3QFY2016 Result Update | IT

February 23, 2016

Tech Mahindra

BUY

CMP

`440

Performance Highlights

Target Price

`530

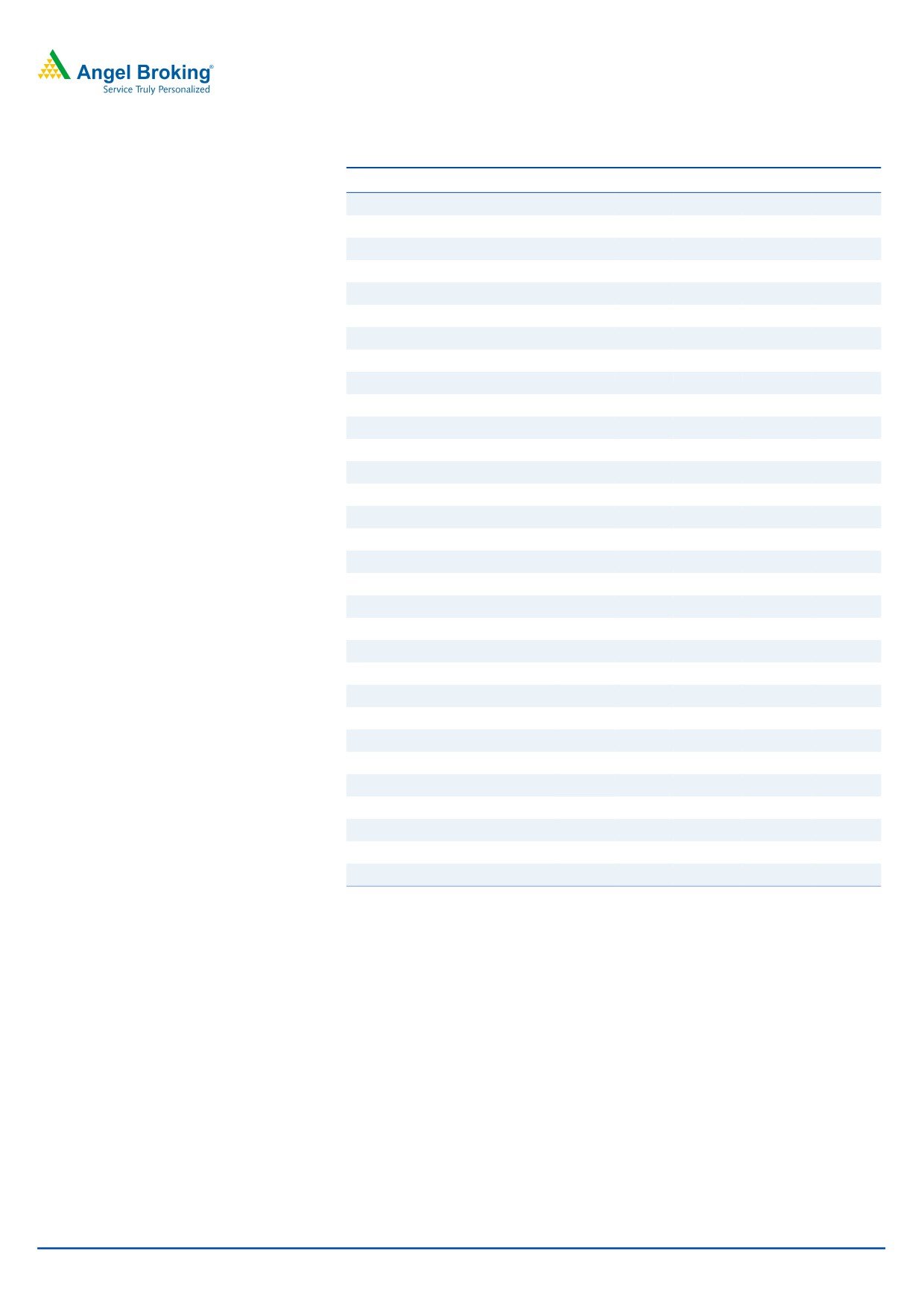

(` cr)

3QFY16

2QFY16

% chg (qoq)

3QFY15

% chg (yoy)

Investment Period

12 Months

Net revenue

6,701

6,616

1.3

5,752

16.5

EBITDA

1,136

1,101

3.2

1,170

(2.9)

Stock Info

EBITDA margin (%)

16.9

16.6

31bp

20.3

(339)bp

Sector

IT

Adj. PAT

759

786

(3.4)

805

(5.7)

Source: Company, Angel Research;

Market Cap (` cr)

42,533

Net Debt (` cr)

(3,833)

For 3QFY2016, Tech Mahindra posted a 0.4% qoq growth in revenues to

Beta

0.5

US$1,015mn V/s an expected US$1,021mn and V/s US$1,011mn in 2QFY2016.

52 Week High / Low

736/416

On constant currency (CC), the company posted a 1.2% qoq revenue growth. On

Avg. Daily Volume

229,545

the operating front, the EBDITA margin came in at 16.9% V/s an expected 17.2%

Face Value (`)

5

and V/s 16.6% in 2QFY2016, a qoq expansion of 70bp. The EBIT margin came

BSE Sensex

23,709

in at 14.3% V/s an expected 14.2% and V/s 13.7% in 2QFY2016. The company

Nifty

7,211

posted a net profit of `759cr V/s an expected `809cr and V/s `786cr in

Reuters Code

TEML.BO

2QFY2016, a qoq de-growth of 3.4%. We remain positive on the stock and

Bloomberg Code

TECHM@IN

recommend a Buy rating with a price target of `530.

Result highlights: For 3QFY2016, the company posted a 0.4% qoq growth in

Shareholding Pattern (%)

revenues to US$1,015mn V/s an expected US$1,021mn and V/s US$1,011mn in

Promoters

36.5

2QFY2016.. In INR terms, the company posted sales of `6,701cr V/s an expected

MF / Banks / Indian Fls

14.2

`6,729cr, a qoq growth of 1.3%. On CC, the company posted a 1.2% qoq

FII / NRIs / OCBs

37.7

revenue growth. The growth was mainly driven by ROW, which constituted around

Indian Public / Others

11.6

23.2% of sales in 3QFY2016 V/s 21.9% of sales in 2QFY2016. USA and Europe

constituted 47.8% (48.9% of sales in 2QFY2016) and 28.9% (29.3% of sales in

2QFY2016) of sales, respectively. In terms of industry, the growth was driven by

Abs.(%)

3m 1yr

3yr

manufacturing. On the operating front, the EBDITA margin came in at 16.9% V/s

Sensex

(8.3)

(19.5)

20.7

an expected 17.2% and V/s 16.6% in 2QFY2016, a qoq expansion of 70bp. The

Tech Mahindra

(17.7)

(37.9)

70.1

EBIT margin came in at 14.3% V/s an expected 14.2% and V/s 13.7% in

2QFY2016. The company posted a net profit of `759cr V/s an expected `809cr

and V/s `786cr in 2QFY2016, a qoq de-growth of 3.4%.

