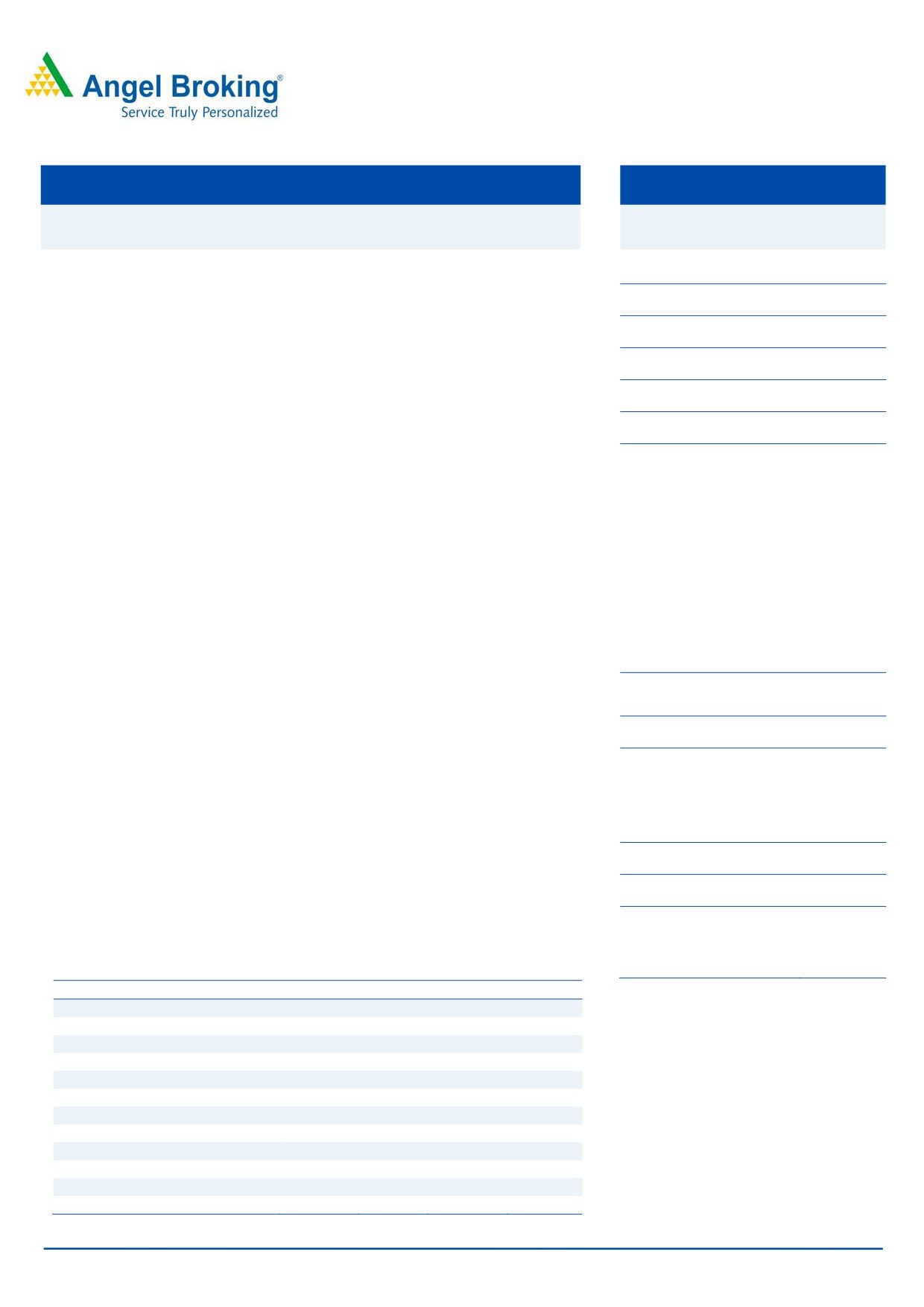

IPO note | Infrastructure

August 28, 2015

Sadbhav Infrastructure Project

NEUTRAL

sue Open: August 31, 2015

Is

Issue price captures all positives in store…

Issue Close: September 2, 2015

Company background: Sadbhav Infrastructure Project Ltd (SIPL) is a subsidiary of

Ahmedabad-based Sadbhav Engineering Ltd (SEL). SIPL was incorporated in

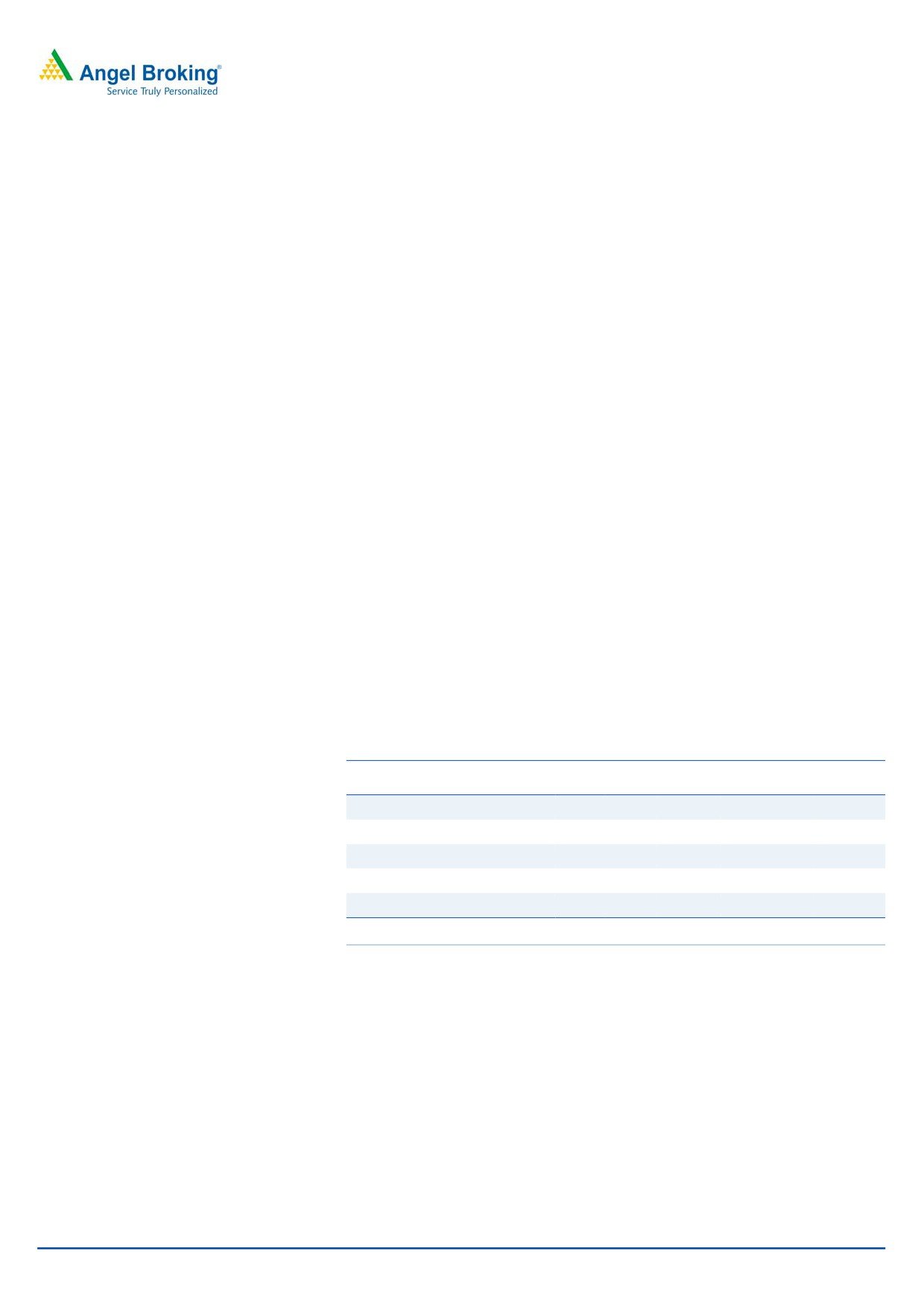

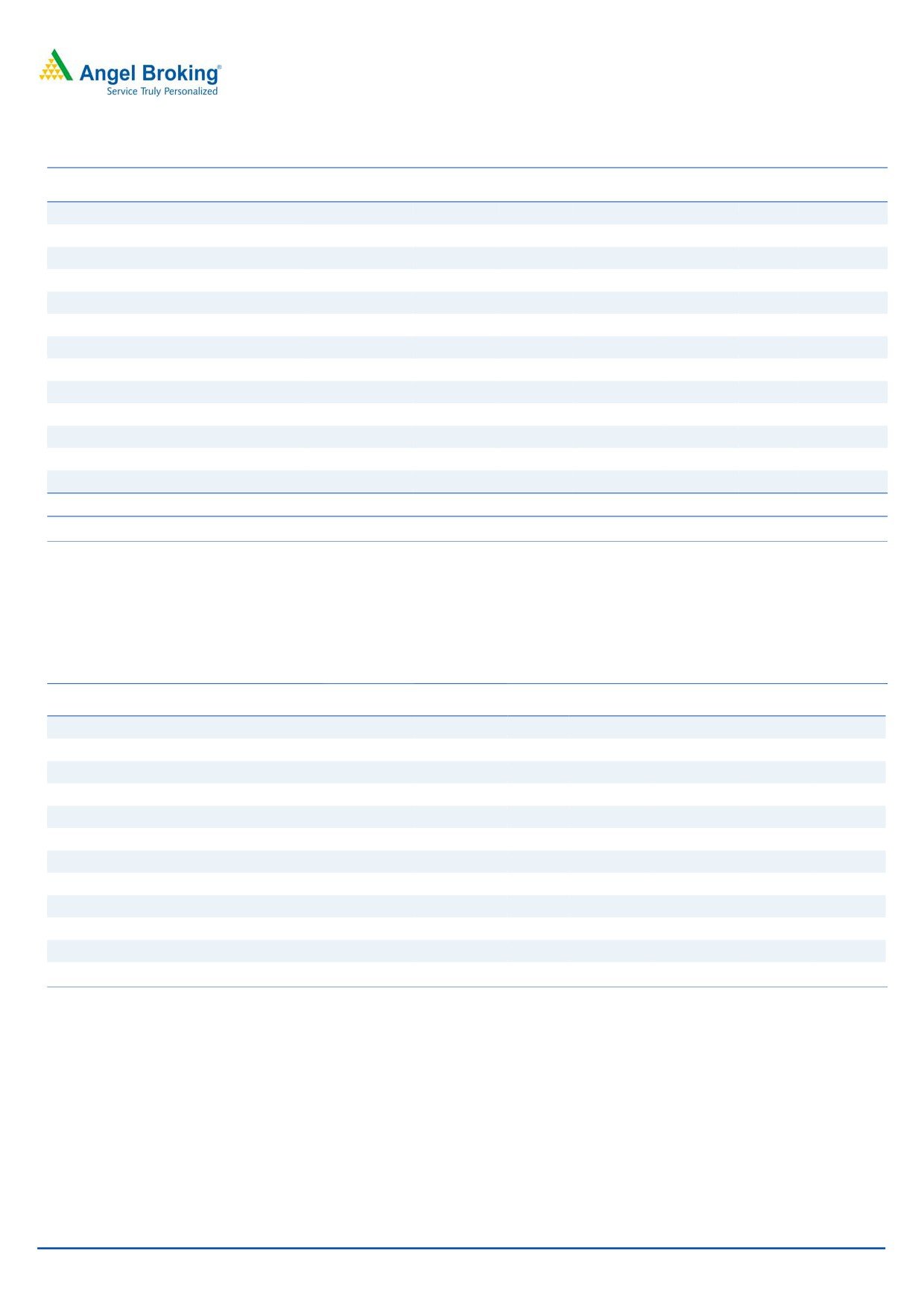

Issue Details

2007 as a roads and highways operator. It has a portfolio of 10 BOT projects of

which 6 road projects are fully operational, 1 is partially operational (border

Face Value: `10

check posts) and 3 are under construction stage. 9 of the 10 BOT projects are toll

projects (including service fee for the border check posts in Maharashtra) and 1 is

Present Eq. Paid up Capital: `311.0cr

an annuity project. In addition to the 10, SIPL is in later stages of acquiring stake

Fresh Issue: 4.12cr Shares*

in 2 projects, of which 1 is operational and the other one is under development.

This restructuring process is in accordance with company’s strategy of

Offer for Sale: 0.64cr Shares

consolidating all BOT road projects developed by SEL under one company- SIPL.

Post Eq. Paid up Capital: `352.2cr

Pros: (1) Strong revival trend seen across many of the company’s BOT road

Fresh Issue size (amount): `425cr

projects which should lead to improvement in its cash flow cycle, (2) diversified

Offer for Sale (amount): `66.65cr

portfolio with minimal risk, as only 4 of the 12 projects are under construction

Price Band: `100-103

stage (3 of them being ahead of schedule), and (3) recent BOT re-financing

initiative, as well as, debt re-payment from the IPO proceeds should relieve near-

Lot Size: 145 shares

term stress on the Balance Sheet.

Post-issue implied mkt. cap:

`3,522.3cr- 3,627.9cr

Cons: (1) Highly levered Balance Sheet (FY2015 debt of `6,342cr; D/E ratio of

Promoters holding Pre-Issue: 78.1%

7.9x), (2) deteriorating interest coverage ratio (from 1.0x in FY2012 to 0.3x in

FY2015), (3) networth erosion from `971cr in FY2012 to `788cr in FY2015, with

Promoters holding Post-Issue: 69.0%

