4QFY2016 Result Update | Tyres

May 18, 2016

TVS Srichakra

BUY

CMP

`2,419

Performance Update

Target Price

`2,932

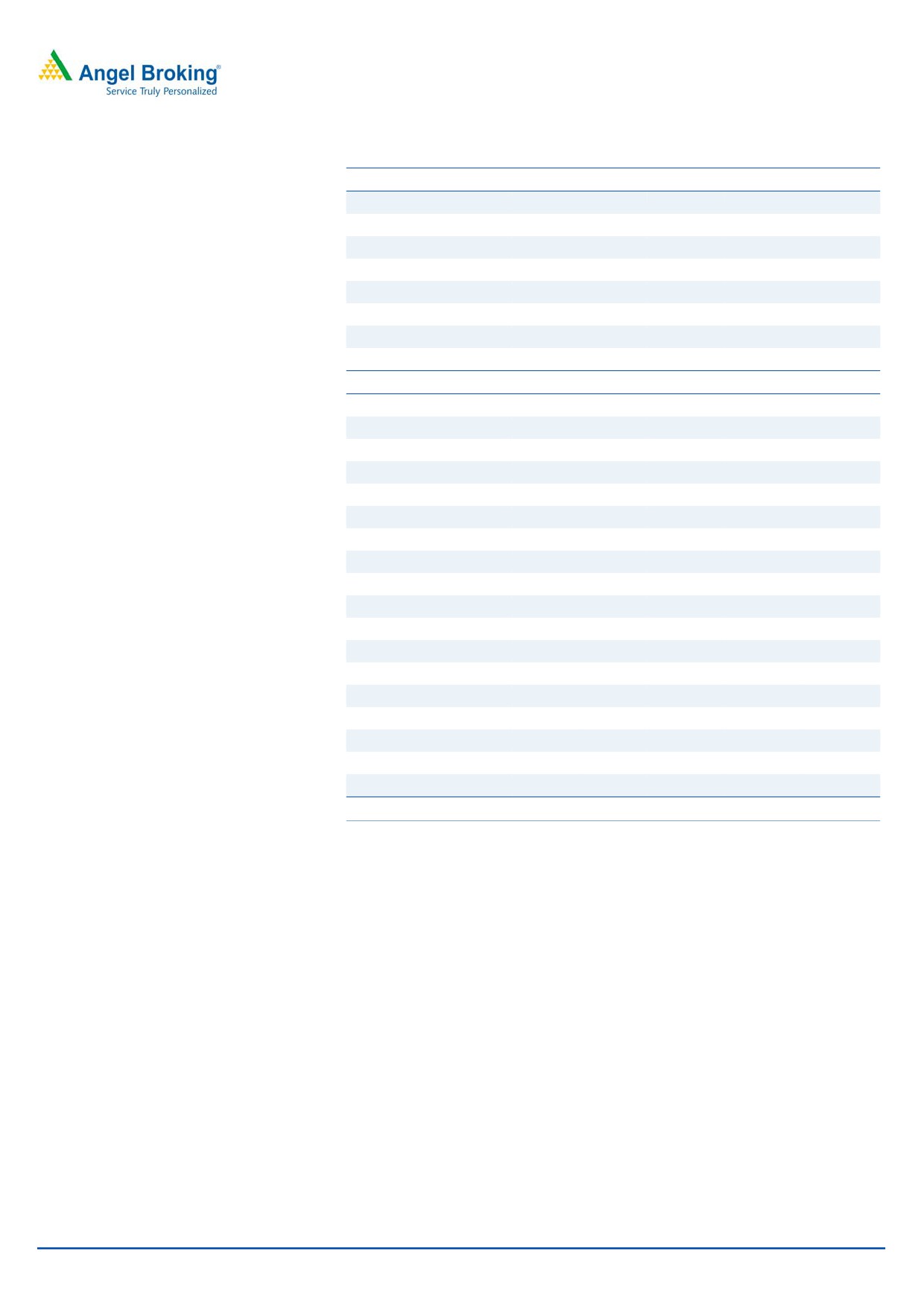

Y/E March (` cr)

4QFY2016

4QFY2015

% chg (yoy) 3QFY2016

% chg (qoq)

Investment Period

12 Months

Total Income

525

465

13.0

509

3.2

EBITDA

76

64

18.5

81

(6.2)

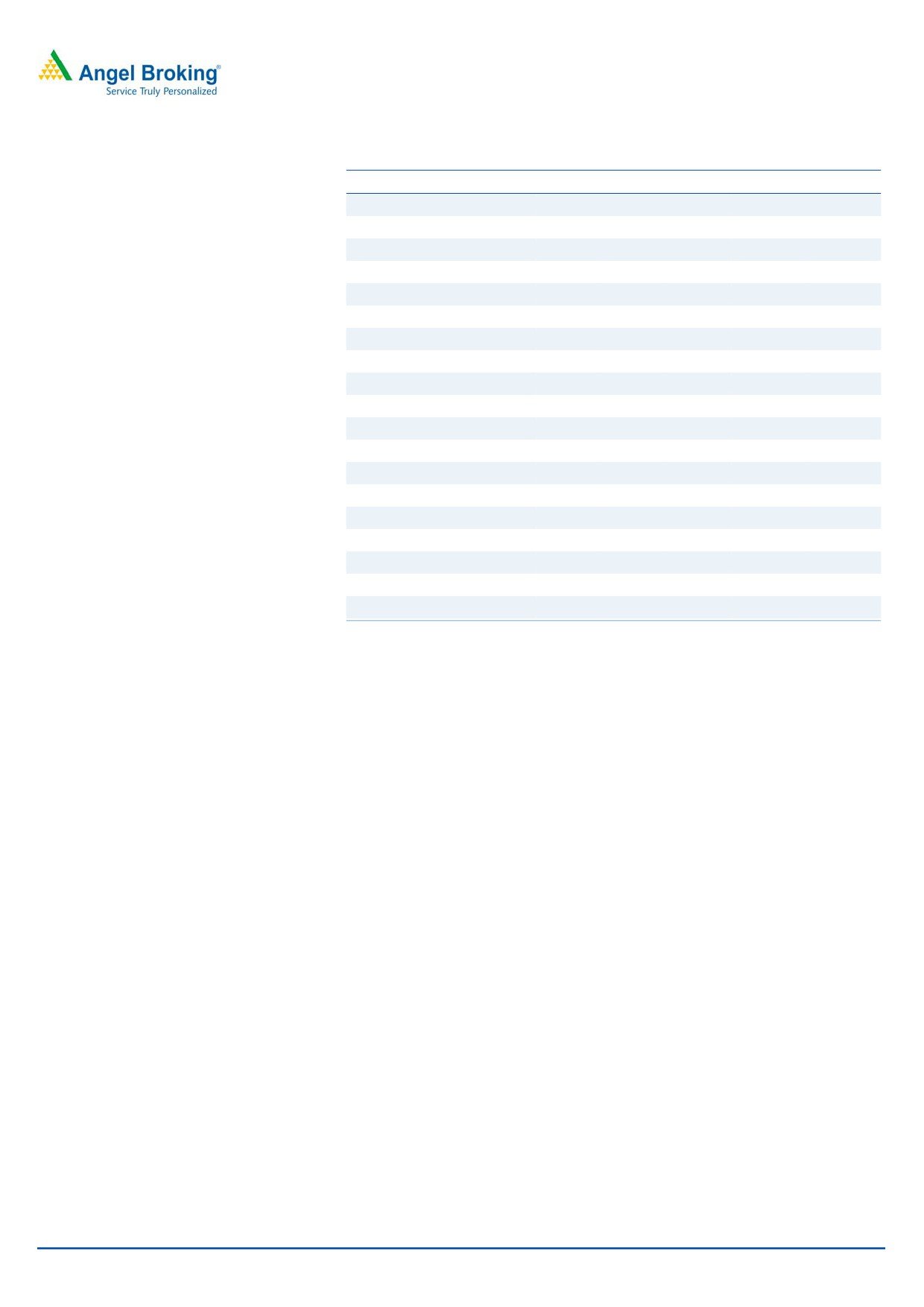

Stock Info

EBITDA margin (%)

14.5

13.8

68bp

15.9

(145)bp

Adj PAT

44

34

28.2

48

(9.4)

Sector

Tyres

Source: Company, Angel Research

Market Cap (` cr)

1,852

TVS Srichakra (TVSSL) reported a good set of numbers for 4QFY2016. Its

Beta

1.1

top-line grew by 13.0% yoy to `525cr. On the operating front, the raw material

Net debt (` cr)

57

cost came down significantly, ie by 805bp yoy to 48.1% of sales. Still, the EBITDA

52 Week High / Low

3,249 / 1,600

margin expanded by a marginal 68bp yoy to 14.5% as raw material cost savings

Avg. Daily Volume

3,954

were offset by higher employee and other expenses. The depreciation expense

Face Value (`)

10

declined by 36.1% on a yoy basis owing to higher depreciation in 4QFY2015

BSE Sensex

25,774

(adjustments in accounting policy in the previous year). The other income increased to

Nifty

7,891

`18cr (against `3cr in 4QFY2015) which we believe was owing to profits from sale of its

subsidiary. Adjusting for the higher other income, the profit grew by 28.2% yoy to `44cr.

