2QFY2016 Result Update | Tyres

November 9, 2015

TVS Srichakra

BUY

CMP

`2,803

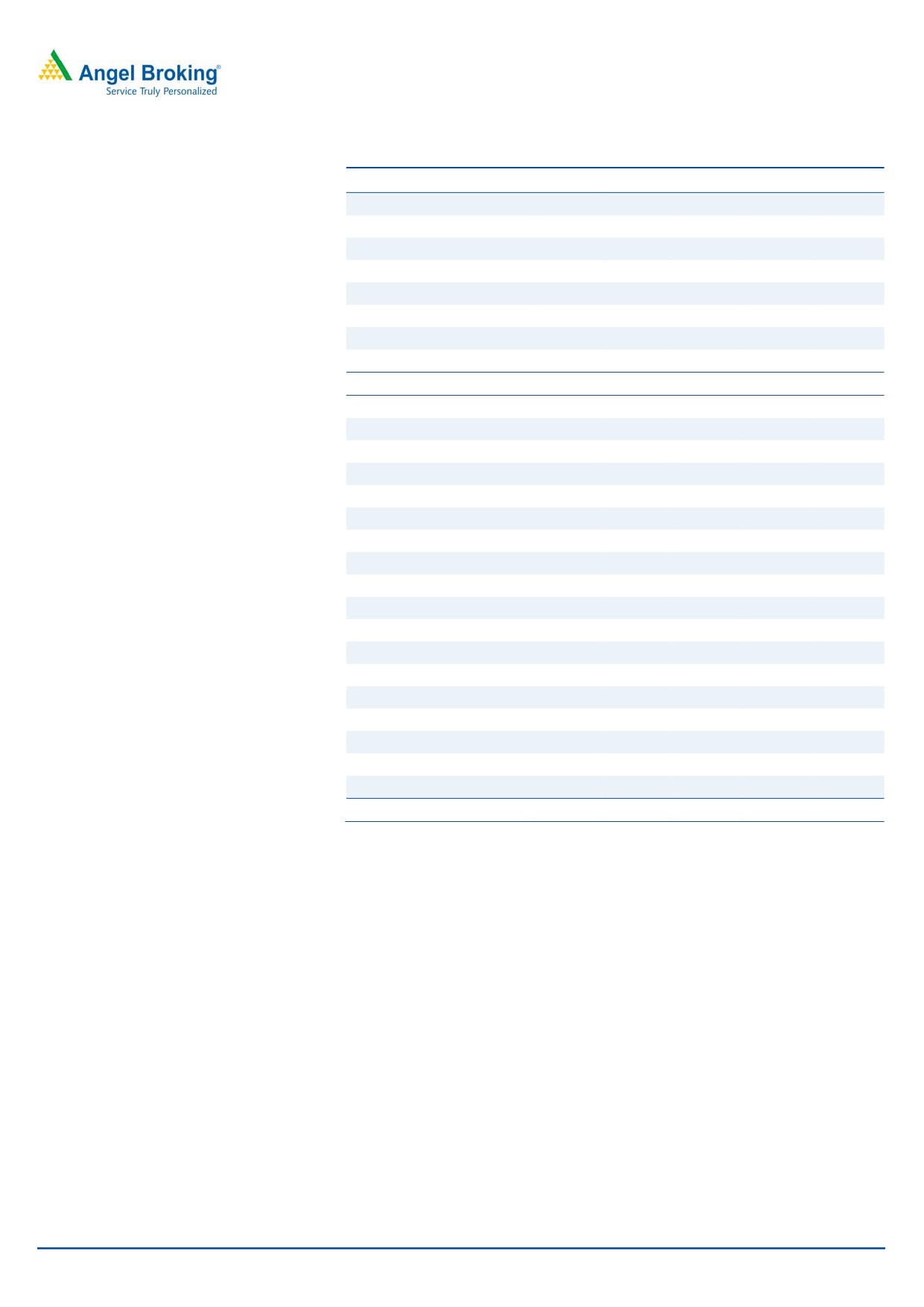

Performance Update

Target Price

`3,240

Y/E March (` cr)

2QFY2016

2QFY2015

% chg (yoy) 1QFY2016

% chg (qoq)

Investment Period

12 Months

Total Income

522

491

6.5

504

3.7

EBITDA

82

51

62.0

83

(1.1)

Stock Info

EBITDA margin (%)

15.7

10.3

539

16.5

(77)

Adj PAT

49

26

86.9

49

(0.6)

Sector

Tyres

Source: Company, Angel Research

Market Cap (` cr)

2,146

TVS Srichakra (TVSSl) reported a good set of numbers for 2QFY2016. The

Beta

1.1

top-line grew by 6.5% yoy to `522cr. The EBITDA margin expanded by 539bp yoy

Net debt (` cr)

164

to 15.7%, mainly due to a 997bp yoy decline in raw material cost (owing to

52 Week High / Low

3,249 / 1,192

rubber prices declining by ~6% qoq). The company has reduced the debt

Avg. Daily Volume

5,010

significantly (from `176cr to `37cr) in 1HFY2016 and as a result its interest

Face Value (`)

10

expense has declined by 57.0% yoy to `4cr. Owing to better operational

BSE Sensex

26,265

performance and lower interest outgo, the net profit nearly doubled to `49cr from

Nifty

7,954

`26cr in the same quarter of the previous year.

Reuters Code

TVSC.BO

Steady two-wheeler (2W) sales and capacity expansion by top clients to

Bloomberg Code

SRTY IN

aid top-line growth: TVSSL’s key client Honda Motorcycle & Scooter India

(HMSI) continues to be the steady performer in comparison to its peers. HMSI has

set out aggressive plans to scale up its business in India with a view to become the

Shareholding Pattern (%)

largest subsidiary of its parent. HMSI has mentioned that capacity constraints had

Promoters

45.4

resulted in the company not being able to grow at a faster pace and has lined up

MF / Banks / Indian Fls

1.7

aggressive capex plans for the future. We expect capacity addition by major

FII / NRIs / OCBs

0.1

clients to result in good revenue visibility for TVSSL as it is a market leader in the

Indian Public / Others

52.8

2W OEM segment. Additionally, the company (TVSSL) wants to garner a larger

share in the high margin replacement market segment where it holds the number

three position. The strong growth experienced in 2W sales in the past year will

Abs.(%)

3m 1yr

3yr

result in better performance for the aftermarket segment of the company.

Sensex

(7.2)

(5.8)

39.6

Outlook and valuation: We expect TVSSL’s top-line to grow at a CAGR of 11.0%

TVSSL

(2.5)

131.4

828.0

over FY2015-17E to `2,338cr. We expect the operating margin to be at 15.0% in

FY2017E on the back of lower rubber prices and improvement in market share in

3 year price chart

the aftermarket segment. Consequently, the net profit is expected to be at `207cr in

FY2017E. At the current market price, the stock is trading at a PE of 10.4x its FY2017E

3,550

earnings. We have a Buy rating on the stock with a revised target price of `3,240

3,050

2,550

based on a target PE of 12.0x for FY2017E earnings.

