1

Please refer to important disclosures at the end of this report

1

1

Budget 2019 - 20 Review

Government sticks to fiscal deficit target for FY2020

The Government stuck to it’s fiscal deficit target for FY2020 despite a significant

shortfall in revenues collections for FY19. Gross tax revenues for FY19 fell way

short of expectations at ` 20.8 lakh cr. as compared of revised target of ` 22.5

lakh cr. As a result net tax revenue came in short at ` 13.17 lakh cr. as compared

to revised estimates of ` 14.84 lakh cr.

The Government stuck to the interim budget fiscal deficit figure of ` 7.03 lakh cr.

for FY2020 in the final budget, though relying more on non tax revenues and

disinvestment proceeds in order to make up for the shortfall in tax revenues. While

the fiscal deficit for FY2020 in absolute numbers was maintained at ` 7.03 lakh cr.

upward revisions in GDP numbers for FY2020 resulted in the fiscal deficit falling to

3.3% against 3.4% of GDP as projected in the interim budget.

The NBFC sector had also been going through a crisis post the collapse of IL&FS

and was unable to extend credit. The Government has announced a slew of policy

measures for the NBFC sector in order to address the liquidity issues faced by the

sector, including a one time six months partial credit guarantee given to banks to

buy pooled asset of NBFCs. PSU bank recapitalization of ` 70,000 cr. would also

provide growth capital to the banking sector.

Higher Government spending to stimulate growth in FY2020

Given the slowdown in growth post the IL&FS crisis there was a significant

slowdown in tax collection in FY19. It was largely expected by the markets that the

Government would resort to cut back in expenditure in FY2020 due to lower tax

collections. However given the increased social outlay in FY20 and thrust on rural

economy it was evident that there was much that the Government could do to cut

back revenue expenditure.

Therefore in a way it is not surprising that Government maintained expenditure in

line with the interim budget estimates of ` 27.9 lakh Cr. which represents a growth

of 20.5% over FY2019. Revenue expenditure is budgeted to grow 21.9% to ` 24.5

lakh cr. while capital expenditure is budgeted to grow at 11.8% to ` 3.4 lakh cr.

which is again in line with the interim budget. In order to budget for the higher

spending the Government has resorted to hikes in both direct as well as indirect

taxes.

On the direct tax front surcharge for individuals earning between ` 2 - 5 cr. has

been proposed increased from 15% to 25%. Similarly for individuals earning

above ` 5 cr. surcharge has been proposed to be increased from 15% to 37%.

This is expected to augment personal income tax collection which had fallen

significantly short of estimates in FY19.

On the indirect tax front the Government has also hiked taxes on petrol and diesel

which is by ` 2 each and also increased import duties on many commodities.

These measures are expected boost indirect tax collections given sluggish growth in

GST collections.

Fiscal deficit for FY2019 at 3.4%, while

fiscal deficit for FY2020 was revised

down to 3.3%.

Various policy measures announced to

address liquidity issues faced by the

NBFC sector.

Government trying to stimulate the

economy by significant increase in

expenditure by 20.5% in FY2020.

Surcharge on Income tax to be hiked

significantly for individuals in highest

tax brackets.

2

Please refer to important disclosures at the end of this report

FY20 Fiscal deficit target is challenging though achievable

Borrowing figures for FY20 have been kept at the same level as that of the interim

budget. Both gross and net borrowing figures have been kept unchanged at

`4.73 lakh cr, and `7.6l lakh cr in FY2020.

Gross tax collections for FY2020 are expected to grow at 18.3% yoy against a

growth of 8.4% in FY2019. Net tax collections are expected to grow at 25.3% in

FY2020 given that devolution to states are expected to grow by 6.0%. Direct taxes

are expected to grow by 18.6% yoy driven by personal income tax which is

budgeted to grow by 23.3% yoy while corporate taxes are expected to grow by

15.4% yoy.

Indirect tax collections are expected to grow by 17.9% yoy which is well ahead of

GDP estimates of 11.2% yoy. GST collections are expected to grow by 13.6% yoy.

