2QFY2016 Result Update | Infrastructure

November 10, 2015

Sadbhav Engineering

NEUTRAL

CMP

`312

Performance Highlights

Target Price

-

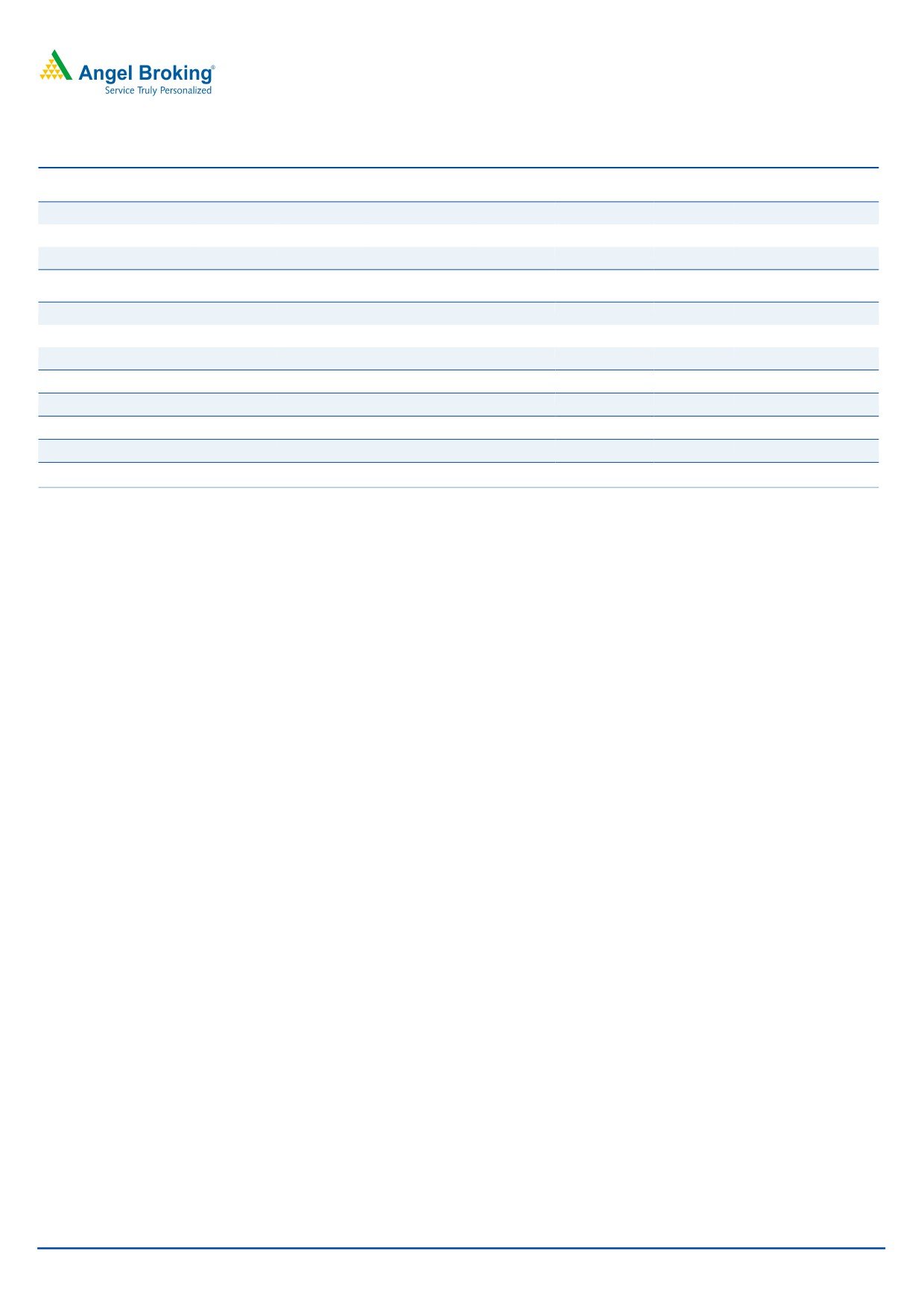

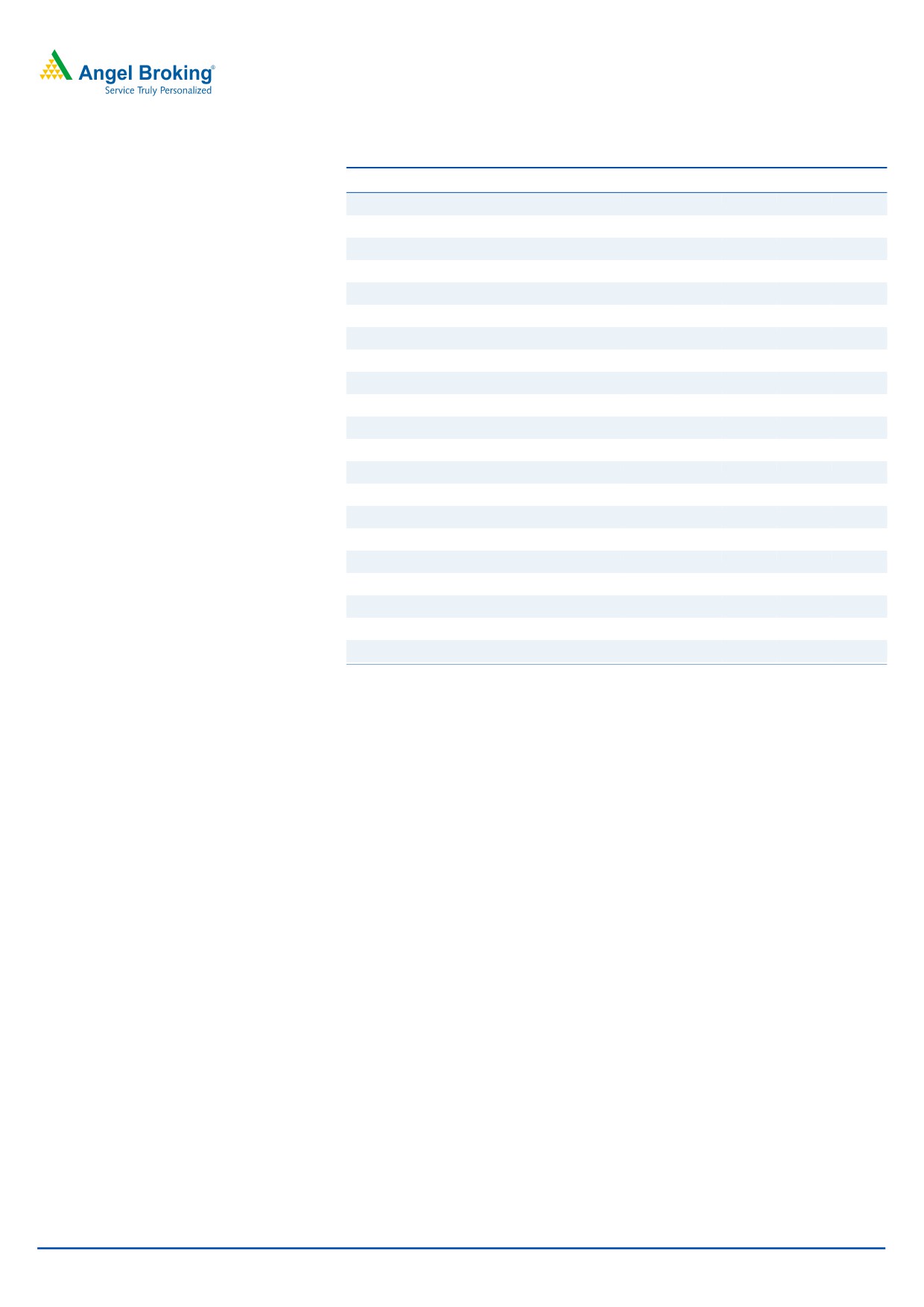

Quarterly highlights - Standalone

Investment Period

-

Y/E March (` cr)

