2QFY2016 Result Update | Oil & Gas

October 23, 2015

Reliance Industries

ACCUMULATE

CMP

`1,050

Refining margins surprise

Target Price

`955

Investment Period

12 Months

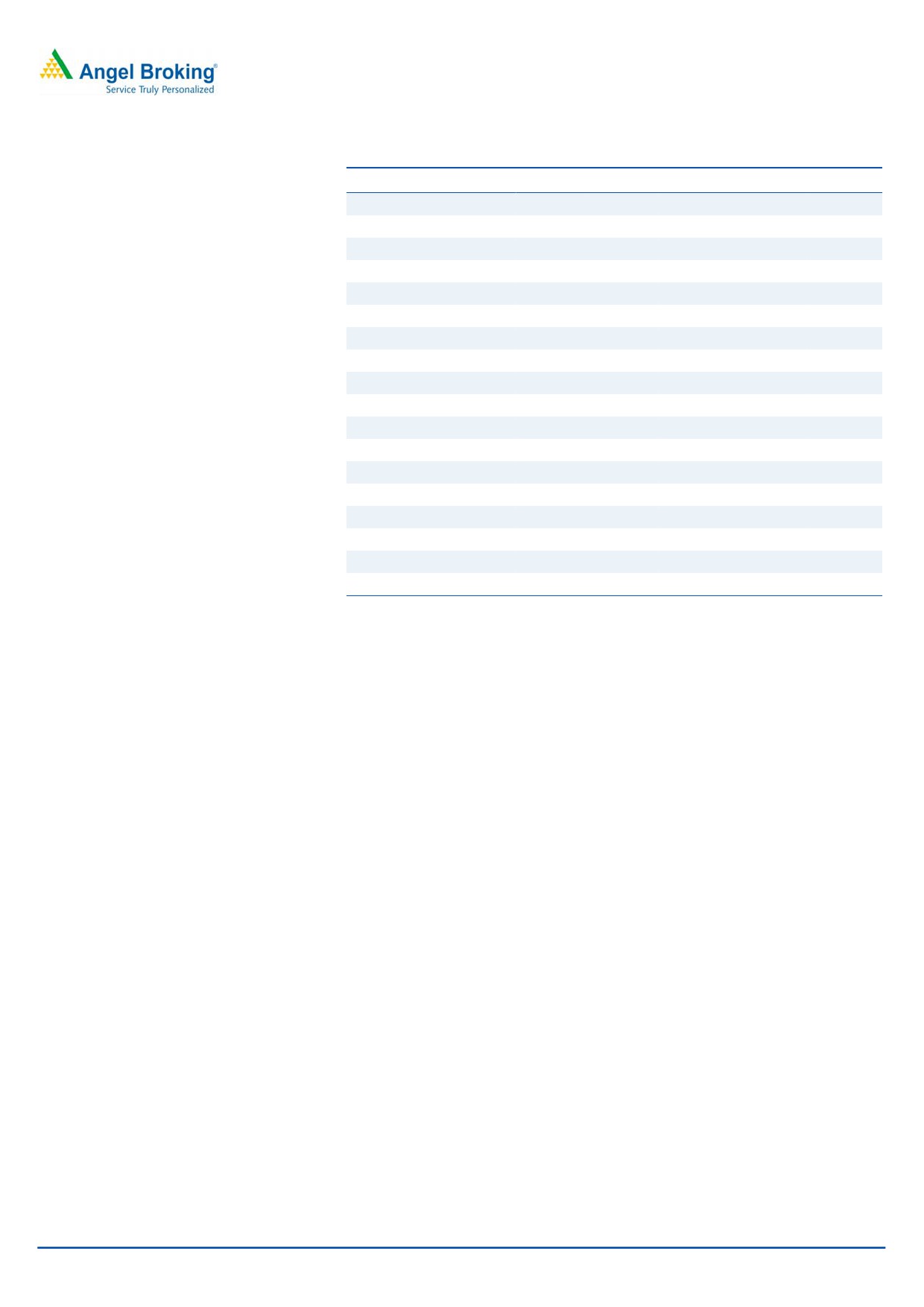

Consolidated (` cr)

2QFY16

2QFY15

yoy (%) 1QFY16

qoq%

Net revenue

70,901

1,09,797

(35.4)

77,130

(8.1)

Stock Info

EBITDA

10,704

9,818

9.0

10,177

5.2

Sector

Oil & Gas

Margin (%)

15.1

8.9

616bp

13.2

190bp

Market Cap (` cr)

3,09,454

Reported PAT

6,625

5,924

11.8

6,137

8.0

Net Debt (` cr)

87,045

Source: Company, Angel Research

Beta

1.1

Reliance Industries (RIL)’ net sales for 2QFY2016 declined by 35% yoy to

52 Week High / Low

1,067/797

`70,901cr as against `109,797cr in the corresponding quarter last year, due to

Avg. Daily Volume

38,02,145

fall in crude oil prices. The EBITDA however increased by 9% yoy to `10,704cr,

Face Value (`)

10

way ahead of consensus estimates, led by strong gross refining margin (GRM)

BSE Sensex

27,307

and better-than-expected EBITDA of the petrochemical division. The GRM stood at

Nifty

8,262

$10.6/bbl for the quarter, the highest in seven years, as against $8.3/bbl in

Reuters Code

RELI.BO

2QFY2015, and was ahead of consensus estimates. The outperformance over the

Bloomberg Code

RIL IN

Singapore GRM, by $4.3/bbl, is also the highest in six years.

The Petrochemicals segment’s revenue declined by 20% yoy to `21,239cr, led by

Shareholding Pattern (%)

lower crude and feedstock prices. The segment’s EBIT however increased by 7.2%

Promoters

45.2

yoy to `2,531cr, led by strong polymer deltas and healthy polyester chain deltas,

FII / NRIs / OCBs

18.7

coupled with higher volumes. The E&P business continued to drag profitability and

MF / Banks / Indian Fls

13.1

the outlook for the business continues to remain weak. The Retail division

Indian Public / Others

23.0

continued to add stores, helping drive revenue growth. RIL is building up an

ecosystem for distribution of Jio devices; the company is gearing up for its roll out

which would be in a phased manner. Reliance Retail will soon be launching its

Abs. (%)

3m 1yr

3yr

own brand of 4G LTE smart phones under the brand ‘LYF’.

Sensex

(3.9)

3.3

46.2

Outlook and valuation: We believe RIL’s growth will be driven by its core Refining

RIL

(6.8)

2.2

19.0

and Petrochemicals business. We value the refining business at 7x EBITDA, while

we assign a 6.5x multiple to the Petrochemicals business. We value the Telecom

3-year price chart

business at 0.3x invested capital, and the Retail business at 1x sales. We retain

1,200

our Accumulate rating on the stock with a target price of `1,050, implying a 10%

1,100

upside from the current levels.

