Initiating Coverage | HFC

March 3, 2017

REPCO Home Finance

BUY

CMP

`642

Reaping the benefits of serving the underserved

Target Price

`825

REPCO Home Finance is a midsized Housing Finance Company (HFC), with

Investment Period

12 Months

focus on the underserved self-employed segment. While the current operations of

the company are predominately concentrated in Southern market

(90%), the

Stock Info

management intends to gradually venture into other geographies over the next 5 years.

Sector

Housing Finance

Focus on underpenetrated non salaried segment and LAP - the key growth

Market Cap (` cr)

4,016

driver: REPCO has developed an expertise in handling the non salaried

Beta

1.0

segment. Volatile cash flows make this segment less focused by banks, and

hence, there is limited competition, taking this as an opportunity, REPCO has

52 Week High / Low

891/500

expanded aggressively on it and the company’s share of revenue from the non

Avg. Daily Volume

21,790

salaried segment has gone up to 60% currently from 45% in FY12. LAP segment has

Face Value (`)

10

been another growth driver reporting 40% CAGR in loan book over FY2012-16 and

BSE Sensex

28,832

its share in the total business has gone up to 20% in FY2016 from 14% in FY12.

Nifty

8,898

LTV in-line with industry, while lower average ticket size indicates volume driven

Reuters Code

RHFL.BO

growth: REPCO has LTV of 62% for its overall loan book, while that of Home

Bloomberg Code

REPCO@IN

Loans is ~75%; it has a conservative approach towards LAP, as its LTV is 50%.

The average ticket size of REPCO stands at `13 lakhs and this is relatively lower

than other HFCs, also the management intends to grow in volume, rather than

Shareholding Pattern (%)

growing its ticket size.

Promoters

37.1

Scope for reduction in cost of funds, should aid in maintaining margins in a

MF / Banks / Indian Fls

27.2

declining interest rate environment: Bank borrowing still accounts for ~63% of

FII / NRIs / OCBs

25.61

the source of funding, and hence, REPCO’s cost of funds is still higher than other

Indian Public / Others

10.0

HFCs. Incrementally higher borrowing from money market instruments should

offset any decline in yield on loans, and thereby protect the NIM.

Expect 23% loan growth, resulting in 26% earnings growth over FY2016-19E,

Abs.(%)

3m 1yr 3yr

backed by moderate credit cost: Post a moderation in growth was witnessed and

Sensex

10.9

23.4

39.6

hence, we expect REPCO to deliver 23% growth in loans, however, moderation

in cost structure and normalized credit cost should result in PAT CAGR of 26%

Repco

13.9

14.1

98.2

over FY2016-19E. REPCO has witnessed some increased stress on the asset

quality in the last few quarters. GNPAs went up from 1.3% in FY2016 to 2.65%

3-year price chart

in 3QFY2017, due to the stress in the non salaried and LAP segment owing to

1,000

volatile cash flows at the end of customers. However, the management remains

800

fairly confident of bouncing back to its GNPA level of 1.5% in the medium term.

600

Outlook and valuation: The target segment of REPCO is highly underserved and

this offers a growth potential for many years going ahead. Unlevered balance

400

sheet and stable NIM coupled with controlled credit cost should result in 26%

200

earnings CAGR over FY2016-19E. At the CMP the stock is trading at 2.7x it

FY2019 ABV. We have valued the stock at

3.5x its FY2019E ABV and

0

Recommend BUY with a Target Price of `825 over the next 12 months.

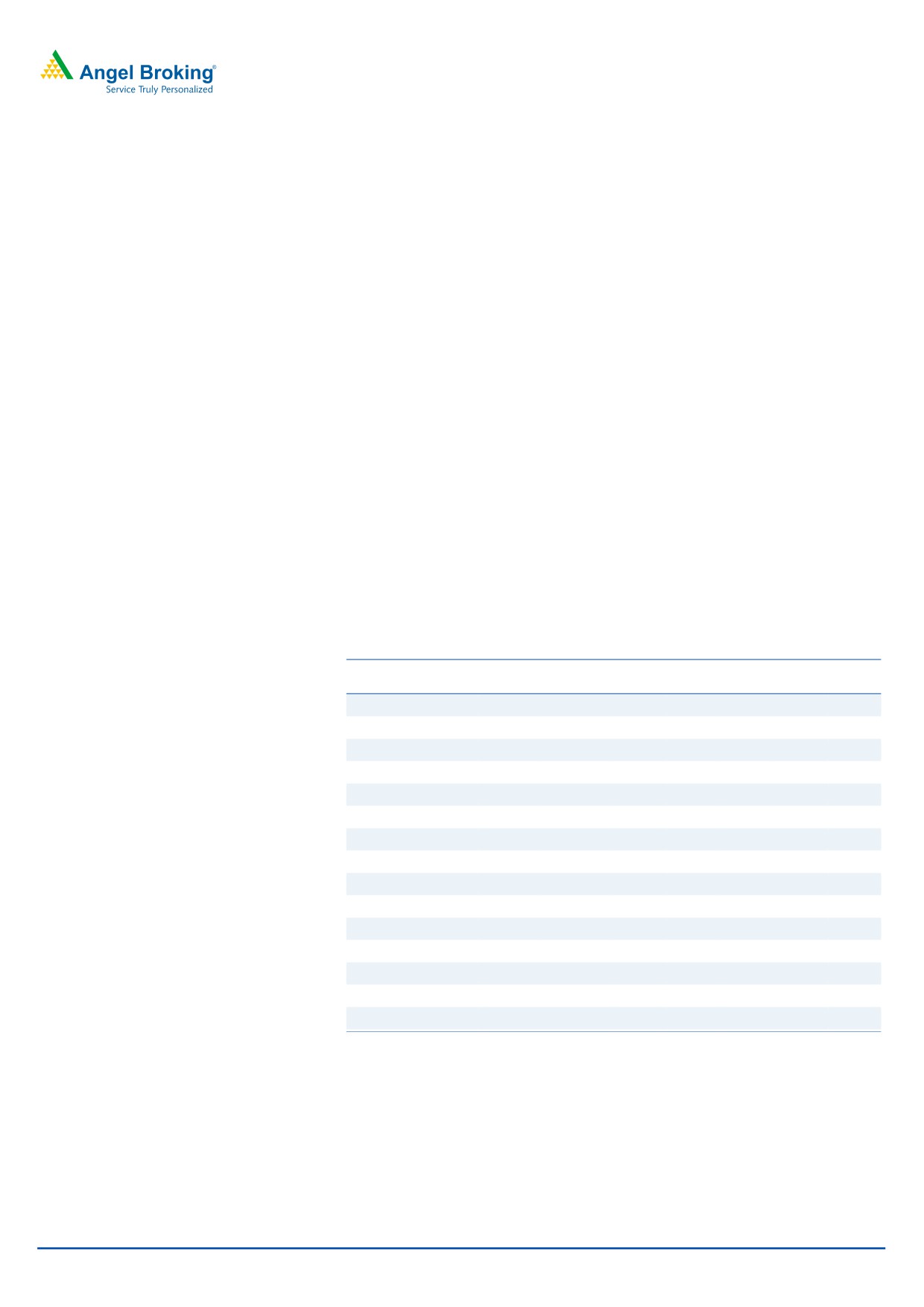

Key financials (Standalone)

Y/E March (` cr)

FY2015

FY2016

FY2017E

FY2018E

FY2019E

Source: Company, Angel Research

NII

237

304

388

457

551

% chg

13.3

28.0

27.6

18.0

20.5

Net profit

123

150

188

237

301

% chg

11.8

22.4

24.7

26.5

26.8

NIM (%)

4.4

4.4

4.5

4.4

4.2

EPS (`)

19.7

24.1

30.0

38.0

48.1

P/E (x)

32.6

26.7

21.4

16.9

13.4

P/ABV (x)

5.1

4.4

4.1

3.4

2.7

Siddharth Purohit

RoA (%)

2.5

2.4

2.4

2.5

2.6

022 - 3935 7800 Ext: 6828

RoE (%)

15.9

17.0

18.0

19.2

20.3

Source: Company, Angel Research; Note: CMP as of March 3, 2017

Please refer to important disclosures at the end of this report

1

REPCO Home | Initiating Coverage

Focus on high growing underpenetrated non salaried

segment

The non salaried segment is perceived to be a risky segment as far as lending is

concerned since their cash flows can be volatile, and hence, banks and some of

the large HFCs do not pursue this set of customers very aggressively. However,

over the years REPCO has developed a strong expertise in handling this segment.

Accordingly, the company’s share of revenue from the non salaried segment has

gone up to 60% from 45% in FY2012. Within the non salaried segment, the

company has a large focus on small traders. While the traditional home loans

continue to be the main area of business, in order to diversify and generate better

return the company has also expanded its business in the Loan Against Property

segment. Share of LAP in the total segment has gone up to 20% by FY2016 from a

level of 14% in FY2012.

