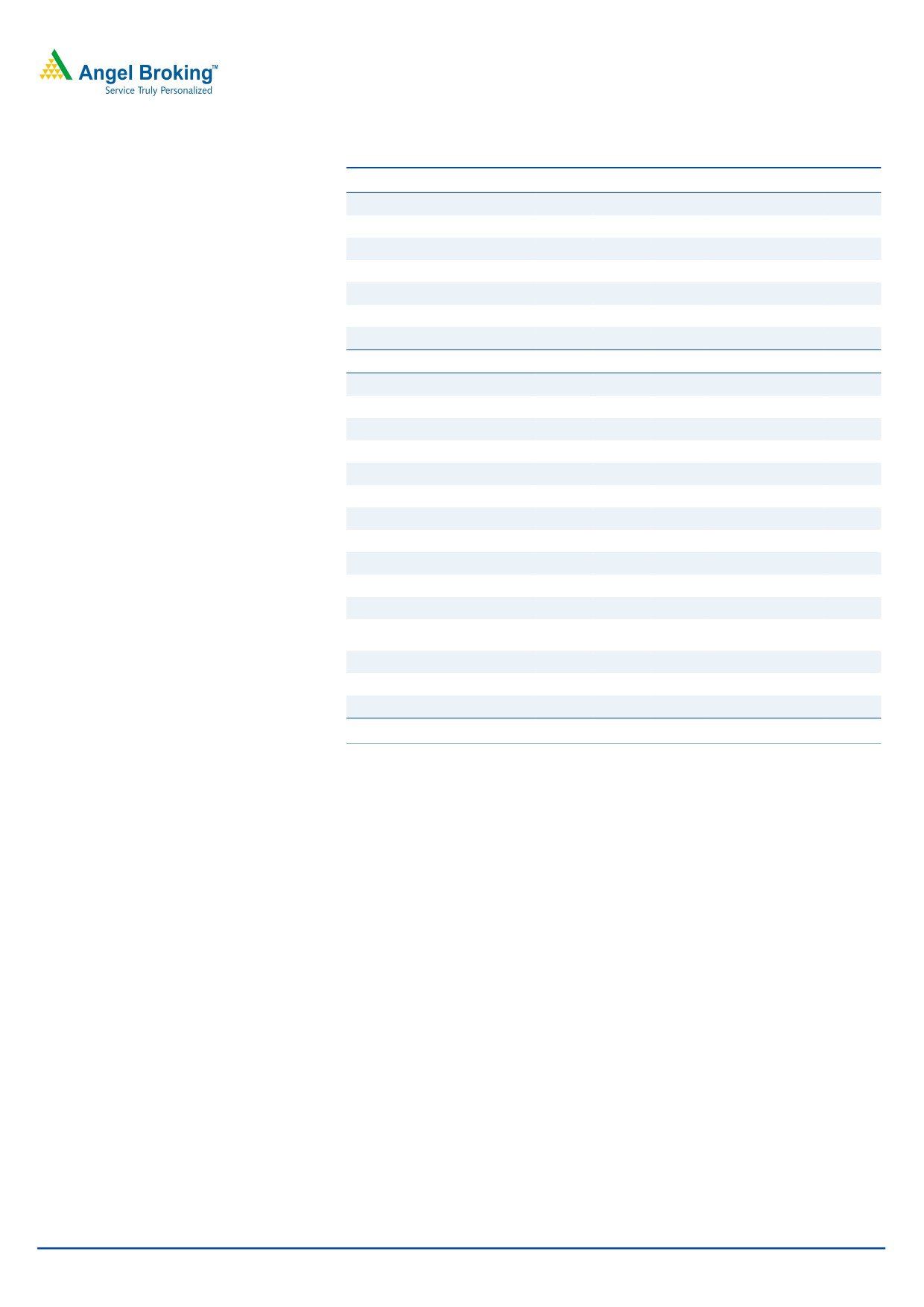

4QFY2016 Result Update | Construction & Eng.

May 24, 2016

Voltas

BUY

CMP

`327

Performance Highlights

Target Price

`407

Quarterly highlights - Consolidated

Investment Period

12 Months

Y/E March (` cr)

4QFY16 4QFY15 3QFY16

% chg (yoy)

% chg (qoq)

Net sales

1,876

1,484

1,301

26.4

44.2

Stock Info

EBITDA

172

137

52

25.6

233.0

Sector

Construction & Eng.

PAT

176

118

54

49.5

225.6

Market Cap (` cr)

10,807

Source: Company, Angel Research;

Net debt (` cr)

63

Voltas reported a strong set of numbers for 4QFY2016. The top-line at `1,876cr

Beta

1.4

is up 26.4% yoy and is higher than our expectation, mainly driven by strong

52 Week High / Low

360/211

execution across the EMP segment. The EMP segment impressed us with a 36.5%

Avg. Daily Volume

2,160,720

yoy increase in revenue to `819cr (accounting for 44% of the company’s overall

Face Value (`)

1

4QFY2016 revenues), whereas the UCP segment’s revenue at `859cr is almost

BSE Sensex

25,305

in-line with our estimate. The EBITDA margin for the quarter was flat yoy at 9.2%.

Nifty

7,749

Notably, with most of the legacy projects nearing completion, the EMP segment

Reuters Code

VOLT.BO

reported a strong EBIT margin of 3.4%, as against a loss in 3QFY2016 and 0.7%

Bloomberg Code

VOLT@IB

margin in the corresponding quarter of the previous year. Better than expected

execution coupled with higher other income helped the company report a PAT of

`176cr, which is up 49.5% on a yoy basis. On adjusting for exceptional items, the PAT

Shareholding Pattern (%)

stood at `149cr, reporting a sharp increase of 27.1% yoy. The Adj. PAT margin for the

Promoters

30.3

quarter stood at 7.9%, which is the same as in the corresponding quarter a year ago.

