4QFY2016 Result Update | IT

April 27, 2016

Tata Consultancy Services (TCS)

BUY

CMP

`2,488

Performance highlights

Target Price

`3,004

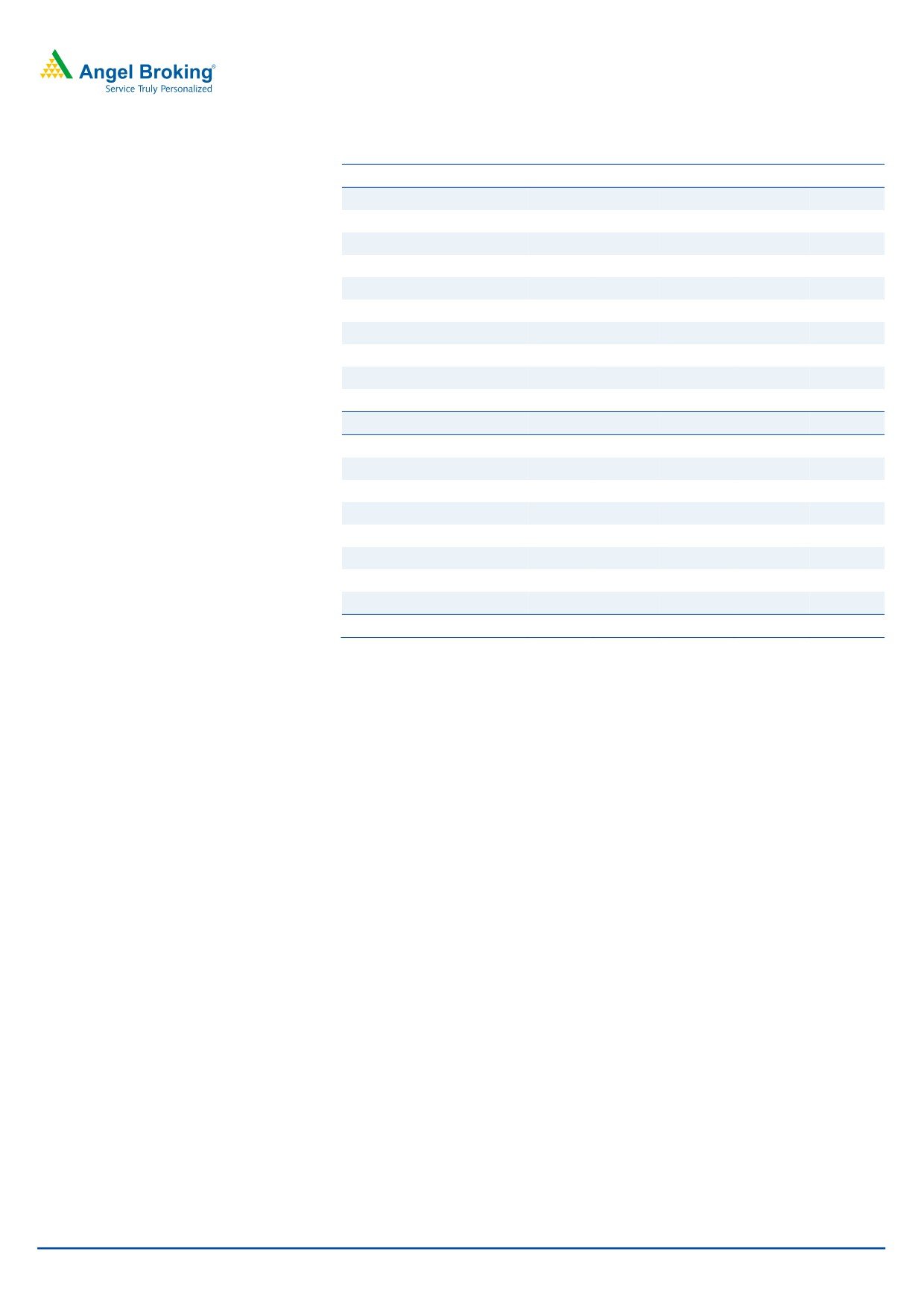

(` cr)

4QFY16 3QFY16

% chg (qoq) 4QFY15

% chg (yoy)

Investment Period

12 Months

Net revenue

28,449

27,364

4.0

24,220

17.5

Adj. EBITDA

7,065

7,747

(8.8)

6,588

7.2

Stock Info

Adj. EBITDA margin (%)

27.7

28.3

(50)bp

27.2

(50)bp

Sector

IT

Adj. PAT

6,341

6,110

3.8

3,858

7.4

Market Cap (` cr)

490,242

Source: Company, Angel Research

Net Debt (` cr)

(14,442)

For 4QFY2016, TCS posted revenue of US$4,207mn (V/s US$4,215mn

Beta

0.6

expected), up 1.5% qoq. The growth was mostly volume led, which grew by 3.2%

52 Week High / Low

2,769/2,119

qoq. In constant currency (CC) terms, the company posted a qoq revenue growth

Avg. Daily Volume

75,650

of 2.1%. In rupee terms, revenues grew by 4.0% qoq to `28,449cr (V/s

Face Value (`)

1

`28,454cr expected), led by rupee depreciation. The EBIT margin for the quarter

BSE Sensex

26,007

came in at 26.1% V/s 26.7% expected. PAT came in at `6,341cr (V/s `6,201cr

Nifty

7,963

expected), up 3.8% qoq. The company expects a stronger FY2017 for which it

Reuters Code

TCS.BO

has guided at an EBIT margin of 26-28%. We maintain our Buy on the stock with

Bloomberg Code

TCS@IN

a target price of `3,004.