there being more potential for erosion, (4) lack of clarity on the sources of funding

*At higher end of the IPO price band of `

of new projects the company intends to build its portfolio upon.

Outlook & Valuation: Although we are impressed by the company’s past

Book Building

execution track record, strong parentage support, and diversified road portfolio

QIBs

75% of issue

(with minimal execution risk), what concerns us is the high debt on the books. The

commencement of 4 BOT projects during FY2016-17E will add to the revenues,

Non-Institutional

15% of issue

but high interest expense will delay the turnaround in profitability. In terms of

Retail

10% of issue

valuation, the company is trading at FY2015-EV/EBITDA multiple of 29.9x and

FY2015-P/BV of 4.1x which is significantly expensive than its peers. On using the

sum-of-the-parts based valuation methodology, we arrive at FY2017 based fair

Post Issue Shareholding Pattern

price of `101/share, which suggests that the issue is fully priced. While positives

emanating from favorable near term prospects would be offset by the high debt

Promoters Group

69.0

on the company’s books, we suggest a NEUTRAL rating on the issue.

DIIs/FIIs/Public & Others

31.0

Key Financials (Consolidated)

Y/E March (` cr)

FY12

FY13

FY14

FY15

Net Sales

176

287

371

500

% chg

153.2

63.2

29.2

34.8

Net Profit

10

(52)

(196)

(330)

% chg

(0.9)

nmf

nmf

nmf

EBITDA (%)

52.9

59.0

65.1

61.7

EPS (Rs)

0.3

(1.5)

(5.0)

(9.7)

P/E (x)

nmf

nmf

nmf

nmf

P/BV (x)

3.8

3.3

3.9

4.1

RoE (%)

1.3

(5.0)

(17.4)

(37.5)

RoCE (%)

2.5

2.9

2.9

2.6

Yellapu Santosh

EV/Sales (x)

33.4

23.7

21.7

18.5

022 - 3935 7800 Ext: 6811

EV/EBITDA (x)

63.0

40.1

33.3

29.9

Source: Company, Angel Research; Note: mnf- not meaningful; Valuation multiples at higher- end

of the price band

Please refer to important disclosures at the end of this report

1

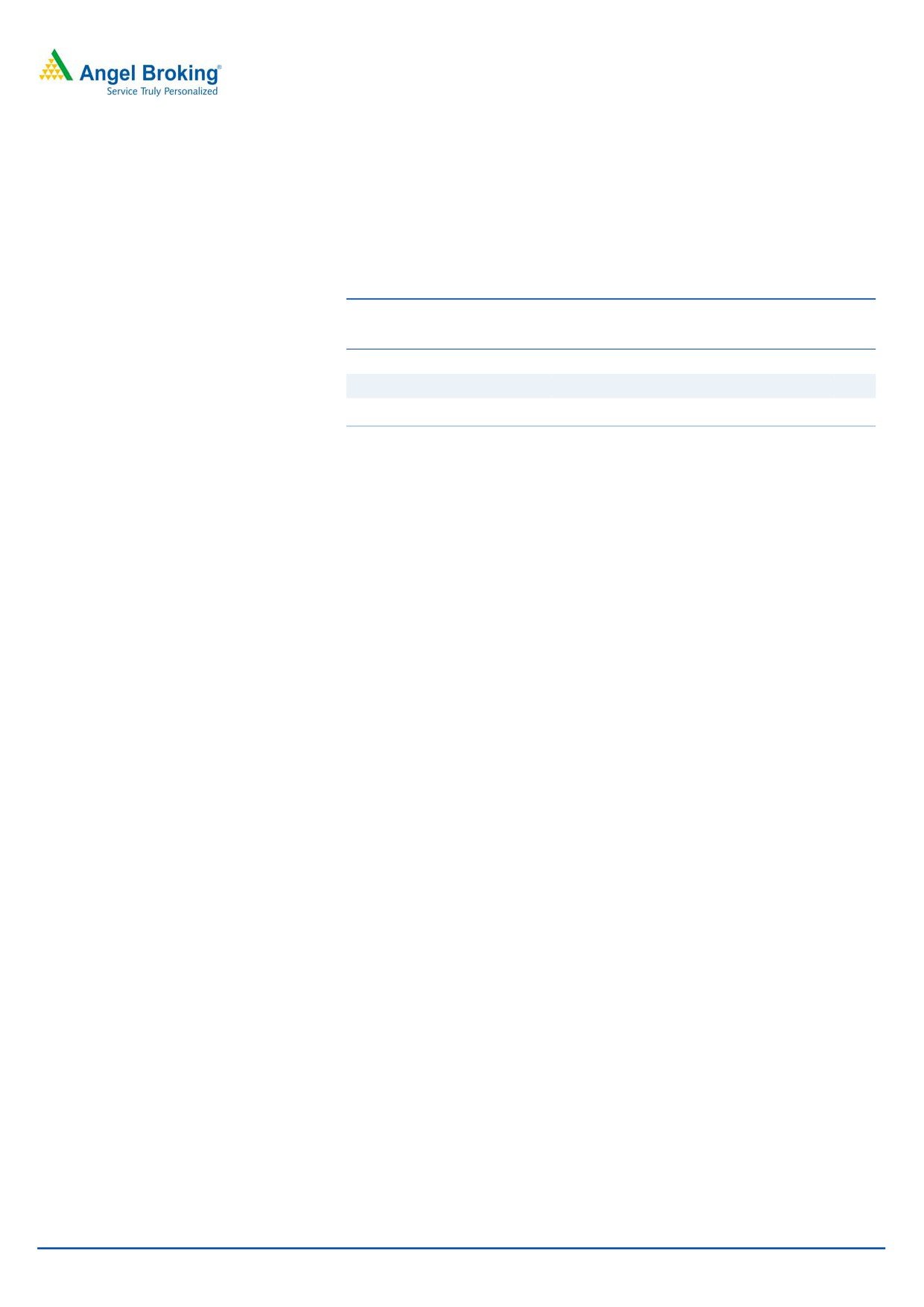

SIPL | IPO note

Issue Details

SIPL is offering 4.77cr equity shares of `10 each via book building route in a price

band of `100-103, consisting of fresh equity issue of 4.12cr shares and offer for

sale by PE firm of 0.64cr equity shares.

