4QFY2016 Result Update | Agrichemical

May 3, 2016

United Phosphorus

BUY

CMP

`595

Performance Highlights

Target Price

`684

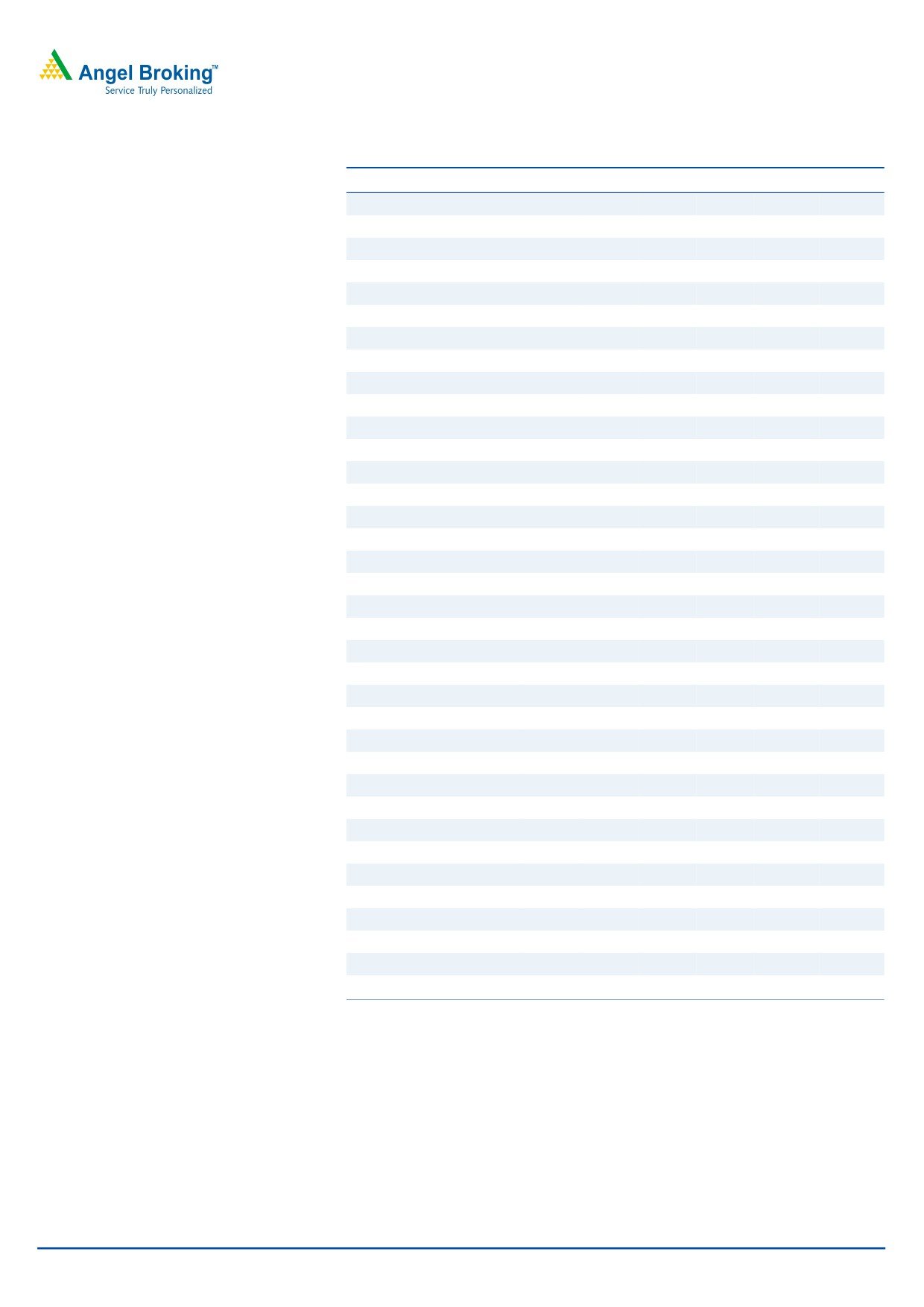

Y/E March (` cr)

4QFY2016 3QFY2016

% chg (qoq) 4QFY2015

% chg (yoy)

Investment Period

12 Months

Net sales

4,292

3050

40.7

3563

20.5

Other income

120

131

(8.2)

16

652.3

Stock Info

Gross profit

2143

1652

29.7

1702

25.9

Sector

Agrichemical

Operating profit

927

579

60.0

711

30.3

Market Cap (` cr)

25,487

Adj. net profit

574

306

87.8

451

27.4

Net Debt (` cr)

1,113

Source: Company, Angel Research

Beta

1.1

52 Week High / Low

600/342

For 4QFY2016, United Phosphorus (UPL) posted sales of `4,292cr, up 20.5% yoy,

Avg. Daily Volume

143071

mainly led by 25% growth in volume and a 1% rise in price. The exchange rate

Face Value (`)

2

dipped by

6.0% during the quarter. In terms of geography, Latin America

BSE Sensex

25,437

(`1,428cr), Europe (`872cr), USA (`971cr), and India (`417cr) posted a yoy growth

Nifty

7,806

of 57%, 8%, 13% and 4%, respectively. The ROW region posted flat sales of

`652cr. On the operating front, strong sales growth led the gross margin to come

Reuters Code

UNPO.BO

in at 49.9% (V/s 47.8% in 4QFY2015), while the OPM came in at 21.6% (V/s

Bloomberg Code

UNTP@IN

20.0% in 4QFY2015). Thus, the Adj. net profit came in at `574cr (V/s `451cr in

4QFY2015), a yoy growth of 27.4%. We recommend a buy on the stock.

