IPO Note | HR Services

January 30, 2016

TeamLease Services

NEUTRAL

Issue Open: February 2, 2016

IPO Note - Valuations expensive

Issue Close: February 4, 2016

TeamLease Services Ltd (TSL) is one of India’s leading providers of human

Issue Details

resource services in the organized segment. It’s staffing business accounts for

98.8% of the revenues while HR services accounts for the balance. It has a market

Face Value: `10

share of ~6% in the Indian Flexi-staffing Industry. It delivers staffing services

across industries like banking, manufacturing, retail, telecom, etc. The company

Present Eq. Paid up Capital: `15.3cr

has shown significant growth over FY2011-15, posting a revenue CAGR of 30.7%

Fresh Issue**: 0.18cr Shares

and after posting losses till FY2013, the company has since turned profitable and

reported net profit of ~`30cr in FY2015 vs. a net loss of ~`16cr in FY2012.

Offer for sale: 0.32cr Shares

Lower penetration levels suggest huge growth potential: The flexi-staffing industry in

Post Eq. Paid up Capital: `17.1cr

India as of FY2014 was valued at around `180-220bn and the penetration level of

the industry in India at ~0.4% is lower than in developed regions where the

Market Lot: 15 Shares

penetration level is between 1.5-3.0%. Going forward, as per industry reports, Flexi-

staffing industry is expected to report a CAGR of 25-30% and be around `610-640bn

Fresh Issue (amount): `150cr

by FY2019 and the penetration level is expected to improve to 1.0% over the same

Price Band: `785-850

period on back of increasing number of enterprises turning formal, skill development

Post-issue implied mkt. cap `1,354cr*-

in the country, and regulatory amendments in favour of formal employment.

1,453cr**

Focus on improving operating margins: The HR services business, which commands

Note:*at Lower price band and **Upper price band

higher margin, accounts for a very small portion of company’s overall top-line. HR

services offers recruitment services, regulatory services, skills and development

corporate training, and payroll services. The company is now focusing on such higher

Book Building

margin businesses apart from its regular staffing business. It is also looking for

opportunities in the IT vertical and improving employee productivity.

QIBs

75%

Intense competition and lack of pricing power: The flexi-staffing industry is highly

Non-Institutional

15%

fragmented with intense competition. Almost 70-80% of the industry is unorganized

consisting of smaller players and balance comprising of major players like Adecco,

Retail

10%

Randstad, Quesscorp, etc. TSL faces stiff competition from these companies as well as

other small players, thus leading to lack of pricing power.

Post Issue Shareholding Pattern(%)

Outlook Valuation: TSL being leading staffing company in India and has the potential

to further increase its market share. However, although the company has shown good

Promoters Group

45.6

growth momentum, it operates in an industry characterised by intense competition,

lack of pricing power, low entry barriers and high degree of fragmentation which

MF/Banks/Indian

renders limited scope for margin improvement.

FIs/FIIs/Public & Others

54.4

On the valuation front, at the upper end of the price band, the pre-issue P/E works out

to 60.6x its 1HFY2016E annualised earnings. In comparison, its global peer Adecco is

trading at 12.9x 9MCY2015 annualised earnings and has a better margin and ROE

profile. Further, post the IPO, TSL’s ROE is not expected to improve significantly in the

near term. Considering the above mentioned business concerns and expensive

valuation, we recommend a Neutral on the issue.

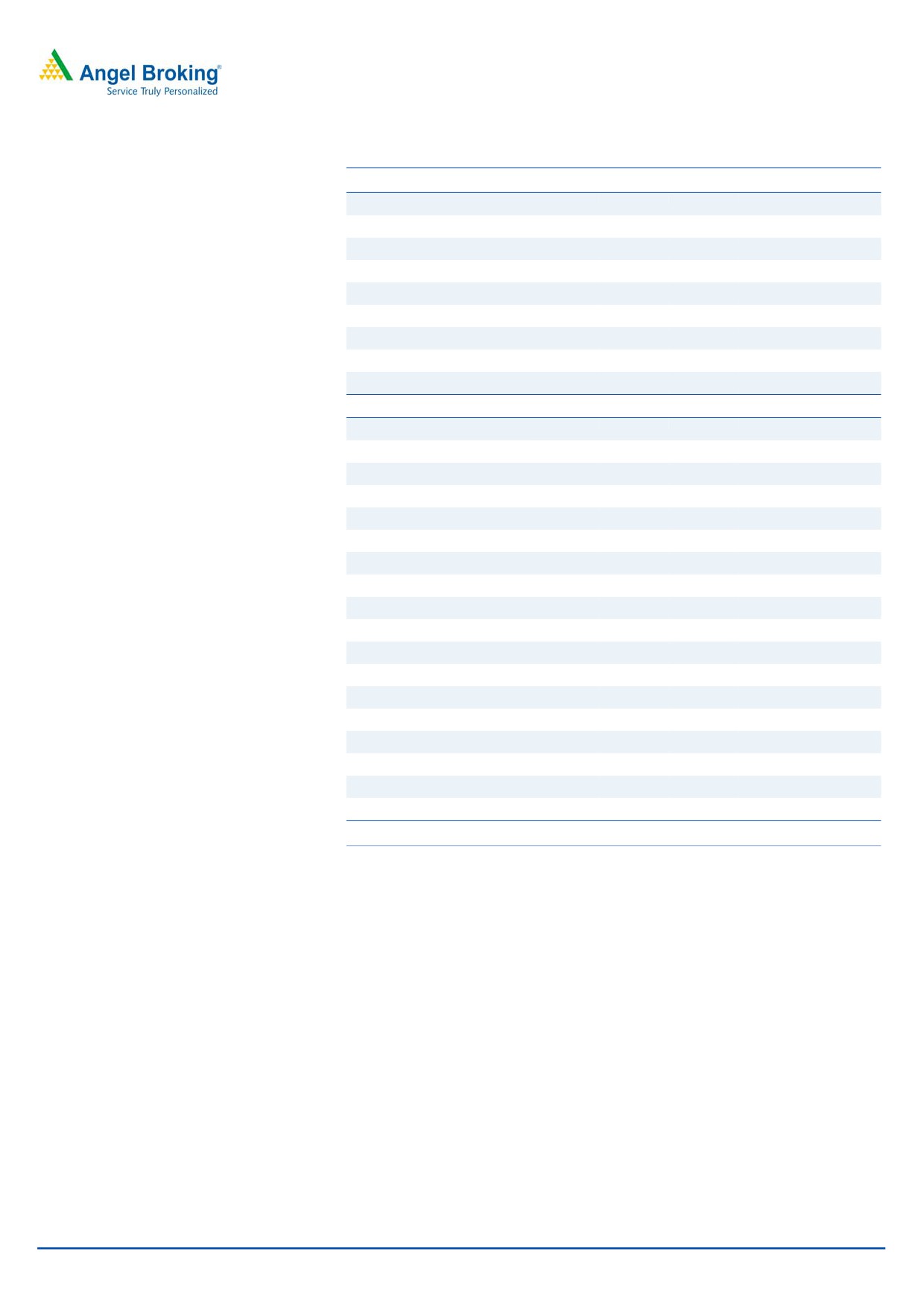

Key Financial

Y/E March (` cr)

FY2012

FY2013

FY2014

FY2015

1HFY2016

Net Sales

926

1,251

1,530

2,007

1,210

% chg

34.8

35.1

22.3

31.2

-

Net Profit

(16)

(4)

18

30

11

% chg

-

-

-

66.3

-

OPM (%)

(2.2)

(0.9)

0.8

1.2

0.9

Amarjeet S Maurya

EPS (`)

(10.8)

(2.4)

11.6

19.4

7.2

+91 22 4000 3600 Ext: 6831

P/E (x)

-

-

73.0

43.9

-

P/BV (x)