MF / Banks / Indian Fls

29.0

Another positive is the company announcing order inflow of `959cr for the

FII / NRIs / OCBs

19.5

quarter. The order book for the EMP segment as of 4QFY2016-end stands at

Indian Public / Others

21.2

`3,914cr (order book [OB] to LTM ratio of 1.4x). Recent report by GFK Nielsen

states that Voltas has retained its top slot in the domestic AC sales market in

FY2016, with ~21% market share.

Abs. (%)

3m 1yr 3yr

Sensex

11.1

(7.7)

27.4

Valuation: We expect Voltas to report a strong 13.3% top-line and

18.1%

Voltas

36.0

(6.1)

260.7

bottom-line CAGR during FY2016-18E, respectively. On considering the case for

improvement in all of its business segments’ performances, we expect improved

profitability and better investment return ratios for the company, going forward.

3-Year Daily Price Chart

We now assign Voltas 25.0x PE multiple to our FY2018E EPS estimate of

400

`16.3/share and arrive at price target of `407. This reflects 25% upside potential

350

from the stock’s current market price. Accordingly, we continue to maintain our

300

BUY rating on the stock.

250

200

Key Financials (Consolidated)

150

Y/E March (` cr)

FY13

FY14

FY15

FY16

FY17E

FY18E

100

Net Sales

5,531

5,266

5,183

5,857

6,511

7,514

50

0

% chg

6.7

(4.8)

(1.6)

13.0

11.2

15.4

Net Profit

208

245

384

386

427

538

% chg

28.2

18.1

56.6

0.3

10.8

26.0

EBITDA (%)

4.4

5.0

7.9

7.5

7.9

8.7

Source: Company, Angel Research

EPS (`)

6.3

7.4

11.6

11.7

12.9

16.3

P/E (x)

52.3

44.3

28.3

28.2

25.4

20.2

P/BV (x)

6.7

6.0

5.2

4.5

4.0

3.5

Adj. RoE (%)

12.8

14.2

19.6

17.1

16.7

18.5

RoCE (%)

19.3

22.4

36.4

42.2

46.4

52.7

Yellapu Santosh

EV/Sales (x)

1.9

2.1

2.1

1.9

1.7

1.4

022 - 3935 7800 Ext: 6811

EV/EBITDA (x)

44.2

40.8

26.2

25.0

21.0

16.5

Source: Company, Angel Research; Note: CMP as of May 24, 2016

Please refer to important disclosures at the end of this report

1

Voltas | 4QFY2016 Result Update

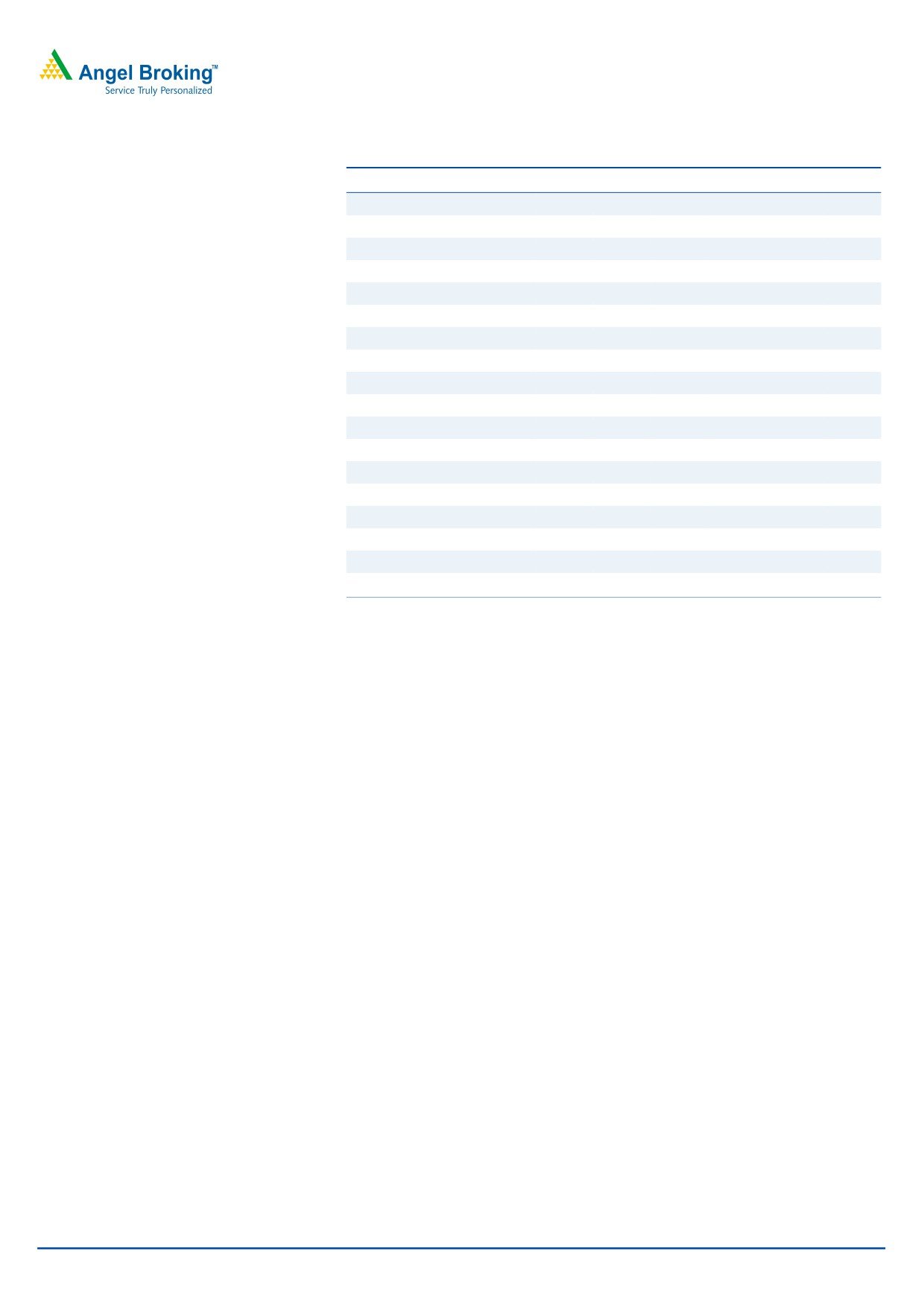

Exhibit 1: Quarterly Performance (Consolidated)

