3QFY2016 Result Update | Cement

January 27, 2016

UltraTech Cement

ACCUMULATE

CMP

`2,755

Performance Highlights

Target Price

`3,107

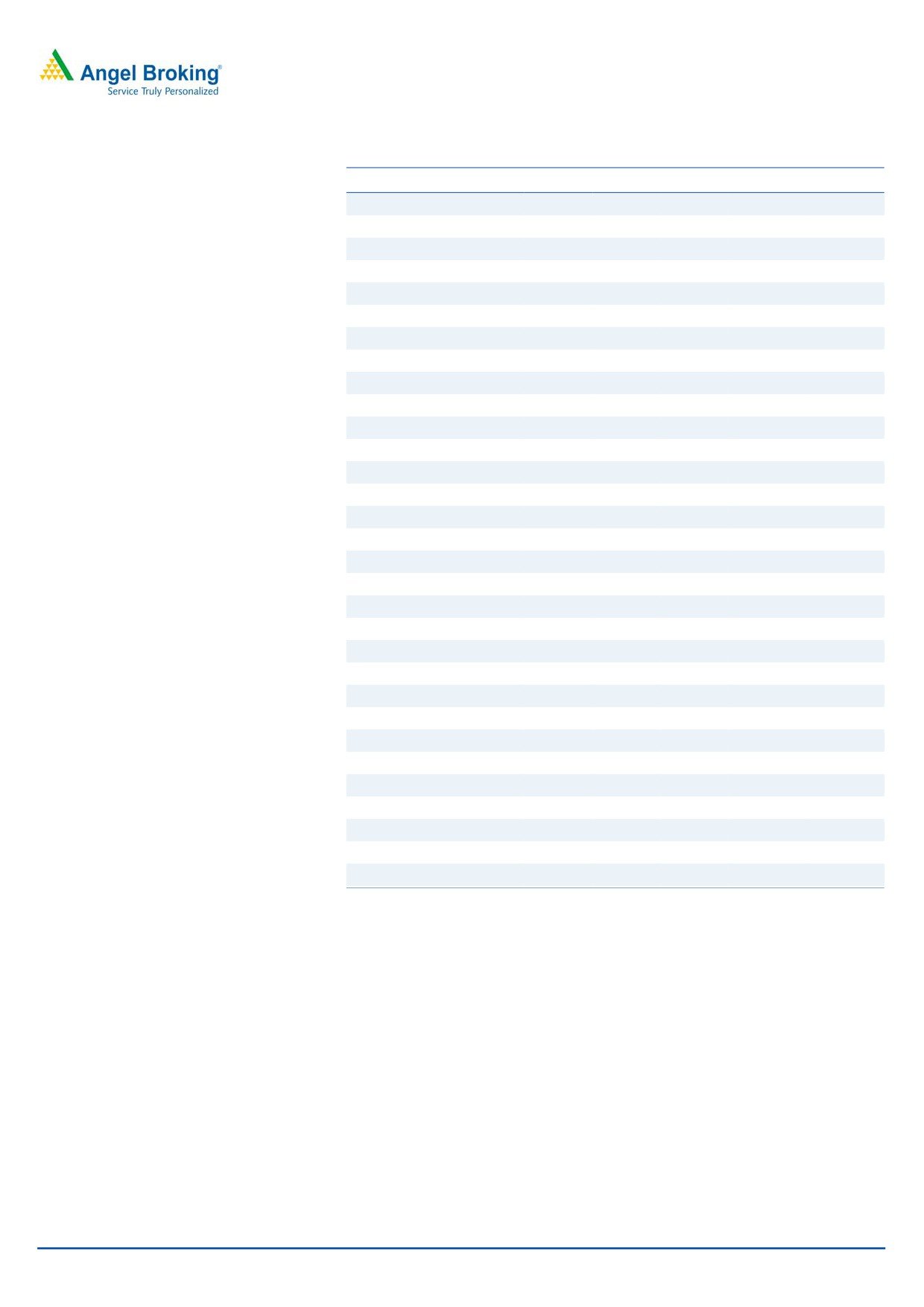

Quarterly results (Standalone)

Investment Period

12 Months

Y/E March (` cr) 3QFY2016

2QFY2016

% chg qoq 3QFY2015

% chg yoy

Net revenue

5,747

5,621

2.2

5,490

4.7

Stock Info

Operating profit

1,044

928

12.5

846

23.4

Sector

Cement

OPM (%)

18.2

16.5

0.0

15.4

2.8

Market Cap (` cr)

75,604

Net profit

509

394

29.1

364

39.6

Net Debt (` cr)

1,838

Source: Company, Angel Research

Beta

1.0

UltraTech Cement (UltraTech)’s 3QFY2016 numbers have come in better than

52 Week High / Low

3,399 / 2531

our expectations on the top-line and operational fronts. The company’s net sales

Avg. Daily Volume

285,287

rose by 4.7% yoy to `5,747cr, aided by better than expected volume growth of

Face Value (`)

10

7.1% yoy. Blended realization was under pressure, down by 2.3% yoy, and was

BSE Sensex

24,486

slightly lower than our estimate. The EBITDA increased by 23% yoy to `1,044cr

Nifty

7,436

and the same was above our estimate of `975cr. The EBITDA margin came in at

Reuters Code

ULTC.BO

18.2%, also above our estimate of 17.3%, backed by strong operational

efficiency. The PAT came in at `509cr, up 39.6% yoy, which is above our

Bloomberg Code

UTCEM IN

estimate of `435cr, driven by margin expansion.

EBITDA margin healthy at 18.2%: For 3QFY2016, UltraTech reported an EBITDA

Shareholding Pattern (%)

growth of 23% yoy to `1,044cr, as against our estimate of `975cr. The strong

Promoters

62.7

EBIDTA performance was led by operational efficiency. The operating cost/tonne

MF / Banks / Indian Fls

7.4

declined by 4.6% yoy to `4,055, led by 13.9% yoy decline in power & fuel

FII / NRIs / OCBs

18.1

cost/tonne, largely due to softening pet coke prices. Higher pet coke usage at

Indian Public / Others

11.8

74% vs 65% in the sequential previous quarter helped savings in power & fuel

cost. The EBITDA margin increased by 280bp yoy to 18.2% and was above our

expectation of 17.3%. The blended EBITDA/tonne came in at `900, an increase

Abs. (%)

3m 1yr 3yr

of 16.1% yoy.