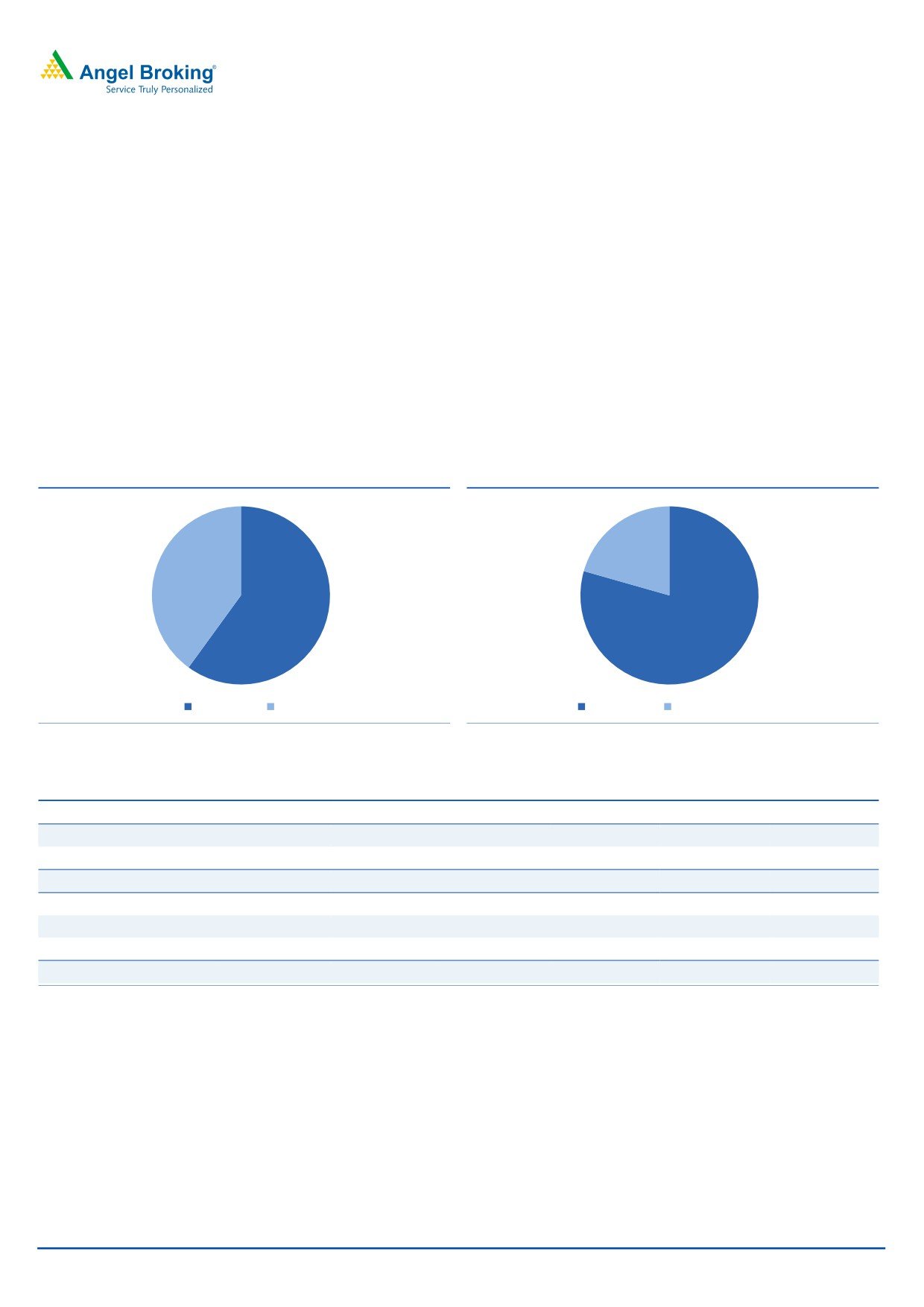

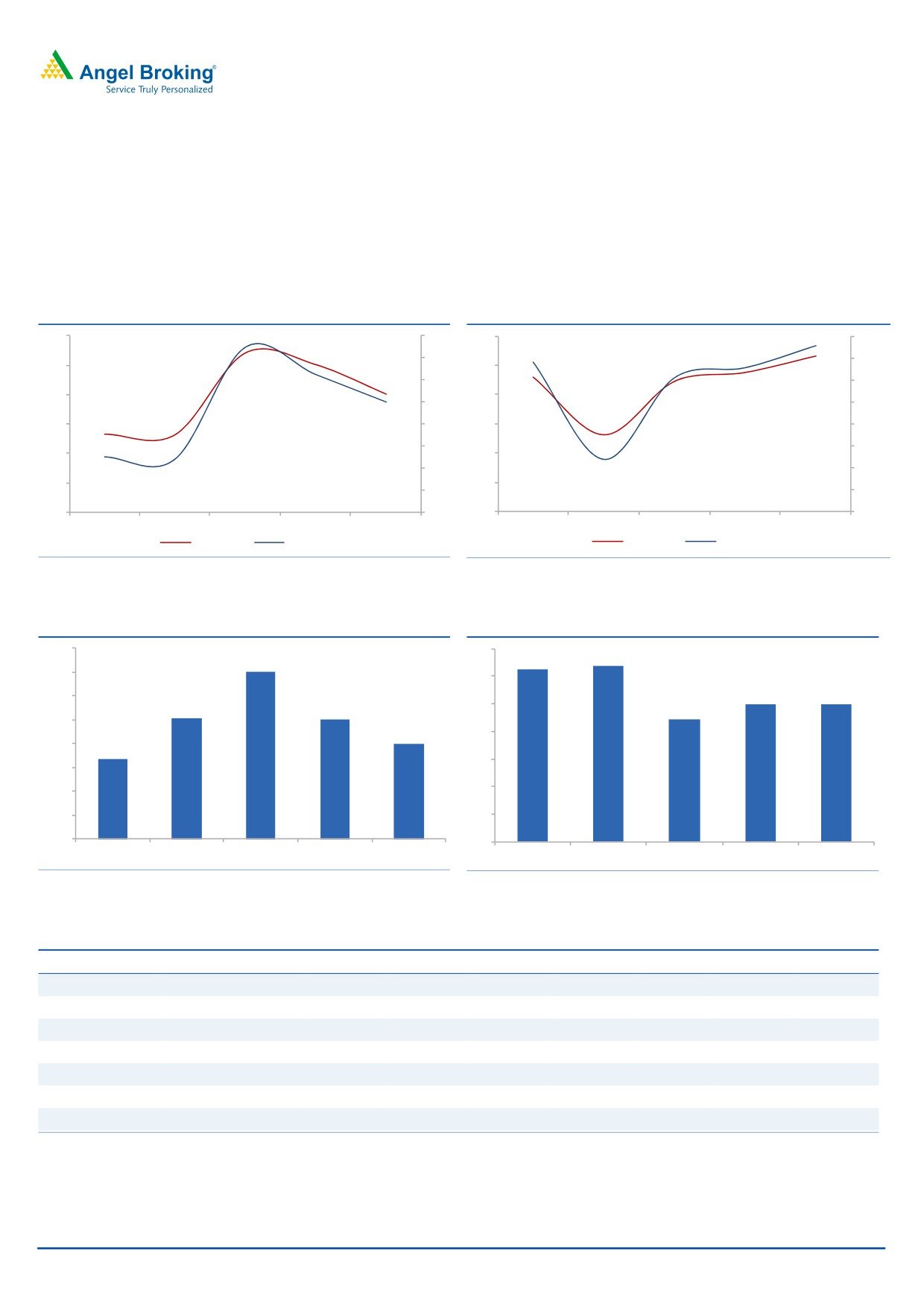

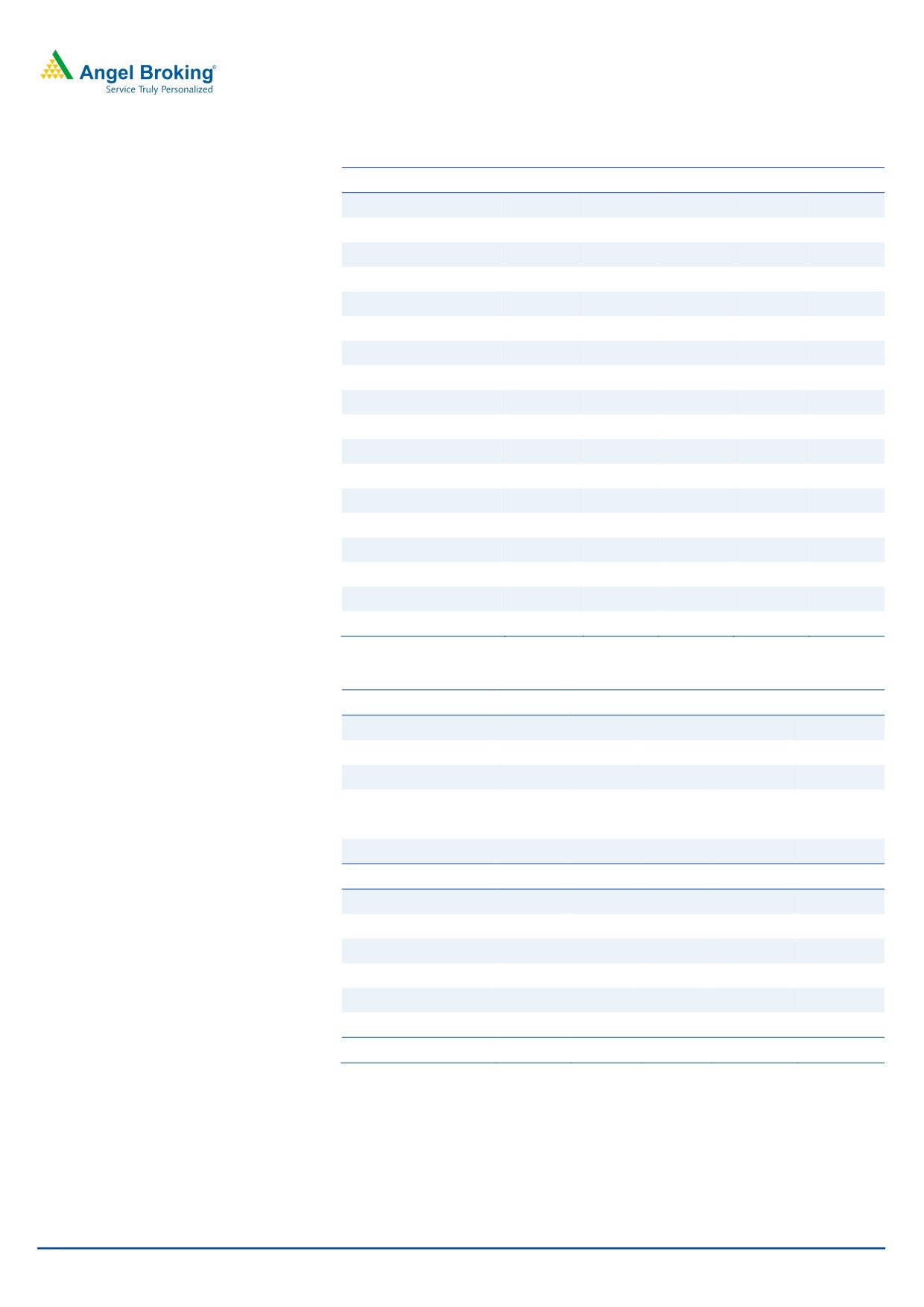

Exhibit 1: Loan Bifurcation Customerwise

Exhibit 2: Loan Bifurcation Productwise

20.6%

40.0%

60.0%

79.4%

Non Salaried

Salaried

Home Loans

Loans Against Property

Source: Company, Angel Research

Source: Company, Angel Research

Exhibit 3: Loan Composition Trend

Loan Composition (% )

FY12

FY13

FY14

FY15

FY16

9mFY17

Non -Salaried

53.5

53.1

55.0

56.8

58.8

60.0

Salaried

46.5

46.9

45.0

43.2

41.2

40.0

Total

100.0

100.0

100.0

100.0

100.0

100.0

Loan Composition (%)

Home Loans

86.0

85.1

81.3

80.8

80.2

79.4

LAP

14.0

14.9

18.7

19.2

19.8

20.6

Total

100.0

100.0

100.0

100.0

100.0

100.0

Source: Company, Angel Research

March 3, 2017

2

REPCO Home | Initiating Coverage

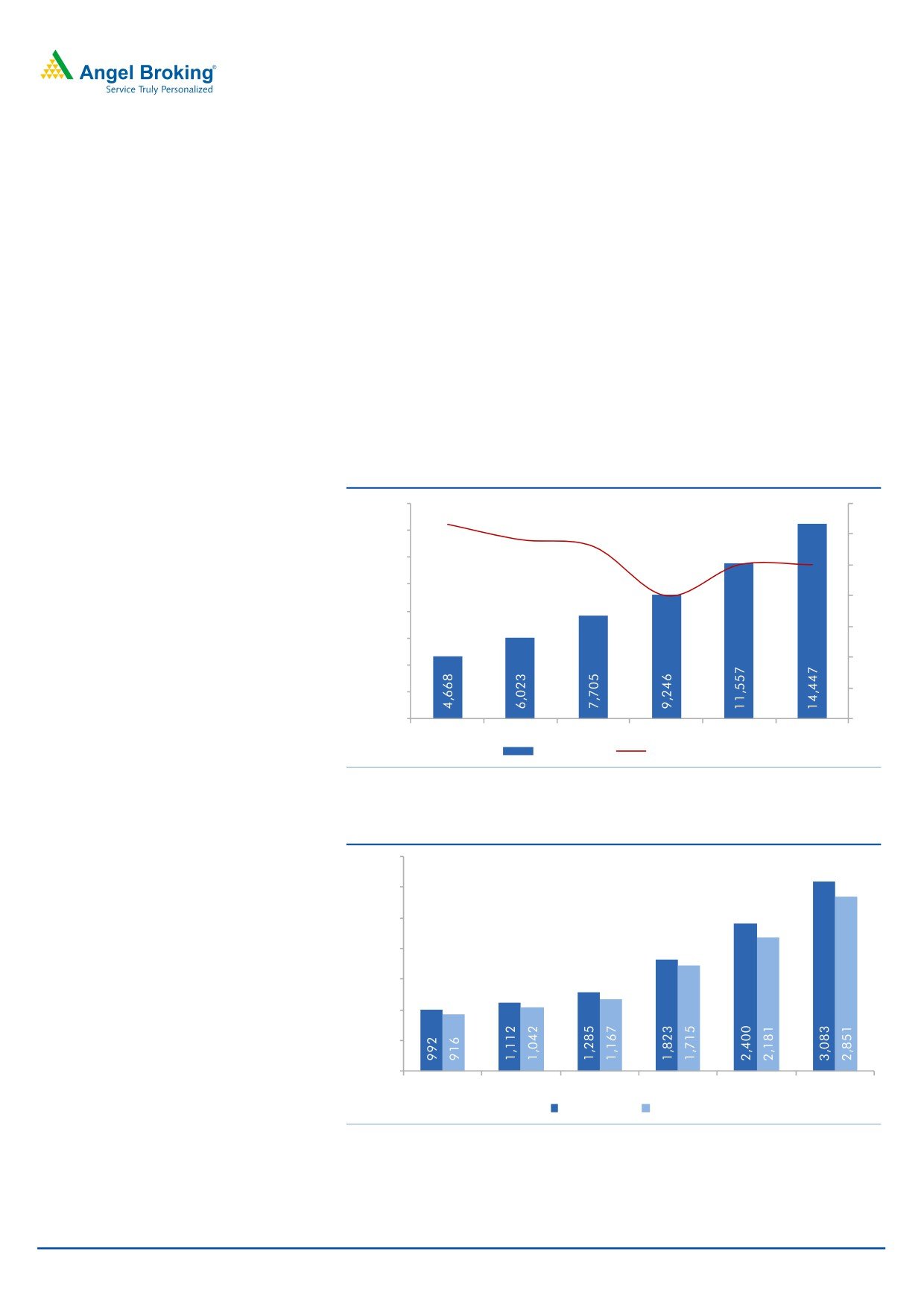

Loan growth to remain decent, albeit with a slower pace as

seen in last two quarters

Over FY2012-16 REPCO has reported a strong 29% CAGR in loan book. While

the Home Loans business has grown at 26%, the LAP business has reported an

impressive 40% CAGR over the same period. Since REPCO has a strong focus on

the non salaried segment, it faces limited competition from other HFCs and Banks.

The competition within the Individual home loans segment has intensified over the

last few months, as banks are flooded with surplus deposits, interest rates have

been slashed aggressively, and hence, the lending to individual segment has

become crowded. This places REPCO in a unique position as it has earned an

expertise in handling the non salaried segment, which is not pursued aggressively

by the large banks. While other HFCs also do have the non salaried segment, still

the focus for them continues to be the salaried class.

