IPO Note | Beverages

October 24, 2016

Varun Beverages Limited

NEUTRAL

sue Open: October 26, 2016

Is

Need more sugar

Issue Close: October 28, 2016

Varun Beverages (VBL) is PepsiCo India’s bottling franchisee, operating since last

25 years. It is engaged in the business of producing and distributing wide range

Issue Details

of PepsiCo’s beverages. It has total 21 manufacturing facilities in India and a few

Face Value: `10

other countries. Indian operations account for 82% of its total revenues while rest

Present Eq. Paid up Capital: `586cr (June 2016)

of the revenues comes from other countries.

Fresh Issue: 1.5 cr Shares

Positives: (1) VBL is the one of the largest bottling franchisee of PepsiCo and

Offer for Sale: 1.0 cr Shares

accounts 44% of PepsiCo India’s revenues (2) In 2015, VBL acquired PepsiCo

Post Eq. Paid up Capital: `182.0cr

India’s business in few states which in our opinion has better profitability (3) The

Issue size (amount): `1,110*-1,112cr**

company has been able to de-leverage its balance sheet partially and improve

Price Band: `440-445

profitability in CY2015.

Lot Size: 33 shares and in multiple thereafter

Investment concerns: (1) VBL’s financial performance has remained lackluster in

Post-issue implied mkt. cap: `8,005.9cr - 8,096.8cr

last four years with losses reported in CY2013 and CY2014. Overall profitability

Promoters holding Pre-Issue: 86.3%

has remained inconsistent which does not give a strong sense of VBL being a

Promoters holding Post-Issue: 73.7%

strongly profitable franchisee (2) The numbers reported by the company indicate

Note:*at Lower price band and **Upper price band

that in CY2015, the beverage volumes from existing territories declined by 7%

which indicates de-growth in existing business (3) Our sense is that VBL has

Book Building

limited strategic flexibility to improve its business further as key decisions such as

QIBs

50% of issue

advertising, product launches, etc will be determined by PepsiCo. (4) VBL

operates an asset heavy model which means it requires a huge capex for growth,

Non-Institutional

15% of issue

in absence of which its RoE will be impacted.

