1QFY2017 Result Update | Agrichemical

July 26, 2016

Rallis India

NEUTRAL

CMP

`218

Performance Highlights

Target Price

-

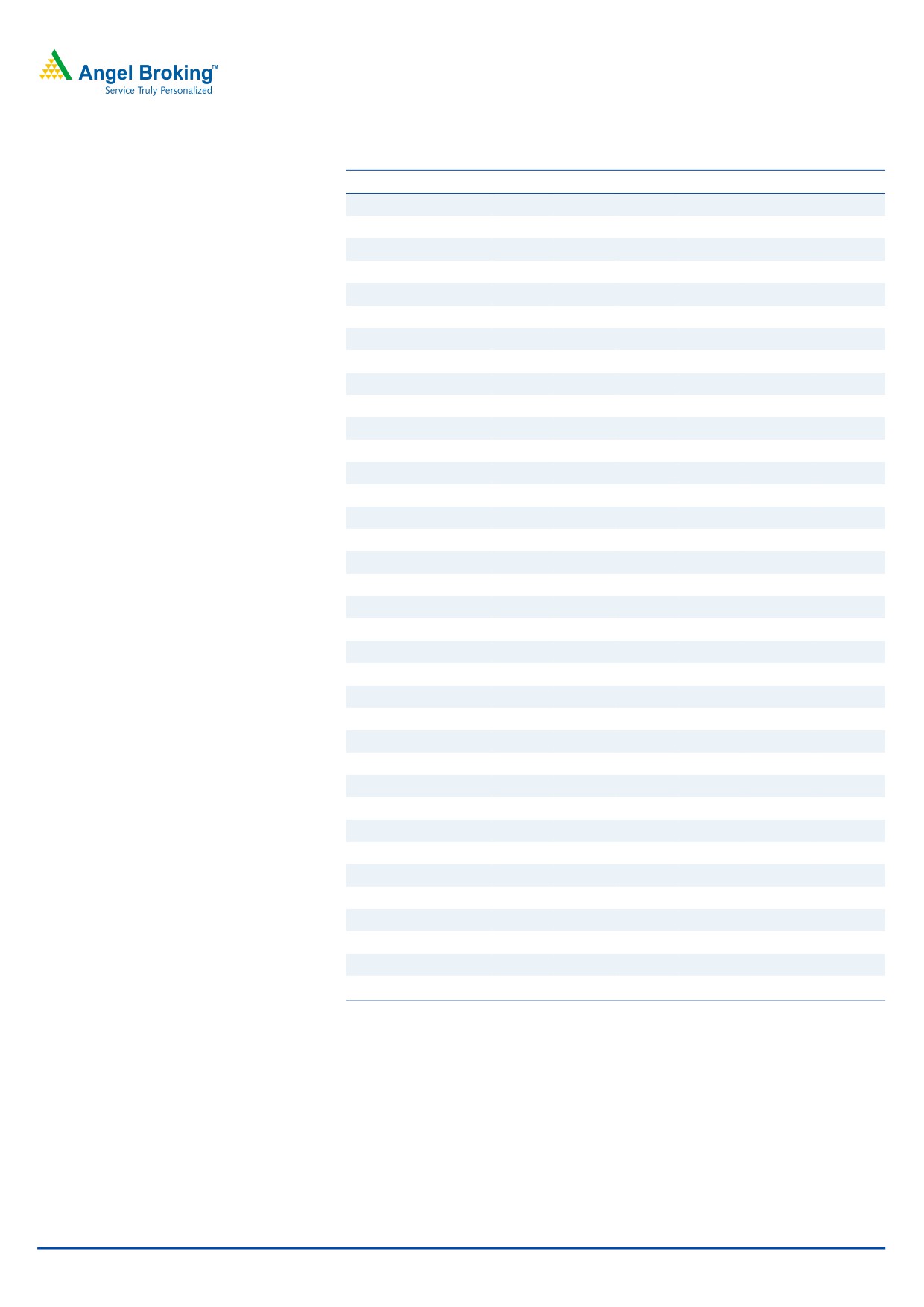

Y/E March (` cr)

1QFY2017 4QFY2016

% chg (qoq) 1QFY2016

% chg (yoy)

Investment Period

-

Net sales

445

342

30.1

415

7.2

Other income

7

15

(53.1)

5

47.8

Stock Info

Gross profit

202

148

36.3

186

8.5

Sector

Agrichemical

Operating profit

70

36

96.8

56

24.8

Market Cap (` cr)

4,246

Adj. Net profit

49

32

52.7

42

16.1

Net debt (` cr)

126

Source: Company, Angel Research

Beta

0.8

52 Week High / Low

240/142

For 1QFY2017, Rallis India (Rallis) reported a yoy growth of 7.2% in sales to

Avg. Daily Volume

83,801

`445cr (V/s `415cr in 1QFY2016). On the operating front, the gross margin

Face Value (`)

1

came in at 45.4% (V/s 44.8% in 1QFY2016), which along with sales growth

BSE Sensex

28,095

aided the OPM to come in at 15.8% (V/s 13.5% in 1QFY2016). Aided by sales

Nifty

8,636

growth, a good operating performance and surge in other income (`7cr V/s `5cr

Reuters Code

RALL.BO

in 1QFY2016), the Adj. Net profit grew 16.1% yoy to `49cr (V/s `42cr in

Bloomberg Code

RALI@IN

1QFY2016). We maintain our Neutral view on the stock.

Robust numbers: For 1QFY2017, the company reported a yoy growth of 7.2% in

Shareholding Pattern (%)

sales to `445cr (V/s `415cr in 1QFY2016). On the operating front, the gross

Promoters

50.1

margin came in at 45.4% (V/s 44.8% in 1QFY2016), which along with sales

MF / Banks / Indian Fls

19.1

growth aided the OPM to come in at 15.8% (V/s 13.5% in 1QFY2016). Aided by

FII / NRIs / OCBs

7.7

sales growth, a good operating performance and surge in other income (`7cr V/s

Indian Public / Others

23.1

`5cr in 1QFY2016), the Adj. Net profit grew 16.1% yoy to `49cr (V/s `42cr in

1QFY2016). The reported net profit came in at `174cr (V/s `42cr in 1QFY2016),

Abs. (%)

3m 1yr 3yr

benefitting from an exceptional income of `158cr related to profit on assignment

Sensex

9.4

(0.1)

39.8

of leasehold rights of a plot of land in MIDC area, Turbhe, Novi Mumbai.