Particulars (` cr)

4QFY16 3QFY16

% chg (qoq) 4QFY15

% chg (yoy)

FY2016

FY2015

% chg

Net Sales

1,876

1,301

44.2

1,484

26.4

5,832

5,144

13.4

Total Expenditure

1,704

1,249

36.3

1,347

26.5

5,421

4,773

13.6

Cost of materials consumed

1,060

796

33.1

801

32.4

3,453

2,905

18.9

Purchase of stock-in-trade

292

131

122.4

231

26.1

673

692

(2.8)

Employee benefits Expense

183

170

7.5

152

20.5

670

590

13.5

Other Expenses

169

152

11.4

163

3.5

625

586

6.7

EBITDA

172

52

233.0

137

25.6

411

371

10.8

EBIDTA %

9.2

4.0

9.2

7.1

7.2

Depreciation

8

7

17.1

8

(1.1)

28

28

(0.8)

EBIT

164

45

265.9

129

27.3

384

343

11.7

Interest and Financial Charges

6

3

78.1

6

1.9

15

23

(34.1)

Other Income

61

25

143.8

36

68.3

143

148

(2.9)

PBT before Exceptional Items

219

67

229.5

159

37.5

511

467

9.4

Exceptional Items

28

2

1

41

46

PBT

247

69

259.7

161

53.8

552

514

7.5

Tax

66

13

427.0

41

160

128

% of PBT

26.9

18.3

25.7

29.0

24.8

PAT bef. Min. Int.

181

56

222.2

119

51.4

392

386

1.6

Share of profit/ (loss) of associate

1

1

(13.6)

(0)

nmf

2

2

39.9

Minority interest in (profit)/ loss

(5)

(2)

(1.2)

(9)

(3)

PAT after Min. Int.

176

54

225.6

118

49.5

386

384

0.3

Adj. PAT

149

52

185.5

117

27.1

345

338

2.0

Adj. PAT %

7.9

4.0

7.9

6.7

7.5

Dil. EPS

5.33

1.64

225.0

3.57

49.3

11.65

11.62

0.3

Source: Company, Angel Research; Note: nmf- Not meaningful

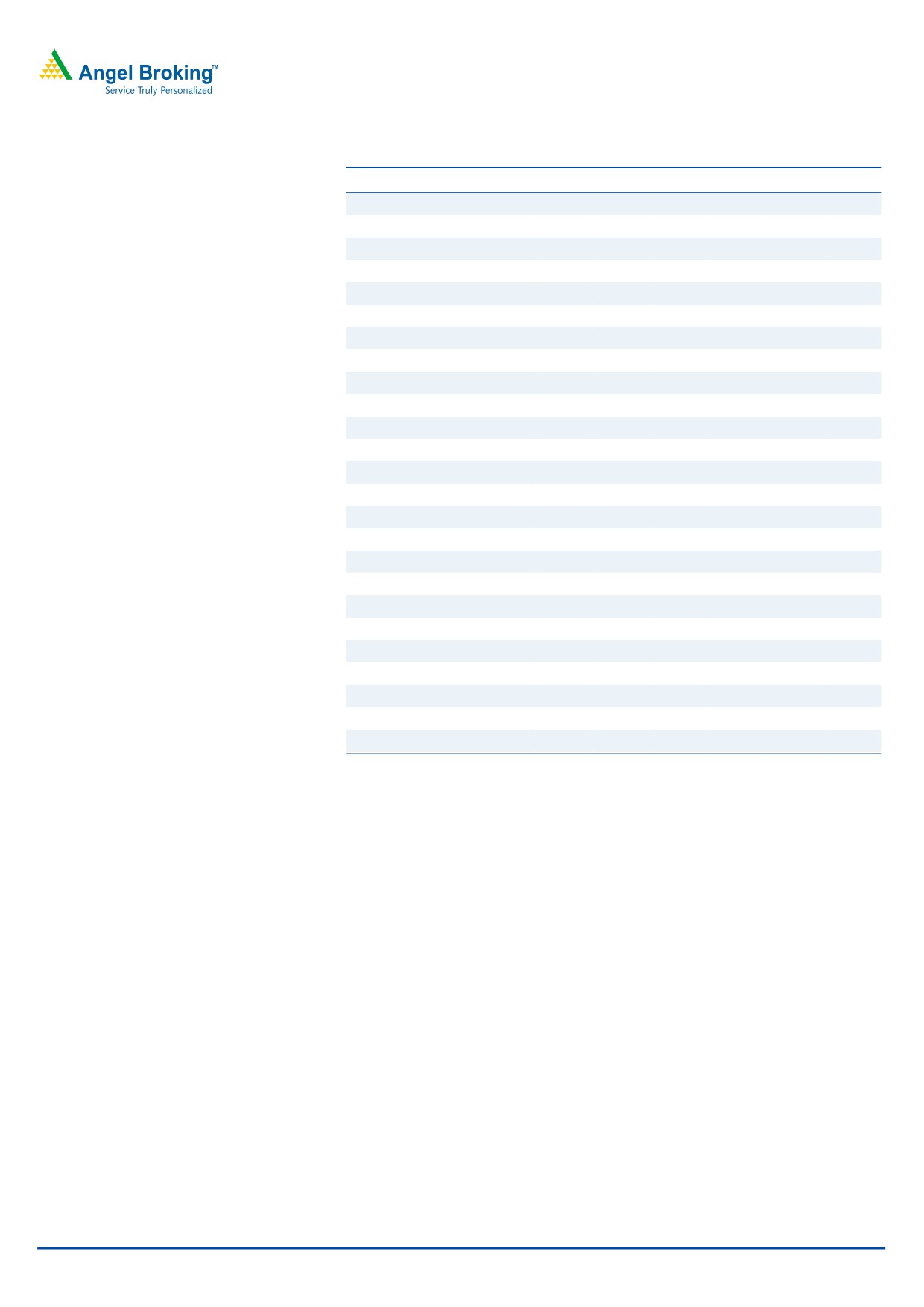

Strong EMP segment execution leads to strong 4Q sales

Voltas reported better than expected top-line numbers for the quarter, mainly

driven by strong execution across the EMP segment. The top-line grew 26.4% yoy

to `1,876cr as the EMP segment impressed with a 36.5% yoy increase in revenue

to `819cr (accounting for 44% of 4QFY2016 revenues), whereas the revenue of

the UCP segment came in in-line with our estimate at `859cr. The performance of

the EMP segment was supported by strong execution across both, domestic

(~`203.6cr) as well as the international business (~`615.0cr). Also, revenue

booking during the quarter benefitted from `106cr of irrigation projects executed