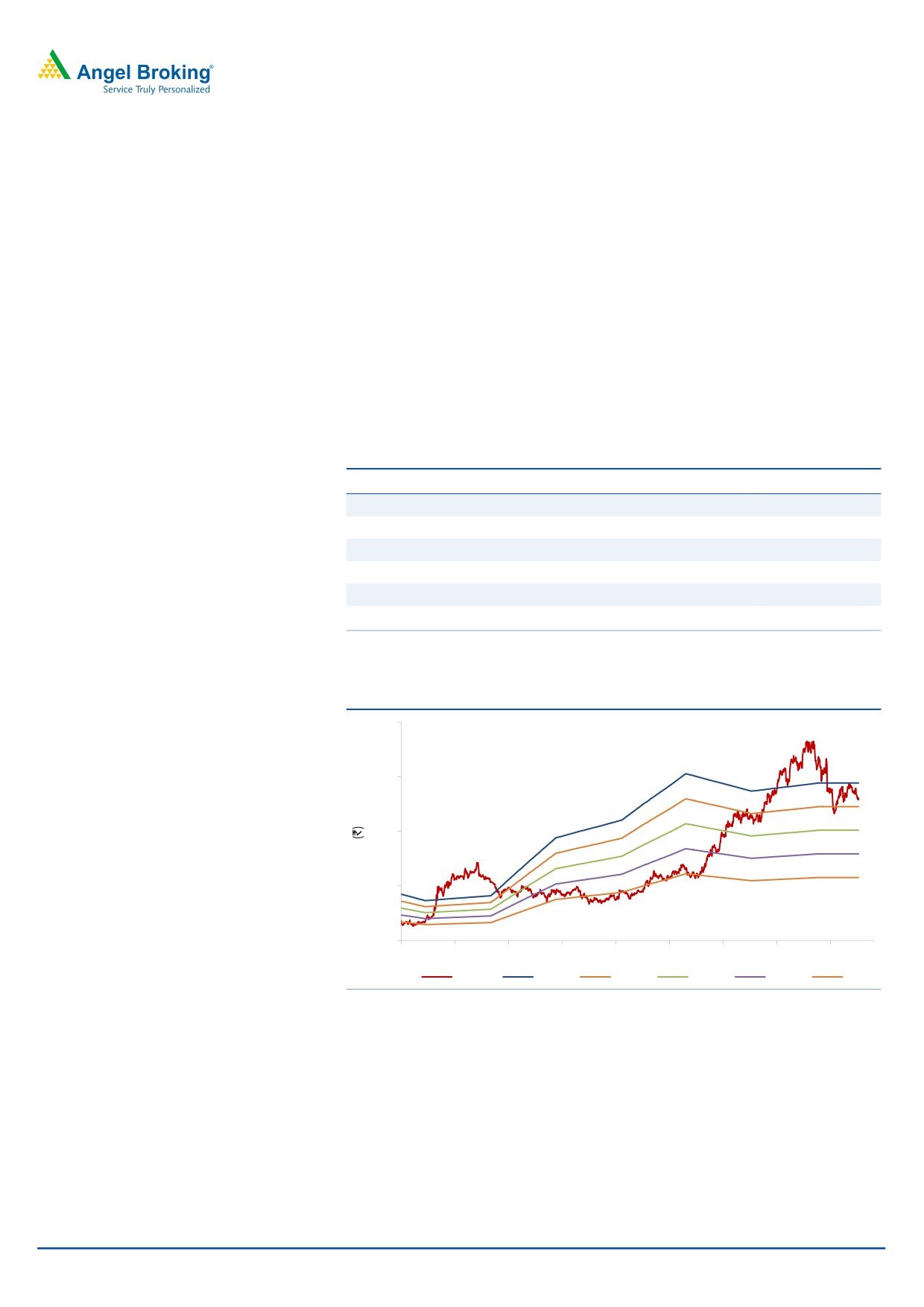

3-year price chart

800

Outlook and valuation: The Management remains confident of reverting back to

700

the original profitability by FY2017-18. We expect a CAGR of 10.3% and 13.6% in USD and

600

500

INR revenue respectively over FY2015-17E, driven by acquisitions. The PAT is expected to

400

300

grow at a CAGR of 10.8% over FY2015-17. We maintain our Buy on the stock.

200

100

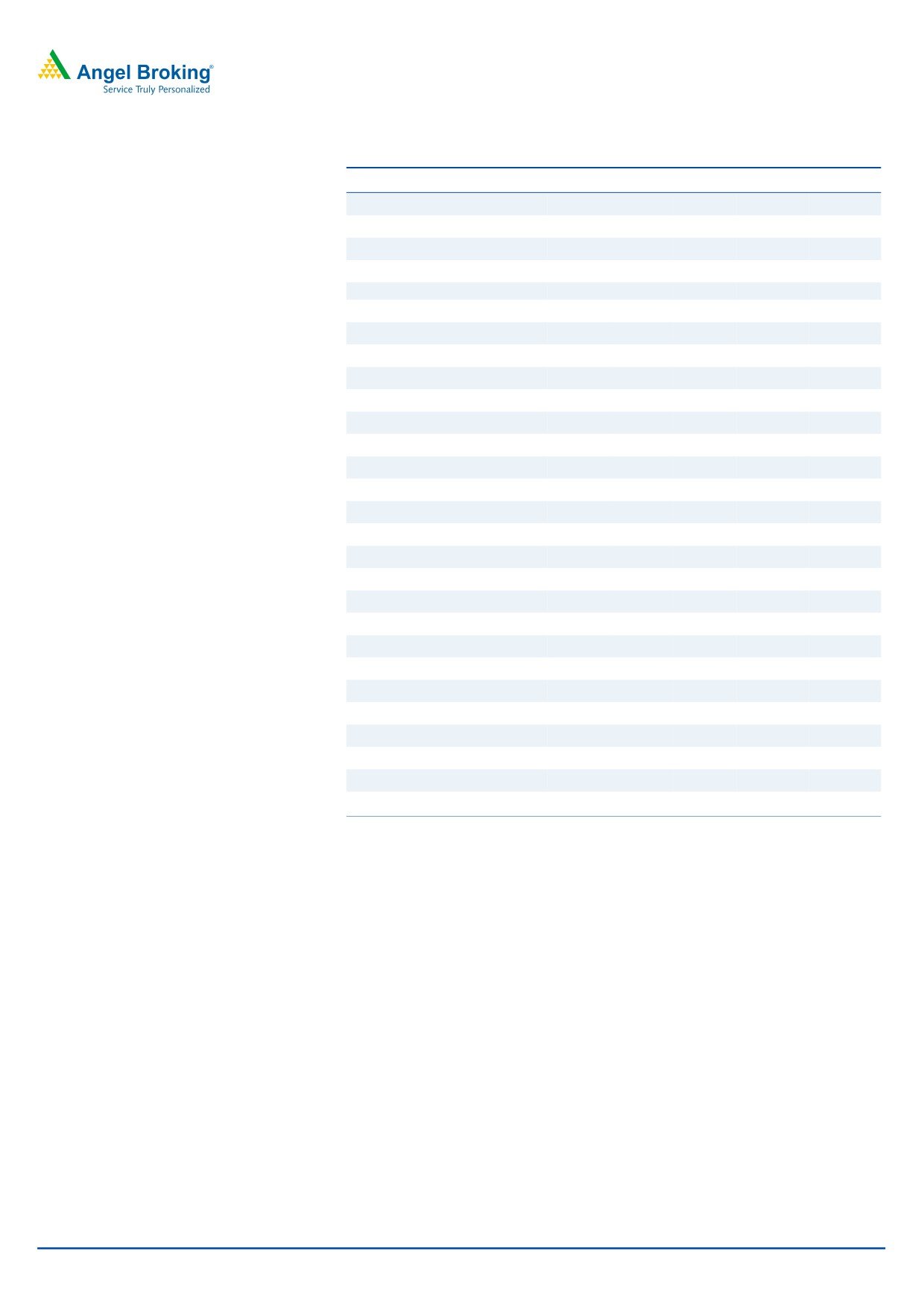

Key financials (Consolidated, Indian GAAP)

0

Y/E March (` cr)

FY2014

FY2015

FY2016E

FY2017E

Net sales

18,831

22,621

26,524

29,177

% chg

31.4

20.1

17.3

10.0

Net profit

2,932

2,628

2,771

3,224

Source: Company, Angel Research

% chg

38.6

(10.4)

5.4

16.4

EBITDA margin (%)

29.6

18.4

16.2

17.0

EPS (`)

30.5

27.4

28.8

33.6

P/E (x)

14.4

16.1

15.2

13.1

P/BV (x)

4.6

3.4

2.9

2.5

RoE (%)

31.9

21.5

19.3

19.1

RoCE (%)

43.2

24.0

21.3

21.5

Sarabjit kour Nangra

EV/Sales (x)