With GST collections struggling to pick up growth in indirect tax collections are

expected to be driven by excise and customs duties which are expected to grow by

29.9% and 32.2% respectively.

Non-tax revenue are expected to grow by 27.2% yoy predominantly driven by

Dividend and profit receipts from PSU’s and the RBI. It seems that the Government

is factoring in marginal transfer of some surplus reserves from the RBI in the

budget estimates. Disinvestment targets for FY2020 has been revised higher to

`105,000 cr. from `90,000 cr.in the interim budget.

Revenue growth for FY2020 seems to be aggressive and there is a possibility of

shortfall in tax collections in FY2020. Tax increases proposed by the Government

in the budget is likely to provide buoyancy to tax collections. However transfer of

surplus RBI reserves to the Government would help the Government in meeting

fiscal deficit target in case there is any shortfall in tax collections.

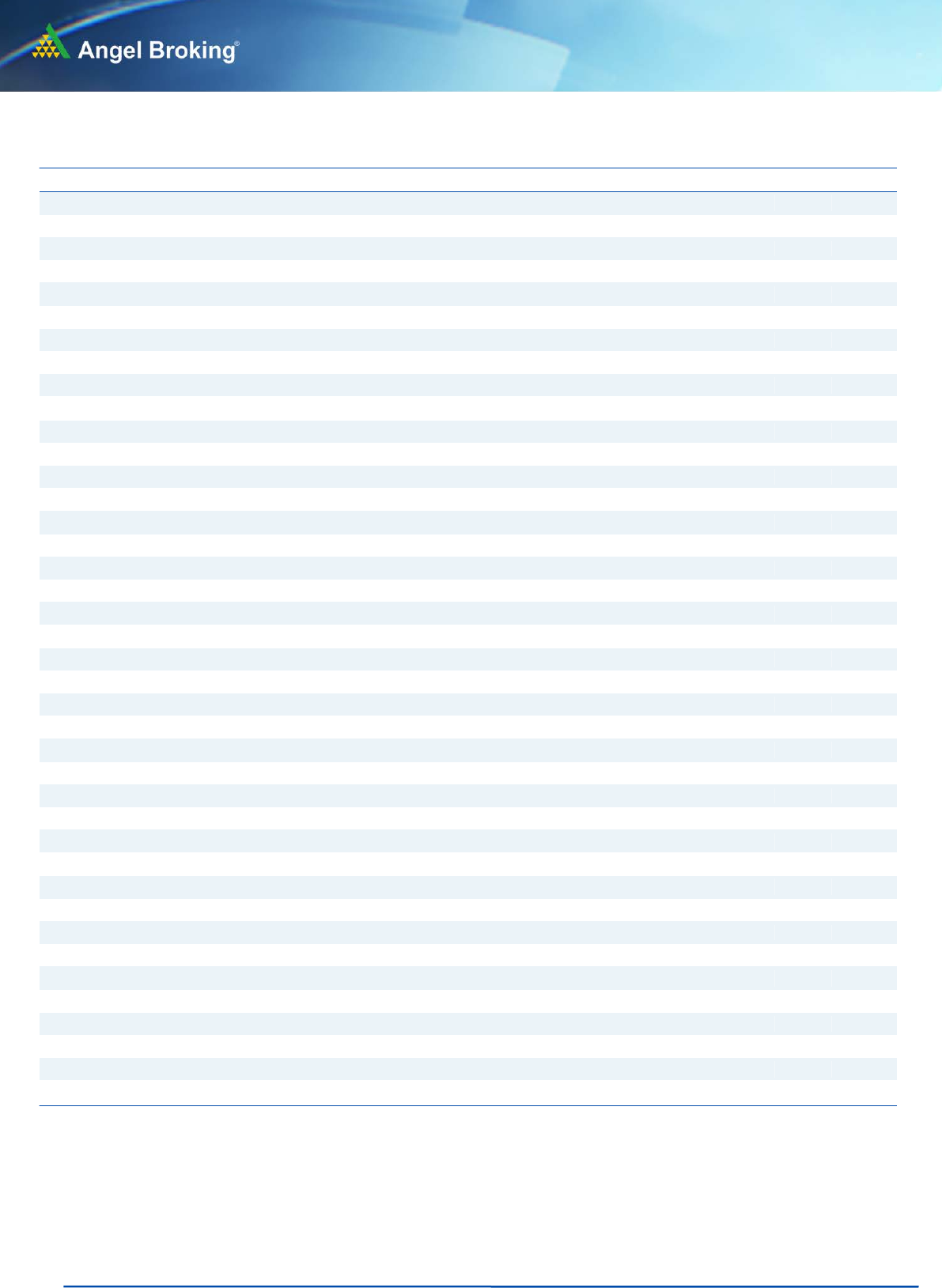

Exhibit 1: Key Fiscal indicators ( % of GDP)

% of GDP

FY18A

FY19RE

FY19A

FY120BE

Gross Tax Revenue

11.2%

12.0%

10.9%

11.7%

Devolution t o State s

3.9%

4.1%

4.0%

3.8%

Net Tax to Centre

7.3%

8.0%

6.9%

7.8%

Direct Taxes

5.9%

6.4%

5.9%

6.3%

Indirect taxes

5.4%

5.6%

5.0%

5.3%

Capital Receipt (ex borrowing)

