1

Please refer to important disclosures at the end of this report

1

1

Yes Bank Ltd. (YBL), a new generation private sector bank, was incorporated in

November 2003 by Mr. Rana Kapoor and Mr. Ashok Kapur. However, the RBI

superseded the Board of Directors of the bank and imposed a moratorium on YBL

from March 05, 2020. Further, on March 13, 2020, the government had

approved a bailout plan for Yes Bank. Under the plan, Yes Bank had received

around `10,000cr from eight financial institutions, including `6,050cr from SBI.

Currently, pre-FPO, SBI owns 48.21% in Yes Bank.

Weakening operations, business metrics; SBI support to take longer time for

stabilizing: Yes Bank was having deposits worth `2,27,610cr as on Q4FY2019,

however, it dropped to `2,09,497cr in Q2FY20. Further, as a result of the

negative news in Q3 & Q4 of FY2020, the bank witnessed sizeable deposit

withdrawal of `1,00,000cr reaching to `1,05,364cr in Q4FY2020. CASA deposits

declined 63% yoy to `28,063cr. We believe rebuilding term deposit and CASA

would be a challenging task, nevertheless SBI image would likely help YBL to stop

further depletion in deposit base. Moreover, constraint in capital and deposit

withdrawal has impacted loan book too, which declined 29% yoy in FY20;

consequently, adversely impacting NII and other income. Subsequently pre-

provision profit plunged 56% in FY20.

Improvement in asset quality a far off thing; economic slowdown to add to

existing woes: GNPA for FY2020 spiked 4.2x to `32,878cr, which led to 6x

increase on provision on bad asset. This impacted profitability adversely, and YBL

reported loss of `16,418cr. However, on positive side, YBL’s provision coverage

ratio increased to 74%. We believe the bank’s provision cost to remain elevated

owing to (1) high overdue advances (SMA I & II) that stood at 6.5% (`11,102cr) of

the standard advances as on Q4FY20, (2) Covid led slowdown in economic

activity to impact bank’s exposure to segments like real estate, hospitality, travel

and tourism

Gap between FPO price & CMP: We believe current market price of Yes Bank is

not the true reflection of fundamentals given that the reconstruction scheme had

locked in 75% of all shares for 3 years, held by existing shareholders and new

investors entering via the scheme. Hence, we believe CMP will converge around

FPO price, once FPO shares float in the market. However, on FPO there is no

locked in period for any investor.

Market outlook and valuation: At the upper end of the price band, Yes Bank

demands Adj. PB of 0.85x post considering FPO. In current market, other banks

are trading at attractive valuation of FY20 net worth viz. IDFC Bank (0.9x), SBI

Bank (0.5x Core banking business), Federal Bank (0.9x). Our concern for Yes

Bank is fresh formation of bad loans that would keep provision highs and return

ratio compressed for longer time. Retail deposit is the key for any bank for lower

cost of funds; however, YBL has witnessed sizable deposit withdrawal over last 2

quarters. Rebuilding CASA and deposits is a challenging task and would take

longer time. Overall, the bank’s revival and decent RoE numbers will take longer

time. Considering above factors, we recommend NEUTRAL rating for FPO.