2.0

1.8

1.4

1.2

+91 22 3935 7800 Ext: 6806

EV/EBITDA (x)

6.8

9.8

8.9

7.3

Source: Company, Angel Research; Note: CMP as of February 19, 2016

Please refer to important disclosures at the end of this report

1

Tech Mahindra | 3QFY2016 Result Update

Exhibit 1: 3QFY2016 performance (Consolidated, Indian GAAP)

(` cr)

3QFY16

2QFY16

% chg (qoq)

3QFY15

% chg (yoy)

9MFY16

9MFY15

% chg (yoy)

Net revenue

6,701

6,616

1.3

5,752

16.5

19,611

16,504

18.8

Cost of revenue

4,607

4,496

2.5

3,756

22.7

13,544

10,790

25.5

Gross profit

2,095

2,120

(1.2)

1,996

4.9

6,067

5,715

6.2

SG&A expense

959

1,019

(5.9)

826

16.1

2,885

2,459

17.3

EBITDA

1,136

1,101

3.2

1,170

(2.9)

3,181

3,255

(2.3)

Dep. and amortization

174

197

(12.1)

144

20.5

544

439

23.9

EBIT

962

904

6.5

1,026

(6.2)

2,637

2,816

(6.4)

Interest

24

17

41.0

14

78.1

63

43

45.6

Other income

64

166

(61.5)

19

236.3

366

172

113.2

PBT

1,002

1,052

(4.8)

1,031

(2.9)

2,940

2,945

(0.1)

Income taxes

233

260

(10.6)

251

(7.4)

703

775

(9.3)

PAT

769

792

(2.9)

780

(1.4)

2,237

2,170

3.1

Minority interest

10

7

49.2

3

212.9

18

14

27.2

PAT after minority interest

759

786

(3.4)

777

(2.3)

2,220

2,156

3.0

Profit from associates

(0)

0

29

1

-

Exceptional item

-

-

-

-

-

Reported PAT

759

786

(3.4)

805

(5.7)

2,221

2,156

3.0

Adj. PAT

759

786

(3.4)

805

(5.7)

2,221

2,156

3.0

Diluted EPS

7.9

8.2

(3.4)

8.4

(5.7)

23.1

22.4

3.0

Gross margin (%)

31.3

32.0

(79)bp

34.7

(345)bp

30.9

34.6

(369)bp

EBITDA margin (%)

16.9

16.6

31bp

20.3

(339)bp

16.2

19.7

(350)bp

EBIT margin (%)

14.4

13.7

70bp

17.8

(348)bp

13.4

17.1

(362)bp

PAT margin (%)

11.3

11.9

(55)bps

14.0

(267)bp

11.3

13.1

(174)bp

Source: Company, Angel Research

Exhibit 2: 3QFY2016 - Actual vs Angel estimates

(` cr)

Actual

Estimate

Var. (%)

Net revenue

6,701

6,729

(0.4)

EBITDA margin (%)

16.9

17.2

(23)bps

PAT

759

809

(6.2)

Source: Company, Angel Research

Revenue growth led by ROW

For 3QFY2016, the company posted a

0.4% qoq

growth in revenues to

US$1,015mn V/s an expected US$1,021mn and V/s US$1,011mn in 2QFY2016.

In INR terms, the company posted sales of `6,701cr V/s an expected `6,729cr, a

qoq growth of 1.3%. On CC, the company posted a 1.2% qoq revenue growth.

The growth was mainly driven by ROW, which constituted ~23.2% of sales in

3QFY2016 V/s 21.9% of sales in 2QFY2016. USA and Europe constituted 47.8%

(48.9% of sales in 2QFY2016) and 28.9% (29.3% of sales in 2QFY2016) of sales,

respectively. In terms of industry, growth was driven by manufacturing. Its key

domain telecom posted a 2.7% qoq de-growth. The business from the Top 5

players constituted ~28% of sales in 3QFY2016 V/s 32% of sales in 2QFY2016.

Delayed decision making in telecom is expected to continue in the near term. The

pressure on service providers in the voice business, budgetary control and newer

areas of capital projects are likely to continue driving volatility for a couple of

February 23, 2016

2

Tech Mahindra | 3QFY2016 Result Update

quarters. The decline in top 5 customers during the quarter was led by negative

impact of cross-currency movement, furloughs and ramp down in certain accounts.