Rallis India

13.5

(7.0)

40.1

Outlook and valuation: For FY2016-18E, we expect a CAGR of 15.0% and

22.3% in net sales and profit, respectively, with recovery expected in FY2017. At

3-year price chart

the current levels, the stock is trading at a fair valuation of 19.8x its FY2018E EPS.

400

350

Hence, we maintain our Neutral recommendation on the stock.

300

250

Key financials (Consolidated)

200

Y/E March (` cr)

FY2015

FY2016

FY2017E

FY2018E

150

Net Sales

1,822

1,637

1,937

2,164

100

% chg

4.3

(10.1)

18.3

11.7

50

0

Adj.Net Profit

157

143

176

214

% chg

3.5

(9.0)

22.8

21.9

EBITDA %

14.2

13.3

13.3

14.3

Source: Company, Angel Research

FDEPS (`)

8.1

7.4

9.0

11.0

P/E (x)

27.0

29.7

24.2

19.8

P/BV (x)

5.2

4.7

4.2

3.7

RoE (%)

20.5

16.7

18.4

19.8

RoACE (%)

24.7

19.2

20.2

22.1

Sarabjit Kour Nangra

EV/Sales (x)

2.3

2.6

2.2

1.9

+91-22-39357800 ext. 6806

EV/EBITDA (x)

16.4

19.5

16.4

13.3

Source: Company, Angel Research; Note: CMP as of July 25, 2016

Please refer to important disclosures at the end of this report

1

Rallis India | 1QFY2017 Result Update

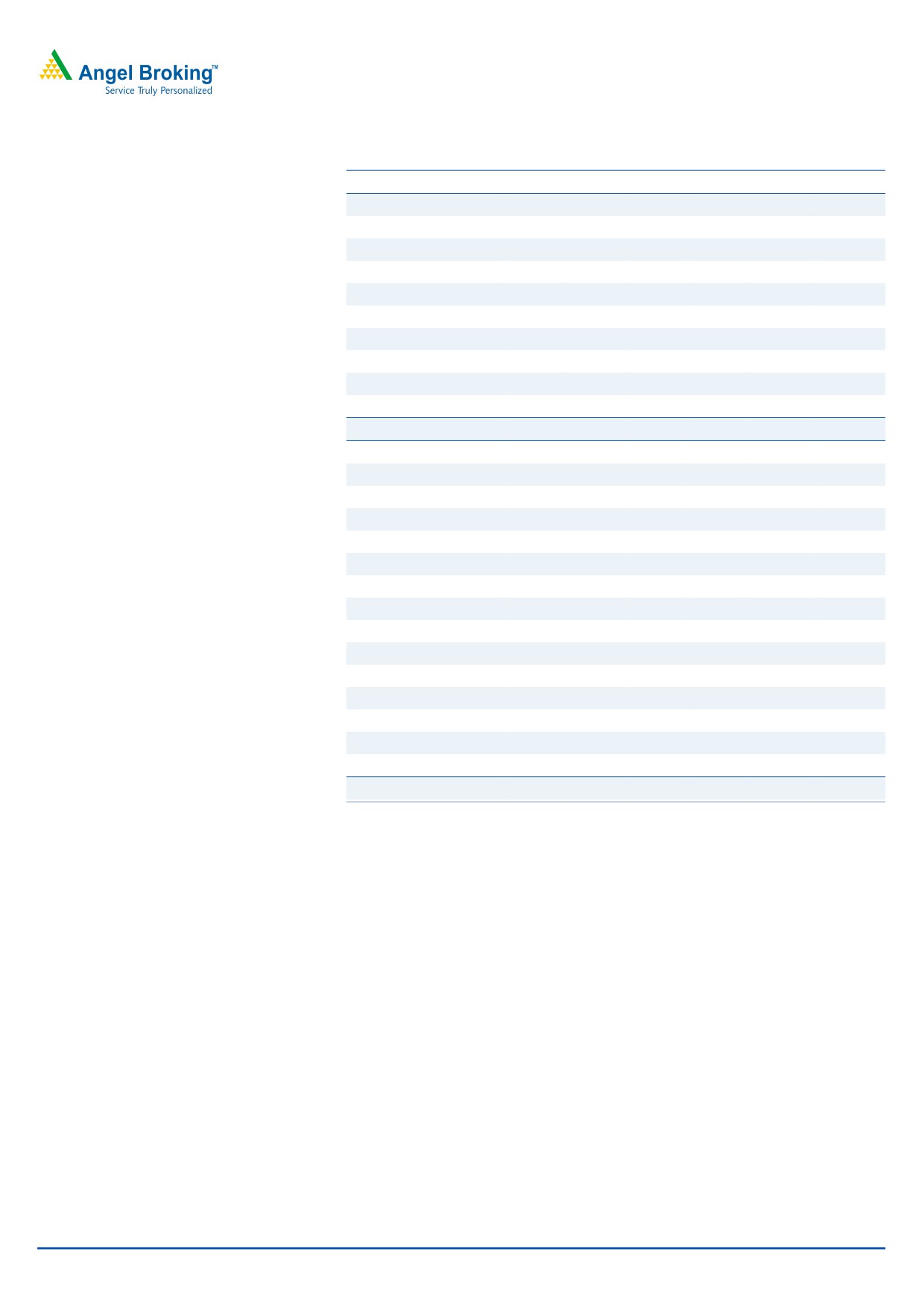

Exhibit 1: 1QFY2017 performance (Consolidated)

Y/E March (` cr)

1QFY2017

4QFY2016

% chg (QoQ) 1QFY2016

% chg (YoY)

FY2016

FY2015

% chg

Net sales

445

342

30.1

415

7.2

1,612

1,801

(10.5)

Other income

7

15

(53.1)

5

47.8

30

25

19.9

Total income

452

357

26.6

420

7.6

1,642

1,826

(10.1)

Gross profit

202

148

36.3

186

8.5

773

806

(4.1)

Gross margin (%)

45.4

43.3

44.8

48.0

44.8

EBDITA

70

36

96.8

56

24.8

214

256

(16.5)

EBDITA margin (%)

15.8

10.4

13.5

13.3

14.2

Financial cost

2

3

(22.5)

4

(43.5)

14

10

35.5

Depreciation

12

6

110.9

11

8.3

45

50

(10.8)

PBT

62

42

49.4

45

37.6

186

221

(16.0)

Provision for taxation

47

10

380.2

3

1473.6

39

62

(37.2)

PAT Before Exc. And MI

16

32

(50.7)