2QFY16 2QFY15

% chg (yoy) 1QFY16

% chg (qoq)

Net sales

746

595

25.4

829

(10.1)

Stock Info

Operating profit

81

60

35.5

89

(9.7)

Adj. Profit

38

10

274.7

39

(3.8)

Sector

Infrastructure

Source: Company, Angel Research

Market Cap (` cr)

5,355

Net Debt (` cr)

903

Sadbhav Engineering (SEL) reported a strong set of numbers for 2QFY2016. On

Beta

0.8

the top-line front, SEL reported a strong 25.4% yoy growth to `746cr in

52 Week High / Low

156/65

2QFY2016. This was mainly on account of execution of in-house BOT projects

Avg. Daily Volume

32,119

(mainly Rohtak-Hissar project, which contributed ~`190cr) and lower base of the

Face Value (` )

1

corresponding period of last year. The company posted an EBITDA margin of

BSE Sensex

26,121

10.8%, up 80bp yoy. Interest cost declined by 20.4% yoy to `18cr. On the

bottom-line front, the company’s reported PAT grew 158.4% yoy to `26cr. On

Nifty

7,915

adjusting for an exceptional item, the Adj. PAT grew 274.7% yoy to `38cr.

Reuters Code

SADE.BO

Bloomberg Code

SADE@IN

SEL reported order inflow of `1,608cr during the quarter, taking the total inflows won

during 1HFY2016 to `2,684cr. SEL is sitting on an order book of `9,306cr (Order

Book to LTM ratio at 2.9x) as of 2QFY2016, which provides good revenue visibility.

Shareholding Pattern (%)

Promoters

47.1

Outlook and valuation: Considering recent order wins and strong 1HFY2016

MF / Banks / Indian Fls

27.1

execution, we model revenue estimates of `3,481cr/`4,219cr for FY2016E/

FII / NRIs / OCBs

14.7

FY2017E, respectively. Given the low competitive intensity for recently won Road

Indian Public / Others

11.1

EPC projects, cool-down in bitumen and aggregate prices (as captive BOT

projects have fixed price contracts), we expect EBITDA margins to expand by 53bp

during FY2015-17E to 10.8%. Further, we model conservative other income

Abs. (%)

3m 1yr

3yr

numbers and low tax rate for FY2016/2017E at `13/14cr and 24%, respectively.

Sensex

(7.0)

(6.3)

39.9

Accordingly, we expect SEL’s PAT margin to expand by

109bp during

Sadbhav

(10.0)

27.7

122.0

FY2015-17E to 5.1%. We value SEL using Sum-Of-The-Parts methodology. We

value standalone entity on P/E multiple of 15.0x its FY2017E EPS of `12.4cr,

3-Year Daily Price Chart

resulting in value of `187 per share. We value BOT projects individually using

400

360

Free Cash flow to Equity holder’s method. Our value for SIPL’s portfolio of BOT

320

280

projects comes to `141/share, which is 43% of the overall SOTP value for the

240

200

company. On combining the value of EPC business and BOT projects, we arrive

160

120

at a combined business value of `328/share, reflecting limited upside in the stock

80

price from current levels. Accordingly, we maintain Neutral rating on the stock.

40

0

Key financials (Standalone)

Y/E March (` cr)

FY13

FY14

FY15

FY16E

FY17E

Net Sales

1,811

2,358

2,970

3,481

4,219

Source: Company, Angel Research

% chg

(32.3)

30.2

25.9

17.2

21.2

Net Profit

13

145

118

145

213

% chg

(47.3)

1,000.3

(18.4)

23.2

46.9

EBITDA (%)

8.6

10.6

10.3

10.7

10.8

EPS (`)

5

7

7

8

12

P/E (x)

62.1

43.4

41.9

35.9

24.4

P/BV (x)

5.6

4.8

3.9

3.5

0.0

RoE (%)

9.3

11.9

9.9

10.3

13.5

RoCE (%)

9.0

12.0

10.3

12.1

0.0

Yellapu Santosh

EV/Sales (x)

2.9

2.3

2.1

1.8

1.5

022 - 3935 7800 Ext: 6811

EV/EBITDA (x)

