Voltas | Construction & Eng.

December 21, 2015

Voltas

BUY

CMP

`304

UCP segment to drive the future earnings

Target Price

`353

Voltas is a market leader in the domestic air conditioning space. The Unitary

Investment Period

12 Months

Cooling Products (UCP) division dealing in air conditioning products contributes

dominantly to the company’s overall revenues. The other two divisions are the Electro-

Mechanical Projects (EMP) division and the Engineering Products Solutions division.

Stock Info

Sector

Construction & Eng.

Growth in Unitary Cooling Products segment to continue: Voltas has maintained

20%+ market share in the domestic air-conditioning (AC) market, despite stiff

Market Cap (` cr)

10,054

competition from MNC players. Its ‘numero uno’ position is owing to its (1) wide

Net debt (` cr)

(325)

distribution network (over 10,000 touch-points), (2) wide portfolio of 50+ models

Beta

1.3

(new launches scheduled in 4QFY2016), (3) strong post-sale support (inc. 5-year

52 Week High / Low

360/227

warranty on compressor), and (4) strong advertising focus (Top 5 Media spender

amongst AC players). With economic indicators turning favorable and summers

Avg. Daily Volume

1,683,183

ahead, the company’s competitive positioning should help UCP segment to report

Face Value (`)

1

12.2% top-line and 10.0% EBIT CAGR, respectively, during FY2015-18E.

BSE Sensex

25,519

Gradual recovery in the EMP business: Voltas’ EMP business is adversely affected

Nifty

7,762

due to the prevalent weak awarding environment, slow execution and cost

Reuters Code

VOLT.BO

over-runs. In run-up to Qatar World Cup 2022 and Dubai Expo 2020, we expect

international awarding activity to gradually catch-up from FY2017E onwards.

Bloomberg Code

VOLT@IB

Surge in order book should translate to uptick in execution (we expect 7.3%

top-line CAGR during FY2015-18E). With legacy projects nearing completion and

contribution of high margin projects kicking-in, we expect segment margins to

Shareholding Pattern (%)

expand from 1.0% in FY2015 to 5.0% in FY2018E.

Promoters

30.3

Balance Sheet strength: Voltas pursues an asset light business model, and in the

MF / Banks / Indian Fls

26.8

due course of business, it resorts to outsourcing and strategic tie-ups, thereby

FII / NRIs / OCBs

21.1

enables it to control its operating costs and generate high profitability. As a result,

Indian Public / Others

21.8

we expect Voltas to revert to it its earlier trend of higher RoEs. Given the asset light

business model, the company has been generating strong cash flows (it generated

`618cr of cash flows from business during FY2013-15). As of 2QFY2016-end,

Voltas is a debt free company (on net basis), with cash balance of `247cr.

Abs. (%)

3m 1yr 3yr

Attractive Valuations: At the current market price of `304, Voltas is trading at

Sensex

(2.6)

(7.9)

31.2

FY2017E and FY2018E P/E multiple of 22.1x and 18.1x, respectively. With

Voltas

17.1

21.5

179.7

economic cues turning favorable, and given Voltas’ strong market positioning

within the AC space, coupled with an expected gradual recovery in its EMP

segment, we expect the company to report 9.5% top-line and 13.1% bottom-line

3-Year Daily price chart

CAGR during FY2015-18E. Considering high contribution of UCP segment (72%

400

of FY2015 EBIT) to overall profitability, and limited left-over legacy orders in the

350

EMP segment, we have compared Voltas to Hitachi (which is trading at FY2018

300

P/E multiple of ~36.0x). We assign Voltas a 21.0x P/E multiple to our FY2018E

250

EPS estimate of `16.8 to arrive at a price target of `353. Given the upside, we

200

initiate coverage on Voltas with a Buy rating.

150

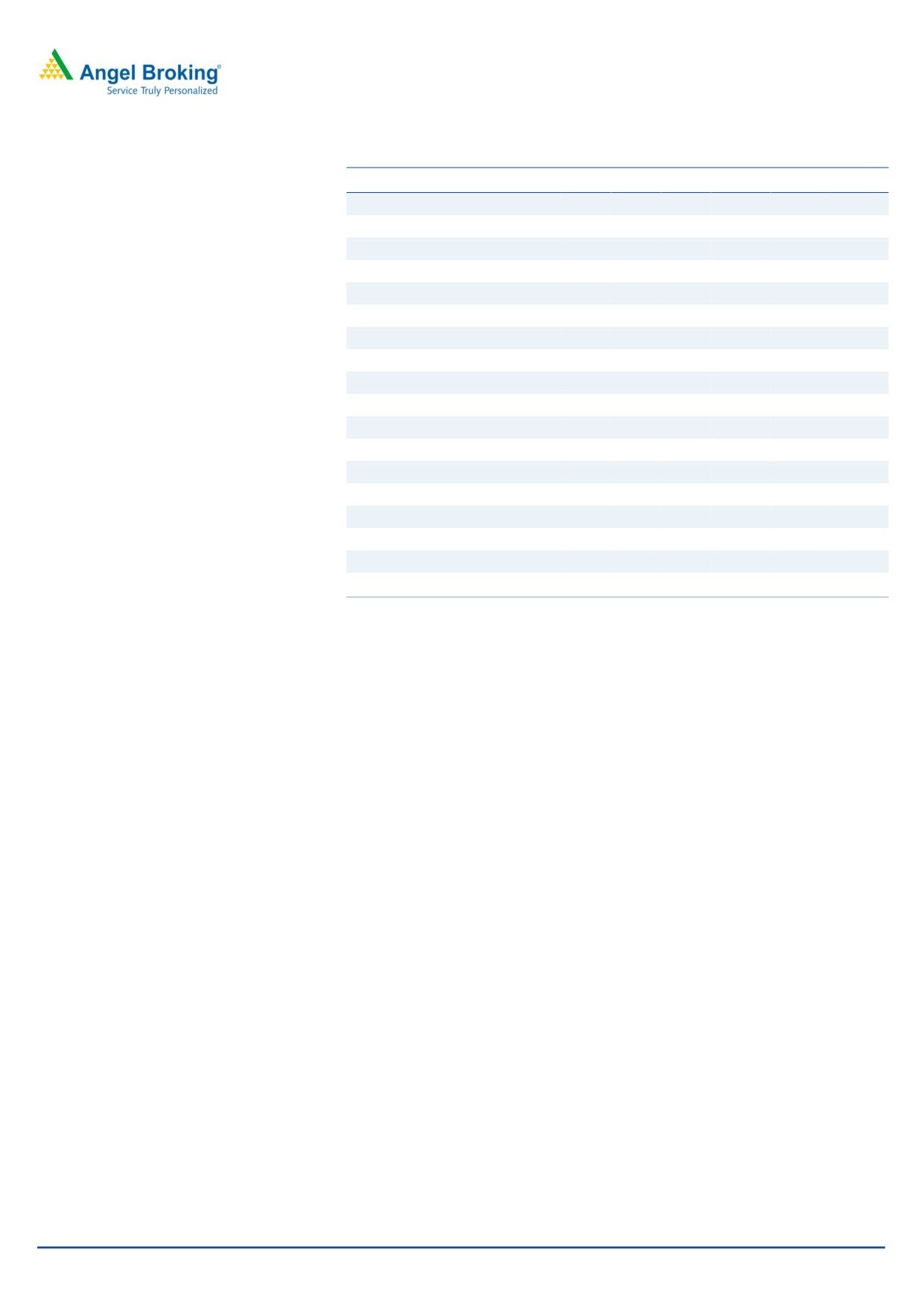

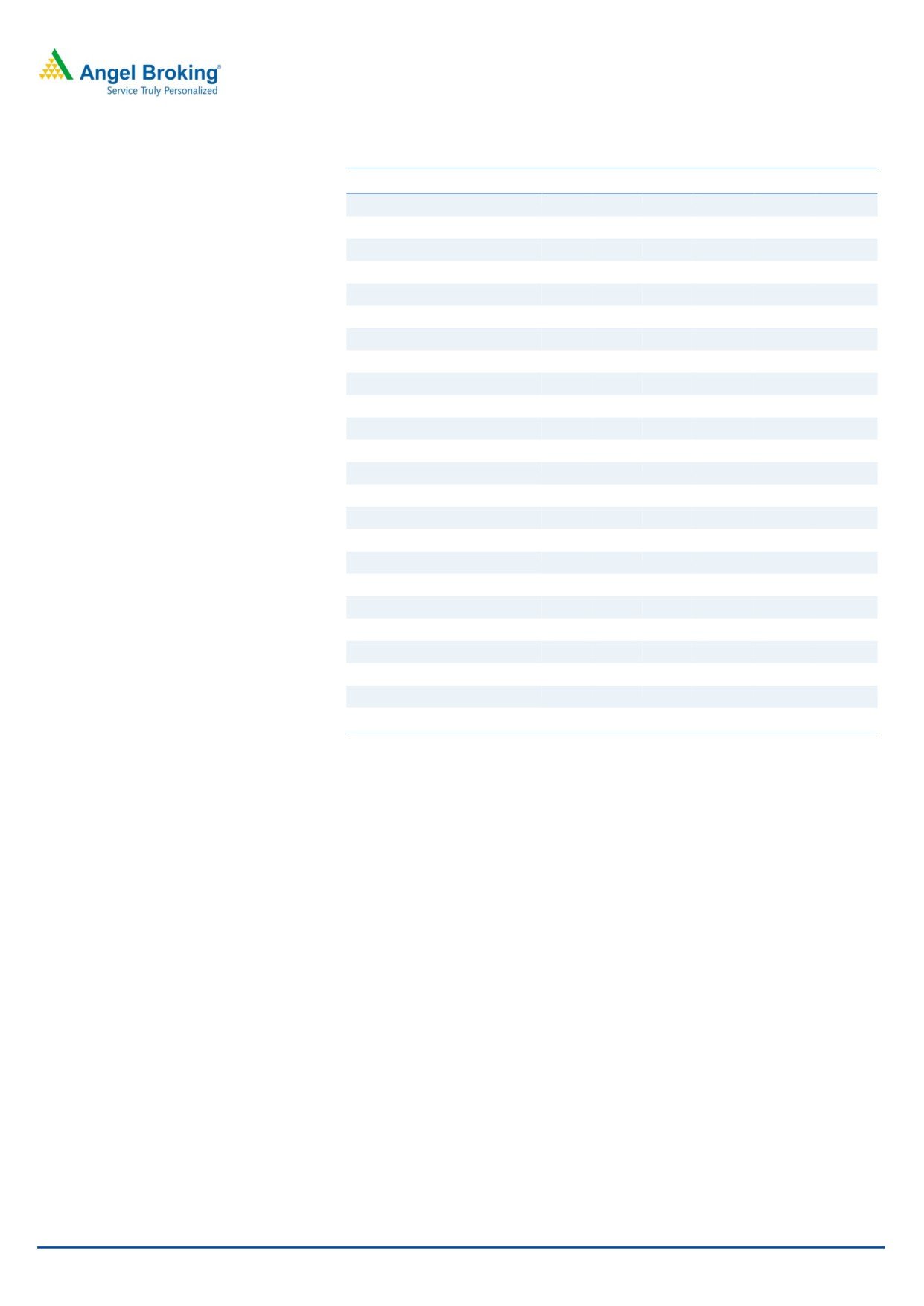

Key Financials

100

Y/E March (` cr)