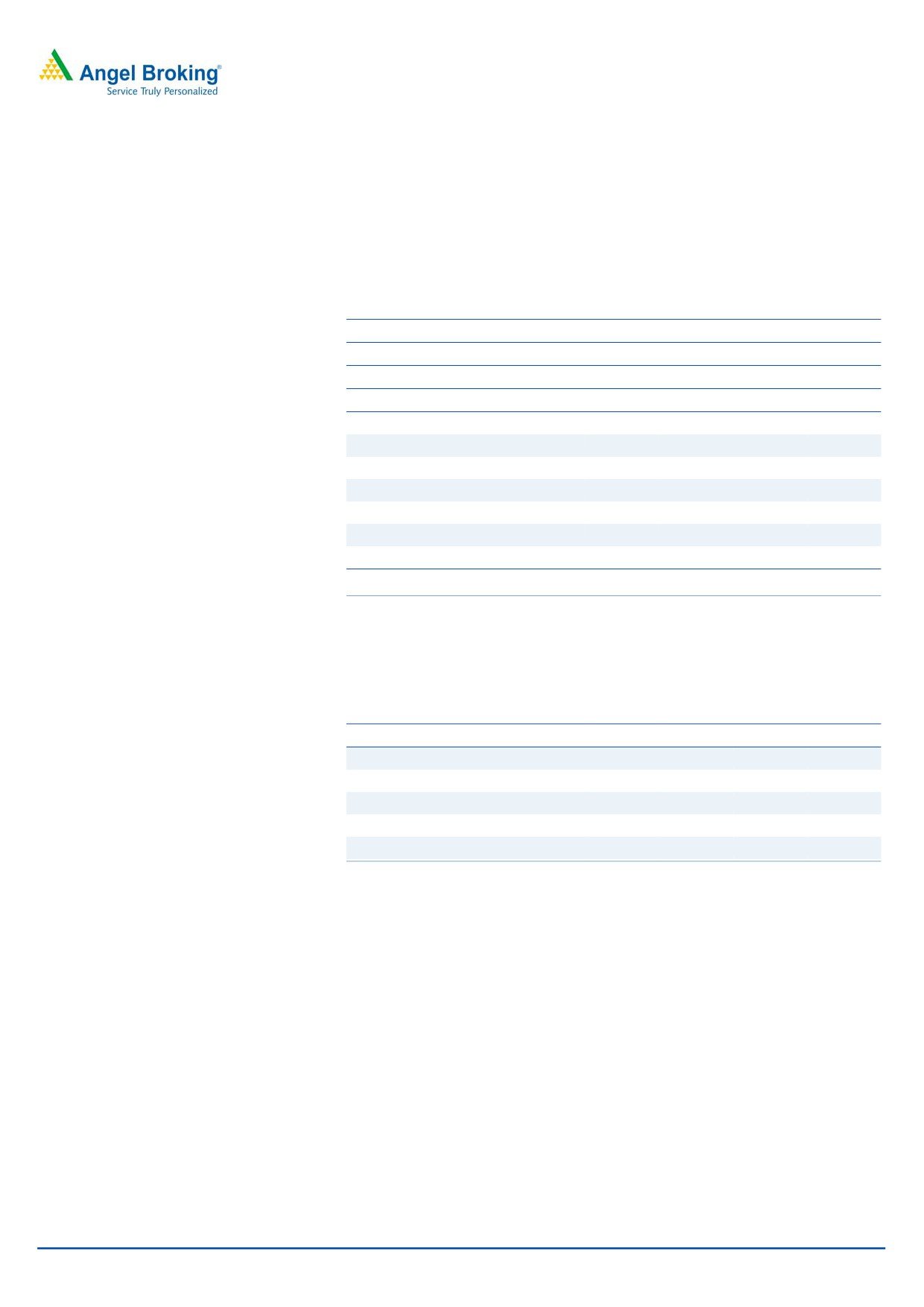

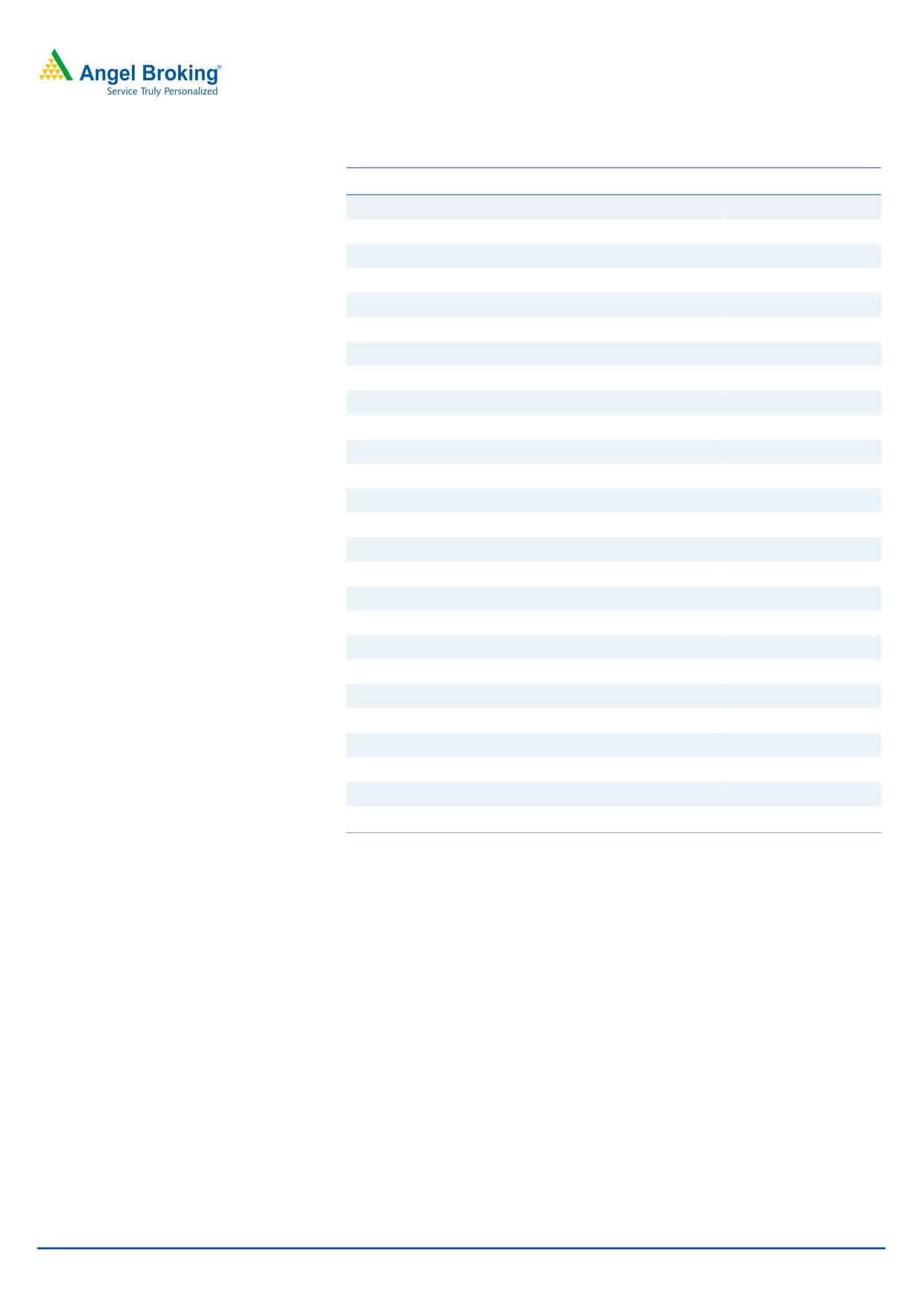

Exhibit 1: Shareholding Pattern

Pre-Issue

Post-Issue

Particulars

No. of Shares

(%)

No. of Shares

(%)

Promoter Group

24,28,67,647

78.1

24,28,67,647

69.0

Retail & HNI Investors

33,80,190

1.1

1,53,13,605

4.3

Institutional Investors

6,47,15,244

20.8

9,40,43,965

26.7

Source: Company, Angel Research

Objects of the Offer

The IPO proceeds are proposed to be utilized as follows: -

`180cr towards repayment of rupee loan facility from ICICI Bank.

`84.84cr towards part repayment of unsecured loans from SEL, the corporate

promoter.

`82.0cr towards equity investment and advancing of subordinate debt to its

subsidiary - Shreenathji-Udaipur Tollway Private Ltd (SUTPL), for part financing

of the SUTPL project.

General corporate purposes.

August 28, 2015

2

SIPL | IPO note

Company details

Sadbhav Infrastructure Project Ltd (SIPL) is a subsidiary of Ahmedabad-based

Sadbhav Engineering Ltd (SEL). SIPL was incorporated in 2007 as a developer and

is a roads and highways operator on a BOT- Toll/ Annuity basis. SIPL is into the

business of development, operation and maintenance of national and state

highways and roads in several states including Maharashtra, Gujarat, Rajasthan,

Karnataka, Haryana, Madhya Pradesh and Telangana, and a border check posts

project in Maharashtra.

It has a portfolio of 10 BOT projects of which 6 road projects are fully operational,

1 is partially operational (border check posts) and 3 are under construction stage.

9 of the 10 BOT projects are toll projects (including service fee for the border

check posts in Maharashtra) and 1 is an annuity project. In addition to the 10, SIPL

is in the process to acquiring stake in 2 projects; ie, it would be acquiring 73.8% in

Mysore-Bellary Highway Pvt. Ltd and 100% in Dhule Palesnar Tollway Ltd. Of these

2 projects, 1 is operational and the other one is under development. Of the 2 BOT

projects, 1 is a toll project and the other one is an Annuity project. This

restructuring process is in accordance with the company’s strategy to consolidate

all BOT road projects to be developed by SEL under one company- SIPL.

