2QFY2016 Result Update | Educational Services

November 10, 2015

Tree House Education & Accessories

BUY

CMP

`249

Performance Highlights

Target Price

`314

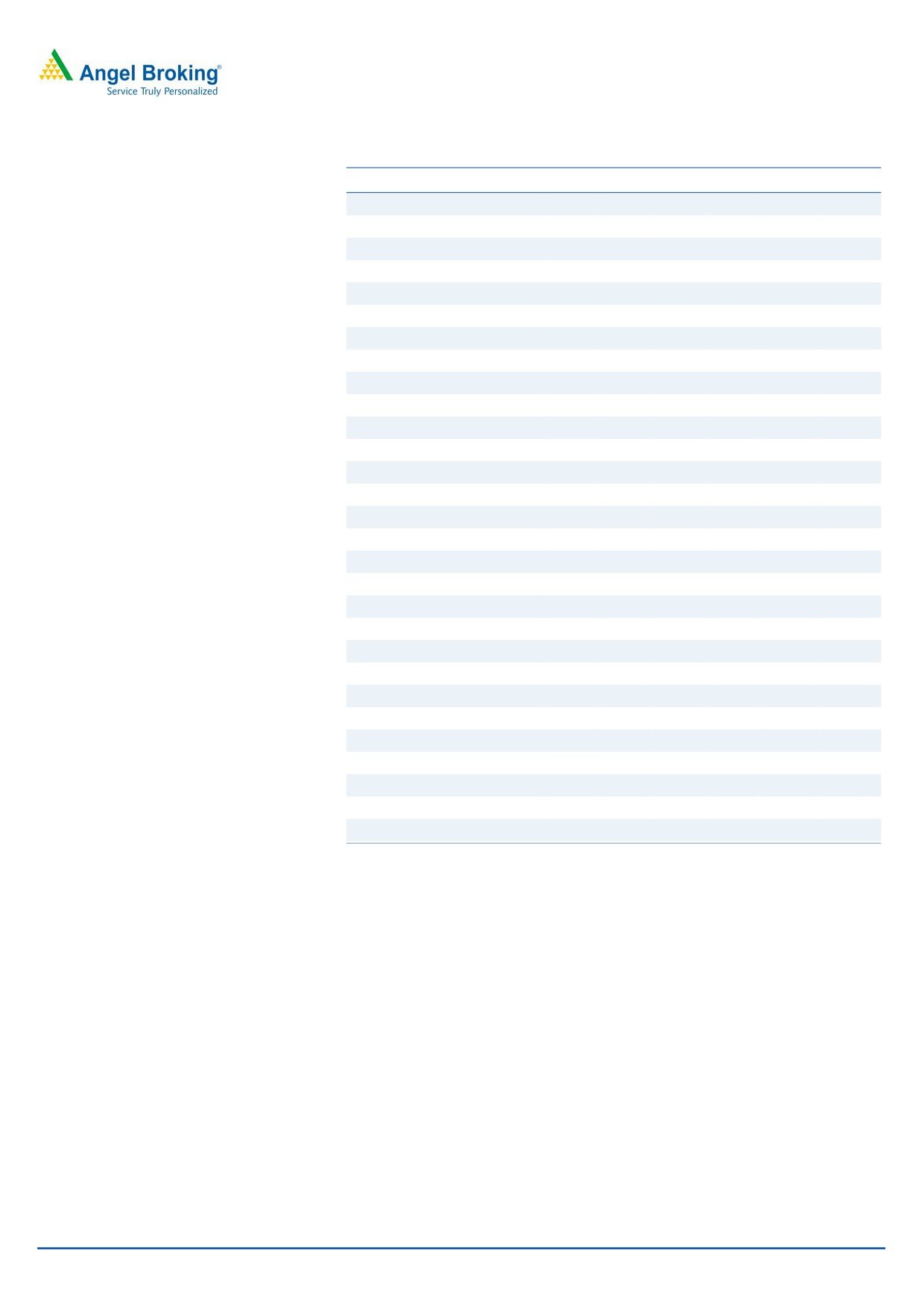

Y/E March (` cr)

2QFY16 2QFY15

% chg (qoq) 1QFY16

% chg (yoy)

Investment Period

12 Months

Net sales

57

50

15.1

69

(17.1)

EBITDA

30.2

30

1.5

41

(26.4)

Stock Info

Sector

Educational Services

EBITDA Margin (%)

52.7

59.7

(700bp)

59.4

(670bp)

Adjusted PAT

13

13

1.2

18

(29.3)

Market Cap (` cr)

1,052

Source: Company, Angel Research

Net Debt

(66.8)

Beta

0.8

Tree House Education & Accessories (THEAL)’ 2QFY2016 results underperformed

52 Week High / Low

548 / 246

our estimates on all parameters. The top-line growth was decent mainly due to

Avg. Daily Volume

10,782

strong addition of 73 new pre-schools. On the operating profit front, the

Face Value (`)

10

company reported flattish growth yoy which resulted into lower growth in

profitability.

BSE Sensex

26,121

Nifty

7,915

Top-line grew ~15% yoy: The company’s top-line grew ~15% yoy to ~`57cr,

Reuters Code

THEA.BO

mainly due to growth in existing pre-schools and addition of new pre-schools. The

Bloomberg Code

THEAL.IN

company added

73 pre-schools in various cities like Ahmednagar, Goa,

Gurgaon, Jalgaon, Noida, and Ratnagiri, during the quarter.

Shareholding Pattern (%)

Poor operating performance drags down Net profit growth: The operating profit came

Promoters

30.0

in at ~`30cr, up ~2% yoy. However, operating margins contracted by 700bp yoy

MF / Banks / Indian Fls

3.5

to 52.7%, as the company opened 73 new centres during the quarter, which is the

FII / NRIs / OCBs

21.3

highest ever in the history of the company in a single quarter. The reported net

profit grew by only ~1% yoy to ~`13cr, due to the poor operating performance.