Quarterly highlights: For 4QFY2016, the company posted revenue of

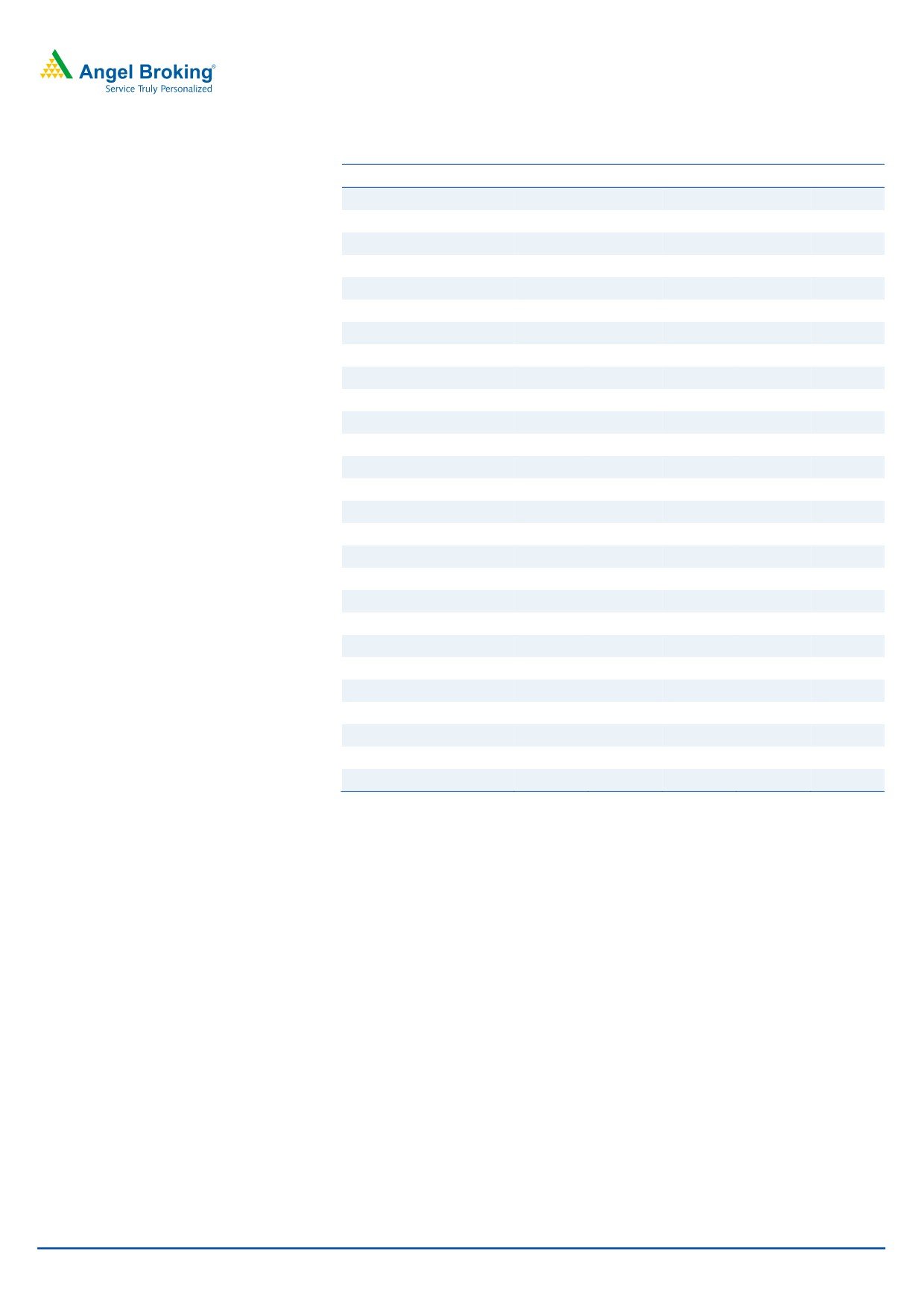

Shareholding Pattern (%)

US$4,207mn (V/s US$4,215mn expected), up 1.5% qoq. The growth was mostly

Promoters

73.4

volume led, which grew by 3.2% qoq. In constant currency (CC) terms, the

MF / Banks / Indian Fls

5.5

company posted a qoq revenue growth of 2.1%. In terms of geography, the

FII / NRIs / OCBs

16.8

company posted a CC growth of 2.4% in USA, 1.8% in Latin America, 3.6% in

Indian Public / Others

4.3

continental Europe, 2.2% in India, 1.1% in Asia Pacific and 9.5% in MEA while UK

posted a dip of 0.4%. . The EBIT margin for the quarter came in at 26.1% V/s

26.7% expected. PAT came in at `6,341cr (V/s `6,201cr expected), up 3.8% qoq.

Abs.(%)

3m 1yr

3yr

Sensex

6.2

(5.2)

34.8

Outlook and valuation: TCS highlighted that it had not received any negative

TCS

7.9

(0.4)

81.8

indications on IT budgets/spending trends and expects FY2017 to be better than

FY2016. Over FY2016-18E, we expect TCS to post a revenue CAGR of 13.0% in

3-Year Daily Price Chart

USD as well as INR terms.

Key financials (Consolidated, IFRS)

Y/E March (` cr)

FY2015

FY2016

FY2017E

FY2018E

Net sales

94,648

1,08,646

1,22,770

1,38,730

% chg

15.7

14.8

13.0

13.0

Net profit

21,696

24,215

27,598

30,941

% chg

13.5

11.6

14.0

12.1

EBITDA margin (%)

28.2

28.3

28.3

28.3

EPS (`)

110.9

123.7

141.0

158.1

Source: Company, Angel Research

P/E (x)

22.4

20.1

17.6

15.7

P/BV (x)

8.5

6.7

6.1

5.6

RoE (%)

34.2

33.1

34.6

35.5

RoCE (%)

33.9

31.6

28.1

28.8

Sarabjit kour Nangra

EV/Sales (x)

4.9

4.3

3.6

3.1

+91 22 3935 7800 Ext: 6806

EV/EBITDA (x)

17.4

15.1

12.7

11.0

sarabjit @angelbroking.com

Source: Company, Angel Research; Note: CMP as of April 26, 2016

Please refer to important disclosures at the end of this report

1

TCS | 4QFY2016 Result Update

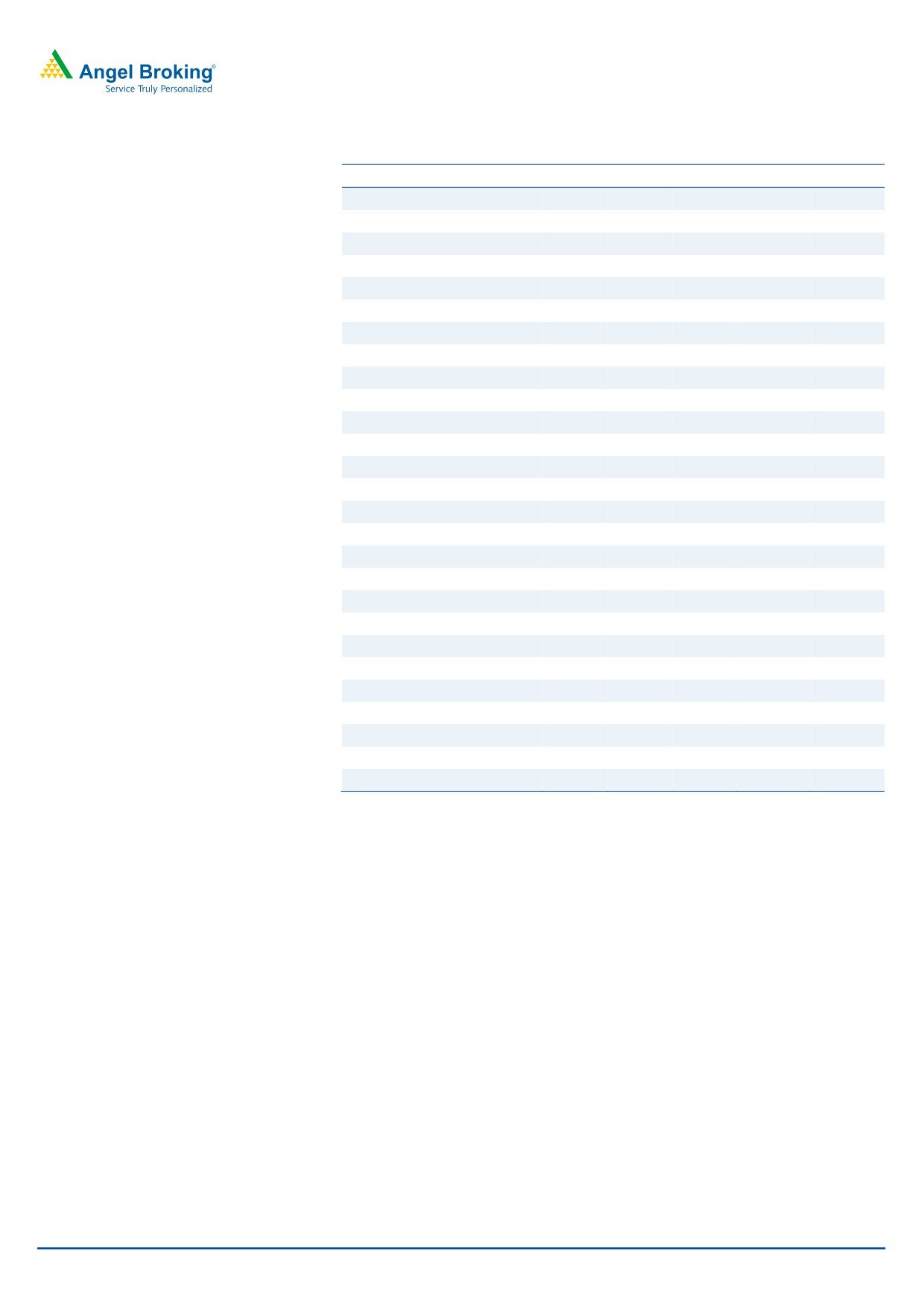

Exhibit 1: 4QFY2016 performance (Consolidated, IFRS)

