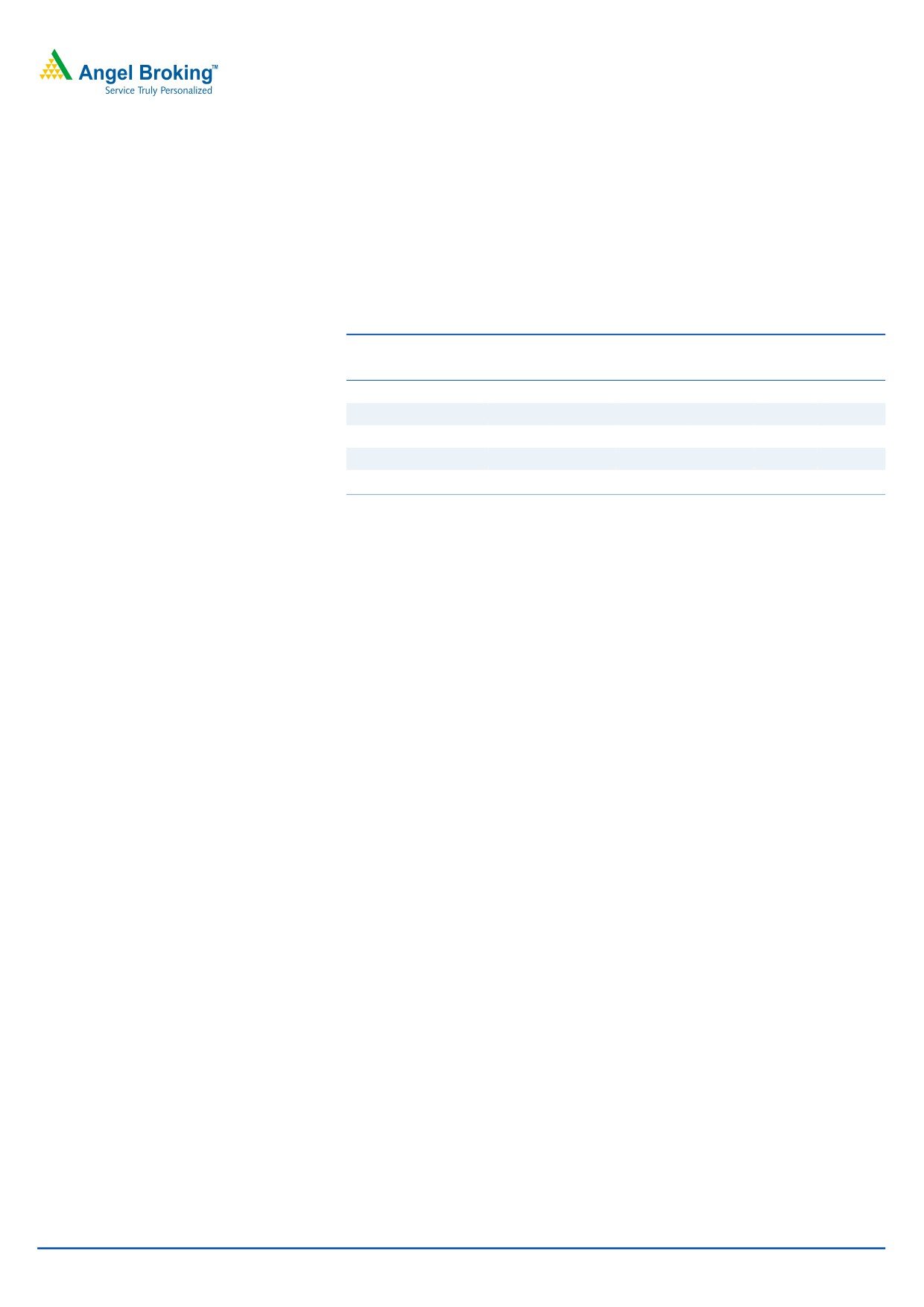

2QFY2016 Result Update | Infrastructure

November 17, 2015

Simplex Infrastructures

NEUTRAL

CMP

`319

Performance Highlights

Target Price

-

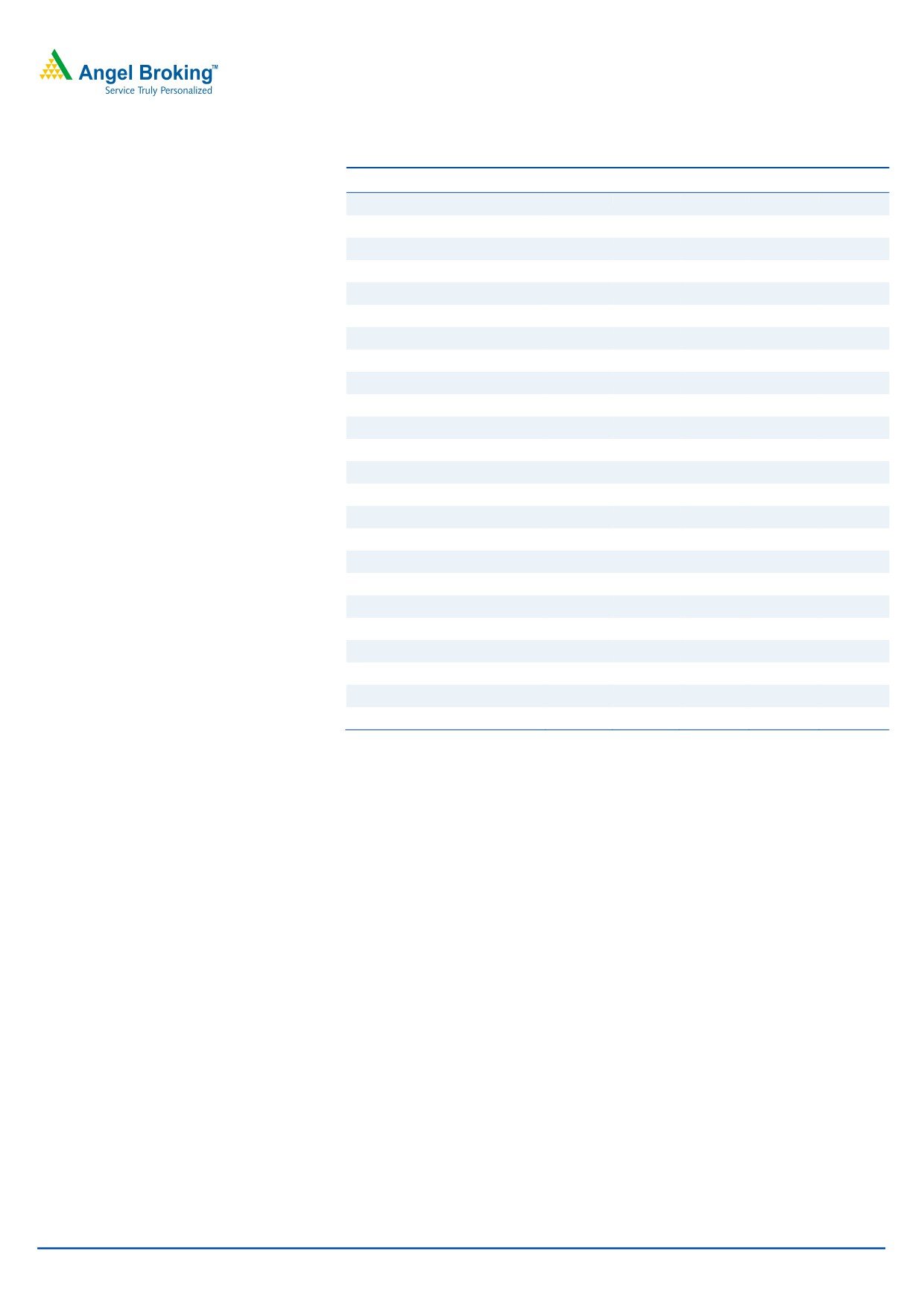

Quarterly highlights - Standalone

Investment Period

-

Y/E March (` cr)