Reuters Code

TVSC.BO

Bloomberg Code

SRTY IN

Leadership position in 2W OEM segment and growing share in aftermarket

segment: TVSSL has been able to maintain its leadership position in the 2W OEM

segment and grow further in the aftermarket space which has enabled it to post

Shareholding Pattern (%)

good growth in the past year despite of fall in realizations. Going forward, we

Promoters

45.4

believe the company will be able to maintain growth on the top-line front given

MF / Banks / Indian Fls

1.4

the encouraging outlook for the 2W industry. The company continues to invest in

brand building and promotions to compete better in the aftermarket space.

FII / NRIs / OCBs

0.5

Indian Public / Others

52.8

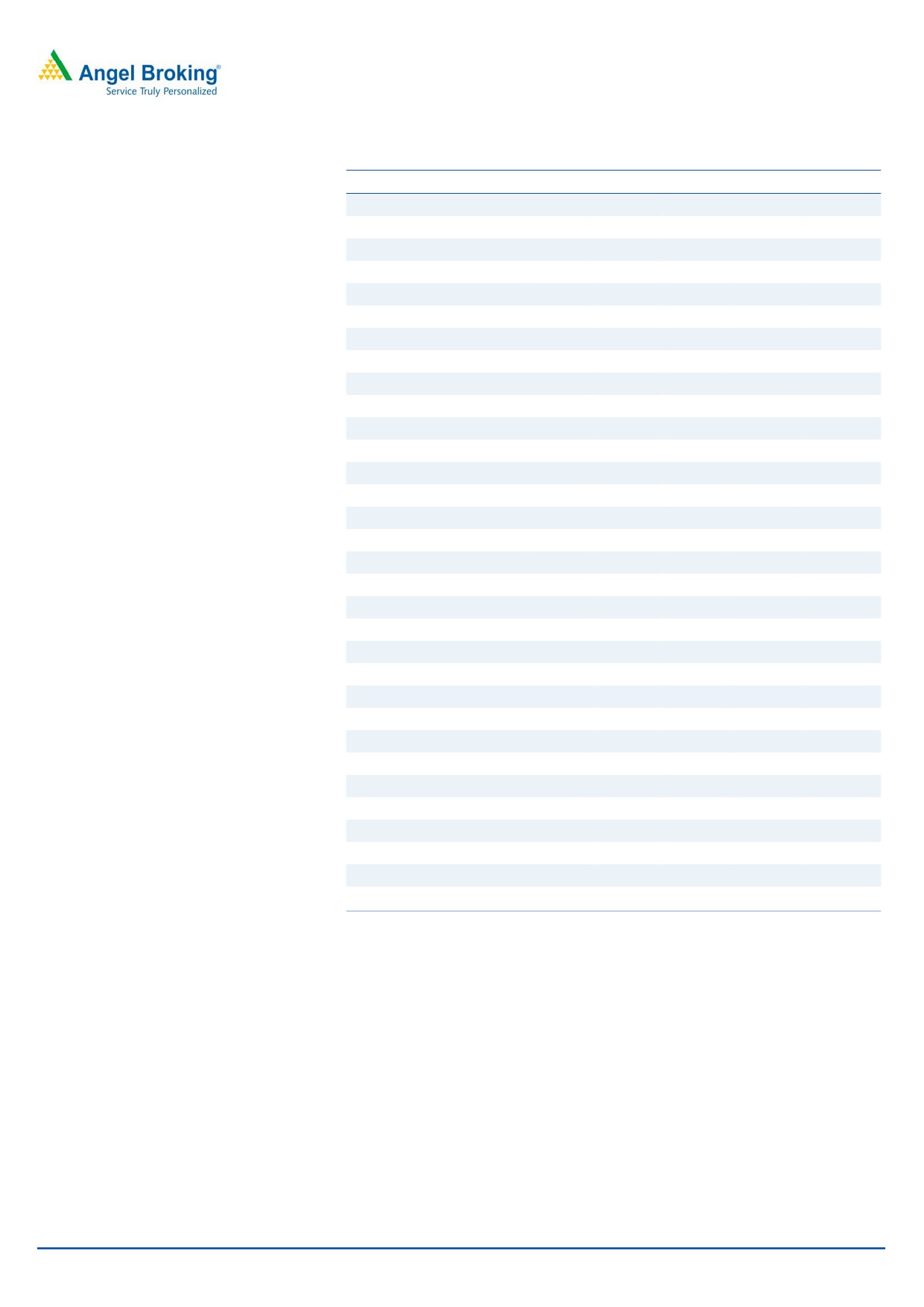

Outlook and valuation: TVVSL has been outperforming the tyre industry over the

past two years which has resulted in it posting good growth on the top-line front

despite of declining realizations. While rubber prices have surged recently, we

Abs.(%)

3m 1yr

3yr

believe that TVVSL will be able to pass on the increase in RM cost in the OEM

segment. Additionally, the outlook on the 2W industry is favorable which augurs

Sensex

(6.3)

(14.3)

25.3

well for the company as it is predominantly a 2W tyre manufacturer. We expect

TVSSL

(7.7)

54.5

914.8

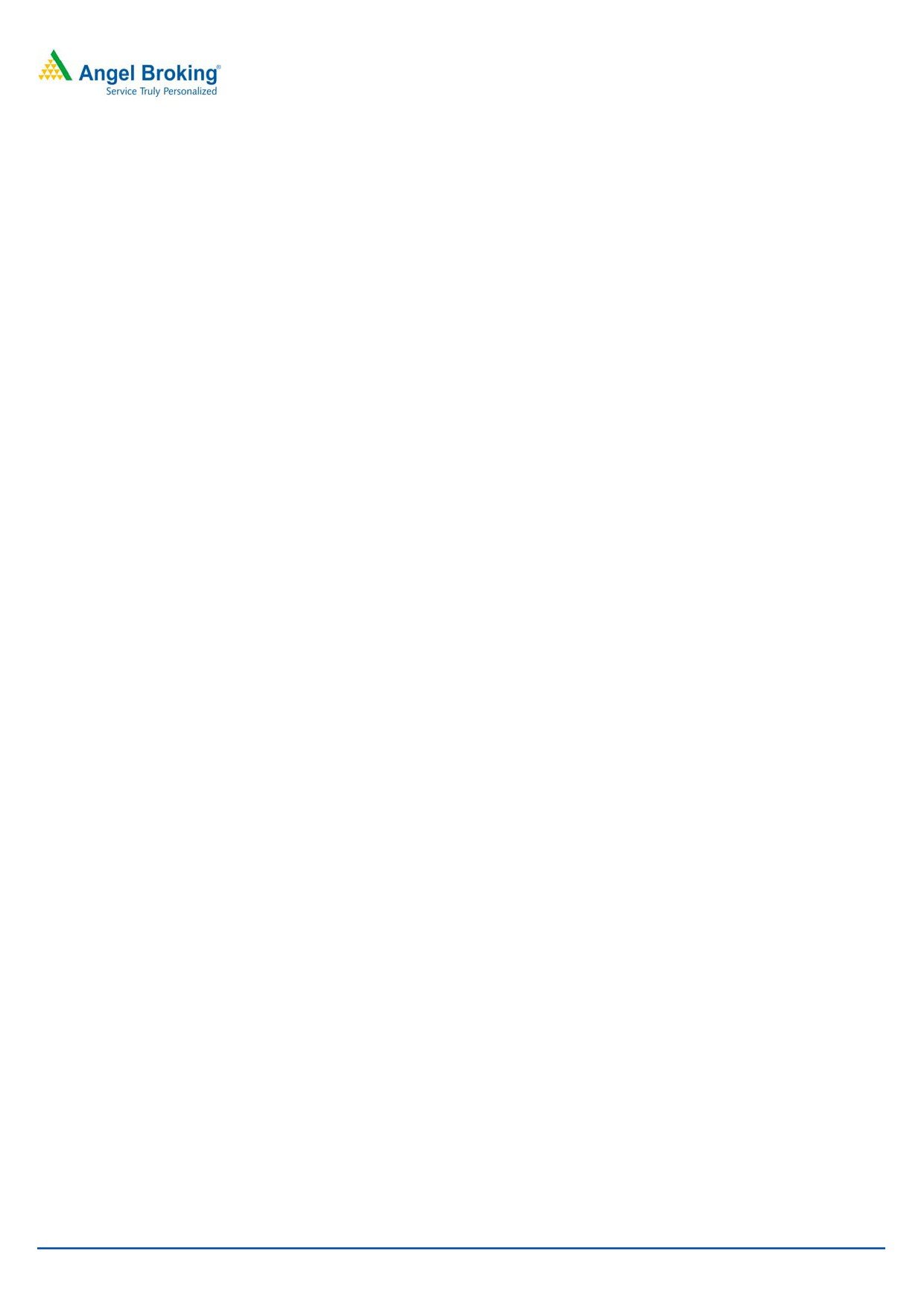

the company to post revenue CAGR of 12.6% over FY2016-18E to `2,614cr. With

higher RM prices, we expect margins to contract by 182bp over FY2016-18E to

3 year price chart

13.8%. The company has increased its capacity and plans to invest in further

3,500

capacity expansion which will increase the depreciation expense going forward.