(` cr)

4QFY16

3QFY16

% chg (qoq)

4QFY15

% chg (yoy)

FY2016

FY2015

% chg(yoy)

Net revenue

28,449

27,364

4.0

24,220

17.5

1,08,646

94,648

14.8

Cost of revenue

15,592

14,883

4.8

15,176

2.7

59,459

53,227

11.7

Gross profit

12,857

12,481

3.0

9,044

42.2

49,187

41,421

18.7

SG&A expense

4,975

4,734

5.1

4,757

4.6

18,956

17,353

9.2

EBITDA

7,883

7,747

1.8

4,287

83.9

30,231

24,068

25.6

Dep. and amortisation

471

471

-

324

45.3

1,441

1,272

13.3

EBIT

7,412

7,276

1.9

3,963

87.0

28,790

22,796

26.3

Other income

905

699

29.5

1,129

(19.8)

3,050

3,140

PBT

8,317

7,975

4.3

5,092

63.3

31,840

25,936

22.8

Income tax

1,970

1,850

1,202

63.9

7,503

6,083

23.3

PAT

6,347

6,125

3.6

3,890

63.2

24,338

19,853

22.6

Earnings in affiliates

-

-

-

-

-

-

-

-

Minority interest

6

16

(64.3)

32

(82.5)

123

205

(40.1)

Reported PAT

6,341

6,110

3.8

3,858

64.4

24,215

19,648

23.2

Adj. PAT

6,341

6,110

3.8

5,906

7.4

24,215

21,696

11.6

EPS

32.2

31.0

3.8

30.2

6.6

123.7

110.9

11.5

Gross margin (%)

45.2

45.6

(42)bp

37.3

785bp

45.3

43.8

151bp

EBITDA margin (%)

27.7

28.3

(60)bp

17.7

1001bp

27.8

25.4

240bp

EBIT margin (%)

26.1

26.6

(54)bp

16.4

969bp

26.5

24.1

241bp

Source: Company, Angel Research

Exhibit 2: Actual vs Angel estimates

(` cr)

Actual

Estimate

Var. (%)

Net revenue

28,449

28,454

(0.0)

EBIT margin (%)

26.1

26.7

(64)bps

Adj. PAT

6,341

6,201

2.3

Source: Company, Angel Research

Numbers in line with expectations

For 4QFY2016, TCS posted revenue of US$4,207mn (V/s US$4,215mn expected),

up 1.5% qoq. The growth was mostly volume led, which grew by 3.2% qoq. In

constant currency (CC) terms, the company posted a qoq revenue growth of 2.1%.

In rupee terms, revenues grew by 4.0% qoq to `28,449cr (V/s `28,454cr

expected), led by rupee depreciation.

In terms of geography, the company posted a CC growth of 2.4% in USA, 1.8% in

Latin America, 3.6% in continental Europe, 2.2% in India, 1.1% in Asia Pacific and

9.5% in MEA while UK posted a dip of 0.4%. .

In terms of verticals, the company posted a CC growth of 3.2% in BSFI, Retail &

Distribution grew by 2.1%, Manufacturing grew by 3.9%, Telecom grew by 1.3%,

and Energy & Utilities grew by 3.0%.