0.7%

0.5%

0.5%

0.6%

Revenue Expenditure

11.0%

11.5%

10.6%

11.6%

Subsidie s

1.3%

1.6%

1.6%

1.6%

Total Capital Expenditure

1.5%

1.7%

1.6%

1.6%

Total Expenditure

12.5%

13.2%

12.2%

13.2%

Revenue Deficit

2.6%

2.2%

2.3%

2.3%

Fiscal Deficit

3.5%

3.4%

3.4%

3.3%

Primary Deficit

0.4%

0.3%

0.3%

0.2%

Source: Budget documents, Angel Research

Budget 2019 - 20 Review

3

Please refer to important disclosures at the end of this report

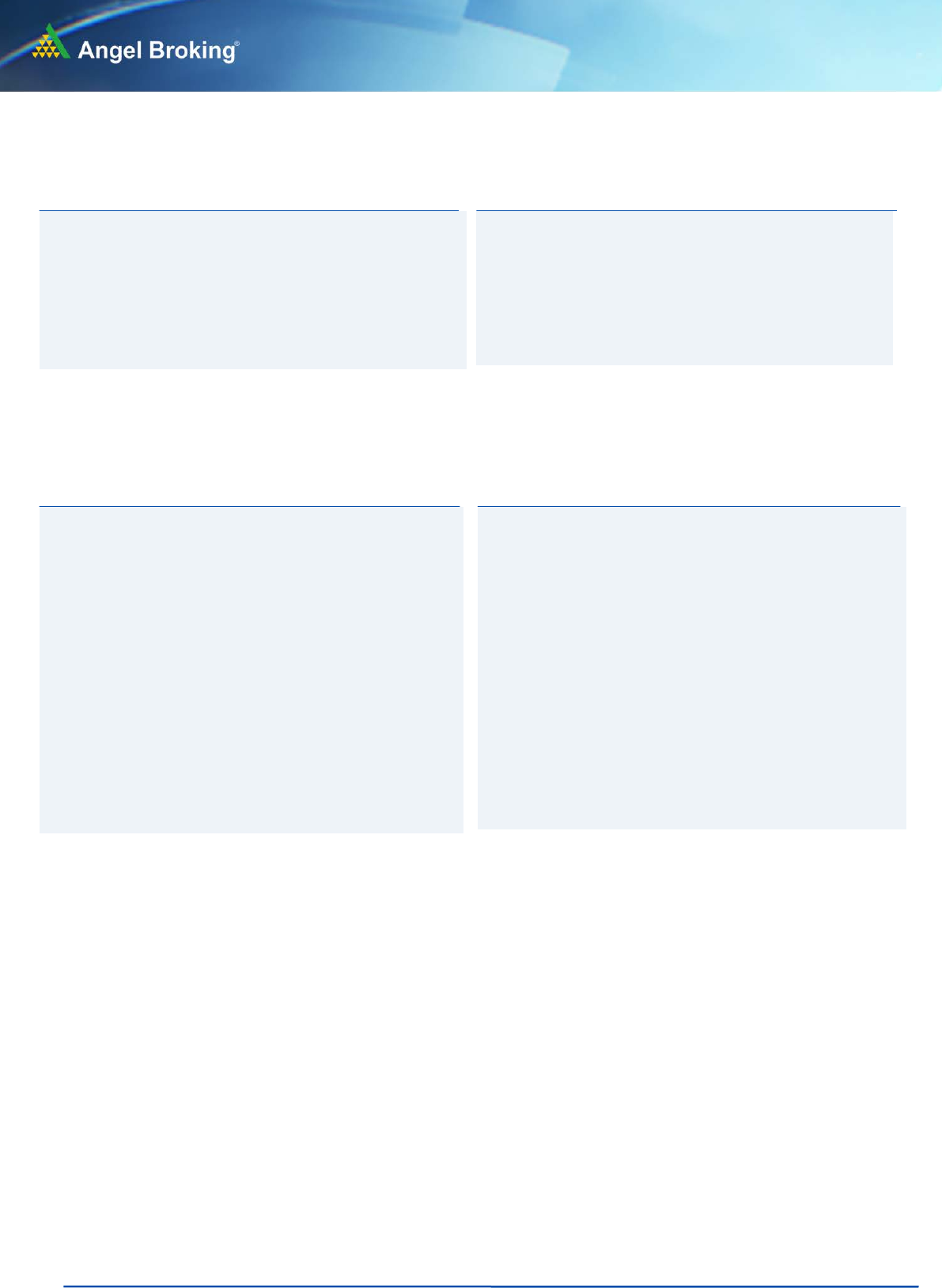

Exhibit 2: Budget 2019-20 at a glance

Particular

Budget (` cr)

YOY (%)

FY18A

FY19RE

FY19A

FY20BE

FY19A

FY20BE

(A) Revenue Receipts (1+2)

14,35,233

17,29,882

15,63,170

19,62,761

8.9

25.6

Gross Tax Revenue (a+b)

19,19,009

22,48,175

20,80,203

24,61,195

8.4

18.3

Devolution to States/Trf to NCCD

6,73,006.0

7,61,454.0

7,63,252

8,09,133

13.4

6.0

%

35.1%

33.9%

36.7%

32.9%

1) Tax Revenue (Net to Centre)

12,42,488

14,84,406

13,16,951

16,49,582

