2QFY2016 Result Update | Automobile

November 16, 2015

Tata Motors

NEUTRAL

CMP

`400

Performance Highlights

Target Price

-

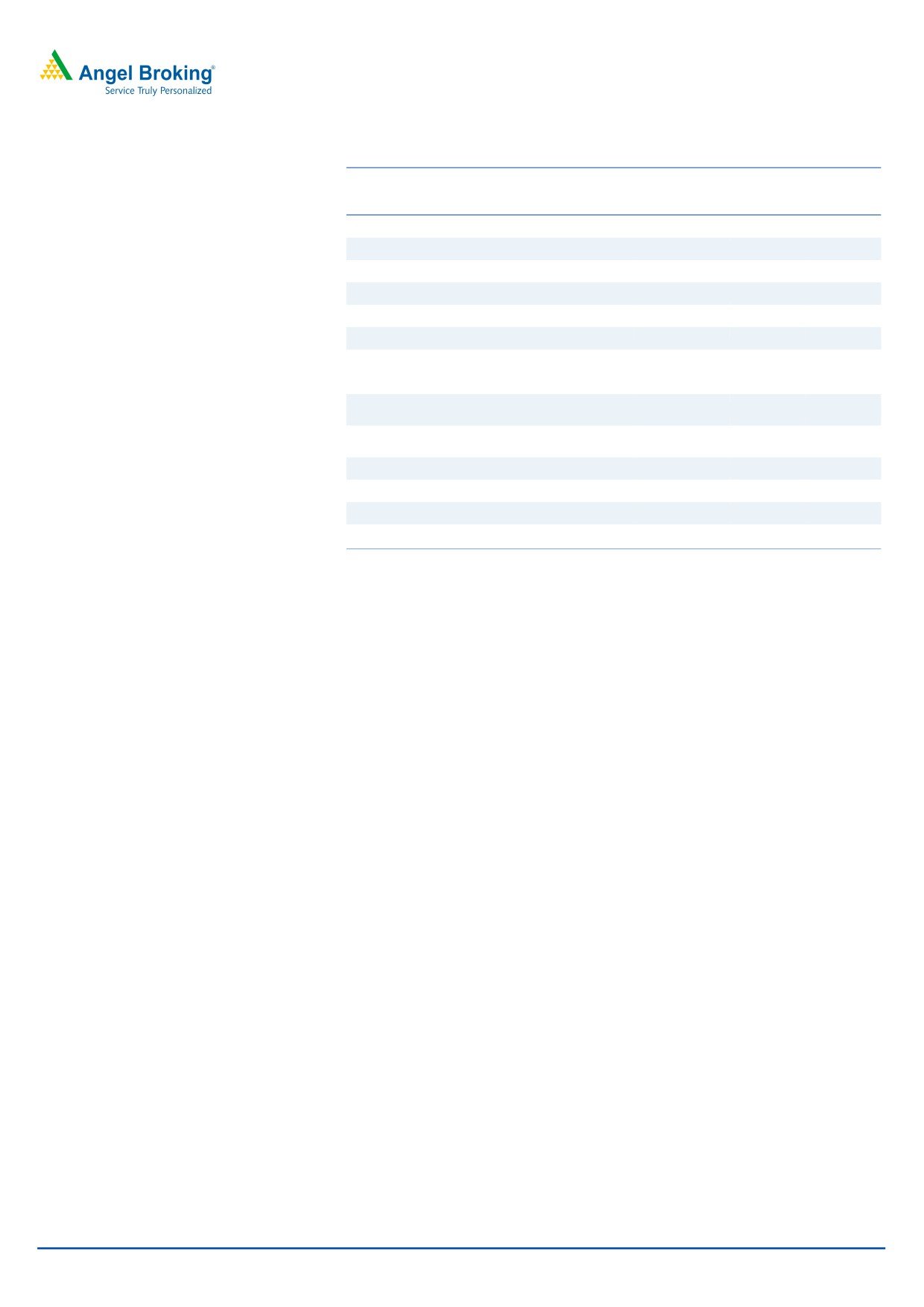

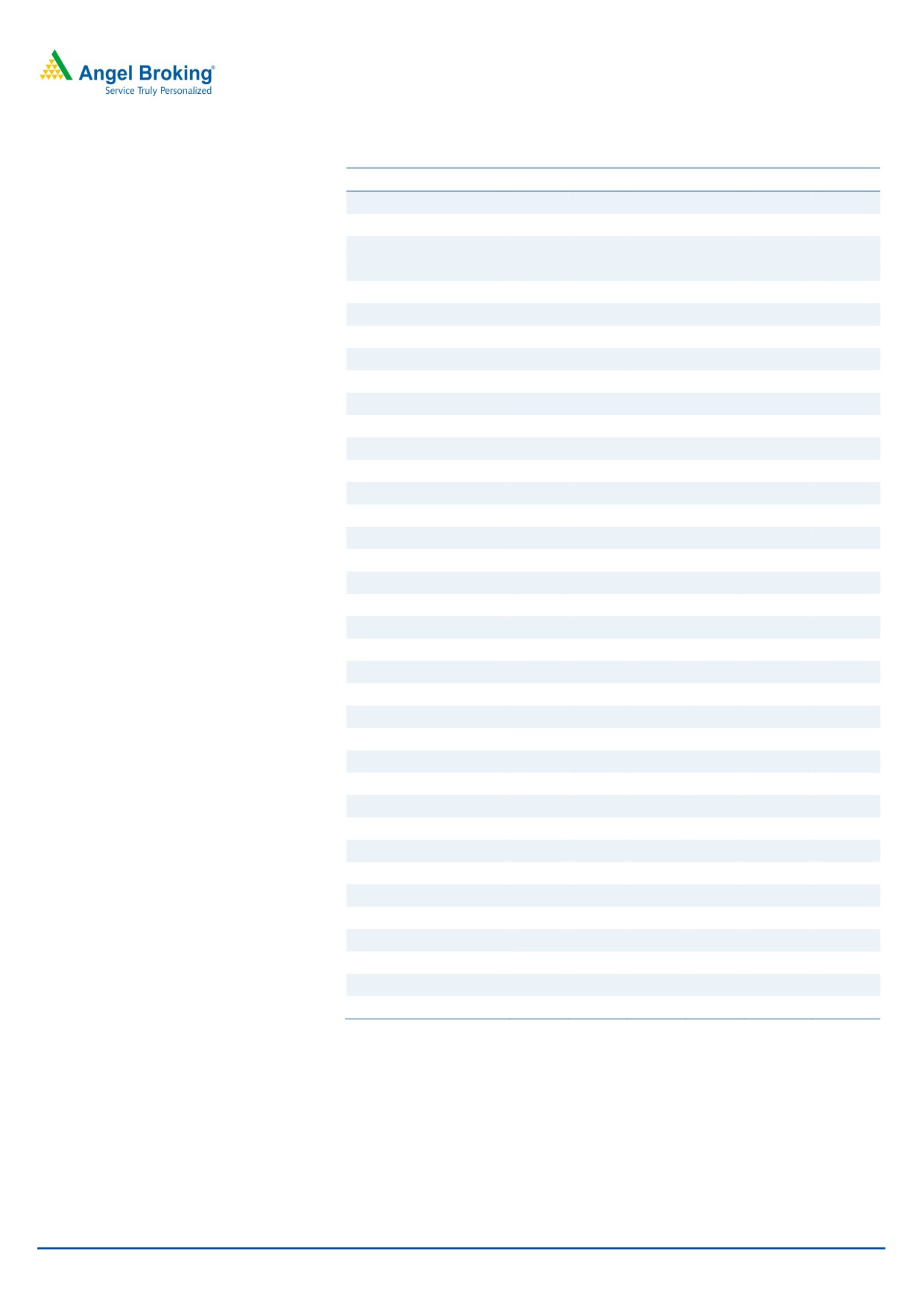

Y/E March (` cr)

