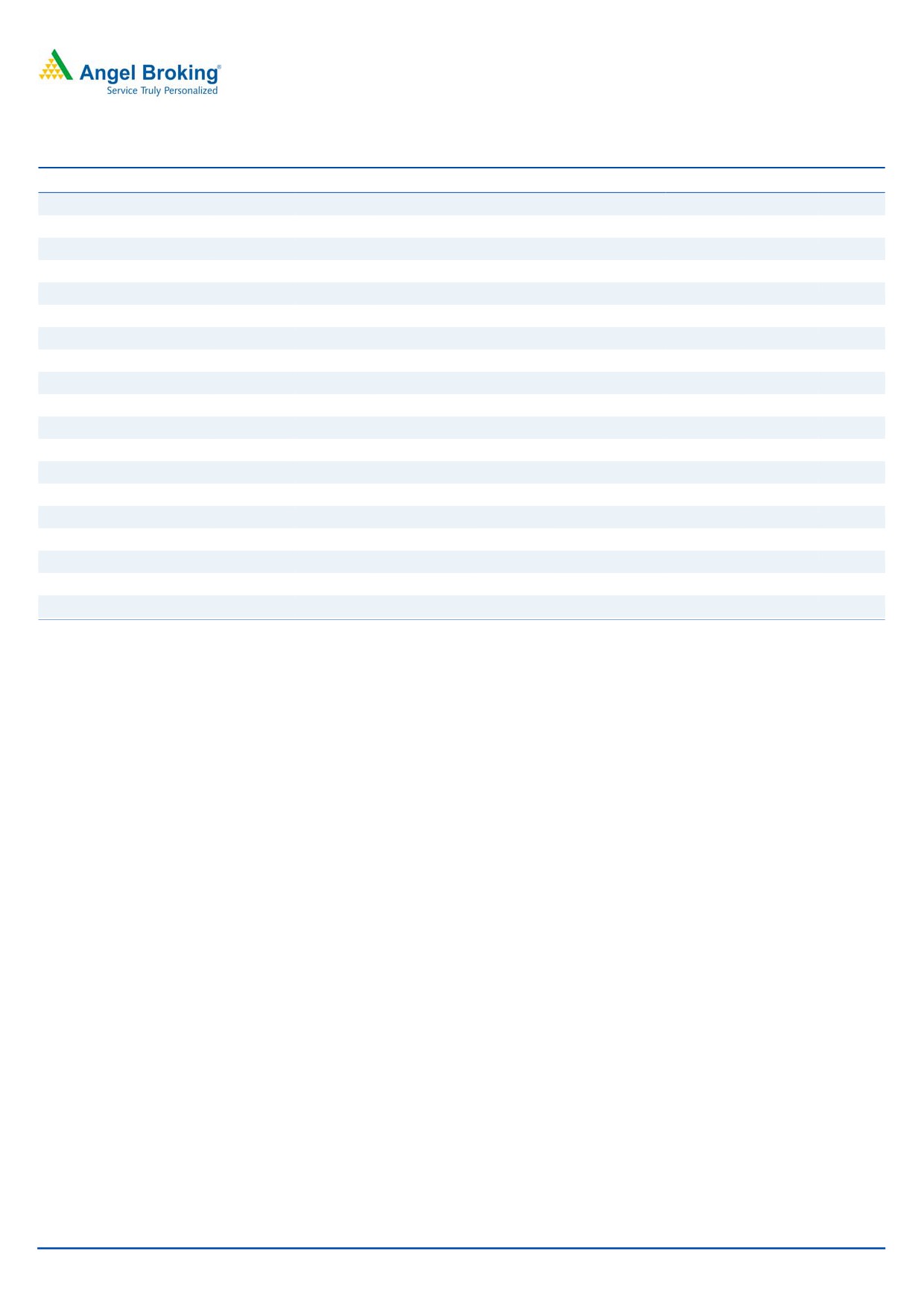

3QFY2017 Result Update | Textile

January 30, 2017

Siyaram Silk Mills

ACCUMULATE

CMP

`1,438

Performance Highlights

Target Price

`1,605

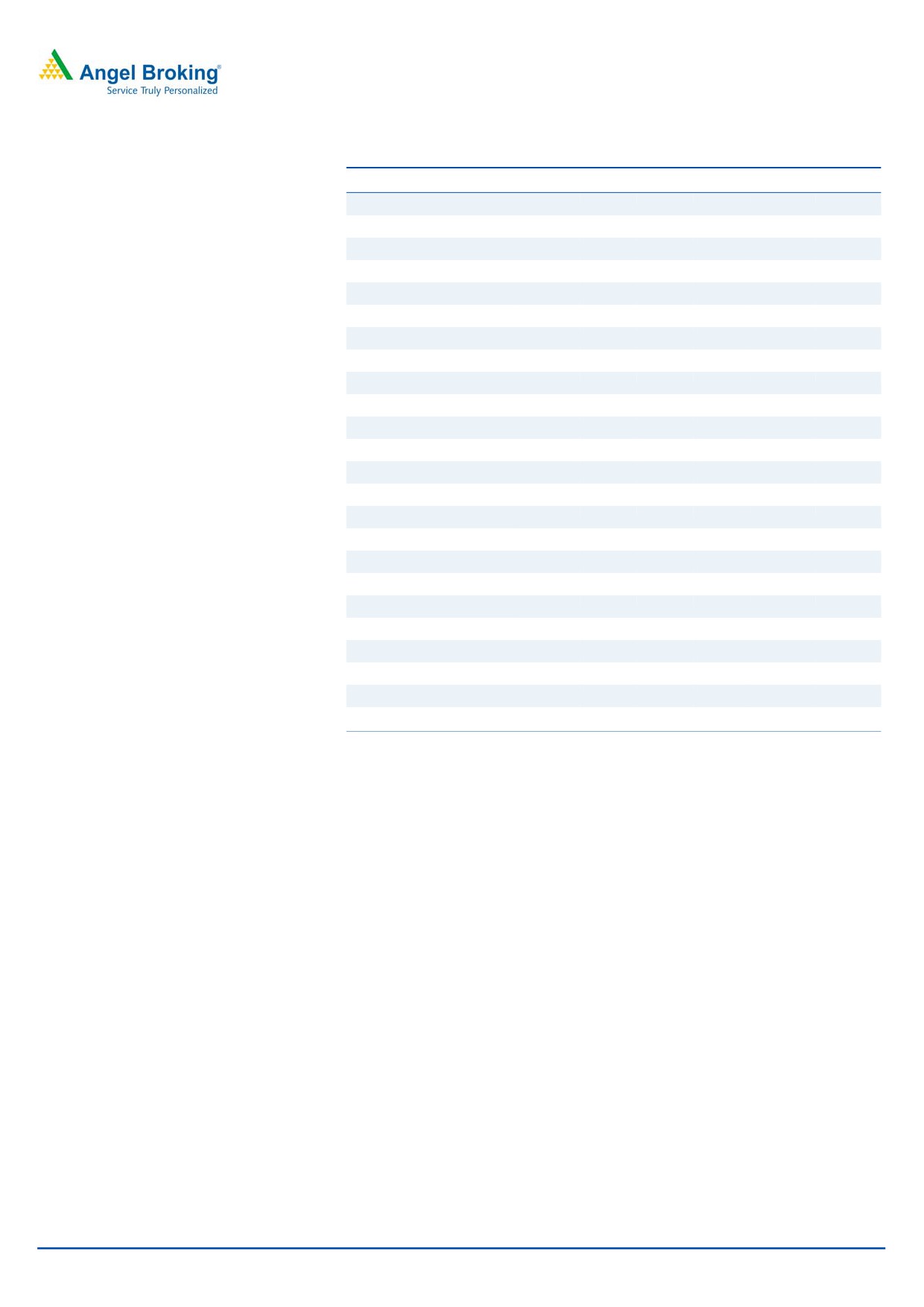

Y/E March (` cr)

3QFY17

3QFY16

% chg. (yoy) 2QFY17

% chg. (qoq)

Investment Period

12 Months

Net Sales

339

413

(18.0)

421

(19.4)

Stock Info

Operating profit

42

47

(11.4)

53

(20.8)

Sector

Textile

OPM (%)

12.4

11.4

91bp

12.6

(22bp)

Market Cap (` cr)

1,332

Adj. PAT

14

21

(33.6)

25.4

(46.2)

Net debt (` cr)

334

Source: Company, Angel Research

Beta

1.0

Siyaram Silk Mills (SSML)’ results for 3QFY2017 have come in below our

52 Week High / Low

1,690 / 925

estimates, both on top-line and bottom-line front, on back of lower volume

Avg. Daily Volume

206,664

Face Value (`)

10

growth due to weak consumer buying sentiments.

BSE Sensex

27,903

Top-line grew modest: The top-line for the quarter de-grew by ~18% yoy to

Nifty

8,651

`339cr, which can be mainly attributed to lower volume growth.

Reuters Code

SIYR.BO

Bloomberg Code

SIYA IN

Operating profit declines ~11%: The EBITDA for the quarter de-grew by ~11%

yoy to `42cr. However, the EBITDA margin has improved by 91bp yoy.

Shareholding Pattern (%)

PAT de-grew by ~34%: During the quarter, the net profit de-grew by ~34% yoy

Promoters

67.1

to `14cr due to lower sales growth, higher depreciation cost and taxes.

MF / Banks / Indian Fls

6.3

Outlook and Valuation: Going forward, we expect SSML to report net sales CAGR

FII / NRIs / OCBs

0.6

of ~7% to ~`1,857cr and adj. net profit CAGR of ~9% to `103cr over

Indian Public / Others

26.0

FY2016-18E. The same would be on the back of market leadership in blended

fabrics, strong branding, wide distribution channel, strong presence in tier II and

tier III cities, and emphasis on latest designs at affordable pricing points. At the

Abs.(%)

3m 1yr

3yr

current market price, SSML trades at an inexpensive valuation (at a P/E of 13.1x

Sensex

(0.1)

13.8

34.6

its FY2018E earnings). We recommend an Accumulate rating on the stock with

SSML

(6.5)

30.3

432.6

the target price of `1,605.

