2QFY2016 Result Update | Metals/Mining

November 18, 2015

Steel Authority of India

NEUTRAL

CMP

`45

Performance Highlights

Target Price

-

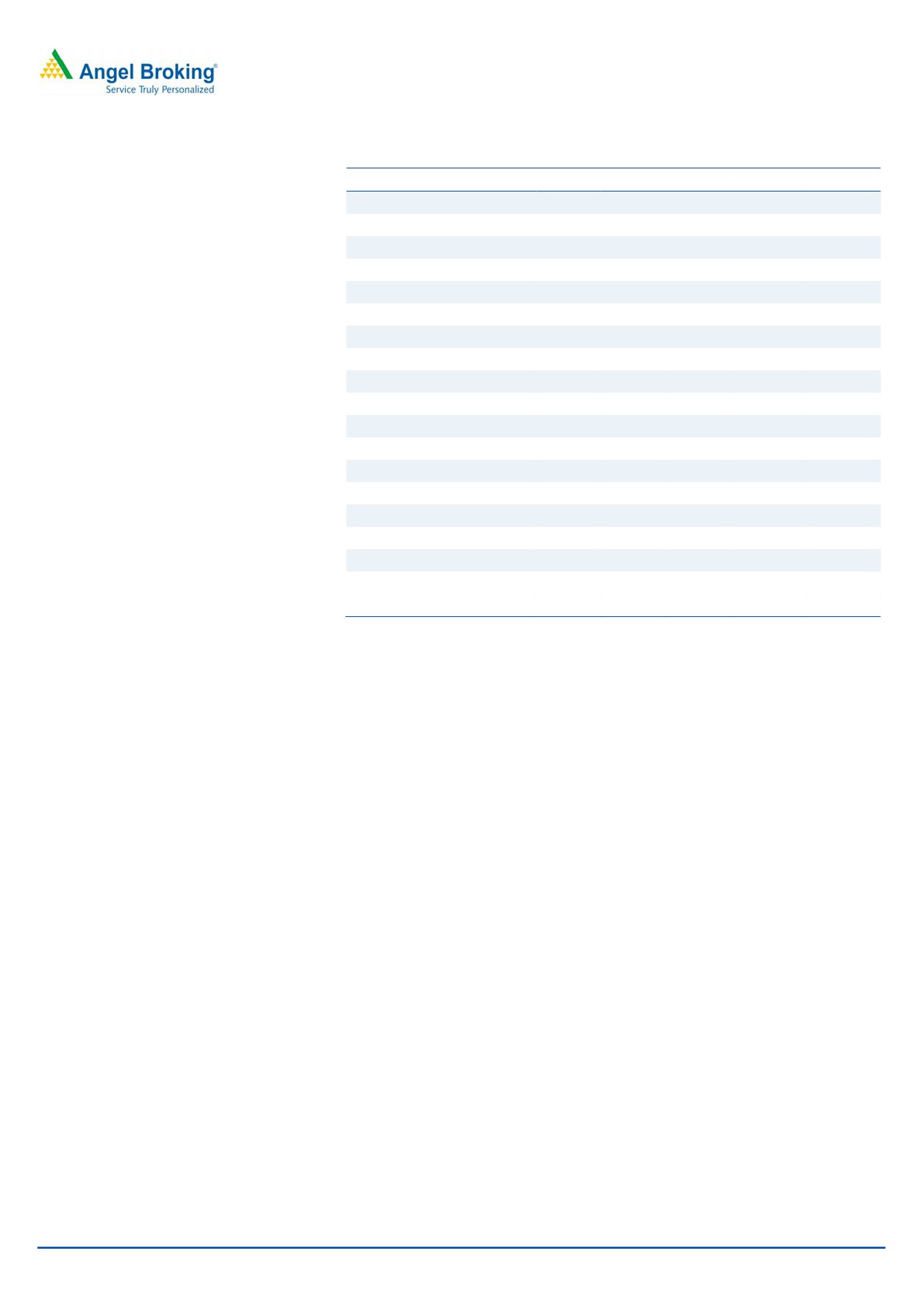

Standalone (` cr)

2QFY16

2QFY15

yoy% 1QFY16 qoq%

Investment Period

-

Net revenue

9,113

11,566

(21.2)

9,384

(2.9)

EBITDA

(1,048)

1,336

-

(82)

-

Stock Info

Sector

Metals/Mining

Margin (%)

(11.5)

11.6

-

(0.9)

-

Market Cap (` cr)

18,773

Reported PAT

(1,056)

649

-

(322)

-

Net Debt (` cr)

29,943

Source: Company, Angel Research

Beta

1.3

Steel Authority of India (Sail) reported a weak set of numbers for 2QFY2016 with

52 Week High / Low

91 / 45

a loss at the operating and net profit level. While volumes were in line with

Avg. Daily Volume

14,02,713

expectations at 2.74MT (estimate 2.75MT), blended realisations declined 15% yoy

Face Value (`)

10

to `37,388/tonne as against our expectation of a 12% decline. Owing to a

BSE Sensex

25,864

higher-than-expected drop in realisations, net sales declined 21% yoy to `9,113,

Nifty

7,838

3% below our estimate.

