Please refer to important disclosures at the end of this report

1

Angel Top Picks – Aug 2021

July sees good recovery – The Indian markets posted a ~10% recovery in Jul’21, in

line with most global markets which were recuperating from heavy losses. Also aiding

the Indian market recovery was a steady flow of good results and a reversal of the

trend seen in FII activity. The FIIs had been sellers for the past nine months and turned

net buyers in Indian equities to the extent of `4,989 Cr in Jul’22 vs. sale of `50,203Cr

in Jun’22. Before this, the FIIs were retreating due to the reversal of expansionary

monetary policy and hikes in policy rates by the Fed to tackle the red-hot inflation.

As a result, in the Fed action, some slowdown is already visible in weaker prints like

contraction in US PMI services as well as a 0.9% QoQ decline in GDP.

Quantum of rate hikes to moderate post 75bps hike in July by US Fed – The US Fed

had further hiked the interest rates by 75bps in July after the inflation in the US soared

to 9.1% YoY. Given the already visible signs of a slowdown and the quantum of

recent hikes, we believe that the Fed would be more data-dependent from here on.

We believe that the markets have digested the hawkishness and a 75bps rate hike is

expected at the FOMC meeting in September given the strong employment data.

Inflation cooling from current levels may result in a lower quantum of rate hikes

going ahead. Globally, the effects of monetary tightening are visible with slowing

growth. Crude has corrected from the highs of US$123 per barrel in Jun’22 to

~US$95 per barrel on a weak global growth outlook.

India is better placed – Compared to the global situation, India is relatively well

placed where inflation is being contained (lower on a MoM basis) and the economy

is showing resilience. The growth in manufacturing continued with Jul’22 PMI

increasing to 56.4 from 53.9 in Jun’22 with better demand conditions and easing of

inflation being witnessed. Services PMI saw some slowing of growth with a reading

of 55.5 for Jul’22. However, easing of pricing pressure would lead to services posting

growth in coming months. GST collections at `1.49 lakh crores, 5th consecutive

month of `1.40 lakh crore+ collections, also point to strength in the economy. E-

way bill generations were up 18% YoY and CV sales remained strong in Jul’22.

Falling crude/commodity prices to provide relief – We believe that the current

scenario of a weaker global outlook can lead to further correction in crude prices.

Indian companies have been impacted on the margin front over the past few quarters

and declining crude/commodity prices would not only prove to be tailwinds but also

aid in containing overall inflation and lead to demand.

Maintain a positive view from a longer-term perspective – We believe that India

stands to benefit from declining crude/commodity prices as it would contain the

widening of trade deficit as a percentage of GDP. Our forex reserves are at

comfortable levels which also provides comfort. Post the recent rally, the NIFTY now

trades closer to its long-term average 1yr- Forward P/E of 20x which we believe

presents limited upside in the current scenario. However, the long-term prospects

remain intact given the low corporate leverage levels, the better position of financial

institutions, and the revival of investment cycle in India.

Top Picks Performance

Return Since Inception (30th Oct, 2015)

Top Picks Return

191.50%

BSE 100

126.70%

Outperformance

64.80%

Source: Company, Angel Research

Top Picks

Company

CMP (`)

TP (`)

Auto

Ashok Leyland

145

175

Sona BLW Precis.

557

843

Ramkrishna Forg.

191

256

Suprajit Engg.

343

485

Banking

Federal Bank

109

120

HDFC Bank

1427

1700

AU Small Finance

648

848

Chemical

P I Industries

3247

3440

Jubilant Ingrev.

491

700

IT

HCL Technologies

958

1192

Others

Stove Kraft

555

805

Sobha

677

750

Amber Enterp.

2269

3850

Oberoi Realty

895

1000

Devyani Intl.

187

219

Marico

520

600

Source: Company, Angel Research

Note: Closing price as on 05

th

Aug, 2022

Research Analyst:

Amarjeet Maurya

(amarjeet.maurya@angelbroking.com)

Milan Desai

(milan.desai@angelbroking.com)

Angel Top Picks – Aug 2022

August 8, 2022

2

Angel Top Picks – Aug 2022

Top Picks

August 8, 2022

3

Angel Top Picks – Aug 2022

Federal Bank

Federal bank is one of India's largest old generation private sector banks.

At the end of Q4 FY2022 the bank had advances of Rs. 1.45 lakh cr. and

deposits of Rs. 1.81 lakh cr. The bank predominantly has a secured

lending book which helped limit asset quality issues during the Covid 19

pandemic.

Federal Bank has posted a good set of numbers for Q4FY22 as NII/

advances increased by 7.4%/9.9% YoY. Provisioning for the quarter was

down by 10% YoY as a result of which PAT was up by 13.1% YoY. GNPA

and NNPA ratio improved to 2.80% and 0.96% while restructuring

remained stable sequentially at 2.6% of advances.

Overall asset quality for the quarter improved in Q4FY22, which was in

line with our expectations. We expect asset quality to improve further in

FY2023 given normalization of the economy. We expect the Federal bank

to post NII/PPOP/PAT CAGR of 24.9%/29.1%/42.7% between FY2022-

24 and remain positive on the bank.

Key Finance

Y/E

NII

NIM

PAT

EPS

ABV

ROA

ROE

P/E

P/ABV

March

(` cr)

(%)

(` cr)

(`)

(`)

(%)

(%)

(x)

(x)

FY2023E

7,532

3.1

3,127.6

14.9

97.2

1.3

15.4

7.3

1.1

FY2024E

9,301

3.2

3,846.2

18.3

114.0

1.3

16.1

6.0

1.0

Source: Company, Angel Research

HDFC Bank

HDFC bank is India's largest private sector bank with a loan book of ₹ 13.68

lakh crore in Q4FY2022 and deposit base of ₹ 15.6 lakh crore. The Bank

has a very well spread-out book with wholesale constituting ~57% of the

asset book while retail accounted for the remaining 44% of the loan book.

Q4FY2022 numbers were below expectations due to change in portfolo mix

towards corporate which resulted in contraction in NIM by 10bps QoQ to

4.0%. Moreover, higher opex dragged down PPOP growth. The bank posted

NII/PPOP growth of 10.2%/5.3% for the quarter on the back of loan growth

of 20.8% YoY.

While operating numbers were below expectations, the bank posted an

improvement in asset quality as GNPA/ NNPA reduced by 9/5bps QoQ to

1.17% and 0.32% of advances. Restructured advances at the end of the

quarter stood at 1.14% of advances. Given best in class asset quality,

expected rebound in retail credit growth we are positive on the bank given

reasonable valuations at 2.3xFY24, adjusted book which is at a discount to

historical averages.

