2QFY2016 Result Update | Infrastructure

November 9, 2015

Sadbhav Infrastructure Project

NEUTRAL

CMP

`100

Performance Highlights

Target Price

-

Investment Period

-

For 1HFY2016, Sadbhav Infrastructure Project Ltd (SIPL) reported a consol.

top-line of `274cr (vs `500cr in FY2015). The Reported top-line (for 1HFY2016),

on a yoy basis benefitted from

(1)

16.2% toll income growth across

Stock Info

Hyderabad-Yadagiri project,

(2)

69.2% gross toll income growth across

Sector

Infrastructure

Maharashtra Border Check Post project (as 4 new check posts commenced

Market Cap (` cr)

3,508

operations in 2QFY2016; 18% toll hike seen during the quarter), and (3) 11.1%

Net Debt (` cr)

6,034

toll income growth seen across the Ahmadabad Ring Road project.

Beta

NA

The Reported EBITDA for 1HFY2016 stood at `180cr while the EBITDA margin for

52 Week High / Low

112/96

the same period was at 65.7% (vs 61.7% for FY2015).

Avg. Daily Volume

201,158

Higher interest expenses (`284cr for 1HFY2016 vs `526cr for FY2015) led to

Face Value (` )

10

losses for SIPL of `159cr for 1HFY2016.

BSE Sensex

26,265

Outlook and valuation: We expect SIPL to report a strong

44.3%/47.8%

Nifty

7,954

revenue/EBITDA CAGR over FY2015-17E. Management expects SIPL’s entire BOT

Reuters Code

SADB.NS

portfolio (we model MBHPL to commission operations in FY2018E only) to be

Bloomberg Code

SINP@IN

operational by FY2017E only. Toll collection at its existing projects would further

ramp-up, going forward. Interest expenses accounted for 170% of the FY2015

consol. EBITDA. We expect this ratio to decline to ~95% by FY2017E.

Shareholding Pattern (%)

Promoters

69.2

PAT level losses since FY2013 have eroded overall net worth of consol. entity from

MF / Banks / Indian Fls

4.7

`971cr in FY2013 to `788cr in FY2015. Despite uptick in traffic numbers across

its road portfolio, there exists a possibility of the company continuing to report

FII / NRIs / OCBs

3.1

losses for next few quarters, as it would be impacted by 3 new projects

Indian Public / Others

23.0

commencing operations in next few months, as highlighted by the Management.

Our view that SIPL would continue to report losses stems from the point that peak

debt requirement of the company (assuming no projects are added/ acquired)

Abs. (%)

3m 1yr

3yr

would be at `8,510cr by FY2017E. The incremental debt requirement would be

Sensex

(7.0)

(5.8)

39.0

towards new projects and stake acquisition of DPTL and MBHPL projects.

SIPL

(6.3)

NA NA

SIPL, at consol. level, should report cash level profits from 4QFY2016E onwards.

*Note- SIPL listed on Sep 16, 2015

We have valued SIPL using Sum-of-The-Parts method, where we have valued each

3-Year Daily Price Chart

project using “Free Cashflow to Equityholders” method and adjusted standalone

108

entity’s FY2016E debt to arrive at a fair value of `100/share. Given the limited upside

106

potential from the current levels, we maintain our NEUTRAL rating on the stock.