Reuters Code

SAIL.BO

Operating expenses came in much higher than expectations, resulting in an

Bloomberg Code

SAIL IN

EBITDA loss of `1,048cr as against our expectations of an EBITDA loss of `170cr.

Material costs came in much ahead of our expectations at `4,065cr (44.6% of net

sales) as against our expectations of `3,713cr (39.5% of revenues). Other

Shareholding Pattern (%)

expenses too were higher than expectations, resulting in a higher than expected

Promoters

75.0

EBITDA loss. Lower than expected depreciation and finance expenses and a

MF / Banks / Indian Fls

15.7

higher than expected deferred tax credit resulted in a net loss of `1,056cr, nearly

FII / NRIs / OCBs

5.6

at par with the loss at the EBITDA level, as against our expectations of a net loss

Indian Public / Others

3.8

of `623cr.

Outlook and valuation

Abs. (%)

3m 1yr

3yr

The stock is currently trading at a P/BV of 0.5x and 0.6x its FY2016E and

Sensex

(7.2)

(8.2)

41.3

FY2017E book value, respectively. Given the weak outlook on steel prices and

SAIL

(20.8)

(46.8)

(42.7)

with the company already in the red at the operating level, we expect tough times

to continue for the stock. The capacity expansion coupled with negative cash flows