6.0

25.3

a) Direct Taxe s

10,01,974

12,00,000

11,25,220

13,35,000

12.3

18.6

Income Tax

4,30,772

5,29,000

4,61,650

5,69,000

7.2

23.3

Corporate Tax

5,71,202.0

6,71,000

6,63,570

7,66,000

16.2

15.4

b) Indirect taxes

9,16,972

10,48,175

9,54,983

11,26,195

3.9

17.9

Custom Duties

1,29,030

1,30,038

1,17,930

1,55,904

-8.6

32.2

Excise Duties

2,59,431

2,59,612

2,30,900

3,00,000

-11.0

29.9

Service Tax

81,228

9,283

6,880

0

-91.5

-100.0

GST

4,42,562

6,43,900

5,83,970

6,63,343

32.0

13.6

Others

4,721

5,342

15,303

6,948

224.1

-54.6

2) Non Tax Revenue

1,92,745

2,45,476

2,46,219

3,13,179

27.7

27.2

(B) Capit al Receipts (3+4+5)

7,02,649

6,86,352

7,48,252

7,72,529

6.5

3.2

3) Recovery of Loans

15,633

13,155

17,840

14,828

14.1

-16.9

4) Disinvestment

1,00,045

80,000

85,045

1,05,000

-15.0

23.5

5) Borrowings and Other Liabilities

5,86,971

5,93,197

6,45,367

6,52,702

9.9

1.1

Total Receipt(A+B)