2QFY16 2QFY15

% chg (yoy)

1QFY16

% chg (qoq)

Investment Period

-

Net Sales

61,318

60,641

1.1

61,302

0.0

EBITDA

6,880

9,569

(28.1)

9,109

(24.5)

Stock Info

EBITDA Margin (%)

11.2

15.8

(460 bp)

14.9

(370 bp)

Sector

Automobile

Adj. PAT

2,223

3,273

(32.1)

2,847

(21.9)

Market Cap (` cr)

115,039

Source: Company, Angel Research

Net Debt (`

cr)

41,495

Operating results below estimates: Tata Motors’ 2QFY2016 results have come in

Beta

1.3

below our estimates on the operating front. Consolidated revenues grew

52 Week High / Low

605/279

marginally by 1% yoy to `61,318cr (coming slightly ahead of our estimates of

Avg. Daily Volume

884,305

`57,484cr). Growth was subdued, mainly due to flattish top-line at JLR. JLR’s

volumes grew a healthy 12% yoy during the quarter but an adverse product

Face Value (`)

2

(higher sales of relatively lower priced cars in the company’s product portfolio)

BSE Sensex

25,760

and regional mix (lower China sales) led to lower realization, thus dragging the

Nifty

7,807

top-line. The consolidated operating margin at 11.2% was below our estimate of

Reuters Code

TAMO.BO

13.4%. JLR’s EBIDTA margin at 12.2% was significantly below our estimate of

Bloomberg Code

TTMT@IN

15%. JLR’s margins were impacted by lower China sales, adverse product mix

and higher launch expenses. During the quarter, Tata Motors reported a loss at

the net level due to a one-off charge of `2,493cr related to damage caused by fire

Shareholding Pattern (%)

explosions caused at the China port location, which affected JLR vehicles. However,

Promoters

33.0

Tata Motors had a tax credit to the tune of `704cr which resulted in the Adj profit

MF / Banks / Indian Fls

17.8

coming in at `2,223cr for the quarter (better than our estimate of `2,041cr).

FII / NRIs / OCBs

21.9

Outlook and valuation: JLR’s volumes are likely to recover from 2HFY2016 on

Indian Public / Others

27.3

back of new product introductions, tapping of new segments, and production

ramp up at the China JV. We expect JLR’s volumes to grow at 13% CAGR over the

FY2015-2017 period. JLR aims to widen its presence across product segments

Abs. (%)

3m 1yr 3yr

and is poised to become a stronger luxury car player in the next four to five years.

Sensex

(8.2)

(8.2)

40.7

Also, the standalone business is expected to turn profitable at the operating level

TAMO

12.6

(22.8)

52.6

in FY2016 on back of pick up in the commercial as well as passenger vehicle

segments and with gradual reduction in discounts. However, JLR margins are

likely to remain under pressure as the company enters new segments which would

3-Year Daily Price Chart

lead to direct competition with established luxury players viz BMW, Audi and

700

Mercedes. We expect JLR margins to be in 14-15% range as against 18% range

600

in the last two years. Also, the stock currently trades at 28.9x its FY2016 and

500

14.9x its FY2017 adjusted earnings respectively, leaving limited scope of upside

400

from current levels. Thus, we have a Neutral view on the stock.

300

Key financials (Consolidated)

200

Y/E March (` cr)

FY2014

FY2015 FY2016E

FY2017E

100

Net Sales

232,834

262,796

255,254

301,772

0

% chg

23.3

12.9

(2.9)

18.2

Adj Net Profit*

11,790

10,544

4,698

9,098

% chg

41.0

(10.6)

(55.4)

93.7

EBITDA (%)

15.0

14.9

12.9

13.4

Source: Company, Angel Research

Adj EPS* (`)

36.6

32.8

13.8

26.8

P/E (x)

10.9

12.2

28.9

14.9

P/BV (x)

2.0

2.3

2.0

1.7

RoE (%)

18.0

18.7

7.4

12.1

RoCE (%)

18.8

19.0

12.3

14.5

Bharat Gianani

EV/Sales (x)

0.7

0.6

0.8

0.7

022-3935 7800 Ext: 6817

EV/EBITDA (x)

4.6

4.3

6.1

5.2

Source: Company, Angel Research; *Adj for deficient R&D

Please refer to important disclosures at the end of this report

1

Tata Motors | 2QFY2016 Result Update

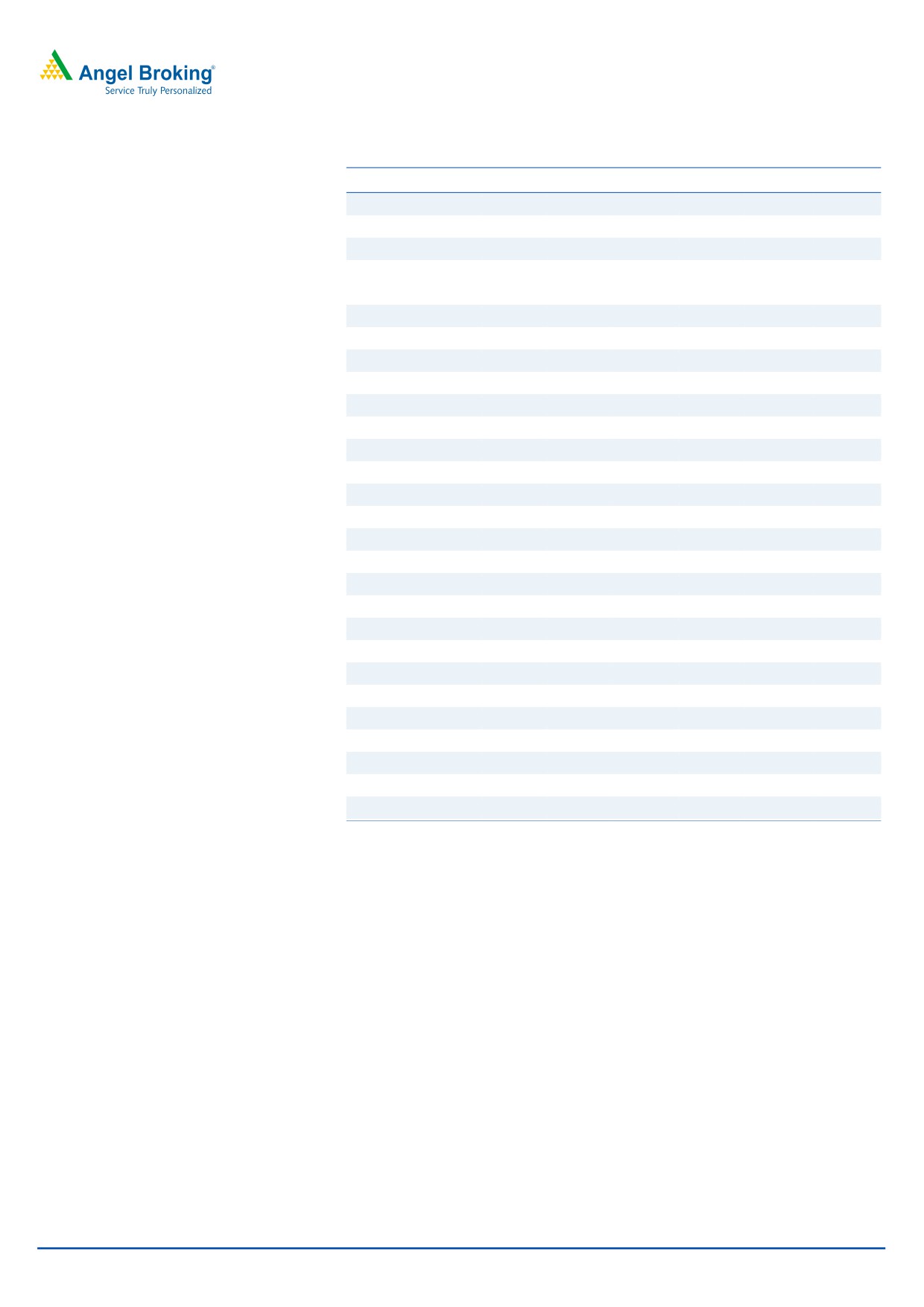

Exhibit 1: Quarterly financial performance (Consolidated)

