2QFY2017 Result Update | IT

October 21, 2016

Tata Consultancy Services (TCS)

ACCUMULATE

CMP

`2,398

Performance highlights

Target Price

`2,620

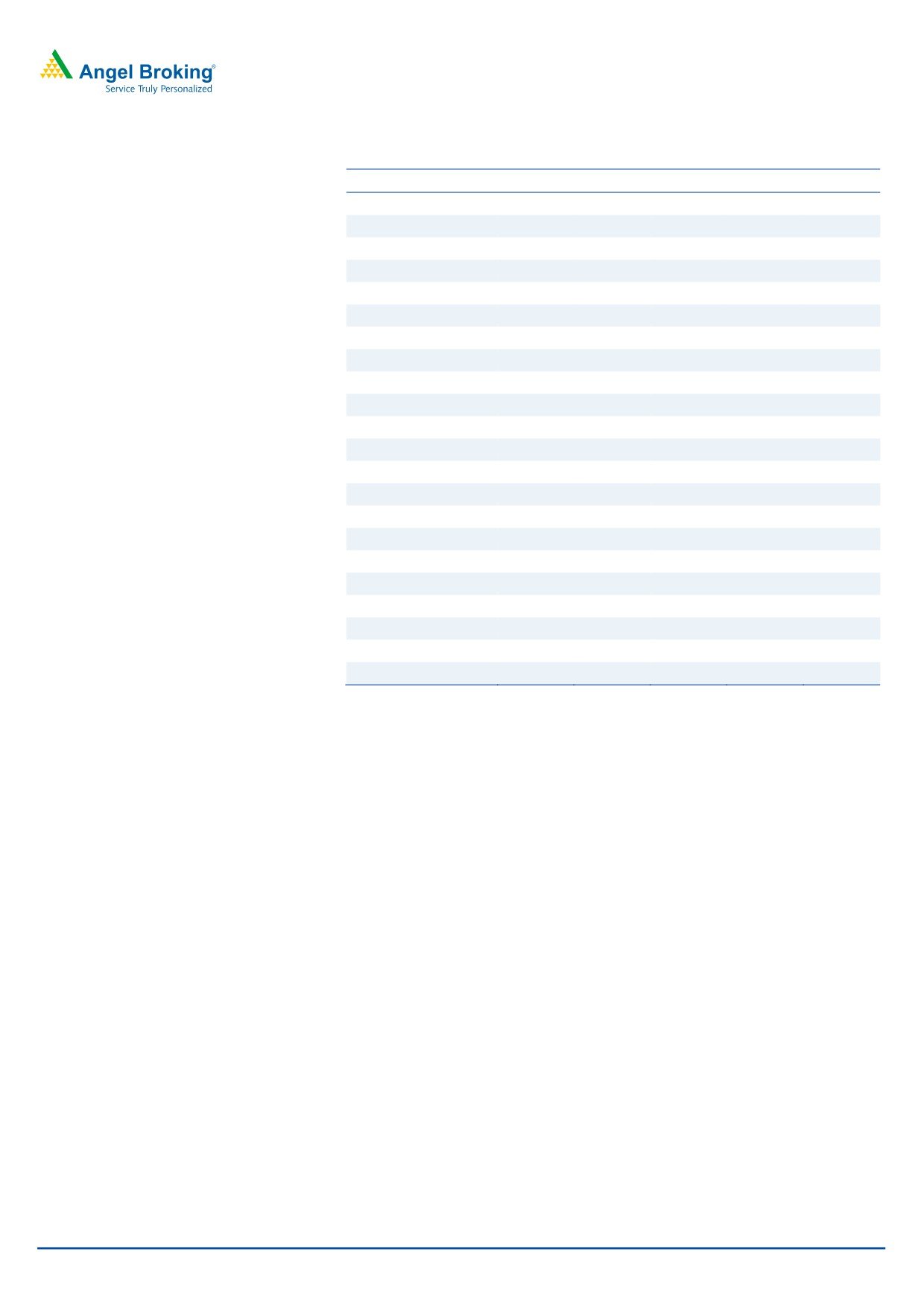

(` cr)

2QFY17 1QFY17

% chg (qoq) 2QFY16

% chg (yoy)

Investment Period

12 Months

Net revenue

29,284

29,305

(0.1)

27,166

7.8

Adj. EBITDA

7,065

7,837

(9.8)

7,389

(4.4)

Stock Info

Adj. EBITDA margin (%)

27.7

26.7

(50)bps

27.2

(50)bps

Sector

IT

Adj. PAT

6,586

6,317

4.3

6,055

8.8

Market Cap (` cr)

472,568

Source: Company, Angel Research

Net Debt (` cr)

(14,442)

Beta

0.7

TCS has announced its 2QFY2017 results and has posted a 0.3% sequential

52 Week High / Low

2,740/2,119

growth in USD revenues to US$4,374mn (V/s US $4,441mn expected). Though

Avg. Daily Volume

85,322

the results came in below expectations, the EBIT margins and net profit came in

much higher than expected. The constant currency (CC) growth stands at 1.0%

Face Value (`)

1

qoq, while the volume growth is at 1.3% qoq. On the operating front, the EBIT

BSE Sensex

28,051

margins came in at 26.2% (V/s 25.2% expected), an expansion of 93bp.

Nifty

8,678

Consequently, the PAT came in at `6,586cr (V/s `6,377cr), a rise of 4.3% qoq.

Reuters Code

TCS.BO

We recommend an accumulate stance on the stock.

Bloomberg Code

TCS@IN

Quarterly highlights: The company posted a 0.3% sequential growth in USD

revenues to US$4,374mn (V/s US $4,441mn expected). In INR terms, revenues

Shareholding Pattern (%)

dipped by 0.1% qoq to `29,284cr (V/s `29,707cr)by. The constant currency

Promoters

73.3

(CC) growth stands at 1.0% qoq, while the volume growth is at 1.3% qoq. On

MF / Banks / Indian Fls

5.5

the operating front, the EBIT margins came in at 26.2% (V/s 25.2% expected), an

FII / NRIs / OCBs

17.0

expansion of 93bp. Consequently, the PAT came in at `6,586cr (V/s `6,377cr),

Indian Public / Others

4.2

a rise of 4.3% qoq. The clients in $50mn+ revenue band increased by 2, in

$20mn+ revenue band by 5 and in $5mn+ revenue band by 13. The attrition

Abs.(%)

3m 1yr

3yr

rate was at 11.9% in the IT services.

Sensex

1.1

3.1

34.3

Outlook and valuation: With headwinds from Diligenta and Latin America

TCS

(1.4)

(3.1)

13.1

behind, still an uncertain BFSI may mar the company’s growth (although the

same is not currently being encountered). However, even on conservative

estimates, we expect TCS to post revenue CAGR of 10.5% in USD as well as INR

3-Year Daily Price Chart

terms over FY2016-18E. The stock trades at 16.5x its FY2018E EPS, which is

expected to be positive in the near term. Hence, we recommend an accumulate

on the stock.