across the Omanese subsidiary (reported under Others segment; Others segment

had reported `22.9cr in revenues in 4QFY2015).

For FY2016, Voltas reported a 13.4% yoy increase in sales to `5,832cr, on the

back of 23% yoy increase in the EMP segment’s sales and 1.8% growth across the

UCP segment. EMP segment revenues in FY2016 also benefitted on account of

`108.1cr of contribution coming in from 4 overseas subsidiary (Lalbuksh Voltas

Engineering Services & Trading LLC, Weathermaker Ltd., Saudi Ensas, Voltas

Oman LLC) and 1 JV (Universal Weathermaker Factory Ltd) as they changed their

accounting period to coincide with the company’s reporting period. The UCP

segment on the other hand, benefitted from strong traction seen across sale of Air

Coolers launched a few months back. The company sold ~70,000 units in

May 24, 2016

2

Voltas | 4QFY2016 Result Update

FY2016, translating to sales of ~`35cr. On adjusting for Air Cooler sales, the UCP

segment reported almost flattish sales in FY2016. On the positive side, Voltas has

been able to retain its numero-uno position commanding a ~21% share in the

domestic air conditioning market in FY2016.

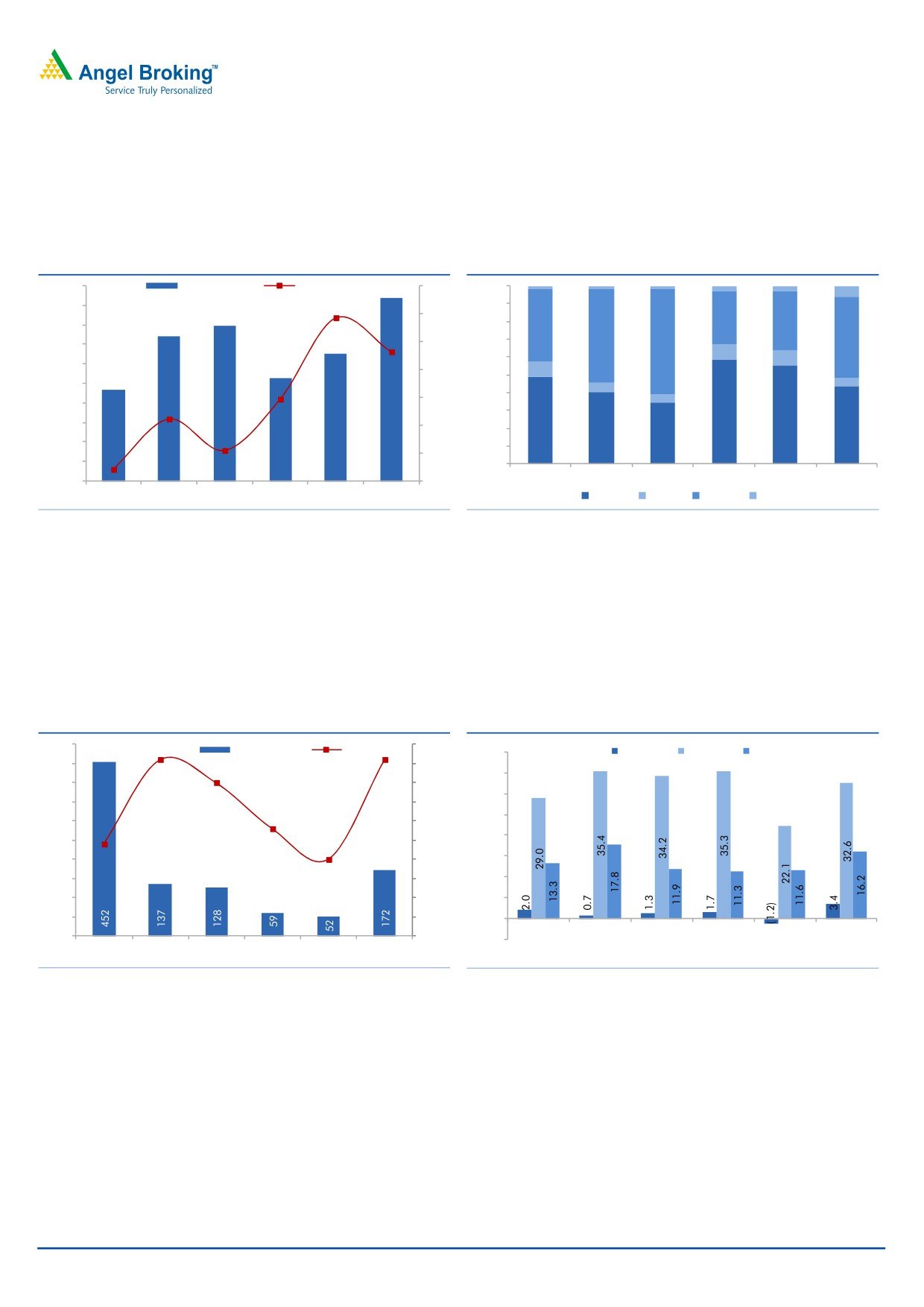

Exhibit 2: Strong revenue growth in 4QFY2016

Exhibit 3: Revenue mix

2,000

Revenue (` in cr)

yoy growth (%)