Shareholding Pattern (%)

Quarterly highlights: For 4QFY2016, United Phosphorus (UPL) posted sales of

Promoters

29.7

`4,292cr, up 20.5% yoy, mainly led by 25% growth in volume and a 1% rise in

MF / Banks / Indian Fls

15.0

price. The exchange rate dipped by

6.0% during the quarter. In terms of

FII / NRIs / OCBs

47.8

geography, Latin America (`1,428cr), Europe (`872cr), USA (`971cr), and India

Indian Public / Others

7.5

(`417cr) posted a yoy growth of 57%, 8%, 13% and 4%, respectively. The ROW

region posted flat sales of `652cr. On the operating front, strong sales growth led

the gross margin to come in at 49.9% (V/s 47.8% in 4QFY2015), while the OPM

Abs. (%)

3m 1yr

3yr

came in at 21.6% (V/s 20.0% in 4QFY2015). Thus, the Adj. net profit came in at

Sensex

3.7

(5.8)

28.9

`574cr (V/s `451cr in 4QFY2015), a yoy growth of 27.4%.

UPL

43.1

21.0

309.4

Outlook and valuation: We expect UPL to post a CAGR of 16.0% and 18.9% in

sales and PAT, respectively, over FY2016-18E. The Management has given its

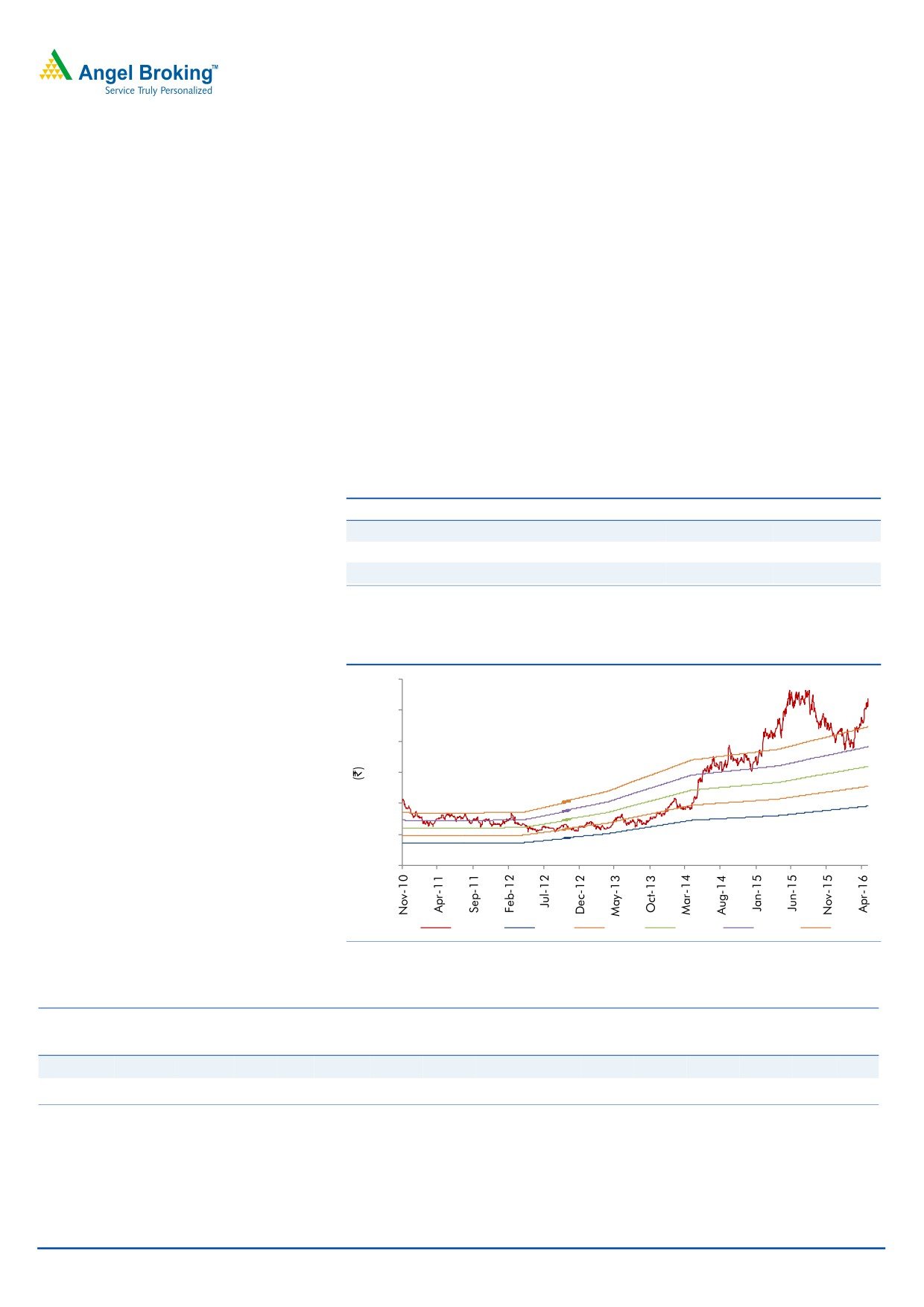

3-year price chart

guidance of 12-15% volume growth with 60-100bp margin expansion in FY2017. We

recommend a buy rating on the stock.