2QFY16 1QFY16 2QFY15

% chg (yoy)

% chg (qoq)

Stock Info

Net sales

1,392

1,505

1,248

11.5

(7.5)

Sector

Infrastructure

EBITDA

143

147

128

12.3

(2.3)

Market Cap (` cr)

1,578

Reported PAT

14

18

13

6.4

(24.3)

Net debt (` cr)

3,172

Source: Company, Angel Research

Beta

1.1

Simplex Infrastructures (Simplex) reported in-line set of numbers for 2QFY2016.

52 Week High / Low

508/255

The company reported a top-line of `1,392cr, up 11.5% yoy, but slightly below

Avg. Daily Volume

6,558

Face Value (`)

2

our expectation of `1,399cr. The EBITDA for the quarter stood at `143cr, ahead

BSE Sensex

25,760

of our estimate of `141cr while the EBITDA margin expanded by 7bp yoy to

Nifty

7,807

10.3%, for 2QFY2016. Stronger execution and almost in-line operating

Reuters Code

SINF.BO

performance helped Simplex report a PAT of `14cr. The reported PAT margin of

Bloomberg Code

SINF@IN

the company was almost flat on a yoy basis at 1.0% in 2QFY2016.

Simplex’s order book (including L1) as of 2QFY2016 stands at ~`18,321cr

Shareholding Pattern (%)

(order book to LTM sales ratio stands at 3.1x).

Promoters

56.0

MF / Banks / Indian Fls

23.8

Outlook and valuation: At the current market price of `319, the standalone EPC

FII / NRIs / OCBs

6.1

business is trading at FY2016E and FY2017E P/E multiple of 20.3x and 10.1x,

Indian Public / Others

14.2

respectively.

(1)

10.6% top-line and

57.8% bottom-line CAGR during

FY2015-17E, (2) strong order book of `18,321cr (OB to LTM sales ratio of 3.1x),

and (3) scope for improvement in WC as % of sales ratio from 64% in FY2015 to

Abs. (%)

3m 1yr 3yr

Sensex

(7.6)

(8.6)

40.5

53% in FY2017E, should lead to improvement in D/E ratio from 2.2x in FY2015

Simplex Infra

(2.1)

2.2

69.4

to 1.8x in FY2017E. We have assigned a 1-year forward P/E multiple of 11.0x to

our FY2017E EPS estimates of `31/share, resulting in a value of `346 per share.

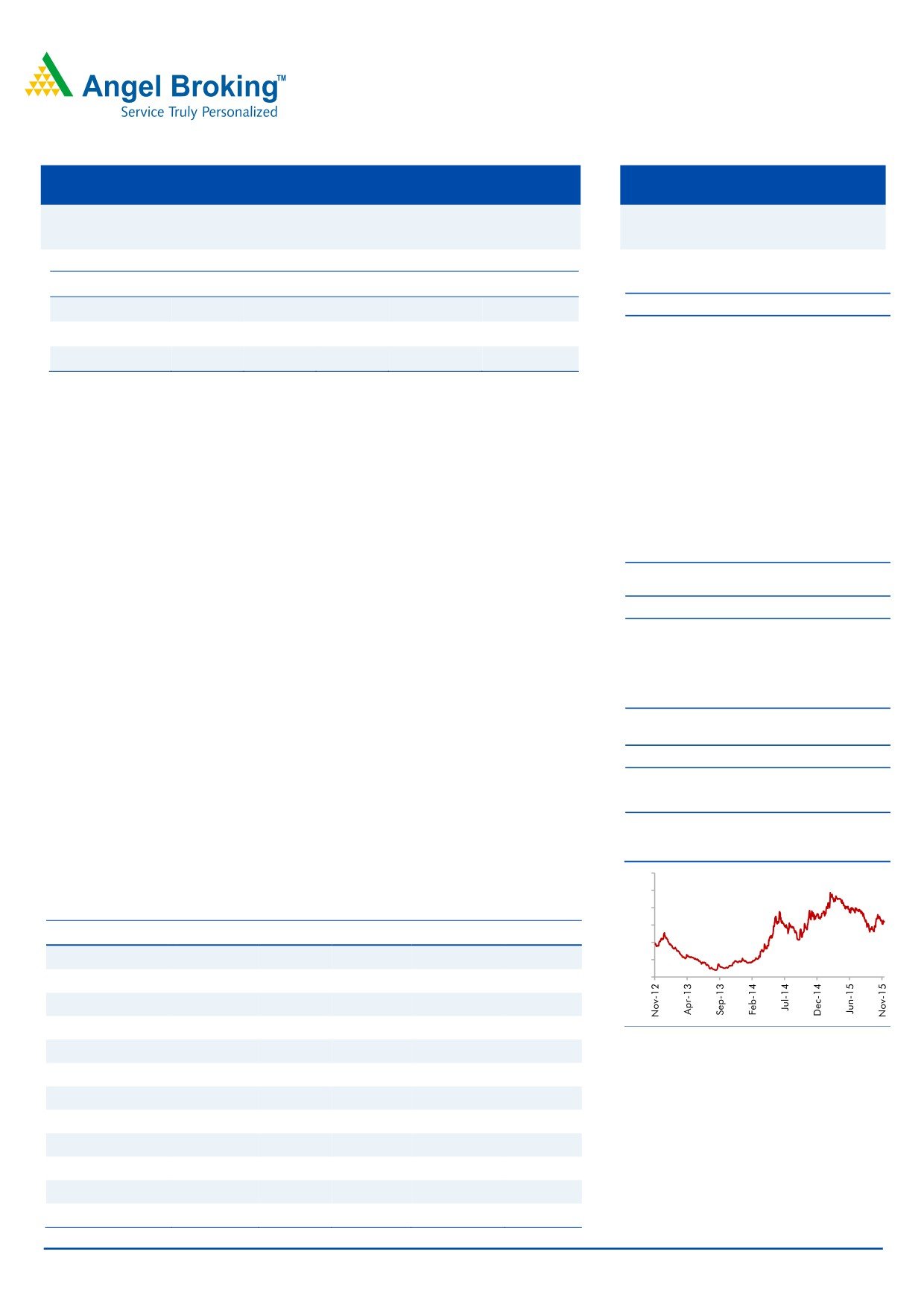

3-Year Daily Price Chart

Given the limited upside in the stock from the current levels, we have a Neutral

600

rating on the stock.