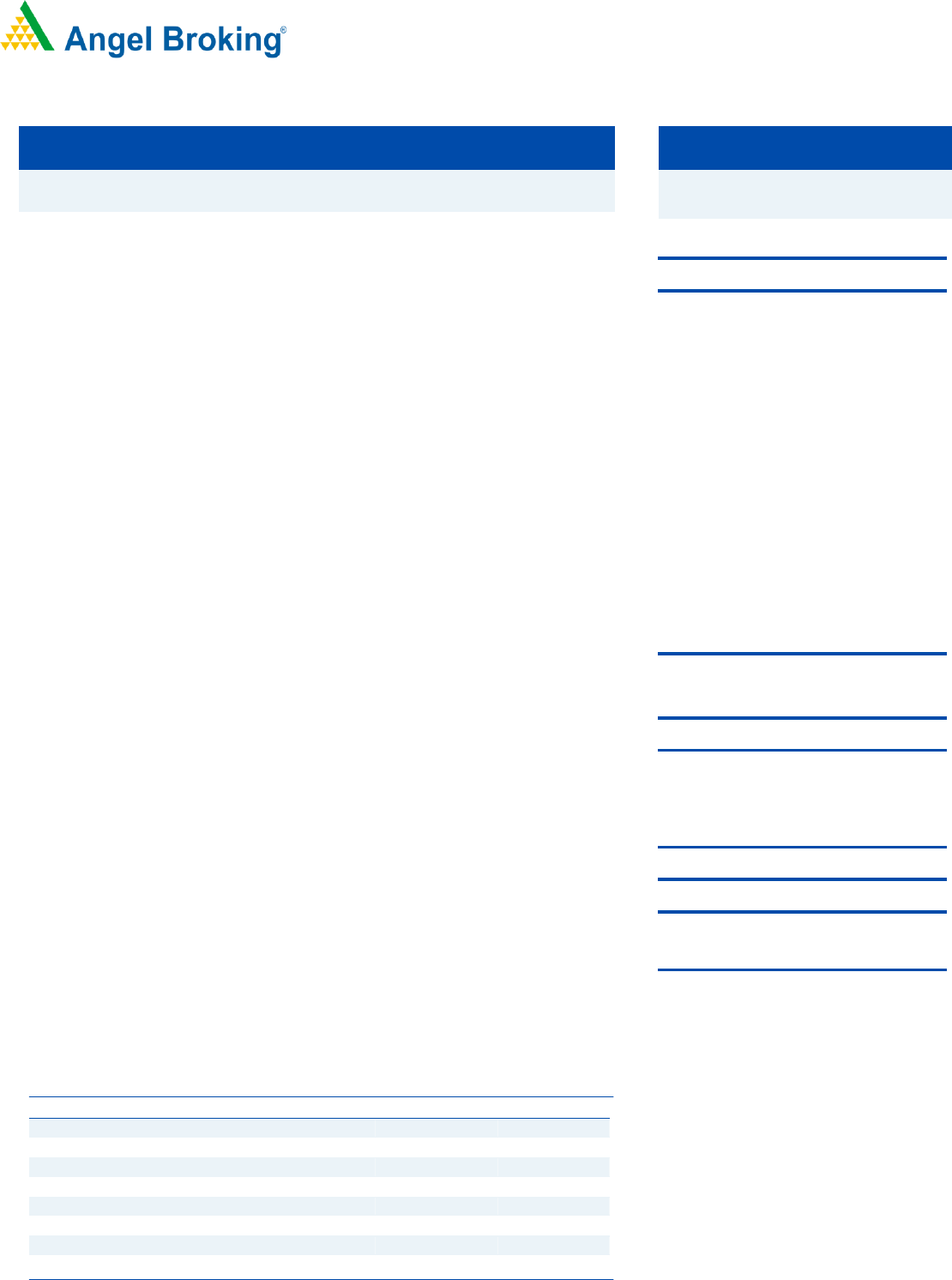

Key Financials

Y/E March

FY17

FY18

FY19

FY20

NII

5,797

7,737

9,809

6,805

% Chg

27

33

27

(31)

Net Profit

3,330

4,225

1,720

(16,432)

% Chg

31

27

(59)

(1,419)

NIM (%)

3.4

3.3

3.1

2.4

EPS (`)

1

2

1

(9)

P/BV (x)

1.5

1.3

1.2

0.9

RoA (%)

1.8

1.6

0.5

(7.1)

Source: Valaution done on upper price band and FY20 PBV considered FPO.