1,000

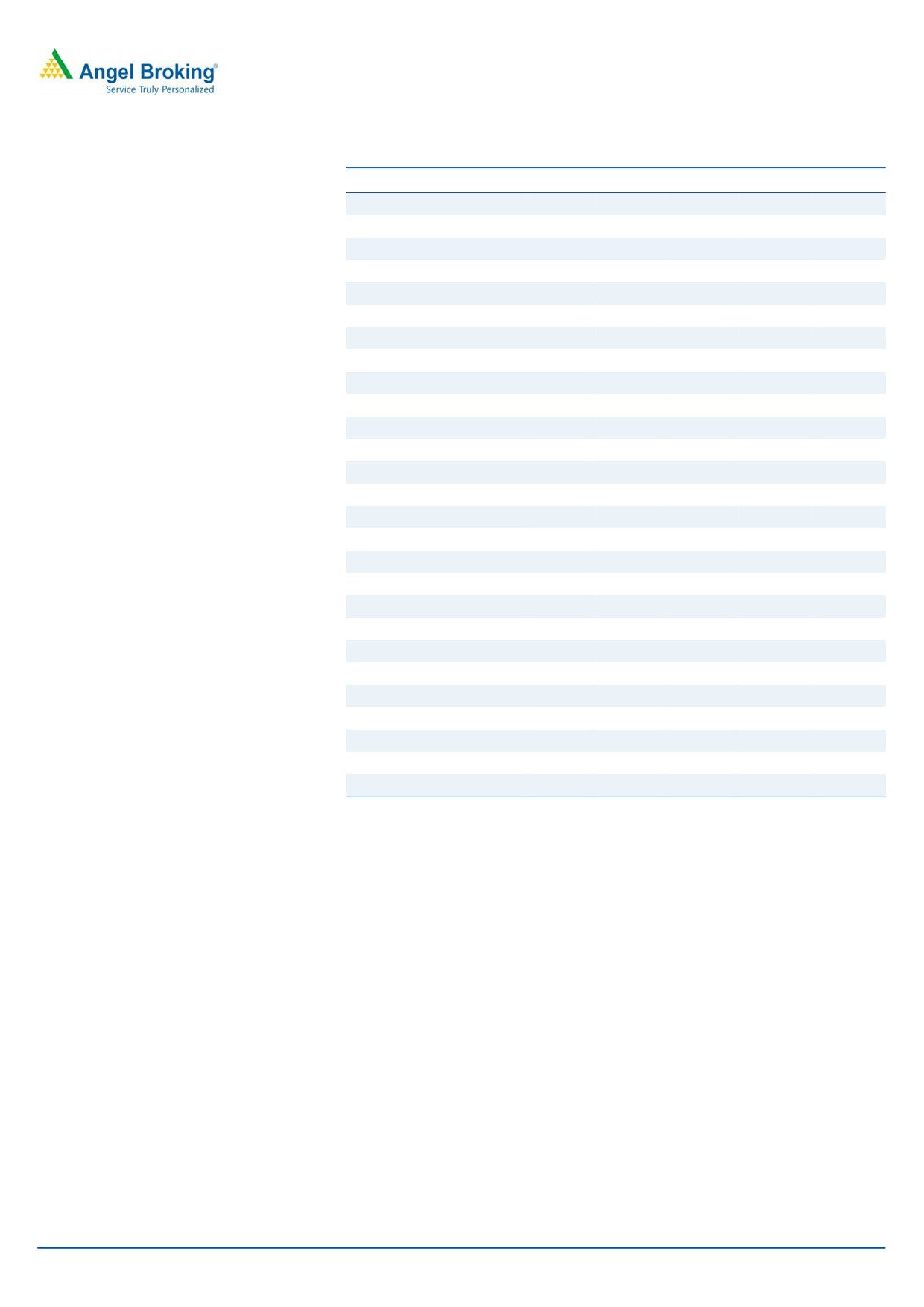

Key financials (Standalone)

900

Y/E March (` cr)

FY2013

FY2014

FY2015

FY2016E

FY2017E

800

Revenue

3,60,297

3,90,117

3,29,076

3,04,775

3,44,392

700

% chg

9.2

8.3

(15.6)

(7.4)

13.0

Adj. net profit

19,716

20,173

20,397

26,883

30,227

% chg

4.8

2.3

1.1

31.8

12.4

Source: Company, Angel Research

Adj. EPS (`)

67.2

68.6

69.3

91.3

102.6

OPM (%)

8.5

7.9

9.6

12.6

13.4

P/E (x)

13.3

12.8

12.4

10.5

9.3

P/BV (x)

1.6

1.4

1.3

1.2

1.1

RoE (%)

12.1

11.7

11.0

11.8

12.0

RoCE (%)

8.8

8.2

7.7

9.0

9.5

Rahul Dholam

EV/Sales (x)

0.8

0.9

1.1

1.2

1.0

Tel: 022- 3935 7800 Ext: 6847

EV/EBIDTA

9.9

10.8

11.6

9.7

7.8

Source: Company, Angel Research; Note: CMP as of October 21, 2015

Please refer to important disclosures at the end of this report

1

Reliance Industries | 2QFY2016 Result Update

Exhibit 1: 2QFY2016 performance (Consolidated)

(` cr)

2QFY16

2QFY15

yoy%

1QFY16

qoq%

FY2015

FY2014

yoy%

Net sales

70,901

1,09,797

(35.4)

77,130

(8.1)

3,75,435

4,34,460

(13.6)

Raw Material Cost

49,451

88,744

(44.3)

55,922

(11.6)

2,94,046

3,63,022

(19.0)

% of net sales

69.7

80.8

72.5

78.3

83.6

Employee Cost

1,786

1,575

13.4

1,976

(9.6)

6,262

5,572

12.4

% of net sales

2.5

1.4

2.6

1.7

1.3

Other expenditure

8,960

9,660

(7.2)

9,055

(1.0)

37,763

31,067

21.6

% of net sales

12.6

8.8

11.7

10.1

7.2

Total expenditure

60,197

99,979

(39.8)

66,953

(10.1)

3,38,071

3,99,661

(15.4)

% of net sales

84.9

91.1

86.8

90.0

92.0

EBITDA

10,704

9,818

9.0

10,177

5.2

37,364

34,799

7.4

Margin (%)

15.1

8.9

616bp

13.2

190bp

10.0

8.0

709bp

Interest

972

997

(2.5)

902

7.8

3,316

3,836

(13.6)

Depreciation

3,171

3,024

4.9

3,041

4.3

11,547

11,201

3.1

Other income

1,848

2,009

(8.0)

1,832

0.9

8,495

8,911

(4.7)

Profit before tax

8,409

7,806

7.7

8,066

4.3

30,996

28,673

8.1

% of net sales

11.9

7.1

10.5

8.3

6.6

Tax

1,784

1,882

1,929

7,474

6,215

20.3

% of PBT

21.2

24.1

23.9

24.1

21.7

Net Profit

6,625

5,924

11.8

6,137

8.0

23,522

22,458

4.7

Minority Int. / Share of ass.

95

48

85

44

35

Reported Net Profit

6,720

5,972

12.5

6,222

8.0

23,566

22,493

4.8

Adjusted Net Profit

6,521

5,972

9.2

6,222

4.8

23,566.0

22,493.0

4.8

Source: Company, Angel Research

Result highlights

Refining margins well ahead of expecations

The Refining segment posted a strong set of numbers with a GRM of $10.6/bbl for

the quarter as against $8.3/bbl in 2QFY2015. The GRM is ahead of consensus

estimates and the highest in seven years. The outperformance over the Singapore

GRM, by $4.3/bbl, is also the highest in six years. The same was led by product

mix flexibility, robust risk management, coupled with opportunistic crude sourcing

and lower energy costs incurred during the quarter.