2,050

1,550

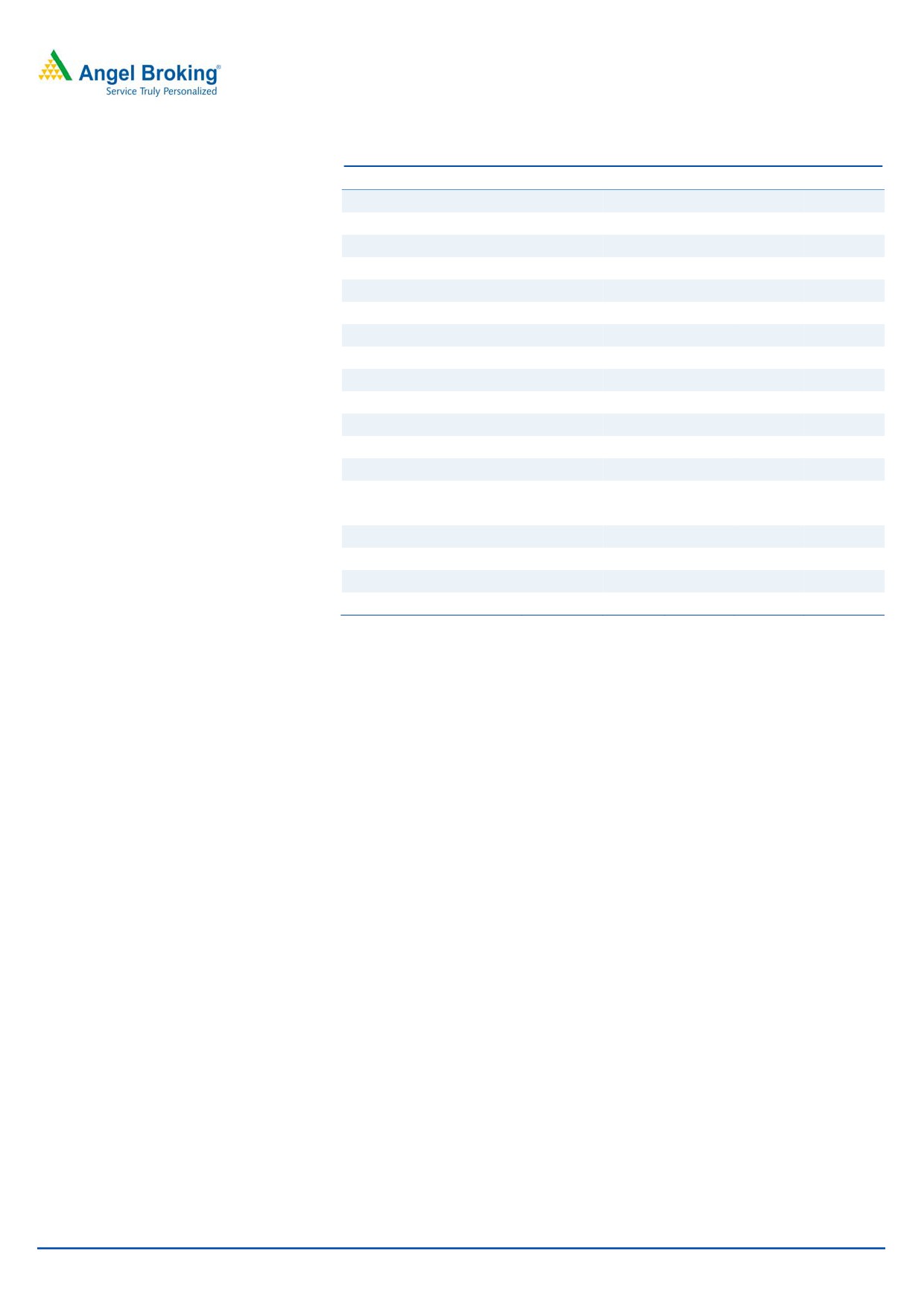

Key financials

1,050

Y/E March (` cr)

FY2013

FY2014

FY2015E

FY2016E

FY2017E

550

Net sales

1,476

1,671

1,896

2,101

2,338

50

% chg

5.1

13.2

13.5

10.8

11.3

Net profit

36

47

104

190

207

% chg

(10.3)

33.0

118.8

83.4

8.6

EBITDA margin (%)

5.7

7.2

11.5

15.7

15.0

Source: Company, Angel Research

EPS (`)

46.6

61.9

135.6

248.6

270.0

P/E (x)

60.2

45.2

20.7

11.3

10.4

P/BV (x)

12.6

10.5

7.8

4.9

3.5

RoE (%)

22.8

25.3

43.3

53.4

39.6

RoCE (%)

13.3

17.7

33.7

45.1

38.7

Milan Desai

EV/Sales (x)

1.6

1.5

1.2

1.1

0.9

39357800 ext: 6846

EV/EBITDA (x)

27.3

20.2

10.6

6.7

6.0

Source: Company, Angel Research; Note: CMP as of November 6, 2015.

Please refer to important disclosures at the end of this report

1

TVS Srichakra | 2QFY2016 Result Update

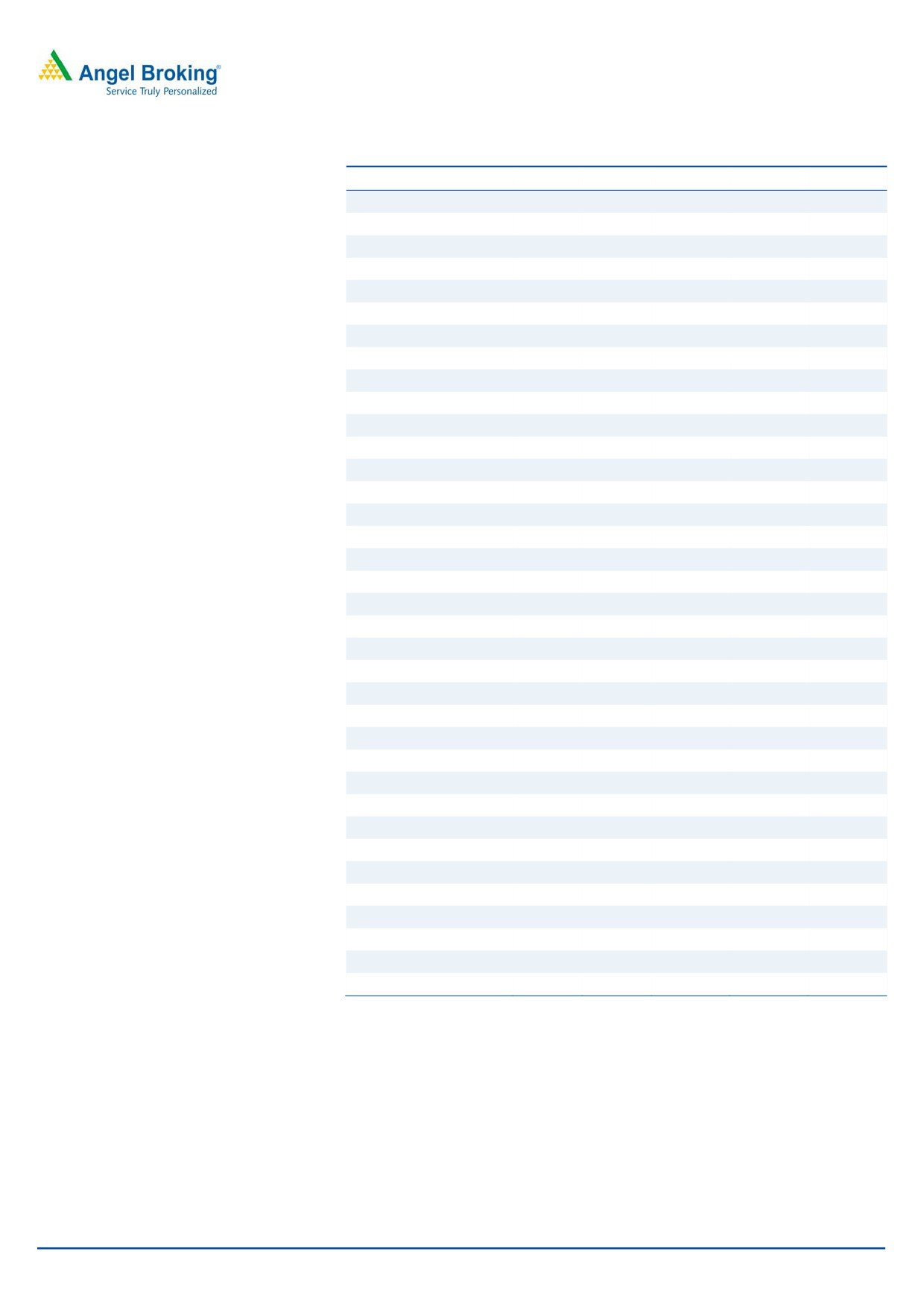

Exhibit 1: 2QFY2016 performance

Y/E March (` cr)

2QFY2016

2QFY2015

% chg (yoy)

1QFY2016

% chg (qoq)

1HFY2016

1HFY2015

% chg

Net Sales

522

491

6.5

504

3.7

1,026

942

9.0

Net raw material

271

304

(10.7)

258

5.2

529

581

(8.8)

(% of Sales)

52.0

61.9

(997)

51.2

75

51.6

61.7

(1,005)

Staff Costs

46

43

6.1

51

(10.1)

97

79

23.5

(% of Sales)

8.8

8.8

(3)

10.1

(135)

9.5

8.3

111

Other Expenses

123

93

32.4

111

10.2

234

192

22.2

(% of Sales)

23.5

18.9

460

22.1

137

22.8

20.4

247

Total Expenditure

440

440

0.1

421

4.7

861

851

1.2

Operating Profit

82

51

62.0

83

(1.1)