Key financials

3-Year Daily price chart

Y/E March (` cr)

FY2015

FY2016

FY2017E

FY2018E

1800

Net Sales

1,510

1,619

1,652

1,857

1600

1400

% chg

15.9

7.2

2.0

12.4

1200

1000

Net Profit

79

88

87

103

800

% chg

78.8

87.6

86.6

103.2

600

400

OPM (%)

11.5

11.6

11.6

11.7

200

0

EPS (`)

84.1

93.5

92.4

110.1

P/E (x)

17.1

15.4

15.6

13.1

P/BV (x)

3.1

2.6

2.3

2.0

Source: Company, Angel Research

RoE (%)

18.1

17.1

14.7

15.2

RoCE (%)

17.9

16.3

14.3

15.4

EV/Sales (x)

1.1

1.0

1.0

0.9

Amarjeet S Maurya

022-39357800 Ext: 6868

EV/EBITDA (x)

9.5

9.0

8.8

7.7

Source: Company,Angel Research; Note: CMP as of January 27, 2017,

Please refer to important disclosures at the end of this report

1

Siyaram Silk Mills | 3QFY2017 Result Update

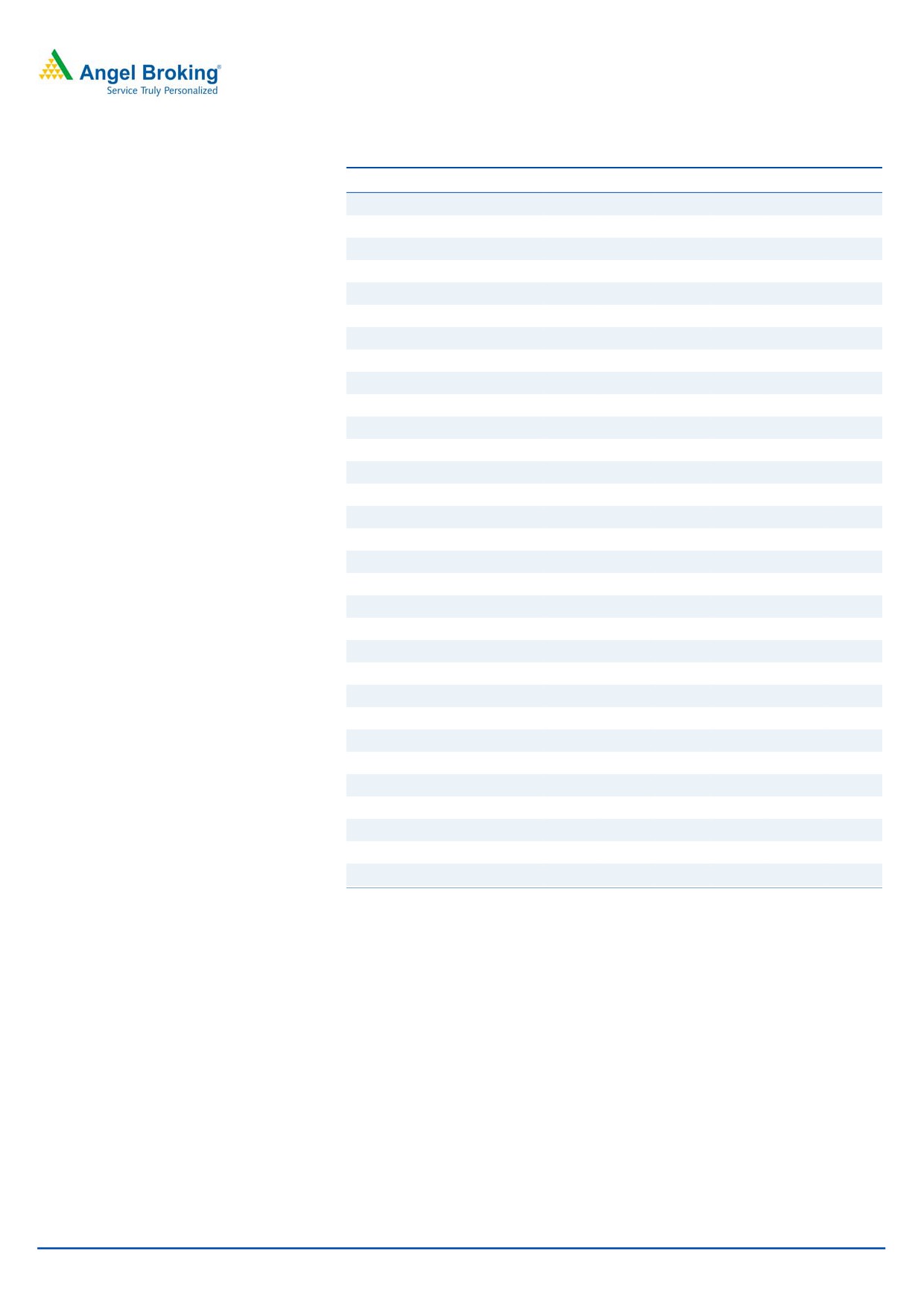

Exhibit 1: Quarterly performance

Y/E March (` cr)