FY13

FY14

FY15

FY16E

FY17E

FY18E

50

Net Sales

5,531

5,266

5,183

5,363

5,963

6,808

0

% chg

6.7

(4.8)

(1.6)

3.5

11.2

14.2

Net Profit

208

245

384

364

455

556

% chg

28.2

18.1

56.6

(5.4)

25.2

22.1

Source: Company, Angel Research

EBITDA (%)

4.4

5.0

7.9

8.0

9.1

9.8

EPS (`)

6.3

7.4

11.6

11.0

13.8

16.8

P/E (x)

48.3

40.9

26.1

27.6

22.1

18.1

P/BV (x)

6.2

5.5

4.8

4.2

3.7

3.2

RoE (%)

12.8

14.2

19.6

16.2

17.9

19.1

RoCE (%)

19.3

22.4

36.4

35.9

37.3

38.3

Yellapu Santosh

EV/Sales (x)

1.8

1.9

1.9

1.8

1.6

1.4

022 - 3935 7800 Ext: 6811

EV/EBITDA (x)

40.8

37.7

24.2

22.7

17.7

13.9

Source: Company, Angel Research; Note: CMP as of December 18, 2015

Please refer to important disclosures at the end of this report

1

Initiating coverage | Voltas

Investment Rationale

AC business growth story intact

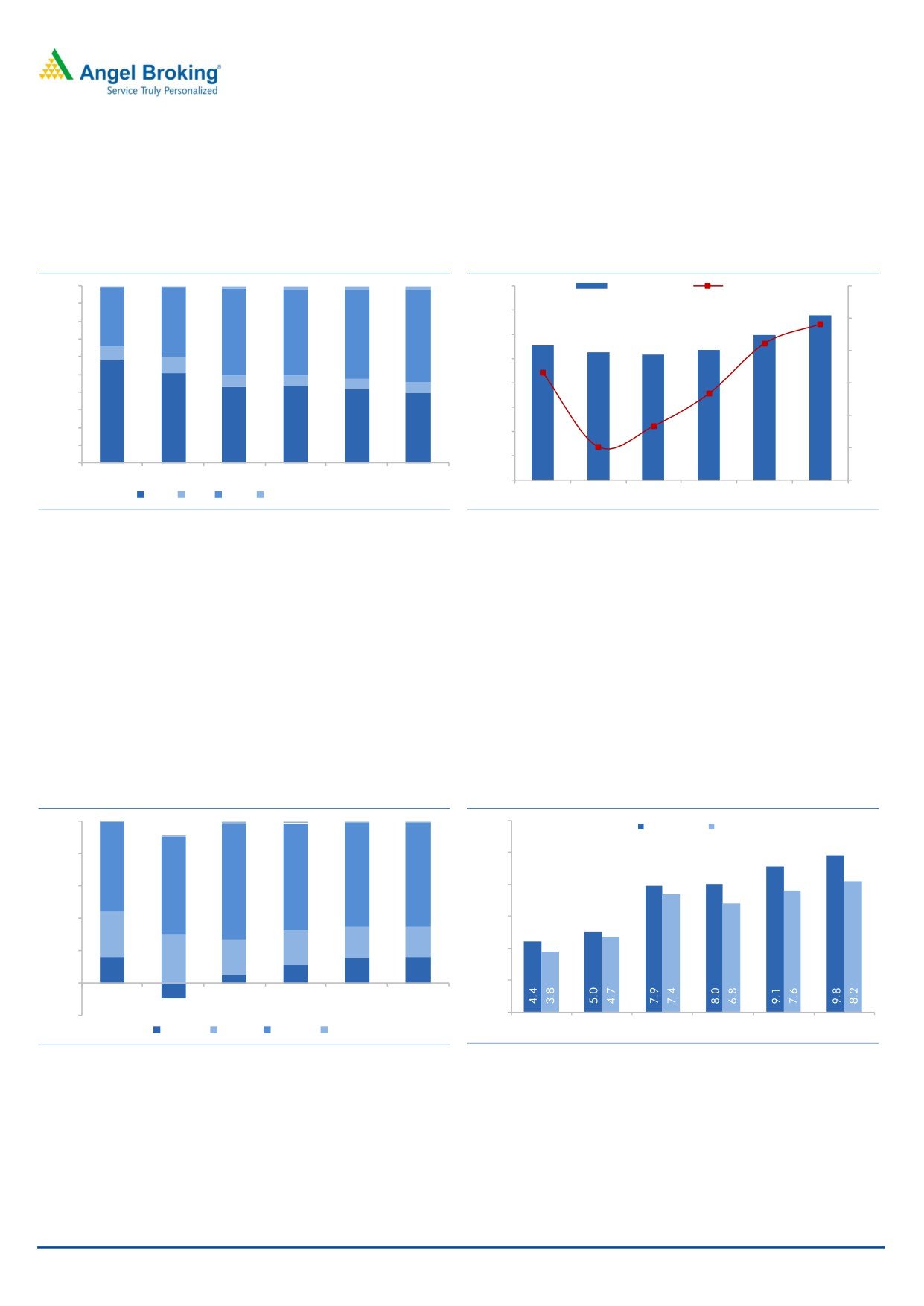

AC sales in India have been in the range of 3.5-3.75mn units annually for the last

2-3 years, lower than the commensurate sale in China of 55mn units. Currently,

AC penetration in India stands at ~4% vs ~25% in China and ~50% in Korea.

Various industry participants indicate that AC sales should see a strong 10-15%

growth for the next 3-5 years, given the current low penetration levels.

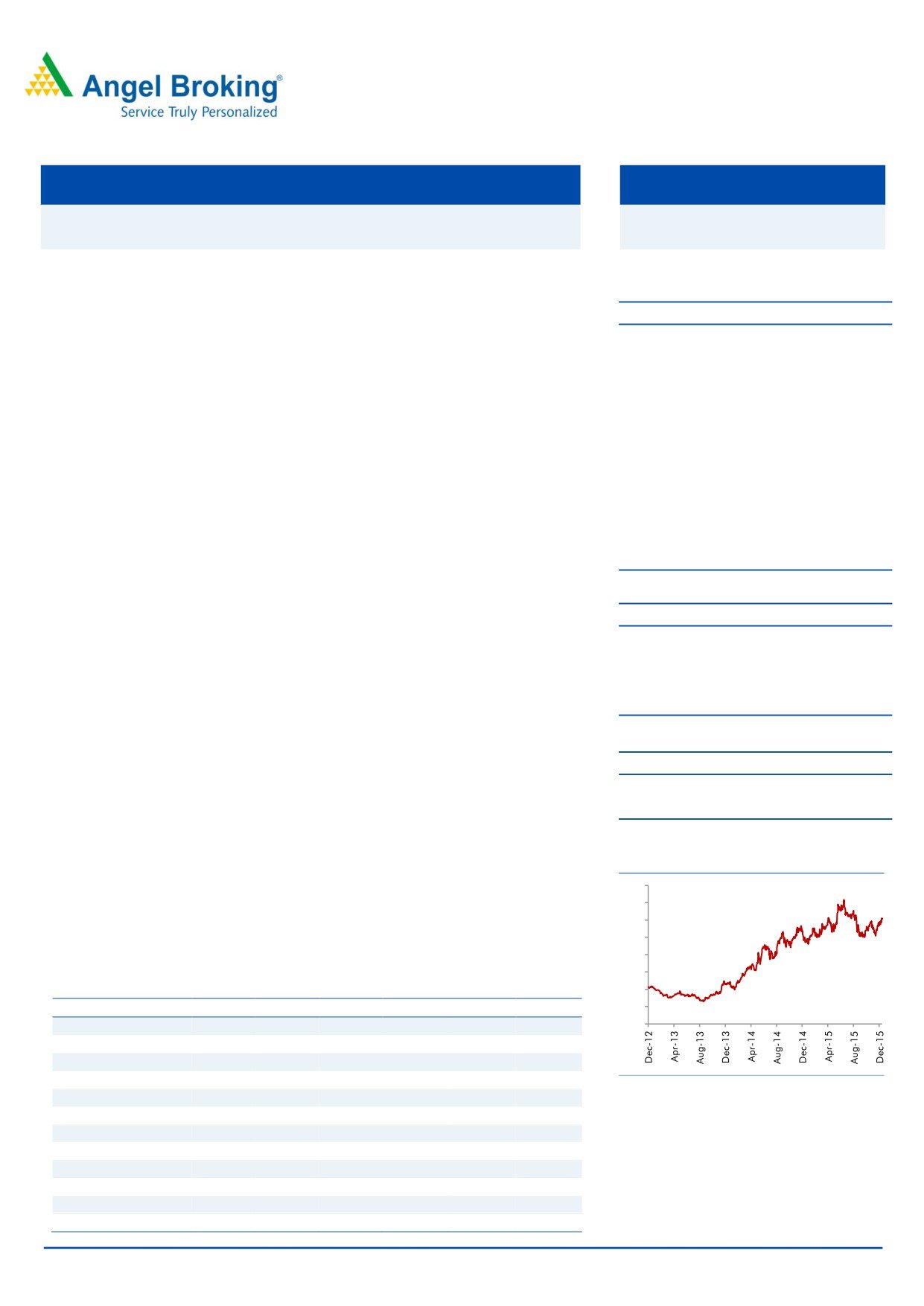

Exhibit 1: AC Sales Penetration (%)

Exhibit 2: Voltas’ Market share

80

72

25

22

22

21

21

70

20

20

18

18

60

50

15

50

40

10

30

25

5

20

8

10

4

0

0

China

India

Indonesia

Korea

Singapore

Source: Company, Angel Research

Source: Company, Angel Research

The UCP segment reported

16.9% top-line CAGR during FY2013-15 to

`2,510cr. Voltas’ market share grew from ~18% in FY2013 to 21% levels as of

2QFY2016-end. The market share gain, as per our sense, came on the back of

the following reasons, (1) growth in dealership/touch points network from 5,300 in

FY2012 to over 10,000 as of 2QFY2016-end, (2) strong penetration into multi-

brand dealers’ network (where it enjoys high market share), (3) strong sales

network in Tier II and III cities (account for almost half of the total AC sales),

(4) successful poaching of top talent from its peers, (5) focus on post sale support

(which includes 5-year warranty on compressors), (6) initiating strong advertising

campaigns to create a distinct brand (Voltas is among the top-5 spenders on

television and print media advertising among the AC players), (7) focus on product

innovation, and (8) tie-ups with more financing firms.

