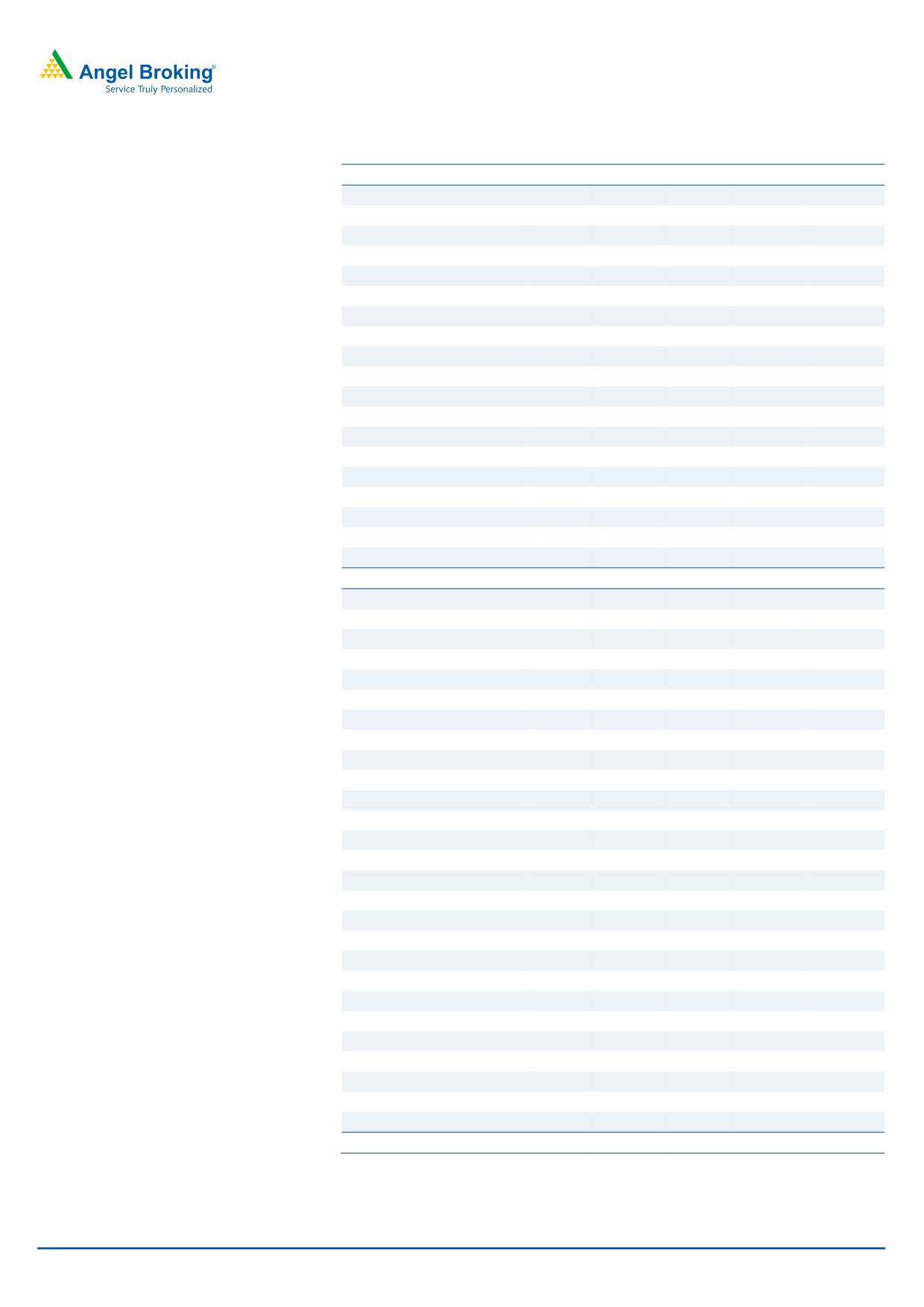

2QFY2017 Result Update | IT

October 25, 2016

Wipro

BUY

CMP

`484

Performance Highlights

Target Price

`590

(` cr)

2QFY17

1QFY17

% chg (qoq)

2QFY16

% chg (yoy)

Investment Period

12 Months

Net revenue

13,766

13,599

1.2

12,238

12.5

EBITDA

2,654

2,653

0.0

2,606

1.8

Stock Info

EBITDA margin (%)

19.3

19.5

(23)bps

21.3

(202)bps

PAT

2,070

2,052

0.9

2,187

(5.3)

Sector

IT

Source: Company, Angel Research

Market Cap (` cr)

117,590

Net Debt (` cr)

(21,460)

On the sales front, Wipro posted a 0.8% sequential de-growth in its IT Services

revenues to US$1,916mn (V/s US$1,921mn expected v/s US$1,931mn in

Beta

0.6

1QFY2017). In Constant Currency (CC) terms, the company posted a qoq growth

52 Week High / Low

607/470

of 0.9%. In terms of verticals, Healthcare, Life Sciences & Services posted a

Avg. Daily Volume

182,727

CC qoq growth of 4.3%; while in terms of geography, US posted a CC qoq

Face Value (`)

2

growth of 1.8%. The EBIT margin came in at 15.8% (V/s 15.1% expected), a dip

BSE Sensex

28,179

of 32bps qoq. Consequently, the PAT came in at `2,070cr (V/s `1,968cr

Nifty

8,709

expected), a growth of 0.9% qoq. On guidance front, the company expects to post

Reuters Code

WIPR.BO

IT Services sales of US$1,916-1,955mn in 3QFY2017, which imply a qoq CC

Bloomberg Code

WPRO@IN

growth of 0-2%. We recommend a buy on the stock.

Quarterly highlights: On the sales front, Wipro posted a

0.8% sequential

Shareholding Pattern (%)

de-growth in its IT Services revenues to US$1,916mn (V/s US$1,921mn expected

Promoters

73.3

v/s US$1,931mn in 1QFY2017). In Constant Currency (CC) terms, the company

MF / Banks / Indian Fls

7.2

posted a qoq growth of 0.9%. In INR terms, the consolidated revenues are

FII / NRIs / OCBs

13.6

expected to come in at `13,766cr (V/s `13,428cr expected), up by 1.2% qoq. In

Indian Public / Others

5.9

terms of verticals, Healthcare, Life Sciences & Services posted a CC qoq growth of

4.3%; while in terms of geography, US posted a CC qoq growth of 1.8%. The

EBIT margin came in at 15.8% (V/s 15.1% expected), an dip of 32bp qoq.

Abs.(%)

3m 1yr

3yr

Consequently, the PAT came in at `2,070cr (V/s `1,968cr expected), a growth of

Sensex

1.4

2.6

36.0

0.9% qoq.

Wipro

(10.0)

(14.9)

2.6

Outlook and valuation: The management has set a target of US$15bn of

revenue and an EBIT margin of 23% by 2020. The company achieving the

3-year price chart

revenue target would imply a CAGR of 20% in sales over the next four years.

700.0

However, the near term guidance suggests a moderate organic growth. We

600.0

recommend a buy on the stock, given the valuations.