Retail

35% of issue

Valuation and outlook: On CY2015’s PAT of `87cr, the issue, at its upper band is

priced at the P/E ratio of 85.4x which looks expensive. The issue still looks

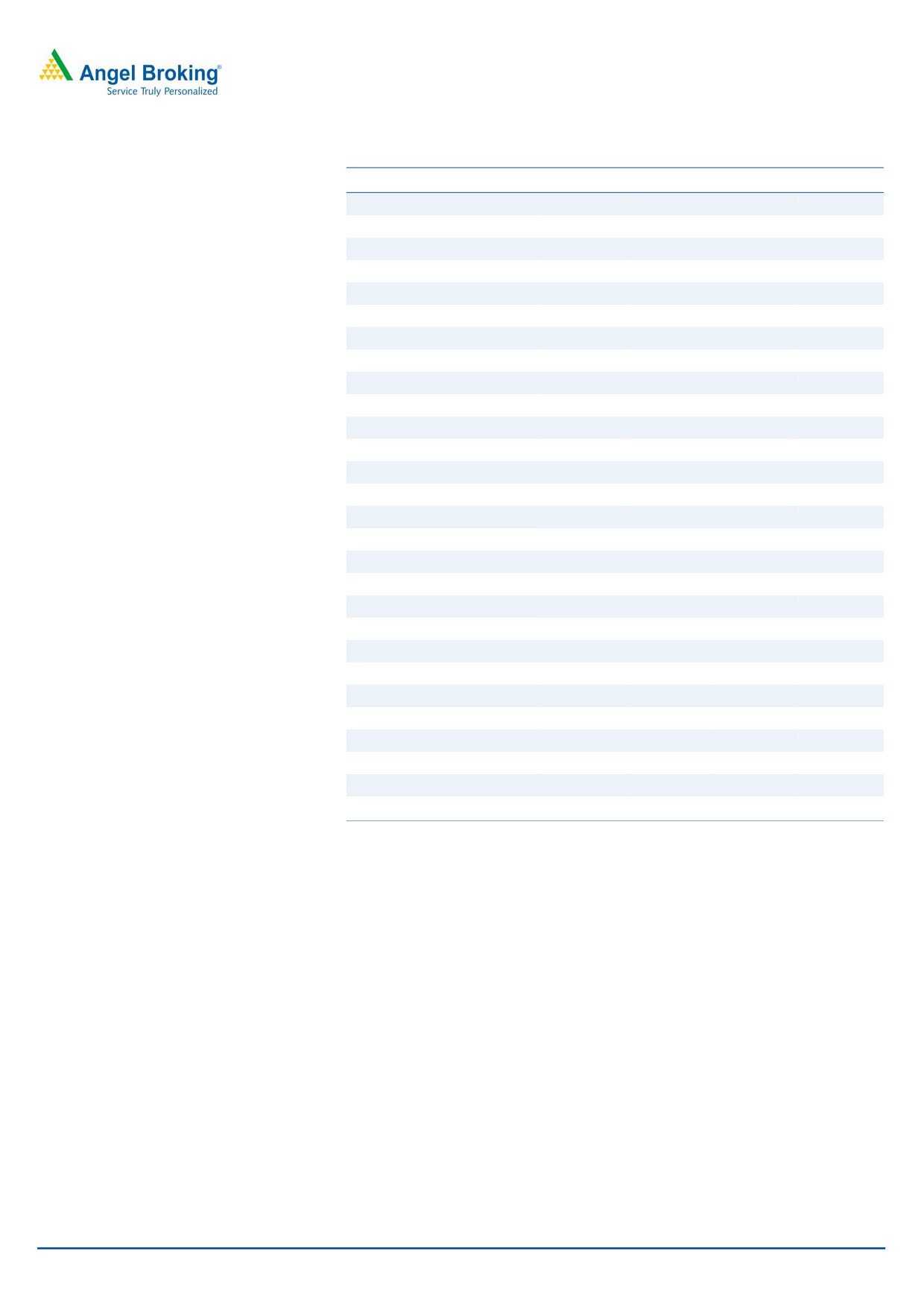

Post Issue Shareholding Pattern

expensive at P/E of 51.4x, calculated on estimated CY2016E PAT of `157cr. We

Promoters Group

73.7

note that a lot of MNC brands have presence in India through franchisees. Few of

DIIs/FIIs/Public & Others

26.3

these franchisees have been able to grow their business by taking strategic

decisions such product launches, advertising etc. which is not the case with VBL .

Considering its inconsistent financial performance, low RoE, asset heavy business

model and high valuation, we rate this IPO as ‘Neutral’.

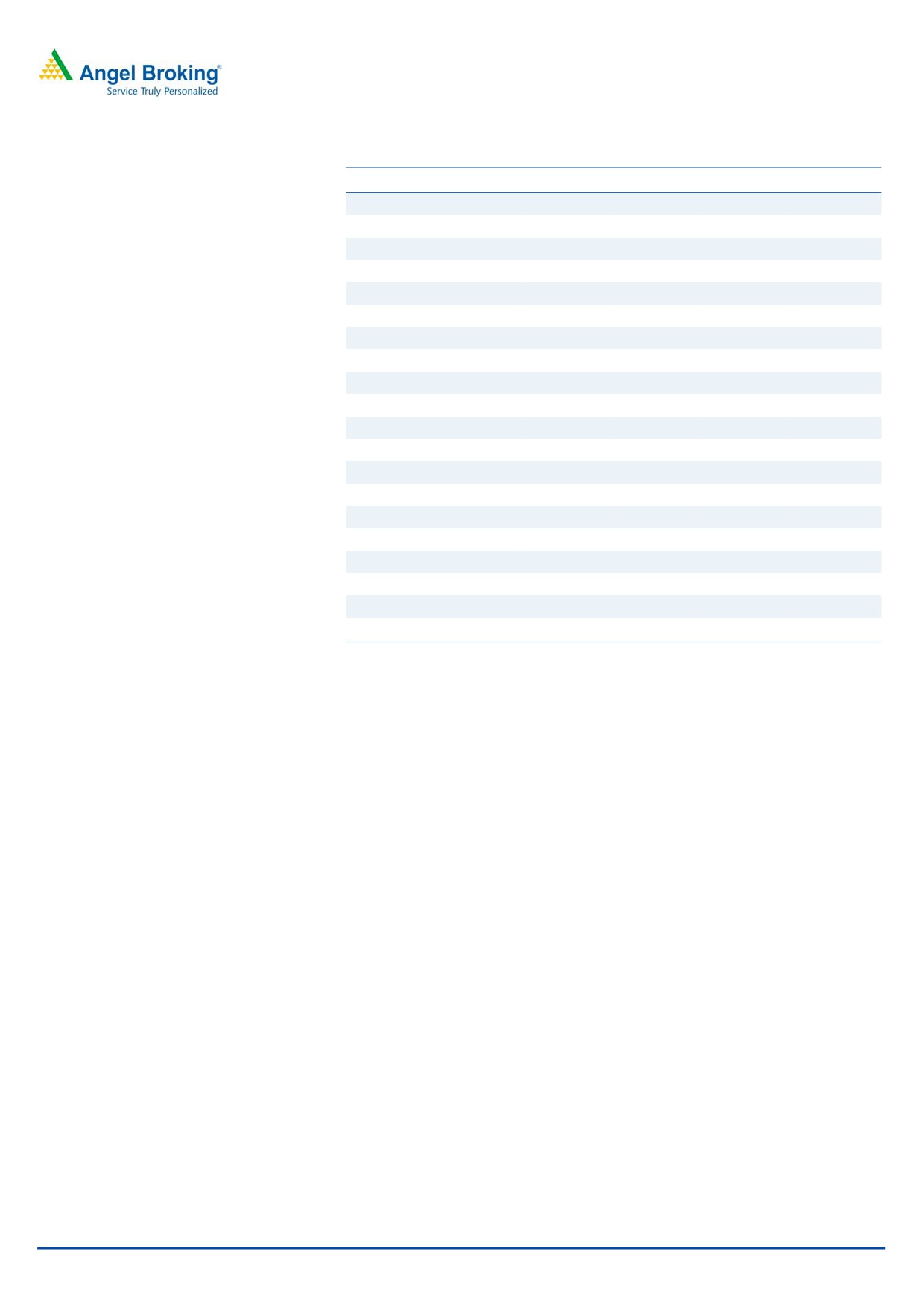

Key Financials (Consolidated)

Y/E Dec. (` cr)

CY2012

CY2013

CY2014

CY2015

H12015

H12016

Net Sales

1,800

2,115

2,502

3,394

2,232

2,530

% chg

17.5

18.3

35.6

NA

13.3

Net Profit

25

(41)

(22)

84

166

207

% chg

(264.1)

(46.8)

(483.3)

NA

24.6

EBITDA (%)

13

14

15

19

21

24

EPS (`)

1.5

(2.4)

(1.2)