500

400

Key financials (Standalone)

300

Y/E March (` cr)

FY13

FY14

FY15

FY16E

FY17E

200

Net Sales

5,821

5,513

5,582

5,955

6,829

100

0

% chg

0.0

(5.3)

1.2

6.7

14.7

Net Profit

60

61

62

78

156

% chg

0.0

1.3

3.1

24.6

99.9

Source: Company, Angel Research

EBITDA (%)

8.0

9.4

10.1

10.3

10.5

EPS (`)

12

12

13

16

31

P/E (x)

26.4

26.0

25.3

20.3

10.1

P/BV (x)

1.2

1.1

1.1

1.1

1.0

RoE (%)

4.8

4.5

4.4

5.3

9.9

RoCE (%)

10.5

10.2

10.7

11.1

13.2

Yellapu Santosh

EV/Sales (x)

0.7

0.8

0.9

0.8

0.7

022 - 3935 7800 Ext: 6811

EV/EBITDA (x)

8.9

8.5

8.5

7.4

6.2

Source: Company, Angel Research; CMP as of November 16, 2015

Please refer to important disclosures at the end of this report

1

Simplex Infrastructures | 2QFY2016 Result Update

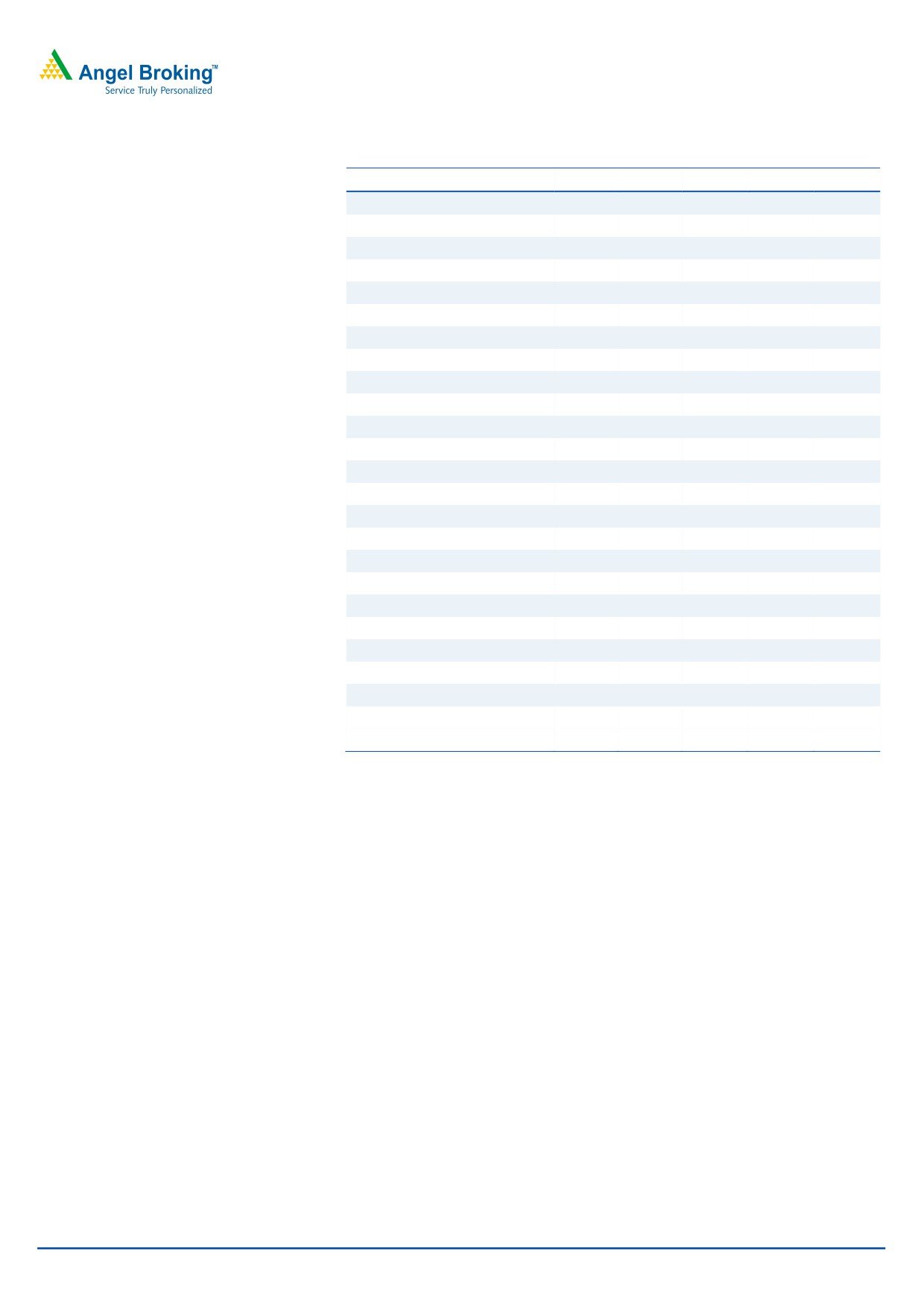

Exhibit 1: Quarterly Performance (Standalone)

Particulars (` cr)

2QFY16

1QFY16

% chg (qoq) 1QFY15

% chg (yoy) 1HFY16 1HFY15

% chg (yoy)

Net Sales

1,392

1,505

(7.5)

1,248

11.5

2,898

2,589

11.9

Total Expenditure

1,249

1,359

(8.1)

1,121

11.4

2,608

2,333

11.8

Cost of materials consumed

472

506

(6.7)

371

27.1

977

810

20.7

Sub-Contractor's Charges

400

456

(12.3)

361

10.8

856

743

15.1

Employee Benefits Expense

127

131

(3.1)

111

13.7

258

224

14.8

Other Expenses

251

266

(5.9)

277

(9.6)

517

555

(6.9)

EBITDA

143

147

(2.3)

128

12.3

290

256

13.4

EBIDTA %

10.3

9.7

10.2

10.0

9.9

Depreciation

34

34

1.7

37

(6.3)

68

72

(5.2)

EBIT

109

113

(3.5)

91

19.8

222

184

20.6

Interest and Financial Charges

106

106

0.3

93

14.0

212

184

15.0

Other Income

18

20

(10.2)

22

(16.4)

28

22

26.0

PBT before Exceptional Items

21

28

(23.0)

20

7.0

38

22

72.7

Exceptional Items

0

0

0

0

0

PBT after Exceptional Items

21

28

(23.0)

20

7.0

38

22

72.7

Tax

8

10

(20.5)

7

8.1

18

15

20.7

% of PBT

36.4

35.2

36.0

45.8

65.5

PAT

14

18

(24.3)

13

6.4

21

8

171.5

PAT %

1.0

1.2

1.0

0.7

0.3

EPS

2.74

3.62

(24.3)