33.7

21.6

20.4

16.5

13.5

Source: Company, Angel Research

Please refer to important disclosures at the end of this report

1

Sadbhav Engineering | 2QFY2016 Result Update

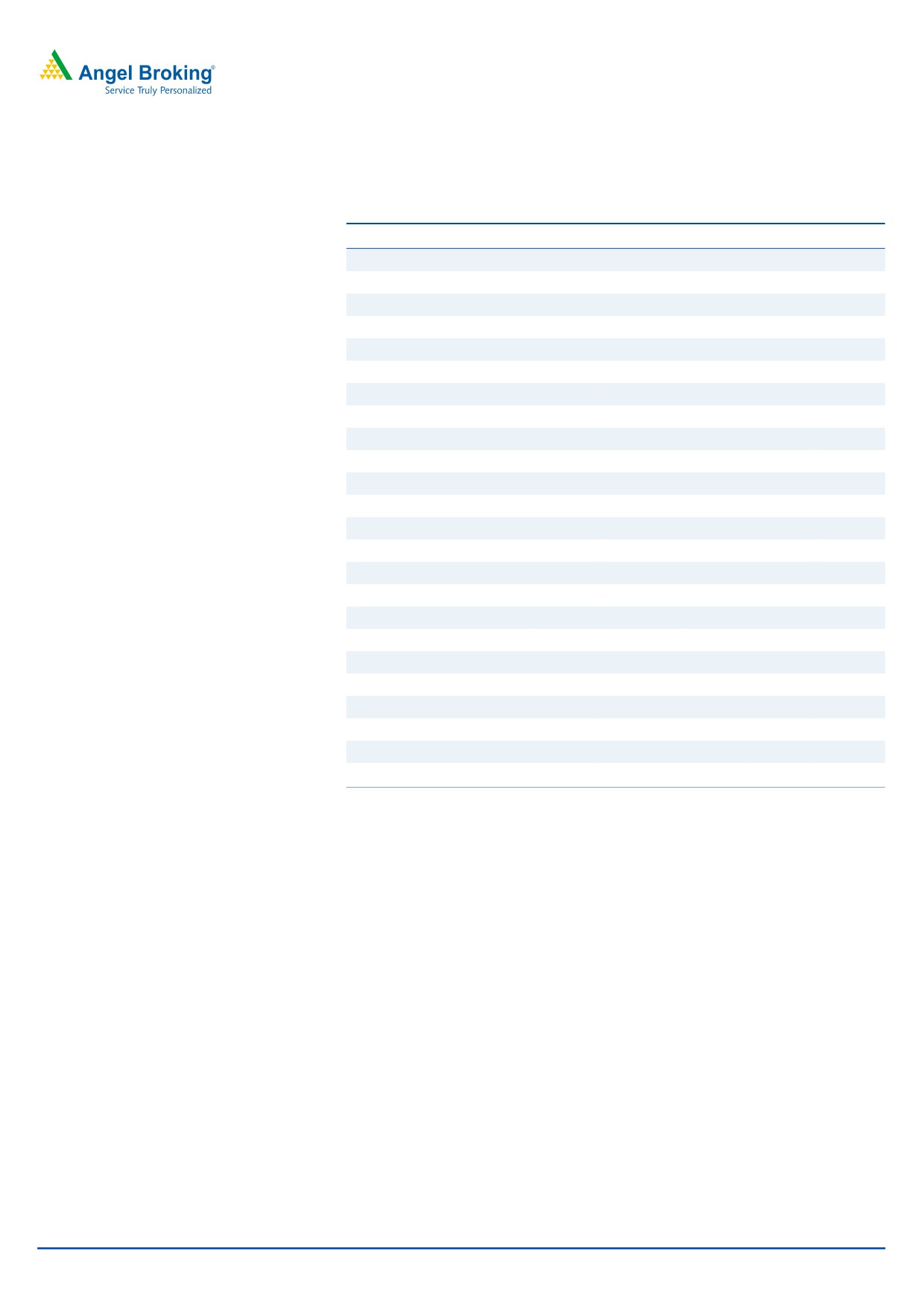

Exhibit 1: 2QFY2016 performance (Standalone)

Particulars (` cr)

2QFY16

1QFY16

% chg (qoq) 2QFY15

% chg (yoy) 1HFY16 1HFY15

% chg (yoy)

Net Sales

746

829

(10.1)

595

25.4

1,575

1,280

23.1

Total Expenditure

665

740

(10.1)

535

24.3

1,405

1,149

22.3

Construction Expenses

602

680

(11.4)

483

24.8

1,282

1,054

21.6

Changes in Inv. Of FG & WIP

0

0

nmf

0

nmf

0

0

nmf

Employee Benefits Expense

32

28

12.8

25

30.1

60

44

36.6

Other Expenses

31

32

(3.2)

28

11.4

63

51

23.3

EBITDA

81

89

(9.7)

60

35.5

170

131

29.8

EBIDTA %

10.8

10.8

10.0

10.8

10.2

Depreciation

21

20

5.5

22

(3.9)

42

44

(5.6)

EBIT

59

69

(14.1)

37

59.1

128

87

47.8

Interest and Financial Charges

18

21

(17.0)

22

(20.4)

39

44

(12.3)

Other Income

3

2

65.9

2

57.2

5

3

35.2

PBT before Exceptional Items

45

50

(10.2)

17

162.3

94

46

104.7

Exceptional Items

12

0

0

12

0

PBT after Exceptional Items

33

50

(33.9)

17

93.0

82

46

79.1

Tax

7

10

(35.0)

7

(4.0)

17

9

88.3

% of PBT

20.0

20.4

40.3

20.2

19.3

PAT

26

39

(33.6)

10

158.4

66

37

76.9

Adj. PAT

38

39

(3.8)

10

274.7

77

37

108.6

Adj. PAT %

5.1

4.8

1.7

4.9

2.9

Dil. EPS

1.53

2.30

(33.5)

0.65

135.4

3.83

2.40

59.6

Source: Company, Angel Research

Strong execution seen during the quarter

On the top-line front, SEL reported a strong 25.4% yoy revenue growth to `746cr

in 2QFY2016. This was mainly on account of strong execution seen across their

captive BOT projects (53.9% yoy increase to `461cr), which are under construction

and had a lower base in the corresponding period of last year. Revenue booking

from EPC road projects declined 10.3% yoy to `132cr, owing to completion of old

projects in the order book.

Exhibit 2: Segment-wise revenue growth

Segment

2QFY16

1QFY16

4QFY15

3QFY15

2QFY15

% chg (qoq)

% chg (yoy)

Roads

593

507

659

445

446

17.0

32.8

BOT

461

407

470

374

300

13.3

53.9

EPC

132

100

189

72

147

32.1

(10.3)

Irrigation

31

201

166

138

35

(84.3)

(10.1)

Mining

120

120

139

139

112

(0.3)

7.1

Power Generation

2

2

1

1

1

6.4

33.6

Revenues (ex. Oth. Opr. Income)

746

829

965

722

595

(10.1)

25.4

Source: Company, Angel Research

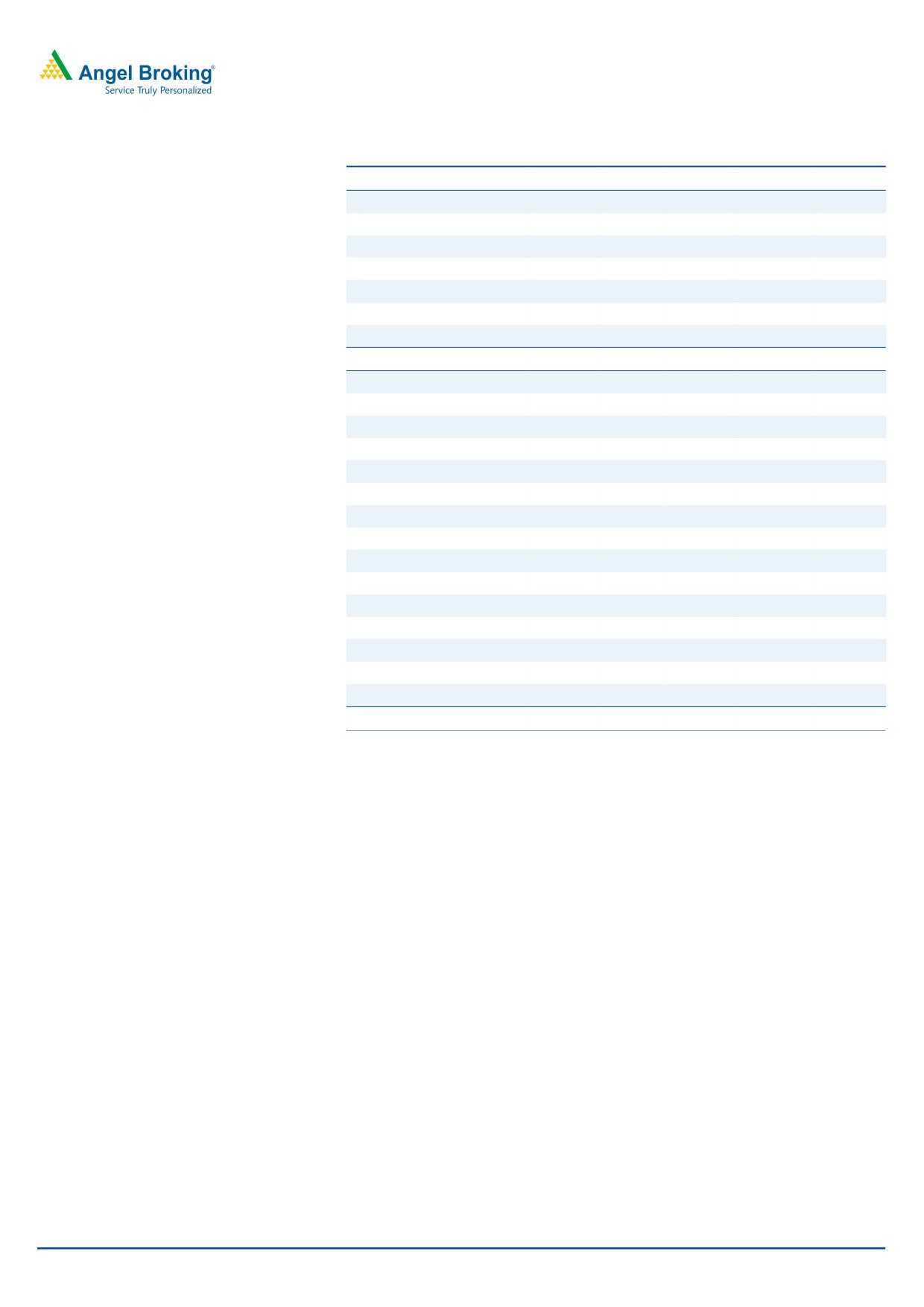

Again, if we look at revenue booking for the quarter from top 5 projects, then the

top 5 projects contributed 68.4% of 2QFY2016 revenues (vs 55.2% in the previous

quarter). Further, all the 4 Captive Road projects contributed a major chunk of the

quarter’s revenues (accounted for 60.9% of the quarter’s revenues).