3QFY17

3QFY16

% chg. (yoy)

2QFY17

% chg. (qoq)

9MFY17

9MFY16

% chg

Net Sales

339

281

20.5

421

(19.4)

1,041

1,106

(5.9)

Net raw material

141

122

15.2

207

(32.0)

472

550

(14.2)

(% of Sales)

41.6

43.5

(190)

49.2

(767)

45.3

49.8

Employee Cost

42

37

14.5

42

0.0

124

107

15.5

(% of Sales)

12.5

13.1

(65)

10.1

243

11.9

9.7

Other Expenses

114

92

23.2

118

(3.8)

320

316

1.5

(% of Sales)

33.6

32.8

76

28.1

546

30.8

28.5

Total Expenditure

297

252

18.0

368

(19.2)

917

974

(5.8)

Operating Profit

42

30

40.9

53

(20.8)

125

133

(6)

OPM (%)

12.4

10.6

179

12.6

(22)

11.97

12.00

(3)

Interest

9

9

(0.3)

9

3.8

26.87

22.77

18.0

Depreciation

17

11

52.7

13

24.6

42.84

38.22

12.1

Other Income

5

6

(2.5)

7

(22.3)

18

13

44.2

PBT

22

15

41.1

38

(42.7)

73

84

(13.4)

(% of Sales)

6.4

5.5

9.0

7.0

7.6

Tax

8

5

50.0

12

(35.7)

25.72

28.05

(8.3)

(% of PBT)

36.9

34.7

32.9

35.2

33.3

Reported PAT

14

10

36.3

25

(46.2)

47

56

(15.9)

PATM

4.0

3.6

6.0

4.5

5.1

Source: Company, Angel Research

January 30, 2017

2

Siyaram Silk Mills | 3QFY2017 Result Update

Investment arguments

Leadership in blended fabric to support growth

Revenue to grow at a CAGR of ~7%

SSML is the largest manufacturer of blended high fashion suitings, shirtings and

over FY2016-18E to `1,857cr

apparels in the country. A portfolio of strong and value-for-money brands like

Siyaram’s, J Hampstead and Mistair in the fabric segment, place SSML in a sweet

spot. The company has launched two new premium cotton brands - Zenesis and

Moretti, and has penetrated further into new growth areas like cotton shirting,

linen fabrics etc.

SSML has been able to differentiate itself from unorganized and organized

competitors in a highly fragmented market. The offerings of the company are

available at various price points in the low and mid-range, which enable it to

compete with brands like Raymond, Reid & Taylor, Grasim, Digjam, and Gwalior,

which offer similar products. Shifting preference of consumers from unbranded

fabrics to branded blended fabrics would likely aid the company’s growth

prospects. With a strong market position, pan-India presence and high brand

recognition, along with increasing diversification in revenue profile, we expect the

company’s revenue to grow at a CAGR of ~10% over FY2016-18E to `1,948.

Rigorous advertisement and retail expansion to push demand

SSML has built a strong brand presence in the country through continuous

advertisement and brand-building efforts. Its emphasis on latest fabrics, innovative

and latest designs, and affordable pricing points give it an edge over competition.

Every brand of the company holds a distinct position in the consumers’ minds, which

has helped the company in creating a niche for itself in a highly competitive industry.

Additionally, the company has been spending rigorously on advertising for the

recognition of its brands. The company has signed up celebrities like M S Dhoni

(Siyaram’s, MSD), Saif Ali Khan (Oxemberg) and Hrithik Roshan (J. Hampstead) as

brand ambassadors for its products.

Moreover, SSML has one of the largest distribution networks in the country with

over 1,600 dealers and 500 agents supplying to more than 40,000 outlets across

India. This enables the company to launch new products with a high success ratio

and low marketing cost, giving it an edge over competition. In order to expand its retail

footprint, the company continues to add stores through the franchise model. The

company plans to increase the number of stores through franchisees to 500 by FY2017.

Venturing into women’s segment - a long term growth driver

Company has roped in celebrities like

The company has ventured into the salwar kameez and ethnic women’s wear

Parineeti Chopra and Karishma Kapoor

segment with its brand - Siya. The Siya brand comprises of semi-stitched cotton,

to endorse Siya

polyester and embroidered designer fabrics, with prices ranging from `700 to

`7,000. For FY2015, the company generated revenue of ~`38cr from the

segment and it plans to grow it to `500cr in the coming four to five years as there

are hardly any national-level mass brands in the category. SSML has roped in

celebrities Parineeti Chopra and Karishma Kapoor to endorse the brand. As per

industry reports (Technopak study in 2011), salwar kameez and ethnic women’s

wear is a `20,690cr category, growing at a CAGR of 10%, which gives immense

opportunity to the company.