April 27, 2016

2

TCS | 4QFY2016 Result Update

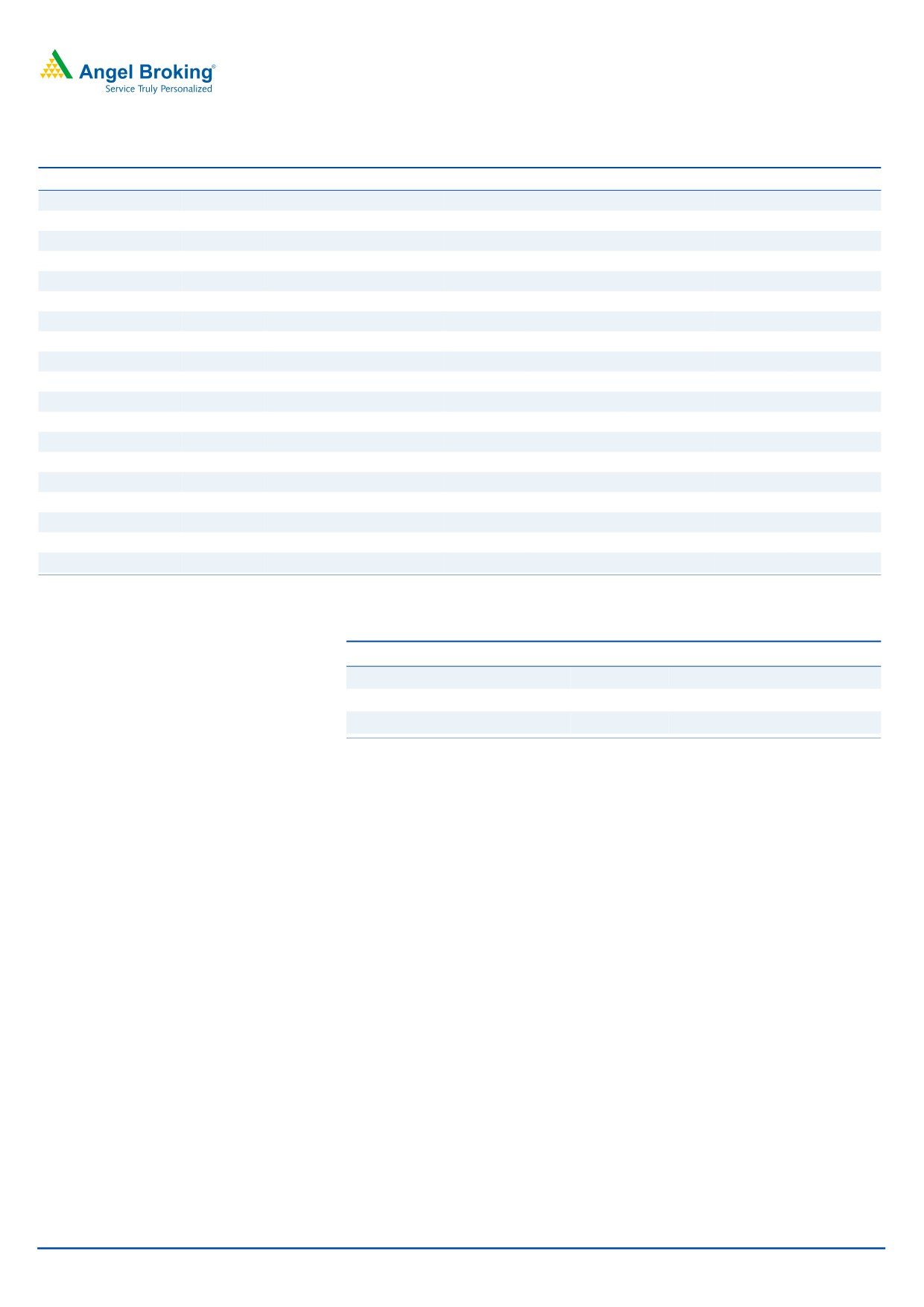

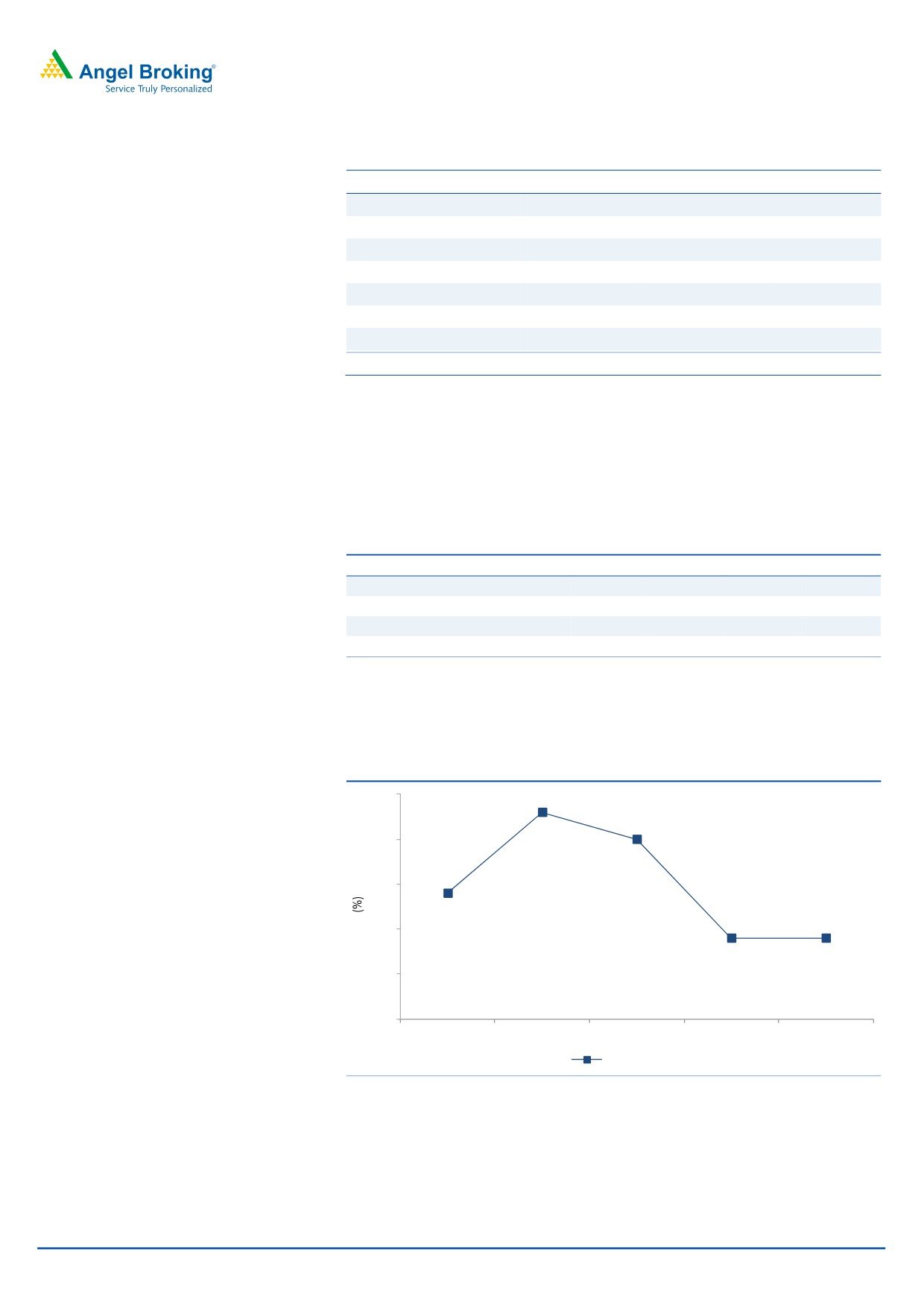

Exhibit 3: Trend in volume and revenue growth (qoq)

8

7

6

4.8

4.9

5

3.2

4

3

3.5

2

3.0

1.4

0.4

1.5

1

0.7

0

4QFY15

1QFY16

2QFY16

3QFY16

4QFY16

(1)

(0.8)

Volume growth

Revenue growth (USD terms)

Source: Company, Angel Research

Exhibit 4: Revenue drivers for 4QFY2016

4

3.2

3

2

1.5

1

0

(1)

(0.6)

(1.1)

(2)

Volume

Currency impact

CC realization

Total revenue growth

Source: Company, Angel Research

In terms of verticals, BFSI (40.9% of sales) grew 3.2% qoq on CC, Telecom (8.3%

of sales) grew 1.3% qoq on CC, Retail & Distribution (14.1% of sales) grew 2.1%

qoq on CC and Manufacturing (10.4% of sales) grew 3.9% qoq on CC, during the

quarter. Hi-Tech and Life Sciences & Healthcare posted a de-growth of 1.5% and

growth of 1.2% qoq on CC, respectively. Travel & Hospitality (3.7% of sales)

posted a growth of 0.8% qoq on CC, while Energy & Utilities (4.1% of sales)

posted a growth of 3.0% qoq on CC basis.

April 27, 2016

3

TCS | 4QFY2016 Result Update

Exhibit 5: Revenue growth (Industry wise on CC basis)

% to revenue

% chg (CC qoq)

% chg (yoy)

BFSI

40.9

3.2

11.8

Manufacturing

10.4

3.9

10.7

Telecom

8.3

1.3

15.3

Life sciences and healthcare

7.3

1.2

19.0

Retail and distribution

14.1

2.1

13.8

Transportation & Hospitality

3.7

0.8

18.2

Energy and utilities

4.1

3.0

16.8

Media and entertainment

2.5

1.9

(0.6)

Hi-tech

5.6

(1.5)

2.0

Others

3.1

(5.4)

(26.4)

Source: Company, Angel Research

Service line wise, Infrastructure Services reported a sequential growth of 2.2% on

CC basis. In the company’s anchor service line - IT Solutions and Services - ADM

grew 1.2% qoq on CC basis, Enterprise Solutions remained flat and Assurance

Services grew by 4.5% qoq on CC basis. The BPO segment grew by 1.1% qoq on

CC basis, during the quarter. Asset Leveraged Solutions (3.2% of sales) grew by

18.5% qoq on CC basis.

Exhibit 6: Revenue growth (Service wise on CC basis)

% to revenue

% chg (CC qoq)

% chg (yoy)

IT solutions and services

ADM

39.7

1.2

8.3

Enterprise solutions

17.1

0.0

1.2

Assurance services

8.8

4.5

15.5

Engg. and industrial services

4.7

5.8

13.5

Infrastructure services

15.2

2.2

15.2

Asset-leveraged solutions

3.2

18.5

64.3

BPO

11.6

1.1

11.1

Source: Company, Angel Research

Geography wise, growth in INR sales in key geographies was as follows: - USA

(1.4% qoq on CC basis), Latin America (13.3% qoq on CC basis), Continental

Europe (2.3% qoq on CC basis), India (-6.7% qoq on CC basis) and MEA (-5.8%

qoq on CC basis). The UK and Asia Pacific posted a de-growth of

0.7% qoq and growth of 0.4% qoq on CC basis, respectively.