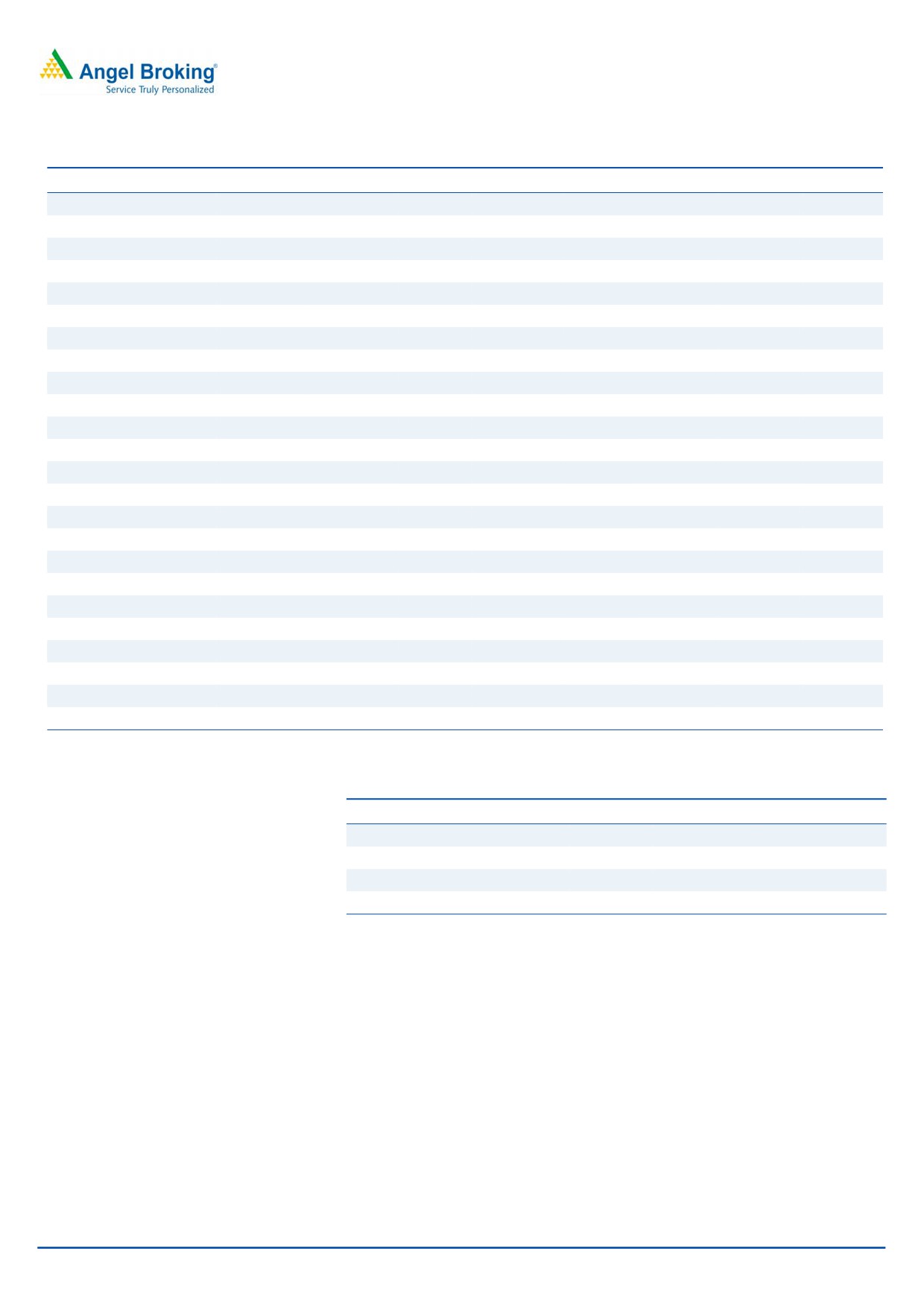

3-year price chart

will also result in a significant worsening in leverage ratios. We retain our Neutral

120

view on the stock.

100

80

Key financials (Consolidated)

Y/E March (` cr)

FY2013

FY2014

FY2015

FY2016E

FY2017E

60

40

Net sales

44,477

46,468

45,472

36,487

34,072

20

% chg

(3.3)

4.5

(2.1)

(19.8)

(6.6)

0

Adj. net profit

2,517

1,446

2,247

(4,207)

(6,109)

% chg

(34.9)

(42.6)

55.4

(287.2)

45.2

Adj. EPS (`)

6.1

3.5

5.4

(10.2)

(14.8)

Source: Company, Angel Research

OPM (%)

11.2

9.0

11.0

(7.7)

(12.4)

P/E (x)

7.5

13.0

8.4

(4.5)

(3.1)

P/BV (x)

0.5

0.4

0.4

0.5

0.6

RoE (%)

5.7

6.2

4.9

(10.1)

(17.2)

RoCE (%)

5.7

3.6

4.4

(6.2)

(8.6)

Rahul Dholam

EV/Sales (x)

0.8

0.9

1.0

1.5

1.8

Tel: 022- 3935 7800 Ext: 6847

EV/EBIDTA

7.4

9.6

9.0

(19.1)

(15.1)