Key financials (Consolidated, IFRS)

Y/E March (` cr)

FY2015

FY2016

FY2017E

FY2018E

Net sales

94,648

1,08,646

1,19,025

1,33,308

% chg

15.7

14.8

9.6

12.0

Net profit

21,696

24,215

25,685

28,483

% chg

13.5

11.6

6.1

10.9

EBITDA margin (%)

28.2

28.3

27.6

27.6

EPS (`)

110.9

123.7

131.2

145.5

Source: Company, Angel Research

P/E (x)

21.6

19.4

18.3

16.5

P/BV (x)

8.2

6.4

5.9

5.4

RoE (%)

34.2

33.1

32.4

33.1

RoCE (%)

33.9

31.6

26.3

26.9

Sarabjit kour Nangra

EV/Sales (x)

4.9

4.2

3.7

3.2

+91 22 3935 7800 Ext: 6806

EV/EBITDA (x)

17.3

14.9

13.4

11.8

sarabjit @angelbroking.com

Source: Company, Angel Research; Note: CMP as of October 18, 2016

Please refer to important disclosures at the end of this report

1

TCS | 2QFY2017 Result Update

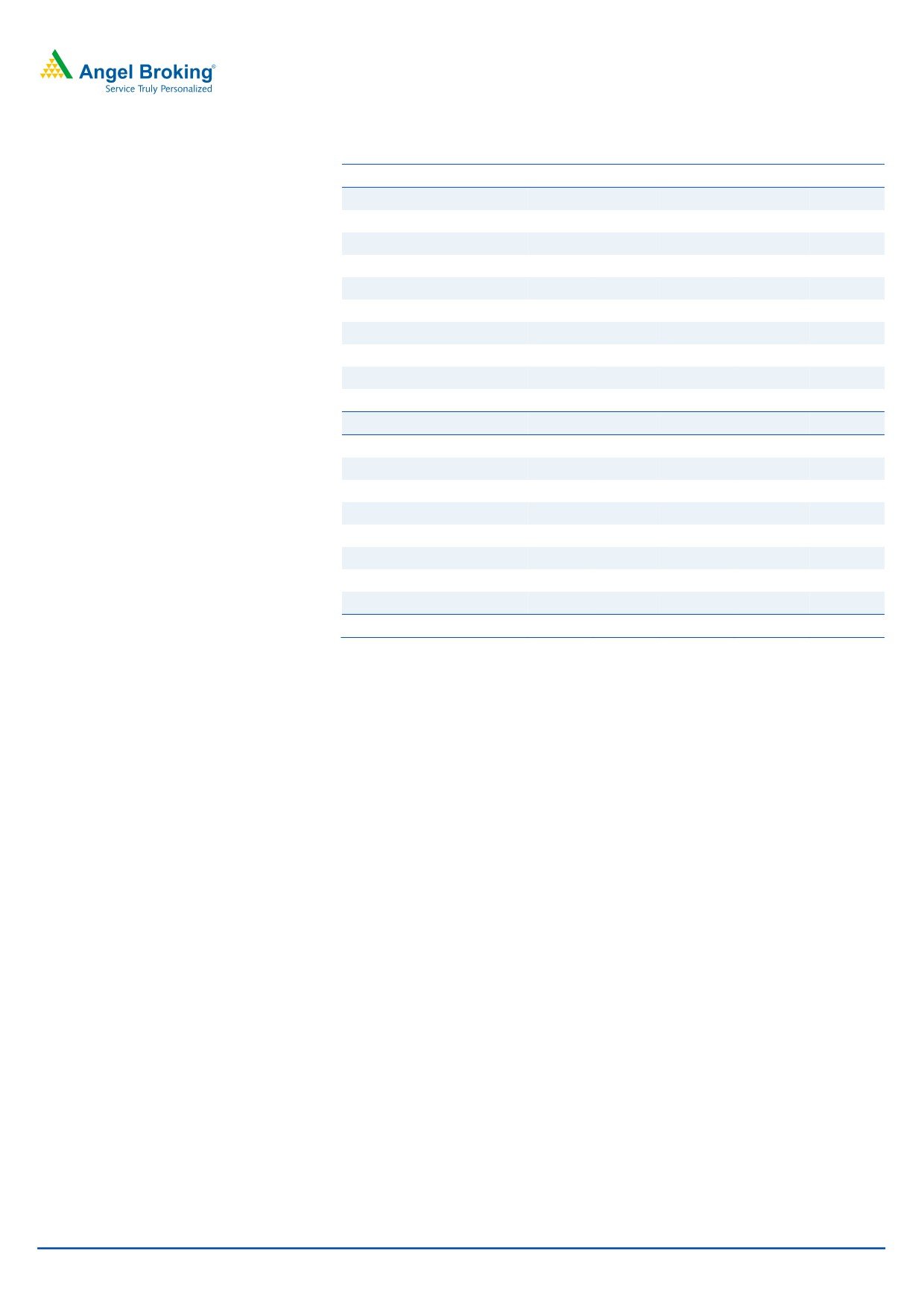

Exhibit 1: 2QFY2017 performance (Consolidated, IFRS)

(` cr)

2QFY17

1QFY17

% chg (qoq)

2QFY16

% chg (yoy)

1HFY17 1HFY16

% chg(yoy)

Net revenue

29,284

29,305

(0.1)

27,166

7.8

58,589

52,833

10.9

Cost of revenue

16,038

16,312

(1.7)

14,607

9.8

32,350

26,914

20.2

Gross profit

13,246

12,993

1.9

12,559

5.5

26,239

25,919

1.2

SG&A expense

5,133

5,156

(0.4)

4,662

10.1

10,289

10,896

(5.6)

EBITDA

8,113

7,837

3.5

7,897

2.7

15,950

15,023

6.2

Dep. and amortisation

496

490

1.2

543

(8.7)

986

922

6.9

EBIT

7,617

7,347

3.7

7,354

3.6

14,964

14,101

6.1

Other income

1,052

963

9.2

675

55.9

2,015

1,447

PBT

8,669

8,310

4.3

8,029

8.0

16,979

15,548

9.2

Income tax

2,066

1,992

1,936

6.7

4,058

3,682

10.2

PAT

6,603

6,318

4.5

6,093

8.4

12,921

11,866

8.9

Earnings in affiliates

-

-

-

-

-

-

-

-

Minority interest

17

-

38

(54.9)

-

-

Reported PAT

6,586

6,317

4.3

6,055

8.8

12,921

11,866

8.9

Adj. PAT

6,586

6,317

4.3

6,055

8.8

12,921

11,866

8.9

EPS

33.4

32.1

4.3

30.8

8.5

65.5

60.0

9.2

Gross margin (%)

45.2

44.3

90bp

46.2

(100)bp

44.8

49.1

(427)bp

EBITDA margin (%)

27.7

26.7

96bp

29.1

(137)bp

27.2

28.4

(121)bp

EBIT margin (%)

26.0

25.1

93bp

26.0

0bp

25.5

26.7

(115)bp

Source: Company, Angel Research

Exhibit 2: Actual vs Angel estimates

(` cr)

Actual

Estimate

Var. (%)

Net revenue

29,284

29,707

(1.4)

EBIT margin (%)

26.0

25.2

80bps

Adj. PAT

6,586

6,377

3.3

Source: Company, Angel Research

Numbers lower than expectations

TCS posted a 0.3% sequential growth in USD revenues to US$4,374mn (V/s US

$4,441mn expected). In INR terms, revenues dipped by 0.1% qoq to `29,284cr

(V/s `29,707cr). The constant currency (CC) growth stands at 1.0% qoq, while the

volume growth is at 1.3% qoq.

The key geographies like USA grew by 1.4% qoq (CC), while Latin America posted

a dip of 0.2% qoq (CC). In Europe, the UK posted a dip of 0.1% qoq (CC) terms,

while the Continental Europe posted a growth of 3.7% qoq (CC). India posted a

dip of 7.6% qoq (CC), while Asia Pacific and MEA posted a growth of 3.5% qoq

and 2.2% qoq (CC).

In terms of domain, the BSFI (40.4% sales) posted a CC qoq growth of 1.2%, Retail

& CPG (13.4% sales) posted a CC qoq de-growth of 3.1%. Communication &

Media (11.4% sales) posted a CC qoq growth of 2.0%, Manufacturing (10.7%

sales) posted a CC qoq growth of 3.1%, and Life sciences & Healthcare ( 7.6% of

sales) posted a CC qoq growth of 4.7%.