500.0

Key financials (Consolidated, IFRS)

Y/E March (` cr)

FY2015

FY2016

FY2017E

FY2018E

400.0

Net sales

46,955

51,631

55,440

60,430

300.0

% chg

8.1

10.0

7.4

17.0

200.0

Net profit

8,653

8,887

9,148

9,853

% chg

11.0

2.7

2.9

7.7

EBITDA margin (%)

22.3

21.7

18.1

18.1

EPS (`)

35.1

35.9

37.0

39.9

Source: Company, Angel Research

P/E (x)

13.8

13.5

13.1

12.1

P/BV (x)

2.9

2.6

2.4

2.2

RoE (%)

21.1

19.0

19.0

17.0

RoCE (%)

15.3

13.4

13.4

13.9

Sarabjit kour Nangra

EV/Sales (x)

2.1

1.8

1.7

1.4

+91 22-39357800 Ext: 6806

EV/EBITDA (x)

9.3

8.5

8.2

6.9

Source: Company, Angel Research; Note: CMP as of October 24, 2016

Please refer to important disclosures at the end of this report

1

Wipro | 2QFY2017 Result Update

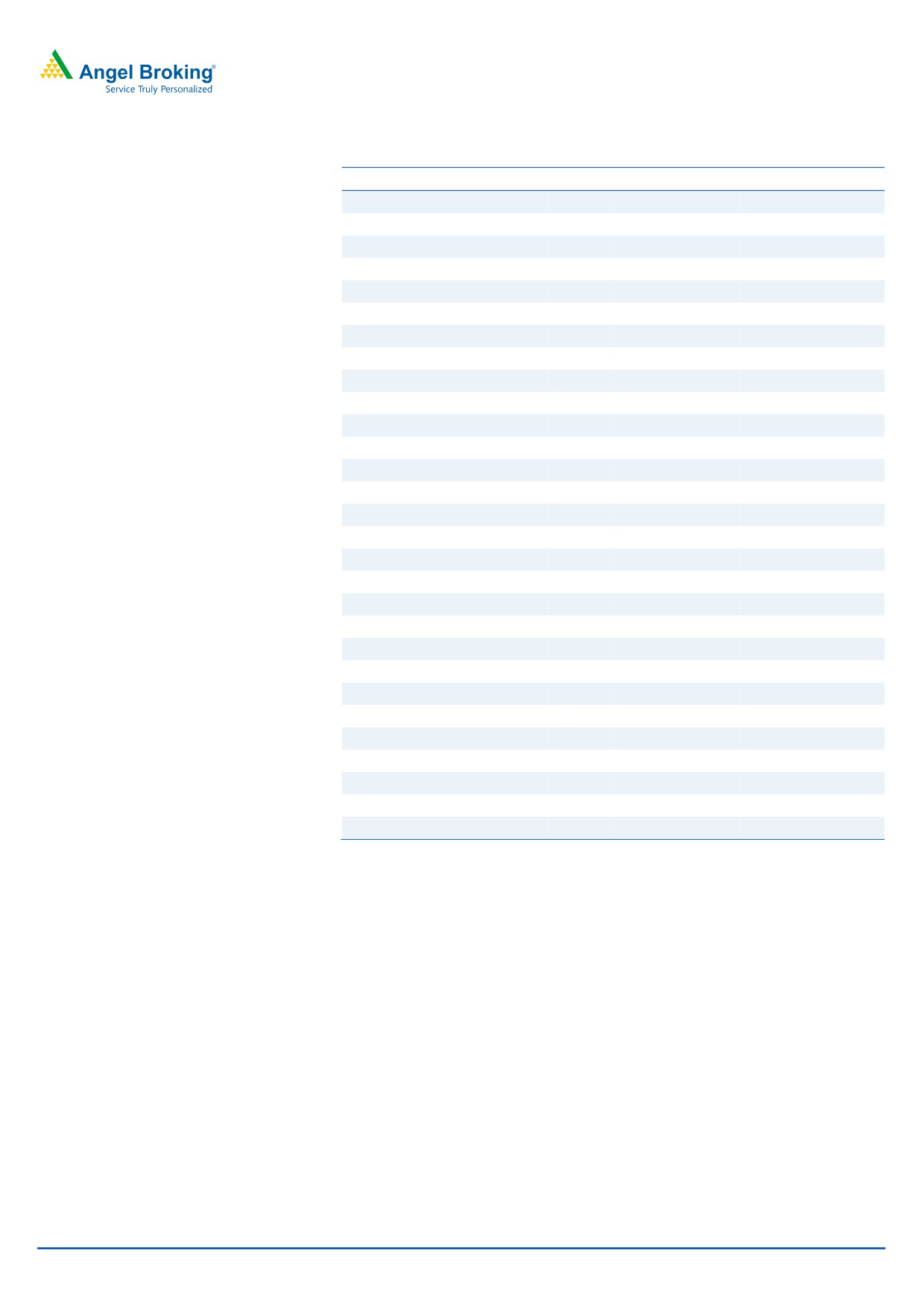

Exhibit 1: 2QFY2017 performance (Consolidated, IFRS)

Y/E March (` cr)

2QFY17

1QFY17

% chg (qoq)

2QFY16

% chg (yoy) 1HFY2017

1HFY2016

% chg (yoy)

Net revenue

13,766

13,599

1.2

12,238

12.5

27,365

24,751

10.6

Cost of revenue

9,296

9,172

1.3

8,142

14.2

18,469

16,372

12.8

Gross profit

4,470

4,427

1.0

4,096

9.1

8,896

8,379

6.2

SGA expense

1,816

1,774

2.4

1,490

21.9

3,590

3,053

17.6

EBITDA

2,654

2,653

0.0

2,606

1.8

5,307

5,326

(0.4)

Dep. and amortisation

485

467

3.9

337

43.8

951

689

38.0

EBIT

2,169

2,186

(0.8)

2,269

(4.4)

4,355

4,637

(6.1)

Other income

496

485

2.3

529

981

1,062

(7.7)

PBT

2,665

2,671

(0.2)

2,798

(4.8)

5,336

5,699

(6.4)

Income tax

591

612

(3.5)

595

(0.7)

1,203

1,247

(3.5)

PAT

2,077

2,059

0.9

2,203

(5.7)

4,133

4,452

(7.2)

Minority interest

7

7

16

14

21

Adj. PAT

2,070

2,052

0.9

2,187

(5.3)

4,119

4,433

(7.1)

Diluted EPS

8.6

8.4

2.4

9.1

(6.2)

16.9

18.1

(6.4)

Gross margin (%)

32.5

32.6

(8)bps

33.5

(100)bps

32.5

33.9

(134)bps

EBITDA margin (%)

19.3

19.5

(23)bps

21.3

(202)bps

19.4

21.5

(213)bps

EBIT margin (%)

15.8

16.1

(32)bps

18.5

(278)bps

15.9

18.7

(282)bps

PAT margin(%)

15.0

15.1

(5)bps

17.9

(283)bps

15.1

17.9

(286)bps

Source: Company, Angel Research

Exhibit 2: 2QFY2017 - Actual vs Angel estimates

(` cr)

Actual

Estimate

Variation (%)

Net revenue

13,766

13,428

2.5

EBIT margin (%)

15.8

15.1

62bps

PAT

2,070

1,968

5.2

Source: Company, Angel Research

Revenues higher than expected

On the sales front, Wipro posted a 0.8% sequential de-growth in its IT Services

revenues to US$1,916mn (V/s US$1,921mn expected v/s US$1,931mn in

1QFY2017). In CC terms, the company posted a qoq growth of 0.9%. In INR

terms, the consolidated revenues are expected to come in at `13,765cr (V/s

`13,428cr expected), up by 1.3% qoq.

In terms of verticals, Healthcare, Life Sciences & Services posted a CC qoq growth

of 4.3%; while in terms of geography, US posted a CC qoq growth of 1.8%.

During the quarter, revenue from the Energy vertical declined by 4.1% qoq (CC).

The pressure is expected to continue until oil prices stabilize, post which customers

would tend to resume their discretionary spends. Finance Solutions saw good

growth and the environment in Healthcare and Life sciences is now robust, post the

integration of recent acquisitions.