Key financials (Consolidated)

Y/E March (` cr)

FY2015

FY2016

FY2017E

FY2018E

Total revenue

11,911

13,083

15,176

17,604

% chg

12.6

9.8

16.0

16.0

Adj. profit

1,147

1,352

1,601

1,912

% chg

10.2

17.9

18.5

19.4

EBITDA (%)

18.3

18.5

18.5

18.5

EPS (`)

26.7

31.5

37.4

44.6

Source: Company, Angel Research

P/E (x)

22.2

18.9

15.9

13.3

P/BV (x)

4.3

3.8

3.1

2.6

RoE (%)

20.6

21.4

21.4

21.2

RoCE (%)

19.9

20.8

20.6

21.1

Sarabjit Kour Nangra

EV/Sales (x)

2.1

2.0

1.7

1.4

+91-22-3935 7800 ext. 6806

EV/EBITDA (x)

11.6

10.8

9.1

7.6

Source: Company, Angel Research; Note: CMP as of May 2, 2016

Please refer to important disclosures at the end of this report

1

United Phosphorus | 4QFY2016 Result Update

Exhibit 1: 4QFY2016 Performance (Consolidated)

Y/E March (` cr)

4QFY2016

3QFY2016

% chg (qoq)

4QFY2015

% chg (yoy) FY2016 FY2015

% chg

Net sales

4,292

3,050

40.7

3,563

20.5

13,083

11,911

9.8

Other income

120

131

(8.2)

16

652.3

383

177

117.0

Total income

4,413

3,181

38.7

3,579

23.3

13,466

12,088

11.4

Gross profit

2143

1652

29.7

1702

25.9

6671

5895

13.2

Gross margin (%)

49.9

54.2

47.8

51.0

49.5

Operating profit

927

579

60.0

711

30.3

2419

2175

11.2

Operating margin (%)

21.6

19.0

20.0

18.5

18.3

Financial cost

203

182

12.0

123

65.4

622

517

Depreciation

159

123

29.1

103

54.4

502

425

18.2

PBT

684

405

68.9

501

36.6

1679

1410

19.0

Provision for taxation

64

73

(11.5)

50

28.5

283

244

16.0

PAT Before Exc. And MI

620

333

86.4

451

37.5

1396

1166

19.7

Minority Income/ ( Exp.)

(8)

(8)

(3)

(13)

(43)

Income from Associate/ (Exp)

(35)

(14)

(8)

(31)

21

Extra ordinary Income/( Exp.)

(25)

(24)

0

(53)

(2)

Reported PAT

552

286

92.9

440

25.5

1299

1144

13.5

Adjusted PAT

574

306

87.8

451

27.4

1343

1146

17.2

EPS (`)

13.4

7.1

10.5

31.3

26.7

Source: Company, Angel Research

Top-line growth supported mainly by USA and Latin America

During the quarter, UPL posted a 20.5% yoy growth in sales to `4,292cr, mainly

boosted by 13% and 57% yoy growth in USA and Latin America, respectively.

Other key markets like India and Europe posted a growth of 4% and 8% yoy,

respectively. Overall growth was driven by price and volume growth of 1% and

25% respectively, while exchange had a weigh down effect by 6%.

India (`417cr) posted a 4% yoy rise on back of high acceptance of the company’s

insecticides. However, the revenue growth was subdued owing to serious drought

conditions affecting agrochemical usage, both in Kharif & Rabi crops. Channel

inventory continued, resulting in tight liquidity conditions in the market. Europe

(`872cr) posted a 8% yoy rise, benefitting from a mild winter and early spring;

however the North Europe suffered from a dry summer which affected the usage of

cereal fungicides.

Latin America (`1,428cr) posted a strong 57% yoy growth as farmers in Brazil and

Argentina benefitted from currency devaluation for their commodity exports. Ease

of export tax on agricultural commodities in Argentina further aided demand for

the company’s agrochemicals. UPL’s North America (`971cr) business registered a

13% yoy revenue growth, led by healthy demand for its newly launched products.

ROW (`652cr) remained flat. The company expects improved market access

through increased registrations in African countries. The company received an

excellent acceptance for its cotton portfolio in Pakistan, though consumption got

affected due to floods. The company expects North Africa and Iran to grow with US

lifting the economic embargo. In Turkey, significant citrus / berries crop damage

due to frost / hail storm affected fungicides consumption.