42

(62.7)

147

160

(8.3)

Minority

0

(0)

0

4

3

-

Exceptional

158

0

0

0

0

Reported PAT

174

32

440.2

42

310.9

143

157

(9.0)

Adjusted PAT

49

32

52.7

42

16.1

143

157

(9.0)

EPS (`)

2.5

1.7

2.2

7.4

8.1

Source: Company, Angel Research

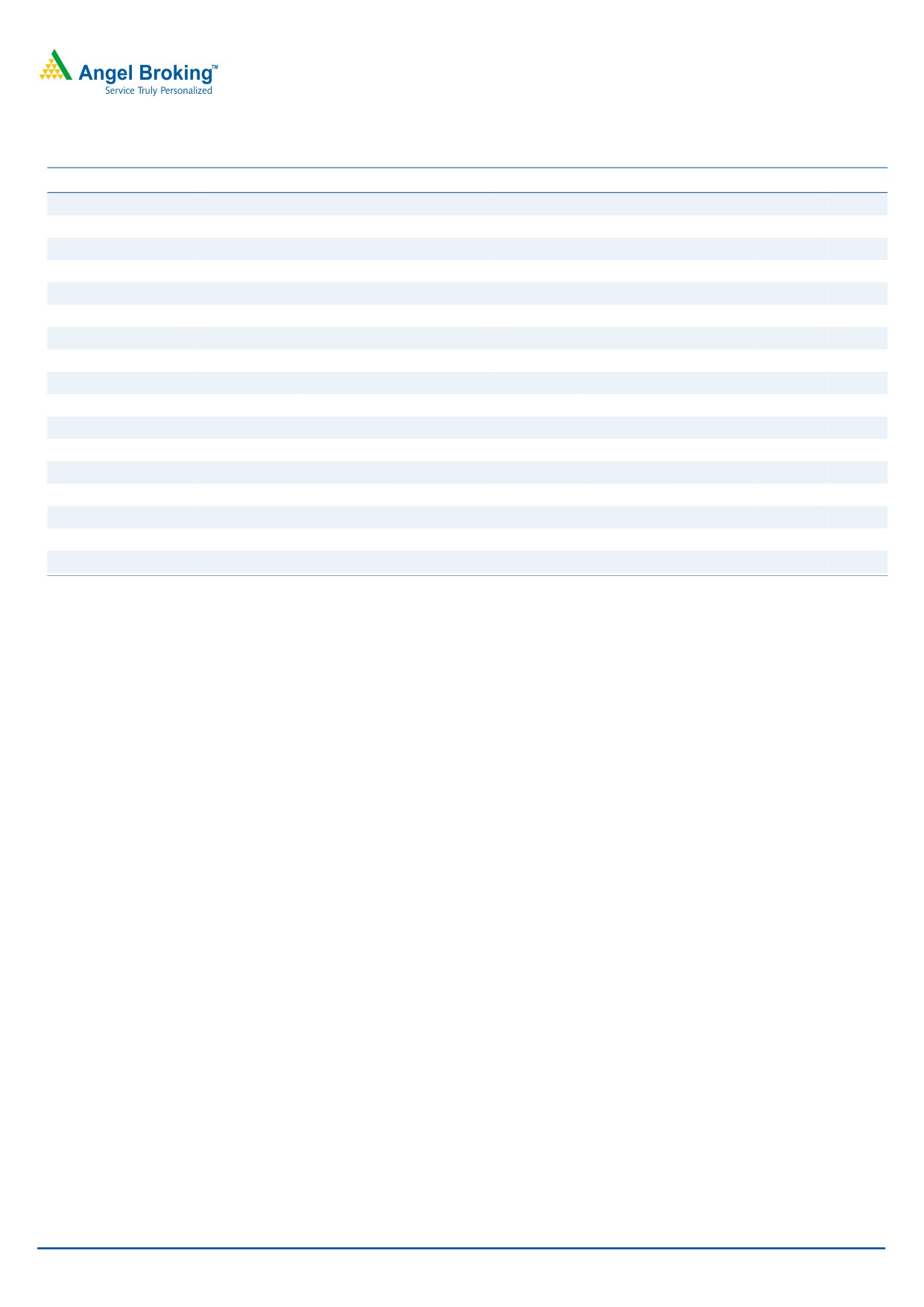

Sales rose by 7.2% yoy

For 1QFY2017, the company’s sales rose 7.2% yoy to `445cr (V/s `415cr in

1QFY2016). The onset of monsoon this year was delayed and the progress in June

was sluggish, leaving a monsoon deficit of 11% by the end of the month. A sharp

drop in cotton planting further accentuated the concerns for the company.

Consequently demand and placement were muted during 1QFY2017 which

however have picked up in July. With purchase of agrochemicals shifting to the

current quarter, the Management remains confident of robust growth in

2QFY2017.

Metahelix revenues registered a 16% yoy growth to `189.7cr, which is soft due to

unavailability of seeds. Poor Rabi yields due to lack of ground water resulted in

shortage of seeds.