October 25, 2016

2

Wipro | 2QFY2017 Result Update

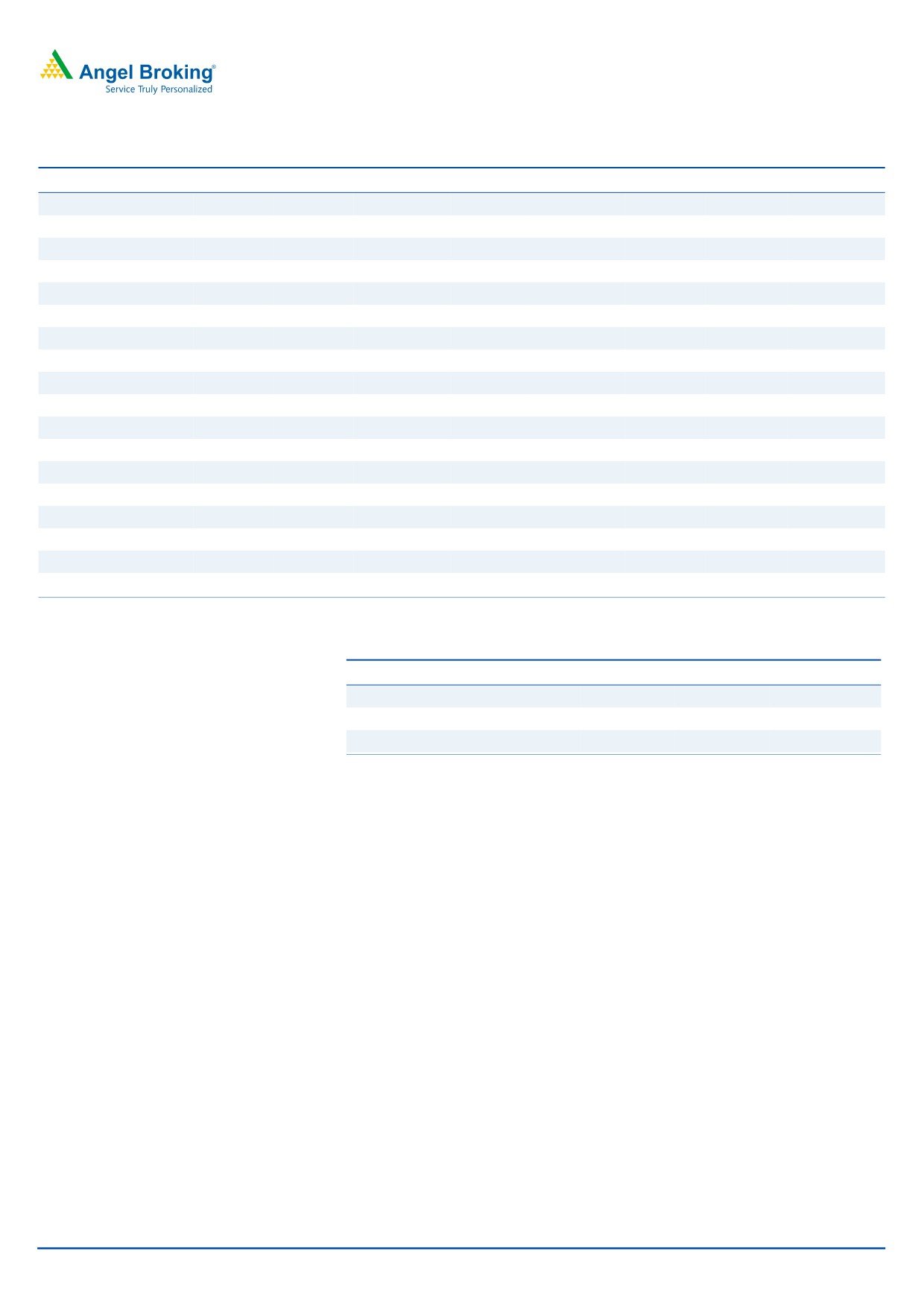

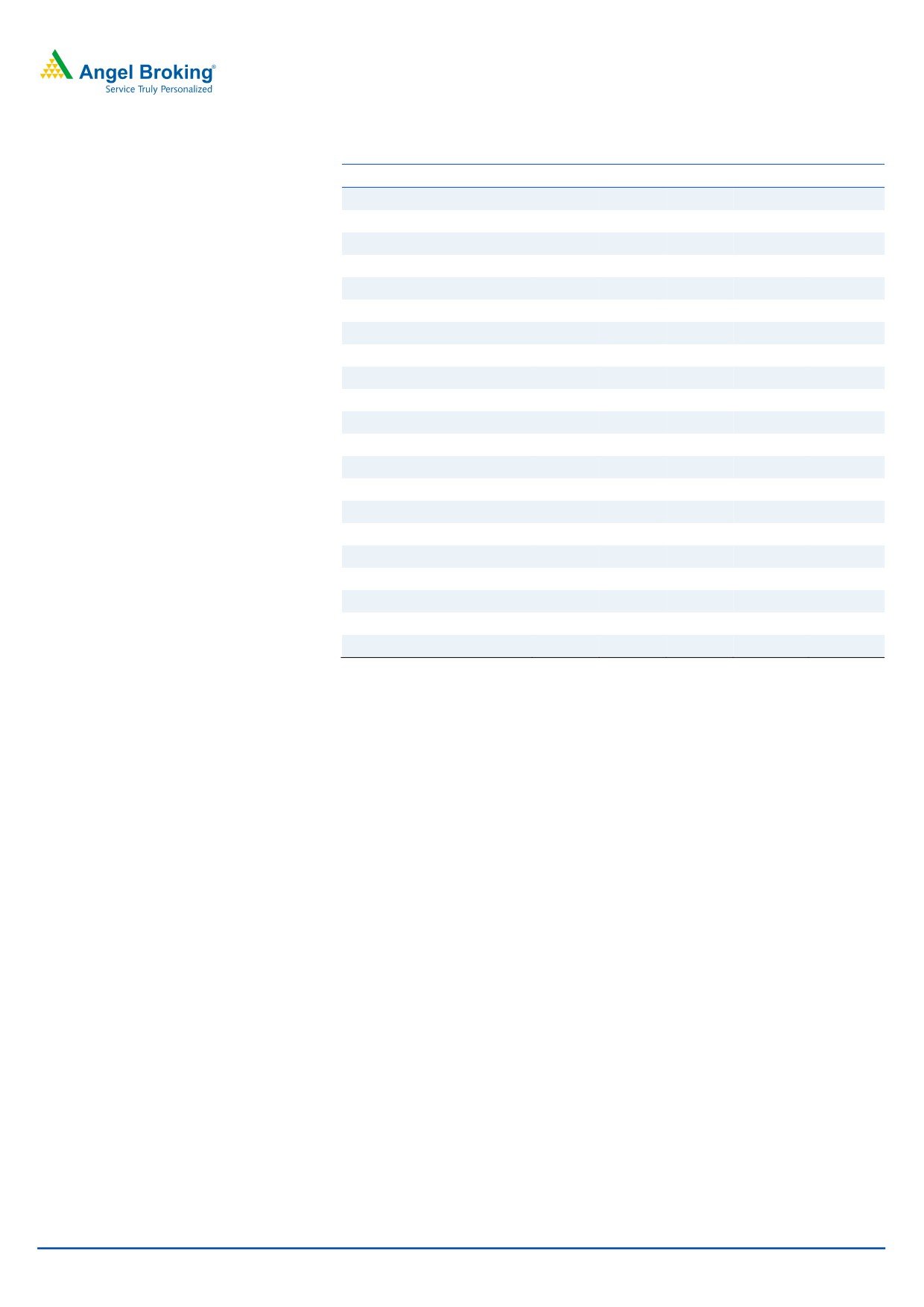

Exhibit 3: Trend in IT Services revenue

2,000

3

1,950

2.4

2.6

2.1

1,900

1,931

1,916

2

1,850

1,882

1,800

1,832

1,838

1

1,750

1,700

0.3

0

1,650

1,600

(0.8)

1,550

-1

2QFY16

3QFY16

4QFY16

1QFY17

2QFY17

IT services

qoq growth (%)

Source: Company, Angel Research

Exhibit 4: Revenue growth (Industry wise - CC basis)

% to

% growth

% growth

revenue

(QoQ)

(yoy)

Global media and telecom

7.5

1.1

8.2

Financial solutions

25.5

0.7

2.8

Manufacturing and hi-tech

22.4

(1.0)

0.5

Healthcare, life sciences and services

16.0

4.3

46.9

Retail and transportation

15.7

0.4

3.7

Energy and utilities

12.9

1.3

(1.8)

Source: Company, Angel Research

Services wise, Wipro’s anchor service lines ADM (contributed 43.8% to revenue)

and Technology Infrastructure Services (contributed 28.2% to revenue) registered a

growth of 0.4% and a dip of 2.1% qoq, respectively. Analytics and Information

Management, which contributed

7.3% of sales, de-grew by

2.6% qoq;

while Product Engineering and Mobility contributed 7.3% of sales and grew

by 0.7% qoq.