50

100%

1,876

1

2

1

3

3

6

1,800

90%

1,595

40

38.6

80%

30

33

1,600

1,484

41

53

46

1,301

30

70%

60

1,400

9

26.4

60%

9

1,200

1,060

20

9

939

50%

1,000

5

6

40%

9.4

10

4

800

30%

59

2.3

49

56

600

0

44

20%

40

35

400

10%

(9.0)

(10)

200

0%

(15.8)

0

(20)

3QFY2015

4QFY2015

1QFY2016

2QFY2016

3QFY2016

4QFY2016

3QFY2015 4QFY2015 1QFY2016 2QFY2016 3QFY2016 4QFY2016

EMP

EPS

UCP

Others

Source: Company, Angel Research

Source: Company, Angel Research

EBITDA margin remains flattish at 9.2%

Voltas reported almost flat yoy EBITDA margin at 9.2% for 4QFY2016 which is

slightly lower than our expectation. One positive emerging on the operational front

is that with most of the legacy projects nearing completion the EMP segment for the

first time in the recent few quarters reported a strong segment level EBIT margin of

3.4%, against a loss in 3QFY2016 and 0.7% margin in 4QFY2015.

Exhibit 4: EBITDA margin remains flat yoy at 9.2%

Exhibit 5: EMP segment margins expand

500

10.0

EBITDA (` in cr)

EBITDA (%)

40.0

EMP (` cr)

EPS (` cr)

UCP (` cr)

450

9.2

9.2

9.0

35.0

400

8.0

8.0

30.0

350

7.0

25.0

300

6.0

5.6

20.0

250

5.0

4.8

200

4.0

4.0

15.0

150

3.0

10.0

100

2.0

5.0

50

1.0

0.0

0

0.0

3QFY2015

4QFY2015

1QFY2016

2QFY2016

3QFY2016

4QFY2016

(5.0)

3QFY2015 4QFY2015 1QFY2016 2QFY2016 3QFY2016 4QFY2016

Source: Company, Angel Research

Source: Company, Angel Research

Higher sales promotion activities led Voltas to report a decline in the UCP

segment’s EBIT margin to 16.2% in 4QFY2016 (from 17.8% in 4QFY2015).

For the full year FY2016, the EBITDA margin marginally declined to 7.1% from

7.2% in FY2015. Segment-wise, the EMP segment’s EBIT margin improved from

1.0% in FY2015 to 1.4% in FY2016, whereas, the UCP segment’s margin declined

from 13.9% in FY2015 to 13.2% in FY2016. If we adjust for shift in subsidiaries

and JVs’ accounting period then the EMP segment’s EBIT margin for FY2016 stood

at 1.2%.