Stock Info

CMP

109

TP

120

Upside

10%

Sector

Banking

Market Cap (` cr)

23,062

Beta

1.2

52 Week High / Low

112/78

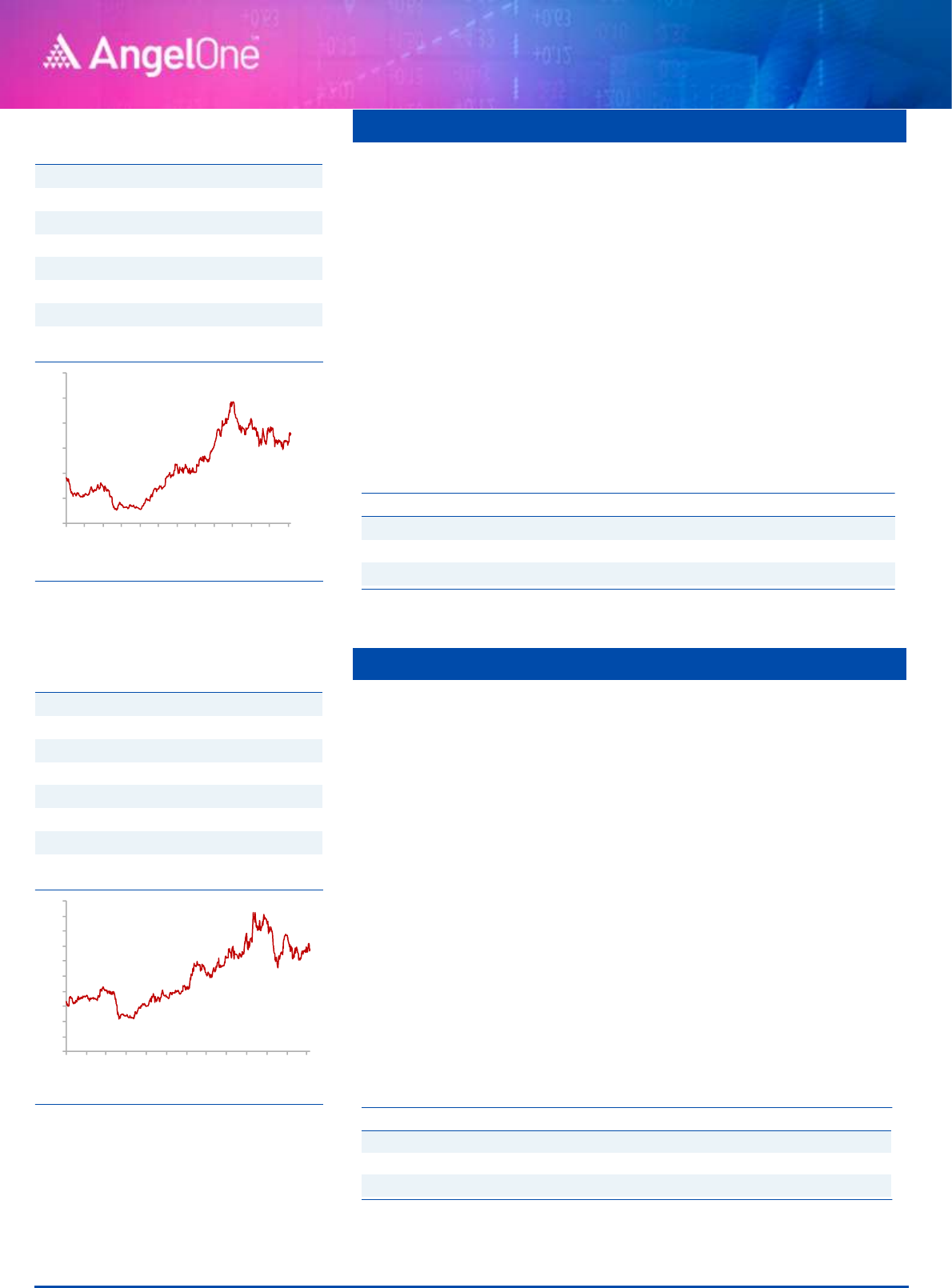

3-Year-Chart

-

20

40

60

80

100

120

Aug-19

Oct-19

Jan-20

Apr-20

Jul-20

Oct-20

Jan-21

Apr-21

Jul-21

Oct-21

Jan-22

Apr-22

Jul-22

Source: Company, Angel Research

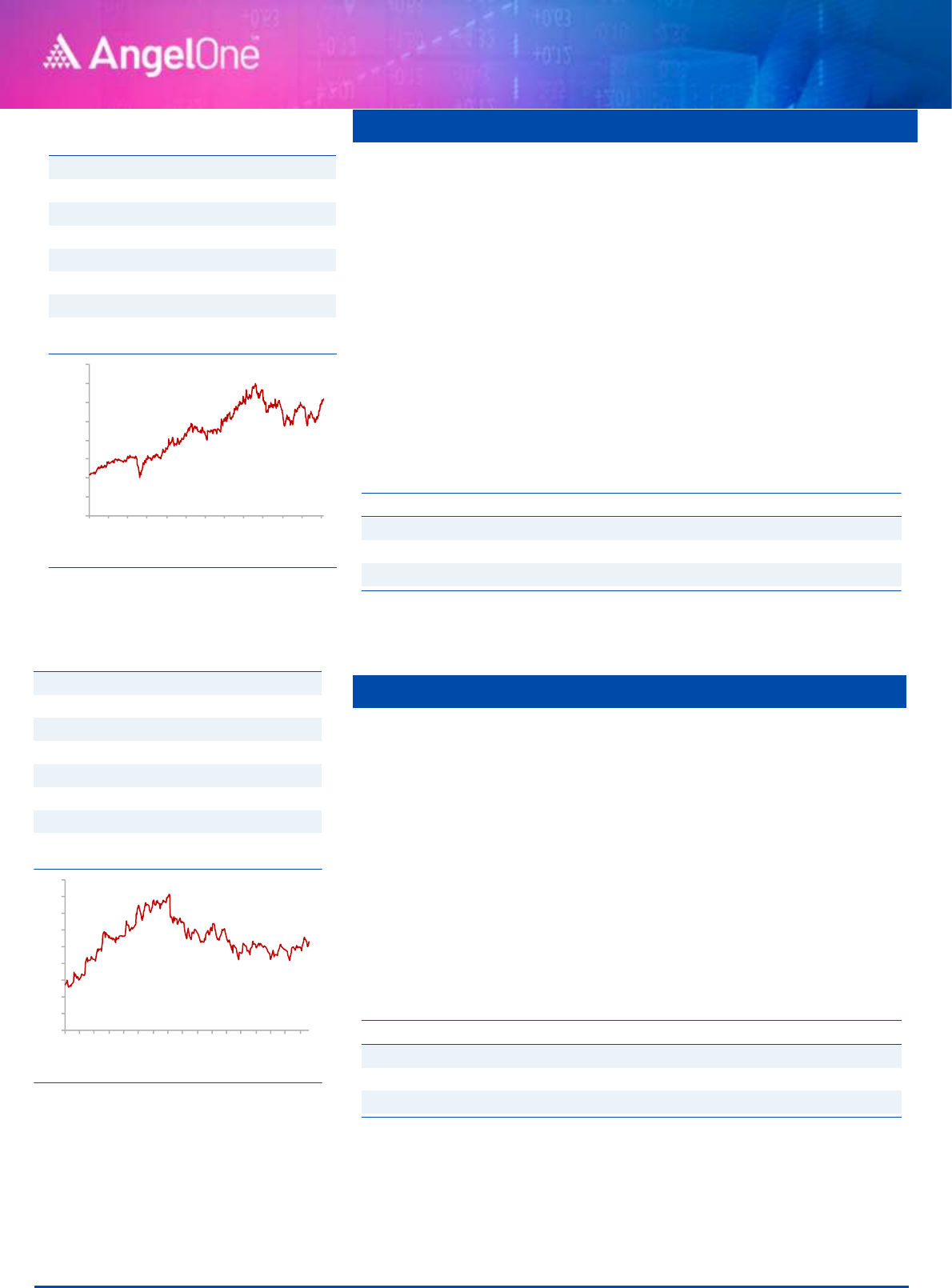

Stock Info

CMP

1427

TP

1700

Upside

19%

Sector

Banking

Market Cap (` cr)

803,841

Beta

1.1

52 Week High / Low

1724/1272

3-Year-Chart

-

200

400

600

800

1,000

1,200

1,400

1,600

1,800

Aug-19

Oct-19

Jan-20

Apr-20

Jul-20

Oct-20

Jan-21

Apr-21

Jul-21

Oct-21

Jan-22

Apr-22

Jul-22

Source: Company, Angel Research

Key Finance

Y/E

NII

NIM

PAT

EPS

ABV

ROA

ROE

P/E

P/ABV

March

(` cr)

(%)

(` cr)

(`)

(`)

(%)

(%)

(x)

(x)

FY2023E

85,512

4.0

46630

84.1

499.0

2.1

18.2

17.0

2.9

FY2024E

108,523

4.1

59845

107.9

606.0

2.2

19.4

13.2

2.4

Source: Company, Angel Research

August 8, 2022

4

Angel Top Picks – Aug 2022

AU Small Finance Bank

AU Small Finance Bank is one of the leading small finance banks with Total

Loan AUM of ~47,831 Cr. at the end of Q4FY2022. It has a well-

diversified geographical presence across India. AU has a very high

exposure to high margin retail business, which accounted for 80% of AUM

at the end of FY2022.

AU continued to report very strong numbers in Q4FY2022 as GNPA/ NNPA

reduced by 62/79bps QoQ to1.98% and 0.5% of advances. Restructured

advances at the end of the quarter also declined to 2.5% of advances. The

bank posted NII growth of 42.8% for the quarter on the back of strong

advances growth of 33% YoY while NIMs for the quarter stood at 6.3%.

We expect AU SFB to post robust NII/PPOP/ PAT CAGR of

35.2%/40.2%/38.7% between FY2022-24 on the back of AUM CAGR of

34.8%. Reducing cost of funds will also help NIM expansion going forward.

We believe that the worst is over for the bank and expect continued

improvement in asset quality in FY2023, which should lead to a rerating.

Key Finance

Y/E

NII

NIM

PAT

EPS

ABV

ROA

ROE

P/E

P/ABV

March

(` cr)

(%)

(` cr)

(`)

(`)

(%)

(%)

(x)

(x)

FY2023E

4,517

5.5

1701