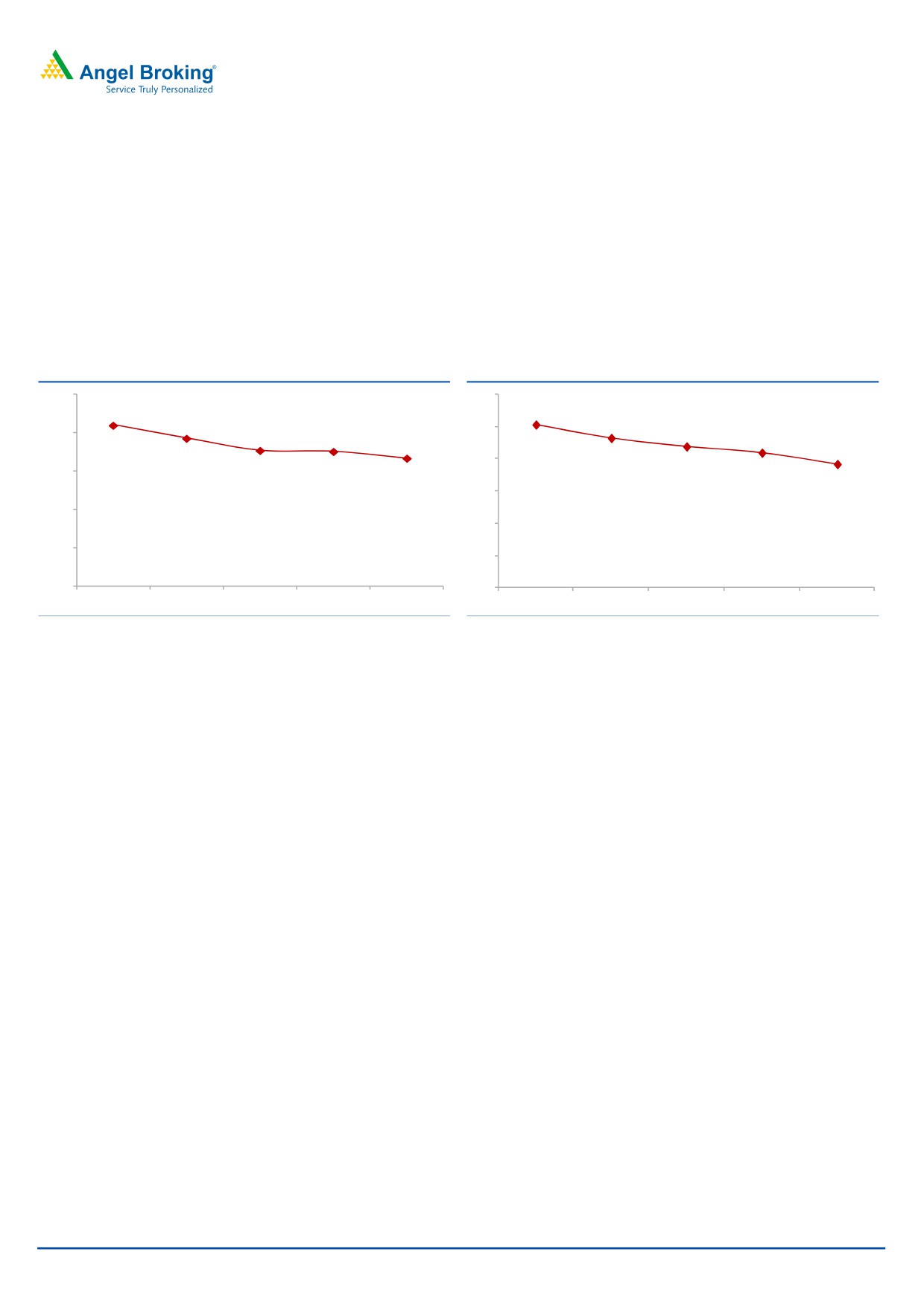

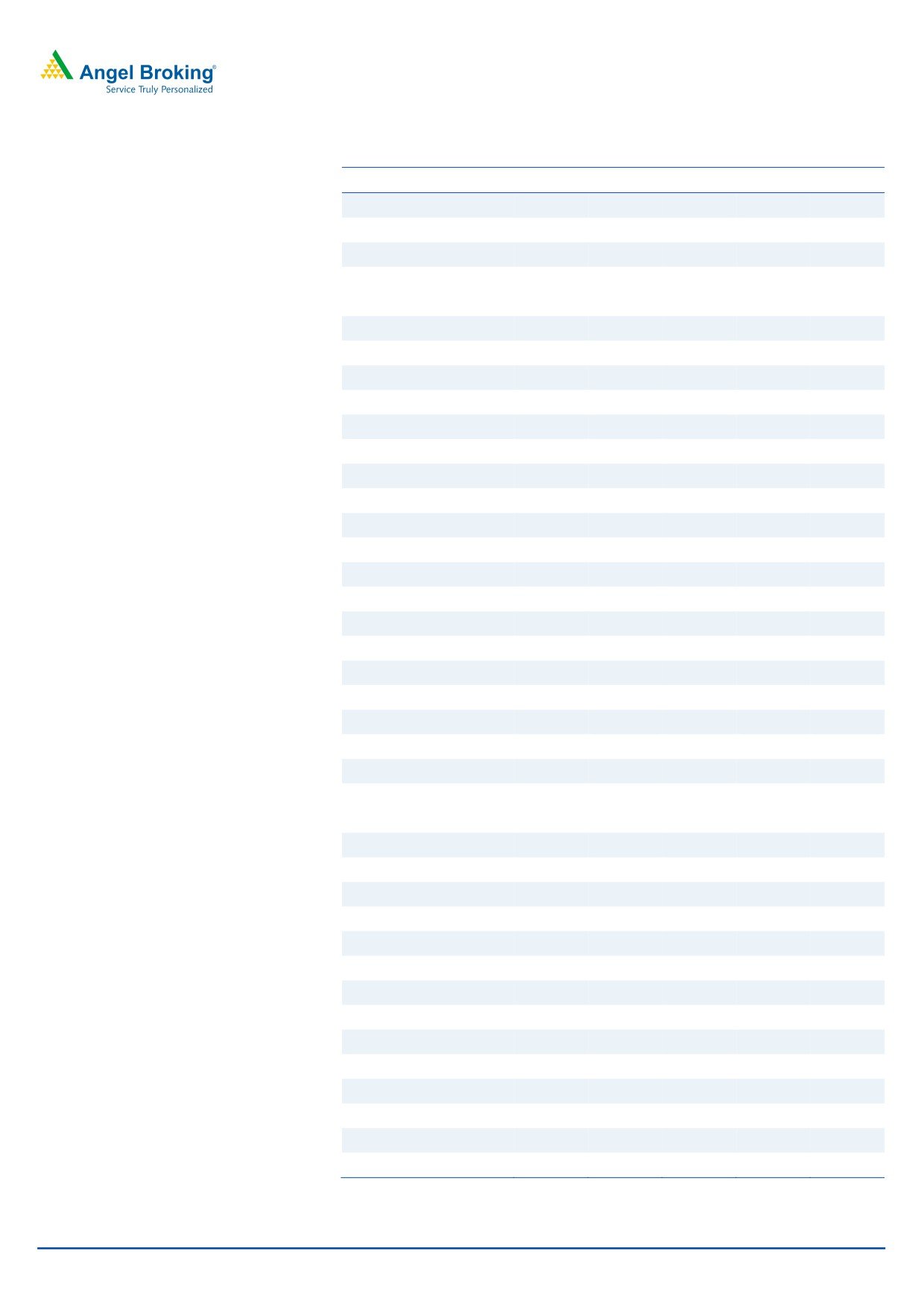

Exhibit 4: Loan book growth has been strong

16,000

35

14,000

30

31.5

12,000

29.0

27.9

25

10,000

25.0

25.0

20

20.0

8,000

15

6,000

10

4,000

2,000

5

-

0

FY14

FY15

FY16

FY17E

FY18E

FY19E

Total Loans

% Growth YoY

Source: Company, Angel Research

Exhibit 5: Sanctions and disbursements (` Cr )

3,500

3,000

2,500

2,000

1,500

1,000

500

-

FY11

FY12

FY13

FY14

FY15

FY16

Sanctions

Disbursments

Source: Company, Angel Research

March 3, 2017

3

REPCO Home | Initiating Coverage

Exhibit 6: Segmental Loan Book Growth

FY12-16

9M

(` Cr)

FY12

FY13

FY14

FY15

FY16

9mFY16

9mFY17

CAGR (%)

% YOY

Outstanding Loan Book

2,804

3,545

4,662

6,013

7,691

29

7,154

8,656

21%

% YoY

35

26

32

29

28

Salaried

1,304

1,663

2,098

2,598

3,169

25

3,155

3,462

10

% YoY

28

26

24

22

Non Salaried

1,500

1,882

2,564

3,415

4,522

32

3,999

5,194

30

% YoY

25

36

33

32

Home Loans

2,412

3,017

3,790

4,858

6,168

26

5,774

6,873

19

% YoY

25

26

28

27

LAP

393

528

872

1,154

1,523

40

1,381

1,783

29

% YoY

35

65

32

32

Sanctions

1,112

1,285

1,823

2,400

3,083

29

2,149

2,178

1

% YoY

16

42

32

28

Disbursements

1,042

1,167

1,715

2,181

2,851

29

1,954

1,978

1

% YoY

12

47

27

31

Source: Company, Angel Research

Exhibit 7: Comparative Loan Book (` Cr)

Company

FY11

FY12

FY13

FY14

FY15

FY16

CAGR 5 (%)