Sensex

(11.0)

(15.8)

22.3

Outlook and valuation: We expect UltraTech to post a 13.6% CAGR in its top-

Ultratech

(6.3)

(12.9)

39.2

line on back of new capacity expansion and healthy expected realization over

FY2015-17 period. The company’s bottom-line is expected to grow at a CAGR of

28% yoy over the same period. At the current levels, the stock is trading at 13x

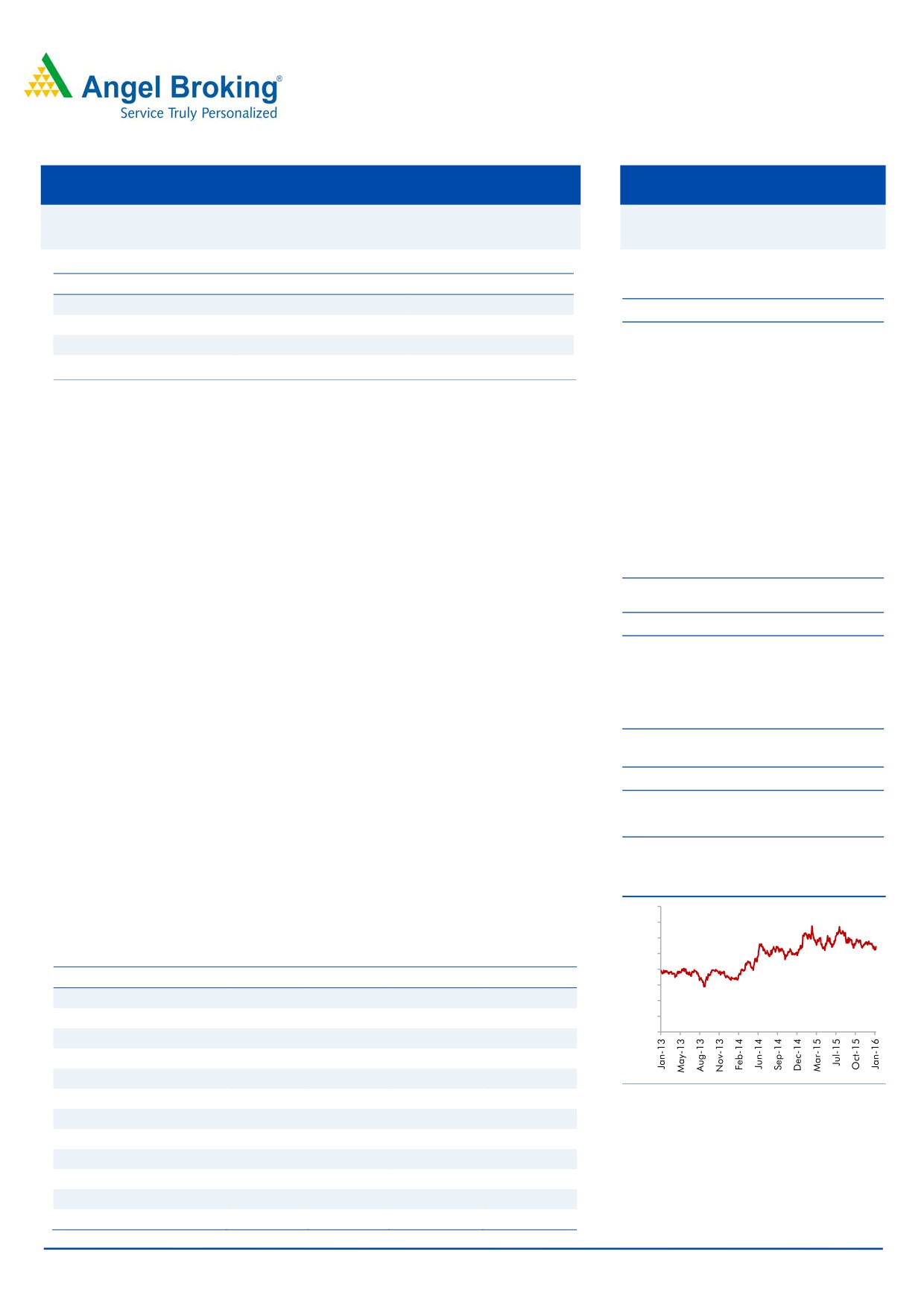

3-year price chart

4,000

EV/EBITDA and at an EV/tonne of US$165 on FY2017 capacity. We maintain

3,500

our Accumulate rating on the stock with a revised target price of `3,107.

3,000

2,500

Key financials (Standalone)

2,000

Y/E March (` cr)

FY2014

FY2015

FY2016E

FY2017E

1,500

Net Sales

20,078

22,656

24,669

29,265

1,000

500

% chg

0.3

12.8

7.6

18.6

0

Net Profit

2,112

2,015

2,253

3,292

% chg

(20.5)

(4.6)

6.7

34.4

FDEPS (`)

73.5

73.4

82.1

120.0

Source: Company, Angel Research

OPM

18.9

18.5

18.2

20.6

P/E(x)

37.3

37.3

33.4

22.8

P/BV(x)

4.4

4.0

3.6

3.1

RoE(%)

12.5

11.2

11.3

14.7

RoCE(%)

11.5

11.4

10.3

13.7

Siddharth Purohit

EV/Sales (x)