54.0

263.5

2.1

20.3

12.0

2.5

FY2024E

5,913

5.4

2174

69.0

332.5

2.0

21.1

9.4

1.9

Source: Company, Angel Research

Stock Info

CMP

648

TP

848

Upside

31%

Sector

Banking

Market Cap (` cr)

40,675

Beta

1.2

52 Week High / Low

733/468

3-Year-Chart

-

100

200

300

400

500

600

700

800

Aug-19

Oct-19

Jan-20

Apr-20

Jul-20

Oct-20

Jan-21

Apr-21

Jul-21

Oct-21

Jan-22

Apr-22

Jul-22

Source: Company, Angel Research

August 8, 2022

5

Angel Top Picks – Aug 2022

Ashok Leyland

After challenging a challenging FY21, Ashok Leyland has rebounded well

in FY22 and is expected to perform well over the next few years owing to a

strong cyclical recovery in MHCVs led by pick up in core sectors, the

government spends on infrastructure, and replacement demand.

ALL market share has improved in last two quarters to over 30% and we

expect the same to gradually improve with recovery in segments like higher

tonnage trucks, tippers, and bus segments where its market share is higher.

Additionally, diversification efforts provide support in terms of sustenance

of market share.

FY21 MHCV industry production volumes have been at the lowest levels

seen in ~12 years and the industry volumes are expected to grow strongly

on a lower base. We expect stronger volumes, and lower discounts coupled

with operating leverage to lead to a rebound in margins and drive earnings

growth.

Key Finance

Y/E

Sales

OPM

PAT

EPS

ROE

P/E

P/BV

EV/Sales

March

(` cr)

(%)

(` cr)

(`)

(%)

(x)

(x)

(x)

FY2023E

31,325

8.0

1,193

4.1

15.2

35.3

5.0

1.3

FY2024E

39,077

10.5

2,409

8.2

27.3

17.7

4.3

1.0

Source: Company, Angel Research

Sona BLW Precis.

Sona BLW, one of India's leading automotive technology companies,

derives ~50% of its revenues from Battery Electric Vehicles (BEV) and

Hybrid Vehicles and stands to benefit from the global electrification trend.

Sona BLW has a strong positioning in the Indian Differential Gears market

across PV, CV, and tractor OEMs and it continues to gain market share

globally aided by its combined motor and driveline capabilities. Focus on

R&D is yielding results in new product development which is likely to aid

further growth.

