2QFY2016 Result Update | Cons. Durable

November 7, 2015

Surya Roshni

BUY

CMP

`127

Performance Highlights

Target Price

`183

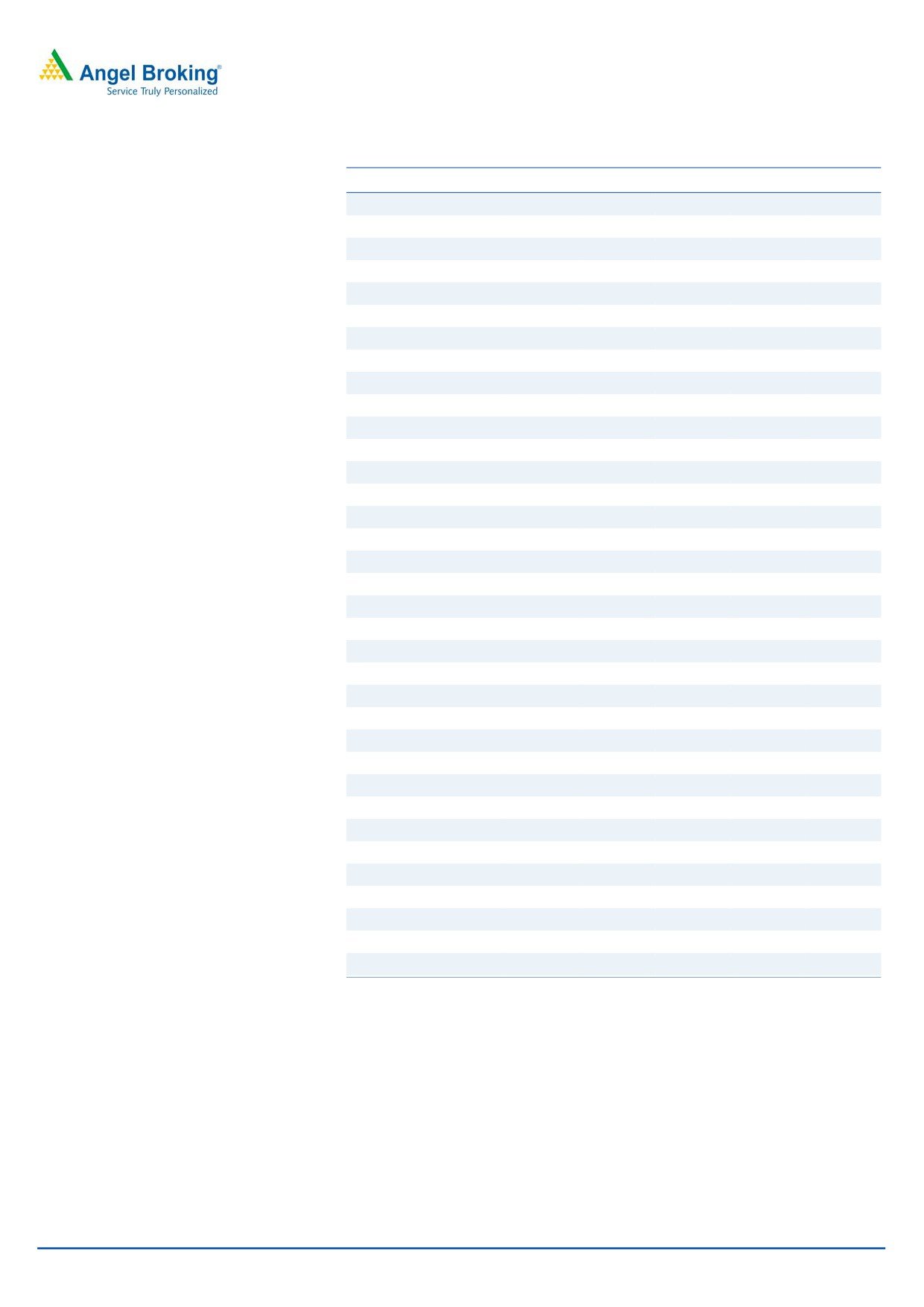

Y/E March (` cr)

2QFY16 2QFY16

% chg (yoy) 2QFY16

% chg (qoq)

Investment Period

12 Months

Net Sales

722

692

4.3

731

(1.3)

EBITDA

57

57

(0.3)

56

1.3

Stock Info

EBITDA margin (%)

7.8

8.2

(36)bp

7.6

20bp

Sector

Con. Durable

PAT

13

12

3.7

12

8.1

Market Cap (` cr)

556

Source: Company, Angel Research

Beta

1.8

Surya Roshni (SRL) reported a decent set of numbers for 2QFY2016. Its top-line grew by

52 Week High / Low

89 / 163

4.3% yoy to `722cr led by a superb performance by the Lighting division. The EBITDA

Avg. Daily Volume

1,22,534

margin witnessed a slight decline of 36bp yoy to 7.8% on account of higher employee and

other expenses. However, the same was mostly made up by a 244bp yoy decline in raw

Face Value (`)

10.00

material cost to 70.3% of sales. The interest cost declined by 16.3% yoy to `24cr and as a

BSE Sensex

26,265

result, the net profit grew by 3.7% yoy to `13cr vis-à-vis our estimate of `17cr.

Nifty

7,954

Structural shift in the Lighting industry presents new growth opportunity: We expect SRL to

Reuters Code

SURR.BO

benefit from the structural shift in the lighting industry towards LED lighting, which is

Bloomberg Code

SYR@IN

expected to grow at a CAGR of 28% over FY2015E-21E. SRL is the second largest lighting

company in India with a market share of ~ 25%. With demand for LEDs expected to rise,

Shareholding Pattern (%)

the company would be a key beneficiary, given that the company’s ”Surya” brand is well

recognized and has superior market reach with its 2 lakh plus retailers.

Promoters

63.3

MF / Banks / Indian Fls

0.1

Higher contribution from Lighting division to boost margins: SRL’s Steel Pipes business,

FII / NRIs / OCBs

0.1

entails low profitability and has higher debt, thus having resulted in high overall debt/equity

Indian Public / Others

36.5

for the company. The Lighting business’ contribution to the overall top-line of the company

has increased from 30% in FY2012 to 40% in FY2015. The Lighting business commands

higher margins (10.7%) vs the steel business (2.9%) and contributes by 70% to the

Abs. (%)

3m 1yr

3yr

company’s overall profitability. We expect the Lighting business’ contribution to rise on

account of growth coming in from LEDs, thus enhancing overall profitability. Additionally,

Sensex

(7.2)

(5.8)

39.6

with healthy cash flow generated from the Lighting business and lower interest rate scenario

Surya Roshni

(19.0)

31.8

85.1

prevailing, we expect the company to slowly reduce its debt.

Outlook and Valuation: With higher contribution from the Lighting business and entry into

3 Year Price Chart

newer businesses, we expect the company to post a top-line CAGR of 6.2% over FY2015E-

180

17E to `3,223cr. The EBITDA margin is estimated to improve from 7.8% in FY2015 to 8.4% in

160

FY2017. Consequently, the net profit is expected to post a CAGR of 21.6% over FY2015E-17 to

140

120

`80cr. At the current market price, the stock is trading at a cheap valuation of 6.9x its

100

FY2017E earnings. We maintain our Buy rating on the company with a target price of

80

`183, based on a target PE of 10.0x for FY2017E.

60

40

Financials

20

Y/E March (` cr)

FY2013

FY2014

FY2015

FY2016E

FY2017E

0

Net Sales

2,959

3,031

2,857

2,992

3,223

% chg

15.8

2.4

(5.7)

4.7

7.7

Adj. Net Profit

69

53

54

64

80

% chg

33.2

(22.9)

1.4

19.1

24.2

OPM (%)

8.0

7.7

7.8

8.1

8.4

EPS (Rs)

15.8

12.2

12.3

14.7

18.3

P/E (x)

8.0

10.4

10.3

8.6

6.9

P/BV (x)

1.0

0.9

0.9

0.8

0.7

RoE (%)

13.3

9.4

8.8

9.7

11.0

RoCE (%)

11.1

10.1

9.0

9.8

11.0

Milan Desai

EV/Sales (x)

0.5

0.5

0.5

0.5

0.4

022 4000 3600 ext- 6846

EV/EBITDA (x)

5.7

6.5

6.4

5.7

5.1

Source: Company, Angel Research

Please refer to important disclosures at the end of this report

1

Surya Roshni | 2QFY2016 Result Update

Exhibit 1: 2QFY2016 Performance highlights

Y/E March (` cr)

2QFY16

2QFY15

yoy chg (%)

1QFY16

qoq chg (%)

1HFY16

1HFY15

% chg

Net Sales

722

692

4.3

731

(1.3)

1,453

1,364

6.5

Net raw material

508

503

0.8

529

(4.0)

1,036

994

4.2

(% of Sales)

70.3

72.8

(244)bp

72.3

(196)bp

71.3

72.9

(160)bp

Staff Costs

45

38

19.4

44

1.7

89

76

17.3

(% of Sales)

6.2

5.5

79bp

6.1

18bp

6.2

5.6

56bp

Other Expenses

112

94

19.9

102

9.8

215

181

18.9

(% of Sales)

15.6

13.6

202bp

14.0

157bp

14.8

13.3

154bp

Total Expenditure

665

635

4.8

675

(1.5)

1,341

1,251

7.1

Operating Profit

57

57

(0.3)

56

1.3

112

112

(0.0)