November 10, 2015

2

Sadbhav Engineering | 2QFY2016 Result Update

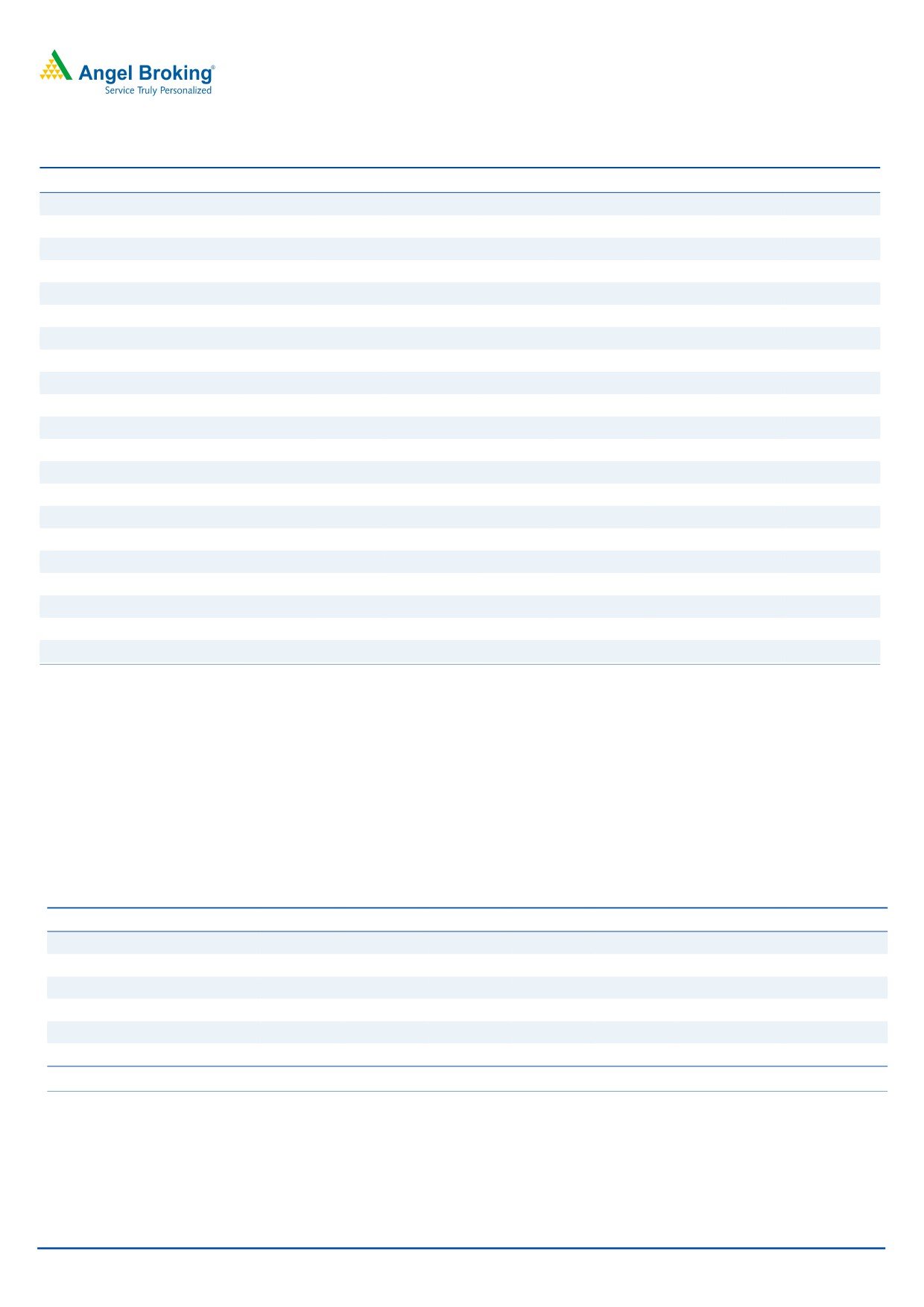

Exhibit 3: Quarterly Revenue growth

Exhibit 4: Revenues booked from Top 5 Projects

1,200

70.0

Revenues (` cr)

yoy growth (%)

Project Name

Vertical 2QFY2016 1QFY2016

58.4

60.0

1,000

Rohtak-Hissar

Captive BOT

190

149

50.0

Mysore-Bellary

Captive BOT

89

108

800

Bhilwara-Rajsamand

Captive BOT

95

78

40.0

600

Omkareshwar Canal

Irrigation

64

25.4

30.0

21.1

21.0

Shreenathji-Udaipur

Captive BOT

81

60

400

16.3

20.0

Jodhpur-Pachpadra

Road EPC

56

200

10.0

Total Revenues

746

829

0

0.0

4QFY14

1QFY15

4QFY15

1QFY16

2QFY16

As % of total

68.4%

55.2%

Source: Company, Angel Research

Source: Company, Angel Research

EBITDA Margins expand to 10.8%

SEL reported an EBITDA of `81cr for 2QFY2016, up 35.5% yoy, but down 9.7%

qoq. Alternatively, the EBITDA margin of the company improved 80bp yoy to

10.8%. However, on a qoq basis, reported margins were flat. In addition to the

stronger execution, surge in yoy EBITDA margin is also attributable to 11.4% yoy

growth (less than the revenue growth) seen across other expenses (to `31cr).

Exhibit 5: EBITDA% expands

Exhibit 6: Quarterly Expense movement

120

10.8

10.8

11.0

Emp. Exp as % of sales Const. Exp as % of sales Oth. Exp as % of sales

EBITDA (` cr)

EBITDA (%)

