Angel Top Picks - January 2018

Top Picks

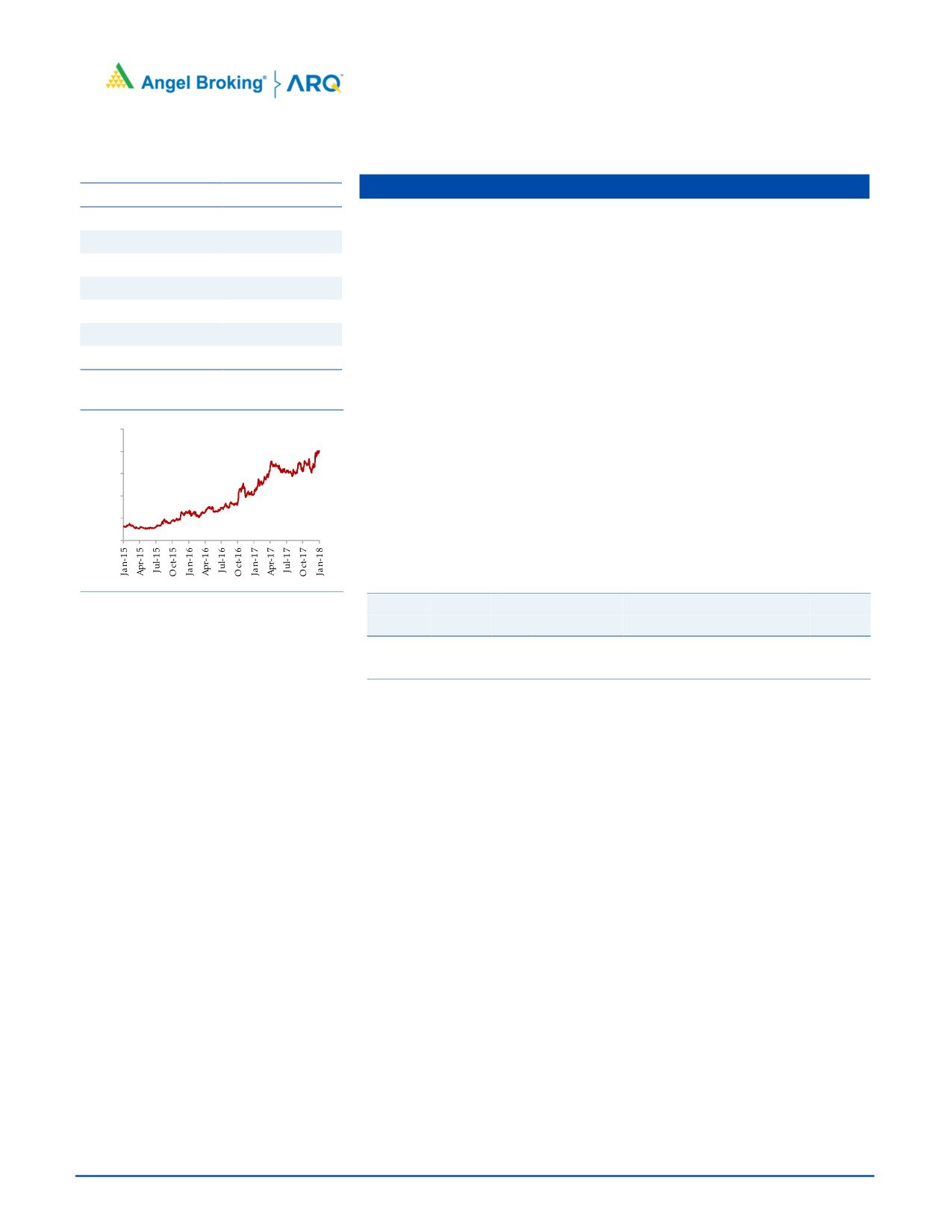

2017 has been a strong year for Indian equities, Indian markets were among one

Company

CMP (`) TP (`)

of the top global equity markets with ~28% returns in the calendar year 2017. The

positive trajectory is expected to continue in CY2018 with expectations of revival in

Banking/NBFC

corporate earnings, lower interest rates and continued inflow by domestic

Dewan Housing

583

712

investors. 2018 is expected to again see a double digit returns paving way for

GIC Housing Finance

456

655

further compounding of investor’s returns. We wish investors a very happy new

Karur Vysya Bank

122

161

year ahead, happy investing.

Consumption

Asian Granito

569

639

GST, key highlight of the year - 2017 saw implementation of major indirect

Blue Star

818

883

tax reform. The implementation of Goods and Services Tax (GST) is expected a

Siyaram Silk Mills

720

813

major milestone. In 1QFY18, the prior quarter to GST implementation, GDP

LT Foods

91

102

growth tanked to multiyear lows, however the 2QFY18 has shown a rebound.

The GST is expected to formalize the economy boosting government’s tax

Century Plyboards

339

400

revenue going ahead. The political stability is expected to remain prevalent

Ruchira Paper

199

244

due to the dominant display by NDA in the recently held state assembly

Media/Automobiles

elections, this will help in implementation of the GST as well other reforms like

Maruti Suzuki

9,545 10,619

Insolvency and Bankruptcy Code Amendment Bill.

Music Broadcast

382

434

TV Today

429

500

Interest rates continue to remain low - We have been maintaining our stance

that we are going through a low yield regime since last two years. While

Real Estate/Infra/Logistics/Power

inflation is showing some signs of firming up, we are of the opinion that it is

KEI Industries

373

436

not something that should lead to sudden spike in the interest rates. The crude

Navkar Corp.

189

265

prices are likely to remain low as OPEC oil cartel remains highly compliant

Pharmaceutical

also with Electrical vehicles seeing a growth momentum, the oil prices may not

Alkem Laboratories

2,200

2,341

see extreme surge, unless geopolitical situation worsens. The rupee

appreciation will also help in reducing the impact of surge in the crude oil.

Source: Angel Research;

Note: CMP as of January 02, 2018

Corporate earnings to revive, MF inflows to remain strong - the Indian

markets are currently trading at ~18.5x of its one year forward earnings. To

sustain these valuation, we need two elements at large, revival in the corporate

earnings and sustained liquidity. The Indian economy is primed for growth due

to the reforms led by the central government, public bank recapitalization,

recovering rural economy and the public expenditure (PMAY and Bharatmala

project). This is expected to significantly boost corporate earnings due to the

multiplier effect. The liquidity also remain ample as domestic MF inflows are

expected to remain strong as equity remain attractive to fixed income or real

estate.