OPM

7.8

8.2

(36)bp

7.6

20bp

7.7

8.2

(51)bp

Interest

24

29

(16.3)

25

(2.2)

49

58

(15.3)

Depreciation

15.37

13.97

10.0

15

3.0

30

28

9.6

Other Income

0.3

0.5

(47.2)

0.2

40.0

0

1

(34.2)

PBT

17

14

20.3

16

5.7

34

28

21.4

(% of Sales)

2.4

2.1

2.2

2.3

2.0

Tax

5

2

5

9

4

(% of PBT)

26

14

28

27

15

Reported PAT

13

12

3.7

12

8.1

25

24

4.4

PATM

1.8

1.8

1.6

1.7

1.7

(3)bp

Source: Company, Angel Research

Exhibit 2: Actual vs. Angel estimate (2QFY2016)

(` cr)

Actual (` cr)

Estimate (` cr)

% variation

Total Income

722

734

(1.6)

EBIDTA

57

61

(6.7)

EBIDTA margin

7.8

8.3

(42)bp

Adj. PAT

13

17

(25.3)

Source: Company, Angel Research

Numbers broadly in-line with estimates

For 2QFY2016, SRL posted a decent set of numbers. The top-line grew by 4.3%

yoy to `722cr led by a superb performance by the Lighting division. The top-line

was marginally below our estimate of `734cr. The EBITDA margin witnessed a

slight decline of 36bp yoy to 7.8% (against our estimate of 8.3%) on account of

higher employee and other expenses. However, the same was mostly made up by

a 244bp yoy decline in raw material cost to 70.3% of sales. The company had

incurred a higher advertisement spent in 1QFY2016 as it roped in celebrities to

promote its Lighting business which could have resulted in higher other expenses

during 2QFY2016. The company has reduced its debt in the half year (1HFY2016)

and as a result, the interest cost for the quarter declined by 16.3% yoy to `24cr.

Aided by lower interest outgo, the net profit grew by 3.7% yoy to `13cr vis-à-vis

our estimate of `17cr.

November 7, 2015

2

Surya Roshni | 2QFY2016 Result Update

Segment-wise performance

Exhibit 3: Segment-wise performance

Y/E March (` cr)

2QFY16

2QFY16

% chg (yoy) 2QFY16

% chg (qoq)

Total Revenue

A) Steel Products

414

457

(9.2)

466

(11.1)

B) Lighting Poducts

355

286

24.1

318

11.7

Total

770

743

3.6

784

(1.8)

Excise Duty

(48)

(51)

(53)

Net Sales

722

692

4.3

731

(1.3)

Segmental Profit

A) Steel Products

9

13

(30.0)

10

(9.5)

B) Lighting Poducts

32

30

7.0

31

4.4

Segmental Margin (%)

A) Steel Products

2.2

2.9

(66)bp

2.2

4bp

B) Lighting Poducts

9.1

10.5

(145)bp

9.7

(64)bp

Source: Company, Angel Research

Steel products: The Steel business’ top-line declined by 9.2% yoy to `414cr.

The volume for the company grew by 9.0% yoy but the lower steel prices dragged

down the realizations by ~17.0%. The segment’s profits declined by 30.0% yoy to

`9cr and the margin declined by 66bp yoy to 2.2% on account of inventory loss.

The company has recently started manufacturing square and rectangular section

(hollow) pipes which are used for civil structures, furniture, transmission towers, etc.

The response has been favorable and is expected to add to the Steel business’

turnover in the future.

Lighting products: The Lighting business posted a robust growth of 24.1% yoy

to `355cr, but the segment’s margin declined by 145bp yoy to 9.1%. The

segment’s profitability increased by 7.0% yoy to `32cr. The decline in margin is

owing to the company increasing its advertisement spend since 4QFY2015 to

promote its newly launched products. As a result, profitability too was impacted.

November 7, 2015

3

Surya Roshni | 2QFY2016 Result Update

Investment Arguments

Structural shift in the industry presents growth opportunity.

In line with the industry trend, the company has added a wide range of LED

products to its offerings. There is an ongoing change in preference towards LED

lighting over CFL and GLS bulbs, owing to the former’s cost effective nature.

Industry reports suggest that LEDs will soon replace GLS and CFL and this will be

due to measures taken by the government like changing all street lights and lights

in public spaces to LED lights, making all LED specifications mandatory, and

providing free LED lamps instead of CFL bulbs to below poverty line (BPL) families.

In our opinion, switchover to LED lighting for street and public lighting provides

significant opportunity to the companies in the segment.

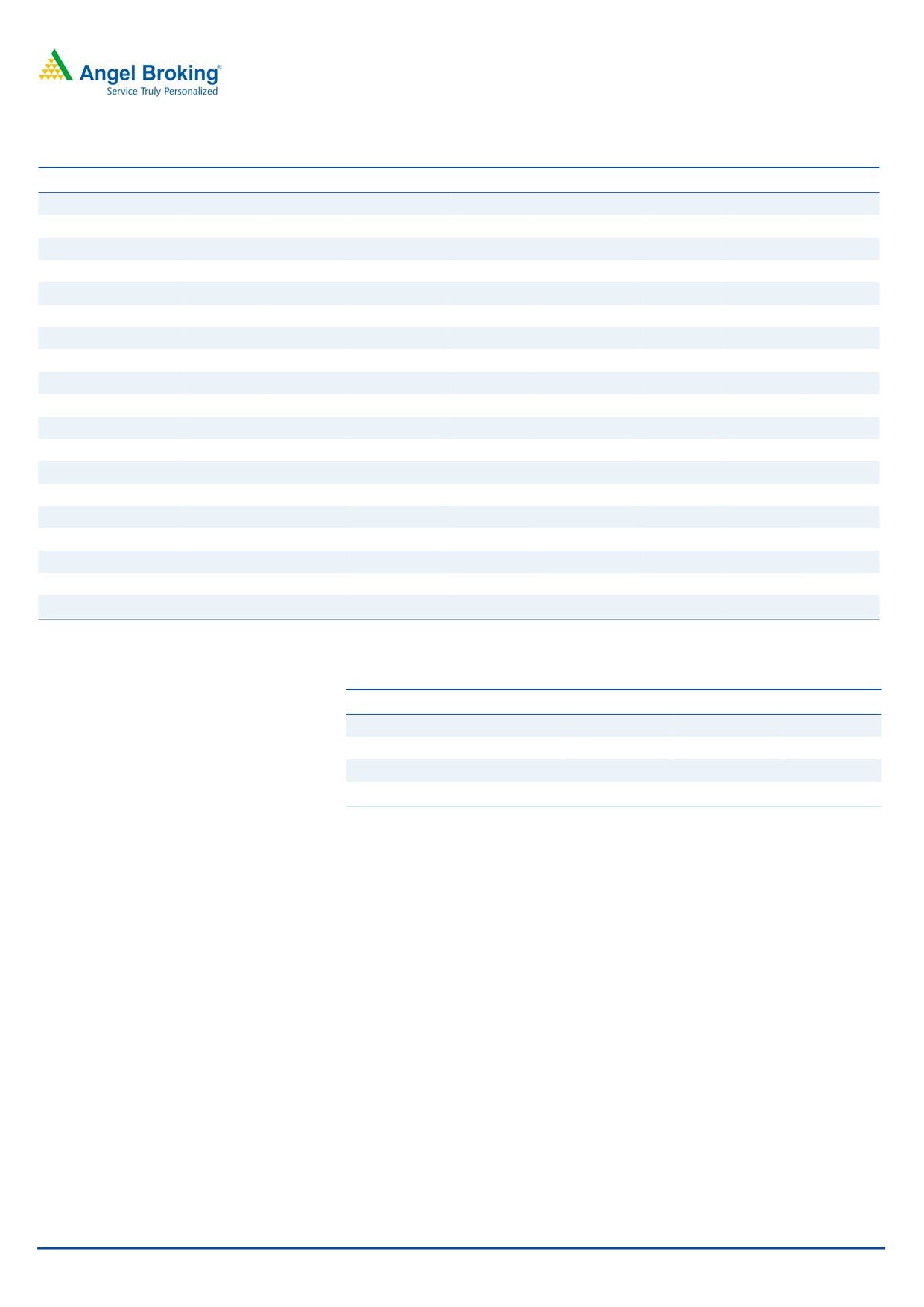

Citing this structural shift, ELCOMA expects the market size of LED to touch

~`10,500cr by FY2017E and reach

~`21,630cr by FY2021. As per the

projections, LEDs are expected to account for ~58% of the total lighting industry by

FY2021. Currently, LED revenues of SRL for FY2015 are estimated to be at

~`100cr. In the current financial year, the company has been awarded orders

worth `100cr to supply LED bulbs, street lights and other lighting products from

EESL and other PSUs. The Management expects LEDs to contribute ~30% to the

company’s Lighting business’ turnover in the next two to three years, while

targeting revenue of ~`500cr from the segment.

Exhibit 4: LEDs’ contribution to increase significantly

40

GLS

Others

LED

CFL

FTL

35

30

25

22

20

19

19

15

15

10

8

10

5

2

5

-

FY14

FY15

FY16

FY17

FY18

FY19

FY20

FY21

Source: ELCOMA, Angel Research

Strong position in the lighting industry

The Indian lighting industry has displayed strong growth over the years, posting a

CAGR of 18.6% over FY2011-14 to reach `13,500cr. The growth has been largely

driven by shift from GLS lamps to CFLs and the next round of growth is expected to

come from the LED segment. Tracing this, the Indian lighting industry is expected

to grow at a CAGR of 22.8% over FY2014-17E to `25,000cr and reach the

`37,000cr mark by FY2021.