January 30, 2017

3

Siyaram Silk Mills | 3QFY2017 Result Update

Outlook and valuation

Going forward, we expect SSML to report net sales CAGR of ~7% to ~`1,857cr

and adj. net profit CAGR of ~9% to `103cr over FY2016-18E. The same would be

on the back of market leadership in blended fabrics, strong branding, wide

distribution channel, strong presence in tier II and tier III cities, and emphasis on

latest designs at affordable pricing points. At the current market price, SSML trades

at an inexpensive valuation (at a P/E of 13.1x its FY2018E earnings). We

recommend an Accumulate rating on the stock with the target price of `1,605.

Concerns

Decline in rural spending: Unseasonal rains or deficient rainfall in the rural areas

may result in lower agriculture output. This, in turn, could result in lower

discretionary spending among rural consumers, which could impact the company’s

overall sales.

Competition from the unorganized sector: SSML, being in a sector that’s highly

fragmented, faces intense competition from unorganized players as they usually

sell their products at a much cheaper rate compared to it. However, due to strong

branding efforts, huge distribution network and affordable price points, the

company is easily able to differentiate its products from those of competitors.

Fluctuation in raw material prices: SSML operates in a highly price-sensitive

market. Any fluctuation in raw-material prices can lead to margin compression, as

the company may not be able to pass on the entire increase to the end-user.

January 30, 2017

4

Siyaram Silk Mills | 3QFY2017 Result Update

Company background

SSML is the largest manufacturer of blended fabrics in India. The company enjoys

a strong brand presence across the country, with brands such as Siyaram’s,

Mistair, MSD, J. Hampstead and Oxemberg in its kitty. The company has also

launched three premium brands - Royal Linen (linen fabrics for men and women),

Moretti (cotton shirting) and Zenesis (cotton suitings). SSML has built a strong

brand presence in the country through continuous advertisement and brand-

building efforts over the past 30 years. The company has created a niche for itself

in a highly competitive industry.

It has a wide distribution network comprising 1,600 dealers and 500 agents

supplying to more than 40,000 outlets across India and has ~160 franchise

stores. The company operates four plants - one at Tarapur near Mumbai for

weaving and yarn dyeing, two at Daman for garments and one at Silvassa for

weaving.