5.2

10.0

12.6

P/E (x)

295.9

NA

NA

85.4

NA

NA

P/BV (x)

43.3

42.4

21.7

11.1

NA

NA

RoE (%)

14.6

(23.5)

(6.4)

12.5

NA

NA

RoCE (%)

4.9

4.8

7.0

10.1

NA

NA

Shrikant Akolkar

EV/Sales (x)

5.5

4.7

3.9

2.9

NA

NA

+91 22 39357800 Ext: 6846

EV/EBITDA (x)

43.3

33.9

25.7

15.6

NA

NA

Source: Company, Angel Research

Please refer to important disclosures at the end of this report

1

Varun Beverages | IPO Note

Company background

Varun Beverages (an RJ Corp group company) is PepsiCo's largest bottling

franchisee of Carbonated Soft Drinks (CSD) and non-carbonated beverages

(NCBs) in the world outside USA. Varun Beverages (VBL) has been associated with

PepsiCo since 1990s and is engaged in producing and distributing PepsiCo

beverages. VBL, produces and distributes wide range of PepsiCo's CSD and NCBs

such as, Pepsi, Diet Pepsi, Seven-Up, Tropicana Slice, Aquafina, etc. PepsiCo has

granted Varun Beverages total 17 states and 2 Union Territories in India and

certain territories of Nepal, Sri Lanka, Morocco, Mozambique and Zambia in

international markets. VBL is also expecting PepsiCo’s franchisee rights in

Zimbabwe and is in process of setting up a Greenfield facility there. Its distribution

network included 57 depots and 1,389 delivery vehicles in India and six depots

and 342 delivery vehicles in International market by end of December 2015.

VBL has total 16 production facilities with an annual production capacity of

3,438.4 million liters in India and, 5 production facilities with annual production

capacity of 991.6 million liters in international licensed territories by March 2016.

Besides, producing and distributing the beverages, VBL also has backward

integration and produces preforms, crowns, corrugated boxes and pads, plastic

crates and shrink-wrap films in certain production facilities.

Exhibit 1: Revenue mix

Exhibit 2: Product mix

11.7%

10.9%

6.6%

6.1%

82.2%

82.5%

Carbonated Soft Drinks

Non-Carbonated Beverages

Packaged Drinking Water

India

Nepal

Others

Source: Company, Angel Research

Source: Company, Angel Research

October 24, 2016

2

Varun Beverages | IPO Note

Issue details

This IPO is a mix of OFS and issue of fresh shares. The company is selling fresh

1.5cr shares whereas total 1.0cr shares will be sold through OFS.

Exhibit 3: The issue

Route

No of shares in cr.

Total value

OFS

1

`440cr* - `445cr**

Fresh issue

1.5

`660cr* - `667cr**

Total

2.5

`1,110cr* - `1,112cr**

Source: RHP, Angel Research; Note:*at Lower price band and **Upper price band

Objects of the offer

`540cr will be used for prepayment of debt

Rest of the net proceeds will be used for general corporate purposes

The portion allocated to general corporate purpose looks to be very high (~50% of

the gross proceeds). We believe that this will also be used to repay its certain non

interest bearing debt.

The company, through a business transfer agreement with PepsiCo India in

November 2014 acquired PepsiCo India’s business of manufacturing, marketing,

selling and distributing soft drink beverages and syrup mix in Uttar Pradesh,

Uttarakhand, Himachal Pradesh, Haryana and the Union Territory of Chandigarh

for `1,158cr. With that, VBL also acquired PepsiCo’s four factories located in

Uttarakhand, UP and Haryana. The company has been permitted by PepsiCo to

pay this amount in equal installments and as of June 2016, an amount of

`623.5cr is left in form of deferred payments to PepsiCo India. We believe that the

company will use the IPO proceeds after debt repayment to repay some, if not

most of the deferred payment to PepsiCo India. The company however has not

explicitly mentioned this in the RHP.

Exhibit 4: Shareholding pattern

Pre-Issue

Post-Issue

Particulars

(%)

(%)

Promoter & Promoter Group

86.3%

73.7%

Others

13.7%

26.3%

Total

100.0%

100.0%

Source: Company, Angel Research

Earlier this month, the company converted its hybrid instruments and preference

shares to common equity share. This includes conversion of Compulsory

Convertible Debentures (CCDs) worth

`414cr and Compulsory Convertible

Preference Shares (CCPSs) worth `450cr. This led to an addition of 31.3 million

fresh shares in its equity. With this conversion, there are no preference shares /

convertible debentures left on the company’s balance sheet.

With fresh issuance of 1.5cr shares through this IPO, the company will further see

9% equity dilution.

October 24, 2016

3

Varun Beverages | IPO Note

Investment Rationale

Largest PepsiCo franchisee in the world: Varun Beverages (VBL) is the largest

franchisee of carbonated soft drinks (CSDs) and non-carbonated beverages

(NCBs) of PepsiCo in the world of outside USA. The company produces and

distributes a wide range of CSDs, NCBs and packaged drinking water. VBL has

been in this business since last 25 years and has been able to increase licensed

territories and sub-territories in India to current 17 states and 2 UT.