Exhibit 5: Revenue growth (Service wise)

Service verticals

% to revenue

% growth (QoQ)

Technology infrastructure services

28.2

(2.1)

Analytics and information management

7.3

(2.6)

BPO

13.4

3.3

Product engineering and mobility

7.3

0.7

ADM

43.8

0.4

Source: Company, Angel Research

Geography wise, the developed economies such as America and Europe grew by

1.8% and 0.3% qoq in CC terms, respectively. India posted a 1.1% qoq CC de-

growth, during the period. However, APAC and other emerging markets posted a

0.1% qoq de-growth for the quarter.

October 25, 2016

3

Wipro | 2QFY2017 Result Update

Exhibit 6: Revenue growth (Geography wise, CC basis)

% to revenue

% growth (QoQ)

% growth (yoy)

America

54.8

1.8

8.4

Europe

24.0

0.3

9.0

India and Middle East

10.4

(1.1)

4.3

APAC and other emerging markets

10.8

(0.1)

0.2

Source: Company, Angel Research

The IT Products segment reported a 36.3% yoy growth in revenue to `770cr,

during the quarter.

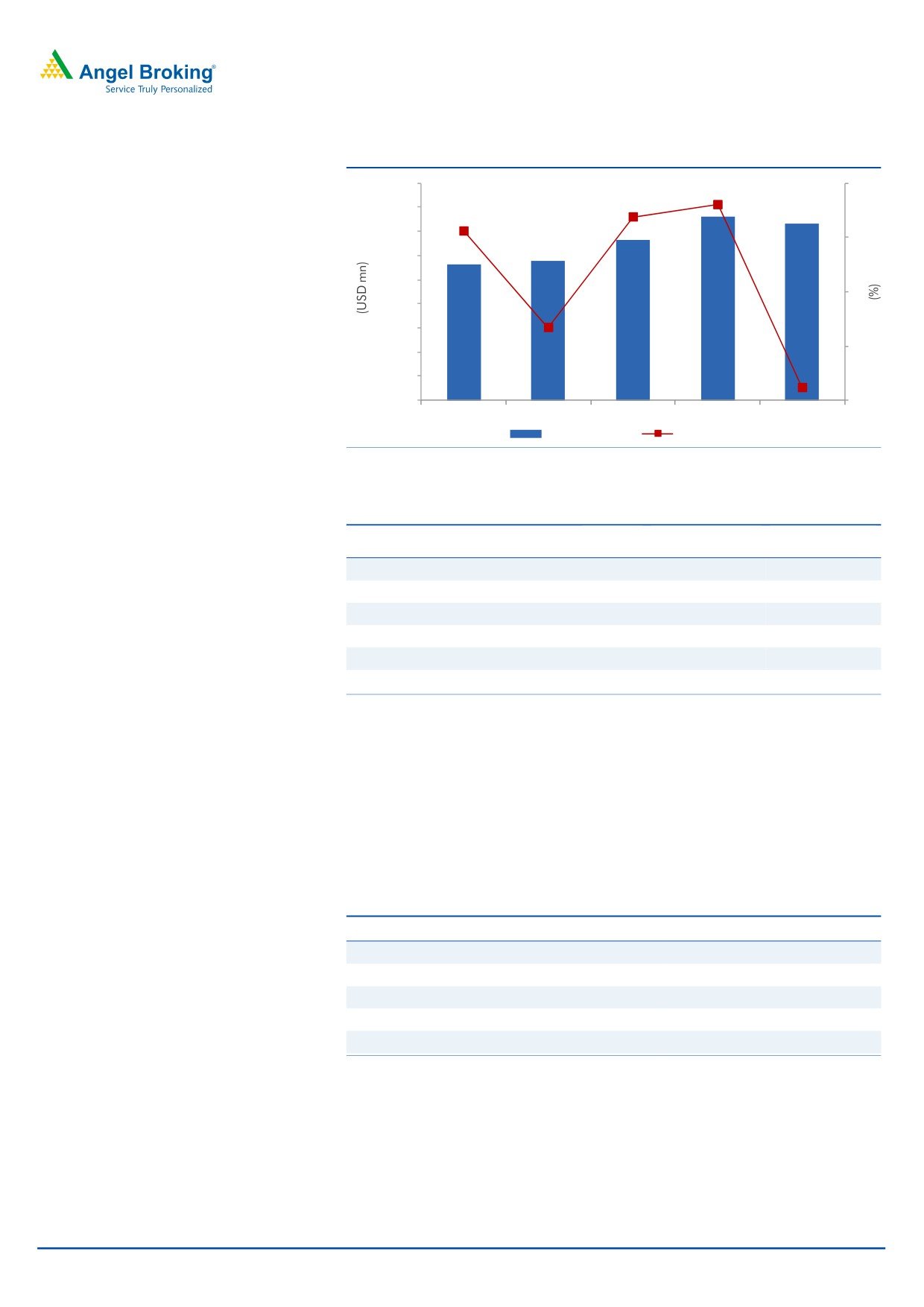

Exhibit 7: IT Products - Revenue growth (yoy)

50

900

36.3

40

800

30

20

700

770

10

600

650

0

590

(10)

500

565

(16.0)

(20)

400

(28.2)

449

(30)

300

(40)

(38.3)

(52.5)

(50)

200

(60)

100

(70)

2QFY16

3QFY16

4QFY16

1QFY2017

2QFY17

IT products

yoy growth (%)

Source: Company, Angel Research

Hiring and utilization

Wipro reported a net addition of 951 employees in its IT Services’ employee base,

which now stands at 1,74,238. Though voluntary attritions (annualized) in the

global IT business increased considerably, it remained stagnant on a net basis at

16.6%. The utilization rate of the global IT business moved up by 130bp

sequentially to 71.2%. Going ahead, an improvement in utilization level will be an

important margin lever.

Exhibit 8: Employee pyramid

Employee pyramid

2QFY16 3QFY16 4QFY16 1QFY17 2QFY17

Utilization - Global IT (%)

69.5

66.4

68.1

69.9

71.2

Attrition (%)

Global IT

16.4

16.3

16.1

16.5

16.6

BPO

10.2

9.9

11.1

11.7

12.2

Net additions

6,607

2,268

2,248

951

951

Source: Company, Angel Research

Margins better than expected

The EBIT margin came in at 15.8% (V/s 15.1% expected), an expansion of 52bp

qoq; the miss in terms of overall EBIT margins was largely on account of operating

losses in the hardware business (-22.1% EBIT margin). The EBIT margins came in

October 25, 2016

4

Wipro | 2QFY2017 Result Update

better aided by better utilization

(+310bp qoq ex-trainees), Offshore mix

(+50bp qoq) and 1% qoq depreciation in realized US $/INR.