December 21, 2015

2

Initiating coverage | Voltas

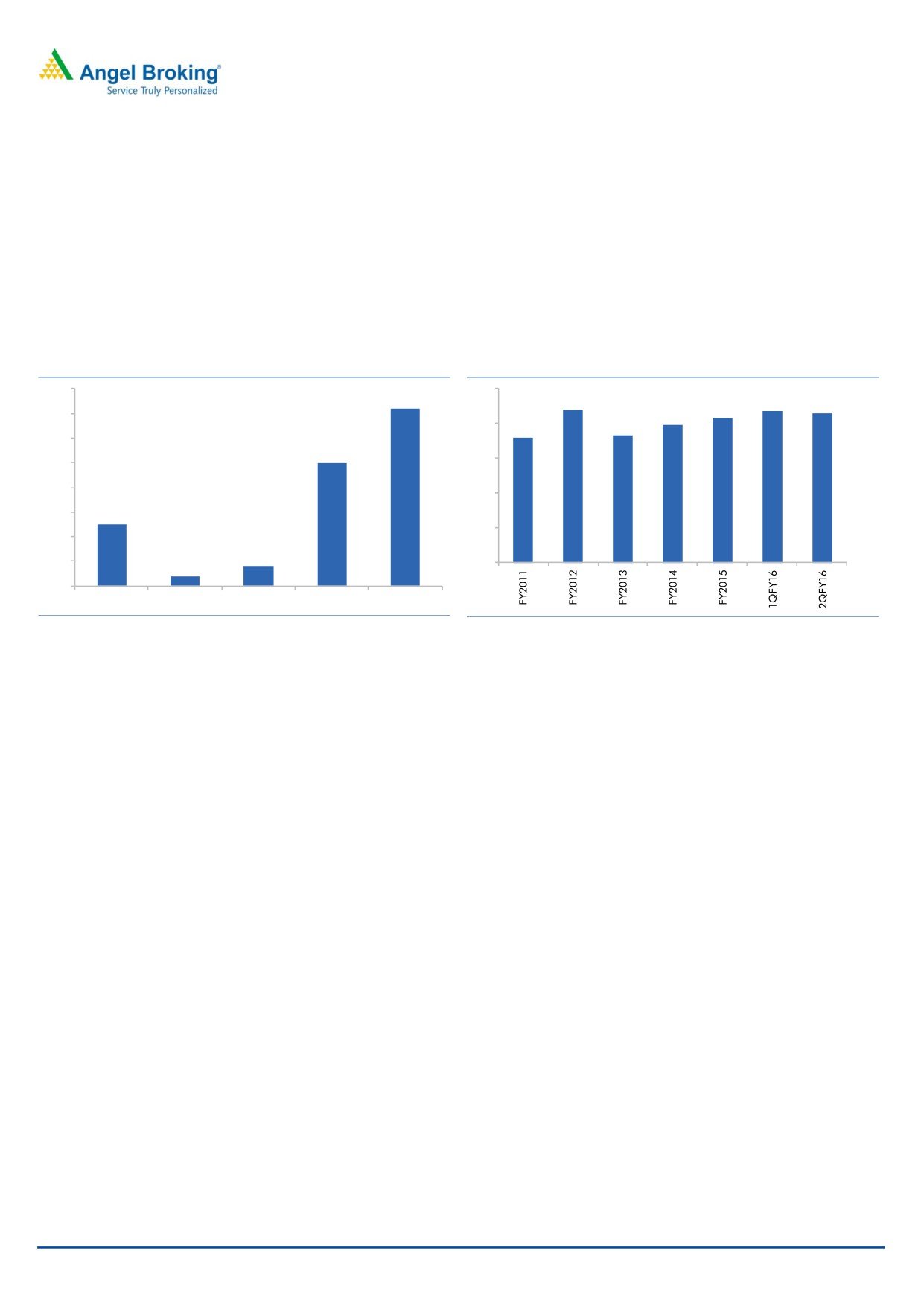

Exhibit 3: Voltas- Number of sale touch-points

12,000

10,000

10,000

8,000

6,500

6,000

5 ,300

4,000

2,000

0

FY2012

FY2014

2QFY2016

Source: Company, Angel Research

Unfavorable climate for the AC business in North India (accounts for 50% of

Voltas’ AC sales) led to ~10% yoy de-growth in the company’s sales across North

India in 1HFY2016. Despite weak North India sales, in a cut throat competitive

scenario with some players resorting to price cutting, Voltas maintained 21% of the

market share as of 2QFY2016.

Given the low AC penetration in India, gradual uptick in the economy and rising

urbanization, we expect AC sales to report strong 10-15% yoy growth for the next

3-5 years. Considering Voltas’ strong market positioning and its entry into the

Air-Coolers segment, we expect its sales to grow at par with the industry. This

should lead to Voltas sustaining its over-20% market share. On the whole, we

expect the UCP segment to report 12.2% top-line CAGR during FY2015-18E.

Exhibit 4: To maintain leadership position in AC business

Exhibit 5: EBIT % to stabilise at ~13% levels in UCP segment

4,000

Revenue (` in cr)

yoy growth (%)

25

500

Unadj. EBIT (` cr)

Margins (%)

16

450

3,500

14

19.3

19.0

22.3

20

400

13.9

3,000

13.2

12

16.0

12.9

13.1

350

12.3

2,500

10

15

300

11.8

2,000

250

9.3

8

10

200

1,500

6

150

1,000

2.4

4

5

100

500

2

50

0

0

0

0

FY2013

FY2014

FY2015

FY2016E FY2017E FY2018E

FY2013

FY2014

FY2015

FY2016E FY2017E FY2018E

Source: Company, Angel Research

Source: Company, Angel Research

In the last few years, consumer buying preferences have shifted towards Split ACs

in comparison to Window ACs, which were more in demand earlier. Over the

years, this has resulted in a shift in the segment product mix, with increased

contribution of Split ACs vs Window ACs. The company in delivering products of

superior quality. There have been provision write-backs, thereby contributing to

segment margin expansion (from 10.1% in FY2010 to 13.9% in FY2015). Despite,

correction in raw material prices, we expect Voltas to feel the heat of competition

from MNCs. Accordingly we expect Voltas to report segment margins of ~13.0%

levels during FY2016-18E.

December 21, 2015

3

Initiating coverage | Voltas

EMP business to recover gradually

Weak awarding activity, payment delays, client specific issues at some large ticket

projects (these projects were won on fixed cost basis, and they experienced cost

escalations on account of client side design changes and other business reasons),

led Voltas to report a negative 16.9% top-line CAGR during FY2013-15 to

`2,209cr. Similarly, segment margins during the same period were under pressure

owing to (1) zero level margins being booked from SIDRA project, (2) higher

provisions for some of the projects in order to comply with AS-7, (3) execution of

fixed cost projects in international markets, which were won at cut throat

competition, and (4) execution delays (owing to design changes from the client

side).

The Management highlighted that currently the domestic market is characterised

by limited awarding activity, high competition from the local players and stretched

working capital cycles. Realising the emerging business dynamics, Voltas is

following selective business strategy, with emphasis on cash flow profile and

project level profitability. Management expects recovery in capex and gradual

uptick in the domestic EMP segment awarding scenario from FY2017E onwards.

In the Middle East markets, correction in oil prices has raised concerns of a

slowdown in the capex cycle in the region. 2 mega events are slated in the Middle

East, going forward, ie the Dubai Expo 2020 and the Qatar Football World Cup

2022. In the run-up to preparation for these 2 events, we expect awarding to pick-

up in Qatar and UAE from FY2017E onwards. We do not expect awarding activity

to be affected due to the corrective trend in oil prices as both of these countries are

gas dependent and are borrowing economies.

Voltas restructured its business approach as well as its operations. The company

(1) has made leadership changes and strengthened its operations team by

defining the business boundaries, (2) defined new parameters, which would

indicate whether or not to bid for a project, and (3) is now resolving to a selective

approach while bidding for new projects with a focus on accruing reasonable

margins rather than following a turnover based growth approach.

Given the company’s resolve to follow a selective bidding strategy, we expect it to

report 5.2% order inflow CAGR during FY2015-17E. With uptick in awarding

activity in the Middle East, we expect Voltas to report a 27.0% yoy increase in its

FY2018E order inflows to `3,500cr.