3.7

3.4

3.2

2.7

022-39357800 Ext 6872

EV/EBITDA

19.8

18.4

17.6

13.0

Source: Company, Angel Research; Note: CMP as of January 25, 2016

Please refer to important disclosures at the end of this report

1

UltraTech Cement | 3QFY2016 Result Update

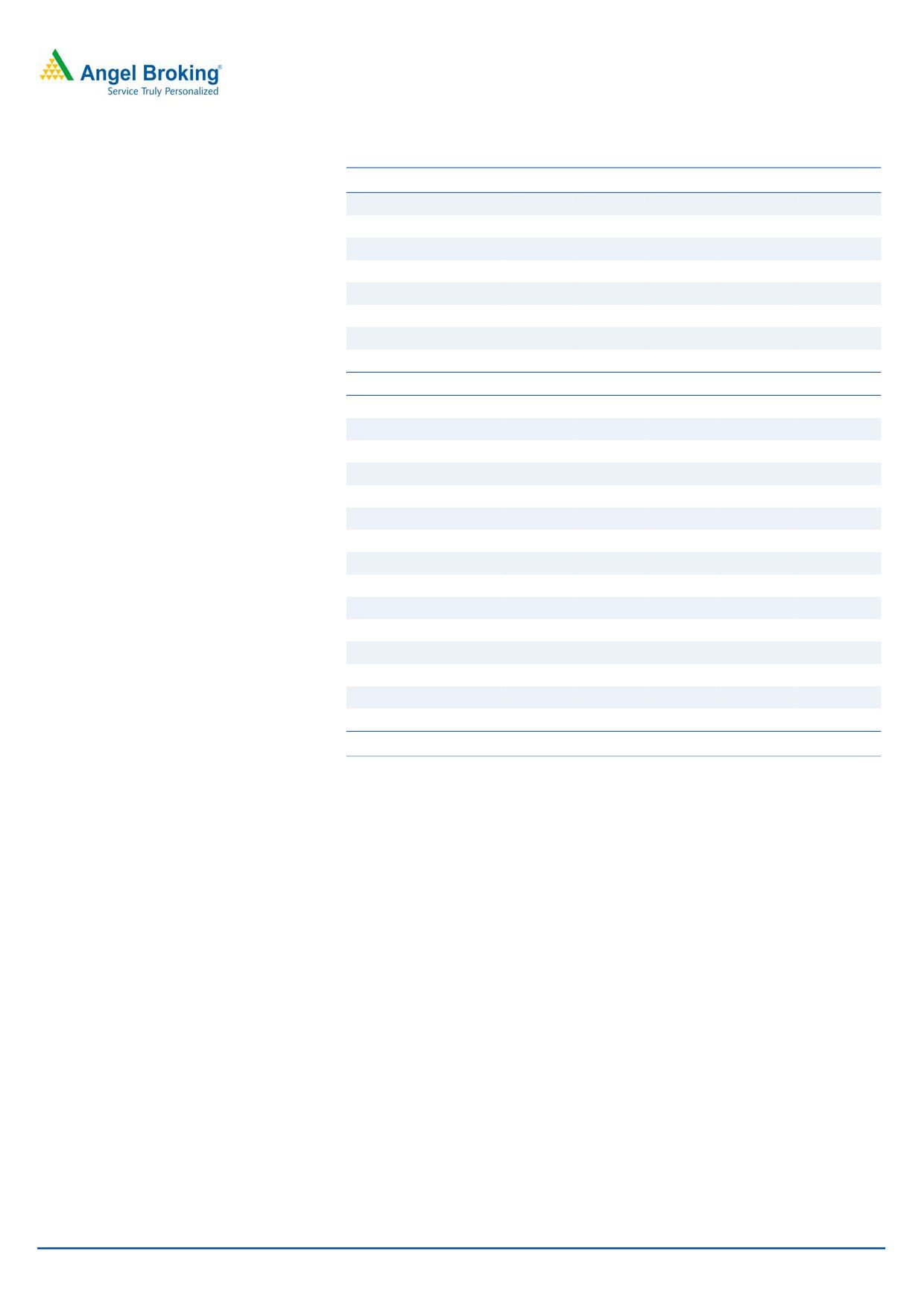

Exhibit 1: 3QFY2016 performance (Standalone)

Y/E March (` cr)

3QFY2016

2QFY2016

% Chg 3QFY2015

% Chg

9MFY2016

9MFY2015

% Chg

Net sales

5,747

5,621

2.2

5,490

4.7

17,406

16,518

5.4

Net raw-material costs

800

800

0.1

741

7.9

2,543

2,423

4.9

(% of sales)

13.9

14.2

13.5

14.6

14.7

Power & fuel

1,068

1,059

0.9

1,206

(11.4)

3,224

3,558

(9.4)

(% of sales)

18.6

18.8

22.0

18.5

21.5

Staff costs

349

341

2.6

306

14.3

1,002

892

12.4

(% of sales)

6.1

6.1

5.6

5.8

5.4

Freight & forwarding

1,398

1,347

3.8

1,318

6.1

4,298

3,938

9.1

(% of sales)

24.3

24.0

24.0

24.7

23.8

Other expenses

979

1,041

(6.0)

939

4.2

2,958

2,853

3.7

(% of sales)

17.0

18.5

17.1

17.0

17.3

Total Expenditure

4,703

4,693

0.2

4,644

1.3

14,341

13,835

3.7

Operating Profit

1,044

928

12.5

846

23.4

3,065

2,683

14.2

OPM (bps)

18.2

16.5

165bp

15.4

275bp

17.6

16.2

90bp

Interest

126

130

(3.5)

154

(18.4)

394

398

(0.8)

Depreciation

324

333

(2.8)

278

16.4

940

845

11.2

Other income

132

105

25.5

144

(8.8)

396

522

(24.1)

PBT

726

570

27.5

558

30.2

2,127

1,962

8.4

Provision for taxation

218

176

23.8

193

12.5

634

562

12.7

(% of PBT)

30.0

30.9

34.7

29.8

28.7

Adjusted PAT

509

394

29.1

364

39.6

1,493

1,400

6.7

PATM

8.8

7.0

6.6

8.6

8.5

EPS (`)