Source: Company, Angel Research; Note: CMP as of November 17, 2015

Please refer to important disclosures at the end of this report

1

Steel Authority of India | 2QFY2016 Result Update

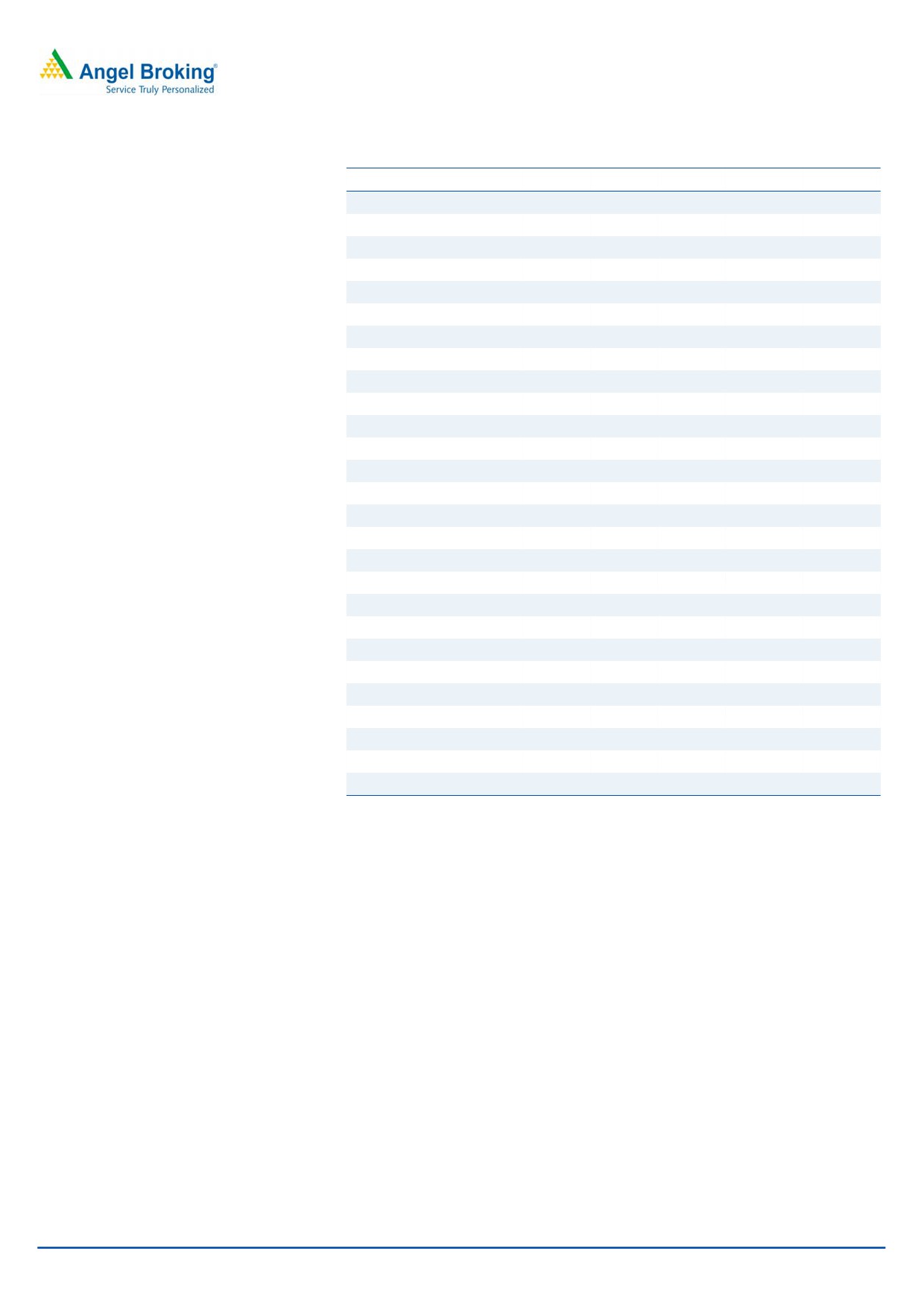

Exhibit 1: 2QFY2016 performance (Standalone)

(` cr)

2QFY16

2QFY15

yoy%

1QFY16

qoq%

FY2015

FY2014

yoy%

Net sales

9,113

11,566

(21.2)

9,384

(2.9)

45,472

46,468

(2.1)

Other operating income

144

113

27.3

119

20.7

480

470

2.2

Total Revenue

9,257

11,679

(20.7)

9,503

(2.6)

45,952

46,938

(2.1)

Raw material

4,065

4,310

(5.7)

3,671

10.7

17,812

20,868

(14.6)

% of net sales

44.6

37.3

39.1

39.2

44.9

Employee Cost

2,417

2,365

2.2

2,417

(0.0)

9,866

9,708

1.6

% of net sales

26.5

20.4

25.8

21.7

20.9

Power & Fuel cost

1,395

1,475

(5.4)

1,347

3.6

4,229

3,731

13.4

% of net sales

15.3

12.8

14.4

9.3

8.0

Other expenditure

2,429

2,193

10.8

2,150

13.0

9,057

8,434

7.4

% of net sales

26.7

19.0

22.9

19.9

18.1

Total expenditure

10,305

10,342

(0.4)

9,584

7.5

40,965

42,741

(4.2)

% of net sales

113.1

89.4

102.1

90.1

92.0

EBITDA

(1,048)

1,336

-

(82)

-

4,987

4,197

18.8

Margin (%)

(11.5)

11.6

(0.9)

11.0

9.0

194bp

Interest

467

356

31.4

443

5.5

1,535

1,047

46.6

Depreciation

436

392

11.3

426

2.3

1,883

1,836

2.6

Other income

131

162

(19.3)

174

(25.0)

983

826

19.0

Exceptional items

0

0

0

(89)

1,206

Profit before tax

(1,821)

751

(777)

2,464

3,346

(43.7)

% of net sales

(20.0)

6.5

(8.3)

5.4

7.2

Tax

(765)

101

(455)

306

693

(55.9)

% of PBT

42.0

13.5

58.6

12.4

20.7

Adj. PAT

(1,056)

649

(322)

2,158

2,652

(18.6)

Source: Company, Angel Research

Exhibit 2: Standalone - 2QFY2016 Actual vs. estimates

(` cr)

Actual

Estimates

Variation (%)

Net sales

9,113

9,392

(3.0)

EBITDA

(1,048)

(170)

-

EBITDA margin (%)

(11.5)

(1.8)

(9.7pp)

Net profit

(1,056)

(623)

-

Source: Company, Angel Research

Result highlights

Volumes in-line; Weak realisations hurt revenue

Sail reported a weak set of numbers for 2QFY2016 with a loss at the operating

and net level. While volumes were in line with our expectations at 2.74MT

(estimate 2.75MT), blended realisations declined 15% yoy to `37,388/tonne as

against our expectation of a 12% decline. Led by the higher than expected drop in

realisations, net sales declined 21% yoy to `9,113cr, 3% below our estimate.

