2QFY2017 Result Update | Pharmaceutical

November 17, 2016

Sun Pharma

BUY

CMP

`683

Performance Highlights

Target Price

`847

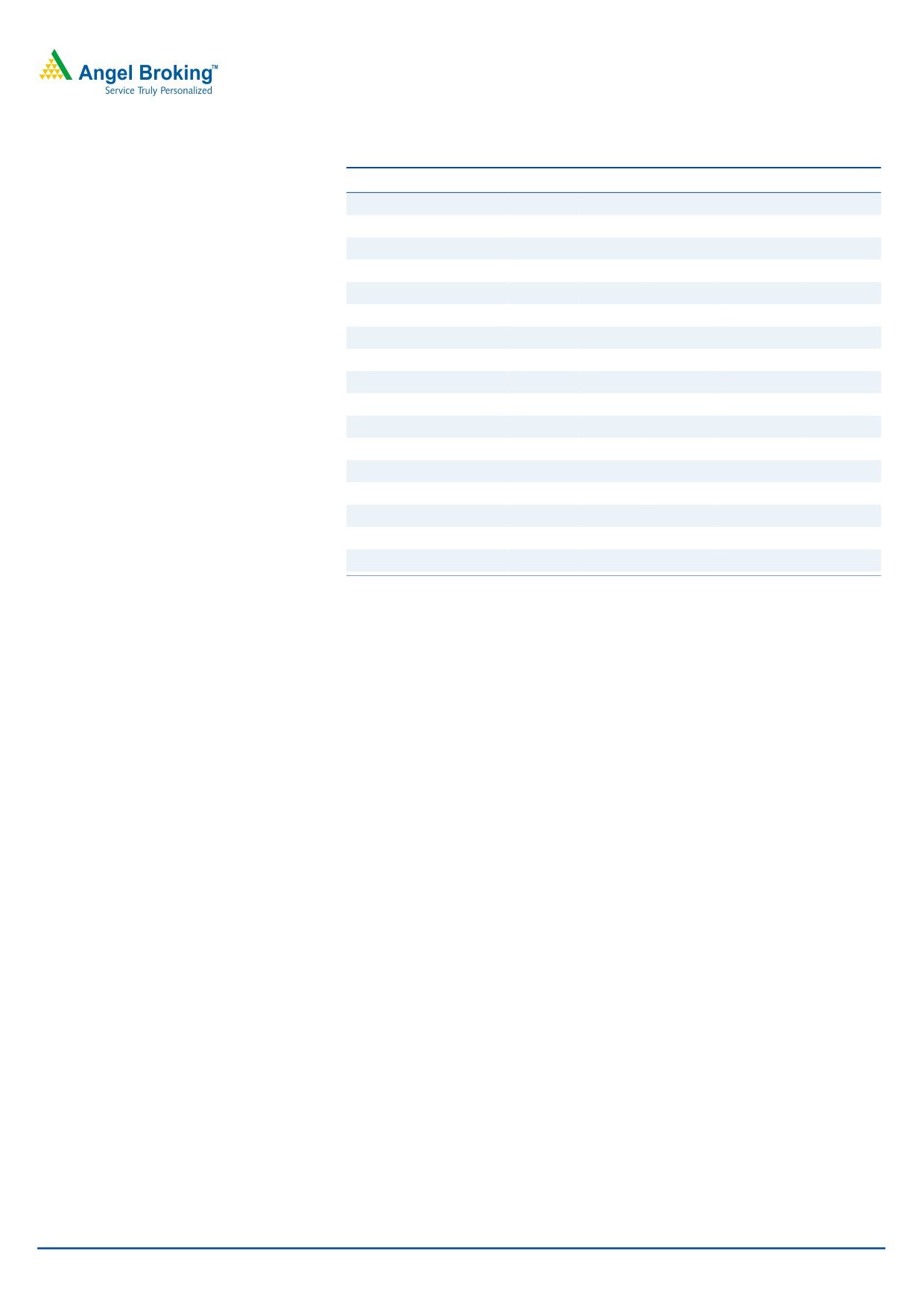

(` cr)

2QFY2017 1QFY2017

% chg (qoq) 2QFY2016

% chg (yoy)

Investment Period

12 months

Net sales

7,764

8,007

(3.0)

6,858

13.2

Other income

621

393

57.7

130

376.0

Stock Info

Gross profit

5,924

6,160

(3.8)

5,360

10.5

Sector

Pharmaceutical

Operating profit

2,667

2,685

(0.7)

1,858

43.5

Market Cap (` cr)

164,261

Adj. Net profit

2,235

2,034

9.9

1,029

117.3

Net Debt (` cr)

(6,960)

Source: Company, Angel Research

Beta

0.7

52 Week High / Low

898/572

Sun Pharma posted numbers better than expected on OPM and net profit front.

Avg. Daily Volume

431,125

Sales came in at`7,764cr vs. `7,800cr expected vs. `6,858cr in 2QFY2016,

Face Value (`)

1

posting a yoy growth of 13.2%. On the operating front, the EBITDA margin came

BSE Sensex

26,305

in at 34.3% vs. 30.1% expected and vs. 27.1% in 2QFY2016. Lower expenses

Nifty

8,108

during the quarter aided the OPM expansion. Consequently, the Adj. PAT came

Reuters Code

SUN.BO

in at `2,235cr vs. `1,545cr expected vs. `1,029cr in 2QFY2016, a yoy growth of

117.3%. Apart from better than expected OPM, the company also posted higher

Bloomberg Code

SUNP@IN

than expected other income (`621cr in 2QFY2017 vs. `226cr in 2QFY2016). We

maintain our Buy rating on the stock.

Shareholding Pattern (%)

Results mostly better than expectations: Sun Pharma posted sales of `7,764cr vs.

Promoters

55.0

`7,800cr expected vs. `6,858cr in 2QFY2016, posting a yoy growth of 13.2%.

MF / Banks / Indian Fls

12.9

India sales at `2,009cr, was up by 11% yoy. US finished dosage sales at

FII / NRIs / OCBs

25.1

US$555mn, was up by 9% yoy. Emerging markets sales stood at US$170mn, up

Indian Public / Others

7.0

by 22% yoy. Rest of World (ROW) sales stood at US$ 79mn, growth of 3% yoy.