18.5

14.4

13.3

54.4

51.0

Source: Company, Angel Research

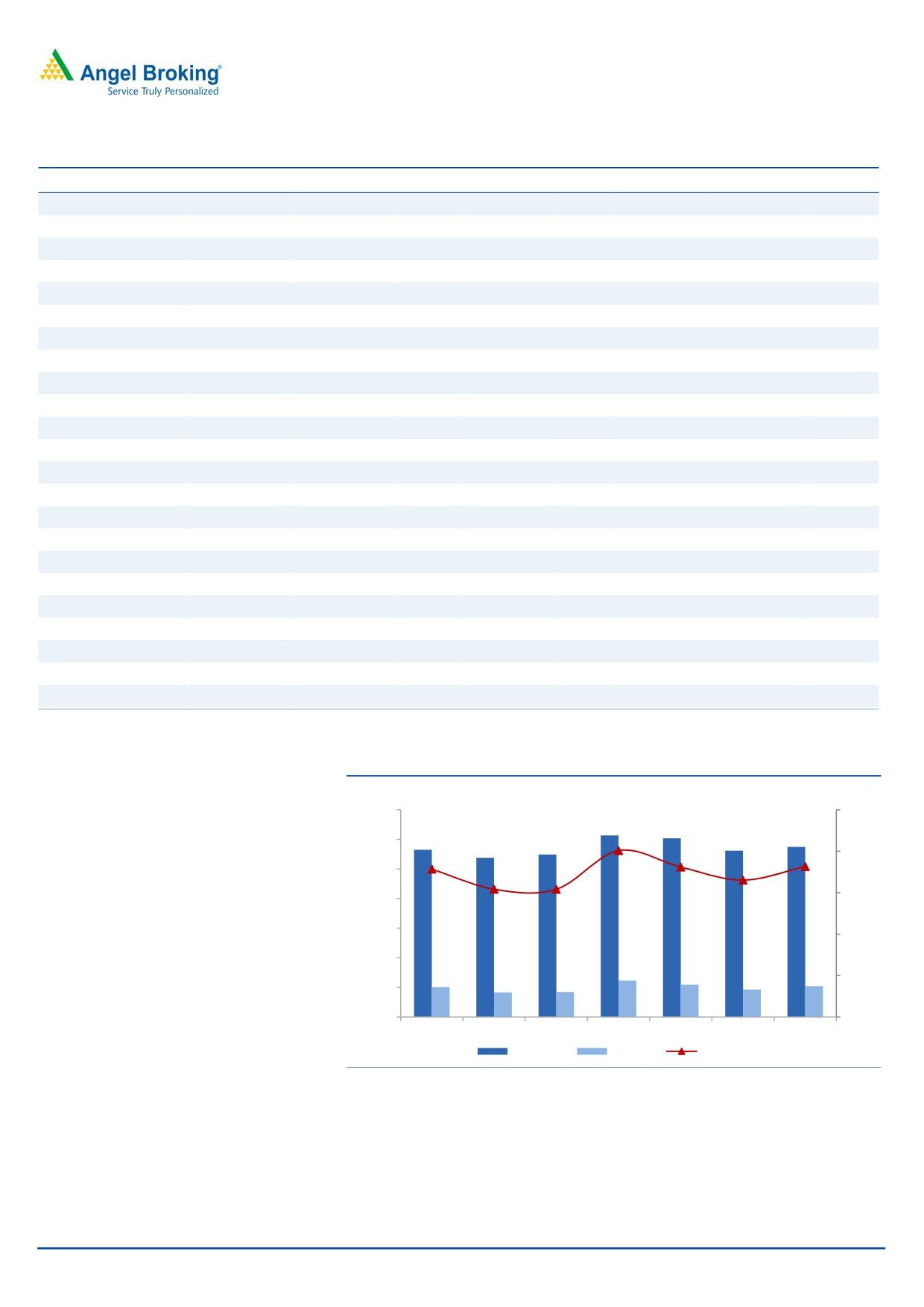

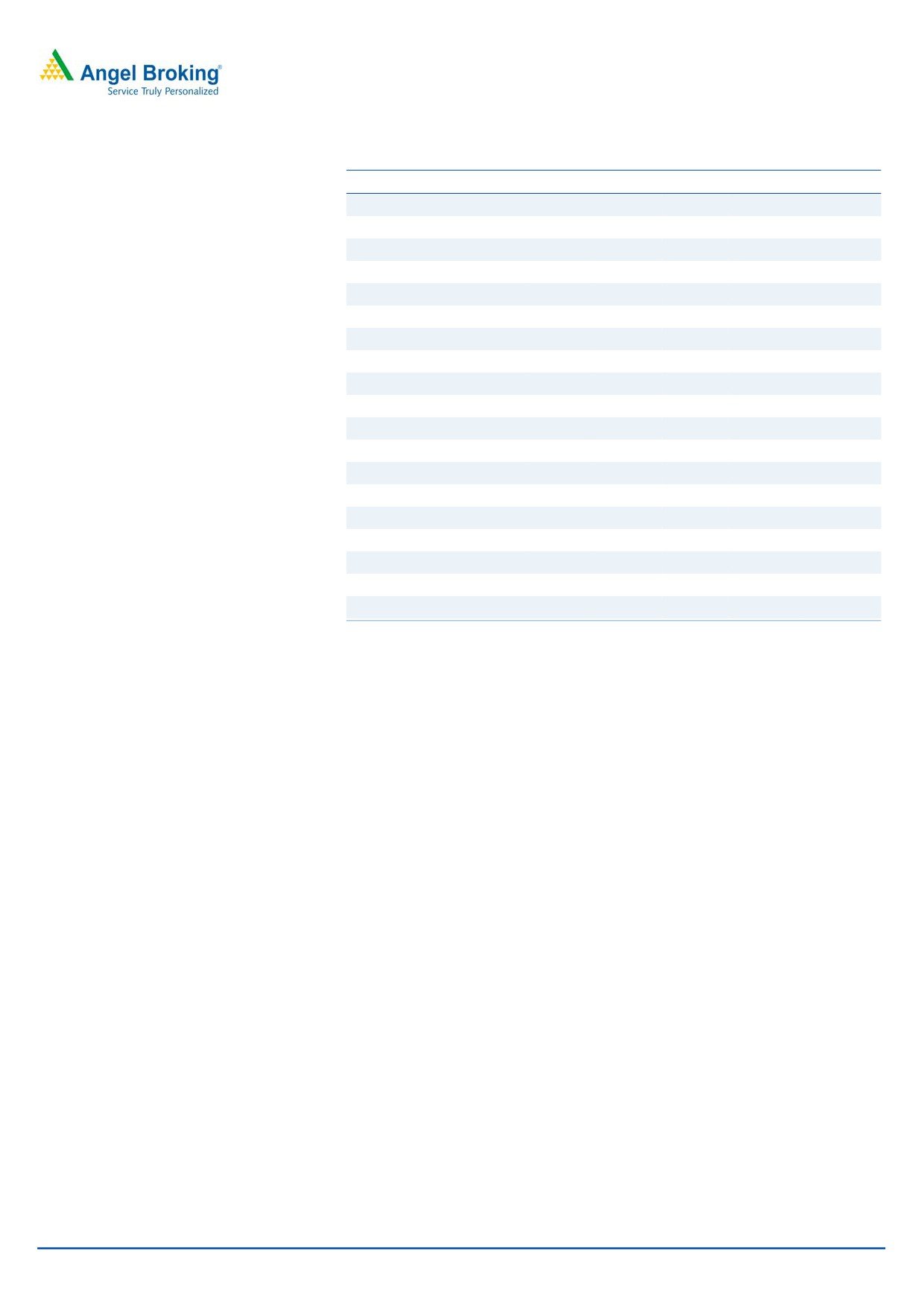

Exhibit 2: Financial performance

(` cr)

(%)

7,000

25.0

6,135

6,038

5,649

5,621

5,747

6,000

5,490

5,379

20.0

5,000

20.1

18.