2.58

6.2

6.36

5.14

23.7

Source: Company, Angel Research

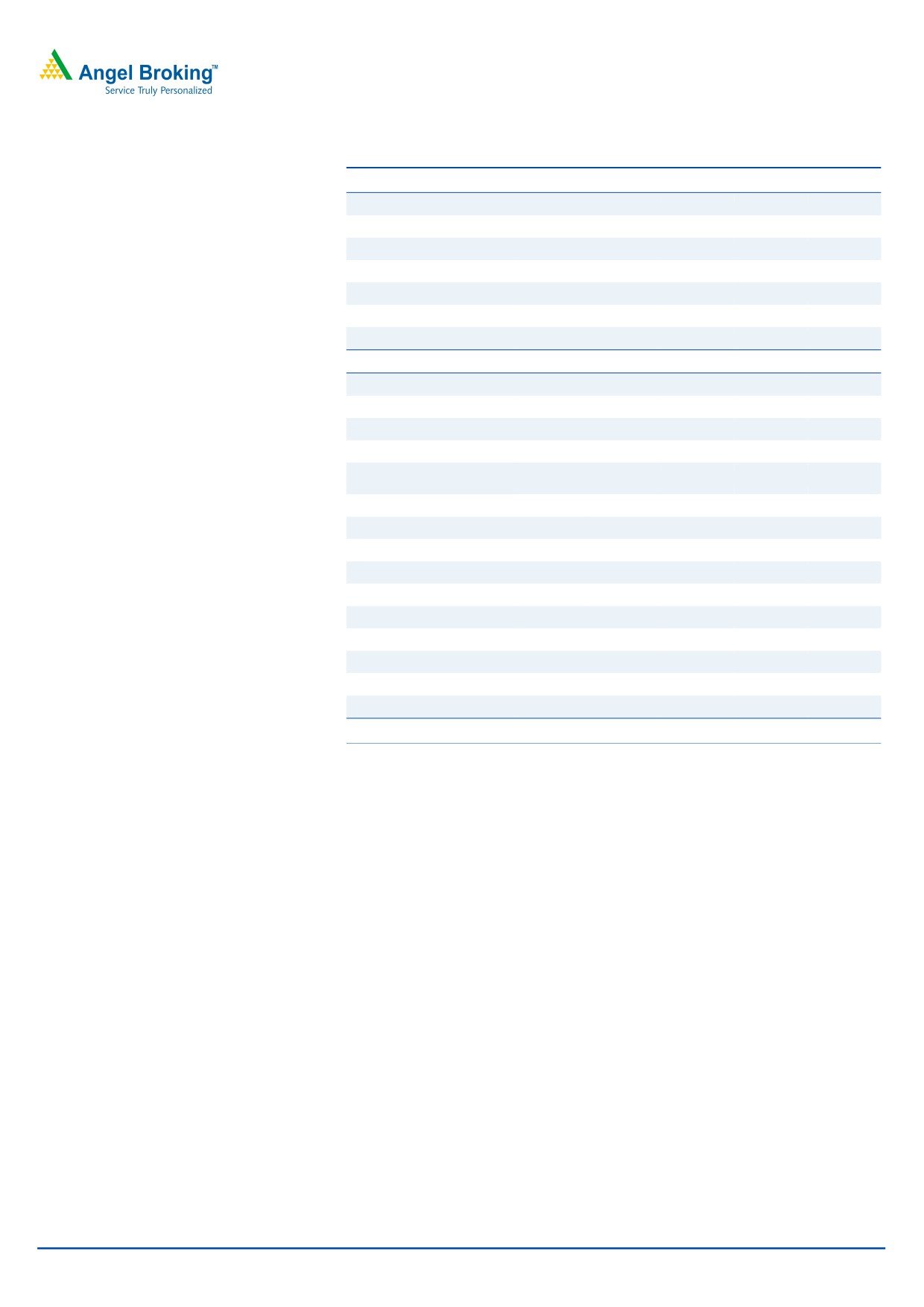

Standalone Business Review

11.5% yoy revenue growth

Simplex reported a top-line of `1,392cr, up 11.5% yoy, but slightly below our

expectation of `1,399cr. However, on a sequential basis it was down 7.5%.

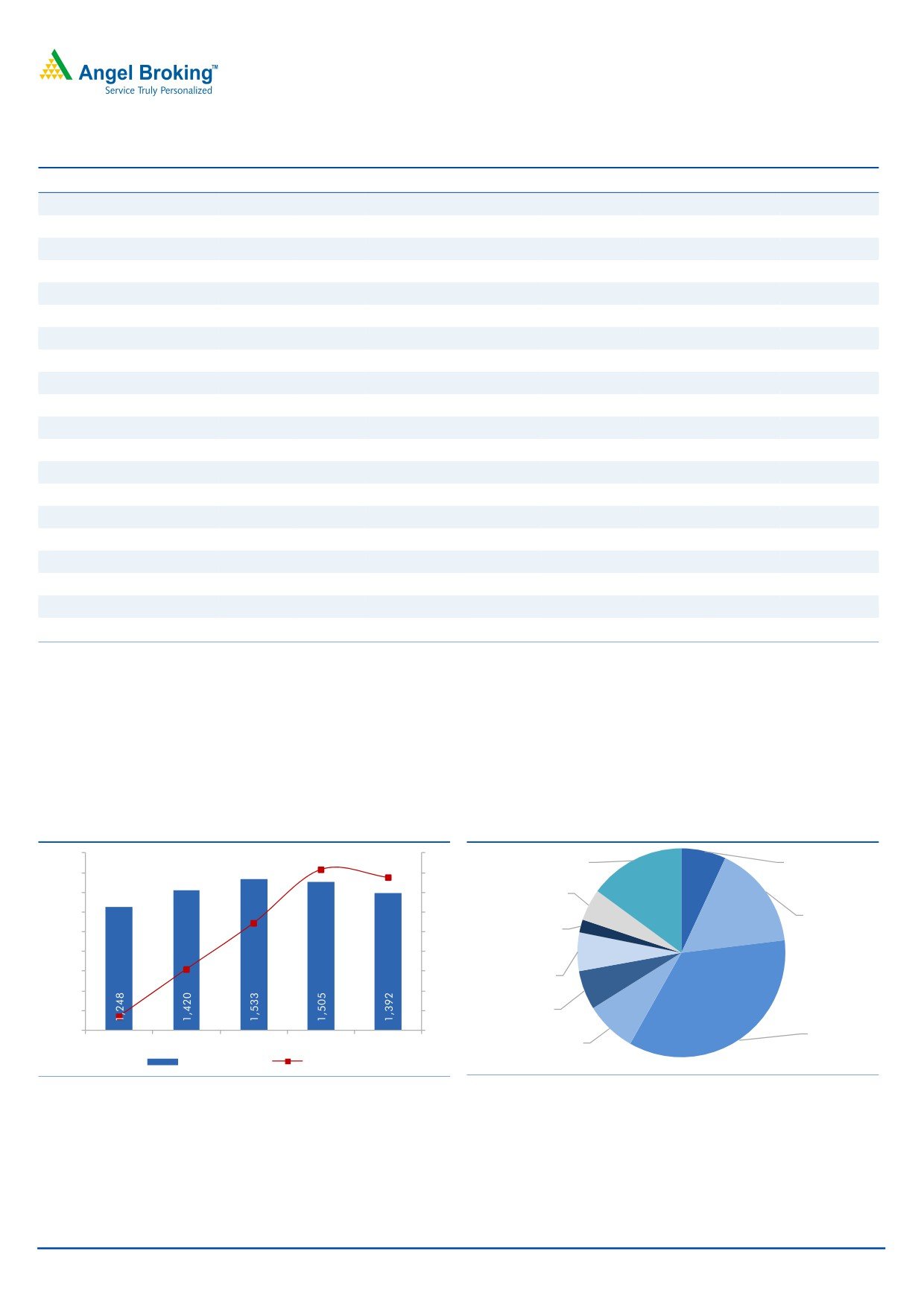

Exhibit 2: Quarterly Revenues

Exhibit 3: Revenue mix for 1HFY2016

1,800

14

Urban Utilities,

Piling & Gound

1,600

12

15%

Eng., 7%

12.3

11.5

1,400

10

Bridges, 5%

1,200

8

Industrial, 16%

6.9

Railways, 2%

1,000

6

800

4

600

2.2

2

Roads, 6%

400

0

Marine, 6%

200

(2)

(2.6)

Building &

0

(4)

Housing, 35%

Power, 8%

2QFY15

3QFY15

4QFY15

1QFY16

2QFY16

Revenues (` cr)

y/y change (%)

Source: Company, Angel Research

Source: Company, Angel Research

Revenue growth on a yoy basis was on account of better execution seen across

Buildings & Housing segment (35% of 2QFY2016 revenues) and Marine segment

(6% of 2QFY2016 revenues).