SIPL’s parent company SEL was incorporated in 1988 and has established itself as

one of the leading engineering, procurement and construction (EPC) and

infrastructure players in the country. In the last 25 years, SEL has developed a

strong project execution track record of various construction projects across 10

states in India and has a strong Balance Sheet. SIPL derives strength from its

parent SEL, which has been an EPC contractor for most of SIPL’s projects.

August 28, 2015

3

SIPL | IPO note

Investment Rationale

SIPL has a diversified and strong portfolio of road BOT assets

SIPL is in the business of development, operation and maintenance of roads and

highway projects. It has a strong portfolio of 10 projects, of which 7 are

operational (includes 1 partially operational) and 3 are under construction stage,

with an average residual life of 18 years and 7 months. In addition to the road

BOT project portfolios, SIPL’s project portfolio also consists of a border check post

project. SIPL is also in the process of acquiring stakes in 2 BOT projects from SEL.

The restructuring is in accordance with the strategy to consolidate all BOT road

projects under one company- SIPL.

SIPL since inception has emerged as an asset developer with quality road assets

portfolio. Currently 7 of its projects are operational (including Maharashtra Border

Check Post Network Ltd project which is partially operational) with total project cost

of `5,641cr, measuring 1,534 lane km. 3 projects with total project cost of

`3,099cr measuring 1,062 lane km are under construction stage. Among the 2

projects being acquired by SIPL, 1 projects with cost of `1,420cr measuring 534

lane km is operational, while 1 project with cost of `789cr measuring 387 lane km

is under construction stage.

Exhibit 2: BOT Projects Portfolio

Projects Under Operation:

BOT Project- Name of the SPV

Stake (%)

Lane kms

Project Type

Maharashtra Border Check Post Network Ltd.

78

NA

User Fee

Rohtak Panipat Tollway Pvt. Ltd.

100

323

BOT- Toll

Bijapur-Hungund Tollway Pvt. Ltd.

77

389

BOT- Toll

Ahmedabad Ring Road Infrastructure Ltd.

100

305

BOT- Toll

Aurangabad Jalna Tollway Ltd.

100

263

BOT- Toll

Hyderabad Yadgiri Tollway Pvt. Ltd.

100

140

BOT- Toll

Nagpur Seoni Express Way Ltd.

100

111

BOT- Annuity

Projects Under Construction:

BOT Project- Name of the SPV

Stake (%)

Lane kms

Project Type

Shreenathji-Udaipur Tollway Pvt. Ltd.

100

317

BOT- Toll

Bhilwara-Rajsamand Tollway Pvt. Ltd.

100

349

BOT- Toll

Rohtak- Hissar Tollway Pvt. Ltd.

100

395

BOT- Toll

Projects being Acquired:

BOT Project- Name of the SPV

Stake (%)

Lane kms

Project Type

Mysore-Bellary Highway Pvt. Ltd.

74

387

BOT- Annuity

Dhule Palesner Tollway Ltd.

100

355

BOT- Toll

Source: Company, Angel Research; Note: NA- Not Applicable; Projects under acquisition stage

capture the stake details post the acquisition

The project portfolio is well distributed across urban and rural vehicular traffic, and

includes national and state highways. The roads and highways project portfolio

has been built across states which have strong industrial activities and are ones

which are economically stable. Currently, all BOT projects except SUTPL are

funded by SIPL. SIPL plans to use `82cr of the IPO proceeds towards the equity

funding of the SUTPL BOT project. On successful completion of the SIPL IPO, equity

funding requirements of the entire project portfolio of SIPL would be fully funded.

August 28, 2015

4

SIPL | IPO note

Minimal execution risk, given that all the 4 Development projects

are progressing well

7 of the 10 BOT projects of SIPL are currently operational (including Maharashtra

Border Check Post project which is partially operational).

For 4 under-development projects (includes one under acquisition stage), execution

risk is minimal as land acquisition for these projects has been completed and all

clearances are in place. The company’s Management has highlighted that 3 of the

4 projects are running ahead of the schedule (with 1 of them nearing completion).

SIPL’s Management expects 3 BOT projects to commence operations in next 10

months.