2

17.8

18.1

16.5

15.0

4,000

15.4

15.4

3,000

10.0

2,000

1,232

1,093

1,008

1,044

5.0

829

846

928

1,000

-

0.0

1QFY15

2QFY15

3QFY15

4QFY15

1QFY16

2QFY16

3QFY16

Net sales

EBITDA

EBITDA %

Source: Company, Angel Research

January 27, 2016

2

UltraTech Cement | 3QFY2016 Result Update

Exhibit 3: 3QFY2016 Actual vs Angel Estimates

(` cr)

Actual

Estimates

Variation (%)

Net Sales

5,747

5,650

1.7

EBITDA

1044

975

7.1

EBITDA M (%)

18.2

17.3

Net Profit

509

435

16.9

Source: Company, Angel Research

Performance highlights

Net sales up 4.7% yoy

For 3QFY2016, UltraTech’s top-line rose by 4.7% yoy to `5,747cr, aided by 7.1%

yoy increase in cement sales volume to 11.6mn tonne. The blended cement

realization/tonne declined by 2.3%/1.2% yoy/qoq to `4,955. Sales volume of

white cement and wall care putty rose by 6.6% yoy to 0.34mn tonne. The company

witnessed strong growth in the East region while the North region continued to be

decent. The company remains hopeful of demand recovery on back of government

spending on infrastructure development and housing schemes.

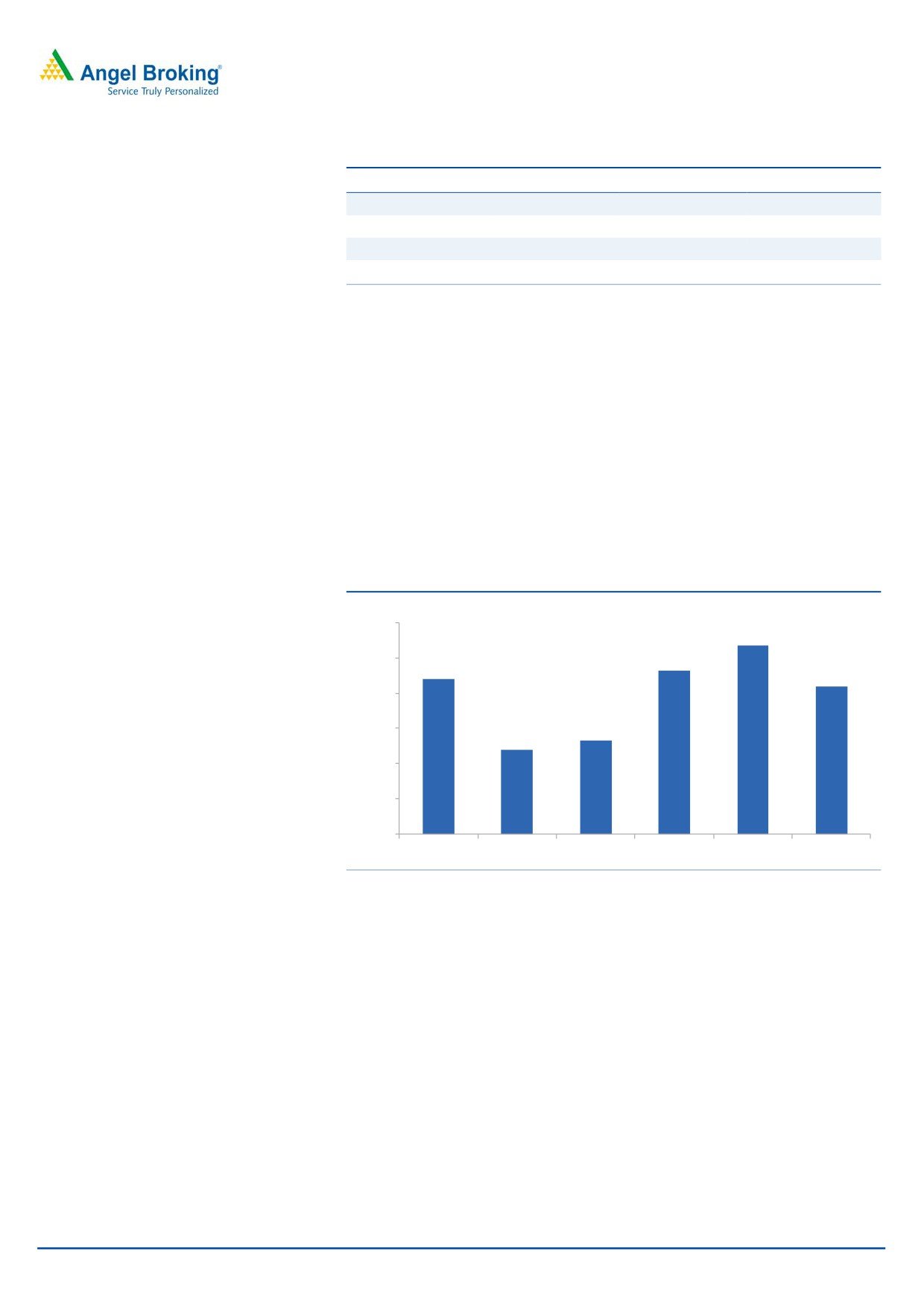

Exhibit 4: Volume performance

(mn tn)

12.5

12.0

12.2

11.8

11.5

11.7

11.6

11.0

10.8

10.5

10.7

10.0

9.5

1QFY15

2QFY15

3QFY15

4QFY15

1QFY16

3QFY16

Source: Company, Angel Research

EBITDA margin improves by 275bp yoy

The EBITDA margin for the quarter improved by 275bp yoy to 18.2% on account

of healthy top-line growth and lower operating costs. Operating efficiency was led

by 11.4% yoy fall in power expenses, mainly due to decline in pet coke prices. The

lower input costs would be reflected in the coming quarters as well. The company

consumed 74% pet coke during the quarter as against 65% consumption in

2QFY2016. Freight cost/tonne at `1,205 remained flat yoy, while it declined

5.5% qoq (`1,276 in 2QFY2016) due lower diesel prices. The company intends to

optimize fuel costs by increasing pet coke consumption levels to 85-90% across

plants from the current levels of 74%.

