Initiating Coverage | Auto Ancillary

June 16, 2015

Rane Brake Lining

BUY

CMP

`282

No Brake to its Ascent

Target Price

`336

Rane Brake Lining (RBL) is engaged in the manufacture of safety critical friction

Investment Period

12 Months

material products viz brake linings, disc pads and brake shoes. It is the leader in

the automobile OEM (Passenger and commercial vehicle) segment with a 38%

Stock Info

share, while it has an 18% share in the aftermarket segment.

Sector

Auto Ancillary

Recovery in OEM segment coupled with aftermarket focus to drive growth

Market Cap (` cr)

223

Passenger vehicle and the MHCV OEM segment, which contribute about 47% to

Net Debt (` cr)

61

RBL’s revenues, are in an uptrend and slated to grow in double digits over the

Beta

1.3

next two years. Improved economic growth, further easing of interest rates, lower

fuel prices and low base during the recent slowdown period would lead to an

52 Week High / Low

387 / 212

OEM upcycle in FY2016/17. RBL, with its market leadership (38% market share)

Avg. Daily Volume

650

and well established client base, would reap benefits from an anticipated upsurge

Face Value (`)

10

in demand. Further, RBL’s strategy to enhance its distribution network in

BSE Sensex

26,587

underpenetrated Northern and Eastern markets and to introduce new products, is

Nifty

8,014

likely to boost its aftermarket revenues. We expect RBL’s aftermarket segment

(constituting 38% of sales) to grow at 14% CAGR over FY2015-2017. RBL is likely

Reuters Code

RABL.BO

to outpace the industry and further augment its share in the aftermarket segment

Bloomberg Code

RABL@IN

(current aftermarket share is 18%).

Operating leverage, raw material localization and energy savings to

Shareholding Pattern (%)

augment margins

Promoters

66.5

RBL would reap benefits of operating leverage given the double digit top-line

growth over the next two years. Also, it is working on enhancing the localization

MF / Banks / Indian Fls

10.9

levels. Imported raw material currently forms about 48% of the material costs and

FII / NRIs / OCBs

-

the company aims to realize 100-200bp cost reduction with increased domestic

Indian Public / Others

22.6

procurement. Further, RBL is also working towards reducing its energy costs by

implementing best practices across manufacturing plants and utilizing power from

low cost sources. We expect RBL’s margins to improve by 70bp over FY2016/17.

Abs. (%)

3m 1yr 3yr

Outlook and valuation: RBL’s revenues are estimated to grow at 12% CAGR over

Sensex

(6.7)

5.4

56.9

the next two years. Upsurge in OEM volumes coupled with focus on the

RBL

(12.5)

