3QCY2015 Result Update | Pharmaceutical

October 30, 2015

Sanofi India

NEUTRAL

CMP

`4,262

Performance Highlights

Target Price

-

Y/E Dec. (` cr)

3QCY2015 2QCY2015

% chg (qoq) 2QCY2014

% chg (yoy)

Investment Period

-

Net sales

553

514

7.5

487

13.4

Other income

42

45

(6.4)

42

1.7

Stock Info

Operating profit

109

86

26.6

76

42.7

Sector

Pharmaceutical

Adj. Net profit

73

64

12.9

62

16.9

Market Cap (` cr)

9,816

Source: Company, Angel Research

Net debt (` cr)

(239)

Beta

0.4

Sanofi India (Sanofi)’s 3QCY2015 results have come in marginally higher than

our expectation. The company posted a 13.4% yoy growth in revenues to `553cr

52 Week High / Low

4,581/3,090

V/s an expected `536cr. On the operating front, the gross margin came in at

Avg. Daily Volume

2,067

52.0% V/s an expected 48.3% and V/s 48.2% in the corresponding period of last

Face Value (`)

10

year. The OPM came in at 19.7% V/s an expected 17.8% and V/s 15.7% in the

BSE Sensex

27,253

corresponding period of last year. Consequently, the PAT came in at `72.5cr (V/s

Nifty

8,233

an expected `70.0cr), a yoy growth of 16.9%. We recommend a Neutral rating

Reuters Code

SANO.BO

on the stock.

Bloomberg Code

SANL@IN

Better-than-expected results, mainly on OPM front: The company posted a 13.4%

yoy growth in revenues to `553cr V/s an expected `536cr. We expect revenue

Shareholding Pattern (%)

growth to sustain in the coming quarters with improvement in volumes along with

Promoters

60.4

likely price hikes in DPCO products. On the operating front, the gross margin

MF / Banks / Indian Fls

21.5

came in at 52.0% V/s an expected 48.3% and V/s 48.2% in the corresponding

FII / NRIs / OCBs

13.0

period of last year. The OPM came in at 19.7% V/s an expected 17.8% and V/s

Indian Public / Others

5.1

15.7% in the corresponding period of last year. Consequently, the PAT came in at

`73cr (V/s an expected `70cr), a yoy growth of 16.9%. Tax as % of PBT was

40.7% V/s 34.0% in 3QCY2014. Other income for the quarter, at `42cr, was

Abs. (%)

3m 1yr

3yr

same as in the corresponding period of last year.

Sensex

(1.1)