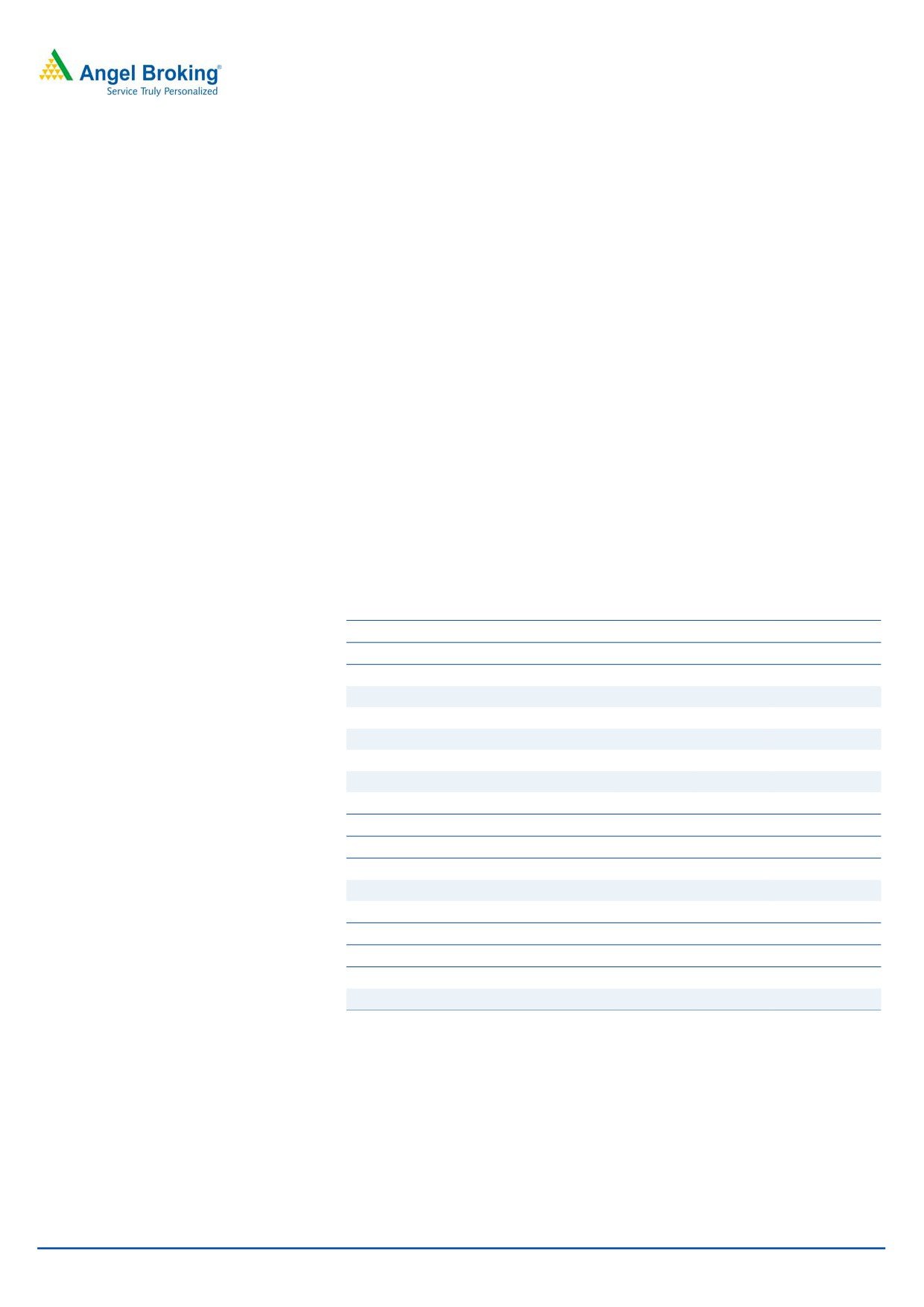

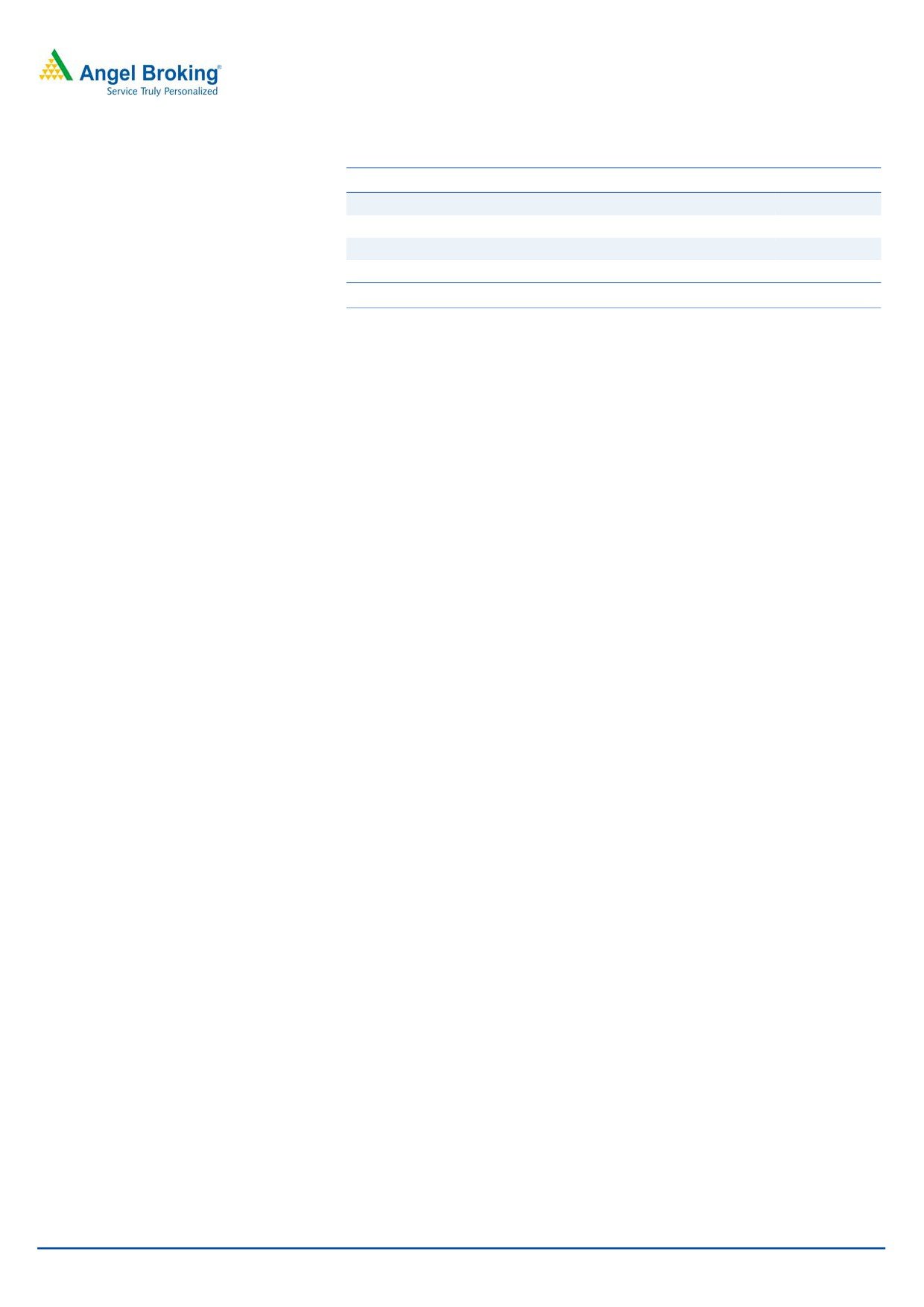

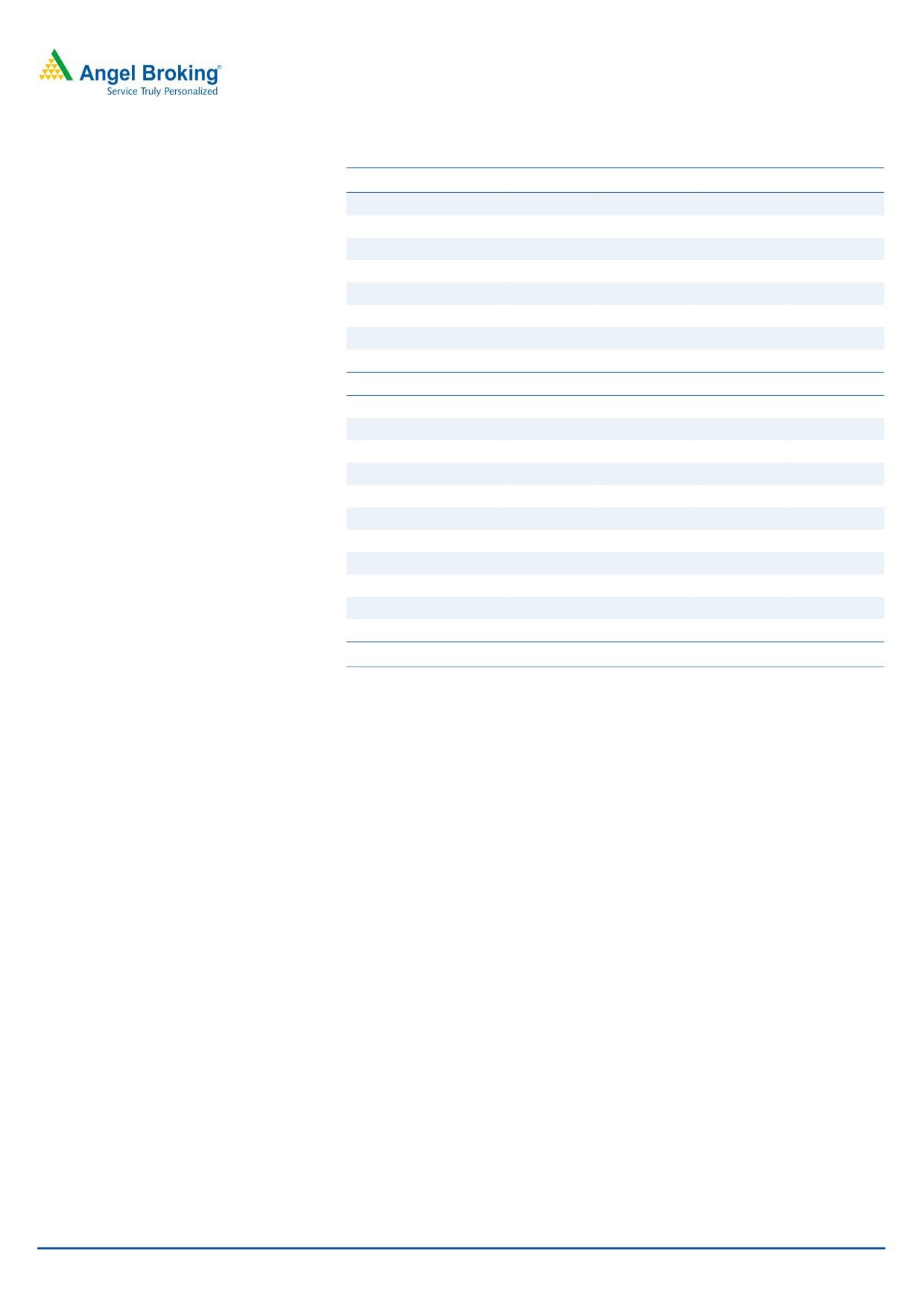

Exhibit 3: Projects under Development/ Construction

Name of the SPV

Sch. CoD

Projects Under Construction stage

Shreenathji-Udaipur Tollway Private Limited

Oct-15

Bhilwara-Rajsamand Tollway Private Limited

Apr-16

Rohtak- Hissar Tollway Private Limited

Jun-16

Projects Under Acquisition stage

Mysore-Bellary Highway Private Limited

Jun-17

Source: Company, Angel Research

SIPL Management expects all 4 BOT projects to be operational in FY2017E. Once

all the 12 BOT projects are operational, SIPL is expected to report revenues of

`752cr, reflecting 25.2% top-line sales during FY2015-17E. Accordingly, we

expect SIPL to see improvement in their cash flow cycle, going forward.

Strong revival trends in traffic growth…

SIPL’s road projects portfolio had been adversely impacted earlier due to slow

down in macroeconomic activity as commercial vehicle traffic growth was almost

muted, resulting in low single digit traffic growth seen across the road portfolio.

However, with some signs of economic recovery now being seen and some of the

road projects’ traffic growth is already seeing sharp recovery. We expect this traffic

growth recovery trend to gradually catch-up, going forward, driven by (1) higher

commercial vehicle traffic on account of recovering macros, and (2) higher growth

in non-bulk commodity traffic, for which roads are preferred mode of transport.

We expect the road traffic to grow north of 5-7% CAGR over the next three years.

Exhibit 4: Traffic/ Volume growth (on yoy basis)

Name of the SPV

3QFY2015 4QFY2015 1QFY2016

Bijapur-Hungund Tollway Pvt. Ltd.

5.2

9.8

8.2

Ahmedabad Ring Road Infrastructure Ltd.

11.8

19.5

8.8

Aurangabad Jalna Tollway Ltd.

17.9

16.2

7.7

Hyderabad Yadgiri Tollway Pvt. Ltd.

10.5

12.2

16.5

Dhule Palesner Tollway Ltd.

10.5

2.7

0.8

Source: Company, Angel Research

The table above highlights that SIPL’s several projects have witnessed improvement

in traffic in the last few quarters.

August 28, 2015

5

SIPL | IPO note

SIPL derives strength from SEL; has proven execution track record

SIPL derives strength from its parent SEL, which is one of the leading road

infrastructure companies in India. SEL is the EPC contractor for most of SIPL’s

projects. Leveraging its domain expertise and experience, SEL has been able to

complete most of SIPL’s projects on schedule; in fact, some of the projects have

been completed ahead of schedule. Further, SIPL’s contracts with SEL are fixed

term-fixed price EPC contracts, implying that any cost escalation has to be

absorbed by SEL.

SEL is financially sound with a robust Balance Sheet. Owing to these factors, SEL is

a pre-qualified bidder for NHAI awards with respect to large public infrastructure

projects for developing and operating road assets. Further, there is a non-compete

agreement between SEL and SIPL to bid for BOT projects. We expect SIPL to gain

support from SEL in bidding for large ticket projects. The relationship also provides

comfort to lenders regarding the financing options for SIPL’s projects.

SIPL to gain from recent re-financing & possible debt repayments

SIPL is currently sitting on a consol. debt of `6,342cr, which translates into a D/E

ratio of 7.9x.

SIPL expects to use ~`265cr of the IPO proceeds towards debt repayment to one

of its key lenders ICICI Bank and its promoter entity SEL. This debt repayment

initiative could potentially translate to savings on interest expenses (on yearly basis)

north of ~`29cr.

Also, the company claims that it has re-financed 5 BOT projects. Table below

highlights the details of the BOT projects re-financed:

Exhibit 5: Savings on Interest Exp. post the recent re-financing..

Int. rate

Int. rate

Swing

Debt o/s

Savings on

Name of the SPV

(earlier)

(current)

(in bps)

(4QFY2015)

Int. exp.

Maharashtra Border Check Post

12.8

11.5

125

892

11

Bijapur-Hungund Tollway Pvt. Ltd.

11.6

10.3

125

642

8

Aurangabad Jalna Tollway Ltd.

11.6

10.4

120

166

2

Hyderabad Yadgiri Tollway Pvt. Ltd.

11.5

10.4

115

373

4

Dhule Palesner Tollway Ltd.

11.6

10.3

125

1,020

13

Totals (` cr)

3,093

38

Source: Company, Angel Research

Based on our estimates, yearly savings on the interest expenses resulting from this

re-financing exercise could be to the tune of `38cr.