December 21, 2015

4

Initiating coverage | Voltas

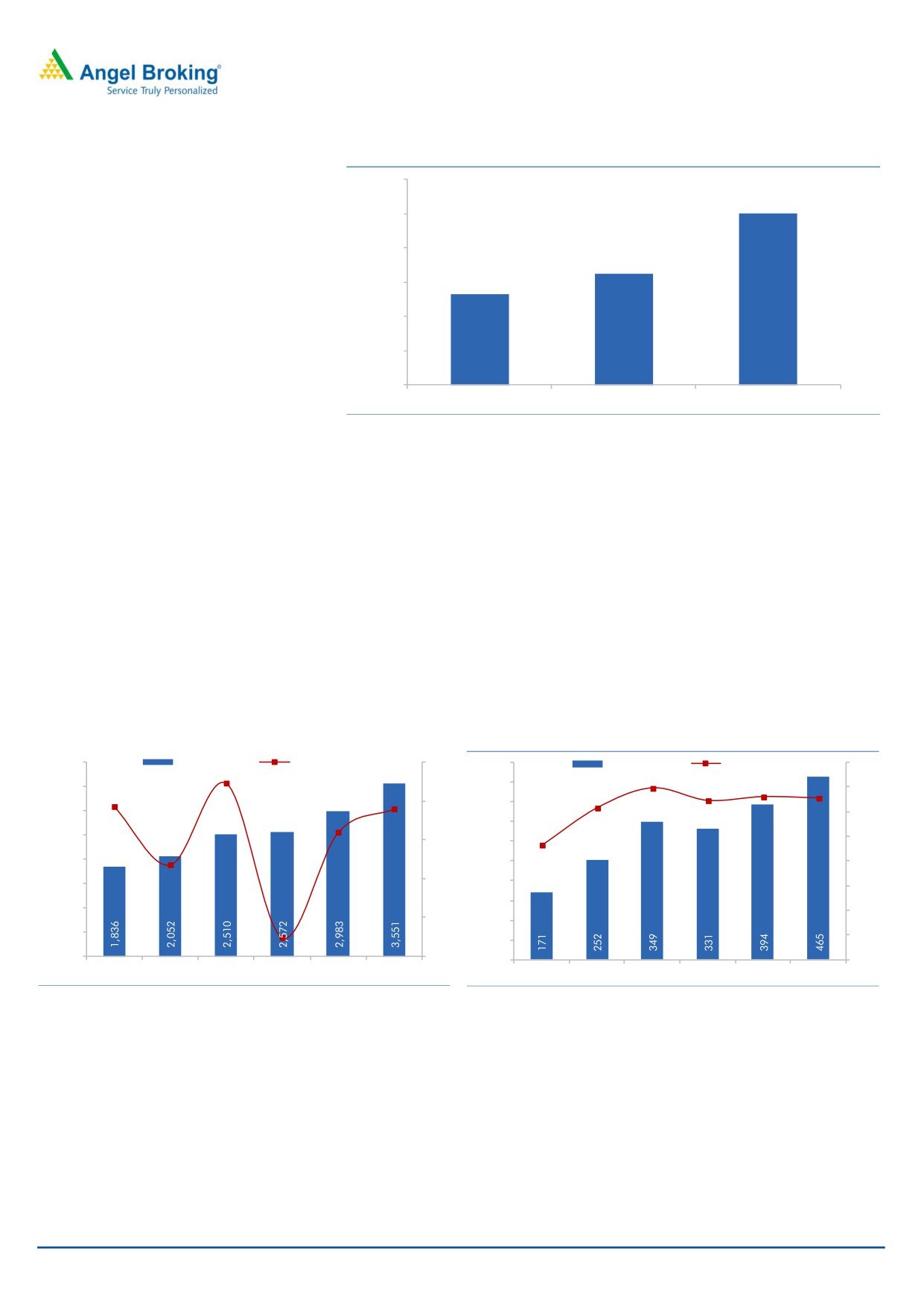

Exhibit 6: Order Inflows to gradually catch-up...

Exhibit 7: OB/LTM sales ratio to improve to 1.9x...

4,000

Order Inflows (` in cr)

yoy growth (%)

30

6,000

Order Book (` in cr)

OB/LTM ratio (x)

2.0

3,500

1.9

1.8

3,500

25

27.0

5,000

1.8

1.6

1.7

1.7

3,000

2,755

20

2,627

2,585

2,490

2,500

1.3

1.4

4,000

1.2

2,500

15

1.2

2,000

10

3,000

1.0

10.2

0.8

1,500

5

2,000

(1.6)

0.6

1,000

0

0.4

0.4

1,000

500

(5)

0.2

(3.7)

0

(10)

0

0.0

FY2013

FY2014

FY2015

FY2016E FY2017E FY2018E

FY2013

FY2014

FY2015

FY2016E FY2017E FY2018E

Source: Company, Angel Research

Source: Company, Angel Research

The EMP segment’s order book as of 2QFY2016-end stands at

`3,599cr,

reflecting order book to Last Twelve Month (LTM) sales ratio of 1.6x. Domestic

orders constituted ~52%, whereas the remaining orders are from the international

markets (mainly from Middle East countries like Qatar, UAE and Oman). Despite

weak near-term awarding trends, we expect gradual recovery in the domestic and

international business from FY2017E onwards. Recovery in order wins should be

followed by uptick in execution. Accordingly, we expect a 9.2% order book CAGR

during FY2015-18E to `5,074cr.

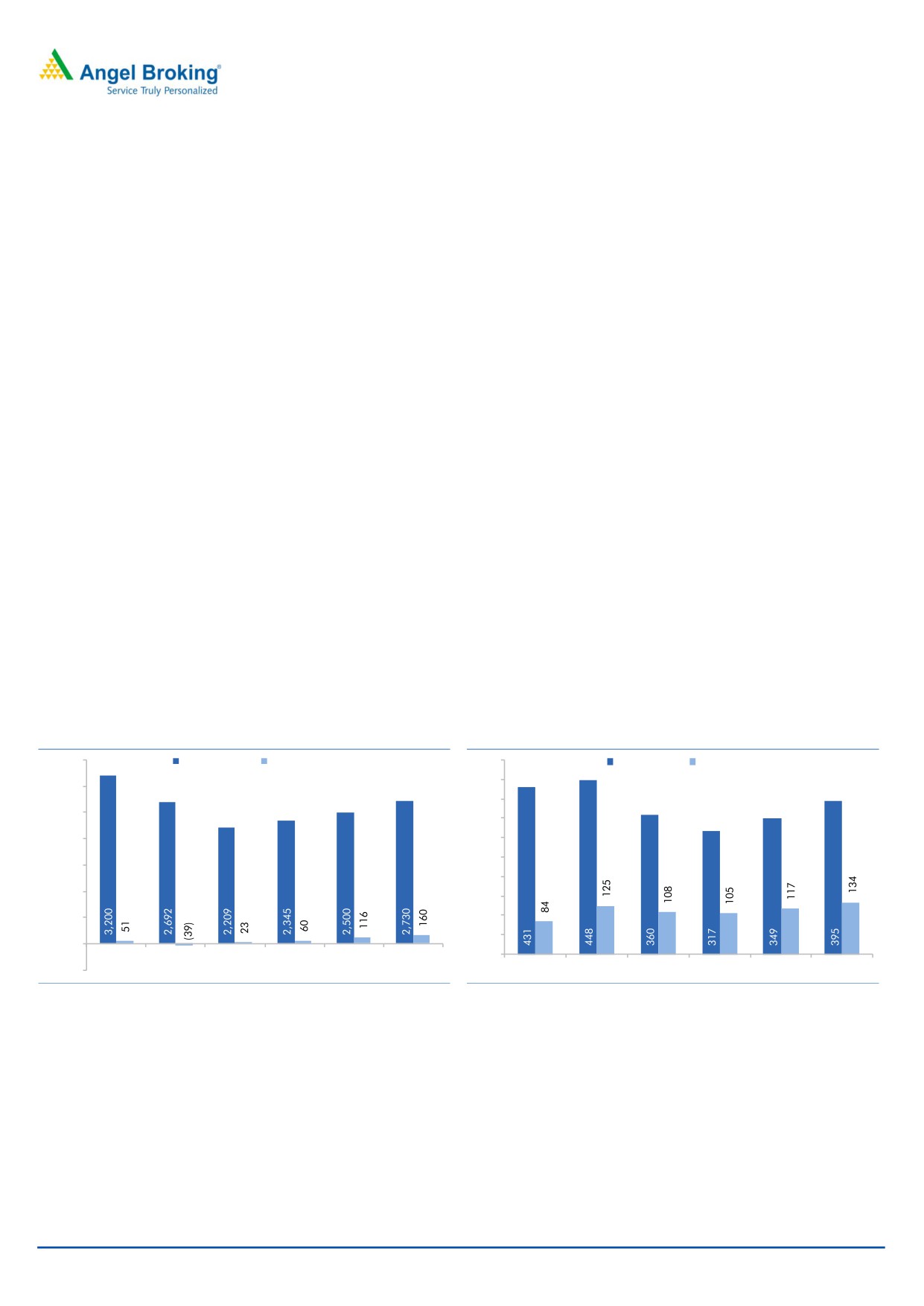

Exhibit 8: Execution momentum to catch-up...

Exhibit 9: EBIT % set to expand from here-on...

3,500

Revenues (` in cr)

yoy growth (%)

15

200

Unadj. EBIT (` in cr)

Margins (%)

6

160

10

5.0

5

3,000

9.2

4.6

6.2

6.6

150

5

116

2,500

4

0.5

0

3

2,000

100

2.6

(5)

60

2

1,500

51

1.6

(10)

50

1

1,000

23 1.0

(15)

(15.8)

(18.0)

0

500

(20)

0

FY2013

FY2014

FY2015

FY2016E FY2017E FY2018E

(1)

0

(25)

(1.5)

FY2013

FY2014

FY2015

FY2016E FY2017E FY2018E

(50)

(39)

(2)

Source: Company, Angel Research

Source: Company, Angel Research

At the back-drop of uptick in new order wins, we expect execution to catch-up,

resulting in

7.3% top-line CAGR during FY2015-18E to

`2,730cr. Voltas’

Management has highlighted that all the legacy projects in the order book would

get completed in FY2016E. Post completion of these projects, the Management

would be executing the recently won good margin orders (4-5% EBIT margins),

which in their view have come at reasonable commercial terms. Accordingly, we

expect the EMP segment to report 91.4% EBIT CAGR during FY2015-18E (EBIT

margins to expand from 1.0% in FY2015 to 5.0% in FY2018E).

Earnings growth to be driven by UCP segment…

Growth across Voltas during FY2013-15 has been driven by the UCP segment,

which reported 16.9% top-line and 42.7% EBIT CAGR, respectively. Negative

33.3% EBIT CAGR from the EMP segment, during the same period, was offset by a

favorable performance from the UCP segment. In other words, the EMP segment’s

December 21, 2015

5

Initiating coverage | Voltas

contribution to EBIT mix in the last few years has declined from 16.7% in FY2013

to 4.7% in FY2015. We expect the EMP segment to report 6.2% revenue CAGR

during FY2015-17E and from there-on, on the back of new order wins, the

segment is expected to report a revenue growth of 9.2% yoy in FY2018E.

Exhibit 10: Segment-wise Revenue mix movement

Exhibit 11: Consol. Revenue & yoy growth

100%

8,000

Revenue (` in cr)

yoy growth (%)

20

1

1

1

2

2

2

6,808

90%

7,000

80%

33

39

5,963

15

49

48

50

5,531

14.2

70%

52

6,000

5,363

5,266

5,183

11.2

8

10

60%

5,000

9

50%

6.7

7

6

6

4,000

5

6

40%

3.5

30%

3,000

58

0

51

20%

43

44

42

40

(1.6)

2,000

10%

(4.8)

(5)

1,000

0%

FY2013

FY2014

FY2015

FY2016E

FY2017E

FY2018E

0

(10)

EMP EPS UCP Others & Inter-seg. Rev.