104

102

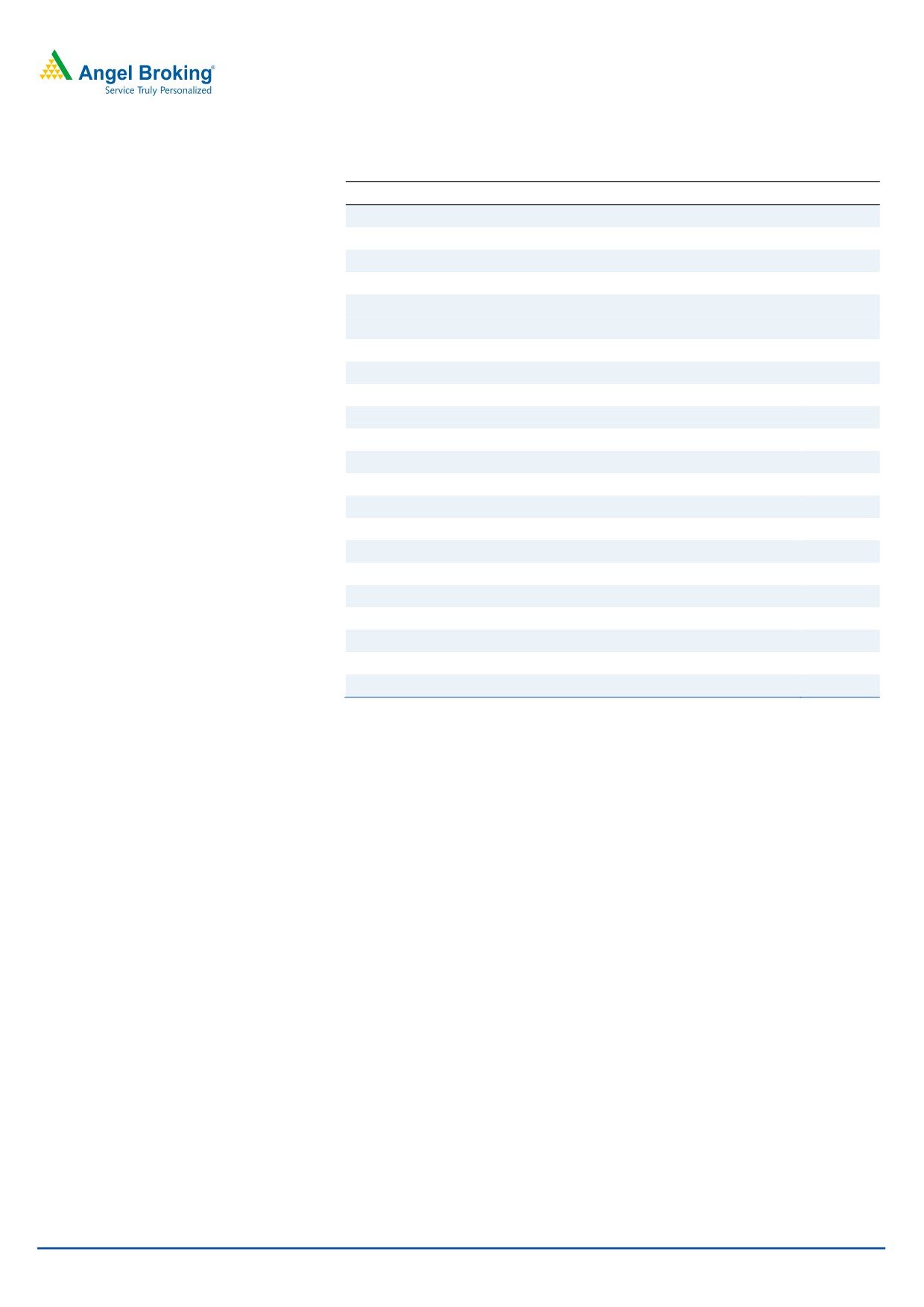

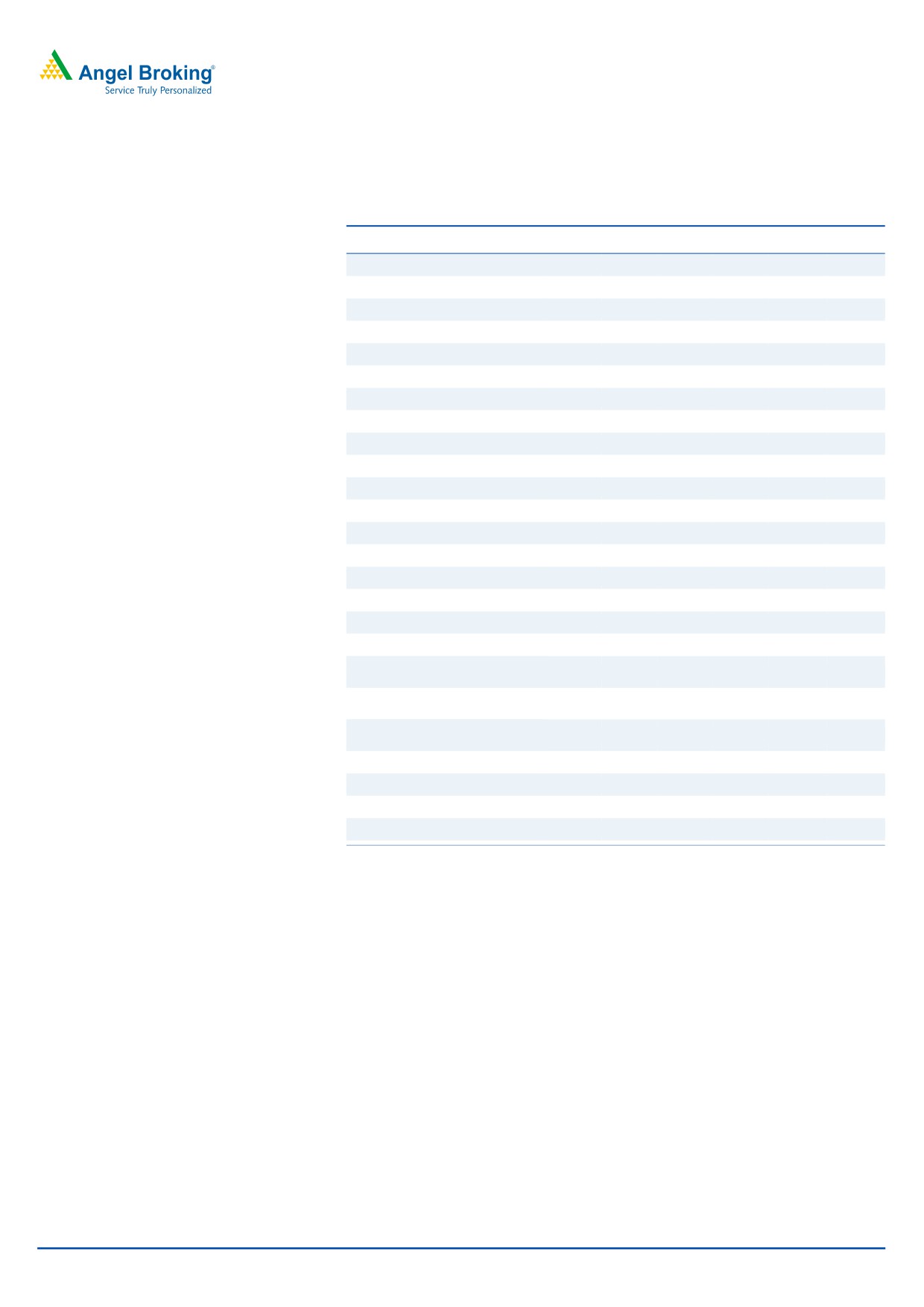

Key financials (Consolidated)

100

Y/E March (` cr)

FY13

FY14

FY15

FY16E

FY17E

98

96

Net Sales

287

371

500

675

1,042

94

% chg

63.2

29.2

34.8

34.9

54.5

Net Profit

(46)

(156)

(313)

(248)

(107)

% chg

nmf

nmf

nmf

nmf

nmf

EBITDA (%)

59.0

65.1

61.7

64.9

66.6

Source: Company, Angel Research

EPS (`)

(1.5)

(5.0)

(10.1)

(8.0)

(3.5)

P/BV (x)

3.2

3.8

4.5

3.7

4.1

RoE (%)

(5.0)

(17.4)

(38.9)

(28.4)

(11.8)

RoCE (%)

2.9

2.9

2.6

3.6

5.5

Yellapu Santosh

EV/Sales (x)

23.3

21.5

19.1

11.6

8.0

022 - 3935 7800 Ext: 6811

EV/EBITDA (x)