12.4

12.9

11.0

8.8

8.2

RoE (%)

-

-

15.0

20.0

-

RoCE (%)

-

-

8.5

14.4

-

Milan Desai

EV/Sales (x)

1.3

1.0

0.8

0.6

-

+91 22 4000 3600 Ext: 6846

EV/EBITDA (x)

-

-

101.2

49.4

-

Source: Company, Angel Research; Note: Valuation ratios based on pre-issue outstanding shares

and at upper end of the price band

Please refer to important disclosures at the end of this report

1

TeamLease Services | IPO Note

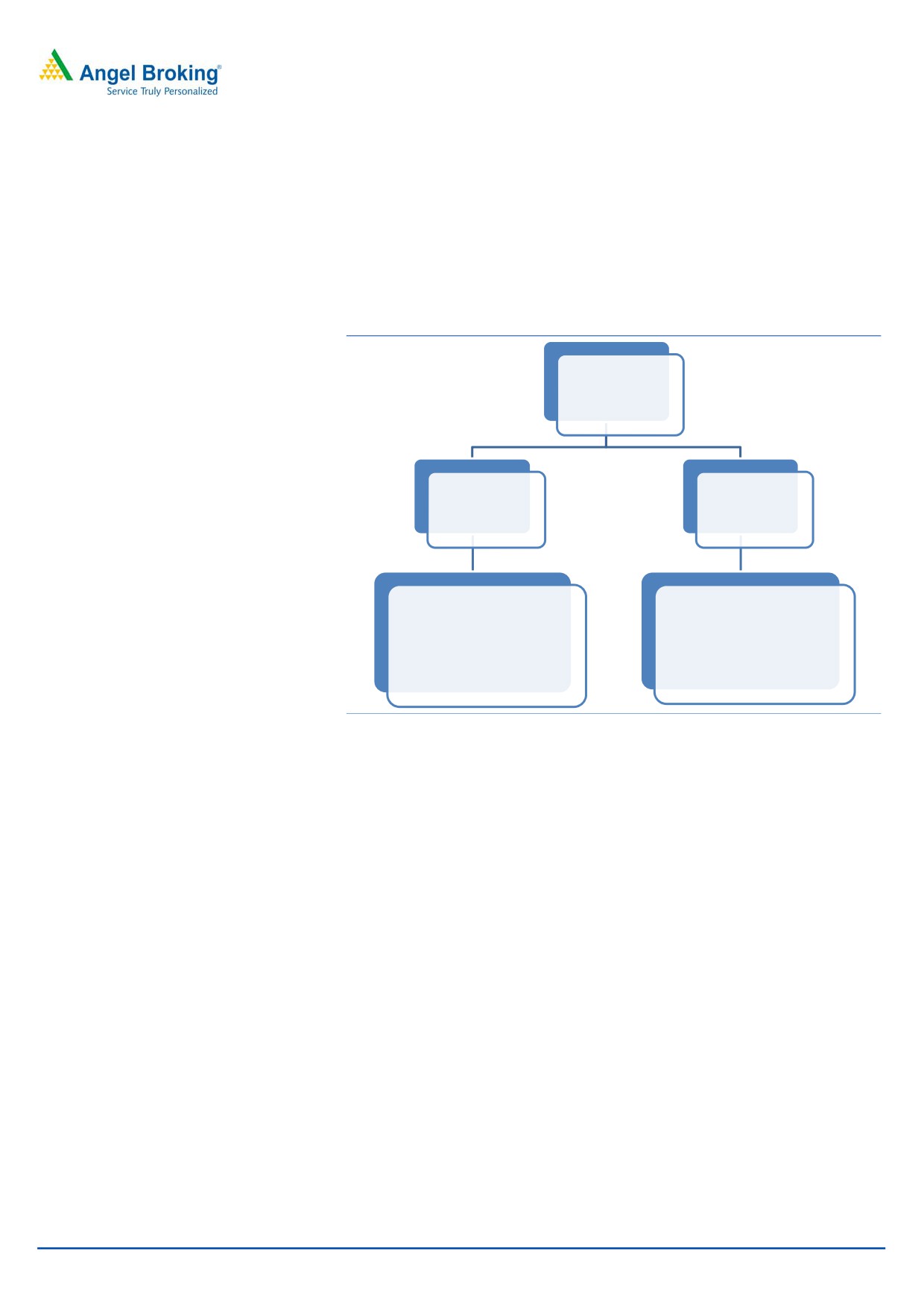

Company background

TSL is one of India’s leading providers of human resource services in the organized

segment, providing staffing solutions across industry sectors and diverse functional

roles. The company’s operations are classified into Staffing and HR services.

Staffing services account for 98.8% of its total revenues. As of March 31, 2015, the

company has provided employment to ~1.12mn associates (since 2002).

Exhibit 1: Business model

Teamlease

Staffing Operations

HR Services

(98.8%)

(1.2%)

Permanent Recruitment.

Regulatory Compliance Consulting.

Staffing Services.

Retail Learning Solutions.

Institutional Learning Solutions .

Payroll.

Source: Company, Angel Research

TSL operates on an asset-light model with low capital expenditure requirements. As

of November 30, 2015, it had 104,946 associate employees, serving 1,021 clients

and 1,218 full time employees based out of eight offices in India.

It delivers staffing services across various industries including the consumer

durables, chemicals, manufacturing, media and telecom, retail, banking, financial

services and insurance, e-commerce, pharmaceuticals and healthcare sectors. The

majority of TSL’s Associate Employees are engaged in sales, logistics and customer

service functions.