Indian Public / Others

45.2

Outlook and Valuation: We continue to remain positive on the stock, as we

Abs.(%)

3m 1yr 3yr

believe THEAL will continue to register robust growth going ahead. The growth

Sensex

(7.5)

(6.3)

39.8

would come on the back of consistent expansion of pre-schools and repayment of

debt which would boost earnings. We expect the company to report a CAGR of

THEAL

(37.5)

(44.7)

10.7

~23% in the top-line and ~21% in the bottom-line over FY2015-17E. We

recommend a Buy rating on the stock, with a target price of `314.

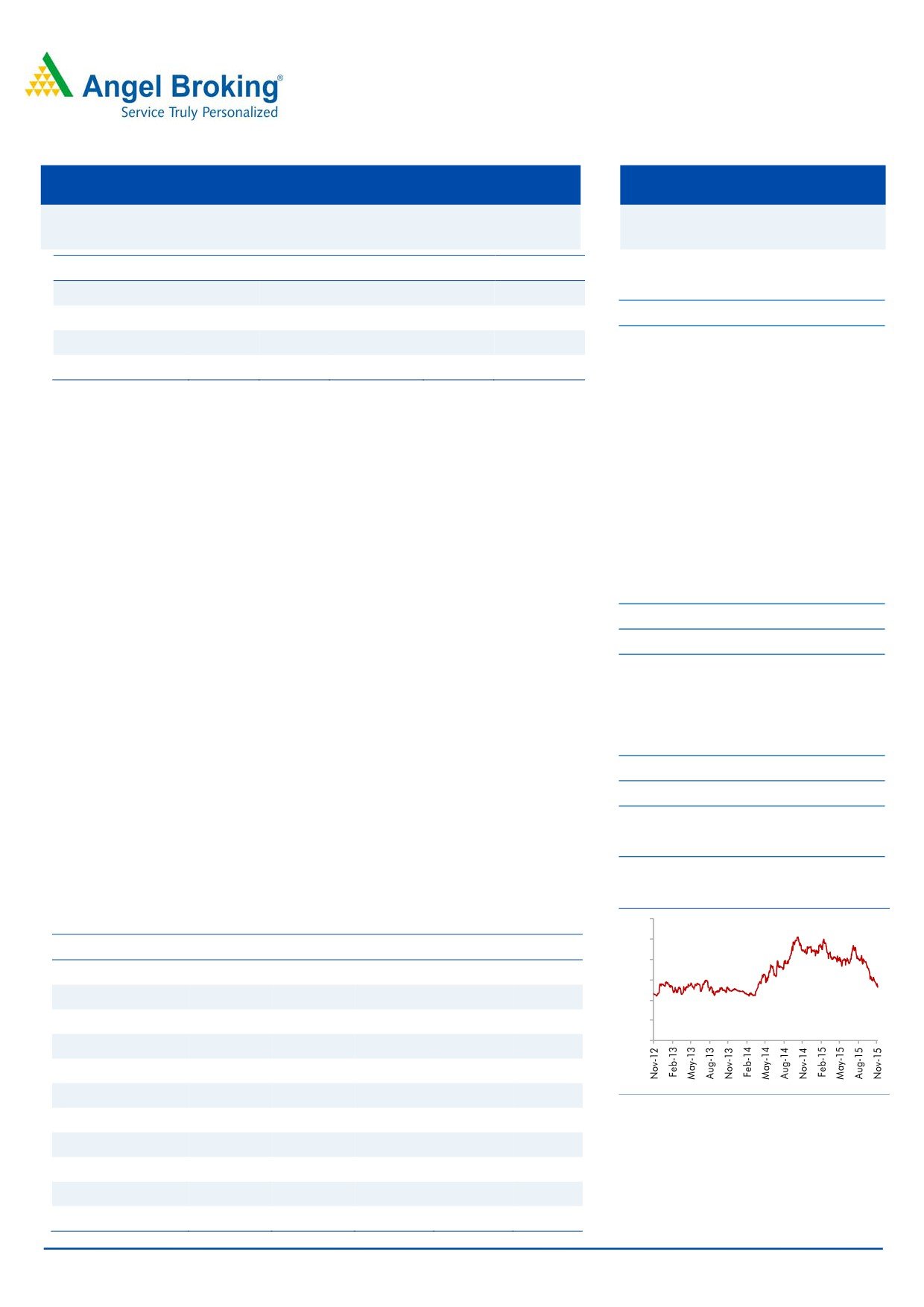

3 year daily price chart

600

Key Financials

500

Y/E March (` cr)

FY2013

FY2014E

FY2015

FY2016E FY2017E

400

Net Sales

114

158

207

256

315

300

% chg

48.0

37.9

31.6

23.4

23.2

200

Net Profit

33

44

61

70

89

100

0

% chg

53.9

31.8

38.6

14.7

27.0

EBITDA Margin (%)

54.1

56.6

57.2

57.2

57.5

FDEPS (`)

7.9

10.4

14.4

16.5

21.0

Source: Company, Angel Research

P/E (x)

31.6

24.0

17.3

15.1

11.9

P/BV (x)

3.1

2.6

1.6

1.5

1.3

RoE (%)

9.7

11.0

9.3

9.6

10.9

Amarjeet S Maurya

RoCE (%)

11.8

14.9

12.0

12.7

14.5

+91 22 39357800 Ext: 6831

EV/Sales (x)