3,000

Consequently the bottom-line is expected to improve to `204cr in FY2018E. At the

2,500

current market price, the stock trades at 9.1x its FY2018E earnings. We have a

2,000

Buy rating on the stock with a revised target price of `2,932 based on a target PE

1,500

of 11.0x for FY2018E earnings.

1,000

Key financials

500

Y/E March (` cr)

FY2014

FY2015

FY2016

FY2017E

FY2018E

-

Net sales

1,671

1,896

2,060

2,304

2,614

% chg

13.2

13.5

8.6

11.9

13.4

Net profit

47

104

189

177

204

% chg

33.0

118.8

82.2

(6.4)

15.3

Source: Company, Angel Research

EBITDA margin (%)

7.2

11.5

15.6

13.7

13.8

EPS (`)

61.9

135.5

247.0

231.1

266.6

P/E (x)

39.1

17.8

9.8

10.5

9.1

P/BV (x)

9.1

6.7

4.4

3.4

2.7

RoE (%)

23.3

37.6

45.2

32.3

29.3

RoCE (%)

17.7

33.7

40.3

33.0

32.0

Milan Desai

EV/Sales (x)

1.3

1.1

0.9

0.8

0.7

39357800 ext: 6846

EV/EBITDA (x)

17.8

9.3

5.9

5.8

4.9

Source: Company, Angel Research; Note: CMP as of May 17, 2016

Please refer to important disclosures at the end of this report

1

TVS Srichakra | 4QFY2016 Result Update

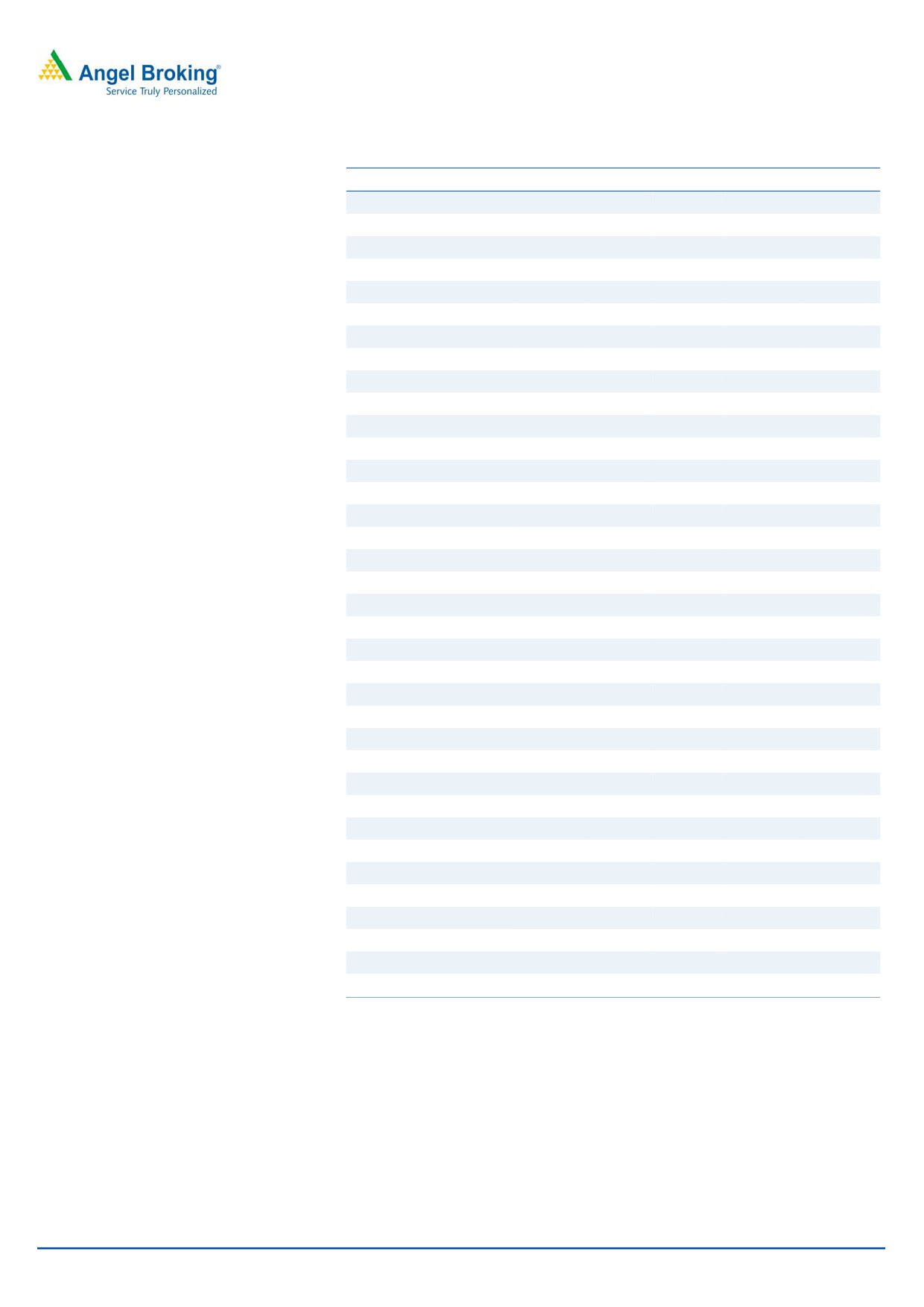

Exhibit 1: 4QFY2016 performance

Y/E March (` cr)

4QFY2016

4QFY2015

% chg (yoy)

3QFY2016

% chg (qoq)

FY2016

FY2015

% chg

Net Sales

525

465

13.0

509

3.2

2,060

1,896

8.6

Net raw material

252

261

(3.2)

258

(2.1)

1,040

1,123

(7.4)

(% of Sales)

48.1

56.1

(805)bp

50.7

(265)bp

50.5

59.3

(877)bp

Staff Costs

57

43

33.4

48

19.0

202

164

22.9

(% of Sales)

10.8

9.2

166bp

9.4

144bp

9.8

8.7

114bp

Other Expenses

140

97

43.8

122

14.7

496

391

26.9

(% of Sales)

26.6

20.9

571bp

23.9

266bp

24.1

20.6

346bp

Total Expenditure

449

401

12.1

428

5.0

1,738

1,678

3.5

Operating Profit

76

64

18.5

81

(6.2)

322

218

48.1

OPM

14.5

13.8

68bp

15.9

(145)bp

15.6

11.5

417bp

Interest

3

4

(30.3)

3

(7.1)

15

30

(50.6)

Depreciation

12

19

(36.1)

10

19.4

42

40

6.2

Other Income

18

3

573.0

0

5487.9

22

4

496.5

Exceptional Item

-

-

-

-

(12)

PBT

80

44

80.9

68

16.7

287

140

105.9

(% of Sales)

15.2

9.5

13.4

14.0

7.4

Tax

28

10

179.6

20

38.8

90

36

152.1

(% of PBT)

35.1

22.7

29.5

31.4

25.6

Reported PAT

52

34

52.0

48

7.4

197

104

90.0

Adjusted PAT

44

34

48

189

104

82.2

PATM

8.3

7.3

9.5

9.2

5.5

Equity capital (cr)

8

8

8

8

8

EPS (`)

56.9

44.4

28.2

62.8

(9.4)

247.0

135.5

90.0

Source: Company, Angel Research

Exhibit 2: Actual vs. Angel estimate (4QFY2016)

(` cr)

Actual (` cr)

Estimate (` cr)

% variation

Total Income

525

502

4.6

EBIDTA

76

77

(1.0)

EBIDTA margin

14.5

15.3

(82)bp

Adj. PAT

44

45

(2.7)

Source: Company, Angel Research

Top-line beats estimates, overall numbers in-line.

TVSSL reported a good set of numbers for 4QFY2016. The top-line grew by an

impressive 13.0% yoy to `525cr which is ahead of our expectation of `502cr. The

company has been outperforming the industry in the past two years with it having

gained market share in the aftermarket segment and maintained its leadership

position in the OEM segment. The company has increased its capacity from 2.0mn

tyres per month as at the end of FY2015 to 2.3mn in December 2015; the

Management stated that the company’s average production for FY2016 was of

2.2mn tyres per month.