TCS has been making significant progress in Digital, which is evident from the

growth in the area and deal wins. Digital, which is now ~15.5% of total revenues,

grew by 14.8% qoq. In FY2016, Digital contributed by 13.8% to the total revenue

and saw a growth of 52.2% yoy.

April 27, 2016

4

TCS | 4QFY2016 Result Update

Exhibit 7: Revenue growth (Geography wise in INR terms)

% of revenue

% chg (CC qoq)

% chg (yoy)

U.S.

54.0

2.4

11.7

Latin America

2.0

1.8

17.5

U.K.

14.9

(0.4)

6.4

Continental Europe

11.2

3.6

10.3

India

5.9

2.2

5.6

Asia Pacific

9.6

1.1

8.6

MEA

2.4

9.5

25.2

Source: Company, Angel Research

Hiring moderate

In 4QFY2016, TCS witnessed a gross addition of 22,576 employees and net

addition of 9,152 employees, taking its total employee base to 3,53,843. During

the quarter, the attrition rate (last twelve month [LTM] basis) for the company

decreased from 15.9% to 14.7% in 4QFY2016.

Exhibit 8: Hiring and attrition trend

Particulars

4QFY15 1QFY16

2QFY16

3QFY16

4QFY16

Gross addition

14,395

20,320

25,186

22,118

22,576

Net addition

1,031

5,279

10,685

9,071

9,152

Total employee base

3,19,656

3,24,935

3,35,620

3,44,691

3,53,843

Attrition (%) - LTM basis

14.9

15.9

16.2

15.9

14.7

Source: Company, Angel Research

For 4QFY2016, the utilization rate (excluding trainees) remained stagnant at

84.9%.