October 21, 2015

2

Reliance Industries | 2QFY2016 Result Update

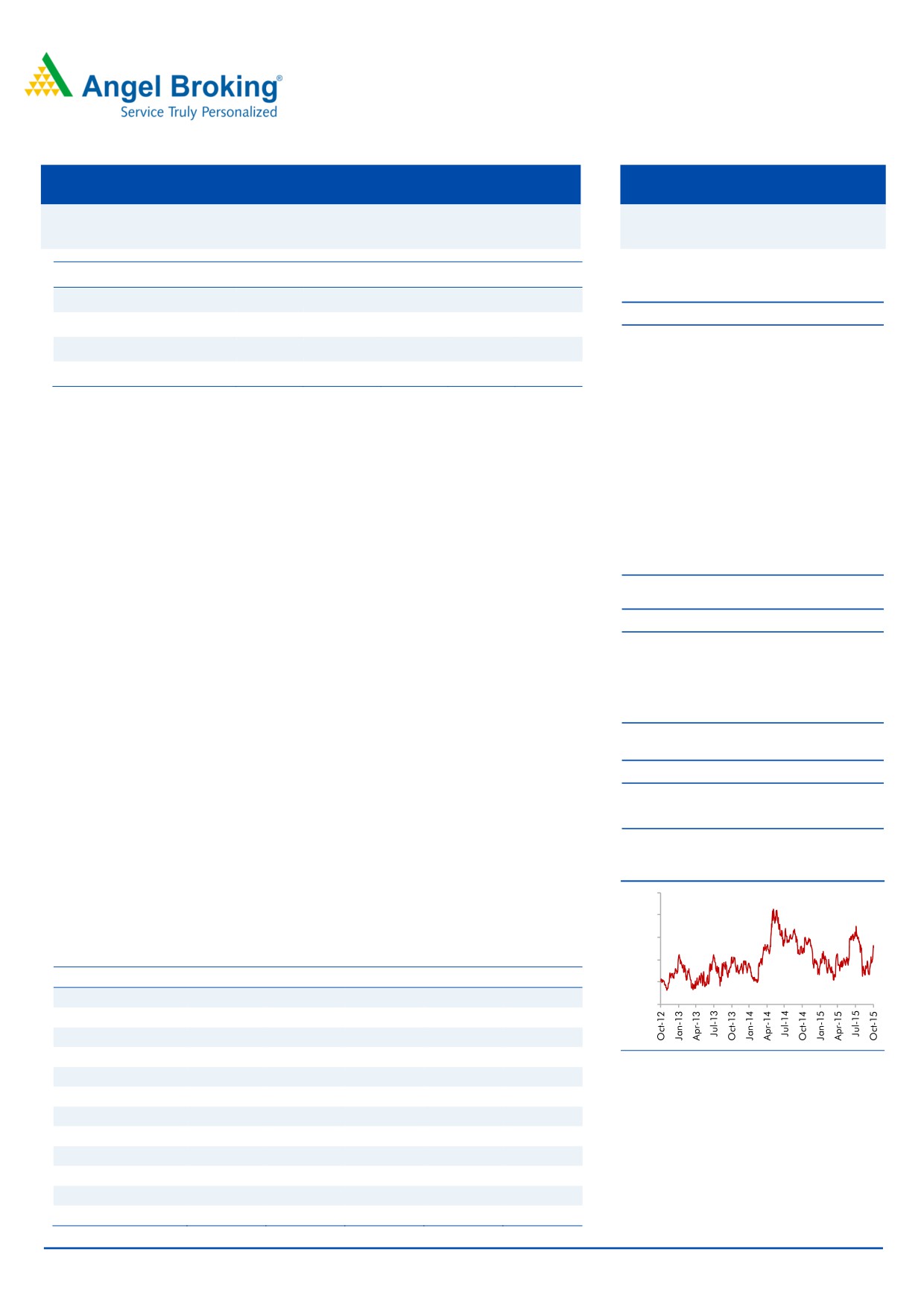

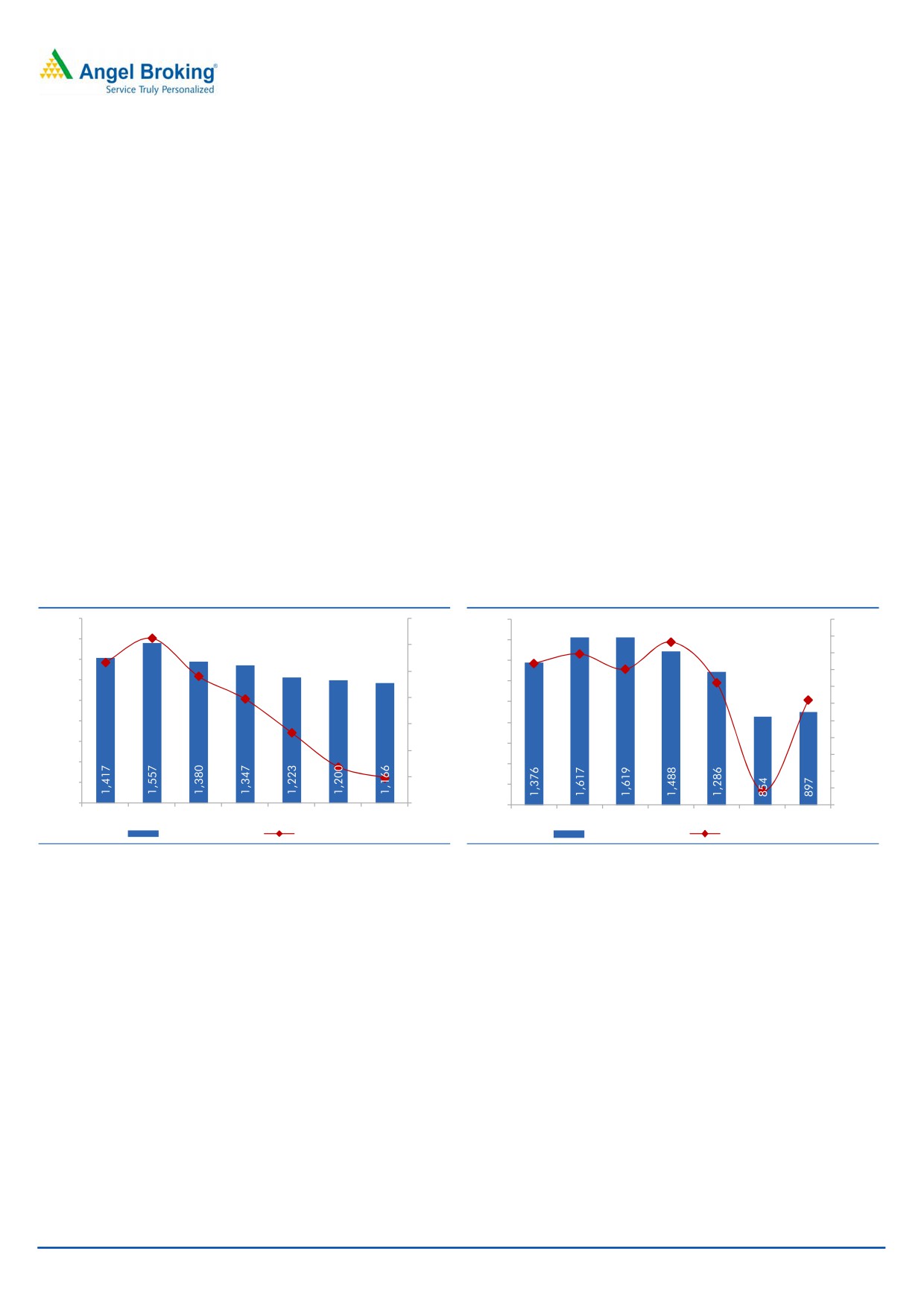

Exhibit 2: Refining Segment Revenues and EBIT Margin

Exhibit 3: RIL’s GRM vs Singapore GRM

120,000

10.0%

12

9.0%

100,000

10

8.0%

7.0%

80,000

8

6.0%

60,000

5.0%

6

4.0%

40,000

3.0%

4

2.0%

20,000

1.0%

2

0

0.0%

0

1Q14 2Q14 3Q14 4Q14 1Q15 2Q15 3Q15 4Q15 1Q16 2Q16

Segment Revenue

EBIT Margin (%)

Singapore GRM ($ / bbl)

RIL GRM ($ / bbl)

Source: Company, Angel Research

Source: Company, Angel Research

October 21, 2015

3

Reliance Industries | 2QFY2016 Result Update

The Refining and Marketing segment’s revenue decreased by

41% yoy to

`60,768cr, led by a decline in crude prices. The EBIT however increased 42% yoy

to a record level of `5,461cr led by record GRM. Jamnagar refineries processed

17.1MMT of crude with an average utilization of 110%, as against 16.6MMT in the

sequential previous quarter.