LIC Housing

51,400

63,080

77,812

91,341

1,08,361

1,25,173

19.5

DHFL

19,740

28,805

42,163

58,810

78,632

1,02,834

39.1

India Bulls Housing

19,800

27,500

34,400

41,200

52,200

68,700

28.3

PNB Housing

2,899

3,800

5,400

8,600

14,400

25,600

54.6

Gruh Finance

3,176

4,077

5,447

7,020

8,926

11,115

28.5

Can Fin Homes

2,205

2,673

4,030

5,874

8,302

10,753

37.3

Repco Home

2,079

2,804

3,545

4,662

6,013

7,691

29.9

GIC Housing

3,416

3,872

4,539

5,313

6,598

7,912

18.3

Source: Company, Angel Research

March 3, 2017

4

REPCO Home | Initiating Coverage

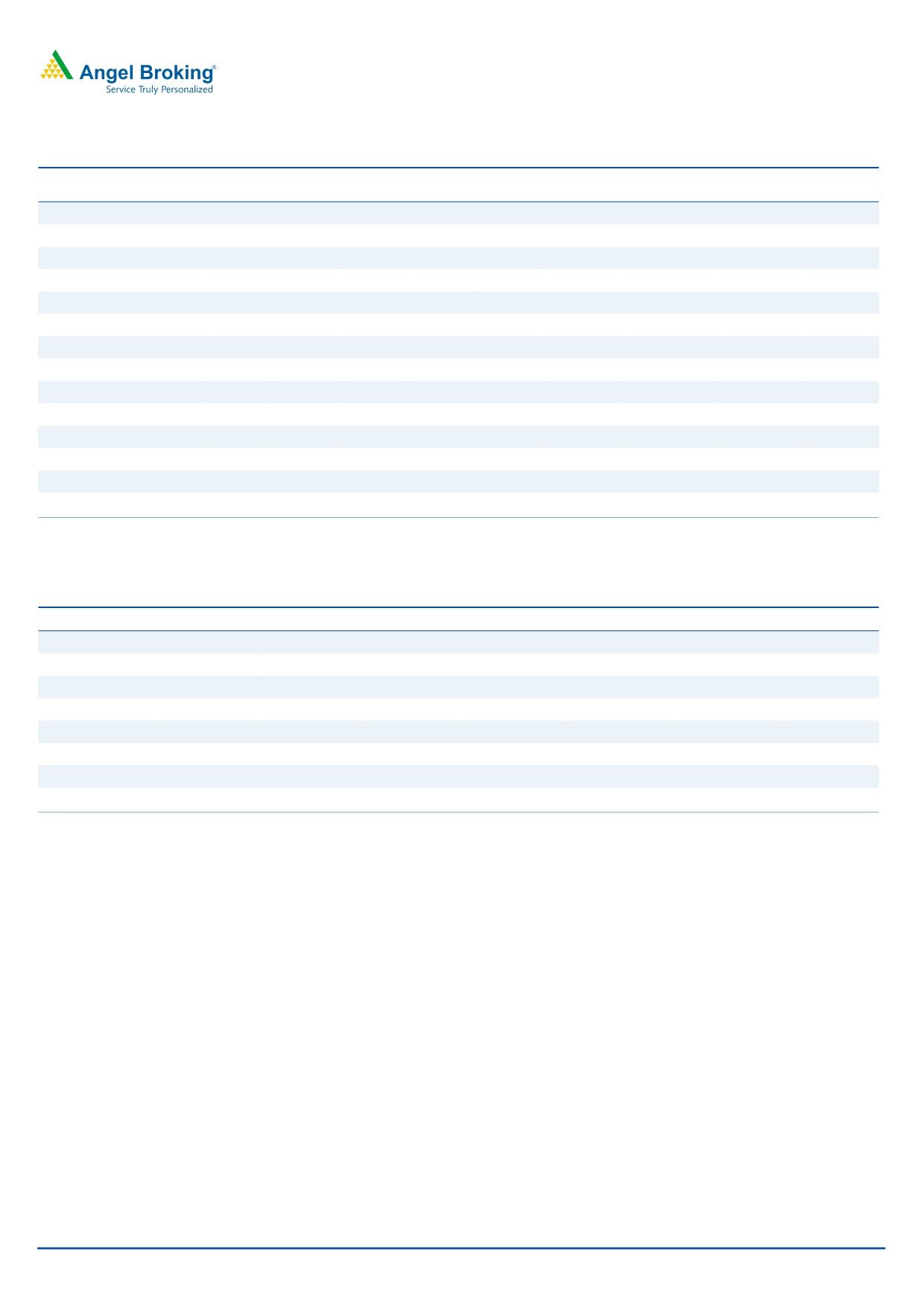

Strong loan growth with stable margins and controlled

credit cost has ensured healthy earnings growth

While lower rates of interest will reduce the yield, simultaneously there has been a

drop in the cost of funds also, and this will ensure a healthy NII growth. NII

reported a CAGR 20.5% over FY2014-16, which is expected to grow by 22% over

FY2016-18E. With moderating operating cost and credit cost PAT should grow by

26% over the same period.

Exhibit 8: NII Growth

Exhibit 9: Other Income Trend

600

35

60.0

30.0

25.7

30

500

50.0

25.0

28.0

27.6

20.0

25

20.0

400

18.0

40.0

20.0

20.5

20

300

30.0

15.0

18.0

15

13.3

200

20.0

10.0

10

100

10.0

5.0

5

23.6

29.7

35.1

42.1

50.5

0

0.0

0

0.0

0.0

FY14

FY15

FY16

FY17E

FY18E

FY19E

FY15

FY16

FY17E

FY18E

FY19E

NII

% Growth YoY

Other Income

% Growth YoY

Source: Company, Angel Research

Source: Company, Angel Research

Exhibit 10: Operating Profit

Exhibit 11: PAT Growth Trend

600

35.0

350

30

30.6

29.2

26.8

30.0

300

500

26.5

25

24.7

25.0

250

22.4

400

20.0

20

21.8

18.3

20.0

200

300

15

15.0

150

11.8

200

10

10.0

100

100

5

5.0

50

0

0.0

0

0

FY15

FY16

FY17E

FY18E

FY19E

FY15

FY16

FY17E

FY18E

FY19E

Operating Profit

% Growth YoY

PAT

% Growth YoY

Source: Company, Angel Research

Source: Company, Angel Research

March 3, 2017

5

REPCO Home | Initiating Coverage

Expect credit cost to moderate after a spike in FY2017: REPCO has witnessed

some increased stress on the asset quality in the last few quarters. GNPAs went up

from 1.3% in FY2016 to 2.65% in 3QFY2017, due to stress in the non salaried

and LAP segment owing to volatile cash flows at the end of customers. However,

the management remains fairly confident of bouncing back to its GNPA levels of

1.5% in the medium term.

Exhibit 12: GNPAs & NNPAs Ratio yearly trend

Exhibit 13: GNPAs & NNPAs Ratio quarterly trend

3.0

1.6

3.0

1.6

2.7

2.65

2.5

1.4

2.37

1.4

2.5

1.5

2.5

2.29

2.22

1.51

2.0

1.2

1.2

1.36

1.31

2.0

1.25

2.0

1.22

1.0

1.0

1.32

1.31

1.0

1.31

1.5

0.8

1.5

0.8

0.6

0.6

1.0

1.0

0.4

0.4

0.5

0.48

0.48

0.5

0.5

0.2

0.2

0.0

0.0

0.0

0.0

FY15

FY16

FY17E

FY18E

FY19E

Q3FY16

Q4FY16

Q1FY17

Q2FY17

Q3FY17

GNPAs %

NNPAs %

GNPAs %

NNPAs %

Source: Company, Angel Research;

Source: Company, Angel Research

Exhibit 14: Credit Cost (%)

Exhibit 15: PCR( %)

0.80

70

62

64

0.70

0.70

60

50

50

0.60

0.50

0.50

50

44

0.50

0.40

40

0.40

0.34

30

0.30

20

0.20

0.10

10

0.00

0

FY15

FY16

FY17E

FY18E

FY19E

FY15

FY16

FY17E

FY18E

FY19E

Source: Company, Angel Research

Source: Company, Angel Research

Exhibit 16: Comparative GNPAs % of Industry

Company

FY12

FY13

FY14

FY15

FY16

Q1FY17

Q2FY17

Q3FY17

Repco Home

1.4

1.5

1.5

1.3

1.3

2.2

2.4

2.7

LIC Housing

0.4

0.6

0.7

0.5

0.5

0.6

0.6

0.6

DHFL

0.8

0.8

0.8

1.0

0.9

1.0

1.0

1.0

India Bulls Housing

0.8

0.8

0.8

0.9

0.8

0.8

0.8

0.9

PNB Housing

1.0

0.6

0.3

0.2

0.2

0.2

0.3

0.4

Gruh Finance

0.5

0.3

0.3

0.3

0.3

0.6

0.6

0.5

Can Fin Homes

0.7

0.4

0.2

0.2

0.2

0.2

0.3

0.2

Source: Company, Angel Research

March 3, 2017

6

REPCO Home | Initiating Coverage

Cost structure has come down in the last few years

REPCO’s cost to income ratio has come down from 21% in FY2015 to ~16.4% by

9MFY2017, and we expect this to further trend down to ~15% by FY2019. The

company has been able to expand its business without being very aggressive on

branch expansion, which implies higher disbursements per branch. The average

loan per branch has gone up from `51.2cr in FY2014 to `66cr by FY2016.

