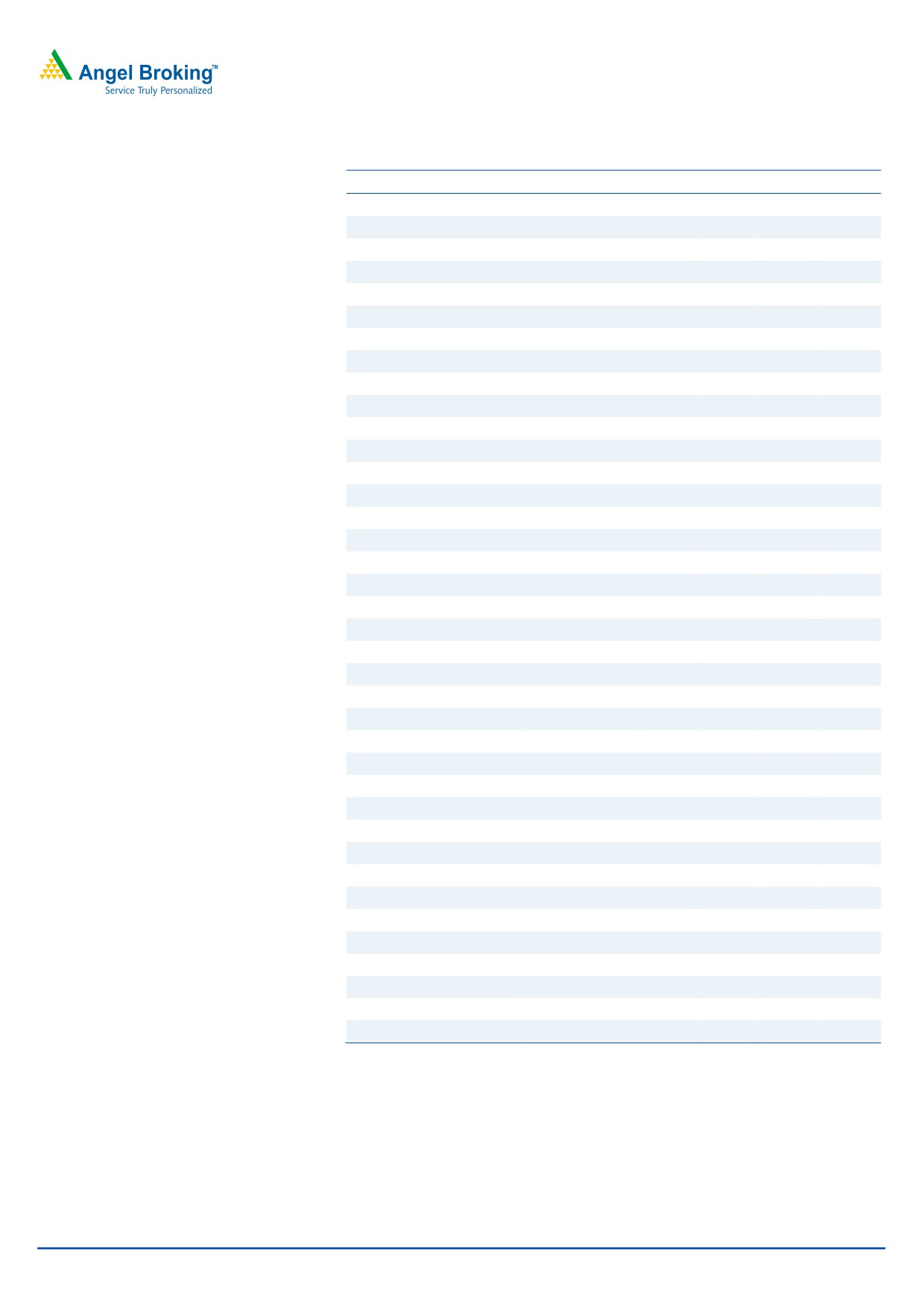

2QFY2016 Result Update | Banking

November 7, 2015

State Bank of India

BUY

CMP

`243

Performance Highlights

Target Price

`283

Particulars (` cr)

2QFY16 1QFY16

% chg (qoq)

2QFY15

% chg (yoy)

Investment Period

12 months

NII

14,253

13,732

3.8

13,275

7.4

Pre-prov. profit*

10,266

9,202

11.6

8,422

21.9

Stock Info

PAT

3,879

3,692

5.1

3,100

25.1

Source: Company, Angel Research

Sector

Banking

Market Cap (` cr)

1,88,830

State Bank of India (SBI)’s 2QFY2016 results have outperformed our as well as

Beta

1.4

street expectations. The PAT for the bank grew 25.1% yoy to `3,879cr, led by

52 Week High / Low

336/221

healthy performance on all fronts.

Avg. Daily Volume

1,67,84,206

Slippages dip, NIM improves, qoq

Face Value (`)

1

During 2QFY2016, the bank’s advances grew by 10.5% yoy, which is the highest

BSE Sensex

26,265

growth rate amongst the previous 5 quarters. Consolidation continued in mid-

Nifty

7,954

corporate and Agri, which posted a decline of 5.2% and 2.2% yoy, respectively.

Reuters Code

SBI.BO

On the other hand, retail and large corporate continued to scale up with a

Bloomberg Code

SBIN@IN

growth of 16.8% yoy and 21.7% yoy, respectively. Deposits outpaced advances

with a 10.9% yoy growth for the quarter, with retail term deposits growing at

12.6% yoy. The Global NIM increased marginally by 2bp qoq to 3.01% in

Shareholding Pattern (%)

2QFY2016 which was mainly due to decline in the cost of funds; but yields

Promoters

60.2

witnessed a decline during the quarter. The non-interest income (excl. treasury)

MF / Banks / Indian Fls

18.4

for the bank grew by 14.2% yoy, with fee income growth of 1.4% yoy.

FII / NRIs / OCBs

10.4

Asset quality showed signs of improvement with Gross and Net NPA ratios

declining by 14bp and 10bp to 4.15% and 2.14% respectively. Fresh slippages

Indian Public / Others

11.1

came in at `5,875cr as against `7,318cr for 1QFY2016. Even restructuring of

loan assets came lower at `2,450cr as against `3,936cr in the sequential

previous quarter. The bank refinanced ~`4,000cr worth of loans under the 5/25

Abs. (%)

3m 1yr 3yr

scheme and `400cr worth of assets were sold to ARCs, during the quarter. Further, it

has guided for a refinacing pipeline of ~`6,600cr (8 loan accounts), going ahead.