27.8

148.2

aftermarket segment would drive the top-line. Also, the company’s margins are

expected to improve on account of operating leverage, enhanced local

procurement and energy savings. Given the healthy top-line growth and margin

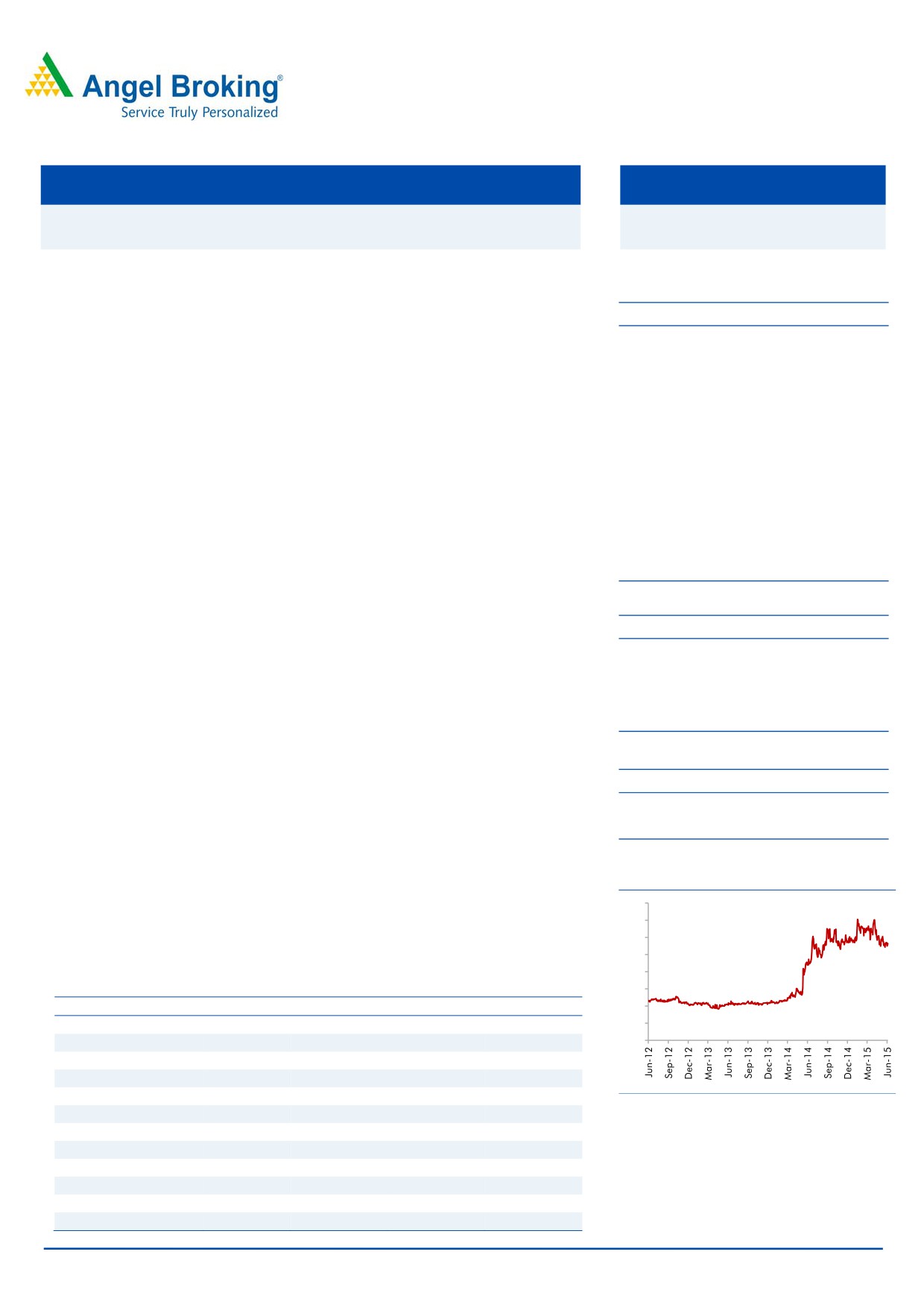

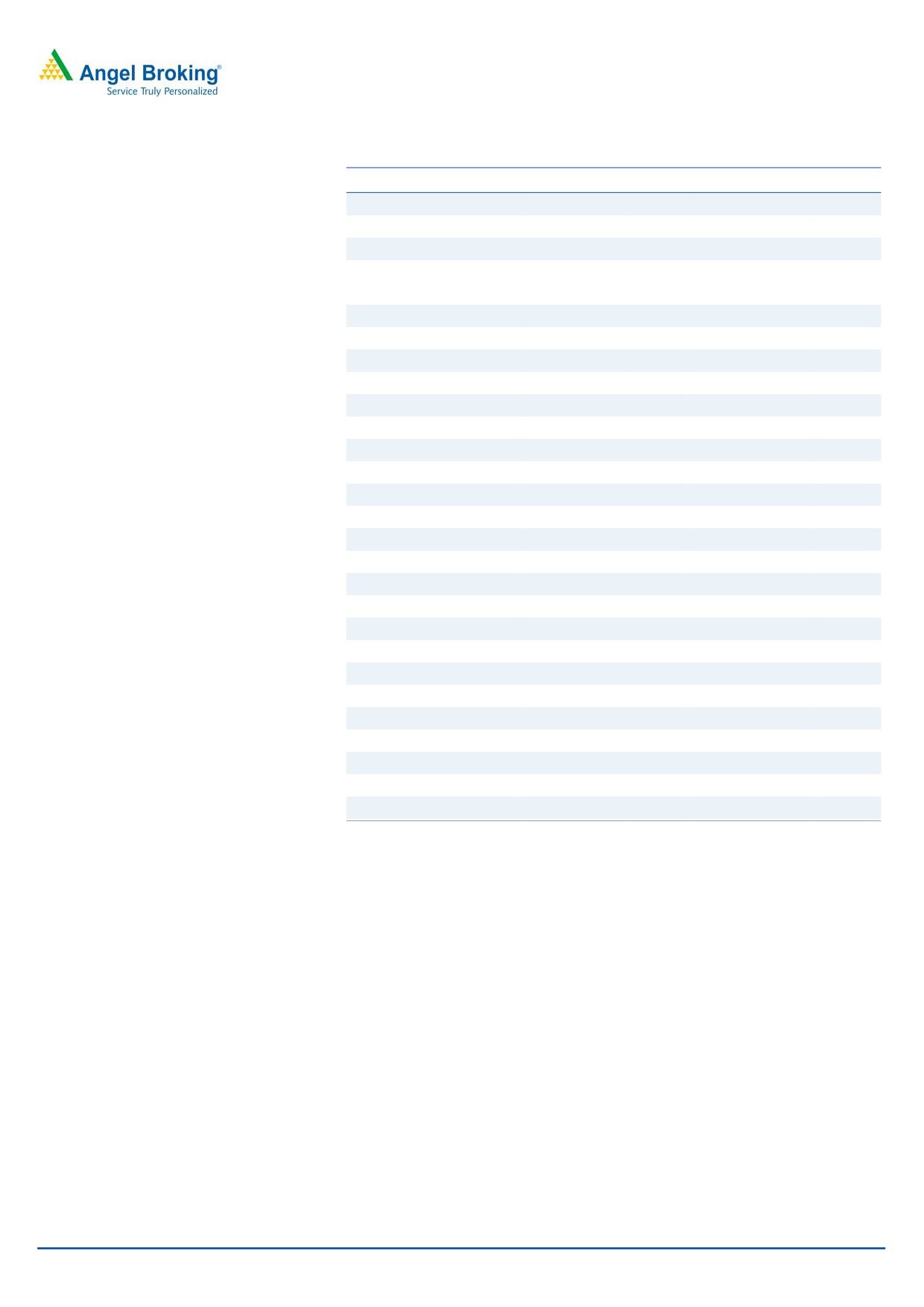

3-Year Daily price chart

improvement, RBL’s earnings are likely to grow at a CAGR of 17% over

400

FY2015-2017. Its return ratios are also estimated to expand due to margin

350

improvement and reduction in leverage. We initiate coverage on RBL with a Buy

300

250

recommendation and target price of `336 (based on 12x FY2017 earnings).

200

Key financials

150

Y/E March (` cr)

FY2014

FY2015

FY2016E

FY2017E

100

Net sales

384

416

460

520

50

% chg

2.0

8.4

10.5

13.0

0

Net profit (Adj.)

17

16

19

22

% chg

89.1

(6.4)

15.4

19.0

EBITDA margin (%)

10.5

10.9

11.3

11.6

Source: Company, Angel Research

EPS (`)

21.7

20.4

23.5

28.0

P/E (x)

13.0

13.9

12.0

10.1

P/BV (x)

2.0

1.8

1.7

1.5

RoE (%)

15.3

13.2

14.0

15.2

RoCE (%)

11.9

13.3

15.7

16.7

Bharat Gianani

EV/Sales (x)

0.8

0.7

0.6

0.6

022-39357800 Ext: 6817

EV/EBITDA (x)

7.5

6.3

5.4

4.9

Source: Company, Angel Research, Note: CMP as of June 15, 2015

Please refer to important disclosures at the end of this report

1

Rane Brake Lining | Initiating Coverage

Investment Arguments

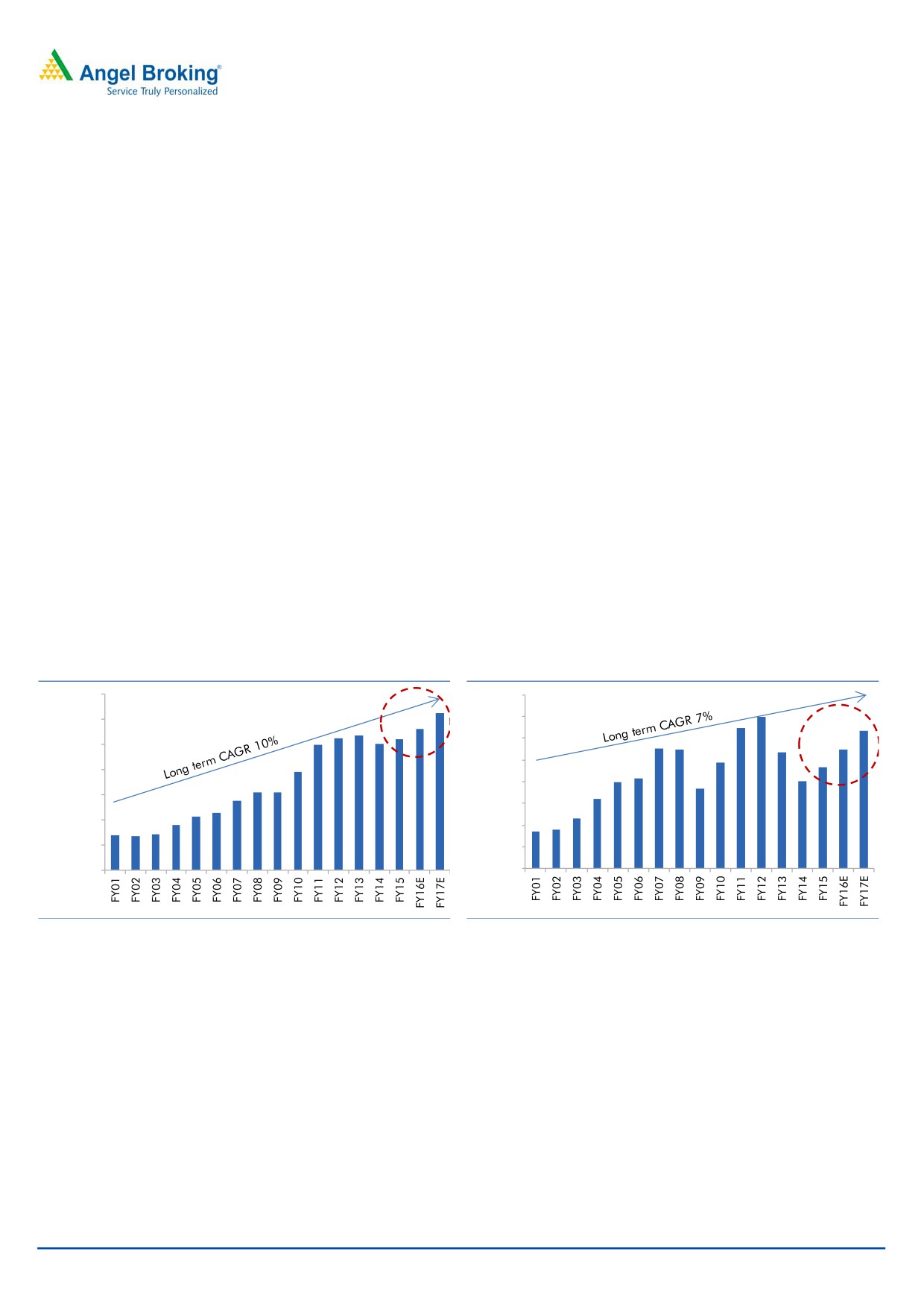

Passenger vehicle and HCV OEM to record double digit growth

The passenger and MHCV OEM industry is clearly in an upcycle in the medium

term. After three consecutive years of slowdown, the industry showed signs of

recovery in FY2015. The passenger vehicle segment grew 4% in FY2015, after

flattish volumes over the FY2012-FY2014 period. Similarly, the MHCV segment

surged 16% after two consecutive years of double digit decline. We expect the

industry growth to accelerate in FY2016/17. Favourable macro economic factors,

viz (a) higher economic growth leading to higher income levels, (b) easing of

interest rates which would reduce the operating cost and (c) lower fuel prices

which reduce the maintenance cost, are likely to boost OEM demand. Further, the

slowdown period has created a low base, thus paving way for healthy growth over

the medium term. The passenger vehicle and MHCV OEM segments are likely to

grow in double digits, ie we estimate a 9% and 16% CAGR respectively over

FY2015-2017 period,_in order to retract to long term CAGR trend of 10% and 7%

respectively.

We believe RBL with its leadership position (commanding 38% market share) and

well established client base is well poised to benefit from an uptrend in volumes. It

derives about 47% revenues from the OEM segment and would be the key

beneficiary of an OEM upcycle. We estimate RBL’S OEM segment revenues to grow

by 10% CAGR over the next two years.