January 30, 2017

5

Siyaram Silk Mills | 3QFY2017 Result Update

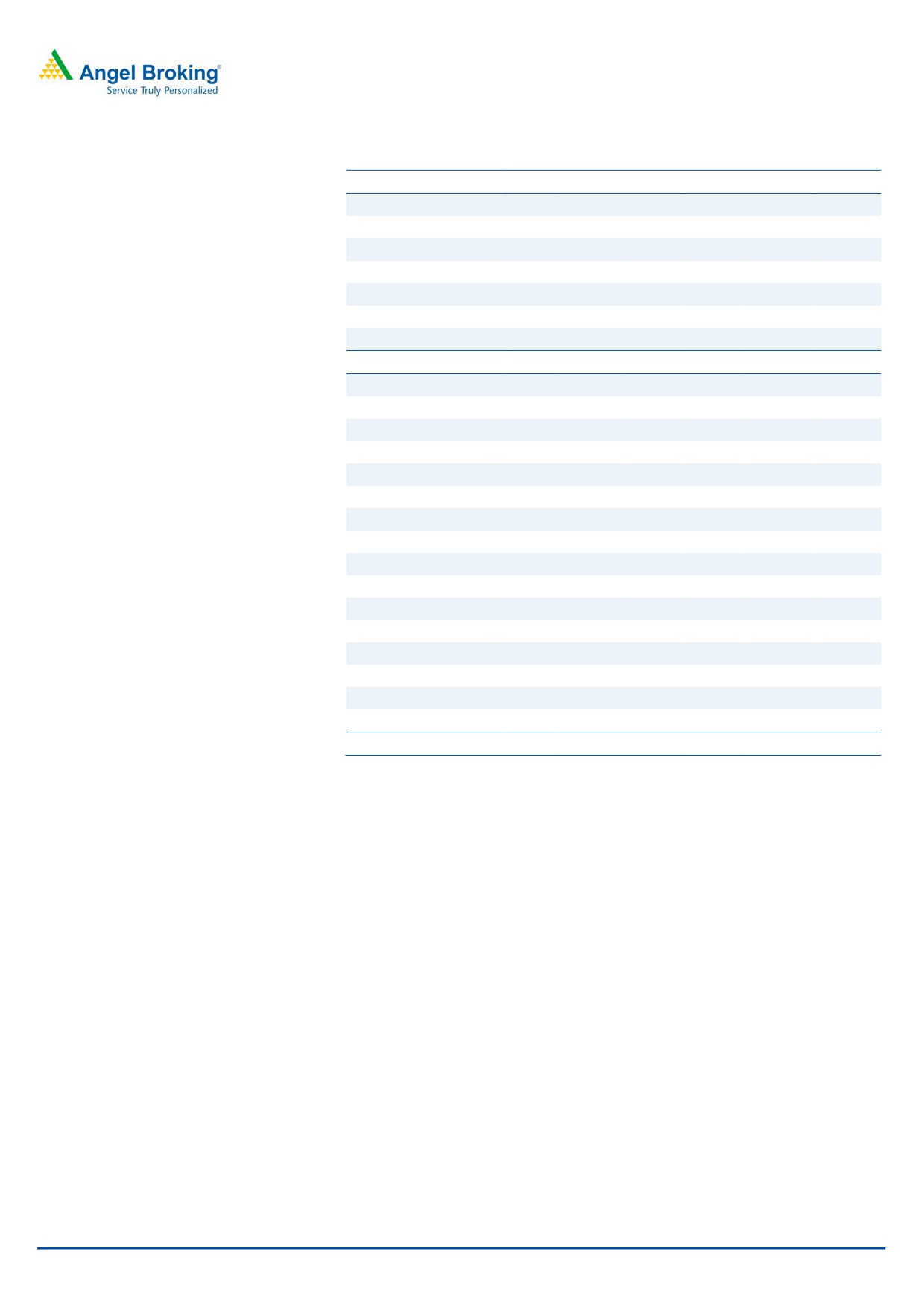

Profit and loss statement

Y/E March (` cr)

FY13

FY14

FY15

FY16

FY17E

FY18E

Total operating income

1,041

1,303

1,510

1,619

1,652

1,857

% chg

13.7

25.2

15.9

7.2

2.0

12.4

Total Expenditure

931

1,163

1,336

1,432

1,460

1,639

Cost of Materials

532

671

794

810

870

980

Personnel

89

108

123

144

139

158

Others Expenses

310

384

419

478

451

500

EBITDA

110

140

174

188

192

218

% chg

(5.4)

27.1

24.3

7.8

2.1

13.8

(% of Net Sales)

10.6

10.7

11.5

11.6

11.6

11.7

Depreciation& Amortisation

22

29

41

42

50

52

EBIT

88

111

133

146

142

166

% chg

(6.1)

25.5

20.1

9.6

(3.1)

17.2

(% of Net Sales)

8.5

8.5

8.8

9.0

8.6

8.9

Interest & other Charges

25

29

31

30

35

36

Other Income

19

16

16

17

23

24

(% of PBT)

22.6

16.1

13.6

12.9

17.8

15.6

Share in profit of Associates

-

-

-

-

-

-

Recurring PBT

82

98

119

133

129

154

% chg

0.7

19.8

21.4

11.6

(2.6)

19.1

Prior Period & Extra. Exp./(Inc.)

-

-

-

-

-

-

PBT (reported)

82

98

119

133

129

154

Tax

27

34

40

45

43

51

(% of PBT)

32.7

35.1

33.8

34.0

33.0

33.0

PAT (reported)

55

64

79

88

87

103

Add: Share of earnings of asso.

-

-

-

-

-

-

ADJ. PAT

55

64

79

88

87

103

% chg

(3.0)

15.6

23.9

11.1

(1.1)

19.1

(% of Net Sales)

5.3

4.9

5.2

5.4

5.2

5.6

Basic EPS (`)

58.7

67.8

84.1

93.5

92.4

110.1

Fully Diluted EPS (`)

58.7

67.8

84.1

93.5

92.4

110.1

% chg

(3.0)

15.6

23.9

11.1

(1.1)