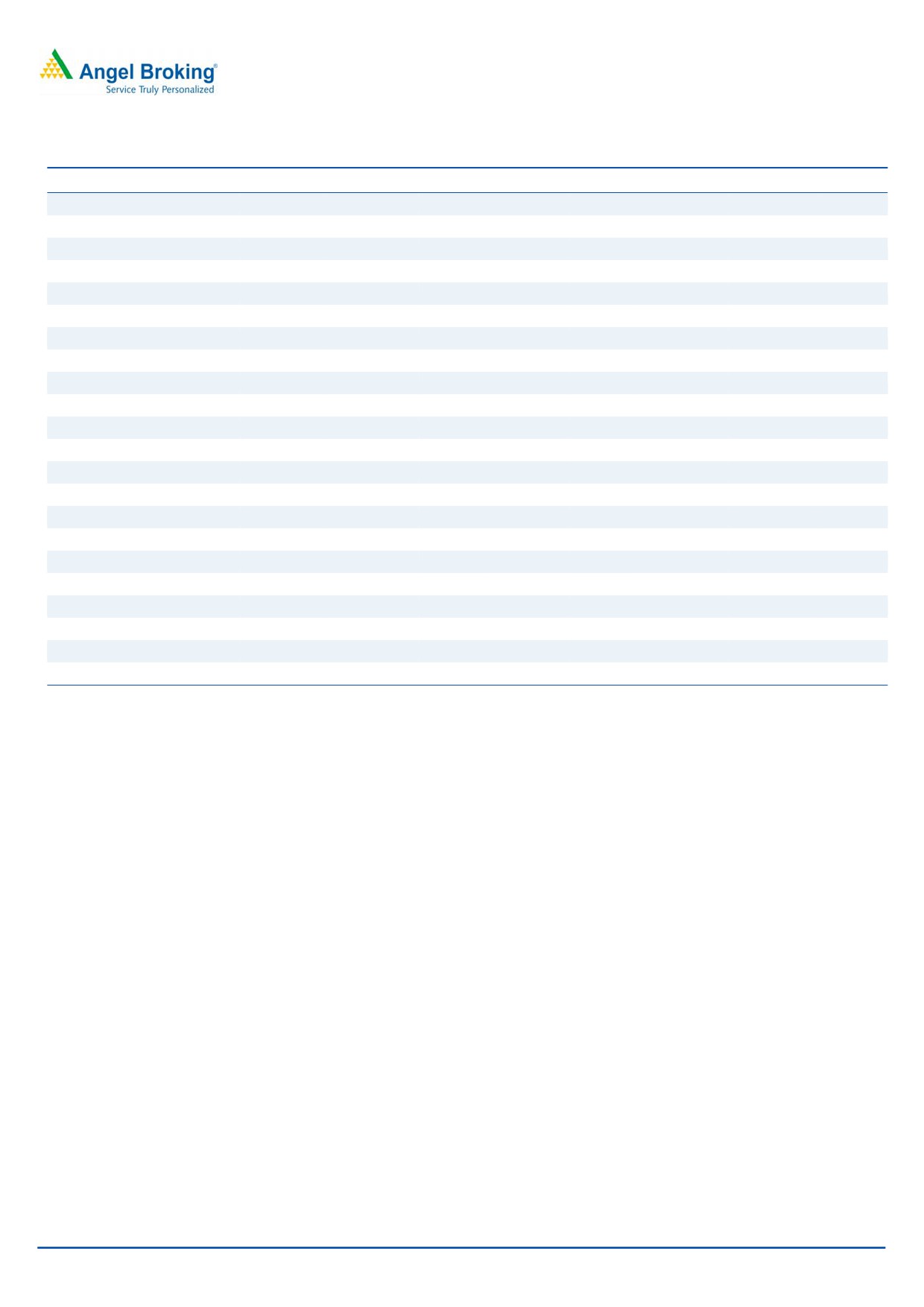

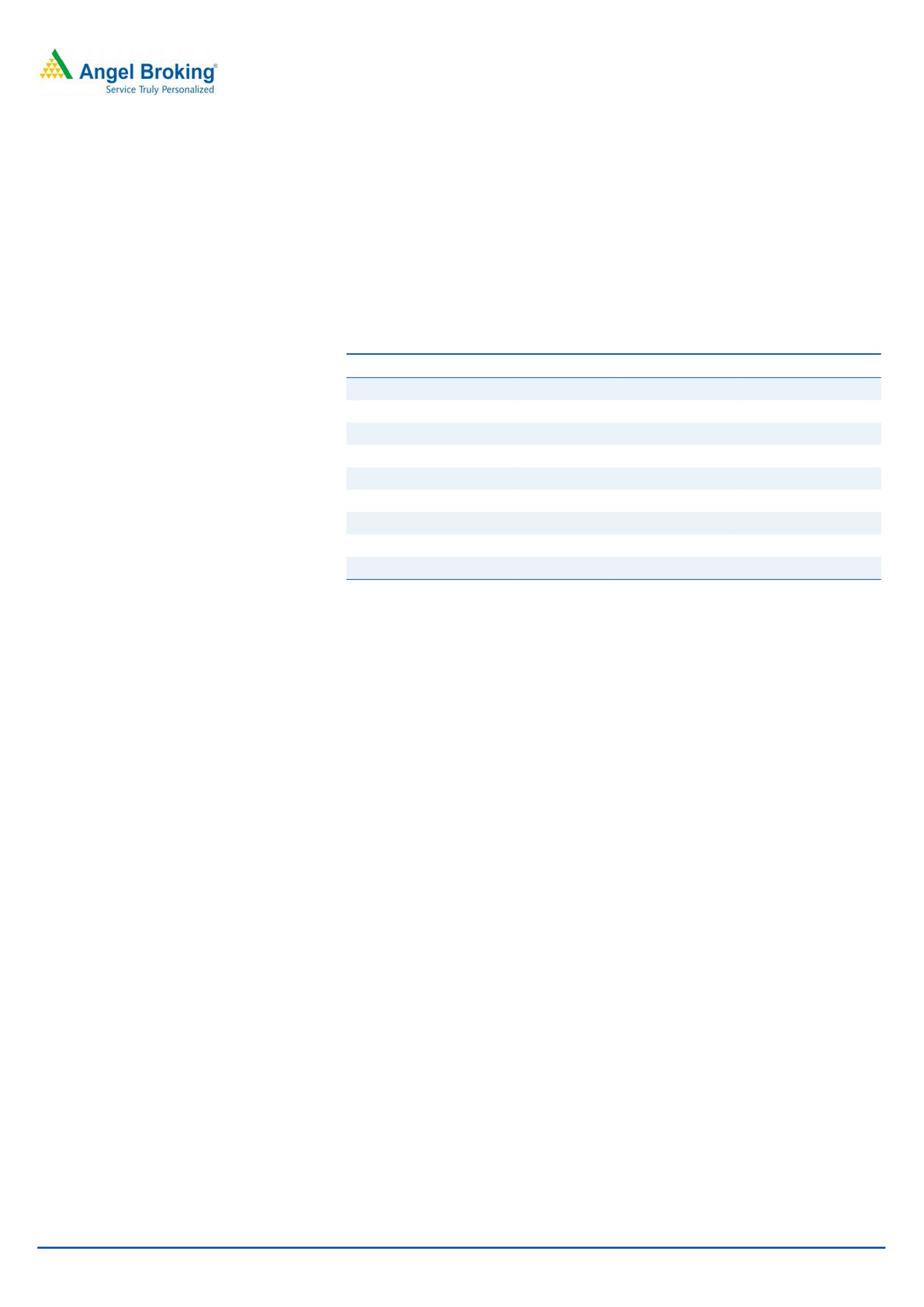

Exhibit 4: Refining volumes

Crude Refined (MMT)