This positive outlook on the lighting industry augurs well for SRL as it is the second

largest lighting company in India. In the domestic lighting segment, Surya is a

November 7, 2015

4

Surya Roshni | 2QFY2016 Result Update

prominent brand in the consumer market and it has a market share in excess of

25%. It has a network of 2 lakh retailers across the country. The company has

maintained its brand identity over the years and has also doubled its advertisement

spend in the past year to assist its dealer network.

It has a state-of-the-art research and development centre in Noida which assists in

launching efficient products for the markets. Additionally, the company has

decided to venture into the business of solar power based lighting systems for rural

and urban use which will be an additional revenue source for the company.

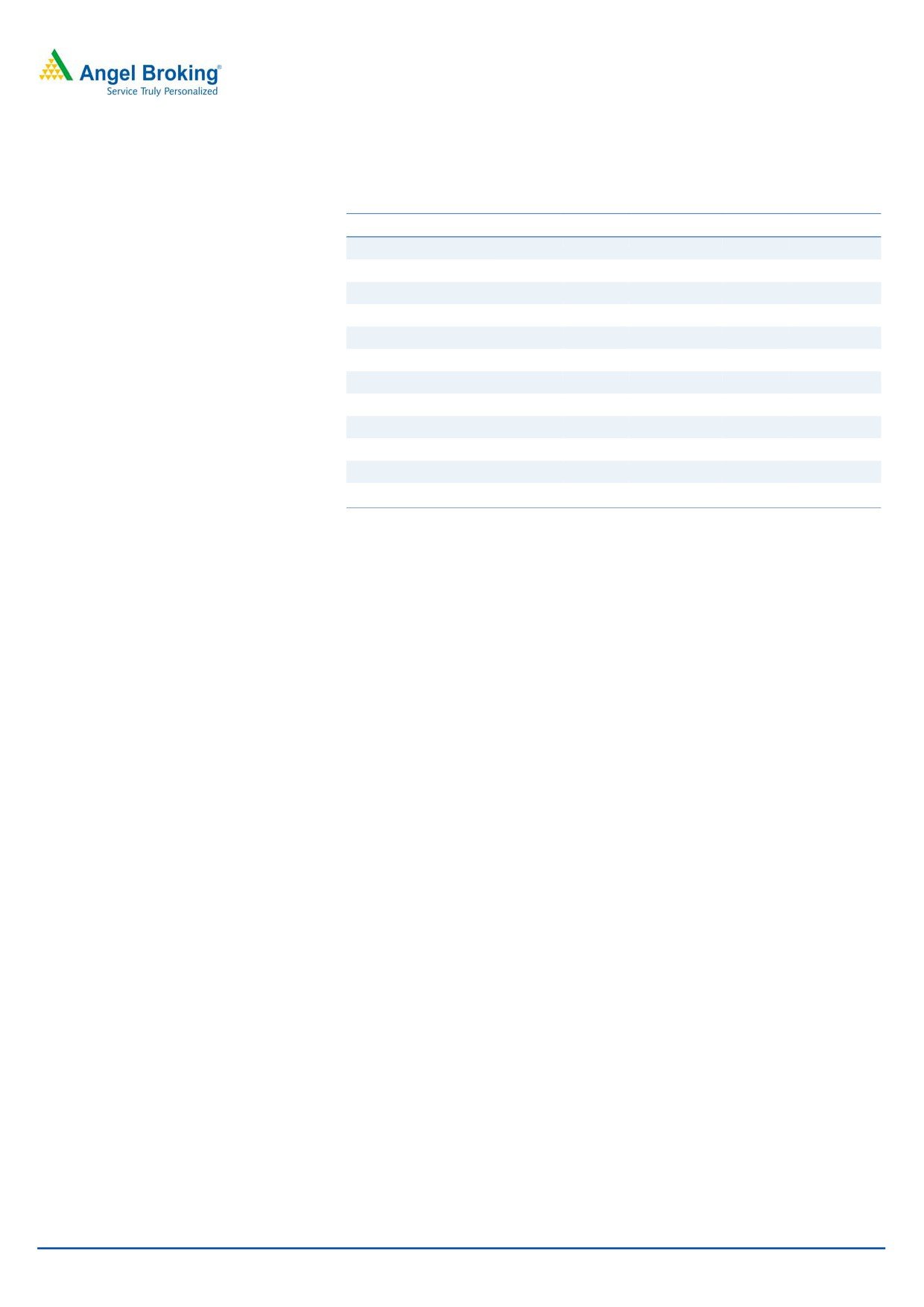

Higher contribution from the Lighting division to boost profitability

Historically, the company’s Steel division has been a major contributor to the

overall revenues vis-à-vis its Lighting division. In the past, the contribution has

been 70%-30% in favor of the Steel division. As for profitability, the Lighting

business has a better margin profile than the Steel business. A look at the recent

performance suggests that the trend seems to be changing, especially since

FY2014, where the Lighting business accounted for 35.5% of overall sales vs

30.6% in FY2013. This share further climbed up to 40.2% in FY2015 and we

expect it to reach the level of 45% by FY2017.