19.1

January 30, 2017

6

Siyaram Silk Mills | 3QFY2017 Result Update

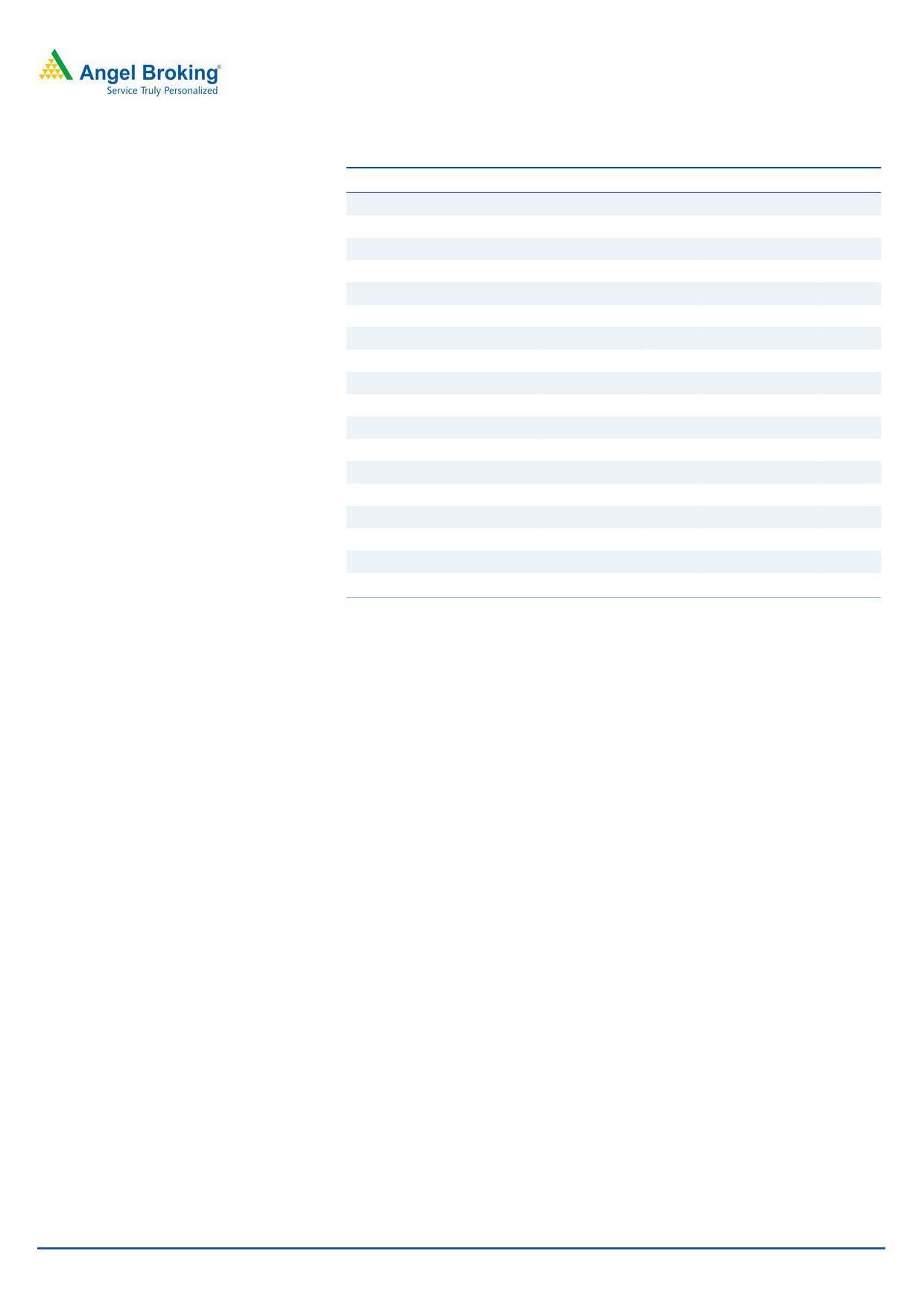

Balance sheet

Y/E March (` cr)

FY13

FY14

FY15

FY16

FY17E

FY18E

SOURCES OF FUNDS

Equity Share Capital

9

9

9

9

9

9

Reserves& Surplus

305

360

426

503

579

670

Shareholders Funds

314

370

435

512

588

679

Minority Interest

-

-

-

-

-

-

Total Loans

278

314

309

386

400

400

Deferred Tax Liability

22

26

23

23

23

23

Total Liabilities

614

709

767

920

1,011

1,102

APPLICATION OF FUNDS

Gross Block

499

570

589

609

639

659

Less: Acc. Depreciation

194

220

258

299

349

401

Net Block

305

349

332

310

290

258

Capital Work-in-Progress

16

3

7

7

7

7

Investments

0

0

0

46

46

46

Current Assets

466

543

638

773

861

1,001

Inventories

222

225

238

326

353

407

Sundry Debtors

200

260

335

368

385

443

Cash

3

6

5

6

15

18

Loans & Advances

33

39

45

57

76

93

Other Assets

8

13

15

16

33

41

Current liabilities

176

190

214

221

202

222

Net Current Assets

290

353

424

551

659

779

Deferred Tax Asset

3

3

4

4

4

4

Mis. Exp. not written off

-

-

-

-

-

-

Total Assets

614

709

767

920

1,011

1,102

January 30, 2017

7

Siyaram Silk Mills | 3QFY2017 Result Update

Cash flow statement

Y/E March (` cr)

FY13

FY14

FY15

FY16

FY17E

FY18E

Profit before tax

82

98

119

133

129

154

Depreciation

22

29

41

42

50

52

Change in Working Capital

(28)

(87)

(120)

(127)

(99)

(116)

Interest / Dividend (Net)

17

19

21

30

35

36

Direct taxes paid

(25)

(34)

(40)

(45)

(43)

(51)

Others

1

41

38

-

-

-

Cash Flow from Operations

68

65

58

33

73

75

(Inc.)/ Dec. in Fixed Assets

(70)

(61)

(23)

(112)

(30)

(20)

(Inc.)/ Dec. in Investments

3

-

-

(46)

-

-

Cash Flow from Investing

(73)

(61)

(23)

(66)

(30)

(20)

Issue of Equity

-

0

-

-

-

-

Inc./(Dec.) in loans

-

-

-

76

14

-

Dividend Paid (Incl. Tax)

(7)

(7)

(7)

11

10

12

Interest / Dividend (Net)

14

5

(30)

(52)

(59)

(64)

Cash Flow from Financing

7

(2)

(38)

35

(34)

(51)

Inc./(Dec.) in Cash

2

3

(2)