October 21, 2016

2

TCS | 2QFY2017 Result Update

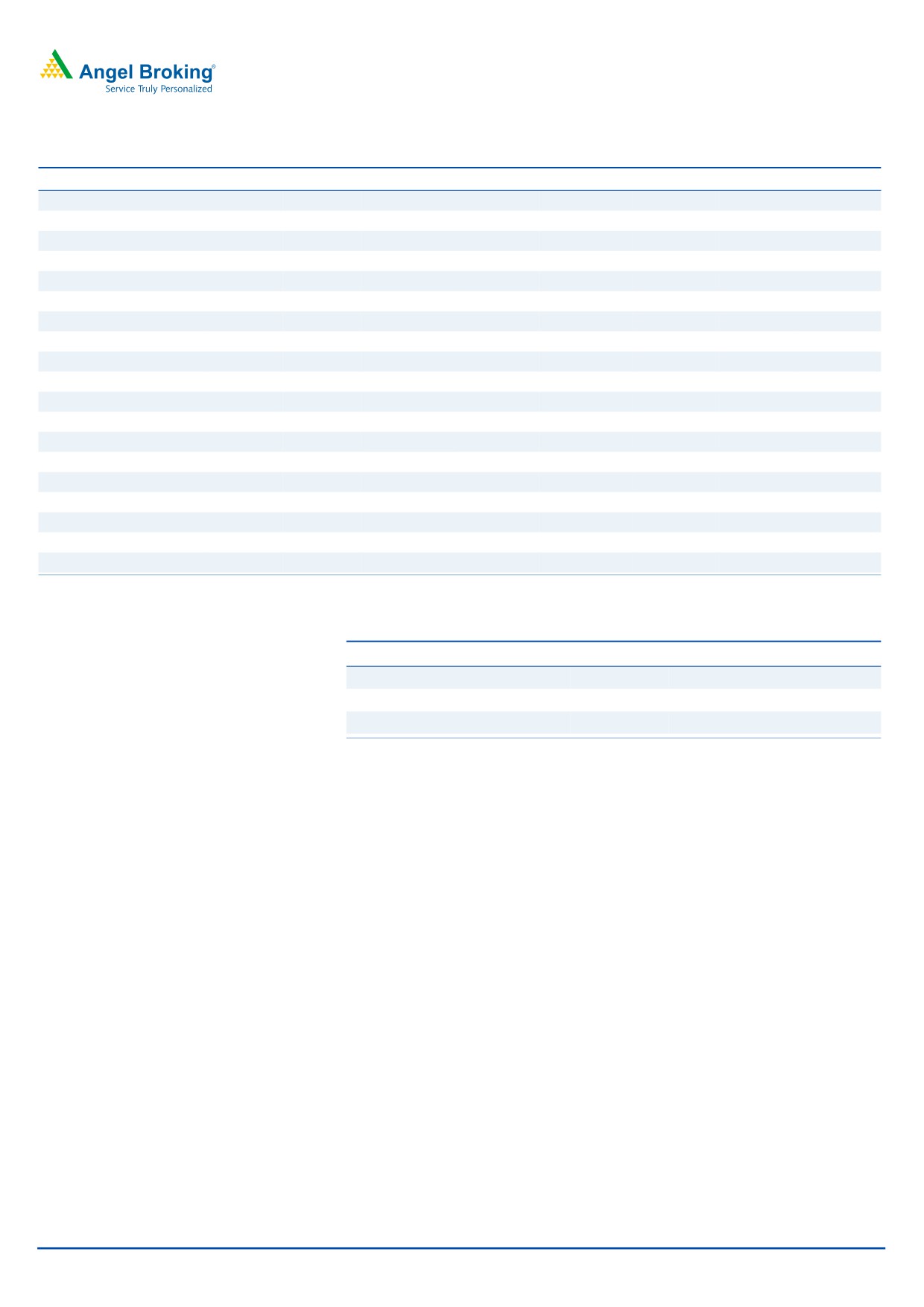

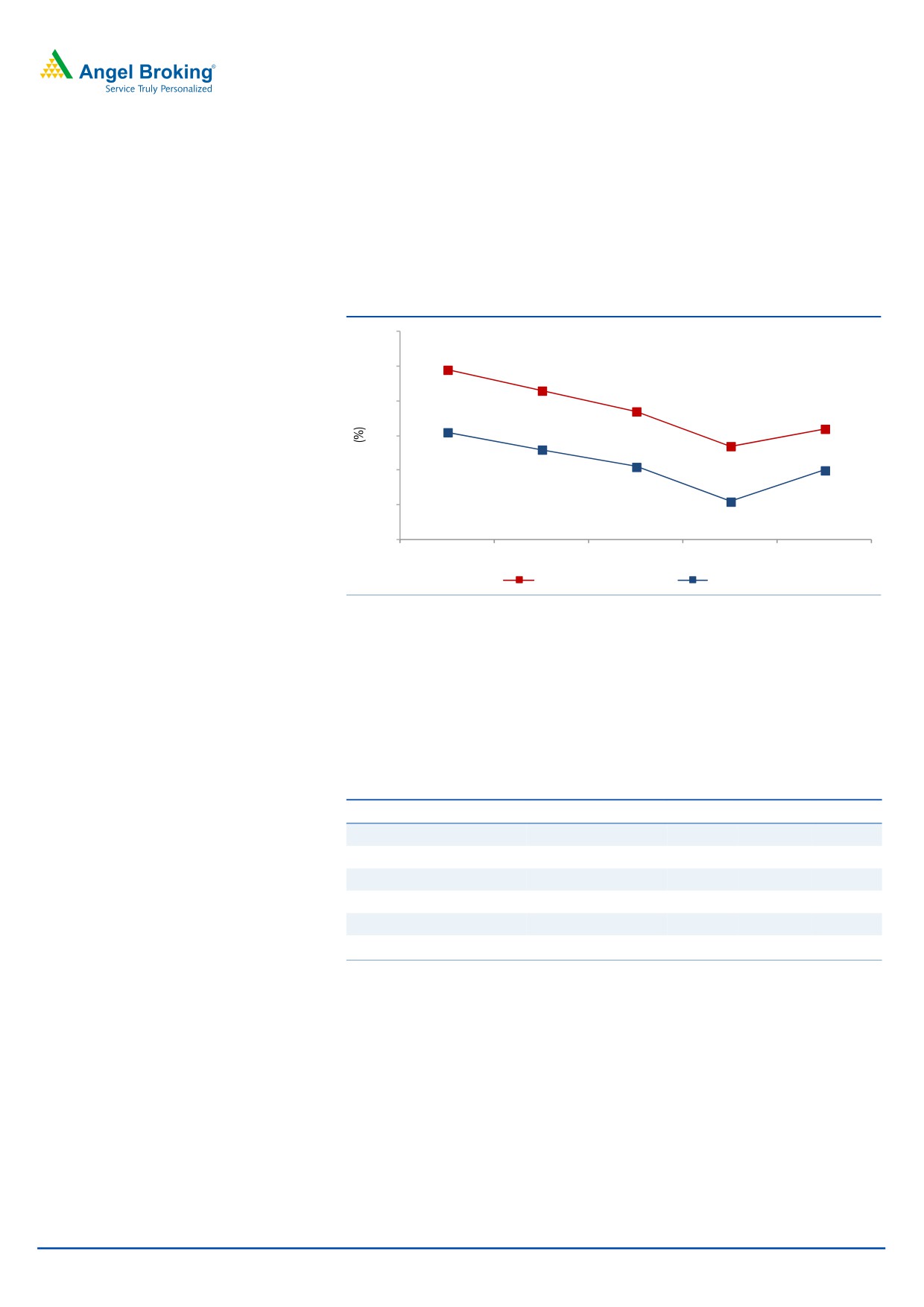

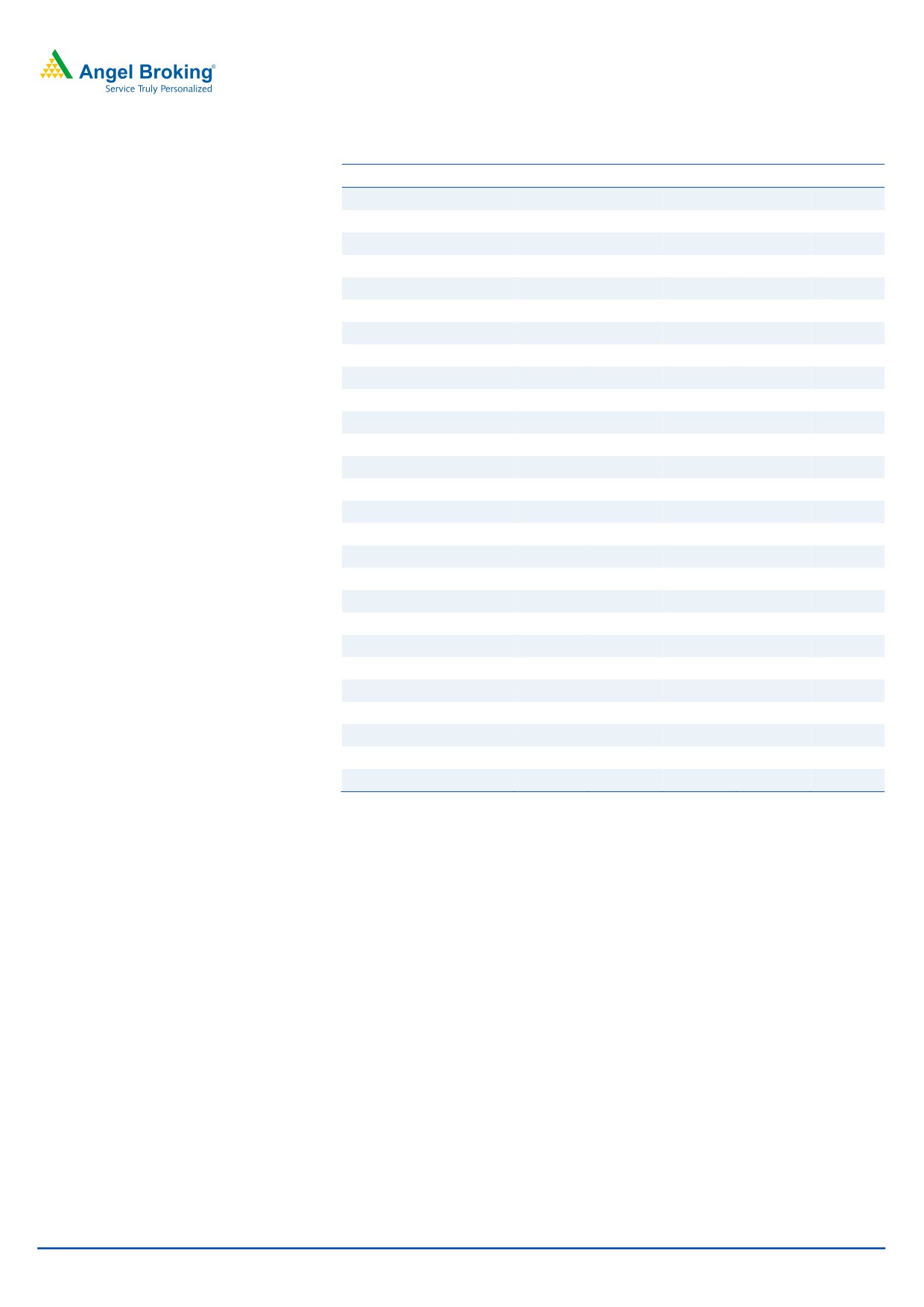

Exhibit 3: Trend in volume and revenue growth (qoq)

6.0

5.0

4.9

4.8

3.7

4.0

3.0

3.0

3.4

3.2

2.0

1.5

0.7

1.0

0.4

0.3

0.0

2QFY16

3QFY16

4QFY16

1QFY17

2QFY17

Volume growth

Revenue growth (USD terms)

Source: Company, Angel Research

Exhibit 4: Revenue drivers for 2QFY2017

2.0

1.3

1.0

0.3

0.0

(0.3)

(0.7)

(1.0)

Volume

Currency impact

CC realization

Total revenue growth

Source: Company, Angel Research

BFSI growth lagged remaining business, owing to an uncertain macro

environment; the company expressed that the potential ramifications of the Brexit

on BFSI are still not totally clear. Digital segment further continued to show weak

numbers by 1.5% qoq to US$704mn and accounted for 16.1% of total revenue

during the quarter.

October 21, 2016

3

TCS | 2QFY2017 Result Update

Exhibit 5: Revenue growth (Industry wise on CC basis)

% to revenue

% chg (CC qoq)

% chg (yoy)

BFSI

40.4

1.2

7.2

Manufacturing

10.7

3.1

15.1

Telecom & Media

11.4

2.0

12.3

Life sciences and healthcare

7.6

4.7

14.8

Retail and distribution

13.4

(3.1)

1.9

Transportation & Hospitality

3.9

2.3

17.1

Energy and utilities

4.3

3.6

17.3

Hi-tech

5.4

0.1

1.1

Others

2.9

(4.6)

31.0

Source: Company, Angel Research

October 21, 2016

4

TCS | 2QFY2017 Result Update

Service line wise, Infrastructure Services reported a sequential growth of 2.1% on

CC basis. In the company’s anchor service line - IT Solutions and Services - ADM

grew 0.9% qoq on CC basis, and Enterprise Solutions and Assurance Services

grew by 2.0% qoq and 3.5% qoq on a CC basis. The BPO segment grew by 2.5%

qoq on a CC basis during the quarter. Asset Leveraged Solutions (2.6% of sales)

de-grew by 20.1% qoq on CC basis.