18.0

17.7

17.7

17.5

17.3

17.1

17.1

17

17.0

16.7

16.6

16.5

16.3

16.2

16.0

15.5

15.0

1Q14

2Q14

3Q14

4Q14

1Q15

2Q15

3Q15

4Q15

1Q16

2Q16

Source: Company, Angel Research

Petrochemicals business posts strong margin expansion

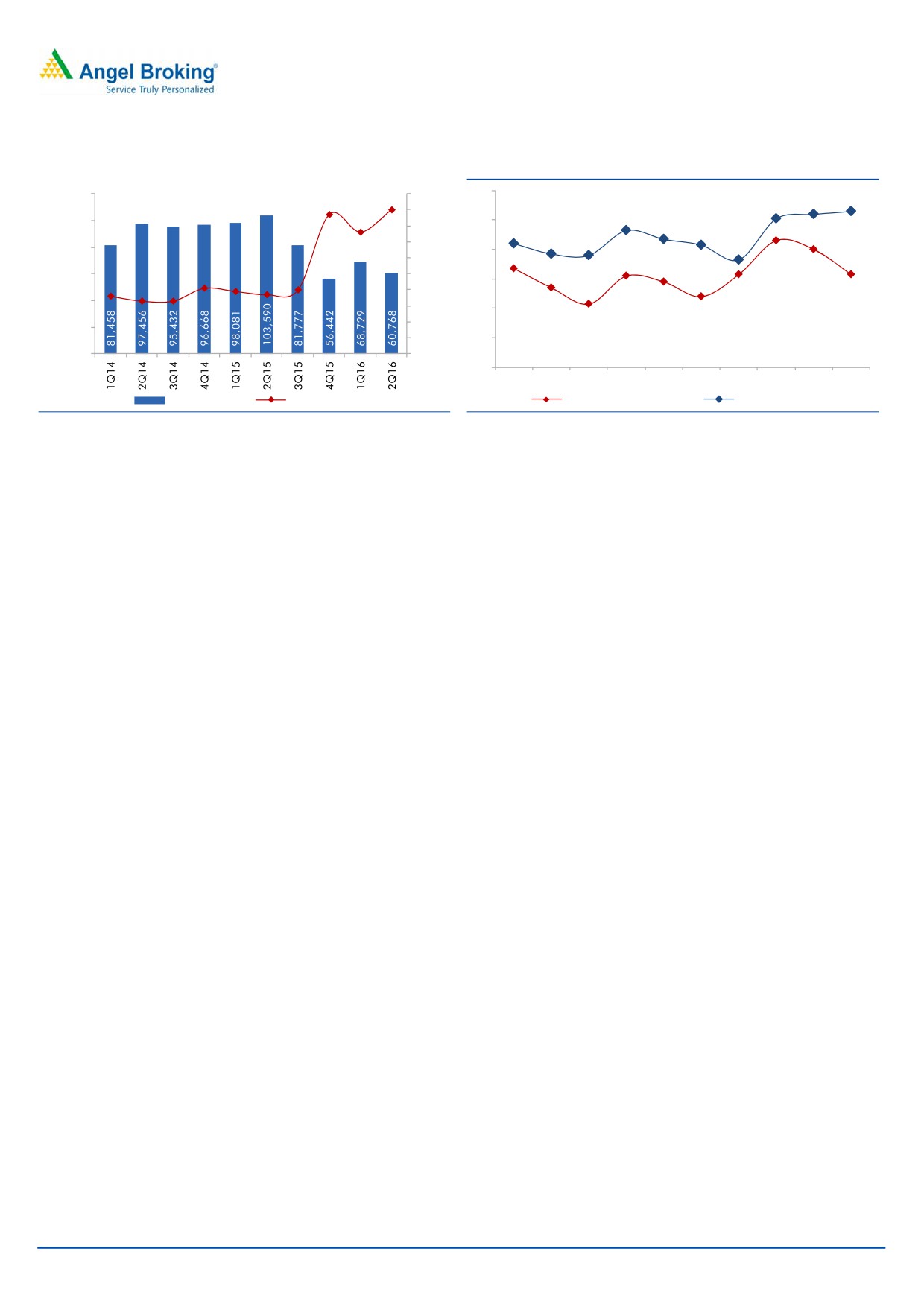

The Petrochemicals segment’s revenue declined by 20% yoy to `21,239cr, led by

lower crude and feedstock prices. The segment’s EBIT however increased 7.2% yoy

to `2,531cr, led by strong polymer deltas and healthy polyester chain deltas,

coupled with higher volumes. Despite lower product prices, the segment’s EBIT

margin improved by 300bp yoy to 11.9%. RIL is currently stabilizing operations at

its new 150KTA capacity SBR plant at Hazira; the plant is expected to make India

self-sufficient in meeting its entire SBR requirement domestically.

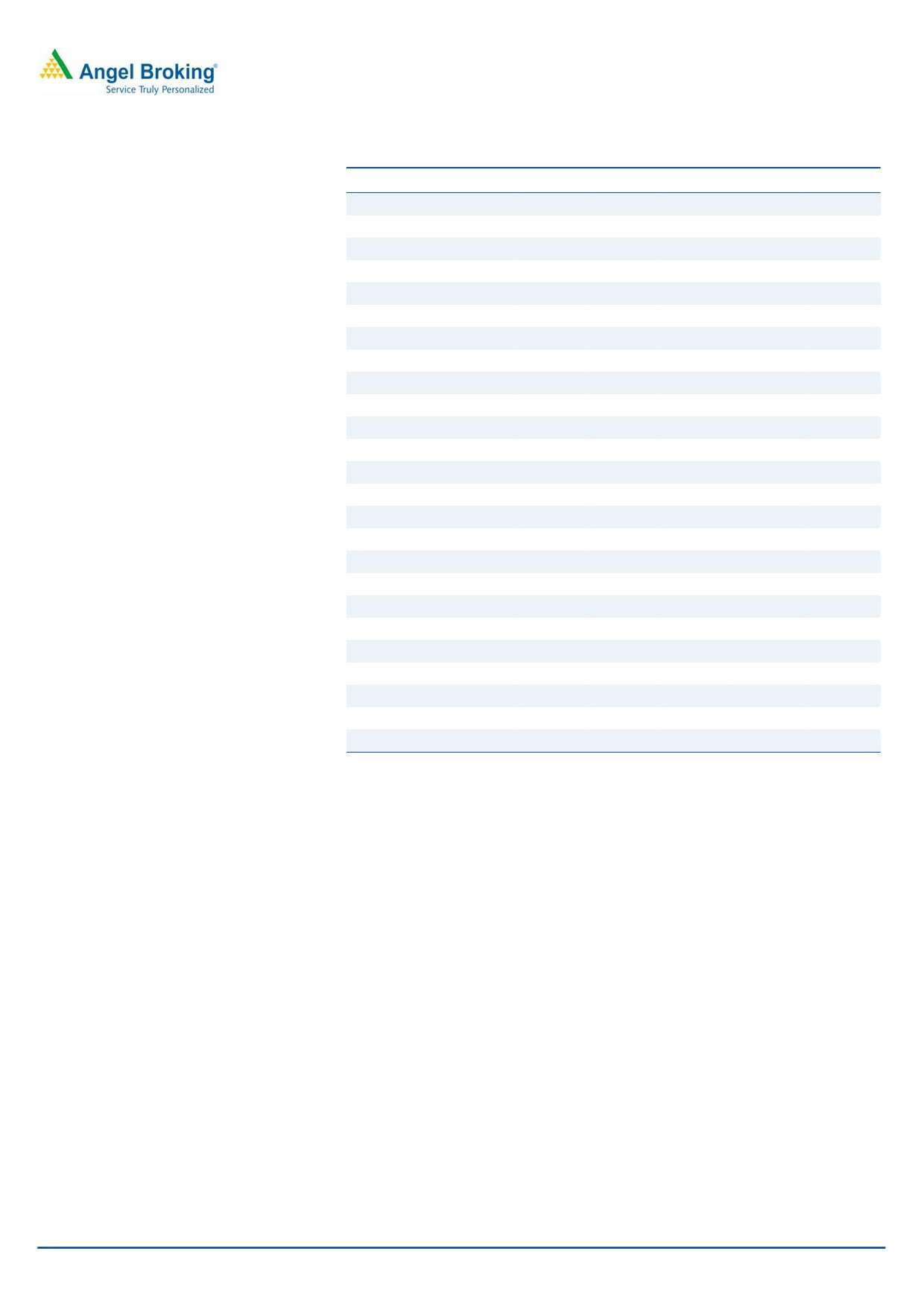

Exhibit 5: Strong increase in petchem production

Exhibit 6: Petchem EBIT margin rises 300bp

6.4

30,000

14%

Petchem Production (MMT)

6.2

12%

25,000

6

10%

20,000

5.8

8%

15,000

5.6

6%

5.4

10,000

4%

5.2

5,000

2%

5

0

0%

4.8

1Q14 2Q14 3Q14 4Q14 1Q15 2Q15 3Q15 4Q15 4Q15 2Q16

1Q14 2Q14 3Q14 4Q14 1Q15 2Q15 3Q15 4Q15 4Q15 2Q16

Petchem Segment Revenue

EBIT Margin (%)