Nevertheless, the company has expanded its branch network from 122 in FY2014

to 153 currently.

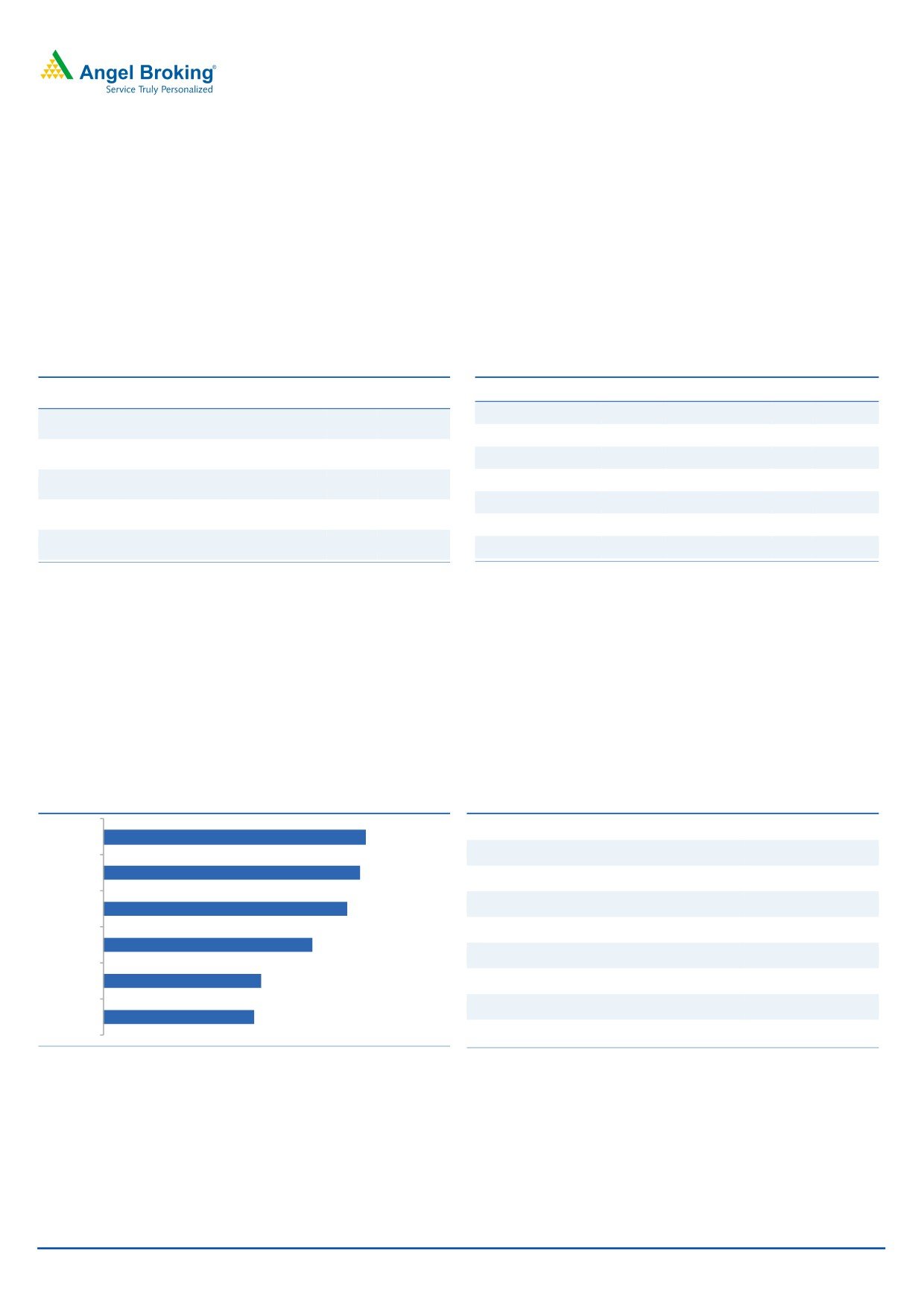

Exhibit 17: Cost/ Income (%)

Exhibit 18: Cost/ Asset (%)

25.0

1.2

21.0

1.0

19.3

0.9

1.0

0.9

20.0

17.7

17.6

0.8

16.7

0.8

0.8

15.0

0.6

10.0

0.4

5.0

0.2

0.0

0.0

FY15

FY16

FY17E

FY18E

FY19E

FY15

FY16

FY17E

FY18E

FY19E

Source: Company, Angel Research;

Source: Company, Angel Research

Increasing share of business from higher yielding segments has

ensured NIM sustaining at higher level

REPCO has always focused on the non salaried segment for business growth,

which is evident from its share of business which has gone up from 53.5% in

FY2012 to ~60% currently. The non salaried segment, while is perceived to be a

riskier segment as far as asset quality is concerned, REPCO has focused on the

small ticket size and while it has been able to generate better yield from that

segment, asset quality has also remained fairly under control. Further, the share of

high yielding LAP business has also gone up from 14% in FY2014 to ~20%

currently. All these factors have ensured strong NIM for the company in the last

many years. While the competition is intensifying within the mortgage business, the

non salaried segment is still not addressed aggressively by the large HFCs and this

leaves a vacuum for the company to grow for multiple years without compromising

on the margins.

March 3, 2017

7

REPCO Home | Initiating Coverage

Exhibit 19: NIM has remained healthy (%)

Exhibit 20: Comparative NIM(%) 3QFY17

6

4.6

4.5

5.0

4.5

5

4.2

4.2

4.1

4.0

4.4

4.4

4.4

4.4

4

3.5

3.1

2.8

3

4.3

4.2

2

4.2

1

4.1

0

4.0

India

Repco PNB Hsg Gruh Fin HDFC Can Fin DHFL LIC Hsg

FY15

FY16

FY17E

FY18E

FY19E

Bulls Hsg

Hom

Source: Company, Angel Research;

Source: Company, Angel Research

High credit cost dented the return ratios so far, expect RoE to

bounce back in FY2018

Despite higher credit cost, REPCO has enjoyed strong RoA and ROE of 2.4% and

17% respectively in FY2016. The cost structure of the company is moving in the

right direction and we feel that this coupled with lower credit cost should help in

better ROE going ahead. REPCO has a history of strong internal capital

generation, which coupled with lower leverage vis-à-vis other HFCs will allow it to

grow optimally without dilution in the near term, which should be RoE accretive.

Exhibit 21: ROA (%)

Exhibit 22: ROE (%)

2.6

25.0

2.6

20.3

2.5

19.2

2.6

20.0

18.0

17.0

15.9

2.5

2.5

15.0

2.4

2.5

10.0

2.4

2.4

5.0

2.4

0.0

FY15

FY16

FY17E

FY18E

FY19E

FY15

FY16

FY17E

FY18E

FY19E

Source: Company, Angel Research;

Source: Company, Angel Research

March 3, 2017

8

REPCO Home | Initiating Coverage

Underleveraged balance sheet leaves enough scope for growth: REPCO has a

CAR of ~20% largely from Tier I itself. REPCO has always maintained high capital

adequacy backed by its strong internal capital generation. The current leverage of

the company at 8x also is lower than other HFCs and this leaves enough scope for

growth without dilution in the near term.

Exhibit 23: CAR (%) Adequate for future growth

Exhibit 24: Comparative CAR (%)

21.0

25

20.8

20.8

20.8

18.8

20

17.8

16.4

16.4

16.3

20.6

20.5

14.0

15

20.4

20.3

20.3

10

20.2

20.0

20.0

5

19.8

0

19.6

Repco

Can Fin Gruh Fin HDFC PNB Hsg DHFL

LIC Hsg

FY15

FY16

FY17E

FY18E

FY19E

Hom

Source: Company, Angel Research;

Source: Company, Angel Research

REPCO’s LTV in-line with industry, while Average ticket size is

lower than industry standard

Though REPCO has been increasing its share of business from the non salaried

segment as well as from the LAP segment, it has very well managed the LTV, which

stands at 60-62%. For the Home Loans, the LTV is 70-72%, while for the LAP it is

50-52%. Further, the average ticket size of the company is `13 lakhs, which has

been reduced intentionally looking at the stress in some segments.