On the whole, the proceeds from the IPO towards debt repayment and recent SPV

level re-financing could translate to yearly savings on interest expense to the tune

of `67cr.

August 28, 2015

6

SIPL | IPO note

Risks & Concerns

1. Operational road projects are susceptible to political risks as agitation by any

political party may impact toll collections adversely. For example, toll

collection at SIPL’s RPTPL project was adversely impacted by protests made by

local political parties.

2. Execution delays on projects under development could affect the outlook on

company’s Debt levels as well as project level IRRs.

3. Any slowdown in traffic at a rate in excess of the company’s expectations could

affect project level IRRs, as well as overall D/E profile of the company.

4. Once Dedicated Freight Corridor (DFC) commences operations, there exists

possibility for some of SIPL’s road projects to see possible slowdown in the

traffic growth. Any such slow-down in the traffic growth in later stages of the

project, may not have been factored by the company at the time of bidding,

thereby this could act as risk to the IRR assumptions of the company.

August 28, 2015

7

SIPL | IPO note

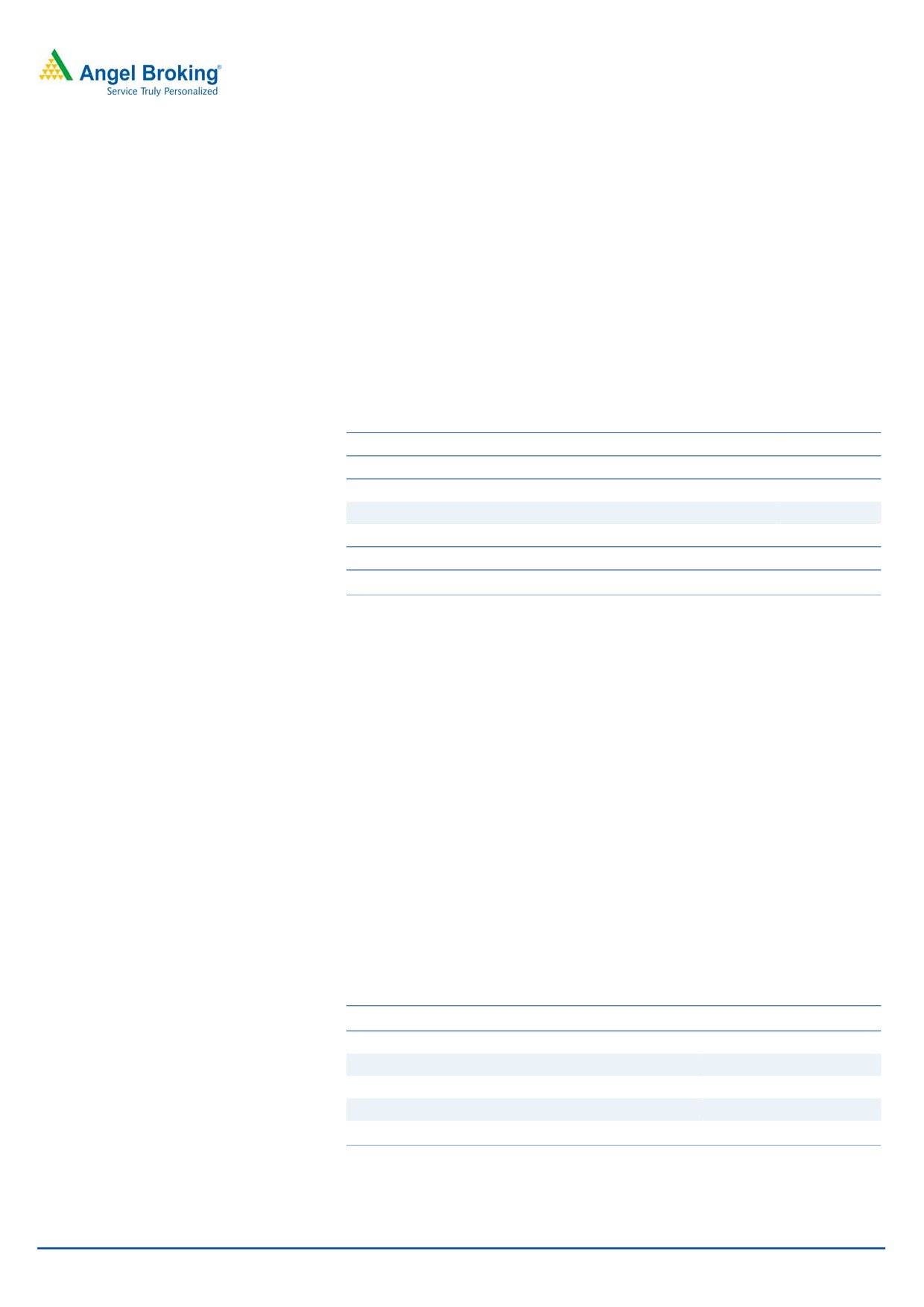

Financial Performance

SIPL’s revenue increased 2.8x during FY2012-15 to `500cr in FY2015 (Tolling and

Annuity income accounts for majority of the revenues) reflecting commencement of

tolling of new projects in the portfolio. Also, the consolidated revenues capture the

impact of SIPL re-structuring, where toll projects have been transferred to SIPL at

book-value over a period of time.

Exhibit 6: Revenue growth driven by commencement of new projects

FY2012

FY2013

FY2014

FY2015

SIPL- Consol. Revenues

176

287

371

500

SIPL- Toll & Annuity Income

101

198

318

473

Rohtak Panipat Tollway Pvt. Ltd.

85

Bijapur-Hungund Tollway Pvt. Ltd.

86

95

104

Ahmedabad Ring Road Infra. Ltd.

74

73

72

85

Aurangabad Jalna Tollway Ltd.

27

28

28

35

Nagpur Seoni Expressway Ltd.

20

61

38

38

Hyderabad Yadgiri Tollway Pvt. Ltd.

11

38

45

Maha. Border Check Post Network Ltd.

30

84

SPV Toll & Annuity Income

121

259

302

477

Source: Company; Note: Totals may not add-up as SIPL's shareholding in SPVs has changed

SIPL’s road portfolio was impacted due to slowdown in the economy, which gets

reflected in the weak traffic data (as seen mainly during FY2013-14).

Exhibit 7: Higher Interest expenses eat in-to EBITDA

FY2012

FY2013

FY2014

FY2015

EBITDA

93

170

242

309

EBITDA Margin (%)

52.9

59.0

65.1

61.7

Depreciation Expenses

22

50

92

141

Interest Expenses

72

195

355

526

PAT

10

(46)

(156)

(302)

Source: Company

Although SIPL has reported EBITDA profit at the SPV level for almost all projects in

its portfolio, higher interest expenses have led the company report net losses.

Surge in the consolidated debt profile of the company, in our view, is on account

of (1) stake purchases in the SPVs, and (2) equity funding of the projects under

construction.

Losses at the PAT level since FY2013 have eroded overall networth of the consol.

entity from `971cr in FY2013 to `788cr in FY2015. Despite the uptick in the traffic

numbers across their road portfolio, with 3 new projects likely to commence

operations in the next 10 months (as highlighted by the Management), there exists

a possibility for the company to continue reporting losses for next few quarters.

Our view that SIPL would continue to report losses stems from the point that peak

debt requirement of the company (assuming no new projects are added/ acquired)

would be at ~`8,262cr by FY2017.