November 18, 2015

2

Steel Authority of India | 2QFY2016 Result Update

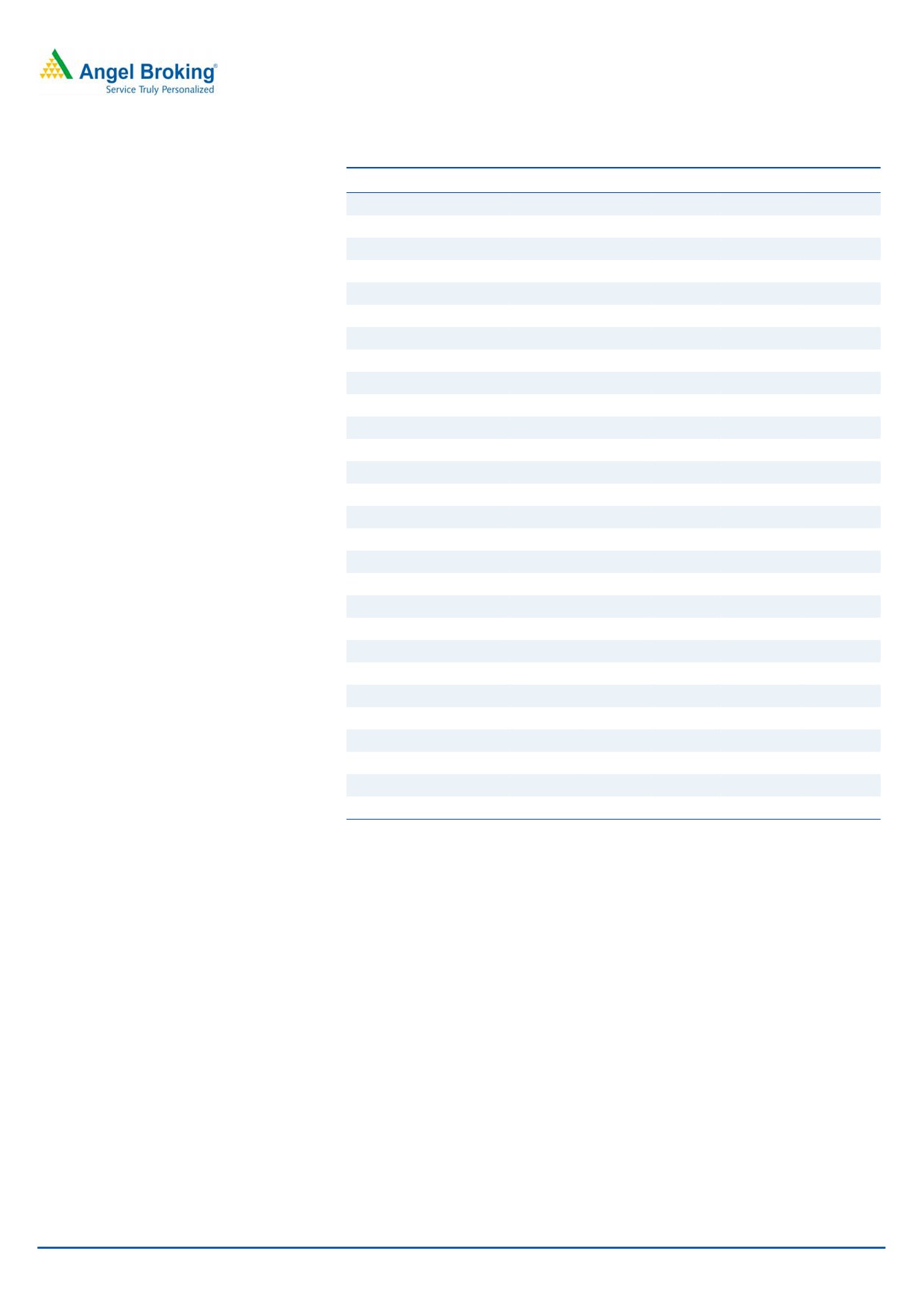

Exhibit 3: Production and Off-take remain stable

Exhibit 4: :Lower realisations impact revenue

4.0

14,000

15

3.5

12,000

10

3.0

5

10,000

2.5

0

8,000

2.0

(5)

6,000

1.5

(10)

4,000

1.0

(15)

0.5

2,000

(20)

0.0

0

(25)

Saleable Steel Volumes (MT)

Saleable Steel Production (MT)

Revenue (` cr)

yoy change (%)

Source: Company, Angel Research

Source: Company, Angel Research

Operating expenses came in much higher than expectations resulting in an EBITDA

loss of `1,048cr as against our expectation of an EBITDA loss of `170cr. Material

costs came in much ahead of our expectation at `4,065cr (44.6% of net sales) as

against our expectations of `3,713cr (39.5% of revenues). Other expenses too

were higher than expectations resulting in an higher than expected EBITDA loss.

Lower than expected depreciation and finance expenses and a higher than

expected deferred tax credit resulted in a net loss of `1,056cr for the quarter,

nearly at par with the loss at the EBITDA level, as against our expectations of a net

loss of `623cr.