January 30, 2016

2

TeamLease Services | IPO Note

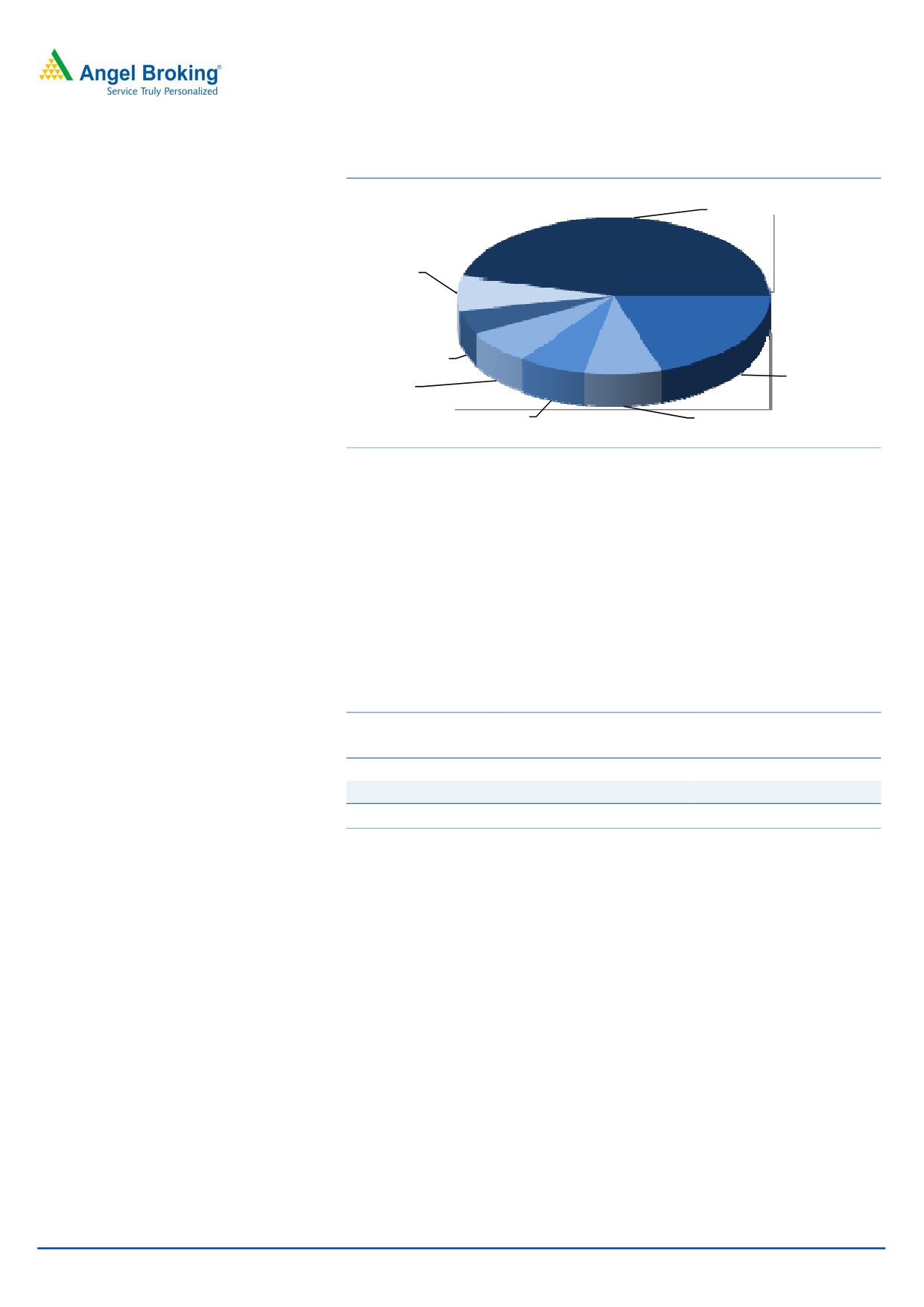

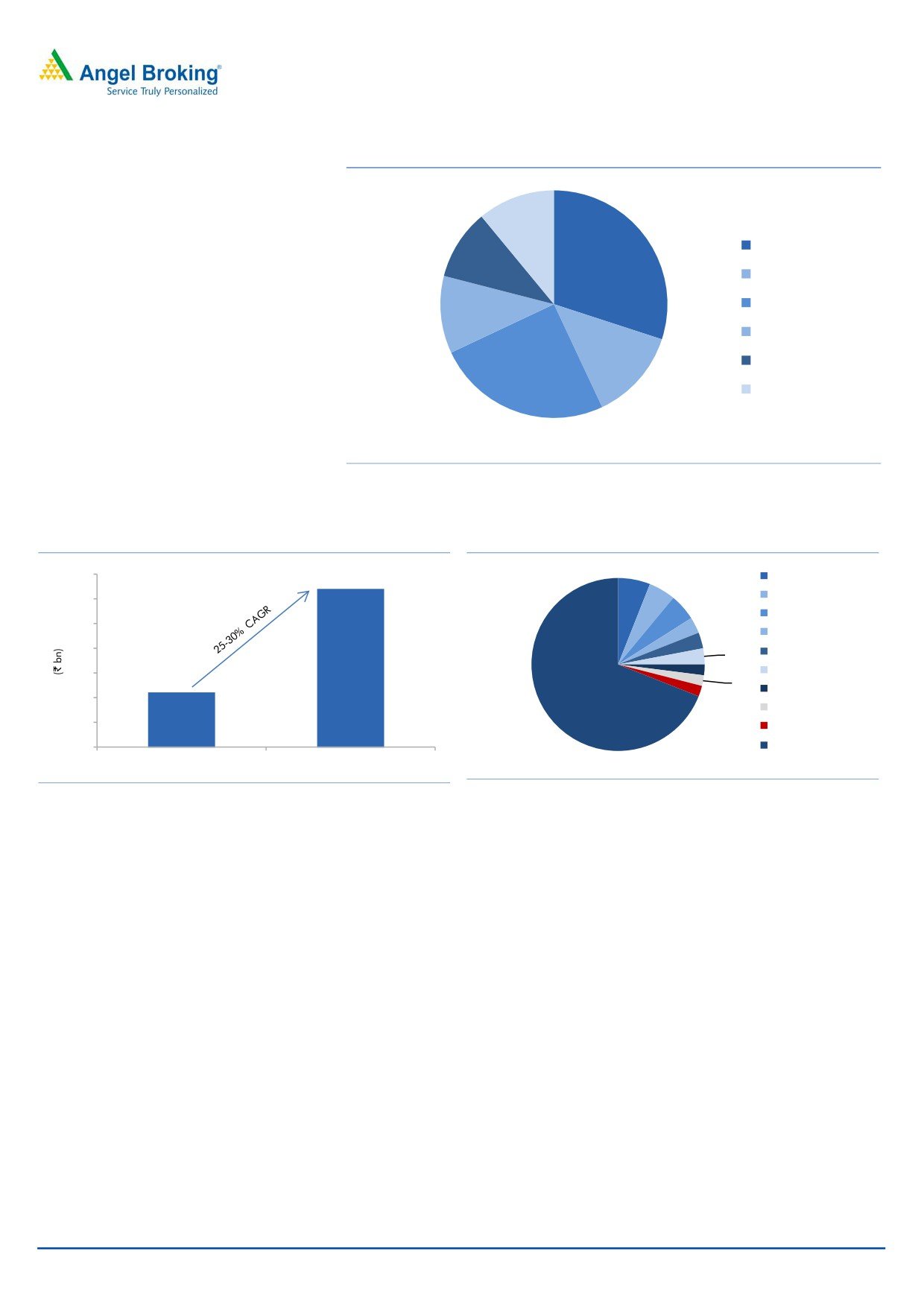

Exhibit 2: Industry wise revenue contribution

Others , 46%

IT/Ites, 7%

Agri-Related, 5%

Consumer

Financial

Goods, 20%

Services, 7%

Telecom Services,

Manufacturing ,

7%

8%

Source: Company, Angel Research

Issue details

The company is raising `150cr through fresh issue of equity shares in the price

band of `785-850. In addition, the issue also consists of offer for sale of 32.2 lakh

shares of which 1.5 lakh shares will be offered by the promoter entities and 30.7

lakh shares by other investors. The fresh issue will constitute 10.3% of the post-

issue paid-up equity share capital of the company assuming the issue is subscribed

at the upper end of the price band.