On the operating front, the EBITDA margin came in at 34.3% vs. 30.1% expected

and vs. 27.1% in 2QFY2016.Consequently, the Adj. PAT came in at `2,235cr vs.

Abs. (%)

3m 1yr

3yr

`1,545cr expected vs. `1,029cr in 2QFY2016, a yoy growth of 117.3%. Apart

Sensex

(6.6)

2.7

28.9

from better than expected OPM, the company also posted higher than expected

Sun Pharma

(14.9)

(8.0)

13.8

other income (`621cr in 2QFY2017 vs. `226cr in 2QFY2016).

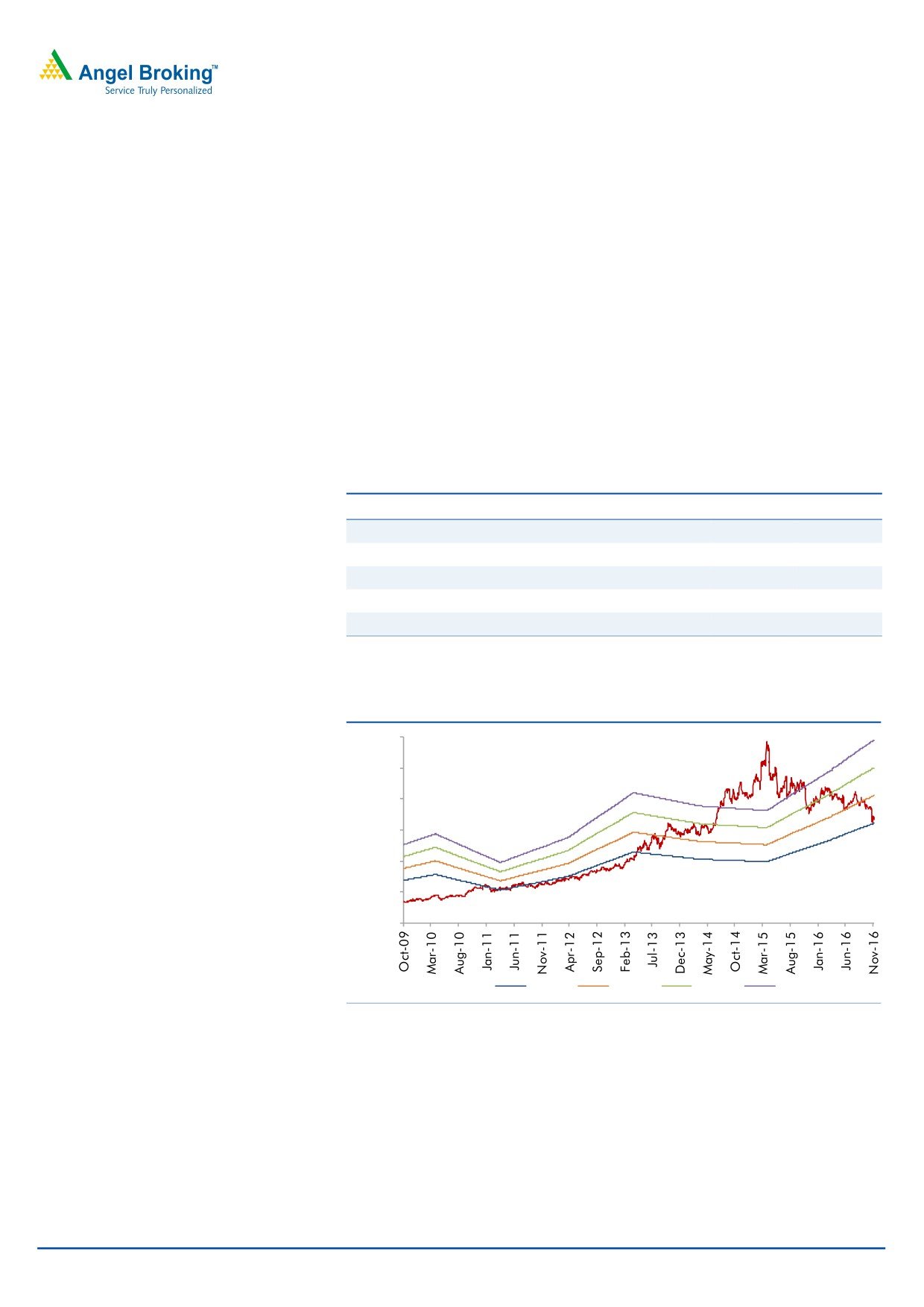

3-year price chart

Outlook and valuation: Sun Pharma is one of the largest and fastest growing

1,200

Indian pharmaceutical companies. We expect its net sales to post a CAGR of

1,000

12.7% (including Ranbaxy Laboratories) to `35,258cr and EPS to post a CAGR of

26.5% to `35.3 over FY2016-18E. We recommend a Buy rating on the stock.

800

Key financials (Consolidated)

600

Y/E March (` cr)

FY2015

FY2016

FY2017E

FY2018E

400

Net sales

27,287

27,744

31,129

35,258

200

% chg

70.6

1.7

12.2

13.3

Adj. Net profit

4,743

5,306

7,260

8,495

% chg

(10.0)

11.9

36.8

17.0

Source: Company, Angel Research

EPS (`)

22.9

22.0

30.2

35.3

EBITDA margin (%)

28.6

26.2

32.0

32.9

P/E (x)

29.8

31.0

22.6

19.4

RoE (%)

21.1

18.3

20.0

20.1

RoCE (%)

21.1

16.6

19.0

19.1

P/BV (x)

6.2

4.5

3.7

3.0

Sarabjit Kour Nangra

EV/Sales (x)

5.1

5.8

4.9

4.2

+91 22 39357600 Ext: 6806

EV/EBITDA (x)