May 18, 2016

2

TVS Srichakra | 4QFY2016 Result Update

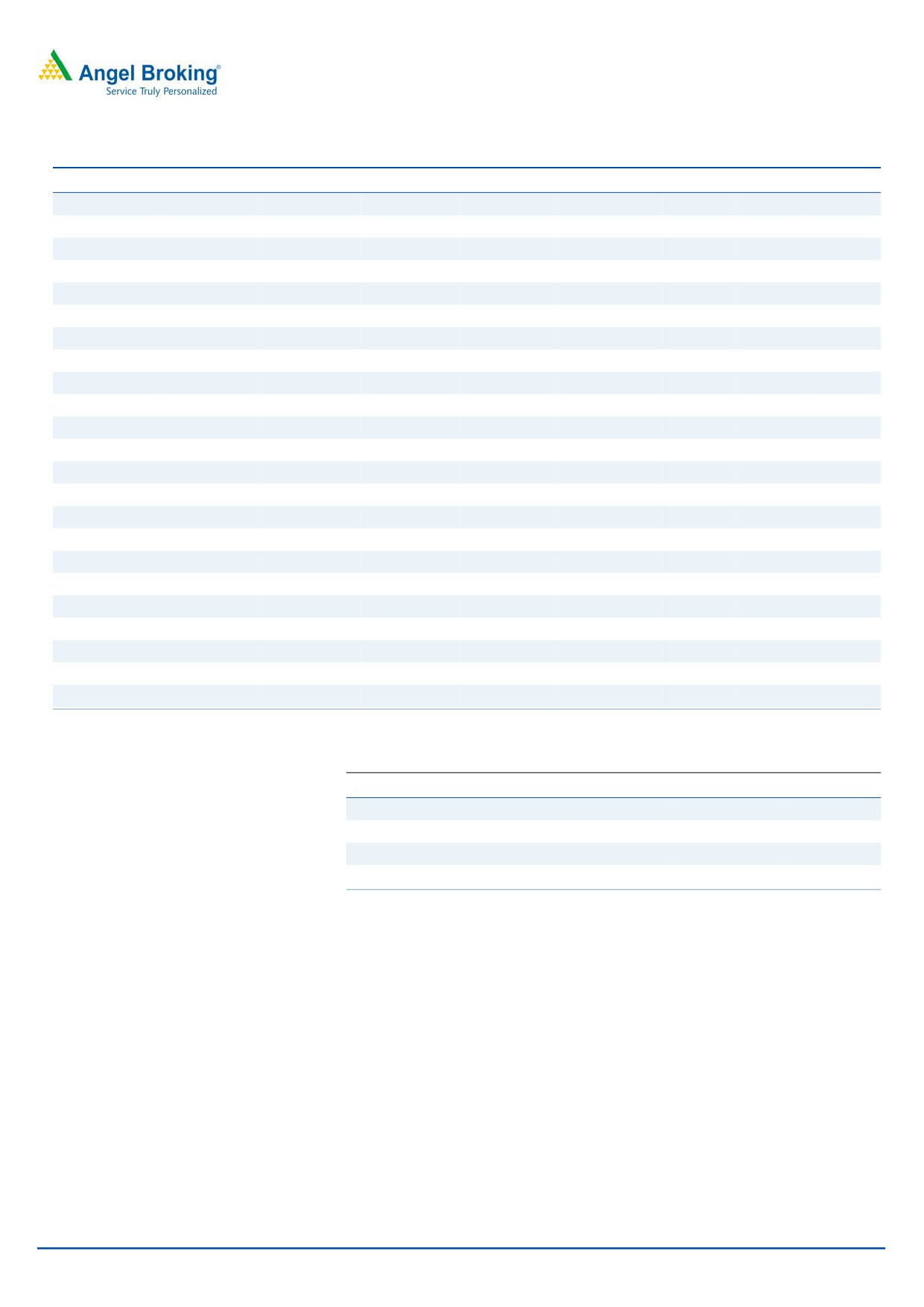

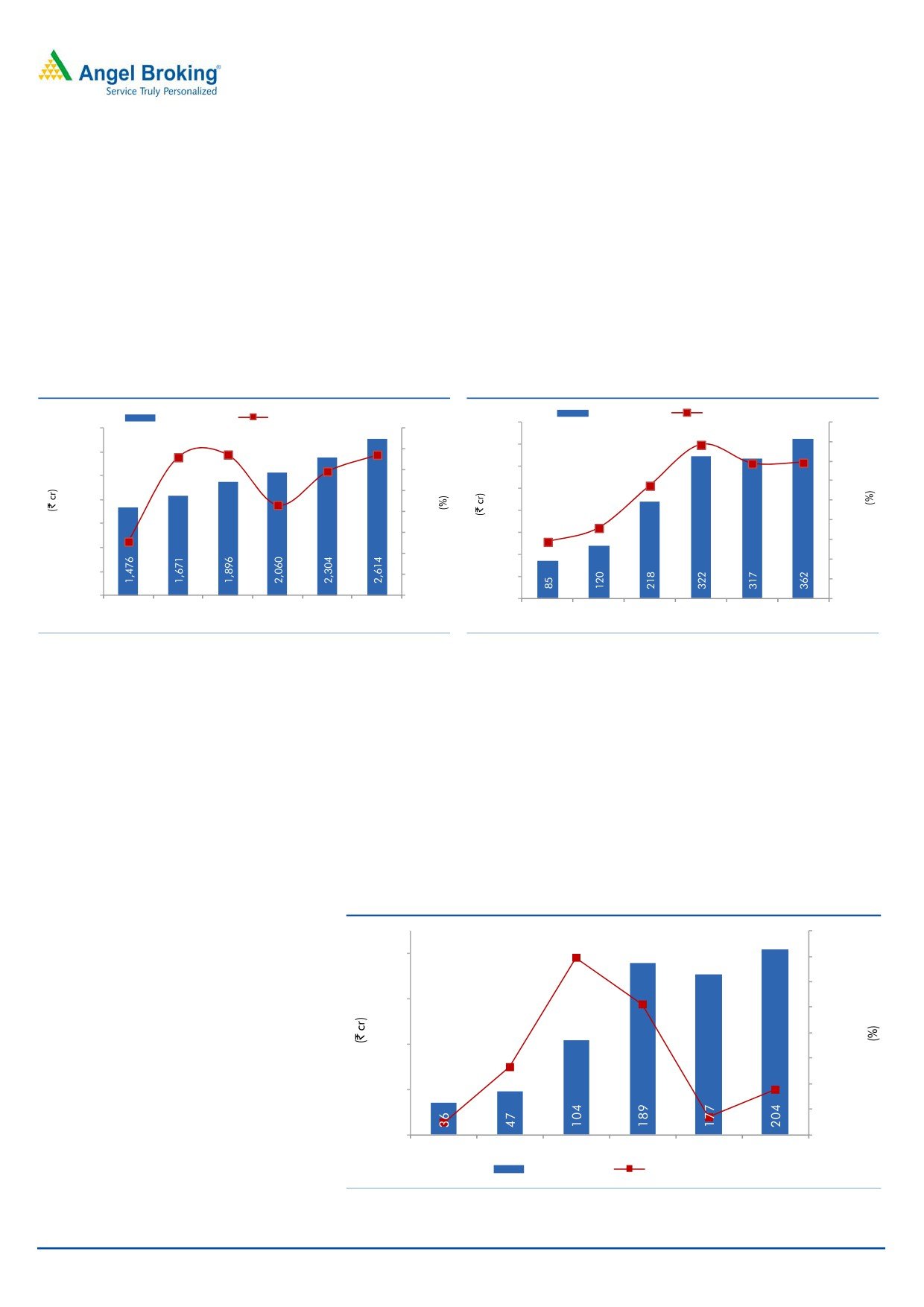

Exhibit 3: Top-line maintaining good growth

Exhibit 4: Lower RM cost led to margin expansion

20.0

17.9

18.5

18.0

61.9

70.0

500

17.2

61.4

15.7

15.9

18.0

57.6

16.0

56.1

60.0

16.0

51.216.5

14.5

400

14.0

14.0

50.0

1

3.0

11.7

12.0

13.8

52.0

12.0

50.7

40.0

300

12.8

10.0

48.1

8.0

10.0

30.0

200

6.5

6.0

8.0

20.0

8.9

10.3

4.0

4.0

100

6.0

10.0

1.8

2.0

-

-

4.0

-

Revenue (LHS)

yoy growth (RHS)

EBITDA margin (LHS)

RM cost/sales (RHS)

Source: Company, Angel Research

Source: Company, Angel Research

On the operating front, the raw material cost as a percentage of sales declined by

805bp yoy to 48.1%; however, the EBITDA margin expanded only by 68bp yoy to

14.5% (vs our estimate of 15.3%) on account of higher employee and other

expenses. The company has been aggressive in terms of promotion over the past

few quarters which resulted in other expenses for 4QFY2016 increasing by 571bp

yoy to 26.6% of sales. The employee expense too increased by 166bp yoy to

10.8% of sales.