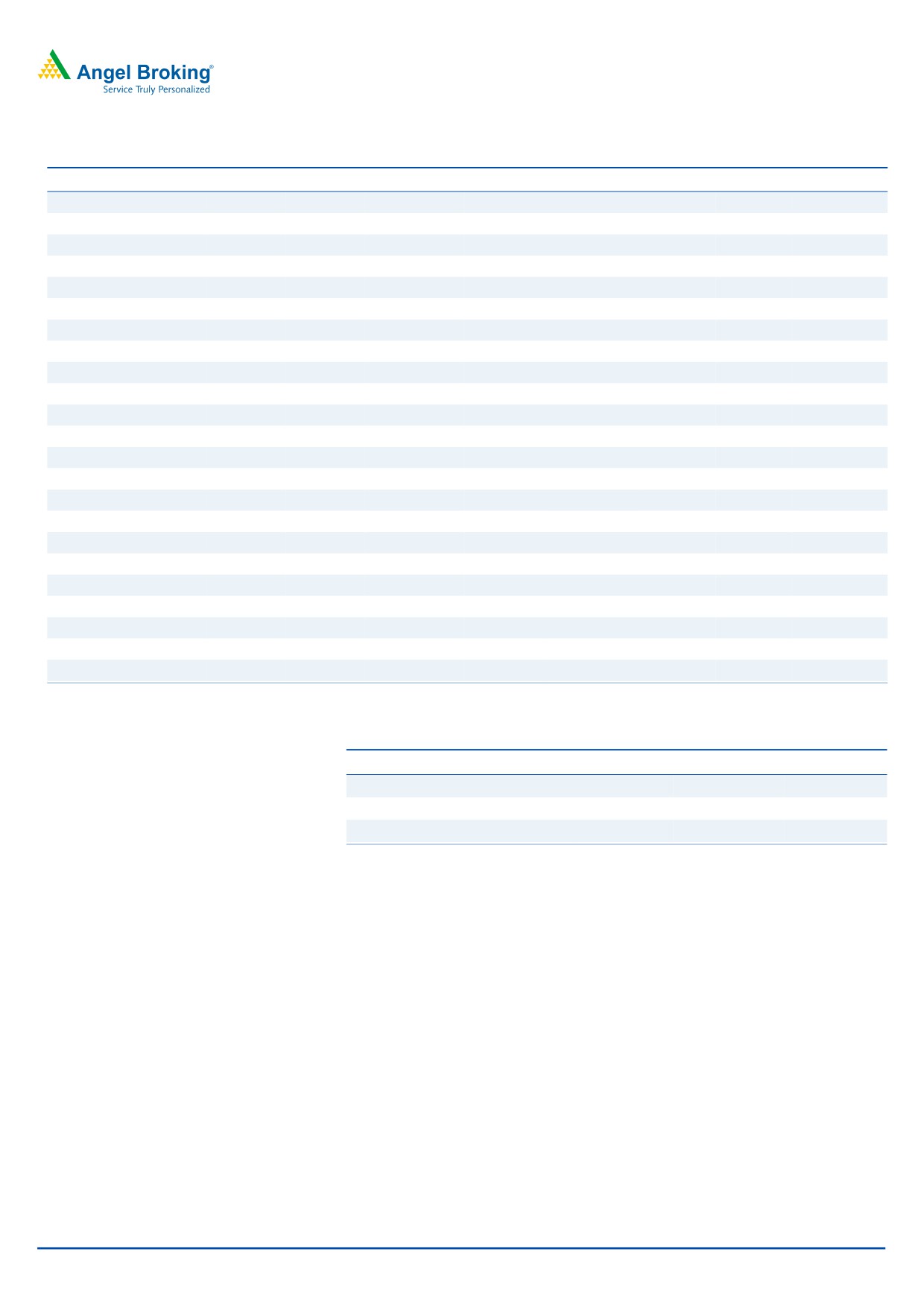

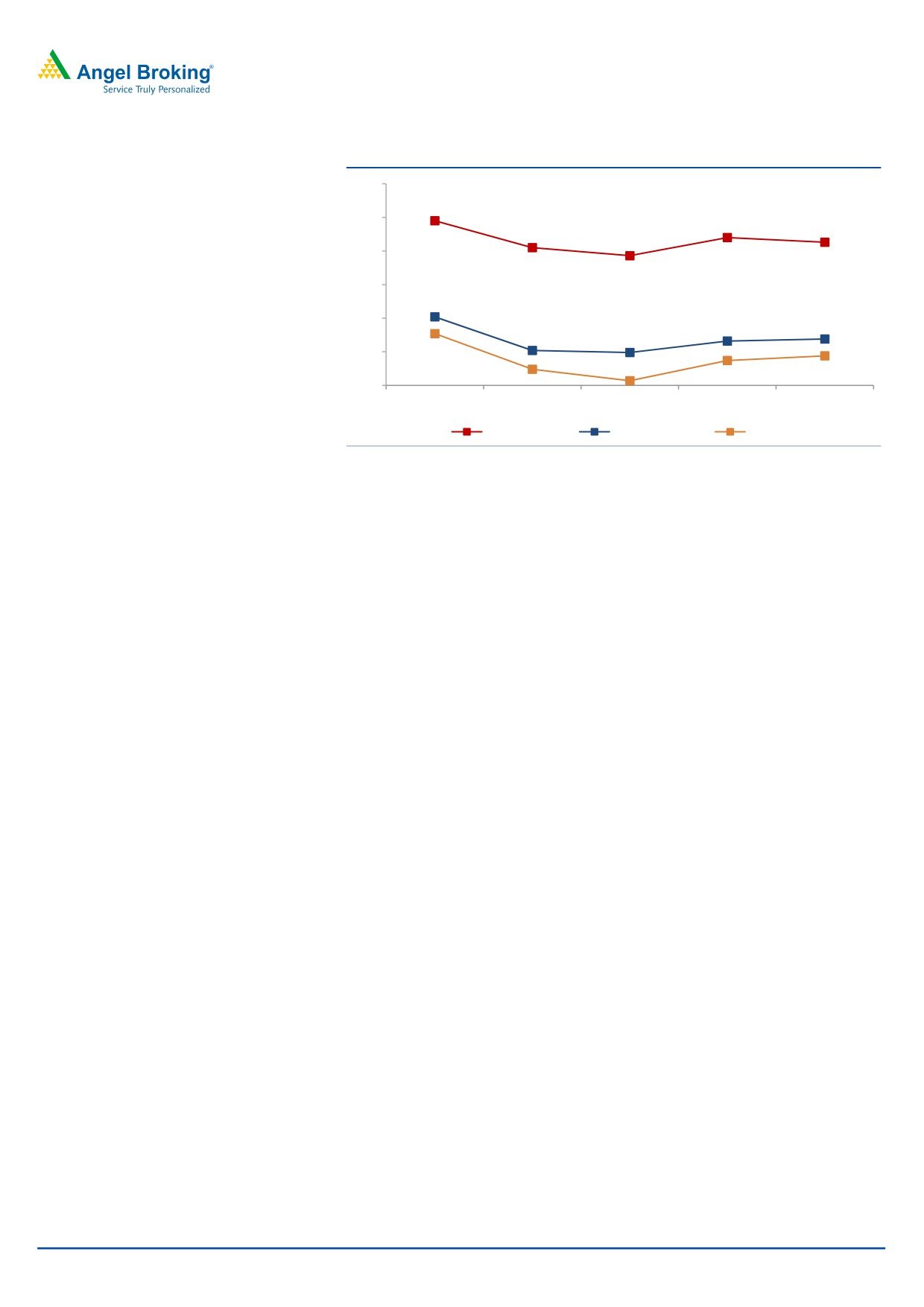

Exhibit 3: Trend in revenue growth

1,040

9.0%

1,020

8.0%

7.0%

1,000

6.5%

6.0%

980

5.0%

960

4.0%

940

3.0%

2.7%

920

2.2%

2.0%

900

1.0%

880

0.4%

0.5%

0.0%

860

-1.0%

3QFY15

4QFY15

1QFY16

2QFY16

3QFY16

Sales ( in US $mn)

qoq (%)

Source: Company, Angel Research

Exhibit 4: Growth in industry segments

Particulars

% to revenue

% growth (qoq)

% growth (yoy)

Telecom

51

(2.7)

10.7

Manufacturing

17

2.8

(4.7)

TME

7

(9.4)

11.3

BFSI

10

2.5

9.8

RTL

7

13.7

16.7

Others

8

15.6

39.1

Source: Company, Angel Research

In terms of geographies, ROW posted a qoq growth of 5.4%. Europe and the US

posted a 1.0% qoq and 1.9% qoq de-growth, respectively.

Exhibit 5: Growth trend in geographies

Particulars

% to revenue

% growth (qoq)

% growth (yoy)

Americas

48

(1.9)

7.6

Europe

29

(1.0)

1.1

RoW

23

5.4

27.6

Source: Company, Angel Research

Hiring and client metrics

During the quarter, the company reported a net addition of 1,902 employees,

taking its overall headcount to 1,07,137. The BPO headcount currently stands at

28,279 and was the only division to witness additions . Attrition (on LTM basis) was

at 20%.

February 23, 2016

3

Tech Mahindra | 3QFY2016 Result Update

Exhibit 6: Employee metrics

Particulars

3QFY15

4QFY15

1QFY16

2QFY16

3QFY16

Software professionals

67,592

72,952

71,997

71,657

71,892

BPO professionals

23,566

22,693

24,394

26,513

28,279

Sales & support

6,851

7,636

7,232

7,065

6,966

Total employees

98,009

1,03,281

1,03,673

1,05,235

1,07,137

Attritions (%)