1.9

46.3

Sanofi India

12.7

27.4

91.8

Outlook and valuation: We expect net sales to post a 10.5% CAGR to `2,371cr

and EPS to register a 33.1% CAGR to `151.5 over CY2014-16. At current levels,

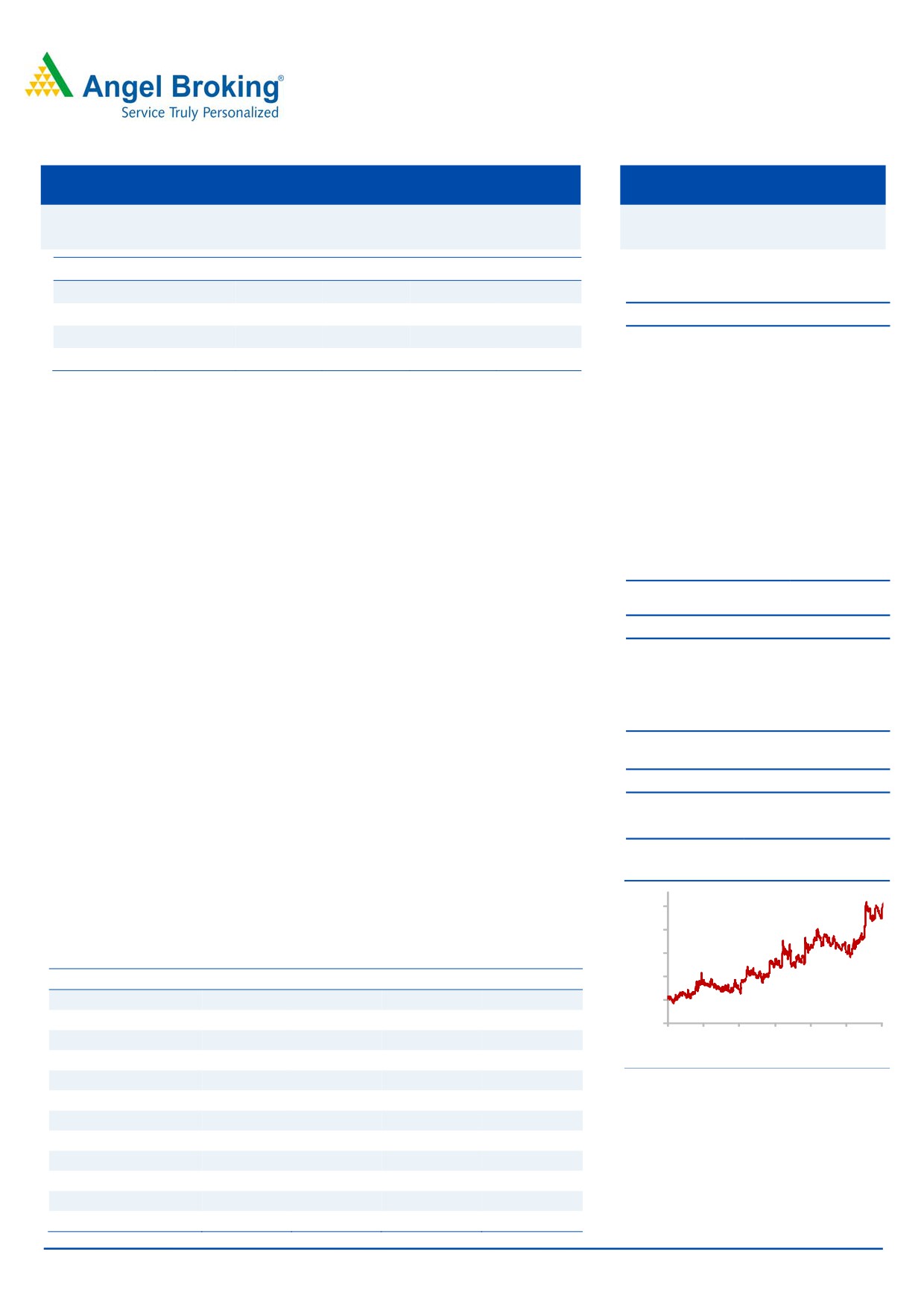

3-year price chart

the stock is trading at 36.0x and 28.1x its CY2015E and CY2016E earnings,

respectively. Given the rich valuations, we recommend a Neutral rating on the

4,200

stock.

3,700

3,200

Key financials

Y E Dec (` cr)

CY2013

CY2014

CY2015E

CY2016E

2,700

Net Sales

1,707

1,875

2,082

2,371

2,200

% chg

14.2

9.9

11.1

13.9

1,700

2

3

3

4

4

5

5

1

1

1

1

Net Profit

239.8

197.1

272.3

349.0

ŧ

1

ŧ

1

ŧ

1

ŧ

c

r

p

c

r

p

c

r

p

c

O

A

O

A

O

A

O

% chg

35.4

(17.8)

38.2

28.2

EPS (`)

104.1

85.6

118.2

151.5

Source: Company, Angel Research

EBITDA(%)

17.3

12.6

17.4

20.8

P/E (x)

40.9

49.8

36.0

28.1

RoE (%)

18.8

14.4

19.9

25.5

RoCE (%)

15.7

10.2

18.5

27.9

P/BV (x)

7.3

6.6

5.3

4.2

Sarabjit Kour Nangra

EV/Sales (x)

5.6

5.0

4.4

3.6

+91 22 3935 7800 Ext: 6806

EV/EBITDA (x)

32.3

39.5

25.1

17.4

Source: Company, Angel Research; Note: CMP as of October 27, 2015

Please refer to important disclosures at the end of this report

1

Sanofi India | 3QCY2015 Result Update

Exhibit 1: 3QCY2015 performance

Y/E Dec (` cr)

3QCY2015

2QCY2015

% chg (qoq) 3QCY2014

% chg (yoy) 9MCY15 9MCY14

% chg yoy

Net sales

553

514

7.5

487

13.4

1,527

1,394

9.5

Other income

42

45

(6.4)

42

1.7

152

121

26.0

Total income

595

560

6.4

529

12.5

1,679

1,515

10.8

PBIDT

109

86

26.6

76

42.7

249

211

17.9

OPM (%)

19.7

16.7

15.7

16.3

15.1

Interest

0.1

0.1

0.0

0

0

Depreciation & amortisation

29

28

2.1

24

20.8

83

72

15.8

PBT & exceptional items

122

103

18.9

94

30.0

317

260

22.3

Less : Exceptional items

0

0

0

16

0

Profit before tax

122

103

18.9

94

30.0

301

260

16.1

Provision for taxation

50

39

28.8

32

55.3

116

88

31.9

Net profit

73

64

12.9

62

16.9

185

171

8.3

Adj net profit

73

64

12.9

62

16.9

169

171

(1.2)

EPS (`)

31.5

27.9

26.9

73.5

74.4

Source: Company, Angel Research

Exhibit 2: 3QCY2015 - Actual Vs Angel estimates

` cr

Actual

Estimates

Variation (%)

Net sales

553

536

3.1

Other income

42

42

1.7

Operating profit

109

95

14.2

Tax

50

39

28.8

Net profit

73

70

3.6

Source: Company, Angel Research

Revenue growth higher than expectation

The company posted sales of `553cr (V/s an expected `536cr), a yoy growth of

13.4%. We expect revenue growth to sustain in the coming quarters with

improvement in volumes along with likely price hikes in DPCO products.