165

91

82.1

OPM

15.7

10.3

539

16.5

(77)

16.1

9.6

647

Interest

4

8

(57.0)

5

(29.5)

9

18

(52.3)

Depreciation

10

7

41.6

10

0.4

20

14

48.2

Other Income

1

1

95.2

2

(43.8)

3

1

375.0

Exceptional Item

-

-

-

-

-

PBT

70

36

95.0

70

(0.6)

140

59

135.2

(% of Sales)

13.3

7.3

13.9

13.6

6.3

Tax

21

10

116.9

21

(0.5)

42

16

161.6

(% of PBT)

30.0

27.0

30.0

30.0

27.0

Reported PAT

49

26

86.9

49

(0.6)

98

43

125.5

Adjusted PAT

49

26

49

98

43

PATM

9.3

5.3

9.7

9.5

4.6

Equity capital (cr)

8

8

8

8

8

EPS (`)

63.5

34.0

86.9

63.9

(0.6)

127.5

56.5

125.5

Source: Company, Angel Research

Exhibit 2: Actual vs. Angel estimate (2QFY2016)

(` cr)

Actual (` cr)

Estimate (` cr)

% variation

Total Income

522

532

(1.8)

EBIDTA

82

86

(4.4)

EBIDTA margin

15.7

16.1

(43)

Adj. PAT

49

50

(2.2)

Source: Company, Angel Research

Top-line slightly below estimates, overall numbers in-line.

TVSSL’s top-line for 2QFY2016 grew by 6.5% yoy to `522cr, against our estimate

of `532cr. This is a positive considering that it is purely a 2-wheeler tyre

manufacturer and 2W sales have been lackluster in the current financial year. The

EBITDA margin has expanded by 539bp yoy to 15.7%, mainly due to 997bp yoy

decline in raw material cost (owing to rubber prices declining by ~6% qoq basis).

We had built in an EBITDA margin estimate of 16.1%. The company has reduced

the debt significantly (from `176cr to `37cr) in 1HFY2016 and as a result its

interest expense has declined by 57.0% yoy to `4cr. Owing to better operational

performance and lower interest outgo the net profit nearly doubled to `49cr from

`26cr in the same quarter of the previous year (against our estimate of `50cr).

November 9, 2015

2

TVS Srichakra | 2QFY2016 Result Update

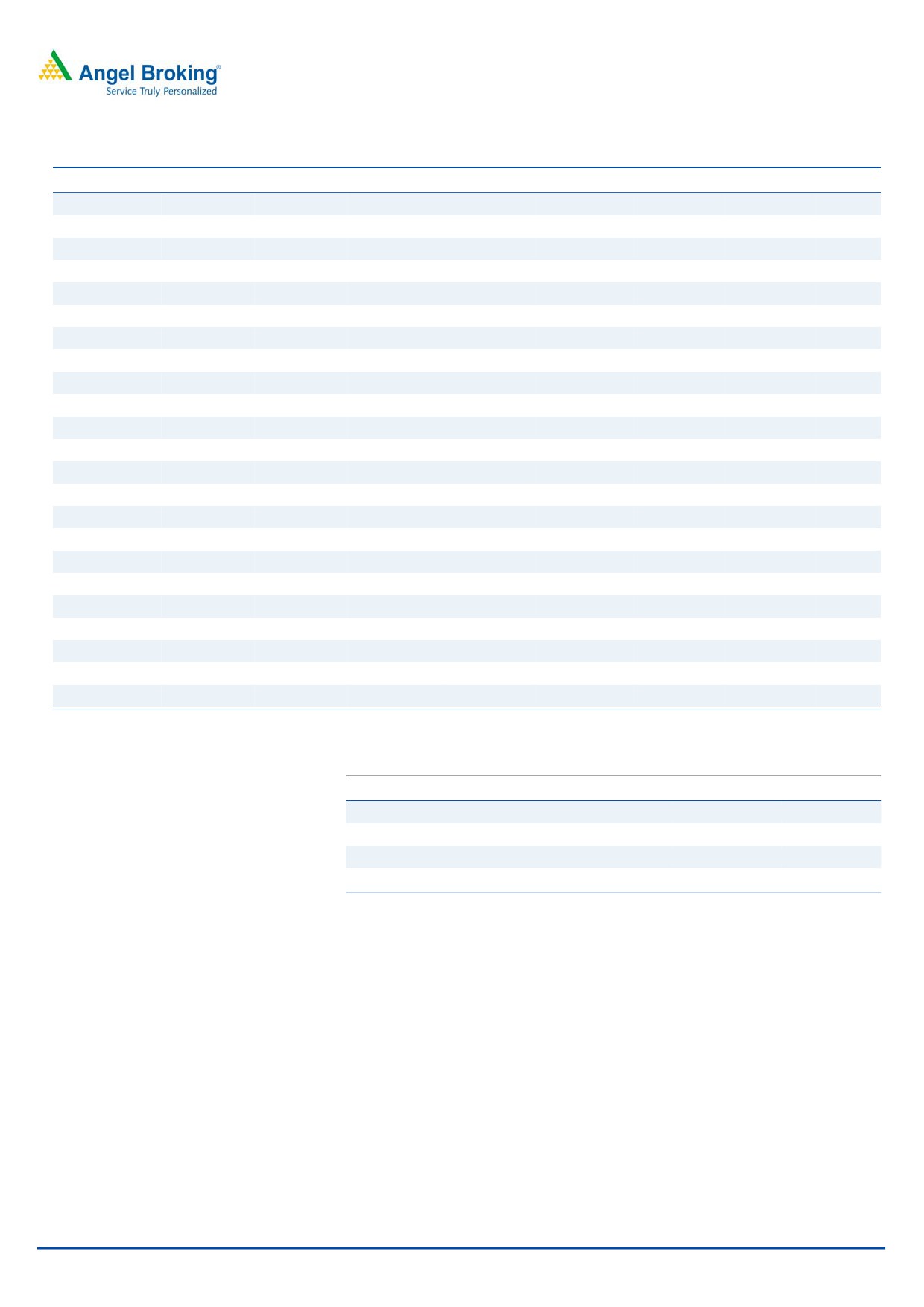

Exhibit 3: Top-line maintaining good growth

Exhibit 4: Lower RM cost led to margin expansion

600

30.0

EBITDA margin (LHS)

RM cost/sales (RHS)

Revenue (LHS)

yoy growth (RHS)