9.3

7.1

4.8

4.2

3.6

Source: Company, Angel Research; Note: CMP as of November 9, 2015

Please refer to important disclosures at the end of this report

1

Tree House | 2QFY2016 Result Update

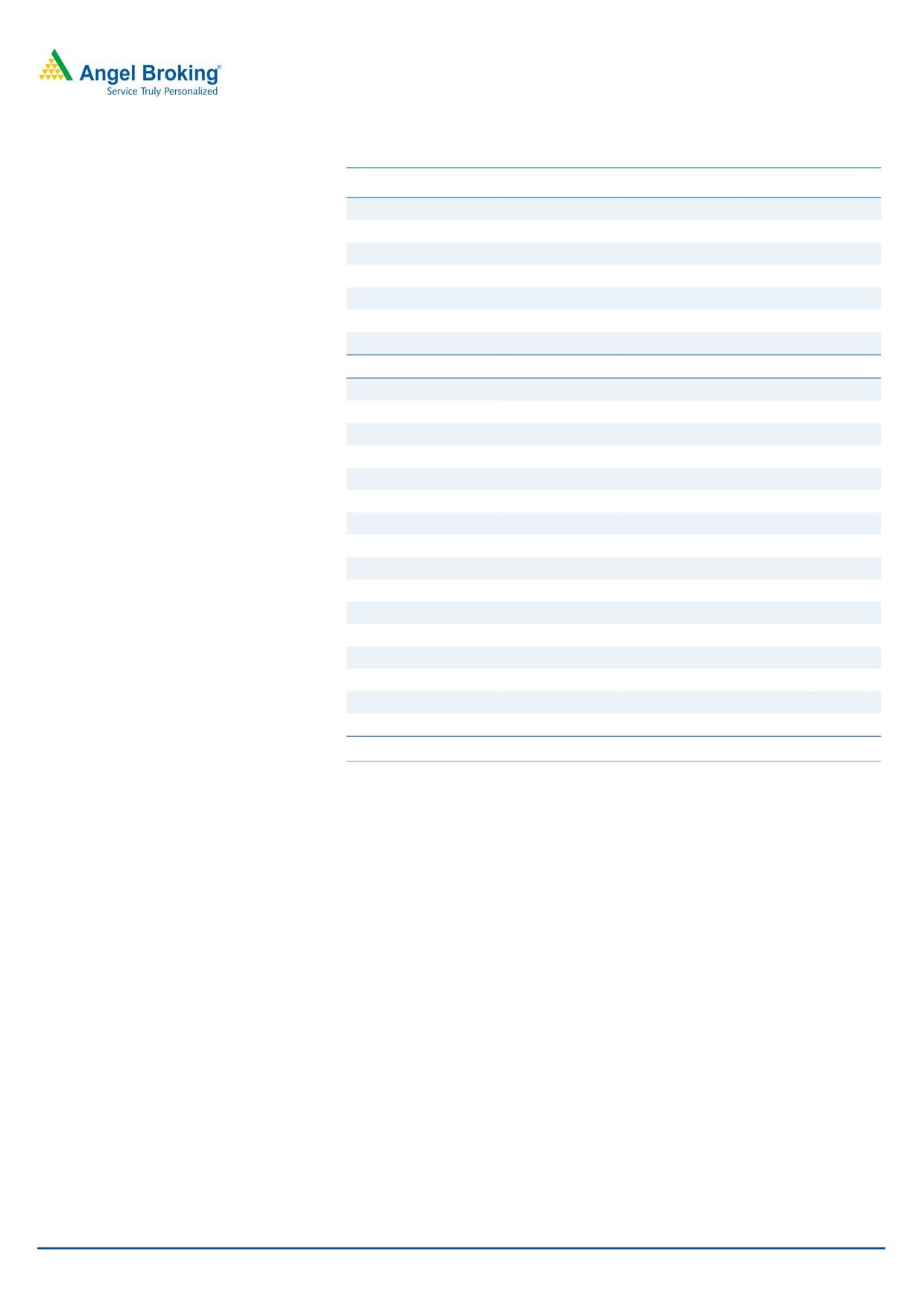

Exhibit 1: 2QFY2016 performance highlights

Y/E March (` cr)

2QFY16

2QFY15

% yoy

1QFY16

% qoq

1HFY16

1HFY15

% chg

Net Sales

57

50

15.1

69

(17.1)

126

104

21.8

Staff Costs

8

6

28.0

6

20.6

14

11

27.4

(% of Sales)

13.4

12.1

9.2

11.1

10.6

Operating Expense

19

14

38.0

22

(10.4)

41

30

38.5

(% of Sales)

33.9

28.3

31.4

32.5

28.6

Total Expenditure

27

20

35.0

28

(3.4)

55

41

35.5

Operating Profit

30

30

2

41

(26.4)

71

63

13.0

OPM (%)

52.7

59.7

59.4

56.3

60.7

Interest

5

4

3.7

4

22.5

8

8

Depreciation

10

6

58.4

10

4.0

20

12

59.7

Other Income

3

0

826.5

3

5.0

6

0

1,155.1

PBT

19

19

(3.1)

31

(38.8)

49

44

13.3

(% of Sales)

32.7

38.8

44.4

39.1

42.0

Provision for Taxation

6

7

(11.0)

13

(52.5)

19

15

24.7

(% of PBT)

32.0

34.9

41.2

37.7

34.3

Minority Interest

Recurring PAT

13

13

1.2

18

(29.3)

31

29

7.4

PATM

22.3

25.3

26.1

24.4

27.6

Extra-ordinary Items (Income)

2

2

Adj. PAT

13

13

1.2

20

(36.0)