Source: Company, Angel Research

Source: Company, Angel Research

October 21, 2015

4

Reliance Industries | 2QFY2016 Result Update

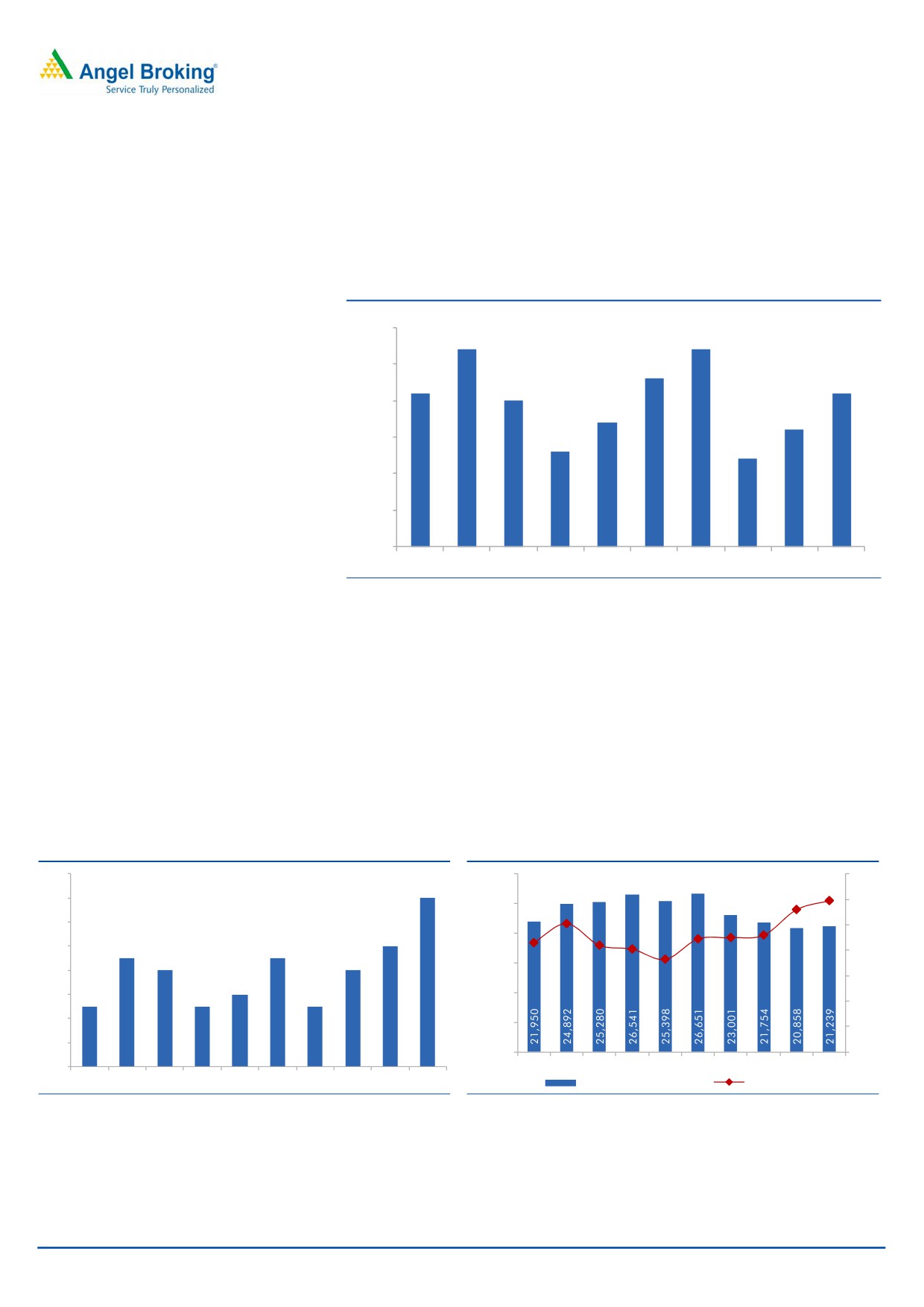

E&P segment outlook continues to remain bleak

On the domestic front, crude oil production at KG-D6 continues to decline; during

the quarter, it declined by 24% yoy to 0.39MMBBL, while natural gas production

declined by 9% yoy to 37BCF. Production at the Panna-Mukta fields increased with

crude oil production rising 7% to 1.88MMBBL, while natural gas production

increased by 5% to 17.2BCF. The Tapti fields produced 0.03MMBBL of condensate

and 0.6BCF of natural gas during the quarter, a yoy decline of 52% and 85%,

respectively. Fall in oil and gas production in the fields could mainly be attributed

to geological reasons.

The domestic Oil & Gas segment’s revenue declined 16% yoy to `1,166cr, led by

a decline in volumes. The segment’s EBIT margin declined significantly, ie to 4.8%

for the quarter as against 24.1% in 2QFY2015, led by decline in revenue.

On the US shale front, the macroeconomic environment remained quite

challenging. Higher supplies from the OPEC and a slowdown in China affected

crude prices and resulted in unit realizations declining by 51% yoy. Consequently,

even with modest growth in volumes, the revenue for the quarter declined 45% yoy

to `897cr. The segment’s EBIT margin declined to 21% during the quarter as

against 30.1% in 2QFY2015.

