associates has not been debarred/ suspended by SEBI or any other regulatory authority for accessing /dealing in securities Market.

This document is solely for the personal information of the recipient, and must not be singularly used as the basis of any investment decision.

Nothing in this document should be construed as investment or financial advice. Each recipient of this document should make such

investigations as they deem necessary to arrive at an independent evaluation of an investment in the securities of the companies referred to

in this document (including the merits and risks involved), and should consult their own advisors to determine the merits and risks of such an

investment.

Angel or its associates or research analyst or his relative may have actual/beneficial ownership of 1% or more in the securities of the subject

company at the end of the month immediately preceding the date of publication of the research report. Neither Angel or its associates nor

Research Analysts or his relative has any material conflict of interest at the time of publication of research report.

Angel or its associates might have received any compensation from the companies mentioned in the report during the period preceding twelve

months from the date of this report for services in respect of managing or co-managing public offerings, corporate finance, investment

banking or merchant banking, brokerage services or other advisory service in a merger or specific transaction in the normal course of

business. Angel or its associates did not receive any compensation or other benefits from the companies mentioned in the report or third party

in connection with the research report. Neither Angel nor its research analyst entity has been engaged in market making activity for the subject

company.

Reports based on technical and derivative analysis center on studying charts of a stock's price movement, outstanding positions and trading

volume, as opposed to focusing on a company's fundamentals and, as such, may not match with a report on a company's fundamentals.

Investors are advised to refer the Fundamental and Technical Research Reports available on our website to evaluate the contrary view, if any.

The information in this document has been printed on the basis of publicly available information, internal data and other reliable sources

believed to be true, but we do not represent that it is accurate or complete and it should not be relied on as such, as this document is for

general guidance only. Angel One Limited or any of its affiliates/ group companies shall not be in any way responsible for any loss or damage

that may arise to any person from any inadvertent error in the information contained in this report. Angel One Limited has not independently

verified all the information contained within this document. Accordingly, we cannot testify, nor make any representation or warranty, express

or implied, to the accuracy, contents or data contained within this document. While Angel One Limited endeavors to update on a reasonable

basis the information discussed in this material, there may be regulatory, compliance, or other reasons that prevent us from doing so.

This document is being supplied to you solely for your information, and its contents, information or data may not be reproduced, redistributed

or passed on, directly or indirectly.

Neither Angel One Limited, nor its directors, employees or affiliates shall be liable for any loss or damage that may arise from or in connection

with the use of this information. Angel or its associates or Research Analyst or his relative might have financial interest in the subject company.

Research analyst has not served as an officer, director or employee of the subject company.