Y/E March (` cr)

2QFY16

2QFY15

% chg (yoy)

1QFY16

% chg (qoq)

1HFY16

1HFY15

% chg (yoy)

Net Sales

61,318

60,641

1.1

61,302

0.0

122,620

125,324

(2.2)

Consumption of RM

37,275

36,968

0.8

35,063

6.3

72,338

76,704

(5.7)

(% of Sales)

60.8

61.0

57.2

59.0

61.2

Staff Costs

7,012

6,231

12.5

6,979

0.5

13,991

12,054

16.1

(% of Sales)

11.4

10.3

11.4

11.4

9.6

Other Expenses

10,152

7,873

28.9

10,151

0.0

20,303

15,855

28.1

(% of Sales)

16.6

13.0

16.6

16.6

12.7

Total Expenditure

54,438

51,072

6.6

52,193

4.3

106,631

104,612

1.9

Operating Profit

6,880

9,569

(28.1)

9,109

(24.5)

15,989

20,711

(22.8)

OPM (%)

11.2

15.8

14.9

13.0

16.5

Interest

1,159

930

24.7

1,117

3.8

2,277

1,875

21.4

Depreciation

4,428

3,213

37.8

3,823

15.8

8,251

6,193

33.2

Other Income

245

218

12.3

307

(20.2)

552

432

28.0

Minority interest

19

16

20

38

31

PBT

1,520

5,628

(73.0)

4,456

(65.9)

5,975

13,044

(54.2)

(% of Sales)

2.5

9.3

7.3

4.9

10.4

Provision for Taxation

(704)

2,364

(129.8)

1,570

(144.8)

867

4,479

(80.6)

(% of PBT)

(46.3)

42.0

35.2

14.5

34.3

PAT before exceptional

2,223

3,264

(31.9)

2,886

(23.0)

5,109

8,565

(40.4)

Exceptional items

(2,653)

26

(117)

(2,770)

120

Reported PAT

(430)

3,291

2,769

2,339

8,685

Adj PAT

2,223

3,273

(32.1)

2,847

(21.9)

5,070

8,605

(41.1)

Adj. PATM

3.6

5.4

4.6

4.1

6.9

Equity capital (cr)

679.2

643.8

679.2

679.2

643.8

Adjusted EPS (`)

6.5

10.2

(35.6)

8.4

(21.9)

14.9

26.7

(44.2)

Source: Company, Angel Research

Exhibit 2: 2QFY2016 - Actual vs Angel Estimates

Y/E March (` cr)

Actual

Estimates

Variation (%)

Net Sales

61,318

57,484

6.7

EBITDA

6,880

7,695

(10.6)

EBITDA margin (%)

11.2

13.4

(220 bp)

Adj. PAT

2,223

2,042

8.9

Source: Company, Angel Research

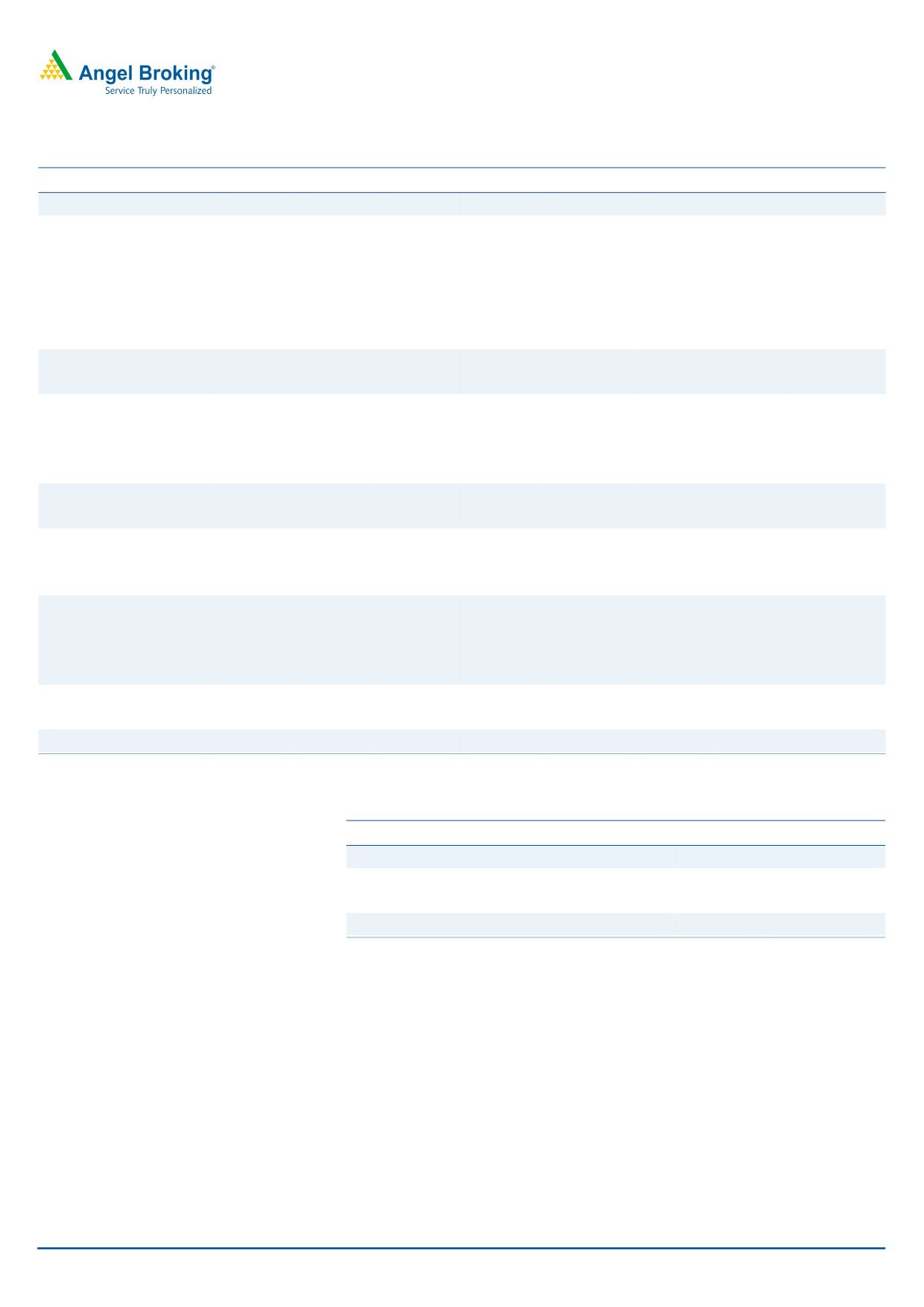

Tata Motors’ standalone revenues continued to recover, reporting the fourth

consecutive quarter of double-digit growth. In 2QFY2016, the standalone top-

line grew a healthy 20% yoy to `10,501cr. While the volumes were flat yoy,

the realization/vehicle grew by 20% yoy led by a better product mix (higher

proportion of MHCV) and price hikes.