August 28, 2015

8

SIPL | IPO note

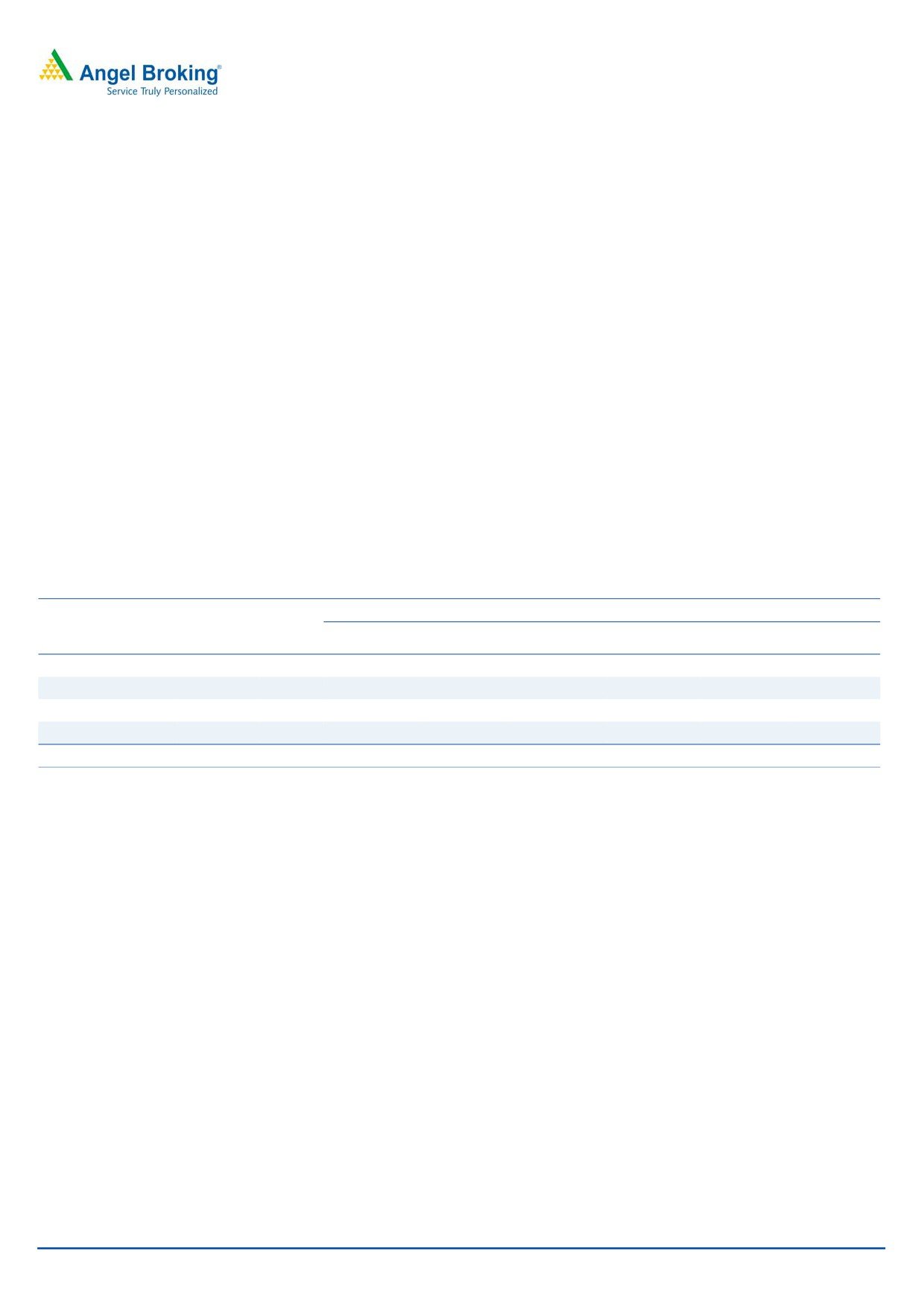

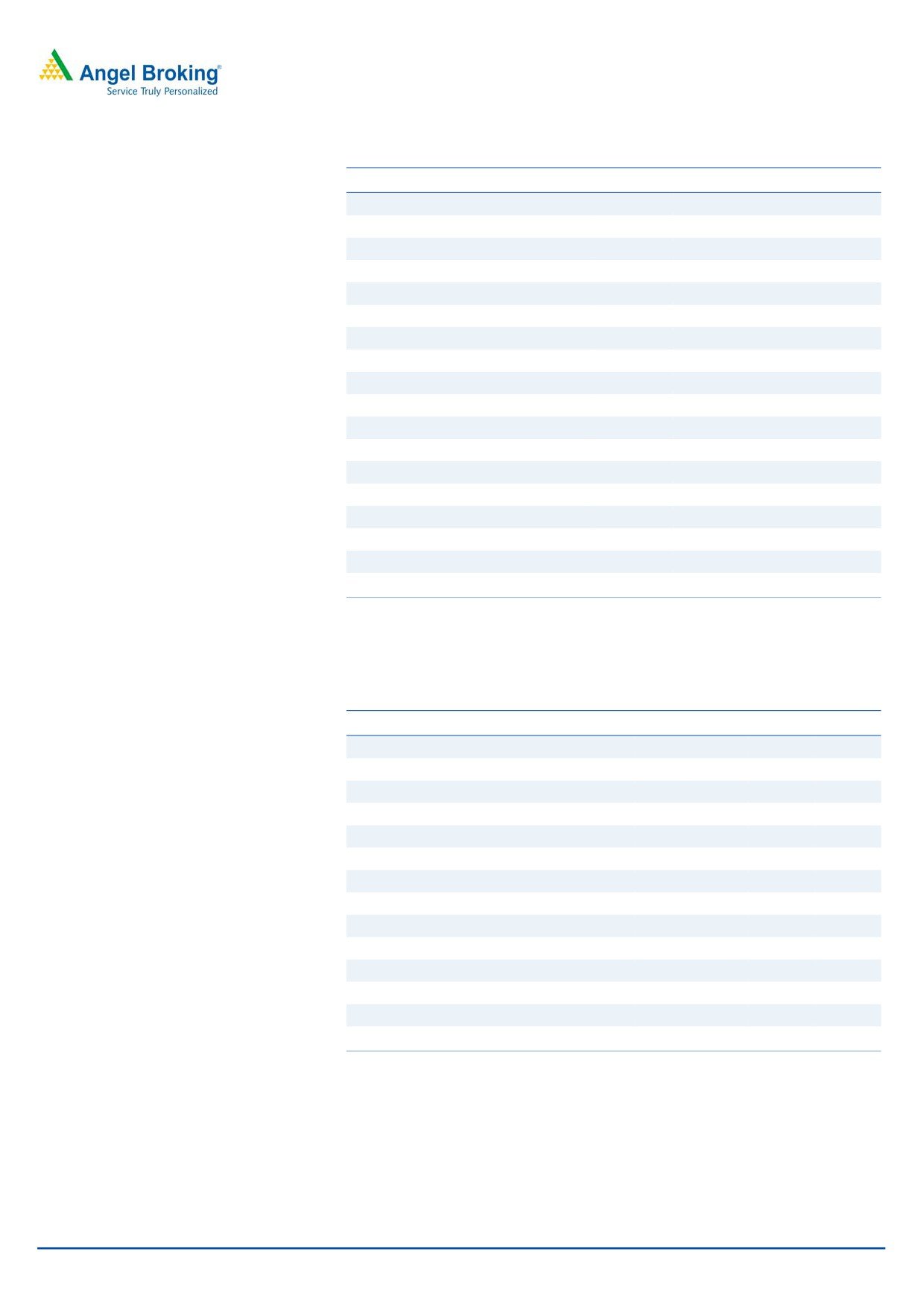

Exhibit 8: Debt Outlook

Particulars

(` cr)

Current Debt o/s (at FY2015-end)

6,342

Debt repayment (from IPO proceeds)

(265)

Incremental Debt from ongoing proj. (inc. IDC)

980

Payment to DPTL (inc. SPV level debt)

1,205

Peak Debt o/s

8,262

Source: Company, Angel Research

The incremental debt requirement of the company would be towards new projects,

and payment to acquire Dhule Palesnar Tollways Ltd. (DPTL) project.

August 28, 2015

9

SIPL | IPO note

Valuation

Even though SIPL has reported strong top-line growth in the past led by

commencement of new BOT projects, the profitability of the company has been

impacted owing to higher interest and depreciation expenses.

Considering (1) uptick in traffic volumes across projects, and (2) commencement of

3 BOT projects in the next 10 months and 4th one getting operational in FY2017E,

we are optimistic that the company would continue to report strong set of top-line

numbers going forward. The commencement of 4 BOT projects during FY2016-

17E and DPTL stake purchase should push the debt to higher levels. We expect

SIPL’s consol. debt to increase from `6,342cr (as of FY2015-end) to peak to

`8,262cr by FY2017E. Increase in debt should translate to further increase in

SIPL’s interest expenses (this would be despite SIPL utilizing part of IPO proceeds

towards debt repayment).

In absence of direct peers for comparison purposes, we have compared SIPL with

3 related companies, namely IL&FS Transportation Networks (ITNL), IRB

Infrastructure Developers (IRB Infra) and Ashoka Buildcon. It be noted that

financials mentioned below capture EPC business financials of these 3 companies.

Exhibit 9: Peer group comparison Table

FY2015

D/E

Int. Cov.

RoE

EV/EBITDA

EV/Sales

Price/BV

Company Name

CMP M-Cap

(x)

(x)

(%)

(x)

(x)

(x)

SIPL *

103

3,628

7.9

0.3

(37.5)

29.9

18.5

4.1

Ashoka Buildcon

176

3,283

2.8

1.9

6.2

13.7

3.0

2.1

ITNL

93

2,285

4.1

1.0

7.5

12.9

4.0

0.4

IRB Infra

229

8,053

2.6

2.4

13.7

8.4

4.8

2.0

Average

3.2

11.7

3.9

1.5

Source: Company, Angel Research, Bloomberg; Note:* Excluding market cap. SIPL numbers capture pre-IPO shares o/s for valuation purpose; CMP as of

August 27, 2015

On comparing with related companies for FY2015 numbers, SIPL has the highest

D/E ratio of 7.9x (vs peers’ 3.2x), lowest interest coverage ratio of 0.3x (vs peers’

range of 1.0-2.4x) and negative RoE returns (vs peers’ 6.2-13.7% range). Despite

the comparatively poor financials, at higher-end of IPO price band (`103/share),

SIPL is trading at FY2015-EV/EBITDA multiple of 29.9x (vs the peers’ average of

11.7x) and FY2015-P/BV of 4.1x (vs the peers’ average of 1.5x).

We understand that SIPL’s return ratios reflect depressed financials on account of 4

projects getting operational during 2012-14 and these projects being in early

stages of operations were reporting losses.

Alternatively, we tried checking whether the company is fairly priced on sum-of-

the-parts based valuation methodology, where we valued BOT projects on FCFE

basis and deducted the standalone entity’s debt from the gross business value. For

our valuation exercise, we have assigned Ke of 14% for projects under construction

stages and 12% for operational projects.

August 28, 2015

10

SIPL | IPO note

Exhibit 10: Sum-of-the-Parts based valuation

Disounted

Project

Adj. FCFE

Value/

% of

Particulars

Proj. Type

Basis

FCFE (` cr)

Stake

Value (` cr)

share (`)

SoTP

Road BOT projects

Maharashtra Border Check Post Network Ltd

Service Fee

1,094

78%

851

24.2

24

Ke of 12%

Rohtak-Panipat BOT Project

Toll

401

100%

401

11.4

11

Ke of 12%

Bijapur-Hungund BOT Project

Toll

489

77%

377

10.7

11

Ke of 12%

Ahmedabad Ring Road

Toll

549

100%

549

15.6

15

Ke of 12%

Aurangabad-Jalna BOT Project

Toll

321

100%

321

9.1

9

Ke of 12%

Hyderabad-Yadgiri BOT Project

Toll

374

100%

374

10.6

11

Ke of 12%

Nagpur-Seoni BOT Project

Annuity

33

100%

33

0.9

1

Ke of 12%

Shreenathji-Udaipur BOT Project

Toll

488

100%

488

13.9

14

Ke of 14%

Bhilwara-Rajsamand BOT Project

Toll

348

100%

348

9.9

10

Ke of 14%

Rohtak-Hissar BOT Project

Toll

364

100%

364

10.3

10

Ke of 14%

Mysore-Bellary BOT Project

Annuity

107

74%

79

2.3

2

Ke of 14%

Dhule-Palesnar BOT Project

Toll

498

100%

498

14.1

14

Ke of 12%

SIPL Standalone Debt- FY2016

(1,127)

(32)

Grand Total

5,066

3,556

101

100

Source: Company, Angel Research

On using the sum-of-the-parts based valuation methodology, we arrive at FY2017

based fair price of `101/share, which leaves less potential to generate returns

from this IPO. Hence, we suggest a NEUTRAL rating on the issue.