33

29

14.0

Source: Company, Angel Research

November 10, 2015

2

Tree House | 2QFY2016 Result Update

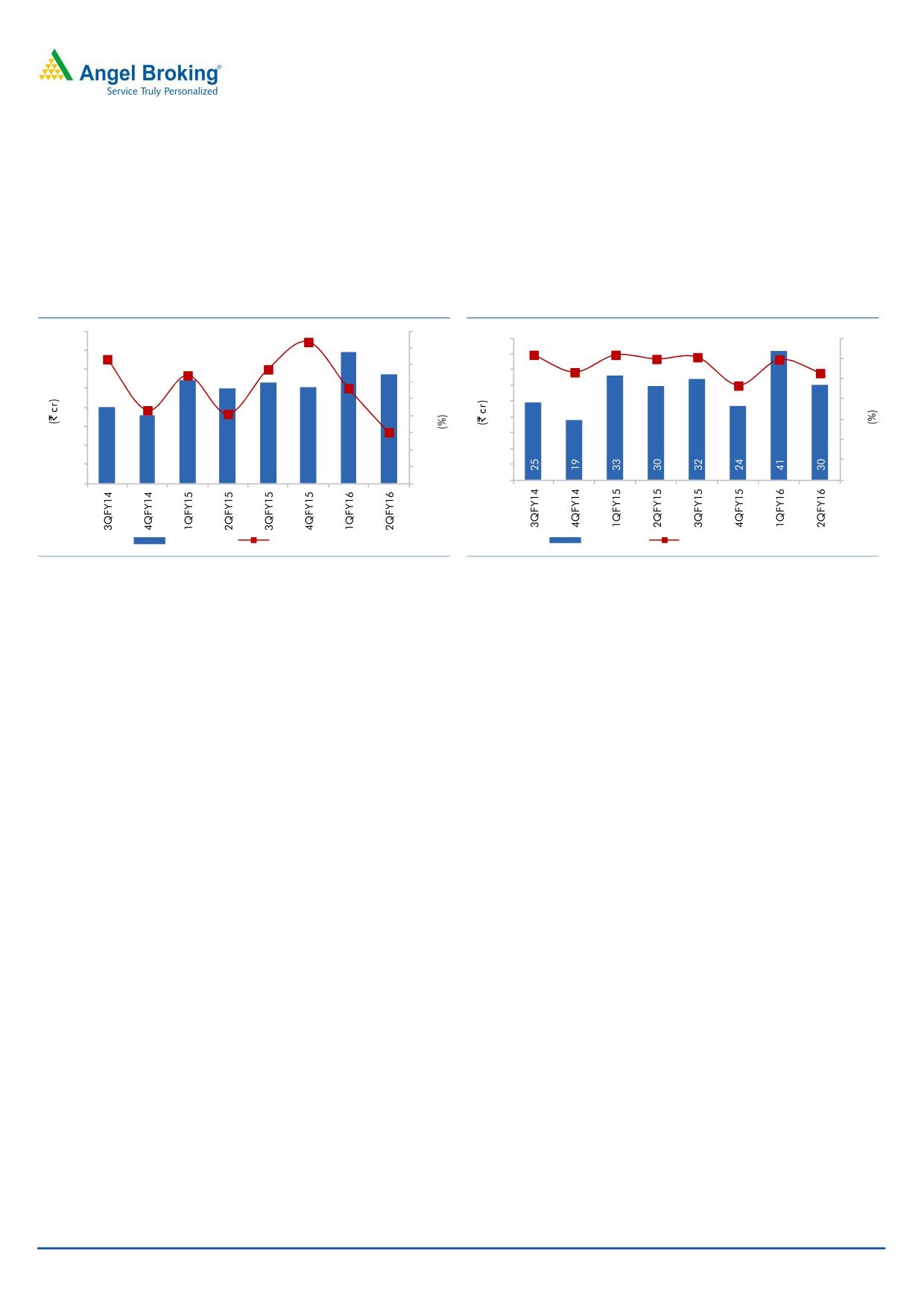

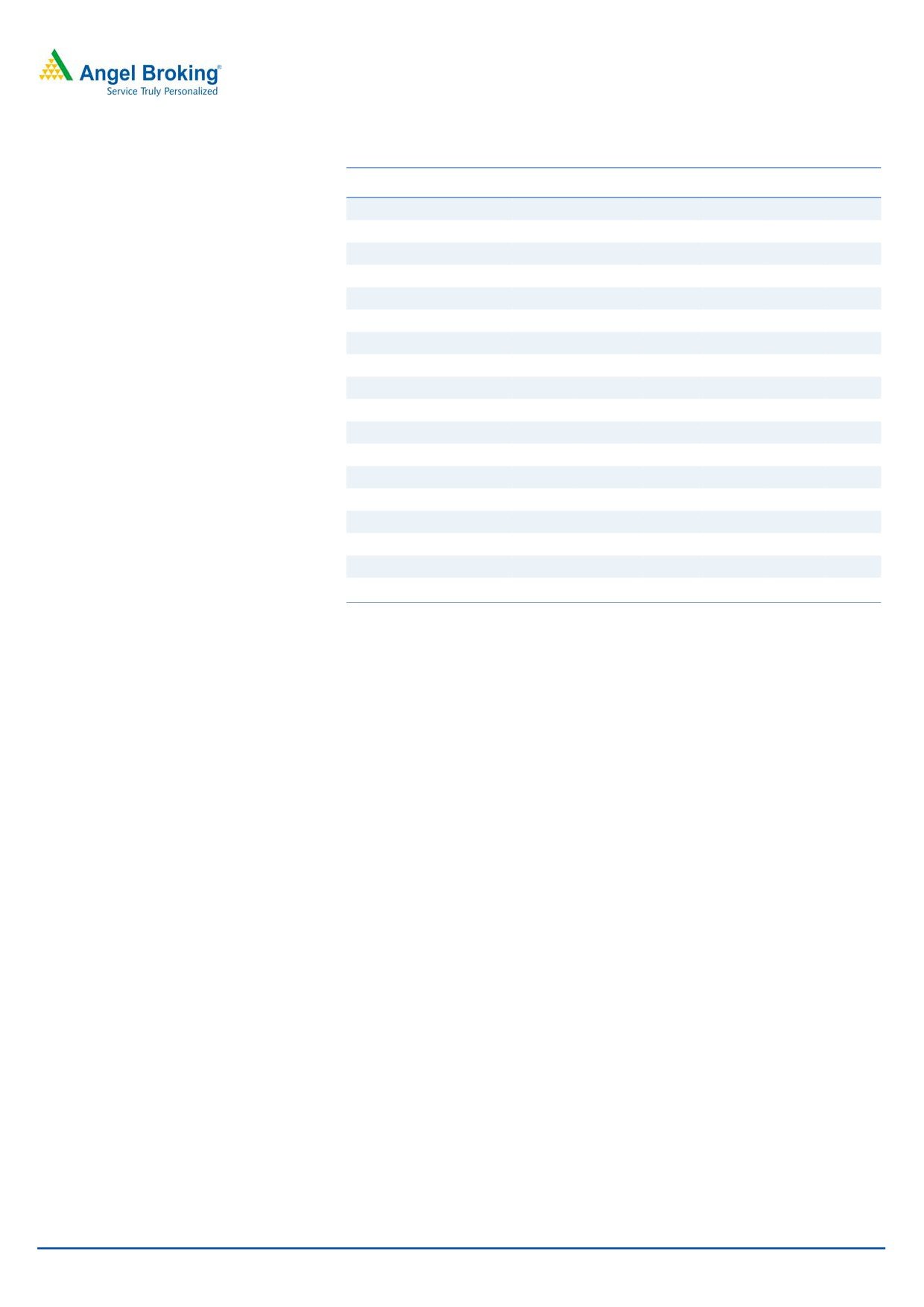

Healthy top-line growth led by addition of pre-schools

The company’s top-line grew ~15% yoy to ~`57cr, mainly due to growth in

existing pre-schools and addition of new pre-schools. The company added 73 pre-

schools in various cities like Ahmednagar, Goa, Gurgaon, Jalgaon, Noida, and

Ratnagiri, during the quarter.

Exhibit 2: Steady expansion aids growth momentum

Exhibit 3: EBIDTA and EBIDTA margin tend

80

33.7

41.8

28.1

45

45

61.7

60.6

70

61.7

59.4

70

36.7

40

59.7

40

53.1

52.7

31.9

60

35

60

20.5

35

46.5

30

50

50

30

21.6

25

25

40

40

20

20

30

30

15.1

15

15

20

20

10

10

10

10

5

5

40

36

54

50

53

51

69

57

0

0

0

0

Revenue (LHS)

Revenue growth yoy (RHS)

EBITDA (LHS)

EBITDA Margin (RHS)

Source: Company, Angel Research

Source: Company, Angel Research

Operating margin contraction by 700bp yoy

The operating profit came in at ~`30cr, up ~2% yoy. However, the operating

margin contracted by 700bp yoy to 52.7%, as the company opened 73 new

centres during the quarter, which is the highest ever in the history of the company

in a single quarter.

Poor operating performance drags down Net profit growth

For the quarter, the reported net profit grew by only ~1% yoy to ~`13cr, due to the

poor operating performance.

November 10, 2015

3

Tree House | 2QFY2016 Result Update

Investment Arguments

Expansion plan for pre-schools to drive growth

THEAL is expected to continue to post revenue growth on the back of its growing

geographic presence. In the past few years, the company has increased its number

of pre-school branches at a rapid pace, ie from 302 in FY2012 to 720 in

2QFY2016 (self-operated branches + franchisees). At present, the company’s