January 27, 2016

3

UltraTech Cement | 3QFY2016 Result Update

Per-tonne analysis

During 2QFY2016, UltraTech’s raw material cost/tonne declined marginally by

0.4% yoy. The power and fuel cost/tonne declined by13.9% yoy, mainly due to

higher pet coke consumption. Pet coke prices have corrected by 18% yoy, thus

resulting in lower power & fuel cost/tonne. Freight cost/tonne remained flat yoy; it

however declined by 5.5% qoq. The company’s operating cost/tonne declined by

4.6% yoy to `4,055 during the quarter. The company’s operating profit/tonne rose

by 16.1% yoy to `900, during the quarter.

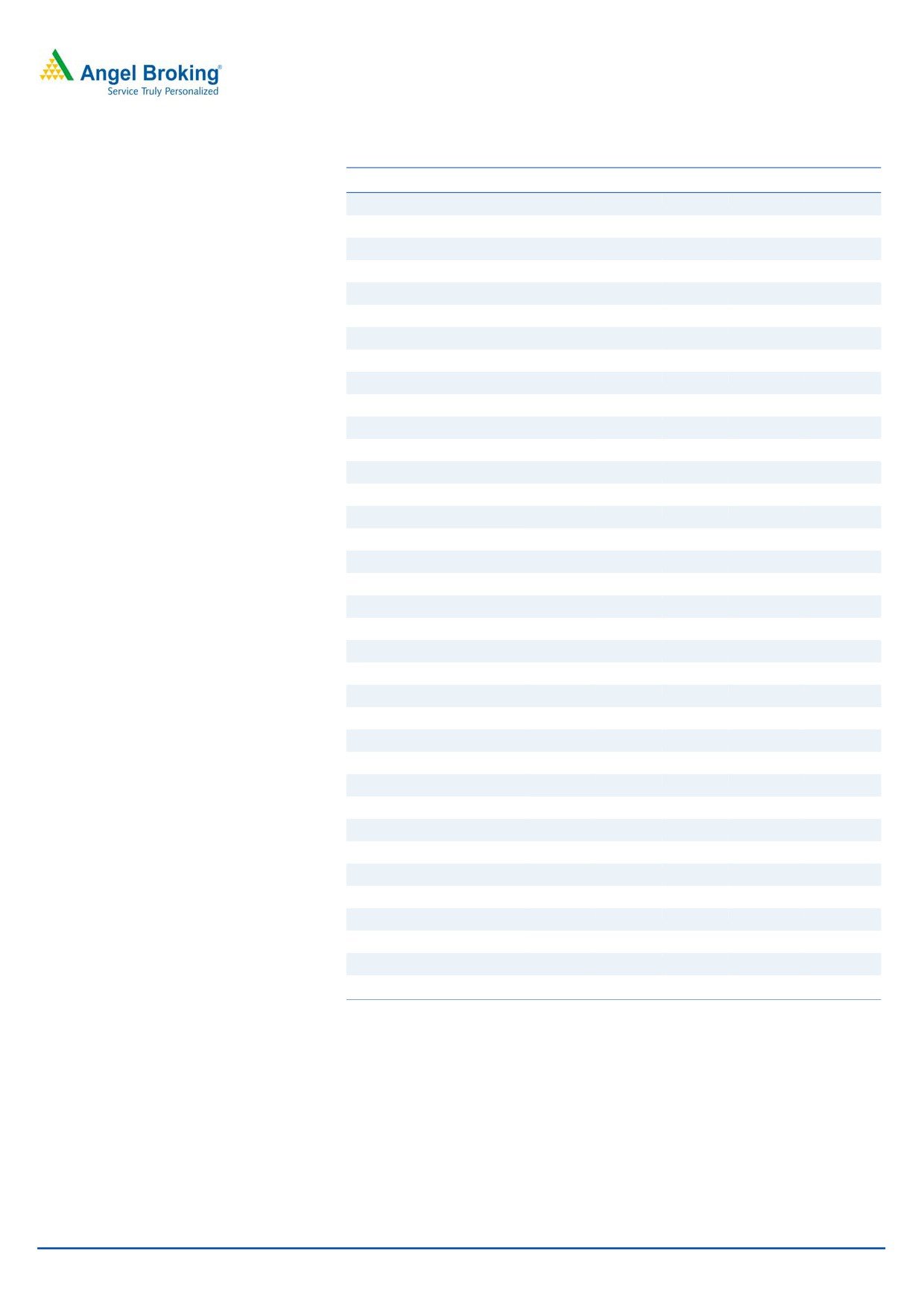

Exhibit 5: Operational performance

Particulars (`/tonne)

3QFY2016 2QFY2016 3QFY2015 qoq chg (%) yoy chg (%)

Net Realization/tonne

4,955

4,962

5,027

(0.1)

(1.4)

Net Raw-Material Cost/tonne

690

775

693

(11.0)

(0.4)

Power and Fuel cost/tonne

921

902

1,070

2.1

(13.9)

Freight Cost/tonne

1,205

1,276

1,206

(5.5)

(0.1)

Other Cost/tonne

844

770

905

9.5

(6.7)

Operating costs/tonne

4,055

4,064

4,252

(0.2)

(4.6)

Operating Profit/tonne

900

898

775

0.2

16.1

Source: Company, Angel Research

Investment arguments

Update on capacity addition plans: UltraTech is the largest cement company in

India with its current capacity standing at 64.7mtpa. The company commissioned

1.6mtpa grinding units each in Jhajjar, Haryana and Dhankuni, West Bengal

during the quarter. The acquisition of JP Associates’ two plants at Bela and Sidhi

district of Madhya Pradesh has been delayed due to provision in new Mines and

Minerals Development and Regulation Act 2015. The new act restricts transfer of

mines that were not allotted through the auction process. The Management expects

the integration of the JP Associates’ Madhya Pradesh units to be completed by

March 2016 end. Post this acquisition, UltraTech’s capacity would increase to

71.2mtpa by the end of FY2017.