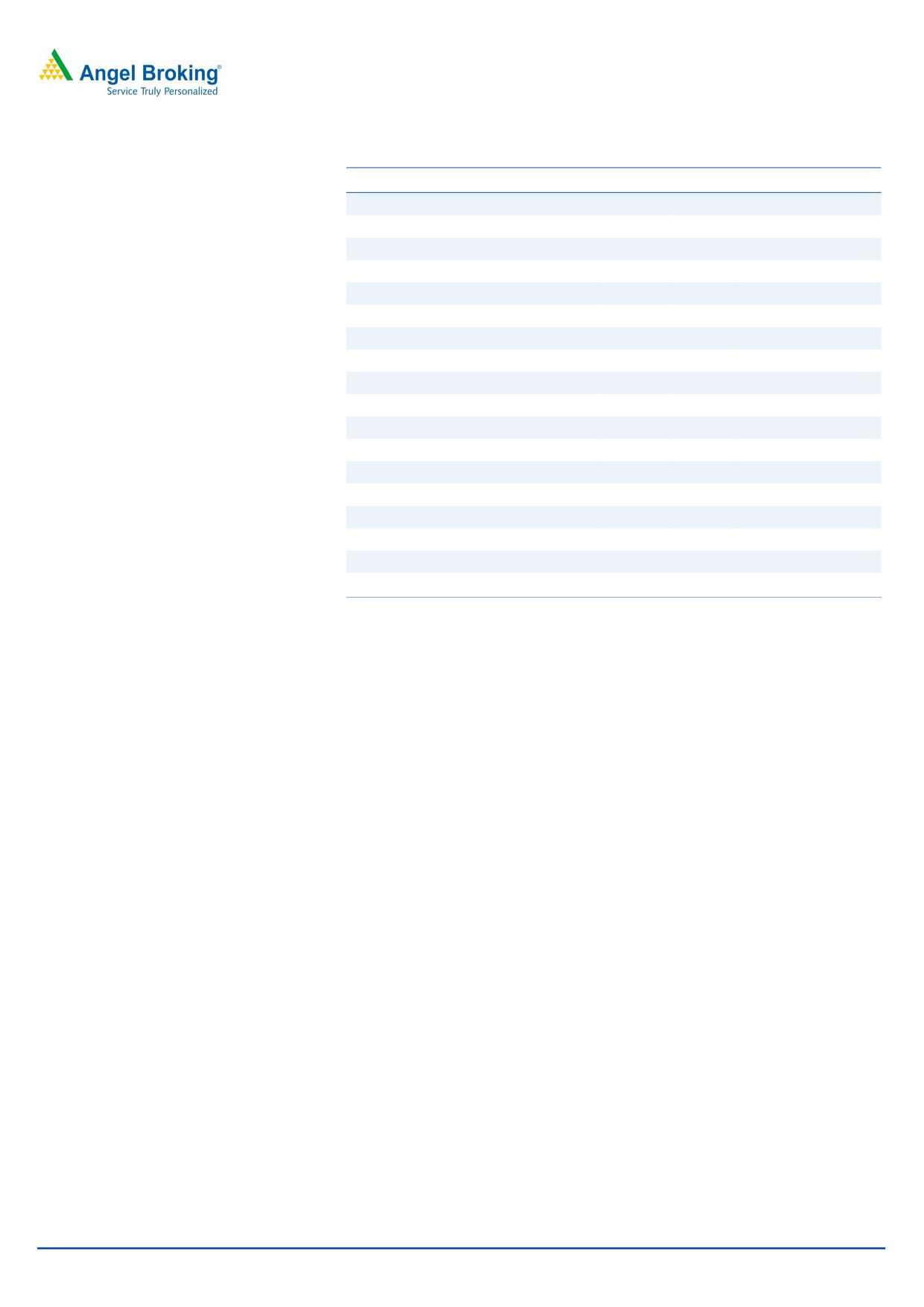

Exhibit 3: Shareholding pattern

Particulars

Pre-Issue

Post-Issue

No. of shares

(%)

No. of shares

(%)

Promoter group

79,51,971

51.9

77,98,650

45.6

Others

73,80,093

48.1

92,98,120

54.4

Total

1,53,32,064

100.0

1,70,96,770

100.0

Source: Company, Angel Research

Objects of the offer

Funding existing and incremental working capital requirements of the

company amounting to `80cr.

Funding for acquisitions and other strategic initiatives amounting to `25cr.

For upgrading existing IT infrastructure amounting to `15cr.

The balance will be utilized for general corporate purposes.

January 30, 2016

3

TeamLease Services | IPO Note

Investment rationale

Lower penetration levels suggest huge growth potential

Penetration level of flexi-staffing industry is lower in India as compared to

In India, the penetration level of flexi-

developed regions like UK, USA, Europe, Japan etc. In India, the penetration level

staffing is at ~0.4% compared to 3% in

of flexi-staffing is at ~0.4% compared to 3% in UK, 2% in USA, and 1.5% in Japan

UK, 2% in USA, and 1.5% in Japan as

as stated by the company.

stated by the company

We believe that going forward, penetration of flexi-staffing would increase on back

of increasing number of enterprises turning formal, skill development in the

country, and regulatory amendments in favour of formal and flexi-staffing industry.

The initiatives taken by the flexi-staffing industry, such as training services, are also

likely to add to the industry growth over the long term. The expected growth in

penetration levels to be witnessed in the domestic flexi-staffing industry over the

next five years is largely in line with many global economies.