Sona BLW continues to add new customers and win new orders and its

order book stands at `20,600 Cr which along with its strong financial

profile and expected ~45% earnings CAGR over FY22-24E justifies the

premium multiples of ~45x FY24E EPS.

Key Finance

Y/E

Sales

OPM

PAT

EPS

ROE

P/E

P/BV

EV/Sales

March

(` cr)

(%)

(` cr)

(`)

(%)

(x)

(x)

(x)

FY2023E

2,915

26.5

451

7.7

21.1

72.4

14.7

11.5

FY2024E

4,066

29.2

739

12.6

29.7

44.2

12.3

8.2

Source: Company, Angel Research

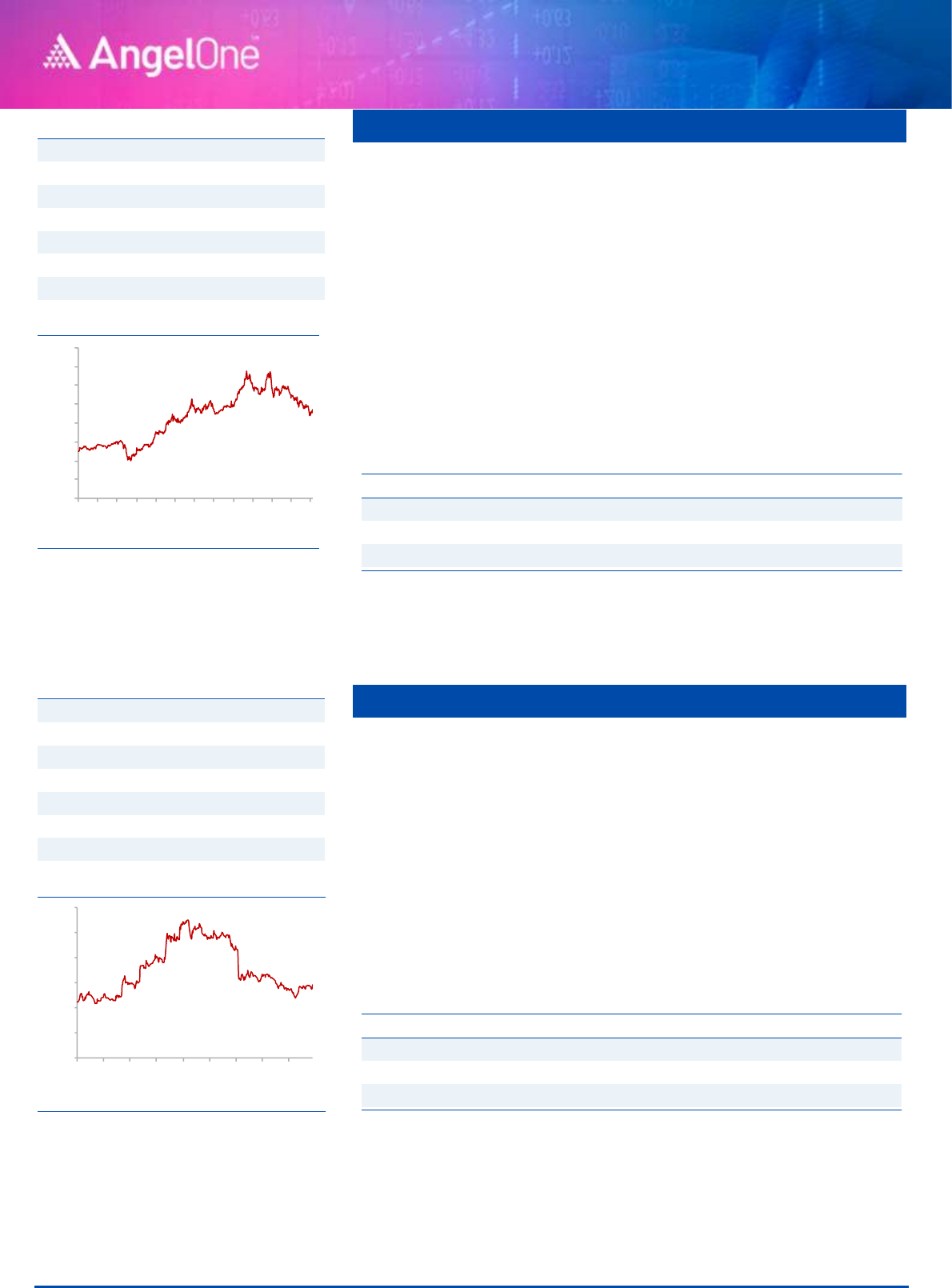

Stock Info

CMP

145

TP

175

Upside

21%

Sector

Auto

Market Cap (` cr)