November 17, 2015

2

Simplex Infrastructures | 2QFY2016 Result Update

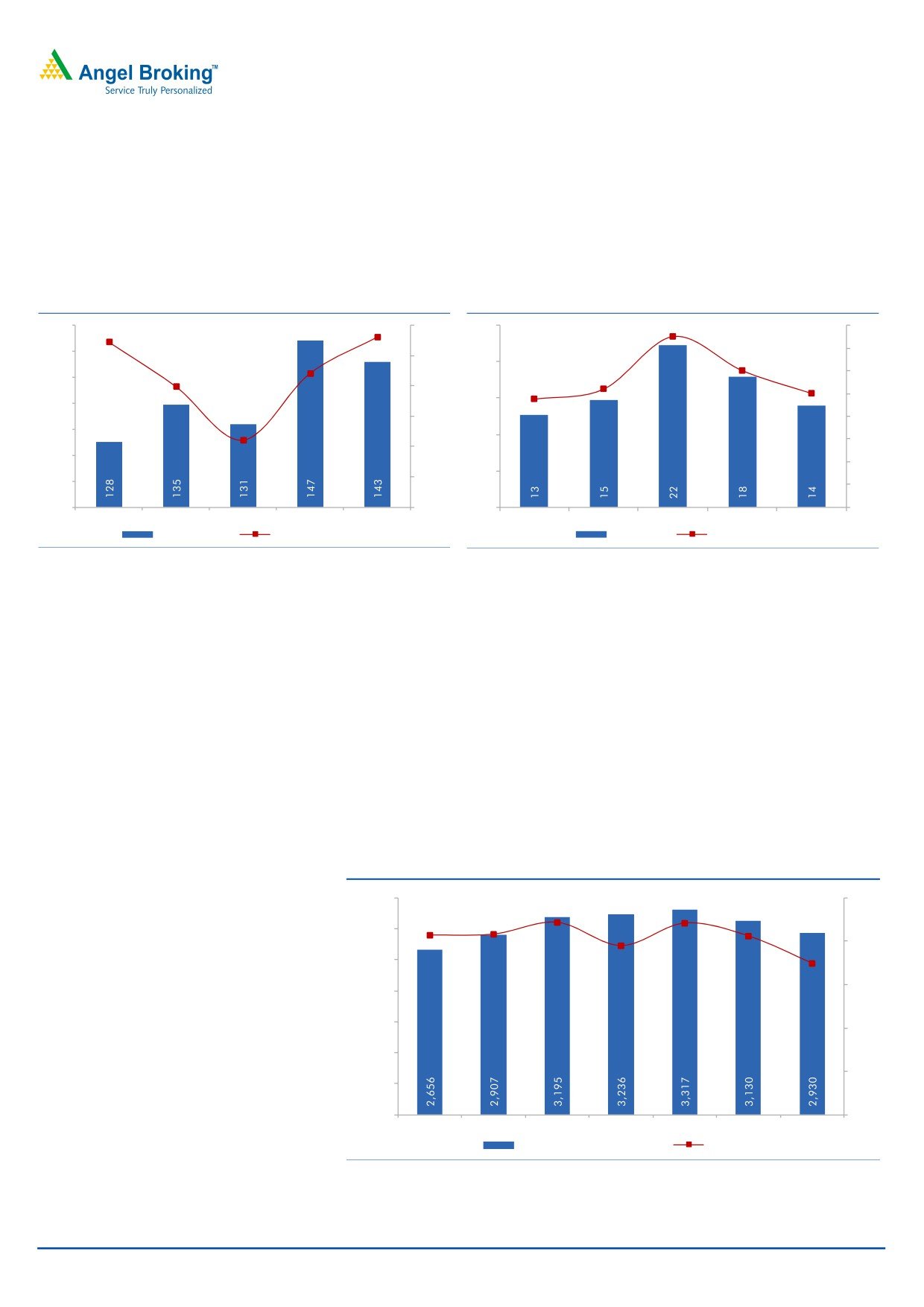

EBITDA margin expands marginally

On the EBITDA margin front, Simplex reported an EBITDA of `141cr, ahead of our

estimates of `143cr. Simplex reported 7bp yoy EBITDA margin expansion to 10.3%

for 2QFY2016. Surge in EBITDA margins is owing to 9.6% yoy decline in other

expenses (18.0% of 2QFY2016 sales) to `251cr.

Exhibit 4: EBITDA margin at 10.3% for the quarter

Exhibit 5: PAT Margin at 1.0% for the quarter

150

10.2

10.3

10.5

25

1.5

1.6

145

1.4

10.0

1.2

20

9.5

9.7

1.0

1.2

140

1.0

9.5

1.0

1.0

15

135

8.6

9.0

0.8

130

10

0.6

8.5

125

0.4

5

8.0

120

0.2

115

7.5

0

0.0

2QFY15

3QFY15

4QFY15

1QFY16

2QFY16

2QFY15

3QFY15

4QFY15

1QFY16

2QFY16

EBITDA (` cr)

EBITDA Margins (%)

PAT (` cr)

PAT Margins (%)

Source: Company, Angel Research

Source: Company, Angel Research

PAT grows yoy

Stronger execution and almost in-line operating performance helped Simplex

report a PAT of `14cr. Reported PAT margins of the company were almost flat on a

yoy basis at 1.0% in 2QFY2016. Flat yoy PAT margins reflect (1) 6.3% decline in

depreciation expenses (to `34cr), and (2) 14.0% increase in interest expenses (to

`106cr).

Comfortable D/E ratio

Simplex reported ~`339cr of recoveries in 1HFY2016 (including `144cr from a

Qatar based cement company and `80cr from Tata Power). Despite recoveries,

stretch in working capital led to surge in D/E ratio to 2.2x (as of 2QFY2016-end).