Sensex

(7.2)

(5.9)

39.6

Outlook and valuation: SBI has been reporting stable numbers with respect to

SBI

(15.6)

(12.6)

11.9

slippages and NPA ratios over the past several quarters as compared to its peers.

With expectation of improvement in economic growth in the medium term, asset

3-year price chart

quality woes could further reduce, which in turn could lead to further

350

improvement in return ratios. The bank’s core strength has been its high CASA

300

250

and fee income, which has supported its core profitability in challenging times. Its

200

strong capital adequacy also provides comfort. In our view, the stock is currently

150

trading at a moderate valuation of 0.9x FY2017E ABV (after adjusting `44/share

100

towards value of subsidiaries) as compared to its peers. Hence, we recommend a

50

0

BUY rating on the stock with a target price of `283.

Key financials (standalone)

Y/E March (` cr)

FY2014

FY2015E

FY2016E

FY2017E

NII

49,282

55,015

56,952

65,593

Source: Company, Angel Research

% chg

11.2

11.6

3.5

15.2

Net profit

10,891

13,169

14,954

18,266

% chg

(22.8)

20.9

13.6

22.2

Vaibhav Agrawal

NIM (%)

3.0

3.0

2.7

2.8

022 - 3935 7800 Ext: 6808

EPS (`)

14.6

17.6

20.0

24.5

P/E (x)

16.3

13.4

11.8

9.7

P/ABV (x)

1.6

1.5

1.3

1.1

Chintan Shah

RoA (%)

0.6

0.7

0.7

0.7

022 - 4000 3600 Ext: 6828

RoE (%)

10.4

11.1

11.5

12.8

Source: Company, Angel Research; Note: CMP as of November 6, 2015

Please refer to important disclosures at the end of this report

1

State Bank of India | 2QFY2016 Result Update

Exhibit 1: 2QFY2016 performance (standalone)

Particulars (` cr)

2QFY16

1QFY16

% chg (qoq)

2QFY15

% chg (yoy)

FY2015

FY2014

% chg

Interest earned

40,658

39,643

2.6

37,263

9.1

1,52,397

1,36,351

11.8

- on Advances / Bills

28,982

28,582

1.4

27,869

4.0

1,12,344

1,02,484

9.6

- on investments

10,565

10,019

5.4

9,061

16.6

37,088

31,942

16.1

- on balance with RBI & others

180

234

(23.2)

105

71.9

505

409

23.4

- on others

931

808

15.3

228

308.9

2,460

1,516

62.3

Interest Expended

26,405

25,911

1.9

23,988

10.1

97,382

87,069

11.8

Net Interest Income

14,253

13,732

3.8

13,275

7.4

55,015

49,283

11.6

Other income

6,197

5,088

21.8

4,571

35.6

22,576

18,553

21.7

Other income excl. treasury

4,703

4,216

11.6

4,118

14.2

18,957

16,477

15.1

- Fee Income

3,153

3,202

(1.5)

3,111

1.4

14,140

12,611

12.1

- Treasury Income*

1,494

872

71.3

453

229.8

3,619

2,076

74.3

- Forex Income

474

489

(3.1)

466

1.7

1,936

1,778

8.9

- Others

1,076

525

105.0

541

99.0

2,881

2,088

38.0

Operating income

20,450

18,820

8.7

17,845

14.6

77,591

67,835

14.4

Operating expenses

10,184

9,618

5.9

9,423

8.1

38,678

35,726

8.3

- Employee expenses

6,142

5,906

4.0

5,564

10.4

23,537

22,504

4.6

- Other Opex

4,042

3,712

8.9

3,860

4.7

15,141

13,222

14.5

Pre-provision Profit

10,266

9,202

11.6

8,422

21.9

38,913

32,109

21.2

Provisions & Contingencies

4,361

4,000

9.0

4,275

2.0

19,600

15,935

23.0

- Provisions for NPAs

3,842

3,359

14.4

4,028

(4.6)

18,709

14,224

31.5

- Provisions for Investments

(51)

180

(128.3)

(1)

5,000.0

(590)

563

(204.8)

- Provisions for Std. Assets

591

396

49.2

159

271.7

1,010

1,261

(19.9)

- Other Provisions

(21)

65

(132.5)

89

(123.8)

470

(112)

(518.9)

PBT

5,905

5,202

13.5

4,147

42.4

19,314

16,174

19.4

Provision for Tax

2,026

1,510

34.2

1,047

93.6

6,212

5,283

17.6

PAT

3,879

3,692

5.1

3,100

25.1

13,102

10,891

20.3

Effective Tax Rate (%)

34.3

29.0

529bp

25.2

908bp

32.2

32.7

(50)bp

Source: Company, Angel Research;

November 7, 2015

2

State Bank of India | 2QFY2016 Result Update

Exhibit 2: 2QFY2016 performance analysis (standalone)

Particulars

2QFY16

1QFY16 % chg (qoq) 2QFY15 % chg (yoy)

Balance sheet

Advances (` cr)

13,37,153 12,80,127

4.5 12,09,648

10.5

Deposits (` cr)

16,34,115 16,13,545

1.3 14,73,785

10.9

Credit-to-Deposit Ratio (%)

81.8

79.3

249bp

82.1

(25)bp

Current deposits (` cr)

1,01,033

96,845

4.3

90,939

11.1

Saving deposits (` cr)

5,50,397

5,39,050

2.1

5,00,861

9.9

CASA deposits (` cr)

6,51,430

6,35,895

2.4

5,91,800

10.1

CASA ratio (%)

39.9

39.4

45bp

40.2

(29)bp

CAR (%)*

12.2

12.0

17bp

12.3

(16)bp

Tier 1 CAR (%)*

9.9

9.6

29bp

10.1

(15)bp

Profitability Ratios (%)

Cost of deposits

6.30

6.35

(5)bp

6.31

(1)bp

Yield on advances

10.32

10.33

(1)bp

10.57

(25)bp

Cost of funds

-

-

0bp

6.4

(642)bp

Reported NIM (global)

3.01

2.99

2bp

3.11

(10)bp

Cost-to-income ratio

49.8

51.1

(131)bp

52.8

(301)bp

Asset quality

Gross NPAs (` cr)

56,834

56,421

0.7

60,712

(6.4)

Gross NPAs (%)

4.2

4.3

(14)bp

4.9

(74)bp

Net NPAs (` cr)

28,592

28,669

(0.3)

32,997

(13.4)

Net NPAs (%)