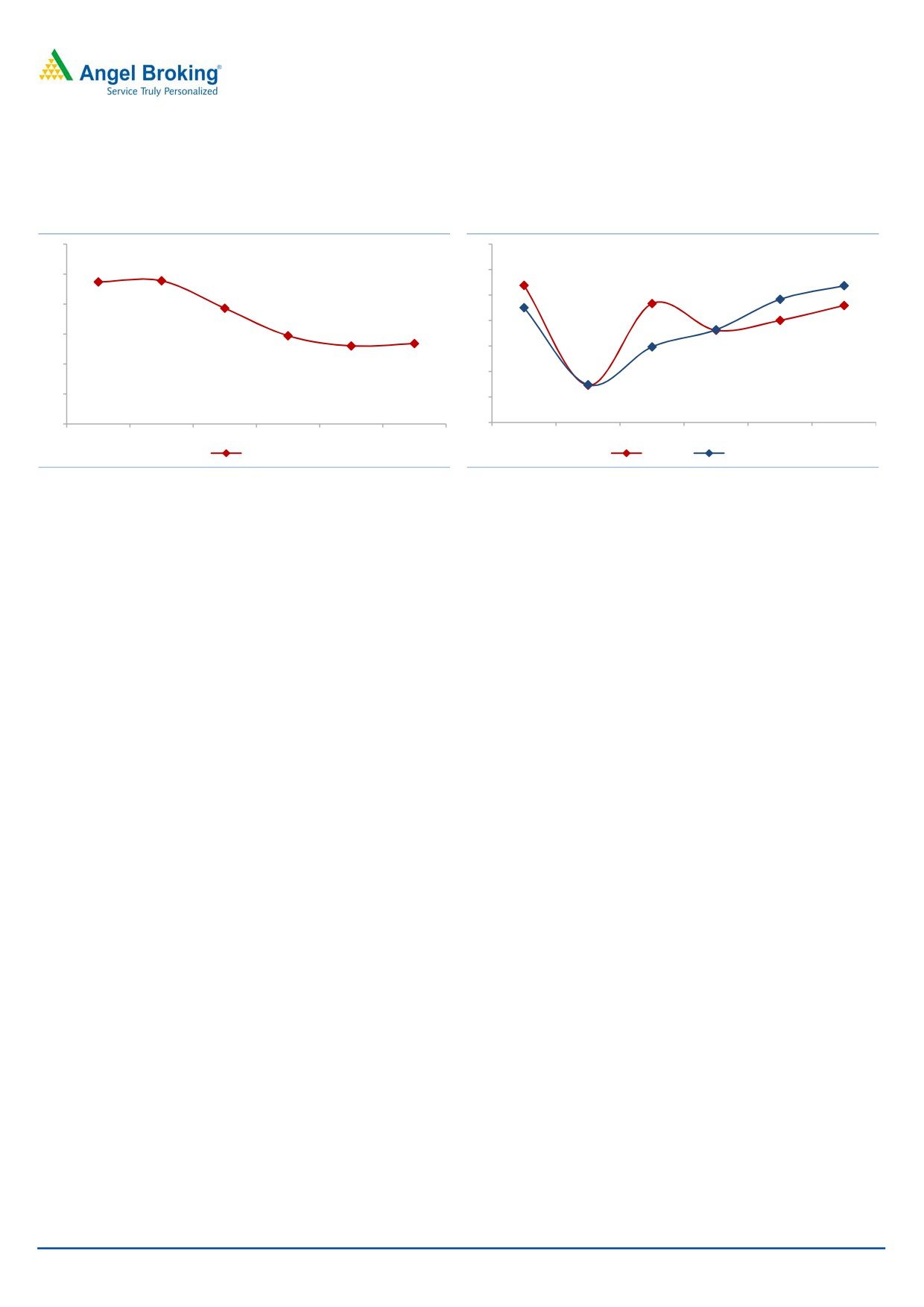

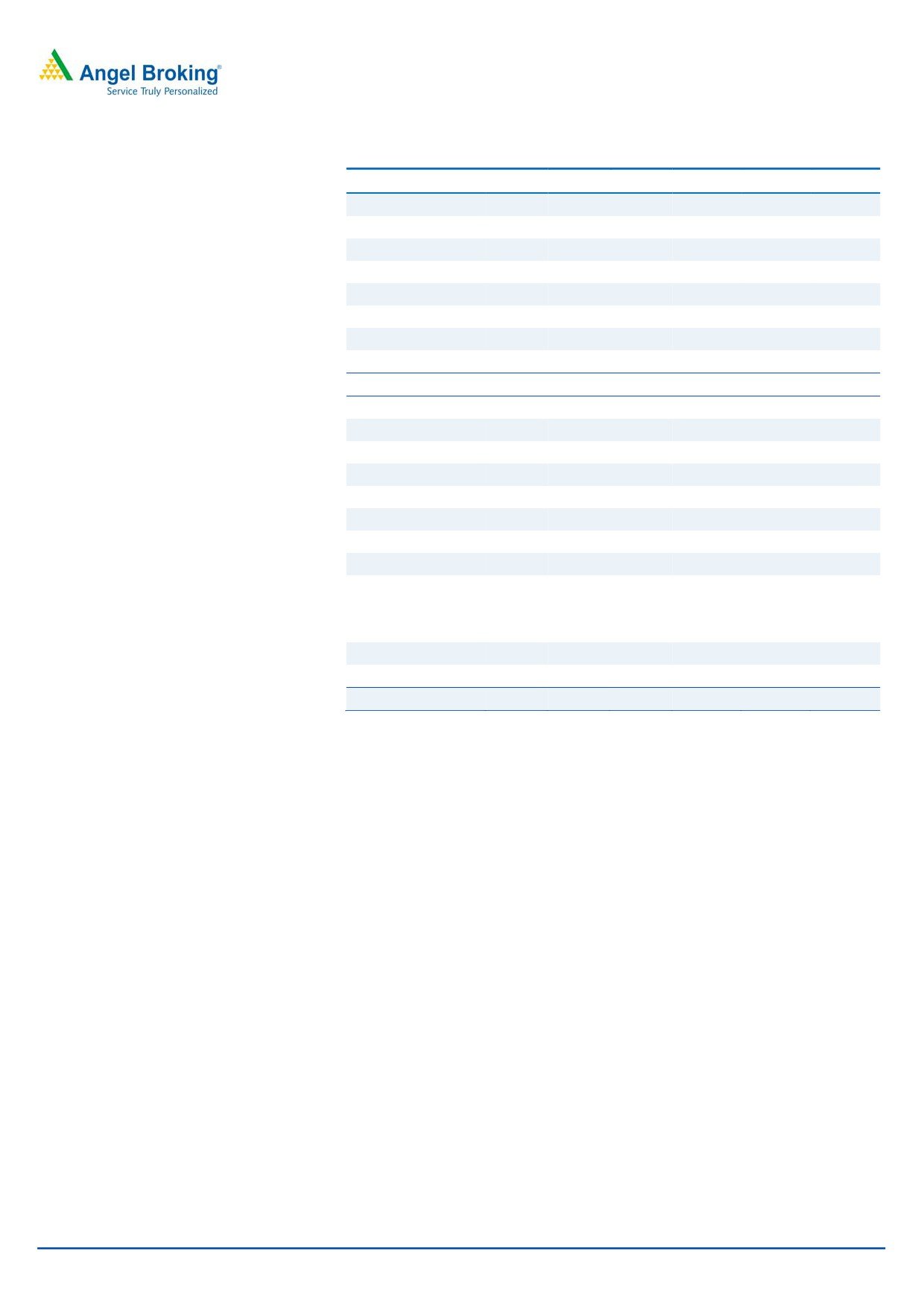

Exhibit 1: Passenger vehicle industry trend

Exhibit 2: MHCV industry trend

3,500,000

400,000

Implied

3,000,000

CAGR

350,000

Implied

9%

CAGR

300,000

2,500,000

16%

250,000

2,000,000

200,000

1,500,000

150,000

1,000,000

100,000

500,000

50,000

0

0

Source: SIAM, Angel Research

Source: SIAM, Angel Research

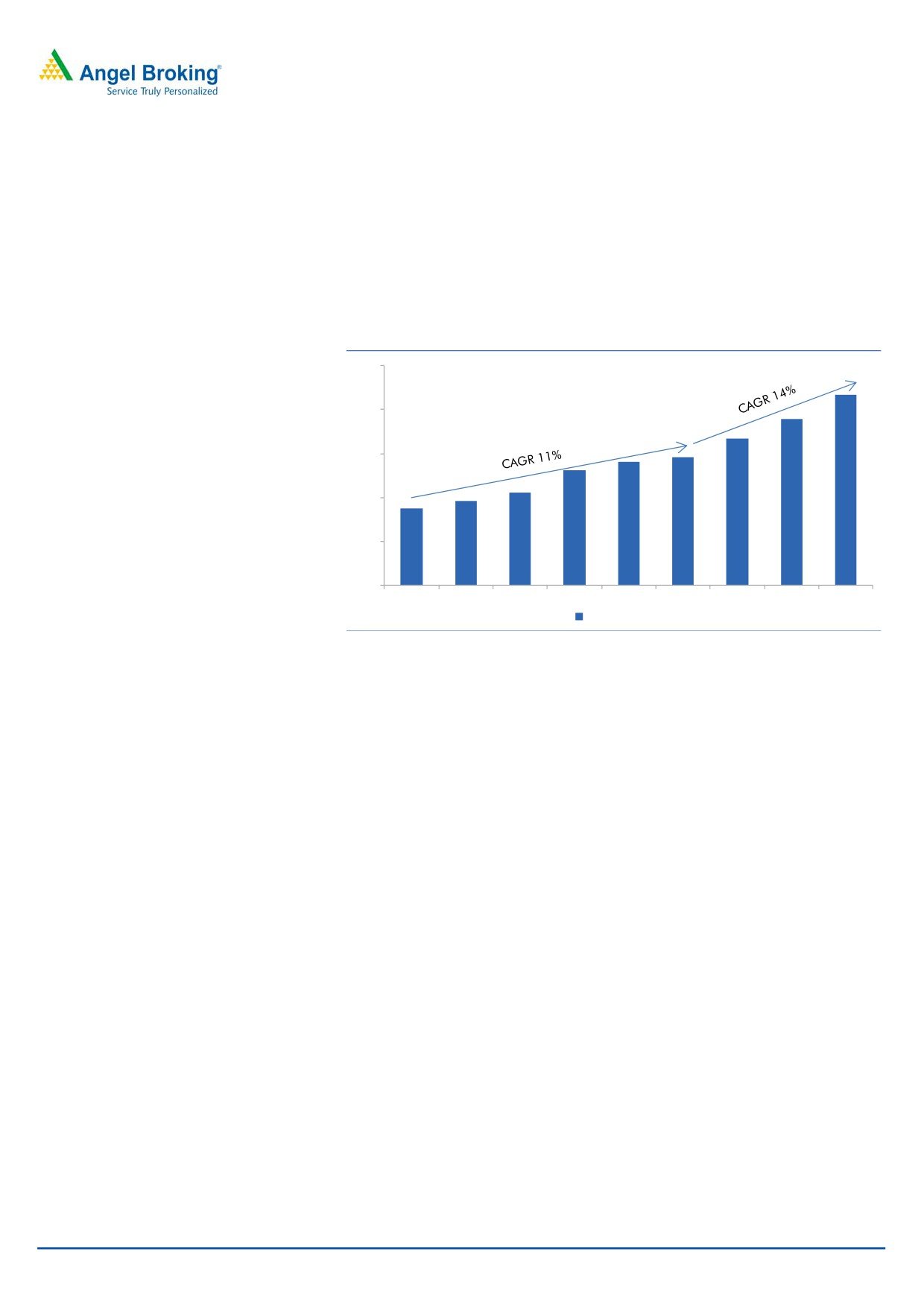

Expanding reach in Northern and Eastern markets and new

product introduction to drive aftermarket segment

RBL’s products have strong acceptance in the aftermarket segment in which it

commands 18% market share. In a move to further boost aftermarket revenues,

RBL is targeting to strengthen the distribution network in the Northern and the

Eastern markets where it has relatively lower dealer penetration. RBL is traditionally

strong in the Southern and Western regions which account for about 60-65% of

the company’s overall aftermarket revenues. With demand potential of Northern

and Eastern regions being almost similar to the Southern and Western regions, RBL

has immense growth potential. Apart from enhancing the dealer network, RBL is

also introducing new related products in the aftermarket space. It recently

introduced brake shoes, thereby enhancing product offerings. Further,

June 16, 2015

2

Rane Brake Lining | Initiating Coverage

improvement in the economy along with uptick in OEM volumes would bolster the

replacement demand going ahead.

As per the industry estimates, replacement market is almost double the size of the

OEM segment. With the dual strategy of enhancing distribution network and

introducing new products, RBL is likely to gain market share in the replacement