Please refer to important disclosures at the end of this report

1

Angel Top Picks | January 2018

Top Picks

January 3, 2018

2

Angel Top Picks | January 2018

Stock Info

Dewan Housing

CMP

583

Loan growth to remain strong going ahead: Backed by healthy capital

TP

712

adequacy and increasing demand for home loans DHFL’s loan book is

Upside

21.1%

expected to report 23% loan growth over next two three years.

Sector

Financials

Strong Capital adequacy lends visibility for growth: DHFL sold 50% stake held

Market Cap (` cr)

18,296

by it in DFHFL Pramerica Life Insurance Co Ltd which added `1,969 cr to its

Beta

1.6

net worth and increases its CAR by 400 bps, to 19.3% which should fuel

52 Week High / Low

679 / 243

growth for next 2-3 years.

Asset quality has been strong: Strong NIM on the back of lower cost of funds

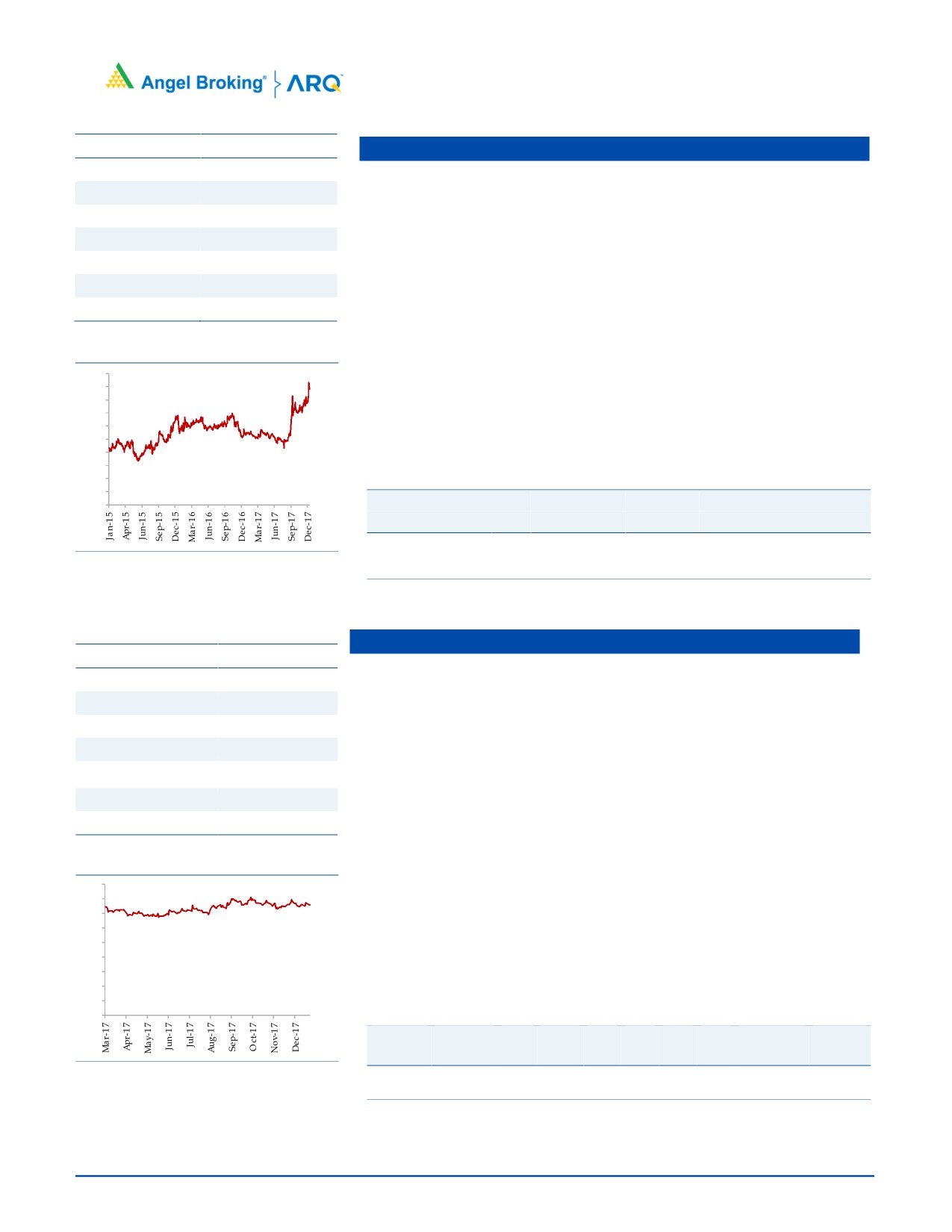

3 year-Chart

and lower credit cost will ensure healthy return ratios for the company. Despite

700

strong growth the company has maintained stable asset quality and we expect

600

the trend to continue.

500

Outlook: We expect the company’s loan growth to remain 23% over next two

400

years and earnings growth is likely to be more than 28%.The stock currently

300

trades at 1.9x FY2019E ABV. We maintain Buy on the stock with a target price of

200

`712.

100

Key Financials

-

Y/E

Op. Inc NIM

PAT

EPS

ABV ROA ROE P/E P/ABV

March

(` cr)

(%)

(` cr)

(`)

(`)

(%)

(%)

(x)

(x)

FY2018E

2,279

2.4

1,171

37.4

268

1.3

13.8

15.6

2.2

Source: Company, Angel Research

FY2019E

2,927

2.7

1,556

49.7

305

1.5

16.2

11.8

1.9

Source: Company, Angel Research

Stock Info

Karur Vysa Bank

CMP

122

Loan growth to pick up from FY18 onwards: KVB had a fairly strong loan

TP

161

CAGR of 14.9% over FY11-17.However, FY17 was year of consolidation and

Upside

32%

loan book grew by only 4.7%. We expect loan growth to pick up to 11% over

Sector

Banking

FY17-19. Deposit growth is expected at 9% during the period.