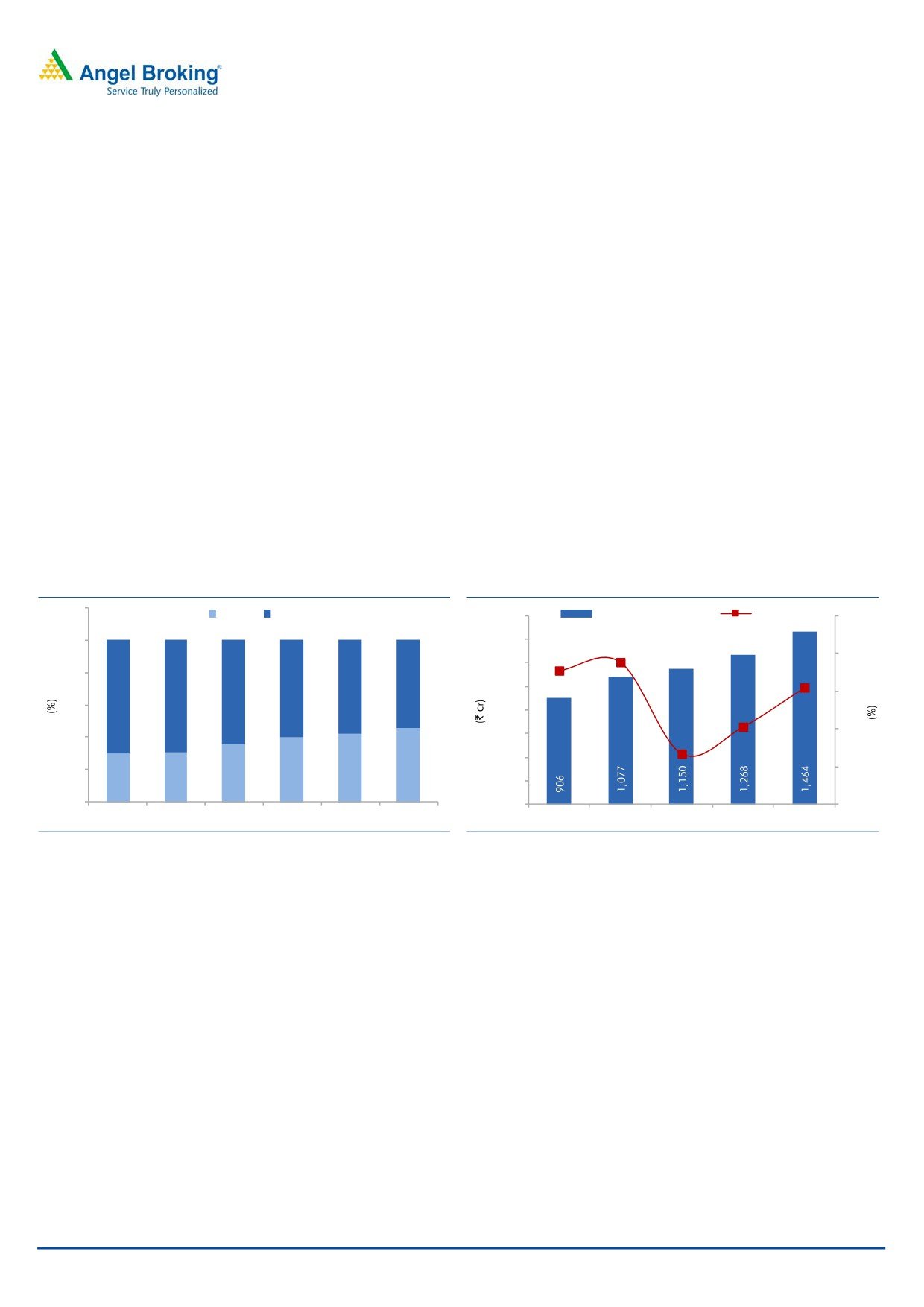

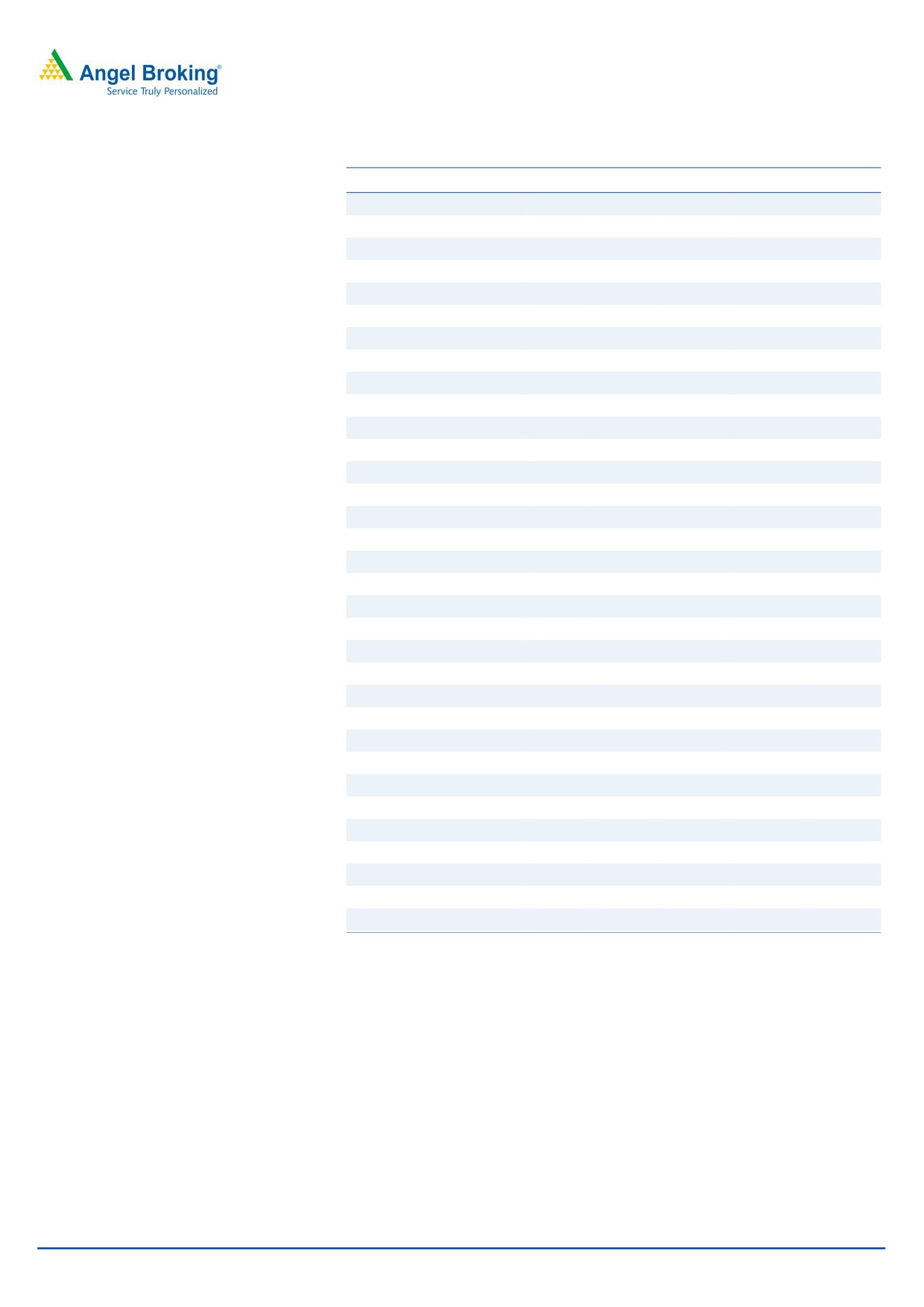

Exhibit 5: Lighting business’ contribution to improve

Exhibit 6: Lighting business Revenue Trend

120

Lighting

Steel

1,600

Lighting Revenue (LHS)

Growth (RHS)

25.0

1,400

100

20.0

1,200

18.8

80

17.7

55

1,000

64

60

58

15.0

70

69

15.5

60

800

10.0

40

600

10.3

6.7

400

45

5.0

20

36

40

42

30

31

200

-

-

-

FY2012

FY2013

FY2014

FY2015E FY2016E FY2017E

FY2013

FY2014

FY2015E

FY2016E

FY2017E

Source: Company, Angel Research

Source: Company, Angel Research

SRL is the only lighting company with 100% backward integration, which benefits

the company in terms of availability of best quality raw materials at effectively

lower costs. We expect increase in contribution from the Lighting division, driven by

shift towards LEDs, to boost the overall profitability of the company.

Lower interest cost to add to bottom-line

The declining interest rate scenario is likely to benefit leveraged companies like

SRL. The Reserve Bank of India (RBI), since the beginning of the current financial

year, has reduced interest rates by 75bp. With interest rates expected to reduce

further, SRL’s interest expense will be lower and we expect the company to use its

healthy cash flows from the Lighting business to slowly reduce its debt. The

company has reduced its debt in the last year and followed on with debt reduction

of ~`65cr in 1HFY2016.

November 7, 2015

5

Surya Roshni | 2QFY2016 Result Update

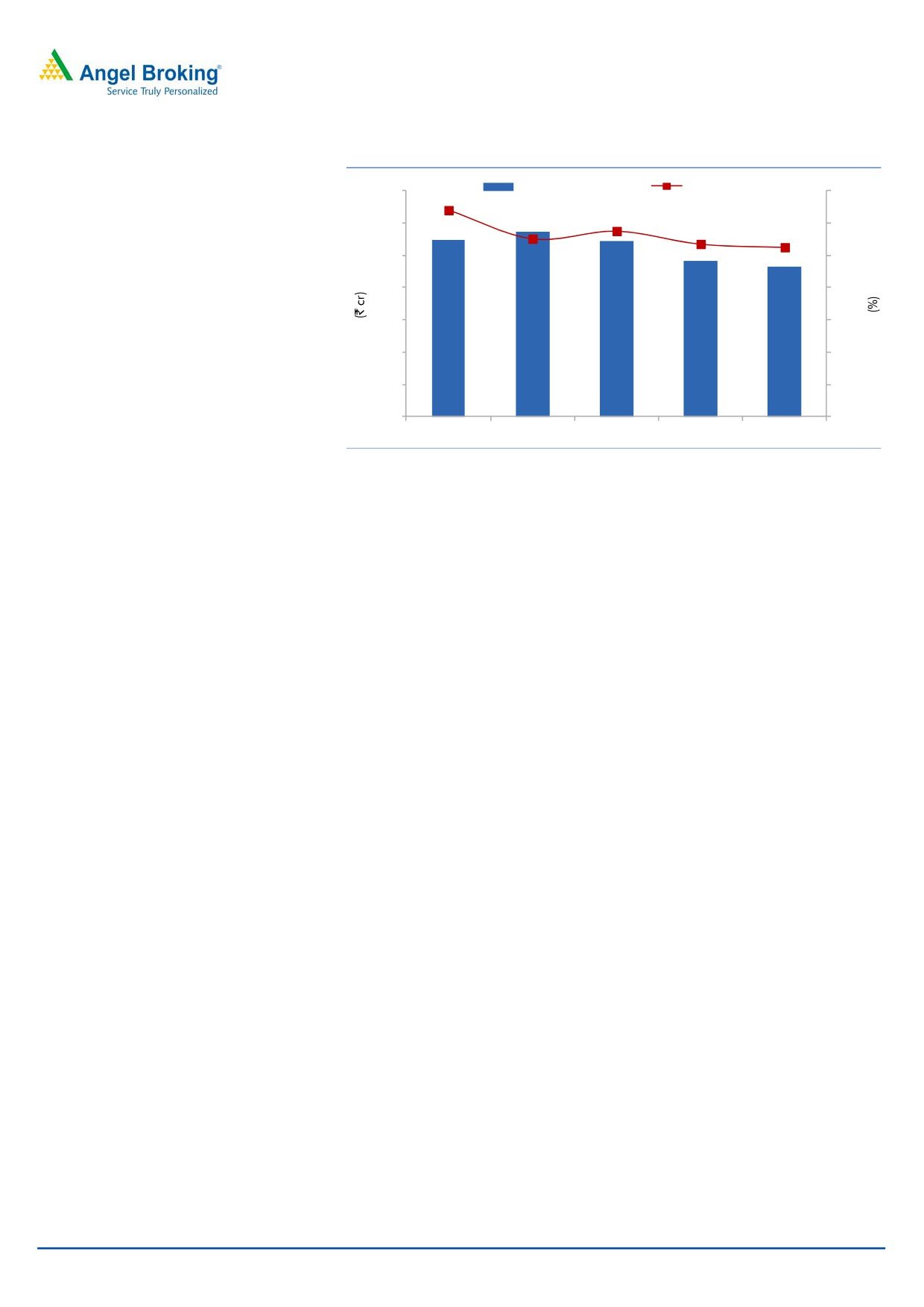

Exhibit 7: Decline in interest cost

Interest Expense (LHS)

% of Debt (RHS)

140

14.0

12.8

120

11.0

12.0

11.5

10.7

100

10.5

10.0

80

8.0

60

6.0

40

4.0

20

2.0

110

114

109

96

93

-

-

FY2013

FY2014

FY2015E

FY2016E

FY2017E

Source: Company, Angel Research

Fans business receiving good response; Company forays into

Appliances business

In January 2014, the company entered the `5,000cr Indian fan industry by

launching its ‘Surya’ brand of fans which has received a favorable response. With

an assist from its strong retail network, the company was able to clock revenues of

~`60cr (FY2015) in a relatively shorter period of time. Encouraged by the

impressive response to its Fans business, the company has recently forayed into the

Home Appliances business in the Indian market. The range of product offerings

includes water heaters/room heaters, dry irons, steam irons and mixer-grinders.