JLR reported flat revenues in 2QFY2016. While volume growth was healthy at

12% yoy, realization/vehicle dipped sharply by 11% yoy on account of adverse

product and regional mix. Higher proportion of low priced models (Jaguar XE,

Land Rover Defender and Discover Sport) and lower proportion of China sales

impacted the realization.

November 16, 2015

2

Tata Motors | 2QFY2016 Result Update

Exhibit 3: Standalone revenues recover

Exhibit 4: JLR revenues under pressure

12,000

30

7,000

40

6,000

10,000

20

30

5,000

8,000

10

20

4,000

6,000

3,000

0

10

4,000

2,000

(10)

0

2,000

1,000

0

(20)

0

(10)

1QFY15

2QFY15

3QFY15

4QFY15

1QFY16

2QFY16

1QFY15

2QFY15

3QFY15

4QFY15

1QFY16

2QFY16

Standalone revenues (` cr)

Growth (%)

JLR revenues (GBP Mn)

Growth (%)

Source: Company, Angel Research

Source: Company, Angel Research

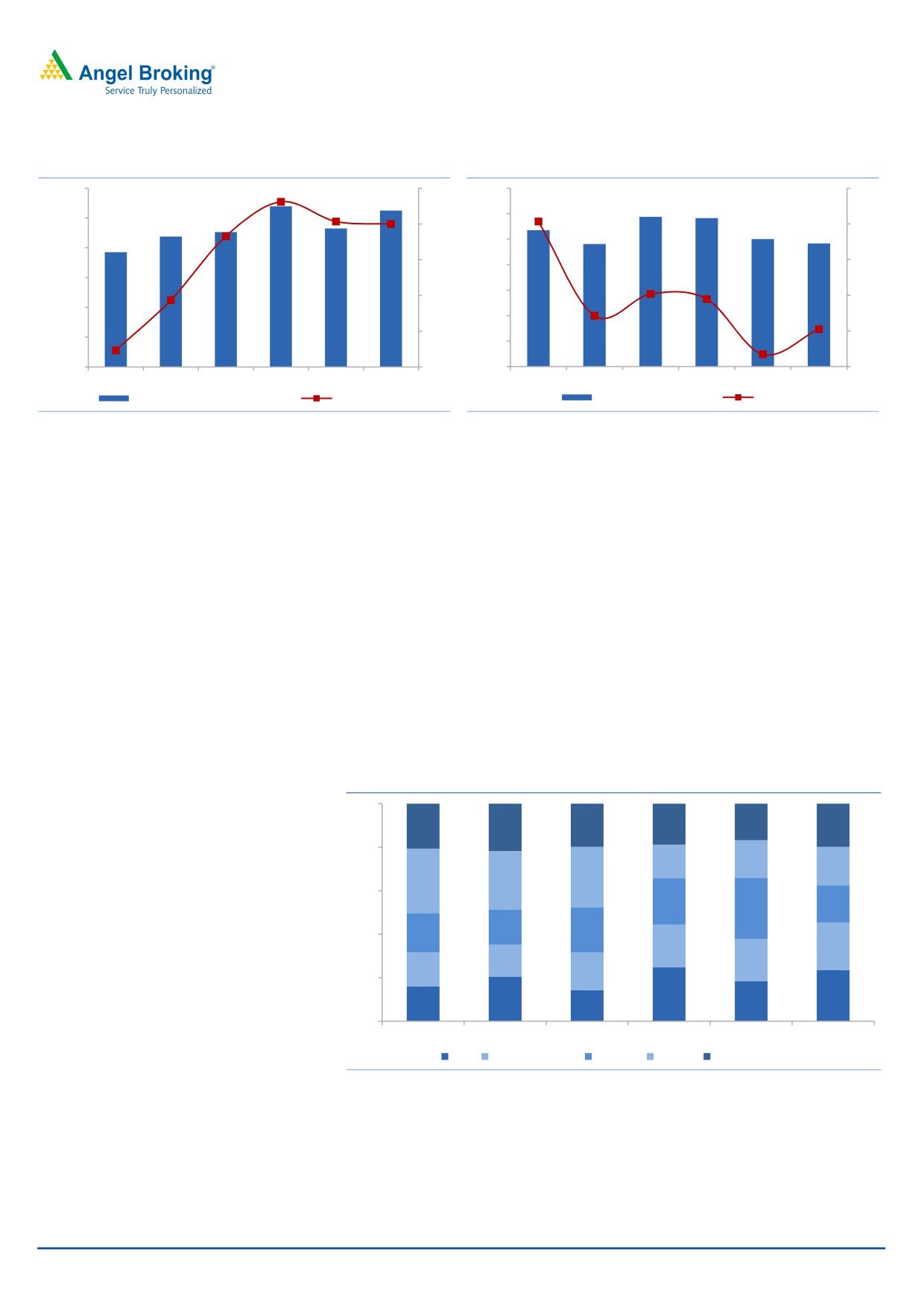

JLR’s regional mix has undergone a huge change in the last one year. Given

the slowdown in China, its share in JLR volumes has gone down from 27% in

2QFY2015 to 17.6% in 2QFY2016. Also, given the slowdown in oil producing

and commodity nations such as Russia, Brazil and Middle East countries, the

share of other regions has fallen from 22% in 2QFY2015 to 20% in

2QFY2016. The share of developed nations such as US and UK to overall

volumes increased by 7% and 3% respectively.