Exhibit 5: Realisation / EBITDA (`/ Tonne)

1Q14

2Q14

3Q14

4Q14

1Q15

2Q15

3Q15

4Q15

1Q16

2Q16

Realisation

43,697

38,033

42,388

43,189

45,346

44,143

42,976

40,779

39,228

37,388

EBITDA

3,251

2,610

3,888

3,493

4,094

4,561

4,224

2,943

(304)

(3,827)

Source: Company, Angel Research

Exhibit 6: High material cost results in EBITDA loss

Exhibit 7: Net profit too declines sharply

1,500

11.4

15.0

1,500

15.0

10.2

10.0

10.9

10.2

9.0

8.3

8.0

1,000

6.8

10.0

1,000

10.0

5.6

5.2

4.4

4.6

4.7

3.4

500

5.0

500

5.0

2.9

(0.9)

-

0.0

-

0.0

(3.4)

(500)

(5.0)

(500)

(5.0)

(1,000)

(10.0)

(1,000)

(10.0)

(11.3)

(11.4

)

(1,500)

(15.0)

(1,500)

(15.0)

EBITDA (` cr)

Margin (%)

Net Profit (` cr)

Margin (%)

Source: Company, Angel Research

Source: Company, Angel Research

November 18, 2015

3

Steel Authority of India | 2QFY2016 Result Update

Investment arguments

Outlook for steel prices continues to remain negative

Steel prices continue to remain under pressure led by Chinese exports and

depreciation of the Russian Ruble. Demand continues to remain weak across the

world. The World Steel Association has forecasted steel demand to decline 1.7% in

CY2015 and increase marginally

(0.7%) in CY2016. Chinese demand is

forecasted to fall by 3.5% and 2% in CY2015 and CY2016 respectively. Global

supply of iron ore also continues to remain strong, with iron ore majors continuing

to increase production. We therefore expect prices on the raw material side to also

remain under pressure resulting in downward pressure on product prices.

Capacity expansion to add pressure in the near term

Sail is expanding its crude steel capacity from 13.9MT at the end of FY2015 to

21.4MT by FY2017. The company has incurred ~63% of the capex for the

ongoing expansion projects and expects to incur a total capex of `6,500cr in

FY2016. We expect Sail to benefit from this additional capacity over the long term

in terms of gaining market share and improving its product mix. However, given

the pressure from imports currently and the weak outlook on steel prices, we

expect cash flow to remain negative, led by a gradual ramp up in utilisation of this

additional capacity. The debt equity ratio for the company has already inched up

to 0.8x at the end of 2QFY2016 from 0.4x at the end of FY2012. Led by the

strong capex and negative cash flow, we expect the net debt to EBITDA ratio to

increase to 1.25x in FY2017.

November 18, 2015

4

Steel Authority of India | 2QFY2016 Result Update

Outlook and valuation

The stock is currently trading at a P/B of 0.5x and 0.6x its FY2016E and FY2017E

book value, respectively. Given the weak outlook on steel prices and with the

company already in the red at the operating level, we expect tough times to

continue for the stock. We retain our Neutral view on the stock.

Company background

Steel Authority of India Ltd is one of the largest steel-making company in India and

one of the seven Maharatnas of the country’s central public sector enterprises. SAIL

produces iron and steel at five integrated plants and three special steel plants,

located principally in the eastern and central regions of India and situated close to

domestic sources of raw materials. The company has a strong product mix that

includes flat products, such as HR coils & plates, CR coils, pipes and electric sheets,

and long products, such as TMT bars and wire rods. It also manufactures long

rails, blooms, billets, slabs, channels, joists, angles, forged alloy and special steel

products, among others.

November 18, 2015

5

Steel Authority of India | 2QFY2016 Result Update

Profit & loss statement (Consolidated)

Y/E March (` cr)

FY2013

FY2014

FY2015

FY2016E

FY2017E

Net Sales

44,477

46,468

45,472

36,487

34,072

Other operating income

497

470

480

486

477

Total operating income

44,975

46,938

45,952

36,973

34,549

% chg

(3.6)

4.4

(2.1)

(19.5)

(6.6)

Total Expenditure

40,004

42,741

40,965

39,797

38,770

Net Raw Materials

19,951

20,868

17,812

15,658

15,332

Employee Expenses

8,756

9,708

9,866

9,451

9,029

Power & Fuel

3,669

3,731

4,229

5,460

5,281

Other

7,628.0

8,433.8

9,057.1

9,227.4

9,127.9

EBITDA

4,970

4,197

4,987

(2,824)

(4,222)

% chg

(22.4)

(15.6)

18.8

(156.6)

49.5

(% of Net Sales)

11.2

9.0

11.0

(7.7)

(12.4)

Depreciation& Amortisation

1,527

1,836

1,883

1,799

2,182

EBIT

3,444

2,361

3,104

(4,623)

(6,404)

% chg

(27.1)

(31.4)

31.5

(248.9)

38.5

(% of Net Sales)

7.7

5.1

6.8

(12.7)

(18.8)