July 26, 2016

2

Rallis India | 1QFY2017 Result Update

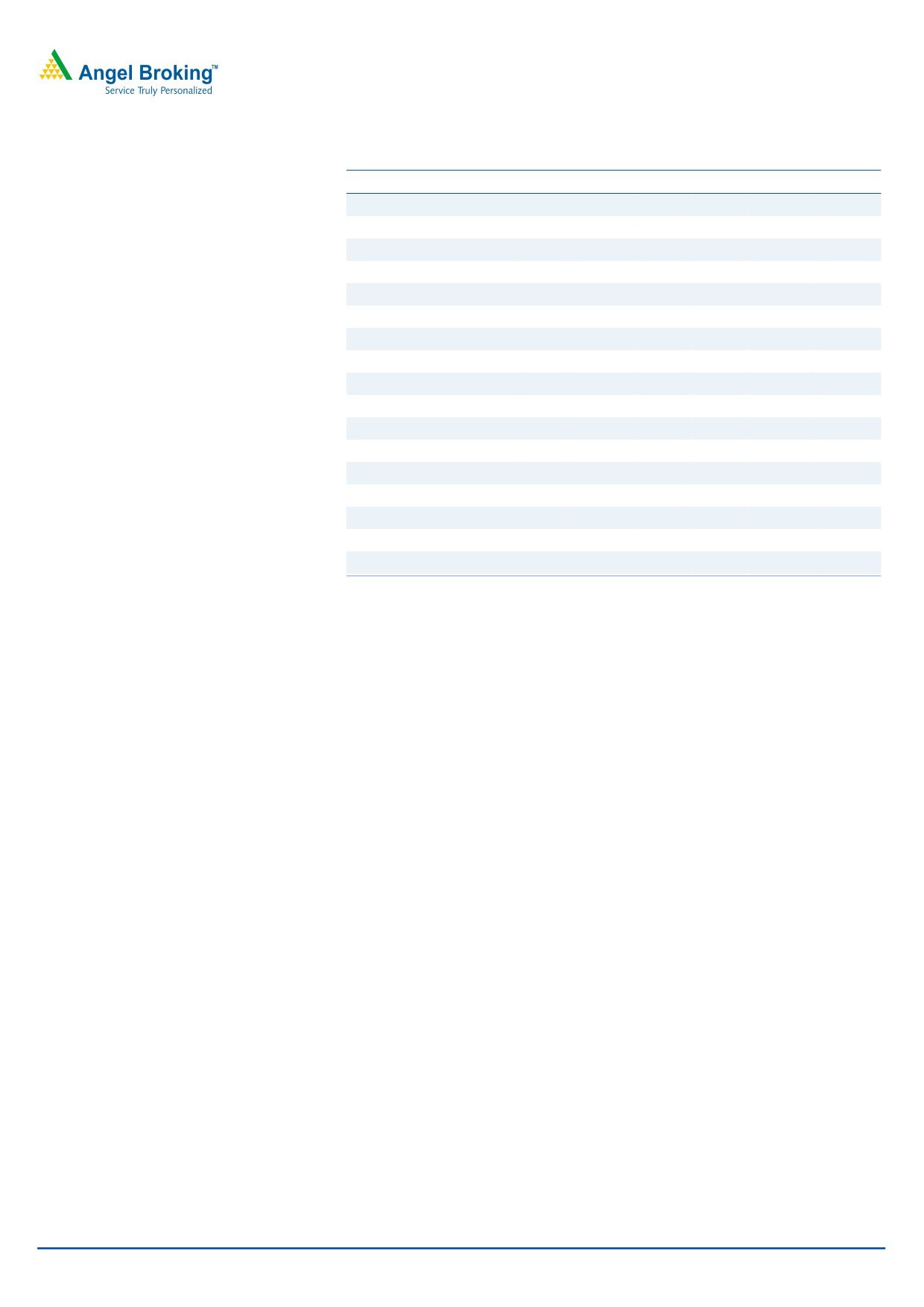

Exhibit 2: Revenue performance

720

15

640

10

560

5

500

480

445

0

415

400

(5)

342

306

320

(10)

240

(15)

160

(20)

80

(25)

0

(30)

1QFY2016

2QFY2016

3QFY2016

4QFY2016

1QFY2017

Total Revenue

% YoY

Source: Company, Angel Research

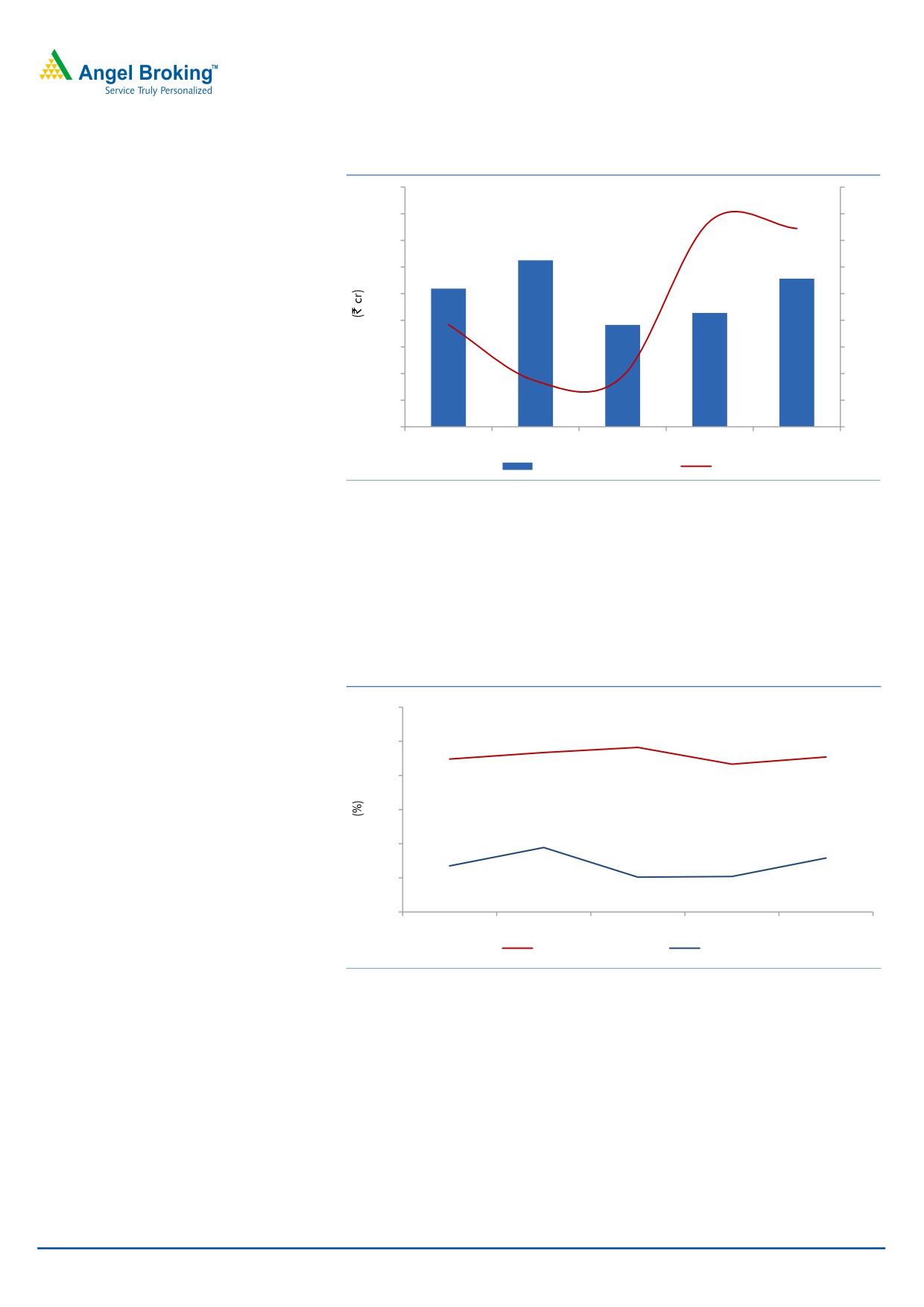

OPM expands yoy

On the operating front, the gross margin came in at 45.4% V/s 44.8% in

1QFY2016, which along with sales growth aided the OPM to come in at 15.8%

(V/s 13.5% in 1QFY2016). The gross margin for the quarter expanded by 55bp

yoy, while the OPM expanded by 220bp.