17.7

22.0

15.4

12.6

Source: Company, Angel Research; Note: CMP as of November 15, 2016

Please refer to important disclosures at the end of this report

1

Sun Pharma | 2QFY2017 Result Update

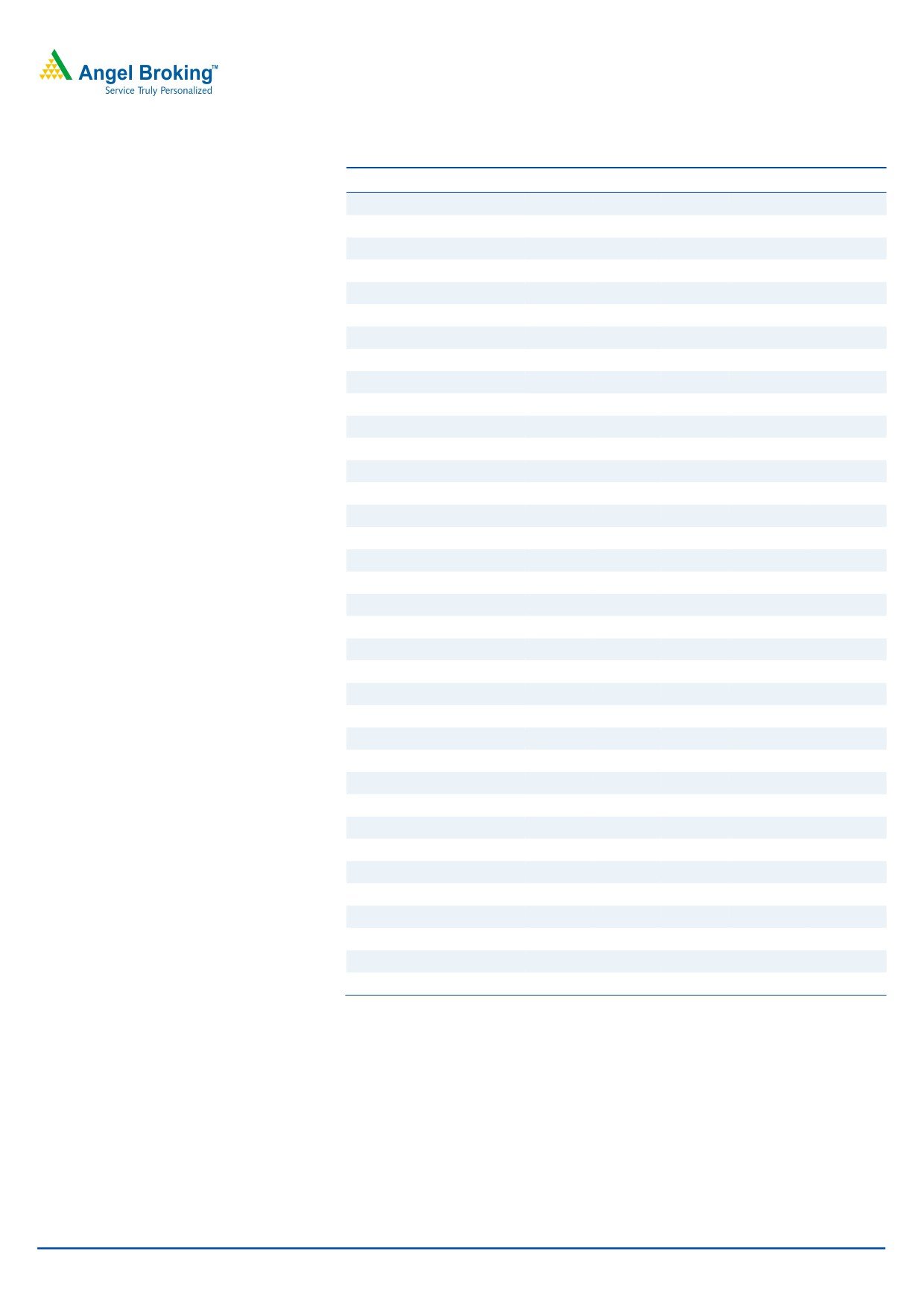

Exhibit 1: 2QFY2017 performance (Consolidated)

Y/E March (` cr)

2QFY2017

1QFY2017

% chg QoQ 2QFY2016

% chg yoy 1HFY2017 1HFY2016

% chg

Net sales

7,764

8,007

(3.0)

6,858

13.2

15,771

13,329

18.3

Other income

620.5

393.4

57.7

130.4

376.0

1,014

566.4

79.0

Total income

8,385

8,400

(0.2)

6,989

20.0

16,785

13,895

20.8

Gross profit

5,924

6,160

(3.8)

5,360

10.5

12,084

10,050

20.2

Gross margin (%)

76.3

76.9

78.2

76.6

75.4

Operating profit

2,667

2,685

(0.7)

1,858

43.5

5,352

3,514

52.3

Operating margin (%)

34.3

33.5

27.1

33.9

26.4

Interest

54

135

(60.1)

158

(66.0)

188

271

(30.5)

Depreciation

304

316

(3.8)

258

17.6

620

511

21.3

Extraordinary item loss/ ( gain)

0

0

0

0

685

PBT

2,930

2,628

11.5

1,572

86.4

5,557

3,298

68.5

Provision for taxation

441.7

352.7

25.2

294.6

31.6

794

562

41.3

PAT before extra-ordinary item

2,488

2,275

9.4

1,277

78.8

4,763

2,736

74.1

Minority interest(MI)

253

241

4.8

248

1.9

446

464

(3.9)

Reported PAT

2,235

2,034

9.9

1,029

117.3

4,269

2,272

87.9

Adj. PAT

2,235

2,034

9.9

1,029

117.3

4,269

1,586

169.2

Adj. EPS (`)

9.3

8.4

4.3

17.7

9.4

Source: Company, Angel Research

Exhibit 2: 2QFY2017 - Actual V/s Angel estimates

(` cr)

Actual

Estimates

Variance (%)

Net sales

7,764

7,800

(0.5)

Other income

621

226

175.0

Operating profit

2,667

2,350

13.5

Tax

442

353

25.2

Adj. Net profit

2,235

1,545

44.7

Source: Company, Angel Research

Numbers just in line with expectations: Sun Pharma posted numbers better than

expected on OPM and net profit front. Sales came in at `7,764cr vs. `7,800cr

expected vs. `6,858cr in 2QFY2016, posting a yoy growth of 13.2%. India sales at

`2,009cr, was up by 11% yoy. US finished dosage sales at US$555mn, was up by

9% yoy. Emerging markets sales stood at US$170mn, up by 22% yoy. Rest of

World (ROW) sales stood at US$ 79mn, growth of 3% yoy.

Amongst the key markets- India (`2,009cr) posted a growth of 11.0% yoy, US

(US$555mn) posted a growth of 9.0% yoy, Emerging markets (US$170mn) were

up by 22% yoy and ROW (US$79mn) a growth of 3.0% yoy.