39.5

32.9

30.9

17.9

11.9

Source: Company, Angel Research

Please refer to important disclosures at the end of this report

1

Sadbhav Infrastructure Project | 2QFY2016 Result Update

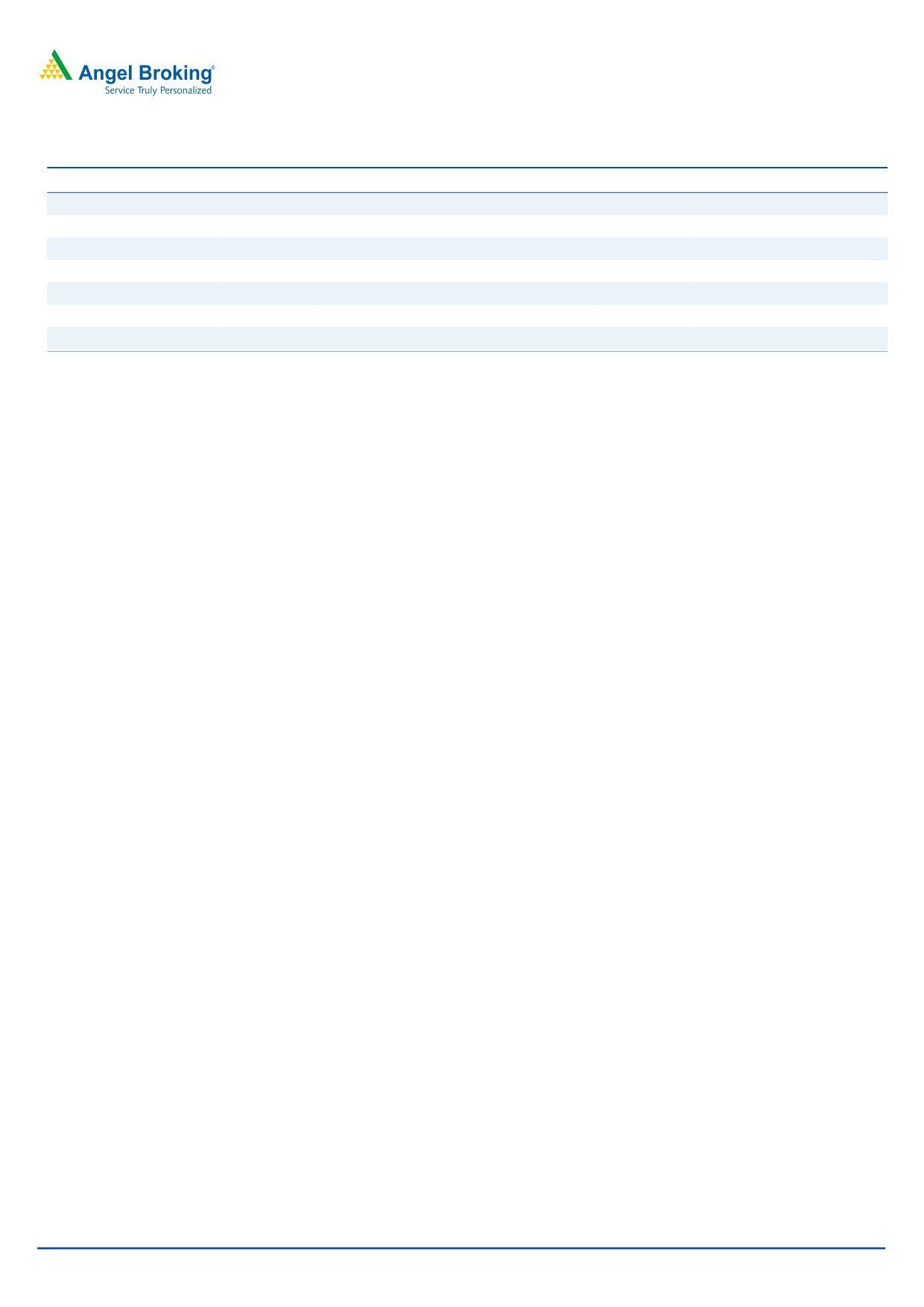

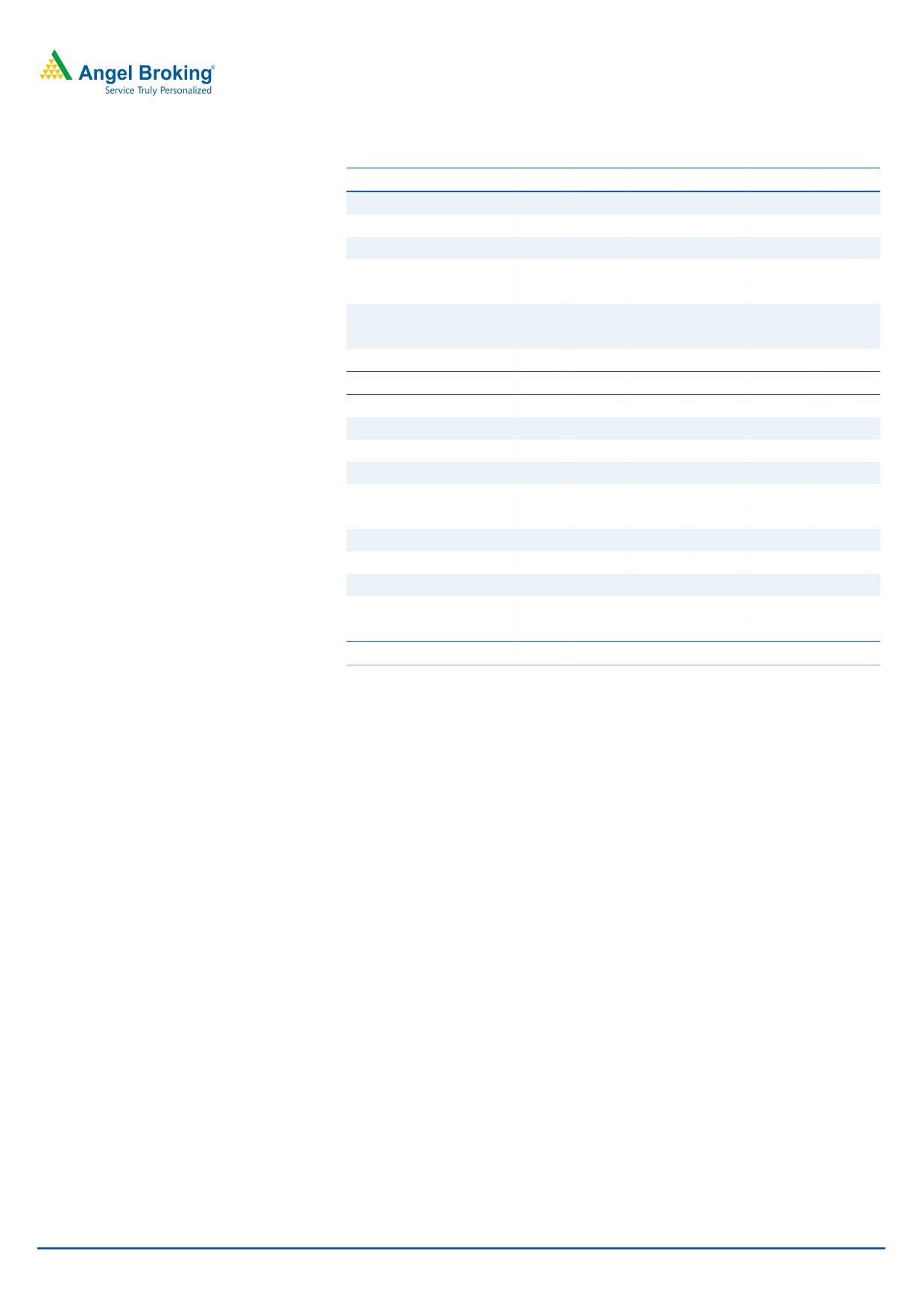

Key financials (Consolidated)

Particulars (` cr)

1HFY16

Net Sales

274

Total Expenditure

94

Operating Expense

70

Employee Benefits Expense

14

Other Expenses

9

EBITDA

180

EBIDTA %

65.7

Depreciation

78

EBIT

102

Interest and Financial Charges

284

Other Income

15

PBT before Exceptional Items

(167)

Exceptional Items

0

PBT after Exceptional Items

(167)

Tax

0

% of PBT

(0.7%)

PAT

(167)

Share of loss transferred to Minority Interest

(8)

Share of loss transferred to Minority Interest related to earlier years

0

Net Loss

(159)

PAT %

(58.3)

Dil. EPS

5.05

Source: Company, Angel Research

Toll Income shows strong growth

For 1HFY2016, SIPL reported a consol. top-line of `274cr (vs `500cr in FY2015).

The Reported top-line (for 1HFY2016), on a yoy basis, benefitted from (1) 16.2%

toll income growth across Hyderabad-Yadagiri project, (2) 69.2% gross toll income

growth across Maharashtra Border Check Post project (as 4 new check posts

commenced operations in 2QFY2016; 18% toll hike seen during the quarter), and

(3) 11.1% toll income growth seen across the Ahmadabad Ring Road project.