VBL's contribution in total PepsiCo's volumes has gone up from 26% in CY2011 to

44.1% in CY2015. PepsiCo during this period has seen its soft drink sales volumes

in India increasing from 1,654.9 million liters (ML) in CY2011 to 2,688.1 ML in

CY2015 (13% CAGR). During this period, VBL has reported 28% CAGR in sales

volumes from 437.9 ML in CY2011 to 1,186.04 ML in CY2015. The strong

revenue growth can be attributed to 1) overall increase in PepsiCo's business

(organic growth) 2) increase in the licensed territories granted to VBL by PepsiCo

(inorganic growth). Organically, VBL’s beverage volumes declined by 7% to 759.5

ML in CY2015 however overall sales volumes increased by 45% due to acquisition

of additional territories from PepsiCo. The new territories contributed 36% of the

total sales volumes. We believe that the company will have to keep adding new

revenue territories to remain on a growth trajectory. The decision to grant new

territories remains with PepsiCo.

VBL also operates similar business model in other countries like Sri Lanka, Nepal,

Morocco, Mozambique, Zambia and Zimbabwe however its contribution in

PepsiCo's business there is not provided by the company. These regions at the

moment contribute ~15% of VBL’s total revenues hence they are relatively less

significant at the moment.

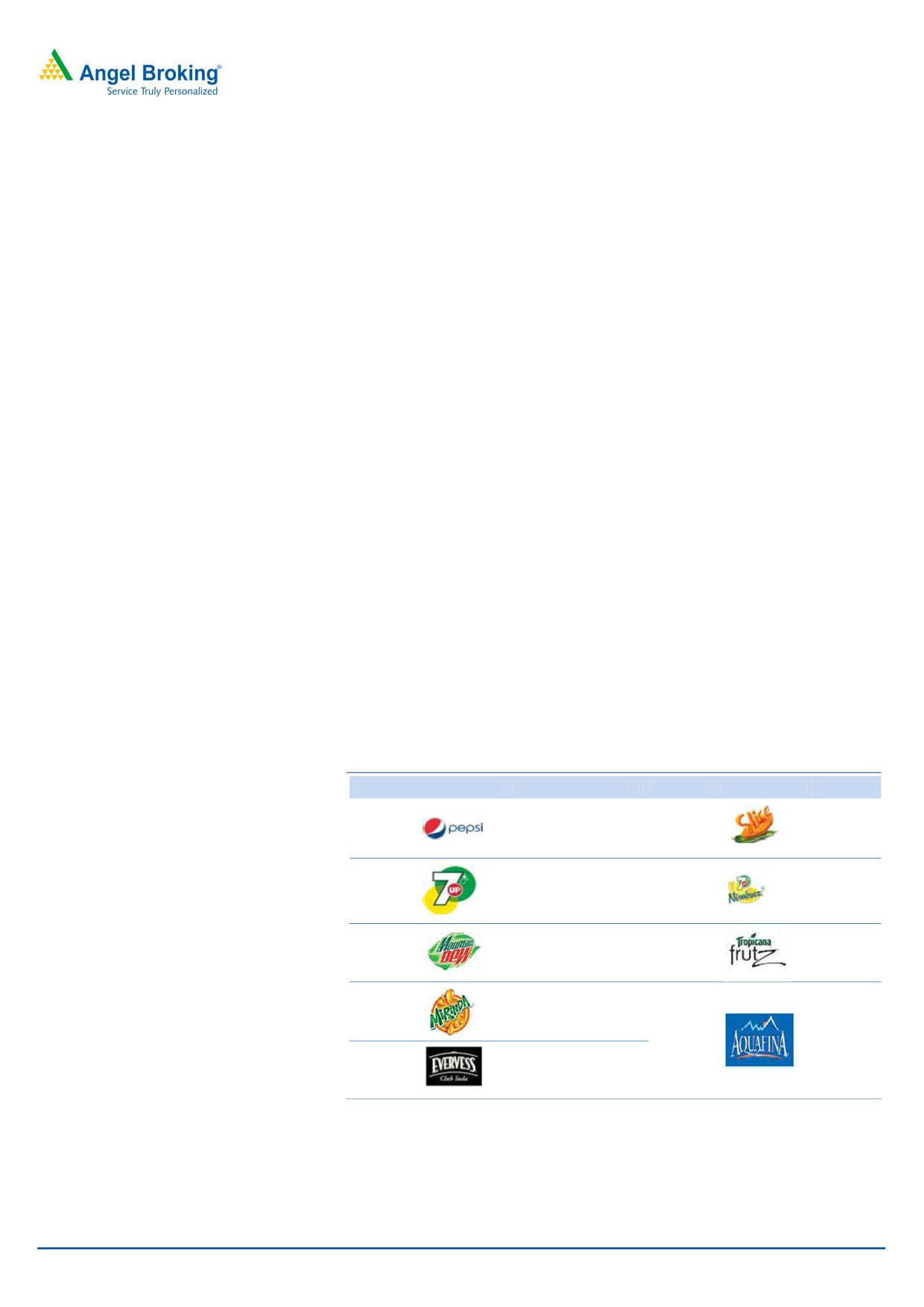

Exhibit 5: VBL’s product portfolio licensed from PepsiCo

Product

Territories

Product

Product

Territories

India, Nepal,

Tropicana

India,

Pepsi

Sri Lanka, Morocco,

Slice

Nepal

Zambia, Mozambique

India, Nepal,

Seven-Up

Sri Lanka, Morocco,

Nimbooz

India

Zambia, Mozambique

Mountain

India, Nepal,

Tropicana

India,

Dew

Sri Lanka , Zambia

Frutz

Sri Lanka

India, Nepal, Sri

Mirinda

Lanka, Morocco,

Zambia, Mozambique

India

Aquafina

Sri Lanka

India, Nepal, Sri

Evervess

Lanka, Zambia,

Mozambique

Source: Company, Angel Research

October 24, 2016

4

Varun Beverages | IPO Note

High dependence on Pepsi: VBL has 100% dependence on PepsiCo for it

revenues. PepsiCo at a time is playing as a raw material supplier, licenser and

franchisee partner. As per its agreement with PepsiCo, VBL is required to buy

concentrates from Pepsi as well as pay royalty of 5% on certain non-CSD products.