Exhibit 6: Standalone D/E at 2.2x

3,500

2.2x

2.5x

2.2x

2.1x

2.1x

2.1x

3,000

2.0x

1.9x

1.7x

2,500

1.5x

2,000

1,500

1.0x

1,000

0.5x

500

0

0.0x

FY2013

FY2014

FY2015

1QFY2015

2QFY2015

FY2016E FY2017E

Standalone Debt (` cr)

D/E ratio (x)

Source: Company, Angel Research

November 17, 2015

3

Simplex Infrastructures | 2QFY2016 Result Update

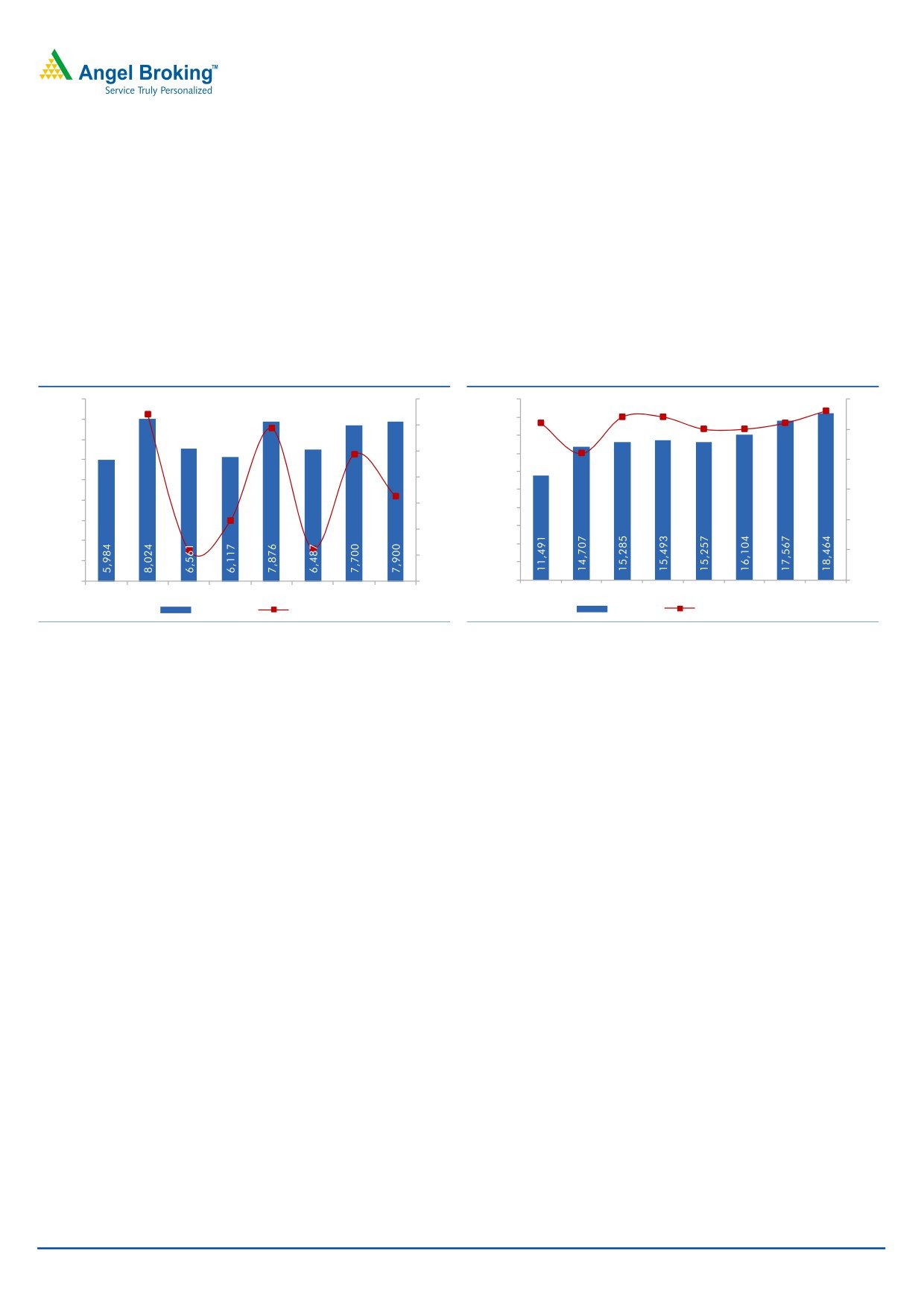

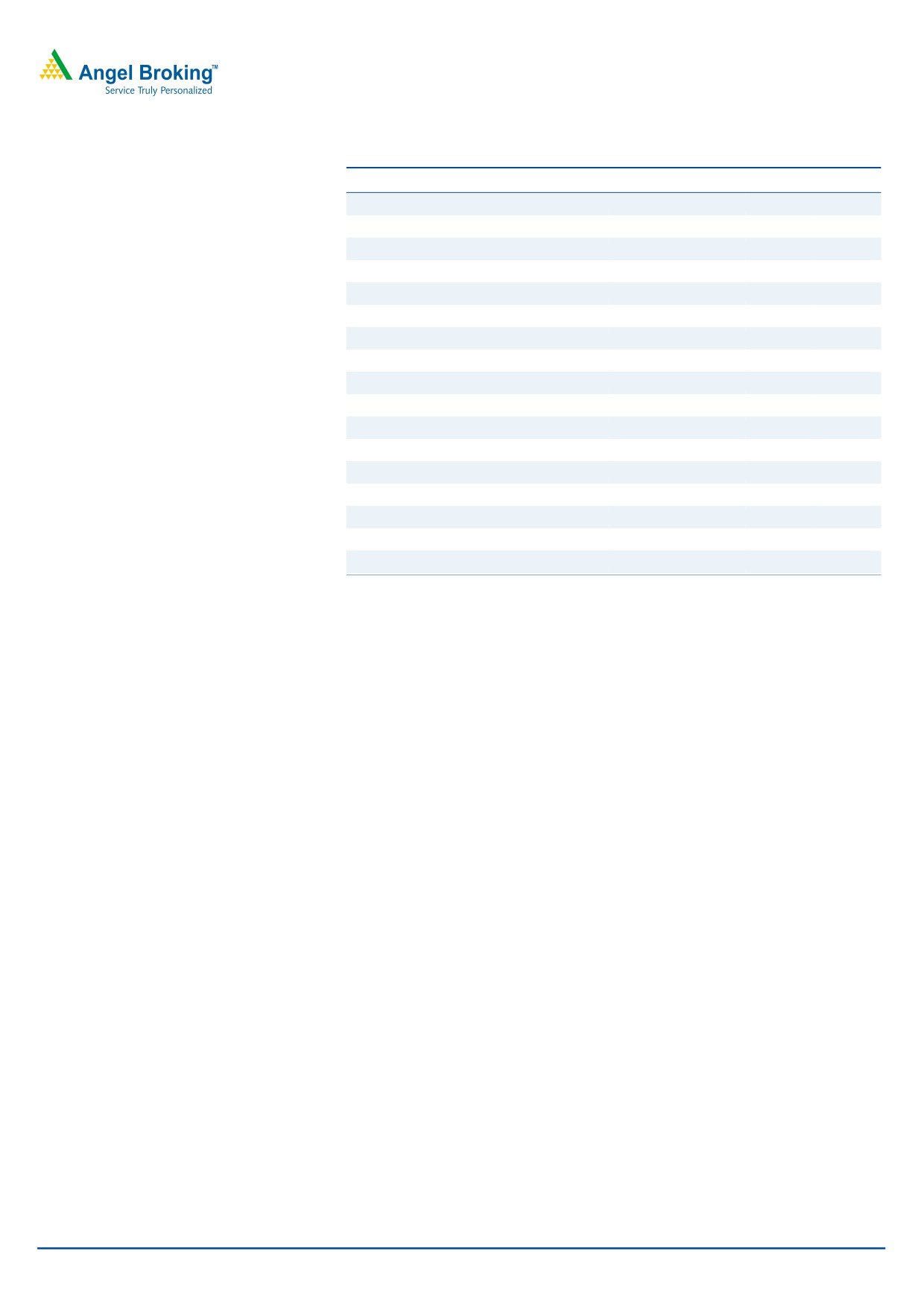

Order Inflow gains momentum

In 2QFY2016, Simplex reported order inflow to the tune of ~`1,197cr, taking the

total order inflow for 1HFY2016 to `1,938cr. Currently, Simplex enjoys L1 position

at projects worth `3,433cr.