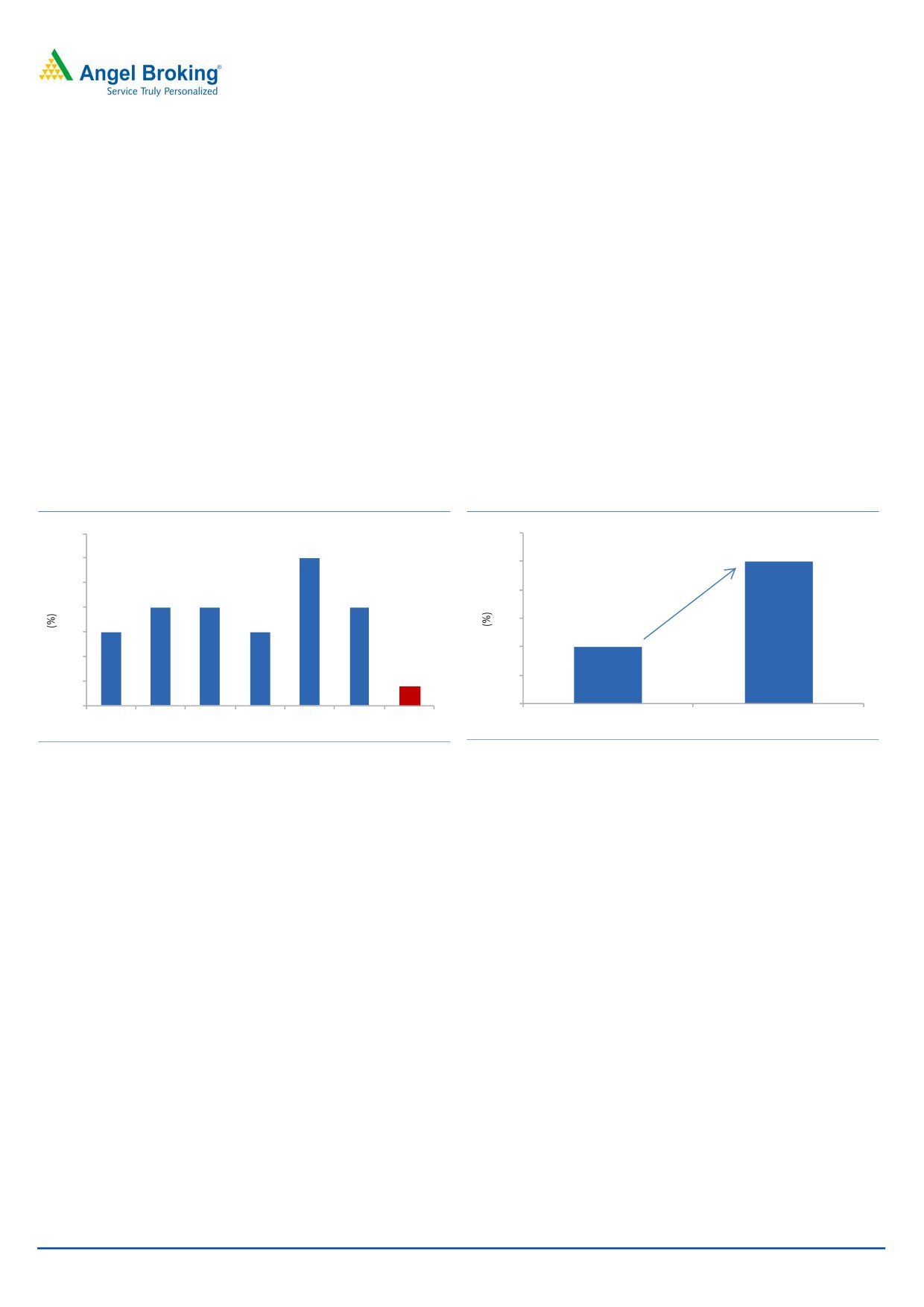

Exhibit 4: Flexi-staffing penetration levels

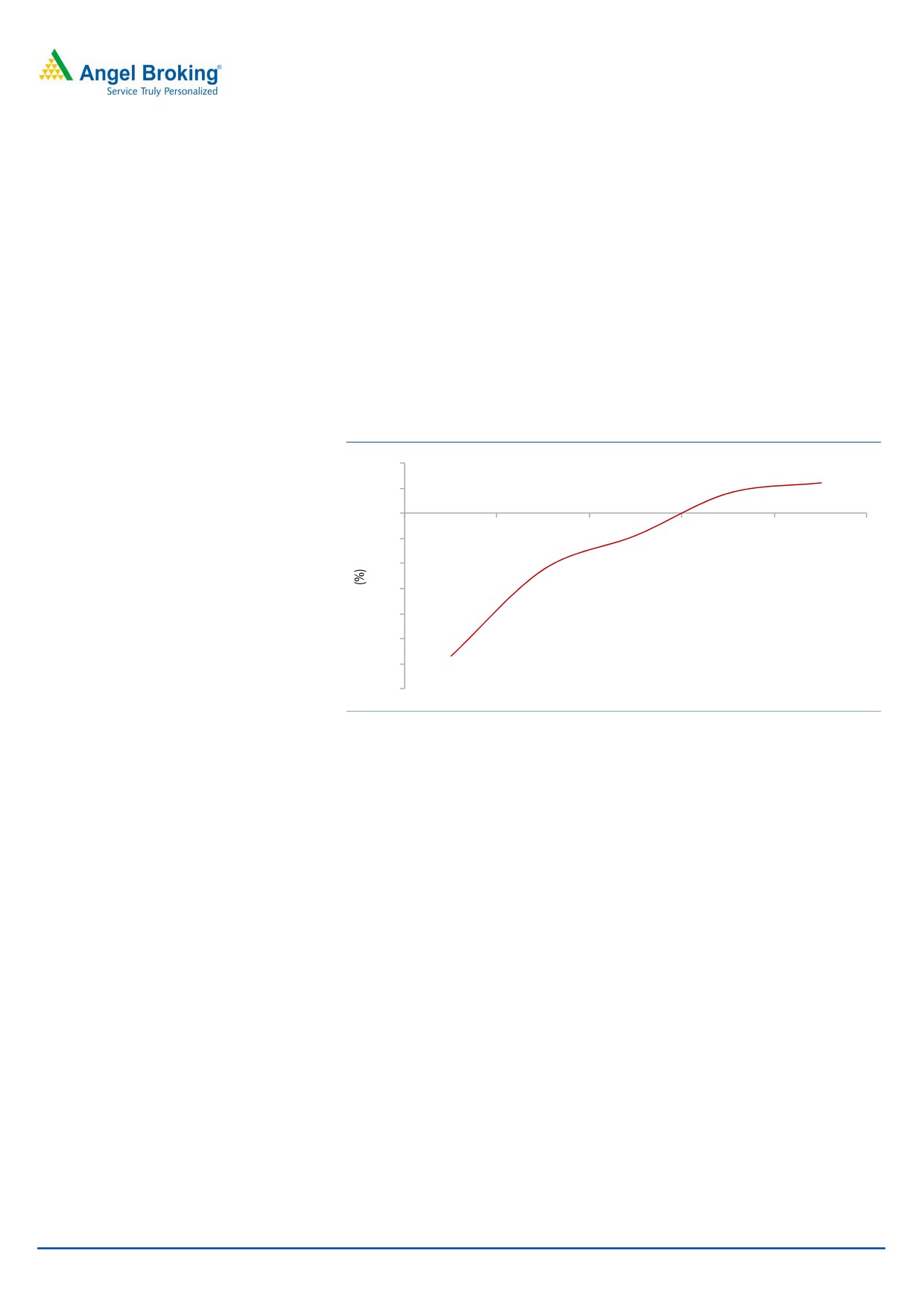

Exhibit 5: Expected growth in flexi-staffing industry

3.5

1.2

3.0

1

3.0

1.0

2.5

0.8

2.0

2.0

2.0

2.0

1.5

1.5

0.6

1.5

0.4

0.4

1.0

0.4

0.2

0.5

0.0

0.0

Austria Germany Ireland

Japan

UK

USA

India

FY14

FY19P

Source: RHP, Angel Research

Source: RHP, Angel Research

Domestic flexi-staffing industry expected to post 25-30% CAGR over the

next five years

The flexi-staffing industry in India as of FY2014 was valued at around `180-

220bn. The average wages for flexi-staffing workers is assumed to be around

Over the next five years, the flexi-

`8,000-10,000 per month (reflects weighted average of wages for organized and

staffing industry is expected to post a

unorganized players). Over the next five years, the flexi-staffing industry is

25-30% CAGR to attain a value of

expected to post a 25-30% CAGR to attain a value of around `610-640bn. This

around `610-640bn

growth is owing to various factors, including an increasing number of enterprises

turning formal, skill development in the country, and regulatory amendments in

favour of formal employment.