Interest & other Charges

846

1,047

1,535

1,882

2,253

Other Income

1,051

826

983

556

511

Recurring PBT

3,649

2,140

2,553

(5,949)

(8,146)

% chg

(34.3)

(41.4)

19.3

(333.0)

36.9

Extraordinary Inc/(Expense)

(188)

1,206

(89)

-

-

PBT (reported)

3,460

3,346

2,464

(5,949)

(8,146)

Tax

1,131

693

306

(1,742)

(2,036)

(% of PBT)

32.7

20.7

12.4

29.3

25.0

Reported PAT

2,329

2,652

2,158

(4,207)

(6,109)

Adjusted PAT

2,517

1,446

2,247

(4,207)

(6,109)

% chg

(34.9)

(42.6)

55.4

(287.2)

45.2

(% of Net Sales)

5.7

3.1

4.9

(11.5)

(17.9)

November 18, 2015

6

Steel Authority of India | 2QFY2016 Result Update

Balance sheet (Consolidated)

Y/E March (` cr)

FY2013

FY2014

FY2015

FY2016E FY2017E

SOURCES OF FUNDS

Equity Share Capital

4,131

4,131

4,131

4,131

4,131

Reserves & Surplus

37,514

39,154

40,072

34,862

27,748

Shareholders Funds

41,644

43,285

44,203

38,992

31,879

Total Loans

22,265

24,855

28,756

36,972

41,723

Deferred Tax Liability

1,900

2,207

2,566

824

(1,212)

Other Long term liabilities

5,609

5,477

5,310

5,495

5,620

Total Liabilities

71,418

75,823

80,835

82,283

78,011

APPLICATION OF FUNDS

Gross Block

45,134

56,512

67,824

82,488

92,070

Less: Acc. Depreciation

26,750

28,337

30,088

31,886

34,068

Net Block

18,384

28,175

37,736

50,601

58,001

Capital Work-in-Progress

36,161

33,959

29,328

19,164

9,982

Goodwill

0

0

0

0

0

Investments

73

91

454

454

454

Current Assets

28,380

27,395

28,959

28,067

21,906

Cash

4,177

3,142

2,606

1,891

(3,350)

Loans & Advances

16,166

15,355

17,943

19,044

18,295

Other

8,036

8,898

8,410

7,133

6,961

Current liabilities

15,086

18,045

20,484

20,941

17,368

Net Current Assets

13,293

9,350

8,475

7,126

4,538

Other Assets

3,507.3

4,248.2

4,842.3

4,938.0

5,035.7

Total Assets

71,418

75,823

80,835

82,283

78,011

November 18, 2015

7

Steel Authority of India | 2QFY2016 Result Update

Cash flow statement (Consolidated)

Y/E March (` cr)

FY2013

FY2014

FY2015

FY2016E FY2017E

Profit before tax

3,460

3,346

2,464

(5,949)

(8,146)

Depreciation

1,530

1,720

1,902

1,799

2,182

Change in Working Capital

(2,236)

2,314

(1,798)

1,350

(1,901)

Others

1,059

(219)

1,141

1,970

2,281

Direct taxes paid

(991)

(848)

(504)

0

0

Cash Flow from Operations

2,823

6,313

3,205

(830)

(5,584)

(Inc.)/ Dec. in Fixed Assets

(9,216)

(8,956)

(6,426)

(4,500)

(400)

(Inc.)/ Dec. in Investments

(4)

(19)

(362)

0

0

Share of profit/ (loss) from asso.

904

610

820

0

0

Cash Flow from Investing

(8,317)

(8,365)

(5,968)

(4,500)

(400)

Issue of Equity

0.7

0.3

27.9

-

-

Inc./(Dec.) in loans

5,003

3,214

4,619

7,500

4,000

Interest Expenses

(849)

(1,009)

(1,503)

(1,882)

(2,253)

Dividend Paid (Incl. Tax)

(1,162)

(1,189)

(1,004)

(1,004)

(1,004)

Others

15

1

86

-

-

Cash Flow from Financing

3,009

1,017

2,227

4,614

743

Inc./(Dec.) in Cash

(2,485)

(1,035)

(536)

(715)

(5,241)

Opening Cash balances

6,662

4,177

3,142

2,606

1,891

Closing Cash balances

4,177

3,142

2,606

1,891

(3,350)

November 18, 2015

8

Steel Authority of India | 2QFY2016 Result Update

Key Ratios

Y/E March

FY2013

FY2014

FY2015

FY2016E

FY2017E

Per Share Data (`)

Reported EPS

6.1

3.5

5.4

-

-

Adjusted EPS

6.1

3.5

5.4

-

-

Cash EPS

9.3

10.9

9.8

-

-

DPS

2.0

2.0

2.0

2.0

2.0

Book Value

100.8

104.8

107.0

94.4

77.2

Valuation Ratio (x)

P/E (on FDEPS)