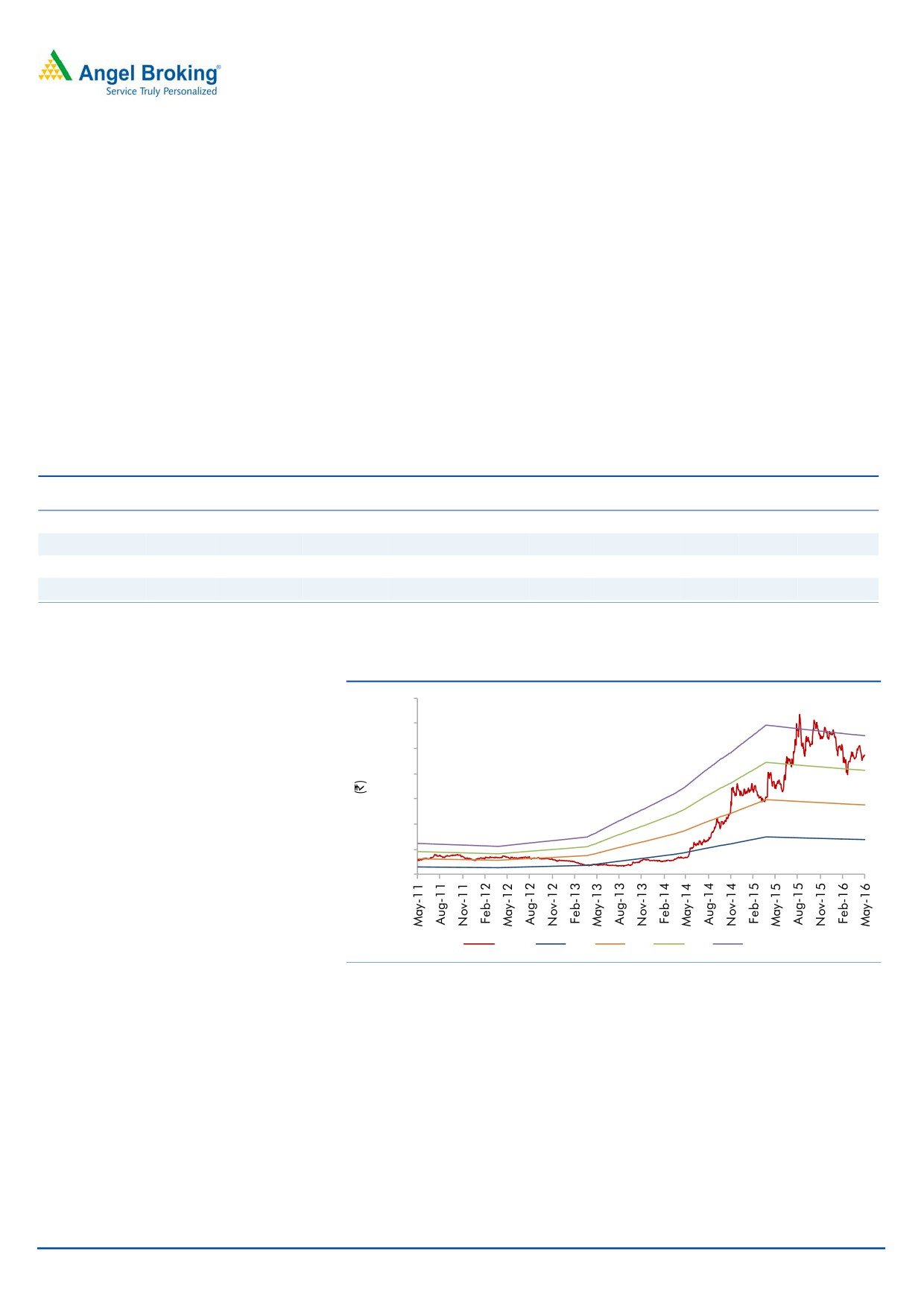

The interest expense declined by 30.3% yoy to `3cr while depreciation was lower

on a yoy basis by 36.1% (on account of higher depreciation in the corresponding

quarter of the previous year due to change in accounting policy).

The other income increased to `18cr (against `3cr in 4QFY2015) which we

estimate to be on account of profits from the recent sale of its subsidiary. Adjusting

for this, the net profit grew by 28.2% yoy to `44cr, which is in-line with our

estimate of `45cr.

Exhibit 5: Declining interest cost

Exhibit 6: Profits growth yoy

60

183.7

200.0

12

10.0

50

150.0

10

8.5

7.3

40

8

86.9

100.0

81.9

30

43.6

5.2

28

.2

6

50.0

4.1

15.1

3.6

20

4

3.1

2.9

(28.3)

-

10

2

-

(50.0)

-

PAT (LHS)

yoy growth (RHS)

Source: Company, Angel Research

Source: Company, Angel Research

May 18, 2016

3

TVS Srichakra | 4QFY2016 Result Update

Investment rationale

Higher share in Aftermarket segment to aid growth

The company’s outperformance to the industry in FY2016 is mainly on back of its

increasing share in the aftermarket segment. The company ranks third in terms of

market share in the aftermarket space and has been aggressive in promotions and

advertisements to attain higher brand recall, which should enable it to sustain if

not grow its market share. As we had reported in the past, Chinese tyres do not

cover a significant market share in the aftermarket segment for two-wheelers and

therefore are not much of a threat to the company.

Leadership position in 2W OEM and better outlook on the

industry to aid growth

After a stellar 9.3% growth in 2W sales in FY2015, the segment reported a muted

growth of 2.6% for FY2016 on account of stressed rural economy. Despite of

muted numbers posted by the 2W industry in FY2016, TVSSL numbers suggest that

it was able to maintain its share with key clients like HMSI which posted flattish

volumes and especially its group company TVS Motor which reported sales volume

growth of 5.6% in FY2016. Within the 2W space, the scooter segment has

performed well with sales growing by 12.6% in FY2016 against flattish growth in

the motorcycle segment. Both HMSI and TVS Motor reported strong growth rates of

12.1% yoy and 6.2% yoy respectively in the scooter segment.

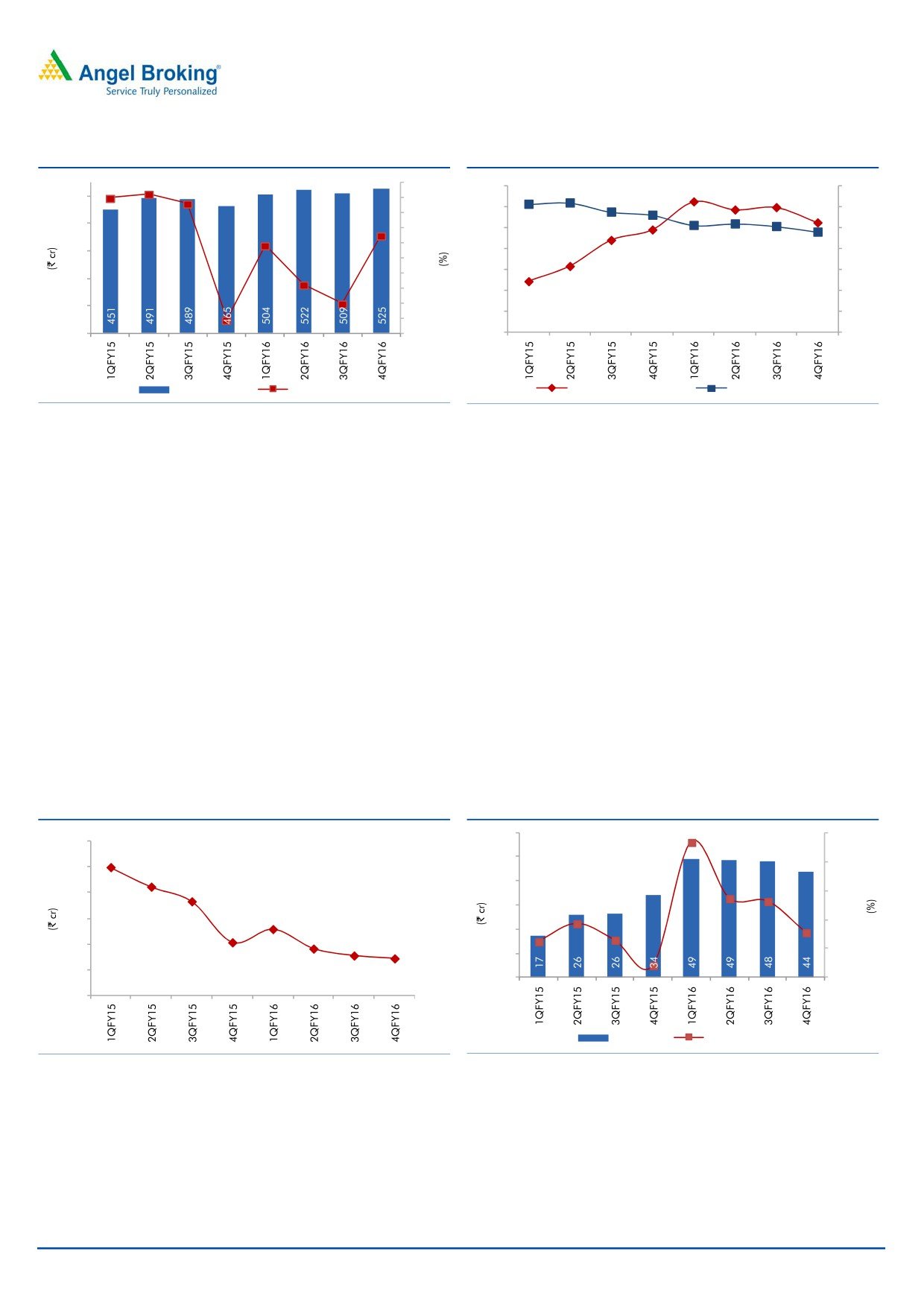

Exhibit 7: 2W/3W growth (yoy)