Market Cap (` cr)

8,775

Asset quality likely to stabilize going ahead: KVB’s slippages remained high

during FY17 and hence GNPAs % went up to 3.58% vs 1.3%. However, large

Beta

0.9

part of the troubled accounts has been classified as NPAs and hence gradually

52 Week High / Low

150 / 76

we expect the asset quality to improve. While in Q2FY18 we saw some

pressure on asset quality, it still remained fairly under control.

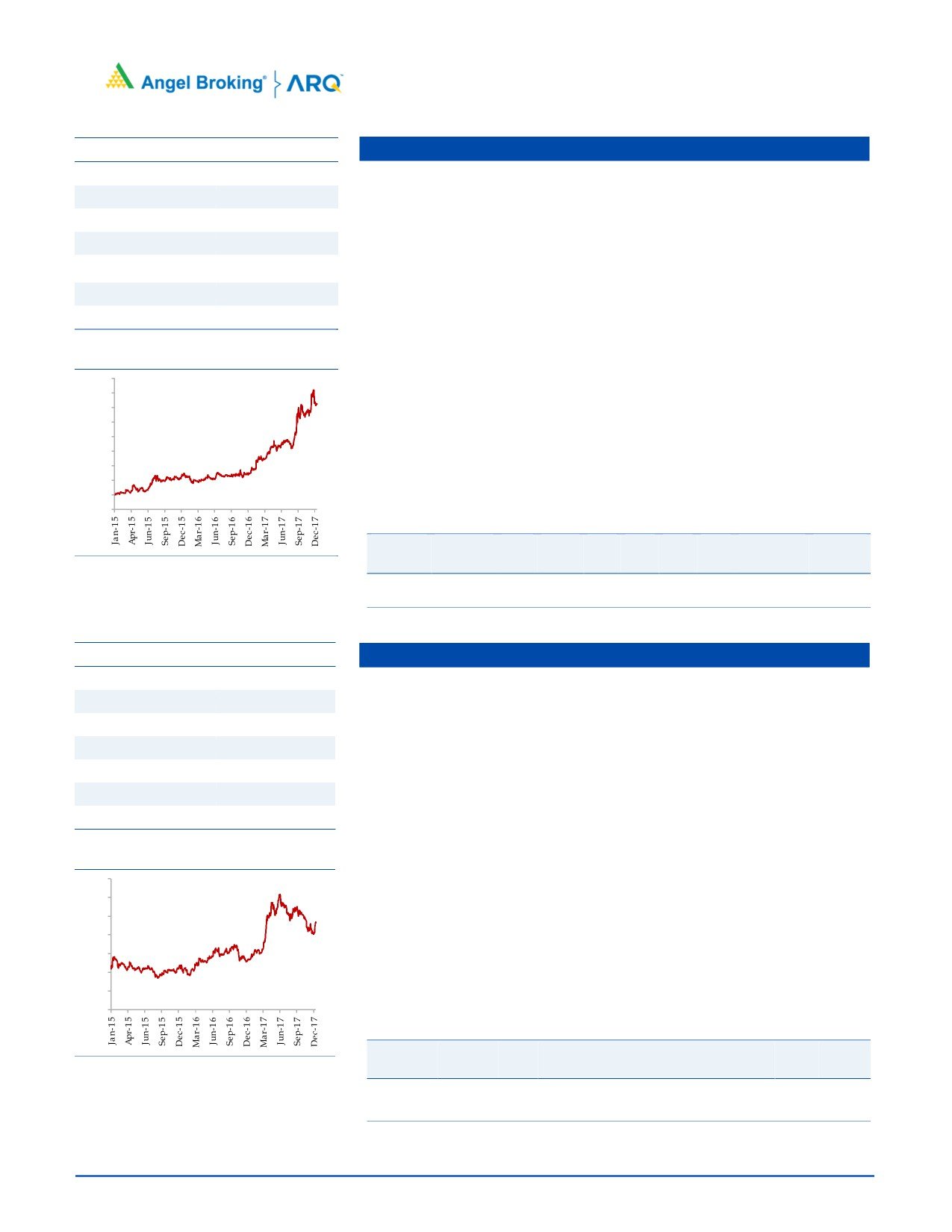

3 year-Chart

NIM likely to see further improvement: There were 25 bps improvements in

160

NIM during FY17, with share of CASA growing and cost of fund coming down

140

120

NIM is expected to improve further going ahead.

100

Outlook: We expect KVB to post a strong loan book & earnings CAGR of 11%

80

& 22% over FY2017-19E. The stock currently trades at 1.4x FY2019E ABV. We

60

have a BUY rating on the stock.

40

20

Key Financials

-

Y/E

Op. Inc NIM

PAT

EPS

ABV ROA ROE P/E P/ABV

March

(` cr)

(%)

(` cr)

(`)

(`)

(%)

(%)

(x)

(x)

FY2018E

2,388

3.7

660

10.8

77.8

1

12.5

10.5

1.6

Source: Company, Angel Research

FY2019E

2,757

3.9

858

14.1

89.6

1.2

14.7

8.1

1.4

Source: Company, Angel Research

January 3, 2018

3

Angel Top Picks | January 2018

Asian Granito

Stock Info

CMP

569

AGIL’s current, vitrified sales (35%) are lower as compared to its peers like

TP

639

Somany Ceramics (47%) and Kajaria Ceramics (61%). Recently, AGIL has

launched various products in premium segment. Going forward, we expect

Upside

12.3%

AGIL’s profit margin to improve due to increase in focus for higher vitrified

Sector

Cons. Durable

product sales, which is a high margin business.

Market Cap (` cr)

1,710

AGIL is continuously putting efforts to increase the B2C sales from the current

Beta

1.2

level (35-36% in FY17). It is expected to reach up to 50% in next 2-3 years on

52 Week High / Low

598 / 176

the back of various initiatives taken by AGIL to increase direct interaction with

customers like strengthening distribution network, participation in key trade

exhibition, etc.

3 year-Chart

In July FY2016, AGIL acquired Artistique Ceramic which has a better margin

600

profile. Going forward, we expect the company to improve its operating

500

margin from 7.5% in FY16 (excluding merger) to

13-13.5% in coming

400

financial year. Artisique Ceramics has a contract with RAS GAS to supply

300

quality natural gas at a discounted rate of 50% to current market rate, which

200

would reduce the overall power & fuel cost of the company.