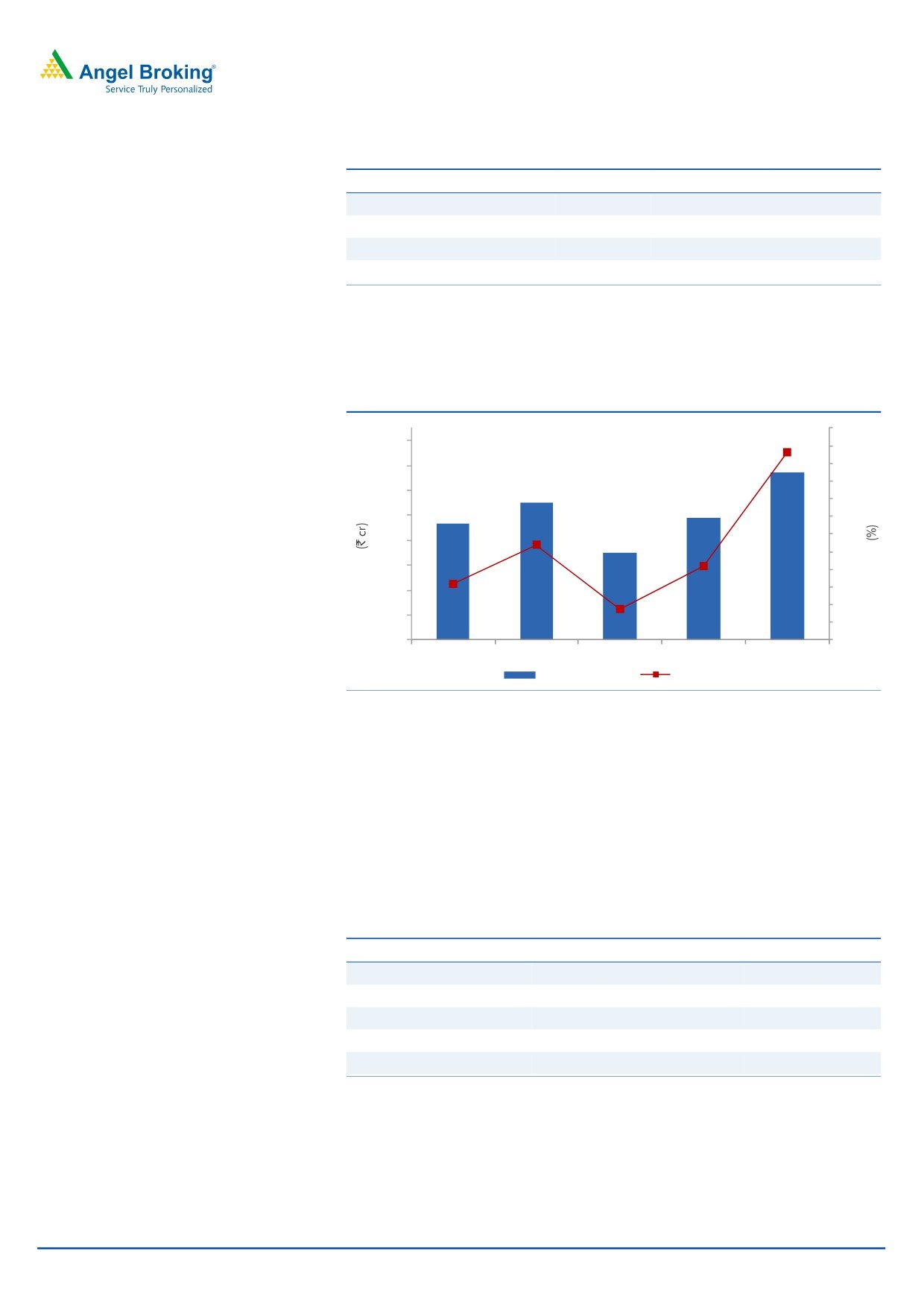

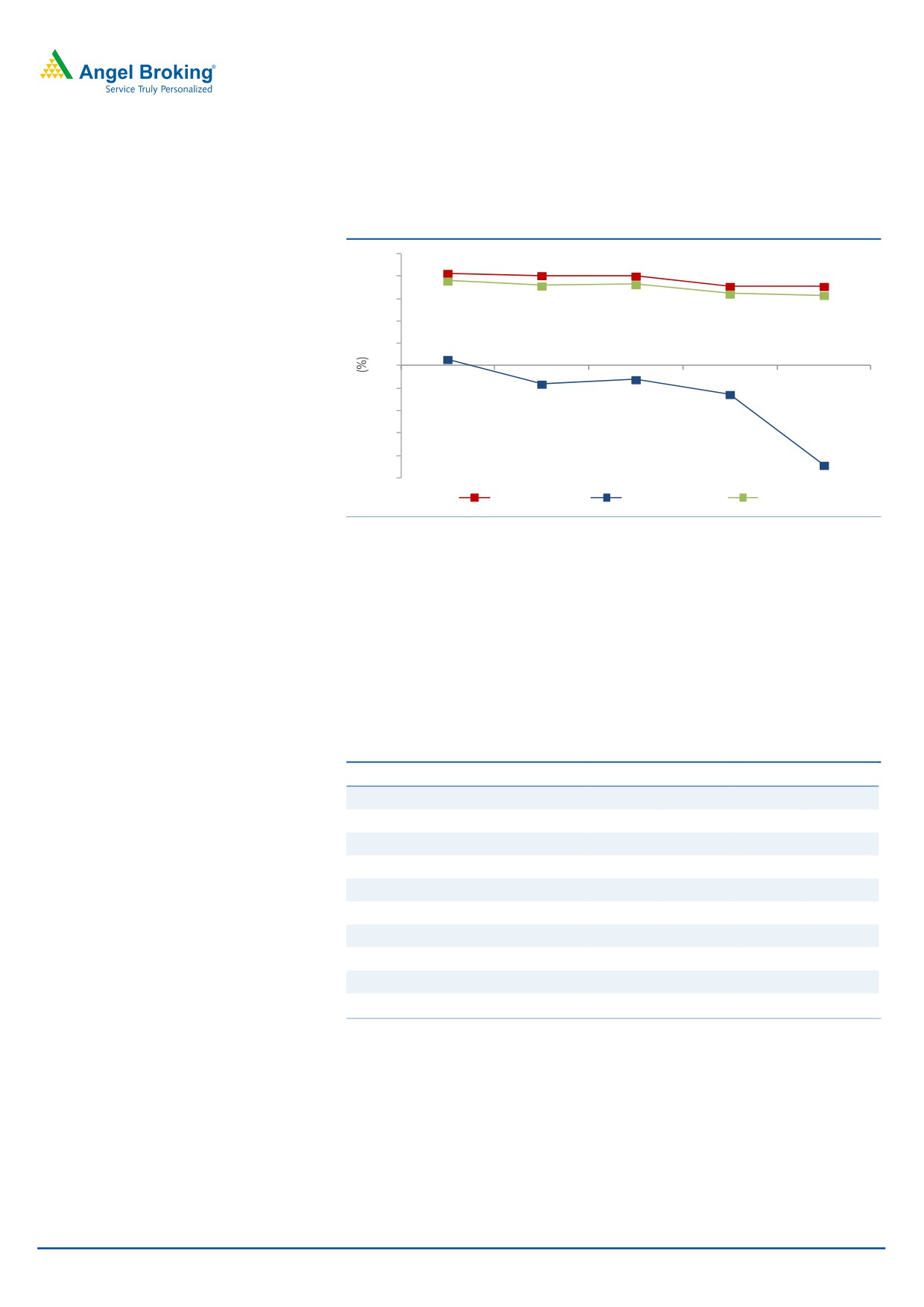

Exhibit 9: Segment-wise EBIT margin trend

25

20.7

20.2

20.1

17.8

17.8

20

15

19.0

17.9

18.2

16.1

15.8

10

5

1.5

0

2QFY16

3QFY16

4QFY16

1QFY2017

2QFY17

(5)

(3.0)

(4.0)

(10)

(6.3)

(15)

(20)

(25)

(22.1)

IT services

IT products

Consolidated

Source: Company, Angel Research

Client pyramid

Wipro added 47 new clients during the quarter with its active client base now

standing at 1,180. Amongst these, 1 has been in the US$75mn+ bracket and 1 in

the US$20mn+ bracket. Wipro cited that there has been increasing pricing

pressure in large deals, led by growing competitive pressures. Both, deal sizes as

well as value of deals are under pressure. In such an environment, Wipro has been

trying to offset pressure by increasing the use of automation.