Sale of branded formulations in India for 2QFY2017 stood at `2,009cr, up by

11.0% yoy and accounted for 26% of total sales. Sun Pharma is ranked No. 1 and

holds ~8.7% market share in the Rs. 100,000cr pharmaceutical market as per the

September-2016 AIOCD-AWACS report.

Sales in the US came in at US$555mn for the quarter, accounting for 48% of total

sales. Sales in emerging markets were at US$170mn for 2QFY2017, a yoy growth

of 22% and accounted for 15% of total sales. Formulation sales in Rest of World

(ROW) markets excluding US and Emerging markets were US$79mn in

November 17, 2016

2

Sun Pharma | 2QFY2017 Result Update

2QFY2017, a growth of 22.0% yoy and accounted for ~7% of revenues for the

quarter.

The company had a total of 423 ANDAs filed with the USFDA. Currently, ANDAs

for 144 products await USFDA approval, including 13 tentative approvals.

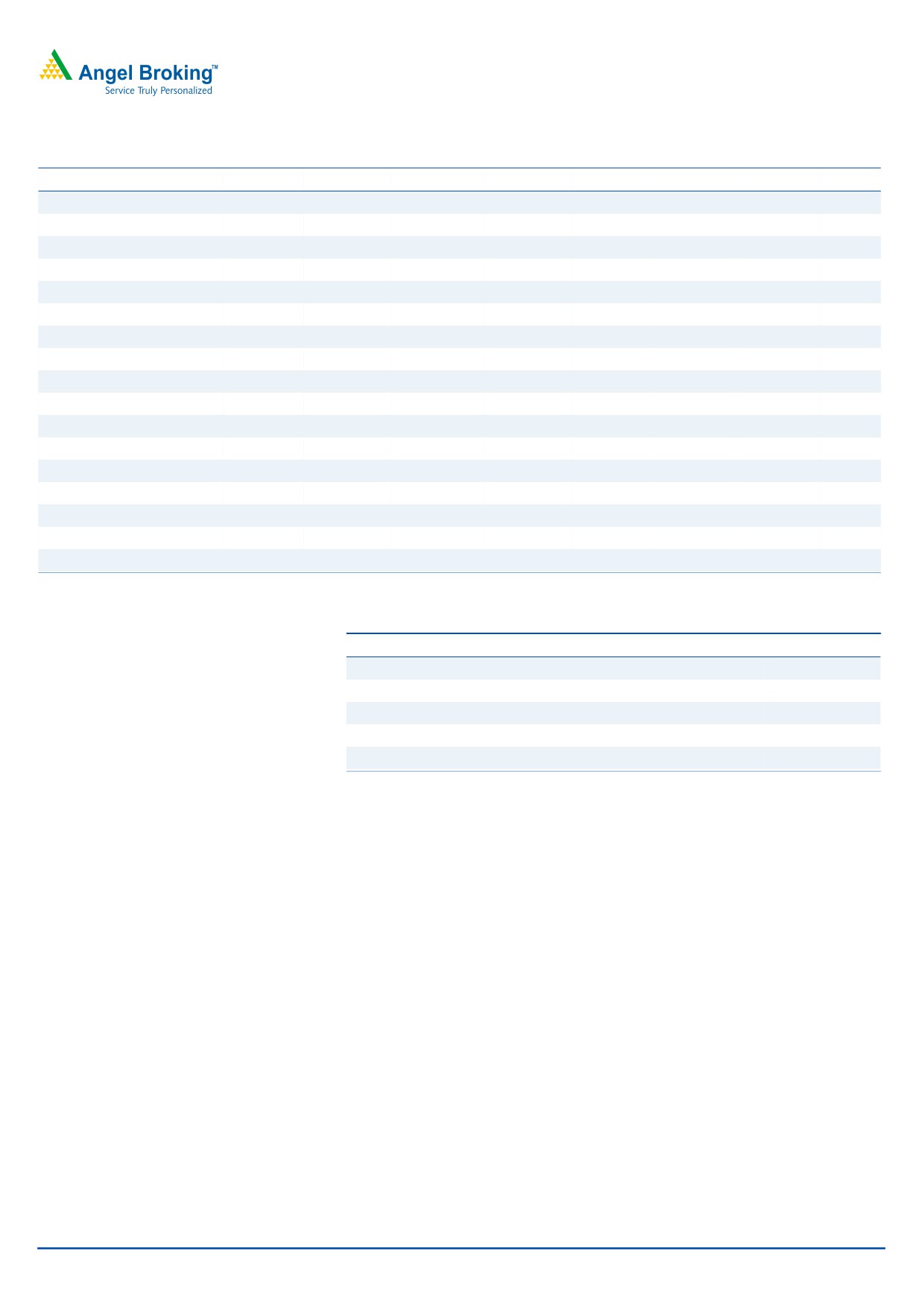

Exhibit 3: Sales trend

7000

6,153

5,755

6000

5,673

5,050

5,212

5000

4000

3000

2,010

1,819

1,890

1,807

1,854

2000

1000

0

2QFY2016

3QFY2016

4QFY2016

1QFY2017

2QFY2017

Domestic Formulation

Export Formulation, Bulk and others

Source: Company, Angel Research

OPM at 34.3%; higher than an expected 30.1%: On the operating front, the

EBITDA margin came in at 34.3% vs. 30.1% expected and vs. 27.1% in

2QFY2016. Lower expenses during the quarter aided the OPM expansion.

Employee and other expenses, during the quarter, posted a decline of 2.0%

and 8.0%, respectively. The R&D expenses came in at 7.3% of sales, same in

line with last year, posting a yoy growth of 14.0%.