100

We expect AGIL to report a net revenue CAGR of ~10% to ~`1,286cr and net

profit CAGR of ~29% to `65cr over FY2017-19E. We recommend an

-

accumulate rating on the stock.

Key Financials

Source: Company, Angel Research

Y/E

Sales OPM PAT EPS ROE P/E P/BV EV/EBITDA EV/Sales

March

(` cr)

(%)

(` cr)

(`)

(%)

(x)

(x)

(x)

(x)

FY2018E

1,140

13.1

49

16.3

10.9

35.0

3.8

13.2

1.7

FY2019E

1,286

13.3

65

21.6

12.6

26.3

3.3

11.3

1.5

Source: Company, Angel Research

Blue Star

Stock Info

CMP

818

BSL is one of the largest air-conditioning companies in India. With a mere 3%

penetration level of ACs vs 25% in China, the overall outlook for the room air-

TP

883

conditioner (RAC) market in India is favourable.

Upside

7.9%

BSL's RAC business has been outgrowing the industry by ~10% points over the

Sector

Cons. Durable

last few quarters, resulting in the company consistently increasing its market

Market Cap (` cr)

7,844

share. This has resulted in the Cooling Products Division (CPD)'s share in

Beta

0.2

overall revenues increasing from~23% in FY2010 to ~45% in FY2017

52 Week High / Low

838 / 484

(expected to improve to ~47-48% in FY2018E). With strong brand equity and

higher share in split ACs, we expect the CPD to continue to drive growth.

3 year-Chart

Aided by increasing contribution from the Unitary Products, we expect the

900

overall top-line to post a revenue CAGR of ~19% over FY2017-19E and

800

700

margins to improve from

5.8% in FY2017 to

6.6% in FY2019E. We

600

recommend an accumulate rating on the stock.

500

400

Key Financials

300

Y/E

Sales OPM PAT EPS ROE P/E P/BV EV/EBITDA EV/Sales

200

100

March

(` cr)

(%)

(` cr)

(`)

(%)

(x)

(x)

(x)

(x)

-

FY2018E

5,220

6.3

161

16.8

19.0

48.7

9.7

23.3

1.5

FY2019E

6,207

6.6

214

22.3

23.3

36.6

8.5

18.7

1.2

Source: Company, Angel Research

Source: Company, Angel Research

January 3, 2018

4

Angel Top Picks | January 2018

Stock Info

Siyaram Silk Mills

CMP

720

SSML has strong brands which cater to premium as well as popular mass

TP

813

segments of the market. Further, SSML entered the ladies' salwar kameez and

Upside

12.9

ethnic wear segment. Going forward, we believe that the company would be able to

Sector

Textile

leverage its brand equity and continue to post strong performance.

Market Cap (` cr)

3,373

The company has a nationwide network of about 1,600 dealers and business

partners. It has a retail network of 160 stores and plans to add another

Beta

0.7

300-350 stores going forward. Further, the company's brands are sold across

52 Week High / Low

253/799

3,00,000 multi brand outlets in the country.

Going forward, we expect SSML to report a net sales CAGR of ~12% to

3 year-Chart

~`1,981cr and adj.net profit CAGR of ~16% to `123cr over FY2017-19E on

900

back of market leadership in blended fabrics, strong brand building, wide

800

distribution channel, strong presence in tier II and tier III cities and emphasis

700

600

on latest designs and affordable pricing points. At the current market price,

500

SSML trades at an inexpensive valuation. We have an accumulate

400

recommendation on the stock and target price of `813.

300

200

Key Financials

100

-

Y/E

Sales

OPM PAT EPS ROE P/E P/BV EV/EBITDA EV/Sales

March

(` cr)

(%)

(` cr)

(`)

(%)

(x)

(x)

(x)

(x)

FY2018E

1,769

12.7

106

22.6

15.4

31.9

4.9

16.4

2.1

Source: Company, Angel Research

FY2019E

1,981

12.7

123

26.2

15.5

27.5

4.3

14.4

1.8

Source: Company, Angel Research

Stock Info

Maruti Suzuki

CMP

9,545

The Automobile sector is expected to benefit from the GST implementation.

TP

10,619

The sector has seen a pick up in the volumes in FY17 as there were several

Upside

11.2%

positive factors like normal monsoon and lower interest rates.

Sector

Automobiles

Maruti Suzuki continues to hold ~52% market share in the passenger vehicles.

Market Cap (` cr)

2,88,340

The launch of exciting models has helped the company to ride on the

Beta

1.0

premiumization wave that is happening in the country. In the last two years,

company has seen improvement in the business mix with the pie of the utility

52 Week High / Low

9,996/5,525

vehicles growing from ~4% to current 15%. The 2-3 months of waiting period

of new models, launch of Swift Hatchback in January-2018 and headroom for

3 year-Chart

more capacity utilization at Gujarat plant are the near term earning triggers.

12,000

10,000

Due to the favorable business mix, company has also been seeing

8,000

improvement in the margins. Company has already moved from ~11-12%

EBITDA margin range in FY14 to current ~17% margin range in 2QFY18.

6,000

Together with higher operating leverage at Gujarat plant, increasing Nexa

4,000

outlets, and improving business mix, we believe that company has further

2,000

room to improve its margins. We have an accumulate rating on the stock.

-

Key Financials

Y/E

Sales

OPM PAT EPS ROE P/E P/BV EV/EBITDA EV/Sales

Source: Company, Angel Research

March

(` cr)

(%)

(` cr)

(`)

(%)

(x)

(x)

(x)

(x)

FY2018E

80,815

15.6

8,506

281.7

21.7

33.9

7.4

18.9

3.3

FY2019E

96,680

16.9

10,991

364.0

22.8

26.2

6.0

13.8

2.7

Source: Company, Angel Research

January 3, 2018

5

Angel Top Picks | January 2018

Stock Info

TV Today Network

CMP

429

TTNL enjoys a strong viewership ranking in the Hindi and English news

TP

500

channel categories. The company’s Hindi news channel - Aaj Tak has

Upside

16.5%

maintained its market leadership position occupying the No.1 rank for several

Sector

Media

consecutive years in terms of viewership. Its English news channel - India

Today too has been continuously gaining viewership; it has now captured the

Market Cap (` cr)

2,556

No. 2 ranking from No. 4 earlier. Its other channels like Dilli Aaj Tak and Tez

Beta

0.3

are also popular among viewers.