Exhibit 10: Client metrics

Particulars

2QFY16

3QFY16

4QFY16

1QFY17

2QFY17

US$100mn plus

10

9

9

9

8

US$75mn-$100mn

7

8

9

10

11

US$50mn-$75mn

14

15

15

14

14

US$20mn-$50mn

54

53

56

58

58

US$10mn-$20mn

69

69

71

79

80

US$5mn-$10mn

90

93

88

82

87

US$3mn-$5mn

77

78

83

84

83

US$1mn-$3mn

212

211

219

229

230

New client addition

67

39

119

50

47

Active customers

1100

1105

1223

1208

1180

Source: Company, Angel Research

Investment highlights

Moderate outlook on growth: For 3QFY2017, the company has given a revenue

guidance of US$1,916-1,955mn implying a US$ qoq growth of 0-2% on CC. after

including one month of revenues from Appirio in 3Q, WPRO’s organic guidance

will be flat at the midpoint. So after the 3QFY2017 guidance, the expected

recovery in the company looks more likely in FY2018. We expect US$ and INR

revenue CAGR to be at 8.4% and 8.2%, respectively, over FY2016-18E.

October 25, 2016

5

Wipro | 2QFY2017 Result Update

Target sales CAGR of 20% and EBIT Margin of 23%: Company as part of its vision

for 2020 is targeting to reach US$15bn revenues with 23% EBIT margin, implying

revenue CAGR of ~20% over the next four years. If the margins expand by 300bp,

then it would imply an even higher CAGR for earnings. The company sees itself

better placed than this time last year to latch on to opportunities in the market

though the same aggression and optimism is yet to reflect in its performance.

Going by the guidance, the company’s organic growth outlook is not even closer

to its peers. However, on the acquisition front, the company has been very

aggressive in comparison to its peers.

During the quarter, company announced the acquisition of Appirio, a leading

cloud services company in areas like Sales force and Workday implementation.

Appirio’s CY15 revenue was US$196mn and purchase consideration for the

acquisition is US$500mn. Its customers include Virgin America, Four Seasons

Hotels & Resorts, Coca Cola, eBay, Home Depot, Honeywell, NYSE Euronext,

Toyota and Facebook, among others.

Earlier, the company acquired HealthPlan Services from Water Street Healthcare

Partners. Since partnering with Water Street in 2008, HealthPlan Services has

grown to become the leading independent technology and Business Process as a

Service (BPaaS) provider in the US health insurance market. As part of the

agreement, Wipro will acquire 100% of HealthPlan Services' shares for a purchase

consideration of US$460mn. Headquartered in Tampa, Florida, HealthPlan

Services employs over 2,000 associates. It offers market-leading technology

platforms and a fully integrated BPaaS solution to health insurance companies in

the individual, group and ancillary markets. HealthPlan Services’ BPaaS solutions

are ideal for players who want to operate in the private and public exchanges and

the off-exchange individual market in the US.

Outlook and valuation

The new CEO of the company has put in place an aggressive target of 20%

revenue CAGR over the next four years, with much improved profitability (where

the company has significant levers in the form of automation and improving

utilization levels). Also, the company announced a total of `6/share in dividend

and up to `2,500cr through a buyback. Thus, the total payout in FY2016 amounts

to ~45% compared to 34% in FY2015. The company guided at sustaining ~40%

payout going forward, which will improve the overall returns of the shareholders.

On the valuation front, the stock is currently trading at 13.1x its FY2017E and

12.1x its FY2018E EPS, ie at a discount to its peers, while we expect the gap to

narrow down once the company’s performance comes in line with its peers in

terms of growth and profitability. We recommend a buy on the stock with a target

price of `590.

October 25, 2016

6

Wipro | 2QFY2017 Result Update

Exhibit 11: Key assumptions

FY2017E

FY2018E

Revenue growth - IT services (USD)

7.8

9.0

USD-INR rate (realized)

66.0

66.0

Revenue growth - Consolidated (`)

7.4

17.0

EBITDA margin (%)

18.1

18.1

Tax rate (%)

22.0

22.0

EPS growth (%)