Exhibit 4: OPM trend (%)

40.0

33.5

34.3

31.0

30.3

30.0

27.1

20.0

10.0

2QFY2016

3QFY2016

4QFY2016

1QFY2017

2QFY2017

Source: Company, Angel Research,

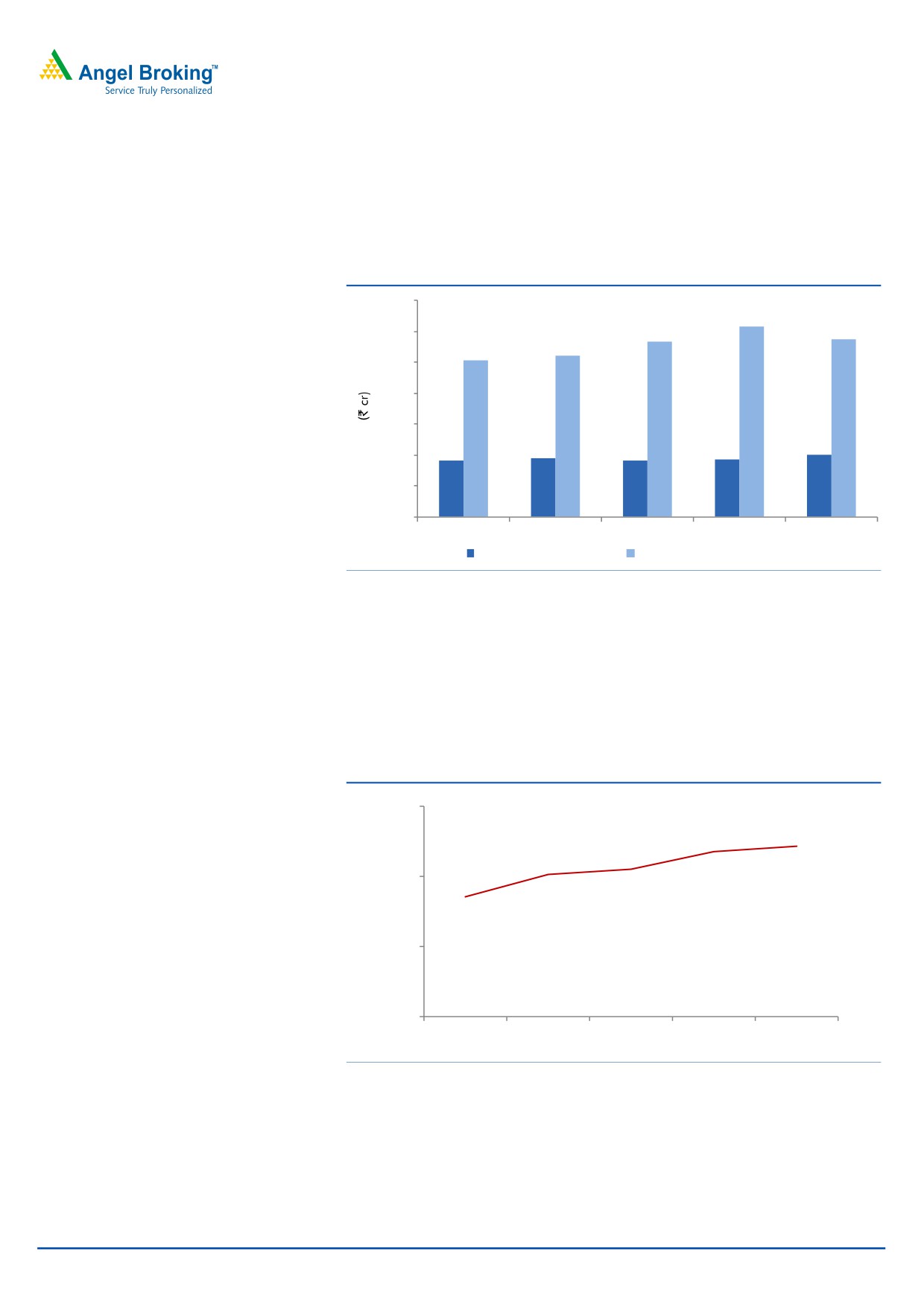

Net profit came in higher than our expectation: Consequently, the Adj. PAT came

in at `2,235cr vs. `1,545cr expected vs. `1,029cr in 2QFY2016, a yoy growth of

117.7%. Apart from better than expected OPM, the company also posted higher

than expected other income (`621cr in 2QFY2017 vs. `226cr in 2QFY2016).

November 17, 2016

3

Sun Pharma | 2QFY2017 Result Update

Exhibit 5: Adjusted Net profit trend (` cr)

3,000

2,500

2,235

2,034

2,034

2,000

1,417

1,500

1,029

1,000

500

0

2QFY2016

3QFY2016

4QFY2016

1QFY2017

2QFY2017

Source: Company, Angel Research

Concall takeaways

Management guided that the company has completed the remediation

process and has re-invited the USFDA for a re-inspection, though the timing of

the re-inspection and potential clearance thereafter remains unpredictable.

Ranbaxy integration is progressing ahead of management’s expected

timelines, and management expects the acquisition to deliver synergies of

US$300mn by FY2018. The focus areas for integration include cGMP

compliance, sourcing efficiencies as well as revenue synergies.

NLEM impact to be ~`1,500cr in FY2017.

Management also guided on pressures in the domestic market on account of

WPI-led price cuts on NLEM portfolio, though it expects growth to revive in the

coming quarters.

R&D expenses to be 9% in FY2017.

Investment arguments

Strongest ANDA pipeline: Sun Pharma, with the recent acquisitions of DUSA, URL

Pharma and Ranbaxy Laboratories, has now become strong in the US region, with

the geography accounting for 52% of its sales in FY2016. In terms of ANDAs, the

company cumulatively has 423 products, out of which 144 products now await

USFDA approval, including 13 tentative approvals. With the merger of Ranbaxy

Laboratories, the company is now the fifth-largest specialty generics company in

the world (behind Teva, Sandoz, Activas and Mylan). However, the near term

performance of the company has been impacted on back of supply constraints at

the Halol facility, although the company has taken redemption measures including

site transfers. Overall, we expect the region to post a CAGR of 14.5% in sales over

FY2016-18E, accounting for almost 49% of the overall sales in FY2018E.

Domestic business: Sun Pharma’s domestic formulation business is among the

fastest growing in the Indian pharmaceutical industry. It contributed 23% to the

company’s total turnover in FY2014. Sun Pharma, with Ranbaxy Laboratories’

November 17, 2016

4

Sun Pharma | 2QFY2017 Result Update

merger, is now the segment leader with a market share of 8.7% in the domestic

formulation market, followed by Abbott India which has a market share of 6.5%.

This is a significant gap considering that the segment is highly fragmented. We

expect the domestic formulation business to post a CAGR of 12.5% over FY2016-

18E, contributing 25% to the overall formulation sales of the company in FY2018.