21,37,882

24,16,234

23,11,422

27,86,349

7.9

20.5

(C)Revenue ex penditure

18,78,835

21,40,611

20,08,463

24,47,780

6.9

21.9

6) Of which interest payments

5,28,951

5,87,570.0

5,82,675

6,60,471

11.1

13.4

(D) Capital expenditure

2,63,140

3,16,624

3,02,959

3,38,569

15.1

11.8

Total Expenditure (C+D)

21,41,975

24,57,235

23,11,422

27,86,349

7.9

20.5

(E) Fiscal Deficit (C+D-A-3-4)

5,91,064

6,34,198

6,45,367

7,03,761

9.2

9.0

(F) Revenue Deficit (C-A)

4,43,602

4,10,729

4,45,293

4,85,019

0.4

8.9

(G) Primary Deficit (E -6)

5,91,064

46,628

62,692

43,290

-6.9

-30.9

GDP

1,70,95,000

1,86,52,882

1,90,10,200

2,11,00,607

11.2

11.0

Fiscal Deficit (% of GDP)

3.5%

3.3%

3.4%

3.3%

Source: Budget documents, Angel Research

Budget 2019 - 20 Review

4

Please refer to important disclosures at the end of this report

Subsidy Burden to remain stable

Since BJP came into power in 2014, the subsidies have been falling as a % of GDP

due to couple of favorable factors like falling prices of oil and fertilizers raw

material, coupled with reforms in agriculture sector like DBT and regularization of

Urea pricing. Subsidies as a % of GDP has come down from 2.2% of GDP in

FY2014 to 1.6% of GDP in FY19. In the final budget subsides are estimates to gow

by 13.3% yoy to ` 3,38,949 cr. which is more or less in line with the interim

budget estimates of ` 334,235 cr. Small increment is on account of ` 5010 cr. of

additional fertilizer subsidies.

Exhibit 3: Subsidy

Subsidy Break-down

FY15

FY16

FY17

FY18

FY19RE

FY20BE

Major Subsidies

2,49,016

2,41,857

2,32,705

1,91,183

2,66,206

301,694

Fertilizer Subsidy

71,076

72,438

70,000

66,441

70075.2

749996

yoy gr owth (%)

6%

1.9%

-3.4%

-5.1%

0.0%

14.2%

Food Subsidy

1,17,671

1,39,419

1,35,173

100281

171298

184220

yoy gr owth (%)

28%

18.5%

1.0%

-25.8%

1.2%

7.5%

Petroleum Subsidy

60,269

30,000

27,532

24,461

24833.2

37478

yoy gr owth (%)

-29%

-50.2%

-8%

-11.2%

-0.4%

50.9%

Interest Subsidy

7,632

13,808

18865

22,146

22676.6

25056.0

yoy gr owth (%)

-6%

80.9%

4%

17.4%

-1.7%

10.5%

Other Subsi dy

1,610

2,136

3,128

11,099

10327.6

12199.5

yoy gr owth (%)

-9%

32.7%

46%

254.8%

27.5%

18.1%

Total Subsidy

2,58,258

2,57,801

2,54,698

2,24,429

2,99,211

3,38,949

yoy gr owth (%)

1%

-0.2%

-1%

-11.9%

1.3%

13.3%

% to GDP

2.0%

1.8%

1.7%

1.3%

1.6%

1.6%

Source: Budget documents, Angel Research

Government trying to stimulate economy through Farm package,

spending and liquidity measures

The government surprised the market and did not go for any major tax cuts in

the budget. With this budget the Government has made its intentions clear

that they will try and spend their way out of the economic slump rather than

go for tax cuts in order to stimulate the economy.

Increased social outlays in FY2020 through various Government scheme like

the PM-KISAN would ensure additional income in the hands of the poorest of

the poor. This would go a long way in supporting rural income and boosting

growth.

The budget also tried to address the liquidity issues faced by the NBFC sector

through various policy measures. PSU bank recapitalization of ` 70,000 cr.

would also ensure that PSU banks are in a position to extend credit to industry.