500

18.0

16.5

15.7

80.0

66.2

21.0

16.0

66.9

64.7

61.9

70.0

61.4

13.8

400

18.5

20.0

57.6

14.0

60.0

17.2

300

14.7

17.9

12.0

50.0

12.8

56.1

11.2

11.7

10.0

52.0

40.0

200

10.0

51.2

10.3

8.0

30.0

6

.5

8.6

8.9

100

6.0

20.0

1.8

6.8

4.0

7.4

10.0

0

0.0

2.0

0.0

Source: Company, Angel Research

Source: Company, Angel Research

November 9, 2015

3

TVS Srichakra | 2QFY2016 Result Update

Investment rationale

Steady performance of HMSI coupled with capacity addition by major

clients to ensure revenue visibility

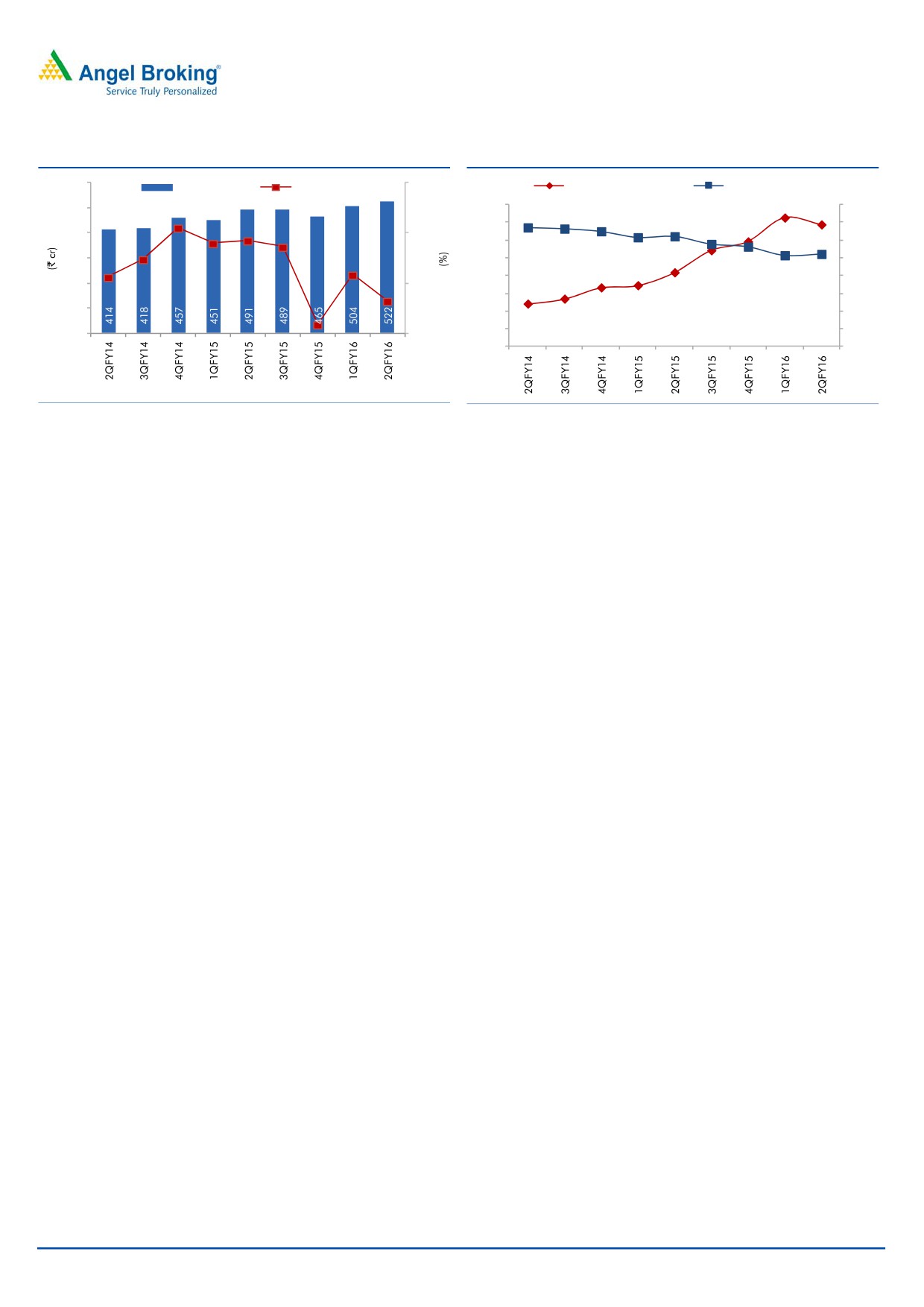

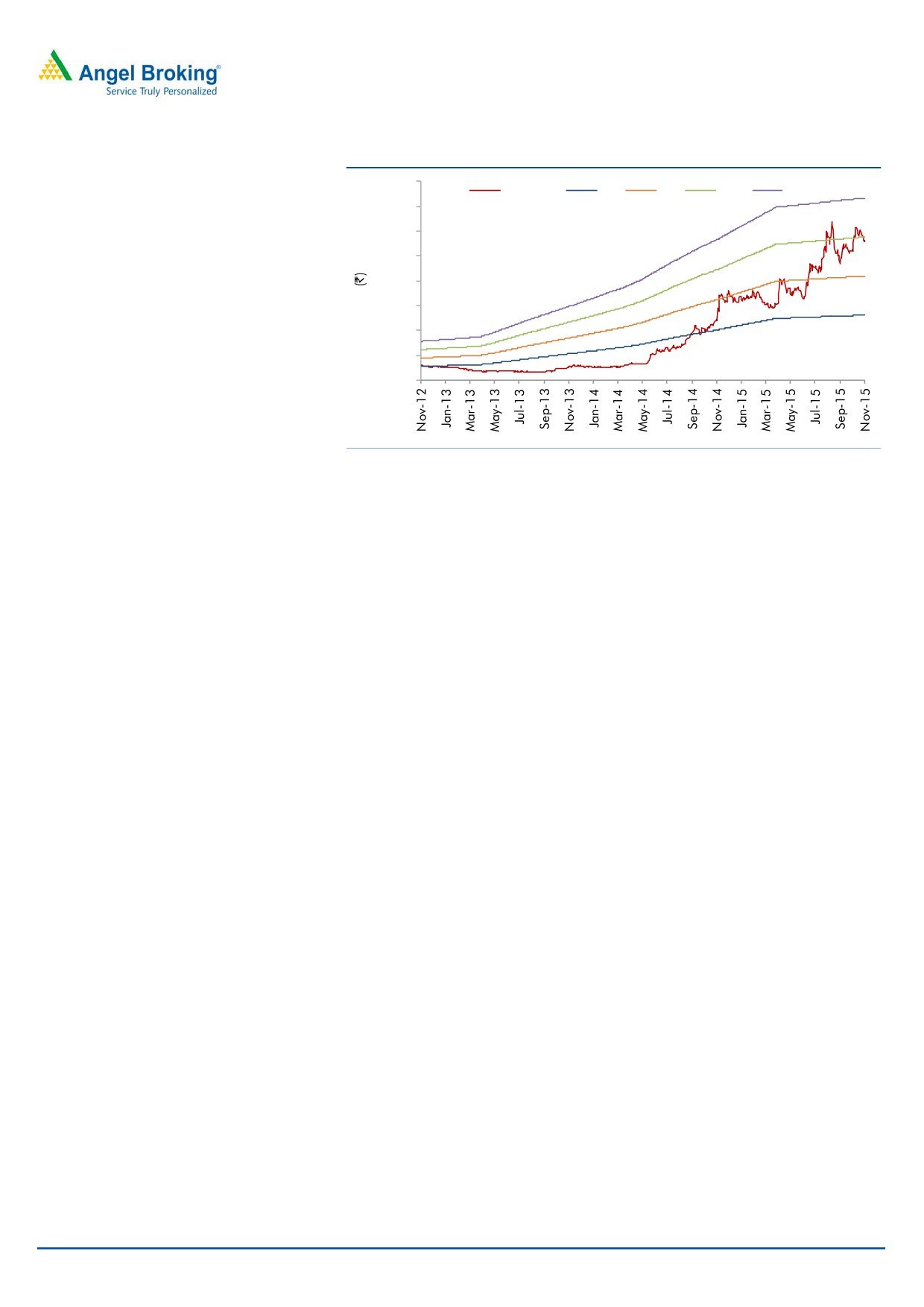

The 2W and 3W industry lost momentum in the past three quarters, after a good

showing over the previous few quarters. 2W sales have remained flat for the past

three quarters, posting a decline of 1.7% in 2QF2016. As far as OEMs are

concerned, TVSSL is a market leader with HMSI, Hero MotoCorp (HMCL), TVS

Motor Company (TVS), Bajaj Auto and India Yamaha Motor (Yamaha) featuring

among its major clients. HMSI and TVS along with Yamaha have been the only

manufacturers to post growth figures while HMCL and Bajaj Auto posted declines

of 8.5% yoy and 0.8% yoy, respectively. Subdued rainfall which has set back rural

consumption of 2Ws and early festive season last year have resulted in subdued

numbers for the current year. However, the October month numbers are

encouraging owing to the onset of the festive season. For the month of October,

HMSI has grown at 19% yoy while HMCL and TVS Motors have performed in-line

with the industry numbers.

Exhibit 5: 2W/3W production growth (yoy)

Exhibit 6: 2W sales growth by manufacturer (yoy)

2-wheeler

3-wheeler

35.0

Bajaj

HMCL

HMSIL

TVS

Yamaha

26.6

25.0

50.0

19.9

15.8

20.4

15.0

11.9

30.0

9.0

14.0

5.4

5.0

10.0

4.3

6.9

(0.5)

(1.0)

3.6

0.2

(5.0)

0.2

(1.7)

(10.0)

(11.8)(7.7)

(15.0)

(30.0)

2QFY14

4QFY14

2QFY15

4QFY15

2QFY16

3QFY14 4QFY14 1QFY15 2QFY15 3QFY15 4QFY15 1QFY16 2QFY16

Source: Company, Angel Research

Source: Company, Angel Research

In order to grow at a rapid pace in India, HMSI has set out aggressive plans to

strengthen its 2W operations in India. The company’s current capacity stands at

4.6mn units per year which it plans to expand to 6.4mn units over the next two

years. HMSI is positive on its growth prospects in India and has citied capacity

constraints faced by the company being the major reason behind its aggressive

capacity expansion plan. Along the same line, HMCL has also undertaken

expansion plans and its capacity is set to touch the 7.9mn units per year mark in

FY2017E from the present 7.7mn units per year.