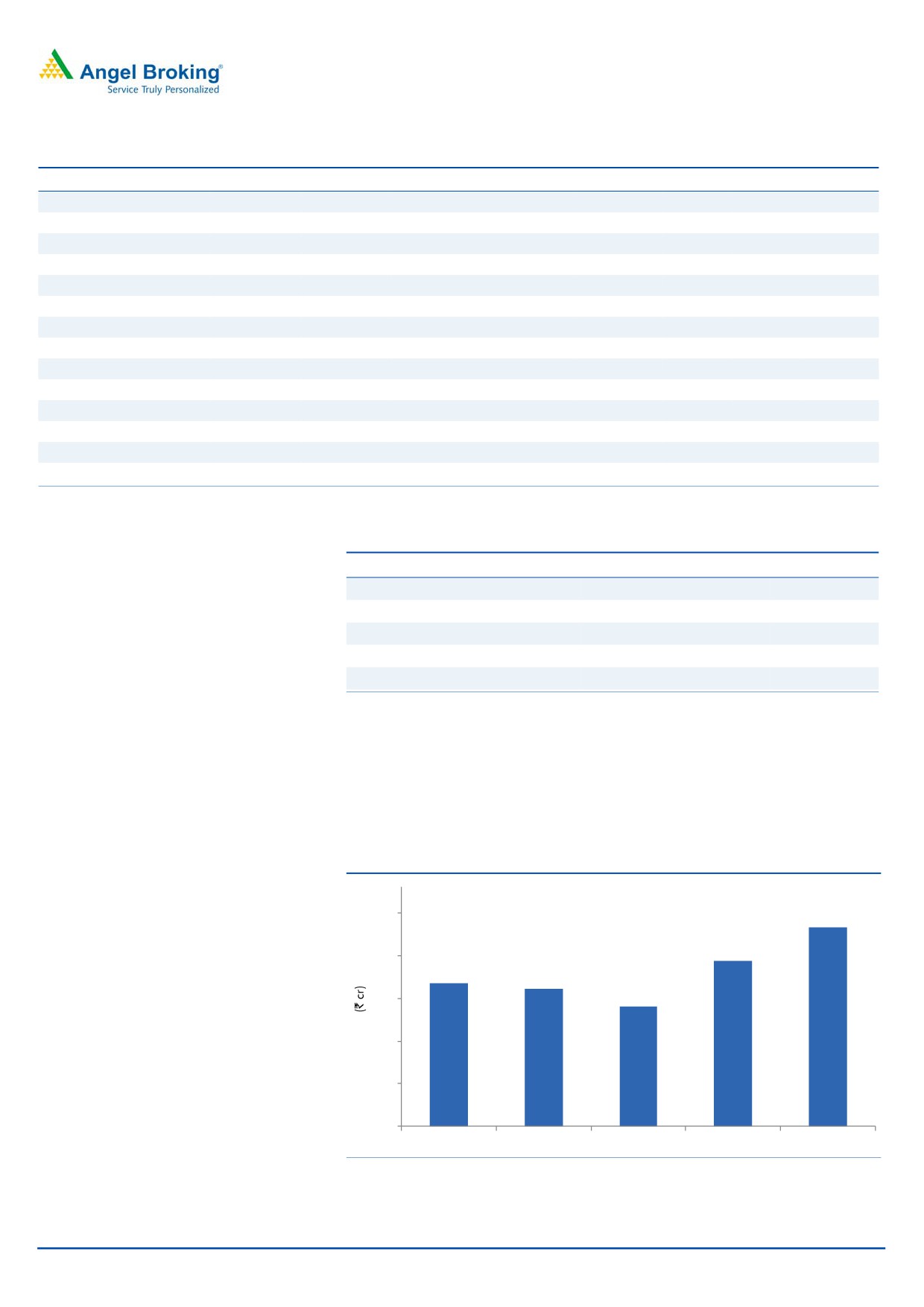

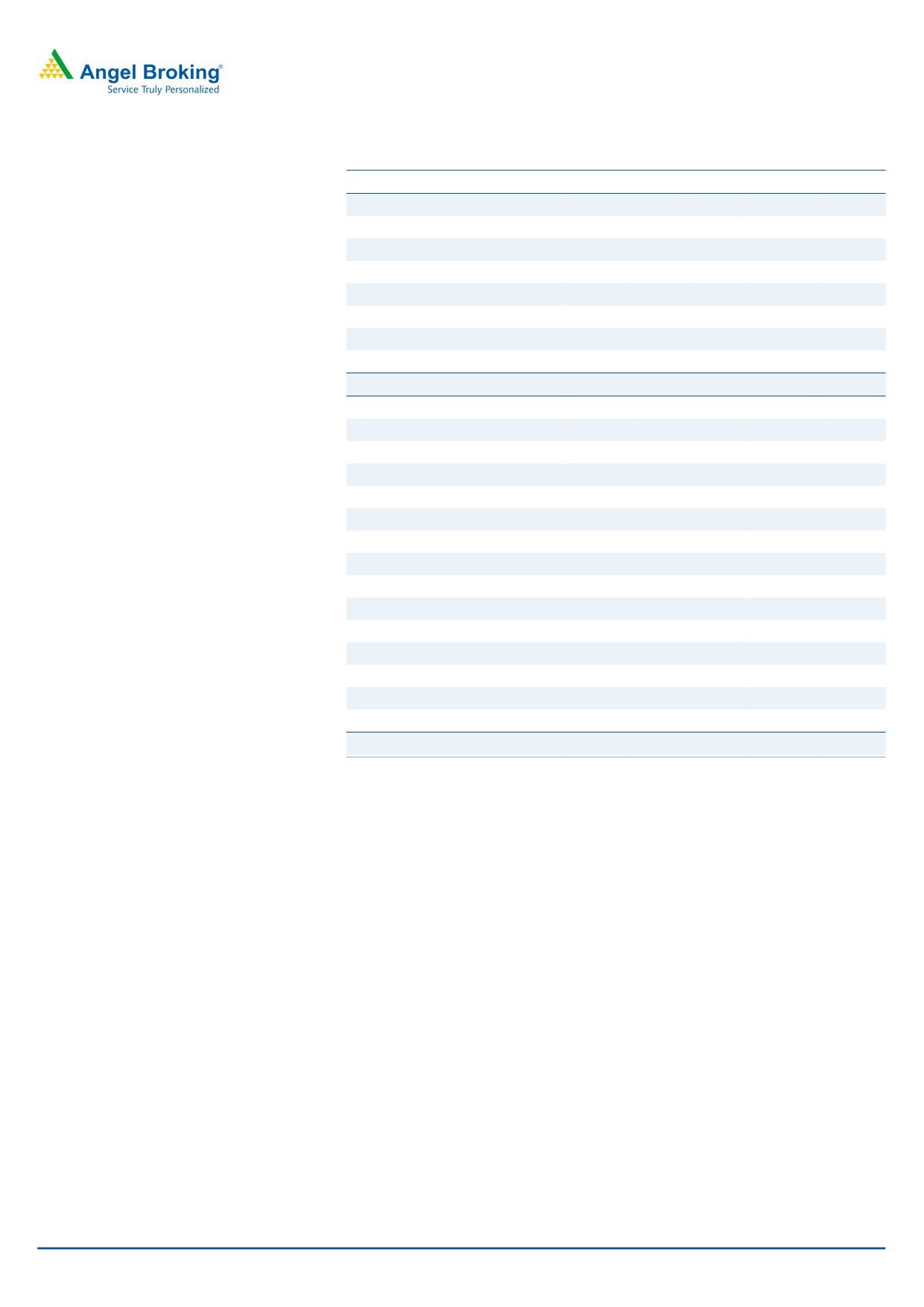

Exhibit 3: Sales trend

570

553

514

520

487

481

460

470

420

370

320

3QCY2014

4QCY2014

1QCY2015

2QCY2015

3QCY2015

Source: Company, Angel Research

October 30, 2015

2

Sanofi India | 3QCY2015 Result Update

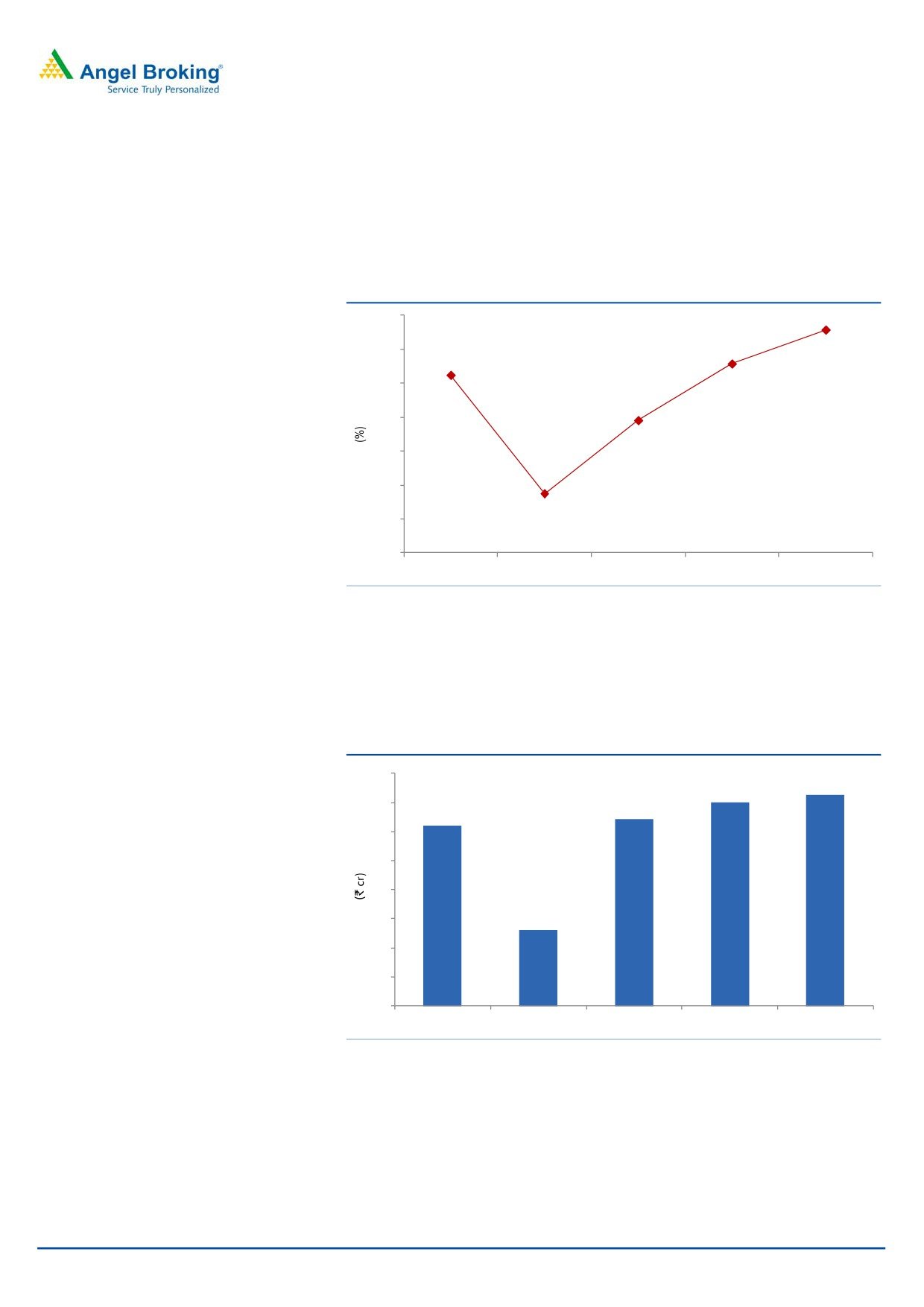

OPM dips to 19.7%: On the operating front, the gross margin came in at 52.0%

V/s an expected 48.3% and V/s 48.2% in the corresponding period of last year.

The expansion in the gross margins came on the back of price hikes. The OPM

came in at 19.7% V/s an expected 17.8% and V/s 15.7% in the corresponding

period of last year.

Exhibit 4: OPM trend

21.0

19.7

18.0

15.7

15.0

16.7

12.0

11.7

9.0

5.2

6.0

3.0

0.0

3QCY2014

4QCY2014

1QCY2015

2QCY2015

3QCY2015

Source: Company, Angel Research

Bottom-line higher than estimate: The PAT came in at `72.5cr (V/s an expected

`70.0cr), a yoy growth of 16.9%. The other income during the quarter came in at

`42.4cr V/s `41.7cr in 3QCY2014, while tax as a % of PBT was at 40.7% V/s

34.0% in 3QCY2014.