2.1

2.2

(10)bp

2.7

(59)bp

Provision Coverage Ratio (%)

70.5

69.5

99bp

63.2

730bp

Slippage ratio (%)

1.8

2.4

(61)bp

2.5

(74)bp

Loan loss prov. to avg assets (%)

0.8

0.7

7bp

0.9

(14)bp

Source: Company, Angel Research

November 7, 2015

3

State Bank of India | 2QFY2016 Result Update

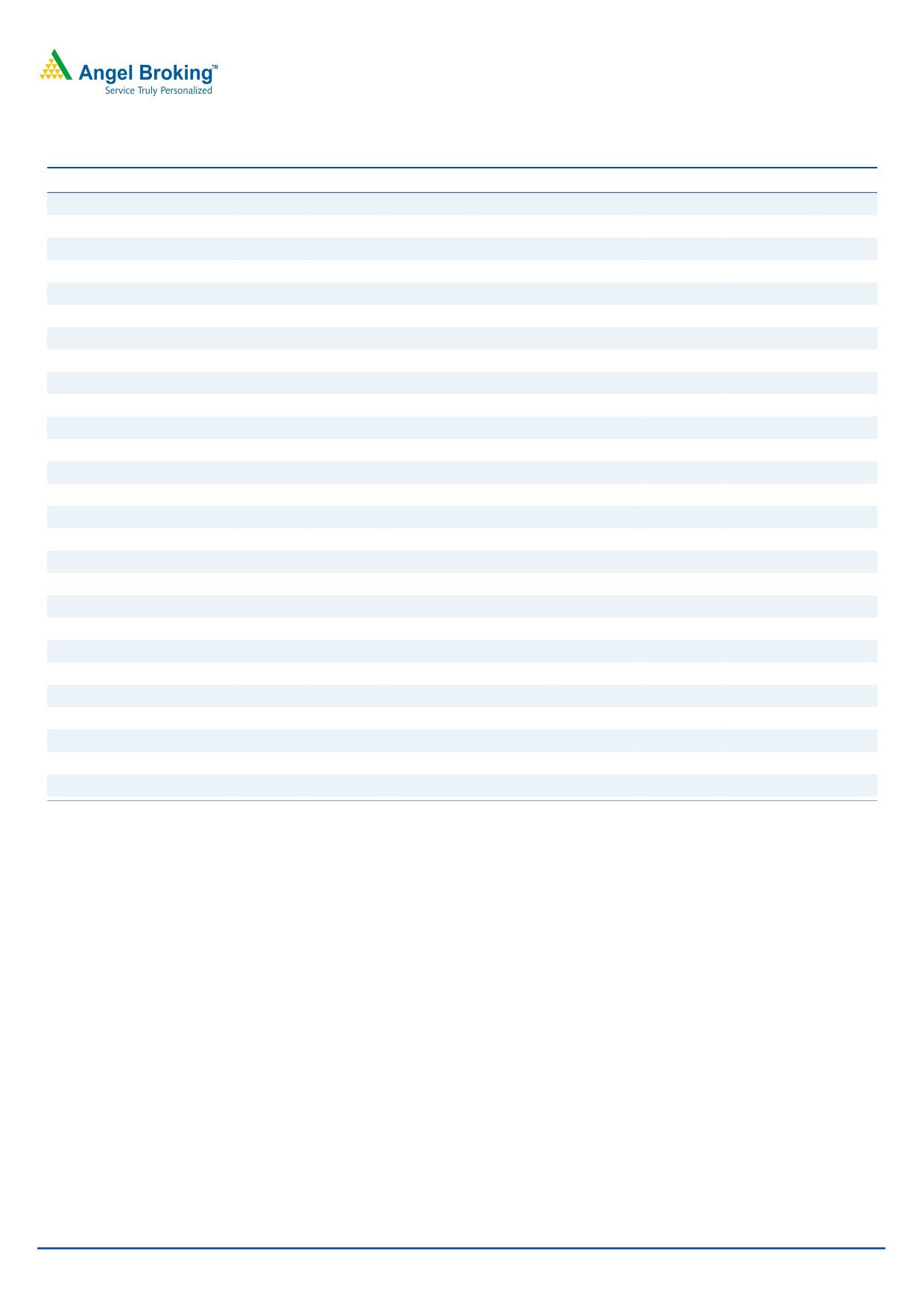

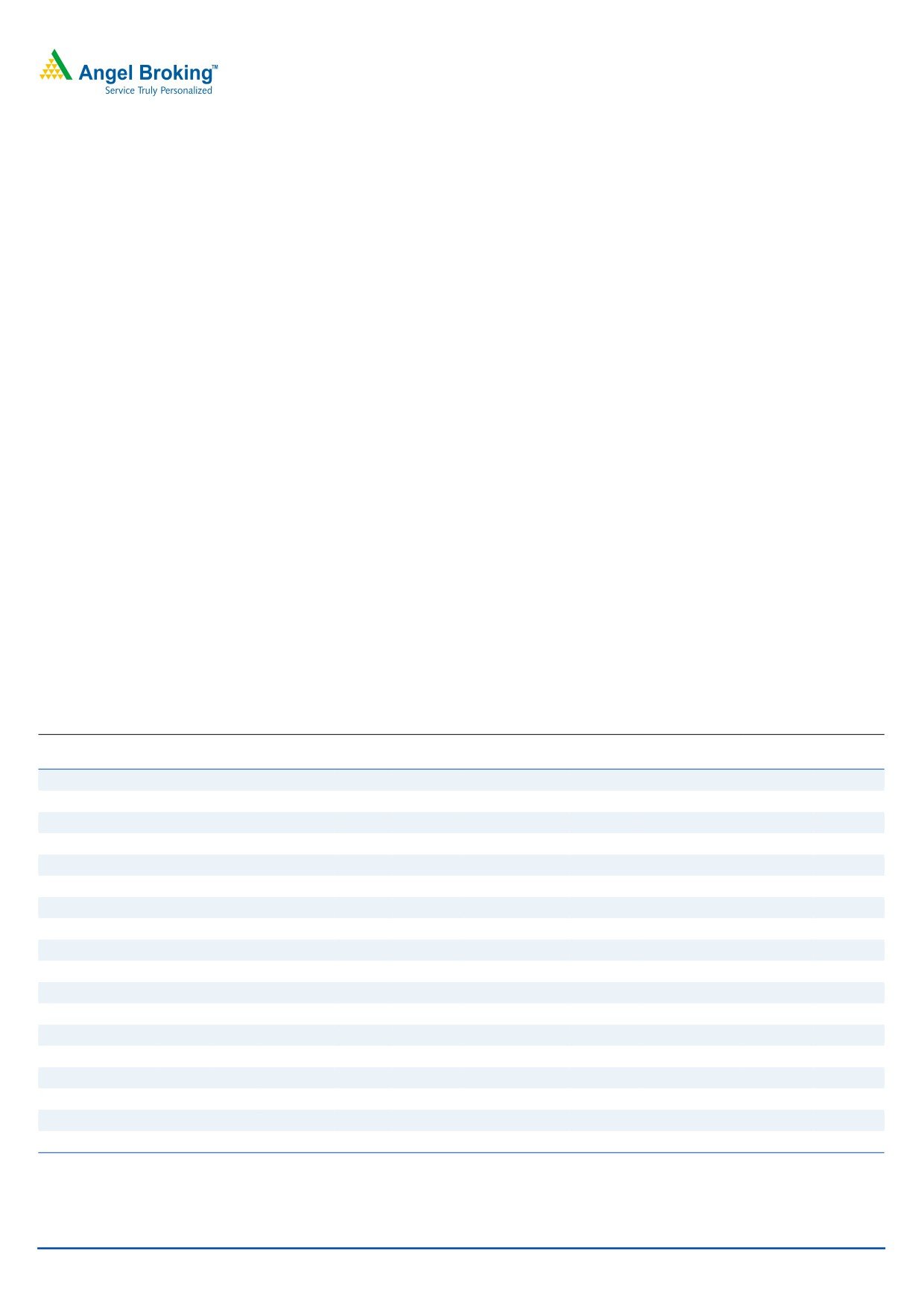

Pick-up in advances growth; Margin improves qoq

During 2QFY2016, the bank’s advances grew by 10.5% yoy, which is the highest

growth rate amongst the previous 5 quarters. Consolidation continued in mid-

corporate and Agri, which posted a decline of 5.2% and 2.2% yoy, respectively.