The Management expects to achieve `200cr of sales from the Fans business by

FY2016 and further targets to reach the `500cr mark in a span of three-four

years. As for Home Appliance, the Management expects to garner revenue of

`200cr from this segment by FY2017E.

Steel business to remain under pressure

Although the Steel business’ share in overall revenues of the company has been

declining in recent times, it is still a major part of the company’s operations. It is a

leader in the steel tube industry in India with products for infra, oil & gas, and

construction sectors. Apart from the standalone business, the company has

investment in Surya Global Steel Tubes Ltd (SGSTL), holding 49.99% stake in it.

SGSTL is into manufacturing of ERW and spiral pipes at its plant in Bhuj (Gujarat),

mainly catering towards exports (75%). Owing to declining steel prices, the

performance of the segment has been negatively impacted. In the near term, we

expect the performance of the division to just be stable and not be impressive

owing to lower steel prices (hurting realizations) and lower oil prices, which has

dampened demand from the oil exploration side. However, in the long run, the

division should post better results once the demand from oil and gas, infra and

other sectors begins to pick up. Further, the government’s vision to build 100 smart

cities will have a favorable impact on the steel pipe business, in the longer term

time horizon.

November 7, 2015

6

Surya Roshni | 2QFY2016 Result Update

Financials

With surging contribution of the Lighting business (on the back of shift from CFL to

LED), we expect the company’s revenue to improve from `2,857cr in FY2015E to

`3,223cr in FY2017E. We also expect the Fans business’ contribution to improve

and expect the Appliances business to benefit from the brand pull and pan India

retail network of the company, much like the Fans business.