Exhibit 5: Adj. net profit trend

80

73

70

70

64

62

60

50

40

30

26

20

10

0

3QCY2014

4QCY2014

1QCY2015

2QCY2015

3QCY2015

Source: Company, Angel Research

October 30, 2015

3

Sanofi India | 3QCY2015 Result Update

Recommendation rationale

Focus on top-line growth: Sanofi recorded revenue CAGR of 9.1% to `1,494cr

over CY2006-12. The growth was impacted by a lower-than-expected growth in

domestic formulations and loss of distribution rights of Rabipur vaccine. Going

forward, to grow in line with the industry’s average growth rate in the domestic

segment, the company has rolled out a project - Prayas, an initiative to increase its

penetration in rural areas. Under the project, the company would launch low-

priced products in the anti-infective and NSAID therapeutic segments and increase

its field force. The project is expected to provide incremental revenue of `500cr

over the next five years.

Sanofi also plans to launch CVS and vaccine products in the domestic market post

the acquisition of Shantha Biotech by its parent company. Further, during CY2011,

the company acquired the nutraceutical business of Universal Medicare Pvt. Ltd,

which led the company’s foray into the nutarceutical business, thus aiding it in

diversifying, and boosting overall growth of its domestic formulation business.

During 2HCY2014 the company’s sales were impacted by the July 2014 National

Pharmaceutical Pricing Authority (NPPA) order which has brought 80 formulations

pertaining to 50 drugs under price control. This severely impacted the company as

three of its major products came under price control. The company is estimated to

suffer a value loss of `120cr on an annualized basis. However, on the positive side

the government has revoked the order, which should aid a recovery in the

domestic formulation sales of the company, going forward. We expect the

company’s net sales to log a 12.4% CAGR over CY2014-17, with domestic

formulation sales expected to post a yoy growth of around 20.0% during the

period.

Valuation: We expect net sales to post a 10.5% CAGR to `2,371cr and EPS to

register a 33.1% CAGR to `151.5 over CY2014-16. At current levels, the stock is

trading at 36.0x and 28.1x its CY2015E and CY2016E earnings, respectively. Given

the rich valuations, we recommend a Neutral rating on the stock.

Exhibit 6: Key assumptions

CY2015E

CY2016E

Net sales growth (%)

11.1

13.9

Domestic sales growth (%)

20.0

15.0

Export sales growth (%)

6.0

10.0

Growth in employee expenses (%)

18.8

6.6

Operating margins (%)

17.4

20.8

Net profit growth (%)

38.2

28.2

Capex (` cr)