Healthy balance sheet: Sun Pharma has one of the strongest balance sheets in the

sector with cash of

~`15,000cr. The same can continue to support the

Management in inorganic growth and in scouting for acquisitions, especially in the

US and in emerging markets.

Outlook and valuation: Sun Pharma is one of the largest and fastest growing

Indian pharmaceutical companies. We expect its net sales to post a CAGR of

12.7% (including Ranbaxy Laboratories) to `35,258cr and EPS to post a CAGR of

26.5% to `35.3 over FY2016-18E. We recommend a Buy rating on the stock.

Exhibit 6: Key assumptions

FY2017E

FY2018E

Domestic Formulation sales growth (%)

10.0

15.0

Export Formulation sales growth (%)

14.3

13.5

Growth in employee expenses (%)

15.0

20.0

Operating margins (%)

32.0

32.9

Tax as % of PBT

15.0

14.0

Source: Company, Angel Research

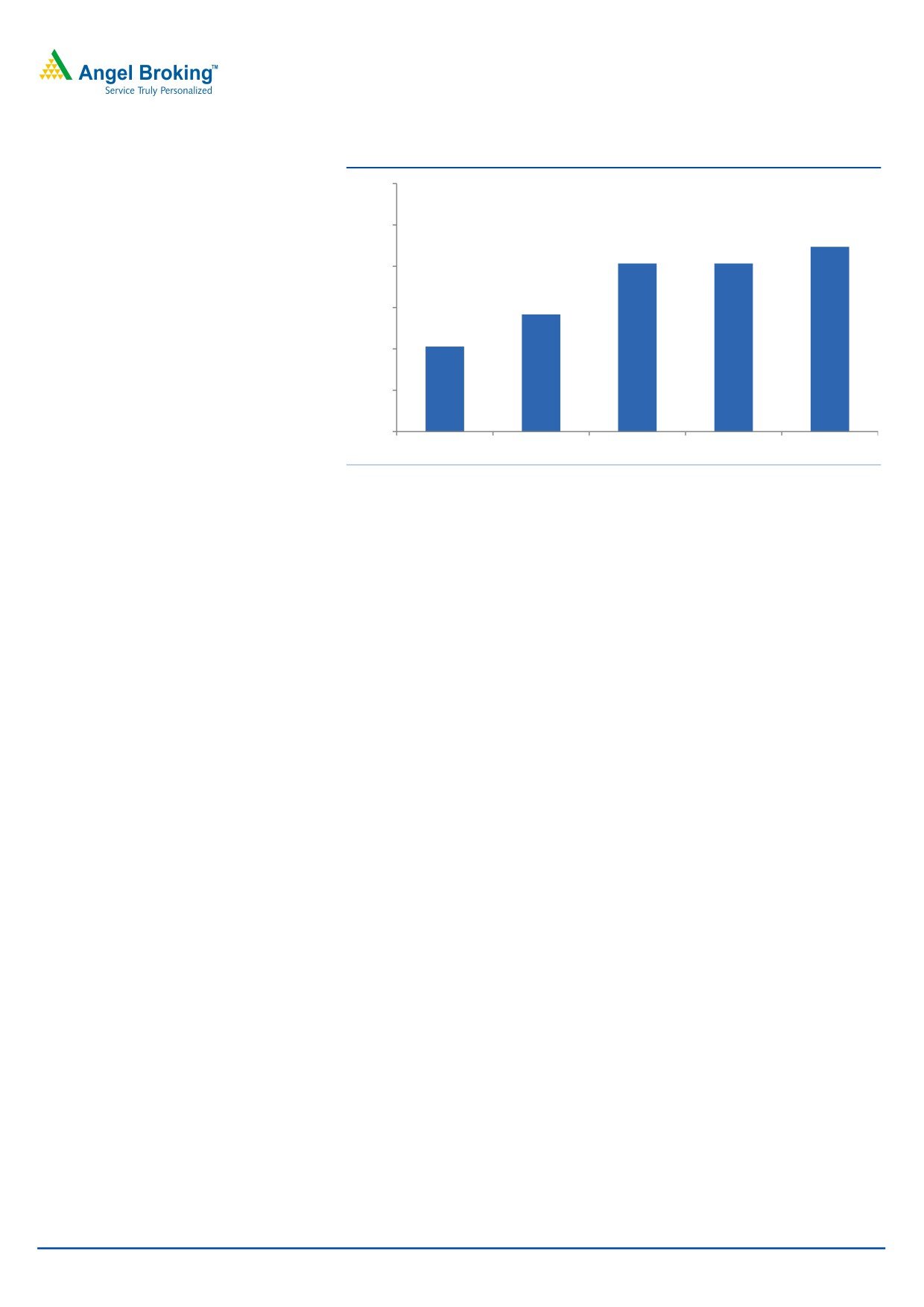

Exhibit 7: One-year forward PE band

1,200

1,000

800

600

400

200

-

10x

15x

20x

25x

Source: Company, Angel Research

November 17, 2016

5

Sun Pharma | 2QFY2017 Result Update

Exhibit 8: Valuation summary

Company

Reco

CMP Tgt. price Upside

FY2018E

FY16-18E

FY2018E

(`)

(`)

% PE (x) EV/Sales (x) EV/EBITDA (x) CAGR in EPS (%) RoCE (%) RoE (%)

Alembic Pharma

Neutral

631

-

-

20.7

2.8

13.0

(10.8)

27.5

25.3

Aurobindo Pharma Buy

733

877

19.7

15.5

2.7

11.5

18.1

22.5

26.1

Cadila Healthcare

Accumulate

358

400

11.7

18.7

2.9

13.0

13.4

22.7

25.7

Cipla

Neutral

553

-

-

20.3

2.6

14.0

20.4

13.5

15.2

Dr Reddy's

Neutral

3,309

-

-

22.9

2.9

13.3

1.7

16.2

15.9

Dishman Pharma

Neutral

229

-

-

20.2

3.0

10.0

3.1

10.3

10.9

GSK Pharma*

Neutral

2,650

-

-

43.6

6.6

32.0

17.3

35.3

32.1

Indoco Remedies

Sell

286

240

(18.5)

17.9

2.1

11.5

33.2

19.1

20.1

Ipca labs

Accumulate

540

613

13.4

27.5

1.9

12.4

36.5

8.8

9.4

Lupin

Buy

1,440

1,809

25.6

20.8

3.4

12.8

17.2

24.4

20.9

Sanofi India*

Neutral

4,253

-

-

24.7

2.6

17.7

22.2

24.9

28.8

Sun Pharma

Buy

683

847

24.0

19.4

4.2

12.6

26.5

19.1

20.1

Source: Company, Angel Research; Note: * December year ending

Company background

Sun Pharma is an international specialty pharma company, with a large presence

in the US and India, and a footprint across 40 other markets. In India and rest of

the world markets, the key chronic therapy areas for the company are cardiology,

psychiatry, neurology, gastroenterology, diabetology etc. The company is a market

leader in specialty therapy areas in India. In India, the company has emerged as a

leading pharma company, where it is the third largest player. Also, in the US, a

key geography, the company has expanded significantly through both in-organic

and organic routes.