10.8

100

2QFY16

4.3

80.8

4.1

10.6

80

1QFY16

3.4

82.0

3.8

10.4

10.2

60

10.2

10.0

4QFY15 2.8

81.2

6.2

9.9

10.0

40

1QFY15

3.7

82.1

3.5

9.8

20

9.6

4QFY14

4.1

81.2

4.7

0

9.4

4QFY14

1QFY15

4QFY15

1QFY16

2QFY16

0%

20%

40%

60%

80%

100%

Source: Company, Angel Research

Source: Company, Angel Research

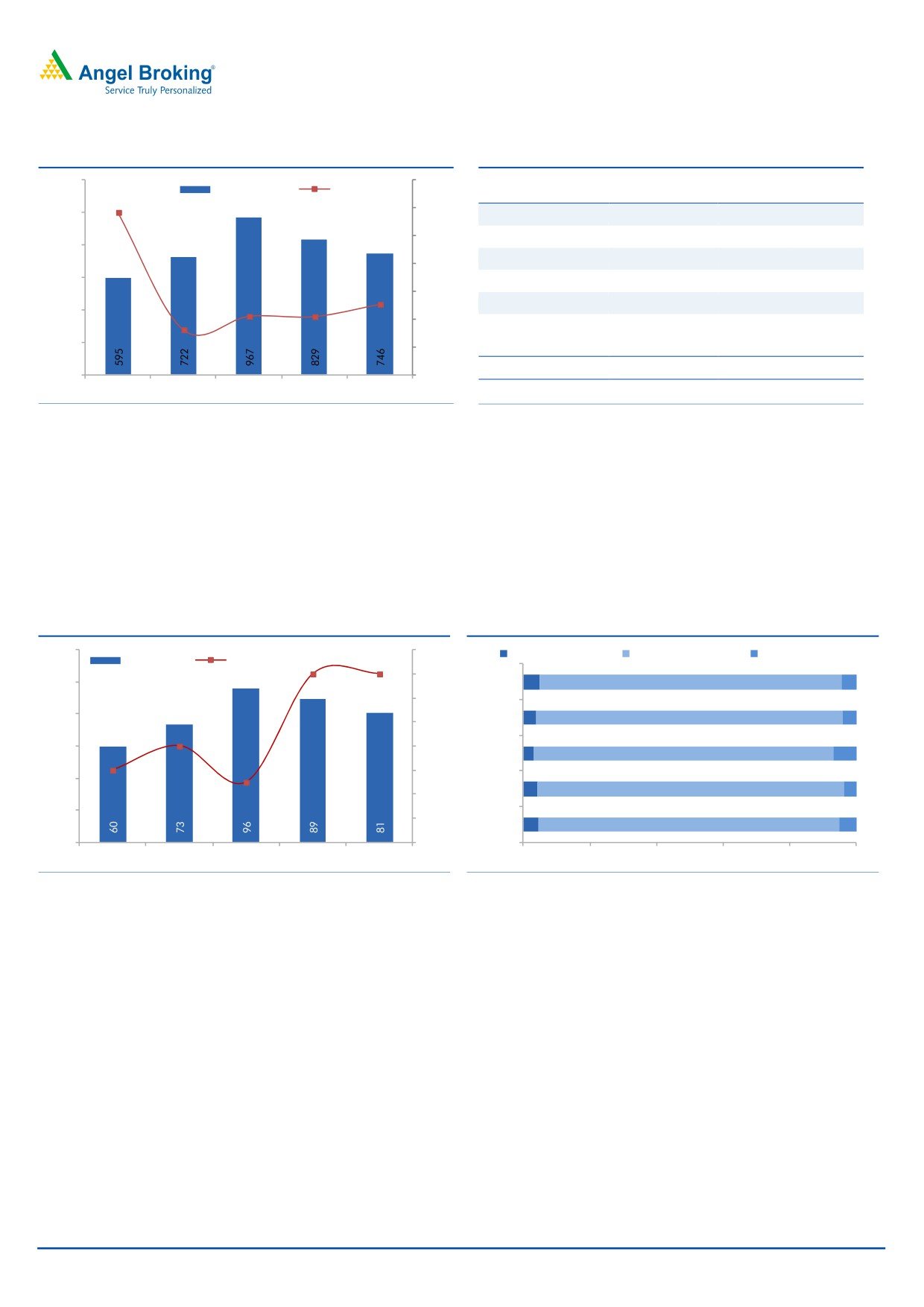

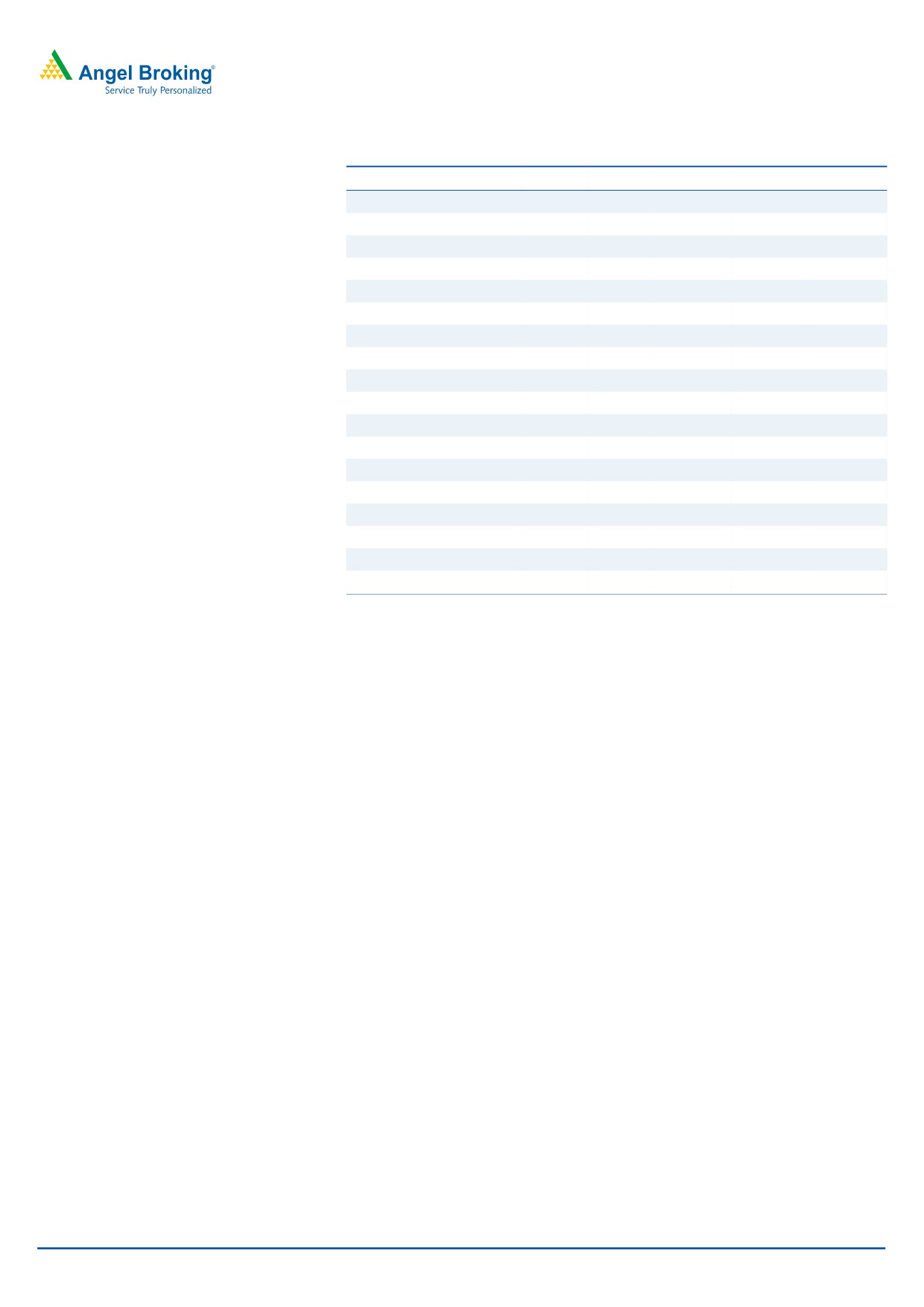

Lower Interest costs aid PAT growth

In line with strong growth seen across EBITDA level, SEL reported a sharp 158.4%

yoy increase in the quarter’s PAT numbers. During the quarter, SEL wrote-off dues

receivable from Ocean Bright Corporation, against sale of assets to the tune of

`11.7cr. On adjusting for this one-time exceptional transaction, SEL reported Adj.