Exhibit 7: Capex plans for major clients

Client

Current Capacity

Increase FY17E Capacity

Increase %

HMSI

4.6mn

1.8mn

6.4mn

39.1

HMCL

7.65mn

2.25mn

9.9mn

29.4

Source: Company, Angel Research

November 9, 2015

4

TVS Srichakra | 2QFY2016 Result Update

We believe that given its market leadership position in the OEM segment, TVSSL

stands to benefit from the expected increase in volume arising out of expansion

programs undertaken by its key clients.

Agreement with Michelin adds to revenue visibility

TVSSL has entered into an agreement with French Tyre major Michelin to

manufacture 2W bias tyres designed by Michelin at its Madurai facility. As per the

agreement, TVVSL would contract manufacture 2W bias tyres under the Michelin

brand name and it will also be manufacturing some tyres from its own range of

2W tyres. TVSSL is in the process of continuously expanding its capacity to 2.3 lakh

tyres per month by FY2016E which will aid in carrying out the agreement.

Although the terms of the agreement are not available, we believe that this is a

positive development for the company as it leads to better revenue visibility.

Higher share in Aftermarket segment to aid growth

The company is looking to focus on the aftermarket segment, which has higher

margins, with an aim to increase its market share. According to the Management,

the company ranks third in terms of market share in the aftermarket segment. The

company has been consistently growing in the aftermarket segment over the past

two years which has enabled it to consistently outperform the industry growth rate.

Stable rubber prices to help in sustaining margins

Natural Rubber(NR) has been trading at lower levels in the recent past leading to

tyre companies reporting all time high margins. NR prices are unlikely to increase

significantly tracing high global inventory levels and slowdown in demand from

China. Moreover, price of SBR (synthetic rubber) is expected to remain under

pressure tracing weakness in butadiene prices.

Despite of Thai government’s effort to shore up NR prices by restricting supply, NR

continues to show no signs of gaining strength and is likely to remain range bound

from current levels. NR currently trades at `111/kg in the domestic market; we

expect it to likely trade at the levels of ~`130/kg in the near future.