FY2013

FY2014

FY2015

FY2016E FY2017E FY2018E

Source: Company, Angel Research

Source: Company, Angel Research

On considering (1) expected structural uptick in domestic AC industry for next

3-5 years, (2) strong market positioning of Voltas within the domestic AC industry,

(3) wide pan-India distribution network (with over 10,000 touch points), and

(4) strong brand perception enjoyed by Voltas, we are optimistic that the UCP

segment’s contribution to overall business would remain so. We expect the UCP

segment to report a

12.2% top-line and

10.0% bottom-line CAGR during

FY2015-18E, respectively. With legacy projects nearing completion (by FY2016E)

and possible increase in contribution of newly won projects at 4-5% EBIT margins,

we are optimistic that the EMP segment would make a meaningful

17%

contribution to the consol. EBIT in FY2018E.

Exhibit 12: Segment-wise EBIT mix movement

Exhibit 13: Consol. EBITDA & PAT Margins

100%

12.0

0

1

1

1

1

EBITDA (%) PAT (%)

0

80%

10.0

56

66

64

64

60%

75

72

8.0

40%

6.0

27

19

19

20%

21

4.0

37

22

17

12

16

17

0%

5

2.0

(12)

FY2013

FY2014

FY2015

FY2016E

FY2017E

FY2018E

0.0

-20%

FY2013

FY2014

FY2015

FY2016E FY2017E FY2018E

EMP

EPS

UCP

Others

Source: Company, Angel Research

Source: Company, Angel Research

In a highly competitive AC sales environment, characterized by competitors

resorting to price cuts, we expect Voltas to be less affected. Our view stems on

account of the following, (1) Voltas’ ACs are competitively priced vis-a-vis its peers

(which until now have focused on maintaining higher realizations), (2) sharp fall in

commodity prices, especially copper, (3) emphasis on advertising (Voltas has been

among the top-5 ad spenders in the AC industry), and (4) one of the few players

December 21, 2015

6

Initiating coverage | Voltas

with strong post-sale support (offers 5-year warranty for compressors). We expect

the UCP segment to maintain its EBIT margins ~13.0% levels during FY2016-18E.

On a whole, UCP segment should help Voltas report a 9.5% top-line and 13.1%

bottom-line CAGR during FY2015-18E.

Strong Balance Sheet & Return ratios…

Voltas pursues an asset light business model, and in the due course of business, it

does outsourcing and strategic tie-ups, thereby helping it in controlling operating

costs and generating high profitability ratios (vs other infrastructure & EMP

players). As a result, the company has been able to maintain higher RoEs. Given

the asset-light nature of Voltas’ business, the company has generated `618cr of

cash flow from operations during FY2013-15. At 2QFY2016-end, Voltas is a debt

free company (on net basis), sitting on a cash balance of `247cr. Its strong

balance sheet position gets reflected in its RoEs, which expanded from 12.8% in

FY2013 to 19.6% in FY2015. Considering that the cash flow generating potential

of the company would be maintained going forward, we expect Voltas to report

16-19% RoEs for FY2016-18E.

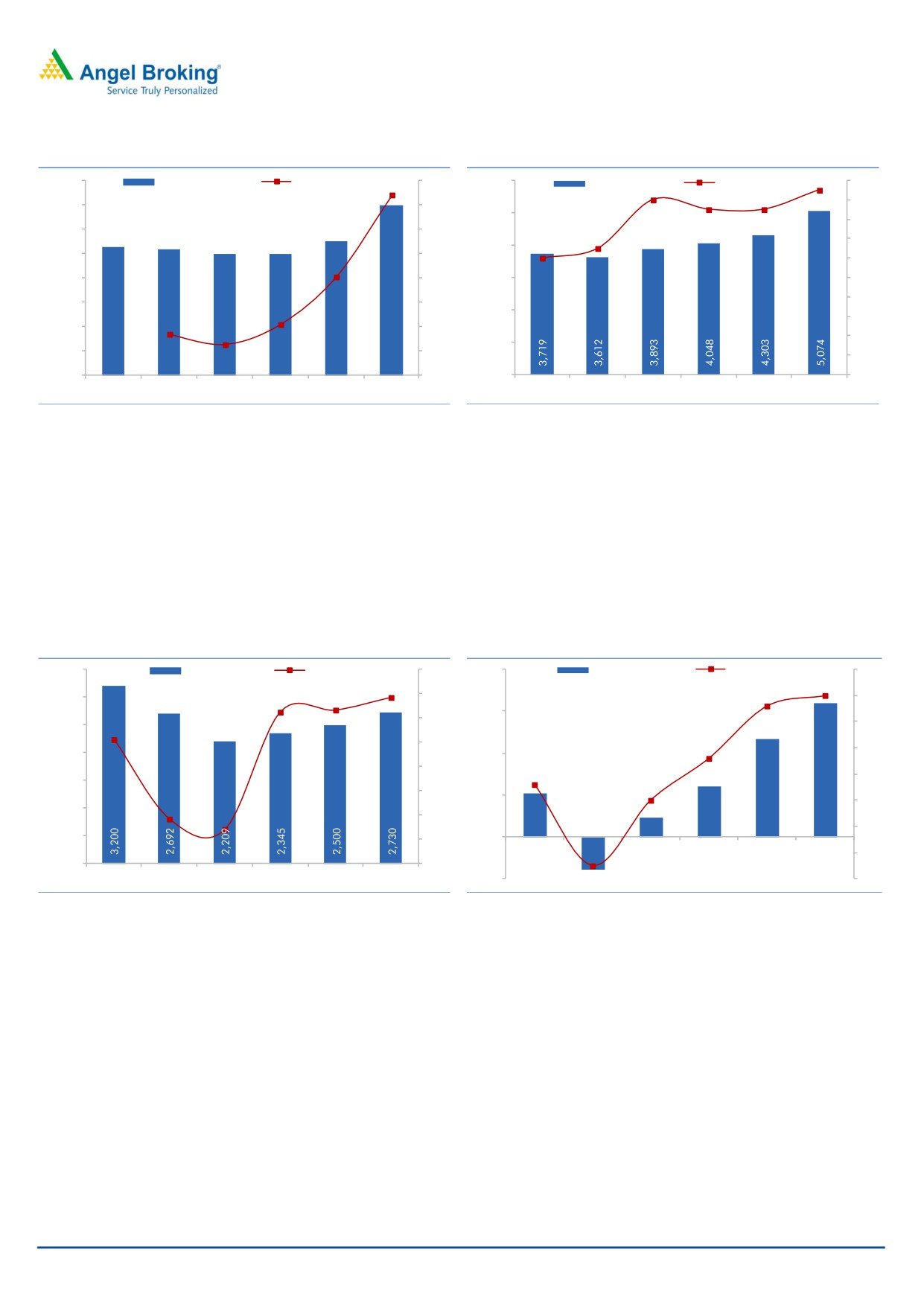

Exhibit 14: Return on Equity (%)

Exhibit 15: Cash flow from Operations

25.0

600

Cash flow from Operations (` in cr)

511

19.1

19.6

17.9

500

20.0

16.2

400

14.2

334

331

15.0

12.8

300

221

10.0

175

200

5.0

100

64

0.0

0

FY2013

FY2014

FY2015

FY2016E

FY2017E

FY2018E

FY2013

FY2014

FY2015

FY2016E

FY2017E

FY2018E

Source: Company, Angel Research

Source: Company, Angel Research

December 21, 2015

7

Initiating coverage | Voltas

Understanding the Business Model

Voltas conducts its entire business under 3 key heads, namely Unitary Cooling

Products (UCP), Electro Mechanical Projects & Services (EMP) and Engineering

Products & Services (EPS). Amongst the 3 business segments, UCP is the largest

one, with it having contributed ~49% and ~72% of FY2015 consolidated revenues

and EBIT, respectively.