19

19

19

20

20

Source: Company, Angel Research

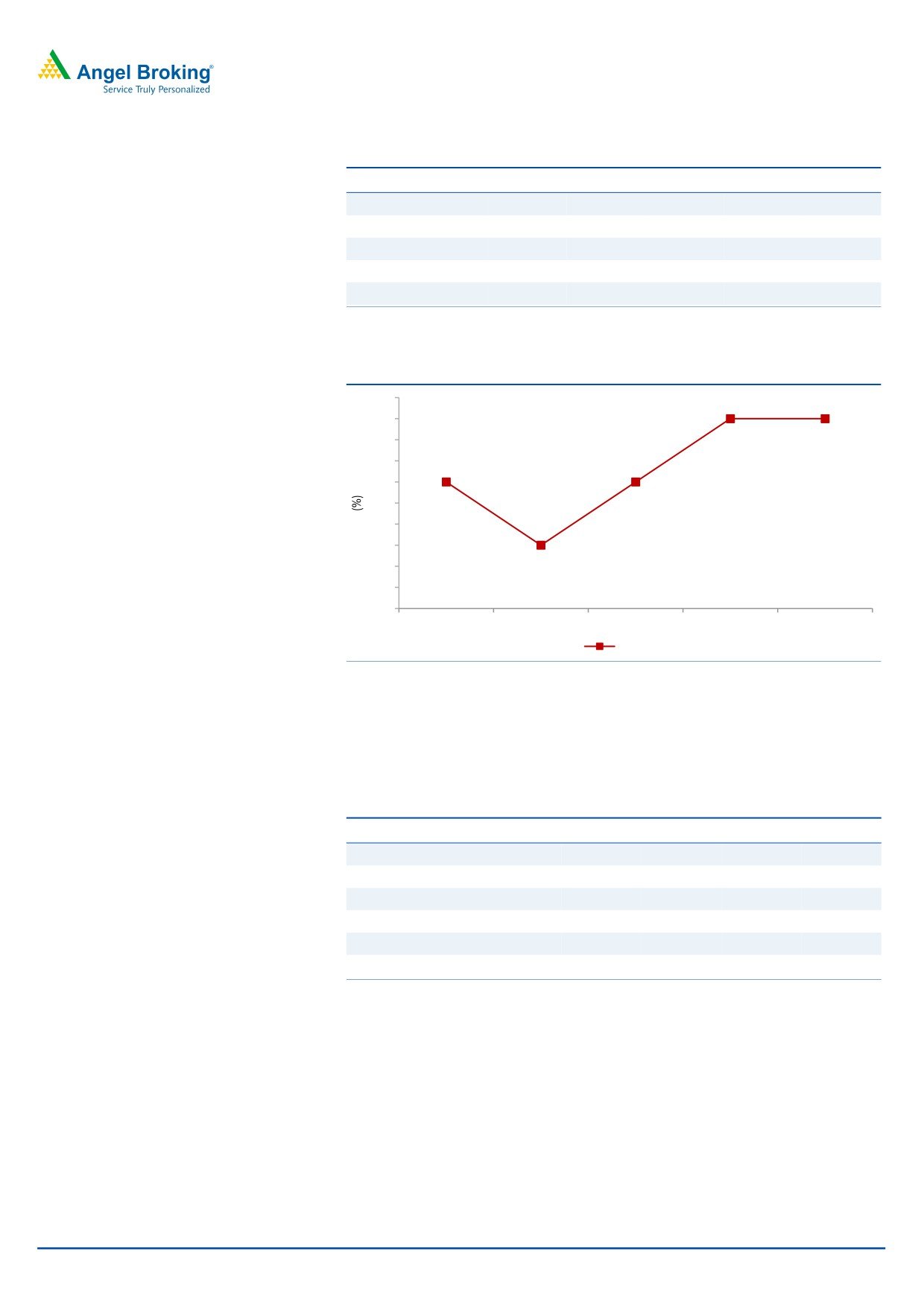

Exhibit 7: Trend in utilization rate

78

77

77

76

77

75

74

73

74

74

72

71

70

71

69

68

3QFY15

4QFY15

1QFY16

2QFY16

3QFY16

Utilization (%)

Source: Company, Angel Research

The company added 13 new clients during the quarter, taking the active client

base to 801 V/s 788 in 2QFY2016, with 1 client added in US$20-50mn+ bracket

and others mainly in the US$1-5mn+ bracket.