On the other hand, retail and large corporate continued to scale up with a growth

of 16.8% yoy and 21.7% yoy, respectively. Advances growth was also backed by a

17% yoy growth in overseas loans, which now constitute 19.4% of the total loan

portfolio. Deposits outpaced advances with a 10.9% yoy growth for the quarter,

with retail term deposits growing at 12.6% yoy.

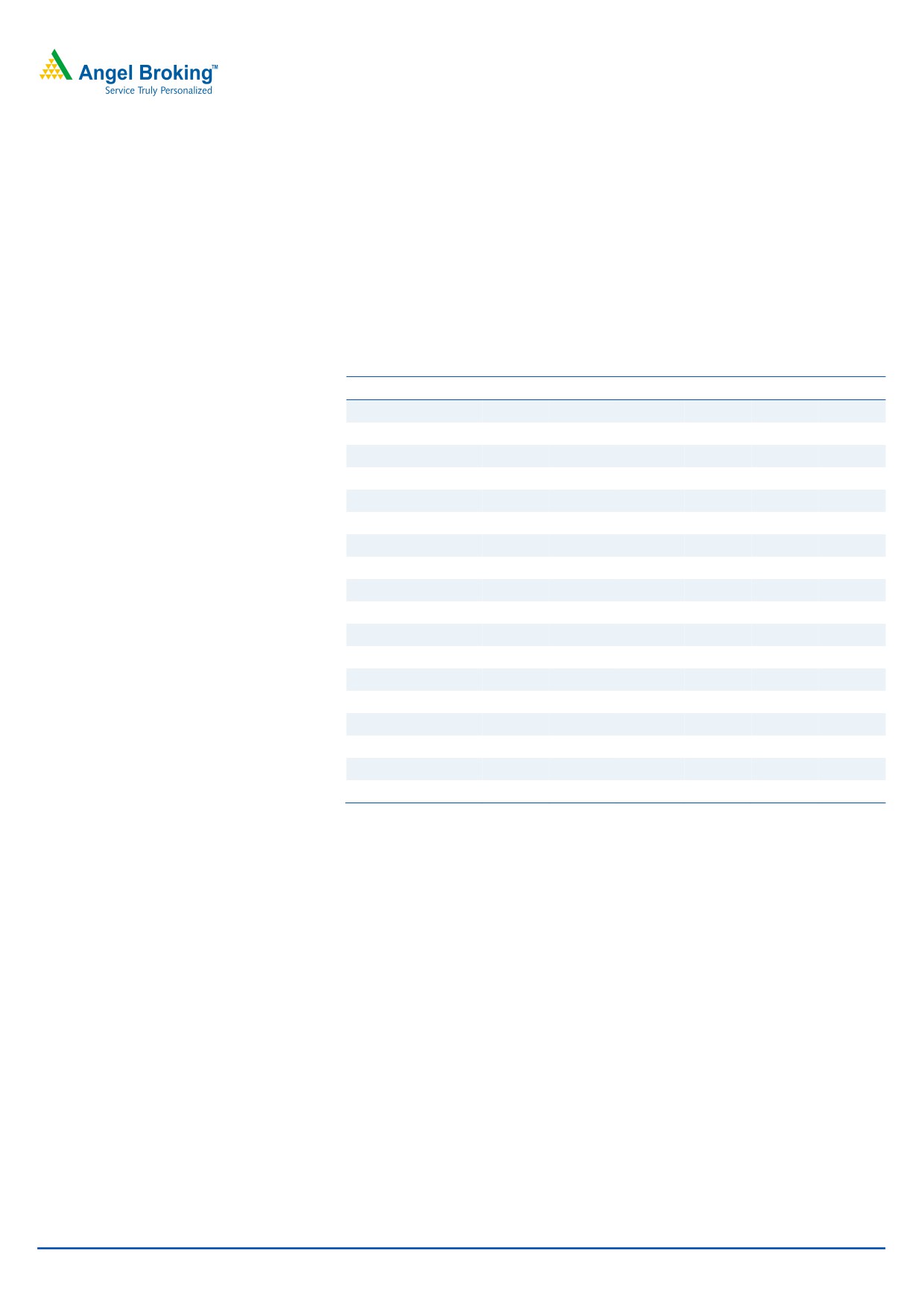

The Global NIM increased marginally by 2bp qoq to 3.01% in 2QFY2016 which

was mainly due to decline in the cost of funds by 5bp qoq to 6.30% whereas the

benefits were partially offset by declining yields, which came at 10.32%. The bank

expects a marginal decline in the NIM from the current level due to a 30bp cut in

the base rate.