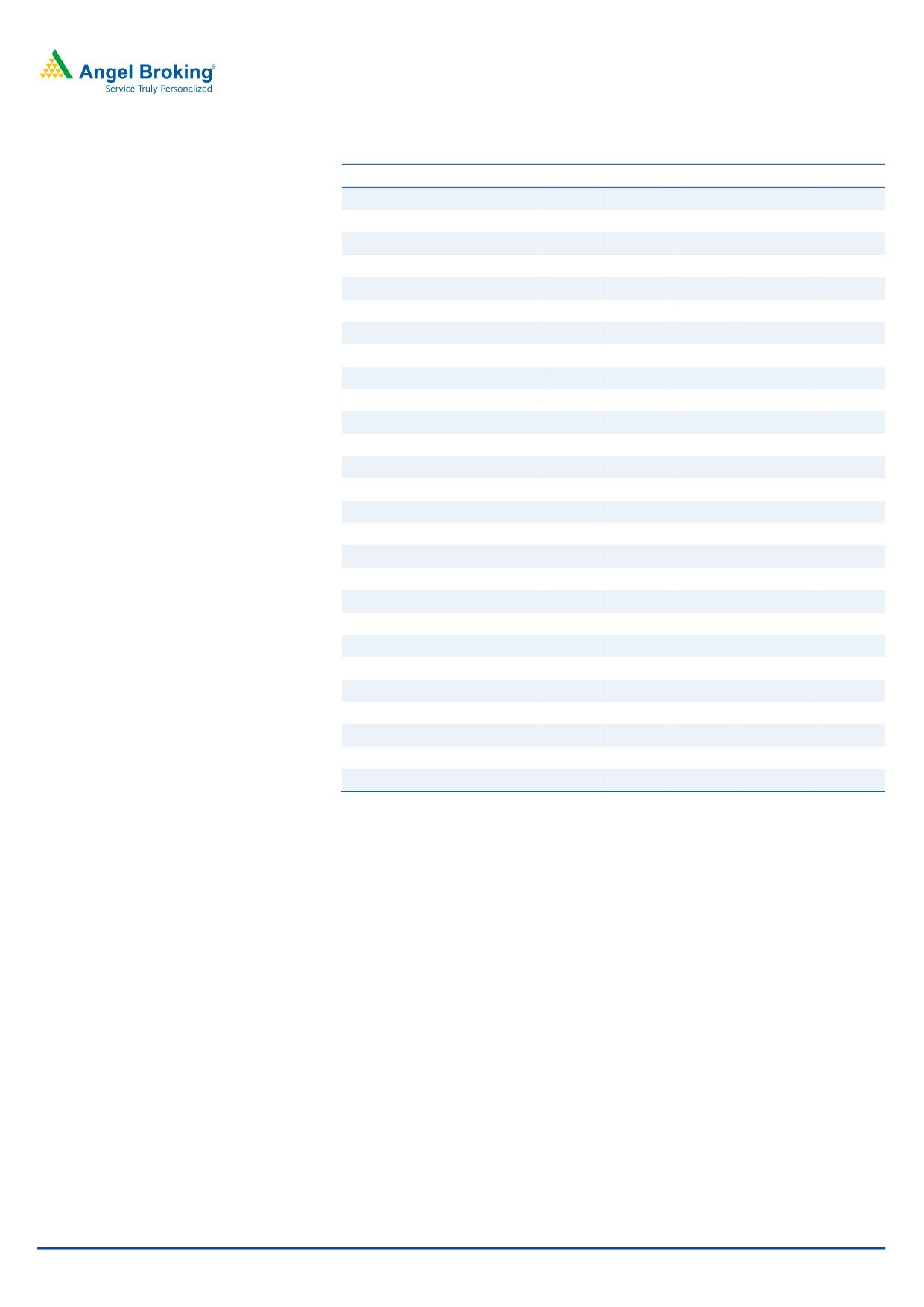

Exhibit 6: Revenue growth (Service wise on CC basis)

% to revenue

% chg (CC qoq)

% chg (yoy)

IT solutions and services

ADM

38.4

0.9

2.5

Enterprise solutions

17.8

2.0

8.6

Assurance services

9.0

3.5

11.9

Engg. and industrial services

4.8

1.1

16.1

Infrastructure services

15.7

2.1

13.7

Asset-leveraged solutions

2.6

(20.1)

(14.5)

BPO

11.7

2.5

10.3

Source: Company, Angel Research

Geography wise, growth in INR sales in key geographies was as follows: USA

(1.4% qoq on CC basis), Latin America (-0.2% qoq on CC basis), UK (-0.1% qoq

on CC basis), India (-7.6% qoq on CC basis), and MEA (2.2% qoq on CC basis).

The Continental Europe and Asia Pacific posted a growth of 3.7% qoq and 3.5% qoq

on CC basis, respectively.

Exhibit 7: Revenue growth (Geography wise in INR terms)

% of revenue

% chg (CC qoq)

% chg (yoy)

U.S.

54.0

1.4

7.9

Latin America

2.0

(0.2)

15.8

U.K.

13.8

(0.1)

7.4

Continental Europe

11.8

3.7

14.9

India

5.8

(7.6)

(4.5)

Asia Pacific

10.2

3.5

6.5

MEA

2.4

2.2

8.8

Source: Company, Angel Research

Attrition rate declines

In 2QFY2017, TCS witnessed a gross addition of 22,665 employees and net

addition of 9,440 employees, taking its total employee base to 3,71,519. During

the quarter, the attrition rate (last twelve month [LTM] basis) for the company

decreased to 12.9% from 13.6% in 1QFY2017.