Exhibit 8: Client metrics

Particulars

3QFY15

4QFY14

1QFY16

2QFY16

3QFY16

Total active clients

674

767

770

788

801

US$1mn-5mn

166

195

195

196

221

US$5mn-10mn

37

40

41

40

42

US$10mn-20mn

19

21

24

26

26

US$20mn-50mn

19

22

23

22

23

US$50mn+

13

13

13

14

14

Source: Company, Angel Research

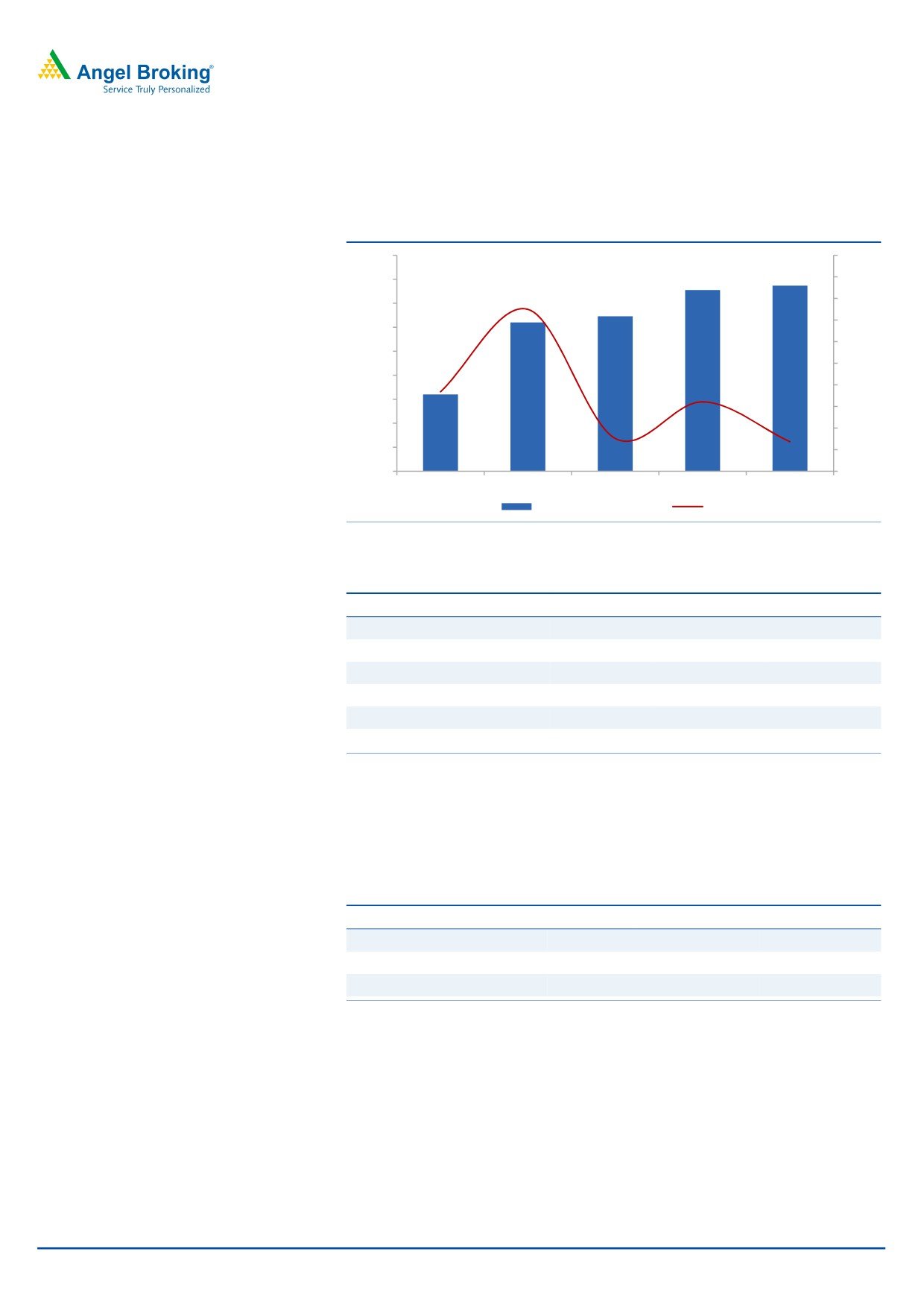

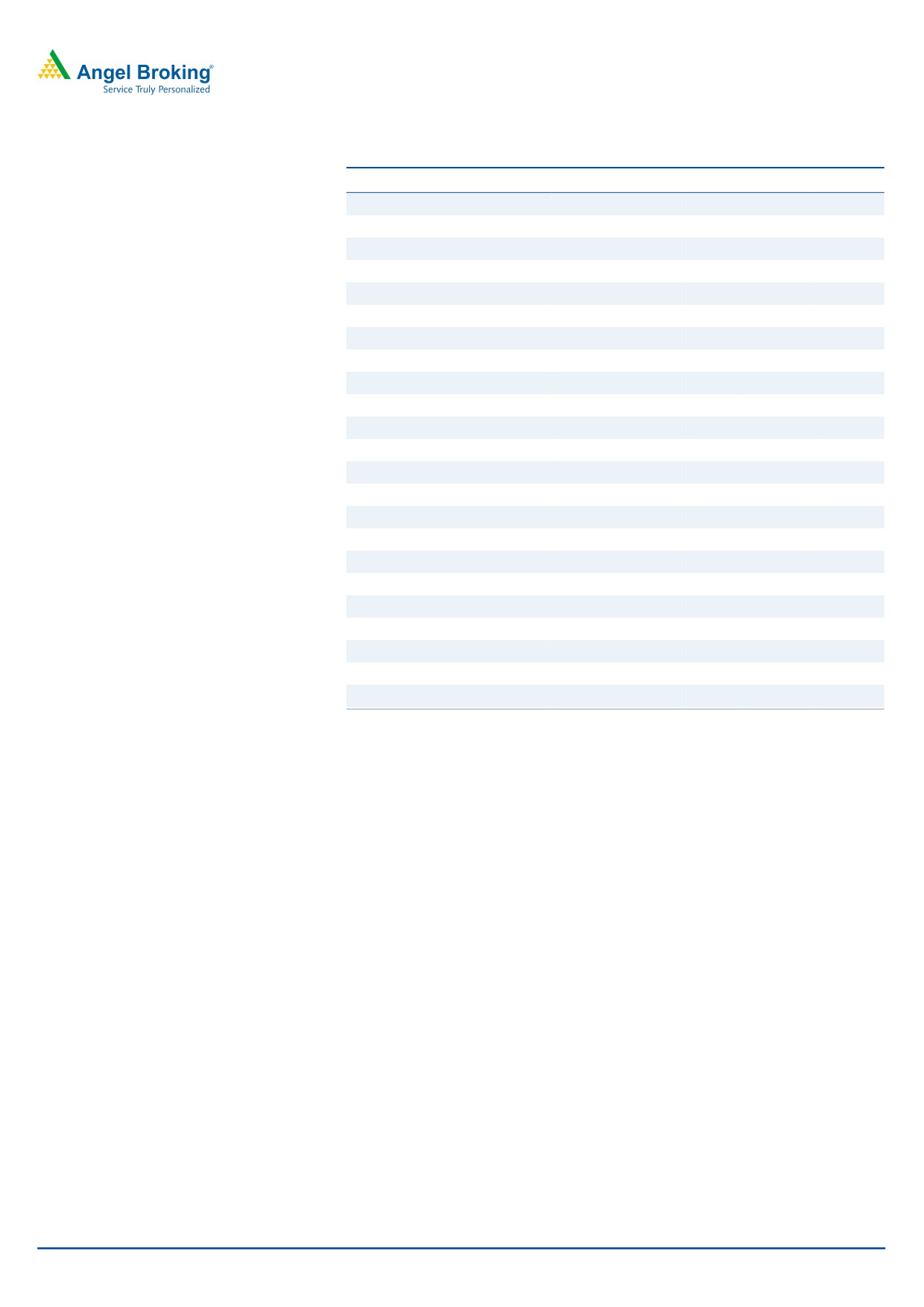

Operating margin expands

On the operating front, the EBDITA margin came in at 16.9% V/s an expected

17.2% and V/s 16.6% in 2QFY2016, a qoq expansion of 70bp. The EBIT margin

came in at 14.3% V/s an expected 14.2% and V/s 13.7% in 2QFY2016. During

the quarter, tailwinds of utilization, INR depreciation and SG&A leverage aided

margin expansion.

February 23, 2016

4

Tech Mahindra | 3QFY2016 Result Update

Exhibit 9: Margin trend (%)

40

35

34.5

30

32.0

31.3

30.5

29.3

25

20.2

20

16.6

16.9

15.2

14.9

15

17.7

14.4

10.7

13.7

12.4

10

3QFY15

4QFY15

1QFY16

2QFY16

3QFY16

Gross margin

EBITDA margin

EBIT margin

Source: Company, Angel Research

Investment arguments

Growth prospects robust: The Management indicated that the company remains

confident of growth in the non-BT business with it continuing to see a robust deal

pipeline across geographies. Also, the company, in the recent past, has been

looking at inorganic mode to enhance its presence in the non-telecom segment.

Tech Mahindra has been able to scale up well across verticals through its focused

approach on large deals. We expect a CAGR of 10.3% and 13.6% in USD and

INR revenue, respectively, over FY2015-17E.

Deal pipeline healthy: Tech Mahindra remains confident of improving revenue

growth, citing healthy deal pipeline along with pick up in discretionary spending,

primarily in the US. The Management sounded confident of demand from BFSI,

Healthcare, Manufacturing and Retail. Tech Mahindra is following a two-pronged

strategy to expand its enterprise business; ie providing end-to-end offerings in

leadership areas like Manufacturing, and following a niche offerings-led entry

strategy in areas like BFSI where it is a challenger. Better cross-sell of services can

help grow marquee accounts post-merger. We expect the enterprise segment

growth to be led by broader revival in the markets and deepening of existing

relationships. During 3QFY2016 the company won deals worth TCV of

US$275mn, mainly from the enterprise vertical.

Inorganic growth initiatives to augment well for company: The company has been

active in the M&A space, with it having acquired Satyam a few years back, to

acquiring LCC and Softgen recently. Softgen’s and LCC’s acquisition was

consolidated in 4QFY2015. LCC is one of the world’s largest independent global

providers of network engineering services to the telecommunications industry. LCC

is estimated to have annual revenues of more than US$400mn (CY2014), with

workforce of over 5,700 network professionals across five continents and more

than 50 countries. With this acquisition, Tech Mahindra will also be addressing a

rapidly growing market opportunity as telecommunications companies and

enterprises accelerate their network upgrade cycle.

February 23, 2016

5

Tech Mahindra | 3QFY2016 Result Update

Outlook and valuation

Given the recent acquisitions and healthy order pipeline, the company is expected

to post a healthy US$ and INR CAGR of 10.3% and 13.6%, respectively, over

FY2015-17. However, the acquisition of LCC will be margin dilutive in the near

term, leading the FY2016E EBDIT margin to drop to 16.2% from 22.2% in

FY2014. The company, given its success in turnaround of its earlier acquisition -

Satyam, believes it would be able to do the same with the recent acquisitions and

would be able to get close to achieving the 20.0% EBIT levels in future. The

company is one of the fastest growing IT companies. Given the conducive

valuation on EV/sales front, where it trades at a significant discount to its peers, we

believe the stock should witness uptrend once the profitability returns to its mean

average. We recommend a Buy rating on the stock.

Exhibit 10: Key assumptions

FY2016E

FY2017E

Revenue growth (US$)

10.7

10.0

USD-INR rate (realized)

65.0

65.0

Revenue growth (`)

17.3

10.0

EBITDA margin (%)

16.2

17.0

Tax rate (%)

23.4

23.4

EPS growth (%)

5.4

16.4

Source: Company, Angel Research

Exhibit 11: One-year forward PE (x)

800

600

400

200

0

Nov-08

Sep-09

Jul-10

May-11

Mar-12

Dec-12

Oct-13

Aug-14

Jun-15

Price

20

17

14

11

8

Source: Company, Angel Research. Note: P/E includes profits of Mahindra Satyam from FY2012