Exhibit 25: Average ticket Size FY2016

Company

` Lakhs

REPCO Homes

13.0

LIC Housing

21.0

DHFL

18.0

India Bulls Housing

25.0

PNB Housing

32.0

Gruh Finance

6.4

Can Fin Homes

17.4

Source: Company, Angel Research

March 3, 2017

9

REPCO Home | Initiating Coverage

Favorable change in source of funding to support higher NIMs

going ahead

While REPCO’s source of funding from NHB has declined, its share of borrowings

from Banks went up to 72.4% in FY2016 from 43% in FY2012. The same has

been reduced to 63% by 3QFY2017. However, on a comparative basis REPCO’s

dependence on bank borrowings has been much higher than other HFCs and

ability to borrow more from the low cost capital market should help in overall

reduction in cost of funds.

Exhibit 26: REPCO’s sources of funding trend

Exhibit 27: Comparative Source of funding

FY12

FY13

FY14

FY15

FY16

3QFY17

FY16

Banks

NCD NHB CP Others

Can Fin Homes

27

23

37

11

2

Banks

43.0

51.0

65.0

67.6

72.4

63.0

LIC Housing

13

77

2.7

1

6.3

NHB

47.0

37.0

25.0

21.4

13.9

17.0

DHFL

53

33

2

-

12

India Bulls Housing

49

38

-

-

13

REPCO Bank

10.0

12.0

10.0

7.9

7.6

7.0

PNB Housing

6

38

8

20

28

NCDs

0.0

0.0

0.0

2.0

6.1

11.0

Gruh Finance

38

-

39

-

23

CPs

0.0

0.0

0.0

1.2

0.0

3.0

Repco Home

72

6

14

-

8

Source: Company, Angel Research

Source: Company, Angel Research

Business so far continues to be focused on Southern states; likely

to tap newer geographies going forward

The company’s business continues to be concentrated in the southern markets,

which accounts for ~90% of the total loan book currently. However, over the next

five years, the management intends to expand in other geographies and also

expects to increase the share of non southern states to increase to ~30% from

current 10% levels.

Exhibit 28: Branch Network

Exhibit 29: Business Concentration

Tamil Nadu

62%

9mFY17

153

Karnataka

12%

FY16

150

AP

7%

Maharastra

6%

FY15

142

Telangana

4%

FY14

122

Kerla

4%

FY13

92

Gujarat

2%

Others

2%

FY12

88

Total

100%

Source: Company, Angel Research

Source: Company, Angel Research

March 3, 2017

10

REPCO Home | Initiating Coverage

Outlook and valuation

The target segment of REPCO is highly underserved and this offers a growth

potential for many years going ahead. Unlevered balance sheet and stable NIM

coupled with controlled credit cost should result in 26% earnings CAGR over

FY2016-19E. At the CMP the stock is trading at 2.7x it FY2019 ABV. We have

valued the stock at 3.5x its FY2019E ABV and Recommend BUY with a Target Price

of `825 over the next 12 months.

Exhibit 30: Comparative Valuation & Return ration

P/BV

RoE%

RoA%

FY17E

FY18E

FY19E

FY17E

FY18E

FY19E

FY17E

FY18E

FY19E

Repco Home Fin

3.6

3.0

2.5

18.0

19.2

20.3

2.4

2.5

2.6

Can Fin Homes

4.9

4.0

3.2

23.6

24.1

25.6

1.9

1.9

2.0

LIC Hsg Fin

2.6

2.2

1.8

20.7

20.2

19.7

1.5

1.6

1.6

DHFL

1.7

1.5

1.3

16.4

17.0

17.6

1.2

1.3

1.3

Indiabulls Hsg Fin

3.0

2.7

2.4

25.2

27.2

28.8

3.6

3.6

3.3

Gruh Finance

13.3

10.8

9.1

29.9

29.8

31.3

2.3

2.3

2.3

Source: Company, Angel Research, Note: CMP as of March 03, 2017, * other companies Consensus taken from Bloomberg,

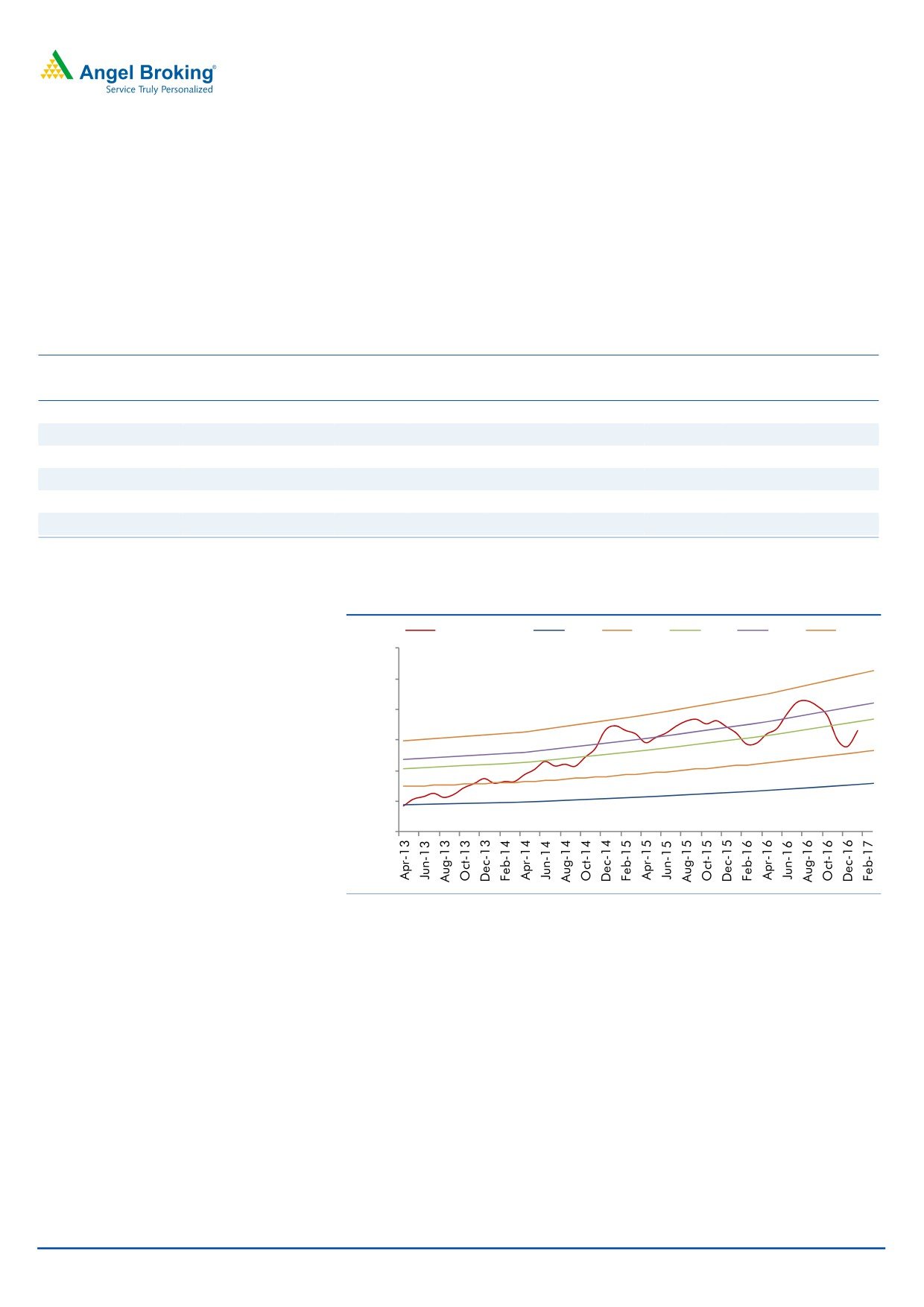

Exhibit 31: One Year Forward P/BV

Close -Unit Curr

1.5 X

2.5 X

3.5 X

4.0 X

5.0 X

1,200

1,000

800

600

400

200

0

Source: Company, Angel Research

March 3, 2017

11

REPCO Home | Initiating Coverage

Company Background

REPCO Home Finance a midsized Housing Finance Company with a focus on the

non salaried segment. Headquartered in Chennai, the company operates through

121 branches and 32 satellite centers across 11 states and the Union Territory of

Pondicherry. Tamil Nadu is the largest market for the company and accounts for

~62% of its loan book, while the five southern states combined account for ~89%

of the loan book. However, gradually the company intends to expand into other

geographies gradually. The non salaried segment was not aggressively tapped by

other HFCs and Banks and REPCO took the opportunity and has been a successful

player in the segment.

Key Risks & Concerns

REPCO has a high concentration in the southern states, which combined account

for ~89% of the business. Any geopolitical issues and natural calamity can impact

the growth and profitability of the company.