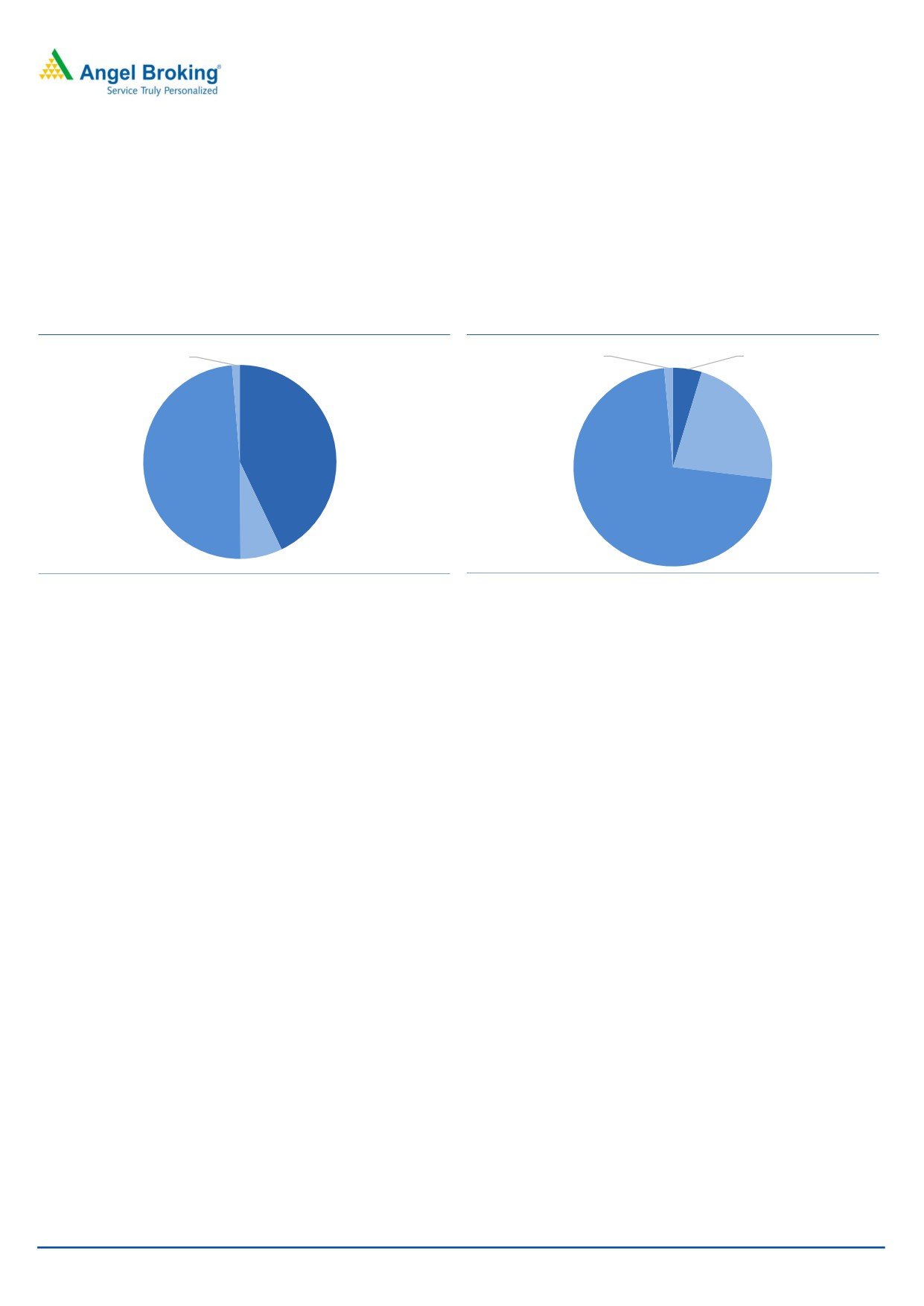

Exhibit 16: FY2015- Consol. Revenue Mix

Exhibit 17: FY2015- Consol. unadj. EBIT Mix

Others, 1%

Others, 1%

EMP Segment,

5%

EPS Segment,

EMP Segment,

22%

43%

UCP Segment,

49%

UCP Segment,

72%

EPS Segment,

7%

Source: Company, Angel Research

Source: Company, Angel Research

(A) Electro Mechanical Projects & Services (EMP) segment

Voltas, in the last two decades, has transformed itself from being a HVAC

(Heating, Ventilation and Air-Conditioning) player to EMP (Electro Mechanical

Projects & Services) player. With larger ticket size projects being awarded, the trend

of awarding the entire MEP project to a single vendor has gained prominence. The

current scope of work under the EMP segment includes Heating, Ventilation, Air

Conditioning, Power Management, Control Systems, Lightning Systems, Fire

Detection & Alarm, Water Treatment Systems, Rain Gutter Systems, Sewerage

Removal System and Fire Fighting System. For a given Building/ Hospital Building/

Education Building, the scope of MEP works account for ~35% of the project cost

in India. Whereas in the developed world, the share of MEP works in a complex

project can increase up to 40-45% of the total project cost.

If we look at the geographical split within the segment, then the international

business contributed 60%+ of segment revenues, with the remaining contribution

coming in from domestic markets. Again, within international markets, a

substantial chunk of revenues would flow-in from the Middle East markets

(especially Qatar, UAE and Oman).

The EMP business is a key business for Voltas, as this segment contributed ~49%

of average consol. revenues over FY2013-15. Despite strong top-line contribution,

large cost overruns across international business led to segmental EBIT level losses

in FY2012 and FY2014.

December 21, 2015

8

Initiating coverage | Voltas

OB/ LTM sales ratio at 1.6x gives revenue visibility…

The EMP segment’s order book as of 2QFY2016-end stands at

`3,599cr,

reflecting order book to Last Twelve Months (LTM) sales ratio of 1.6x. Domestic

orders constitute ~52%, whereas remaining orders are from international markets

(mainly from Middle East countries like Qatar, UAE and Oman). Despite weak

near-term awarding trends, we expect recovery going forward led by international

business from FY2017E onwards. Our assumption on recovery from international

markets is on factoring an expected catch-up in awarding in run-up to FIFA 2022

and Dubai Expo 2020 events.

During FY2012-15, the segment’s performance (mainly the international business)

was impacted due to ongoing disputes with clients (as projects were won on fixed

cost basis, and were experiencing cost escalations, on account of client side design

changes and other business reasons). On the whole, cut-throat competition in a

weak awarding environment led to weak execution and payment delays. As a

result, Voltas’ Management went ahead and restructured its operations as well as

its business.

Voltas’ Management has (1) made leadership changes and strengthened its

operations team by defining business boundaries, (2) defined new parameters,

which would indicate whether or not to bid for a project, (3) resolved to a selective

bidding strategy (focusing on new projects with reasonable margins instead of

following a turnover growth approach). These initiatives coupled with declining

proportion of low margin legacy projects indicate that margins are likely to

expand. Accordingly, we expect the segment’s EBIT margins to expand from 1.0%

in FY2015 to 5.0% in FY2018E.

Exhibit 18: EMP Segment Financials

Exhibit 19: EPS Segment Financials

3,500

Revenue (` cr)

EBIT (` cr)

500

Revenue (` cr) EBIT (` cr)

450

3,000

400

2,500

350

2,000

300

250

1,500

200

1,000

150

500

100

50

0

FY2013

FY2014

FY2015

FY2016E FY2017E FY2018E

0

(500)

FY2013

FY2014

FY2015

FY2016E

FY2017E

FY2018E

Source: Company, Angel Research

Source: Company, Angel Research

(B) Engineering Products & Services (EPS) segment

The Engineering Products and Services (EPS) segment sells machinery and

equipment across 2 sub-verticals, namely, (1) Textile Machinery, and (2) Mining &

Construction Equipment. Voltas generates revenues from this segment in the form

of commission and non-commission revenues. Commission income comes from

the distribution of textiles as well as mining & construction equipment, as the

company does not manufacture these equipments. Non-commission income

mainly includes income from maintenance contract services drawn from

equipments sold.

December 21, 2015

9

Initiating coverage | Voltas

This segment showed flattish yoy revenue growth trend during FY2013-14, except

in FY2015-1QFY2016, when the company reported yoy de-growth. This de-growth

was owing to slowdown seen across the domestic mining industry, impact of

regulatory clam-downs on the mining sector and loss of clients (such as

Caterpillar) owing to global consolidation.

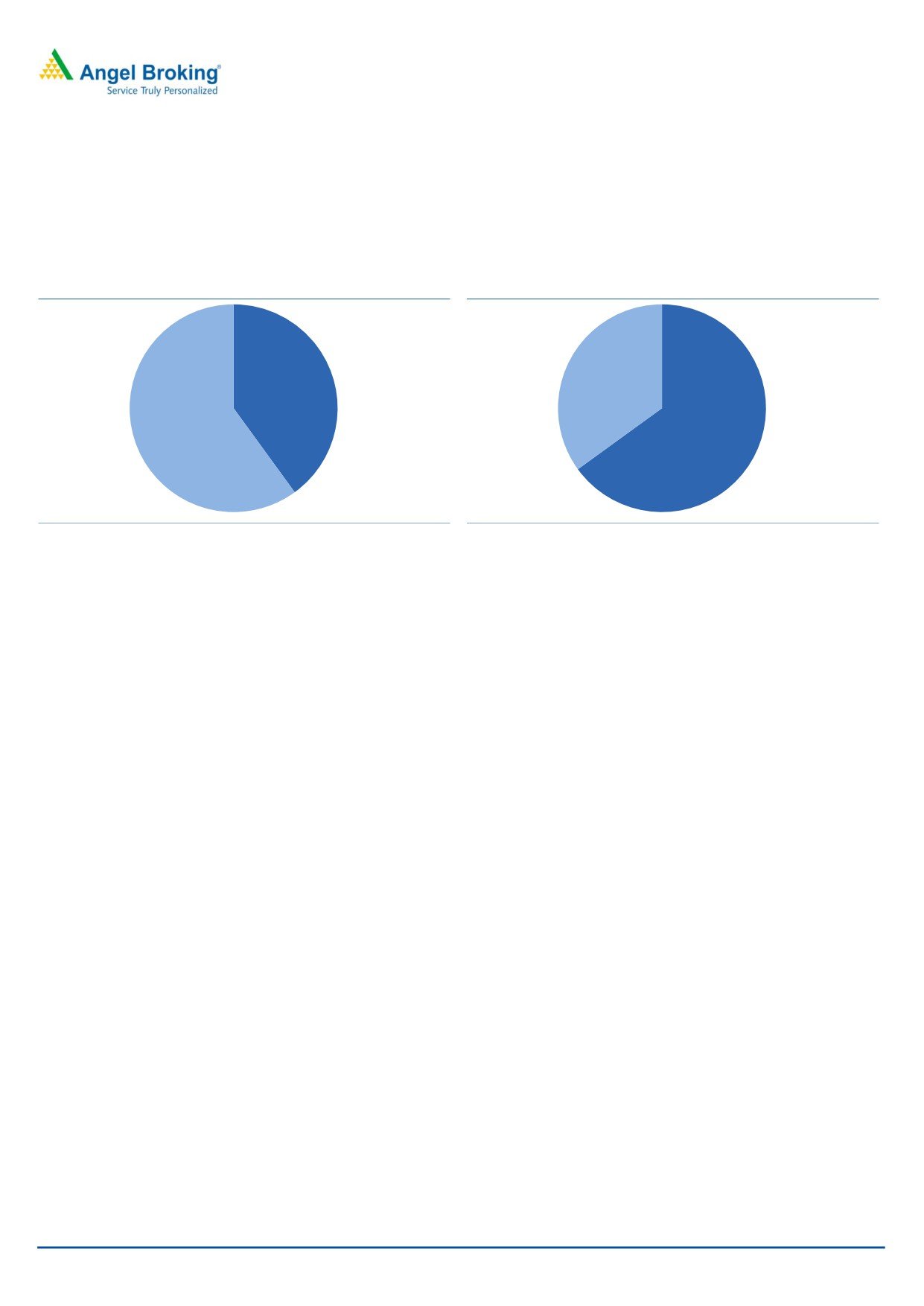

Exhibit 20: Sub-Segment Revenue mix (as of FY2015)

Exhibit 21: Business-wise Revenue mix (as of FY2015)

Mining &

O&M and

Construction

Spare Parts,

Equip., 40%

35%

Textile

Machinery,

Equipment

60%

Sales, 65%

Source: Company, Angel Research

Source: Company, Angel Research

Voltas acts as an agent for sale of machinery (Indian as well as foreign) across the

entire value chain of the textile industry, namely spinning, weaving, knitting,

processing and finishing applications. The company’s key principals include-

Lakshmi Machine Works (LMW; which has a major chunk of market share in the

domestic textile equipment industry) from India, and Terrot and Thies GmbH from

the international market.

The textile industry in India is currently undergoing tough times given the exports

decline in China, excess capacity in the domestic markets, muted yarn prices and

technological advancements happening within the sector (especially weaving,

knitting & processing and finishing divisions). Lack of clarity on the government

plan to extend support towards Technology Up gradation Fund Scheme (TUFS) is

leading to subdued demand. Despite these adversaries, spurt in demand from

some states held the sub-segment revenue growth in 2QFY2016.