52 Week High / Low

476 /210

TTNL is a play of higher operating leverage that would be visible as

advertisement revenues gain traction. Going ahead, we expect EBITDA

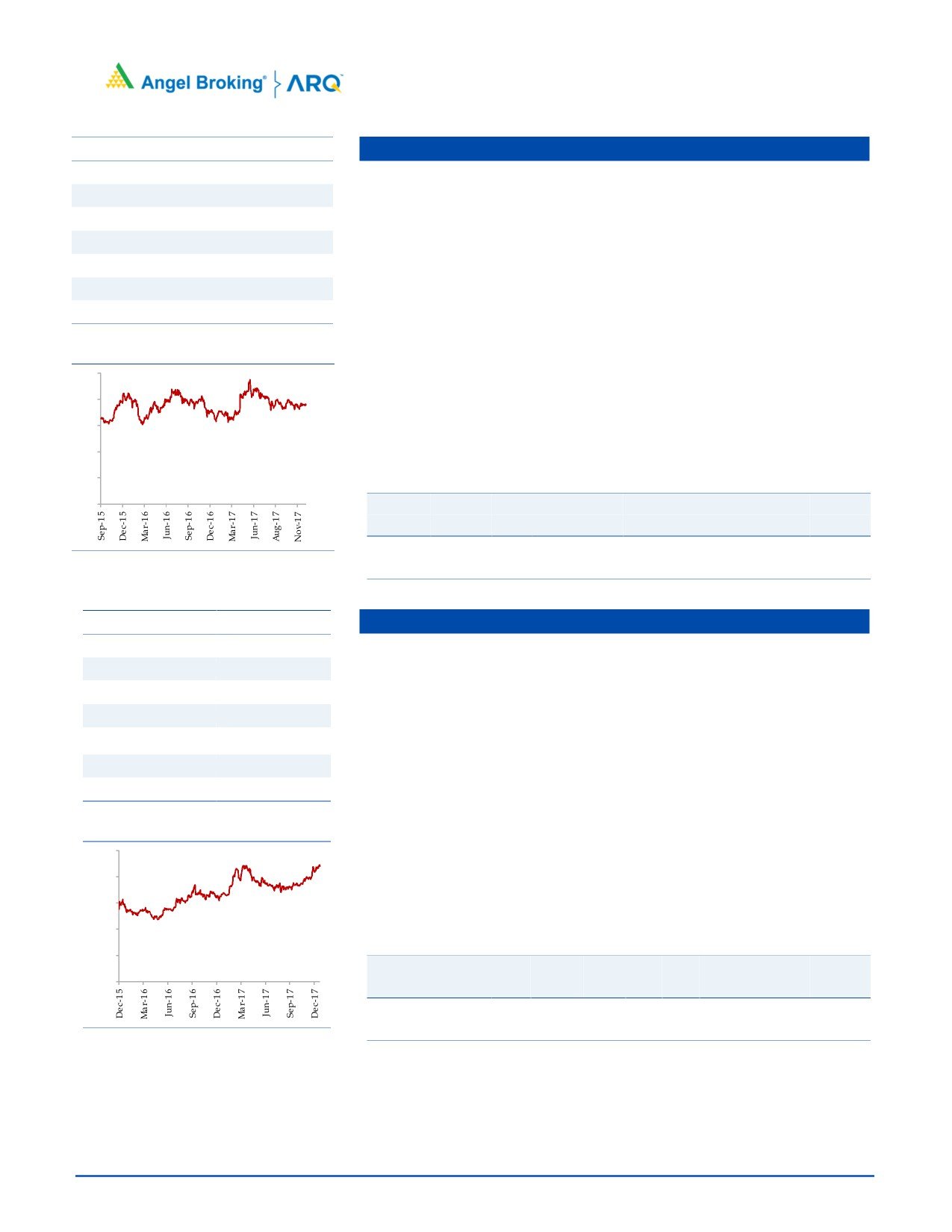

3 year-Chart

margins would improve.

500

450

400

We expect TTNL to report a net revenue CAGR of ~11% to ~`727cr and net

350

profit CAGR of ~14% to `122cr over FY2017-19E. We have a buy rating on

300

250

the stock

200

150

100

Key Financials

50

-

Y/E

Sales

OPM PAT EPS ROE P/E P/BV EV/EBITDA EV/Sales

March

(` cr)

(%)

(` cr)

(`)

(%)

(x)

(x)

(x)

(x)

FY2018E

669

26.9

109

18.3

15.3

23.5

3.7

12.5

3.4

Source: Company, Angel Research

FY2019E

749

26.9

122

20.5

17.5

21.0

3.6

11.3

3.0

Source: Company, Angel Research

Music Broadcast

Stock Info

Radio Industry is protected by licenses for 15 years, thereby restricting the entry

CMP

382

of new players. This would support the existing companies to strengthen their

TP

434

position and maintain a healthy growth rate.

Upside

13.6%

It has grabbed the Number 1 position in Mumbai, Bengaluru and Delhi in

Sector

Media

terms of number of listener. This is helping MBL to charge premium rate,

Market Cap (` cr)

2,178

which resulting into higher EBITDA margin (33.6%) compare to 22% of ENIL.

Beta

0.5

MBL outperformed its closest peer with 18.4% CAGR in revenue over FY2013-

52 Week High / Low

415/333

17 (ENIL reported 13.2% CAGR in revenue). On the profitability front too,

MBL, with 32.3% CAGR in PAT over FY2013-17, has performed much better

3 year-Chart

than ENIL (-5.2% CAGR in PAT). Moreover, Radio City posted a six year CAGR

450

of 12.1% v/s. 9.1% of industry owing to higher advertising volumes.

400

350

Capex for 39 licenses have been done for the next 15 years, hence no heavy

300

incremental Capex requirement would emerge. Moreover, the maintenance

250

Capex would be as low as `5-10cr. This would leave sufficient cash flow to

200

150

distribute as dividend. We have a Buy recommendation on the stock and

100

target price of `434.