Exhibit 3: Margin trend (%)

60.0

48.2

46.7

50.0

44.8

45.4

43.3

40.0

30.0

20.0

18.9

10.0

15.8

13.5

10.2

10.4

0.0

1QFY2016

2QFY2016

3QFY2016

4QFY2016

1QFY2017

Gross margin

EBITDA margin

Source: Company, Angel Research

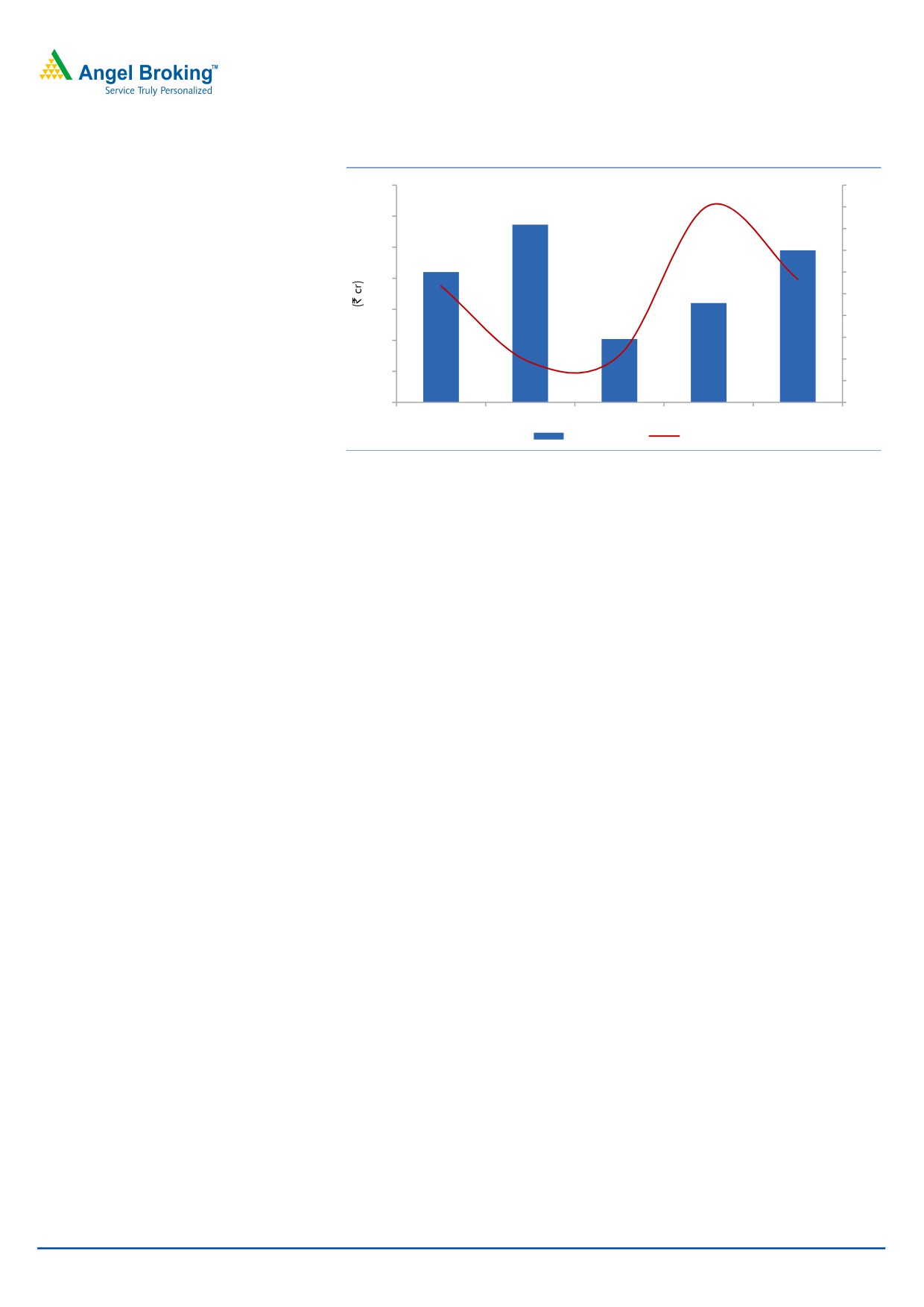

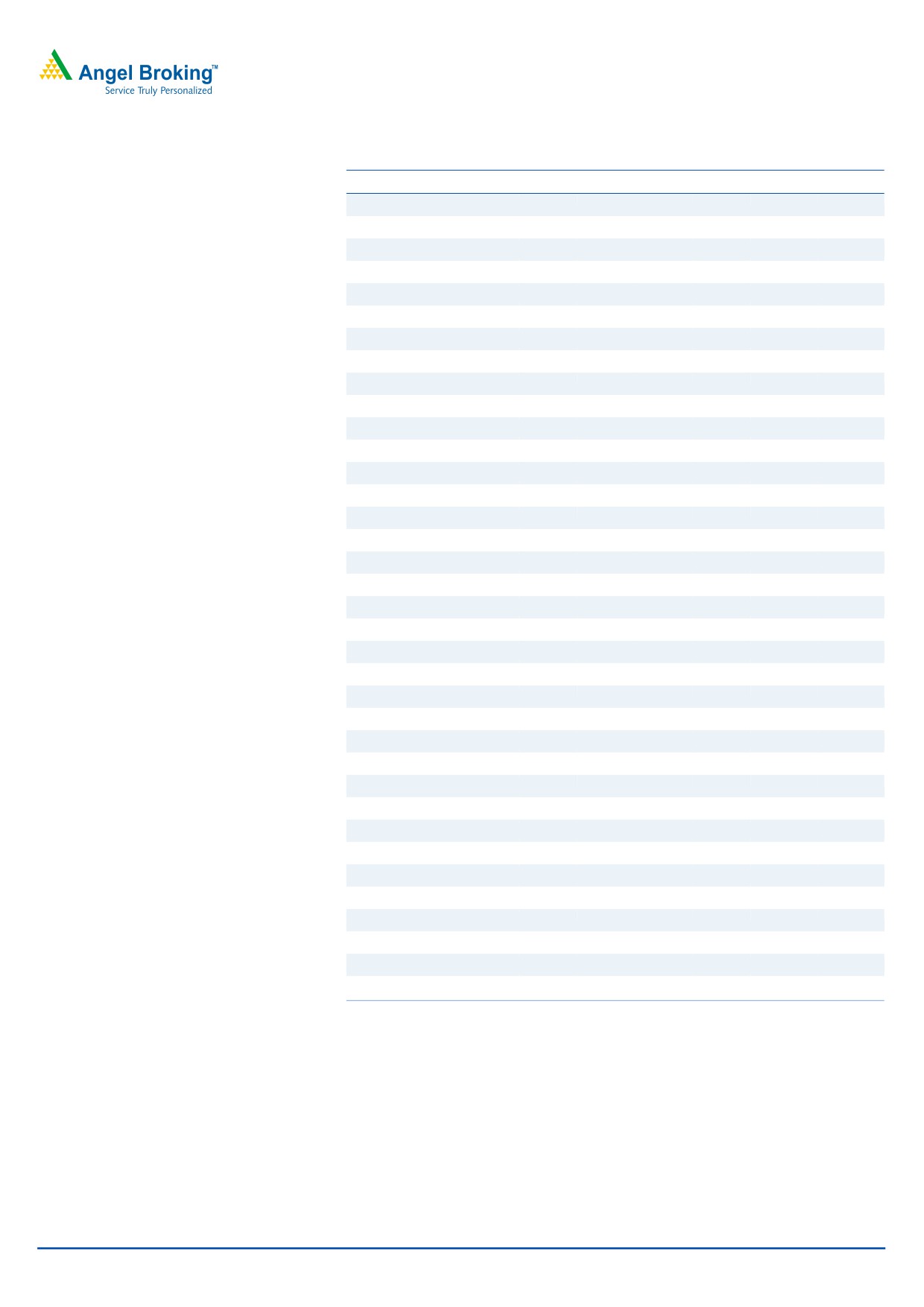

Earnings rise 16.1% yoy on back of exceptional income

Aided by sales growth, a good operating performance and surge in other income

(`7cr V/s `5cr in 1QFY2016), the Adj. Net profit grew 16.1% yoy to `49cr (V/s

`42cr in 1QFY2016). The reported net profit came in at `174cr (V/s `42cr in

1QFY2016), benefitting from an exceptional income of `158cr related to profit on

assignment of leasehold rights of a plot of land in MIDC area, Turbhe, Novi

Mumbai. The profit is net of costs including a premium levied under the repealed

Urban Land (Ceiling and Regulation) Act 1976, which has been paid under

protest.

July 26, 2016

3

Rallis India | 1QFY2017 Result Update

Exhibit 4: Adjusted PAT trend

70

60

50

57

60

40

49

50

30

42

20

40

32

10

30

0

20

20

(10)

(20)

10

(30)

0

(40)

1QFY2016

2QFY2016

3QFY2016

4QFY2016

1QFY2017

Adj PAT

% YoY

Source: Company, Angel Research

July 26, 2016

4

Rallis India | 1QFY2017 Result Update

Concall highlights

The Management has shared a positive outlook for the year on the back of a

normal monsoon and pick up in the company’s export business.

The onset of monsoon was delayed and the progress in June was sluggish,

leaving an 11% monsoon deficit by the end of the month. Concerns got

accentuated by a sharp drop in cotton planting. Consequently, demand and

placement were muted during 1QFY2017 which however have picked up in

July. With purchase of agrochemicals shifting to the current quarter, the

Management remains confident of robust growth in 2QFY2017.

Investment arguments

Company set to seize rising opportunities in the domestic crop protection market:

India's overall pesticide consumption is one of the lowest in the world and has a

huge potential to grow. We believe Rallis is well placed to seize this opportunity on

the back of its wide distribution network, strong brands, and a robust new-product

pipeline. According to industry estimates, the unorganized market accounts for

50% of the industry. Nonetheless, we believe Rallis is in a position to wrest market

share as well as charge a premium for its products. FY2016 has been challenging