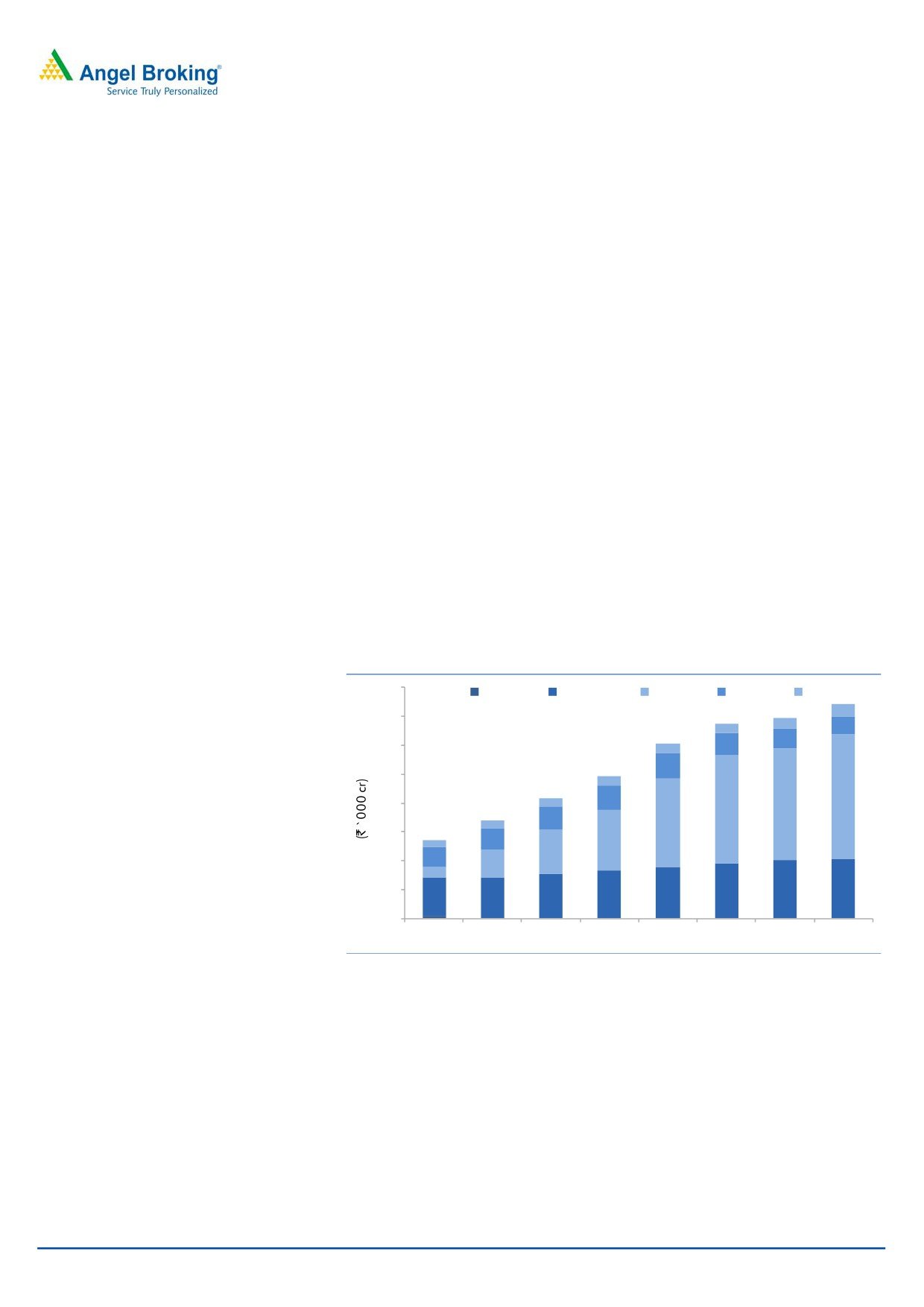

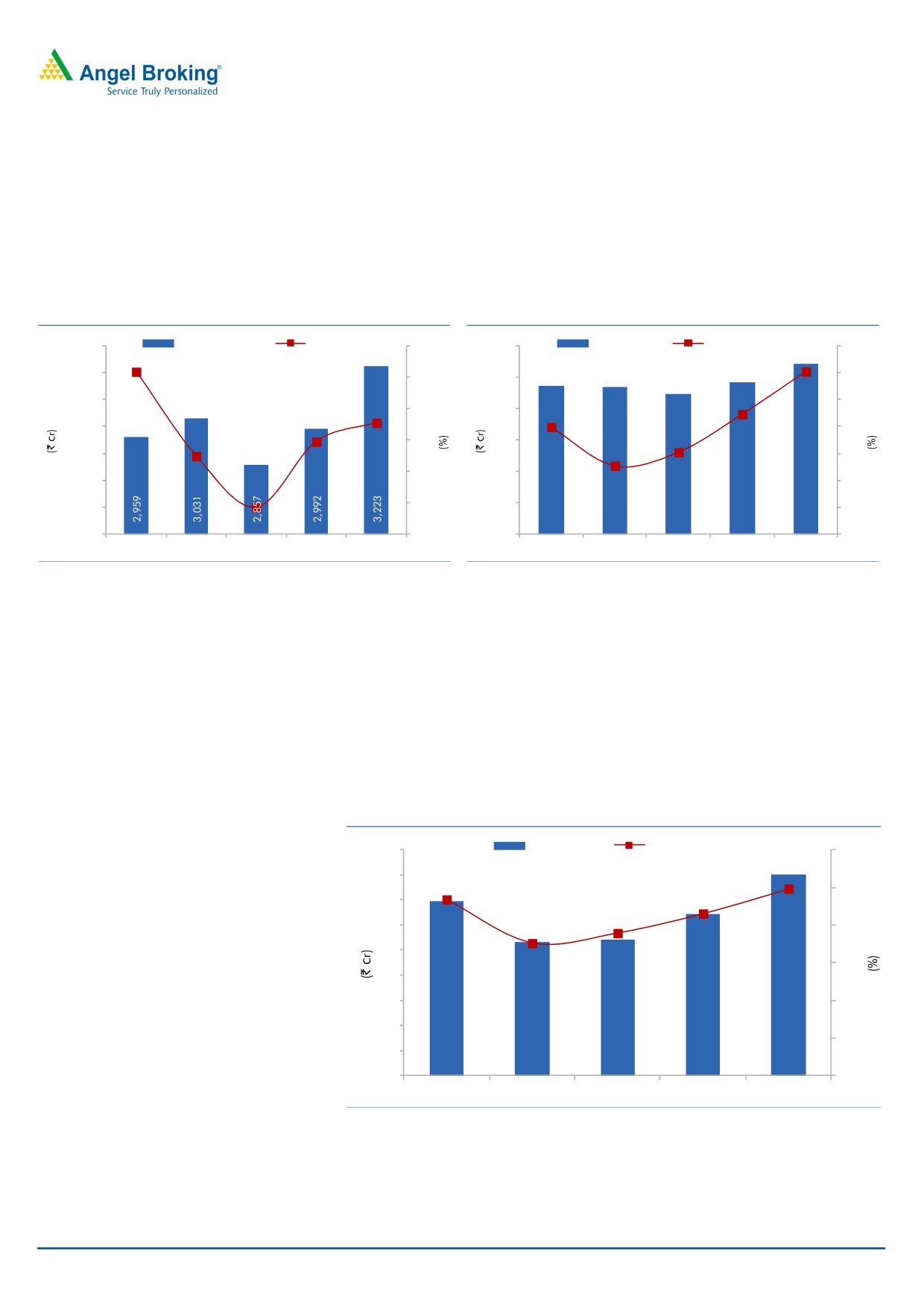

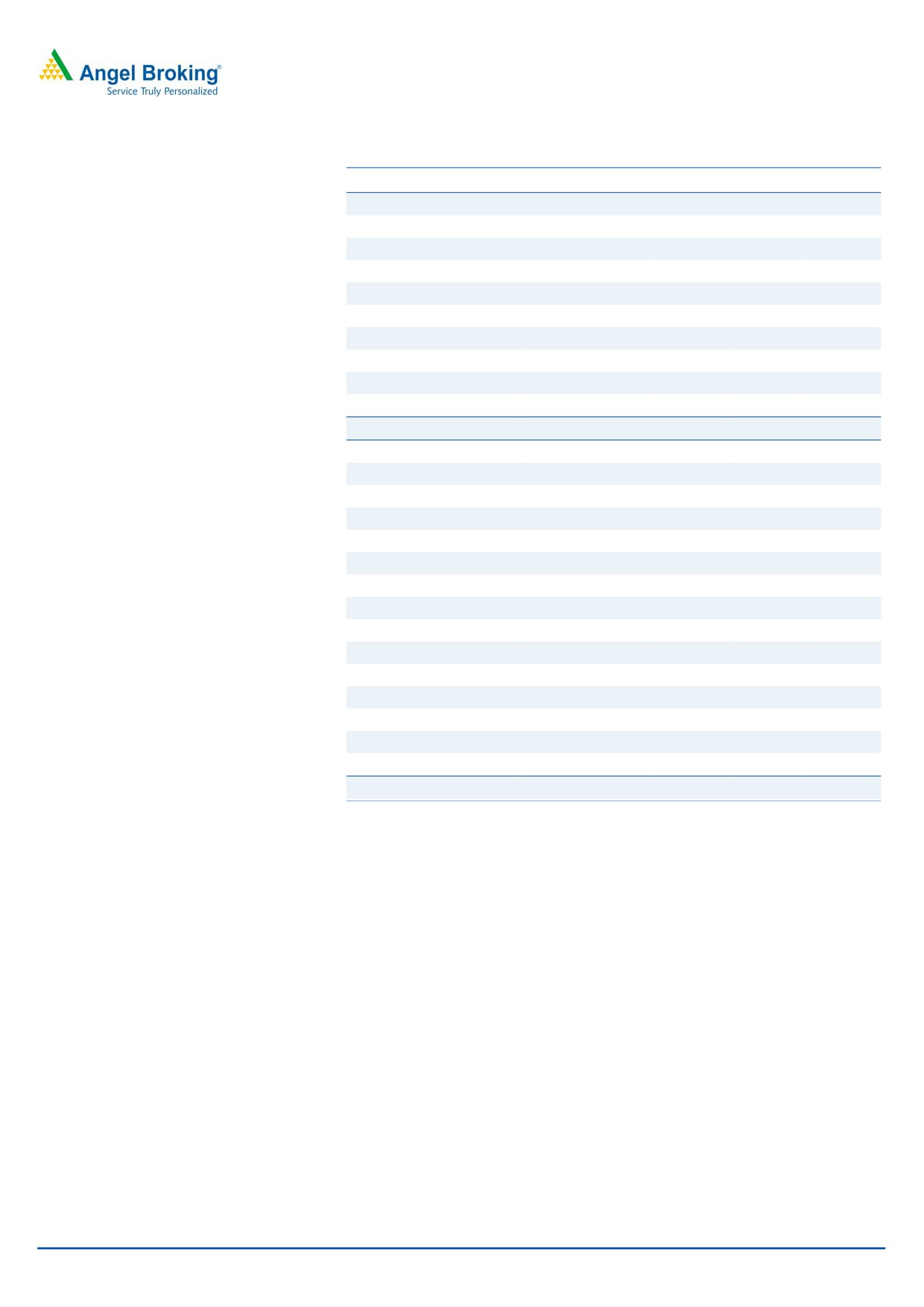

Exhibit 8: Revenue trend

Exhibit 9: EBITDA Margins to improve

3,300

Revenue (LHS)

Growth (RHS)

20.0

300

EBITDA (LHS)

EBITDA Margins (RHS)

8.6

3,200

15.8

8.4

15.0

250

8.4

3,100

8.2

10.0

200

3,000

7.7

8.0

8.1

8.0

5.0

150

2,900

4.7

7.8

7.8

2.4

7.7

-

100

2,800

7.6

(5.7)

(5.0)

50

2,700

7.4

237

234

223

242

271

2,600

(10.0)

0

7.2

FY2013

FY2014

FY2015E FY2016E FY2017E

FY2013

FY2014

FY2015E

FY2016E

FY2017E

Source: Company, Angel Research

Source: Company, Angel Research

Higher contribution from Lighting to maintain EBITDA margins

Owing to higher contribution from the Lighting business, the EBITDA margins for

the company are expected to improve from 7.8% in FY2015 to 8.4% in FY2017

despite of declining profitability of the Steel business. The declining interest rate

environment will have a positive impact on leveraged companies like SRL. We

expect interest expense to decline from `109cr in FY2015 to `93cr in FY2017.

With the above estimates we believe that the company’s net profit should improve

from `54cr in FY2015 to `80cr in FY2017.

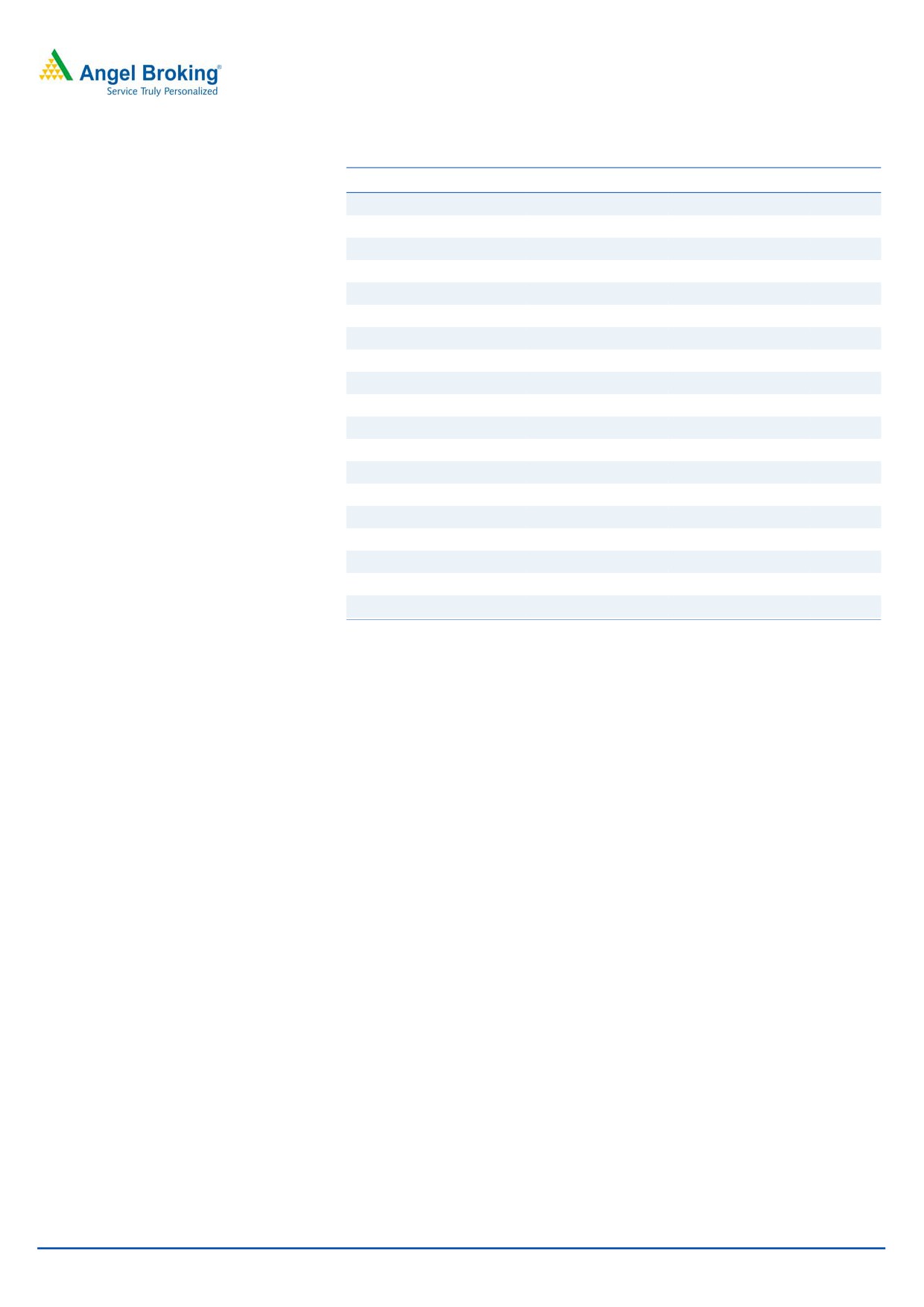

Exhibit 10: PAT trajectory

PAT (LHS)

PAT Margins (RHS)

90

3.0

80

2.3

2.5

2.5

70

1.9

2.2

60

1.8

2.0

50

1.5

40

30

1.0

20

0.5

10

69

53

54

64

80

0

0.0

FY2013

FY2014

FY2015E

FY2016E

FY2017E

Source: Company, Angel Research

November 7, 2015

7

Surya Roshni | 2QFY2016 Result Update

Outlook and Valuation

With higher contribution from the Lighting business and entry into newer

businesses, we expect the company to post a CAGR of 6.2% in the top-line over

FY2015E-17E to `3,223cr. The EBITDA margin is estimated to improve from 7.8%

in FY2015 to 8.4% in FY2017. Consequently, the net profit is expected to post a

CAGR of 21.6% over FY2015E-17 to `80cr. At the current market price, the stock

is trading at a cheap valuation of 6.9x its FY2017E earnings. We maintain our Buy

rating on the company and revise our target price to `183, based on a target PE of

10.0x for FY2017E.