Exhibit 3: Business grows at steady pace

Exhibit 4: CASA growth remains moderate

Adv. YoY growth

Dep. YoY growth

CD ratio (RHS)

Reported domestic CASA ratio (%)

CASA yoy growth (%, RHS)

15.0

84.0

41.0

12.4

14.0

82.4

82.1

12.0

81.8

9.9

10.1

12.0

81.6

9.8

82.0

9.3

10.0

40.0

9.0

8.0

79.3

80.0

6.0

6.0

39.0

4.0

78.0

3.0

2.0

-

76.0

38.0

-

2QFY15

3QFY15

4QFY15

1QFY16

2QFY16

2QFY15

3QFY15

4QFY15

1QFY16

2QFY16

Source: Company, Angel Research

Source: Company, Angel Research

Exhibit 5: Yields on Advances witness a dip

Exhibit 6: Global NIM improves qoq

(%)

(%)

3.5

11.0

10.57

10.57

10.55

3.11

3.12

3.16

2.99

3.01

10.33

10.32

10.5

3.0

10.0

2.5

9.5

9.0

2.0

8.5

8.0

1.5

2QFY15

3QFY15

4QFY15

1QFY16

2QFY16

2QFY15

3QFY15

4QFY15

1QFY16

2QFY16

Source: Company, Angel Research

Source: Company, Angel Research, * Cumulative NIMs

Steady growth in non-interest income (excl. treasury)

The non-interest income (excl. treasury) for the bank grew by 14.2% yoy, with

subdued fee income growth of 1.4% yoy. The profit on sale on investments came

at `1,494cr, growing by 230% yoy, which boosted other income. The profit on sale

November 7, 2015

4

State Bank of India | 2QFY2016 Result Update

of investments grew 230% yoy to `1,494cr. It includes ~`1,000cr on account of

churning of the G-Sec portfolio. Also included in the non-interest income is a one-

time extraordinary profit of `485cr pertaining to repatriation of profits from

abroad.

Exhibit 7: Treasury enables healthy non-int. Income

Particulars (` cr)

2QFY16

1QFY16

% chg (qoq) 2QFY15

% chg (yoy)

Fee income

3,153

3,202

(1.5)

3,111

1.4

Treasury

1,494

872

71.3

453

229.8

Forex

474

489

(3.1)