PAT of `38cr, which is up 274.7% on a yoy basis. The Adj. PAT margin of the

company expanded from 1.7% in 2QFY2015 to 5.1% in 2QFY2016. Adj. PAT also

benefitted from a 20.4% yoy decline in interest expenses to `18cr. Decline in yoy

interest expenses is owing to reduction in overall debt from `1,121cr in 2QFY2015

to `975cr in 2QFY2016.

November 10, 2015

3

Sadbhav Engineering | 2QFY2016 Result Update

Exhibit 7: D/E ratio at 0.7x

Exhibit 8: PAT% also expands

1,200

1.2

45

6.0

Debt o/s (` cr)

D/E (x)

Adj. PAT (` cr)

Adj. PAT %

5.1

1.1

40

1,000

5.0

35

5.2

4.0

1.1

1.0

4.8

800

30

4.0

1.0

0.9

0.9

25

600

0.8

3.0

20

0.7

400

15

1.7

2.0

0.7

0.7

0.6

10

200

1.0

0.5

5

0

0.4

0

0.0

2QFY14

4QFY14

2QFY15

4QFY15

2QFY16

4QFY14

1QFY15

4QFY15

1QFY16

2QFY16

Source: Company, Angel Research

Source: Company, Angel Research

Company to gain from recent order inflow…

In FY2015 SEL reported an order inflow of `2,229cr, majorly from the Road EPC

projects (worth `1,084cr). In 1HFY2016 SEL won projects worth `2,684cr, entirely

from the Road EPC space.

Exhibit 9: Details of Order Inflows during 1HFY2016

Project Detail

Segment

Length (kms)

TPC (` cr)

Duration

6-lane Eastern peripheral Expressway

Road EPC

21

792

2.5 yrs

6-lane Eastern peripheral Expressway

Road EPC

25

756

2.5 yrs

6-lane of UP/ Haryana border-Yamunanagar-Saha-Barwala-Panchkula

Road EPC

45

468

2.5 yrs

6-lane of UP/ Haryana border-Yamunanagar-Saha-Barwala-Panchkula

Road EPC

42

437

2.5 yrs

4-lane of Tapa-Bathinda (SEL stake-51%)

Road EPC

41

231

2.5 yrs

Total (5 Road Projects)

173

2,684

Source: Company, Angel Research

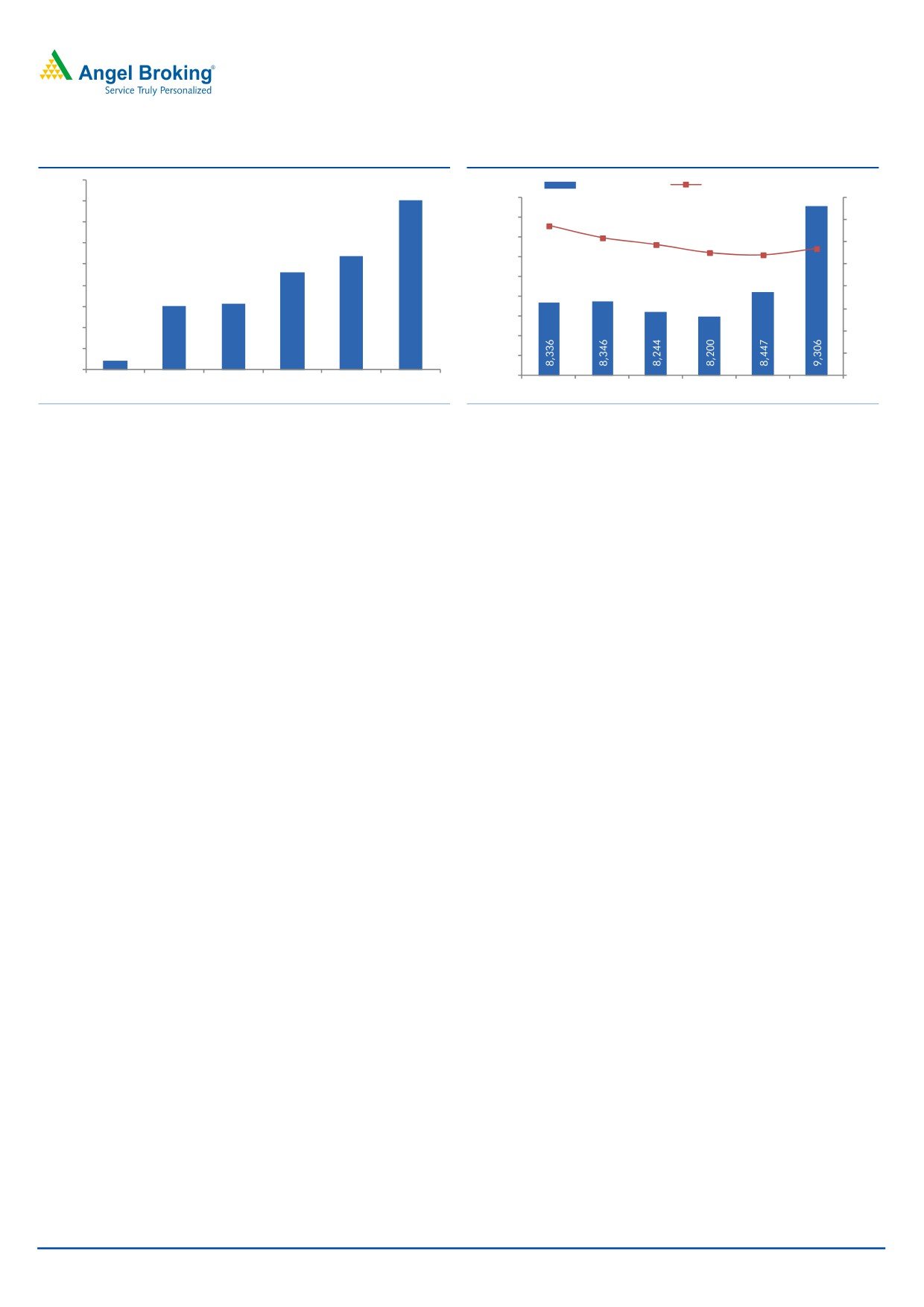

SEL’s unexecuted order book as of 2QFY2016 stands at ~`9,306cr (order book to

LTM sales ratio at 2.9x). The Roads & Highways vertical (58%) continues to

dominate SEL’s order book mix.

The Management expects uptick in NHAI & MoRTH’s award activity in 2HFY2016.

SEL expects to participate in 28 tenders worth `1,800cr which are from Himachal

Pradesh, Punjab, Uttar Pradesh, and Madhya Pradesh. Tenders for these projects

are to be opened up in the next 3-6 months. SEL is pre-qualified for NHAI based

projects to the tune of `2,650cr.

SEL’s Management indicated that 2 large ticket multi-year MDO orders worth

`35,000cr from the Mining space, would come-up for awarding.

Considering the emerging bid-pipeline, the Management maintained optimism

that it would win orders to the tune of `5,000cr. Accordingly, we have built order

inflow assumption of `4,550/5,830cr for FY2016/FY2017E, respectively. With

surge in the order inflows, we expect uptick in the execution cycle as well.