43,138

Beta

1.4

52 Week High / Low

158/93

3-Year-Chart

-

20

40

60

80

100

120

140

160

Aug-19

Oct-19

Jan-20

Apr-20

Jul-20

Oct-20

Jan-21

Apr-21

Jul-21

Oct-21

Jan-22

Apr-22

Jul-22

Source: Company, Angel Research

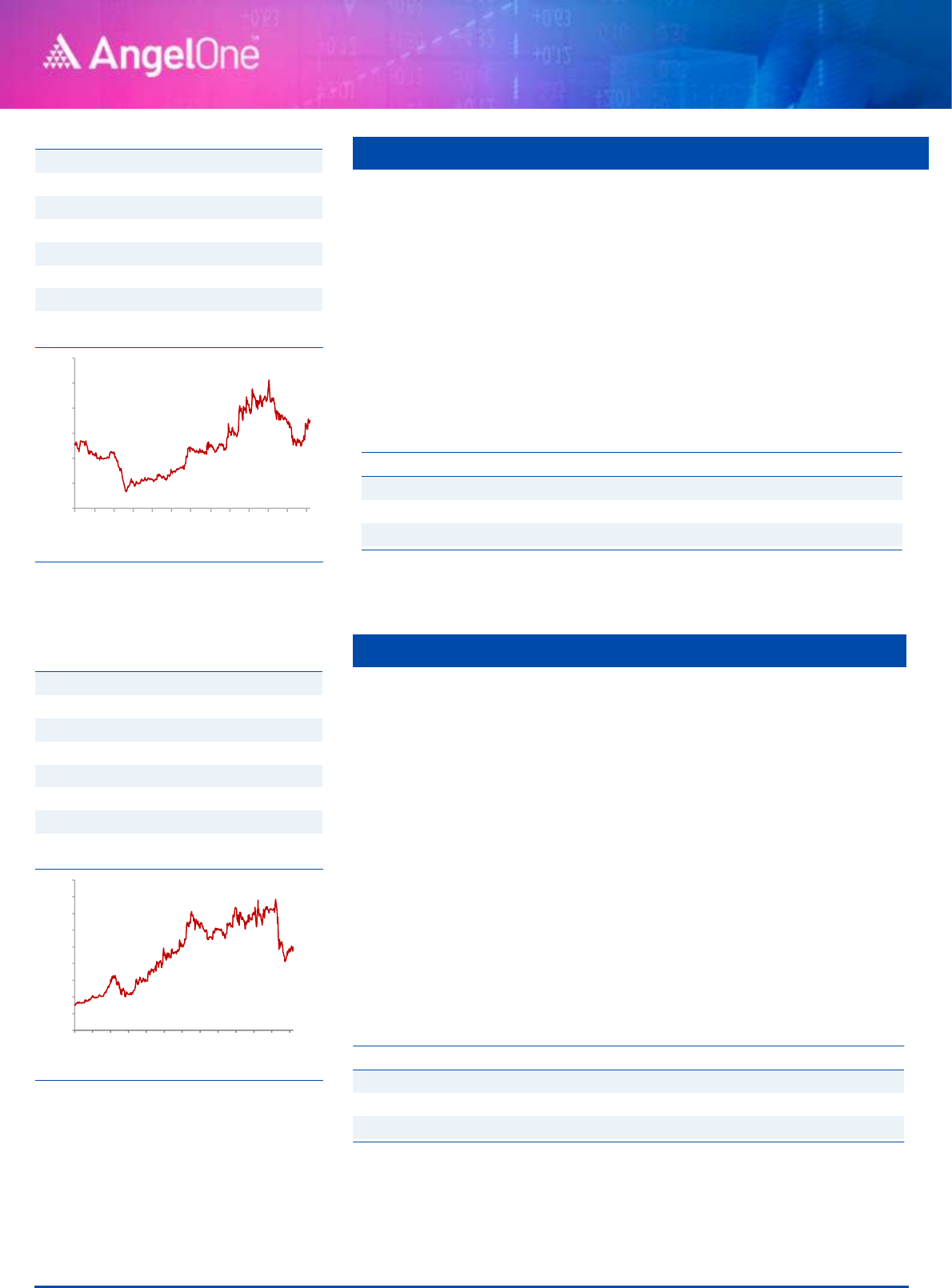

Stock Info

CMP

557

TP

843

Upside

51%

Sector

Auto

Market Cap (` cr)

32,870

Beta

1.3

52 Week High / Low

839/425

14-Month-Chart

-

100

200

300

400

500

600

700

800

900

Jun-21

Jul-21

Aug-21

Sep-21

Oct-21

Nov-21

Dec-21

Jan-22

Feb-22

Mar-22

Apr-22

May-22

Jun-22

Jul-22

Source: Company, Angel Research

August 8, 2022

6

Angel Top Picks – Aug 2022

Ramakrishna forg.

Ramkrishna Forgings (RKFL), a leading forging player in India and among

a select few having heavy press, stands to benefit from a favorable

demand outlook for the Medium & Heavy Commercial Vehicle (M&HCV)

industry in domestic and other key geographies in the near term.

The company has phased out its CAPEX over the past few years during

which it was impacted by industry slowdown in certain periods. With the

end to the CAPEX cycle, the favorable outlook in the medium term, and

sufficient capacity in place, we believe RKFL volumes would be able to

post a volume CAGR of 14% over FY22-24E.

RKFL has been able to add new products which have higher value

addition. Better mix along with operating leverage aided ~520 bps YoY

improvement in EBITDA margins in FY22 and are expected to sustain

going ahead.

Key Finance

Y/E

Sales

OPM

PAT

EPS

ROE

P/E

P/BV

EV/Sales

March

(` cr)

(%)

(` cr)

(`)

(%)

(x)

(x)

(x)

FY2023E

2,688

23.5

261

16.3

19.7

11.7

2.0

1.3

FY2024E

3,074

24.1

339

21.2

21.0

9.0

1.6

1.1

Source: Company, Angel Research

Suprajit Eng.

Suprajit Engineering (SEL) is the largest supplier of automotive cables to

the domestic OEMs with a presence across both 2Ws and PVs. Over the

years, SEL has evolved from a single product/client company in India to

have a diversified exposure which coupled with its proposition of low-cost

player has enabled it to gain market share and more business from

existing customers.

SEL overall has outperformed the Indian Auto industry in recent years

aided by market share gains as well as commercialization of new

products. The company believes that consolidation of vendors and new

client additions would help in maintaining the trend of market/wallet

share gains.

SEL has grown profitably over the years and as a result, it boasts a strong

balance sheet (net cash). We believe SEL is a prime beneficiary of a ramp-

up in production by OEMs and its newly developed products for EVs would

support revenues due to higher kit value. Its premium valuations are

justified in our opinion owing to its strong outlook and top-grade quality

of earnings.

Key Finance

Y/E

Sales

OPM

PAT

EPS

ROE

P/E

P/BV

EV/Sales

March

(` cr)

(%)

(` cr)

(`)

(%)

(x)

(x)

(x)

FY2023E

2,794

14.4

221

16.0

19.2

21.4

3.7

1.8

FY2024E

3,132

14.8

266

19.2

22.8

17.8

4.1

1.7

Source: Company, Angel Research

Stock Info

CMP

191

TP

256

Upside

34%

Sector

Auto

Market Cap (` cr)

3,054

Beta

1.2

52 Week High / Low

252/146

3-Year-Chart

-

50

100

150

200

250

300

Aug-19

Oct-19

Jan-20

Apr-20

Jul-20

Oct-20

Jan-21

Apr-21

Jul-21

Oct-21

Jan-22

Apr-22

Jul-22

Source: Company, Angel Research

Stock Info

CMP

343

TP

485

Upside

42%

Sector

Auto

Market Cap (` cr)

4,759

Beta

1.3

52 Week High / Low

478/272

3-Year-Chart

-

50

100

150

200

250

300

350

400

450

500

Aug-19

Oct-19

Jan-20

Apr-20

Jul-20

Oct-20

Jan-21

Apr-21

Jul-21

Oct-21

Jan-22

Apr-22

Jul-22

Source: Company, Angel Research

August 8, 2022

7

Angel Top Picks – Aug 2022

P I Industries

PI Industries is a leading player in providing Custom synthesis and

manufacturing solutions (CSM) to global agrochemical players. The CSM

business accounted for over 70% of the company's revenues in FY22 and is

expected to be the key growth driver for the company in future.