on back of poor monsoons but the outlook for FY2017 is favorable and should

bode well for domestic sales growth. A lower base would result in 17.3% CAGR in

the domestic business during FY2016-18E.

Exports under pressure: Although a late entrant, the company has been enhancing

its focus in the exports market, which is now turning out to be its main growth

driver. Overall exports formed ~30% of sales in FY2016. In FY2016, the global

weakness in the agrochemical industry put pressure on Rallis’ exports business

where the revenues dropped by 20% yoy to `400cr. The company’s primary export

market is Brazil where a sluggish demand environment, currency volatility and

macro headwinds led to deferment/cancelation of many orders. However, export

orders saw a revival in 4QFY2016; still the Management remains cautious on

recovery in Brazil which could take more than a couple of quarters. This would

likely keep the exports business revenues under pressure. Going forward, the

segment will continue to post a 7.2% CAGR over FY2016-18E.

Seed business to augment the domestic portfolio: After the acquisition of

Metahelix’ seeds business in 2010, the seeds business forms a major part of the

domestic business of the company. During FY2016, Rallis’ seed business under

Metahelix reported a decent growth of 8% yoy to `334cr (almost 23% of the

domestic business) on back of increased market share and despite significant

reduction in acreages for some of the key crops such as paddy and corn. The

company is also strengthening its cotton portfolio and will be launching a new

product to take on the market leaders in this crop. The Management remains

confident of Metahelix achieving 12-14% margins in a good monsoon year.

During FY2016, the company increased its stake in Metahelix to 100%.

Contract manufacturing ramping up slowly: Rallis plans to focus on contract

manufacturing for exports and selectively target top players. To facilitate the same,

the company has set up a plant at Dahej, which in FY2013 was working at full

capacity and contributed significantly to the overall growth of the company. The

July 26, 2016

5

Rallis India | 1QFY2017 Result Update

company has bagged two CRAMS projects on a pilot basis during the year. The

Management expects to convert these pilot projects into full commercial contracts

in FY2017 and expects them to contribute to earnings growth from FY2018-2019.

Currently, Rallis has two molecules under CRAMS which are being manufactured

at its Dahej facility.