NEUTRAL

Issue Open: July 15, 2020

Issue Close: July 17, 2020

Offer for sale: ` -

QIBs 50% of issue

Non-Institutional 15% of issue

Retail 35% of issue

Promoters

0.7%

Others

99.3%

Fresh issue: `15,000cr

Issue Details

Face Value: `2

Present Eq. Paid up Capital: ` 2510cr

Post Issue Shareholding Pattern

Post Eq. Paid up Capital: `5,013cr

Issue size (amount): *`15,000cr

Price Band: `12-13

Lot Size: 1000 shares and in multiple

thereafter

Post-issue implied mkt. cap: *`30,079cr -

**`31,332cr

Promoters holding Pre-Issue: 1.4%

Promoters holding Post-Issue: 0.7%

*Calculated on lower price band

** Calculated on upper price band

Book Building

Yes Bank

FPO Note | BFSI

July 14, 2020

2

July

14,

Yes Bank| FPO Note

July 14, 2020

2

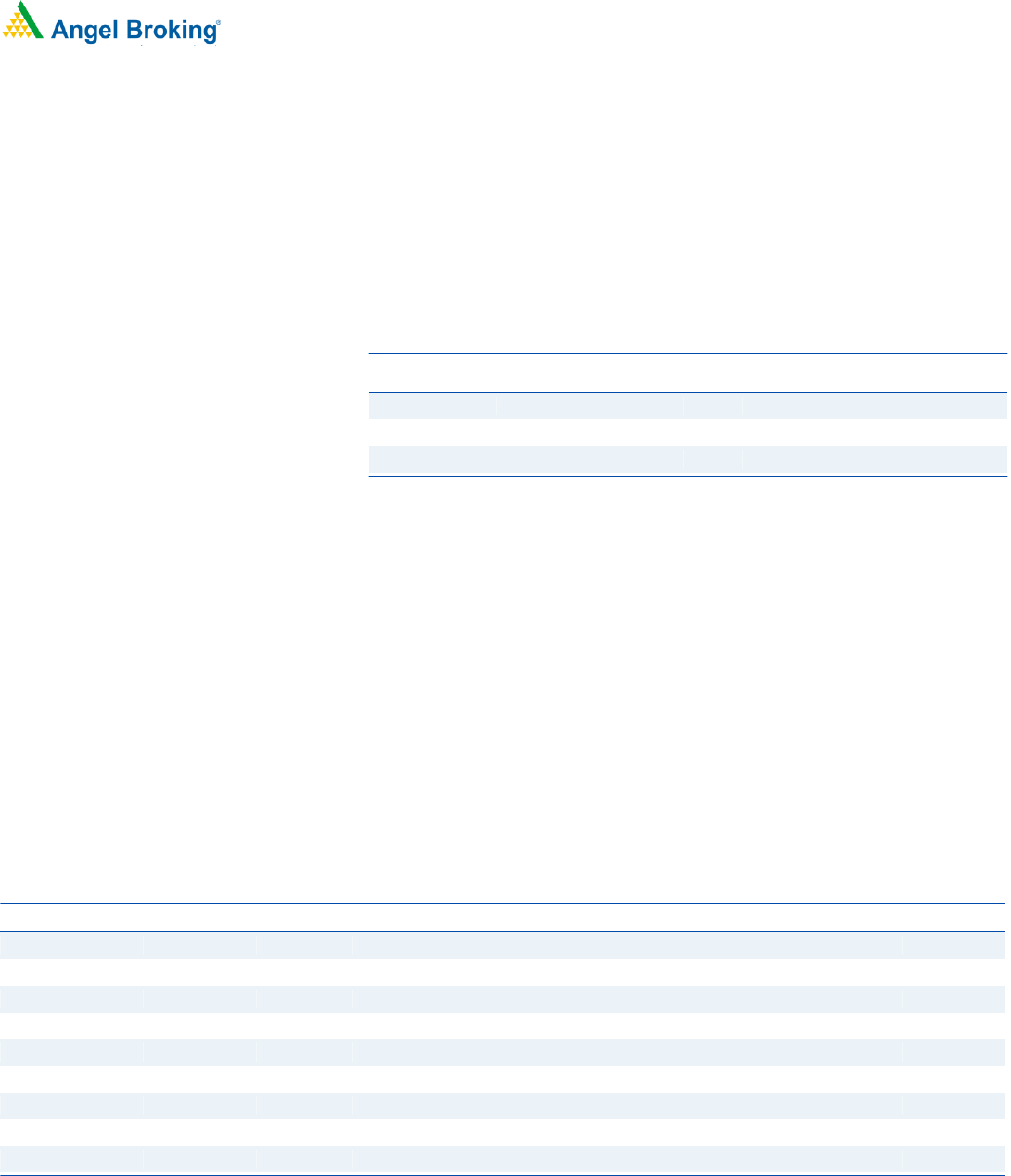

Issue details

Yes Bank FPO is raising `15,000cr through fresh issue.