Exhibit 11: Steel Business Peer comparison (TTM basis)

Sales EBIT

EBIT Margin Capital Employed

ROCE

(` cr)

(` cr)

(%)

(` cr)

(%)

APL Apollo Consolidated

3,265

164

5.0

928

17.7

Surya Roshni

1,843

43

2.3

1,047

4.1

Source: Company, Angel Research

Exhibit 12: Lighting Business Peer comparison (TTM basis)

Sales

EBIT

EBIT Margin

Capital Employed

ROCE

(` cr)

(` cr)

(%)

(` cr)

(%)

Orient Paper & Ind Ltd

1,225

57

4.6

363

15.6

Surya Roshni

1,312

125

9.5

721

17.3

Source: Company, Angel Research

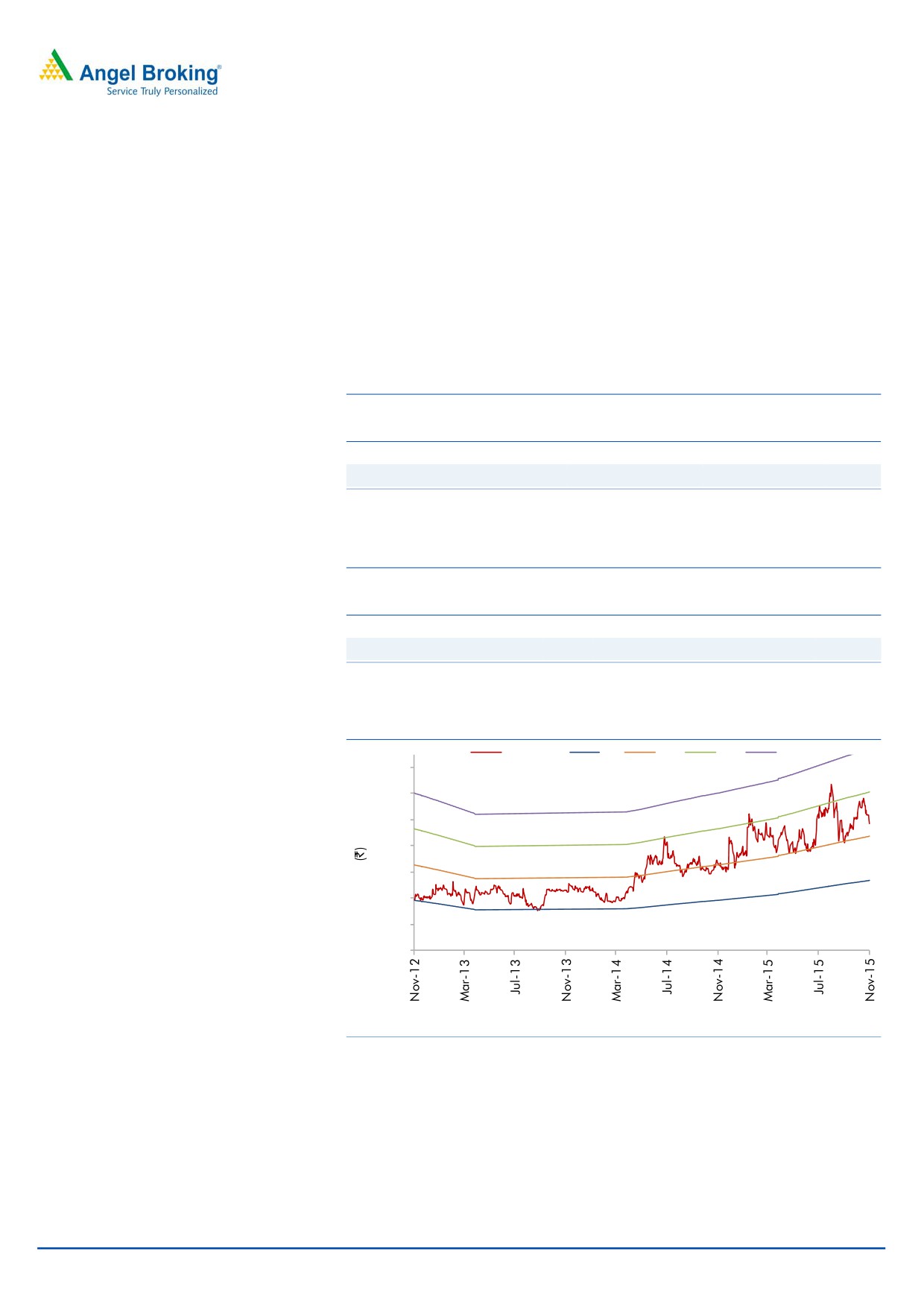

Exhibit 13: One-year forward P/E band

Price (`)

4

7x

9x

11x

170

150

130

110

90

70

50

30

Source: Company, Angel Research

Key Risks

Competition from Unorganized players - Competition from the unorganized sector

and cheaper imports from China could hurt the company’s sales.

November 7, 2015

8

Surya Roshni | 2QFY2016 Result Update

Sharp movement in commodity prices - Metal is a major raw material for the steel

tube and pipes segment. Steep increase in raw material cost will have a negative

impact on the performance of the company.

Downturn in Economy - Failure in revival of the economy or deterioration in the

economic condition will have a negative impact on both the Steel and Lighting

businesses.

Corporate Guarantee for Loans to Subsidiary - The company has provided

corporate guarantee in favor of bank for loans to its subsidiary Surya Global Steel

Tubes Ltd for a sum of `135cr (outstanding portion is `21cr as on 31st March

2015). Non repayment of the loan may result in an increase in debt, thus working

against our estimates.

We have based our assumptions on the structural shift in the Lighting industry

towards LED lighting. Delay in switchover to LED or any other issues that may

impact the LED switchover will have a negative impact on the revenues of the

company.

November 7, 2015

9

Surya Roshni | 2QFY2016 Result Update

Company Background

Surya Roshni Ltd is a 38 year old conglomerate with its core business comprising

of lighting and steel tube products. The company has nearly four decades of

experience in the steel pipe industry and nearly three decades of experience in the

lighting industry. The company is a reputable name in India and also has presence

in over more than 54 countries. It has recently forayed into fans and appliances

businesses.

Steel - The company is a leader in the steel pipe industry and is the largest G.I &

Hollow section Pipe manufacturer in India. It has the largest ERW pipe and cold

rolled strips mills at Bahadurgarh, Haryana. It also produces API pipes for India as

well as export markets. The pipe division produces nearly 8 lakh MT per annum in

various sizes and specifications. The exports from the segment account for ~17%

(`340cr) of total revenues.

Lighting

- The company is the second largest lighting company in India

commanding a market share in excess of 25%. The company’s existing range of

products includes LED lamps, CFL, tube light, GLS, luminaries and accessories,

high mast lighting systems, lighting poles, etc.

Fans - The company has recently entered the fans business with product offering

that include ceiling, table, pedestal, wall mounted and exhaust fans.

Approximately, the fans business accounts for ~`60cr of the overall revenues.

The company in FY2012 had set up a development (R&D) centre in Noida, which

is equipped with most advanced equipments for light measurement and optical

evaluation for conventional lighting as well as LED measurement. It is listed as one

of the best testing laboratories in India by Bureau of Energy Efficiency (BEE) for LED

lighting system.

Plant Locations

Exhibit 14: Plant Locations

Lighting Division

Steel Division

Kashipur, Uttaranchal

Malanpur, Madhya Pradesh

Malanpur, Madhya Pradesh

Bahadurgarh, Haryana

Source: Company

November 7, 2015

10

Surya Roshni | 2QFY2016 Result Update

Profit and loss statement

Y/E March (` cr)

FY2013

FY2014

FY2015

FY2016E

FY2017E

Total operating income

2,959

3,031

2,857

2,992

3,223

% chg

15.8

2.4

(5.7)

4.7

7.7

Net Raw Materials

2,251

2,266

2,063

2,136

2,293

% chg

15.4

0.7

(8.9)

3.5

7.3

Personnel

135

151

156

180

193

% chg

6.5

12.2

3.5

14.8

7.7

Other

337

380

414

434

465

% chg

19.6

12.8

8.9

4.7

7.3

Total Expenditure

2,722

2,797

2,634

2,750

2,952

EBITDA

237

234

223

242

271

% chg

20.8

(1.3)

(4.5)

8.5

11.9

(% of Net Sales)

8.0

7.7

7.8

8.1

8.4

Depreciation& Amortisation

57

56

56

61

64

EBIT

180

178

167

181

207

% chg

21.2

(1.2)

(6.1)

8.3

14.5

(% of Net Sales)

6.1

5.9

5.8

6.0

6.4

Interest & other Charges

110

114

109

96

93

(% of Net Sales)

3.7

3.8

3.8

3.2

2.9

Other Income

2

4

4

1

1

(% of Net Sales)

0.1

0.1

0.1

0.0

0.0

Recurring PBT

70

64

58

85

115

% chg

28.7

(9.8)

(8.6)

45.7

35.4

PBT (reported)

72

67

62

86

116

Tax

3

14

8

21

36

(% of PBT)

3.9

20.5

12.4

25.0

31.0

PAT (reported)

69

53

54

64

80

Extraordinary Expense/(Inc.)