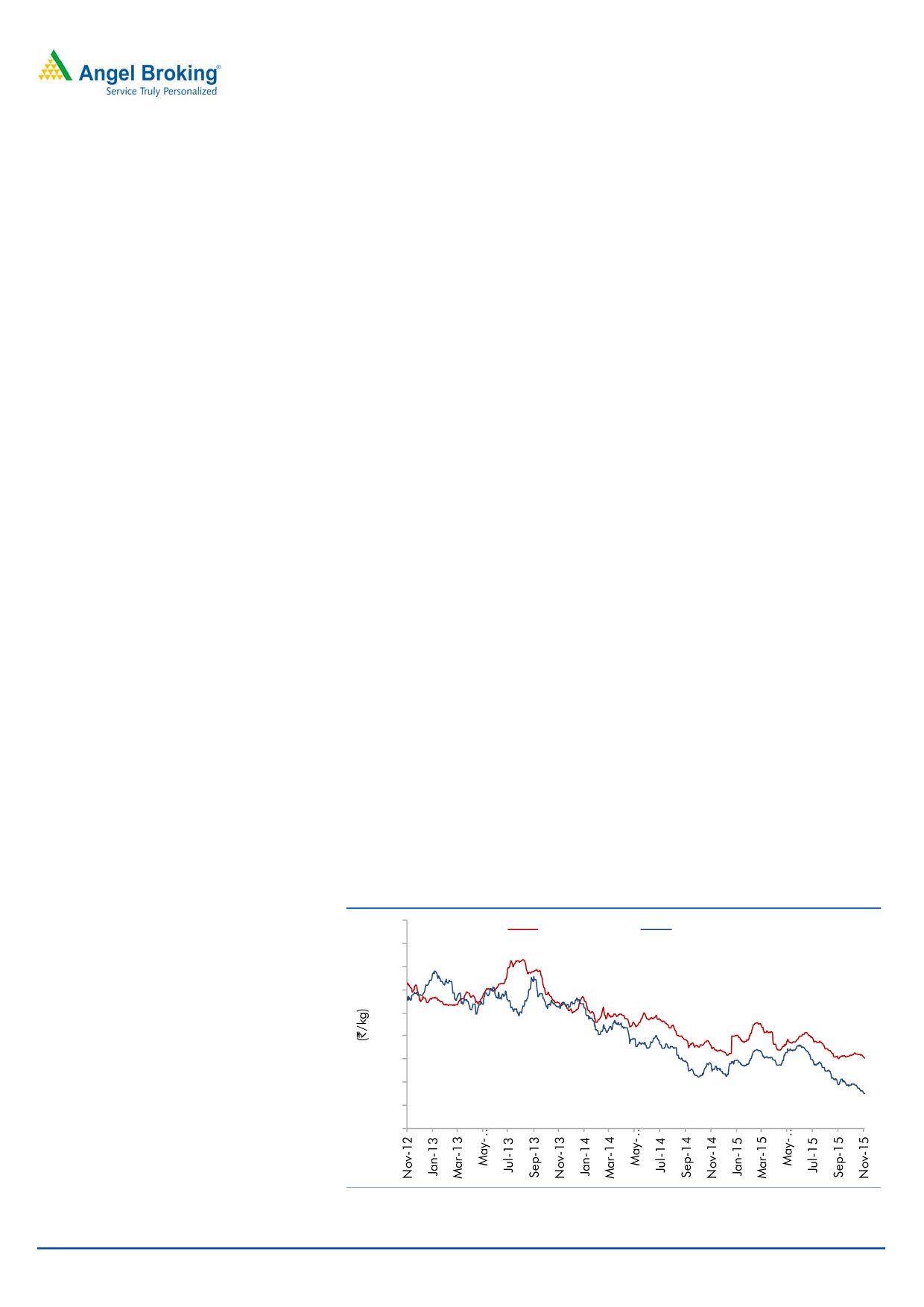

Exhibit 8: International vs. Domestic rubber price trend

230

Domestic Price

International Price

210

190

170

150

130

110

111

90

70

80

50

Source: Angel Research

November 9, 2015

5

TVS Srichakra | 2QFY2016 Result Update

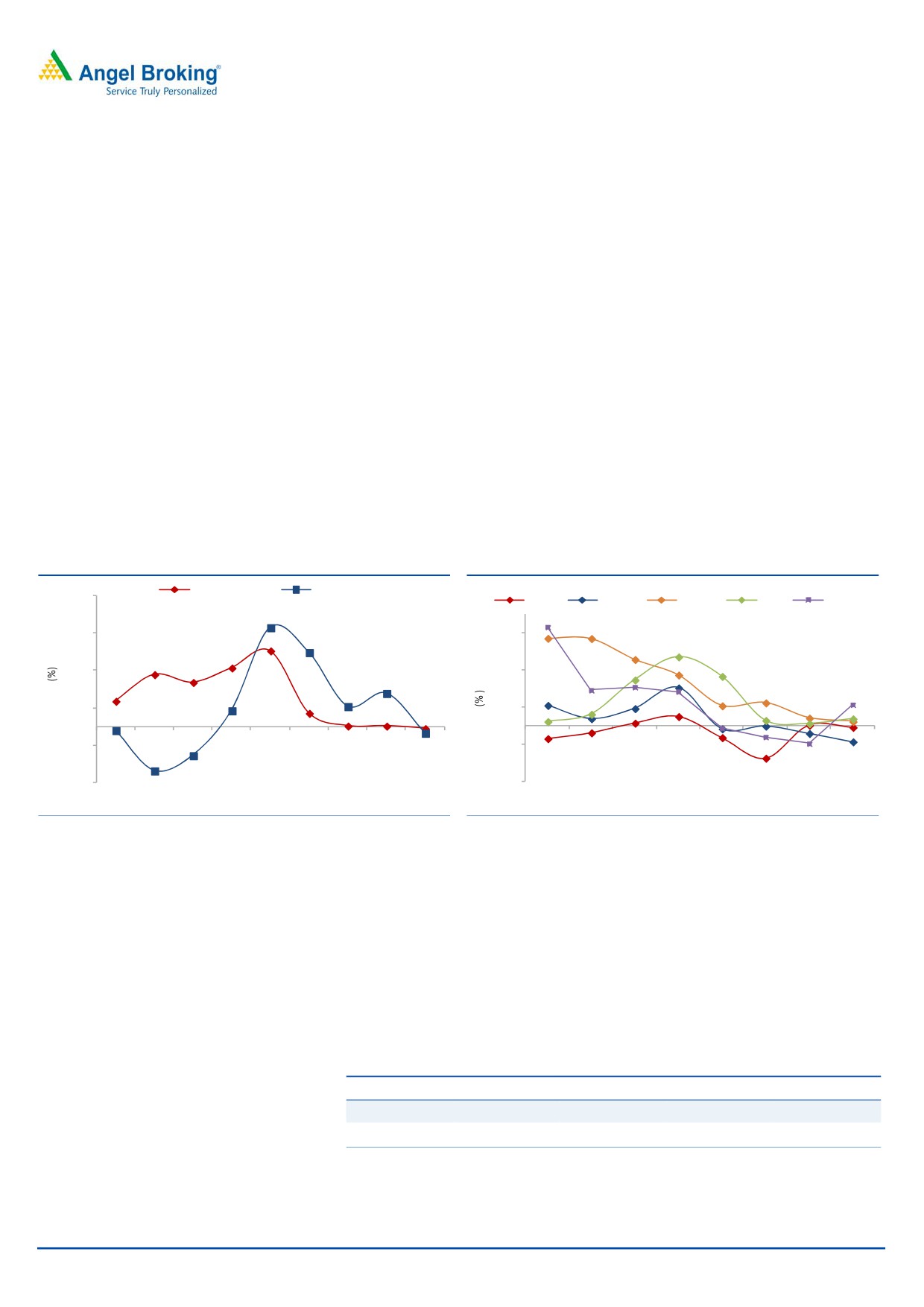

Financial performance

On the back of better performance by HMSI and capacity addition undertaken by

major clients, we expect TVSSL to perform well. We expect its top-line to grow at a

CAGR of 11.0% over FY2015-17E to `2,338cr. The company is confident of

smooth revenue flow backed by strong growth in its major OEM consumer

segment and is also focusing on increasing its market share in the aftermarket

segment. Raw material cost continues to be at lower levels helping the company

maintain its margins in 2QFY2016. We expect the lower raw material cost

environment to prevail amidst pressure on NR and SBR. We expect the operating

margin to be at 15.7% and 15.0% in FY2016E and FY2017E, respectively.

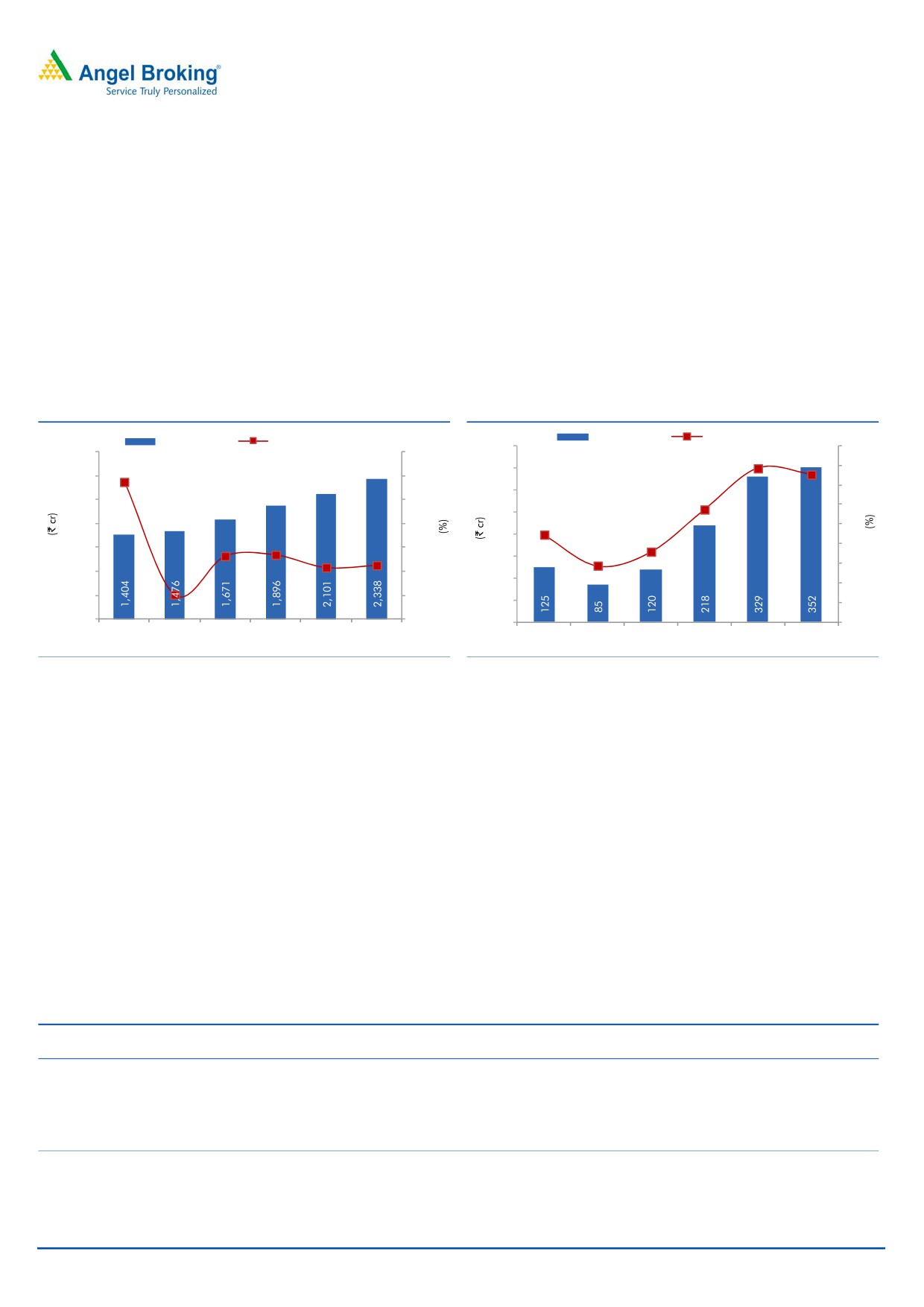

Exhibit 9: Revenue to grow at 12.3% CAGR

Exhibit 10: EBITDA Margin to be at 15.0% in FY2017E

EBITDA (LHS)

EBITDA margin (RHS)

Revenue (LHS)

Revenue growth (RHS)

400

18

2,800

35.0

350

16

2,400

28.7

30.0

15.7

15.

0

14

300

2,000

25.0

12

250

8.9

11.5

1,600

20.0

10

13.2

200

7.2

13.5

8

1,200

10.8

15.0

5.7

150

11.

3

6

800

10.0

100

4

400

5.1

5.0

50

2

0

0.0

0

0

FY2012

FY2013

FY2014

FY2015

FY2016E FY2017E

FY2012

FY2013

FY2014

FY2015

FY2016E FY2017E

Source: Company, Angel Research

Source: Company, Angel Research

The company has significantly lowered its debt in 1HFY2016. We expect the

company to reduce its debt to `107cr in FY2017E, which will lower its interest

expense. Consequently, we expect the company to report a profit of `207cr in

FY2017E.

Outlook and valuation

We expect the top-line of the company to grow at a CAGR of 11.0% over

FY2015-17E to `2,338cr. We expect the operating margin to be at 15.0% in

FY2017E owing to lower rubber prices and improvement in market share in the

aftermarket segment. Consequently, the net profit is expected to be at `207cr in

FY2017E. At the current market price, the stock is trading at a PE of 10.4x its

FY2017E earnings. We have a Buy rating on the stock with a revised target price of

`3,240 based on a target PE of 12.0x for FY2017E earnings.