In this FPO, there is a reservation (`200cr) kept for employees of Yes Bank, along

with this they will also get `1/- discount.

Exhibit 1: Pre and Post Shareholding Pattern

Particular

No of shares

(Pre-issue)

%

No of shares

(Post-issue)

%

Promoter

17,79,40,925

1.4

17,79,40,925

0.7

Investor/Public

12,37,25,31,306

98.6

24,88,76,82,820

99.3

12,55,04,72,231

100.0

25,06,56,23,745

100.0

Source RHP Note : Calculated on upper price band

Objects of the offer

Ensuring adequate capital to support growth and expansion, including

enhancing the Bank’s solvency and capital adequacy ratio

Risk

Improvement in asset quality and Deposit in mid term would be key risk to our

NEUTRAL call.

Exhibit 2: Relative Valuation

Banks (` cr)

Mcap

NW

Advance

Deposit

GNPA

NPA

PCR

PBV FY20

Yes Bank

31,332

36,726

1,71,443

1,05,364

16.8

5.0

70

0.85

Axis Bank

1,24,056

84,947

5,71,424

6,40,105

4.9

1.6

68

1.46

ICICI bank

2,33,366

1,12,091

6,45,290

7,70,969

5.5

1.4

75

1.45

IDFC Bank

15,372

17,342

85,595

65,108

2.6

0.9

64

0.94

SBI Bank

1,74,000

2,08,244

24,22,845

32,41,621

6.2

2.2

64

0.50

Bank Of Baroda

23,842

65,776

6,90,121

9,45,985

9.4

3.1

67

0.37

Federal Bank

10,800

14,513

1,24,153

1,52,290

2.8

1.3

54

0.89

HDFC Bank

6,06,731

1,70,985

9,93,703

11,47,502

1.3

0.4

71

3.55

Canara Bank

15,000