2

9

4

Opening Cash balances

2

3

5

3

6

15

Closing Cash balances

3

5

3

6

15

18

January 30, 2017

8

Siyaram Silk Mills | 3QFY2017 Result Update

Key ratios

Y/E March

FY13

FY14

FY15

FY16

FY17E

FY18E

Valuation Ratio (x)

P/E (on FDEPS)

24.5

21.2

17.1

15.4

15.6

13.1

P/CEPS

71.1

82.2

101.9

113.2

112.0

133.5

P/BV

4.3

3.6

3.1

2.6

2.3

2.0

Dividend yield (%)

0.5

0.5

0.7

0.7

0.7

0.9

EV/Sales

1.6

1.3

1.1

1.0

1.0

0.9

EV/EBITDA

14.7

11.8

9.5

9.0

8.8

7.7

EV / Total Assets

2.1

1.8

1.7

1.5

1.4

1.3

Per Share Data (`)

EPS (Basic)

58.7

67.8

84.1

93.5

92.4

110.1

EPS (fully diluted)

58.7

67.8

84.1

93.5

92.4

110.1

Cash EPS

20.2

17.5

14.1

12.7

12.8

10.8

DPS

7.0

7.5

9.4

10.5

10.4

12.4

Book Value

335.2

394.5

464.2

546.4

627.8

724.7

Returns (%)

ROCE

14.9

16.2

17.9

16.3

14.3

15.4

Angel ROIC (Pre-tax)

15.0

16.4

18.0

17.3

15.3

16.4

ROE

17.5

17.2

18.1

17.1

14.7

15.2

Turnover ratios (x)

Asset Turnover (Gross Block)

2.1

2.3

2.6

2.7

2.6

2.8

Inventory / Sales (days)

78

63

58

74

78

80

Receivables (days)

70

73

81

83

85

87

Payables (days)

42

34

34

34

33

33

WC cycle (ex-cash) (days)

106

102

105

123

130

134

January 30, 2017

9

Siyaram Silk Mills | 3QFY2017 Result Update

Research Team Tel: 022 - 39357800

DISCLAIMER

Angel Broking Private Limited (hereinafter referred to as “Angel”) is a registered Member of National Stock Exchange of India Limited,

Bombay Stock Exchange Limited and Metropolitan Stock Exchange Limited. It is also registered as a Depository Participant with CDSL

and Portfolio Manager with SEBI. It also has registration with AMFI as a Mutual Fund Distributor. Angel Broking Private Limited is a

registered entity with SEBI for Research Analyst in terms of SEBI (Research Analyst) Regulations, 2014 vide registration number

INH000000164. Angel or its associates has not been debarred/ suspended by SEBI or any other regulatory authority for accessing

/dealing in securities Market. Angel or its associates/analyst has not received any compensation / managed or co-managed public

offering of securities of the company covered by Analyst during the past twelve months.

This document is solely for the personal information of the recipient, and must not be singularly used as the basis of any investment

decision. Nothing in this document should be construed as investment or financial advice. Each recipient of this document should

make such investigations as they deem necessary to arrive at an independent evaluation of an investment in the securities of the

companies referred to in this document (including the merits and risks involved), and should consult their own advisors to determine

the merits and risks of such an investment.

Reports based on technical and derivative analysis center on studying charts of a stock's price movement, outstanding positions and

trading volume, as opposed to focusing on a company's fundamentals and, as such, may not match with a report on a company's

fundamentals. Investors are advised to refer the Fundamental and Technical Research Reports available on our website to evaluate the

contrary view, if any.

The information in this document has been printed on the basis of publicly available information, internal data and other reliable

sources believed to be true, but we do not represent that it is accurate or complete and it should not be relied on as such, as this

document is for general guidance only. Angel Broking Pvt. Limited or any of its affiliates/ group companies shall not be in any way

responsible for any loss or damage that may arise to any person from any inadvertent error in the information contained in this report.

Angel Broking Pvt. Limited has not independently verified all the information contained within this document. Accordingly, we cannot

testify, nor make any representation or warranty, express or implied, to the accuracy, contents or data contained within this document.

While Angel Broking Pvt. Limited endeavors to update on a reasonable basis the information discussed in this material, there may be

regulatory, compliance, or other reasons that prevent us from doing so.

This document is being supplied to you solely for your information, and its contents, information or data may not be reproduced,

redistributed or passed on, directly or indirectly.

Neither Angel Broking Pvt. Limited, nor its directors, employees or affiliates shall be liable for any loss or damage that may arise from

or in connection with the use of this information.

Disclosure of Interest Statement

Siyaram Silk Mills

1. Financial interest of research analyst or Angel or his Associate or his relative

No

2. Ownership of 1% or more of the stock by research analyst or Angel or associates or relatives

No

3. Served as an officer, director or employee of the company covered under Research

No

4. Broking relationship with company covered under Research

No

Ratings (Based on expected returns

Buy (> 15%)

Accumulate (5% to 15%)

Neutral (-5 to 5%)

over 12 months investment period):

Reduce (-5% to -15%)

Sell (< -15)

January 30, 2017

10