In exchange brand promotion and advertising is taken care by PepsiCo. There

are three very important aspects of VBL’s partnership agreement with

PepsiCo: 1) product pricing 2) raw material pricing 3) Brand promotion.

Product pricing - The product prices are decided by PepsiCo and not by VBL.

PepsiCo’s pricing depends upon various factors including the prices set by its

competitors. So we believe that VBL has no say in the pricing of the products

hence exerts no command on the products they sell.

Raw material pricing - As per agreement, VBL purchases concentrate from

PepsiCo. Concentrate is the most important ingredient of the carbonated soft

drinks and prices of which are determined by PepsiCo in discussion with VBL.

Even though PepsiCo considers VBL's opinion at the moment, in longer term

this is negative for VBL as a unilateral pricing determined by PepsiCo will

impact VBLs financial performance. The cost of concentrate was between

28-34% from 2014 and H1CY2016 which means it is a significant expense to

VBL.

Brand promotion - PepsiCo takes care of marketing of its brands however

merchandising at the relevant points of sale level is done by VBL. We believe

that this is positive for VBL as brand promotion would cost it a large chunk of

money.

Overall we see the pricing arrangements to be negative to VBL as it has no pricing

power over raw materials and its produces.

Capital intensive business with low asset turnover: VBL is operating a

capital intensive model without showing significant economies of scale. While it is

true that high capital investments act as an entry barrier, it is equally offset by its

nearly non-existent pricing power. For PepsiCo, it is difficult to replace VBL due to

the capital intensive nature of the business and VBL’s experience and strong

distribution abilities would score if PepsiCo decides to look for a new partner.

October 24, 2016

5

Varun Beverages | IPO Note

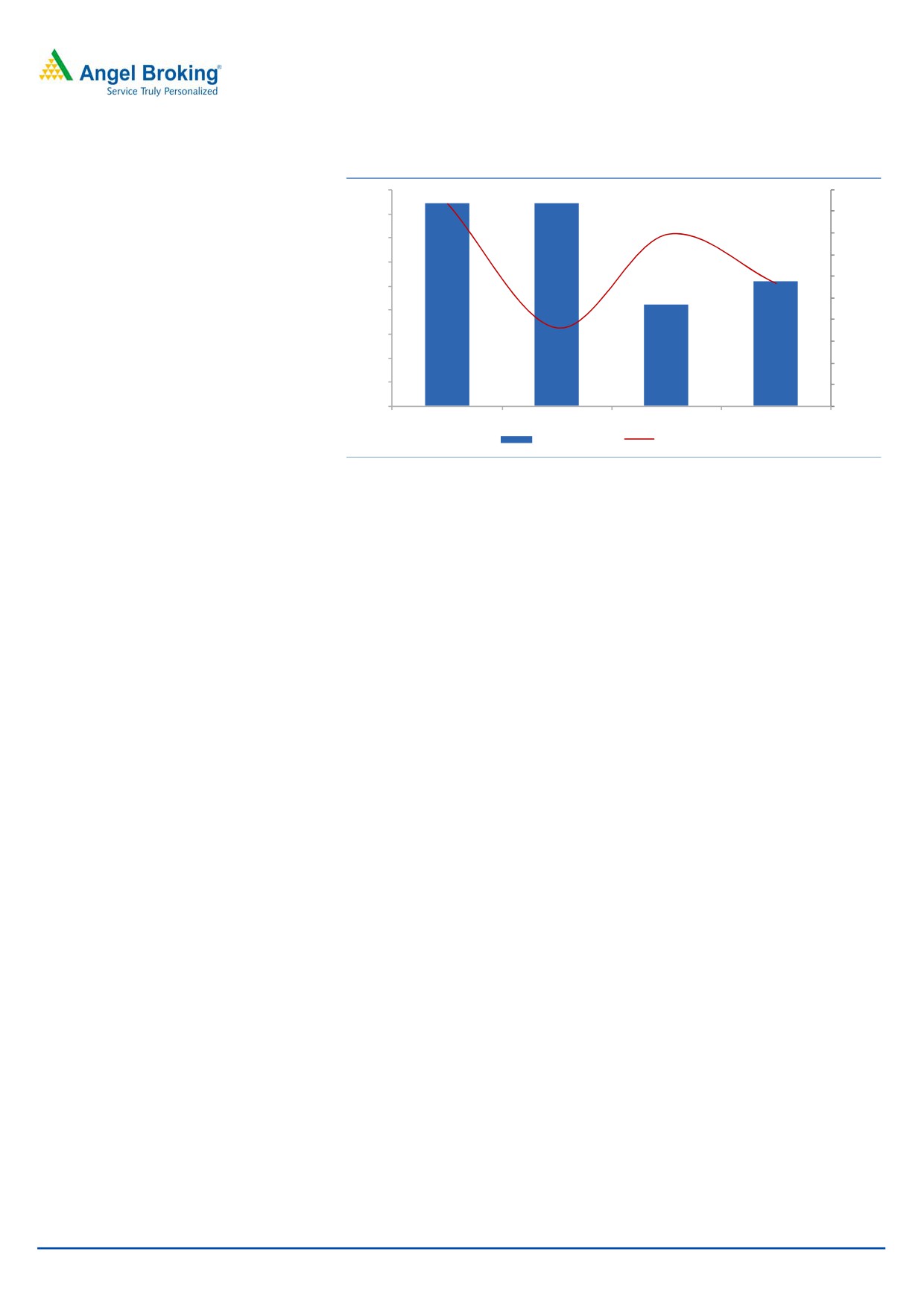

Exhibit 6: Increasing assets despite lower asset turnover

450

0.82

400

0.80

0.78

350

0.76

300

0.74

250

0.72

200

0.70

150

0.68

100

0.66

50

0.64

-

0.62

CY2012

CY2013

CY2014

CY2015

Capex (` cr)