Outlook and valuation

Over FY2016-18E, we expect the company to post a CAGR of 15.0% and 22.3%

in net sales and profit, respectively, with recovery expected in FY2017, driven by

above normal monsoons. At the current levels, the stock is trading at a fair

valuation of

19.8x its FY2018E EPS. Hence, we maintain our Neutral

recommendation on the stock.

Exhibit 5: Key assumptions

Particulars (%)

FY2017E

FY2018E

Domestic growth

24.0

11.0

Export growth

5.0

15.0

Total revenue growth

18.3

11.7

EBITDA margin

13.3

14.3

Capex (` cr)

70

70

Source: Company, Angel Research

Exhibit 6: Peer valuation

Company Reco

Mcap CMP TP

Upside

P/E (x)

EV/Sales (x)

EV/EBITDA (x)

RoE (%)

CAGR (%)

(` cr)

(`)

(`)

(%) FY17E FY18E FY17E FY18E FY17E FY18E FY17E FY18E Sales PAT

Rallis

Neutral

4,215

218

-

-

24.2

19.8

2.2

1.9

16.4

13.3

18.4

19.8

15.0

22.3

UPL

Buy

25,888

579

684

18.1

15.9

13.3

1.7

1.4

9.1

7.6

21.4

21.2

16.0

18.9

Source: Company, Angel Research, Bloomberg

July 26, 2016

6

Rallis India | 1QFY2017 Result Update

Company background

Rallis is one of the oldest and second largest pesticide agrichemical companies in

the country with a market share of around 13% and belongs to the Tata Group.

The company also has a credible presence in the international market.

Contribution from the domestic business stands at ~70%, while exports account

for the balance.

July 26, 2016

7

Rallis India | 1QFY2017 Result Update

Profit & loss (Consolidated)

Y/E March (` cr)

FY2013

FY2014

FY2015

FY2016

FY2017E

FY2018E

Gross sales

1,535

1,840

1,922

1,730

2,059

2,302

Less: Excise duty

95

114

121

119

147

164

Net Sales

1,440

1,726

1,801

1,612

1,911

2,138

Other operating income

18

21

21

26

26

26

Total operating income

1,458

1,747

1,822

1,637

1,937

2,164

% chg

14.4

19.8

4.3

(10.1)

18.3

11.7

Total Expenditure

1,241

1,485

1,545

1,398

1,656

1,832

Net Raw Materials

823

1,008

995

839

1,110

1,242

Other Mfg costs

304

342

341

404

382

406

Personnel

94

111

129

132

137

154

Other

20

24

25

22

27

30

EBITDA

199

240

256

214

255

306

% chg

3.9

20.8

6.5

(16.5)

19.1

20.3

(% of Net Sales)

13.8

13.9

14.2

13.3

13.3

14.3

Depreciation & Amort.

32

41

50

45

56

61

EBIT

186

221

228

195

225

271

% chg

(1.5)

18.9

3.1

(14.3)

15.1

20.8

(% of Net Sales)

12.9

12.8

12.6

12.1

11.8

12.7

Interest & other Charges

21

13

10

14

9

8

Other Income

5

6

4

4

4

4

(% of PBT)

3

3

2

2

2

2

Share in profit of Asso.

-

-

-

-

-

-

Recurring PBT

170

214

222

186

220

268

% chg

(3.5)

26.3

3.4

(16.2)

18.2

21.9

Extraordinary Exp./(Inc.)

3

-

-

-

-

-

PBT (reported)

172

214

222

186

220

268

Tax

53

62

62

39

44

54

(% of PBT)

31.0

28.8

27.9

21.0

20.0

20.0

Minority Interest

(0)

0.8

2.6

3.7

3.7

3.7

PAT (reported)

119

152

157

143

176

214

ADJ. PAT

114

152

157

143

176

214

% chg

4.6

32.9

3.5

(9.0)

22.8

21.9

(% of Net Sales)

7.9

8.8

8.7

8.9

9.2

10.0

Basic EPS (`)

5.9

7.8

8.1

7.4

9.0

11.0

Fully Diluted EPS (`)

5.9

7.8

8.1

7.4

9.0

11.0

% chg

4.6

32.9

3.5

(9.0)

22.8

21.9

July 26, 2016

8

Rallis India | 1QFY2017 Result Update

Balance sheet (Consolidated)

Y/E March (` cr)

FY2013

FY2014

FY2015

FY2016

FY2017E

FY2018E

SOURCES OF FUNDS

Equity Share Capital

19

19

19

19

19

19

Preference Capital

-

-

-

-

-

-

Reserves & Surplus

601

699

795

880

987

1,132

Shareholders Funds

621

718

815

899

1,006

1,152

Minority Interest

5

10

10

4

4

4

Total Loans

131

75

111

75

110

50

Other Long Term Liabilities

6

4

4

4

4

4

Long Term provisions

30

15

19

18

18

18

Deferred Tax Liability

28

32

36

39

39

39

Total Liabilities

821

853

993

1,038

1,184

1,270

APPLICATION OF FUNDS

Gross Block

581

651

687

764

834

904

Less: Acc. Depreciation

195

233

282

327

383

444

Net Block

386

418

405

437

451

460

Capital Work-in-Progress

35

21

21

21

21

21

Goodwill

169

186

196

259

259

259

Investments

20

25

24

28

28

28

Long Term Loans and Adv.

92

98

110

110

109

122

Current Assets

488

549

680

650

778

895

Cash

26

9

7

8

25

53

Loans & Advances

28

40

28

35

69

77

Other

435

500

645

607

684

765

Current liabilities

368

445

443

467

462

517

Net Current Assets

120

104

237

183

316

379

Mis. Exp. not written off

-

-

-

-

-

-

Total Assets

821

853

993

1,038

1,184

1,270

July 26, 2016

9

Rallis India | 1QFY2017 Result Update

Cash flow statement (Consolidated)

Y/E March (` cr)

FY2013

FY2014

FY2015

FY2016

FY2017E FY2018E

Profit before tax

172

214

222

186

220

268

Depreciation

32

41

50

45

56

61

(Inc)/Dec in Working Capital

(61)

(7)

(147)

55

(115)

(47)

Direct taxes paid

(53)

(62)

(62)

(39)

(44)

(54)

Cash Flow from Operations

150

186

63

246

117

227

(Inc.)/ Dec. in Fixed Assets

(5)

(56)

(36)

(76)

(70)

(70)

(Inc.)/ Dec. in Investments

3

(5)

1

(4)

-

-

Inc./ (Dec.) in loans and adv.