Amongst other projects, Dhule Palesnar BOT and Bijapur Hungund BOT reported

a 10.4% and 9.9% yoy gross toll income growth for 1HFY2016 to `72.5cr and

`56.6cr, respectively.

With toll exemption levied for passenger vehicles, Aurangabad-Jalna BOT project

was the only BOT which reported a 2.4% yoy decline in toll income for 1HFY2016

to `16.1cr.

November 9, 2015

2

Sadbhav Infrastructure Project | 2QFY2016 Result Update

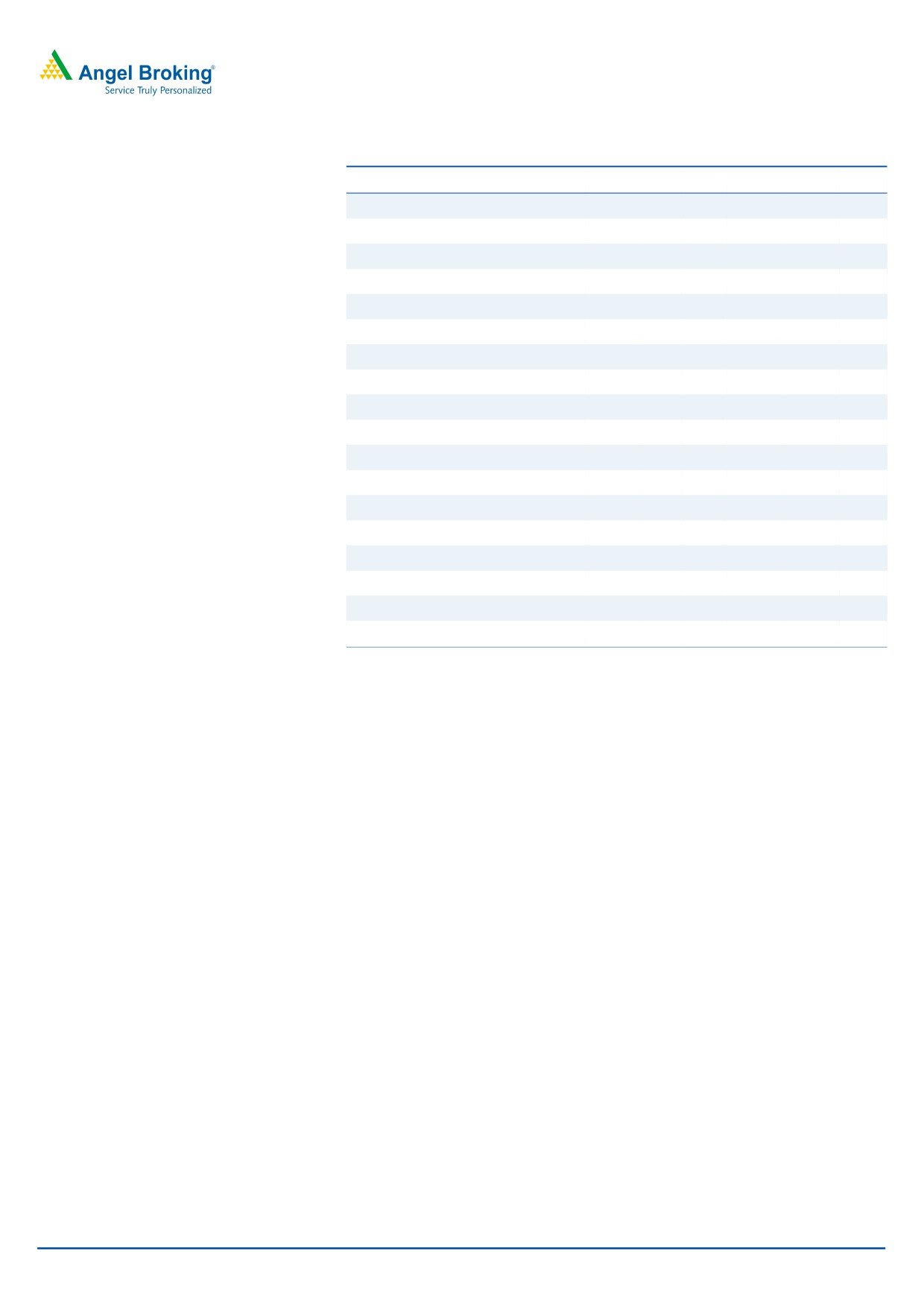

Exhibit 1: Gross Quarterly Toll Income (unadj. for stake)

(` cr)

2QFY2016

1QFY2016

4QFY2015

3QFY2015

2QFY2015

1QFY2015

4QFY2014

yoy chg. (%)

ARRIL

21

22

22

22

20

19

19

4.8

AJTL

7

9

10

9

8

9

8

(13.4)

DPTL

37

36

36

34

32

34

33

15.9

MBCPNL

37

34

26

24

22

20

15

65.3

RPTL

20

22

20

21

20

22

NA

0.0

BHTPL

28

28

27

25

26

26

24

8.5

HYTPL

12

13

12

11

11

11

12

12.0

Source: Company, Angel Research

The reported EBITDA for 1HFY2016 stood at `180cr while the EBITDA margin for

the same period was at 65.7% (vs 61.7% for FY2015).

Overall debt increased in 1HFY2016 as the company pursued stake purchases at

some of the SPVs and borrowed debt at standalone level (stop gap funding to

cover for shortfall of debt servicing). This resulted in higher interest expenses

(`284cr for 1HFY2016 vs `526cr for FY2015). Accordingly, SIPL incurred bottom-

line level loss of `159cr for 1HFY2016.

Update on Under-development Projects

During the quarter, construction works of Shreenathji-Udaipur (SUTPL) BOT Project

were completed. SIPL has already applied for CoD in Oct-2015 and expects to

commission the project soon.

Construction works across the Bhilwara-Rajsamand (BRTPL), Rohtak-Hissar

(RHTPL), and Mysore-Bellary (MBHPL) BOT projects are going-on as per schedule.

SIPL’s Management expects BRTPL and RHTPL to complete the construction works

ahead of the scheduled time of Apr-2016/ Jun-2016 by Jan-2016/ Apr-2016.

Works across MBHPL are progressing as per schedule and the Management

expects to finish EPC works by Jun-2016, which is before the scheduled CoD of

Jun-2017.

Equity requirement for ongoing BOT projects

At the time of the IPO, SIPL had pending equity requirements towards SUTPL. SIPL

through IPO route raised `82cr of equity and subordinate debt towards its

subsidiary, SUTPL. Given that entire equity is infused and SUTPL is awaiting CoD,

SIPL has no equity requirement towards the projects under execution phase.

Notably, SIPL is currently acquiring stake process from SEL and GKC for Mysore-

Bellary BOT project. For stake acquisition purposes, Management expects cash

outflow of `79cr. On completion of the stake acquisition, SIPL would hold the

entire 100% in the company.