50

-

Key Financials

Y/E

Sales

OPM PAT EPS ROE P/E P/BV EV/EBITDA EV/Sales

March

(` cr)

(%)

(` cr)

(`)

(%)

(x)

(x)

(x)

(x)

Source: Company, Angel Research

FY2018E

317

34.4

56

9.8

9.3

39.6

3.7

18.0

6.2

FY2019E

372

34.9

80

14.0

12.0

27.8

3.3

14.6

5.1

Source: Company, Angel Research

January 3, 2018

6

Angel Top Picks | January 2018

Stock Info

KEI Industries

CMP

373

KEI’s current order book (OB) stands at `2,780cr (segmental break-up:

TP

436

`1,990cr in EPC, `560cr in Cable & `230cr in EHV). Its OB grew by ~28% in

Upside

16.8%

the last 3 years due to strong order inflows from State Electricity Boards, Power

Sector

Cable

grid, etc.

Market Cap (` cr)

2,922

KEI’s consistent effort to increase its retail business from 30-32% of revenue in

Beta

1.3

FY17 to 40-45% of revenue in the next 2-3 years on the back of strengthening

52 Week High / Low

423/125

distribution network (currently 926 which is expect to increase `1,500 by FY19)

and higher ad spend (increased from `2cr in FY13 to `7.5cr in FY17 and

expected to spend).

3 year-Chart

450

KEI’s export (FY17 - 8-10% of revenue) is expected to reach a level of ~14-

400

15% in next two years with higher order execution from current OB and

350

300

participation in various international tenders. We expect a strong

~26%

250

growth CAGR over FY2017-19 in exports. We expect KEI to report net revenue

200

150

CAGR of ~13% to ~`3,392cr and net profit CAGR of ~19% to `140cr over

100

FY2017-19E. Hence we have a buy rating on the stock.

50

-

Key Financials

Y/E

Sales

OPM PAT EPS ROE P/E P/BV EV/EBITDA EV/Sales

Source: Company, Angel Research

March

(` cr)

(%)

(` cr)

(`)

(%)

(x)

(x)

(x)

(x)

FY2018E

3,001

10.0

119

15.5

21.0

24.1

5.1

10.8

1.1

FY2019E

3,392

10.0

140

18.1

20.0

20.6

4.1

9.7

1.0

Source: Company, Angel Research

Stock Info

GIC Housing Finance Ltd

CMP

456

Backed by the new management, GICHF is aiming for 2.0x growth in the loan

TP

655

book over the period of FY16-FY19E to `16,000cr. GICHF has healthy capital

Upside

43.6%

adequacy, and is seeing an increase in demand for home loans. GICHF’s

Sector

Financials

loan book is expected to report 24.3% loan growth over next two years.

GICHF is consistently decreasing bank borrowing and increasing high yield

Market Cap (` cr)

2,456

loan book which is expected to boost its Net Interest Margin. The share of

Beta

1.3

bank borrowing was 75% in FY15, which fell to 55% in FY17. In our opinion,

52 Week High / Low

623 /266

the impetus on lower bank borrowings and increasing high yield loan book is

likely to result in 17bps NIM over FY16-FY19E.

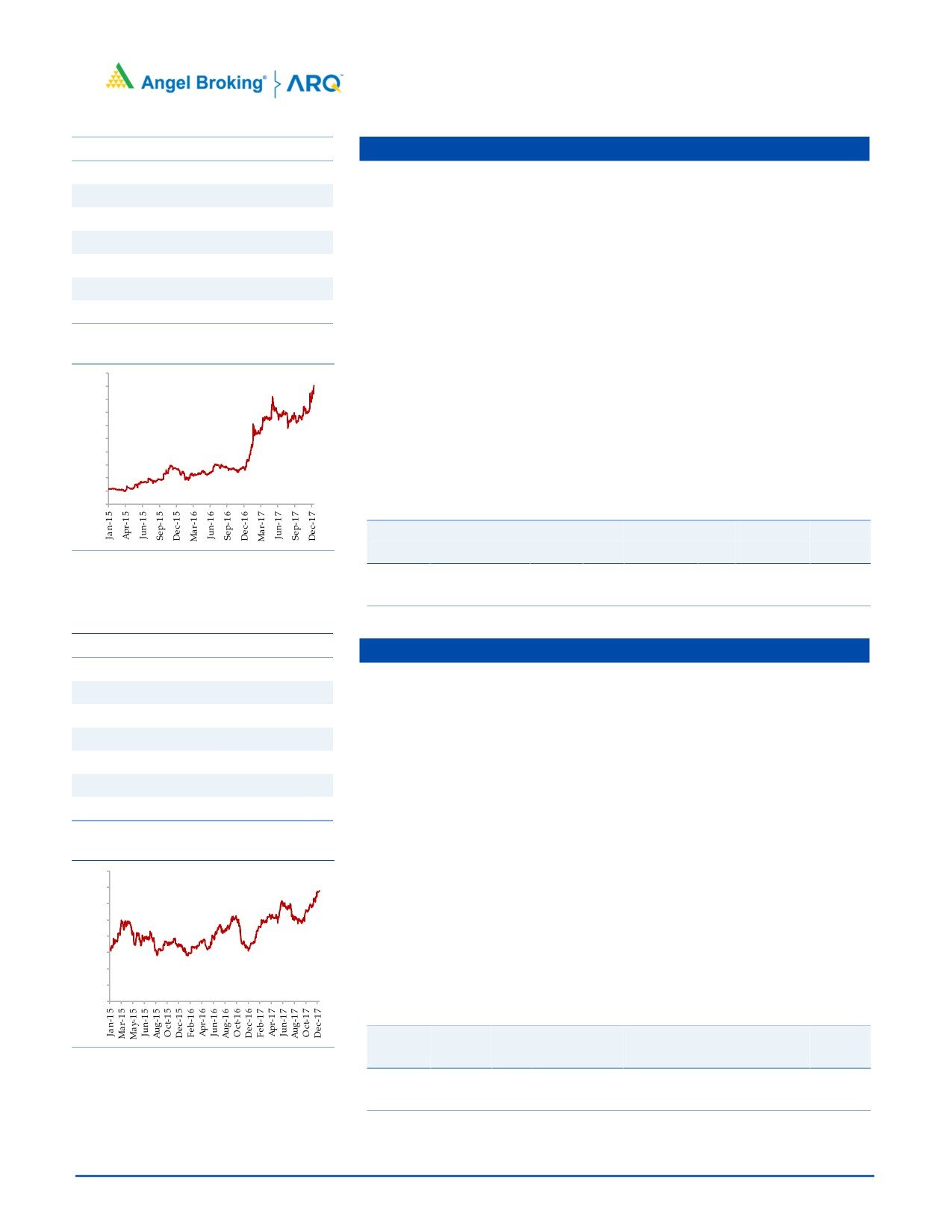

3 year-Chart

GICHF’s asset quality is on the higher side compared to other HFCs (As on

700

FY17 GNPA-2.3% and NPA-0.3%). This is primarily due to GICHF has not

600

written off any bad asset and has not sold any bad assets to ARC. New

500

Management is expediting asset quality improvement.