May 24, 2016

3

Voltas | 4QFY2016 Result Update

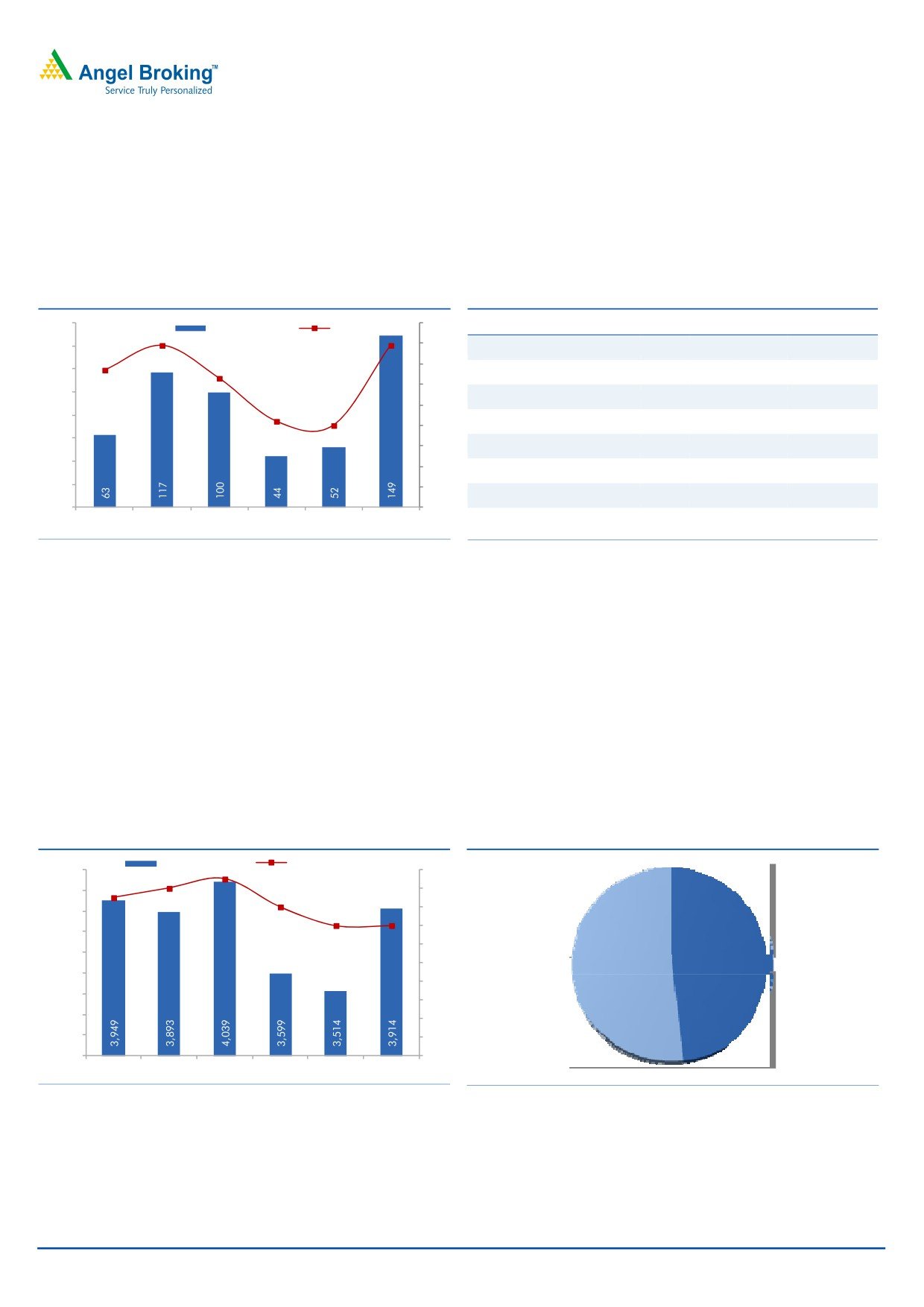

Adj.PAT margin remains flat at 7.9%

Better than expected execution, coupled with higher other income helped the

company report a PAT of `176cr, which is up 49.5% yoy. Other income increased

68.3% yoy to `61cr (reflecting impact of 20% yoy increase in current investments

and cash balance, combined at `864cr).

Exhibit 6: Adj. PAT margin remains flat at 7.9%

Exhibit 7:

160

9.0

4QFY16 3QFY16 4QFY15 FY16 FY15

Adj. PAT (` in cr)

Adj. PAT (%)

140

7.9

7.9

8.0

Reported PAT

176

54

118

386

384

7.0

120

6.7

Adjustments:

6.3

6.0

100

Sidra Project Charges

0

0

0

0

(190)

5.0

80

4.2

4.0

4.0

Profit from sale of properties

31

2

1

33

236

60

3.0

Profit on sale of investments

1

0

0

12

0

40

2.0

Rev. of prov. for contingencies

4

0

0

4

0

20

1.0

Impair. of goodwill on consol.

(8)

0

0

(8)

0

0

0.0

3QFY2015 4QFY2015 1QFY2016 2QFY2016 3QFY2016 4QFY2016

Adj. PAT

149

52

117

345

338

Source: Company, Angel Research

Source: Company, Angel Research

On adjusting for exceptional items, the PAT stood at `149cr, still reporting a

sizable 27.1% yoy increase. The Adj. PAT margin for 4QFY2016 stood at 7.9%,

same as in the year ago quarter.

Order Book grows 11.4% qoq to `3,914cr

Voltas reported a 11.4% qoq increase in its Order book to `3,914cr (OB to LTM

ratio of 1.4x), reflecting `959cr of Order wins during 4QFY2016. Among the

projects won during the quarter, the two key ones are (1) `381cr order for MEP

works of commercial office building in Dubai, and (2) `100cr order for MEP works

of a Hotel in Oman.

Exhibit 8: OB/LTM sales ratio stands at 1.4x

Exhibit 9: 4QFY2016 Order Book Mix (%)

Order Book (` in cr)

OB/LTM ratio (x)

4,100

2.0

1.8

1.7

1.8

4,000

1.9

1.6

3,900

1.6

1.4

3,800

1.4

1.4

1.2

3,700

International,

1.0

Domestic,

48.3%

3,600

51.7%

0.8

3,500

0.6

3,400

0.4

3,300

0.2

3,200

0.0

3QFY2015 4QFY2015 1QFY2016 2QFY2016 3QFY2016 4QFY2016

Source: Company, Angel Research

Source: Company, Angel Research

May 24, 2016

4

Voltas | 4QFY2016 Result Update

Valuation

At the current market price of `327, the stock is trading at FY2017E and FY2018E

P/E of 25.3x and 20.1x, respectively. With inflation under control, rate cut cycle

expected to continue, coupled with Voltas’ strong positioning in the air

conditioning market, we believe that the company should continue to report strong

growth in air conditioner sales, going forward.

In FY2015, the UCP segment contributed ~72% of the consol. EBIT. Also,

completion of the low margin EMP projects and increased contribution of high

margin projects indicate that the EBIT margins of the EMP segment would improve

from 1.4% in FY2016 to 5.0% in FY2018E. On the whole, we expect Voltas to

report a top-line and bottom-line CAGR of 13.3% and 18.1% during FY2016-18E,

respectively. Our growth assumption captures (a) pick-up in international award

activity, which should lead to top-line growth as well as EMP segment EBIT margin

expansion, and (b) continued growth in domestic AC sales, with Voltas being able

to retain its ‘numero uno’ status. Noticeably in the last few years, the EBIT mix of

Voltas has shifted from being heavily dependent on the EMP segment to a now

dominant share of the UCP segment. The contribution of the UCP segment in the

consol. EBIT has increased from 32% in FY2011 to 72% in FY2015. We expect the

same to be over 61% levels during FY2016-18E. Considering the shift in the

consol. EBIT mix, positive cues, and case for improvement in the business

segments’ performances, we expect scope for improved profitability and better

investment return ratios, going forward. We now assign Voltas 25.0x PE multiple to

our FY2018E EPS estimate of `16.3/share and arrive at a price target of `407.

This reflects 25% upside potential from the current levels. Accordingly, we continue

to maintain our Buy rating on the stock.

May 24, 2016

5

Voltas | 4QFY2016 Result Update

Investment Arguments

Growth in UCP segment to continue: Voltas has maintained 20%+ market share in

the domestic air-conditioning market despite stiff competition from MNC players.

Its ‘numero uno’ position is owing to its (1) wide distribution network (10,000-

11,000 touch-points), (2) wide portfolio of 65+ models, (3) strong post-sale

support (including 5-year warranty on compressor), and (4) strong advertising

focus with the company being among the top 5 media spenders in the AC

segment. With economic indicators turning favorable, the company’s competitive

positioning should help the UCP segment report a 19.5% top-line and 16.6% EBIT

CAGR, respectively, during FY2016-18E.

Gradual recovery in the EMP business: Voltas’ EMP business was adversely affected

due to weak awarding environment, slow execution and cost over-runs. In the run-

up to the Qatar World Cup 2022 and Dubai Expo 2020, we expect international

awarding activity to gradually catch-up from FY2017E onwards. Surge in order

book should translate to uptick in execution (we expect 10.7% top-line CAGR

during FY2016-18E). With legacy projects almost completed and contribution of

high margin projects kicking-in, we expect the segment’s margins to expand from

1.4% in FY2016 to 5.0% in FY2018E.