November 17, 2016

6

Sun Pharma | 2QFY2017 Result Update

Profit & Loss statement (Consolidated)

Y/E March (` cr)

FY2014

FY2015

FY2016

FY2017E

FY2018E

Gross sales

16,200

27,652

28,110

31,412

35,578

Less: Excise duty

195

366

366

283

320

Net sales

16,004

27,287

27,744

31,129

35,258

Other operating income

76

147

526

526

526

Total operating income

16,080

27,433

28,270

31,655

35,784

% chg

42.3

70.6

3.0

12.0

13.0

Total expenditure

9,081

19,470

20,473

21,177

23,643

Net raw materials

2,779

6,739

6,483

7,274

8,239

Other mfg costs

699

1,192

1,212

1,360

1,540

Personnel

2,074

4,430

4,797

5,382

6,459

Other

3,528

7,109

7,981

7,160

7,404

EBITDA

6,923

7,817

7,271

9,953

11,615

% chg

41.1

12.9

-7.0

-18.0

-14.1

(% of Net Sales)

43.3

28.6

26.2

32.0

32.9

Depreciation & amort.

409

1,195

1,014

1,214

1,414

EBIT

6,514

6,622

6,783

9,265

10,727

% chg

42.5

1.7

2.4

(15.0)

15.8

(% of Net Sales)

40.7

24.3

24.4

29.8

30.4

Interest & other charges

44

579

477

477

477

Other income

552

451

1,050

1,050

1,050

(% of PBT)

7.8

6.8

14.3

10.7

9.3

Share in profit of Asso.

-

-

-

Recurring PBT

7,098

6,641

7,356

9,838

11,300

% chg

44.9

-6.4

10.8

(9.9)

0.0

Extraordinary expense/(inc.)

2,517

237.8

590.5

-

-

PBT (reported)

7,098

6,641

6,765

9,848

11,300

Tax

702.2

914.7

934.9

1,477.2

1,695.0

(% of PBT)

9.9

13.8

13.8

15.0

15.0

PAT (reported)

6,396

5,726

5,830

8,371

9,605

Add: Share of earnings of asso.

(13)

(2)

-

-

Less: Minority interest (MI)

738

936

1,111

1,111

1,111

Prior period items

-

-

-

-

-

PAT after MI (reported)

3,141

4,539

4,716

7,260

8,495

ADJ. PAT

5,273

4,743

5,306

7,260

8,495

% chg

52.6

(10.0)

11.9

(5.8)

17.0

(% of Net Sales)

19.6

16.6

0.0

1.0

2.0

Basic EPS (`)

25.5

22.9

22.0

30.2

35.3

Fully Diluted EPS (`)

25.5

22.9

22.0

30.2

35.3

% chg

52.6

(10.0)

(3.7)

(18.9)

17.0

November 17, 2016

7

Sun Pharma | 2QFY2017 Result Update

Balance Sheet (Consolidated)

Y/E March (` cr)

FY2014

FY2015

FY2016

FY2017E

FY2018E

SOURCES OF FUNDS

Equity share capital

207

207

241

241

241

Preference capital

-

-

-

-

-

Reserves & surplus

18,318

26,300

31,164

38,142

46,355

Shareholders’ funds

18,525

26,507

31,404

38,382

46,595

Minority interest

1,921

2,851

4,085

5,196

6,307

Total loans

2,561

7,596

8,338

8,338

8,338

Deferred tax liability

(911)

(1,752)

(2,126)

(2,126)

(2,126)

Other Long Term Liabilities

9

9

10

10

11

Long Term Provisions

2,602

2,710

2,293

2,221

2,480

Total liabilities

24,707

37,922

44,006

52,022

61,605

APPLICATION OF FUNDS

Gross block

6,389

15,041

18,621

19,621

20,621

Less: Acc. depreciation

3,668

4,863

6,102

7,315

8,729

Net block

2,721

10,179

12,519

12,306

11,892

Capital work-in-progress

842

842

842

303

1,144

Goodwill

4,097

3,701

4,181

4,181

4,181

Investments

2,786

2,716

1,309

1,551

1,388

Long term long & adv.

1,051

2,736

3,032

3,402

3,854

Current assets

16,688

27,005

30,149

38,581

48,415

Cash

7,590

10,998

13,989

20,220

27,947

Loans & advances

3,774

2,193

2,006

2,480

2,481

Other

3,816

13,813

14,154

15,881

17,987

Current liabilities

3,477

9,256

8,026

8,302

9,269

Net current assets

13,211

17,748

22,123

30,279

39,147

Others

-

-

-

-

-

Total assets

24,707

37,922

44,006

52,022

61,605

November 17, 2016

8

Sun Pharma | 2QFY2017 Result Update

Cash Flow Statement (Consolidated)

Y/E March (` cr)

FY2014

FY2015

FY2016

FY2017E

FY2018E

Profit before tax

7,098

6,641

7,356

9,838

11,300

Depreciation

409

1,195

1,014

1,214

1,414

(Inc)/Dec in working capital

(1,782)

(4,322)

(1,680)

(5,059)

(15,053)

Direct taxes paid

702

915

935

1,477

1,695

Cash Flow from Operations

5,024

2,598

5,754

4,515

(4,034)

(Inc.)/Dec.in Fixed Assets

681

(8,653)

(3,580)

(3,141)

(1,842)

(Inc.)/Dec. in Investments

(374)