May 3, 2016

2

United Phosphorus | 4QFY2016 Result Update

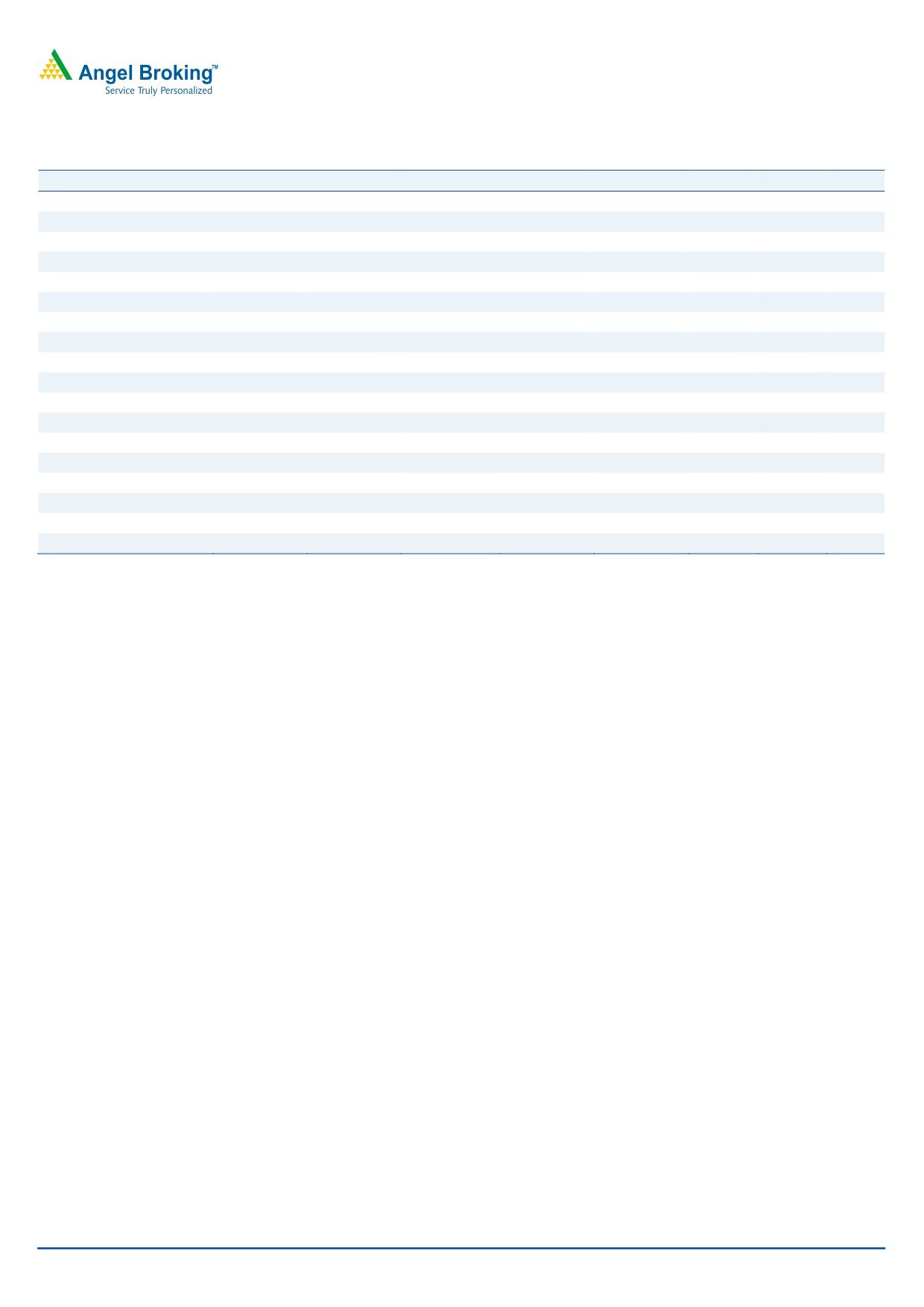

Exhibit 2: Sales Break-up (Marketwise)

100%

923

80%

1,557

1,354

2,080

1,705

60%

505

804

358

40%

300

872

1,083

401

715

498

417

20%

862

971

553

594

374

0%

4QFY2015

1QFY2016

2QFY2016

3QFY2016

4QFY2016

North America

India

EU

Others

Source: Company

Exhibit 3: Sales performance (including export incentives)

Exhibit 4: Growth break-up

4,292

30

4,200

26

3,563

25

3,600

3,064

3,050

20

2,801

3,000

15

2,400

10

1,800

5

1

1,200

0

600

(5)

0

(10)

(6)

4QFY2015

1QFY2016

2QFY2016

3QFY2016

4QFY2016

Exchange impact

Realisation

Volume

Source: Company, Angel Research

Source: Company, Angel Research

Exhibit 5: Volume and realisation break-up (yoy)

30

26

25

18

20

16

15

13

11

10

5

2

3

1

0

0

(2)

(5)