Exhibit 9: Trend in utilization

87

86.3

86.0

86

85.4

86

84.9

84.9

85

85

84

4QFY15

1QFY16

2QFY16

3QFY16

4QFY16

Excluding trainees

Source: Company, Angel Research

April 27, 2016

5

TCS | 4QFY2016 Result Update

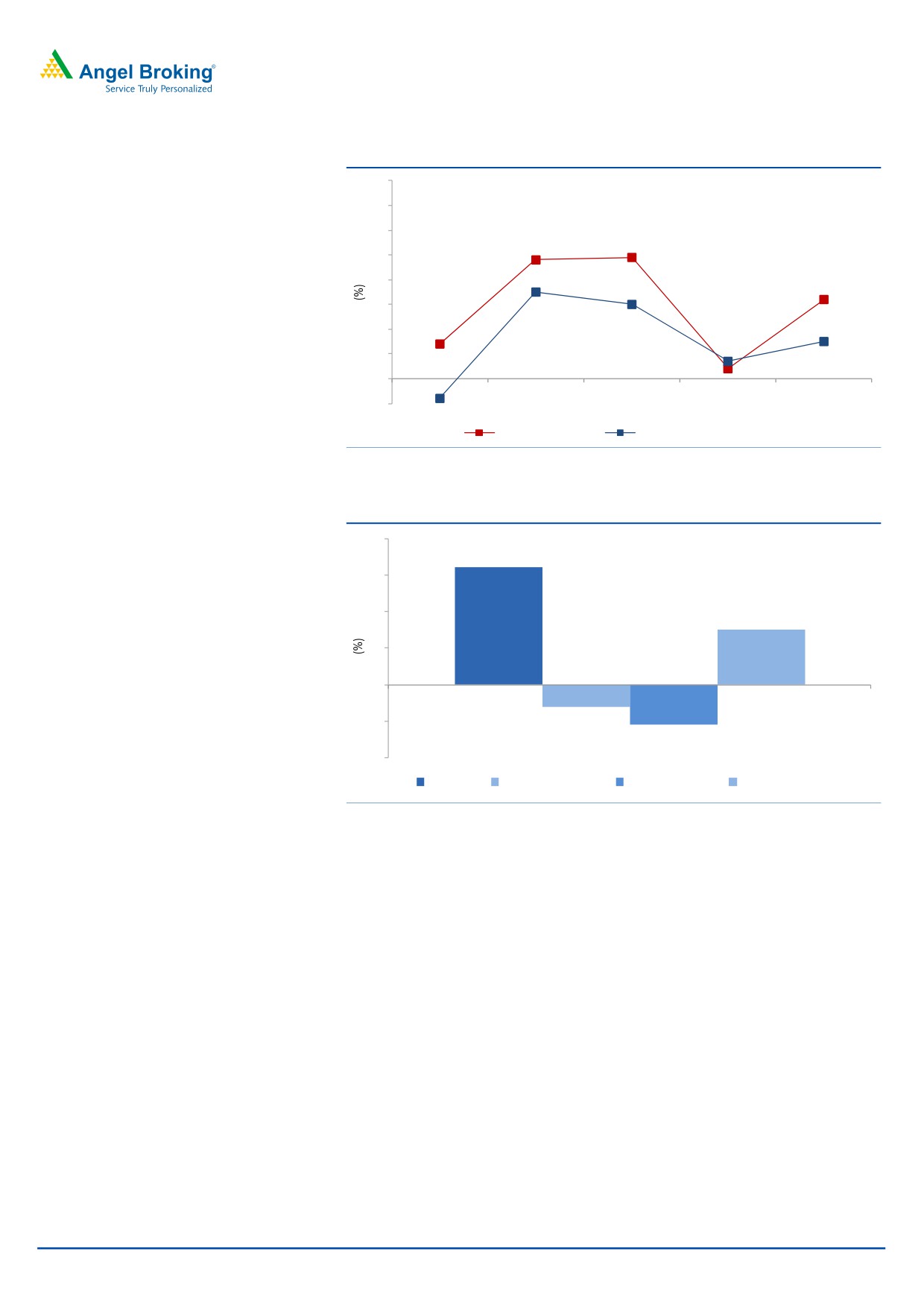

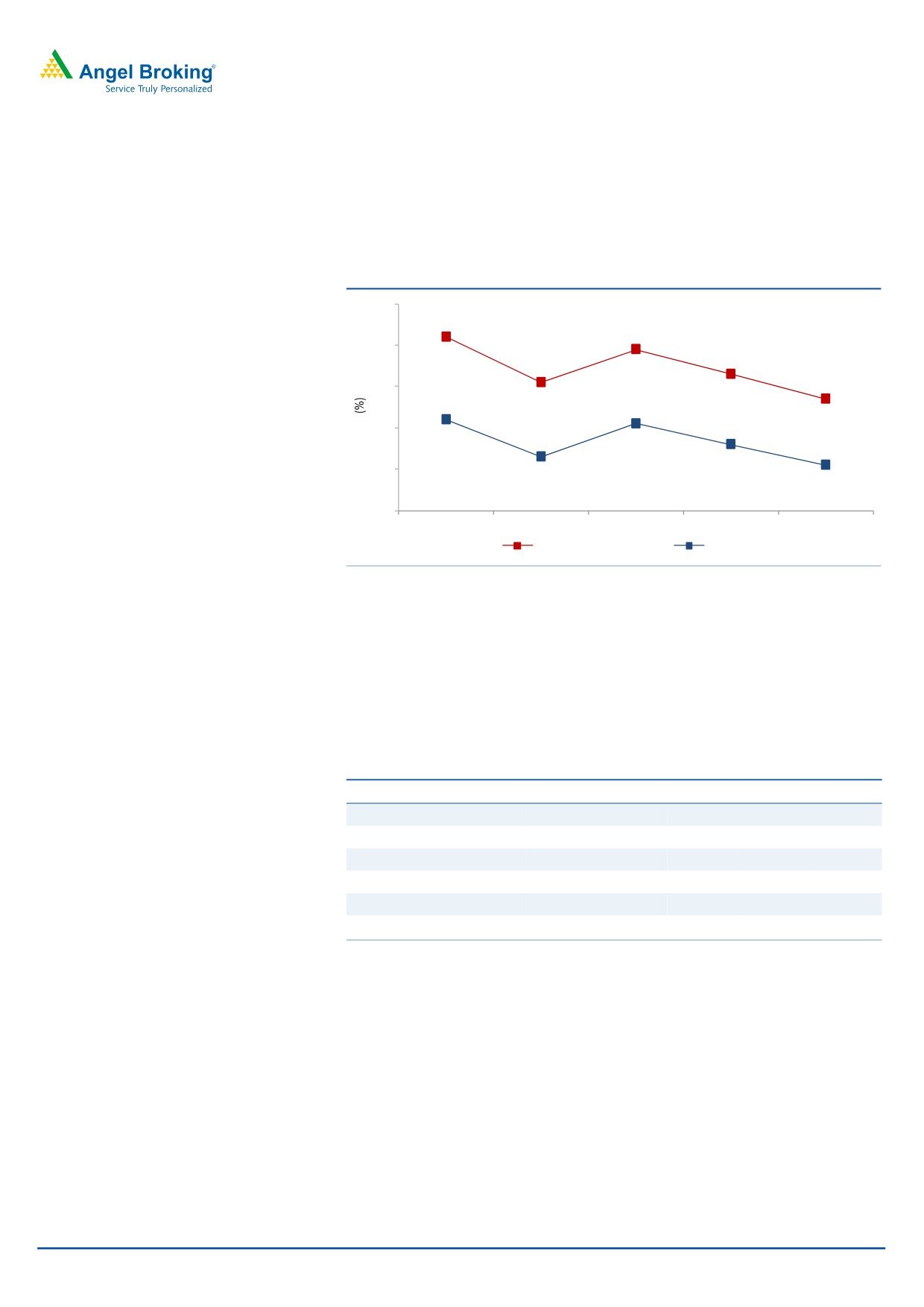

Margin dips

TCS’ EBIT margins for the quarter came in at 26.1% V/s 26.7% expected, a dip of

54bp qoq. Rupee depreciation and strong growth in Asset Leveraged Solutions

weren’t able to offset pricing pressure and reinvestments.

Exhibit 10: Adj. Margin profile

30

29.2

28.9

29

28.3

28.1

27.7

28

27

27.2

27.1

26.6

26

26.3

26.1

25

4QFY15

1QFY16

2QFY16

3QFY16

4QFY16

EBITDA margin

EBIT margin

Source: Company, Angel Research

Client metrics

The client pyramid during the quarter witnessed a qualitative improvement, with

client additions seen in higher revenue brackets. The clients in $100mn+ revenue

band increased by 3, in $50mn+ revenue band by 8 and in $10mn+ revenue

band by 17.

Exhibit 11: Client pyramid

4QFY15 1QFY16 2QFY16 3QFY16 4QFY16

US$1mn-5mn

389

391

415

425

400

US$5mn-10mn

128

123

130

132

131

US$10mn-20mn

99

96

103

108

125

US$20mn-50mn

94

103

106

108

100

US$50mn-100mn

39

39

32

31

36

US$100mn plus

29

30

33

34

37

Source: Company, Angel Research

April 27, 2016

6

TCS | 4QFY2016 Result Update

Investment Argument

Guidance

- Outlook upbeat: The Management refrained from giving any

additional color on FY2017E revenue growth outlook, but expects FY2017 to be

better than FY2016 as most of the headwinds (like Diligenta and Japan’s

underperformance) that were effecting the company’s growth in FY2016, seems to

be diminishing. TCS highlighted that deal wins remain decent across major

markets like the US and Europe with traction in Digital deals also remaining solid.

We expect the company to post a US$ revenue CAGR of 13.0% over FY2016-18E.

Deal pipeline outlook healthier: The Company has given a positive outlook for

FY2017. It expects a strong demand environment across the board in most areas

that it focuses on. TCS, post 4QFY2016, is in a much better position relative to the

end of FY2015. The key reasons behind the same are - dramatic acceleration in

the adoption of Digital technologies, good resilience and strong momentum in

BFSI, North America and Continental Europe, major headwinds of Diligenta,

Insurance vertical, Japan and Latin America are now behind, strong order book

and pipeline, and robust growth in platforms.