February 23, 2016

6

Tech Mahindra | 3QFY2016 Result Update

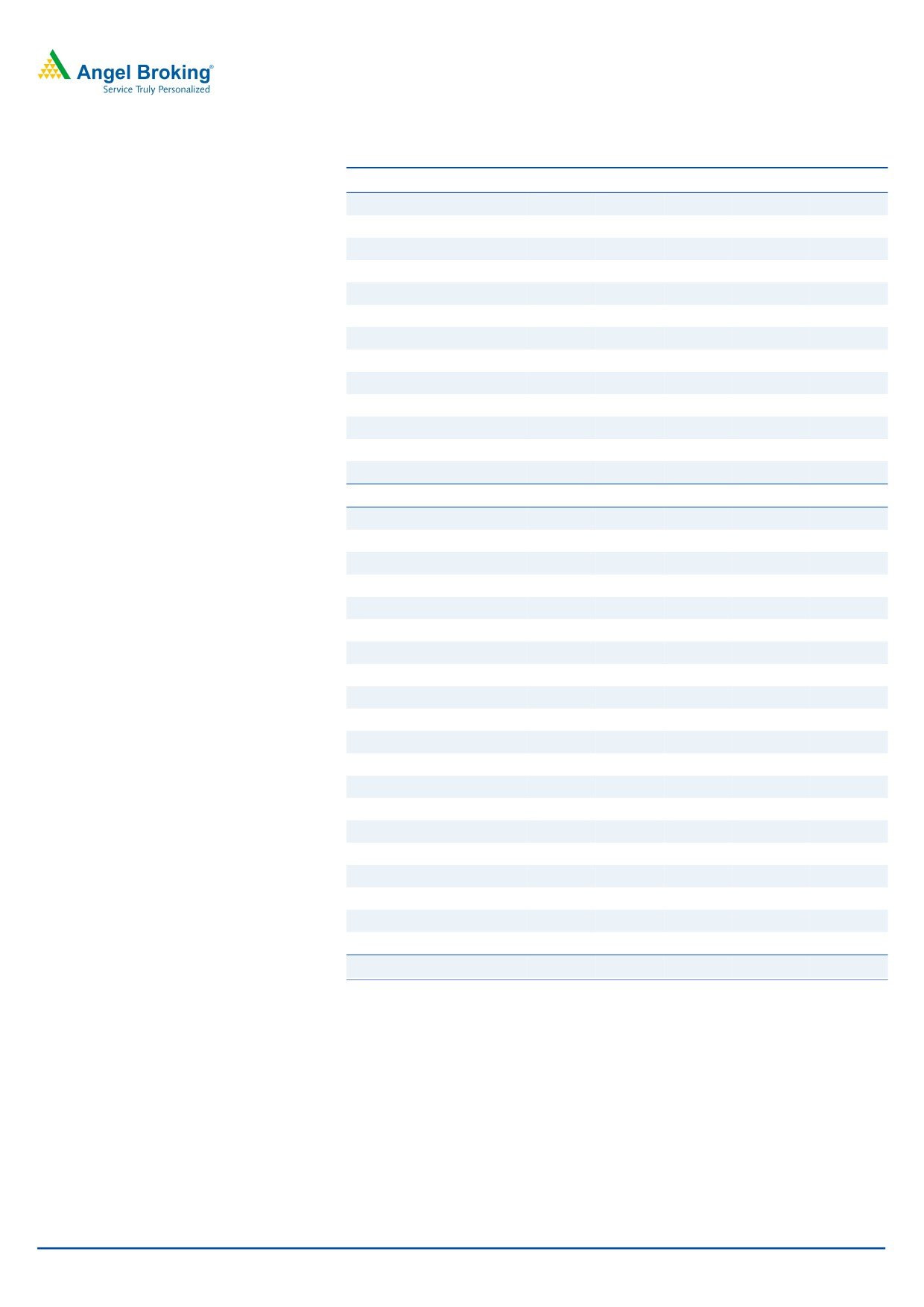

Exhibit 12: Recommendation summary

Company

Reco

CMP Tgt Price Upside

FY2017E FY2017E

FY2015-17E

FY2017E FY2017E

(`)

(`)

(%)

EBITDA (%)

P/E (x)

EPS CAGR (%)

EV/Sales (x)

RoE (%)

HCL Tech

Buy

850

1,038

22.1

21.5

14.7

6.0

2.0

18.8

Infosys

Buy

1,126

1,347

19.7

27.5

17.1

10.6

2.9

20.1

TCS

Buy

2,320

2,854

23.0

28.5

16.8

11.8

3.3

38.9

Tech Mahindra

Buy

440

530

20.5

17.0

13.1

10.8

1.2

19.1

Wipro

Buy

547

670

22.5

23.8

13.0

9.7

1.7

17.2

Source: Company, Angel Research.

Company Background

Tech Mahindra was founded in 1986 as a joint venture between Mahindra Group

and British Telecom (BT) to service the latter. Later on, the company started

servicing other external clients as well (solely in the telecom industry).In June 2009,

Tech Mahindra acquired a 42.7% stake in erstwhile Satyam Computers (now

Mahindra Satyam) and now the latter is entirely merged with the company.

The company has recently acquired the companies - LCC and Softgen. These two

acquisitions have been consolidated in 4QFY2015. LCC is one of the world’s

largest independent global providers of network engineering services to the

telecommunications industry. LCC is estimated to have annual revenues of more

than US$400mn (CY2014), with workforce of over 5,700 network professionals

across five continents and more than 50 countries.

February 23, 2016

7

Tech Mahindra | 3QFY2016 Result Update

Profit and loss statement (Consolidated, Indian GAAP)

Y/E March (` cr)

FY2013 FY2014E FY2015 FY2016E FY2017E

Net sales

14,332

18,831

22,621

26,524

29,177

Cost of revenues

9,001

10,790

11,914

18,036

19,548

Gross profit

5,331

8,042

10,708

8,488

9,628

% of net sales

37.2

42.7

47.3

32.0

33.0

SG&A expenses

2,268

2,459

6,555

4,191

4,668

% of net sales

15.8

13.1

29.0

15.8

16.0

EBITDA

3,063

5,582

4,153

4,297

4,960

% of net sales

21.4

29.6

18.4

16.2

17.0

Depreciation and amortization

390

522

611

716

788

% of net sales

2.7

2.8

2.7

2.7

2.7

EBIT

2,674

5,060

3,541

3,581

4,172

% of net sales

18.7

26.9

15.7

13.5

14.3

Interest expense

92

43

30

30

30

Other inc., net of forex gain/(loss)

212

113

106

106

106

Profit before tax

2,793

5,130

3,618

3,657

4,249

Provision for tax

648

775

960

856

994

% of PBT

23.2

15.1

26.5

23.4

23.4

PAT

2,146

4,355

2,659

2,802

3,255

Exceptional item

160

120

-

-

-

Minority interest

30

14

31

31

31

Reported PAT

1,955

4,461

2,628

2,771

3,224

Adjusted PAT

2,115

2,932

2,628

2,771

3,224

Fully diluted EPS (`)

22.0

30.5

27.4

28.8

33.6

February 23, 2016

8

Tech Mahindra | 3QFY2016 Result Update

Balance sheet (Consolidated, Indian GAAP)

Y/E March (` cr)

FY2013

FY2014

FY2015

FY2016E

FY2017E

Equity capital

232

234

480

480

480

Preference capital

-

-

-

-

-

Share premium

-

-

-

-

-

Profit and loss

6,621

8,947

11,768

13,864

16,414

Other reserves

-

2

0

0

0

Net worth

6,854

9,182

12,249

14,345

16,894

Secured loans

322

309

621

621

621

Unsecured loans

531

54

54

54

55

Total debt

853

363

675

675

676

Other long term liability

224

376

376

376

377

Long-term provisions

393

414

414

414

415

Minority interest

134

144

160

144

145

Amount pending investigation

1,230

1,230

895

895

895

Total capital employed

9,689

11,709

14,768

16,848

19,401

Gross block

3,611

5,460

7,811

8,811

9,811

Accumulated dep.

(1,379)

(2,866)

(3,477)

(4,193)

(4,981)

Net block

2,232

2,594

4,334

4,618

4,830

Capital WIP

260

266

266

266

267

Total fixed assets

2,491

2,861

4,601

4,884

5,098

Investments

36

36

2,103

2,103

2,103

Long term loans and adv.

743

914

1,306

1,502

1,727

Interest in TML benefit trust

1,207

-

-

-

-

Deferred tax asset, net

348

383

390

390

390

Other non-current assets

120

16

-

-

-

Inventories

11

10

24

11

11

Sundry debtors

3,369

4,349

5,206

5,987

6,885

Cash and cash equv.