4QFY2015

1QFY2016

2QFY2016

3QFY2016

4QFY2016

Realisation

Volume

Source: Company, Angel Research

May 3, 2016

3

United Phosphorus | 4QFY2016 Result Update

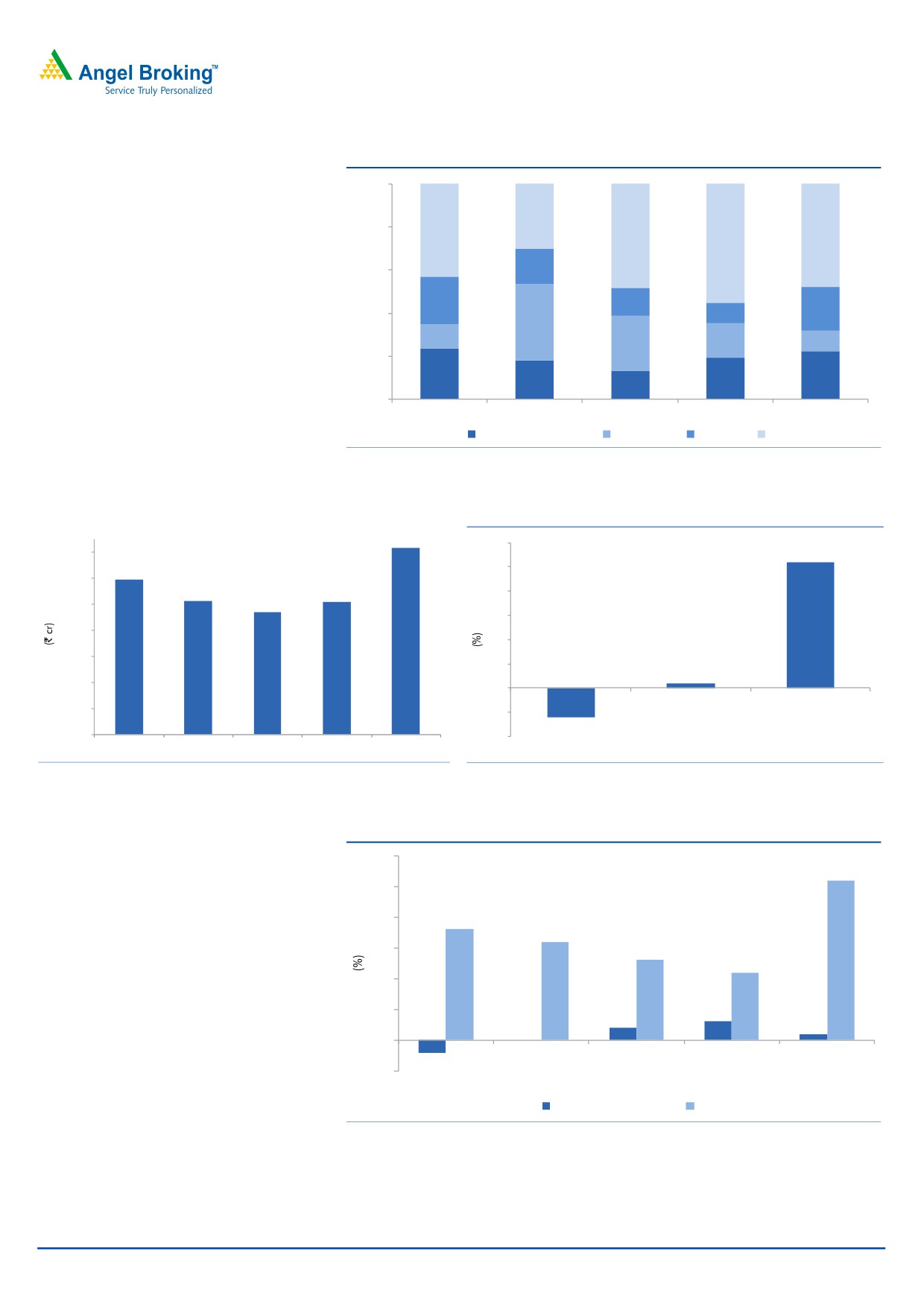

EBITDA margin improves

On the operating front, strong sales growth led the gross margin to come in at

49.9% V/s (47.8% in 4QFY2015) and the OPM to come in at 21.6% (V/s 20.0% in

4QFY2015) (supported by healthy volume growth and price rise).

Exhibit 6: EBITDA margin trend

25.0

24.0

23.0

22.0

21.0

21.6

20.0

20.0

19.0

19.0

18.0

17.0

17.3

16.0

16.5

15.0

4QFY2015

1QFY2016

2QFY2016

3QFY2016

4QFY2016

Source: Company, Angel Research

Adj net profit grew 27.4% yoy

A strong top-line and operating performance aided the Adj. net profit to come in

at `574cr V/s `451cr in 4QFY2015, a growth of 27.4% yoy. Other income during

the quarter came in at `120cr V/s `16cr in 4QFY2015, a yoy growth of 652.3%.

Exhibit 7: Adjusted PAT trend

700

30

574

600

25

500

451

20

400

306

15

285

300

190

10

200

5

100

0

0

4QFY2015

1QFY2016

2QFY2016

3QFY2016

4QFY2016

Adj PAT

% YoY

Source: Company, Angel Research

May 3, 2016

4

United Phosphorus | 4QFY2016 Result Update

Concall Highlights

The company targets a revenue growth of 12-15% (at constant currency) for

FY2017 on the back of volumes. It expects EBITDA margin to improve 60-

100bp, driven by improvement in gross margins.

The company is targeting a RoCE of 23-25% over the next 3-5 years. It plans

to invest `850cr including on product registrations.

UPL attained an innovation rate (contribution of products launched in the last

5 years) of ~14% in FY2016 (v/s 5% in FY2015 and v/s 2.5% in FY2014). It is

targeting to attain ~15% in FY2017. In India business, 28-29% of revenues

come from innovative products.

UPL’s LatAm business grew by ~25% as against 18-20% decline for the

industry, driven by new product launches. It applied for

~20 product

registrations in CY2015 and plans for another ~20 registrations in CY2016.

Hence, it expects strong growth in LatAm to continue.

UPL continued to gain market share in the global agro-chemical industry.

While its revenues grew ~10% in FY2016 (~18% on constant currency basis),

global industry declined by ~9.6% in CY2015.

Investment arguments

Innovators dominant in the off-patent space; Generic firms in

a sweet spot

The global agrichem industry, valued at US$53bn (CY2014), is dominated by the

top six innovators, viz Bayer, Syngenta, Monsanto, BASF, DuPont and Dow, which

enjoy a large market share of the patented (28%) and off-patent (32%) market.

The top six innovators enjoy a large share of the off-patent market due to high

entry barriers for pure generic players. Thus, one-third of the total pie worth

US$18bn, which is controlled by the top six innovators through proprietary

off-patent products, provides a high-growth opportunity for larger integrated

generic players like UPL.

Generic segment’s market share to increase

Generic players have been garnering a high market share; their share has

increased from 32% levels in 1998 to 40% by 2006-end. The industry registered a

CAGR of 3% over 1998-2006, while generic players outpaced the industry with a

CAGR of 6%. Going ahead, given the opportunities and a drop in the rate of new

molecule introduction by innovators, we expect generic players to continue to

outpace the industry’s growth rate and augment their market share in the overall

pie. Historically, global agrichem players have been logging in-line growth with

global GDP. Going ahead, over CY2016-17, the global economy is expected to

grow by 2-3%. Assuming this trend plays out in terms of growth for the agrichem

industry, and the same rate of genericisation occurs, then the agrichemical generic

industry could log in 6-8% yoy growth during the period and garner a market

share of 44-45%.

May 3, 2016

5

United Phosphorus | 4QFY2016 Result Update

A global generic play

UPL figures among the top five global generic agrichemical players with presence

across major markets including the US, EU, Latin America, and India. Given the

high entry barriers by way of high investments, entry of new players is restricted.

Thus, amidst this scenario and on account of having a low-cost base,

we believe UPL enjoys an edge over competition and is placed in a sweet spot to

leverage the upcoming opportunities in the global generic space.