January 30, 2016

4

TeamLease Services | IPO Note

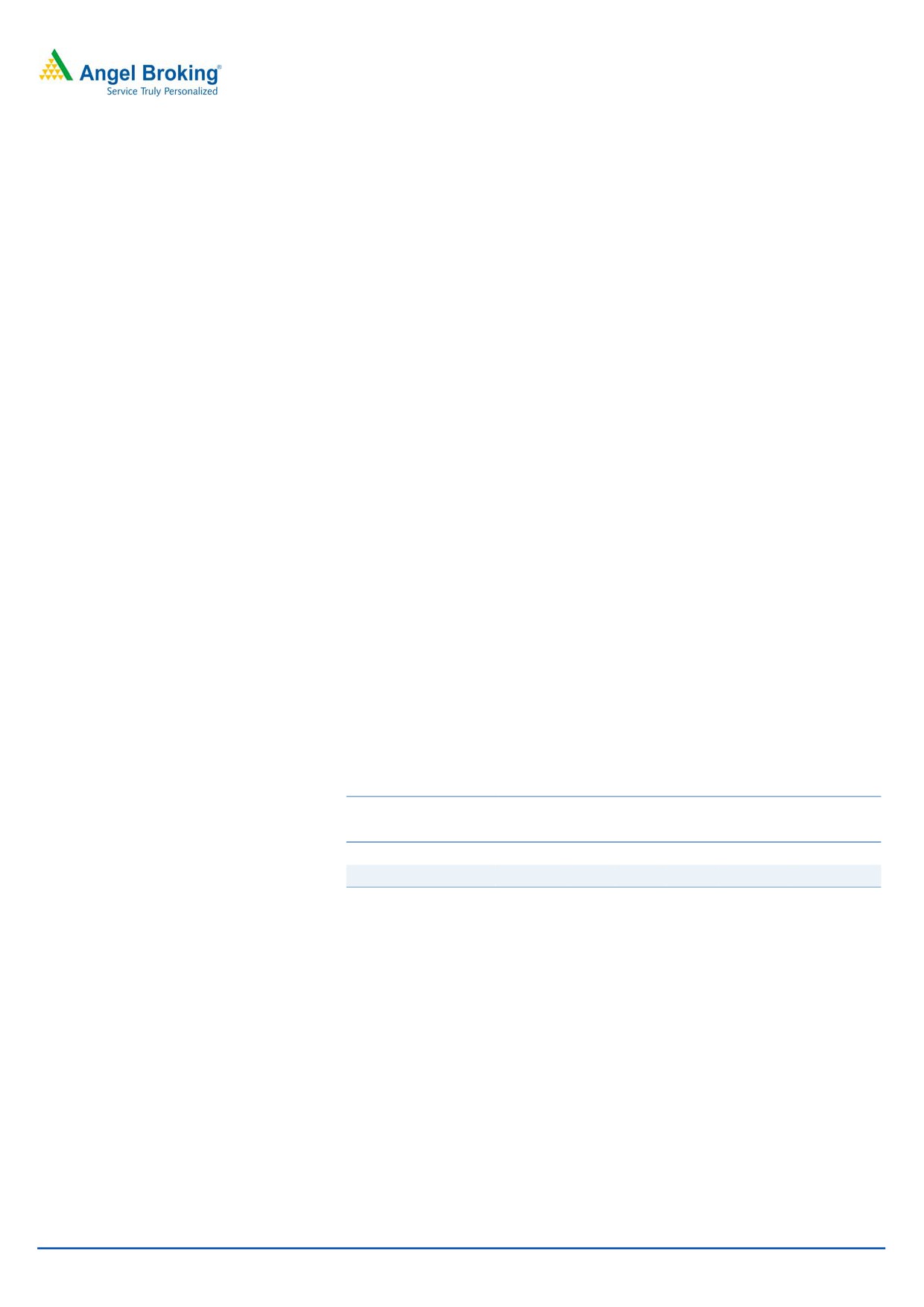

Exhibit 6: Industry-wise demand for flexi-staffing

11%

Manufacturing

30%

10%

BFSI

FMCG/CD/Retail

11%

Logistics/ telecom

13%

IT/Ites

25%

others

Source: CRISIL

Exhibit 7: Flexi-staffing industry size

Exhibit 8: Market Share of TSL

700

Teamlease

6%

Adecco

600

5%

Randstad

5%

3%

500

Quesscorp

3%

400

3%

Genius Consultants

2%

Manpower

300

2%

Global Innov

200

2%

69%

Need Manpower

100

GI Staffing

0

Others

FY2014

FY2019P

Source: RHP, Angel Research

Source: RHP, Angel Research

The unorganized sector constitutes 70-80% of the total industry. At present, TSL is

one of the leading player in the flexi-staffing industry with a market share of ~6%,

Currently, TSL is the largest player in

while Adecco and Randstad have a market share of 5% each, followed by

the flexi-staffing industry with a market

Quesscorp and Genius Consultant Manpower with a combined market share of

share of ~6%

less than 5%. We expect TSL to benefit from increasing demand for manpower

across industries on the back of its strong management, healthy track record, and

with it being the market leader, which would help it to enhance its market share

and increase revenue.

January 30, 2016

5

TeamLease Services | IPO Note

Focus on high-margin business

More than 98% of the company’s revenue comes from its staffing business. The

balance is accounted by recruitment services, regulatory services, skills and

development corporate training, payroll, etc, which earn higher margins than the

TSL is also focusing on recruitment

staffing business. The company is now focusing on such higher margin businesses

services and regulatory services which

apart from its regular staffing business. It is currently looking for opportunities in

are high-margin businesses

the IT vertical through an acquisition. It is also increasingly focusing on achieving

internal cost efficiency. For instance, in the past, a full time employee of the

company was handling 45 associate employees; now an employee handles more

than 95 associate employees while the same is expected to touch 150, going

forward.

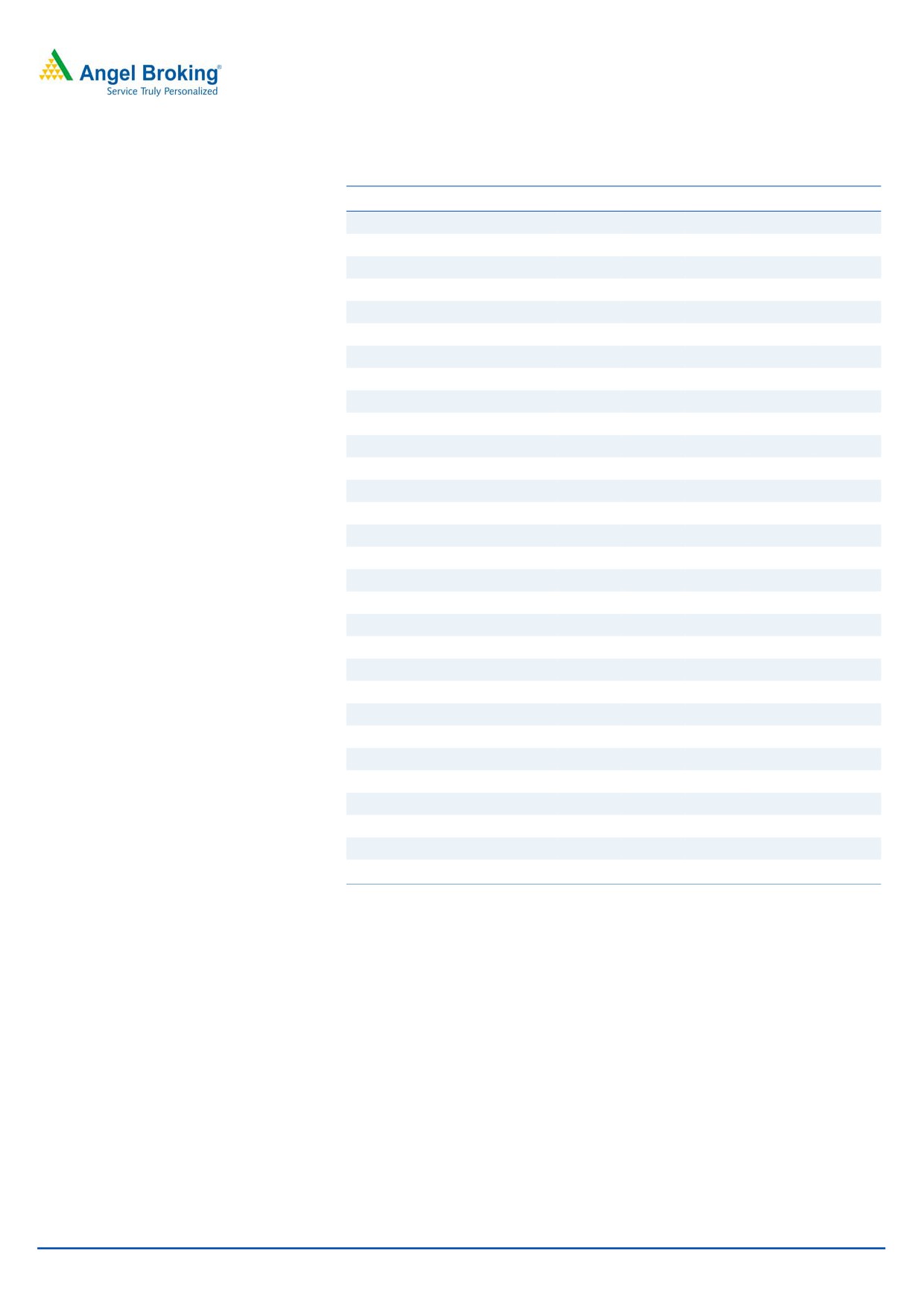

Exhibit 9: Operating margin trend

2.0

1.2

0.8

1.0

-

FY2011

FY2012

FY2013

FY2014

FY2015

(1.0)

(2.2)

(0.9)

(2.0)

(3.0)

(4.0)

(5.0)

(5.7)

(6.0)

(7.0)

Source: Company, Angel Research

Strong Management and thought leadership in public policy

initiatives

TSL is a professionally managed company with a high-quality senior Management

team, which thus provides the right balance of experience, expertise and strategic

vision. This is contributing significantly to TLS’ growth.

The company’s Management team is backed by its individual Promoters, who have

an extensive experience in the HR services industry in general and the staffing

segment in particular. The company’s Chairman, Manish Mahendra Sabharwal, is

a well recognized person in the staffing industry and was selected to be a member

of the Planning Commission Committee for labour reforms.

The company’s Promoters are also well versed with labour reforms in the country

and help in creating a market for the company’s services in an otherwise

unorganized sector and in building the TeamLease brand. We believe that the

thought leadership demonstrated by the company’s Promoters to reform India's

labour laws together with focus on regulatory compliance and technology, would

provide the company with significant competitive advantages in any resulting

market size expansion.