7.5

13.0

8.4

-

-

P/CEPS

4.9

4.2

4.6

-

-

P/BV

0.5

0.4

0.4

0.5

0.6

Dividend yield (%)

4.4

4.4

4.4

4.4

4.4

EV/Sales

0.8

0.9

1.0

1.5

1.8

EV/EBITDA

7.4

9.6

9.0

-

-

EV/Total Assets

0.5

0.5

0.6

0.7

0.8

Returns (%)

ROCE

5.7

3.6

4.4

-

-

ROE

5.7

6.2

4.9

-

-

Turnover ratios (x)

Asset Turnover (Gross Block)

1.0

0.9

0.7

0.5

0.4

Inventory (days)

123.3

123.8

133.6

185.0

200.0

Receivables (days)

38.6

39.4

35.0

31.0

31.0

Payables (days)

173.4

204.1

255.1

354.0

370.3

WC cycle (ex-cash) (days)

14.9

(13.8)

(52.0)

(91.3)

(94.8)

Solvency ratios (x)

Net debt to equity

0.4

0.5

0.6

0.9

1.4

Net debt to EBITDA

0.8

0.9

0.9

0.9

1.1

Interest Coverage (EBIT / Int.)

4.1

2.3

2.0

-

-

November 18, 2015

9

Steel Authority of India | 2QFY2016 Result Update

Research Team Tel: 022 - 39357800

DISCLAIMER

Angel Broking Private Limited (hereinafter referred to as “Angel”) is a registered Member of National Stock Exchange of India Limited,

Bombay Stock Exchange Limited and MCX Stock Exchange Limited. It is also registered as a Depository Participant with CDSL and

Portfolio Manager with SEBI. It also has registration with AMFI as a Mutual Fund Distributor. Angel Broking Private Limited is a

registered entity with SEBI for Research Analyst in terms of SEBI (Research Analyst) Regulations, 2014 vide registration number

INH000000164. Angel or its associates has not been debarred/ suspended by SEBI or any other regulatory authority for accessing

/dealing in securities Market. Angel or its associates including its relatives/analyst do not hold any financial interest/beneficial

ownership of more than 1% in the company covered by Analyst. Angel or its associates/analyst has not received any compensation /

managed or co-managed public offering of securities of the company covered by Analyst during the past twelve months. Angel/analyst

has not served as an officer, director or employee of company covered by Analyst and has not been engaged in market making activity

of the company covered by Analyst.

This document is solely for the personal information of the recipient, and must not be singularly used as the basis of any investment

decision. Nothing in this document should be construed as investment or financial advice. Each recipient of this document should

make such investigations as they deem necessary to arrive at an independent evaluation of an investment in the securities of the

companies referred to in this document (including the merits and risks involved), and should consult their own advisors to determine

the merits and risks of such an investment.

Reports based on technical and derivative analysis center on studying charts of a stock's price movement, outstanding positions and

trading volume, as opposed to focusing on a company's fundamentals and, as such, may not match with a report on a company's

fundamentals.

The information in this document has been printed on the basis of publicly available information, internal data and other reliable

sources believed to be true, but we do not represent that it is accurate or complete and it should not be relied on as such, as this

document is for general guidance only. Angel Broking Pvt. Limited or any of its affiliates/ group companies shall not be in any way

responsible for any loss or damage that may arise to any person from any inadvertent error in the information contained in this report.

Angel Broking Pvt. Limited has not independently verified all the information contained within this document. Accordingly, we cannot

testify, nor make any representation or warranty, express or implied, to the accuracy, contents or data contained within this document.

While Angel Broking Pvt. Limited endeavors to update on a reasonable basis the information discussed in this material, there may be

regulatory, compliance, or other reasons that prevent us from doing so.

This document is being supplied to you solely for your information, and its contents, information or data may not be reproduced,

redistributed or passed on, directly or indirectly.

Neither Angel Broking Pvt. Limited, nor its directors, employees or affiliates shall be liable for any loss or damage that may arise from

or in connection with the use of this information.

Note: Please refer to the important ‘Stock Holding Disclosure' report on the Angel website (Research Section). Also, please refer to the

latest update on respective stocks for the disclosure status in respect of those stocks. Angel Broking Pvt. Limited and its affiliates may

have investment positions in the stocks recommended in this report.

Disclosure of Interest Statement

Steel Authority of India

1. Analyst ownership of the stock

No

2. Angel and its Group companies ownership of the stock

No

3. Angel and its Group companies' Directors ownership of the stock

No

4. Broking relationship with company covered

No

Note: We have not considered any Exposure below ` 1 lakh for Angel, its Group companies and Directors

Ratings (Based on expected returns

Buy (> 15%)

Accumulate (5% to 15%)

Neutral (-5 to 5%)

over 12 months investment period):

Reduce (-5% to -15%)

Sell (< -15)

November 18, 2015

10