466

1.7

Dividend

47

32

46.9

41

14.6

Others

1,029

493

108.8

500

106.0

Other income

6,197

5,088

21.8

4,571

35.6

Other income excl. treasury

4,703

4,216

11.6

4,118

14.2

Source: Company, Angel Research

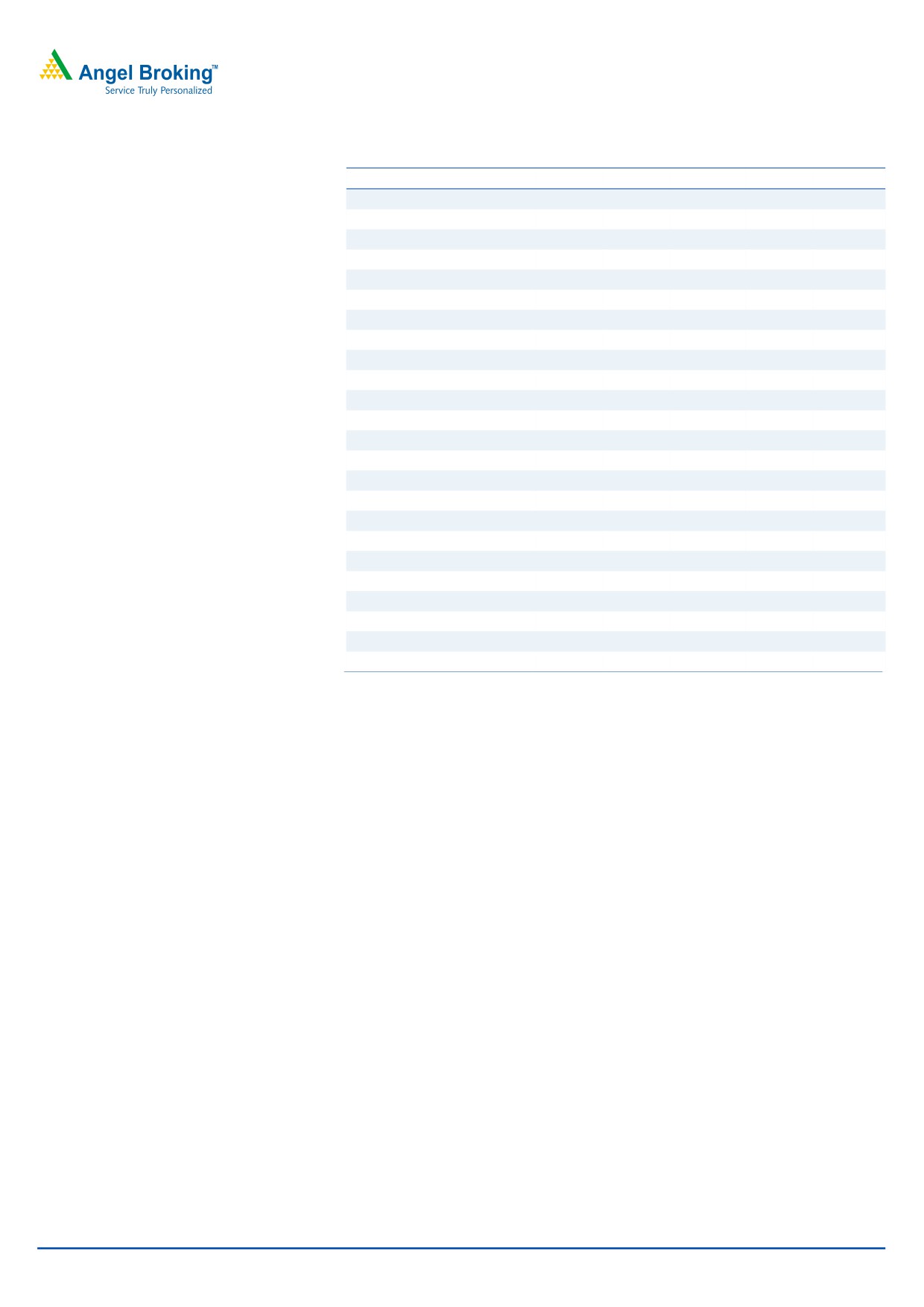

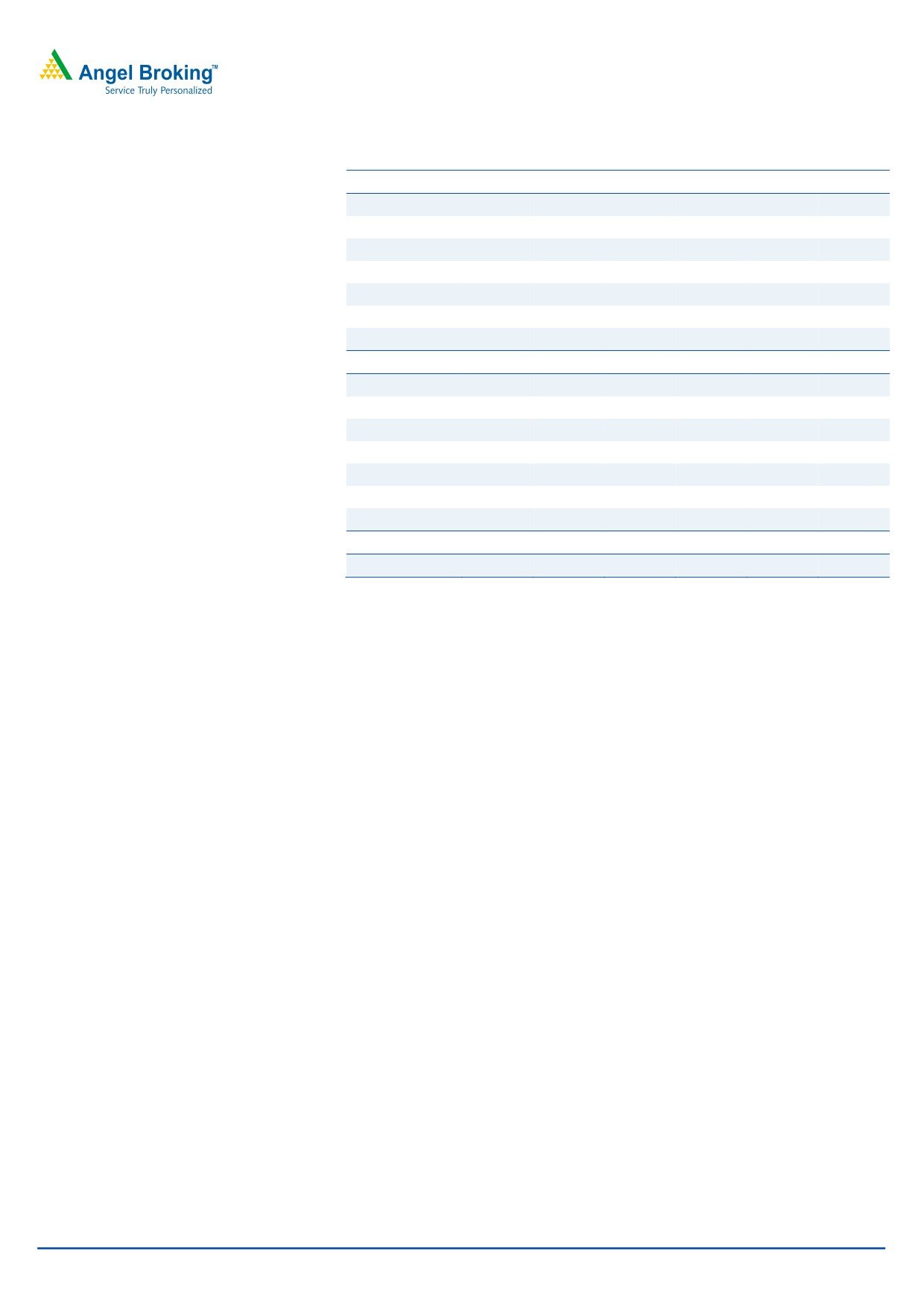

Asset quality improves; Slippages dip qoq

Asset quality showed signs of improvement with Gross and Net NPA ratios

declining by 14bp and 10bp to 4.15% and 2.14% respectively. Fresh slippages for

the quarter came in at `5,875cr as against `7,318cr for 1QFY2016 resulting in

annualized slippage ratio of 1.8% in 2QFY2016 as against 2.3% in 1QFY2016.

Sequential increase in fresh slippages was primarily due to higher slippages from

mid corporate and SME segments. Even restructuring of loan assets came lower at

`2,450cr as against `3,936cr in the sequential previous quarter. The bank

refinanced ~`4,000cr worth of loans under the 5/25 scheme and `400cr worth of

assets were sold to ARCs, during the quarter. Further, it has guided for a pipeline

of ~`6,600cr (8 loan accounts), going ahead. The Reported Gross NPA +

Restructured Std. to Gross advances stood at 8.04% for the quarter, as compared

to 8.55% in 1QFY2016.

Exhibit 8: NPA ratios improving

Exhibit 9: Slippages dip qoq

Gross NPAs (%)

Net NPAs (%)

NPA coverage (%, RHS)

Slippages (%)

Credit cost (%, RHS)

3.0

1.5

6.0

70.5

72.0

69.1

69.5

1.2

5.0

1.2

1.0

68.0

2.0

0.9

4.0

0.7

0.9

63.6

63.2

0.7

3.0

64.0

0.6

2.0

1.0

60.0

0.3

1.0

2.5

2.3

1.6

2.4

1.9

-

56.0

-

-

2QFY15

3QFY15

4QFY15

1QFY16

2QFY16

2QFY15

3QFY15

4QFY15

1QFY16

2QFY16

Source: Company, Angel Research

Source: Company, Angel Research

November 7, 2015

5

State Bank of India | 2QFY2016 Result Update

Performance overview of subsidiaries

SBI Life reported a PAT of `206cr for 2QFY2016, as compared to `218cr in

1QFY2015.

SBI Cards and Payment Services posted a PAT of `70cr for 2QFY2016 as

against `80cr posted in 2QFY2015, while SBI Funds Management recorded a

PAT of `43cr for 2QFY2016 as against `44cr for 2QFY2015.

SBI Capital Markets registered a PAT of

`57cr during 2QFY2016, as

compared to a PAT of `108cr in 2QFY2015.

SBI’s associate banks recorded earnings growth of 38.1% yoy to `873cr for

1QFY2016.

On a consolidated basis, the bottom-line of the bank rose 24% yoy to

`4,992cr during the quarter ended September 30, 2015

Outlook and valuation: SBI has been reporting stable numbers with respect to

slippages and NPA ratios over the past several quarters as compared to its peers.