Exhibit 8: 2W sales growth by manufacturer (yoy)

2-wheeler

3-wheeler

40.0

Bajaj

HMCL

HMSIL

TVS

35.0

27.9

25.0

18.7

20.0

11.8

15.0

20.0

12.6

9.3

15.0

7.0

12.9

7.4

0.9

2.3

0.0

5.0

3.2

(0.4)

(2.1)

3.6

1.4

1.6

(3.4)

(5.0)

0.1

(3.0)

(20.0)

(7.7)

(15.0)

4QFY14

2QFY15

4QFY15

2QFY16

4QFY16

Source: Company, Angel Research

Source: Company, Angel Research

Exhibit 9: Key Clients Sales (Domestic +Exports) Growth

HMSI

TVS Motor

(Units)

FY2015

FY2016

yoy (%)

FY2015

FY2016

yoy (%)

Scooters

25,80,161

28,92,779

12.1

14,60,290

15,51,074

6.2

Motorcycles

18,59,820

15,91,056

(14.5)

9,52,242

10,16,807

6.8

Source: SIAM, Angel Research

May 18, 2016

4

TVS Srichakra | 4QFY2016 Result Update

Going forward, 2W sales are expected to improve on account of increased rural

allocation in the Union Budget 2016-17, expectations of a favorable monsoon,

and positive impact of the Seventh Pay Commission. The scooter segment is

expected to maintain its growth rate and HMSI is likely to post robust numbers as it

is expected to commence a second production line at its Gujarat facility in order to

bring down the waiting period for Activa from near six months.

Given its leadership position in the 2W OEM segment, and positive outlook on the

2W industry, we expect TVSSL to maintain its performance on the top-line front.

Agreement with Michelin adds to revenue visibility

TVSSL has an agreement with French tyre major Michelin to manufacture 2W bias

tyres designed by Michelin at its Madurai facility. As per the agreement, TVSSL

would contract manufacture 2W bias tyres under the Michelin brand name and it

will also be manufacturing some tyres from its own range of 2W tyres. The

agreement is encouraging as it not only provides revenue visibility but also speaks

volumes about trust in TVSSL’s technological and manufacturing capabilities.

May 18, 2016

5

TVS Srichakra | 4QFY2016 Result Update

Financial performance

The company is estimated to have posted good volume growth in the range of 11-

12% in FY2016 while realizations were down which resulted in 8.6% yoy growth in

top-line for the year. As for realizations from the OEM segment, escalations in raw

material prices are passed on and this should protect the company from the recent

rebound in natural rubber prices in the domestic market which have jumped by

~31.4% in 1QFY2017 to `131/Kg. On account of higher realizations coupled with

improvement in volumes, we expect the company to post revenue CAGR of 12.6%

over FY2016-18E to `2,614cr.

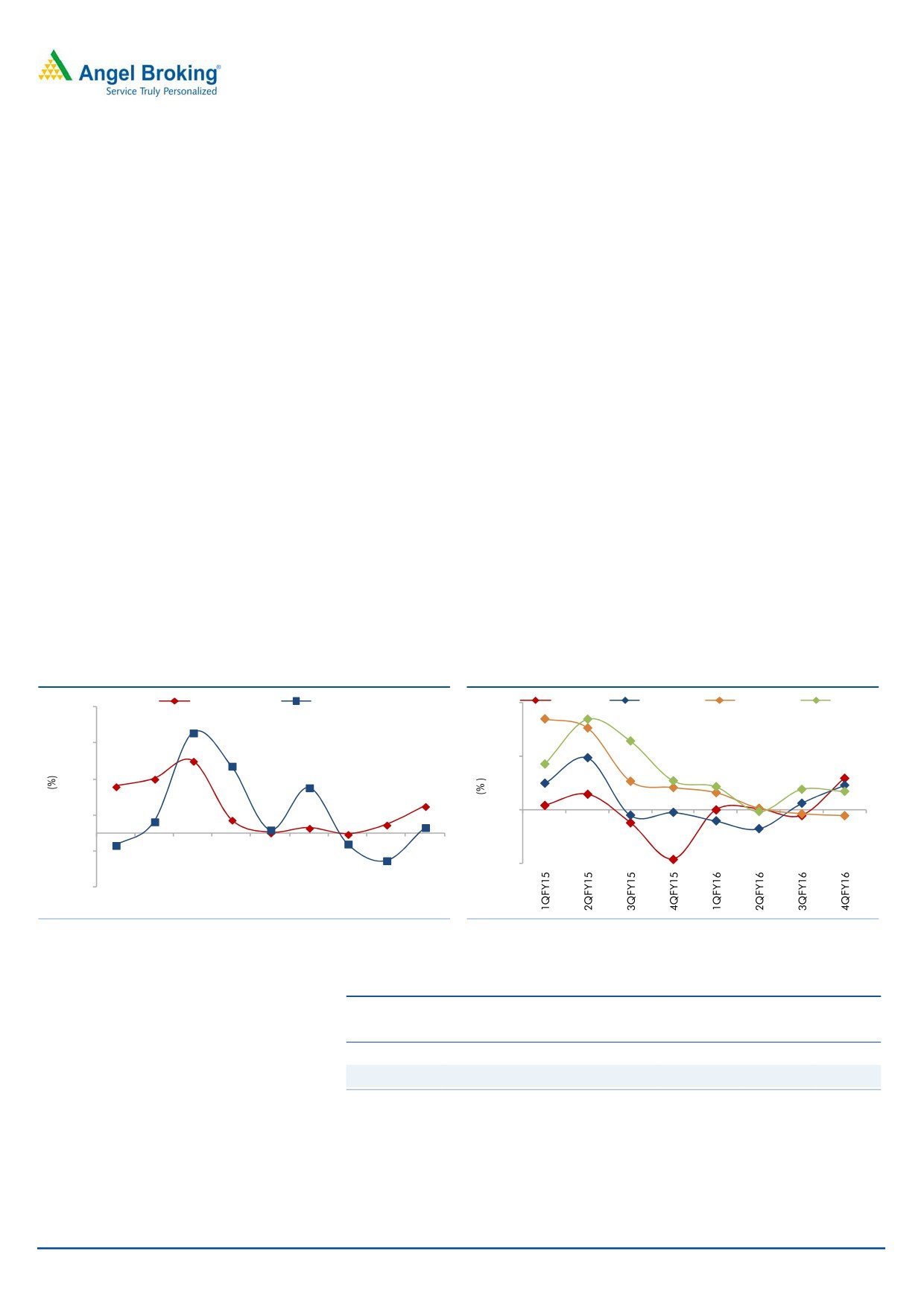

Exhibit 10: Revenue to grow at 12.6% CAGR

Exhibit 11: EBITDA Margin to witness contraction

EBITDA (LHS)

EBITDA margin (RHS)

Revenue (LHS)

Revenue growth (RHS)

400

18.0

2,800

16.0

13.5

350

16.0

2,400

13.

4

14.0

11.9

15.6

13

.8

13.2

13.7

14.0

12.0

300

11.5

2,000

12.0

8.6

10.0

250

1,600

10.0

8.0

200

7.2

1,200

5.7

8.0

6.0

150

5.1

6.0

800

4.0

100

4.0

400

2.0

50

2.0

-

-

-

-

FY2013

FY2014

FY2015

FY2016

FY2017E FY2018E

FY2013

FY2014

FY2015

FY2016

FY2017E FY2018E

Source: Company, Angel Research

Source: Company, Angel Research

We have revised our natural rubber cost per Kg upwards from our flattish estimate

of `118/kg to `130/Kg for FY2017E and expect rubber prices to rise up to

~`140/kg in FY2018E. As a result, we expect margins to come under pressure

and expect 182bp contraction in EBITDA margin over FY2016-18E to 13.8%. The

company is estimated to have incurred capex of ~`160cr in FY2016 to increase its

capacity to 2.3mn tyres/month. The company will be scaling it up to 2.5mn

tyres/month in FY2017E and we estimate it to further expand the capacity by

similar quantum in FY2018E which will result in higher depreciation expense. As a

result, the net profit is expected to be at `204cr in FY2018E.