May 3, 2016

6

United Phosphorus | 4QFY2016 Result Update

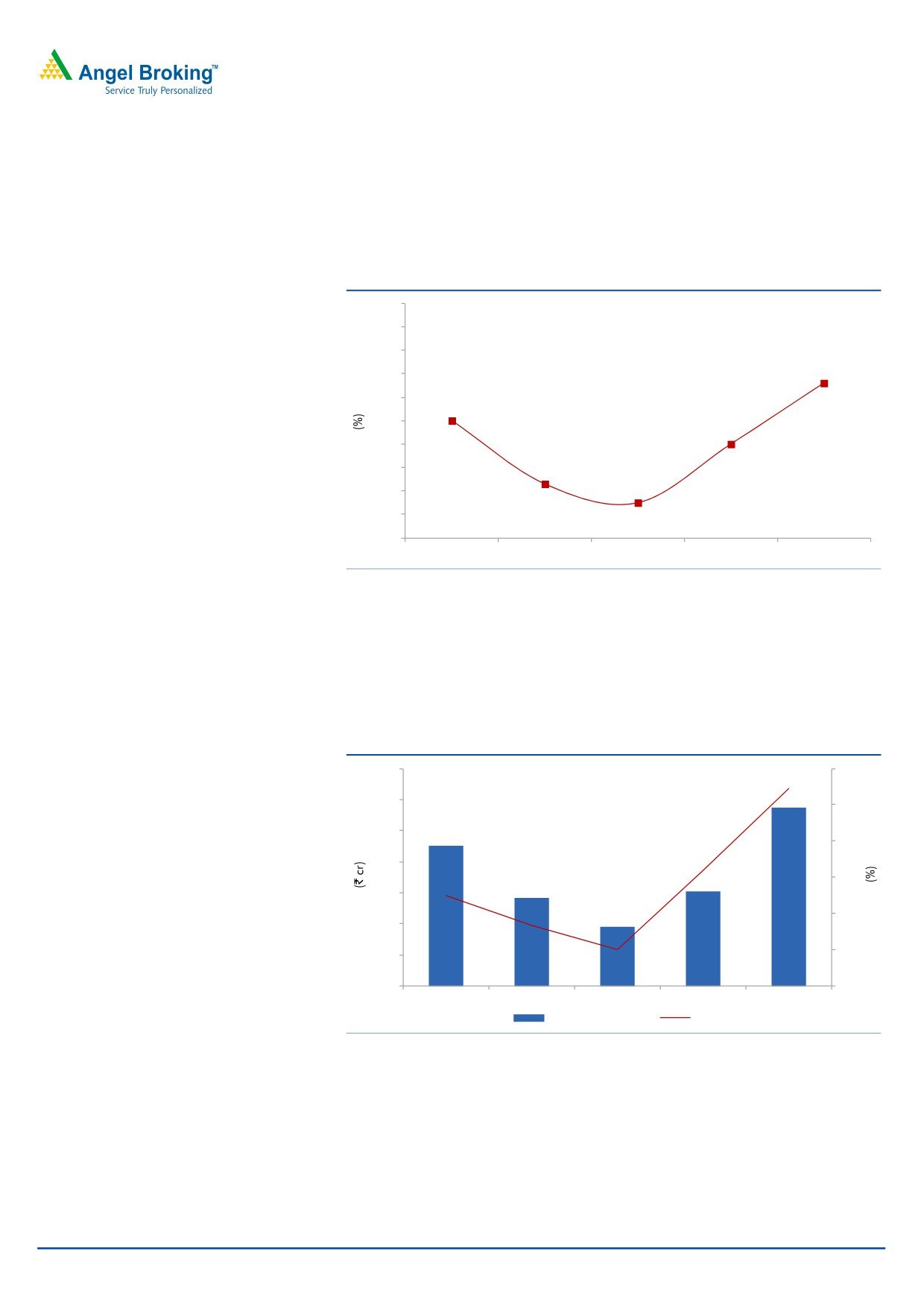

Outlook and valuation

Over the last few years, the global agriculture sector has been reviving on the back

of rising food prices. Food security is also a top priority for most governments;

reducing food loss is one of the easiest ways to boost food inventory. Hence, we

believe agrichemical companies would continue to do well in the wake of

heightened food security risks, and strong demand is likely to be witnessed across

the world. Overall, we expect the global agrichemical industry to perform well

from here on. Generics are expected to register a healthy growth due to a)

increasing penetration and wresting market share from innovators and b) patent

expiries worth US$3bn-4bn during the next five years.

We estimate UPL to post a 16.0% and 18.9% CAGR in sales and PAT, respectively,

over FY2016-18E. We believe at the current market price the stock provides decent

upsides (13.3x FY2018E EPS). Hence we recommend a buy rating on the stock.

Exhibit 8: Key assumption

FY2017E

FY2018E

Sales growth

16.0

16.0

EBITDA margin

18.5

19.4

Tax rate

20.0

20.0

Source: Company, Angel Research

Exhibit 9: P/E band

600

500

400

300

200

100

0

Price

6x

8x

10x

12x

14x

Source: Company, Angel Research

Exhibit 10: Peer valuation

Company Reco

Mcap CMP TP Upside

P/E (x)

EV/Sales (x)

EV/EBITDA (x)

RoE (%)

CAGR (%)

(` cr)

(`)

(`)

(%) FY17E FY18E FY17E FY18E FY17E FY18E FY17E FY18E Sales PAT

Rallis

Neutral

3,817

196

-

-

21.7

17.8

2.2

1.9

16.4

13.3

18.4

19.8

15.0

22.3

UPL

Buy

25,487

595

684

15.0

15.9

13.3

1.7

1.4

9.1

7.6

21.4

21.2

16.0

18.9

Source: Company, Angel Research, Bloomberg

May 3, 2016

7

United Phosphorus | 4QFY2016 Result Update

Company background

United Phosphorus (UPL) is a global generic crop protection, chemicals and seeds

company. The company is fully backward and forward integrated by taking

advantage of the consolidation opportunities within the agrochemical industry. UPL

is the largest Indian agrochemical company and had revenue of about `13,083cr

for the year ended March 2016.

Profit & Loss Statement (Consolidated)

Y/E March (` cr)

FY2013

FY2014

FY2015

FY2016

FY2017E

FY2018E

Net Sales

9,010

10,580

11,911

13,083

15,176

17,604

Other operating income

184

191

45

219

219

219

Total operating income

9,195

10,771

11,956

13,302

15,395

17,823

% chg

19.9

17.1

11.0

11.3

15.7

15.8

Total Expenditure

7,568

8,751

9,736

10,663

12,369

14,349

Net Raw Materials

4,687

5,441

6,016

6,411

7,437

8,627

Other Mfg costs

741

942

980

1,164

1,351

1,567

Personnel

853

946

1,043

1,224

1,420

1,647

Other

1,287

1,422

1,697

1,864

2,162

2,508

EBITDA

1,442

1,829

2,175

2,419

2,806

3,255

% chg

19.6

26.8

19.0

11.2

16.0

16.0

(% of Net Sales)

16.0

17.3

18.3

18.5

18.5

18.5

Depreciation& Amortisation

354

407

425

502

573

629

EBIT

1,273

1,613

1,796

2,137

2,452

2,845

% chg

21.1

26.7

11.4

19.0

14.8

16.0

(% of Net Sales)

13.8

15.0

15.0

16.1

15.9

16.0

Interest & other Charges

429

487

517

622

502

502

Other Income

73

131

131

112

112

112

(% of PBT)

8

10

9

7

5

5

Recurring PBT

917

1,257

1,410

1,626

2,062

2,455

% chg

25.0

37.1

12.2

15.3

26.8

19.1

Extraordinary Expense/(Inc.)