Budget 2019 - 20 Review

5

Please refer to important disclosures at the end of this report

Sectoral Impact

Budget 2019 - 20 Review

6

Please refer to important disclosures at the end of this report

Agriculture Positive

Announcement

Fishery focused scheme - Pradhan Mantri Matsya

Sampada Yojana (PMMSY) was introduced to establish a

robust fisheries management framework. It will address

critical gaps in the value chain, including infrastructure,

modernization, traceability, production, productivity, post-

harvest management, and quality control.

Impact

Positive for fishery industry, as PMMSY scheme shall

boost income for fishermen and shall also improve

productivity due to superior infrastructure development.

Stocks like Avanti Feeds stands to benefit from this.

Automobile Positive

Announcement

To make electric vehicle affordable to consumers, the

government has proposed to provide additional income

tax deduction of ` 1.5 lakh on the interest paid on loans

taken to purchase electric vehicles. This amounts to a

benefit of around ` 2.5 lakh over the loan period to the

taxpayers who take loans to purchase electric vehicle.

Increase in customs duty in the range of 2.5-7.5% on

various auto ancillary equipments like Glass mirrors, rear

view mirrors, locks, lighting or visual signaling, horns,

windscreen wipers, Completely Built Unit (CBU), etc.

Reduction in customs duty on parts exclusively used for

Electric vehicles like E-drive assembly, on board charger,

E-compressor, Charging Gun to zero.

Impact

This will be positive for the electric vehicle manufacturer

companies like Tata Motors and M&M

This would be positive for domestic auto ancillary

equipment manufacturers.

Positive for all electric vehicle manufacturers.

Budget 2019 - 20 Review

7

Please refer to important disclosures at the end of this report

Banks & Financial Services (BFSI) Positive

Announcement

The Fiscal deficit for FY2020 has been reduced by 10bps

to 3.3% of GDP and government has kept gross

borrowings unchanged. The government also proposed

to raise some part of borrowing through global bond

markets.

Continuing with its focus to realize the goal of 'Housing

for All' by 2022, (1) 1.95cr houses are proposed to be

provided to eligible beneficiaries under PMAY-Grameen;

(2) The interest deduction limit has increased by

`1,50,000 to `3,50,000 for self occupied properties on

loans borrowed up to March 31, 2020 and purchase

value of up to `45 lakh.

`70,000cr capital infusion in public sector banks

NBFCs will not have to maintain debenture redemption

reserve (DDR) for debt raised through public issue. One

time six months partial credit guarantee given to banks to

buy pooled asset of NBFCs.

Interest on certain bad or doubtful debts by deposit-

taking as well as systemically important non-deposit

taking NBFCs to be taxed in the year in which interest is

actually received.

Impact

This will reduce crowding out effect in domestic market

and ease G-Sec yield.

Positive for Housing Finance Companies such as GIC

Housing, CanFin Homes, Gruh Finance, PNB Housing.

Positive for PSU banks, as they will be able to meet

regulatory requirement and step up lending activity.

Positive for NBFCs (STFC, AB Capital, Piramal Ent., etc.),

as these steps will help them to improve their liquidity

position.

Positive for NBFC

Ceramic Positive

Announcement

Increase in customs duty on ceramic roofing tiles, ceramic

flags and hearth or wall tiles, etc. from 10% to 15%.

Impact

Positive for domestic ceramic companies like Kajaria

Ceramics, Asian Granite, Somany Ceramics, etc.

Budget 2019 - 20 Review

8

Please refer to important disclosures at the end of this report

Consumption discretionary Negative

Announcement

Increase in customs duty on indoor and outdoor unit of

split system air conditioner from 10% to 20%.

Impact

Negative for Air Conditioner manufacturers like Voltas,

Blue Star, etc. However, we believe industry would pass

on the hike to consumers.

FMCG Negative

Announcement

Removal of custom duty exemption on palm oil & other

industrial fatty acids used in manufacturing of soaps.

Custom duty of 7.5% is proposed to be levied.