January 30, 2016

6

TeamLease Services | IPO Note

Key investment concerns

Intense competition and lack of pricing power

The flexi-staffing industry is highly fragmented with intense competition and lacks a

clear cut leader accounting for dominant share in the employment services market.

Almost 70-80% of the industry is unorganized consisting of small players. Although

TSL is a leading player in the industry, the gap between the top three to five players

(Adecco, Manpower Inc., Randstad, etc) is very small if not miniscule. TSL faces stiff

competition from these companies as well as other small players, thus leading to

lack of pricing power.

Valuation expensive

The company has shown significant growth over FY2011-15, posting a revenue

CAGR of 30.7%. After posting losses till FY2013, the company has since turned

profitable and reported net profit of ~`30cr in FY2015 vs. a net loss of ~`16cr in

FY2012. The company is a leading staffing company in India and has the potential

to further increase its market share. However, although the company has shown

good growth momentum in recent times, it operates in an industry characterised by

intense competition, lack of pricing power, low entry barriers and high degree of

fragmentation which renders limited scope for margin improvement.

On the valuation front, at the upper end of the price band, the pre-issue P/E works

out to 60.6x its 1HFY2016E annualised earnings. In comparison, its global peer

Adecco is trading at 12.9x 9MCY2015 annualised earnings and has a better

margin and ROE profile. Further, post the IPO, TSL’s ROE is not expected to

improve significantly in the near term. Considering the above mentioned business

concerns and expensive valuation, we recommend a Neutral on the issue.

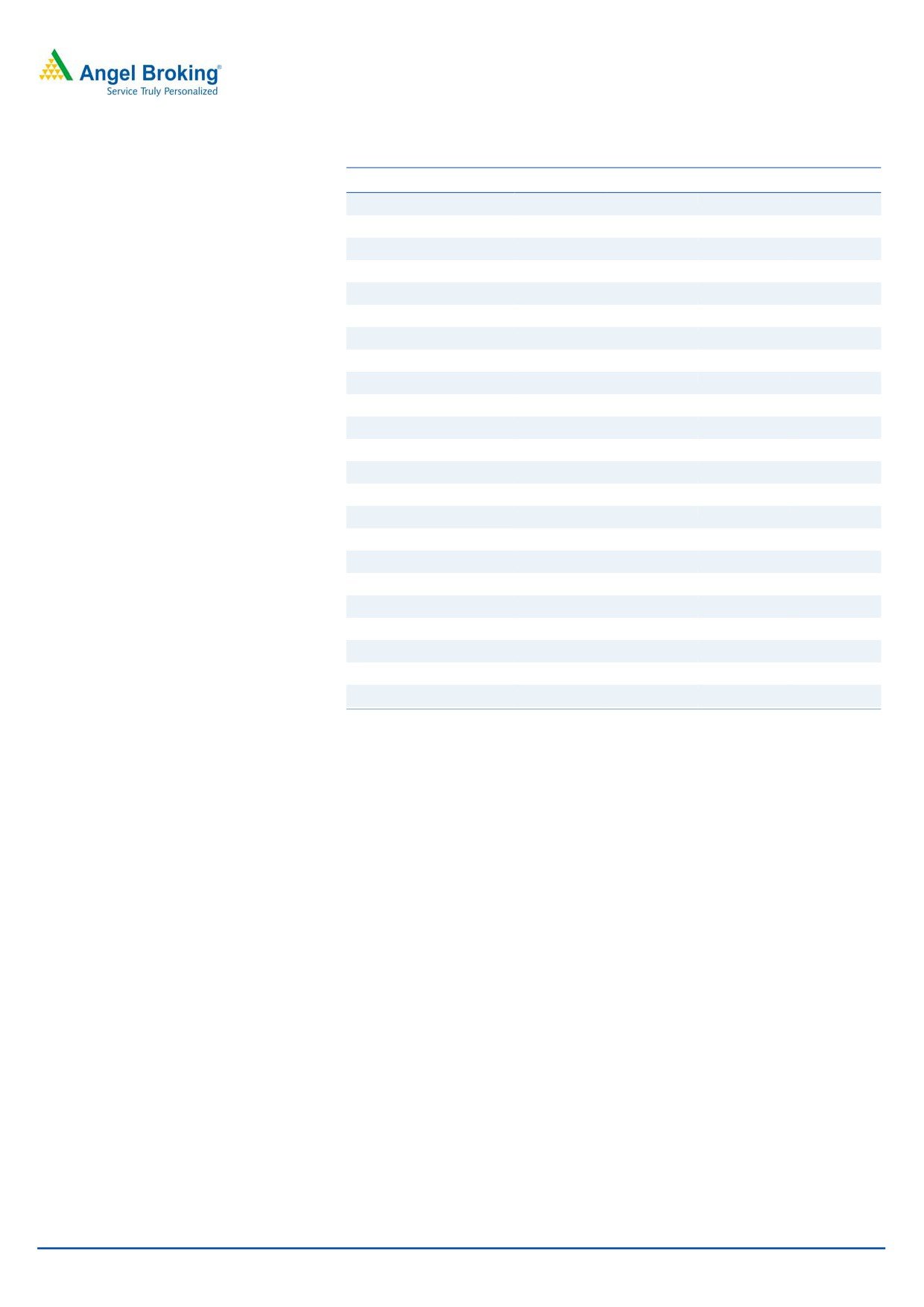

Exhibit 10: Comparative Valuation

P/E

P/BV

ROE EV/Sales

EV/EBITDA

Pre issue valuation^

(x)

(x)

(%)

(x)

(x)

TeamLease*

FY2016

60.6

7.6

12.6

0.5

52.3

Adecco#

FY2015

12.9

2.9

22.4

0.5

9.2

Source: RHP, Bloomberg; Note: *based on 1HFY16 annualised numbers; # based on 9MCY15

annualised numbers; ^based on price at upper band

Risks

Slowdown in economy: Slowdown in economy can restrict TSL’s growth as it

provides temporary staffing solution to the various sectors like manufacturing,

logistic, telecom, hospitality, IT/ITes etc. which are dependent on economic growth.

Upcoming Smart Cities could be a trigger for flexi staffing industry: Upcoming

Smart cities projects are expected to create huge job opportunities in flexi-staffing

industry which could be an upside risk to our recommendation.

January 30, 2016

7

TeamLease Services | IPO Note

Profit & Loss (consolidated)

Y/E March (` cr)

FY2012

FY2013

FY2014

FY2015

1HFY16

Total operating income

926

1,251

1,530

2,007

1,210

% chg

34.8

35.1

22.3

31.2

-

Total Expenditure

947

1,262

1,518

1,983

1,198

Personnel Expenses

903

1,216

1,484

1,944

1,179

Others Expenses

43

45

34

39

19

EBITDA

(21)

(11)

12

24

11

% chg

-

-

-

99.7

-

(% of Net Sales)

(2.2)

(0.9)

0.8

1.2

0.9

Depreciation& Amortisation

4

4

2

3

1

EBIT

(24)

(15)

10

21

10

% chg

-

-

-

110.8

-

(% of Net Sales)

(2.6)

(1.2)

0.7

1.1

0.9

Interest & other Charges

0

1

0

0

0

Other Income

8

11

8

11

6

Share in profit of Associates

-

-

-

-

-

Recurring PBT

(17)

(4)

18

33

16

% chg

-

-

-

83.4

-

Prior Period & Extraord.Exp./(Inc.)