-

-

-

-

-

ADJ. PAT

69

53

54

64

80

% chg

33.2

(22.9)

1.4

19.1

24.2

(% of Net Sales)

2.3

1.8

1.9

2.2

2.5

Basic EPS (`)

15.8

12.2

12.3

14.7

18.3

Fully Diluted EPS (`)

15.8

12.2

12.3

14.7

18.3

% chg

33.2

(22.9)

1.4

19.1

24.2

November 7, 2015

11

Surya Roshni | 2QFY2016 Result Update

Balance Sheet

Y/E March (` cr)

FY2013

FY2014

FY2015

FY2016E

FY2017E

SOURCES OF FUNDS

Equity Share Capital

44

44

44

44

44

Reserves& Surplus

502

551

588

647

722

Warrants

-

-

-

-

-

Shareholders’ Funds

546

595

632

691

766

Revaluation of Land

186

179

179

179

179

Total Loans

857

1,038

948

900

882

Other Long Term Liabilities

5

6

7

7

7

Long Term Provisions

18

17

19

19

19

Deferred Tax Liability

42

48

51

51

51

Total Liabilities

1,655

1,883

1,836

1,848

1,905

APPLICATION OF FUNDS

Gross Block

1,364

1,470

1,553

1,622

1,692

Less: Acc. Depreciation

511

558

617

678

742

Net Block

853

912

936

944

950

Capital Work-in-Progress

26

54

26

20

15

Investments

50

50

50

50

50

Current Assets

886

1,055

1,066

1,060

1,132

Cash

19

25

26

22

13

Loans & Advances

70

94

118

120

129

Inventory

380

433

390

402

435

Debtors

410

497

524

508

547

Other current assets

6

7

8

8

8

Current liabilities

161

188

243

226

243

Net Current Assets

725

867

823

834

890

Misc. Exp. not written off

-

-

-

-

-

Total Assets

1,655

1,883

1,836

1,848

1,905

November 7, 2015

12

Surya Roshni | 2QFY2016 Result Update

Cash flow statement

Y/E March (` cr)

FY2013

FY2014

FY2015

FY2016E FY2017E

Profit before tax

72

67

62

86

116

Depreciation

57

56

56

61

64

Change in Working Capital

(50)

(136)

46

(15)

(64)

Direct taxes paid

(3)

(14)

(11)

(21)

(36)

Others

99

117

114

(1)

(1)

Cash Flow from Operations

175

90

267

109

78

(Inc.)/Dec. in Fixed Assets

(72)

(133)

(56)

(62)

(65)

(Inc.)/Dec. in Investments

0

0

-

-

-

(Incr)/Decr In LT loans & adv.

-

-

-

-

-

Others

(4)

(13)

(6)

1

1

Cash Flow from Investing

(77)

(146)

(62)

(61)

(63)

Issue of Equity

(15)

(7)

(0)

-

-

Inc./(Dec.) in loans

25

181

(87)

(47)

(18)

Dividend Paid (Incl. Tax)

(20)

(5)

(5)

(5)

(5)

Others

(89)

(107)

(111)

-

-

Cash Flow from Financing

(100)

61

(203)

(53)

(23)

Inc./(Dec.) in Cash

(2)

6

2

(5)

(9)

Opening Cash balances

21

19

25

26

22

Closing Cash balances

19

25

26

22

13

November 7, 2015

13

Surya Roshni | 2QFY2016 Result Update

Key Ratios

Y/E March

FY2013

FY2014

FY2015E

FY2016E

FY2017E

Valuation Ratio (x)

P/E (on FDEPS)

8.0

10.4

10.3

8.6

6.9

P/CEPS

4.4

5.1

5.0

4.4

3.9

P/BV

1.0

0.9

0.9

0.8

0.7

EV/Net sales

0.5

0.5

0.5

0.5

0.4

EV/EBITDA

5.7

6.5

6.4

5.7

5.1

EV / Total Assets

0.8

0.8

0.8

0.7

0.7

Per Share Data (`)

EPS (Basic)

15.8

12.2

12.3

14.7

18.3

EPS (fully diluted)

15.8

12.2

12.3

14.7

18.3

Cash EPS

28.7

24.9

25.1

28.6

32.8

DPS

4.0

1.0

1.0

1.0

1.0

Book Value

124.6

135.6

144.1

157.6

174.7

DuPont Analysis

EBIT margin

6.1

5.9

5.8

6.0

6.4

Tax retention ratio

1.0

0.8

0.9

0.8

0.7

Asset turnover (x)

1.9

1.8

1.6

1.7

1.8

ROIC (Post-tax)

11.4

8.5

8.4

7.8

8.0

Cost of Debt (Post Tax)

12.5

9.6

9.6

7.8

7.2

Leverage (x)

1.4

1.6

1.4

1.2

1.1

Operating ROE

9.8

6.8

6.7

7.7

8.8

Returns (%)

ROCE (Pre-tax)

11.1

10.1

9.0

9.8

11.0

Angel ROIC (Pre-tax)

11.9

10.7

9.6

10.4

11.6

ROE

13.3

9.4

8.8

9.7

11.0

Turnover ratios (x)

Asset TO (Gross Block)

2.2

2.1

1.9

1.9

1.9

Inventory / Net sales (days)

47

49

53

48

47

Receivables (days)

46

55

65

62

62

Payables (days)

18

23

30

30

30

WC cycle (ex-cash) (days)

84

93

105

98

96

Solvency ratios (x)

Net debt to equity

1.4

1.6

1.4

1.2

1.1

Net debt to EBITDA

3.3

4.1

3.9

3.4

3.0

Int. Coverage (EBIT/ Int.)

1.6

1.6

1.5

1.9

2.2

November 7, 2015

14

Surya Roshni | 2QFY2016 Result Update

Research Team Tel: 022 - 39357800

DISCLAIMER

Angel Broking Private Limited (hereinafter referred to as “Angel”) is a registered Member of National Stock Exchange of India Limited,

Bombay Stock Exchange Limited and Metropolitan Stock Exchange of India Limited. It is also registered as a Depository Participant with

CDSL and Portfolio Manager with SEBI. It also has registration with AMFI as a Mutual Fund Distributor. Angel Broking Private Limited is

a registered entity with SEBI for Research Analyst in terms of SEBI (Research Analyst) Regulations, 2014 vide registration number

INH000000164. Angel or its associates has not been debarred/ suspended by SEBI or any other regulatory authority for accessing

/dealing in securities Market. Angel or its associates including its relatives/analyst do not hold any financial interest/beneficial

ownership of more than 1% in the company covered by Analyst. Angel or its associates/analyst has not received any compensation /

managed or co-managed public offering of securities of the company covered by Analyst during the past twelve months. Angel/analyst

has not served as an officer, director or employee of company covered by Analyst and has not been engaged in market making activity

of the company covered by Analyst.

This document is solely for the personal information of the recipient, and must not be singularly used as the basis of any investment

decision. Nothing in this document should be construed as investment or financial advice. Each recipient of this document should

make such investigations as they deem necessary to arrive at an independent evaluation of an investment in the securities of the

companies referred to in this document (including the merits and risks involved), and should consult their own advisors to determine

the merits and risks of such an investment.

Reports based on technical and derivative analysis center on studying charts of a stock's price movement, outstanding positions and

trading volume, as opposed to focusing on a company's fundamentals and, as such, may not match with a report on a company's

fundamentals.

The information in this document has been printed on the basis of publicly available information, internal data and other reliable

sources believed to be true, but we do not represent that it is accurate or complete and it should not be relied on as such, as this

document is for general guidance only. Angel Broking Pvt. Limited or any of its affiliates/ group companies shall not be in any way

responsible for any loss or damage that may arise to any person from any inadvertent error in the information contained in this report.

Angel Broking Pvt. Limited has not independently verified all the information contained within this document. Accordingly, we cannot

testify, nor make any representation or warranty, express or implied, to the accuracy, contents or data contained within this document.

While Angel Broking Pvt. Limited endeavors to update on a reasonable basis the information discussed in this material, there may be

regulatory, compliance, or other reasons that prevent us from doing so.

This document is being supplied to you solely for your information, and its contents, information or data may not be reproduced,

redistributed or passed on, directly or indirectly.

Neither Angel Broking Pvt. Limited, nor its directors, employees or affiliates shall be liable for any loss or damage that may arise from

or in connection with the use of this information.

Note: Please refer to the important ‘Stock Holding Disclosure' report on the Angel website (Research Section). Also, please refer to the

latest update on respective stocks for the disclosure status in respect of those stocks. Angel Broking Pvt. Limited and its affiliates may

have investment positions in the stocks recommended in this report.

Disclosure of Interest Statement

Surya Roshni

1. Analyst ownership of the stock

No

2. Angel and its Group companies ownership of the stock

No

3. Angel and its Group companies' Directors ownership of the stock

No

4. Broking relationship with company covered

No

Note: We have not considered any Exposure below ` 1 lakh for Angel, its Group companies and Directors

Ratings (Based on expected returns

Buy (> 15%)

Accumulate (5% to 15%)

Neutral (-5 to 5%)

over 12 months investment period):

Reduce (-5% to -15%)

Sell (< -15)

November 7, 2015

15