After a few quarters of muted performance, the Mining & Construction Equipment

sub-segment has reported some signs of growth in 2QFY2016. The mining

equipment sector has been impacted due to re-tendering activity and delays in

uptick in the capex cycle.

Within the Mining & Construction Equipment sub-segment, low contribution from

the domestic business was offset up to a certain extent by high revenue

contribution from the African markets (especially from the Mozambique business).

In-line with the Management’s commentary, we expect FY2016 to be a weak year

for the company. Thereafter, we expect gradual uptick in the segment’s business.

The Management has highlighted that strategic focus on the spare parts and

servicing business, maintaining strong customer relations, uptick in construction

activity, as well as diversification into the post spinning space (within the Textiles

Machinery space) should help the segment report growth, going forward. On the

whole, we expect this segment to report a 3.1% top-line CAGR during FY2015-18E

to `395cr.

December 21, 2015

10

Initiating coverage | Voltas

Despite a weak 1HFY2016 in terms of revenues, the reported EBIT margin stood

impressive at ~35% levels, owing to strong service business contribution from the

Mozambique markets. We expect the segment’s EBIT margin to be at ~33% levels

going forward during FY2016-18E (vs 30.0% in FY2015).

(C) Unitary Cooling Products (UCP) segment

Voltas has built a strong brand name and has emerged as one of the largest air

conditioner players with in the domestic AC markets. At 2QFY2016-end, as per a

report by AC Neilson, Voltas enjoys 21% market share of the Indian AC market,

with the second nearest competitor having a market share lower by ~400bp.

Apart from being present in the domestic AC market, Voltas has gone ahead and

deployed cooling solutions expertise towards Cold Chain Storage, Retail and Food

Processing industries. The Commercial Refrigeration sub-segment’s offerings

include Package and Ductable Air conditioners, VRF Technology, and Chillers. The

current product range includes Voltas’ in-house manufactured product range: ie

Package and Ductable Air conditioners: 5.5-22 TR (Ton of refrigeration); Chillers

range include- Screw Chiller Packages: 80-500 TR; Scroll Chillers: 12-100 TR and

Vapour Absorption Machines: 40-1,450 TR.

Home AC penetration in India currently stands at ~4%, well below 50-70% levels

across developed nations and 25-40% levels across some of developing nations

(includes countries like Thailand and Malaysia). On account of growing disposable

incomes, upcoming summer season, declining maintenance costs, attractive

consumer financing options and increased availability of power, we expect

penetration levels in the Indian AC market to reach 10% over the next 5 years.

Expected surge in the penetration levels translates to ~10-15% increase in the

market size over the next 3-5 years.

The UCP segment contributed ~49% of the FY2015 consol. revenues and ~72%

of the FY2015 consol. EBIT. Of the FY2015 UCP segment sales, the AC business

contributed ~75.0% of segment sales (total of ~0.4cr ACs were sold vs assembly

line capacity of ~0.7cr ACs) and remaining ~25.0% were from the Commercial

Refrigeration business.

UCP segment has reported impressive 16.9% revenue CAGR during FY2013-15,

reflecting (1) market leadership position in domestic AC market, (2) wide pan-India

distribution network (with over 10,000 touch points), and (3) strong brand

perception being enjoyed by Voltas. The AC market in India reported de-growth in

1HFY2016, owing to ~10% de-growth seen across one of the largest AC markets

in India, ie North India. Strong market positioning in a growing AC market,

coupled with new product launches (scheduled in 4QFY2016), wide distribution

reach, entry into Air-Coolers space (expect to sell 1 lakh units p.a. by third year),

and strong post-sales support should help the UCP segment report 12.2% revenue

CAGR (on a high base) during FY2015-18E. Our assumptions capture a muted

2.4% yoy segment growth for FY2016, reflecting 1H numbers and strong sales

witnessed in the festive season. Seasonality aspect to AC sales has been declining

as urban India is looking upon ACs as a necessity. Accordingly, we expect 16.0%

and 19.0% yoy revenue growth in FY2017-18E.

Owing to shift in the product mix and higher sales of better quality product mix,

the company has reversed its provisions, resulting in improvement in the EBIT

margins. EBIT margins of the segment improved from 9.3% in FY2013 to 13.9% in

December 21, 2015

11

Initiating coverage | Voltas

FY2015. Despite stiff competition, correction in raw material prices should support

EBIT margins at 13%+ levels.

Valuation

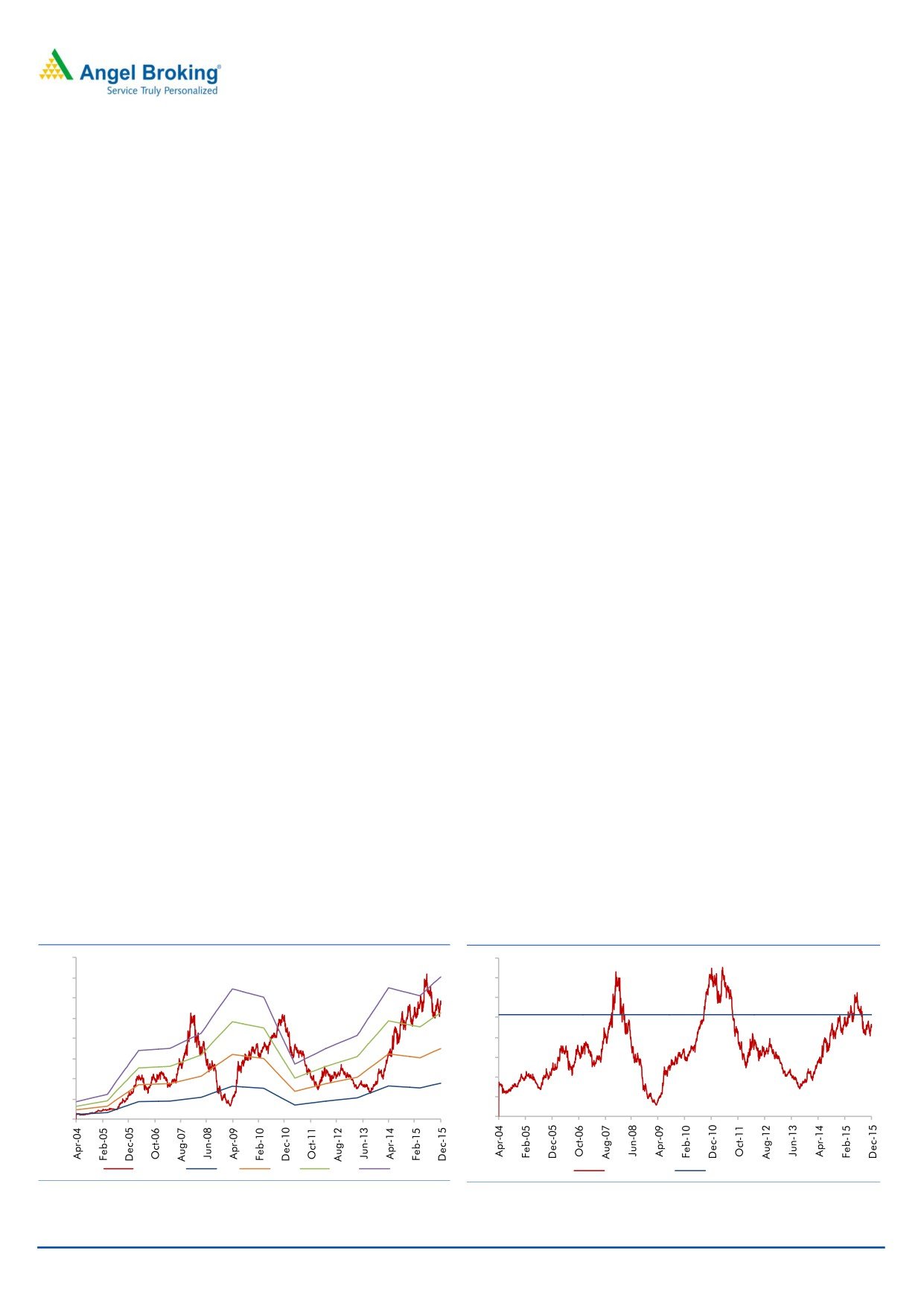

At the current market price of `304, based on our estimates, the stock is trading at

FY2017E and FY2018E P/E of 22.1x and 18.1x, respectively.

With inflation under control, rate cuts announced, when coupled with Voltas’

strong positioning in the lowly penetrated AC market, comforts us that AC sales

should continue to report strong growth, going forward. In FY2015, the UCP

segment contributed ~72% of the consol. EBIT.

Also, completion of low margin EMP projects and increased contribution of high

margin projects indicate that the EBIT margins of the EMP segment would improve

from 1.0% in FY2015 to 5.0% in FY2018E.

On the whole, we expect Voltas to report a top-line and bottom-line CAGR growth

of 9.5% and 13.1% during FY2015-18E, respectively. Our growth assumption

captures (a) pick-up in international award activity, which should lead top-line

growth as well as EMP segment EBIT margin expansion, (b) continued growth in

domestic AC sales, with Voltas being able to retain its ‘Numero Uno’ status.

Noticeably in the last few years, the EBIT mix of Voltas has shifted from being

heavily dependent on the EMP segment to a now dominant share of the UCP

segment. The contribution of the UCP segment in the consol. EBIT has increased

from 32% in FY2011 to 72% in FY2015. We expect the same to be over 64% levels

during FY2016-18E. Considering the shift in the consol. EBIT mix, positive cues,

and case for improvement in the business segments’ performances, we expect

scope for improved profitability and better investment return ratios, going forward.

Considering the higher dependency on the UCP segment, we have compared

Voltas to Hitachi (which is trading at a FY2018 P/E multiple of ~36.0x). We assign

Voltas a 21.0x PE multiple to our FY2018E EPS estimate of `16.8/share and arrive

at a price target of `353. This reflects 16% upside potential from the current levels.

We initiate coverage on Voltas with a BUY rating from a 12-month perspective and

price target of `353.

Exhibit 22: 1-year forward P/E band (x)

Exhibit 23: 1-year forward Avg. P/E band (x)

400

40

350

35

300

30

250

25

200

20

150

15

100

10

50

5

0

0

Price (`)

7x

14x

21x

28x

Price (`)

Avg. P/E band (x)

Source: Angel Research

Source: Angel Research

December 21, 2015

12

Initiating coverage | Voltas

Risks to our Estimates

AC sales contributed ~36% of FY2015 consolidated revenues. Given that

Voltas is present only in the AC business across the entire Consumer Durables

space, loss of major market share could act as a risk to our estimates. Any

such development could lead to lower than expected EBIT contribution to the

consol. profits and our estimates.