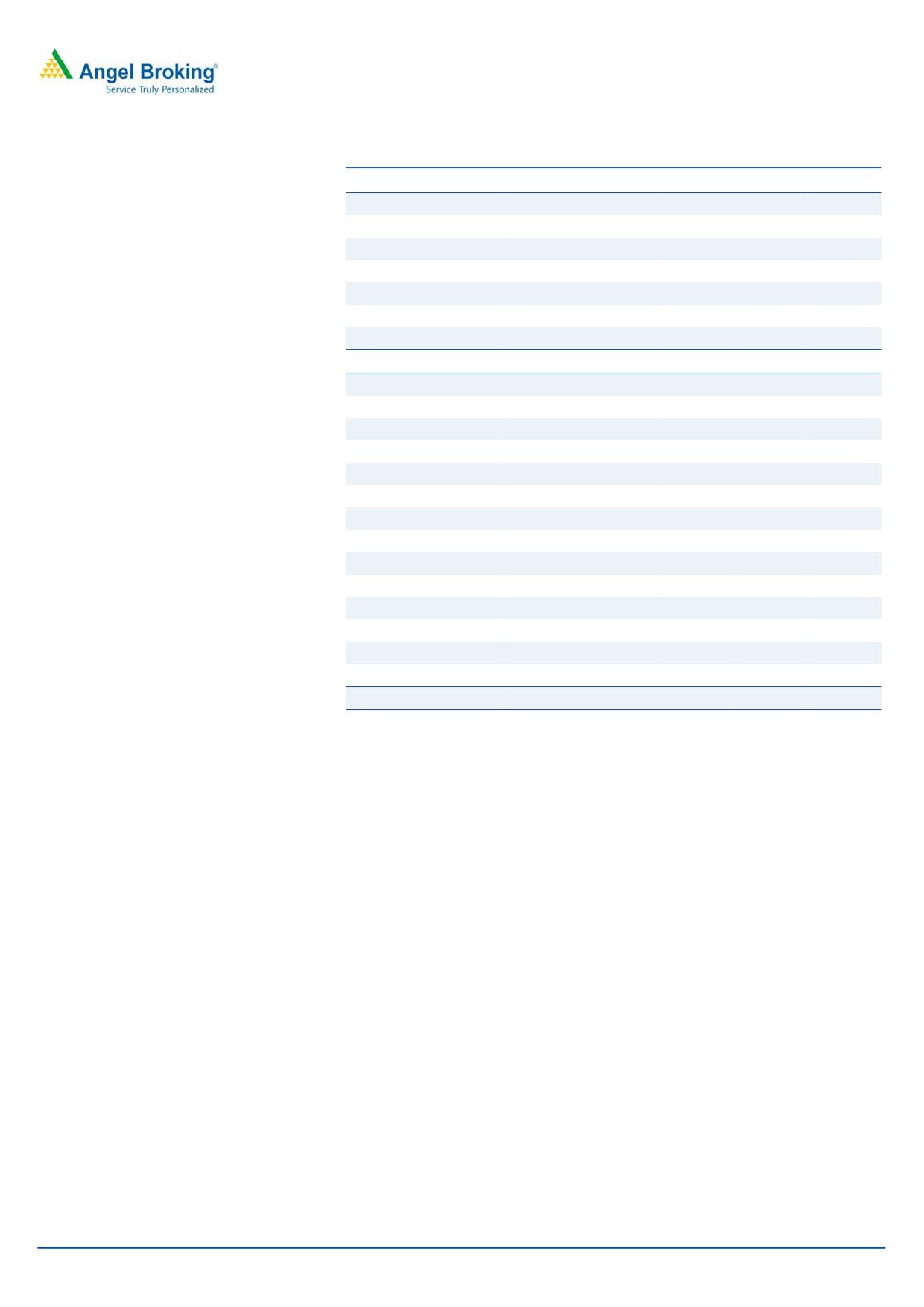

Exhibit 7: Domestic E&P revenues and EBIT Margin

Exhibit 8: US Shale revenues and EBIT Margin

1,800

35.0%

1,800

45.0%

40.0%

1,600

1,600

30.0%

35.0%

1,400

1,400

25.0%

30.0%

1,200

1,200

25.0%

1,000

20.0%

1,000

20.0%

800

15.0%

800

15.0%

10.0%

600

600

10.0%

5.0%

400

400

0.0%

5.0%

200

200

-5.0%

0

0.0%

0

-10.0%

4Q14

1Q15

2Q15

3Q15

4Q15

4Q15

2Q16

4Q14

1Q15

2Q15

3Q15

4Q15

4Q15

2Q16

Segment Revenue

EBIT Margin (%)

Segment Revenue

EBIT Margin (%)

Source: Company, Angel Research

Source: Company, Angel Research

Store expansion continues to drive Retail segment revenues

The Retail segment added 110 stores during the quarter, leading to a

22%

increase in revenue at `4,167cr. The store count reached 2,857 with 1,379 of

these being Reliance Digital stores. The segment’s EBIT remained stable at 2.3% as

against 2.4% in 2QFY2015.

RIL is building up an ecosystem for distribution of Jio devices; the company is

gearing up for its roll out, which would be in a phased manner. Reliance Retail will

soon be launching its own brand of 4G LTE smartphones under the brand ‘LYF’.

The company has made investments of ~`95,000cr in the Telecom business.

Reliance Jio is the first telecom operator to hold a pan-India Unified License and

holds the highest amount of liberalised spectrum among telecom operators,

totaling to 751.1MHz. The company plans to provide seamless 4G services using

LTE in 800MHz, 1800MHz and 2300MHz bands through an integrated ecosystem.

We believe the Retail and Telecom businesses would be the key drivers for growth

for the company in the coming years.

October 21, 2015

5

Reliance Industries | 2QFY2016 Result Update

Investment arguments

Growth in core business profits to remain strong

We expect RIL’s core Refining and Petrochemicals business to continue to

outperform, led by its leadership in these segments. Refining margins are expected

to remain strong considering delays in other upcoming refinery projects, which

should limit supplies in the market. Also, new capacity additions are expected to

drive revenues and EBIT of the Petrochemicals business. While the E&P business

would continue to remain a drag, we believe the Refining and Petrochemicals

businesses would more than offset the declines.

Strong investments in Jio and Retail business to drive growth

RIL is nearing the end of its massive capex programme of ~`200,000cr, the full

benefit of which should start showing up from the next fiscal. The company has

made huge investments in Jio (~`95,000cr so far with another ~`5,000cr to be

invested by the time of launch of services), while it continues to invest in the Retail

business. RIL plans to expand its store presence from 200 locations to over 900

cities and towns. Apart from these, the company has spent ~80% of the capex for

its four key projects (petcoke gasification plant at its refinery, refinery off-gas

cracker in petrochemicals, polyester/aromatics capacity expansion and import of

ethane from US). We expect these investments to drive EBITDA for the company

over the coming years.

October 21, 2015

6

Reliance Industries | 2QFY2016 Result Update

Outlook and valuation

We believe RIL’s growth in the coming years to be driven by its core Refining and

Petrochemicals business. We value the Refining business at 7x EBITDA, while we

assign a 6.5x multiple to the Petrochemicals business. We value the telecom

business at 0.3x invested capital, while retail is valued at 1x sales. We retain our

Accumulate rating on the stock with a target price of `1,050, implying a 10%

upside from current levels.

Exhibit 9: RIL - SOTP Valuation

Business

Value (` Cr)

` per share

Methodology

Refining Segment

1,70,736

580

EV/EBITDA (7x)

Petrochemicals

1,35,325

459

EV/EBITDA (6.5x)

KG D6

12,014

41

DCF

PMT

5,396

18

EV/EBITDA (4x)

Shale

8,273

28

EV/EBITDA (3x)

Retail

21,189

72

1x Sales

Telecom

30,000

102

0.3x investments

Net Debt

(73,510)

(250)

Target Value

3,09,424

1,050

Source: Company, Angel Research

Company background

Reliance Industries Ltd is a Fortune Global 500 company and the largest private

sector company in India with interests in the energy and materials value chain.

Over the years the company has successfully integrated backwards in the energy

chain and has attained leadership in most areas. The company operates one of

the largest refining capacities of 1.24mmbbl/day and has one of the most complex

refineries in the world. The company is now foraying into newer businesses such as

organized retail and broadband services.

October 21, 2015

7

Reliance Industries | 2QFY2016 Result Update

Profit & Loss Statement (Standalone)

Y/E March (` cr)

FY2013

FY2014

FY2015

FY2016E FY2017E

Net Sales

3,60,297

3,90,117

3,29,076

3,04,775

3,44,392

Other operating income

0

0

0

0

0

Total operating income

3,60,297

3,90,117

3,29,076

3,04,775

3,44,392

% chg

9.2

8.3

(15.6)

(7.4)

13.0

Total Expenditure

3,29,510

3,59,240

2,97,474

2,66,250

2,98,286

Raw Material cost

3,03,312

3,30,249

2,65,075

2,28,623

2,41,235

Employee Costs

3,354

3,370

3,686

4,928

5,416

Other Expenses

22,844

25,621

28,713

21,01,219

35,86,895

EBITDA

30,787

30,877

31,602

38,524

46,106

% chg

(8.4)

0.3

2.3

21.9

19.7

(% of Net Sales)

8.5

7.9

9.6

12.6

13.4

Depreciation& Amortisation

9,465

8,789

8,488

8,922

12,009

EBIT

21,322

22,088

23,114

29,602

34,097

% chg

(4.1)

3.6

4.6

28.1

15.2

(% of Net Sales)

5.9

5.7

7.0

9.7

9.9

Interest & other Charges

3,036

3,206

2,367

2,746

3,155

Other Income

7,998

8,936

8,721

8,167

9,028

Profit before tax

26,284

27,818

29,468

35,023

39,969

% chg

2.1

5.8

5.9

18.9

14.1

Tax Expense

5,281

5,834

6,749

8,141

9,742

(% of PBT)

20.1

21.0

22.9

23.2

24.4

Recurring PAT

21,003

21,984

22,719

26,883

30,227

Adjusted PAT

19,716

20,173

20,397

26,883

30,227

% chg

4.8

2.3

1.1

31.8

12.4

(% of Net Sales)

5.5

5.2

6.2

8.8

8.8

October 21, 2015

8

Reliance Industries | 2QFY2016 Result Update

Balance Sheet (Standalone)

Y/E March (` cr)