Exhibit 8: Hiring and attrition trend

Particulars

2QFY16 3QFY16

4QFY16

1QFY17

2QFY17

Gross addition

25,186

22,118

22,576

17,792

22,665

Net addition

10,685

9,071

9,152

8,236

9,440

Total employee base

3,35,620

3,44,691

3,53,843

3,62,079

3,71,519

Attrition (%) - LTM basis

16.2

15.9

14.7

13.6

12.9

Source: Company, Angel Research

October 21, 2016

5

TCS | 2QFY2017 Result Update

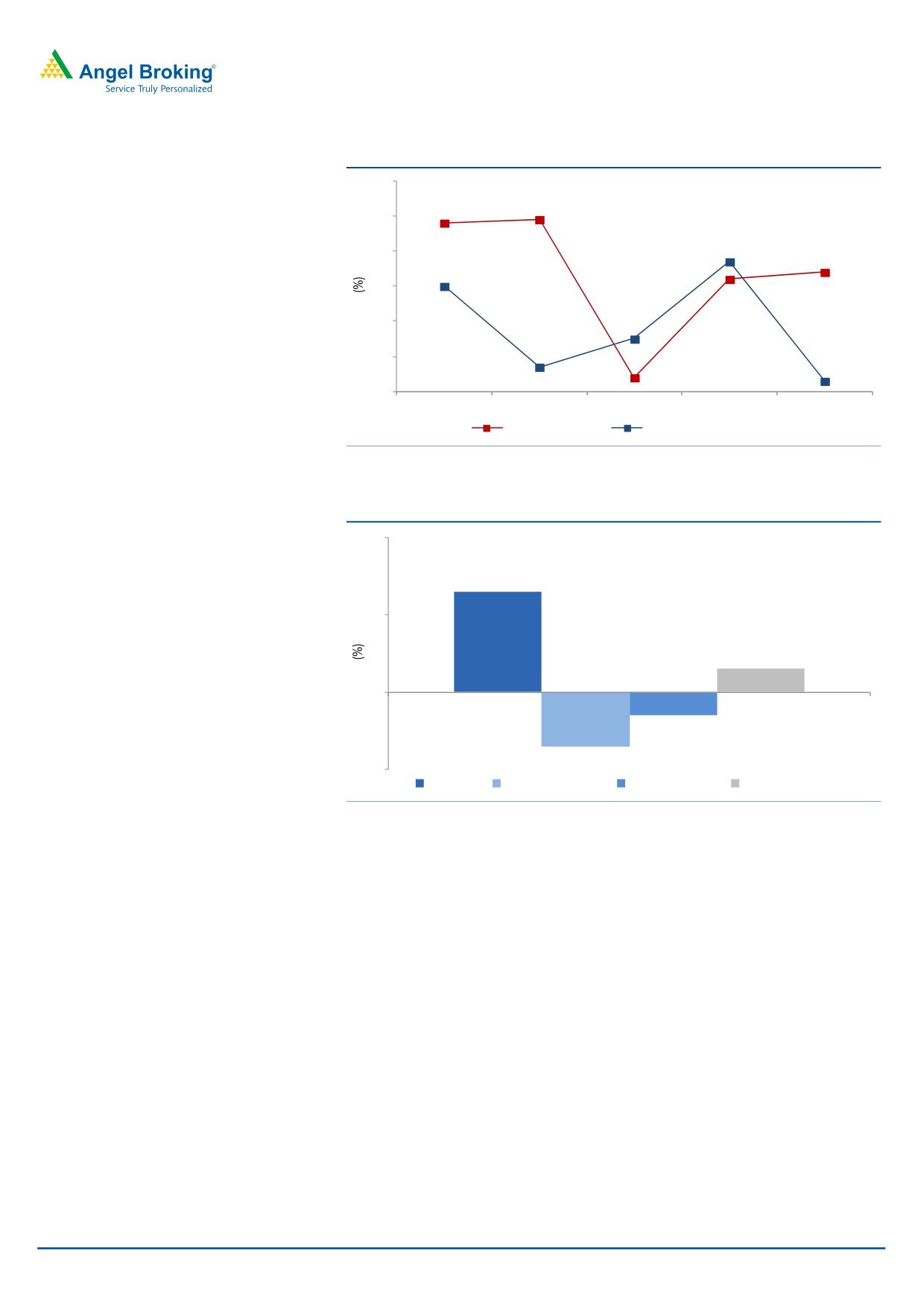

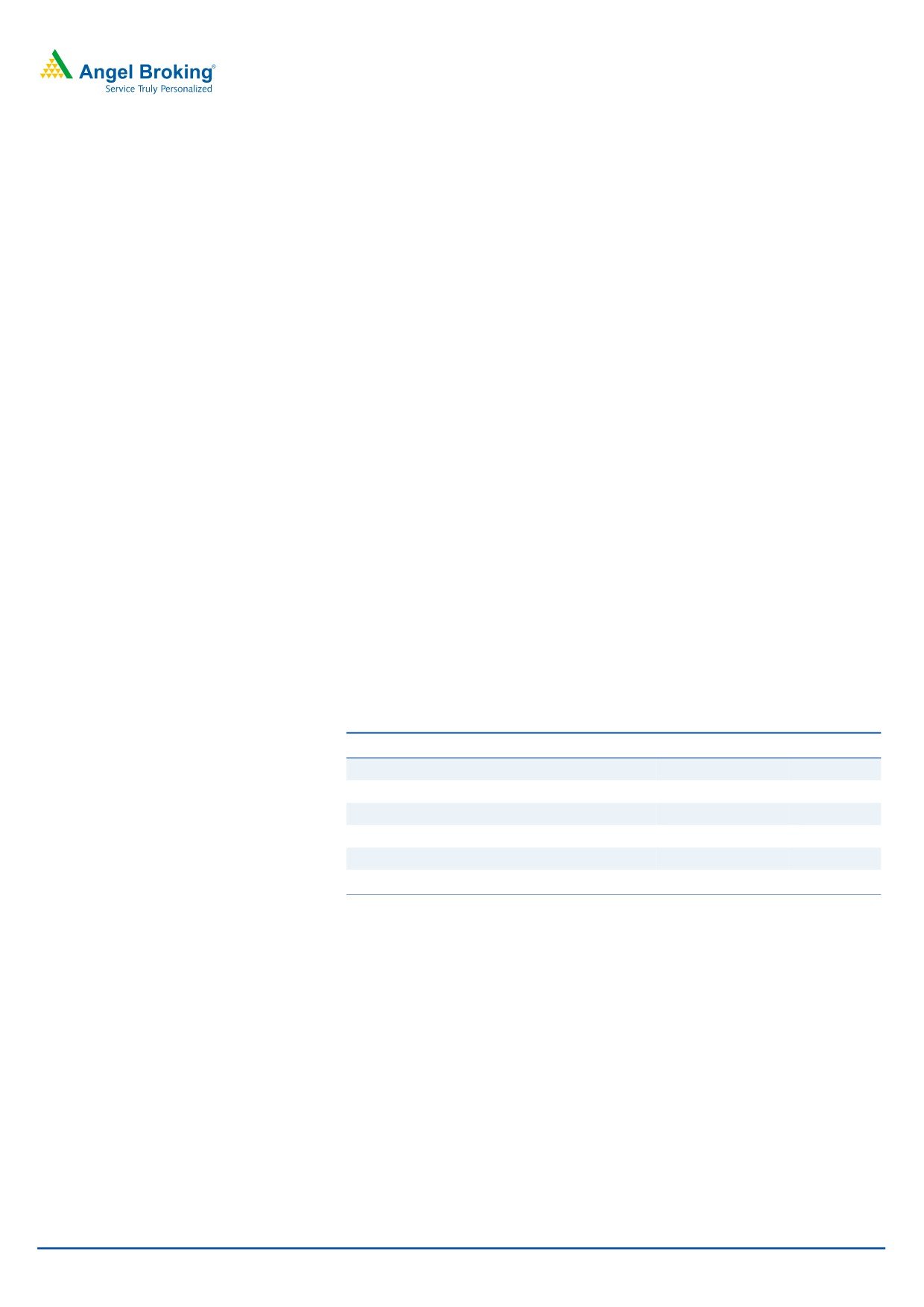

Margin expands

On the operating front, the EBITDA and EBIT margins came in at 27.2% and

26.0%, an expansion of

~50bp and ~90bp qoq respectively, better than

expected. The 130bp tailwind from operational efficiencies is more than the offset

40bp headwind from cross currency movements on EBIT margins.

Exhibit 9: Adj. Margin profile

30

28.9

29

28.3

27.7

28

27.2

26.7

27

27.1

26

26.6

26.1

26.0

25

25.1

24

2QFY16

3QFY16

4QFY16

1QFY17

2QFY17

EBITDA margin

EBIT margin

Source: Company, Angel Research

Client metrics

The client pyramid during the quarter witnessed a qualitative improvement with

client additions seen in higher revenue brackets. The clients in $50mn+ revenue

band increased by 2, in $20mn+ revenue band by 5 and in $5mn+ revenue

band by 13.

Exhibit 10: Client pyramid

2QFY16 3QFY16 4QFY16 1QFY17 2QFY17

US$1mn-5mn

415

425

400

408

410

US$5mn-10mn

130

132

131

141

154

US$10mn-20mn

103

108

125

119

110

US$20mn-50mn

106

108

100

102

107

US$50mn-100mn

32

31

36

40

42

US$100mn plus

33

34

37

37

36

Source: Company, Angel Research

October 21, 2016

6

TCS | 2QFY2017 Result Update

Investment Argument

Guidance - near term outlook uncertain: The management refrained from giving

any additional color on FY2017E revenue growth outlook. However, uncertainty on

back of the Brexit and its impact could impair growth in the near term, though the

Management expects ramp up in deal execution. We expect the company to post a

US$ revenue CAGR of 10.5% over FY2016-18E.

Growth fundamentals intact: In spite of the near term uncertainty arising out of

Brexit, TCS expects revenue growth to make a comeback after current cyclical

headwinds are behind. Long term drivers of tech spending will remain intact and

new growth areas are emerging like Big data and Analytics. Though the growth in

Digital segment weakened, the segmental revenue remained strong with 30% yoy

CC basis and will continue to drive business performance. In terms of verticals, the

softness in BFSI was expected. The weakness was more pronounced in UK than in

the US.

Outlook and valuation

Over FY2016-18E, we expect TCS’ revenue to post a CAGR of 10.5% in

USD and INR terms. The company highlighted that it stands comfortable of

sustaining the EBIT margin in the range of 26-28%. On the EBIT and PAT fronts,

we expect the company to post a 9.3% and 8.5% CAGR over FY2016-18E,

respectively. The stock is trading at 16.5x FY2018E EPS of `145.5. We reduce our

rating on the stock to accumulate from Buy, as we believe that the stock has

discounted the near term growth well.