400

We expect the GICHF’s loan growth to grow at a CAGR of 24.3% over next

300

two years and RoA/RoE to improve from 1.7%/19.0% in FY17 to 2.0%/23.0%

200

in FY19E.The stock is currently trading at 2.1x FY2019E ABV. We have a Buy

100

rating on the stock.

-

Key Financials

Y/E

Op. Inc NIM

PAT

EPS

ABV ROA ROE P/E P/ABV

Source: Company, Angel Research

March

(` cr)

(%)

(` cr)

(`)

(`)

(%)

(%)

(x)

(x)

FY2018E

376

3.6

180

33

184

1.7

20

14

2.5

FY2019E

477

3.7

215

40

219

1.9

23

11

2.1

Source: Company, Angel Research

January 3, 2018

7

Angel Top Picks | January 2018

Stock Info

Navkar

CMP

189

NCL is one of the largest and one of the three CFS at JNPT with rail

TP

265

connectivity, helping it garner high market share at the port. NCL is in a massive

Upside

40.2%

expansion mode where it is increasing its capacity by 234% to 1,036,889 TEUs

Sector

Logistics

at JNPT and coming up with an ICD at Vapi (with Logistics Park).

Market Cap (` cr)

2,846

The ICD with rail link should benefit from first mover advantage in a region

Beta

0.7

that has huge market potential and accounts for ~27% of volumes at JNPT.

52 Week High / Low

247 / 155

The ICD should be able to capture the EXIM volumes from the region through

rail link that till now was being custom cleared at JNPT (Import) or being

transported via road and consolidated at JNPT (Export). South Gujarat

3 year-Chart

volumes will now head straight to the Vapi ICD; thus the company can now

250

cater to bulk commodities and domestic traffic that it had been rejecting owing

200

to capacity constraints at CFS.

150

We expect NCL to successfully use its rail advantage and scale up its

100

utilizations at both JNPT and Vapi ICD. We have a Buy rating on the stock.

50

Key Financials

-

Y/E

Sales

OPM PAT EPS ROE P/E P/BV EV/EBITDA EV/Sales

March

(` cr)

(%)

(` cr)

(`)

(%)

(x)

(x)

(x)

(x)

FY2018E

400

41.5

104

7.3

6.9

26.0

1.8

18.0

7.5

Source: Company, Angel Research

FY2019E

530

41.5

142

9.9

8.6

19.0

1.6

13.4

5.6

Source: Company, Angel Research

Stock Info

Alkem Laboratories

CMP

2,200

Alkem is 5th largest pharma company is the domestic market and also has

TP

2,341

presence in US. It derives 73% of its revenues come from the Indian markets

Upside

6.4%

while rest come from the other countries. Alkem has leadership position in the

Sector

Pharmaceutical

domestic anti infective segment and it is ranked #3 in Gastro-Intestinal and

Pain/Analgesics segments. Company holds ~3.6% and ~7.9% market share

Market Cap (` cr)

26,305

in the formulations and overall prescriptions in the country.

Beta

0.3

In the domestic market, company operates in acute and chronic segments. It is

52 Week High / Low

2,400 /1,578

a prominent player in acute segment has forayed in chronic segment from

which it expects faster growth. Alkem has been outperforming the domestic

3 year-Chart

industry growth which is likely to continue. Company is focusing on

2,500

monetization of its pipeline (92 ANDAs) in the US with high single digit ANDA

launches to grow the US revenues at ~20% growth rate from FY17-FY19E.

2,000

Overall outlook remains strong with 9% CAGR in the topline and 13% CAGR

1,500

in the bottom-line. We have an accumulate rating on the stock.

1,000

Key Financials

500

Y/E

Sales

OPM PAT EPS ROE P/E P/BV EV/EBITDA EV/Sales

-

March

(` cr)

(%)

(` cr)

(`)

(%)

(x)

(x)

(x)

(x)

FY2018E

6,272

17.5

862

72.1

17.6

30.3

5.4

22.8

4.1

FY2019E

7,254

19.8

1,139

95.3

19.6

22.8

4.5

16.9

3.5

Source: Company, Angel Research

Source: Company, Angel Research

January 3, 2018

8

Angel Top Picks | January 2018

Stock Info

LT Foods

CMP

91

LT Foods LTD (LTFL) is branded specialty Foods Company engaged in milling,

TP

102

processing and marketing of branded/non-branded basmati rice and

Upside

12.1%

manufacturing of rice food products in the domestic and overseas markets.

Sector

Food Processing

LTFL’s flagship brand Daawat enjoys 22% market share in the branded rice

Market Cap (` cr)

2,899

market of India. It also has strong market share in North America selling

Beta

1.2

Basmati rice under the brand ‘Royal’. Currently it has access to 1,40,000

52 Week High / Low

95 / 32

traditional retail outlets, 93% reach of towns with over 2 lakh population,and

a access to 3000 Wholesalers. It has also strong network in modern trade.

3 year-Chart

LTFL is the 1st Rice company to place Brown Basmati Rice in Medical Chains.

100

90

The company has a well-diversified product basket catering to consumers of

80

70

all income groups. The company is present in segments like Basmati rice,

60

Specialty rice (non-Basmati) and other food products.

50

40

30

Outlook remains strong with 14%/20% CAGR in the top-line/bottom-line. We

20

have an accumulate rating on the stock.