space. We expect RBL’s aftermarket division (constituting about 40% of revenues)

to grow at a CAGR of 14% over FY2015-17.

Exhibit 3: RBL after market growth trend

250

200

150

100

50

0

FY09

FY10

FY11

FY12

FY13

FY14

FY15

FY16E FY17E

Aftermarket (` cr)

Source: Company, Angel Research

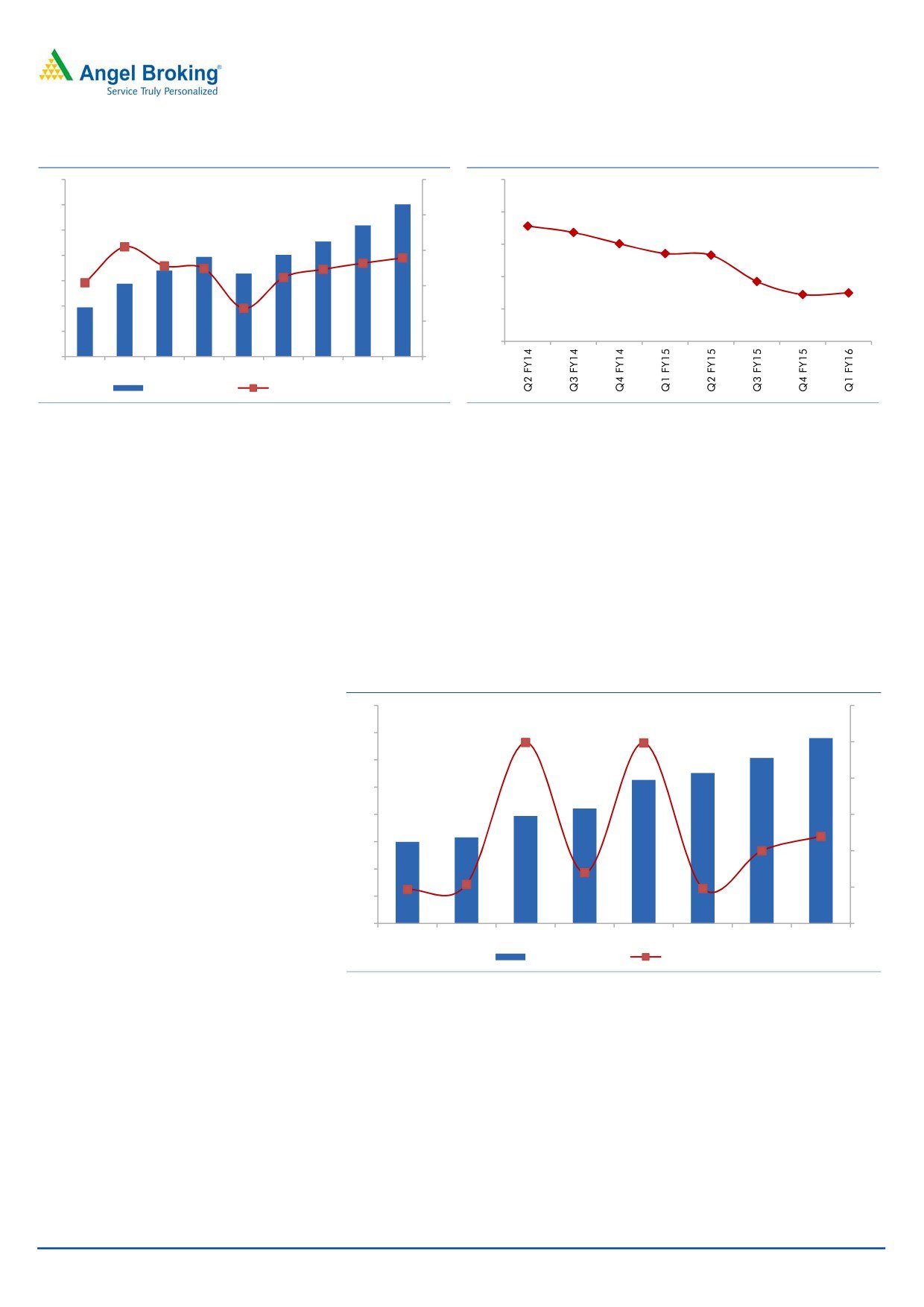

Operating leverage, raw material localization and energy

savings to lead to margin improvement

RBL is poised to register double digit top-line growth (12% CAGR) over the next two

years. Uptick in the OEM segment coupled with healthy growth in the aftermarket

space would boost the top-line. The company is likely to draw benefits of operating

leverage on the back of healthy top-line growth. Also it’s working on reducing the

raw material costs by increasing the local content. It is planning to enhance

sourcing domestically and reduce dependence on imports (Imported raw material

currently contributes about 50% of the overall raw material costs). RBL aims to curb

the material costs by 100-200bp on back of increased localization. Further, it is

planning to reduce energy consumption by improving manufacturing processes

across its plants and utilizing power from low cost sources. Given the cost

reduction initiatives, we expect RBL’s margins to improve by 70bp over the next two

years.

RBL is also likely to realize the benefits of JPY weakening against INR given that the

imported raw material constitutes about half of the material costs and is largely

JPY denominated. Benefits of weak Yen would accrue from FY2016, given the

policy of hedging raw material costs for the next 6 months. (JPY had started to

depreciate from 2HFY2015).