Exhibit 11: Relative valuation

Mcap

Sales

OPM

PAT

EPS

ROE

P/E

P/BV

EV/

Company

Year

(` cr)

(` cr)

(%)

(` cr)

(`)

(%)

(x)

(x)

Sales (x)

TVSSL

FY2017E

2,146

2,338

15.0

207

270.0

39.6

10.4

3.5

0.9

CEAT

FY2017E

4,107

6,597

13.7

453

111.9

18.5

9.0

1.7

0.7

Apollo tyres

FY2017E

8,081

12,689

16.0

968

19.0

14.1

8.3

1.1

0.8

MRF

SY2016E

16,329

14,488

21.1

1,611

3,797.9

21.2

10.1

1.9

1.0

Source: Company, Angel Research, Bloomberg

November 9, 2015

6

TVS Srichakra | 2QFY2016 Result Update

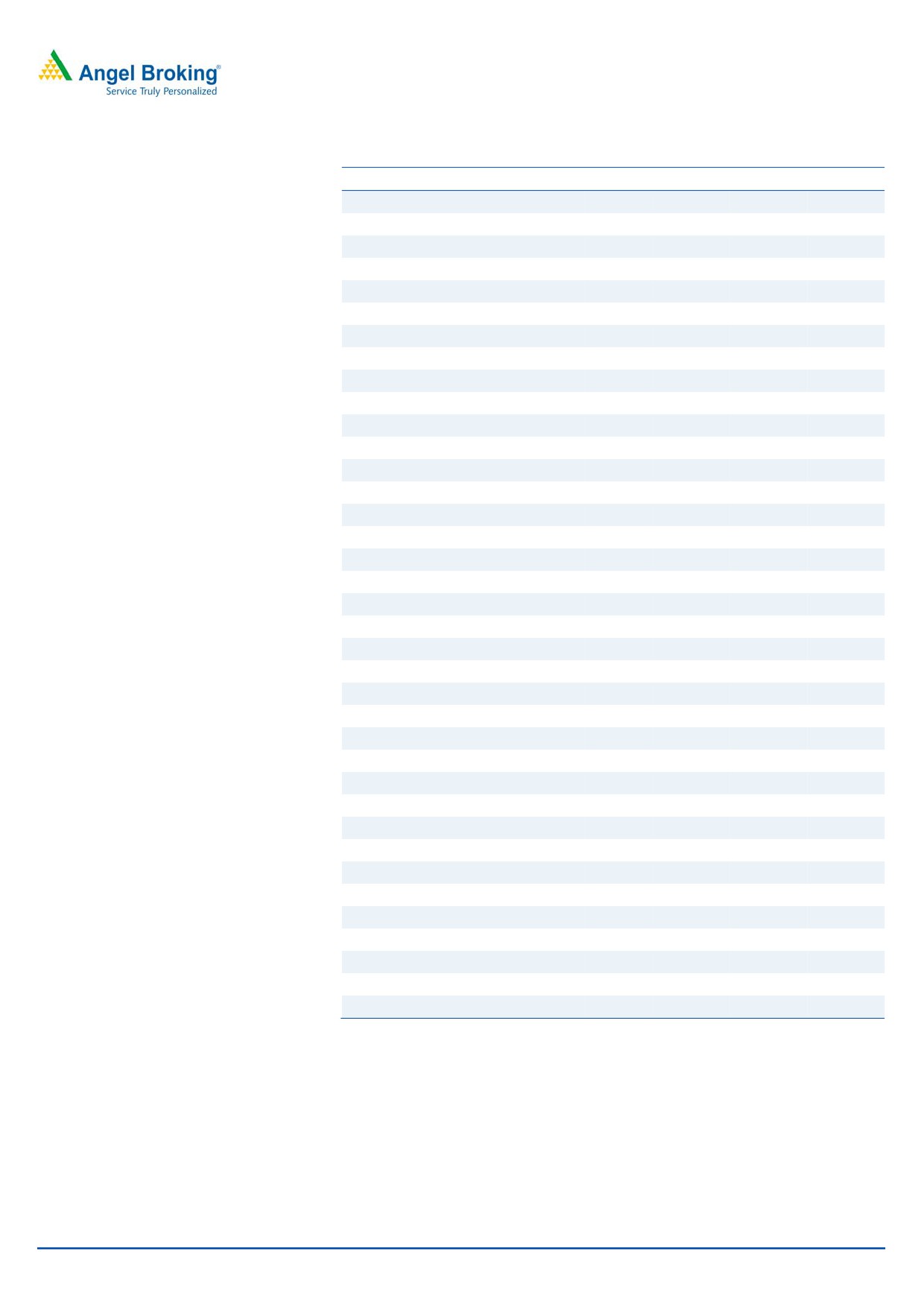

Exhibit 12: One-year forward PE band

4,000

Price (`)

5x

8x

11x

14

3,500

3,000

2,500

2,000

1,500

1,000

500

-

Source: Company, Angel Research

Key downside risks to our recommendation: Any rise in rubber prices, increase in

inflation, increasing competition, slowdown in 2W and 3W industry and lower-

than-expected demand in the replacement market, will have an adverse impact on

the company’s performance. The import duty on NR has been increased from 20%

or `30/kg to 25% or `30/kg. Further upward revision in the duty will have an

adverse impact on TVSSL’s profitability.

The Company

TVSSL is a part of the TVS Group. The company is a leading manufacturer of

two-wheeler and three-wheeler tyres and enjoys a market share of 25% (FY2011).

The company manufactures a complete range of two-wheeler and three-wheeler

tyres for the domestic market. For the export market, the company manufactures

industrial pneumatic tyres, farm and implements tyres, skid steer tyres,

multipurpose tyres and floatation tyres, among others. TVSSL’s manufacturing units

are located at Madurai, Tamil Nadu and Pantnagar, Uttarakhand rolling out

~250 lakh tyres per year. With a network of over 2,400 dealers and 34 depots

across the country, the company is a major supplier to TVS Motors, Hero

MotoCorp, HMSI, Bajaj Auto, LML, Piaggio, Atul Auto Ltd., Mahindra 2Wheelers

and India Yamaha Motor. The company also exports to the US, Europe, South

America, Africa and Australia.

November 9, 2015

7

TVS Srichakra | 2QFY2016 Result Update

Standalone Profit & Loss Statement

Y/E March (` cr)

FY2013

FY2014

FY2015

FY2016E

FY2017E

Total operating income

1,476

1,671

1,896

2,101

2,338

% chg

5.1

13.2

13.5

10.8

11.3

Net Raw Materials

1,011

1,104

1,123

1,097

1,245

% chg

7.1

9.2

1.7

(2.3)

13.4

Other Mfg costs

106

124

146

180

198

% chg

5.1

16.4

18.1

23.0

10.0

Personnel

113

125

164

194

213

% chg

17.4

10.5

31.5

18.0

10.0

Other

161

198

245

301

331

% chg

17.0

23.3

23.3

23.0

10.0

Total Expenditure

1,391

1,551

1,678

1,772

1,987

EBITDA

85

120

218

329

352

% chg

(32.1)

41.1

81.7

51.4

6.7

(% of Net Sales)

5.7

7.2

11.5

15.7

15.0

Depreciation& Amortisation

24

24

40

45

52

EBIT

61

96

178

284

300

% chg

(41.8)

58.5

85.0

60.0

5.4

(% of Net Sales)

4.1

5.8

9.4

13.6

12.9

Interest & other Charges

57

42

30

19

12

Other Income

44

1

4

6

8

(% of Net Sales)

3.0

0.1

0.1

0.2

0.2

Recurring PBT

3

55

148

266

287

% chg

(92.9)

1477.9

171.2

79.7

8.2

Exceptional Item

-

-

(12)

-

-

PBT (reported)

47

56

140

272

295

Tax

12

8

36

82

89

(% of PBT)

24.5

15.2

25.6

30.0

30.0

PAT (reported)

36

47

104

190

207

Extraordinary Expense/(Inc.)