Exhibit 11: Key assumptions

FY2017E

FY2018E

Revenue growth (USD)

9.0

11.0

USD-INR rate (realized)

66.0

66.0

Revenue growth (`)

9.6

12.0

EBITDA margin (%)

27.3

27.3

Tax rate (%)

23.5

23.5

EPS growth (%)

6.9

11.1

Source: Company, Angel Research

October 21, 2016

7

TCS | 2QFY2017 Result Update

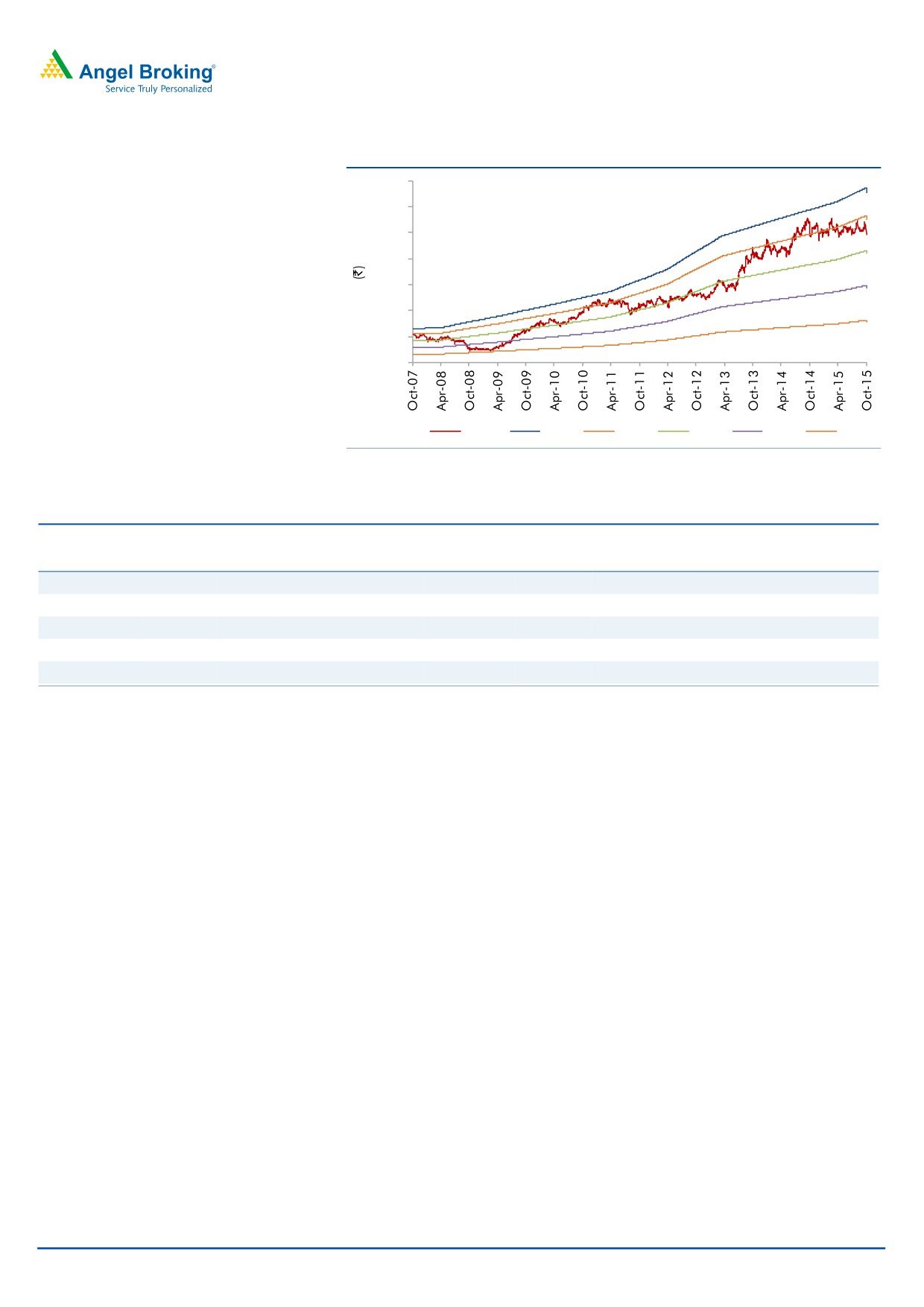

Exhibit 12: One-year forward PE chart

3,500

3,000

2,500

2,000

1,500

1,000

500

0

Price

25x

21x

16x

11x

6x

Source: Company, Angel Research

Exhibit 13: Recommendation summary

Company

Reco

CMP Tgt. price

Upside

FY2018E FY2018E

FY2016-18E

FY2018E FY2018E

(`)

(`)

(%)

EBITDA (%)

P/E (x)

EPS CAGR (%)

EV/Sales (x)

RoE (%)

HCL Tech

Buy

834

1,000

19.9

20.5

13.0

9.6

1.8

17.9

Infosys

Buy

1,038

1,249

20.3

27.0

15.0

8.4

2.5

21.6

TCS

Accumulate

2,398

2,620

9.3

27.6

16.5

8.5

3.2

33.1

Tech Mahindra

Buy

426

700

64.5

17.0

10.3

13.2

0.9

20.7

Wipro

Buy

481

680

41.3

17.9

13.0

1.3

1.7

18.1

Source: Company, Angel Research

October 21, 2016

8

TCS | 2QFY2017 Result Update

Company background

TCS is Asia's largest IT services provider and is amongst the top 10 technology

firms in the world. The company has a global footprint with an employee base of

over 3.0 lakh professionals, offering services to more than 1,000 clients across

various industry segments. The company has one of the widest portfolios of

services offerings, spanning across the entire IT service value chain - from

traditional application development and maintenance to consulting and package

implementation to products and platforms.

October 21, 2016

9

TCS | 2QFY2017 Result Update

Profit & Loss statement (Consolidated, IFRS)

Y/E March (` cr)

FY2014

FY2015

FY2016

FY2017E

FY2018E

Net sales

81,809

94,648

1,08,646

1,19,025

1,33,308

Cost of revenue

42,207

50,599

58,952

64,273

71,986

Gross profit

39,603

44,049

49,695

54,751

61,322

% of net sales

48.4

46.5

45.7

46.0

46.0

SGA expenses

14,471

17,353

18,956

21,901

24,529

% of net sales

17.7

18.3

17.4

18.4

18.4

EBITDA

25,132

26,696

30,738

32,851

36,793

% of net sales

30.7

28.2

28.3

27.6

27.6

Dep. and amortization

1324

1272

1948

2142

2400

% of net sales

1.6

1.3

1.8

1.8

1.8

EBIT

23,808

25,424

28,790

30,708

34,393

% of net sales

29.1

26.9

26.5

25.8

25.8

Other income, net

1589

3140

3050

3050

3050

Profit before tax

25,397

28,564

31,840

33,759

37,444

Provision for tax

6,071

6,083

7,503

7,933

8,799

% of PBT

23.9

21.3

23.6

23.5

23.5

PAT

19,326

22,481

24,338

25,825

28,644

Minority interest

209

205

123

141

161

Extra-ordinary (Exp.)/ Inc.

(2,627.9)

Reported PAT

19,117

19,648

24,215

25,685

28,483

Adj. PAT

19,117

21,696

24,215

25,685

28,483

Diluted EPS (`)

97.6

110.9

123.7

131.2

145.5

October 21, 2016

10

TCS | 2QFY2017 Result Update

Balance sheet (Consolidated, IFRS)

Y/E March (` cr)

FY2014 FY2015

FY2016

FY2017E

FY2018E

Assets

Cash and cash equivalents

1,469

1,862

1,862

1,862.2

1,862.2

Other current financial assets

18,107

16,383

4,833

24,974

30,729

Accounts receivable

18,230

20,440

24,073

27,071

31,694

Unbilled revenues

4,006

3,827

3,992

5,347

5,348

Other current assets

-

6,414

5,975

5,975

5,975

Property and equipment

10,364

11,572

11,790

12,790

13,790

Intangible assets and goodwill

4,157

3,931

3,946

3,946

3,946

Investments

3,449

9,619

22,822

22,822

22,822

Other non current assets

-

906

11,919

11,919

11,919

Total assets

68,913

74,954

91,212

1,16,707

1,28,085

Liabilities

Current liabilities

10,906

14,428

15,407

34,345

38,466

Short term borrowings

170

243

162

162

162

Redeemable preference shares

-

-

(0)

-

1

Long term debt

127

114

83

83

83

Other non current liabilities

1,684

1,778

2,017

2,282

2,556

Minority interest

691

914

354

495

656

Shareholders funds

55,335

57,477

73,190

79,341

86,163

Total liabilities

68,913

74,954

91,212

1,16,707

1,28,085

October 21, 2016

11

TCS | 2QFY2017 Result Update

Cash flow statement (Consolidated, IFRS)

Y/E March (` cr)

FY2014

FY2015

FY2016

FY2017E

FY2018E

Pre-tax profit from oper.