The company has been increasing it's share of high margin CSM business

driven by strong relationship with global agrochemical players. PI is

leveraging its chemistry skill sets and is looking to diversify its CSM portfolio

to electronic chemicals, Pharma API, fluoro chemicals, etc. which will help

drive business.

We expect PI Industries to post revenue/PAT CAGR of 17%/24% between

FY22-FY24 driven by 20% growth in the CSM business over the next 2-3

years. Moreover foray into new segments like electronic chemicals and APIs

will also help drive growth over next 3-4 years for the company.

Key Finance

Y/E

Sales

OPM

PAT

EPS

ROE

P/E

P/BV

EV/Sales

March

(` cr)

(%)

(` cr)

(`)

(%)

(x)

(x)

(x)

FY2023E

6,181

23.0

1064

70.0

15.0

46.4

5.7

6.2

FY2024E

7,194

23.8

1299

85.5

15.6

38.0

4.9

5.2

Source: Company, Angel Research

Jubilant Ingrev.

Jubilant Ingrevia was formed by spinning off the chemical and life science

ingredients of Jubilant Life Sciences Ltd. The company has a vast array of

products across its three divisions and is one of the top two producers of

Pyridine - Beta and vitamin B3 globally.

The company derives 56% of its revenues from the life science chemicals

division while the specialty chemicals and nutrition & health solution

business account for 28% and 15% of revenues respectively.

At current levels the stock is trading at P/E multiple of ~13.5xFY24 EPS

which is at a significant discount to other chemical companies. Therefore,

we believe that there is value in the stock at current levels and hence rate

it a BUY.

Key Finance

Y/E

Sales

OPM

PAT

EPS

ROE

P/E

P/BV

EV/Sales

March

(` cr)

(%)

(` cr)

(`)

(%)

(x)

(x)

(x)

FY2023E

5,020

17.0

544

34.2

19.9

14.4

2.9

1.6

FY2024E

5,572

17.4

633

39.7

19.5

12.4

2.4

1.4

Source: Company, Angel Research

Stock Info

CMP

3247

TP

3440

Upside

6%

Sector

Chemical

Market Cap (` cr)

48,941

Beta

0.9

52 Week High / Low

3533/2334

3-Year-Chart

-

500

1,000

1,500

2,000

2,500

3,000

3,500

4,000

Aug-19

Oct-19

Jan-20

Apr-20

Jul-20

Oct-20

Jan-21

Apr-21

Jul-21

Oct-21

Jan-22

Apr-22

Jul-22

Source: Company, Angel Research

Stock Info

CMP

491

TP

700

Upside

43%

Sector

Chemical

Market Cap (` cr)

7,584

Beta

1.7

52 Week High / Low

878/401

16-Months-Chart

-

100

200

300

400

500

600

700

800

900

Mar-21

Apr-21

May-21

Jun-21

Jul-21

Aug-21

Sep-21

Oct-21

Nov-21

Dec-21

Jan-22

Feb-22

Mar-22

Apr-22

May-22

Jun-22

Jul-22

Source: Company, Angel Research

August 8, 2022

8

Angel Top Picks – Aug 2022

HCL Technologies

HCL Tech (HCLT) is amongst the top four IT services companies based out

of India and provides a vast gamut of services like ADM, Enterprise

solutions, Infrastructure management services, etc.

IT services growth of over 2.7% QoQ CC in Q1FY23 which largely broad-

based and due to recovery in Products which grew by 5.1% QoQ CC.

New deal TCV at USD 2.1bn was up by 23% YoY and included many

large deals. Strong deal wins will help drive growth in the services

business, which should make up for the continued softness in the product

business.

At CMP, the stock is trading at a significant discount to the other large-

cap IT companies like Infosys and TCS and offers tremendous value at

current levels given market leader status in Infrastructure management.

Key Finance

Y/E

Sales

OPM

PAT

EPS

ROE

P/E

P/BV

EV/Sales

March

(` cr)

(%)

(` cr)

(`)

(%)

(x)

(x)

(x)

FY2023E

98,316

22.0

14,028

52.3

21.9

18.3

4.1

2.4

FY2024E

1,08,179

22.6

16,017

59.6

23.7

16.1

3.8

2.2

Source: Company, Angel Research

Stove Kraft

Stove Kraft Ltd (SKL) is engaged in the business of manufacturing & selling

Kitchen & Home appliances products like pressure cookers, LPG stoves, non-

stick cookware etc. under the brand name of 'Pigeon' and 'Gilma'.

In the Pressure Cookers and Cookware segment, over the last two years, the

company has outperformed Industry and its peers. Post Covid, organized

players are gaining market share from unorganized players which would

benefit the player like SKL.

Going forward, we expect SKL to report healthy top-line & bottom-line growth

on the back of new product launches, strong brand name and wide

distribution network.

Key Finance

Y/E

Sales

OPM

PAT

EPS

ROE

P/E

P/BV

EV/Sales

March

(` cr)

(%)

(` cr)

(`)

(%)

(x)

(x)

(x)

FY2023E

1,341

8.4

62.6

19.2

14.7

28.9

4.2

1.3

FY2024E

1,582

9.1

86.0

26.4

16.8

21.0

3.5

1.1

Source: Company, Angel Research

-

200

400

600

800

1,000

1,200

1,400

1,600

Jul-19

Sep-19

Dec-19

Mar-20

Jun-20

Sep-20

Dec-20

Mar-21

Jun-21

Sep-21

Dec-21

Mar-22

Jun-22

Stock Info

CMP

555

TP

805

Upside

45%

Sector

Others

Market Cap (` cr)

1,822

Beta

0.8

52 Week High / Low

1135/472

17-Months-Chart

-

200

400

600

800

1,000

1,200

Feb-21

Apr-21

Jun-21

Aug-21

Oct-21

Dec-21

Feb-22

Apr-22

Jun-22

Source: Company, Angel Research

Stock Info

CMP

958

TP

1192

Upside

24%

Sector

IT

Market Cap (` cr)

257,482

Beta

0.8

52 Week High / Low

1377/877

3-Year-Chart

-

200

400

600

800

1,000

1,200

1,400

1,600

Aug-19

Oct-19

Jan-20

Apr-20

Jul-20

Oct-20

Jan-21

Apr-21

Jul-21

Oct-21

Jan-22

Apr-22

Jul-22

Source: Company, Angel Research

August 8, 2022

9

Angel Top Picks – Aug 2022

Sobha

Company operates in Residential & Commercial real-estate along with

Contractual business. Companies 64% of residential pre-sales come from the

Bangalore market, which is one of the IT hubs in India, we expect new hiring by

the IT industry will increase residential demand in the South India market.