Over the last few years REPCO has grown its LAP portfolio quite aggressively and

any sharp drop in property prices can result in pressure in asset quality. However,

the management doesn’t intend to increase LAP portfolio beyond 20% of its total

loan book and hence we don’t expect incrementally much stress to arise

Exhibit 32: Comparative DuPont Analysis for FY16

Can Fin

LIC

India

PNB

Gruh

DHFL

Repco

Home Housing

Bulls

HSG

Fin

Interest Income

10.9

10.1

11.4

11.6

10.4

11.9

12.3

Interest expenses

7.8

7.7

9.0

7.4

7.6

7.8

7.9

Net Interest margin

3.1

2.4

2.4

4.2

2.8

4.1

4.4

Fees & Other Income

0.4

0.2

0.6

2.0

0.6

0.5

0.4

Total Income

3.6

2.6

3.0

6.1

3.4

4.5

4.8

Employee Exp

0.3

0.1

0.4

0.6

0.3

0.4

0.6

Other exp

0.4

0.3

0.5

0.3

0.7

0.4

0.3

Opex

0.7

0.4

0.9

0.9

1.0

0.8

0.9

PPP

2.9

2.2

2.1

5.3

2.4

3.7

3.9

Provision

0.2

0.1

0.3

0.6

0.3

0.2

0.6

PBT

2.7

2.1

1.8

4.7

2.1

3.5

3.3

Tax

1.0

0.7

0.6

1.2

0.7

1.1

1.2

RoA

1.6

1.4

1.2

3.5

1.3

2.4

2.2

Leverage

11.6

14.3

12.7

7.7

13.1

13.3

7.8

RoE (%)

19.0

19.6

15.1

27.0

17.6

31.5

17.0

Source: Company, Angel Research

March 3, 2017

12

REPCO Home | Initiating Coverage

Income statement (Standalone)

Y/E March (` cr)

FY15

FY16

FY17E

FY18E

FY19E

Net Interest Income

237

304

388

457

551

- YoY Growth (%)

13.3

28.0

27.6

18.0

20.5

Other Income

24

30

35

42

51

- YoY Growth (%)

-

25.7

18.0

20.0

20.0

Operating Income

261

334

423

499

602

- YoY Growth (%)

23.9

27.8

26.7

18.1

20.5

Operating Expenses

55

64

75

88

100

- YoY Growth (%)

41.1

17.5

16.4

17.2

14.5

Pre - Provision Profit

206

269

348

412

501

- YoY Growth (%)

20.0

30.6

29.2

18.3

21.8

Prov. & Cont.

20

39

59

52

52

- YoY Growth (%)

(11.5 )

92.0

52.9

(12.3 )

-

Profit Before Tax

186

230

289

360

449

- YoY Growth (%)

24.9

23.9

25.2

24.6

24.9

Prov. for Taxation

63

80

101

122

148

- as a % of PBT

33.9

34.7

35.0

34.0

33.0

PAT

123

150

188

237

301

- YoY Growth (%)

11.8

22.4

24.7

26.5

26.8

Balance sheet (Standalone)

Y/E March (` cr)

FY15

FY16

FY17E

FY18E

FY19E

Share Capital

62

63

63

63

63

Reserve & Surplus

750

892

1,063

1,280

1,555

Net Worth

812

955

1,126

1,342

1,617

Borrowings

4,365

5,522

6,627

8,151

10,066

Growth (%)

31.9

26.5

20.0

23.0

23.5

Other Liab. & Prov.

899

1,286

1,556

2,134

2,855

Total Liabilities

6,076

7,763

9,309

11,628

14,539

Cash & Bank Balance

18

20

20

20

20

Investments

12

12

15

15

15

Advances

6,023

7,705

9,246

11,557

14,447

- Growth (%)

29.0

27.9

20.0

25.0

25.0

Fixed Assets

9

9

10

15

35

Other Assets

14

17

18

20

22

Total Assets

6,076

7,763

9,309

11,628

14,539

March 3, 2017

13

REPCO Home | Initiating Coverage

Ratio analysis (Standalone)

Y/E March

FY15

FY16

FY17E

FY18E

FY19E

Profitability ratios (%)

NIMs

4.4

4.4

4.5

4.4

4.2

Cost to Income Ratio

21.0

19.3

17.7

17.6

16.7

Cost to Asset Ratio

1.0

0.9

0.9

0.8

0.8

RoA

2.5

2.4

2.4

2.5

2.6

RoE

15.9

17.0

18.0

19.2

20.3

Capital Adequacy (%)

CAR %

20.3

20.8

20.0

20.5

20.3

Tier I

20.3

20.8

20.0

20.5

20.3

Asset Quality (%)

Gross NPAs (` Cr )

79

101

250

289

289

Net NPAs ( ` Cr)

30

37

139

144

144

Gross NPAs (%)

1.3

1.3

2.7

2.5

2.0

Net NPAs (%)

0.5

0.5

1.5

1.3

1.0

Credit Cost (%)

0.3

0.5

0.7

0.5

0.4

Provision coverage

62

64

44

50

50

Per Share Data (`)

EPS

19.7

24.1

30.0

38.0

48.1

BVPS

130

153

180

215

259

ABVPS

125

147

158

192

235

DPS

1.5

1.8

2.2

2.8

3.6

Valuation Ratios

PER (x)

32.6

26.7

21.4

16.9

13.4

P/ BVPS(x)

4.9

4.2

3.6

3.0

2.5

P/ABVPS (x)

5.1

4.4

4.1

3.4

2.7

Dividend Yield

0.2

0.3

0.3

0.4

0.5

DuPont Analysis

Interest Income

12.4

12.3

12.0

11.4

10.9

Interest Expenses

8.0

7.9

7.5

7.1

6.7

NII

4.4

4.4

4.5

4.4

4.2

Non Interest Income

0.4

0.4

0.4

0.4

0.4

Total Revenues

4.8

4.8

5.0

4.8

4.6

Operating Cost

1.0

0.9

0.9

0.8

0.8

PPP

3.8

3.9

4.1

3.9

3.8

Total Provisions

0.4

0.6

0.7

0.5

0.4

PBT

3.4

3.3

3.4

3.4

3.4

Tax

1.2

1.2

1.2

1.2

1.1

ROA

2.3

2.2

2.2

2.3

2.3

Leverage

7.0

7.8

8.2

8.5

8.8

RoE (%)

15.9

17.0

18.0

19.2

20.3

March 3, 2017

14

REPCO Home | Initiating Coverage

Research Team Tel: 022 - 39357800

DISCLAIMER

Angel Broking Private Limited (hereinafter referred to as “Angel”) is a registered Member of National Stock Exchange of India Limited,

Bombay Stock Exchange Limited and Metropolitan Stock Exchange Limited. It is also registered as a Depository Participant with CDSL

and Portfolio Manager with SEBI. It also has registration with AMFI as a Mutual Fund Distributor. Angel Broking Private Limited is a

registered entity with SEBI for Research Analyst in terms of SEBI (Research Analyst) Regulations, 2014 vide registration number

INH000000164. Angel or its associates has not been debarred/ suspended by SEBI or any other regulatory authority for accessing

/dealing in securities Market. Angel or its associates/analyst has not received any compensation / managed or co-managed public

offering of securities of the company covered by Analyst during the past twelve months.

This document is solely for the personal information of the recipient, and must not be singularly used as the basis of any investment

decision. Nothing in this document should be construed as investment or financial advice. Each recipient of this document should

make such investigations as they deem necessary to arrive at an independent evaluation of an investment in the securities of the

companies referred to in this document (including the merits and risks involved), and should consult their own advisors to determine

the merits and risks of such an investment.

Reports based on technical and derivative analysis center on studying charts of a stock's price movement, outstanding positions and

trading volume, as opposed to focusing on a company's fundamentals and, as such, may not match with a report on a company's

fundamentals. Investors are advised to refer the Fundamental and Technical Research Reports available on our website to evaluate the

contrary view, if any.

The information in this document has been printed on the basis of publicly available information, internal data and other reliable

sources believed to be true, but we do not represent that it is accurate or complete and it should not be relied on as such, as this

document is for general guidance only. Angel Broking Pvt. Limited or any of its affiliates/ group companies shall not be in any way

responsible for any loss or damage that may arise to any person from any inadvertent error in the information contained in this report.

Angel Broking Pvt. Limited has not independently verified all the information contained within this document. Accordingly, we cannot

testify, nor make any representation or warranty, express or implied, to the accuracy, contents or data contained within this document.

While Angel Broking Pvt. Limited endeavors to update on a reasonable basis the information discussed in this material, there may be

regulatory, compliance, or other reasons that prevent us from doing so.

This document is being supplied to you solely for your information, and its contents, information or data may not be reproduced,

redistributed or passed on, directly or indirectly.

Neither Angel Broking Pvt. Limited, nor its directors, employees or affiliates shall be liable for any loss or damage that may arise from

or in connection with the use of this information.

Disclosure of Interest Statement

REPCO Home

1. Financial interest of research analyst or Angel or his Associate or his relative

No

2. Ownership of 1% or more of the stock by research analyst or Angel or associates or relatives

No

3. Served as an officer, director or employee of the company covered under Research

No

4. Broking relationship with company covered under Research

No

Ratings (Based on expected returns

Buy (> 15%)

Accumulate (5% to 15%)

Neutral (-5 to 5%)

over 12 months investment period):

Reduce (-5% to -15%)

Sell (< -15)

March 3, 2017

15