November 9, 2015

3

Sadbhav Infrastructure Project | 2QFY2016 Result Update

Outlook and Valuation

We expect SIPL to report a strong 44.3%/47.8% revenue/EBITDA CAGR over

FY2015-17E. Management expects SIPL’s entire BOT portfolio (we model MBHPL

to commission operations in FY2018E only) to be operational by FY2017E only.

Toll collection at its existing projects would further ramp-up, going forward. Interest

expenses accounted for 170% of the FY2015 consol. EBITDA. We expect this ratio

to decline to ~95% by FY2017E.

PAT level losses since FY2013 have eroded the overall net worth of the consol.

entity from `971cr in FY2013 to `788cr in FY2015. Despite uptick in traffic

numbers across its road portfolio, there exists a possibility for SIPL to continue

reporting losses for next few quarters, as it would be impacted by 3 new projects

commencing operations in next few months, as highlighted by the Management.

Our view that SIPL would continue to report losses stems from the point that peak

debt requirement of the company (assuming no projects are added/ acquired)

would be at `8,510cr by FY2017E. The incremental debt requirement would be

towards new projects and towards stake acquisition of DPTL and MBHPL projects.

Notably, SIPL at consol. level should report cash profits from 4QFY2016E

onwards.

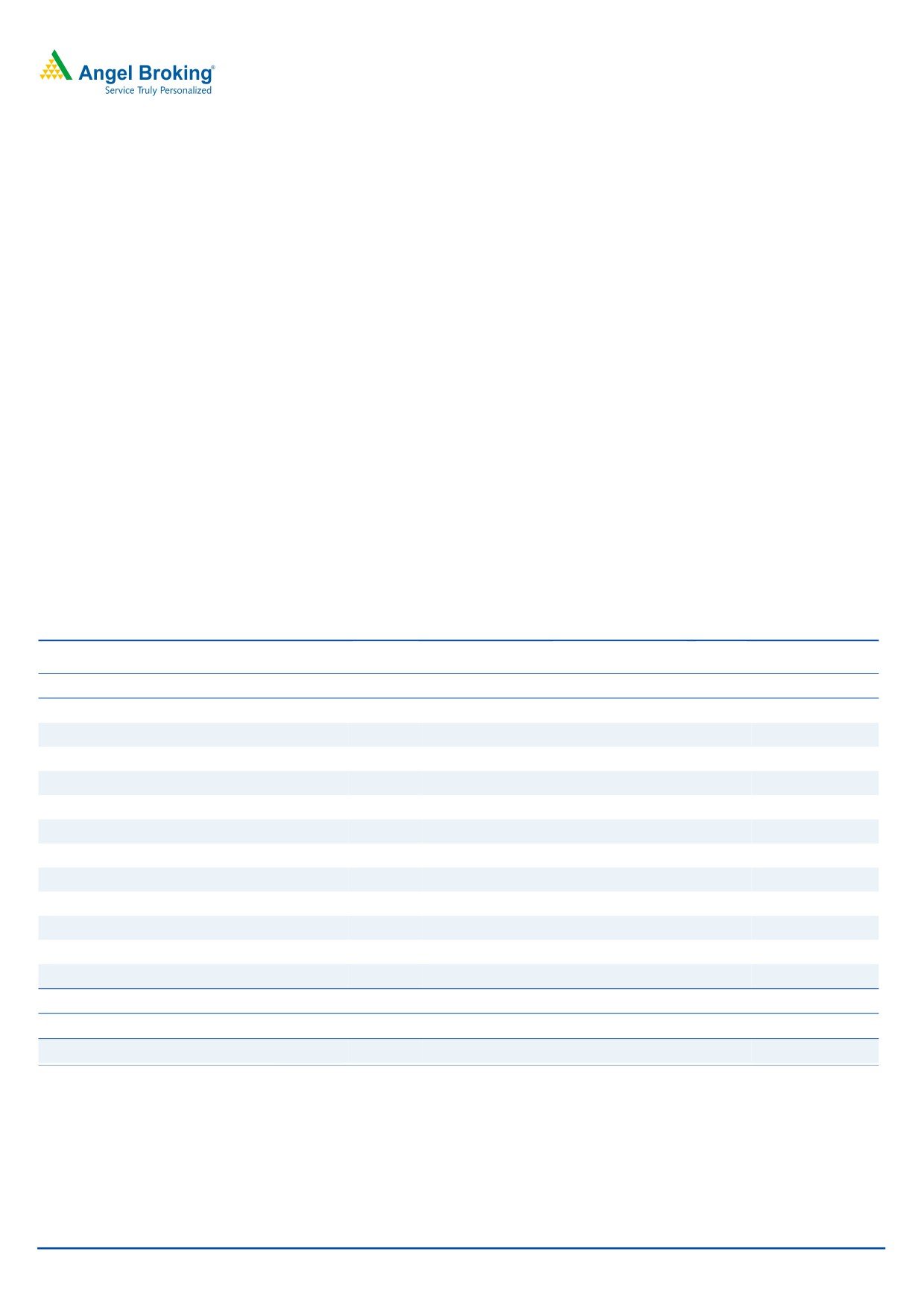

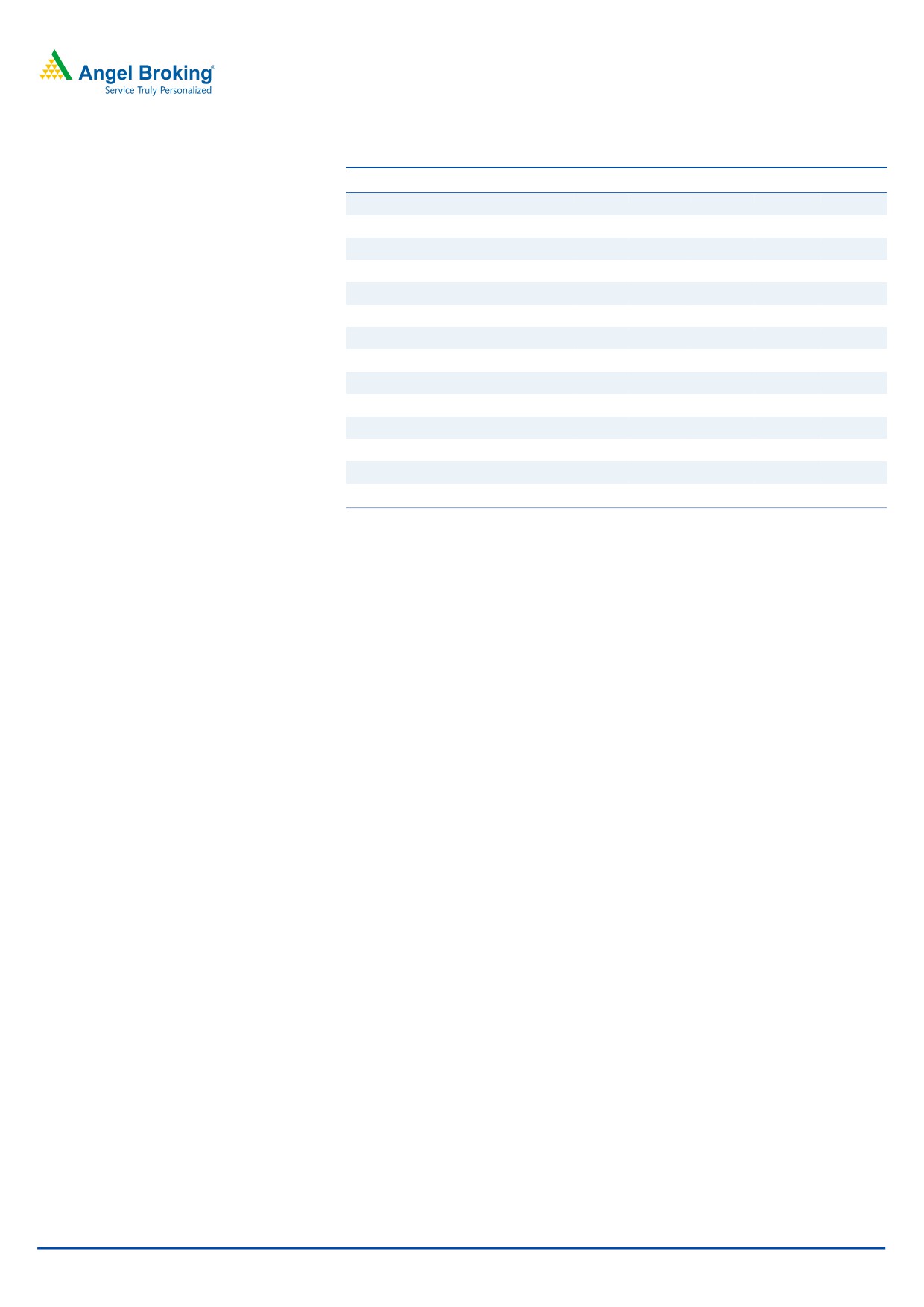

Exhibit 2: SOTP break-up

Discounted

Adj. FCFE

Value/

Particulars