Asset T/O (x)

Source: Company, Angel Research

Companies which create significant entry barriers in their industry also enjoy

superior return ratios. However this is not a case with VBL. Due to its partnership

with PepsiCo, VBL cannot produce any other competitive beverages. This means

despite acquisition / addition of new capacity, VBL is not allowed to leverage on its

additional capacities and industry experience. This is reflected in its gross asset

turnover ratio which has remained well below 1x showing lower turnover of its

fixed assets. The company has also aggressively added new capacities in last few

years which have also led to decline in its asset turnover.

Inconsistent profitability: VBL's financial performance has been inconsistent

with losses reported in CY2013 and CY2014. Overall its top line has witnessed a

CAGR of 25% from CY2011 to CY2015. The CAGR works out to be 51% at the

bottom-line, this has only improved in CY2015 thanks to the acquisition of

PepsiCo India's additional territories which helped it improve its profitability.

VBL’s has decent performance at EBITDA level with margins increasing from ~13%

in 2011 to ~19% in CY2015. The same however is not reflected in its EBT which

has shown drastic decline due to the high depreciation costs which represents

more than 50% of its EBITDA. Owing to its high leverage, VBL’s profitability eroded

significantly in CY2013 and CY2014 as it interest costs took away decent

profitability at EBITDA level. The company has also seen poor set of return ratios.

Return on Equity in CY2015 was at 12.5% vs. 14.6% in CY2011. VBL has also

seen poor cash generation in all years despite having strong cash flow from

operations.