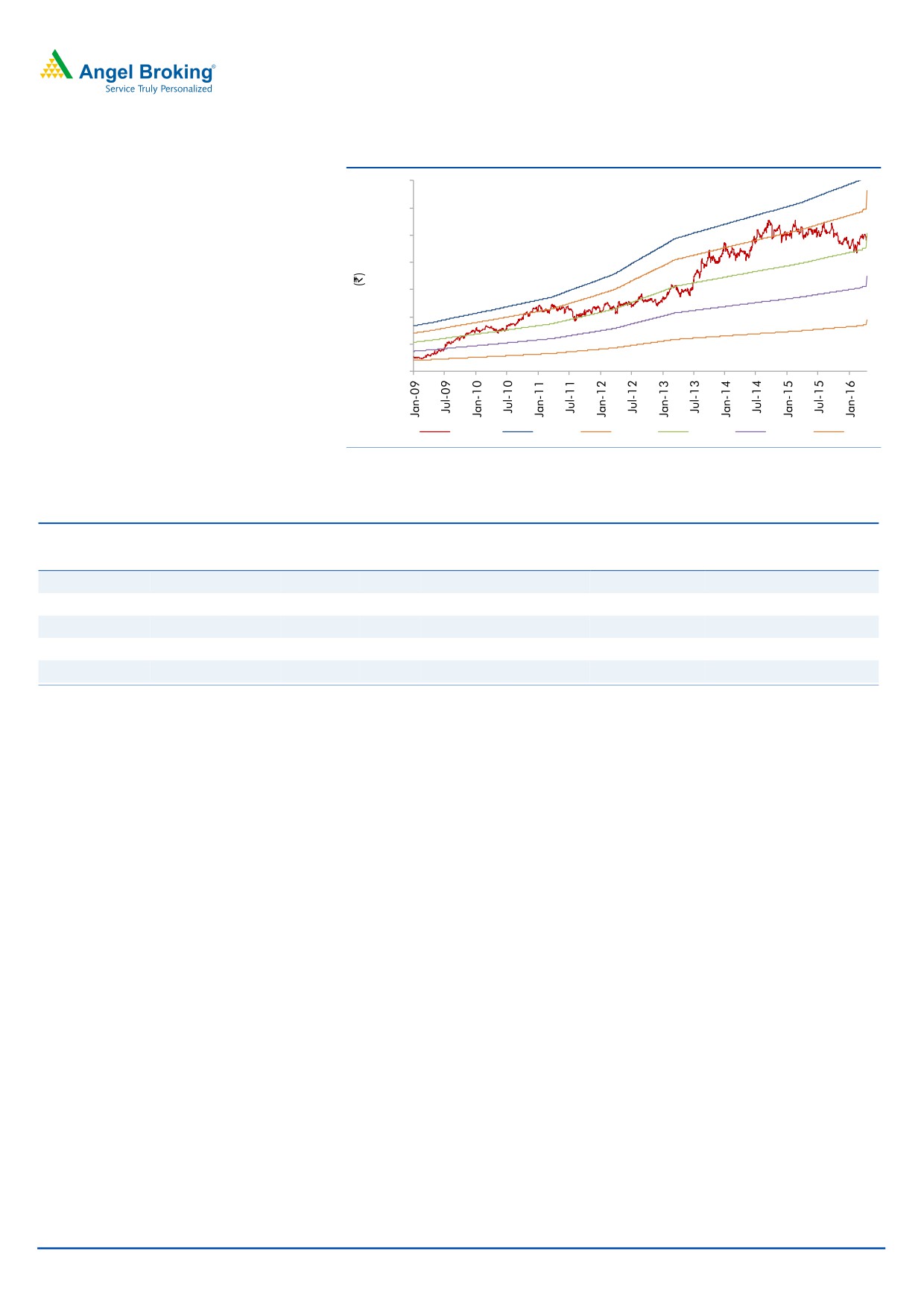

Outlook and valuation

Over FY2016-18E, we expect TCS’ revenue to post a CAGR of 13.0% in

USD and INR terms. The company highlighted that it stands comfortable of

sustaining the EBIT margin in the range of

26-28%. On the

EBIT and PAT fronts, we expect the company to post a 14.3% and 13.0% CAGR

over FY2016-18E, respectively. At the current market price of `2,488, the stock is

trading at 17.6x FY2017E and 15.7x FY2018E EPS of `141.0 and `158.1,

respectively. We maintain our Buy rating on the stock with a target price of `3,004.

Exhibit 12: Key assumptions

FY2017E

FY2018E

Revenue growth (USD)

13.0

13.0

USD-INR rate (realized)

65.7

65.7

Revenue growth (`)

13.0

13.0

EBITDA margin (%)

28.3

28.3

Tax rate (%)

23.5

23.5

EPS growth (%)

14.0

12.1

Source: Company, Angel Research

April 27, 2016

7

TCS | 4QFY2016 Result Update

Exhibit 13: One-year forward PE chart

3,500

3,000

2,500

2,000

1,500

1,000

500

0

Price

25x

21x

16x

11x

6x

Source: Company, Angel Research

Exhibit 14: Recommendation summary

Company

Reco

CMP Tgt. price Upside

FY2017E FY2017E

FY2015-17E

FY2017E FY2017E

(`)

(`)

(%)

EBITDA (%)

P/E (x)

EPS CAGR (%)

EV/Sales (x)

RoE (%)

HCL Tech

Buy

850

1,038

22.1

21.5

16.5

10.6

2.5

19.8

Infosys

Accumulate

1,233

1,374

11.4

27.5

20.9

8.9

4.0

19.7

TCS

Buy

2,488

3,004

20.7

28.3

17.6

12.8

4.1

35.5

Tech Mahindra

Accumulate

476

530

11.3

17.0

16.5

8.0

1.5

18.6

Wipro

Buy

555

6801

22.6

23.8

14.9

9.7

2.2

17.9

Source: Company, Angel Research

April 27, 2016

8

TCS | 4QFY2016 Result Update

Company background

TCS is Asia's largest IT services provider and is amongst the top 10 technology

firms in the world. The company has a global footprint with an employee base of

over 3.0 lakh professionals, offering services to more than 1,000 clients across

various industry segments. The company has one of the widest portfolios of

services offerings, spanning across the entire IT service value chain - from

traditional application development and maintenance to consulting and package

implementation to products and platforms.

April 27, 2016

9

TCS | 4QFY2016 Result Update

Profit & Loss statement (Consolidated, IFRS)

Y/E March (` cr)

FY2014

FY2015

FY2016

FY2017E FY2018E

Net sales

81,809

94,648

1,08,646

1,22,770

1,38,730

Cost of revenue

42,207

50,599

58,952

65,068

73,527

Gross profit

39,603

44,049

49,695

57,702

65,203

% of net sales

48.4

46.5

45.7

47.0

47.0

SGA expenses

14,471

17,353

18,956

22,958

25,943

% of net sales

17.7

18.3

17.4

18.7

18.7

EBITDA

25,132

26,696

30,738

34,744

39,261

% of net sales

30.7

28.2

28.3

28.3

28.3

Dep. and amortization

1324

1272

1948

1535

1655

% of net sales

1.6

1.3

1.8

1.3

1.2

EBIT

23,808

25,424

28,790

33,209

37,606

% of net sales

29.1

26.9

26.5

27.0

27.1

Other income, net

1589

3140

3050

3050

3050

Profit before tax

25,397

28,564

31,840

36,259

40,656

Provision for tax

6,071

6,083

7,503

8,521

9,554

% of PBT

23.9

21.3

23.6

23.5

23.5

PAT

19,326

22,481

24,338

27,738

31,102

Minority interest

209

205

123

141

161

Extra-ordinary (Exp.)/ Inc.

(2,627.9)

Reported PAT

19,117

19,648

24,215

27,598

30,941

Adj. PAT

19,117

21,696

24,215

27,598

30,941

Diluted EPS (`)

97.6

110.9

123.7

141.0

158.1

April 27, 2016

10

TCS | 4QFY2016 Result Update

Balance sheet (Consolidated, IFRS)

Y/E March (` cr)

FY2014 FY2015

FY2016 FY2017E FY2018E

Assets

Cash and cash equivalents

1,469

1,862

1,862

1,603

1,770

Other current financial assets

18,107

16,383

4,833

27,366

35,229

Accounts receivable

18,230

20,440

24,073

26,506

29,952

Unbilled revenues

4,006

3,827

3,992

5,347

5,348

Other current assets

-

6,414

5,975

5,975

5,975

Property and equipment

10,364

11,572

11,790

12,790

13,790

Intangible assets and goodwill

4,157

3,931

3,946

3,946

3,946

Investments

3,449

9,619

22,822

22,822

22,822

Other non current assets

-

906

11,919

11,919

11,919

Total assets

68,913

74,954

91,212

1,18,274

1,30,752

Liabilities

Current liabilities

10,906

14,428

15,407

35,425

40,031

Short term borrowings

170

243

162

162

162

Redeemable preference shares

-

-

(0)

-

1

Long term debt

127

114

83

83

83

Other non current liabilities

1,684

1,778

2,017

2,310

2,610

Minority interest

691

914

354

495

656

Shareholders funds

55,335

57,477

73,190

79,800

87,210

Total liabilities

68,913

74,954

91,212

1,18,274

1,30,752

April 27, 2016

11

TCS | 4QFY2016 Result Update

Cash flow statement (Consolidated, IFRS)

Y/E March (` cr)

FY2014

FY2015

FY2016

FY2017E

FY2018E

Pre-tax profit from oper.