30.0

30.0

Source: Company, Angel Research

October 30, 2015

4

Sanofi India | 3QCY2015 Result Update

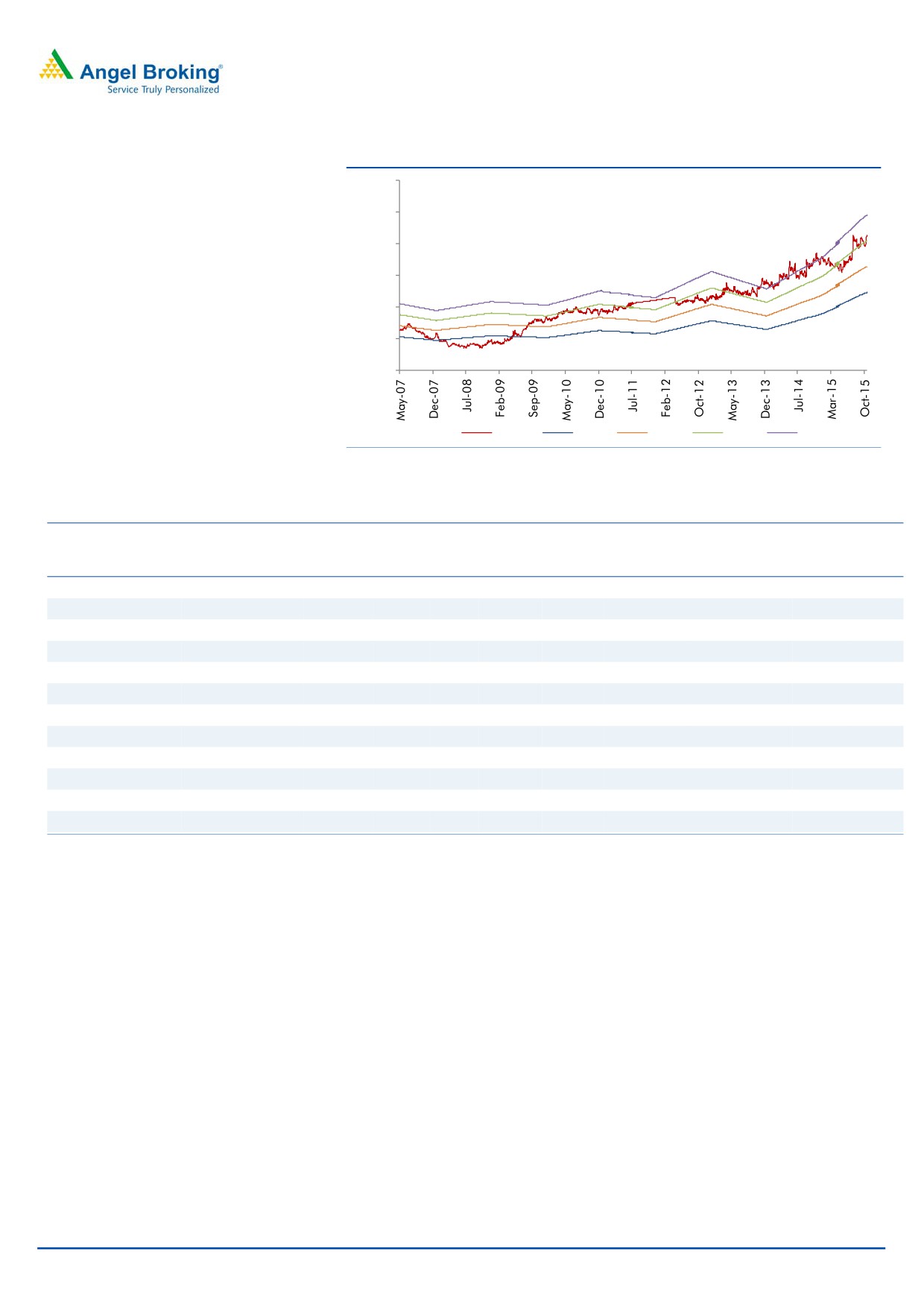

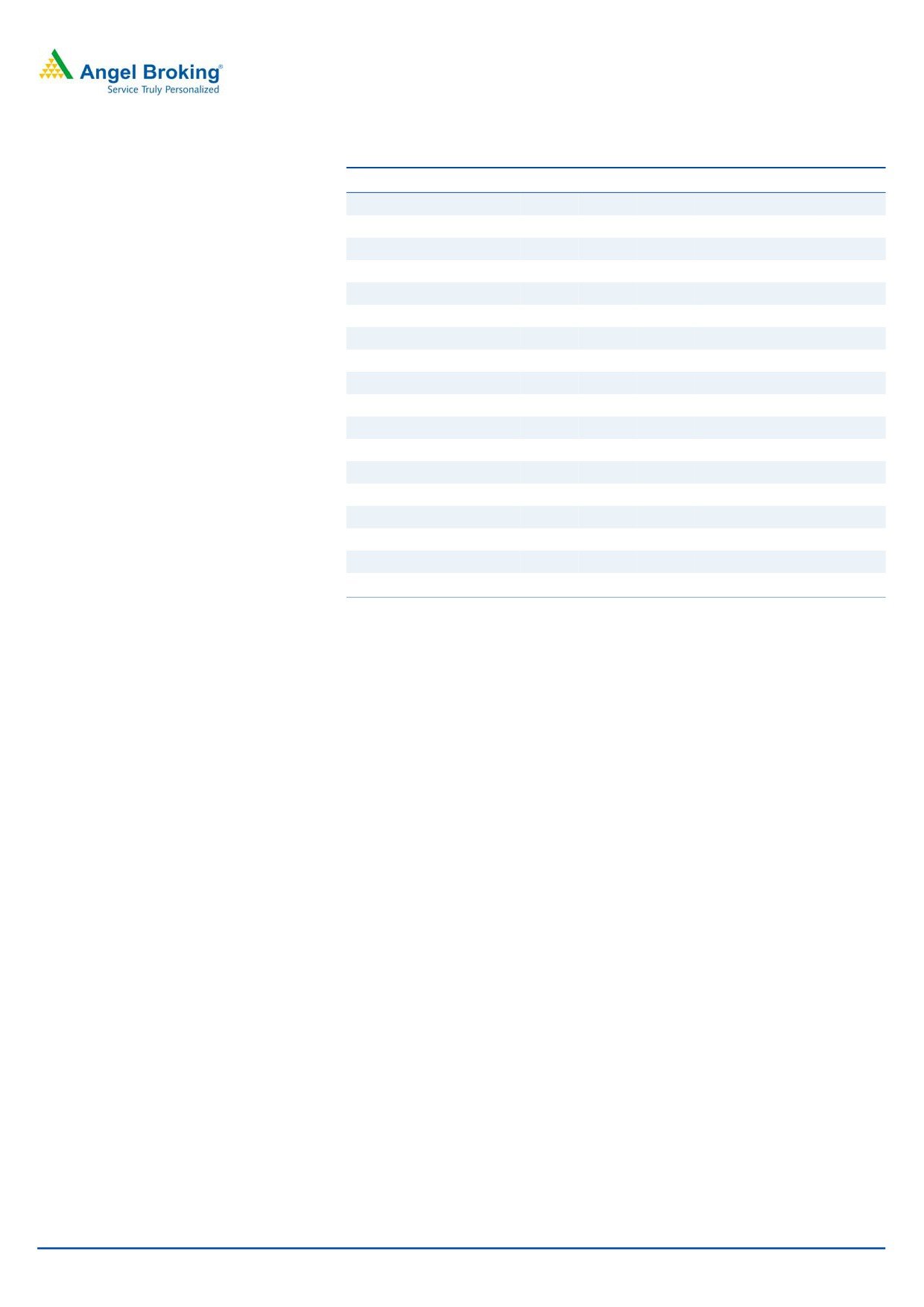

Exhibit 7: One-year forward P/E

6,000

5,000

4,000

3,000

2,000

1,000

0

Price

10x

15x

20x

25x

Source: Company, Angel Research

Exhibit 8: Recommendation summary

Company

Reco.

CMP Tgt Price Upside

FY2017E

FY15-17E

FY2017E

EV/Sales

EV/EBITDA

CAGR in EPS

RoCE

(`)

(`)

(%)

PE (x)

RoE (%)

(x)

(x)

(%)

(%)

Alembic Pharma

Neutral

664

-

-

27.8

4.0

19.7

26.2

31.5

31.8

Aurobindo Pharma Neutral

846

-

19.4

3.1

13.5

16.3

23.4

30.2

Cadila Healthcare

Neutral

425

-

-

24.1

3.6

16.5

24.6

25.2

29.0

Cipla

Neutral

684

-

-

22.4

3.2

16.1

24.6

18.0

17.5

Dr Reddy's

Neutral

4,182

-

-

21.7

3.3

14.4

21.6

20.6

22.0

Dishman Pharma

Neutral

346

-

-

16.0

1.5

7.5

20.4

11.7

11.7

GSK Pharma*

Neutral

3,271

-

-

47.9

8.4

37.8

6.6

33.7

34.3

Indoco Remedies

Neutral

333

-

-

21.5

2.5

13.7

31.4

20.1

21.1

Ipca labs

Neutral

781

-

-

24.4

2.6

14.1

26.1

13.0

14.9

Lupin

Neutral

1,946

-

-

27.4

4.7

17.5

9.7

27.9

23.4

Sanofi India*

Neutral

4,262

-

-

28.1

3.6

17.4

33.1

27.9

25.5

Sun Pharma

Neutral

905

-

-

33.7

6.0

19.6

8.4

15.8

16.6

Source: Company, Angel Research

Company Background

Sanofi, a leading global pharmaceutical company, operates in India through four

entities - Sanofi India, Sanofi-Synthelabo (India) Ltd, Sanofi Pasteur India Private