Balance Sheet strength: Voltas pursues an asset light business model and in the

due course of business it resorts to outsourcing and strategic tie-ups, thereby

enabling it to control its operating costs and generate high profitability. As a result,

we expect Voltas to revert to it its earlier trend of higher RoEs. Given the asset light

business model, the company has been generating strong cash flows (it generated

`1,029cr of cash flows from business during FY2013-16). As of 4QFY2016-end,

Voltas is a debt free company (on net basis), with cash & liquid investment balance

of `863cr.

Risks & Concerns

AC sales contributed ~35% of FY2016 consolidated revenues. Given that

Voltas is present only in the AC business across the entire Consumer Durables

space, loss of major market share could act as a risk to our estimates. Any

such development could lead to lower than expected EBIT contribution to the

consol. profits and our estimates.

Revenues from the EPS segment are based on agreement for supplying Textile,

Mining & Construction equipment. Any termination of such agreements shall

impact our forecasted revenues for the segment.

Most of the long term international projects are fixed price contracts and in the

due course of its business, Voltas also imports. Any adverse currency

fluctuations may impact the raw material pricing as well as margins.

Cancellation of Qatar World Cup 2022 or Expo 2020 could affect our EMP

segment assumptions.

May 24, 2016

6

Voltas | 4QFY2016 Result Update

Profit & Loss Statement (Consolidated)

Y/E March (` cr)

FY13

FY14

FY15

FY16

FY17E

FY18E

Net Sales

5,531

5,266

5,183

5,857

6,511

7,514

% Chg

6.7

(4.8)

(1.6)

13.0

11.2

15.4

Total Expenditure

5,287

5,000

4,773

5,421

5,995

6,859

Cost of RM Consumed

4,167

3,854

3,597

4,126

4,568

5,242

Employee benefits Expense

633

595

590

670

746

845

Other Expenses

487

551

586

625

681

771

EBITDA

244

266

410

437

516

655

% Chg

(27.5)

8.9

54.4

6.6

18.1

26.9

EBIDTA %

4.4

5.0

7.9

7.5

7.9

8.7

Depreciation

28

25

28

28

31

33

EBIT

216

241

382

409

485

622

% Chg

(28.6)

11.4

58.7

7.1

18.5

28.3

Interest and Fin. Charges

38

23

23

15

15

9

Other Income

90

100

109

118

131

142

PBT

268

318

467

511

600

755

Exceptional Items

12

22

46

41

0

0

Prior Period Adjustments

0

0

0

0

0

0

Tax

73

94

128

160

174

219

% of PBT

27.2

29.6

27.3

31.3

29.0

29.0

PAT from ordinary activities

207

246

386

392

426

536

Share of Profit / (loss of

Associate) & Minority Interest

1

(0)

(2)

(7)

1

3

in (profit)/ loss

PAT

208

245

384

386

427

538

% Chg

28.2

18.1

56.6

0.3

10.8

26.0

PAT %

3.8

4.7

7.4

6.6

6.6

7.2

Diluted EPS

6.3

7.4

11.6

11.7

12.9

16.3

% Chg

28.2

18.1

56.6

0.3

10.8

26.0

May 24, 2016

7

Voltas | 4QFY2016 Result Update

Balance Sheet (Consolidated)

Y/E March (` cr)

FY13

FY14

FY15

FY16

FY17E FY18E

Sources of Funds

Equity Capital

33

33

33

33

33

33

Reserves & Surplus Total

1,593

1,786

2,069

2,362

2,675

3,064

Networth

1,626

1,819

2,102

2,395

2,708

3,097

Total Debt

261

263

122

260

155

100

Minority Interest

12

14

16

26

26

26

Long-term Liabilities & Provision

120

122

130

156

166

180

Total Liabilities

2,019

2,218

2,370

2,837

3,055

3,402

Application of Funds

Gross Block

406

459

455

508

534

560

Accumulated Depreciation

195

251

266

294

325

358

Net Block

211

209

189

215

209

202

Capital WIP

0

2

4

8

6

7

Goodwill

89

80

80

72

72

72

Investments

407

732

1,094

1,526

1,609

1,844

Deferred Tax Assets

24

26

37

53

53

53

Inventories

978

901

867

893

1,013

1,190

Sundry Debtors

1,362

1,335

1,339

1,307

1,538

1,765

Cash and Bank Balance

350

282

252

197

186

131

Loans & Advances & Oth.

1,041

1,027

922

1,167

1,174

1,338

Current Assets

Current Liabilities

2,548

2,527

2,519

2,762

2,969

3,375

Net Current Assets

1,183

1,018

861

802

942

1,048

Other Assets

104

152

105

162

165

176

Total Assets

2,019

2,218

2,370

2,837

3,055

3,402

May 24, 2016

8

Voltas | 4QFY2016 Result Update

Cash Flow Statement (Consolidated)

Y/E March (` cr)

FY13

FY14

FY15

FY16

FY17E FY18E

Profit before tax

243

257

434

511

600

755

Depreciation

22

19

22

28

31

33

Other Adjustments

(147)

(40)

(248)

47

(75)

(83)

Change in Working Capital

21

164

83

(26)

(144)

(159)

Interest & Fin. Charges (net)

17

8

10

11

10

5

Direct taxes paid

(92)

(74)

(80)

(160)

(174)

(219)

Cash Flow from Operations

64

334

221

411

249

332

(Inc)/ Dec in Fixed Assets

8

(20)

210

(57)

(23)

(27)

(Inc)/ Dec in Invest. & Int. recd.