Ready to move inventory and under construction inventory levels have moved

down to its lowest levels. Customers are now having preference towards the

branded players like Sobha Developers.

Company expected new projects/phase spread over 13.53mn sqft across 7

cities. Majority of launches will be coming from existing land banks. Company

having land bank of approx. 200mn Sqft of salable area.

Key Finance

Y/E

Sales

OPM

PAT

EPS

ROE

P/E

P/BV

EV/Sales

March

(` cr)

(%)

(` cr)

(`)

(%)

(x)

(x)

(x)

FY2023E

3,350

58.0

457.0

48.1

15.6

14.1

1.7

1.9

FY2024E

3,752

59.0

524.0

55.4

16.2

12.2

1.5

1.7

Source: Company, Angel Research

Amber Enterp.

Amber Enterprises India Ltd. (Amber) is the market leader in the room air

conditioners (RAC) outsourced manufacturing space in India. Amber would

outperform the industry due to dominant position in Room AC contract

manufacturer, increase in share of business in existing customers and new

client additions.

Amber plans to increase revenues from components (by increasing product

offerings, catering to newer geographies, adding new clients) and exports

(already started in the Middle east). In the past 2-3 year, Amber has acquired

companies like IL JIN Electronics, Ever and Sidwal Refrigeration Industries,

which would help in backward integration and also help the company to foray

in different segments like railway, metro and defense.

Going forward, we expect healthy profitability on back of foray into the

Commercial AC segment, entry into export markets, participation in the PLI

scheme.

Key Finances

Y/E

Sales

OPM

PAT

EPS

ROE

P/E

P/BV

EV/Sales

March

(` cr)

(%)

(` cr)

(`)

(%)

(x)

(x)

(x)

FY2023E

5,522

7.4

208

61.8

16.4

36.7

4.4

1.5

FY2024E

6,850

8.0

304

90.2

18.8

25.2

4.1

1.2

Source: Company, Angel Research

Stock Info

CMP

677

TP

750

Upside

11%

Sector

Others

Market Cap (` cr)

6,410

Beta

1.2

52 Week High / Low

1045/480

3-Year-Chart

-

200

400

600

800

1,000

1,200

Aug-19

Oct-19

Jan-20

Apr-20

Jul-20

Oct-20

Jan-21

Apr-21

Jul-21

Oct-21

Jan-22

Apr-22

Jul-22

Source: Company, Angel Research

Stock Info

CMP

2269

TP

3850

Upside

70%

Sector

Others

Market Cap (` cr)

7,690

Beta

0.5

52 Week High / Low

4024/2030

3-Year-Chart

-

500

1,000

1,500

2,000

2,500

3,000

3,500

4,000

4,500

Aug-19

Oct-19

Jan-20

Apr-20

Jul-20

Oct-20

Jan-21

Apr-21

Jul-21

Oct-21

Jan-22

Apr-22

Jul-22

Source: Company, Angel Research

August 8, 2022

10

Angel Top Picks – Aug 2022

Oberoi Realty

Oberoi Realty is a real-estate company, focusing on the MMR region.

Company having business vertices of residential and commercial real-

estate.

Company has reported a strong set of numbers in Q4FY22, we expect

residential real-estate growth momentum to continue for the next couple of

quarters as in Q1FY23 company has launched Elysian Tower B in Goregon

along with this upcoming launch of Thane in current year.

We have seen good consolidation in across India towards top-10 players.

Top-10 players now holds 11.2% market share as compared to 5.4% in 2017.

We believes that top-10 players will continue to gain market share.

Key Finance

Y/E

Sales

OPM

PAT

EPS

ROE

P/E

P/BV

EV/Sales

March

(` cr)

(%)

(` cr)

(`)

(%)

(x)

(x)

(x)

FY2023E

3,621

59.0

1502

41.2

12.9

21.7

2.6

8.6

FY2024E

4,055

59.2

1550

42.6

13.1

21.0

2.6

8.2

Source: Company, Angel Research

Devyani Intl.

Devyani International Ltd. (DIL) is Yum! Brands’ largest franchisee in India,

with more than 800 stores including KFC, Pizza Hut and Costa Coffee.

Currently, DIL operates 339 KFC stores, 391 Pizza Hut stores, 50 Costa Coffee

stores in India and balance stores from other brands and from international

locations.

QSR industry is expected to grow ~23% CAGR over FY20-25 which would

benefit the player like DIL. Going ahead, We expect DIL would add 200 stores

per annum (at least 3-4 year) which would drive strong revenue growth.

Lower capex (shifted its strategy to smaller & delivery-focused stores) and

improving store-level economics would boost the operating margin going

ahead. Going forward, we expect DIL to report strong top-line growth &

improvement in operating on the back of aggressive store addition, improving

store unit economics and strong brand.

Key Finance

Y/E

Sales

OPM

PAT

EPS

ROE

P/E

P/BV

EV/Sales

March

(` cr)

(%)

(` cr)

(`)

(%)

(x)

(x)

(x)

FY2023E

2,990

23.0

258

2.4

27.3

78.1

20.5

5.9

FY2024E

3,947

23.4

410

3.9

30.3

48.0

14.3

5.2

Source: Company, Angel Research

Stock Info

CMP

895

TP

1000

Upside

12%

Sector

Others

Market Cap (` cr)

32,946

Beta

1.5

52 Week High / Low

1052/644

3-Year-Chart

-

200

400

600

800

1,000

1,200

Aug-19

Oct-19

Jan-20

Apr-20

Jul-20

Oct-20

Jan-21

Apr-21

Jul-21

Oct-21

Jan-22

Apr-22

Jul-22

Source: Company, Angel Research

Stock Info

CMP

187

TP

219

Upside

17%

Sector

Others

Market Cap (` cr)

22,480

Beta

1.4

52 Week High / Low

199/108

12-Month-Chart

-

50

100

150

200

250

Aug-21

Sep-21

Oct-21

Nov-21

Dec-21

Jan-22

Feb-22

Mar-22

Apr-22

May-22

Jun-22

Jul-22

Source: Company, Angel Research

August 8, 2022

11

Angel Top Picks – Aug 2022

Marico

Marico is one of the major FMCG companies present in hair oil, edible oil,

foods & personal care segment. Major brands include Parachute, Saffola,

Nihar, Hair & Care, Set Wet, Livon & Beardo.