Cash Flow from Investing

(2)

(61)

(35)

(80)

(70)

(70)

Issue of Equity

-

-

-

-

-

-

Inc./(Dec.) in loans

(6)

(73)

40

(36)

35

(60)

Dividend Paid (Incl. Tax)

(50)

(55)

(68)

(68)

(68)

(68)

Others

(78)

(14)

(1)

-

-

(1)

Cash Flow from Financing

(134)

(142)

(29)

(165)

(29)

(129)

Inc./(Dec.) in Cash

15

(17)

(2)

1

17

28

Opening Cash balances

11

26

9

7

8

25

Closing Cash balances

26

9

7

8

25

53

July 26, 2016

10

Rallis India | 1QFY2017 Result Update

Key ratios

Y/E March

FY2013

FY2014

FY2015

FY2016

FY2017E

FY2018E

Valuation Ratio (x)

P/E (on FDEPS)

37.2

28.0

27.0

29.7

24.2

19.8

P/CEPS

28.2

22.1

20.5

22.6

18.3

15.5

P/BV

6.8

5.9

5.2

4.7

4.2

3.7

Dividend yield (%)

0.9

0.9

0.9

1.4

1.8

2.3

EV/Sales

2.9

2.4

2.3

2.6

2.2

1.9

EV/EBITDA

21.3

17.4

16.4

19.5

16.4

13.3

EV / Total Assets

5.2

4.9

4.2

4.0

3.5

3.2

Per Share Data (`)

EPS (Basic)

5.9

7.8

8.1

7.4

9.0

11.0

EPS (fully diluted)

5.9

7.8

8.1

7.4

9.0

11.0

Cash EPS

7.7

9.9

10.6

9.6

11.9

14.1

DPS

2.0

2.0

2.0

3.0

4.0

5.0

Book Value

31.9

36.9

41.9

46.2

51.7

59.2

Dupont Analysis

EBIT margin

12.9

12.8

12.6

12.1

11.8

12.7

Tax retention ratio

69.0

71.2

72.1

79.0

80.0

80.0

Asset turnover (x)

1.9

2.1

2.0

1.6

1.7

1.8

ROIC (Post-tax)

16.6

19.0

18.0

15.4

16.4

17.9

Cost of Debt (Post Tax)

10.1

8.7

7.9

11.6

8.0

8.0

Leverage (x)

0.2

0.2

0.2

0.2

0.1

0.1

Operating ROE

18.0

20.6

19.6

16.1

17.3

18.7

Returns (%)

ROCE (Pre-tax)

23.8

26.4

24.7

19.2

20.2

22.1

Angel ROIC (Pre-tax)

33.7

35.9

32.4

25.7

27.6

29.9

ROE

19.5

22.7

20.5

16.7

18.4

19.8

Turnover ratios (x)

Asset Turnover (Gross Block)

2.6

2.8

2.7

2.3

2.4

2.5

Inventory / Sales (days)

67

62

74

89

81

85

Receivables (days)

34

35

37

44

40

42

Payables (days)

111

98

105

119

102

98

WC cycle (ex-cash) (days)

16

20

33

46

45

53

Solvency ratios (x)

Net debt to equity

0.2

0.1

0.2

0.1

0.1

0.0

Net debt to EBITDA

0.7

0.3

0.5

0.4

0.4

0.1

Interest Coverage (EBIT / Int.)

9.0

17.5

22.5

14.4

24.3

33.9

July 26, 2016

11

Rallis India | 1QFY2017 Result Update

Research Team Tel: 022 - 39357800

DISCLAIMER

Angel Broking Private Limited (hereinafter referred to as “Angel”) is a registered Member of National Stock Exchange of India Limited,

Bombay Stock Exchange Limited and Metropolitan Stock Exchange Limited. It is also registered as a Depository Participant with CDSL

and Portfolio Manager with SEBI. It also has registration with AMFI as a Mutual Fund Distributor. Angel Broking Private Limited is a

registered entity with SEBI for Research Analyst in terms of SEBI (Research Analyst) Regulations, 2014 vide registration number

INH000000164. Angel or its associates has not been debarred/ suspended by SEBI or any other regulatory authority for accessing

/dealing in securities Market. Angel or its associates/analyst has not received any compensation / managed or co-managed public

offering of securities of the company covered by Analyst during the past twelve months.

This document is solely for the personal information of the recipient, and must not be singularly used as the basis of any investment

decision. Nothing in this document should be construed as investment or financial advice. Each recipient of this document should

make such investigations as they deem necessary to arrive at an independent evaluation of an investment in the securities of the

companies referred to in this document (including the merits and risks involved), and should consult their own advisors to determine

the merits and risks of such an investment.

Reports based on technical and derivative analysis center on studying charts of a stock's price movement, outstanding positions and

trading volume, as opposed to focusing on a company's fundamentals and, as such, may not match with a report on a company's

fundamentals. Investors are advised to refer the Fundamental and Technical Research Reports available on our website to evaluate the

contrary view, if any.

The information in this document has been printed on the basis of publicly available information, internal data and other reliable

sources believed to be true, but we do not represent that it is accurate or complete and it should not be relied on as such, as this

document is for general guidance only. Angel Broking Pvt. Limited or any of its affiliates/ group companies shall not be in any way

responsible for any loss or damage that may arise to any person from any inadvertent error in the information contained in this report.

Angel Broking Pvt. Limited has not independently verified all the information contained within this document. Accordingly, we cannot

testify, nor make any representation or warranty, express or implied, to the accuracy, contents or data contained within this document.

While Angel Broking Pvt. Limited endeavors to update on a reasonable basis the information discussed in this material, there may be

regulatory, compliance, or other reasons that prevent us from doing so.

This document is being supplied to you solely for your information, and its contents, information or data may not be reproduced,

redistributed or passed on, directly or indirectly.

Neither Angel Broking Pvt. Limited, nor its directors, employees or affiliates shall be liable for any loss or damage that may arise from

or in connection with the use of this information.

Disclosure of Interest Statement

Rallis India

1. Financial interest of research analyst or Angel or his Associate or his relative

No

2. Ownership of 1% or more of the stock by research analyst or Angel or associates or relatives

No

3. Served as an officer, director or employee of the company covered under Research

No

4. Broking relationship with company covered under Research

No

Ratings (Based on expected returns

Buy (> 15%)

Accumulate (5% to 15%)

Neutral (-5 to 5%)

over 12 months investment period):

Reduce (-5% to -15%)

Sell (< -15)

July 26, 2016

12