Revenues from EPS segment are based on agreement for supplying Textile,

Mining & Construction equipment. Any termination of such agreements shall

impact our forecasted revenues for the segment.

Most of the long term international projects are fixed price contracts and in the

due course of its business, Voltas also imports. Any, adverse currency

fluctuations may impact the raw material pricing as well as margins.

Cancellation of Qatar World Cup 2022 or Expo 2020 could affect our EMP

segment assumptions.

December 21, 2015

13

Initiating coverage | Voltas

Profit and Loss Statement

Y/E March (` cr)

FY13

FY14

FY15

FY16E

FY17E

FY18E

Net Sales

5,531

5,266

5,183

5,363

5,963

6,808

% Chg

6.7

(4.8)

(1.6)

3.5

11.2

14.2

Total Expenditure

5,287

5,000

4,773

4,935

5,419

6,141

Cost of Raw Mat. Consumed

4,167

3,854

3,597

3,728

4,094

4,665

Employee benefits Expense

633

595

590

612

671

763

Other Expenses

487

551

586

594

654

713

EBITDA

244

266

410

428

544

667

% Chg

(27.5)

8.9

54.4

4.4

27.1

22.6

EBIDTA %

4.4

5.0

7.9

8.0

9.1

9.8

Depreciation

28

25

28

27

30

32

EBIT

216

241

382

401

513

635

% Chg

(28.6)

11.4

58.7

4.9

28.1

23.6

Interest and Financial Charges

38

23

23

17

13

8

Other Income

90

100

109

111

131

142

PBT

268

318

467

495

631

768

Exceptional Items

12

22

46

11

0

0

Prior Period Adjustments

0

0

0

0

0

0

Tax

73

94

128

142

177

215

% of PBT

27.2

29.6

27.3

28.6

28.0

28.0

PAT from ordinary activities

207

246

386

364

454

553

Share of Profit / (loss of Ass.)

1

(0)

(2)

(1)

1

3

& Minority Int. in (profit)/ loss

PAT

208

245

384

364

455

556

% Chg

28.2

18.1

56.6

(5.4)

25.2

22.1

PAT %

3.8

4.7

7.4

6.8

7.6

8.2

Diluted EPS

6.3

7.4

11.6

11.0

13.8

16.8

% Chg

28.2

18.1

56.6

(5.4)

25.2

22.1

December 21, 2015

14

Initiating coverage | Voltas

Balance Sheet

Y/E March (` cr)

FY13

FY14

FY15

FY16E FY17E FY18E

Sources of Funds

Equity Capital

33

33

33

33

33

33

Reserves & Surplus Total

1,593

1,786

2,069

2,340

2,674

3,075

Networth

1,626

1,819

2,102

2,373

2,707

3,108

Total Debt

261

263

122

185

85

70

Minority Interest

12

14

16

18

18

18

Long-term Liabilities & Prov.

120

122

130

150

153

156

Total Liabilities

2,019

2,218

2,370

2,725

2,963

3,351

Application of Funds

Gross Block

406

459

455

496

521

548

Accumulated Depreciation

195

251

266

293

324

355

Net Block

211

209

189

203

198

192

Capital WIP

0

2

4

8

6

7

Goodwill

89

80

80

80

80

80

Investments

407

732

1,094

1,068

1,078

1,083

Deferred Tax Assets

24

26

37

46

46

46

Inventories

978

901

867

923

1,042

1,190

Sundry Debtors

1,362

1,335

1,339

1,304

1,465

1,673

Cash and Bank Balance

350

282

252

510

484

851

Loans & Advances &

1,041

1,027

922

1,057

1,151

1,317

Oth. Current Assets

Current Liabilities

2,548

2,527

2,519

2,609

2,732

3,226

Net Current Assets

1,183

1,018

861

1,186

1,410

1,806

Other Assets

104

152

105

135

145

136

Total Assets

2,019

2,218

2,370

2,725

2,963

3,351

December 21, 2015

15

Initiating coverage | Voltas

Cash Flow Statement

Y/E March (` cr)

FY13

FY14

FY15

FY16E FY17E FY18E

Profit before tax

243

257

434

495

631

768

Depreciation

22

19

22

27

30

32

Other Adjustments

(147)

(40)

(248)

14

(61)

(61)

Change in Working Capital

21

164

83

(76)

(257)

(17)

Interest & Financial Charges (net)

17

8

10

12

8

4

Direct taxes paid

(92)

(74)

(80)

(142)

(177)

(215)

Cash Flow from Operations

64

334

221

331

175

511

(Inc)/ Dec in Fixed Assets

8

(20)

210

(44)

(23)

(27)

(Inc)/ Dec in Invest. & Int. received

36

(273)

(269)

26

56

62

Cash Flow from Investing

44

(292)

(59)

(19)

33

34

Inc./ (Dec.) in Borrowings

34

(19)

(140)

63

(100)

(15)

Issue/ (Buy Back) of Equity

0

0

0

0

0

0

Dividend Paid (Incl. Tax)

(61)

(57)

(64)

(93)

(121)

(155)

Finance Cost

(26)

(17)

(16)

(17)

(13)

(8)

Cash Flow from Financing

(53)

(93)

(221)

(46)

(234)

(178)

Inc./(Dec.) in Cash

54

(51)

(59)

266

(27)

367

Opening Cash balances

200

255

203

144

410

384

Closing Cash balances

255

203

144

410

384

751

December 21, 2015

16

Initiating coverage | Voltas

Key Ratios

Y/E March

FY13

FY14

FY15

FY16E FY17E FY18E

Valuation Ratio (x)

P/E (on FDEPS)

48.3

40.9

26.1

27.6

22.1

18.1

P/CEPS

42.6

37.2

24.4

25.7

20.7

17.1

Dividend yield (%)

0.6

0.6

0.7

0.8

1.0

1.3

EV/Sales

1.8

1.9

1.9

1.8

1.6

1.4

EV/EBITDA

40.8

37.7

24.2

22.7

17.7

13.9

EV / Total Assets

4.9

4.5

4.2

3.6

3.3

2.8

Per Share Data (`)

EPS (Diluted)

6.3

7.4

11.6

11.0

13.8

16.8

Cash EPS

7.1

8.2

12.5

11.8

14.7

17.8

DPS

1.9

1.9

2.3

2.4

3.2

4.0

Book Value

49.1

55.0

63.5

71.7

81.8

93.9

Returns (%)

RoCE (Pre-tax)

19.3

22.4

36.4

35.9

37.3

38.3

Angel RoIC (Pre-tax)

16.2

16.4

22.1

20.0

23.1

24.4

RoE

12.8

14.2

19.6

16.2

17.9

19.1

Turnover ratios (x)

Asset Turnover (Gross Block) (x)

13.6

12.2

11.3

11.3

11.7

12.7

Inventory / Sales (days)

65

65

62

61

60

60

Receivables (days)

90

93

94

90

85

84

Payables (days)

113

116

112

108

101

98

NWC days

41

43

45

43

44

46

Leverage Ratios (x)

Net D/E ratio (x)

(0.1)

(0.0)

(0.1)

(0.1)

(0.1)

(0.3)

December 21, 2015

17

Initiating coverage | Voltas

Research Team Tel: 022 - 39357800

DISCLAIMER

Angel Broking Private Limited (hereinafter referred to as “Angel”) is a registered Member of National Stock Exchange of India Limited,

Bombay Stock Exchange Limited and Metropolitan Stock Exchange of India Limited. It is also registered as a Depository Participant with

CDSL and Portfolio Manager with SEBI. It also has registration with AMFI as a Mutual Fund Distributor. Angel Broking Private Limited is

a registered entity with SEBI for Research Analyst in terms of SEBI (Research Analyst) Regulations, 2014 vide registration number

INH000000164. Angel or its associates has not been debarred/ suspended by SEBI or any other regulatory authority for accessing

/dealing in securities Market. Angel or its associates including its relatives/analyst do not hold any financial interest/beneficial

ownership of more than 1% in the company covered by Analyst. Angel or its associates/analyst has not received any compensation /

managed or co-managed public offering of securities of the company covered by Analyst during the past twelve months. Angel/analyst

has not served as an officer, director or employee of company covered by Analyst and has not been engaged in market making activity

of the company covered by Analyst.

This document is solely for the personal information of the recipient, and must not be singularly used as the basis of any investment

decision. Nothing in this document should be construed as investment or financial advice. Each recipient of this document should

make such investigations as they deem necessary to arrive at an independent evaluation of an investment in the securities of the

companies referred to in this document (including the merits and risks involved), and should consult their own advisors to determine

the merits and risks of such an investment.

Reports based on technical and derivative analysis center on studying charts of a stock's price movement, outstanding positions and

trading volume, as opposed to focusing on a company's fundamentals and, as such, may not match with a report on a company's

fundamentals.

The information in this document has been printed on the basis of publicly available information, internal data and other reliable

sources believed to be true, but we do not represent that it is accurate or complete and it should not be relied on as such, as this

document is for general guidance only. Angel Broking Pvt. Limited or any of its affiliates/ group companies shall not be in any way

responsible for any loss or damage that may arise to any person from any inadvertent error in the information contained in this report.

Angel Broking Pvt. Limited has not independently verified all the information contained within this document. Accordingly, we cannot

testify, nor make any representation or warranty, express or implied, to the accuracy, contents or data contained within this document.

While Angel Broking Pvt. Limited endeavors to update on a reasonable basis the information discussed in this material, there may be

regulatory, compliance, or other reasons that prevent us from doing so.

This document is being supplied to you solely for your information, and its contents, information or data may not be reproduced,

redistributed or passed on, directly or indirectly.

Neither Angel Broking Pvt. Limited, nor its directors, employees or affiliates shall be liable for any loss or damage that may arise from

or in connection with the use of this information.

Note: Please refer to the important ‘Stock Holding Disclosure' report on the Angel website (Research Section). Also, please refer to the

latest update on respective stocks for the disclosure status in respect of those stocks. Angel Broking Pvt. Limited and its affiliates may

have investment positions in the stocks recommended in this report.

Disclosure of Interest Statement

Voltas

1. Analyst ownership of the stock

No

2. Angel and its Group companies ownership of the stock

No

3. Angel and its Group companies' Directors ownership of the stock

No

4. Broking relationship with company covered

No

Note: We have not considered any Exposure below ` 1 lakh for Angel, its Group companies and Directors

Ratings (Based on expected returns

Buy (> 15%)

Accumulate (5% to 15%)

Neutral (-5 to 5%)

over 12 months investment period):

Reduce (-5% to -15%)

Sell (< -15)

December 21, 2015

18