Exhibit 12: Net profit trend

140.0

200

120.0

118.8

100.0

150

82.2

80.0

60.0

100

40.0

33.0

20.0

50

15.3

-

(6.4)

(10.3)

-

(20.0)

FY2013

FY2014

FY2015

FY2016

FY2017E FY2018E

PAT (LHS)

PAT growth (RHS)

Source: Company, Angel Research

May 18, 2016

6

TVS Srichakra | 4QFY2016 Result Update

Outlook and valuation

TVVSL has been outperforming the tyre industry over the past two years which has

resulted in it posting good growth on the top-line front despite of declining

realizations. While rubber prices have surged recently, we believe that TVVSL will

be able to pass on the increase in RM cost in the OEM segment. Additionally, the

outlook on the 2W industry is favorable which augurs well for the company as it is

predominantly a 2W tyre manufacturer. We expect the company to post revenue

CAGR of 12.6% over FY2016-18E to `2,614cr. With higher RM prices, we expect

margins to contract by 182bp over FY2016-18E to 13.8%. The company has

increased its capacity and plans to invest in further capacity expansion which will

increase the depreciation expense going forward. Consequently the bottom-line is

expected to improve to `204cr in FY2018E. At the current market price, the stock

trades at 9.1x its FY2018E earnings. We have a Buy rating on the stock with a

revised target price of `2,932 based on a target PE of 11.0x for FY2018E

earnings.

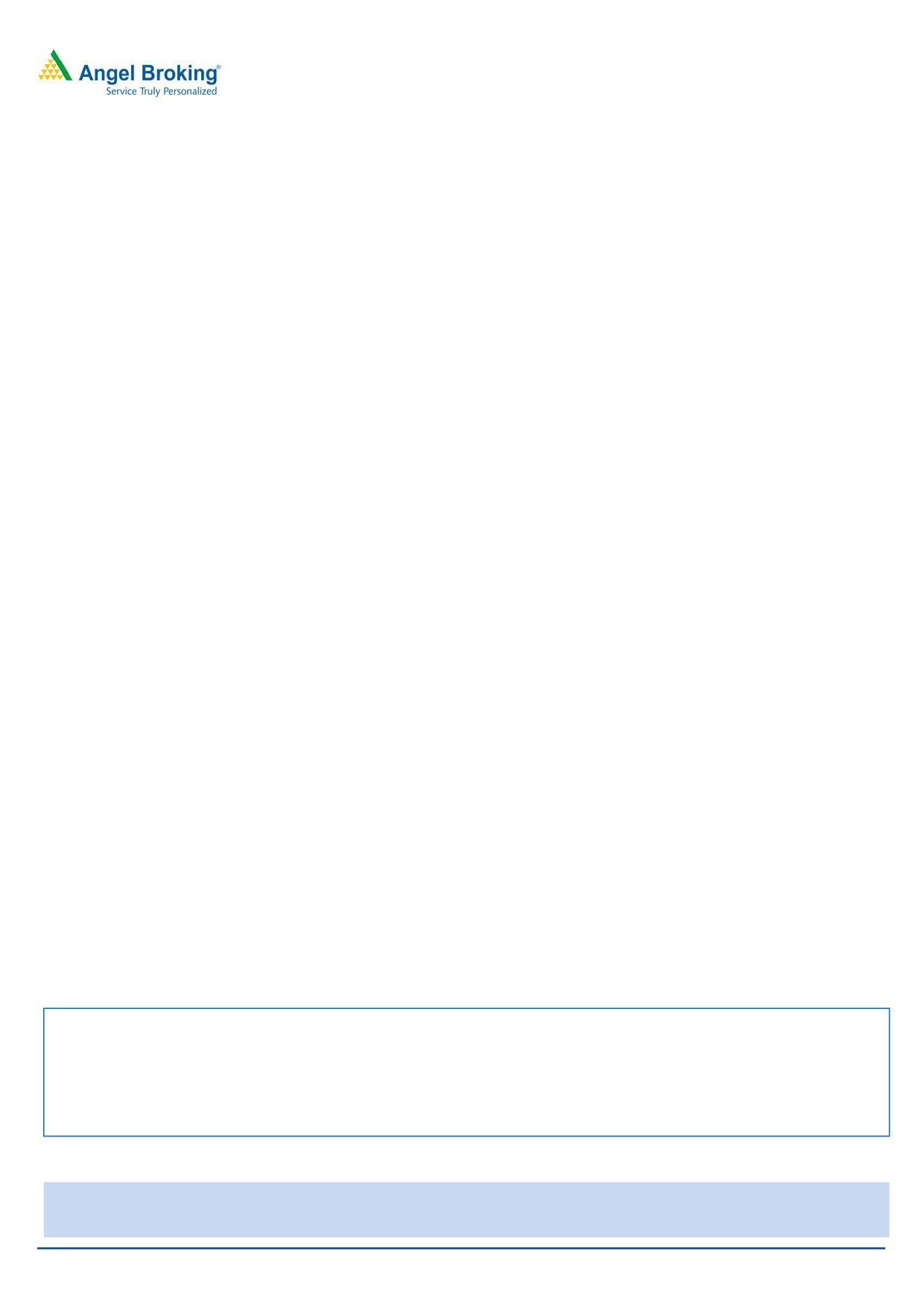

Exhibit 11: Relative valuation

Mcap

Sales

OPM

PAT

EPS

ROE

P/E

P/BV

EV/

Company

Year

(` cr)

(` cr)

(%)

(` cr)

(`)

(%)

(x)

(x)

Sales (x)

TVSSL

FY2018E

1,852

2,614

13.8

204

266.6

29.3

9.1

2.7

0.7

CEAT

FY2018E

4,066

7,116

13.0

498

122.9

18.1

8.2

1.4

0.6

Apollo tyres

FY2018E

7,819

14,731

15.2

1,108

21.8

14.5

7.0

1.0

0.6

MRF

FY2018E

13,920

16,985

20.1

1,733

4,015.0

19.0

8.2

1.5

0.8

Source: Company, Angel Research, Bloomberg

Exhibit 12: One-year forward PE band

3,500

3,000

2,500

2,000

1,500

1,000

500

-

Price

3x

6x

9x

12x

Source: Company, Angel Research

Key downside risks to our recommendation: Any rise in rubber prices, increase in

inflation, increasing competition, slowdown in 2W and 3W industry and lower-

than-expected demand in the replacement market will have an adverse impact on

the company’s performance. The import duty on natural rubber has been

increased from 20% or `30/kg to 25% or `30/kg. Further upward revision in the

duty will have an adverse impact on TVSSL’s profitability.

May 18, 2016

7

TVS Srichakra | 4QFY2016 Result Update

The Company

TVSSL is a part of the TVS Group. The company is a leading manufacturer of

two-wheeler and three-wheeler tyres. The company manufactures a complete

range of two-wheeler and three-wheeler tyres for the domestic market. For the

export market, the company manufactures industrial pneumatic tyres, farm and

implements tyres, skid steer tyres, multipurpose tyres and floatation tyres, among

others. TVSSL’s manufacturing units are located at Madurai, Tamil Nadu and

Pantnagar, Uttarakhand. With a network of over 2,400 dealers and 34 depots

across the country, the company is a major supplier to TVS Motors, Hero

MotoCorp, HMSI, Bajaj Auto, LML, Piaggio, Atul Auto Ltd., Mahindra 2Wheelers

and India Yamaha Motor. The company also exports to the US, Europe, South

America, Africa and Australia.

May 18, 2016

8

TVS Srichakra | 4QFY2016 Result Update

Profit & Loss Statement (Standalone)

Y/E March (` cr)

FY2014

FY2015

FY2016

FY2017E

FY2018E

Total operating income

1,671

1,896

2,060

2,304

2,614

% chg

13.2

13.5

8.6

11.9

13.4

Net Raw Materials

1104

1123

1040

1225

1408

% chg

9.2

1.7

(7.4)

17.8

14.9

Personnel

125

164

202

220

242

% chg

10.5

31.5

22.9

8.9

10.1

Other

322

391

496

543

603

% chg

20.6

21.3

26.9

9.5

11.0

Total Expenditure

1551

1678

1738

1987

2252

EBITDA

120

218

322

317

362

% chg

41.1

81.7

48.1

(1.8)

14.2

(% of Net Sales)

7.2

11.5

15.6

13.7

13.8

Depreciation& Amortisation

24

40

42

57

72

EBIT

96

178

280

260

290

% chg

58.5

85.0

57.5

(7.2)

11.6

(% of Net Sales)

5.8

9.4

13.7

11.4

11.2

Interest & other Charges

42

30

15

14

10

Other Income

1

4

22

7

12

(% of Net Sales)

0.1

0.2

0.2

0.0

0.0

Recurring PBT

55

148

265

246

279

% chg

1477.9

171.2

79.4

(7.3)

13.6

Exceptional Item

-

(12)

-

-

-

PBT (reported)

56

140

287

253

291

Tax

8

36

90

76

87

(% of PBT)

15.2

25.6

31.4

30.0

30.0

PAT (reported)

47

104

197

177

204

Extraordinary Expense/(Inc.)