Segment

Project

Stake (%)

Basis

FCFE (` cr)

Val. (` cr)

share (`)

Road BOT projects

Maharashtra Border Check Post

Service Fee

2,051

90%

1,846

52

NPV at CoE of 12%

Rohtak-Panipat BOT Project

Toll

111

100%

111

3

NPV at CoE of 12%

Bijapur-Hungund BOT Project

Toll

330

77%

254

7

NPV at CoE of 12%

Ahmedabad Ring Road

Toll

568

100%

568

16

NPV at CoE of 12%

Aurangabad-Jalna BOT Project

Toll

428

100%

428

12

NPV at CoE of 12%

Hyderabad-Yadagiri BOT Project

Toll

135

100%

135

4

NPV at CoE of 12%

Nagpur-Seoni BOT Project

Annuity

15

100%

15

0

NPV at CoE of 12%

Shreenathji-Udaipur BOT Project

Toll

180

100%

180

5

NPV at CoE of 12%

Bhilwara-Rajsamand BOT Project

Toll

320

100%

320

9

NPV at CoE of 14%

Rohtak-Hissar BOT Project

Toll

262

100%

262

7

NPV at CoE of 14%

Mysore-Bellary BOT Project

Annuity

124

100%

124

4

NPV at CoE of 14%

Dhule-Palesnar BOT Project

Toll

390

100%

390

11

NPV at CoE of 12%

Total SIPL value

4,633

132

Standalone entity- Net debt (FY2016E)

(1,127)

(32)

Standalone net debt

Grand Total

4,914

3,506

100

Source: Company, Angel Research

We have valued SIPL using Sum-of-The-Parts method, where we have valued each

project using “Free cash-flow to Equity holders” method and adjusted the

standalone entity’s FY2016E debt to arrive at fair value of `100/share. Given the

limited upside the stock has from the current level, we maintain our NEUTRAL

rating on the stock.