Marico’s products have strong brand recall coupled with an extensive

distribution reach of more than 5mn outlets and direct reach of ~1 million

outlets. Parachut flagship brand gained market share by 170 bps in FY22 &

expected to performance better going ahead.

In the medium term, the company aspires to grow revenue at 13-15% with

8-10% volume growth. Marico has a strong balance sheet along with free cash

flow and higher profitability. We expect Marico to report healthy bottom-line

CAGR of ~11% over FY2022-24E due to better volume growth on the back

of strong brand, wide distribution network.

Key Finance

Y/E

Sales

OPM

PAT

EPS

ROE

P/E

P/BV

EV/Sales

March

(` cr)

(%)

(` cr)

(`)

(%)

(x)

(x)

(x)

FY2023E

10,368

17.9

1287

10.2

30.3

50.9

15.3

6.2

FY2024E

11,301

18.8

1478

11.7

28.0

44.4

12.3

5.6

Source: Company, Angel Research

Stock Info

CMP

520

TP

600

Upside

15%

Sector

Others

Market Cap (` cr)

67,958

Beta

1.2

52 Week High / Low

606/456

3-Year-Chart

-

100

200

300

400

500

600

700

Aug-19

Oct-19

Jan-20

Apr-20

Jul-20

Oct-20

Jan-21

Apr-21

Jul-21

Oct-21

Jan-22

Apr-22

Jul-22

Source: Company, Angel Research

August 8, 2022

12

Angel Top Picks – Aug 2022

Stock bought in last 12 Months

Stock

Date

Reco

Price

P I Industries

9-Sep-21

BUY

3,420

Amber Enterp.

14-Sep-21

BUY

3243.00

Sobha

22-Sep-21

BUY

729.00

Lemon Tree Hotel

23-Sep-21

BUY

43.25

Whirlpool India

29-Sep-21

BUY

2,299

Ramkrishna Forg.

13-Oct-21

BUY

244

HCL Technologies

20-Dec-21

BUY

1,159

Jubilant Ingrev.

31-Dec-21

BUY

565

Oberoi Realty

7-Jan-22

BUY

922

Devyani Intl.

9-Feb-22

BUY

175.00

Marico

14-Jun-22

BUY

498.00

Source: Company, Angel Research

Stock sold in last 12 Months

Stock

Date

Reco

Price

Sobha

7-Sep-21

EXIT

780

Crompton Gr. Con

14-Sep-21

EXIT

484.00

Dalmia BharatLtd

22-Sep-21

EXIT

2,143

Bajaj Electrical

24-Sep-21

EXIT

1,499

L & T Infotech

27-Sep-21

EXIT

5,950

GNA Axles

19-Oct-21

EXIT

1,076

Whirlpool India

3-Nov-21

EXIT

2,074

Shri.City Union.

6-Dec-21

EXIT

2,066

Lemon Tree Hotel

17-Dec-21

EXIT

47.25

Safari Inds.

10-Feb-22

EXIT

942.00

Carborundum Uni.

28-Feb-22

EXIT

813

Source: Company, Angel Research

August 8, 2022

13

Angel Top Picks – Aug 2022

Ratings (Based on Expected Returns: Buy (> 15%) Accumulate (5% to 15%) Neutral (-5 to 5%)

Over 12 months investment period) Reduce (-5% to -15%) Sell (< -15%)

Hold (Fresh purchase not recommended)

Research Team Tel: 022 - 40003600 E-mail: [email protected] Website: www.angelone.in

DISCLAIMER

Angel One Limited (hereinafter referred to as “Angel”) is a registered Member of National Stock Exchange of India Limited, Bombay Stock

Exchange Limited and Metropolitan Stock Exchange Limited. It is also registered as a Depository Participant with CDSL and Portfolio Manager

and investment advisor with SEBI. It also has registration with AMFI as a Mutual Fund Distributor. Angel One Limited is a registered entity with

SEBI for Research Analyst in terms of SEBI (Research Analyst) Regulations, 2014 vide registration number INH000000164. Angel or its

associates has not been debarred/ suspended by SEBI or any other regulatory authority for accessing /dealing in securities Market.

This document is solely for the personal information of the recipient, and must not be singularly used as the basis of any investment decision.

Nothing in this document should be construed as investment or financial advice. Each recipient of this document should make such

investigations as they deem necessary to arrive at an independent evaluation of an investment in the securities of the companies referred to

in this document (including the merits and risks involved), and should consult their own advisors to determine the merits and risks of such an

investment.

Angel or its associates or research analyst or his relative may have actual/beneficial ownership of 1% or more in the securities of the subject

company at the end of the month immediately preceding the date of publication of the research report. Neither Angel or its associates nor

Research Analysts or his relative has any material conflict of interest at the time of publication of research report.

Angel or its associates might have received any compensation from the companies mentioned in the report during the period preceding twelve

months from the date of this report for services in respect of managing or co-managing public offerings, corporate finance, investment

banking or merchant banking, brokerage services or other advisory service in a merger or specific transaction in the normal course of

business. Angel or its associates did not receive any compensation or other benefits from the companies mentioned in the report or third party

in connection with the research report. Neither Angel nor its research analyst entity has been engaged in market making activity for the subject

company.

Reports based on technical and derivative analysis center on studying charts of a stock's price movement, outstanding positions and trading

volume, as opposed to focusing on a company's fundamentals and, as such, may not match with a report on a company's fundamentals.

Investors are advised to refer the Fundamental and Technical Research Reports available on our website to evaluate the contrary view, if any.

The information in this document has been printed on the basis of publicly available information, internal data and other reliable sources

believed to be true, but we do not represent that it is accurate or complete and it should not be relied on as such, as this document is for

general guidance only. Angel One Limited or any of its affiliates/ group companies shall not be in any way responsible for any loss or damage

that may arise to any person from any inadvertent error in the information contained in this report. Angel One Limited has not independently

verified all the information contained within this document. Accordingly, we cannot testify, nor make any representation or warranty, express

or implied, to the accuracy, contents or data contained within this document. While Angel One Limited endeavors to update on a reasonable

basis the information discussed in this material, there may be regulatory, compliance, or other reasons that prevent us from doing so.

This document is being supplied to you solely for your information, and its contents, information or data may not be reproduced, redistributed

or passed on, directly or indirectly.

Neither Angel One Limited, nor its directors, employees or affiliates shall be liable for any loss or damage that may arise from or in connection

with the use of this information. Angel or its associates or Research Analyst or his relative might have financial interest in the subject company.

Research analyst has not served as an officer, director or employee of the subject company.