Ltd and Shantha Biotechnics. Sanofi India focuses its activities on seven major

therapeutic areas, namely

- Cardiovascular diseases, Metabolic Disorders,

Thrombosis, Oncology, Central Nervous System disorders, Internal Medicine and

Vaccines. Predominately a domestic company, the company exports to

semi-regulated markets; exports at ~`500cr, contributed around 26% of sales in

CY2014.

October 30, 2015

5

Sanofi India | 3QCY2015 Result Update

Profit & loss statement

Y/E Dec. (` cr)

CY2011

CY2012

CY2013

CY2014

CY2015E

CY2016E

Gross sales

1,259

1,534

1,746

1,915

2,131

2,427

Less: Excise duty

29

40

39

40

48

56

Net sales

1,230

1,494

1,707

1,875

2,082

2,371

Other operating income

86

91

102

103

103

103

Total operating income

1,315

1,585

1,809

1,978

2,185

2,474

% chg

15.0

20.5

14.1

9.3

10.5

13.2

Total expenditure

1,054

1,261

1,411

1,639

1,720

1,877

Net raw materials

619

735

820

974

947

1,055

Other mfg costs

61

74

82

93

106

114

Personnel

174

214

242

288

340

336

Other

199

238

267

283

326

372

EBITDA

176

233

296

236

362

494

% chg

22.9

32.2

27.0

7.3

8.3

9.3

(% of Net Sales)

14.3

15.6

17.3

12.6

17.4

20.8

Depreciation& amortisation

31

90

92

97

109

112

EBIT

145

143

203

140

253

382

% chg

18.2

(1.5)

42.4

5.7

6.7

7.7

(% of Net Sales)

11.8

9.6

11.9

10.2

11.2

12.2

Interest & other charges

0

1

0

-

-

-

Other income

54

30

58

64

100

100

(% of PBT)

19.0

11.4

15.9

18.6

19.6

20.6

Share in profit of Associates

-

-

-

-

-

-

Recurring PBT

284

262

363

307

456

585

% chg

21.8

(7.7)

38.7

3.8

4.8

5.8

Extraordinary Expense/(Inc.)

-

PBT (reported)

284

262

363

307

456

585

Tax

92.8

85.0

123.3

109.0

182.2

234.0

(% of PBT)

32.7

32.4

33.9

35.6

40.0

40.0

PAT (reported)

191

177

240

198

273

351

Extra-ordinary items

(0)

(0)

(25)

(67)

-

-

PAT after MI (reported)

191

177

266

264

272

349

ADJ. PAT

191

177

240

197

272

349

% chg

23.3

(7.4)

35.4

(17.8)

38.2

28.2

(% of Net Sales)

15.5

11.8

15.6

14.1

13.1

14.7

Basic EPS (`)

83

77

104

86

118

152

Fully Diluted EPS (`)

83

77

104

86

118

152

% chg

23.3

(7.4)

35.4

(17.8)

38.2

28.2

October 30, 2015

6

Sanofi India | 3QCY2015 Result Update

Balance sheet

Y/E Dec (` cr)

CY2011 CY2012 CY2013 CY2014 CY2015E CY2016E

SOURCES OF FUNDS

Equity share capital

23

23

23

23

23

23

Preference Capital

-

-

-

-

-

-

Reserves & surplus

1,094

1,181

1,324

1,463

1,839

2,291

Shareholders funds

1,117

1,204

1,347

1,486

1,862

2,314

Long term provisions

20

19

25

32

32

32

Other long term liabilities

1

-

-

-

-

-

Total loans

-

-

-

-

-

-

Total liabilities

1,137

1,223

1,372

1,518

1,895

2,349

APPLICATION OF FUNDS

Gross block

843

889

1,075

1,195

1,225

1,255

Less: Acc. depreciation

231

315

409

506

615

726

Net block

612

574

666

690

611

529

Goodwill

125

125

125

125

125

125

Capital Work-in-Progress

23

43

43

43

43

43

Long term loan and adv.

76

61

62

106

106

106

Investments

0.4

0.4

0.2

0.2

0.2

0.2

Current assets

667

827

947

1,263

1,670

2,290

Cash

234

429

264

469

718

1,206

Loans & advances

174

208

219

196

305

348

Other

327

191

464

598

646

736

Current liabilities

357

387

435

656

607

691

Net current assets

310

441

512

607

1,063

1,599

Deferred tax assets

(8)

(21)

(37)

(54)

(54)

(54)

Total assets

1,137

1,223

1,372

1,518

1,895

2,349

October 30, 2015

7

Sanofi India | 3QCY2015 Result Update

Cash flow statement

Y/E Dec. (` cr)

CY2011 CY2012 CY2013 CY2014 CY2015E CY2016E

Profit before tax

282

285

291

292

293

282

Depreciation

90

92

97

109

112

90

(Inc)/Dec in Working Capital

(147)

236

(64)

207

48

(147)

Less: Other income

91

102

66

67

68

91

Direct taxes paid

93

91

93

94

95

93

Cash Flow from Operations

41

420

164

447

290

41

(Inc.)/Dec.in Fixed Assets

(67)

(186)

(120)

(30)

(30)

(67)

(Inc.)/Dec. in Investments

-

0

0

-

-

-

Other income

91

102

66

67

68

91

Cash Flow from Investing

24

(84)

41

42

43

24

Issue of Equity

-

-

-

-

-

-

Inc./(Dec.) in loans

-

-

-

-

-

-

Dividend Paid (Incl. Tax)

(88)

(104)

(104)

(104)

(104)

(88)

Others

218

(397)

102

(136)

259

218

Cash Flow from Financing

130

(501)

(1)

(240)

155

130

Inc./(Dec.) in Cash

195

(164)

204

249

488

195

Opening Cash balances

234

429

264

469

718

234

Closing Cash balances

429

264

469

718

1,206

429

October 30, 2015

8

Sanofi India | 3QCY2015 Result Update

Key ratios

Y/E Dec.