June 16, 2015

3

Rane Brake Lining | Initiating Coverage

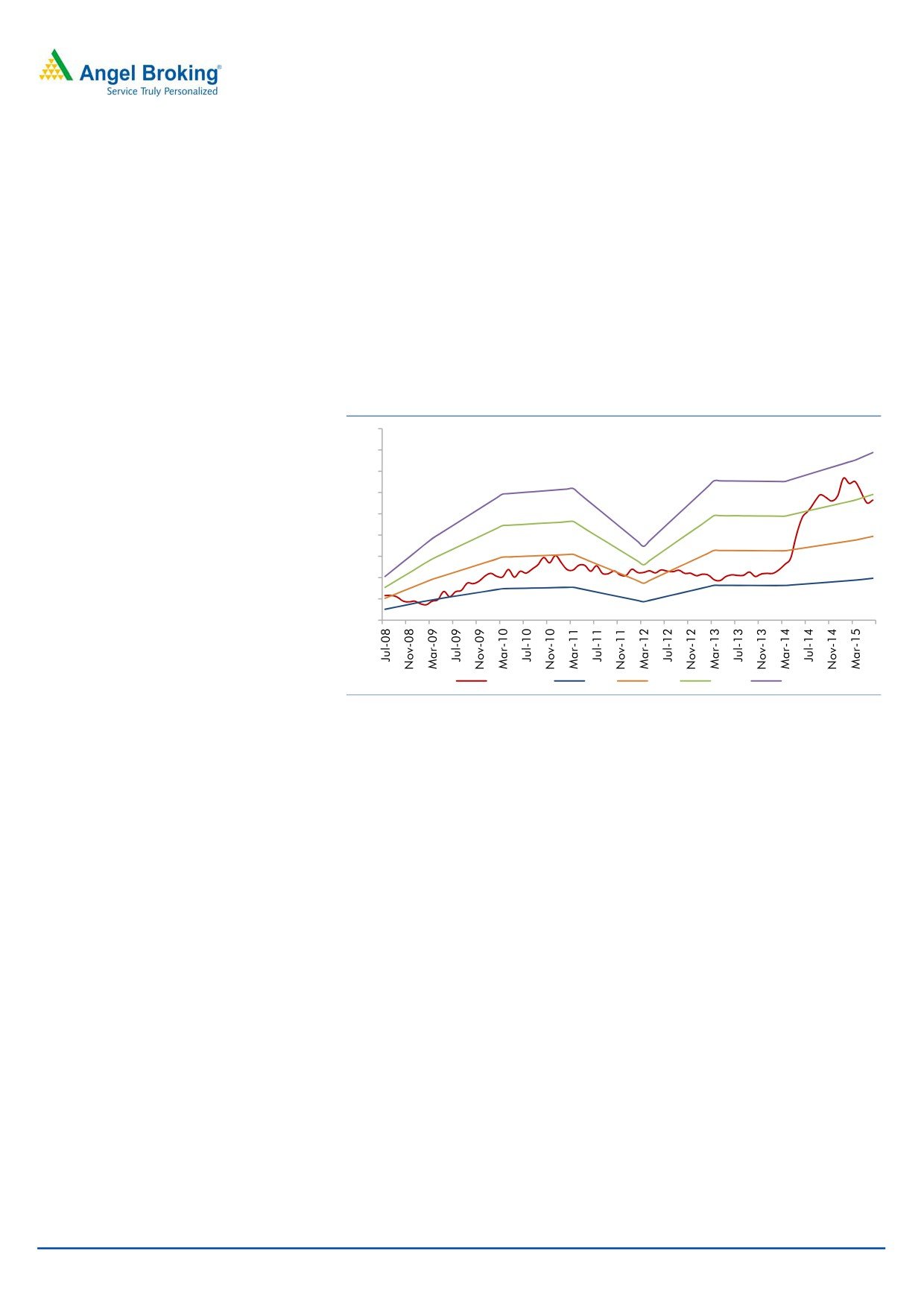

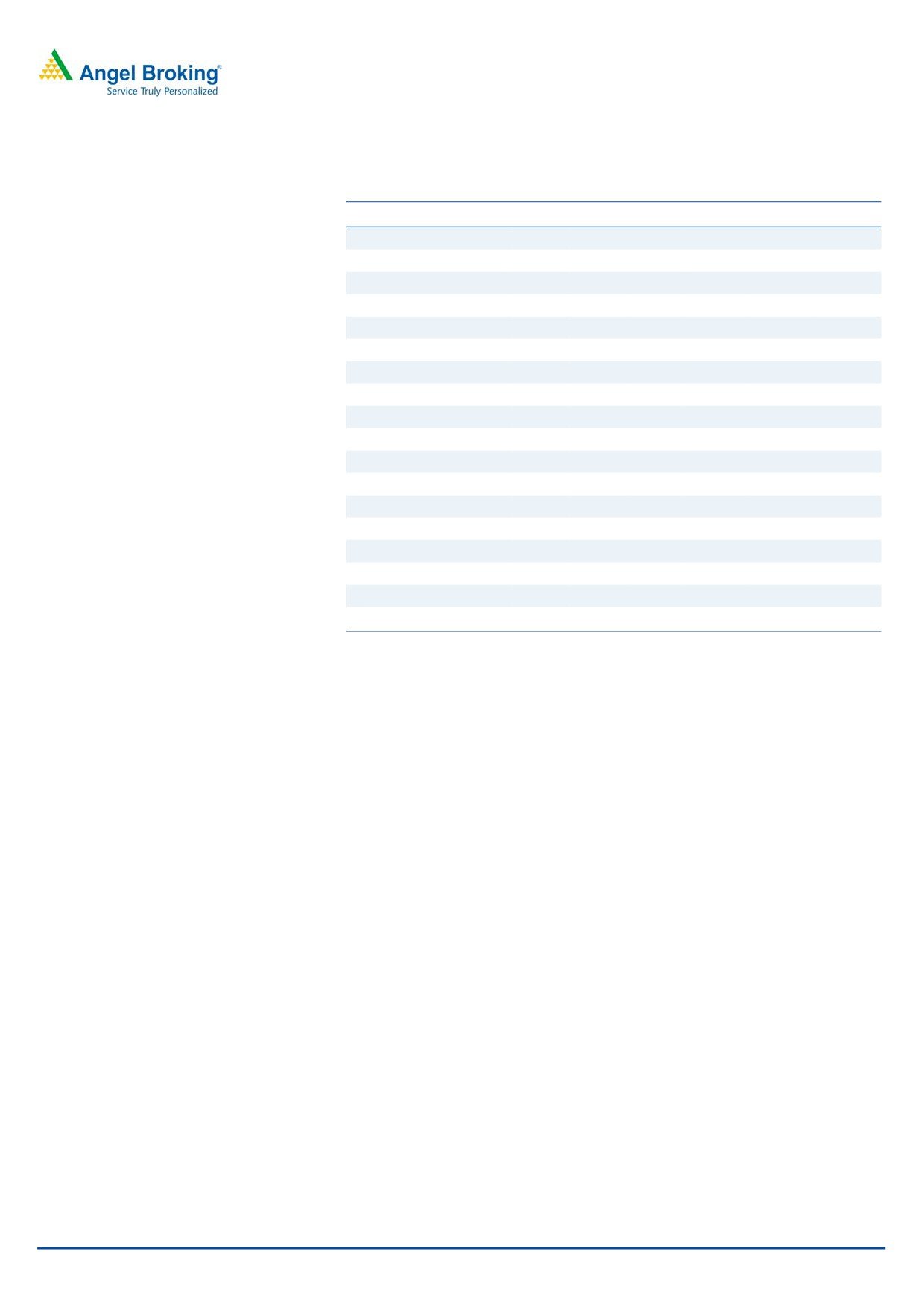

Exhibit 4: EBIDTA margin to improve

Exhibit 5: INR-JPY Trend

70

16

0.70

60

14

0.65

50

0.60

12

40

30

0.55

10

20

0.50

8

10

0.45

0

6

FY09

FY10

FY11

FY12

FY13

FY14

FY15

FY16E FY17E

EBIDTA (` cr)

EBIDTA Margin (%)

Source: Company, Angel Research

Source: Exchange rates, Angel Research

Exports to provide steady growth

The export segment, constituting about 7% of revenues, is expected to provide

steady revenue stream for the company. Apart from boosting the top-line, exports

act as a natural hedge given the high level of raw material imports. To enhance

exports, RBL aims to strengthen distribution network in the existing markets of

SAARC, Middle East and Africa. It is also tapping new markets and has recently

commenced supplies to Nigeria, Malawi and Ukraine. Further, RBL has identified

Europe as a focus area to enhance export revenues and it also aims to expand

product offerings in the market.

Exhibit 6: RBL export growth trend

40

30

35

25

30

20

25

20

15

15

10

10

5

5

0

0

FY10

FY11

FY12

FY13

FY14

FY15

FY16E

FY17E

Exports (` cr)

Growth (%)

Source: Company, Angel Research

Margin improvement coupled with improvement in leverage to

boost return ratios

RBL’s margins are estimated to improve by 70bp over FY2016/17. This would be

on the back of a double digit top-line growth, increased localization coupled with

savings in energy costs. Further, RBL has no major capex plans in the immediate

term. We also estimate the leverage metrics of RBL to improve over the next two

years, considering the improving profitability and stable debt levels. Consequently,

we expect the Debt/Equity ratio to improve marginally. Given the improvement in

profitability coupled with improving D/E ratio, we expect the RoCE to improve from

June 16, 2015

4

Rane Brake Lining | Initiating Coverage

13% in FY2015 to 17% in FY2017. Also, RoE is estimated to improve from 13%

currently to 15% in FY2017.