36

(273)

(269)

(432)

(3)

(145)

Cash Flow from Investing

44

(292)

(59)

(489)

(26)

(173)

Inc./ (Dec.) in Borrowings

34

(19)

(140)

138

(105)

(55)

Issue/ (Buy Back) of Equity

0

0

0

0

0

0

Dividend Paid (Incl. Tax)

(61)

(57)

(64)

(92)

(114)

(150)

Finance Cost

(26)

(17)

(16)

(15)

(15)

(9)

Cash Flow from Financing

(53)

(93)

(221)

30

(234)

(214)

Inc./(Dec.) in Cash

54

(51)

(59)

(47)

(11)

(55)

Opening Cash balances

200

255

203

144

97

86

Closing Cash balances

255

203

144

97

86

31

May 24, 2016

9

Voltas | 4QFY2016 Result Update

Key Ratios

Y/E March

FY13

FY14

FY15

FY16

FY17E FY18E

Valuation Ratio (x)

P/E (on FDEPS)

52.0

44.0

28.1

28.0

25.3

20.1

P/CEPS

45.9

40.0

26.2

26.1

23.6

18.9

Dividend yield (%)

0.6%

0.6%

0.7%

0.7%

0.9%

1.2%

EV/Sales

1.9

2.0

2.1

1.9

1.7

1.4

EV/EBITDA

43.9

40.6

26.0

24.9

20.9

16.5

EV / Total Assets

5.3

4.9

4.5

3.8

3.5

3.2

Per Share Data (`)

EPS (Diluted)

6.3

7.4

11.6

11.7

12.9

16.3

Cash EPS

7.1

8.2

12.5

12.5

13.9

17.3

DPS

1.9

1.9

2.3

2.4

3.0

3.9

Book Value

49.1

55.0

63.5

72.4

81.9

93.6

Returns (%)

RoCE (Pre-tax)

19.3

22.4

36.4

42.2

46.4

52.7

Angel RoIC (Pre-tax)

16.2

16.4

22.1

19.8

21.5

23.9

RoE

12.8

14.2

19.6

17.1

16.7

18.5

Turnover ratios (x)

Asset Turnover (Gross Block) (x)

13.6

12.2

11.3

12.2

12.5

13.7

Inventory / Sales (days)

65

65

62

55

53

54

Receivables (days)

90

93

94

82

80

80

Payables (days)

113

116

112

102

100

95

NWC days

41

43

45

35

33

38

Leverage Ratios (x)

Net D/E ratio (x)

(0.1)

(0.0)

(0.1)

0.0

(0.0)

(0.0)

Interest Coverage Ratio (x)

8.0

15.1

21.1

34.4

41.0

81.1

May 24, 2016

10

Voltas | 4QFY2016 Result Update

Research Team Tel: 022 - 39357800

DISCLAIMER

Angel Broking Private Limited (hereinafter referred to as “Angel”) is a registered Member of National Stock Exchange of India Limited,

Bombay Stock Exchange Limited and Metropolitan Stock Exchange of India Limited. It is also registered as a Depository Participant with

CDSL and Portfolio Manager with SEBI. It also has registration with AMFI as a Mutual Fund Distributor. Angel Broking Private Limited is

a registered entity with SEBI for Research Analyst in terms of SEBI (Research Analyst) Regulations, 2014 vide registration number

INH000000164. Angel or its associates has not been debarred/ suspended by SEBI or any other regulatory authority for accessing

/dealing in securities Market. Angel or its associates including its relatives/analyst do not hold any financial interest/beneficial

ownership of more than 1% in the company covered by Analyst. Angel or its associates/analyst has not received any compensation /

managed or co-managed public offering of securities of the company covered by Analyst during the past twelve months. Angel/analyst

has not served as an officer, director or employee of company covered by Analyst and has not been engaged in market making activity

of the company covered by Analyst.

This document is solely for the personal information of the recipient, and must not be singularly used as the basis of any investment

decision. Nothing in this document should be construed as investment or financial advice. Each recipient of this document should

make such investigations as they deem necessary to arrive at an independent evaluation of an investment in the securities of the

companies referred to in this document (including the merits and risks involved), and should consult their own advisors to determine

the merits and risks of such an investment.

Reports based on technical and derivative analysis center on studying charts of a stock's price movement, outstanding positions and

trading volume, as opposed to focusing on a company's fundamentals and, as such, may not match with a report on a company's

fundamentals.

The information in this document has been printed on the basis of publicly available information, internal data and other reliable

sources believed to be true, but we do not represent that it is accurate or complete and it should not be relied on as such, as this

document is for general guidance only. Angel Broking Pvt. Limited or any of its affiliates/ group companies shall not be in any way

responsible for any loss or damage that may arise to any person from any inadvertent error in the information contained in this report.

Angel Broking Pvt. Limited has not independently verified all the information contained within this document. Accordingly, we cannot

testify, nor make any representation or warranty, express or implied, to the accuracy, contents or data contained within this document.

While Angel Broking Pvt. Limited endeavors to update on a reasonable basis the information discussed in this material, there may be

regulatory, compliance, or other reasons that prevent us from doing so.

This document is being supplied to you solely for your information, and its contents, information or data may not be reproduced,

redistributed or passed on, directly or indirectly.

Neither Angel Broking Pvt. Limited, nor its directors, employees or affiliates shall be liable for any loss or damage that may arise from

or in connection with the use of this information.

Note: Please refer to the important ‘Stock Holding Disclosure' report on the Angel website (Research Section). Also, please refer to the

latest update on respective stocks for the disclosure status in respect of those stocks. Angel Broking Pvt. Limited and its affiliates may

have investment positions in the stocks recommended in this report.

Disclosure of Interest Statement

Voltas

1. Analyst ownership of the stock

No

2. Angel and its Group companies ownership of the stock

No

3. Angel and its Group companies' Directors ownership of the stock

No

4. Broking relationship with company covered

No

Note: We have not considered any Exposure below ` 1 lakh for Angel, its Group companies and Directors

Ratings (Based on expected returns

Buy (> 15%)

Accumulate (5% to 15%)

Neutral (-5 to 5%)

over 12 months investment period):

Reduce (-5% to -15%)

Sell (< -15%)

May 24, 2016

11