branches are concentrated in Maharashtra, with the region accounting for ~40%

of its branches. THEAL is now looking at expansion of pre-schools on a large scale

and across different regions, with particular focus on the Delhi & NCR region. The

company would be adding 150 pre-schools in FY2016. This move, we believe, is a

positive step in terms of mitigating the risk of geographic concentration.

Day care centers to trigger growth & profitability

THEAL has expanded its day-care foot print to 190 centers, with it receiving an

encouraging response in this segment. The Management believes that this service

will contribute significantly to the company’s top-line and bottom-line, going

ahead. THEAL has entered into tie-ups with large corporates in the IT, ITES,

banking and consulting space to provide day-care services for their employees.

Focus on monetization of K-12 School assets

The company is providing school management services to 24 K-12 schools in 3

states in India. The company is now focusing on monetizing its investments in K-12

school premises and moving towards an asset-light model while it would continue

to provide educational services in this segment. The company owns 5 set-ups (land

& building) including 1 in collaboration with a joint venture (JV) partner; THEAL

has a 50% stake in the JV. Of these, the company has sold 1 school property for

~`17cr; for another property, it has signed a MOU for sale of its land and

building in Vadodara for a consideration of `52.5cr.

Payment of debt

Currently the company is more focused on expansion and debt reduction. The

company has raised `200cr through a QIP to fund its expansion plans. Further, it

would be selling its K-12 school property, and would utilize its free cash flows to

offset debt. The company expects to be virtually debt free within two years.