10

-

Key Financials

Y/E

Sales OPM

PAT EPS ROE P/E P/BV EV/EBITDA EV/Sales

March

(` cr)

(%)

(` cr)

(`)

(%)

(x)

(x)

(x)

(x)

Source: Company, Angel Research

FY2018E

3,747

11.5

139

5.2

17.5

17.5

3.1

9.3

1.1

FY2019E

4,234

11.5

170

6.4

17.6

14.3

2.5

8.2

0.9

Source: Company, Angel Research

Stock Info

Century Plyboards India

CMP

339

Century Plyboards India Ltd (CPIL) is a plywood manufacturer dealing in

TP

400

plywood, laminates, MDF (Medium Density Fibreboard) and others with

Upside

17.9%

presence across India and overseas. CPIL is also engaged in logistics business

Sector

Miscellaneous

through management of a container freight station.

Market Cap (` cr)

7,528

Indian plywood industry is estimated at `18,000cr and is largely unorganised

Beta

0.8

(~75% share of revenues). However, with the implementation of GST, the

52 Week High / Low

354/175

share of organized players is expected to improve, which would be beneficial

for branded players like CPIL.

3 year-Chart

400

CPIL has recently added new MDF plant (1,98,000 m3, to generate ~`450-

350

500cr revenue), laminates (4.8 mn sheets by scaling ~50%, to generate

300

~`250-300cr revenue), particle boards

(`100cr of revenue). Capacity

250

200

addition across segments would boost revenue and profitability going ahead.

150

100

We expect CPIL to report net revenue & PAT CAGR of ~17% & 16%

50

respectively. We have a Buy recommendation with Target Price of `400.

-

ey Financials

Y/E

Sales

OPM PAT EPS ROE P/E P/BV EV/EBITDA EV/Sales

Source: Company, Angel Research

March

(` cr)

(%)

(` cr)

(`)

(%)

(x)

(x)

(x)

(x)

FY2018E

450

41.5

124

8.7

8.4

30.4

7.0

18.4

3.3

FY2019E

617

41.5

181

12.7

11.0

24.7

5.7

15.7

2.8

Source: Company, Angel Research

January 3, 2018

9

Angel Top Picks | January 2018

Ruchira Paper

Stock Info

CMP

199

Ruchira Papers Limited (RPL) manufactures writing paper, printing paper and

TP

244

Kraft paper. The company’s writing and printing paper and Kraft paper is

Upside

23%

manufactured by using agricultural residues like wheat straw, bagasse,

sarkanda and other materials.

Sector

Paper

Market Cap (` cr)

449

Indian paper industry is estimated to grow at a CAGR of 7.6% over the next

Beta

1.2

couple of years, in-line with India’s GDP growth. Further, Kraft paper segment

52 Week High / Low

207/105

is also growing at a faster rate due to strong demand from packaging industry

(owing to increasing e-commerce and FMCG demand).

3 year-Chart

We forecast RPL to report healthy top-line of ~13% CAGR over FY17-20E on

250

the back of healthy demand growth in printing & writing paper and Kraft

200

paper. On the bottom-line front, we estimate ~16% CAGR owing to strong

150

improvement in operating performance.

100

Further, improvement in manufacturing efficiency and benefits from increasing

50

global finished paper prices (ban in China) would aid margins. We have a

0

Buy recommendation with Target Price of `244.

Key Financials

Source: Company, Angel Research

Y/E

Sales

OPM PAT EPS ROE P/E P/BV EV/EBITDA EV/Sales

March

(` cr)

(%)

(` cr)

(`)

(%)

(x)

(x)

(x)

(x)

FY2018E

470

15.6

36.9

16.5

20.0

10.5

2.0

6.2

1.0

FY2019E

532

15.6

42.5

19.0

19.2

9.0

1.7

5.2

0.8

Source: Company, Angel Research

January 3, 2018

10

Angel Top Picks | January 2018

Research Team Tel: 022 - 39357800

DISCLAIMER

Angel Broking Private Limited (hereinafter referred to as “Angel”) is a registered Member of National Stock Exchange of India Limited,

Bombay Stock Exchange Limited and Metropolitan Stock Exchange Limited. It is also registered as a Depository Participant with CDSL

and Portfolio Manager and investment advisor with SEBI. It also has registration with AMFI as a Mutual Fund Distributor. Angel Broking

Private Limited is a registered entity with SEBI for Research Analyst in terms of SEBI (Research Analyst) Regulations, 2014 vide

registration number INH000000164. Angel or its associates has not been debarred/ suspended by SEBI or any other regulatory

authority for accessing /dealing in securities Market. Angel or its associates/analyst has not received any compensation / managed or

co-managed public offering of securities of the company covered by Analyst during the past twelve months.

This document is solely for the personal information of the recipient, and must not be singularly used as the basis of any investment

decision. Nothing in this document should be construed as investment or financial advice. Each recipient of this document should

make such investigations as they deem necessary to arrive at an independent evaluation of an investment in the securities of the

companies referred to in this document (including the merits and risks involved), and should consult their own advisors to determine

the merits and risks of such an investment.

Reports based on technical and derivative analysis center on studying charts of a stock's price movement, outstanding positions and

trading volume, as opposed to focusing on a company's fundamentals and, as such, may not match with a report on a company's

fundamentals. Investors are advised to refer the Fundamental and Technical Research Reports available on our website to evaluate the

contrary view, if any.

The information in this document has been printed on the basis of publicly available information, internal data and other reliable

sources believed to be true, but we do not represent that it is accurate or complete and it should not be relied on as such, as this

document is for general guidance only. Angel Broking Pvt. Limited or any of its affiliates/ group companies shall not be in any way

responsible for any loss or damage that may arise to any person from any inadvertent error in the information contained in this report.

Angel Broking Pvt. Limited has not independently verified all the information contained within this document. Accordingly, we cannot

testify, nor make any representation or warranty, express or implied, to the accuracy, contents or data contained within this document.

While Angel Broking Pvt. Limited endeavors to update on a reasonable basis the information discussed in this material, there may be

regulatory, compliance, or other reasons that prevent us from doing so.

This document is being supplied to you solely for your information, and its contents, information or data may not be reproduced,

redistributed or passed on, directly or indirectly.

Neither Angel Broking Pvt. Limited, nor its directors, employees or affiliates shall be liable for any loss or damage that may arise from

or in connection with the use of this information.

Ratings (Based on expected returns

Buy (> 15%)

Accumulate (5% to 15%)

Neutral (-5 to 5%)

over 12 months investment period):

Reduce (-5% to -15%)

Sell (< -15)