Impact

Imposition of custom duty on Palm Oil shall effect

companies like Godrej consumer which uses palm oil as

raw material in manufacturing soaps.

Infrastructure/Cement/ Real Estate Positive

Announcement

Government under the Pradhan Mantri Gram Sadak

Yojana (PMGSY) aims to upgrade 1.25 lakh kms of rural

roads over the next five years with an outlay of ` 80,250

cr.

Government has highlighted their intent to invest over `

100 lakh crore in Infrastructure over the next 5 years.

Government looking to develop inland waterways under

the Jal Amrg Vikas project which will ease movement of

goods in the domestic market.

The interest deduction limit has increased by `1,50,000

to `3,50,000 for self occupied properties on loans

borrowed up to March 31, 2020 and purchase value of

up to `45 lakh..

Impact

Positive for Infrastructure (Road) companies and cement

companies such as Ultractech, ACC, Shree Cement, Star

cement, etc.

Positive for Logistics companies like container

corporation and companies involved in developing

inland waterways like dredging corporation

Positive for real estate companies like Sobha Developers

who cater to the affordable housing segment.

Jewellery Negative

Announcement

Increase in customs duty on gold from 10% to 12.5%.

Impact

Negative for Jewellery companies like Titan Company,

PC Jeweller, TBZ, etc. It will increase overall cost of

jewellery, which will result in negative sentiment in

consumers

Budget 2019 - 20 Review

9

Please refer to important disclosures at the end of this report

Paper Positive

Announcement

Increase in customs duty on Newsprint from 0% to 10%.

Impact

Positive for domestic paper companies like Tamil Nadu

Newsprint & Paper.

Textile Positive

Announcement

Reduction in customs duty on wool fibre & wool tops

from 5% to 2.5%.

Impact

This would be positive for textile companies like Monte

Carlo Fashions.

Others Positive

Announcement

Pradhan Mantri Awas Yojana – Gramin (PMAY-G) aims

to achieve the objective of “Housing for All” by 2022. A

total of 1.54 crore rural homes have been completed in

the last five years. In the second phase of PMAY-G,

during 2019-20 to 2021-22, 1.95 crore houses are

proposed to be provided to the eligible beneficiaries.

Impact

It would create demand for steel, cement and other

building materials. This will be positive for companies in

these sectors.

Budget 2019 - 20 Review

10

Please refer to important disclosures at the end of this report

Research Team Tel: 022 - 39357800 E-mail: research@angelbroking.com Website: www.angelbroking.com

DISCLAIMER

Angel Broking Limited (hereinafter referred to as “Angel”) is a registered Member of National Stock Exchange of India Limited,

Bombay Stock Exchange Limited, Metropolitan Stock Exchange Limited, Multi Commodity Exchange of India Ltd and National

Commodity & Derivatives Exchange Ltd It is also registered as a Depository Participant with CDSL and Portfolio Manager and

Investment Adviser with SEBI. It also has registration with AMFI as a Mutual Fund Distributor. Angel Broking Limited is a reg istered

entity with SEBI for Research Analyst in terms of SEBI (Research Analyst) Regulations, 2014 vide registration number INH000000164.

Angel or its associates has not been debarred/ suspended by SEBI or any other regulatory authority for accessing /dealing in securities

Market. Angel or its associates/analyst has not received any compensation / managed or co -managed public offering of securities of

the company covered by Analyst during the past twelve months.

This document is solely for the personal information of the recipient, and must not be singularly used as the basis of any investment

decision. Nothing in this document should be construed as investment or financial advice. Each recipient of this document sh o uld

make such investigations as they deem necessary to arrive at an independent evaluation of an investment in the securities of the

companies referred to in this document (including the merits and risks involved), and should consult their own advisors to de termine

the merits and risks of such an investment.