November 10, 2015

4

Sadbhav Engineering | 2QFY2016 Result Update

Exhibit 10: Quarterly Order Inflows (` cr)

Exhibit 11: Order Book (OB/ LTM sales at 2.9x)

1,800

Order Book (` cr)

OB/LTM sales (x)

1,608

9,400

4.0

1,600

3.4

1,400

9,200

3.1

3.5

2.9

2.9

9,000

2.8

2.7

1,200

1,076

3.0

923

8,800

1,000

2.5

8,600

800

2.0

605

620

8,400

600

1.5

8,200

400

1.0

8,000

200

81

7,800

0.5

0

7,600

0.0

1QFY2015

2QFY2015

3QFY2015

4QFY2015

1QFY2016

2QFY2016

1QFY2015 2QFY2015 3QFY2015 4QFY2015 1QFY2016 2QFY2016

Source: Company, Angel Research

Source: Company, Angel Research

Outlook and Valuation

Considering recent order wins and strong 1HFY2016 execution, we model revenue

estimates of `3,481cr/`4,219cr for FY2016E/ FY2017E, respectively. Given the

low competitive intensity for recently won Road EPC projects, and cool-down in

bitumen and aggregate prices (as captive BOT projects have fixed price contracts),

we expect EBITDA margins to expand by 53bps during FY2015-17E to 10.8%.

Further, we have modeled conservative other income numbers and low tax rate for

FY2016/2017E at `13cr/14cr and 24%, respectively. Accordingly, we expect SEL’s

PAT margins to expand by 109bp during FY2015-17E to 5.1%.

We value SEL using Sum-Of-The-Parts method. SEL’s EPC business (under

standalone entity) has been valued using FY2017E P/E multiple, whereas we have

used Free Cash flow to Equity holders method to value BOT Road projects, which

are held under SIPL, the holding company for BOT Road projects.

Value of Core EPC business

Considering better visibility on SEL’s core EPC business (standalone entity), we

have valued the standalone entity on P/E multiple of 15.0x its FY2017E EPS of

`12.4cr, resulting in a value of `187 per share.

Value of BOT projects

We have used Free Cash flow to Equity holders method to value BOT Road

projects, which are held under SIPL, the holding company for BOT Road projects.

Our value for SIPL’s portfolio of BOT projects comes to `141/share, which is 43%

of the overall SOTP value for the company.

On combining the value of EPC business and BOT projects, we arrive at a

combined business value of `328/share, reflecting limited upside in the stock price

from the current levels. Accordingly, we maintain Neutral rating on the stock.

November 10, 2015

5

Sadbhav Engineering | 2QFY2016 Result Update

Exhibit 12: SOTP break-up

FY17E Std.

Target

Target

Value/

% of

Particulars

Segment

Basis

PAT (` cr)

Multiple

Value (` cr)

share (`)

SoTP

EPC business

Construction

213

15.0

3,202

187

57

P/E of 15.0x

Total

3,202

187

57

Disounted

Subsidiary

Adj. FCFE

Value/

% of

Subsidiary

Segment

Basis

FCFE (` cr)

Stake

Value (` cr)

share (`)

SoTP

Sadbhav Infra. Projects

BOT Projects

3,506

69%

2,425

141

43

FCFE valuation

Total

3,506

2,425

141

43

Grand Total

5,627

328

100

Upside

5%

CMP

312

Source: Company, Angel Research

Risks & Concerns

Any slowdown in orders from NHAI / State governments could affect the

company’s order inflow adversely.

Delays in the commencement of BOT projects than the estimated time-line.

November 10, 2015

6

Sadbhav Engineering | 2QFY2016 Result Update

Investment arguments

Strong Order Backlog: Sadbhav in FY2015/ 1HFY2016 has reported order wins to

the tune of `2,229cr/`2,684cr. Notably, all these EPC order wins have been from

Captive as well as Non-Captive Road works, Irrigation and Mining works projects.

At 2QFY2016-end, Sadbhav was sitting on healthy order book of `9,306cr (2.9x

order book to LTM ratio). We expect the awarding activity from NHAI & MoRTH to

further gain momentum and SEL to emerge as a strong beneficiary. Accordingly,

we model 1.3x growth in order backlog from `8,200cr in FY2015 to `10,880cr by

FY2017E.

Order Backlog gives strong revenue visibility: As of 2QFY2016-end, SEL was sitting

on a strong order book of `9,306cr. Considering their diligent bidding strategy,

and past execution track record, we are comforted that the project execution

momentum at the company level would further gain from the current levels.

Accordingly, we expect Sadbhav to report a strong 19.2% top-line CAGR during

FY2015-17E.

Strong execution to further drive PAT growth: At the back-drop of strong execution,

benign bitumen costs and other operating levers coming into play, we expect SEL

to report 22.2% EBITDA CAGR during FY2015-17E. In-line with EBITDA growth,

we expect SEL to report 34.5% PAT CAGR during FY2015-17E.

Sound balance sheet: SEL has a sound balance sheet with parent net debt/equity

of 0.6x as of 1HFY2016. The company’s working capital position (Working Capital

to LTM sales ratio as of 1HFY2016 stands at 20.9%) is also much better than its

peers. This has helped the company maintain strong earnings growth up to a

certain extent.

Funds tied up for SIPL projects in the portfolio: SEL had successfully raised `400cr

through 22% stake dilution in its subsidiary, Sadbhav Infrastructure Projects Ltd.

(SIPL) in Aug-2010. Further, in Sep-2015, SIPL got listed on the Indian bourses,

where it raised equity for its last pending project Shreenathji-Udaipur (SUTPL). Now,

SIPL is fully tied-up for all of its BOT projects in-hand. The timely fund raising

exercise at regular intervals have helped the company focus on project execution,

thereby, leading to early completion of projects.

Company background

SEL was incorporated in 1988. The company is a leading EPC and infrastructure

development company based in Ahmedabad. SEL is present in the Roads and

Highways (69.7% of order book), Irrigation (14.7%) and Mining (15.2%) sectors.

The company forayed into the road sector in 1995 and has since then executed

several projects for NHAI and state governments. Currently, SEL through its

subsidiary SIPL is one of the largest BOT players in India with 12 projects in its

portfolio.

November 10, 2015

7

Sadbhav Engineering | 2QFY2016 Result Update

Profit & loss statement (Standalone)

Y/E March (` cr)

FY13

FY14

FY15

FY16E

FY17E

Net Sales

1,811

2,358

2,970

3,481

4,219

% Chg

(32.3)

30.2

25.9

17.2

21.2

Total Expenditure

1,655

2,109

2,665

3,110

3,764

Construction Expenses

1,520

1,945

2,432

2,854

3,455

Employee benefits Expense

43

60

97

113

136

Other Expenses

93

104

136

143

173

EBITDA

156

249

304

371

455

% Chg

(46.3)

60.1

22.1

21.8

22.7

EBIDTA %

8.6

10.6

10.3

10.7

10.8

Depreciation

32

47

82

89

98

EBIT

124

202

223

282

357

% Chg

(51.0)

63.0

10.3

26.5

26.6

Interest and Financial Charges

84

93

89

88

90

Other Income

10

11

16

13

14

PBT

50

120

150

207

281

Tax

37

(24)

32

50

67

% of PBT

73.7

(20.1)

21.4

24.0

24.0

PAT before Exceptional item

13

145

118

157

213

Exceptional item

0

0

0

12

0

PAT

13

145

118

145

213

% Chg

(47.3)

1000.3

(18.4)

23.2

46.9

PAT %

0.7

6.1

4.0

4.2

5.1

Diluted EPS

5

7

7

8

12

% Chg

(47.7)

43.3

3.4

16.8

46.9

November 10, 2015

8

Sadbhav Engineering | 2QFY2016 Result Update

Balance sheet (Standalone)

Y/E March (` cr)