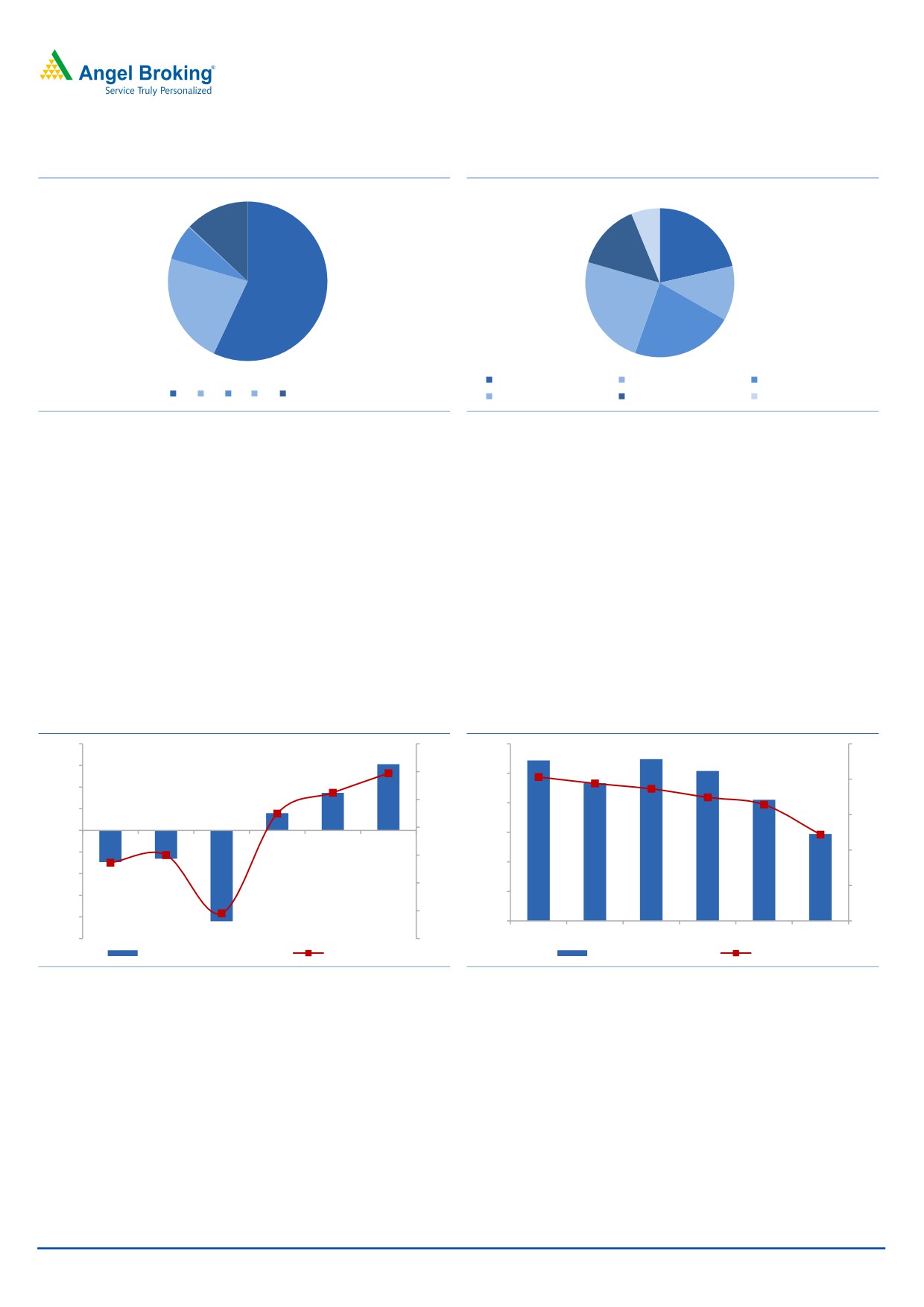

Jaguar XE sales have started to pick up and currently constitute about 57% of

the overall Jaguar volumes. Launch of the new XF and XJ has led to fall in the

volumes of the current model. Share of Land Rover Evoque has fallen from

32% in 2QFY2015 to 24% now due to slowdown in the key market - China.

Successful launch of Discovery Sport which replaces Freelander has gone up

from 15% in 2QFY2015 to 24% of overall Land Rover volumes.

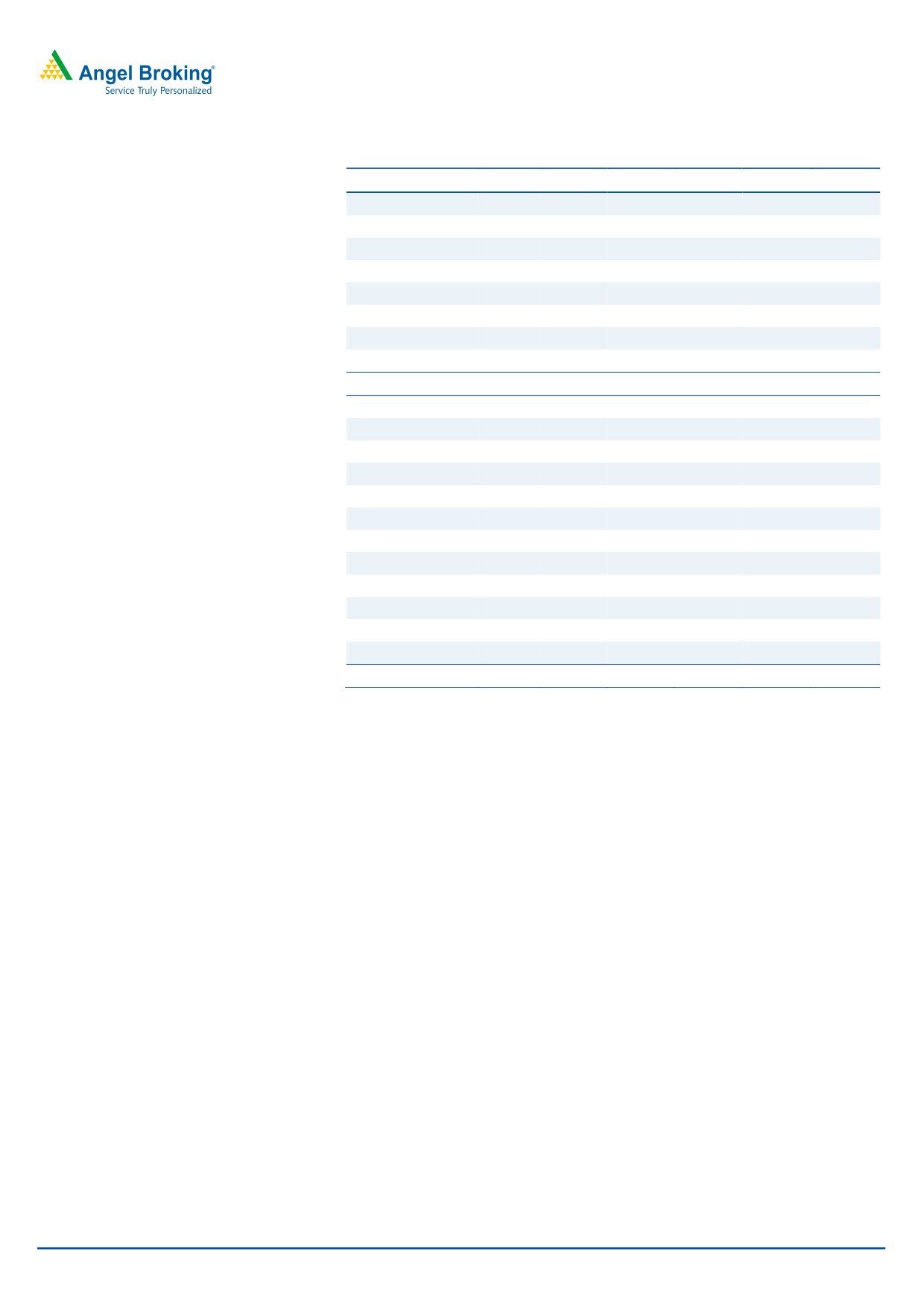

Exhibit 5: JLR regional sales mix

100

20.7

21.8

19.9

18.9

16.8

19.9

80

15.3

17.3

17.6

29.5

27.0

27.9

60

21.5

17.1

28.1

16.0

20.7

40

18.1

19.6

21.8

14.8

19.3

15.7

17.2

20

24.8

23.6

20.4

18.5

15.9

14.3

0

1QFY15

2QFY15

3QFY15

4QFY15

1QFY16

2QFY16

UK North America Europe China Other markets

Source: Company, Angel Research

November 16, 2015

3

Tata Motors | 2QFY2016 Result Update

Exhibit 6: Jaguar sales mix

Exhibit 7: Land Rover mix

6.2

21.4

0.2

13.0

14.3

7.3

57.0

11.9

22.6

24.0

22.2

Discovery Sport

Discovery

New Range Rover Sport

XE XF XJ XK F TYPE

Range Rover Evoque

New Range Rover

Others

Source: Company, Angel Research

Source: Company, Angel Research

Standalone EBIDTA margins continued to recover, reporting a third

consecutive quarter of positive margins. In 2QFY2016, standalone margins

stood at 5.8% as against -3% in corresponding quarter last year. Robust

revenue growth (20% yoy) coupled with cost control initiatives led to a steep

margin improvement.

JLR margins continued to remain under pressure declining steeply by 720bp

yoy to 12.2%. Adverse product and regional mix, higher marketing expenses

and new product launches (new model and engine upgrades) dented margins.