Outlook and valuation:

We expect UltraTech to post a 13.6% CAGR in its top-line on back of new capacity

expansion and expected healthy realization over FY2015-17. The company’s

bottom-line is expected to grow at a CAGR of 28% yoy over the same period. At

the current levels, the stock is trading at 13x EV/EBITDA and at EV/tonne of

US$165 on FY2017E capacity. We maintain our Accumulate rating on the stock

with a revised target price of `3,107.

Company Background

UltraTech became India's largest cement player on a standalone basis, with total

capacity of 64.7 mtpa post the merger of Jaiprakash Associates’ Gujarat’s

4.8mtpa unit with itself in 1QFY2015. UltraTech also acquired a controlling stake

in Dubai-based ETA Star (cement capacities of 3mtpa in the Middle East and

Bangladesh) in 2010, which took its total consolidated capacity to 67.7mtpa.

UltraTech is a pan-India player, with 22 cement plants spread across the country.

January 27, 2016

4

UltraTech Cement | 3QFY2016 Result Update

Profit and Loss statement (Standalone)

Y/E March (` cr)

FY2013

FY2014

FY2015

FY2016E

FY2017E

Net Sales

20,018

20,078

22,656

24,669

29,265

Other operating income

157

202

280

-

-

Total operating income

20,175

20,280

22,936

24,669

29,265

% chg

10.2

0.5

13.1

7.6

18.6

Total Expenditure

15,499

16,494

18,741

20,192

23,245

Net Raw Materials

2,910

3,327

3,560

3,992

4,625

Other Mfg costs

4,299

4,135

4,743

4,794

5,443

Personnel

968

1,015

1,218

1,401

1,611

Other

7,323

8,017

9,220

10,004

11,566

EBITDA

4,675

3,785

4,195

4,478

6,020

% chg

12.7

(19.0)

10.8

6.7

34.4

(% of Net Sales)

23.4

18.9

18.5

18.2

20.6

Depreciation& Amortization

945

1,052

1,133

1,354

1,545

EBIT

3,730

2,733

3,062

3,124

4,475

% chg

15.0

(26.7)

12.0

2.0

43.2

(% of Net Sales)

18.6

13.6

13.5

12.7

15.3

Interest & other Charges

210

319

547

569

547

Other Income

305

329

372

673

788

(% of PBT)

8.0

12.0

12.9

20.9

16.7

Recurring PBT

3,825

2,743

2,886

3,228

4,716

% chg

12.8

(28.3)

5.2

11.9

46.1

Extraordinary Expense/(Inc.)

-

-

-

-

-

PBT (reported)

3,825

2,743

2,886

3,228

4,716

Tax

1,170.0

631.0

871.5

974.8

1,424.0

(% of PBT)

30.6

23.0

30.2

30.2

30.2

PAT (reported)

2,655

2,112

2,015

2,253

3,292

ADJ. PAT

2,655

2,016

2,015

2,253

3,292

% chg

8.6

(24.1)

(0.1)

11.9

46.1

(% of Net Sales)

13.3

10.0

8.9

9.1

11.2

Basic EPS (`)

97

74

73

82

120

Fully Diluted EPS (`)

97

74

73

82

120

January 27, 2016

5

UltraTech Cement | 3QFY2016 Result Update

Balance Sheet (standalone)

Y/E March (` cr)

FY2013

FY2014

FY2015

FY2016E

FY2017E

SOURCES OF FUNDS

Equity Share Capital

274

274

274

274

274

Reserves& Surplus

14,961

16,823

18,583

20,653

23,609

Shareholders Funds

15,235

17,098

18,858

20,928

23,883

Total Loans

5,409

5,199

7,414

7,414

7,414

Deferred Tax Liability

1,906

2,296

2,792

2,792

2,792

Other long term liabilities

2

2

1

1

1

Long term provisions

134

138

138

138

138

Total Liabilities

22,685

24,733

29,203

31,273

34,229

APPLICATION OF FUNDS

Gross Block

21,382

25,078

30,660

35,660

39,660

Less: Acc. Depreciation

8,260

9,206

10,339

11,693

13,238

Net Block

13,122

15,872

20,321

23,968

26,423

Capital Work-in-Progress

3,505

2,042

2,700

700

1,700

Goodwill

-

-

-

-

-

Investments

5,109

5,392

5,209

5,209

5,209

Long term loans and adv.

983

1,181

1,181

1,181

1,181

Current Assets

4,689

5,268

5,805

6,782

7,169

Cash

143

278

214

609

271

Loans & Advances

1,173

1,326

1,620

1,819

2,104

Other

3,373

3,665

3,971

4,353

4,794

Current liabilities

4,724

5,021

6,012

6,565

7,452

Net Current Assets

(35)

247

(207)

216

(283)

Mis. Exp. not written off

-

-

-

-

-

Total Assets

22,685

24,733

29,203

31,273

34,229

January 27, 2016

6

UltraTech Cement | 3QFY2016 Result Update

Cash flow statement (Standalone)

Y/E March (` cr)

FY2013

FY2014

FY2015

FY2016E FY2017E

Profit before tax

3,825

2,743

2,886

3,228

4,716

Depreciation

945

1,052

1,133

1,354

1,545

Change in Working Capital

808

(340)

391

(29)

162

Add: Interest expenses

210

319

547

569

547

Less: Other income

305

329

372

673

788

Direct taxes paid

1,170

631

872

975

1,424

Cash Flow from Operations

4,313

2,814

3,714

3,474

4,757

(Inc)/ Decin Fixed Assets

(3,977)

(2,232)

(6,241)

(3,000)

(5,000)

(Inc)/ Dec in Investments

(1,320)

(283)

183

-

-

Other income

305

329

372

673

788

Cash Flow from Investing

(4,992)

(2,186)

(5,686)

(2,327)

(4,212)

Issue of Equity

0

0

0

-

-

Inc./(Dec.) in loans

1,256

(209)

2,214

0

0

Dividend Paid (Incl. Tax)

289

289

297

332

486

Others

334

(4)

9

457

420

Cash Flow from Financing

633

(493)