CY2011

CY2012

CY2013

CY2014

CY2015E CY2016E

Valuation Ratio (x)

P/E (on FDEPS)

51.4

55.4

40.9

49.8

36.0

28.1

P/CEPS

44.2

36.8

27.4

27.2

25.7

21.3

P/BV

8.8

8.2

7.3

6.6

5.3

4.2

EV/Sales

7.8

6.3

5.6

5.0

4.4

3.6

EV/EBITDA

54.4

40.4

32.3

39.5

25.1

17.4

Per Share Data (`)

EPS (Basic)

83.0

76.9

104.1

85.6

118.2

151.5

EPS (fully diluted)

83.0

76.9

104.1

85.6

118.2

151.5

Cash EPS

96.5

115.9

155.4

156.7

165.5

200.0

DPS

33.0

33.0

33.0

33.0

33.0

33.0

Book Value

484.9

522.9

584.8

645.2

808.4

1,004.9

Returns (%)

RoCE (Pre-tax)

13.5

12.1

15.7

10.2

18.5

27.9

Angel ROIC (Pre-tax)

23.6

17.5

22.4

14.6

26.4

39.8

ROE

17.9

15.3

18.8

14.4

19.9

25.5

Turnover ratios (x)

Inventory / Sales (days)

69

61

31

28

26

23

Receivables (days)

19

23

9

8

7

7

Payables (days)

48

44

24

21

20

18

October 30, 2015

9

Sanofi India | 3QCY2015 Result Update

Research Team Tel: 022 - 39357800

DISCLAIMER

Angel Broking Private Limited (hereinafter referred to as “Angel”) is a registered Member of National Stock Exchange of India Limited,

Bombay Stock Exchange Limited and and Metropolitan Stock Exchange of India Limited. It is also registered as a Depository Participant

with CDSL and Portfolio Manager with SEBI. It also has registration with AMFI as a Mutual Fund Distributor. Angel Broking Private

Limited is a registered entity with SEBI for Research Analyst in terms of SEBI (Research Analyst) Regulations, 2014 vide registration

number INH000000164. Angel or its associates has not been debarred/ suspended by SEBI or any other regulatory authority for

accessing /dealing in securities Market. Angel or its associates including its relatives/analyst do not hold any financial

interest/beneficial ownership of more than 1% in the company covered by Analyst. Angel or its associates/analyst has not received any

compensation / managed or co-managed public offering of securities of the company covered by Analyst during the past twelve

months. Angel/analyst has not served as an officer, director or employee of company covered by Analyst and has not been engaged in

market making activity of the company covered by Analyst.

This document is solely for the personal information of the recipient, and must not be singularly used as the basis of any investment

decision. Nothing in this document should be construed as investment or financial advice. Each recipient of this document should

make such investigations as they deem necessary to arrive at an independent evaluation of an investment in the securities of the

companies referred to in this document (including the merits and risks involved), and should consult their own advisors to determine

the merits and risks of such an investment.

Reports based on technical and derivative analysis center on studying charts of a stock's price movement, outstanding positions and

trading volume, as opposed to focusing on a company's fundamentals and, as such, may not match with a report on a company's

fundamentals.

The information in this document has been printed on the basis of publicly available information, internal data and other reliable

sources believed to be true, but we do not represent that it is accurate or complete and it should not be relied on as such, as this

document is for general guidance only. Angel Broking Pvt. Limited or any of its affiliates/ group companies shall not be in any way

responsible for any loss or damage that may arise to any person from any inadvertent error in the information contained in this report.

Angel Broking Pvt. Limited has not independently verified all the information contained within this document. Accordingly, we cannot

testify, nor make any representation or warranty, express or implied, to the accuracy, contents or data contained within this document.

While Angel Broking Pvt. Limited endeavors to update on a reasonable basis the information discussed in this material, there may be

regulatory, compliance, or other reasons that prevent us from doing so.

This document is being supplied to you solely for your information, and its contents, information or data may not be reproduced,

redistributed or passed on, directly or indirectly.

Neither Angel Broking Pvt. Limited, nor its directors, employees or affiliates shall be liable for any loss or damage that may arise from

or in connection with the use of this information.

Note: Please refer to the important ‘Stock Holding Disclosure' report on the Angel website (Research Section). Also, please refer to the

latest update on respective stocks for the disclosure status in respect of those stocks. Angel Broking Pvt. Limited and its affiliates may

have investment positions in the stocks recommended in this report.

Disclosure of Interest Statement

Sanofi India

1. Analyst ownership of the stock

No

2. Angel and its Group companies ownership of the stock

No

3. Angel and its Group companies' Directors ownership of the stock

No

4. Broking relationship with company covered

No

Note: We have not considered any Exposure below ` 1 lakh for Angel, its Group companies and Directors

Ratings (Based on expected returns

Buy (> 15%)

Accumulate (5% to 15%)

Neutral (-5 to 5%)

over 12 months investment period):

Reduce (-5% to -15%)

Sell (< -15)

October 30, 2015

10