FY13

FY14

FY15

FY16E

FY17E

Sources of Funds

Equity Capital

15

15

17

17

17

Reserves Total

817

942

1,335

1,464

1,659

Networth

833

957

1,352

1,481

1,677

Total Debt

673

863

938

978

1,033

Other Long-term Liabilities

80

52

34

49

51

Deferred Tax Liability

32

36

24

24

24

Total Liabilities

1,618

1,908

2,348

2,532

2,785

Application of Funds

Gross Block

515

726

851

929

1,018

Accumulated Depreciation

185

228

315

404

502

Net Block

330

498

536

524

516

Capital WIP

0

0

0

0

0

Investments

538

521

531

646

741

Current Assets

Inventories

102

164

213

242

279

Sundry Debtors

736

732

907

1,102

1,348

Cash and Bank Balance

22

76

35

57

88

Loans, Advances & Deposits

535

489

651

745

867

Other Current Asset

33

46

64

68

70

Current Liabilities

873

1,120

1,177

1,392

1,641

Net Current Assets

555

387

693

821

1,011

Other Assets

194

502

588

541

517

Total Assets

1,618

1,908

2,348

2,532

2,785

November 10, 2015

9

Sadbhav Engineering | 2QFY2016 Result Update

Cash flow statement (Standalone)

Y/E March (` cr)

FY13

FY14

FY15E

FY16E

FY17E

Profit before tax

74

106

114

145

213

Depreciation

32

47

82

89

98

Change in Working Capital

(107)

312

(296)

44

(154)

Interest & Financial Charges

84

118

138

88

90

Direct taxes paid

(49)

(49)

(59)

(50)

(67)

Other Non-Cash Charges

32

(11)

(15)

(3)

(1)

Cash Flow from Operations

66

524

(37)

314

178

(Inc)/ Dec in Fixed Assets

(70)

(218)

(149)

(78)

(90)

(Inc)/ Dec in Inv. & Oth. Adj.

(263)

(349)

(103)

(150)

(9)

Cash Flow from Investing

(332)

(568)

(252)

(228)

(98)

Issue/ (Buy Back) of Equity

3

27

315

0

0

Inc./ (Dec.) in Loans

310

258

66

40

55

Dividend Paid (Incl. Tax)

(10)

(11)

(12)

(16)

(18)

Interest Expenses

(84)

(118)

(132)

(88)

(90)

Cash Flow from Financing

218

157

237

(64)

(53)

Inc./(Dec.) in Cash

(48)

113

(52)

22

27

Opening Cash balances

55

6

58

6

28

Closing Cash balances

6

120

6

28

56

November 10, 2015

10

Sadbhav Engineering | 2QFY2016 Result Update

Key Ratios

Y/E March

FY13

FY14

FY15E FY16E FY17E

Valuation Ratio (x)

P/E (on FDEPS)

62.1

43.4

41.9

35.9

24.4

P/CEPS

102.8

24.1

26.7

22.3

16.7

Dividend yield (%)

0.2

0.2

0.2

0.3

0.3

EV/Sales

2.9

2.3

2.1

1.8

1.5

EV/EBITDA

33.7

21.6

20.4

16.5

13.5

EV / Total Assets

3.2

2.8

2.6

2.4

2.2

Per Share Data (`)

EPS (fully diluted)

0.9

9.5

7.3

8.5

12.4

Cash EPS

3.0

12.6

11.4

13.7

18.2

DPS

0.6

0.7

0.7

0.8

0.9

Book Value

55

63

79

86

98

Returns (%)

RoCE (Pre-tax)

9.0

12.0

10.3

12.1

0.0

Angel RoIC (Pre-tax)

10.5

13.4

11.9

12.8

0.0

RoE

9.3

11.9

9.9

10.3

13.5

Turnover ratios (x)

Asset Turnover (Gross Block) (X)

5.9

5.7

5.7

6.6

8.1

Inventory / Sales (days)

19

21

23

24

23

Receivables (days)

150

114

101

105

106

Payables (days)

176

154

141

135

131

November 10, 2015

11

Sadbhav Engineering | 2QFY2016 Result Update

Research Team Tel: 022 - 39357800

DISCLAIMER

Angel Broking Private Limited (hereinafter referred to as “Angel”) is a registered Member of National Stock Exchange of India Limited,

Bombay Stock Exchange Limited and Metropolitan Stock Exchange of India Limited. It is also registered as a Depository Participant with

CDSL and Portfolio Manager with SEBI. It also has registration with AMFI as a Mutual Fund Distributor. Angel Broking Private Limited is

a registered entity with SEBI for Research Analyst in terms of SEBI (Research Analyst) Regulations, 2014 vide registration number

INH000000164. Angel or its associates has not been debarred/ suspended by SEBI or any other regulatory authority for accessing

/dealing in securities Market. Angel or its associates including its relatives/analyst do not hold any financial interest/beneficial

ownership of more than 1% in the company covered by Analyst. Angel or its associates/analyst has not received any compensation /

managed or co-managed public offering of securities of the company covered by Analyst during the past twelve months. Angel/analyst

has not served as an officer, director or employee of company covered by Analyst and has not been engaged in market making activity

of the company covered by Analyst.

This document is solely for the personal information of the recipient, and must not be singularly used as the basis of any investment

decision. Nothing in this document should be construed as investment or financial advice. Each recipient of this document should

make such investigations as they deem necessary to arrive at an independent evaluation of an investment in the securities of the

companies referred to in this document (including the merits and risks involved), and should consult their own advisors to determine

the merits and risks of such an investment.

Reports based on technical and derivative analysis center on studying charts of a stock's price movement, outstanding positions and

trading volume, as opposed to focusing on a company's fundamentals and, as such, may not match with a report on a company's

fundamentals.

The information in this document has been printed on the basis of publicly available information, internal data and other reliable

sources believed to be true, but we do not represent that it is accurate or complete and it should not be relied on as such, as this

document is for general guidance only. Angel Broking Pvt. Limited or any of its affiliates/ group companies shall not be in any way

responsible for any loss or damage that may arise to any person from any inadvertent error in the information contained in this report.

Angel Broking Pvt. Limited has not independently verified all the information contained within this document. Accordingly, we cannot

testify, nor make any representation or warranty, express or implied, to the accuracy, contents or data contained within this document.

While Angel Broking Pvt. Limited endeavors to update on a reasonable basis the information discussed in this material, there may be

regulatory, compliance, or other reasons that prevent us from doing so.

This document is being supplied to you solely for your information, and its contents, information or data may not be reproduced,

redistributed or passed on, directly or indirectly.

Neither Angel Broking Pvt. Limited, nor its directors, employees or affiliates shall be liable for any loss or damage that may arise from

or in connection with the use of this information.

Note: Please refer to the important ‘Stock Holding Disclosure' report on the Angel website (Research Section). Also, please refer to the

latest update on respective stocks for the disclosure status in respect of those stocks. Angel Broking Pvt. Limited and its affiliates may

have investment positions in the stocks recommended in this report.

Disclosure of Interest Statement

Sadbhav Engg

1. Analyst ownership of the stock

No

2. Angel and its Group companies ownership of the stock

No

3. Angel and its Group companies' Directors ownership of the stock

No

4. Broking relationship with company covered

No

Note: We have not considered any Exposure below ` 1 lakh for Angel, its Group companies and Directors.

Ratings (Based on expected returns

Buy (> 15%)

Accumulate (5% to 15%)

Neutral (-5 to 5%)

over 12 months investment period):

Reduce (-5% to -15%)

Sell (< -15)

November 10, 2015

12