November 10, 2015

4

Tree House | 2QFY2016 Result Update

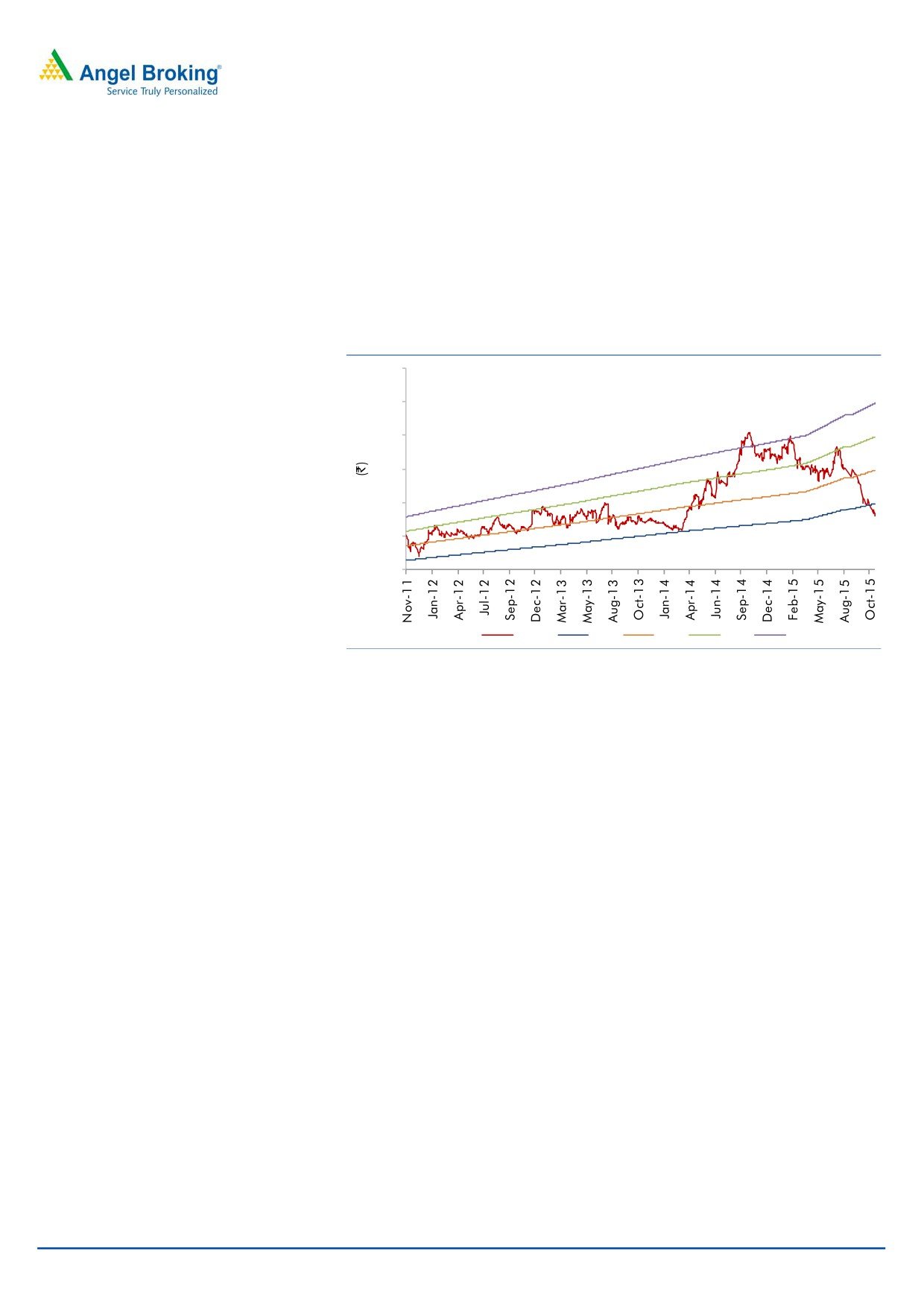

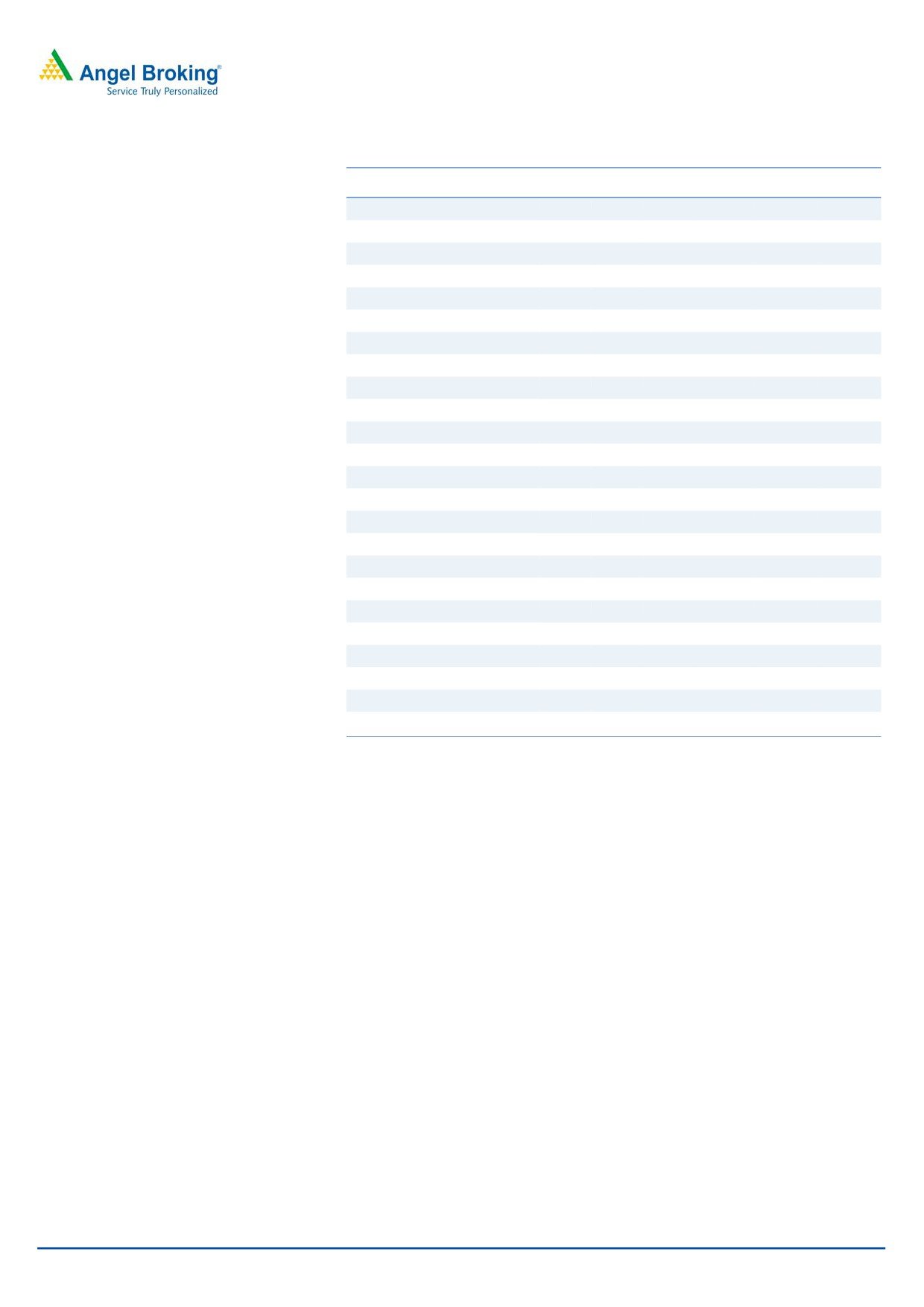

Outlook and Valuations:

We continue to remain positive on the stock, as we believe THEAL will continue to

register robust growth going ahead. The growth would come on the back of

consistent expansion of pre-schools and repayment of debt which would boost

earnings. We expect the company to report a CAGR of ~23% in the top-line and

~21% in the bottom-line over FY2015-17E. We recommend a Buy rating on the

stock, with a target price of `314.