October 24, 2016

6

Varun Beverages | IPO Note

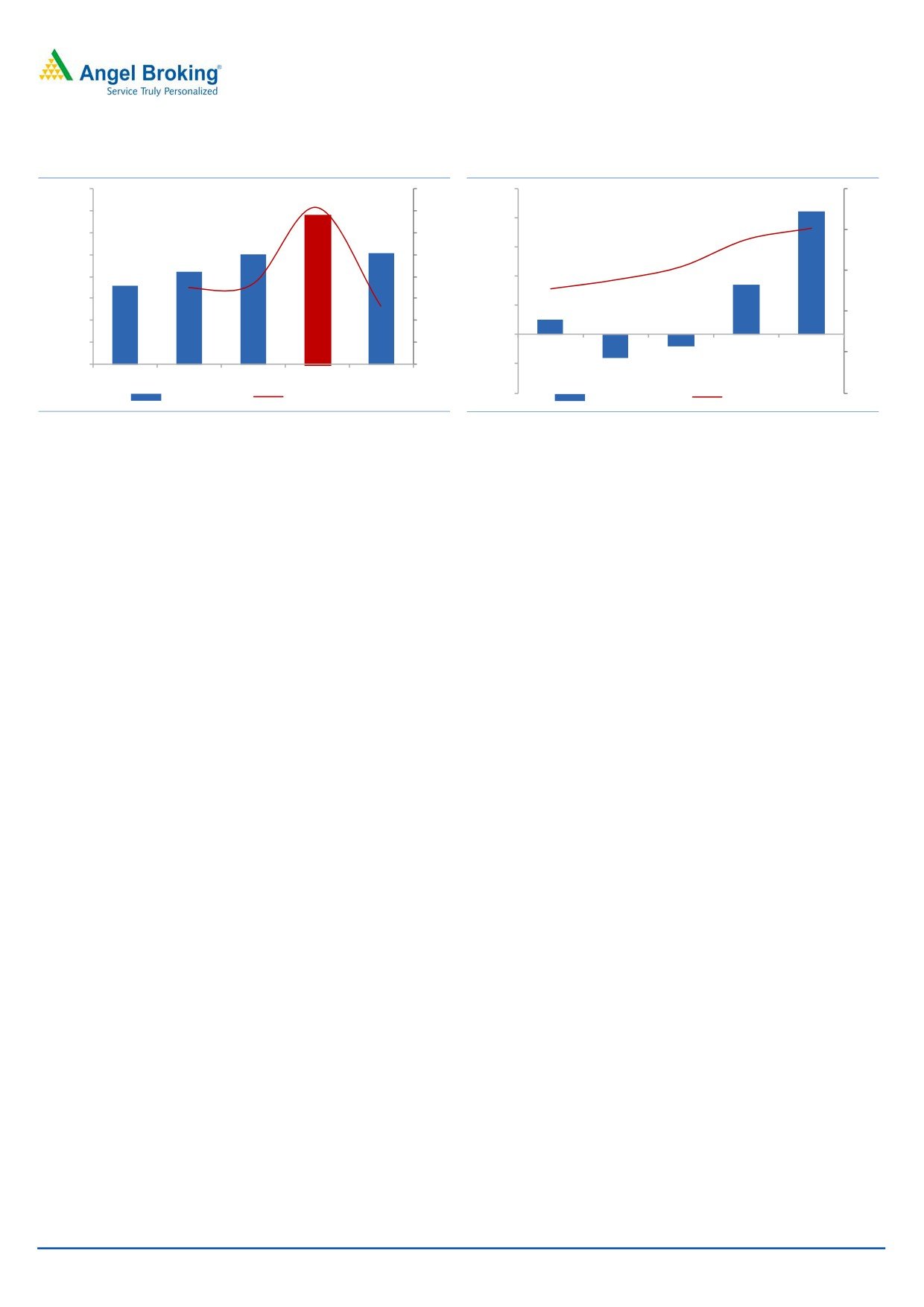

Exhibit 7: Strong growth in 2015

Exhibit 8: Inconsistent profitability

4,000.0

40.0

250.0

25.0

35.0

3,500.0

200.0

3,000.0

30.0

20.0

150.0

2,500.0

25.0

15.0

2,000.0

20.0

100.0

15.0

1,500.0

50.0

10.0

1,000.0

10.0

0.0

500.0

5.0

5.0

0.0

0.0

(50.0)

CY2012

CY2013

CY2014

CY2015

H1CY16

(100.0)

0.0

Net Sales(` cr)

YoY growth (%)

Net profit (` cr)

EBITDA margins

Source: Company, Angel Research

Source: Company, Angel Research

By end of H1CY2016, VBL has `2,138cr in debt (excluding PepsiCo's debt of

`623cr) Due to its high leverage and lower profitability, debt to equity ratios went

up to as high as 11.6x in CY2013. With reduction in debt and improved

profitability in last 18 months, debt to equity ratio has come down to 2.3x.

Outlook and Valuation: Overall we see VBL as a weak franchisee due to the

inconsistent profitability and poor pricing power. Due to the nature of its business,

(bottling, distribution and license to sell PepsiCo’s products), it can neither be

classified as a pure bottler nor a pure distribution company. We believe that there

is no comparable peer for the company in India.

On its upper band of price or `445, the issue is priced at P/E ratio of 85.4x of its

CY2015 EPS of

`5.2 which we believe is expensive. Considering its high

dependence on PepsiCo, low return ratios, poor profitability and high valuation we

rate this IPO ‘Neutral’

Upside risks

Grant of more territories by PepsiCo: PepsiCo’s decision to grant more territories

to VBL in future will increase VBL’s financial performance significantly.

Decline in Concentrate prices by PepsiCo: VBL is dependent on PepsiCo for

concentrate supply, prices of which are decided by PepsiCo. If PepsiCo decides to

cut the concentrate prices, it will lead to improve VBL’s performance.

October 24, 2016

7

Varun Beverages | IPO Note

Income Statement

Y/E December (` cr)

CY2012

CY2013

CY2014

CY2015

Total operating income

1,800

2,115

2,502

3,394

% chg

17.5

18.3

35.6

Total Expenditure

1,572

1,824

2,118

2,760

Raw Material Consumed

1,028

1,199

1,376

1,716

Personnel Expenses

152

183

217

324

Others Expenses

392

442

525

720

EBITDA

228

291

385

634

% chg

27.7

32.1

64.9

(% of Net Sales)

12.7

13.8

15.4

18.7

Depreciation& Amortisation

136

184

210

317

EBIT

92

107

174

317

% chg

15.7

63.4

81.5

(% of Net Sales)

5.1

5.0

7.0

9.3

Net Interest charges

71

152

171

155

Recurring PBT

21

(46)

4

162

% chg

(318.7)

(108.3)

4,195.2

Extraordinary Expense/(Inc.)

-

-

-

-

PBT (reported)

21

(46)

4

162

Tax

(4)

(5)

25

77

(% of PBT)

(20.4)

11.4

657.3

47.3

PAT before MI

25

(40)

(21)

86

Minority Interest (after tax)

0

(0)

-

-

Profit/Loss of Associate Company

-

1

1

2

PAT after MI(reported)

25

(41)

(22)

84

Exceptional Items

-

-

-

-

Reported PAT

25

(41)

(22)

84

% chg

NA

NA

NA

(% of Net Sales)

1.4

(1.9)

(0.9)

2.5

Basic EPS (`)

1.5

(2.4)

(1.2)

5.2

Fully Diluted EPS (`)

1.5

(2.4)

(1.2)

5.2

% chg

NA

NA

NA

October 24, 2016

8

Varun Beverages | IPO Note

Balance Sheet

Y/E December (` cr)

CY2012

CY2013

CY2014

CY2015

SOURCES OF FUNDS

Equity Share Capital

27

134

334

584

Reserves& Surplus

145

42

9

89

Shareholder’s Funds

172

175

343

672

Share application money

-

40

-

-

Minority Interest

0

0

-

-

Total Loans

1,701

2,033

2,139

1,832

Other long term liabilities

35

31

11

636

Long-term provisions

14

18

26

44

Deferred Tax Liability

72

64

81

151

Total Liabilities

1,994

2,361

2,600

3,336

APPLICATION OF FUNDS

Gross Block

2,231

3,055

3,214

4,627

Less: Acc. Depreciation

527

689

868

1,137

Net Block

1,703

2,365

2,345

3,490

Capital Work in Progress

189

27

25

38

Goodwill

10

10

10

10

Investments

0

1

2

3

Other long term assets

68

43

55

127

Current Assets

584

544

859

770

Investments

0

0

302

0

Inventories

231

246

289

425

Sundry Debtors

91

65

97

98

Cash

38

51

34

58

Loans & Advances

220

171

125

180

Other Assets

5

10

11

9

Current liabilities

560

628

695

1,102

Net Current Assets

24

(85)

164

(331)

Total Assets

1,994

2,361

2,600

3,336

October 24, 2016

9

Varun Beverages | IPO Note

Cash Flow Statement

Y/E December (` cr)