1,908

(790)

(906)

Inc./(Dec.) in Cash

(46)

135

(64)

358

(360)

Opening Cash balances

188

143

277

214

572

Closing Cash balances

143

277

214

572

211

January 27, 2016

7

UltraTech Cement | 3QFY2016 Result Update

Key Ratios

Y/E March

FY2013

FY2014

FY2015

FY2016E

FY2017E

Valuation Ratio (x)

P/E (on FDEPS)

28.3

37.3

37.3

33.4

22.8

P/CEPS

20.9

23.7

23.9

20.8

15.5

P/BV

4.9

4.4

4.0

3.6

3.1

Dividend yield (%)

0.4

0.4

0.4

0.4

0.6

EV/Sales

3.7

3.7

3.4

3.2

2.7

EV/EBITDA

15.8

19.8

18.4

17.6

13.0

EV / Total Assets

3.2

3.0

2.6

2.5

2.3

Per Share Data (`)

EPS (Basic)

96.8

73.5

73.4

82.1

120.0

EPS (fully diluted)

96.8

73.5

73.4

82.1

120.0

Cash EPS

131.3

115.4

114.7

131.5

176.3

DPS

10.5

10.5

10.8

12.1

17.7

Book Value

555.7

623.5

687.2

762.7

870.4

Dupont Analysis

EBIT margin

18.5

13.5

13.3

12.7

15.3

Tax retention ratio

69.4

77.0

69.8

69.8

69.8

Asset turnover (x)

1.0

0.9

0.9

0.8

0.9

ROIC (Post-tax)

12.6

9.0

8.0

7.3

9.7

Cost of Debt (Post Tax)

3.1

4.6

6.1

5.4

5.2

Leverage (x)

0.3

0.3

0.4

0.4

0.3

Operating ROE

15.8

10.4

8.7

8.0

11.2

Returns (%)

ROCE (Pre-tax)

18.0

11.5

11.4

10.3

13.7

Angel ROIC (Pre-tax)

26.6

17.7

16.1

13.6

17.3

ROE

18.9

12.5

11.2

11.3

14.7

Turnover ratios (x)

Asset Turnover (Gross Block)

1.0

0.9

0.8

0.7

0.8

Inventory / Sales (days)

40

42

41

43

39

Receivables (days)

16

21

20

19

17

Payables (days)

104

108

107

114

110

WC cycle (ex-cash) (days)

(2)

(2)

(4)

(6)

(6)

Solvency ratios (x)

Net debt to equity

0.0

(0.0)

0.1

0.1

0.1

Net debt to EBITDA

0.0

(0.1)

0.5

0.4

0.3

Interest Coverage (EBIT / Int.)

17.8

8.6

5.6

5.5

8.2

January 27, 2016

8

UltraTech Cement | 3QFY2016 Result Update

Research Team Tel: 022 - 39357800

DISCLAIMER

Angel Broking Private Limited (hereinafter referred to as “Angel”) is a registered Member of National Stock Exchange of India Limited,

Bombay Stock Exchange Limited and Metropolitan Stock Exchange of India Limited. It is also registered as a Depository Participant with

CDSL and Portfolio Manager with SEBI. It also has registration with AMFI as a Mutual Fund Distributor. Angel Broking Private Limited is

a registered entity with SEBI for Research Analyst in terms of SEBI (Research Analyst) Regulations, 2014 vide registration number

INH000000164. Angel or its associates has not been debarred/ suspended by SEBI or any other regulatory authority for accessing

/dealing in securities Market. Angel or its associates including its relatives/analyst do not hold any financial interest/beneficial

ownership of more than 1% in the company covered by Analyst. Angel or its associates/analyst has not received any compensation /

managed or co-managed public offering of securities of the company covered by Analyst during the past twelve months. Angel/analyst

has not served as an officer, director or employee of company covered by Analyst and has not been engaged in market making activity

of the company covered by Analyst.

This document is solely for the personal information of the recipient, and must not be singularly used as the basis of any investment

decision. Nothing in this document should be construed as investment or financial advice. Each recipient of this document should

make such investigations as they deem necessary to arrive at an independent evaluation of an investment in the securities of the

companies referred to in this document (including the merits and risks involved), and should consult their own advisors to determine

the merits and risks of such an investment.

Reports based on technical and derivative analysis center on studying charts of a stock's price movement, outstanding positions and

trading volume, as opposed to focusing on a company's fundamentals and, as such, may not match with a report on a company's

fundamentals.

The information in this document has been printed on the basis of publicly available information, internal data and other reliable

sources believed to be true, but we do not represent that it is accurate or complete and it should not be relied on as such, as this

document is for general guidance only. Angel Broking Pvt. Limited or any of its affiliates/ group companies shall not be in any way

responsible for any loss or damage that may arise to any person from any inadvertent error in the information contained in this report.

Angel Broking Pvt. Limited has not independently verified all the information contained within this document. Accordingly, we cannot

testify, nor make any representation or warranty, express or implied, to the accuracy, contents or data contained within this document.

While Angel Broking Pvt. Limited endeavors to update on a reasonable basis the information discussed in this material, there may be

regulatory, compliance, or other reasons that prevent us from doing so.

This document is being supplied to you solely for your information, and its contents, information or data may not be reproduced,

redistributed or passed on, directly or indirectly.

Neither Angel Broking Pvt. Limited, nor its directors, employees or affiliates shall be liable for any loss or damage that may arise from

or in connection with the use of this information.

Note: Please refer to the important ‘Stock Holding Disclosure' report on the Angel website (Research Section). Also, please refer to the

latest update on respective stocks for the disclosure status in respect of those stocks. Angel Broking Pvt. Limited and its affiliates may

have investment positions in the stocks recommended in this report.

Disclosure of Interest Statement

UltraTech Cement

1. Analyst ownership of the stock

No

2. Angel and its Group companies ownership of the stock

No

3. Angel and its Group companies' Directors ownership of the stock

No

4. Broking relationship with company covered

No

Note: We have not considered any Exposure below ` 1 lakh for Angel, its Group companies and Directors

Ratings (Based on expected returns

Buy (> 15%)

Accumulate (5% to 15%)

Neutral (-5 to 5%)

over 12 months investment period):

Reduce (-5% to -15%)

Sell (< -15)

January 27, 2016

9