27

85

(2)

(53)

-

-

PBT (reported)

944

1,172

1,413

1,679

2,062

2,455

Tax

203

222

244

283

412

491

(% of PBT)

21.5

18.9

17.3

16.9

20.0

20.0

PAT (reported)

741

950

1,169

1,396

1,649

1,964

Add: Share of earnings of asso.

32

30

21

(31)

(35)

(39)

Less: Minority interest (MI)

(2)

7

43

13

13

13

Prior period items

-

24

-

-

-

-

PAT after MI (reported)

775

950

1,144

1,299

1,601

1,912

ADJ. PAT

754

1,040

1,147

1,352

1,601

1,912

% chg

34.3

38.0

10.2

17.9

18.5

19.4

(% of Net Sales)

8.4

9.8

9.6

10.3

10.6

10.9

Basic EPS (`)

17.0

24.3

26.7

31.5

37.4

44.6

Fully Diluted EPS (`)

17.0

24.3

26.7

31.5

37.4

44.6

% chg

40.1

42.5

10.2

17.9

18.5

19.4

May 3, 2016

8

United Phosphorus | 4QFY2016 Result Update

Balance Sheet (Consolidated)

Y/E March (` cr)

FY2013

FY2014

FY2015

FY2016

FY2017E

FY2018E

SOURCES OF FUNDS

Equity Share Capital

89

86

86

86

86

86

Preference Capital

-

-

-

-

-

-

Reserves& Surplus

4,557

5,162

5,775

6,705

8,092

9,790

Shareholders’ Funds

4,645

5,247

5,860

6,791

8,178

9,875

Minority Interest

234

172

44

42

55

68

Total Loans

4,203

2,873

2,781

3,860

3,860

3,860

Other Long term liab.

395

311

594

464

464

464

Long Term Provisions

51

53

53

53

53

53

Deferred Tax Liability

(13)

57

45

(5)

(5)

(5)

Total Liabilities

9,516

8,714

9,378

11,205

12,605

14,315

APPLICATION OF FUNDS

Gross Block

5,386

6,039

6,792

7,791

8,591

9,391

Less: Acc. Depreciation

3,173

3,580

4,005

4,507

5,080

5,709

Net Block

2,213

2,459

2,787

3,285

3,511

3,682

Capital Work-in-Progress

378

378

378

378

378

378

Goodwill / Intangilbles

1,277

1,212

1,449

1,463

1,463

1,463

Investments

1,025

737

764

1,066

1,066

1,066

Long Term Loan & Adv.

277

389

418

537

532

618

Current Assets

7,154

7,572

8,372

10,069

11,756

14,187

Cash

1,548

1,023

1,010

1,068

1,688

2,508

Loans & Advances

852

771

586

840

1,435

1,664

Other

4,754

5,779

6,776

8,162

8,633

10,015

Current liabilities

2,807

4,033

4,789

5,593

6,102

7,078

Net Current Assets

4,346

3,539

3,582

4,476

5,654

7,109

Others

-

-

-

-

-

-

Total Assets

9,516

8,714

9,378

11,205

12,605

14,315

May 3, 2016

9

United Phosphorus | 4QFY2016 Result Update

Cash Flow Statement (Consolidated)

Y/E March (` cr)

FY2013 FY2014 FY2015 FY2016 FY2017E FY2018E

Profit before tax

944

1,172

1,413

1,679

2,062

2,455

Depreciation

354

407

425

502

573

629

Change in Working Capital

(806)

171

(86)

(955)

(553)

(720)

Less: Other income

-

-

-

-

-

-

Direct taxes paid

(203)

(222)

(244)

(283)

(412)

(491)

Cash Flow from Operations

288

1,528

1,508

942

1,670

1,873

(Inc.)/ Dec. in Fixed Assets

(771)

(653)

(753)

(1,000)

(800)

(800)

(Inc.)/ Dec. in Investments

(231)

-

-

-

-

-

Inc./ (Dec.) in loans and adv.

-

-

-

-

-

-

Other income

-

-

-

-

-

-

Cash Flow from Investing

(1,002)

(653)

(753)

(1,000)

(800)

(800)

Issue of Equity

-

(3)

-

-

-

-

Inc./(Dec.) in loans

(908)

1,413

(192)

(949)

0

0

Dividend Paid (Incl. Tax)

(129)

(201)

(214)

(214)

(214)

(214)

Others

1,733

(2,612)

(362)

1,278

(35)

(39)

Cash Flow from Financing

696

(1,403)

(768)

115

(249)

(253)

Inc./(Dec.) in Cash

(18)

(525)

(13)

58

620

820

Opening Cash balances

1,566

1,548

1,023

1,010

1,068

1,688

Closing Cash balances

1,548

1,023

1,010

1,068

1,688

2,508

May 3, 2016

10

United Phosphorus | 4QFY2016 Result Update

Key Ratios

Y/E March

FY2013

FY2014

FY2015

FY2016

FY2017E

FY2018E

Valuation Ratio (x)

P/E (on FDEPS)

34.9

24.5

22.2

18.9

15.9

13.3

P/CEPS

23.8

17.6

16.2

13.8

11.7

10.0

P/BV

5.7

4.9

4.3

3.8

3.1

2.6

Dividend yield (%)