November 9, 2015

4

Sadbhav Infrastructure Project | 2QFY2016 Result Update

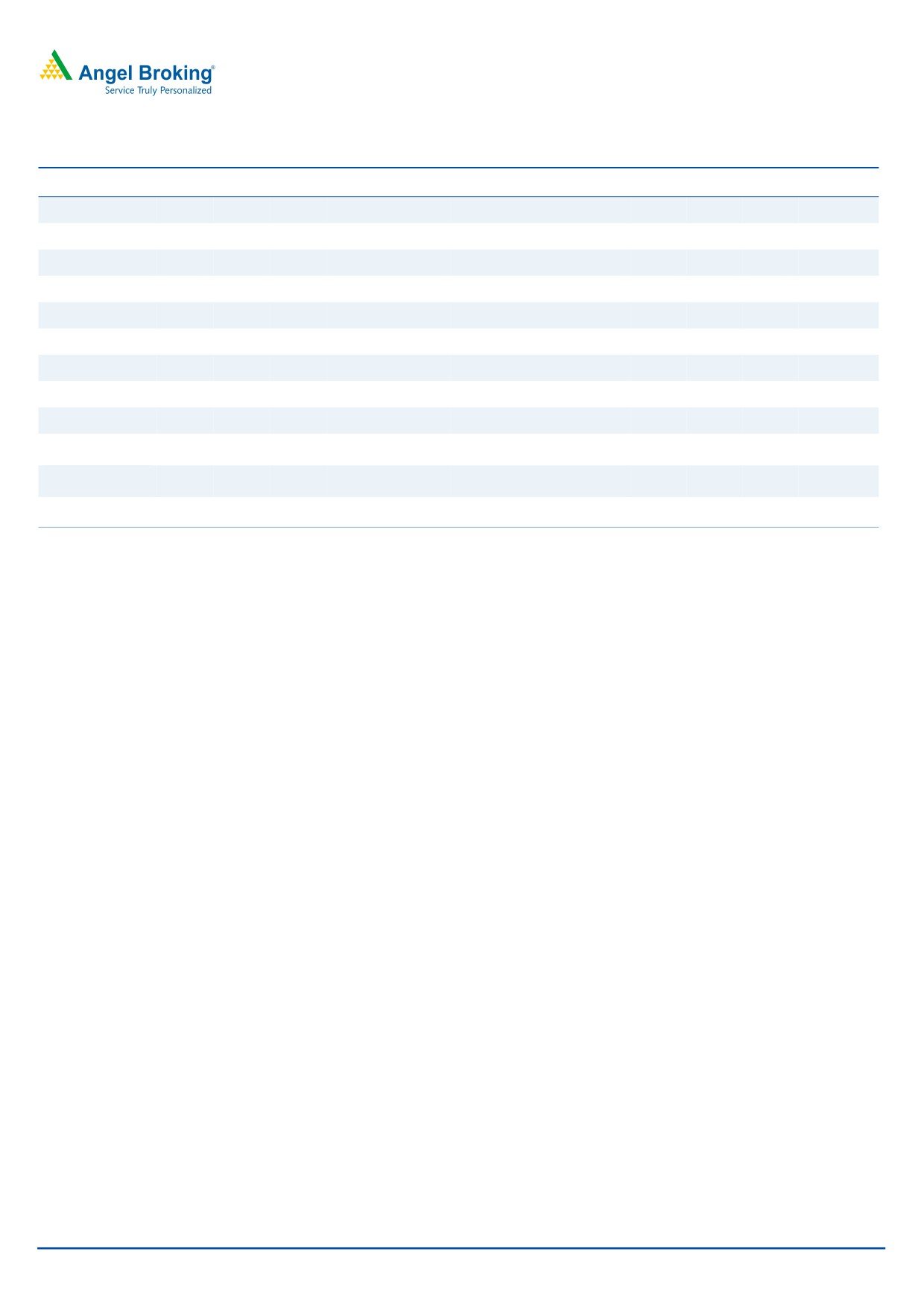

Exhibit 3: BOT Project Details

Project

ARRIL

AJTL

RHTL

NSEL

DPTL

MBCPNL

RPTL

BHTL

SUTL

BRTL

HYTL

Type

Toll

Toll

Toll Annuity

Toll

Entry Fees

Toll

Toll

Toll

Toll

Toll

Status

Oper. Oper. Oper. Oper.

Oper.

Part. Oper. Under Dev. Oper. Oper. Oper. Under Dev.

Lane Kms

305

263

395

111

355

22 CPs

323

389

317

349

143

Issuing Auth.

AUDA MSRDC NHAI NHAI

NHAI

MSRDC

NHAI NHAI NHAI NHAI

NHAI

State

Gujarat

Mah.

Har.

MP Mah./MP

Mah.

Haryana Karn.

Raj.

Raj.

Tel.

Concession (Yrs)

20

24

22

20

18

25

25

20

27

30

23

Con. Start

Dec-06 Feb-07 Jun-16 May-07 Dec-09 Dif. for all CPs

Apr-11 Sep-10 Apr-13 Apr-16

Jul-10

Con. End

Nov-26 Jul-30 May-28 Nov-27 Dec-27 Dif. for all CPs

Mar-36 Aug-30 Mar-40 Mar-46

Jun-33

TPC (` cr)

544

272

1,272

375

1,420

1,426

1,161

1,369

1,151

676

495

Equity+Sub-Debt

49

83

111

60

344

381

243

162

287

133

147

(` cr)

Debt o/s (` cr)

350

161

663

187

1,015

1,001

986

833

820

206

395

(as of 30.09.2015)

Grant (` cr)

36

-

-

-

-

-

-

273

-

-

-

Source: Company, Angel Research

November 9, 2015

5

Sadbhav Infrastructure Project | 2QFY2016 Result Update

Company background

Sadbhav Infrastructure Project Ltd (SIPL) is a subsidiary of Ahmedabad-based

Sadbhav Engineering Ltd (SEL). SIPL was incorporated in 2007 as a developer and

is a roads and highways operator on a BOT- Toll/ Annuity basis. SIPL is into the

business of development, operation and maintenance of national and state

highways and roads in several states including Maharashtra, Gujarat, Rajasthan,

Karnataka, Haryana, Madhya Pradesh and Telangana, and a border check posts

project in Maharashtra.

It has a portfolio of 12 BOT projects of which 7 road projects are fully operational,

1 is partially operational (border check post) and 4 are under construction stage.

10 of the 12 BOT projects are toll projects (including service fee for the border

check posts in Maharashtra) and 2 are annuity projects. Of the 12, SIPL is in the

process of acquiring stake in 2 projects; ie, it would be acquiring 100% stake in

Mysore-Bellary Highway Pvt. Ltd and 100% in Dhule Palesnar Tollway Ltd. Of these

2 projects, 1 is operational and the other one is under development. Again, one of

them is a toll project and the other one is an Annuity project. This restructuring

process is in accordance with the company’s strategy to consolidate all BOT road

projects to be developed by SEL under one company- SIPL.

SIPL’s parent company SEL was incorporated in 1988 and has established itself as

one of the leading engineering, procurement and construction (EPC) and

infrastructure players in the country. In the last 25 years, SEL has developed a

strong project execution track record of various construction projects across 10

states in India and has a strong Balance Sheet. SIPL derives strength from its

parent SEL, which has been an EPC contractor for most of SIPL’s projects.

November 9, 2015

6

Sadbhav Infrastructure Project | 2QFY2016 Result Update

Profit & loss statement (Consolidated)

Y/E March (` cr)

FY12

FY13

FY14

FY15

FY16E

FY17E

Net Sales

176

287

371

500

675

1,042

% Chg

153.2

63.2

29.2

34.8

34.9

54.5

Total Expenditure

83

118

129

191

237

348

Operating Expenses

65

97

89

141

165

240

Employee benefit Expense

6

10

16

24

33

51

Other Expenses

12

10

25

26

39

57

EBITDA

93

170

242

309

438

694

% Chg

108.2

82.1

42.5

27.8

41.7

58.6

EBIDTA %

52.9

59.0

65.1

61.7

64.9

66.6

Depreciation

22

50

92

141

152

190

EBIT

72

120

150

168

285

504

% Chg

107.8

67.1

25.4

12.1

69.5

76.7

Interest and Financial Charges

72

195

355

526

587

661

Other Income

23

28

22

28

32

31

PBT

23

(47)

(184)

(330)

(270)

(127)

Exceptional Items

0

0

0

(12)

0

0

Tax

13

5

12

0

0

0

% of PBT

56.6

nmf

nmf

nmf

nmf

nmf

PAT before share of losses

10

(52)

(196)

(342)

(270)

(127)

of Minority Interest & Associates

Share of (Profit)/Loss attributable

2

13

40

28

22

19

to Minority Interest

Share of Profit/(Loss) from Assoc.

(2)

(7)

0

0

0

0

Co.

Net Profit

10

(46)

(156)

(313)

(248)

(107)

% Chg

(0.3)

nmf

nmf

nmf

nmf

nmf

PAT %

5.6

(15.9)

(42.0)

(62.6)

(36.7)

(10.3)

Adj. EPS

0.3

(1.5)

(5.0)

(10.1)

(8.0)

(3.5)

Nmf- Not meaningful

November 9, 2015

7

Sadbhav Infrastructure Project | 2QFY2016 Result Update

Balance sheet (Consolidated)

Y/E March (` cr)

FY12

FY13

FY14

FY15

FY16E

FY17E

Sources of Funds

Equity Capital

26

28

28

311

352

352

Reserves Total

820

943

792

477

606

508

Networth

847

971

820

788

958

860

Minority Interest

126

159

186

57

49

48

Total Debt

2,791

3,643

4,902

6,204

8,020

8,510

Other Long-term Liabilities

0

418

2,241

2,233

2,236

2,243

Long-term Provision

39

11

38

100

51

53

Total Liabilities

3,804

5,202

8,188

9,382

11,313

11,714

Application of Funds

Net Block & Capital WIP

3,319

4,744

7,781

9,013

10,920

11,323

Goodwill on Consolidation

50

48

45

118

128

128

Investments

17

9

105

8

21

21

Other Current Assets

10

44

14

92

81

81

Sundry Debtors

0

1

14

14

14

14

Cash and Bank Balance

124

52

52

170

165

215

Loans & Advances

101

91

35

63

69

69

Current Liabilities

190

182

434

514

412

373

Net Current Assets

45

5

(318)