23,808

22,481

24,338

25,825

28,644

Depreciation

1,324

1,272

1,948

2,142

2,400

Exp. (deferred)/written off

209

160

174

-

-

Pre tax cash from oper

24,923

23,913

26,460

27,968

31,044

Other inc./prior period ad

1,589

1,272

1,948

2,142

2,400

Net cash from operations

26,512

25,185

28,408

30,110

33,443

Tax

6,071

6,083

7,503

7,933

8,799

Cash profits

20,441

19,102

20,905

22,177

24,644

(Inc)/dec in acc. recv.

(4,154)

(2,210)

(3,633)

(2,999)

(4,623)

(Inc)/dec in unbilled rev.

(846)

179

(165)

(1,355)

(1)

(Inc)/dec in oth. current asst.

(6,650)

(6,414)

439

-

-

Inc/(dec) in current liab.

2,223

(1,207)

(218)

(1,000)

(1,000)

Net trade working capital

(9,427)

(9,652)

(3,577)

(5,354)

(5,624)

Cash flow from opert. actv.

11,015

9,450

17,328

16,823

19,021

(Inc)/dec in fixed assets

(3,494)

(1,207)

(218)

(1,000)

(1,000)

(Inc)/dec in investments

(1,409)

(4,446)

(1,653)

(20,141)

(5,755)

(Inc)/dec in intangible asst.

(651)

(226)

16

-

-

(Inc)/dec in non-cur.asst.

(1,335)

(906)

(11,013)

-

-

Cash flow from invt. actv.

(6,889)

(6,786)

(12,869)

(21,141)

(6,755)

Inc/(dec) in debt

203

61

(113)

-

-

Inc/(dec) in equity

34

223

(559)

141

161

Inc/(dec) in minority int.

(14,666)

(19,923)

(18,415)

(19,533)

(21,661)

Dividends

10,303

16,976

14,629

23,711

9,234

Cash flow from finan. actv.

(4,126)

(2,664)

(4,459)

4,318

(12,266)

Cash generated/(utilized)

(374)

393

-

-

-

Cash at start of the year

1,843

1,469

1,862

1,862

1,862

Cash at end of the year

1,469

1,862

1,862

1,862

1,862

October 21, 2016

12

TCS | 2QFY2017 Result Update

Key ratios

Y/E March

FY2014

FY2015

FY2016

FY2017E

FY2018E

Valuation ratio(x)

P/E (on FDEPS)

24.6

21.6

19.4

18.3

16.5

P/CEPS

23.0

22.5

18.0

16.9

15.2

P/BVPS

8.5

8.2

6.4

5.9

5.4

Dividend yield (%)

1.3

1.8

1.7

1.8

2.0

EV/Sales

5.7

4.9

4.2

3.7

3.2

EV/EBITDA

18.5

17.3

14.9

13.4

11.8

EV/Total assets

6.8

6.1

5.0

3.8

3.4

Per share data (`)

EPS

97.6

110.9

123.7

131.2

145.5

Cash EPS

104.4

106.8

133.6

142.1

157.7

Dividend

32.0

43.5

40.2

42.6

47.3

Book value

283

294

374

405

440

Dupont analysis

Tax retention ratio (PAT/PBT)

0.8

0.8

0.8

0.8

0.8

Cost of debt (PBT/EBIT)

1.1

1.1

1.1

1.1

1.1

EBIT margin (EBIT/Sales)

0.3

0.3

0.3

0.3

0.3

Asset turnover ratio (Sales/Assets)

1.2

1.3

1.2

1.0

1.0

Leverage ratio (Assets/Equity)

1.2

1.3

1.2

1.5

1.5

Operating ROE

34.9

39.1

33.3

32.5

33.2

Return ratios (%)

RoCE (pre-tax)

34.5

33.9

31.6

26.3

26.9

Angel RoIC

51.9

54.0

46.7

45.8

47.3

RoE

34.5

34.2

33.1

32.4

33.1

Turnover ratios(x)

Asset turnover (fixed assets)

7.9

8.2

9.2

9.3

9.7

Receivables days

81

79

81

83

87

October 21, 2016

13

TCS | 2QFY2017 Result Update

Research Team Tel: 022 - 39357800

DISCLAIMER

Angel Broking Private Limited (hereinafter referred to as “Angel”) is a registered Member of National Stock Exchange of India Limited,

Bombay Stock Exchange Limited and Metropolitan Stock Exchange Limited. It is also registered as a Depository Participant with CDSL

and Portfolio Manager with SEBI. It also has registration with AMFI as a Mutual Fund Distributor. Angel Broking Private Limited is a

registered entity with SEBI for Research Analyst in terms of SEBI (Research Analyst) Regulations, 2014 vide registration number

INH000000164. Angel or its associates has not been debarred/ suspended by SEBI or any other regulatory authority for accessing

/dealing in securities Market. Angel or its associates/analyst has not received any compensation / managed or co-managed public

offering of securities of the company covered by Analyst during the past twelve months.

This document is solely for the personal information of the recipient, and must not be singularly used as the basis of any investment

decision. Nothing in this document should be construed as investment or financial advice. Each recipient of this document should

make such investigations as they deem necessary to arrive at an independent evaluation of an investment in the securities of the

companies referred to in this document (including the merits and risks involved), and should consult their own advisors to determine

the merits and risks of such an investment.

Reports based on technical and derivative analysis center on studying charts of a stock's price movement, outstanding positions and

trading volume, as opposed to focusing on a company's fundamentals and, as such, may not match with a report on a company's

fundamentals. Investors are advised to refer the Fundamental and Technical Research Reports available on our website to evaluate the

contrary view, if any.

The information in this document has been printed on the basis of publicly available information, internal data and other reliable

sources believed to be true, but we do not represent that it is accurate or complete and it should not be relied on as such, as this

document is for general guidance only. Angel Broking Pvt. Limited or any of its affiliates/ group companies shall not be in any way

responsible for any loss or damage that may arise to any person from any inadvertent error in the information contained in this report.

Angel Broking Pvt. Limited has not independently verified all the information contained within this document. Accordingly, we cannot

testify, nor make any representation or warranty, express or implied, to the accuracy, contents or data contained within this document.

While Angel Broking Pvt. Limited endeavors to update on a reasonable basis the information discussed in this material, there may be

regulatory, compliance, or other reasons that prevent us from doing so.

This document is being supplied to you solely for your information, and its contents, information or data may not be reproduced,

redistributed or passed on, directly or indirectly.

Neither Angel Broking Pvt. Limited, nor its directors, employees or affiliates shall be liable for any loss or damage that may arise from

or in connection with the use of this information.

Disclosure of Interest Statement

TCS

1. Financial interest of research analyst or Angel or his Associate or his relative

No

2. Ownership of 1% or more of the stock by research analyst or Angel or associates or relatives

No

3. Served as an officer, director or employee of the company covered under Research

No

4. Broking relationship with company covered under Research

No

Ratings (Based on expected returns

Buy (> 15%)

Accumulate (5% to 15%)

Neutral (-5 to 5%)

over 12 months investment period):

Reduce (-5% to -15%)

Sell (< -15)

October 21, 2016

14