-

-

8

-

-

ADJ. PAT

47

104

189

177

204

% chg

33.0

118.8

82.2

(6.4)

15.3

(% of Net Sales)

2.9

5.5

9.3

7.8

7.9

Basic EPS (`)

61.9

135.5

247.0

231.1

266.6

Fully Diluted EPS (`)

61.9

135.5

247.0

231.1

266.6

May 18, 2016

9

TVS Srichakra | 4QFY2016 Result Update

Balance Sheet (Standalone)

Y/E March (` cr)

FY2014

FY2015

FY2016E

FY2017E

FY2018E

SOURCES OF FUNDS

Equity Share Capital

8

8

8

8

8

Reserves& Surplus

196

269

411

540

689

Shareholders’ Funds

204

276

419

548

696

Total Loans

304

205

156

119

91

Other Long Term Liabilities

10

15

88

88

88

Long Term Provisions

3

8

4

4

4

Deferred Tax Liability

22

23

28

28

28

Total Liabilities

541

527

694

786

907

APPLICATION OF FUNDS

Gross Block

370

446

536

670

844

Less: Acc. Depreciation

141

179

222

279

350

Net Block

229

267

314

391

493

Capital Work-in-Progress

20

18

92

80

40

Goodwill

-

-

-

-

-

Investments

19

32

87

87

87

Long Term Loans and adv.

53

65

35

35

35

Other Non-current asset

12

7

1

1

1

Current Assets

505

411

429

499

598

Cash

8

9

12

36

72

Loans & Advances

24

25

38

43

49

Inventory

207

210

208

232

263

Debtors

266

167

171

189

214

Other current assets

-

-

-

-

-

Current liabilities

297

274

264

307

348

Net Current Assets

207

137

165

192

250

Misc. Exp. not written off

-

-

-

-

-

Total Assets

541

527

694

786

907

May 18, 2016

10

TVS Srichakra | 4QFY2016 Result Update

Cash Flow Statement (Standalone)

Y/E March (` cr)

FY2014

FY2015

FY2016

FY2017E FY2018E

Profit before tax

56

140

287

253

291

Depreciation

24

40

42

57

72

Change in Working Capital

(81)

72

(26)

(3)

(21)

Direct taxes paid

(8)

(37)

(85)

(76)

(87)

Others

25

27

(22)

(7)

(12)

Cash Flow from Operations

15

242

197

224

242

(Inc.)/Dec. in Fixed Assets

(57)

(74)

(163)

(122)

(134)

(Inc.)/Dec. in Investments

0

(13)

(55)

-

-

(Incr)/Decr In LT loans & adv.

(7)

(7)

36

-

-

Others

(7)

(1)

22

7

12

Cash Flow from Investing

(70)

(95)

(159)

(115)

(122)

Issue of Equity

0

-

-

-

-

Inc./(Dec.) in loans

71

(88)

20

(37)

(28)

Dividend Paid (Incl. Tax)

(14)

(31)

(55)

(48)

(55)

Others

(38)

(26)

-

-

-

Cash Flow from Financing

19

(145)

(35)

(85)

(84)

Inc./(Dec.) in Cash

(37)

1

3

24

37

Opening Cash balances

45

8

9

12

36

Closing Cash balances

8

9

12

36

72

May 18, 2016

11

TVS Srichakra | 4QFY2016 Result Update

Key Ratios (Standalone)

Y/E March

FY2014

FY2015

FY2016

FY2017E

FY2018E

Valuation Ratio (x)

P/E (on FDEPS)

39.1

17.8

9.8

10.5

9.1

P/CEPS

26.1

12.9

8.0

7.9

6.7

P/BV

9.1

6.7

4.4

3.4

2.7

Dividend yield (%)

0.7

1.4

2.5

2.1

2.5

EV/Net sales

1.3

1.1

0.9

0.8

0.7

EV/EBITDA

17.8

9.3

5.9

5.8

4.9

EV / Total Assets

3.9

3.8

2.8

2.4

2.0

Per Share Data (`)

EPS (Basic)

61.9

135.5

247.0

231.1

266.6

EPS (fully diluted)

61.9

135.5

247.0

231.1

266.6

Cash EPS

92.9

187.6

312.9

305.5

360.2

DPS

16.0

33.8

60.0

52.0

60.0

Book Value

266.0

360.8

546.6

715.1

909.5

DuPont Analysis

EBIT margin

5.8

9.4

13.7

11.4

11.2

Tax retention ratio

0.8

0.7

0.7

0.7

0.7

Asset turnover (x)

3.4

4.0

4.1

3.9

3.7

ROIC (Post-tax)

16.5

28.3

38.2

31.2

28.7

Cost of Debt (Post Tax)

11.6

10.8

6.5

8.1

8.1

Leverage (x)

1.2

1.0

0.4

0.1

-0.1

Operating ROE

22.2

45.3

49.7

32.7

27.6

Returns (%)

ROCE (Pre-tax)

17.7

33.7

40.3

33.0

32.0

Angel ROIC (Pre-tax)

19.5

38.1

55.6

44.5

41.0

ROE

23.3

37.6

45.2

32.3

29.3

Turnover ratios (x)

Asset TO (Gross Block)

4.9

4.6

4.2

3.8

3.4

Inventory / Net sales (days)

51

40

37

35

35

Receivables (days)

50

42

30

30

30

Payables (days)

77

62

56

56

56

WC cycle (ex-cash) (days)

44

25

27

25

25

Solvency ratios (x)

Net debt to equity

1.5

0.7

0.3

0.2

0.0

Net debt to EBITDA

2.3

0.8

0.2

(0.0)

(0.2)

Int. Coverage (EBIT/ Int.)

2.3

5.9

18.9

18.9

27.6

May 18, 2016

12

TVS Srichakra | 4QFY2016 Result Update

Research Team Tel: 022 - 39357800

DISCLAIMER

Angel Broking Private Limited (hereinafter referred to as “Angel”) is a registered Member of National Stock Exchange of India Limited,

Bombay Stock Exchange Limited and Metropolitan Stock Exchange of India Limited. It is also registered as a Depository Participant with

CDSL and Portfolio Manager with SEBI. It also has registration with AMFI as a Mutual Fund Distributor. Angel Broking Private Limited is

a registered entity with SEBI for Research Analyst in terms of SEBI (Research Analyst) Regulations, 2014 vide registration number

INH000000164. Angel or its associates has not been debarred/ suspended by SEBI or any other regulatory authority for accessing

/dealing in securities Market. Angel or its associates including its relatives/analyst do not hold any financial interest/beneficial

ownership of more than 1% in the company covered by Analyst. Angel or its associates/analyst has not received any compensation /

managed or co-managed public offering of securities of the company covered by Analyst during the past twelve months. Angel/analyst

has not served as an officer, director or employee of company covered by Analyst and has not been engaged in market making activity

of the company covered by Analyst.

This document is solely for the personal information of the recipient, and must not be singularly used as the basis of any investment

decision. Nothing in this document should be construed as investment or financial advice. Each recipient of this document should

make such investigations as they deem necessary to arrive at an independent evaluation of an investment in the securities of the

companies referred to in this document (including the merits and risks involved), and should consult their own advisors to determine

the merits and risks of such an investment.

Reports based on technical and derivative analysis center on studying charts of a stock's price movement, outstanding positions and

trading volume, as opposed to focusing on a company's fundamentals and, as such, may not match with a report on a company's

fundamentals.

The information in this document has been printed on the basis of publicly available information, internal data and other reliable

sources believed to be true, but we do not represent that it is accurate or complete and it should not be relied on as such, as this

document is for general guidance only. Angel Broking Pvt. Limited or any of its affiliates/ group companies shall not be in any way

responsible for any loss or damage that may arise to any person from any inadvertent error in the information contained in this report.

Angel Broking Pvt. Limited has not independently verified all the information contained within this document. Accordingly, we cannot

testify, nor make any representation or warranty, express or implied, to the accuracy, contents or data contained within this document.

While Angel Broking Pvt. Limited endeavors to update on a reasonable basis the information discussed in this material, there may be

regulatory, compliance, or other reasons that prevent us from doing so.

This document is being supplied to you solely for your information, and its contents, information or data may not be reproduced,

redistributed or passed on, directly or indirectly.

Neither Angel Broking Pvt. Limited, nor its directors, employees or affiliates shall be liable for any loss or damage that may arise from

or in connection with the use of this information.

Note: Please refer to the important ‘Stock Holding Disclosure' report on the Angel website (Research Section). Also, please refer to the

latest update on respective stocks for the disclosure status in respect of those stocks. Angel Broking Pvt. Limited and its affiliates may

have investment positions in the stocks recommended in this report.

Disclosure of Interest Statement

TVS Srichakra

1. Analyst ownership of the stock

No

2. Angel and its Group companies ownership of the stock

No

3. Angel and its Group companies' Directors ownership of the stock

No

4. Broking relationship with company covered

No

Note: We have not considered any Exposure below ` 1 lakh for Angel, its Group companies and Directors

Ratings (Based on expected returns

Buy (> 15%)

Accumulate (5% to 15%)

Neutral (-5 to 5%)

over 12 months investment period):

Reduce (-5% to -15%)

Sell (< -15)

May 18, 2016

13