(174)

(83)

5

Other Assets

373

397

575

417

327

237

Total Assets

3,804

5,202

8,188

9,382

11,313

11,714

November 9, 2015

8

Sadbhav Infrastructure Project | 2QFY2016 Result Update

Cash flow statement (Consolidated)

Y/E March (` cr)

FY12

FY13

FY14

FY15

FY16E FY17E

Profit/ (Loss) before tax

23

(47)

(184)

(330)

(270)

(127)

Depreciation & Amortization

22

50

92

141

152

190

Other Adjustments

(22)

(27)

(13)

(27)

(16)

(17)

Change in Working Capital

26

(25)

86

54

104

110

Interest & Financial Charges

72

195

355

526

587

661

Direct taxes paid

(14)

(12)

(12)

(7)

(5)

(5)

Cash Flow from Operations

107

134

325

356

553

813

(Inc)/ Dec in Fixed Assets

(1,323)

(921)

(905)

(1,135)

(2,060)

(593)

(Inc)/ Dec in Invest., Int. recd & Oth. Adj.

(135)

17

(34)

(70)

(134)

0

Cash Flow from Investing

(1,458)

(904)

(939)

(1,206)

(2,194)

(593)

Inc./ (Dec.) in Borrowings

1,480

869

1,037

1,390

1,816

490

Issue/ (Buy Back) of Equity

224

215

68

124

409

0

Dividend Paid (Incl. Tax)

0

0

0

0

0

0

Finance Cost

(281)

(387)

(490)

(549)

(587)

(661)

Cash Flow from Financing

1,423

698

615

965

1,639

(171)

Inc./(Dec.) in Cash

72

(72)

0

116

(2)

49

Opening Cash balances

52

124

52

52

168

165

Closing Cash balances

124

52

52

168

165

215

November 9, 2015

9

Sadbhav Infrastructure Project | 2QFY2016 Result Update

Key Ratios

Y/E March

FY12

FY13

FY14

FY15

FY16E

FY17E

Valuation Ratio (x)

EV/Sales

32.8

23.3

21.5

19.1

11.6

8.0

EV/EBITDA

62.0

39.5

32.9

30.9

17.9

11.9

EV / Total Assets

1.5

1.3

1.0

1.0

0.7

0.7

Per Share Data (`)

Adj. EPS

0.3

(1.5)

(5.0)

(10.1)

(8.0)

(3.5)

Book Value

27.2

31.2

26.4

22.4

27.2

24.4

Returns (%)

RoCE (Pre-tax)

2.5

2.9

2.9

2.6

3.6

5.5

Angel RoIC (Pre-tax)

2.0

2.6

2.6

2.5

3.2

5.5

RoE

1.3

(5.0)

(17.4)

(38.9)

(28.4)

(11.8)

Leverage Ratios (x)

D/E ratio (x)

3.3

3.8

6.0

7.9

8.4

9.9

Interest Coverage Ratio (x)

1.0

0.6

0.4

0.3

0.5

0.8

November 9, 2015

10

Sadbhav Infrastructure Project | 2QFY2016 Result Update

Research Team Tel: 022 - 39357800

DISCLAIMER

Angel Broking Private Limited (hereinafter referred to as “Angel”) is a registered Member of National Stock Exchange of India Limited,

Bombay Stock Exchange Limited and Metropolitan Stock Exchange of India Limited. It is also registered as a Depository Participant with

CDSL and Portfolio Manager with SEBI. It also has registration with AMFI as a Mutual Fund Distributor. Angel Broking Private Limited is

a registered entity with SEBI for Research Analyst in terms of SEBI (Research Analyst) Regulations, 2014 vide registration number

INH000000164. Angel or its associates has not been debarred/ suspended by SEBI or any other regulatory authority for accessing

/dealing in securities Market. Angel or its associates including its relatives/analyst do not hold any financial interest/beneficial

ownership of more than 1% in the company covered by Analyst. Angel or its associates/analyst has not received any compensation /

managed or co-managed public offering of securities of the company covered by Analyst during the past twelve months. Angel/analyst

has not served as an officer, director or employee of company covered by Analyst and has not been engaged in market making activity

of the company covered by Analyst.

This document is solely for the personal information of the recipient, and must not be singularly used as the basis of any investment

decision. Nothing in this document should be construed as investment or financial advice. Each recipient of this document should

make such investigations as they deem necessary to arrive at an independent evaluation of an investment in the securities of the

companies referred to in this document (including the merits and risks involved), and should consult their own advisors to determine

the merits and risks of such an investment.

Reports based on technical and derivative analysis center on studying charts of a stock's price movement, outstanding positions and

trading volume, as opposed to focusing on a company's fundamentals and, as such, may not match with a report on a company's

fundamentals.

The information in this document has been printed on the basis of publicly available information, internal data and other reliable

sources believed to be true, but we do not represent that it is accurate or complete and it should not be relied on as such, as this

document is for general guidance only. Angel Broking Pvt. Limited or any of its affiliates/ group companies shall not be in any way

responsible for any loss or damage that may arise to any person from any inadvertent error in the information contained in this report.

Angel Broking Pvt. Limited has not independently verified all the information contained within this document. Accordingly, we cannot

testify, nor make any representation or warranty, express or implied, to the accuracy, contents or data contained within this document.

While Angel Broking Pvt. Limited endeavors to update on a reasonable basis the information discussed in this material, there may be

regulatory, compliance, or other reasons that prevent us from doing so.

This document is being supplied to you solely for your information, and its contents, information or data may not be reproduced,

redistributed or passed on, directly or indirectly.

Neither Angel Broking Pvt. Limited, nor its directors, employees or affiliates shall be liable for any loss or damage that may arise from

or in connection with the use of this information.

Note: Please refer to the important ‘Stock Holding Disclosure' report on the Angel website (Research Section). Also, please refer to the

latest update on respective stocks for the disclosure status in respect of those stocks. Angel Broking Pvt. Limited and its affiliates may

have investment positions in the stocks recommended in this report.

Disclosure of Interest Statement

Sadbhav Infrastructure Project

1. Analyst ownership of the stock

No

2. Angel and its Group companies ownership of the stock

No

3. Angel and its Group companies' Directors ownership of the stock

No

4. Broking relationship with company covered

No

Note: We have not considered any Exposure below ` 1 lakh for Angel, its Group companies and Directors.

Ratings (Based on expected returns

Buy (> 15%)

Accumulate (5% to 15%)

Neutral (-5 to 5%)

over 12 months investment period):

Reduce (-5% to -15%)

Sell (< -15)

November 9, 2015

11