Further, forex loss of 40mn Euros on commodity hedges also impacted the

margins.

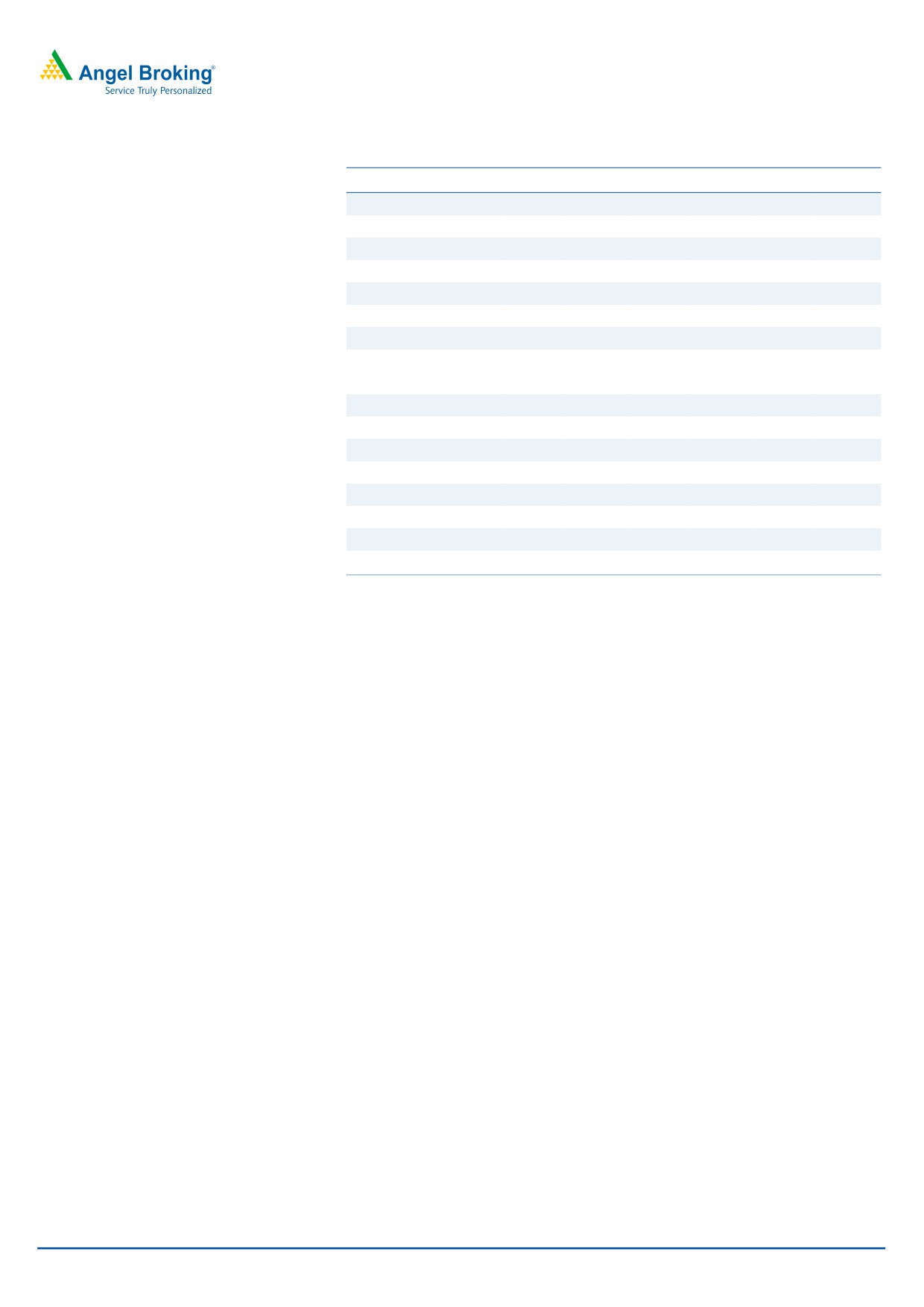

Exhibit 8: Standalone margins continue to recover

Exhibit 9: JLR Margins under pressure

800

9

1,200

25

600

6

1,000

20

400

3

800

200

15

0

0

600

1QFY15

2QFY15

3QFY15

4QFY15

1QFY16

2QFY16

(200)

10

(3)

400

(400)

(6)

5

(600)

200

(9)

(800)

0

0

(1000)

(12)

1QFY15

2QFY15

3QFY15

4QFY15

1QFY16

2QFY16

Standalone Ebidta (` cr)

Margin (%)

JLR Ebidta (GBP mn)

Margin (%)

Source: Company, Angel Research

Source: Company, Angel Research

November 16, 2015

4

Tata Motors | 2QFY2016 Result Update

Conference call - Key highlights

JLR’s margins in the quarter at 12.2% were lower by 720bp yoy and by 420bp

on a sequential basis. The margins were impacted by adverse product and

geographical mix, higher launch expenses (upgrades and new engine

variants) and a forex charge of Euro 40mn on Euro payables.

JLR is ramping production at the China JV. Apart from ramp up of Evoque, it

plans to commence production of Discovery Sport in JV. The loss in the JV in

2QFY2016 stood at GBP 1mn.

JLR has a strong product pipeline which would drive the growth ahead. JLR

recently launched new XF and is scheduled to launch new XJ which would

boost the respective models’ sales. Further it aims to enter the crossover

segment with the launch of the Jaguar F-pace in CY2016.

Given the new product launches and capacity expansion, the capex is likely to

remain at elevated levels. JLR has guided for a capex of more than GBP 3.5

bn for FY2016.

The standalone commercial vehicle business is likely to recover in 2HFY2016.

Tata Motors reported robust double-digit growth in the MHCV segment due to

improved economic growth and pent up demand from fleet operators along

with recovery in the LCV segment on account of pick up in MHCVs and

economic recovery.

The standalone passenger vehicle segment would continue with its strong

growth on back of strong product pipeline. Tata Motors has planned to

introduce two new products in the passenger vehicle space every year till

2020.

Investment arguments

New product launches and entry into new segments to drive growth at JLR: JLR

volumes are likely to grow at a healthy 13% CAGR over FY2015-17 period on

back of new product launches viz Jaguar XJ and XF which would boost the

respective model sales. Also the launch of Land Rover Evoque 16 MY would

also lift sales. Further, JLR’s entry sedan (Jaguar XE) has opened up a new

segment and the company is ramping sales by entering new geographies viz

North America, China and other global markets. Further, JLR will also enter

the crossover segment with the launch of Jaguar F pace in 2016. We believe

the new product launches coupled with entry into new segments would help

maintain double digit volume growth momentum for JLR.

Standalone business performance to improve: After three consecutive years of

double-digit volume decline, the standalone business (comprising of

commercial and passenger vehicles) returned to the growth path in

1HFY2016. The recovery was led by the passenger vehicle segment (forms

about 30% of volumes) which grew 16% yoy. New product launches (Zest and

Bolt) helped bolster sales, leading to market share gains. Also, with a sharp

recovery in the MHCV segment due to revival in the economy, the commercial

vehicle segment’s volumes also recovered. The commercial vehicle segment’s

November 16, 2015

5

Tata Motors | 2QFY2016 Result Update

volume decline moderated to 4% in 1HFY2016 as against a 16% decline in

FY2015.

Tata Motors has lined up new launches in the passenger vehicle segment

which would enable it to further gain market share. Also, the commercial

vehicle segment would continue to recover given the improving MHCV

volumes, on back of better economic growth and due to low base of the

previous year. Further, the LCV segment is also expected to recover from

4QFY2016 due to pick up in MHCV volumes, improving rural consumption

and low base of the previous years. We expect the passenger and the

commercial vehicle segment to grow by 21% and 7%, respectively, in FY2016.