With expectation of improvement in economic growth in the medium term, asset

quality woes could further reduce, which in turn could lead to further improvement

in return ratios. The bank’s core strength has been its high CASA and fee income,

which has supported its core profitability in challenging times. Its strong capital

adequacy also provides comfort. In our view, the stock is currently trading at a

moderate valuation of 0.9x FY2017E ABV (after adjusting `44/share towards value

of subsidiaries) as compared to its peers. Hence, we recommend a BUY rating on

the stock with a target price of `283.

Exhibit 10: Recommendation summary

CMP

Tgt. Price

Upside

FY2017E

FY2017E Tgt.

FY2017E

FY15-17E

FY2017E

FY2017E

Company

Reco.

(`)

(`)

(%)

P/ABV (x)

P/ABV (x)

P/E (x)

EPS CAGR (%)

RoA (%)

RoE (%)

HDFCBk

Buy

1,081

1,262

16.8

3.3

3.8

17.7

22.4

1.9

19.7

ICICIBk*

Buy

267

348

30.0

1.8

2.0

10.6

15.3

1.6

15.2

YesBk

Buy

758

914

20.5

2.0

2.4

10.9

20.2

1.6

19.6

AxisBk

Buy

465

630

35.5

1.9

2.6

10.7

18.4

1.8

18.9

SBI*

Buy

243

283

16.4

1.2

1.2

9.9

17.8

0.7

12.8

FedBk

Neutral

55

-

-

1.0

1.0

8.7

3.1

1.0

11.9

SIB

Neutral

21

-

-

0.7

0.8

6.2

21.6

0.7

11.6

BOB

Neutral

167

-

-

0.9

0.8

7.9

17.5

0.6

10.6

PNB

Neutral

133

-

-

0.6

0.6

4.9

28.5

0.7

12.0

BOI

Neutral

134

-

-

0.3

0.8

4.0

14.0

0.3

7.6

IndBk

Neutral

128

-

-

0.4

0.4

4.3

19.4

0.7

9.3

Vijaya Bank

Neutral

34

-

-

0.5

0.5

5.1

14.1

0.4

8.8

OBC

Neutral

145

-

-

0.3

0.5

3.2

65.5

0.5

9.4

Allahabad Bank

Neutral

74

-

-

0.3

0.3

2.9

53.5

0.6

10.9

UnionBk

Neutral

163

-

-

0.5

0.4

4.2

18.1

0.6

11.4

CanBk

Neutral

275

-

-

0.4

0.3

4.0

9.8

0.5

10.7

AllBk

Neutral

74

-

-

0.3

0.4

2.9

53.5

0.6

10.9

IDBI#

Neutral

85

-

-

0.6

0.6

6.0

61.6

0.6

9.3

Source: Company, Angel Research; Note:*Target multiples=SOTP Target Price/ABV (including subsidiaries), #Without adjusting for SASF

November 7, 2015

6

State Bank of India | 2QFY2016 Result Update

Company background

State Bank of India is the largest bank in India, with an asset size of ~`20.5lakh

cr. The bank has the widest network of ~16,400 branches, with dominant

presence across all regions in the country, with two-third of its branches in rural

and semi-urban areas. It has subsidiaries in life insurance, asset management,

credit cards and capital markets space, among others; and five regional subsidiary

banks.

Income statement (standalone)

Y/E March (` cr)

FY12

FY13

FY14

FY15

FY16E

FY17E

Net Interest Income

43,291

44,331

49,282

55,015

56,952

65,593

- YoY Growth (%)

33.1

2.4

11.2

11.6

3.5

15.2

Other Income

14,351

16,035

18,553

22,643

25,568

27,706

- YoY Growth (%)

(9.3)

11.7

15.7

22.0

12.9

8.4

Operating Income

57,643

60,366

67,835

77,659

82,520

93,299

- YoY Growth (%)

19.2

4.7

12.4

14.5

6.3

13.1

Operating Expenses

26,069

29,284

35,726

38,678

42,192

46,828

- YoY Growth (%)

13.3

12.3

22.0

8.3

9.1

11.0

Pre - Provision Profit

31,574

31,082

32,109

38,981

40,328

46,471

- YoY Growth (%)

24.6

(1.6)

3.3

21.4

3.5

15.2

Prov. & Cont.

13,090

11,131

15,793

19,599

17,733

18,537

- YoY Growth (%)

26.1

(15.0)

41.9

24.1

(9.5)

4.5

Profit Before Tax

18,483

19,951

16,316

19,382

22,595

27,934

- YoY Growth (%)

23.6

7.9

(18.2)

18.8

16.6

23.6

Prov. for Taxation

6,776

5,846

5,425

6,213

7,641

9,667

- as a % of PBT

36.7

29.3

33.2

32.1

33.8

34.6

PAT

11,707

14,105

10,891

13,169

14,954

18,266

- YoY Growth (%)

41.7

20.5

(22.8)

20.9

13.6

22.2

November 7, 2015

7

State Bank of India | 2QFY2016 Result Update

Balance sheet (standalone)

Y/E March (` cr)

FY12

FY13

FY14

FY15

FY16E

FY17E

Share Capital

671

684

747

747

747

747

Reserves & Surplus

83,280

98,200

1,17,536

1,28,741

1,40,353

1,54,347

Deposits

10,43,647

12,02,740

13,94,409

15,76,793

17,97,544

20,49,201

- Growth (%)

11.7

15.2

15.9

13.1

14.0

14.0

Borrowings

86,989

1,28,954

1,40,550

1,63,633

1,83,736

2,09,459

Tier 2 Capital

40,016

40,229

42,581

41,517

40,479

39,467

Other Liab & Prov.