70

1,408

1,165

163

Other income

-

-

-

-

-

Cash Flow from Investing

306

(8,583)

(2,172)

(1,975)

(1,679)

Issue of Equity

-

-

-

-

-

Inc./(Dec.) in loans

(548)

(4,928)

(1,157)

(1,230)

260

Dividend Paid (Incl. Tax)

(606)

-

(282)

(282)

(282)

Others

(645)

14,320

847

5,203

13,462

Cash Flow from Financing

(1,799)

9,392

(592)

(2,921)

13,440

Inc./(Dec.) in Cash

3,531

3,408

2,991

6,231

7,727

Opening Cash balances

4,059

7,590

10,998

13,989

20,220

Closing Cash balances

7,590

10,998

13,989

20,220

27,947

November 17, 2016

9

Sun Pharma | 2QFY2017 Result Update

Key Ratios

Y/E March

FY2014

FY2015

FY2016

FY2017E

FY2018E

Valuation Ratio (x)

P/E (on FDEPS)

26.8

29.8

31.0

22.6

19.4

P/CEPS

39.8

24.7

28.7

19.4

16.6

P/BV

7.6

6.2

4.5

3.7

3.0

Dividend yield (%)

0.4

0.4

0.1

0.1

0.1

EV/Sales

8.5

5.1

5.8

4.9

4.1

EV/EBITDA

19.7

17.7

22.0

15.4

12.6

EV / Total Assets

5.5

3.6

3.6

2.9

2.4

Per Share Data (`)

EPS (Basic)

25.5

22.9

22.0

30.2

35.3

EPS (fully diluted)

25.5

22.9

22.0

30.2

35.3

Cash EPS

17.1

27.7

23.8

35.2

41.2

DPS

2.5

3.0

1.0

1.0

1.0

Book Value

89.4

110.2

151.6

185.3

225.0

Dupont Analysis

EBIT margin

40.7

24.3

24.4

29.8

30.4

Tax retention ratio

90.1

86.2

86.2

85.0

85.0

Asset turnover (x)

1.1

1.2

1.0

1.1

1.1

ROIC (Post-tax)

40.5

26.1

20.9

28.0

28.3

Cost of Debt (Post Tax)

2.9

9.8

5.2

5.1

9.7

Leverage (x)

0.0

0.0

0.0

0.0

0.0

Operating ROE

40.5

26.1

20.9

28.0

28.3

Returns (%)

ROCE (Pre-tax)

32.0

21.1

16.6

18.9

18.9

Angel ROIC (Pre-tax)

57.4

38.3

28.6

38.4

38.6

ROE

32.3

21.1

18.3

20.0

20.1

Turnover ratios (x)

Asset Turnover (Gross Block)

2.3

2.6

1.7

1.8

1.8

Inventory / Sales (days)

98

58

78

89

99

Receivables (days)

80

50

77

89

99

Payables (days)

49

61

94

72

72

WC cycle (ex-cash) (days)

91

82

96

92

57

Solvency ratios (x)

Net debt to equity

(0.3)

(0.1)

(0.2)

(0.3)

(0.4)

Net debt to EBITDA

(0.7)

(0.4)

(0.8)

(1.2)

(1.7)

Interest Coverage (EBIT/Int.)

-

-

-

-

-

November 17, 2016

10

Sun Pharma | 2QFY2017 Result Update

Research Team Tel: 022 - 39357800

DISCLAIMER

Angel Broking Private Limited (hereinafter referred to as “Angel”) is a registered Member of National Stock Exchange of India Limited,

Bombay Stock Exchange Limited and Metropolitan Stock Exchange Limited. It is also registered as a Depository Participant with CDSL

and Portfolio Manager with SEBI. It also has registration with AMFI as a Mutual Fund Distributor. Angel Broking Private Limited is a

registered entity with SEBI for Research Analyst in terms of SEBI (Research Analyst) Regulations, 2014 vide registration number

INH000000164. Angel or its associates has not been debarred/ suspended by SEBI or any other regulatory authority for accessing

/dealing in securities Market. Angel or its associates/analyst has not received any compensation / managed or co-managed public

offering of securities of the company covered by Analyst during the past twelve months.

This document is solely for the personal information of the recipient, and must not be singularly used as the basis of any investment

decision. Nothing in this document should be construed as investment or financial advice. Each recipient of this document should

make such investigations as they deem necessary to arrive at an independent evaluation of an investment in the securities of the

companies referred to in this document (including the merits and risks involved), and should consult their own advisors to determine

the merits and risks of such an investment.

Reports based on technical and derivative analysis center on studying charts of a stock's price movement, outstanding positions and

trading volume, as opposed to focusing on a company's fundamentals and, as such, may not match with a report on a company's

fundamentals. Investors are advised to refer the Fundamental and Technical Research Reports available on our website to evaluate the

contrary view, if any.

The information in this document has been printed on the basis of publicly available information, internal data and other reliable

sources believed to be true, but we do not represent that it is accurate or complete and it should not be relied on as such, as this

document is for general guidance only. Angel Broking Pvt. Limited or any of its affiliates/ group companies shall not be in any way

responsible for any loss or damage that may arise to any person from any inadvertent error in the information contained in this report.

Angel Broking Pvt. Limited has not independently verified all the information contained within this document. Accordingly, we cannot

testify, nor make any representation or warranty, express or implied, to the accuracy, contents or data contained within this document.

While Angel Broking Pvt. Limited endeavors to update on a reasonable basis the information discussed in this material, there may be

regulatory, compliance, or other reasons that prevent us from doing so.

This document is being supplied to you solely for your information, and its contents, information or data may not be reproduced,

redistributed or passed on, directly or indirectly.

Neither Angel Broking Pvt. Limited, nor its directors, employees or affiliates shall be liable for any loss or damage that may arise from

or in connection with the use of this information.

Disclosure of Interest Statement

Sun Pharma

1. Financial interest of research analyst or Angel or his Associate or his relative

No

2. Ownership of 1% or more of the stock by research analyst or Angel or associates or relatives

No

3. Served as an officer, director or employee of the company covered under Research

No

4. Broking relationship with company covered under Research

No

Ratings (Based on expected returns

Buy (> 15%)

Accumulate (5% to 15%)

Neutral (-5 to 5%)

over 12 months investment period):

Reduce (-5% to -15%)

Sell (< -15)

November 17, 2016

11