3,463

4,756

2,405

4,815

6,907

Loans and advances

1,293

2,616

3,813

2,998

2,999

Current investments

175

-

-

-

-

Unbilled revenue

556

-

-

-

-

Sundry creditors

(858)

(1,549)

(1,654)

(1,903)

(2,188)

Other liabilities

(2,037)

(1,415)

(1,627)

(1,871)

(2,152)

Provision

(1,227)

(1,267)

(1,799)

(2,068)

(2,379)

Working capital

4,744

7,500

6,368

7,969

10,083

Total capital deployed

9,689

11,709

14,768

16,848

19,401

February 23, 2016

9

Tech Mahindra | 3QFY2016 Result Update

Cash flow statement (Consolidated, Indian GAAP)

Y/E March (` cr)

FY2013

FY2014

FY2015

FY2016E

FY2017E

Pre tax profit from operations

2,581

4,355

2,659

2,802

3,255

Depreciation

390

522

611

716

788

Exp. (deffered)/written off/others

-

-

-

-

-

Pre tax cash from operations

2,971

4,877

3,270

3,518

4,042

Other income/prior period ad

182

113

106

106

106

Net cash from operations

3,153

4,990

3,376

3,624

4,149

Tax

(648)

(775)

(960)

(856)

(994)

Cash profits

2,505

4,215

2,417

2,768

3,155

(Inc)/dec in

Sundry Debtors

(647)

(980)

(857)

(781)

(898)

Inventories

4

1

(15)

13

-

Loans and advances

(235)

(1,324)

(1,197)

815

(1)

Sundry creditors

167

692

105

248

285

Others

673

(623)

212

244

281

Net trade working capital

(39)

(2,233)

(1,752)

540

(333)

Cashflow from operating activities

2,466

1,981

665

3,308

2,822

(Inc)/dec in fixed assets

(1,025)

(369)

(1,740)

(284)

(213)

(Inc)/dec in investments

(1)

-

(2,067)

-

-

(Inc)/dec in other non current assets

(611)

104

16

-

-

Cashflow from investing activities

(1,636)

(265)

(3,791)

(284)

(213)

Inc/(dec) in debt

(297)

490

(311)

-

(1)

Inc/(dec) in deferred revenue

(207)

-

-

-

1

Inc/(dec) in equity/premium

1

(2)

1

-

-

Inc/(dec) in minority interest

119

(9)

(16)

16

(1)

Addition to reser. on amalgamation

70

-

-

-

1

Dividends

(149)

(231)

(674)

(674)

(674)

Others

(670)

1,776

44

158

Cashflow from financing activities

(463)

(423)

775

(614)

(516)

Cash generated/(utilised)

367

1,293

(2,351)

2,410

2,092

Cash at start of the year

3,096

3,463

4,756

2,405

4,815

Cash at end of the year

3,463

4,756

2,405

4,815

6,907

February 23, 2016

10

Tech Mahindra | 3QFY2016 Result Update

Key Ratios

Y/E March

FY2013

FY2014

FY2015

FY2016E

FY2017E

Valuation ratio (x)

P/E (on FDEPS)

20.0

14.4

16.1

15.2

13.1

P/CEPS

18.0

8.5

13.0

12.1

10.5

P/BVPS

6.2

4.6

3.4

2.9

2.5

Dividend yield (%)

1.1

1.1

1.1

1.1

1.4

EV/Sales

2.8

2.0

1.8

1.4

1.2

EV/EBITDA

13.0

6.8

9.8

8.9

7.3

EV/Total assets

16.0

13.3

8.9

7.9

7.1

Per share data (`)

EPS

22.0

30.5

27.4

28.8

33.6

Cash EPS

24.4

51.9

33.7

36.3

41.8

Dividend

5.0

5.0

5.0

5.0

6.0

Book value

71.3

95.6

127.5

149.3

175.9

Dupont analysis

Tax retention ratio (PAT/PBT)

0.7

0.9

0.7

0.8

0.8

Cost of debt (PBT/EBIT)

1.0

1.0

1.0

1.0

1.0

EBIT margin (EBIT/Sales)

0.2

0.3

0.2

0.1

0.1

Asset turnover ratio (Sales/Assets)

5.8

6.6

4.9

5.4

5.7

Leverage ratio (Assets/Equity)

0.4

0.3

0.4

0.3

0.3

Operating ROE (%)

28.5

48.6

21.5

19.3

19.1

Return ratios (%)

RoCE (pre-tax)

27.6

43.2

24.0

21.3

21.5

Angel RoIC

46.2

75.7

29.3

30.4

34.1

RoE

30.9

31.9

21.5

19.3

19.1

Turnover ratios( x)

Asset turnover (fixed assets)

5.8

6.6

4.9

5.4

5.7

Receivables days

78

78

92

89

90

Payable days

25

26

29

28

29

February 23, 2016

11

Tech Mahindra | 3QFY2016 Result Update

Research Team Tel: 022 - 39357800

DISCLAIMER

Angel Broking Private Limited (hereinafter referred to as “Angel”) is a registered Member of National Stock Exchange of India Limited,

Bombay Stock Exchange Limited and Metropolitan Stock Exchange of India Limited. It is also registered as a Depository Participant with

CDSL and Portfolio Manager with SEBI. It also has registration with AMFI as a Mutual Fund Distributor. Angel Broking Private Limited is

a registered entity with SEBI for Research Analyst in terms of SEBI (Research Analyst) Regulations, 2014 vide registration number

INH000000164. Angel or its associates has not been debarred/ suspended by SEBI or any other regulatory authority for accessing

/dealing in securities Market. Angel or its associates including its relatives/analyst do not hold any financial interest/beneficial

ownership of more than 1% in the company covered by Analyst. Angel or its associates/analyst has not received any compensation /

managed or co-managed public offering of securities of the company covered by Analyst during the past twelve months. Angel/analyst

has not served as an officer, director or employee of company covered by Analyst and has not been engaged in market making activity

of the company covered by Analyst.

This document is solely for the personal information of the recipient, and must not be singularly used as the basis of any investment

decision. Nothing in this document should be construed as investment or financial advice. Each recipient of this document should

make such investigations as they deem necessary to arrive at an independent evaluation of an investment in the securities of the

companies referred to in this document (including the merits and risks involved), and should consult their own advisors to determine

the merits and risks of such an investment.

Reports based on technical and derivative analysis center on studying charts of a stock's price movement, outstanding positions and

trading volume, as opposed to focusing on a company's fundamentals and, as such, may not match with a report on a company's

fundamentals.

The information in this document has been printed on the basis of publicly available information, internal data and other reliable

sources believed to be true, but we do not represent that it is accurate or complete and it should not be relied on as such, as this

document is for general guidance only. Angel Broking Pvt. Limited or any of its affiliates/ group companies shall not be in any way

responsible for any loss or damage that may arise to any person from any inadvertent error in the information contained in this report.

Angel Broking Pvt. Limited has not independently verified all the information contained within this document. Accordingly, we cannot

testify, nor make any representation or warranty, express or implied, to the accuracy, contents or data contained within this document.

While Angel Broking Pvt. Limited endeavors to update on a reasonable basis the information discussed in this material, there may be

regulatory, compliance, or other reasons that prevent us from doing so.

This document is being supplied to you solely for your information, and its contents, information or data may not be reproduced,

redistributed or passed on, directly or indirectly.

Neither Angel Broking Pvt. Limited, nor its directors, employees or affiliates shall be liable for any loss or damage that may arise from

or in connection with the use of this information.

Note: Please refer to the important ‘Stock Holding Disclosure' report on the Angel website (Research Section). Also, please refer to the

latest update on respective stocks for the disclosure status in respect of those stocks. Angel Broking Pvt. Limited and its affiliates may

have investment positions in the stocks recommended in this report.

Disclosure of Interest Statement

Tech Mahindra

1. Analyst ownership of the stock

No

2. Angel and its Group companies ownership of the stock

No

3. Angel and its Group companies' Directors ownership of the stock

No

4. Broking relationship with company covered

No

Note: We have not considered any Exposure below ` 1 lakh for Angel, its Group companies and Directors

Ratings (Based on expected returns

Buy (> 15%)

Accumulate (5% to 15%)

Neutral (-5 to 5%)

over 12 months investment period):

Reduce (-5% to -15%)

Sell (< -15%)

February 23, 2016

12