We estimate the company to report profits at the operating level; we estimate

margins at 4.6% in FY2016 as against an operating loss in FY2015.

Outlook and valuation

JLR’s volumes are likely to recover from 2HFY2016 on back of new product

introductions, tapping of new segments, and production ramp up at the China JV.

We expect JLR’s volumes to grow at 13% CAGR over the FY2015-2017 period. JLR

aims to widen its presence across product segments and is poised to become a

stronger luxury car player in the next four to five years. Also, the standalone

business is expected to turn profitable at the operating level in FY2016 on back of

pick up in the commercial as well as passenger vehicle segments and with gradual

reduction in discounts. However, JLR margins are likely to remain under pressure

as the company enters new segments which would lead to direct competition with

established luxury players viz BMW, Audi and Mercedes. We expect JLR margins to

be in 14-15% range as against 18% levels in the last two years. Also, the stock

currently trades at 28.9x its FY2016 and 14.9x its FY2017 adjusted earnings

respectively, leaving limited scope of upside from current levels. Thus, we have a

Neutral view on the stock.

R&D treatment adopted by JLR

We have analysed the R&D expenses recognized by JLR in the profit and loss

statement. We have benchmarked the same with other global peers such as

Volkswagen and BMW and have found that the R&D expenses recognized by JLR

are at 3.6% of sales as against above-5.7% and 5.1% recognized by Volkswagen

and BMW, respectively.

November 16, 2015

6

Tata Motors | 2QFY2016 Result Update

Exhibit 10: R&D Treatment

CY2014

Volkswagen

BMW

JLR*

Revenues

202,458

80,401

21,866

R&D Costs

13120

4566

1411

R&D expensed to P&L… (a)

8519

3067

253

Capitalised R&D expenses

4601

1499

1158

Capitalised %/R&D

35%

33%

82%

Overall R&D exps/sales

6.5%

5.7%

6.5%

Depn exps (Amortisation of Capitailsed

3026

1068

526

Devp cost)… (b)

Gross Block (Capitalised prod devp and

27837

9341

5226

prod development in progress)

Overall Gross Block

241158

95213

12713

Overall P&L exps (R&D chg+Amortisation)..(a+b)

11545

4135

779

% of sales

5.7%

5.1%

3.6%

Source: *JLR nos are for FY2015, Company, Angel Research

Company background

Tata Motors (TTMT) is the largest commercial vehicle manufacturer in India with a

domestic market share of ~55% and ~43% in the MHCV and LCV segments,

respectively. The company also has a domestic market share of ~6% in the

passenger vehicle segment. The company operates from its plants in Jamshedpur,

Pune, Lucknow, Sanand, Pantnagar and Dharwad. TTMT acquired UK based

luxury car manufacturer Jaguar Land Rover (JLR) in June 2008; it now accounts for

~80% of its consolidated revenue.

November 16, 2015

7

Tata Motors | 2QFY2016 Result Update

Profit & Loss Statement (Consolidated)

Y/E March (` cr)

FY2012

FY2013

FY2014

FY2015

FY2016E

FY2017E

Total operating income

165,654

188,818

232,834

262,796

255,254

301,772

% chg

35.6

14.0

23.3

12.9

(2.9)

18.2

Total Expenditure

143,343

164,270

197,980

223,558

222,326

261,274

Net Raw Materials

109,468

120,321

143,586

159,920

154,939

184,383

Personnel

12,298

16,584

21,556

25,549

25,270

28,065

Other

21,577

27,365

32,837

38,089

42,117

48,827

EBITDA

22,311

24,547

34,853

39,239

32,928

40,498

% chg

32.7

10.0

42.0

12.6

(16.1)

23.0

(% of Net Sales)

13.5

13.0

15.0

14.9

12.9

13.4

Depreciation & Amort.

5,625

7,569

11,078

13,389

17,099

20,130

EBIT

17,348

17,790

24,604

26,749

16,862

21,608

% chg

37.8

2.5

38.3

8.7

(37.0)

28.1

(% of Net Sales)

10.5

9.4

10.6

10.2

6.6

7.2

Interest & other Charges

2,982

3,553

4,749

4,861

4,340

4,216

Other Income

662

812

829

899

1,034

1,240

PBT (recurring)

14,365

14,236

19,854

21,887

12,522

17,392

% chg

40.8

(0.9)

39.5

10.2

(42.8)

38.9

Tax

(40)

3,771

4,765

7,643

3,506

4,870

(% of PBT)

(0.3)

26.5

24.0

34.9

28.0

28.0

Minority interest

107

197

6

100

118

143

Exceptional items

(832)

(603)

(985)

(185)

(2,770)

-

PAT (reported)

13,517

9,893

13,991

13,986

6,164

12,425

ADJ. PAT*

11,894

8,362

11,790

10,544

4,698

9,098

% chg

52.4

(29.7)

41.0

(10.6)

(55.4)

93.7

(% of Net Sales)

7.2

4.5

5.1

4.0

1.9

3.0

Basic EPS (`)

44.3

32.3

45.5

43.8

23.7

37.3

Adj EPS* (`)

37.5

26.2

36.6

32.8

13.8

26.8

% chg

54.3

(27.2)

41.0

(3.7)

(45.9)

57.4

*Adjusted for deficient R&D

November 16, 2015

8

Tata Motors | 2QFY2016 Result Update

Balance sheet statement

Y/E March (` cr)

FY2012 FY2013 FY2014 FY2015 FY2016E FY2017E

SOURCES OF FUNDS

Equity Share Capital

635

638

644

644

644

644

Reserves& Surplus

32,064

36,999

64,960

55,618

62,927

74,859

Shareholders Funds

32,699

37,637

65,603

56,262

63,571

75,503

Total Loans

47,149

53,716

60,642

73,610

62,000

62,000

Minority interest

307

370

421

433

533

653

Deferred tax liab

2,165

2,048

1,572

1,343

1,343

1,343

Other long term liab

2,298

3,284

2,597

9,142

9,142

9,142

Total Liabilities

84,617

97,056

130,836

140,791

136,590

148,642

APPLICATION OF FUNDS

Gross Block

89,779

103,132

132,928

158,207

196,207

240,207

Less: Acc. Dep.

49,512

51,723

68,815

74,424

91,523

111,653

Net Block

40,267

51,409

64,113

83,783

104,684

128,554

Capital WIP

15,946

18,454

33,263

28,640

28,640

28,640

Investments

8,918

8,765

10,687

15,337

9,200

9,200

Other long term asset

575

1,024

5,068

858

858

858

Current Assets

70,593

82,195

99,542

102,610

78,361

83,978

Cash

18,238

21,115

29,712

32,116

6,255

56

Other

52,355

61,081

69,830

70,495

72,107

83,922

Current liabilities

60,314

73,322

89,163

97,867

92,584

110,019

Net Current Assets

10,279

8,873

10,379

4,743

(14,222)

(26,040)

Total Assets

84,617

97,056

130,836

140,791

136,590

148,642

November 16, 2015

9

Tata Motors | 2QFY2016 Result Update

Cash flow statement

Y/E March (` cr)

FY2012

FY2013

FY2014

FY2015

FY2016E FY2017E

Profit before tax

13,537

13,727

19,854

21,887

12,522

17,392

Depreciation

9,814

2,210

17,093

5,609

17,099

20,130

Change in Working Capital

(2,852)

(4,283)

(7,091)

(8,040)

6,895

(5,619)

Others

(3,090)

(3,694)