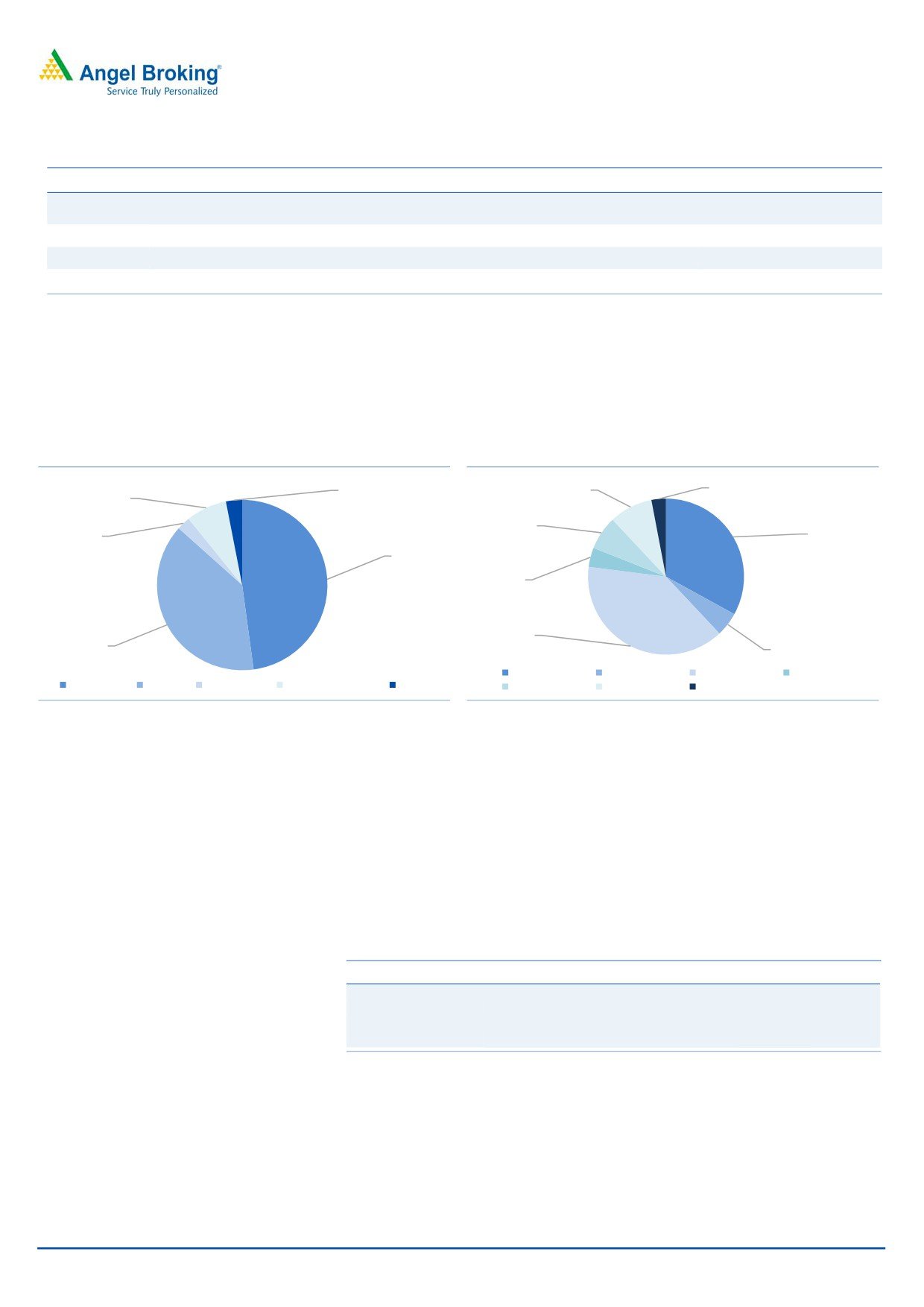

Exhibit 7: Capital Gearing

Exhibit 8: Return ratios

1.2

20

18

1.0

16

0.8

14

0.6

12

0.4

10

0.2

8

0.0

6

FY12

FY13

FY14

FY15

FY16E

FY17E

FY12

FY13

FY14

FY15

FY16E

FY17E

Debt/Equity (x)

RoE (%)

RoCE (%)

Source: Company, Angel Research

Source: Company, Angel Research

Management targets

The Management is targeting revenue CAGR of 18% over FY2015-FY2018. As

per the Management, uptrend in OEM sales would contribute to the robust

growth. Also, the company’s efforts of enhancing aftermarket base by

increasing dealer network in the underpenetrated Northern and Eastern

markets & introducing new products would boost the top-line.

The Management is aiming to double the RoCE to 25% by FY2018. Margin

improvement on back of raw material localization, energy savings, and

lowering leverage would be the key drivers to achieve the desired RoCE.

RBL has guided for a cumulative capex of `120cr over the next three years.

June 16, 2015

5

Rane Brake Lining | Initiating Coverage

Outlook and Valuation

RBL’s revenues are estimated to grow at 12% CAGR over the next two years.

Upsurge in OEM volumes coupled with focus on the aftermarket segment would

drive the top-line. Also, the company’s margins are expected to improve on

account of operating leverage, enhanced local procurement and energy savings.

Given the healthy top-line growth and margin improvement, RBL’s earnings are

likely to grow at a CAGR of 17% over FY2015-2017. Its return ratios are also

estimated to expand due to margin improvement and reduction in leverage. We

initiate coverage on RBL with a Buy recommendation and target price of `336

(based on 12x FY2017 earnings).