32,959

4,51,223

6,25,351

8.2

4.2

49

0.58

Source: Company, Valaution done on closing price of 10/7/2020

3

July

14,

Yes Bank| FPO Note

July 14, 2020

3

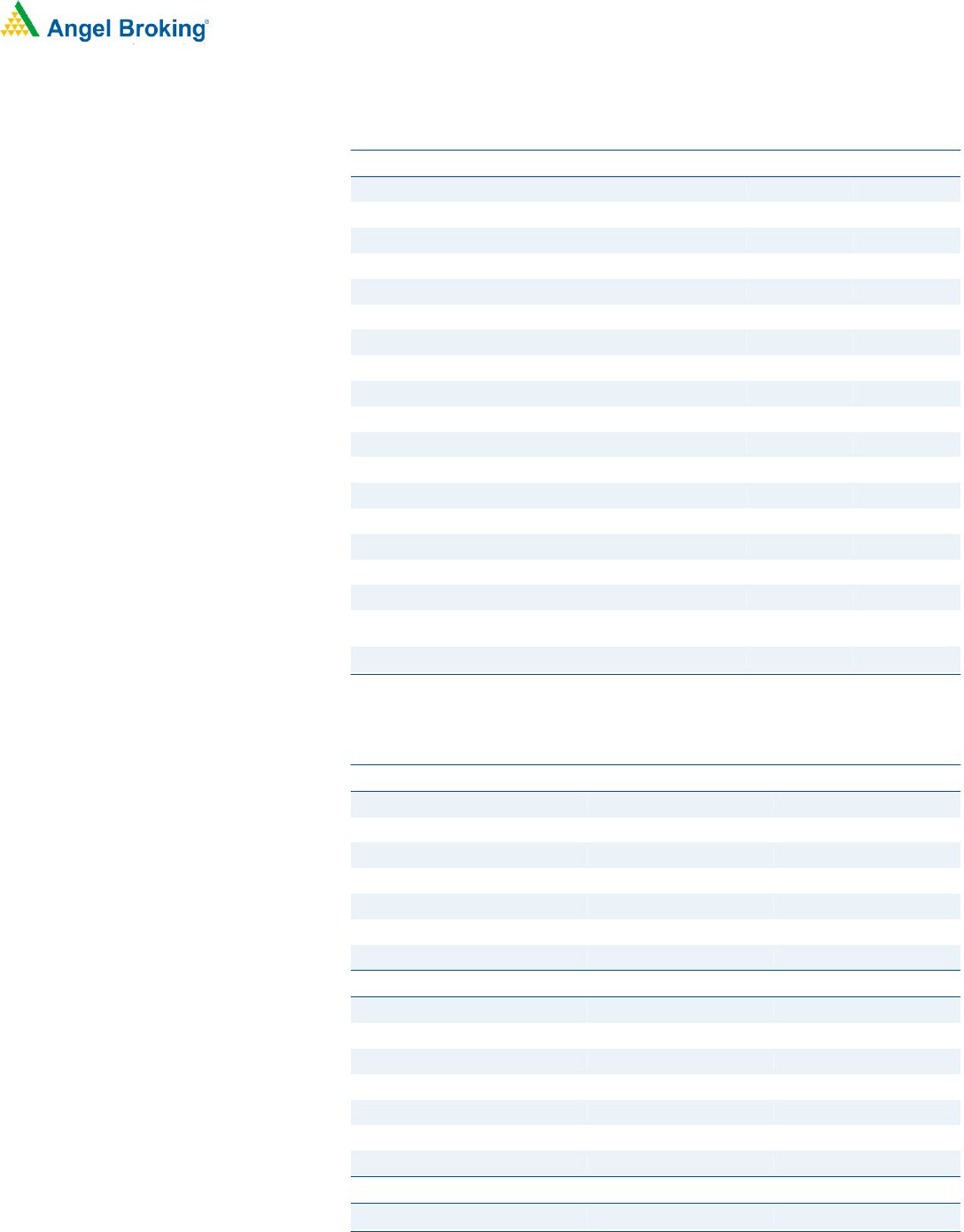

Income Statement

Particular (` cr)

FY17

FY18

FY19

FY20

Net Interest Income

5,797

7,737

9,809

6,805

- YoY Growth (%)

27

33

27

(31)

Other Income

4,157

5,224

4,590

3,441

- YoY Growth (%)

53

26

(12)

(25)

Operating Income

9,954

12,961

14,399

10,247

- YoY Growth (%)

37

30

11

(29)

Operating Expenses

4,117

5,213

6,264

6,706

- YoY Growth (%)

38

27

20

7

Pre - Provision Profit

5,838

7,748

8,135

3,541

- YoY Growth (%)

36

33

5

(56)

Prov. & Cont.

793

1,554

5,778

32,758

- YoY Growth (%)

48

96

272

467

Profit Before Tax

5,044

6,194

2,357

(29,217)

- YoY Growth (%)

34

23

(62)

(1,339)

Prov. for Taxation

1,714

1,970

637

(6,530)

- as a % of PBT

34

32

27

22

PAT

3,330

4,225

1,720

(22,688)

Extraordinary Item

(Net of tax )

6,297

Adj Pat

3,330

4,225

1,720

(16,391)

Balancesheet

Y/E March (` cr)

FY17

FY18

FY19

FY20

Equity

456

461

463

2,510

Reserve & Surplus

21,598

25,298

26,441

19,216

Networth

22,054

25,758

26,904

21,726

Deposits

1,42,874

2,00,738

2,27,610

1,05,364

- Growth (%)

28

41

13

(54)

Borrowings

38,607

74,894

1,08,424

1,13,791

Other Liab. & Prov.