Exhibit 4: One Year Forward PE

700

600

500

400

300

200

100

Price

15x

20x

25x

30x

Source: Company, Angel Research

Competition

The education sector in India is largely unorganized and the business of pre-

schools is highly fragmented and competitive. In addition to competition from

unorganized players in the pre-schools business, THEAL faces a lot of competition

from organized players in the market where it competes with various pre-schools

like Kidzee, Euro Kids, and Roots to Wings (operated by Educomp Solutions).

Key Risks

Geographical concentration risk: Around 42% of the company’s pre-schools

are located in and around Mumbai metropolitan. This suggests a geographical

concentration risk to the company.

Regulatory risk: Government introduced regulations on pre-schools may impose

restrictions on the company.

Company Background

Tree House Education and Accessories Limited (THEAL) runs quality pre-schools

and also provides educational services to K-12 schools throughout the country.

THEAL has revolutionized the concept of pre-school pedagogy in India through the

use of innovative teaching methods and child-focused personal care. The company

currently has 647 pre-schools, of which, 540 are self-operated. These are present

across 88 cities in India (data as of June 30, 2015). The company also provides

school management services to 24 K-12 schools in 3 states in India.

November 10, 2015

5

Tree House | 2QFY2016 Result Update

Profit and loss statement (Standalone)

Y/E March (` cr)

FY12

FY13

FY14

FY15

FY16E

FY17E

Total operating income

77

114

158

207

256

315

% chg

96.8

48.0

37.9

31.6

23.4

23.2

Total Expenditure

35

52

68

89

110

134

Personnel Expenses

10

13

17

24

30

38

Others Expenses

26

39

51

65

79

96

EBITDA

42

62

89

119

146

181

% chg

148.4

47.2

44.4

33.0

23.4

23.8

(% of Net Sales)

54.4

54.1

56.6

57.2

57.2

57.5

Depreciation& Amortisation

8

13

17

27

36

46

EBIT

34

48

72

92

110

135

% chg

41.6

49.2

27.2

19.9

22.4

(% of Net Sales)

44.3

42.4

45.8

44.3

43.0

42.8

Interest & other Charges

7

7

8

15

18

18

Other Income

4

7

1

7

8

10

(% of PBT)

12.3

14.4

2.0

8.5

8.0

7.9

Share in profit of Associates

-

-

-

-

-

-

Recurring PBT

32

49

66

84

100

127

% chg

54.7

35.1

26.8

19.1

27.0

Prior Period & Extraord. Exp./(Inc.)

-

-

-

-

-

-

PBT (reported)

32

49

66

84

100

127

Tax

10

16

22

23

30

38

(% of PBT)

31.4

31.8

33.5

27.3

30.0

30.0

PAT (reported)

22

33

44

61

70

89

ADJ. PAT

22

33

44

61

70

89

% chg

53.9

31.8

38.6

14.7

27.0

(% of Net Sales)

28.1

29.2

27.9

29.3

27.3

28.1

Basic EPS (`)

5.1

7.9

10.4

14.4

16.5

21.0

Fully Diluted EPS (`)

5.1

7.9

10.4

14.4

16.5

21.0

% chg

135.7

53.9

31.8

38.6

14.7

27.0

November 10, 2015

6

Tree House | 2QFY2016 Result Update

Balance Sheet (Standalone)

Y/E March (` cr)

FY12

FY13

FY14

FY15

FY16E

FY17E

SOURCES OF FUNDS

Equity Share Capital

34

36

37

42

42

42

Equity Share Warrants

-

10

3

-

-

-

Reserves& Surplus

223

297

360

615

682

768

Shareholders Funds

256

343

401

657

725

810

Total Loans

51

67

83

106

140

120

Deferred Tax Liability

3

5

5

5

5

5

Total Liabilities

311

415

489

768

870

935

APPLICATION OF FUNDS

Gross Block

154

185

293

393

533

663

Less: Acc. Depreciation

17

30

46

73

109

156

Net Block

137

155

247

320

424

507

Capital Work-in-Progress

20

40

28

28

28

28

Investments

31

10

11

11

11

11

Current Assets

149

240

240

462

471

469

Inventories

4

5

6

7

8

10

Sundry Debtors

6

7

29

39

48

60

Cash

48

49

11

161

100

35

Loans & Advances

7

10

7

10

13

16

Other Assets

85

169

187

244

302

347

Current liabilities

25

30

38

54

65

81

Net Current Assets

123

210

202

408

406

388

Deferred Tax Asset

0

0

0

0

0

0

Mis. Exp. not written off

-

-

-

-

-

-

Total Assets

311

415

489

768

870

935

November 10, 2015

7

Tree House | 2QFY2016 Result Update

Cash Flow statement

Y/E March (` cr)

FY12

FY13

FY14

FY15

FY16E FY17E

Profit Before Tax

32

49

66

84

100

127

Depreciation

8

13

17

27

36

46

Other Income

(29)

(58)

(35)

(56)

(60)

(46)

Change in Working Capital

3

3

6

15

18

18

Direct taxes paid

(7)

(18)

(19)

(23)

(30)

(38)

Cash Flow from Operations

(0)

(3)

0

-

-

-

(Incr)/ Decr in Fixed Assets

6

(14)

35

47

65

107

(Incr)/Decr In Investments

(73)

(71)

(96)

(100)

(140)

(130)

Other Income

(29)

21

(2)

-

-

-

Cash Flow from Investing

(101)