Exhibit 11: BOT Projects details

Prop. Stake

Lane

Awarded

Concession

TPC

Debt o/s

Name of the SPV

Proj. Type

(%)

kms

by

(in yrs.)

(` cr)

(` cr)

Rohtak Panipat Tollway Pvt. Ltd.

100

Toll

324

NHAI

25.0

1,213

975

Bijapur-Hungund Tollway Pvt. Ltd.

77

Toll

389

NHAI

20.0

1,323

834

Ahmedabad Ring Road Infrastructure Ltd.

100

Toll

306

AUDA

20.0

501

371

Aurangabad Jalna Tollway Ltd.

100

Toll

263

MSRDC

23.6

275

166

Hyderabad Yadgiri Tollway Pvt. Ltd.

100

Toll

143

NHAI

23.0

513

373

Maharashtra Border Check Post Network Ltd.

78

Service Fee

NA Maha. SG

24.6

1,426

1,141

Dhule Palesner Tollway Ltd.

100

Toll

534

NHAI

17.9

1,420

1,020

Nagpur Seoni Expressway Ltd.

100

Annuity

55

NHAI

20.0

278

190

Shreenathji-Udaipur Tollway Pvt. Ltd.

100

Toll

317

NHAI

27.0

1,151

639

Bhilwara-Rajsamand Tollway Pvt. Ltd.

100

Toll

349

NHAI

30.0

676

127

Rohtak Hissar Tollway Pvt. Ltd.

100

Toll

395

NHAI

22.0

1,272

444

Mysore Bellary Highway Pvt. Ltd.

74

Annuity

387

Karnat. SG

10.0

811

482

Source: Company, Angel Research; Note: NA- Not Applicable; Last 4 BOT projects mentioned above are under construction stage

August 28, 2015

11

SIPL | IPO note

Profit & Loss Statement (Consolidated)

Y/E March (` cr)

FY12

FY13

FY14

FY15

Net Sales

176

287

371

500

% Chg

153.2

63.2

29.2

34.8

Total Expenditure

83

118

129

191

Operating Expenses

65

97

89

141

Employee benefit Expense

6

10

16

24

Other Expenses

12

10

25

26

EBITDA

93

170

242

309

% Chg

107.9

82.1

42.5

27.8

EBIDTA %

52.9

59.0

65.1

61.7

Depreciation

22

50

92

141

EBIT

72

120

150

168

% Chg

107.4

67.1

25.4

12.1

Interest & Financial Charges

72

195

355

526

Other Income

23

28

22

28

PBT

23

(47)

(184)

(330)

Exceptional Items

0

0

0

0

Tax

13

5

12

0

% of PBT

56.6

nmf

nmf

nmf

PAT before losses of MI & Associates

10

(52)

(196)

(330)

Share of Loss attributable to MI

2

13

40

28

Share of Profit/ (Loss) from Ass. Co.

(2)

(7)

0

0

Net Profit

10

(46)

(156)

(302)

% Chg

(0.9)

nmf

nmf

nmf

PAT %

5.6

(15.9)

(42.0)

(60.3)

Adj. EPS

0.3

(1.5)

(5.0)

(9.7)

% Chg

(0.9)

nmf

nmf

nmf

August 28, 2015

12

SIPL | IPO note

Balance Sheet (Consolidated)

Y/E March (` cr)

FY12

FY13

FY14

FY15

Sources of Funds

Equity Capital

26

28

28

311

Reserves Total

820

943

792

477

Networth

847

971

820

788

Minority Interest

126

159

186

57

Total Debt

2,791

3,643

4,902

6,204

Other Long-term Liabilities

0

418

2,241

2,233

Long-term Provision

39

11

38

100

Total Liabilities

3,804

5,202

8,188

9,382

Application of Funds

Net Block & Capital WIP

3,319

4,744

7,781

9,013

Goodwill on Consolidation

50

48

45

118

Investments

17

9

105

8

Other Current Assets

10

44

14

92

Sundry Debtors

0

1

14

14

Cash and Bank Balance

124

52

52

170

Loans & Advances

101

91

35

63

Current Liabilities

190

182

434

514

Net Current Assets

45

5

(318)

(174)

Other Assets

373

397

575

417

Total Assets

3,804

5,202

8,188

9,382

August 28, 2015

13

SIPL | IPO note

Cash Flow Statement (Consolidated)

Y/E March (` cr)

FY12

FY13

FY14

FY15

Profit/ (Loss) before tax

23

(47)

(184)

(330)

Depreciation & Amortization

22

50

92

141

Other Adjustments

(22)

(27)

(13)

(27)

Change in Working Capital

26

(25)

86

54

Interest & Financial Charges

72

195

355

526

Direct taxes paid

(14)

(12)

(12)

(7)

Cash Flow from Operations

107

134

325

356

(Inc)/ Dec in Fixed Assets

(1,323)

(921)

(905)

(1,135)

(Inc)/ Dec in Invest., Int. recd. & Oth. Adj.

(135)

17

(34)

(70)

Cash Flow from Investing

(1,458)

(904)

(939)

(1,206)

Inc./ (Dec.) in Borrowings

1,480

869

1,037

1,390

Issue/ (Buy Back) of Equity

224

215

68

124

Dividend Paid (Incl. Tax)

0

0

0

0

Finance Cost

(281)

(387)

(490)

(549)

Cash Flow from Financing

1,423

698

615

965

Inc./(Dec.) in Cash

72

(72)

0

116

Opening Cash balances

52

124

52

52

Closing Cash balances

124

52

52

168

Ratio Analysis (Consolidated)

Y/E March

FY12

FY13

FY14

FY15

Valuation Ratio (x)

EV/Sales

33.4

23.7

21.7

18.5

EV/EBITDA

63.0

40.1

33.3

29.9

EV / Total Assets

1.5

1.3

1.0

1.0

Per Share Data (`)

Adj. EPS

0.3

(1.5)

(5.0)

(9.7)

Book Value

27.2

31.2

26.4

25.3

Returns (%)

RoCE (Pre-tax)

2.5

2.9

2.9

2.6

Angel RoIC (Pre-tax)

2.0

2.6

2.6

2.5

RoE

1.3

(5.0)

(17.4)

(37.5)

Leverage Ratios (x)

D/E ratio (x)

3.3

3.8

6.0

7.9

Interest Coverage Ratio (x)

1.0

0.6

0.4

0.3

August 28, 2015

14

SIPL | IPO note

Research Team Tel: 022 - 39357800

DISCLAIMER

Angel Broking Private Limited (hereinafter referred to as “Angel”) is a registered Member of National Stock Exchange of India Limited,

Bombay Stock Exchange Limited and MCX Stock Exchange Limited. It is also registered as a Depository Participant with CDSL and

Portfolio Manager with SEBI. It also has registration with AMFI as a Mutual Fund Distributor. Angel Broking Private Limited is a

registered entity with SEBI for Research Analyst in terms of SEBI (Research Analyst) Regulations, 2014 vide registration number

INH000000164. Angel or its associates has not been debarred/ suspended by SEBI or any other regulatory authority for accessing

/dealing in securities Market. Angel or its associates including its relatives/analyst do not hold any financial interest/beneficial

ownership of more than 1% in the company covered by Analyst. Angel or its associates/analyst has not received any compensation /

managed or co-managed public offering of securities of the company covered by Analyst during the past twelve months. Angel/analyst

has not served as an officer, director or employee of company covered by Analyst and has not been engaged in market making activity

of the company covered by Analyst.

This document is solely for the personal information of the recipient, and must not be singularly used as the basis of any investment

decision. Nothing in this document should be construed as investment or financial advice. Each recipient of this document should

make such investigations as they deem necessary to arrive at an independent evaluation of an investment in the securities of the

companies referred to in this document (including the merits and risks involved), and should consult their own advisors to determine

the merits and risks of such an investment.

Reports based on technical and derivative analysis center on studying charts of a stock's price movement, outstanding positions and

trading volume, as opposed to focusing on a company's fundamentals and, as such, may not match with a report on a company's

fundamentals.

The information in this document has been printed on the basis of publicly available information, internal data and other reliable

sources believed to be true, but we do not represent that it is accurate or complete and it should not be relied on as such, as this

document is for general guidance only. Angel Broking Pvt. Limited or any of its affiliates/ group companies shall not be in any way

responsible for any loss or damage that may arise to any person from any inadvertent error in the information contained in this report.

Angel Broking Pvt. Limited has not independently verified all the information contained within this document. Accordingly, we cannot

testify, nor make any representation or warranty, express or implied, to the accuracy, contents or data contained within this document.

While Angel Broking Pvt. Limited endeavors to update on a reasonable basis the information discussed in this material, there may be

regulatory, compliance, or other reasons that prevent us from doing so.

This document is being supplied to you solely for your information, and its contents, information or data may not be reproduced,

redistributed or passed on, directly or indirectly.

Neither Angel Broking Pvt. Limited, nor its directors, employees or affiliates shall be liable for any loss or damage that may arise from

or in connection with the use of this information.

Note: Please refer to the important ‘Stock Holding Disclosure' report on the Angel website (Research Section). Also, please refer to the

latest update on respective stocks for the disclosure status in respect of those stocks. Angel Broking Pvt. Limited and its affiliates may

have investment positions in the stocks recommended in this report.

August 28, 2015

15