Simplex’s Management has given order inflow guidance of

~`8,000cr for

FY2016E. Based on the bid pipeline and order wins reported in 1HFY2016, we

expect Simplex to report

`7,700/7,900cr of order wins in FY2016/2017E,

respectively.

Exhibit 7: Order Inflows to see uptrend

Exhibit 8: Order Book gives better revenue visibility

9,000

34

40

20,000

0.3x

0.3x

0.3x

0.3x

0.3x

0.3x

29

0.3x

0.3x

8,000

18,000

30

0.3x

7,000

19

16,000

0.2x

20

14,000

6,000

0.2x

12,000

5,000

3

10

10,000

0.2x

4,000

(7)

0

8,000

3,000

0.1x

6,000

-10

(18)

(18)

2,000

4,000

0.1x

-20

1,000

2,000

0

-30

0

0.0x

FY10

FY11

FY12

FY13

FY14

FY15

FY16E FY17E

FY10

FY11

FY12

FY13

FY14

FY15

FY16E FY17E

OI (` cr)

y/y change (%)

OB (` cr)

Execution Rate (x)

Source: Company, Angel Research

Source: Company, Angel Research

At 2QFY2016-end, Simplex reported an order book of `14,888cr, which reflects

8% yoy de-growth. However, if we include projects where Simplex stands L1, then

the order book at 2QFY2016-end stands at `18,321cr, which reflects OB to LTM

sales ratio of 3.1x. As of 2QFY2016, Simplex’s order book is majorly dominated

by Buildings & Housing vertical (40%).

November 17, 2015

4

Simplex Infrastructures | 2QFY2016 Result Update

Outlook & Valuation

Considering the external macro environment, the Management in its 2QFY2016

post results concall, guided that it expects 5-7% revenue growth for FY2016.

However, recent order wins and expectations of an improvement in the economy

lead the Management to tone-up the revenue growth estimate for FY2017E at 15-

20%. Accordingly, we have revised our FY2016/17E estimates.

Exhibit 9: Earnings Revision

FY2016E

FY2017E

Y/E March (` cr)

Old

New Chg. (%)

Old

New Chg. (%)

Net Sales

6,241

5,955

(4.6)

7,008

6,829

(2.6)

EBITDA

649

613

(5.5)

750

717

(4.4)

EBITDA Margins (%)

10.4

10.3

10.7

10.5

PAT

101

78

(22.8)

177

156

(11.9)

PAT Margins (%)

1.6

1.3

2.5

2.4

Source: Angel Research

Recommend Neutral with a target price of `346

At the current market price of `319, the standalone EPC business is trading at

FY2016E and FY2017E P/E multiple of 20.3x and 10.1x, respectively. (1) 10.6%

top-line and 57.8% bottom-line CAGR during FY2015-17E, (2) strong order book

of `18,321cr (OB to LTM sales ratio of 3.1x), and (3) scope for improvement in

WC as % of sales ratio from 64% in FY2015 to 53% in FY2017E, should lead to

improvement in D/E ratio from 2.2x in FY2015 to 1.8x in FY2017E. We have

assigned a 1-year forward P/E multiple of 11.0x to our FY2017E EPS estimates of

`31/share, resulting in a value of `346 per share. Given the limited upside in the

stock from the current levels, we have a Neutral rating on the stock.

November 17, 2015

5

Simplex Infrastructures | 2QFY2016 Result Update

Investment arguments

Recent order wins/ L1 give better revenue visibility: Revival in award activity

across verticals has helped Simplex build an order pipeline across sub-

segments. To-date in FY2016, Simplex has reported L1+ order wins

(combined) to the tune of `3,433cr. At 2QFY2016-end (including L1), the

order book of Simplex stands at ~`18,321cr (order book to LTM sales ratio

stands at 3.1x). We expect the flattish order book scenario to take a few more

quarters to catch-up growth momentum from here-on. Accordingly, we expect

Simplex to report a 10.6% top-line CAGR during FY2016-18E to `6,829cr.

57.8% PAT CAGR during FY2015-17E: Uptick in execution, benefits of

operating levers coming into play, coupled with decline in interest expenses,

resulting from ease in working capital cycle (WC excluding cash as % of sales

would decline from 64% in FY2015 to 53% in FY2017E), should translate to

strong earnings growth for the company. We expect Simplex to report a strong

57.8% PAT CAGR during FY2015-17E.

Risks & Concerns

Delay in ease of WC cycle than expected could pose as a risk to our estimates.

Delay in capex cycle revival than anticipated and slowdown in infra award

activity could affect our order inflow and financial estimates adversely.

Company background

Simplex Infrastructure is a diversified engineering and construction company with

an execution track record of more than 83 years. The company has presence

across a wide range of infrastructure domains with expertise in piling, roads,

railways, bridges, ports, power, industrial construction, buildings and housing, and

urban infrastructure.

November 17, 2015

6

Simplex Infrastructures | 2QFY2016 Result Update

Profit and Loss Statement (Standalone)

Y/E March (` cr)

FY13

FY14

FY15

FY16E

FY17E

Net Sales

5,821

5,513

5,582

5,955

6,829

% Chg

(5.3)

1.2

6.7

14.7

Total Expenditure

5,353

4,997

5,020

5,342

6,112

Cost of Raw Materials Consumed

2,195

1,979

1,839

2,037

2,380

Change in Inventories of WIP

26

(18)

36

(60)

(123)

Employee benefits Expense

490

462

481

512

584

Other Expenses

2,641

2,574

2,664

2,853

3,271

EBITDA

468

516

562

613

717

% Chg

10.2

8.9

9.1

16.9

EBIDTA %

8.0

9.4

10.1

10.3

10.5

Depreciation

130

136

137

147

158

EBIT

338

380

425

467

560

% Chg

12.6

11.8

9.8

19.9

Interest and Financial Charges

289

334

384

397

371

Other Income

42

39

53

48

47

PBT

90

86

94

118

236

Tax

31

25

31

40

80

% of PBT

33.8

29.2

33.5

34.0

34.0

PAT before Exceptional item

60

61

62

78

156

Exceptional item

0

0

0

0

0

PAT

60

61

62

78

156

% Chg

1.3

3.1

24.6

99.9

PAT %

1.0

1.1

1.1

1.3

2.3

Diluted EPS

12

12

13

16

31

% Chg

1.3

3.1

24.6

99.9

November 17, 2015

7

Simplex Infrastructures | 2QFY2016 Result Update

Balance Sheet (Standalone)

Y/E March (` cr)

FY13

FY14

FY15

FY16E

FY17E

Sources of Funds

Equity Capital

10

10

10

10

10

Reserves Total

1,274

1,388

1,432

1,490

1,628

Networth

1,284

1,398

1,442

1,500

1,638

Total Debt

2,656

2,907

3,195

3,130

2,950

Other Long-term Liabilities

18

18

18

18

18

Deferred Tax Liability

205

207

192

192

192

Total Liabilities

4,163

4,531

4,847

4,839

4,798

Application of Funds

Gross Block

1,863

1,954

2,023

2,133

2,261

Accumulated Depreciation

642

790

927

1,074

1,231

Net Block

1,221

1,164

1,096

1,060

1,029

Cap.l WIP & Intan.