-

-

-

-

-

PBT (reported)

(17)

(4)

18

33

16

Tax

-

-

-

2

6

(% of PBT)

-

-

-

5.5

34.7

PAT before Adjustments

(17)

(4)

18

31

11

Adjustments

(0)

(1)

(0)

1

(0)

Less: Minority interest (MI)

-

-

-

-

-

PAT after MI & Adj. (reported)

(16)

(4)

18

30

11

ADJ. PAT

(16)

(4)

18

30

11

% chg

-

-

-

66.3

-

(% of Net Sales)

(1.8)

(0.3)

1.2

1.5

0.9

Basic EPS (`)

(10.8)

(2.4)

11.6

19.4

7.2

Fully Diluted EPS (`)

(10.8)

(2.4)

11.6

19.4

7.2

January 30, 2016

8

TeamLease Services | IPO Note

Balance Sheet (consolidated)

Y/E March (` cr)

FY2012

FY2013

FY2014

FY2015

1HFY16

SOURCES OF FUNDS

Equity Share Capital

1

1

1

1

15

Reserves& Surplus

104

100

118

148

144

Shareholders’ Funds

105

101

119

149

160

Minority Interest

-

-

-

-

-

Total Loans

8

12

1

-

-

Other long term liabilities

4.7

5.4

5.8

5.2

5.1

Long-term provisions

6.4

9.1

13.0

17.6

25.2

Deferred Tax Liability

-

-

-

-

-

Total Liabilities

124

128

138

171

190

APPLICATION OF FUNDS

Gross Block

36

26

25

26

30

Less: Acc. Depreciation

19

17

17

19

20

Net Block

17

8

8

7

10

Goodwill

2

2

2

2

2

Investments

0

0

0

0

0

Current Assets

150

173

192

275

357

Inventories

1

1

0

0

0

Sundry Debtors

54

62

59

80

119

Cash

82

78

85

115

122

Loans & Advances

8

8

26

8

12

Other Assets

5

25

22

72

105

Current liabilities

73

97

105

179

269

Net Current Assets

77

76

88

96

88

Long term loans and adv.

21.0

30.9

25.5

43.6

54.2

Other Non Current Assets

6.6

9.4

14.6

16.7

27.8

Deferred Tax Asset

-

-

-

6

7

Mis. Exp. not written off

-

-

-

-

-

Total Assets

124

128

138

171

190

January 30, 2016

9

TeamLease Services | IPO Note

Cash flow statement (consolidated)

Y/E March (` cr)

FY2012

FY2013

FY2014

FY2015

1HFY16

Profit before tax

(16)

(4)

18

32

17

Depreciation

4

4

2

3

1

Change in Working Capital

(16)

(2)

6

5

10

Interest / Dividend (Net)

(8)

(6)

(7)

(10)

(5)

Direct taxes paid

(10)

(9)

(8)

2

(13)

Others

7

8

6

4

2

Cash Flow from Operations

(40)

(9)

16

34

11

(Inc.)/ Dec. in Fixed Assets

(4)

(1)

(3)

(4)

(4)

(Inc.)/ Dec. in Investments

(26)

8

(32)

(21)

6

Cash Flow from Investing

(31)

7

(35)

(24)

3

Issue of Equity

99

-

-

-

-

Inc./(Dec.) in loans

5

4

(11)

(1)

-

Dividend Paid (Incl. Tax)

-

-

-

-

-

Interest / Dividend (Net)

(0)

(1)

(0)

(0)

(0)

Cash Flow from Financing

104

4

(11)

(1)

(0)

Inc./(Dec.) in Cash

33

1

(30)

9

14

Opening Cash balances

9

42

43

13

22

Closing Cash balances

42

43

13

22

35

January 30, 2016

10

TeamLease Services | IPO Note

Key Ratios

Y/E March

FY2012

FY2013

FY2014

FY2015

Valuation Ratio (x)

P/E (on FDEPS)

-

-

73.0

43.9

P/CEPS

-

-

66.2

38.9

P/BV

12.4

12.9

11.0

8.8

Dividend yield (%)

0.0

0.0

0.0

0.0

EV/Sales

1.3

1.0

0.8

0.6

EV/EBITDA

-

-

101.2

49.4

EV / Total Assets

6.2

5.5

5.0

3.4

Per Share Data (`)

EPS (Basic)

(10.8)

(2.4)

11.6

19.4

EPS (fully diluted)

(10.8)

(2.4)

11.6

19.4

Cash EPS

(8.3)

(0.4)

12.8

21.8

DPS

0.0

0.0

0.0

0.0

Book Value

68.3

65.9

77.5

96.9

Returns (%)

ROCE

-

-

8.5

14.4

ROE

-

-

15.0

20.0

Turnover ratios (x)

Asset Turnover (Gross Block)

25.6

48.4

60.6

76.5

Inventory / Sales (days)

0

0

0

0

Receivables (days)

21

18

14

15

Payables (days)

1

0

2

1

WC cycle (ex-cash) (days)

21

18

13

13

Note: Valuation ratios based on pre-issue outstanding shares and at upper end of the price band

January 30, 2016

11

TeamLease Services | IPO Note

Research Team Tel: 022 - 39357800

DISCLAIMER

Angel Broking Private Limited (hereinafter referred to as “Angel”) is a registered Member of National Stock Exchange of India Limited,

Bombay Stock Exchange Limited and Metropolitan Stock Exchange of India Limited. It is also registered as a Depository Participant with

CDSL and Portfolio Manager with SEBI. It also has registration with AMFI as a Mutual Fund Distributor. Angel Broking Private Limited is

a registered entity with SEBI for Research Analyst in terms of SEBI (Research Analyst) Regulations, 2014 vide registration number

INH000000164. Angel or its associates has not been debarred/ suspended by SEBI or any other regulatory authority for accessing

/dealing in securities Market. Angel or its associates including its relatives/analyst do not hold any financial interest/beneficial

ownership of more than 1% in the company covered by Analyst. Angel or its associates/analyst has not received any compensation /

managed or co-managed public offering of securities of the company covered by Analyst during the past twelve months. Angel/analyst

has not served as an officer, director or employee of company covered by Analyst and has not been engaged in market making activity

of the company covered by Analyst.

This document is solely for the personal information of the recipient, and must not be singularly used as the basis of any investment

decision. Nothing in this document should be construed as investment or financial advice. Each recipient of this document should

make such investigations as they deem necessary to arrive at an independent evaluation of an investment in the securities of the

companies referred to in this document (including the merits and risks involved), and should consult their own advisors to determine

the merits and risks of such an investment.

Reports based on technical and derivative analysis center on studying charts of a stock's price movement, outstanding positions and

trading volume, as opposed to focusing on a company's fundamentals and, as such, may not match with a report on a company's

fundamentals.

The information in this document has been printed on the basis of publicly available information, internal data and other reliable

sources believed to be true, but we do not represent that it is accurate or complete and it should not be relied on as such, as this

document is for general guidance only. Angel Broking Pvt. Limited or any of its affiliates/ group companies shall not be in any way

responsible for any loss or damage that may arise to any person from any inadvertent error in the information contained in this report.

Angel Broking Pvt. Limited has not independently verified all the information contained within this document. Accordingly, we cannot

testify, nor make any representation or warranty, express or implied, to the accuracy, contents or data contained within this document.

While Angel Broking Pvt. Limited endeavors to update on a reasonable basis the information discussed in this material, there may be

regulatory, compliance, or other reasons that prevent us from doing so.

This document is being supplied to you solely for your information, and its contents, information or data may not be reproduced,

redistributed or passed on, directly or indirectly.

Neither Angel Broking Pvt. Limited, nor its directors, employees or affiliates shall be liable for any loss or damage that may arise from

or in connection with the use of this information.

Note: Please refer to the important ‘Stock Holding Disclosure' report on the Angel website (Research Section). Also, please refer to the

latest update on respective stocks for the disclosure status in respect of those stocks. Angel Broking Pvt. Limited and its affiliates may

have investment positions in the stocks recommended in this report.

January 30, 2016

12