11,525

11,056

17,888

16,946

Total Liabilities

2,15,060

3,12,446

3,80,826

2,57,827

Cash Balances

6,952

11,426

10,798

5,944

Bank Balances

12,597

13,309

16,092

2,439

Investments

50,032

68,399

89,522

43,915

Advances

1,32,263

2,03,534

2,41,500

1,71,443

- Growth (%)

35

54

19

(29)

Fixed Assets

684

832

817

1,009

Other Assets

12,532

14,946

22,098

33,077

Total Assets

2,15,060

3,12,446

3,80,826

2,57,827

- Growth (%)

30

45

22

(32)

4

July

14,

Yes Bank| FPO Note

July 14, 2020

4

Key Ratio

Particular

FY17

FY18

FY19

FY20

Profitability ratios (%)

NIMs

3.4

3.3

3.1

2.4

Cost to Income Ratio

41.4

40.2

43.5

65.4

RoA

1.8

1.6

0.5

-7.1

RoE

18.6

17.7

6.5

-93.3

B/S ratios (%)

CASA Ratio

36

36

33

27

Credit/Deposit Ratio

0.9

1.0

1.1

1.6

Asset Quality

Gross NPAs %

1.52

1.28

3.22

16.80

Gross NPAs (Amt)

2,019

2,627

7,883

32,878

Net NPAs %

0.81

0.64

1.86

5.03

Net NPAs (Amt)

1,072

1,313

4,485

8,624

Credit Cost on Advance %

0.60

0.76

2.39

19.11

Provision Coverage %

47%

50%

43%

74%

Per Share Data (`)

EPS

1.3

1.7

0.7

-9.1

BV

8.8

10.3

10.7

14.7

Valuation Ratios

PER (x)

9.8

7.7

18.9

-1.4

P/BV

1.5

1.3

1.2

0.9

Valuation done at upper price band and FPO share considered

5

July

14,

Yes Bank| FPO Note

July 14, 2020

5

Research Team Tel: 022 - 39357800 E-mail: [email protected] Website: www.angelbroking.com

DISCLAIMER

Angel Broking Limited (hereinafter referred to as “Angel”) is a registered Member of National Stock Exchange of India Limited,

Bombay Stock Exchange Limited, Metropolitan Stock Exchange Limited, Multi Commodity Exchange of India Ltd and National

Commodity & Derivatives Exchange Ltd It is also registered as a Depository Participant with CDSL and Portfolio Manager and

Investment Adviser with SEBI. It also has registration with AMFI as a Mutual Fund Distributor. Angel Broking Limited is a registered

entity with SEBI for Research Analyst in terms of SEBI (Research Analyst) Regulations, 2014 vide registration number INH000000164.

Angel or its associates has not been debarred/ suspended by SEBI or any other regulatory authority for accessing /dealing in securities

Market. Angel or its associates/analyst has not received any compensation / managed or co-managed public offering of securities of

the company covered by Analyst during the past twelve months.

This document is solely for the personal information of the recipient, and must not be singularly used as the basis of any investment

decision. Nothing in this document should be construed as investment or financial advice. Each recipient of this document should

make such investigations as they deem necessary to arrive at an independent evaluation of an investment in the securities of the

companies referred to in this document (including the merits and risks involved), and should consult their own advisors to determine

the merits and risks of such an investment.

Reports based on technical and derivative analysis center on studying charts of a stock's price movement, outstanding positions and

trading volume, as opposed to focusing on a company's fundamentals and, as such, may not match with a report on a company's

fundamentals. Investors are advised to refer the Fundamental and Technical Research Reports available on our website to evaluate the

contrary view, if any

The information in this document has been printed on the basis of publicly available information, internal data and other reliable

sources believed to be true, but we do not represent that it is accurate or complete and it should not be relied on as such, as this

document is for general guidance only. Angel Broking Limited or any of its affiliates/ group companies shall not be in any way

responsible for any loss or damage that may arise to any person from any inadvertent error in the information contained in this report.

Angel Broking Limited has not independently verified all the information contained within this document. Accordingly, we cannot

testify, nor make any representation or warranty, express or implied, to the accuracy, contents or data contained within this document.

While Angel Broking Limited endeavors to update on a reasonable basis the information discussed in this material, there may be

regulatory, compliance, or other reasons that prevent us from doing so.

This document is being supplied to you solely for your information, and its contents, information or data may not be reproduced,

redistributed or passed on, directly or indirectly.

Neither Angel Broking Limited, nor its directors, employees or affiliates shall be liable for any loss or damage that may arise from or in

connection with the use of this information..