-

-

-

-

-

ADJ. PAT

36

47

104

190

207

% chg

(10.3)

33.0

118.8

83.4

8.6

(% of Net Sales)

2.4

2.9

5.5

9.1

8.9

Basic EPS (`)

46.6

61.9

135.6

248.6

270.0

Fully Diluted EPS (`)

46.6

61.9

135.6

248.6

270.0

% chg

(10.3)

33.0

118.8

83.4

8.6

Dividend

6

12

26

26

31

Retained Earning

30

35

73

160

171

November 9, 2015

8

TVS Srichakra | 2QFY2016 Result Update

Standalone Balance Sheet

Y/E March (` cr)

FY2013

FY2014

FY2015

FY2016E

FY2017E

SOURCES OF FUNDS

Equity Share Capital

8

8

8

8

8

Reserves& Surplus

163

196

269

429

600

Shareholders’ Funds

171

204

276

436

607

Total Loans

233

304

205

133

107

Other Long Term Liabilities

29

10

15

30

30

Long Term Provisions

2

3

8

8

8

Deferred Tax Liability

23

22

23

23

23

Total Liabilities

458

541

527

630

774

APPLICATION OF FUNDS

Gross Block

303

370

446

531

611

Less: Acc. Depreciation

117

141

179

224

276

Net Block

185

229

267

307

335

Capital Work-in-Progress

31

20

18

20

20

Goodwill

-

-

-

-

-

Investments

19

19

32

32

32

Long Term Loans and advances

50

53

65

65

65

Other Non-current asset

8

12

7

7

7

Current Assets

525

505

411

515

669

Cash

45

8

9

25

125

Loans & Advances

40

24

25

27

31

Inventory

253

207

210

222

246

Debtors

186

266

167

240

267

Other current assets

-

-

-

-

-

Current liabilities

362

297

274

316

354

Net Current Assets

164

207

137

199

315

Misc. Exp. not written off

-

-

-

-

-

Total Assets

458

541

527

630

774

November 9, 2015

9

TVS Srichakra | 2QFY2016 Result Update

Standalone Cash Flow Statement

Y/E March (` cr)

FY2013 FY2014 FY2015 FY2016E

FY2017E

Profit before tax

47

56

140

272

295

Depreciation

24

24

40

45

52

Change in Working Capital

129

(81)

72

(46)

(16)

Less: Direct taxes paid

(12)

(8)

(37)

(82)

(89)

Others

4

25

27

(6)

(8)

Cash Flow from Operations

192

15

242

183

234

(Inc.)/Dec. in Fixed Assets

(19)

(57)

(74)

(86)

(80)

(Inc.)/Dec. in Investments

1

0

(13)

-

-

Interest received

(21)

(7)

(7)

-

-

Others

81

(7)

(1)

6

8

Cash Flow from Investing

42

(70)

(95)

(80)

(72)

Issue of Equity

-

0

-

-

-

Inc./(Dec.) in loans

(106)

71

(88)

(57)

(27)

Dividend Paid (Incl. Tax)

(7)

(14)

(31)

(30)

(36)

Others

(82)

(38)

(26)

-

-

Cash Flow from Financing

(195)

19

(145)

(87)

(63)

Inc./(Dec.) in Cash

39

(37)

1

16

100

Opening Cash balances

6

45

8

9

25

Closing Cash balances

45

8

9

25

125

November 9, 2015

10

TVS Srichakra | 2QFY2016 Result Update

Standalone Key Ratios

Y/E March

FY2013

FY2014

FY2015E

FY2016E

FY2017E

Valuation Ratio (x)

P/E (on FDEPS)

60.2

45.2

20.7

11.3

10.4

P/CEPS

35.8

30.2

14.9

9.1

8.3

P/BV

12.6

10.5

7.8

4.9

3.5

Dividend yield (%)

0.3

0.6

1.2

1.2

1.4

EV/Net sales

1.6

1.5

1.2

1.1

0.9

EV/EBITDA

27.3

20.2

10.6

6.7

6.0

EV / Total Assets

5.1

4.5

4.4

3.5

2.7

Per Share Data (`)

EPS (Basic)

46.6

61.9

135.6

248.6

270.0

EPS (fully diluted)

46.6

61.9

135.6

248.6

270.0

Cash EPS

78.2

92.9

187.6

307.6

337.8

DPS

7.5

16.0

33.8

33.8

40.0

Book Value

223.2

266.0

360.8

569.9

793.1

DuPont Analysis

EBIT margin

4.1

5.8

9.4

13.6

12.9

Tax retention ratio

0.8

0.8

0.7

0.7

0.7

Asset turnover (x)

4.1

3.4

4.0

3.8

3.9

ROIC (Post-tax)

12.6

16.5

28.3

36.0

35.1

Cost of Debt (Post Tax)

18.5

11.6

10.8

9.8

8.1

Leverage (x)

1.6

1.2

1.0

0.4

0.0

Operating ROE

3.2

22.2

45.3

46.1

36.4

Returns (%)

ROCE (Pre-tax)

13.3

17.7

33.7

45.1

38.7

Angel ROIC (Pre-tax)

16.7

19.5

38.1

51.4

50.2

ROE

20.9

23.3

37.6

43.6

34.0

Turnover ratios (x)

Asset TO (Gross Block)

4.9

4.9

4.6

4.3

4.1

Inventory / Net sales (days)

69

51

40

38

37

Receivables (days)

47

50

42

42

42

Payables (days)

85

77

62

65

65

WC cycle (ex-cash) (days)

29

44

25

30

30

Solvency ratios (x)

Net debt to equity

1.1

1.5

0.7

0.2

0.0

Net debt to EBITDA

2.0

2.3

0.8

0.2

(0.1)

Int. Coverage (EBIT/ Int.)

1.1

2.3

5.9

15.3

24.3

November 9, 2015

11

TVS Srichakra | 2QFY2016 Result Update

Research Team Tel: 022 - 39357800

DISCLAIMER

Angel Broking Private Limited (hereinafter referred to as “Angel”) is a registered Member of National Stock Exchange of India Limited,

Bombay Stock Exchange Limited and Metropolitan Stock Exchange of India Limited. It is also registered as a Depository Participant with

CDSL and Portfolio Manager with SEBI. It also has registration with AMFI as a Mutual Fund Distributor. Angel Broking Private Limited is

a registered entity with SEBI for Research Analyst in terms of SEBI (Research Analyst) Regulations, 2014 vide registration number

INH000000164. Angel or its associates has not been debarred/ suspended by SEBI or any other regulatory authority for accessing

/dealing in securities Market. Angel or its associates including its relatives/analyst do not hold any financial interest/beneficial

ownership of more than 1% in the company covered by Analyst. Angel or its associates/analyst has not received any compensation /

managed or co-managed public offering of securities of the company covered by Analyst during the past twelve months. Angel/analyst

has not served as an officer, director or employee of company covered by Analyst and has not been engaged in market making activity

of the company covered by Analyst.

This document is solely for the personal information of the recipient, and must not be singularly used as the basis of any investment

decision. Nothing in this document should be construed as investment or financial advice. Each recipient of this document should

make such investigations as they deem necessary to arrive at an independent evaluation of an investment in the securities of the

companies referred to in this document (including the merits and risks involved), and should consult their own advisors to determine

the merits and risks of such an investment.

Reports based on technical and derivative analysis center on studying charts of a stock's price movement, outstanding positions and

trading volume, as opposed to focusing on a company's fundamentals and, as such, may not match with a report on a company's

fundamentals.

The information in this document has been printed on the basis of publicly available information, internal data and other reliable

sources believed to be true, but we do not represent that it is accurate or complete and it should not be relied on as such, as this

document is for general guidance only. Angel Broking Pvt. Limited or any of its affiliates/ group companies shall not be in any way

responsible for any loss or damage that may arise to any person from any inadvertent error in the information contained in this report.

Angel Broking Pvt. Limited has not independently verified all the information contained within this document. Accordingly, we cannot

testify, nor make any representation or warranty, express or implied, to the accuracy, contents or data contained within this document.

While Angel Broking Pvt. Limited endeavors to update on a reasonable basis the information discussed in this material, there may be

regulatory, compliance, or other reasons that prevent us from doing so.

This document is being supplied to you solely for your information, and its contents, information or data may not be reproduced,

redistributed or passed on, directly or indirectly.

Neither Angel Broking Pvt. Limited, nor its directors, employees or affiliates shall be liable for any loss or damage that may arise from

or in connection with the use of this information.

Note: Please refer to the important ‘Stock Holding Disclosure' report on the Angel website (Research Section). Also, please refer to the

latest update on respective stocks for the disclosure status in respect of those stocks. Angel Broking Pvt. Limited and its affiliates may

have investment positions in the stocks recommended in this report.

Disclosure of Interest Statement

TVS Srichakra

1. Analyst ownership of the stock

No

2. Angel and its Group companies ownership of the stock

No

3. Angel and its Group companies' Directors ownership of the stock

No

4. Broking relationship with company covered

No

Note: We have not considered any Exposure below ` 1 lakh for Angel, its Group companies and Directors

Ratings (Based on expected returns

Buy (> 15%)

Accumulate (5% to 15%)

Neutral (-5 to 5%)

over 12 months investment period):

Reduce (-5% to -15%)

Sell (< -15)

November 9, 2015

12