Reports based on technical and derivative analysis center on studying charts of a stock's price movement, outstanding positions and

trading volume, as opposed to focusing on a company's fundamentals and, as such, may not match with a report on a company's

fundamentals. Investors are advised to refer the Fundamental and Technical Research Reports available on our website to evaluate the

contrary view, if any

The information in this document has been printed on the basis of publicly available information, internal dat a and other reliable

sources believed to be true, but we do not represent that it is accurate or complete and it should not be relied on as such, as this

document is for general guidance only. Angel Broking Limited or any of its affiliates/ group companies shall not be in any way

responsible for any loss or damage that may arise to any person from any inadvertent error in the information contained in th is report.

Angel Broking Limited has not independently verified all the information contained within this document. Accordingly, we cannot

testify, nor make any representation or warranty, express or implied, to the accuracy, contents or data contained within this document.

While Angel Broking Limited endeavors to update on a reasonable basis the information d iscussed in this material, there may be

regulatory, compliance, or other reasons that prevent us from doing so.

This document is being supplied to you solely for your information, and its contents, information or data may not be reproduc ed,

redistributed or passed on, directly or indirectly.

Neither Angel Broking Limited, nor its directors, employees or affiliates shall be liable for any loss or damage that may ari se from or in

connection with the use of this information.

Ratings (Based on expected returns Buy (> 15%) Accumulate (5% to 15%) Neutral (-5 to 5%)

over 12 months investment period): Reduce (-5% to -15%) Sell (< -15)

Budget 2019 - 20 Review

Angel

Broking

®

(

J\R

Q

6th Floor, Ackruti Star, Central Road, MIDC, Andheri(E), Mumbai - 400 093. Tel: (022) 39357800

Research Team

Fundamental:

Vaibhav Agrawal

Amarjeet S Maurya

Jaikishan Parmar

Jyoti Roy

Head of Research & ARQ

Analyst (Mid-Caps)

Analyst (BFSI)

Analyst (Strategy)

vaibhav.agrawal@angelbroking.com

amarjeet.maurya@angelbroking.com

jaikishan.parmar@angelbroking.com

jyoti.roy@angelbroking.com

Technical and Derivatives:

Sameet Chavan

RuchitJain

Rajesh Dashrath Bhosle

Sneha Seth

Chief Technical & Derivative Analyst

Technical Analyst

Technical Analyst

Derivatives Analyst

sameet.chavan@angelbroking.com ruch

it.jain@angelbroking.com

rajesh.bhosle@angelbroking.com

sneha.seth@angelbroking.com

Discl aim er: 'Investm en ts in se curi ties m ark et ar e su bje ct to m ark et risk, r ead al l t he re lat ed do cu me nts car efully befo re inv es tin g.'

Ang el Br oki ng Li mit ed (for merly k now n as Ang el Br oki ng Priva te Li mit ed), R egis ter ed O ffice: G - 1, A ckr uti Tra de C ent er, R oad N o. 7, M IDC,

A n dh e ri ( E), M u m b ai - 4 0 0 0 9 3. T el: ( 02 2) 3 0 8 3 7 7 00 . Fa x : ( 0 22) 28 3 5 8 8 1 1, CI N: U 6 7 12 0 MH 1 9 9 6P L C1 0 1 7 09 , SE BI R e g n. N o. :

INZ0001 615 34- BSE C ash/F&O/ CD (M e mbe r I D: 6 12), N SE C ash/F &O/CD (M e mb er ID: 127 98), M SEI Cas h/F&O /C D (M em be r ID : 10 50 0), M CX

Com mo dity Der ivatives (M em ber I D: 126 85) a nd N CDEX Co m mod ity D eriva tives (M e mb er ID: 22 0), C DSL Reg n. N o .: IN-DP -38 4-2 01 8, P M S

Reg n. N o.: IN P00 000 15 46, R esea rc h Ana lyst SEBI Re gn. No.: INH 0 000 00 164 , Inv estm en t Advise r SEBI Re gn. No. : INA 00 000 81 72, A M FI

R e gn . N o. : ARN- 7 7 4 04 . Co m p li a n ce off ic e r: Ms . Na m i ta G od b ol e , T el: (0 2 2) 3 9 4 1 39 4 0 E m ai l: c o m pli a n c e@ a n ge l br o ki n g. c o m