0.4

0.4

0.4

0.4

0.4

0.4

EV/Sales

2.9

2.4

2.1

2.0

1.7

1.4

EV/EBITDA

18.0

13.9

11.6

10.8

9.1

7.6

EV / Total Assets

2.7

2.9

2.7

2.3

2.0

1.7

Per Share Data (`)

EPS (Basic)

17.0

24.3

26.7

31.5

37.4

44.6

EPS (fully diluted)

17.0

24.3

26.7

31.5

37.4

44.6

Cash EPS

25.0

33.8

36.7

43.2

50.7

59.3

DPS

2.5

2.5

2.5

2.5

2.5

2.5

Book Value

105.0

122.4

136.7

158.4

190.8

230.4

DuPont Analysis

EBIT margin

13.8

15.0

15.0

16.1

15.9

16.0

Tax retention ratio

78.5

81.1

82.7

83.1

80.0

80.0

Asset turnover (x)

1.4

1.5

1.6

1.6

1.6

1.7

ROIC (Post-tax)

15.4

18.5

20.3

21.0

20.4

21.8

Cost of Debt (Post Tax)

8.9

11.2

15.1

15.6

10.4

10.4

Leverage (x)

0.5

0.5

0.3

0.4

0.3

0.2

Operating ROE

18.6

21.9

22.0

22.9

23.8

24.1

Returns (%)

ROCE (Pre-tax)

14.4

17.7

19.9

20.8

20.6

21.1

Angel ROIC (Pre-tax)

20.0

23.2

24.7

25.6

25.9

27.6

ROE

17.1

21.0

20.6

21.4

21.4

21.2

Turnover ratios (x)

Asset Turnover (Gross Block)

1.8

1.9

1.9

1.8

1.9

2.0

Inventory / Sales (days)

78

83

86

86

84

84

Receivables (days)

102

83

86

86

84

84

Payables (days)

108

69

72

73

71

71

WCcycle (ex-cash) (days)

96

92

78

83

89

89

Solvency ratios (x)

Net debt to equity

0.4

0.6

0.4

0.3

0.4

0.3

Net debt to EBITDA

1.5

1.8

1.0

0.8

1.2

0.8

Interest Coverage (EBIT / Int.)

3.0

3.3

3.5

3.4

4.9

5.7

May 3, 2016

11

United Phosphorus | 4QFY2016 Result Update

Research Team Tel: 022 - 39357800

DISCLAIMER

Angel Broking Private Limited (hereinafter referred to as “Angel”) is a registered Member of National Stock Exchange of India Limited,

Bombay Stock Exchange Limited and Metropolitan Stock Exchange of India Limited. It is also registered as a Depository Participant with

CDSL and Portfolio Manager with SEBI. It also has registration with AMFI as a Mutual Fund Distributor. Angel Broking Private Limited is

a registered entity with SEBI for Research Analyst in terms of SEBI (Research Analyst) Regulations, 2014 vide registration number

INH000000164. Angel or its associates has not been debarred/ suspended by SEBI or any other regulatory authority for accessing

/dealing in securities Market. Angel or its associates including its relatives/analyst do not hold any financial interest/beneficial

ownership of more than 1% in the company covered by Analyst. Angel or its associates/analyst has not received any compensation /

managed or co-managed public offering of securities of the company covered by Analyst during the past twelve months. Angel/analyst

has not served as an officer, director or employee of company covered by Analyst and has not been engaged in market making activity

of the company covered by Analyst.

This document is solely for the personal information of the recipient, and must not be singularly used as the basis of any investment

decision. Nothing in this document should be construed as investment or financial advice. Each recipient of this document should

make such investigations as they deem necessary to arrive at an independent evaluation of an investment in the securities of the

companies referred to in this document (including the merits and risks involved), and should consult their own advisors to determine

the merits and risks of such an investment.

Reports based on technical and derivative analysis center on studying charts of a stock's price movement, outstanding positions and

trading volume, as opposed to focusing on a company's fundamentals and, as such, may not match with a report on a company's

fundamentals.

The information in this document has been printed on the basis of publicly available information, internal data and other reliable

sources believed to be true, but we do not represent that it is accurate or complete and it should not be relied on as such, as this

document is for general guidance only. Angel Broking Pvt. Limited or any of its affiliates/ group companies shall not be in any way

responsible for any loss or damage that may arise to any person from any inadvertent error in the information contained in this report.

Angel Broking Pvt. Limited has not independently verified all the information contained within this document. Accordingly, we cannot

testify, nor make any representation or warranty, express or implied, to the accuracy, contents or data contained within this document.

While Angel Broking Pvt. Limited endeavors to update on a reasonable basis the information discussed in this material, there may be

regulatory, compliance, or other reasons that prevent us from doing so.

This document is being supplied to you solely for your information, and its contents, information or data may not be reproduced,

redistributed or passed on, directly or indirectly.

Neither Angel Broking Pvt. Limited, nor its directors, employees or affiliates shall be liable for any loss or damage that may arise from

or in connection with the use of this information.

Note: Please refer to the important ‘Stock Holding Disclosure' report on the Angel website (Research Section). Also, please refer to the

latest update on respective stocks for the disclosure status in respect of those stocks. Angel Broking Pvt. Limited and its affiliates may

have investment positions in the stocks recommended in this report.

Disclosure of Interest Statement

UPL

1. Analyst ownership of the stock

No

2. Angel and its Group companies ownership of the stock

No

3. Angel and its Group companies' Directors ownership of the stock

No

4. Broking relationship with company covered

No

Note: We have not considered any Exposure below ` 1 lakh for Angel, its Group companies and Directors

Ratings (Based on expected returns

Buy (> 15%)

Accumulate (5% to 15%)

Neutral (-5 to 5%)

over 12 months investment period):

Reduce (-5% to -15%)

Sell (< -15)

May 3, 2016

12