80,915

94,826

96,413

1,37,677

1,37,278

1,57,226

Total Liabilities

13,35,519

15,65,632

17,92,235

20,49,108

23,00,137

26,10,447

Cash balances

54,076

65,830

84,956

1,15,884

89,877

1,02,460

Bank balances

43,087

48,990

47,594

58,978

66,223

75,494

Investments

3,12,198

3,50,927

3,98,308

4,96,055

6,52,554

7,46,591

Advances

8,67,579

10,45,617

12,09,829

13,00,026

14,04,029

15,86,552

- Growth (%)

14.7

20.5

15.7

7.5

8.0

13.0

Fixed Assets

5,467

7,005

8,002

9,329

10,161

11,236

Other Assets

53,113

47,263

43,546

68,836

77,292

88,113

Total Assets

13,35,519

15,65,632

17,92,235

20,49,108

23,00,137

26,10,447

- Growth (%)

9.1

17.3

14.5

14.3

12.3

14.0

November 7, 2015

8

State Bank of India | 2QFY2016 Result Update

Ratio analysis (standalone)

Y/E March

FY12

FY13

FY14

FY15

FY16E

FY17E

Profitability Ratios (%)

NIMs

3.6

3.2

3.0

3.0

2.7

2.8

Cost to Income Ratio

45.2

48.5

52.7

49.8

51.1

50.2

RoA

0.9

0.9

0.6

0.7

0.7

0.7

RoE

16.5

16.2

10.4

11.1

11.5

12.8

B/S ratios (%)

CASA Ratio

44.8

44.8

42.9

40.4

40.4

41.2

Credit/Deposit Ratio

83.1

86.9

86.8

82.4

78.1

77.4

CAR

13.9

12.9

12.4

11.6

11.0

10.4

- Tier I

9.8

9.5

9.6

9.1

8.8

8.5

Asset Quality (%)

Gross NPAs

4.5

4.8

5.0

4.3

5.1

5.6

Net NPAs

1.8

2.1

2.6

2.1

2.0

1.8

Slippages

3.2

3.6

3.8

2.4

2.4

2.3

Loan Loss Prov./Avg. Assets

0.9

0.7

0.9

1.0

0.8

0.7

Provision Coverage

68.1

66.6

62.9

65.0

71.0

75.0

Per Share Data (`)

EPS

17.4

20.6

14.6

17.6

20.0

24.5

ABVPS

120.0

136.5

144.8

162.9

183.9

207.7

DPS

35.0

41.5

30.0

58.2

39.5

50.5

Valuation Ratios

PER (x)

13.6

11.5

16.3

13.4

11.8

9.7

P/ABVPS (x)

2.0

1.7

1.6

1.5

1.3

1.1

Dividend Yield

14.8

17.5

12.6

24.5

16.7

21.3

DuPont Analysis (%)

NII

3.4

3.1

2.9

2.9

2.6

2.7

(-) Prov. Exp.

1.0

0.8

0.9

1.0

0.8

0.8

Adj. NII

2.4

2.3

2.0

1.9

1.8

1.9

Treasury

(0.1)

0.1

0.1

0.1

0.2

0.2

Int. Sens. Inc.

2.3

2.4

2.1

2.0

2.0

2.1

Other Inc.

1.2

1.0

1.0

1.0

1.0

1.0

Op. Inc.

3.5

3.4

3.1

3.0

3.0

3.1

Opex

2.0

2.0

2.1

2.0

1.9

1.9

PBT

1.4

1.4

1.0

1.0

1.0

1.1

Taxes

0.5

0.4

0.3

0.3

0.4

0.4

RoA

0.9

0.9

0.6

0.7

0.7

0.7

Leverage (x)

18.8

17.1

16.6

16.6

17.3

17.1

RoE

16.5

16.2

10.4

11.1

11.5

12.8

November 7, 2015

9

State Bank of India | 2QFY2016 Result Update

Research Team Tel: 022 - 39357800

DISCLAIMER

Angel Broking Private Limited (hereinafter referred to as “Angel”) is a registered Member of National Stock Exchange of India Limited,

Bombay Stock Exchange Limited and Metropolitan Stock Exchange of India Limited. It is also registered as a Depository Participant with

CDSL and Portfolio Manager with SEBI. It also has registration with AMFI as a Mutual Fund Distributor. Angel Broking Private Limited is

a registered entity with SEBI for Research Analyst in terms of SEBI (Research Analyst) Regulations, 2014 vide registration number

INH000000164. Angel or its associates has not been debarred/ suspended by SEBI or any other regulatory authority for accessing

/dealing in securities Market. Angel or its associates including its relatives/analyst do not hold any financial interest/beneficial

ownership of more than 1% in the company covered by Analyst. Angel or its associates/analyst has not received any compensation /

managed or co-managed public offering of securities of the company covered by Analyst during the past twelve months. Angel/analyst

has not served as an officer, director or employee of company covered by Analyst and has not been engaged in market making activity

of the company covered by Analyst.

This document is solely for the personal information of the recipient, and must not be singularly used as the basis of any investment

decision. Nothing in this document should be construed as investment or financial advice. Each recipient of this document should

make such investigations as they deem necessary to arrive at an independent evaluation of an investment in the securities of the

companies referred to in this document (including the merits and risks involved), and should consult their own advisors to determine

the merits and risks of such an investment.

Reports based on technical and derivative analysis center on studying charts of a stock's price movement, outstanding positions and

trading volume, as opposed to focusing on a company's fundamentals and, as such, may not match with a report on a company's

fundamentals.

The information in this document has been printed on the basis of publicly available information, internal data and other reliable

sources believed to be true, but we do not represent that it is accurate or complete and it should not be relied on as such, as this

document is for general guidance only. Angel Broking Pvt. Limited or any of its affiliates/ group companies shall not be in any way

responsible for any loss or damage that may arise to any person from any inadvertent error in the information contained in this report.

Angel Broking Pvt. Limited has not independently verified all the information contained within this document. Accordingly, we cannot

testify, nor make any representation or warranty, express or implied, to the accuracy, contents or data contained within this document.

While Angel Broking Pvt. Limited endeavors to update on a reasonable basis the information discussed in this material, there may be

regulatory, compliance, or other reasons that prevent us from doing so.

This document is being supplied to you solely for your information, and its contents, information or data may not be reproduced,

redistributed or passed on, directly or indirectly.

Neither Angel Broking Pvt. Limited, nor its directors, employees or affiliates shall be liable for any loss or damage that may arise from

or in connection with the use of this information.

Note: Please refer to the important ‘Stock Holding Disclosure' report on the Angel website (Research Section). Also, please refer to the

latest update on respective stocks for the disclosure status in respect of those stocks. Angel Broking Pvt. Limited and its affiliates may

have investment positions in the stocks recommended in this report.

Disclosure of Interest Statement

State Bank of India

1. Analyst ownership of the stock

No

2. Angel and its Group companies ownership of the stock

No

3. Angel and its Group companies' Directors ownership of the stock

No

4. Broking relationship with company covered

No

Note: We have not considered any Exposure below ` 1 lakh for Angel, its Group companies and Directors

Ratings (Based on expected returns

Buy (> 15%)

Accumulate (5% to 15%)

Neutral (-5 to 5%)

over 12 months investment period):

Reduce (-5% to -15%)

Sell (< -15%)

November 7, 2015

10