2.9

7.7

Source: Company, Angel Research

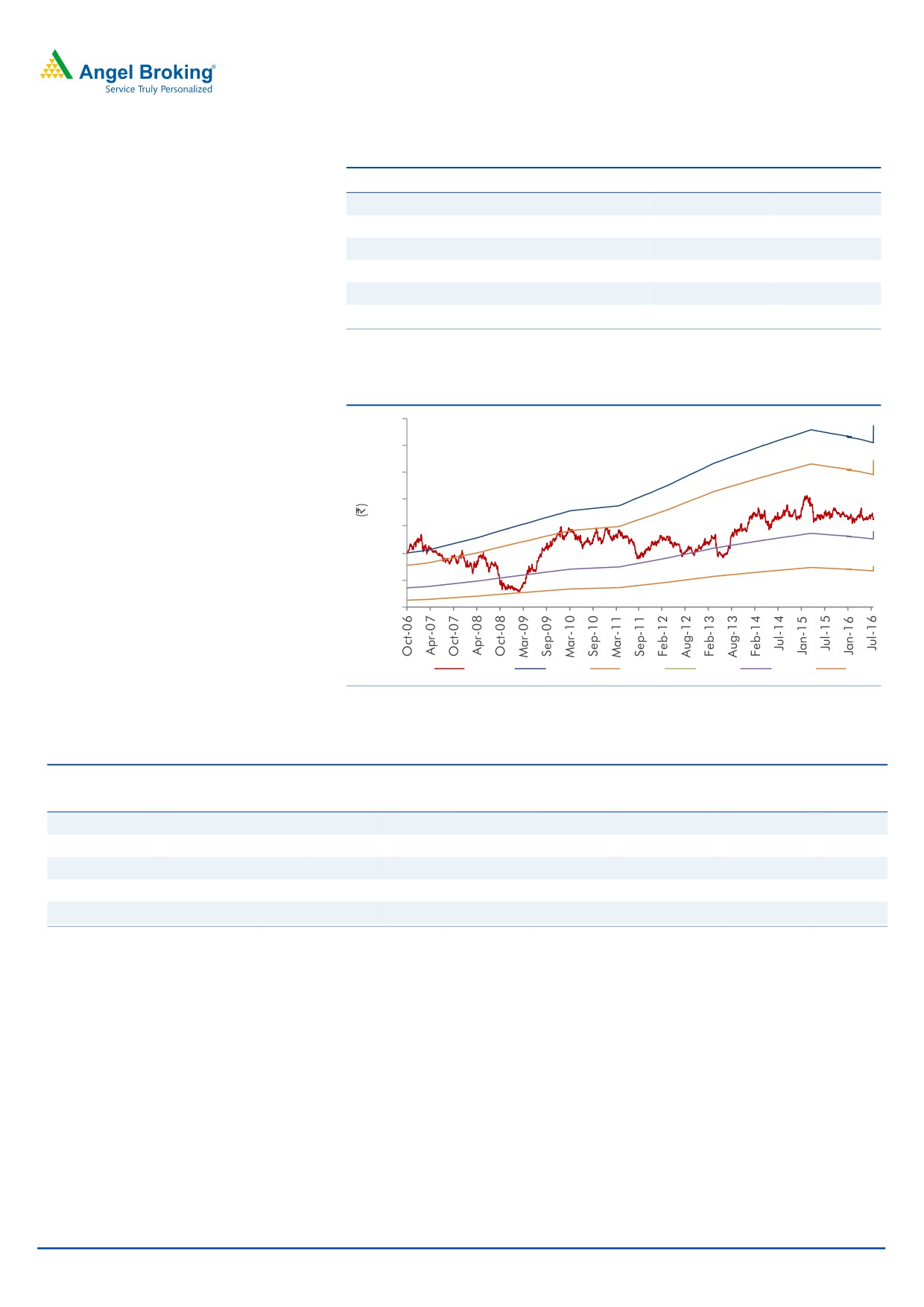

Exhibit 12: One-year forward PE chart

1100

950

800

650

500

350

200

50

Price

27x

22x

17x

12x

7x

Source: Company, Angel Research

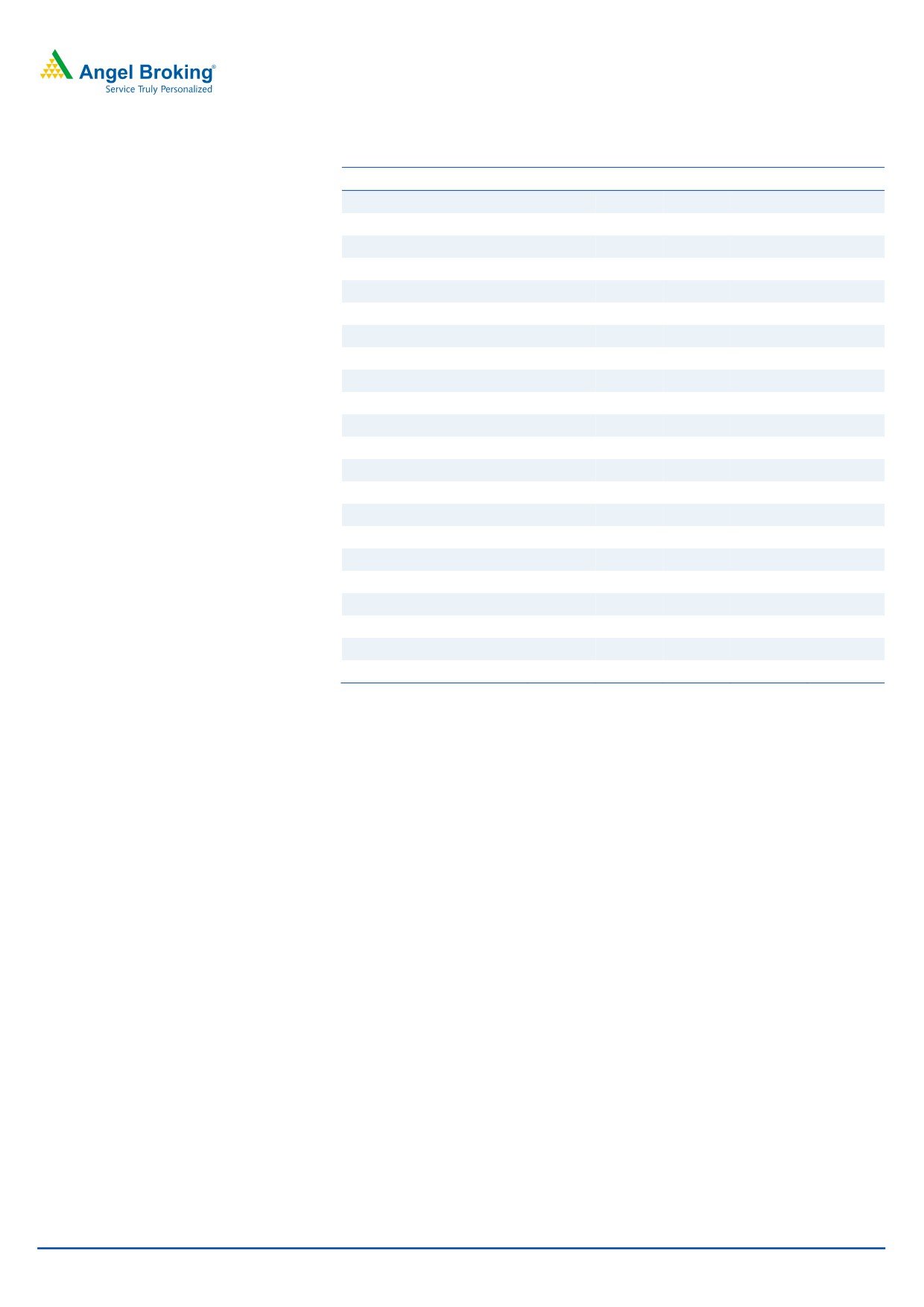

Exhibit 13: Recommendation summary

Company

Reco

CMP Tgt. price Upside

FY2018E FY2018E

FY2016-18E

FY2018E FY2018E

(`)

(`)

(%)

EBITDA (%)

P/E (x)

EPS CAGR (%) EV/Sales (x)

RoE (%)

HCL Tech

Buy

811

1,000

23.4

20.5

12.6

9.6

1.8

17.9

Infosys

Buy

1,029

1,249

21.4

27.0

14.8

8.4

2.5

21.6

TCS

Accumulate

2,428

2,867

7.9

27.6

16.7

8.5

3.3

33.1

Tech Mahindra

Buy

428

700

38.6

17.0

10.4

13.2

0.9

20.7

Wipro

Buy

484

590

22.0

18.1

12.1

5.3

1.7

19.3

Source: Company, Angel Research

Company background

Wipro is among the leading Indian companies, majorly offering IT services. The

company is also engaged in the IT hardware (10% of sales) business. Wipro's IT

arm is India's fourth largest IT firm, employing more than 1,68,000 professionals,

offering a wide portfolio of services such as ADM, consulting and package

implementation, and servicing more than 1,000 clients.

October 25, 2016

7

Wipro | 2QFY2017 Result Update

Profit & Loss account (Consolidated, IFRS)

Y/E March (` cr)

FY2014 FY2015 FY2016

FY2017E

FY2018E

Net revenue

43,427

46,955

51,631

55,440

60,430

Cost of revenues

29,549

30,846

34,325

38,143

41,576

Gross profit

13,878

16,108

17,306

17,297

18,854

% of net sales

32.0

34.3

33.5

31.2

31.2

Selling and mktg exp.

2,925

3,063

3,319

3,714

4,049

% of net sales

6.7

6.5

6.4

6.7

6.7

General and admin exp.

2,354

2,585

2,788

3,548

3,867

% of net sales

5.4

5.5

5.4

6.4

6.4

Depreciation and amortization

1,111

1,282

1,496

1,608

1,752

% of net sales

2.6

2.7

2.9

2.9

2.9

EBIT

8,600

9,179

9,703

10,035

10,938

% of net sales

19.8

19.5

18.8

18.1

18.1

Other income, net

1,501

1,990

1,770

1,770

1,770

Share in profits of eq. acc. ass.

0

0

0

0

0

Profit before tax

10,101

11,168

11,473

11,804

12,708

Provision for tax

2,260

2,462

2,537

2,597

2,796

% of PBT

22.4

22.0

22.1

22.1

22.0

PAT

7,840

8,706

8,936

9,207

9,912

Share in earnings of associate

-

-

-

-

-

Minority interest

44

53

49

59

59

Adj. PAT

7,797

8,653

8,887

9,148

9,853

Diluted EPS (`)

31.5

35.1

35.9

35.9

39.9

October 25, 2016

8

Wipro | 2QFY2017 Result Update

Balance sheet (Consolidated, IFRS)

Y/E March (` cr)

FY2014

FY2015

FY2016

FY2017E

FY2018E

Assets

Goodwill

6,342

6,808

10,199

6,316

6,317

Intangible assets

194

793

1,584

1,584

1,584

Property, plant & equipment

5,145

5,421

6,495

6,795

6,795

Investment in equ. acc. investees

268

387

491

491

491

Derivative assets

29

74

26

26

26

Non-current tax assets

1,019

1,141

1,175

1,175

1,175

Deferred tax assets

336

295

380

380

380

Other non-current assets

1,430

1,437

1,583

1,583

1,583

Total non-current assets

14,762

16,354

21,933

18,350

18,351

Inventories

229

485

539

539

539

Trade receivables

8,539

9,153

10,238

10,063

11,778

Other current assets

3,947

7,336

10,407

10,407

10,407

Unbilled revenues

3,933

4,234

4,827

4,827

4,827

Available for sale investments

6,056

5,391

13,294

13,294

13,294

Current tax assets

977

649

781

781

781

Derivative assets

366

508

568

568

568

Cash and cash equivalents

11,420

15,894

9,902

17,852

24975

Total current assets

35,469

43,649

50,556

58,330

67,169

Total assets

50,230

60,003

72,489

72,489

85,519

Equity

Share capital

493

493

494

493

494

Share premium

1,266

1,403

1,462

1,462

1,462

Retained earnings

31,495

37,225

42,574

49,680

53,937

Share based payment reserve

102

131

223

102

103

Other components of equity

1,047

1,545

1,853

1,853

1,853

Shares held by controlled trust

(54)

-

-

-

-

Eq. attrib. to shareholders of Co.