23,808

22,481

24,338

27,738

31,102

Depreciation

1,324

1,272

1,948

1,535

1,655

Exp. (deferred)/written off

209

160

174

-

-

Pre tax cash from oper

24,923

23,913

26,460

29,273

32,757

Other inc./prior period ad

1,589

1,272

1,948

1,535

1,655

Net cash from operations

26,512

25,185

28,408

30,808

34,412

Tax

6,071

6,083

7,503

8,521

9,554

Cash profits

20,441

19,102

20,905

22,287

24,857

(Inc)/dec in acc. recv.

(4,154)

(2,210)

(3,633)

(2,433)

(3,446)

(Inc)/dec in unbilled rev.

(846)

179

(165)

(1,355)

(1)

(Inc)/dec in oth. current asst.

(6,650)

(6,414)

439

-

-

Inc/(dec) in current liab.

2,223

(1,207)

(218)

(1,000)

(1,000)

Net trade working capital

(9,427)

(9,652)

(3,577)

(4,788)

(4,447)

Cash flow from opert. actv.

11,015

9,450

17,328

17,499

20,411

(Inc)/dec in fixed assets

(3,494)

(1,207)

(218)

(1,000)

(1,000)

(Inc)/dec in investments

(1,409)

(4,446)

(1,653)

(22,533)

(7,863)

(Inc)/dec in intangible asst.

(651)

(226)

16

-

-

(Inc)/dec in non-cur.asst.

(1,335)

(906)

(11,013)

-

-

Cash flow from invt. actv.

(6,889)

(6,786)

(12,869)

(23,533)

(8,863)

Inc/(dec) in debt

203

61

(113)

-

-

Inc/(dec) in equity

34

223

(559)

141

161

Inc/(dec) in minority int.

(14,666)

(19,923)

(18,415)

(20,988)

(23,530)

Dividends

9,929

17,369

14,629

26,622

11,989

Cash flow from finan. actv.

(4,500)

(2,271)

(4,459)

5,774

(11,380)

Cash generated/(utilized)

(374)

393

-

(260)

167

Cash at start of the year

1,843

1,469

1,862

1,862

1,603

Cash at end of the year

1,469

1,862

1,862

1,603

1,770

April 27, 2016

12

TCS | 4QFY2016 Result Update

Key ratios

Y/E March

FY2014

FY2015

FY2016

FY2017E

FY2018E

Valuation ratio(x)

P/E (on FDEPS)

25.5

22.4

20.1

17.6

15.7

P/CEPS

23.8

23.3

18.6

16.7

15.0

P/BVPS

8.8

8.5

6.7

6.1

5.6

Dividend yield (%)

1.3

1.7

1.6

1.8

2.1

EV/Sales

5.7

4.9

4.3

3.6

3.1

EV/EBITDA

18.7

17.4

15.1

12.7

11.0

EV/Total assets

6.8

6.2

5.1

3.7

3.3

Per share data (`)

EPS

97.6

110.9

123.7

141.0

158.1

Cash EPS

104.4

106.8

133.6

148.7

166.4

Dividend

32.0

43.5

40.2

45.8

51.3

Book value

283

294

374

408

446

Dupont analysis

Tax retention ratio (PAT/PBT)

0.8

0.8

0.8

0.8

0.8

Cost of debt (PBT/EBIT)

1.1

1.1

1.1

1.1

1.1

EBIT margin (EBIT/Sales)

0.3

0.3

0.3

0.3

0.3

Asset turnover ratio (Sales/Assets)

1.2

1.3

1.2

1.0

1.1

Leverage ratio (Assets/Equity)

1.2

1.3

1.2

1.5

1.5

Operating ROE

34.9

39.1

33.3

34.8

35.7

Return ratios (%)

RoCE (pre-tax)

34.5

33.9

31.6

28.1

28.8

Angel RoIC

51.9

54.0

46.7

50.0

53.0

RoE

34.5

34.2

33.1

34.6

35.5

Turnover ratios(x)

Asset turnover (fixed assets)

7.9

8.2

9.2

9.6

10.1

Receivables days

81

79

81

79

79

April 27, 2016

13

TCS | 4QFY2016 Result Update

Research Team Tel: 022 - 39357800

DISCLAIMER

Angel Broking Private Limited (hereinafter referred to as “Angel”) is a registered Member of National Stock Exchange of India Limited,

Bombay Stock Exchange Limited and Metropolitan Stock Exchange of India Limited. It is also registered as a Depository Participant with

CDSL and Portfolio Manager with SEBI. It also has registration with AMFI as a Mutual Fund Distributor. Angel Broking Private Limited is

a registered entity with SEBI for Research Analyst in terms of SEBI (Research Analyst) Regulations, 2014 vide registration number

INH000000164. Angel or its associates has not been debarred/ suspended by SEBI or any other regulatory authority for accessing

/dealing in securities Market. Angel or its associates including its relatives/analyst do not hold any financial interest/beneficial

ownership of more than 1% in the company covered by Analyst. Angel or its associates/analyst has not received any compensation /

managed or co-managed public offering of securities of the company covered by Analyst during the past twelve months. Angel/analyst

has not served as an officer, director or employee of company covered by Analyst and has not been engaged in market making activity

of the company covered by Analyst.

This document is solely for the personal information of the recipient, and must not be singularly used as the basis of any investment

decision. Nothing in this document should be construed as investment or financial advice. Each recipient of this document should

make such investigations as they deem necessary to arrive at an independent evaluation of an investment in the securities of the

companies referred to in this document (including the merits and risks involved), and should consult their own advisors to determine

the merits and risks of such an investment.

Reports based on technical and derivative analysis center on studying charts of a stock's price movement, outstanding positions and

trading volume, as opposed to focusing on a company's fundamentals and, as such, may not match with a report on a company's

fundamentals.

The information in this document has been printed on the basis of publicly available information, internal data and other reliable

sources believed to be true, but we do not represent that it is accurate or complete and it should not be relied on as such, as this

document is for general guidance only. Angel Broking Pvt. Limited or any of its affiliates/ group companies shall not be in any way

responsible for any loss or damage that may arise to any person from any inadvertent error in the information contained in this report.

Angel Broking Pvt. Limited has not independently verified all the information contained within this document. Accordingly, we cannot

testify, nor make any representation or warranty, express or implied, to the accuracy, contents or data contained within this document.

While Angel Broking Pvt. Limited endeavors to update on a reasonable basis the information discussed in this material, there may be

regulatory, compliance, or other reasons that prevent us from doing so.

This document is being supplied to you solely for your information, and its contents, information or data may not be reproduced,

redistributed or passed on, directly or indirectly.

Neither Angel Broking Pvt. Limited, nor its directors, employees or affiliates shall be liable for any loss or damage that may arise from

or in connection with the use of this information.

Note: Please refer to the important ‘Stock Holding Disclosure' report on the Angel website (Research Section). Also, please refer to the

latest update on respective stocks for the disclosure status in respect of those stocks. Angel Broking Pvt. Limited and its affiliates may

have investment positions in the stocks recommended in this report.

Disclosure of Interest Statement

TCS

1. Analyst ownership of the stock

No

2. Angel and its Group companies ownership of the stock

No

3. Angel and its Group companies' Directors ownership of the stock

No

4. Broking relationship with company covered

No

Note: We have not considered any Exposure below ` 1 lakh for Angel, its Group companies and Directors

Ratings (Based on expected returns

Buy (> 15%)

Accumulate (5% to 15%)

Neutral (-5 to 5%)

over 12 months investment period):

Reduce (-5% to -15%)

Sell (< -15)

April 27, 2016

14