CY2012

CY2013

CY2014

CY2015

Profit before tax

21

(46)

4

162

Depreciation

136

184

210

317

Change in Working Capital

20

(12)

44

(41)

Interest / Dividend (Net)

107

157

175

153

Direct taxes paid

(11)

(4)

(11)

(43)

Others Expenses

8

18

9

12

Cash Flow from Operations

280

297

431

560

(Inc.)/ Dec. in Fixed Assets

(421)

(421)

(212)

(260)

(Inc.)/ Dec. in Investments

(91)

(0)

(302)

307

Others Expenses

5

(153)

14

(339)

Cash Flow from Investing

(507)

(574)

(500)

(292)

Issue of Equity

-

-

-

-

Inc./(Dec.) in loans

340.5

395.0

83.7

(667.7)

Dividend Paid (Incl. Tax)

-

-

-

-

Interest / Dividend (Net)

(111.3)

(160.7)

(185.9)

(151.4)

Others

-

40.0

160.0

570.0

Cash Flow from Financing

229

274

58

(249)

Inc./(Dec.) in Cash

3

(2)

(11)

19

Opening Cash balances

15.7

18.7

16.5

5.2

Closing Cash balances

18.7

16.5

5.2

24.3

October 24, 2016

10

Varun Beverages | IPO Note

Key Ratios

Y/E December

CY2012

CY2013

CY2014

CY2015

Valuation Ratio (x)

P/E (on FDEPS)

295.9

NA

NA

85.4

P/CEPS

46.2

51.3

39.1

18.4

P/BV

43.3

42.4

21.7

11.1

Dividend yield (%)

0.0

0.0

0.0

0.0

EV/Sales

5.5

4.7

3.9

2.9

EV/EBITDA

43.3

33.9

25.7

15.6

EV / Total Assets

3.9

3.3

3.0

2.2

Per Share Data (`)

EPS (Basic)

1.5

(2.4)

(1.2)

5.2

EPS (fully diluted)

1.5

(2.4)

(1.2)

5.2

Cash EPS

9.6

8.7

11.4

24.2

DPS

0.0

0.0

0.0

0.0

Book Value

10.3

10.5

20.5

40.3

Returns (%)

ROCE

4.9

4.8

7.0

10.1

Angel ROIC (Pre-tax)

5.6

5.0

7.2

10.4

ROE

14.6

(23.5)

(6.4)

12.5

Turnover ratios (x)

Asset Turnover (Gross Block)

0.8

0.7

0.8

0.7

Inventory / Sales (days)

82

75

77

90

Receivables (days)

17

10

13

9

Payables (days)

32

42

48

39

WC cycle (ex-cash) (days)

66

43

41

60

Solvency ratios (x)

Net debt to equity

9.7

11.3

6.1

3.6

Net debt to EBITDA

7.3

6.8

5.5

3.8

Interest Coverage (EBIT / Interest)

1.3

0.7

1.0

2.0

October 24, 2016

11

Varun Beverages | IPO Note

Research Team Tel: 022 - 39357800

DISCLAIMER

Angel Broking Private Limited (hereinafter referred to as “Angel”) is a registered Member of National Stock Exchange of India Limited,

Bombay Stock Exchange Limited and Metropolitan Stock Exchange Limited. It is also registered as a Depository Participant with CDSL

and Portfolio Manager with SEBI. It also has registration with AMFI as a Mutual Fund Distributor. Angel Broking Private Limited is a

registered entity with SEBI for Research Analyst in terms of SEBI (Research Analyst) Regulations, 2014 vide registration number

INH000000164. Angel or its associates has not been debarred/ suspended by SEBI or any other regulatory authority for accessing

/dealing in securities Market. Angel or its associates/analyst has not received any compensation / managed or co-managed public

offering of securities of the company covered by Analyst during the past twelve months.

This document is solely for the personal information of the recipient, and must not be singularly used as the basis of any investment

decision. Nothing in this document should be construed as investment or financial advice. Each recipient of this document should

make such investigations as they deem necessary to arrive at an independent evaluation of an investment in the securities of the

companies referred to in this document (including the merits and risks involved), and should consult their own advisors to determine

the merits and risks of such an investment.

Reports based on technical and derivative analysis center on studying charts of a stock's price movement, outstanding positions and

trading volume, as opposed to focusing on a company's fundamentals and, as such, may not match with a report on a company's

fundamentals. Investors are advised to refer the Fundamental and Technical Research Reports available on our website to evaluate the

contrary view, if any.

The information in this document has been printed on the basis of publicly available information, internal data and other reliable

sources believed to be true, but we do not represent that it is accurate or complete and it should not be relied on as such, as this

document is for general guidance only. Angel Broking Pvt. Limited or any of its affiliates/ group companies shall not be in any way

responsible for any loss or damage that may arise to any person from any inadvertent error in the information contained in this report.

Angel Broking Pvt. Limited has not independently verified all the information contained within this document. Accordingly, we cannot

testify, nor make any representation or warranty, express or implied, to the accuracy, contents or data contained within this document.

While Angel Broking Pvt. Limited endeavors to update on a reasonable basis the information discussed in this material, there may be

regulatory, compliance, or other reasons that prevent us from doing so.

This document is being supplied to you solely for your information, and its contents, information or data may not be reproduced,

redistributed or passed on, directly or indirectly.

Neither Angel Broking Pvt. Limited, nor its directors, employees or affiliates shall be liable for any loss or damage that may arise from

or in connection with the use of this information.

October 24, 2016

12