34,350

40,789

46,606

46,606

57,849

Minority interest

139

165

222

222

222

Total equity

34,489

40,954

46,828

46,828

58,072

Liabilities

Long term loans and borrowings

1,091

1,271

1,736

1,736

1,736

Deferred tax liability

180

324

511

511

511

Derivative liabilities

63

16

12

12

12

Non-current tax liability

345

670

823

823

823

Other non-current liabilities

417

366

723

723

723

Provisions

1

1

-

-

-

Total non-current liabilities

2,096

2,647

3,804

3,804

3,804

Loans and bank overdraft

4,068

6,621

10,786

10,786

10,786

Trade payables

5,226

5,875

6,819

6,659

8,066

Unearned revenues

1,277

1,655

1,808

1,877

1,878

Current tax liabilities

1,248

804

702

1,015

1,171

Derivative liabilities

250

75

234

234

234

Other current liabilities

1,439

1,222

1,382

1,382

1,382

Provisions

137

152

126

126

126

Total current liabilities

13,646

16,403

21,856

21,856

23,643

Total liabilities

15,742

19,050

25,661

25,661

27,448

Total equity and liabilities

50,230

60,003

72,489

72,489

85,519

October 25, 2016

9

Wipro | 2QFY2017 Result Update

Cash flow statement (Consolidated, IFRS)

Y/E March (` cr)

FY2014

FY2015

FY2016

FY2017E

FY2018E

Pre tax profit from operations

8,935

11,168

11,473

11,473

12,708

Depreciation

1,111

1,282

1,496

1,496

1,752

Expenses (deferred)/written off

(13)

(13)

(13)

(13)

(13)

Pre tax cash from operations

10,033

12,438

12,956

12,956

14,447

Other income/prior period ad

1,165

1,990

1,770

1,770

1,770

Net cash from operations

11,198

14,428

14,726

14,726

16,217

Tax

(2,260)

(2,462)

(2,537)

(2,537)

(2,929)

Cash profits

8,938

11,965

12,189

12,189

13,289

(Inc)/dec in current assets

(2,653)

(8,181)

(6,906)

-

(9,506)

Inc/(dec) in current liab.

(828)

2,757

5,453

-

1,787

Net trade working capital

(3,482)

(5,423)

(1,453)

(1,453)

(7,719)

Cashflow from oper. actv.

5,456

6,542

10,736

10,736

5,570

(Inc)/dec in fixed assets

(1,203)

(276)

(1,075)

-

(300)

(Inc)/dec in intangibles

(889)

(600)

(791)

-

-

(Inc)/dec in investments

594

(119)

(104)

-

-

(Inc)/dec in net def. tax assets

87

-

-

-

-

(Inc)/dec in derivative assets

(24)

-

-

-

-

(Inc)/dec in non-current tax asset

12

7

146

-

-

(Inc)/dec in minority interest

22

9

(4)

-

10

Inc/(dec) in other non-current liab

90

273

510

-

-

(Inc)/dec in other non-current ast.

(122)

(122)

(34)

-

-

Cashflow from investing activities

(1,667)

(826)

(1,352)

(1,352)

(290)

Inc/(dec) in debt

1,006

180

465

-

-

Inc/(dec) in equity/premium

(123)

314

(14,062)

3,654

473

Dividends

(1,736)

(1,736)

(1,780)

(5,089)

(5,596)

Cashflow from financing activities

(853)

(1,242)

(15,377)

(1,435)

(5,123)

Cash generated/(utilized)

2,936

4,474

(5,992)

7,950

157

Cash at start of the year

8,935

11,168

11,473

11,473

12,708

Cash at end of the year

1,111

1,282

1,496

1,496

1,752

October 25, 2016

10

Wipro | 2QFY2017 Result Update

Key Ratios

Y/E March

FY2014 FY2015 FY2016

FY2017E

FY2018E

Valuation ratio (x)

P/E (on FDEPS)

15.3

13.8

13.5

13.1

12.1

P/CEPS

7.3

6.7

6.4

6.4

5.8

P/BVPS

3.5

2.9

2.6

2.4

2.2

Dividend yield (%)

1.7

2.5

1.2

4.3

4.7

EV/Sales

2.3

2.1

1.8

1.7

1.4

EV/EBITDA

10.4

9.3

8.5

8.2

6.9

EV/Total assets

2.0

1.6

1.3

1.3

1.0

Per share data (`)

EPS (Fully diluted)

31.5

35.1

35.9

35.9

39.9

Cash EPS

66.3

72.1

75.2

75.2

84.1

Dividend

8.0

12.0

6.0

20.6

22.6

Book value

139.5

165.7

189.4

200.9

218.2

Return ratios (%)

RoCE (pre-tax)

17.1

15.3

13.4

13.4

13.9

Angel RoIC

32.6

28.8

24.8

24.8

22.8

RoE

22.6

21.1

19.0

19.0

17.0

Turnover ratios(x)

Asset turnover (fixed assets)

8.5

8.9

8.7

7.9

9.0

Receivables days

68

69

69

70

71

Payable days

67

67

67

67

67

October 25, 2016

11

Wipro | 2QFY2017 Result Update

Research Team Tel: 022 - 39357800

DISCLAIMER

Angel Broking Private Limited (hereinafter referred to as “Angel”) is a registered Member of National Stock Exchange of India Limited,

Bombay Stock Exchange Limited and Metropolitan Stock Exchange Limited. It is also registered as a Depository Participant with CDSL

and Portfolio Manager with SEBI. It also has registration with AMFI as a Mutual Fund Distributor. Angel Broking Private Limited is a

registered entity with SEBI for Research Analyst in terms of SEBI (Research Analyst) Regulations, 2014 vide registration number

INH000000164. Angel or its associates has not been debarred/ suspended by SEBI or any other regulatory authority for accessing

/dealing in securities Market. Angel or its associates/analyst has not received any compensation / managed or co-managed public

offering of securities of the company covered by Analyst during the past twelve months.

This document is solely for the personal information of the recipient, and must not be singularly used as the basis of any investment

decision. Nothing in this document should be construed as investment or financial advice. Each recipient of this document should

make such investigations as they deem necessary to arrive at an independent evaluation of an investment in the securities of the

companies referred to in this document (including the merits and risks involved), and should consult their own advisors to determine

the merits and risks of such an investment.

Reports based on technical and derivative analysis center on studying charts of a stock's price movement, outstanding positions and

trading volume, as opposed to focusing on a company's fundamentals and, as such, may not match with a report on a company's

fundamentals. Investors are advised to refer the Fundamental and Technical Research Reports available on our website to evaluate the

contrary view, if any.

The information in this document has been printed on the basis of publicly available information, internal data and other reliable

sources believed to be true, but we do not represent that it is accurate or complete and it should not be relied on as such, as this

document is for general guidance only. Angel Broking Pvt. Limited or any of its affiliates/ group companies shall not be in any way

responsible for any loss or damage that may arise to any person from any inadvertent error in the information contained in this report.

Angel Broking Pvt. Limited has not independently verified all the information contained within this document. Accordingly, we cannot

testify, nor make any representation or warranty, express or implied, to the accuracy, contents or data contained within this document.

While Angel Broking Pvt. Limited endeavors to update on a reasonable basis the information discussed in this material, there may be

regulatory, compliance, or other reasons that prevent us from doing so.

This document is being supplied to you solely for your information, and its contents, information or data may not be reproduced,

redistributed or passed on, directly or indirectly.

Neither Angel Broking Pvt. Limited, nor its directors, employees or affiliates shall be liable for any loss or damage that may arise from

or in connection with the use of this information.

October 25, 2016

12