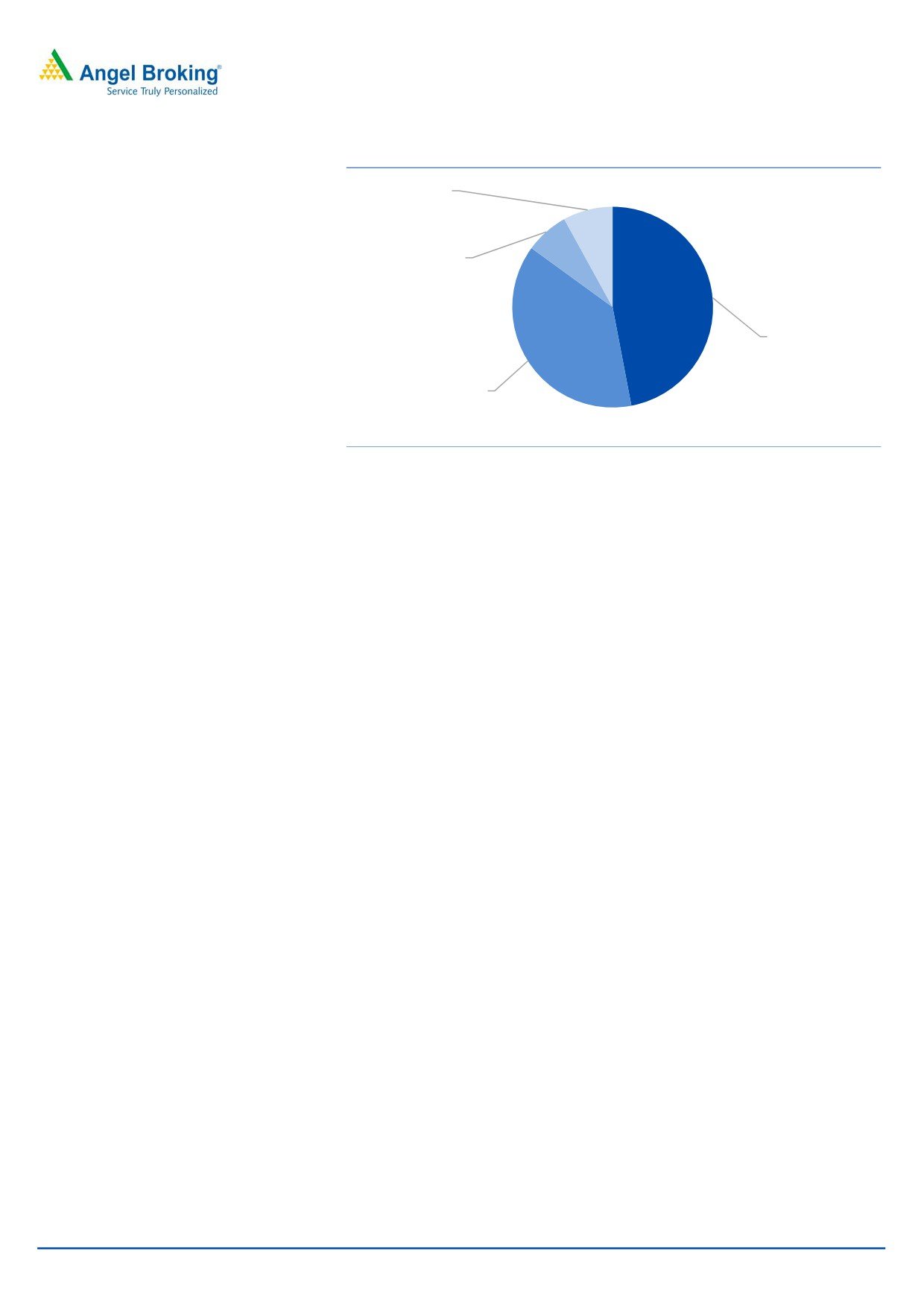

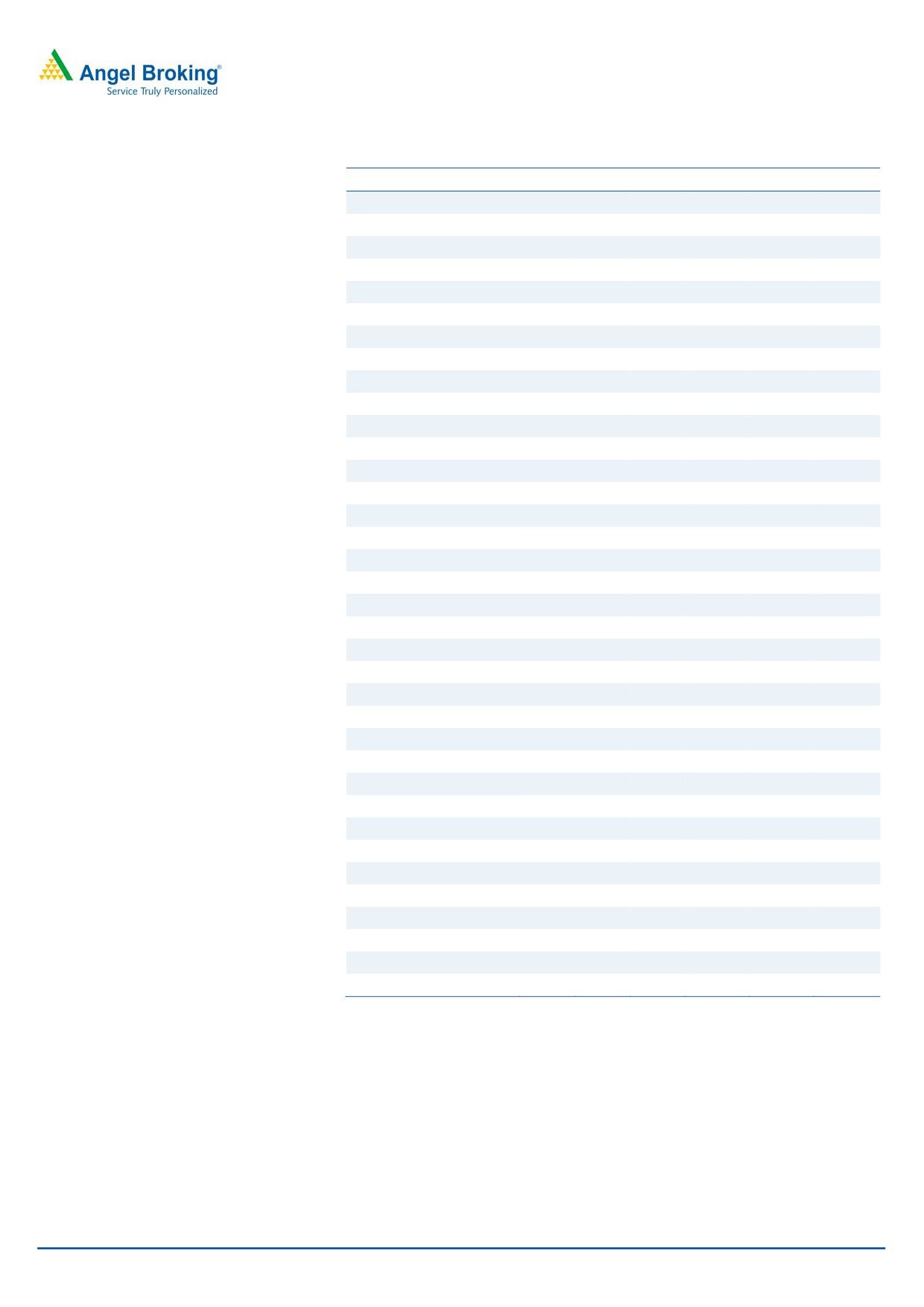

Exhibit 9: One-year forward P/E band

450

400

350

300

250

200

150

100

50

0

Price (`)

4x

8x

12x

16x

Source: Company, Angel Research

Company Background

Rane Brake Lining Ltd (RBL) is a part of diversified ancillary supplier Rane Group.

Rane Group has a strong and diversified clientele and supplies various products viz

steering and suspension systems, steering columns, hydraulic pumps, friction

material, engine components and diecast components. The group through its

holding arm (Rane Holdings Ltd) has four subsidiaries viz Rane Madras Ltd, Rane

Engine Valves Ltd, Rane Brake Lining Ltd and Rane Holdings America Inc. Rane

Group also has three joint ventures namely Rane TRW Steering Systems, Rane NSK

Steering Systems and JMA Marketing Ltd.

RBL is the flagship company of the Rane Group engaged in the manufacturing of

safety critical components such as brake linings, disc pads, clutch facings, clutch

buttons, brake shoes and railway brake blocks. Key braking components ie brake

lining and disc pads constitute bulk of the revenues (approximately 87%) for the

company. The products are manufactured across four plants based in South India.

June 16, 2015

6

Rane Brake Lining | Initiating Coverage

Exhibit 10: RBL manufacturing footprint

Location

Products

User segment

Brake linings, disc pads and clutch facings; Composite brake blocks; Organic pads for

Automotive, Railway,

Chennai

trainer aircraft

Aerospace

Hyderabad

Brake linings, clutch facings & sintered clutch buttons; Compositive brake blocks

Automotive, Railway

Puducherry

Disc pads, clutch facings & CV brake pads; Composite brake blocks

Automotive, Railway

Trichy

Disc pads & brake linings

Automotive

Source: Company, Angel Research

RBL supplies braking and related components across the automotive segments viz

passenger vehicles, commercial vehicles, two wheelers and railways. Passenger car

and the HCV segment constitute about 33% and 39% revenues for the company.

Aircraft and the utility vehicle segment contribute about 9% and 7% respectively.

Exhibit 11: Product breakup

Exhibit 12: Segmentwise breakup

3%

9%

3%

8%

7%

3%

33%

48%

4%

39%

39%

5%

Pasenger cars

SCV/LCV/MCV HCV

2W/3W

Brake Linings Disc Pads Clutch facings Railway brake blocks Others

Railways

Aircraft and UV

Tractors

Source: Company, Angel Research

Source: Company, Angel Research

The OEM segment forms about half of the revenues of the company. RBL has

leadership position in the domestic market commanding share of 38%. RBL is a

Tier 2 supplier catering to leading OEMs such as Maruti Suzuki, Toyota, Honda

and Nissan. In the commercial vehicle segment RBL’s key clientele includes leading

players like Tata Motors, Ashok Leyland and M&M. Apart from the OEM segment,

RBL also has strong presence in the aftermarket space, which forms about 40% of

the revenues. Given the strong OEM base and a well established dealer network,

RBL is a preferred aftermarket supplier commanding a market share of 18%.

Exhibit 13: Client base

Key clientile

End customers

Tier 1 clientle

Passenger vehicle

Maruti Suzuki, Toyota, Honda India,

Brakes India, Brembo,

Nissan, Volkswagen India

Mando, Endurance,

Commercial Vehicle Tata Motors, Ashok Leyland, M&M,

Chassis Brakes

Bharat Benz

International

Source: Company, Angel Research

June 16, 2015

7

Rane Brake Lining | Initiating Coverage

Exhibit 14: Customer segmentation

Others, 8%

Exports, 7%

OEM, 47%

Aftermarket, 38%

Source: Company, Angel Research

June 16, 2015

8

Rane Brake Lining | Initiating Coverage

Profit & Loss Statement

Y/E March (` cr)

FY2012

FY2013

FY2014

FY2015

FY2016E

FY2017E

Total operating income

359

376

384

416

460

520

% chg

17.4

4.8

2.0

8.4

10.5

13.0

Total Expenditure

320

344

344

371

408

460

Net Raw Materials

195

204

194

204

224

252

Personnel

46

49

53

61

69

78

Other

79

90

97

106

115

130

EBITDA

39

33

40

45

52

60

% chg

15.9

(16.7)

22.5

13.1

14.0

16.0

(% of Net Sales)

11.0

8.7

10.5

10.9

11.3

11.6

Depreciation & Amortisation

15

18

18

21

22

25

EBIT

26

14

19

23

30

36

% chg

18.5

(46.1)

35.1

18.6

32.1

18.8

(% of Net Sales)

7.3

3.8

5.0

5.4

6.5

6.8

Interest & other Charges

7

7

8

6

6

7

Other Income

4

3

2

2

3

4

PBT (recurring)

22

11

17

21

27

32

% chg

11.3

(50.1)

53.2

23.2

30.9

19.0

Extraordinary Expense/(Inc.)

0

0

0

0

0

0

PBT (reported)

22

11

17

21

27

32

Tax

6

2

0

4

8

10

(% of PBT)

26.1

16.7

(2.9)

21.8

31.0

31.0

PAT (reported)

16

9

17

16

19

22

ADJ. PAT

16

9

17

16

19

22

% chg

5.9

(43.8)

89.1

(6.4)

15.4

19.0

(% of Net Sales)

4.5

2.4

4.5

3.9

4.0

4.3

Basic EPS (`)

20.5

11.5

21.7

20.4

23.5

28.0

Fully Diluted EPS (`)

20.5

11.5

21.7

20.4

23.5

28.0

% chg

5.9

(43.8)

89.1

(6.4)

15.4

19.0

June 16, 2015

9

Rane Brake Lining | Initiating Coverage

Balance sheet statement

Y/E March (` cr)

FY2012 FY2013 FY2014 FY2015E FY2016E FY2017E

SOURCES OF FUNDS

Equity Share Capital

8

8

8

8

8

8

Reserves& Surplus

89

94

104

114

125

138

Shareholders Funds

97

102

112

122

133

146

Total Loans

84

90

81

67

65

74

Deferred Tax Liability

9

9

9

9

9

9

Other long term liab.