(49)

(97)

(100)

(140)

(130)

Issue of Equity/Preference

135

50

20

201

-

-

Incr/(Decr) in Debt

-

-

-

20

34

(20)

Dividend Paid (Incl. Tax)

-

(3)

(4)

(2)

(2)

(3)

Others

(21)

17

9

(15)

(18)

(18)

Cash Flow from Financing

114

64

24

203

13

(41)

Incr/(Decr) In Cash

19

1

(38)

151

(62)

(64)

Opening cash balance

29

48

49

11

161

100

Closing cash balance

48

49

11

161

100

35

November 10, 2015

8

Tree House | 2QFY2016 Result Update

Key Ratios

Y/E March

FY12

FY13

FY14

FY15

FY16E

FY17E

Valuation Ratio (x)

P/E (on FDEPS)

48.6

31.6

24.0

17.3

15.1

11.9

P/CEPS

35.8

22.6

17.3

12.0

9.9

7.8

P/BV

4.1

3.1

2.6

1.6

1.5

1.3

Dividend yield (%)

0.3

0.4

0.5

0.8

0.9

1.3

EV/Sales

13.3

9.3

7.1

4.8

4.2

3.6

EV/EBITDA

24.4

17.2

12.5

8.3

7.4

6.2

EV / Total Assets

3.0

2.4

2.1

1.2

1.2

1.1

Per Share Data (`)

EPS (Basic)

5.1

7.9

10.4

14.4

16.5

21.0

EPS (fully diluted)

5.1

7.9

10.4

14.4

16.5

21.0

Cash EPS

7.0

11.0

14.4

20.7

25.1

31.9

DPS

0.8

1.1

1.3

2.0

2.3

3.1

Book Value

60.6

81.2

94.7

155.3

171.3

191.5

Returns (%)

ROCE

11.1

11.8

14.9

12.0

12.7

14.5

Angel ROIC (Pre-tax)

14.9

13.8

15.7

15.6

14.6

15.3

ROE

8.4

9.7

11.0

9.3

9.6

10.9

Turnover ratios (x)

Asset Turnover (Gross Block)

0.6

0.7

0.6

0.6

0.6

0.6

Inventory / Sales (days)

17

15

13

13

12

12

Receivables (days)

27

22

67

68

69

70

Payables (days)

23

12

13

13

14

14

WC cycle (ex-cash) (days)

22

25

67

68

67

68

November 10, 2015

9

Tree House | 2QFY2016 Result Update

Research Team Tel: 022 - 39357800

DISCLAIMER

Angel Broking Private Limited (hereinafter referred to as “Angel”) is a registered Member of National Stock Exchange of India Limited,

Bombay Stock Exchange Limited and Metropolitan Stock Exchange of India Limited. It is also registered as a Depository Participant with

CDSL and Portfolio Manager with SEBI. It also has registration with AMFI as a Mutual Fund Distributor. Angel Broking Private Limited is

a registered entity with SEBI for Research Analyst in terms of SEBI (Research Analyst) Regulations, 2014 vide registration number

INH000000164. Angel or its associates has not been debarred/ suspended by SEBI or any other regulatory authority for accessing

/dealing in securities Market. Angel or its associates including its relatives/analyst do not hold any financial interest/beneficial

ownership of more than 1% in the company covered by Analyst. Angel or its associates/analyst has not received any compensation /

managed or co-managed public offering of securities of the company covered by Analyst during the past twelve months. Angel/analyst

has not served as an officer, director or employee of company covered by Analyst and has not been engaged in market making activity

of the company covered by Analyst.

This document is solely for the personal information of the recipient, and must not be singularly used as the basis of any investment

decision. Nothing in this document should be construed as investment or financial advice. Each recipient of this document should

make such investigations as they deem necessary to arrive at an independent evaluation of an investment in the securities of the

companies referred to in this document (including the merits and risks involved), and should consult their own advisors to determine

the merits and risks of such an investment.

Reports based on technical and derivative analysis center on studying charts of a stock's price movement, outstanding positions and

trading volume, as opposed to focusing on a company's fundamentals and, as such, may not match with a report on a company's

fundamentals.

The information in this document has been printed on the basis of publicly available information, internal data and other reliable

sources believed to be true, but we do not represent that it is accurate or complete and it should not be relied on as such, as this

document is for general guidance only. Angel Broking Pvt. Limited or any of its affiliates/ group companies shall not be in any way

responsible for any loss or damage that may arise to any person from any inadvertent error in the information contained in this report.

Angel Broking Pvt. Limited has not independently verified all the information contained within this document. Accordingly, we cannot

testify, nor make any representation or warranty, express or implied, to the accuracy, contents or data contained within this document.

While Angel Broking Pvt. Limited endeavors to update on a reasonable basis the information discussed in this material, there may be

regulatory, compliance, or other reasons that prevent us from doing so.

This document is being supplied to you solely for your information, and its contents, information or data may not be reproduced,

redistributed or passed on, directly or indirectly.

Neither Angel Broking Pvt. Limited, nor its directors, employees or affiliates shall be liable for any loss or damage that may arise from

or in connection with the use of this information.

Note: Please refer to the important ‘Stock Holding Disclosure' report on the Angel website (Research Section). Also, please refer to the

latest update on respective stocks for the disclosure status in respect of those stocks. Angel Broking Pvt. Limited and its affiliates may

have investment positions in the stocks recommended in this report.

Disclosure of Interest Statement

Tree House

1. Analyst ownership of the stock

No

2. Angel and its Group companies ownership of the stock

No

3. Angel and its Group companies' Directors ownership of the stock

No

4. Broking relationship with company covered

No

Note: We have not considered any Exposure below ` 1 lakh for Angel, its Group companies and Directors

Ratings (Based on expected returns

Buy (> 15%)

Accumulate (5% to 15%)

Neutral (-5 to 5%)

over 12 months investment period):

Reduce (-5% to -15%)

Sell (< -15)

November 10, 2015

10