18

53

25

15

11

Assets under Develop.

Investments

127

134

148

152

156

Current Assets

Inventories

785

862

952

943

1,005

Sundry Debtors

2,274

2,095

2,165

2,233

2,504

Cash and Bank Balance

72

81

23

159

73

Loans & Advances

742

723

822

844

911

Other Current Asset

1,660

2,029

2,562

2,564

2,656

Current Liabilities

2,911

2,756

2,993

3,177

3,595

Net Current Assets

2,622

3,034

3,532

3,566

3,554

Other Assets

175

146

46

47

49

Total Assets

4,163

4,531

4,847

4,839

4,798

November 17, 2015

8

Simplex Infrastructures | 2QFY2016 Result Update

Cash Flow Statement (Standalone)

Y/E March (` cr)

FY13

FY14

FY15

FY16E

FY17E

Profit before tax

90

86

94

118

236

Dep. & Other Non-cash Charges

182

183

101

104

126

Change in Working Capital

(621)

(421)

(457)

102

(75)

Interest & Financial Charges

289

334

384

397

371

Direct taxes paid

(74)

17

(50)

(40)

(80)

Cash Flow from Operations

(133)

199

72

681

577

(Inc)/ Dec in Fixed Assets

(47)

(101)

(41)

(100)

(123)

(Inc)/ Dec in Investments

(31)

18

11

22

23

Cash Flow from Investing

(77)

(83)

(29)

(78)

(100)

Issue/ (Buy Back) of Equity

0

0

0

0

0

Inc./ (Dec.) in Loans

531

233

288

(65)

(180)

Dividend Paid (Incl. Tax)

(11)

(6)

(4)

(5)

(12)

Net Interest Expenses

(282)

(333)

(384)

(397)

(371)

Cash Flow from Financing

237

(105)

(100)

(468)

(563)

Inc./(Dec.) in Cash

28

11

(57)

135

(86)

Opening Cash balances

41

69

80

24

159

Closing Cash balances

69

80

24

159

73

November 17, 2015

9

Simplex Infrastructures | 2QFY2016 Result Update

Key Ratios (Standalone)

Y/E March

FY13

FY14

FY15

FY16E

FY17E

Valuation Ratio (x)

P/E (on FDEPS)

26.4

26.0

25.3

20.3

10.1

P/CEPS

8.3

8.0

7.9

7.0

5.0

Dividend yield (%)

6.4

12.9

10.2

6.8

3.2

EV/Sales

0.7

0.8

0.9

0.8

0.7

EV/EBITDA

8.9

8.5

8.5

7.4

6.2

EV / Total Assets

0.6

0.6

0.6

0.6

0.5

Per Share Data (`)

EPS (fully diluted)

12.1

12.2

12.6

15.7

31.4

Cash EPS

38.4

39.6

40.3

45.4

63.3

DPS

1.0

0.5

0.6

0.9

2.0

Book Value

260

283

292

303

331

Returns (%)

RoCE (Pre-tax)

10.5

10.2

10.7

11.1

13.2

Angel RoIC (Pre-tax)

10.8

10.5

10.9

11.4

13.5

RoE

4.8

4.5

4.4

5.3

9.9

Turnover ratios (x)

Asset Turnover (Gross Block) (X)

3.2

2.9

2.8

2.9

3.1

Inventory / Sales (days)

52

55

59

58

52

Receivables (days)

124

145

139

135

127

Payables (days)

108

122

128

125

121

Leverage Ratios (x)

D/E ratio (x)

2.1

2.1

2.2

2.1

1.8

Interest Coverage Ratio (x)

1.3

1.3

1.2

1.3

1.6

November 17, 2015

10

Simplex Infrastructures | 2QFY2016 Result Update

Research Team Tel: 022 - 39357800

DISCLAIMER

Angel Broking Private Limited (hereinafter referred to as “Angel”) is a registered Member of National Stock Exchange of India Limited,

Bombay Stock Exchange Limited and Metropolitan Stock Exchange of India Limited. It is also registered as a Depository Participant with

CDSL and Portfolio Manager with SEBI. It also has registration with AMFI as a Mutual Fund Distributor. Angel Broking Private Limited is

a registered entity with SEBI for Research Analyst in terms of SEBI (Research Analyst) Regulations, 2014 vide registration number

INH000000164. Angel or its associates has not been debarred/ suspended by SEBI or any other regulatory authority for accessing

/dealing in securities Market. Angel or its associates including its relatives/analyst do not hold any financial interest/beneficial

ownership of more than 1% in the company covered by Analyst. Angel or its associates/analyst has not received any compensation /

managed or co-managed public offering of securities of the company covered by Analyst during the past twelve months. Angel/analyst

has not served as an officer, director or employee of company covered by Analyst and has not been engaged in market making activity

of the company covered by Analyst.

This document is solely for the personal information of the recipient, and must not be singularly used as the basis of any investment

decision. Nothing in this document should be construed as investment or financial advice. Each recipient of this document should

make such investigations as they deem necessary to arrive at an independent evaluation of an investment in the securities of the

companies referred to in this document (including the merits and risks involved), and should consult their own advisors to determine

the merits and risks of such an investment.

Reports based on technical and derivative analysis center on studying charts of a stock's price movement, outstanding positions and

trading volume, as opposed to focusing on a company's fundamentals and, as such, may not match with a report on a company's

fundamentals.

The information in this document has been printed on the basis of publicly available information, internal data and other reliable

sources believed to be true, but we do not represent that it is accurate or complete and it should not be relied on as such, as this

document is for general guidance only. Angel Broking Pvt. Limited or any of its affiliates/ group companies shall not be in any way

responsible for any loss or damage that may arise to any person from any inadvertent error in the information contained in this report.

Angel Broking Pvt. Limited has not independently verified all the information contained within this document. Accordingly, we cannot

testify, nor make any representation or warranty, express or implied, to the accuracy, contents or data contained within this document.

While Angel Broking Pvt. Limited endeavors to update on a reasonable basis the information discussed in this material, there may be

regulatory, compliance, or other reasons that prevent us from doing so.

This document is being supplied to you solely for your information, and its contents, information or data may not be reproduced,

redistributed or passed on, directly or indirectly.

Neither Angel Broking Pvt. Limited, nor its directors, employees or affiliates shall be liable for any loss or damage that may arise from

or in connection with the use of this information.

Note: Please refer to the important ‘Stock Holding Disclosure' report on the Angel website (Research Section). Also, please refer to the

latest update on respective stocks for the disclosure status in respect of those stocks. Angel Broking Pvt. Limited and its affiliates may

have investment positions in the stocks recommended in this report.

Disclosure of Interest Statement

Simplex Infrastructures

1. Analyst ownership of the stock

No

2. Angel and its Group companies ownership of the stock

No

3. Angel and its Group companies' Directors ownership of the stock

No

4. Broking relationship with company covered

No

Note: We have not considered any Exposure below ` 1 lakh for Angel, its Group companies and Directors

Ratings (Based on expected returns

Buy (> 15%)

Accumulate (5% to 15%)

Neutral (-5 to 5%)

over 12 months investment period):

Reduce (-5% to -15%)

Sell (< -15%)

November 17, 2015

11