0

0

0

0

0

0

Long term provisions

1

2

2

2

2

2

Total Liabilities

191

203

205

200

209

232

APPLICATION OF FUNDS

Gross Block

240

259

286

293

315

356

Less: Acc. Dep.

119

136

153

174

196

221

Net Block

121

123

133

119

119

135

Capital WIP

3

19

0

0

0

0

Investments

0

0

0

0

0

0

Long Loans and adv.

8

7

9

10

11

12

Current Assets

119

113

125

136

151

165

Cash

11

2

3

6

7

3

Short term loan

8

7

7

8

9

10

Other

100

104

114

122

135

153

Current liabilities

61

58

63

66

73

82

Net Current Assets

58

55

61

70

78

83

Total Assets

191

203

205

200

209

232

June 16, 2015

10

Rane Brake Lining | Initiating Coverage

Cash flow statement

Y/E March (` cr)

FY2012

FY2013

FY2014

FY2015E FY2016E FY2017E

Profit before tax

22

11

17

21

27

32

Depreciation

15

17

17

21

22

25

Change in Working Capital

(4)

(5)

(6)

(7)

(7)

(10)

Others

1

(0)

(0)

0

0

0

Direct taxes paid

(6)

(2)

0

(4)

(8)

(10)

Cash Flow from Operations

28

21

29

31

34

38

(Inc.)/ Dec. in Fixed Assets

(31)

(35)

(9)

(7)

(22)

(41)

(Inc.)/ Dec. in Investments

0

0

0

0

0

0

(Inc.)/ Dec. in Loans & Adv

-

-

-

-

-

-

Cash Flow from Investing

(31)

(35)

(9)

(7)

(22)

(41)

Issue of Equity

-

-

-

-

-

-

Inc./(Dec.) in loans

20

6

(9)

(14)

(2)

9

Dividend Paid (Incl. Tax)

(6)

(3)

(6)

(7)

(8)

(9)

Others

(3)

2

(3)

(1)

(1)

(1)

Cash Flow from Financing

12

5

(18)

(21)

(11)

(1)

Inc./(Dec.) in Cash

9

(8)

2

2

1

(5)

Opening Cash balances

2

11

2

3

6

7

Closing Cash balances

11

2

3

6

7

3

June 16, 2015

11

Rane Brake Lining | Initiating Coverage

Key ratios

Y/E March

FY2012

FY2013

FY2014

FY2015E

FY2016E

FY2017E

Valuation Ratio (x)

P/E (on FDEPS)

13.8

24.5

13.0

13.9

12.0

10.1

P/CEPS

7.1

8.3

6.3

6.0

5.5

4.7

P/BV

2.3

2.2

2.0

1.8

1.7

1.5

Dividend yield (%)

2.0

1.1

2.1

2.0

2.3

2.7

EV/Sales

0.8

0.8

0.8

0.7

0.6

0.6

EV/EBITDA

7.5

9.5

7.5

6.3

5.4

4.9

EV / Total Assets

1.6

1.5

1.5

1.4

1.3

1.3

Per Share Data (`)

EPS (Basic)

20.5

11.5

21.7

20.4

23.5

28.0

EPS (fully diluted)

20.5

11.5

21.7

20.4

23.5

28.0

Cash EPS

39.5

34.1

44.8

46.8

51.4

59.5

DPS

5.5

3.2

5.9

5.6

6.5

7.7

Book Value

122.0

128.9

141.8

153.9

167.7

184.3

Dupont Analysis

EBIT margin

7.3

3.8

5.0

5.4

6.5

6.8

Tax retention ratio

0.7

0.8

1.0

0.8

0.7

0.7

Asset turnover (x)

2.0

1.9

1.9

2.1

2.3

2.3

ROIC (Post-tax)

10.8

5.9

9.8

9.1

10.2

10.7

Cost of Debt (Post Tax)

5.9

6.8

9.8

7.0

6.2

6.2

Leverage (x)

0.8

0.9

0.7

0.5

0.4

0.5

Operating ROE

14.4

5.1

9.8

10.2

12.0

12.9

Returns (%)

ROCE (Pre-tax)

15.0

9.0

11.9

13.3

15.7

16.7

Angel ROIC (Pre-tax)

14.6

7.0

9.5

11.6

14.8

15.5

ROE

16.8

8.9

15.3

13.2

14.0

15.2

Turnover ratios (x)

Asset Turnover (Gross Block)

1.50

1.46

1.34

1.42

1.46

1.46

Inventory / Sales (days)

28.7

27.3

26.5

27.0

27.0

27.0

Receivables (days)

70.6

72.9

81.8

80.0

80.0

80.0

Payables (days)

61.8

56.5

60.3

57.6

57.6

57.4

WC cycle (ex-cash) (days)

48.2

50.9

55.2

56.7

56.6

56.8

Solvency ratios (x)

Net debt to equity

0.8

0.9

0.7

0.5

0.4

0.5

Net debt to EBITDA

1.9

2.7

1.9

1.3

1.1

1.2

Interest Coverage (EBIT / Int.)

3.9

1.9

2.5

3.8

5.1

5.3

June 16, 2015

12

Rane Brake Lining | Initiating Coverage

Research Team Tel: 022 - 39357800

DISCLAIMER

Angel Broking Private Limited (hereinafter referred to as “Angel”) is a registered Member of National Stock Exchange of India Limited,

Bombay Stock Exchange Limited and MCX Stock Exchange Limited. It is also registered as a Depository Participant with CDSL and

Portfolio Manager with SEBI. It also has registration with AMFI as a Mutual Fund Distributor. Angel Broking Private Limited is a

registered entity with SEBI for Research Analyst in terms of SEBI (Research Analyst) Regulations, 2014 vide registration number

INH000000164. Angel or its associates has not been debarred/ suspended by SEBI or any other regulatory authority for accessing

/dealing in securities Market. Angel or its associates including its relatives/analyst do not hold any financial interest/beneficial

ownership of more than 1% in the company covered by Analyst. Angel or its associates/analyst has not received any compensation /

managed or co-managed public offering of securities of the company covered by Analyst during the past twelve months. Angel/analyst

has not served as an officer, director or employee of company covered by Analyst and has not been engaged in market making activity

of the company covered by Analyst.

This document is solely for the personal information of the recipient, and must not be singularly used as the basis of any investment

decision. Nothing in this document should be construed as investment or financial advice. Each recipient of this document should

make such investigations as they deem necessary to arrive at an independent evaluation of an investment in the securities of the

companies referred to in this document (including the merits and risks involved), and should consult their own advisors to determine

the merits and risks of such an investment.

Reports based on technical and derivative analysis center on studying charts of a stock's price movement, outstanding positions and

trading volume, as opposed to focusing on a company's fundamentals and, as such, may not match with a report on a company's

fundamentals.

The information in this document has been printed on the basis of publicly available information, internal data and other reliable

sources believed to be true, but we do not represent that it is accurate or complete and it should not be relied on as such, as this

document is for general guidance only. Angel Broking Pvt. Limited or any of its affiliates/ group companies shall not be in any way

responsible for any loss or damage that may arise to any person from any inadvertent error in the information contained in this report.

Angel Broking Pvt. Limited has not independently verified all the information contained within this document. Accordingly, we cannot

testify, nor make any representation or warranty, express or implied, to the accuracy, contents or data contained within this document.

While Angel Broking Pvt. Limited endeavors to update on a reasonable basis the information discussed in this material, there may be

regulatory, compliance, or other reasons that prevent us from doing so.

This document is being supplied to you solely for your information, and its contents, information or data may not be reproduced,

redistributed or passed on, directly or indirectly.

Neither Angel Broking Pvt. Limited, nor its directors, employees or affiliates shall be liable for any loss or damage that may arise from

or in connection with the use of this information.

Note: Please refer to the important ‘Stock Holding Disclosure' report on the Angel website (Research Section). Also, please refer to the

latest update on respective stocks for the disclosure status in respect of those stocks. Angel Broking Pvt. Limited and its affiliates may

have investment positions in the stocks recommended in this report.

Disclosure of Interest Statement

Rane Brake Lining

1. Analyst ownership of the stock

No

2. Angel and its Group companies ownership of the stock

No

3. Angel and its Group companies' Directors ownership of the stock

No

4. Broking relationship with company covered

No

Note: We have not considered any Exposure below ` 1 lakh for Angel, its Group companies and Directors

Ratings (Based on expected returns

Buy (> 15%)

Accumulate (5% to 15%)

Neutral (-5 to 5%)

over 12 months investment period):

Reduce (-5% to -15%)

Sell (< -15)

June 16, 2015

13