FY2013

FY2014

FY2015

FY2016E FY2017E

SOURCES OF FUNDS

Equity Share Capital

3,229

3,232

3,236

3,236

3,236

Reserves & Surplus

1,76,791

1,93,859

2,12,940

2,36,099

2,61,432

Shareholders Funds

1,80,020

1,97,091

2,16,176

2,39,335

2,64,668

Total Loans

72,427

89,968

97,620

1,07,750

1,03,075

Deferred Tax Liability

12,293

12,376

12,956

13,109

14,474

Other Long term liabilities

0

0

1,404

0

0

Total Liabilities

2,64,740

2,99,435

3,28,156

3,60,194

3,82,217

APPLICATION OF FUNDS

Gross Block

2,13,154

2,22,565

2,36,062

2,50,210

3,31,775

Less: Acc. Depreciation

1,03,406

1,13,159

1,21,499

1,30,779

1,43,154

Net Block

1,09,748

1,09,406

1,14,563

1,19,432

1,88,622

Capital Work-in-Progress

19,116

41,716

75,753

92,250

33,000

Investments

52,509

86,062

1,12,573

1,15,989

1,19,114

Current Assets

1,15,610

1,01,963

65,637

96,376

1,09,798

Cash

49,547

36,624

11,571

16,239

25,044

Inventories

42,729

42,932

36,551

31,243

33,830

Debtor

11,880

10,664

4,661

6,468

7,363

Other

11,454

11,743

12,854

42,427

43,561

Current liabilities

53,871

68,309

69,908

63,853

68,317

Net Current Assets

61,739

33,654

(4,271)

32,523

41,481

Other Assets

21,628.0

28,597.0

29,538.0

-

-

Total Assets

2,64,740

2,99,435

3,28,156

3,60,194

3,82,217

October 21, 2015

9

Reliance Industries | 2QFY2016 Result Update

Cash flow statement (Standalone)

Y/E March (` cr)

FY2013

FY2014

FY2015

FY2016E FY2017E

Profit before tax

39,598

49,547

33,224

35,023

39,969

Depreciation

9,465

8,789

8,488

8,922

12,009

Change in Working Capital

5,782

14,515

8,315

(32,127)

(152)

Others

(17,185)

(24,626)

(8,660)

28,036

(1,261)

Direct taxes paid

(4,665)

(6,065)

(6,082)

(7,987)

(8,377)

Cash Flow from Operations

32,995

42,160

35,285

31,868

42,187

(Inc.)/ Dec. in Fixed Assets

(15,911)

(32,399)

(42,634)

(30,645)

(22,315)

(Inc.)/ Dec. in Investments

2,132

(31,232)

(23,403)

(3,416)

(3,125)

Others

(1,018)

(382)

10,039

0

0

Cash Flow from Investing

(14,797)

(64,013)

(55,998)

(34,061)

(25,440)

Issue of Equity

12

183

226

-

-

Inc./(Dec.) in loans

1,230

12,476

5,453

10,130

(4,675)

Dividend Paid (Incl. Tax)

(2,924)

(3,093)

(3,268)

(3,268)

(3,268)

Others

(6,567)

(4,036)

(3,351)

-

-

Cash Flow from Financing

(8,249)

5,530

(940)

6,862

(7,943)

Inc./(Dec.) in Cash

9,949

(16,323)

(21,653)

4,668

8,805

Opening Cash balances

39,598

49,547

33,224

11,571

16,239

Closing Cash balances

49,547

33,224

11,571

16,239

25,044

October 21, 2015

10

Reliance Industries | 2QFY2016 Result Update

Key ratios

Y/E March

FY2013

FY2014

FY2015

FY2016E

FY2017E

Per Share Data (`)

Reported EPS

71.5

74.8

77.2

91.3

102.6

Adjusted EPS

67.2

68.6

69.3

91.3

102.6

Cash EPS

103.8

104.7

106.0

121.5

143.4

DPS

9.0

9.5

10.0

10.0

10.0

Book Value

613.1

670.4

734.5

812.4

898.4

Valuation Ratio (x)

P/E (on FDEPS)

13.3

12.8

12.4

10.5

9.3

P/CEPS

9.2

9.1

9.0

7.9

6.7

P/BV

1.6

1.4

1.3

1.2

1.1

Dividend yield (%)

0.9

1.0

1.0

1.0

1.0

EV/Sales

0.8

0.9

1.1

1.2

1.0

EV/EBITDA

9.9

10.8

11.6

9.7

7.8

EV/Total Assets

1.1

1.1

1.1

1.0

0.9

Returns (%)

ROCE

8.8

8.2

7.7

9.0

9.5

ROE

12.1

11.7

11.0

11.8

12.0

Turnover ratios (x)

Asset Turnover (Gross Block)

1.7

1.8

1.4

1.3

1.2

Inventory (days)

39.9

40.1

44.1

40.6

34.5

Receivables (days)

15.3

10.5

8.5

6.7

7.3

Payables (days)

51.8

57.2

76.7

80.1

70.0

WC cycle (ex-cash) (days)

14.9

4.3

(10.4)

0.3

17.3

Solvency ratios (x)

Net debt to equity

0.1

0.3

0.4

0.4

0.3

Net debt to EBITDA

0.3

0.6

0.9

0.8

0.8

Interest Coverage (EBIT / Int.)

7.0

6.9

9.8

10.8

10.8

October 21, 2015

11

Reliance Industries | 2QFY2016 Result Update

Research Team Tel: 022 - 39357800

DISCLAIMER

Angel Broking Private Limited (hereinafter referred to as “Angel”) is a registered Member of National Stock Exchange of India Limited,

Bombay Stock Exchange Limited and Metropolitan Stock Exchange of India Limited. It is also registered as a Depository Participant with

CDSL and Portfolio Manager with SEBI. It also has registration with AMFI as a Mutual Fund Distributor. Angel Broking Private Limited is

a registered entity with SEBI for Research Analyst in terms of SEBI (Research Analyst) Regulations, 2014 vide registration number

INH000000164. Angel or its associates has not been debarred/ suspended by SEBI or any other regulatory authority for accessing

/dealing in securities Market. Angel or its associates including its relatives/analyst do not hold any financial interest/beneficial

ownership of more than 1% in the company covered by Analyst. Angel or its associates/analyst has not received any compensation /

managed or co-managed public offering of securities of the company covered by Analyst during the past twelve months. Angel/analyst

has not served as an officer, director or employee of company covered by Analyst and has not been engaged in market making activity

of the company covered by Analyst.

This document is solely for the personal information of the recipient, and must not be singularly used as the basis of any investment

decision. Nothing in this document should be construed as investment or financial advice. Each recipient of this document should

make such investigations as they deem necessary to arrive at an independent evaluation of an investment in the securities of the

companies referred to in this document (including the merits and risks involved), and should consult their own advisors to determine

the merits and risks of such an investment.

Reports based on technical and derivative analysis center on studying charts of a stock's price movement, outstanding positions and

trading volume, as opposed to focusing on a company's fundamentals and, as such, may not match with a report on a company's

fundamentals.

The information in this document has been printed on the basis of publicly available information, internal data and other reliable

sources believed to be true, but we do not represent that it is accurate or complete and it should not be relied on as such, as this

document is for general guidance only. Angel Broking Pvt. Limited or any of its affiliates/ group companies shall not be in any way

responsible for any loss or damage that may arise to any person from any inadvertent error in the information contained in this report.

Angel Broking Pvt. Limited has not independently verified all the information contained within this document. Accordingly, we cannot

testify, nor make any representation or warranty, express or implied, to the accuracy, contents or data contained within this document.

While Angel Broking Pvt. Limited endeavors to update on a reasonable basis the information discussed in this material, there may be

regulatory, compliance, or other reasons that prevent us from doing so.

This document is being supplied to you solely for your information, and its contents, information or data may not be reproduced,

redistributed or passed on, directly or indirectly.

Neither Angel Broking Pvt. Limited, nor its directors, employees or affiliates shall be liable for any loss or damage that may arise from

or in connection with the use of this information.

Note: Please refer to the important ‘Stock Holding Disclosure' report on the Angel website (Research Section). Also, please refer to the

latest update on respective stocks for the disclosure status in respect of those stocks. Angel Broking Pvt. Limited and its affiliates may

have investment positions in the stocks recommended in this report.

Disclosure of Interest Statement

Reliance Industries

1. Analyst ownership of the stock

No

2. Angel and its Group companies ownership of the stock

No

3. Angel and its Group companies' Directors ownership of the stock

No

4. Broking relationship with company covered

No

Note: We have not considered any Exposure below ` 1 lakh for Angel, its Group companies and Directors

Ratings (Based on expected returns

Buy (> 15%)

Accumulate (5% to 15%)

Neutral (-5 to 5%)

over 12 months investment period):

Reduce (-5% to -15%)

Sell (< -15)

October 21, 2015

12