Direct taxes paid

4

(377)

(476)

(764)

(351)

(487)

Cash Flow from Operations

17,412

7,583

29,380

18,692

36,166

31,416

(Inc.)/ Dec. in Fixed Assets

(22,805)

(15,861)

(44,605)

(20,656)

(38,000)

(44,000)

(Inc.)/ Dec. in Investments

(6,373)

153

(1,922)

(4,650)

6,137

0

Cash Flow from Investing

(29,179)

(15,708)

(46,527)

(25,306)

(31,863)

(44,000)

Issue of Equity

(3)

3

6

0

0

0

Inc./(Dec.) in loans

14,338

6,567

6,927

12,968

(11,610)

0

Dividend Paid (Incl. Tax)

(1,481)

(741)

(748)

(748)

(748)

(748)

Others

-

-

-

-

Cash Flow from Financing

12,855

5,829

6,184

12,220

(12,358)

(748)

Inc./(Dec.) in Cash

6,829

2,877

8,597

2,404

(25,861)

(6,199)

Opening Cash balances

11,410

18,238

21,115

29,712

32,116

6,255

Closing Cash balances

18,238

21,115

29,712

32,116

6,255

56

November 16, 2015

10

Tata Motors | 2QFY2016 Result Update

Key ratios

Y/E March

FY2012

FY2013

FY2014

FY2015

FY2016E

FY2017E

Valuation Ratio (x)

P/E (on FDEPS)

9.0

12.4

8.8

9.1

16.9

10.7

P/E (on Adj EPS)

10.7

15.3

10.9

12.2

28.9

14.9

P/CEPS

7.2

8.0

5.6

5.4

5.9

4.4

P/BV

4.0

3.4

2.0

2.3

2.0

1.7

Dividend yield (%)

1.0

1.0

0.5

0.5

0.5

0.5

EV/Sales

0.9

0.8

0.7

0.6

0.8

0.7

EV/EBITDA

7.0

6.5

4.6

4.3

6.1

5.2

EV / Total Assets

1.8

1.7

1.2

1.2

1.5

1.4

Per Share Data (`)

EPS (Basic)

44.3

32.3

45.5

43.8

23.7

37.3

Adj EPS*

37.5

26.2

36.6

32.8

13.8

26.8

Cash EPS

55.2

49.9

71.0

74.4

67.7

90.8

DPS

4.0

4.0

2.0

2.0

2.0

2.0

Book Value

101.0

116.0

201.8

172.8

195.5

232.6

Dupont Analysis

EBIT margin

10.5

9.4

10.6

10.2

6.6

7.2

Tax retention ratio

1.0

0.7

0.8

0.7

0.7

0.7

Asset turnover (x)

2.5

2.5

2.3

2.4

2.0

2.0

ROIC (Post-tax)

26.2

17.2

18.5

16.0

9.3

10.5

Cost of Debt (Post Tax)

6.3

4.9

6.0

4.3

5.0

4.9

Leverage (x)

0.9

0.9

0.5

0.7

0.9

0.8

Operating ROE

43.8

27.9

24.4

24.7

13.1

15.0

Returns (%)

ROCE (Pre-tax)

20.5

18.3

18.8

19.0

12.3

14.5

Angel ROIC (Pre-tax)

26.1

23.4

24.3

24.6

12.9

14.5

ROE

36.4

22.2

18.0

18.7

7.4

12.1

Turnover ratios (x)

Asset Turnover (Gross Block)

1.8

1.8

1.8

1.7

1.3

1.3

Inventory / Sales (days)

40

41

43

41

41

41

Receivables (days)

18

21

17

17

18

18

Payables (days)

10

11

11

11

10

10

WC cycle (ex-cash) (days)

(18)

(24)

(30)

(38)

(29)

(32)

Solvency ratios (x)

Net debt to equity

0.9

0.9

0.5

0.7

0.9

0.8

Net debt to EBITDA

1.3

1.3

0.9

1.1

1.7

1.5

Interest Coverage (EBIT / Int.)

5.8

5.0

5.2

5.5

3.9

5.1

*Adjusted for deficient R&D

November 16, 2015

11

Tata Motors | 2QFY2016 Result Update

Research Team Tel: 022 - 39357800

DISCLAIMER

Angel Broking Private Limited (hereinafter referred to as “Angel”) is a registered Member of National Stock Exchange of India Limited,

Bombay Stock Exchange Limited and Metropolitan Stock Exchange of India Limited. It is also registered as a Depository Participant with

CDSL and Portfolio Manager with SEBI. It also has registration with AMFI as a Mutual Fund Distributor. Angel Broking Private Limited is

a registered entity with SEBI for Research Analyst in terms of SEBI (Research Analyst) Regulations, 2014 vide registration number

INH000000164. Angel or its associates has not been debarred/ suspended by SEBI or any other regulatory authority for accessing

/dealing in securities Market. Angel or its associates including its relatives/analyst do not hold any financial interest/beneficial

ownership of more than 1% in the company covered by Analyst. Angel or its associates/analyst has not received any compensation /

managed or co-managed public offering of securities of the company covered by Analyst during the past twelve months. Angel/analyst

has not served as an officer, director or employee of company covered by Analyst and has not been engaged in market making activity

of the company covered by Analyst.

This document is solely for the personal information of the recipient, and must not be singularly used as the basis of any investment

decision. Nothing in this document should be construed as investment or financial advice. Each recipient of this document should

make such investigations as they deem necessary to arrive at an independent evaluation of an investment in the securities of the

companies referred to in this document (including the merits and risks involved), and should consult their own advisors to determine

the merits and risks of such an investment.

Reports based on technical and derivative analysis center on studying charts of a stock's price movement, outstanding positions and

trading volume, as opposed to focusing on a company's fundamentals and, as such, may not match with a report on a company's

fundamentals.

The information in this document has been printed on the basis of publicly available information, internal data and other reliable

sources believed to be true, but we do not represent that it is accurate or complete and it should not be relied on as such, as this

document is for general guidance only. Angel Broking Pvt. Limited or any of its affiliates/ group companies shall not be in any way

responsible for any loss or damage that may arise to any person from any inadvertent error in the information contained in this report.

Angel Broking Pvt. Limited has not independently verified all the information contained within this document. Accordingly, we cannot

testify, nor make any representation or warranty, express or implied, to the accuracy, contents or data contained within this document.

While Angel Broking Pvt. Limited endeavors to update on a reasonable basis the information discussed in this material, there may be

regulatory, compliance, or other reasons that prevent us from doing so.

This document is being supplied to you solely for your information, and its contents, information or data may not be reproduced,

redistributed or passed on, directly or indirectly.

Neither Angel Broking Pvt. Limited, nor its directors, employees or affiliates shall be liable for any loss or damage that may arise from

or in connection with the use of this information.

Note: Please refer to the important ‘Stock Holding Disclosure' report on the Angel website (Research Section). Also, please refer to the

latest update on respective stocks for the disclosure status in respect of those stocks. Angel Broking Pvt. Limited and its affiliates may

have investment positions in the stocks recommended in this report.

Disclosure of Interest Statement

Tata Motors

1. Analyst ownership of the stock

No

2. Angel and its Group companies ownership of the stock

No

3. Angel and its Group companies' Directors ownership of the stock

No

4. Broking relationship with company covered

No

Note: We have not considered any Exposure below ` 1 lakh for Angel, its Group companies and Directors

Ratings (Based on expected returns

Buy (> 15%)

Accumulate (5% to 15%)

Neutral (-5 to 5%)

over 12 months investment period):

Reduce (-5% to -15%)

Sell (< -15)

November 16, 2015

12