3QFY2016 Result Update | Breweries & Distilleries

February 6, 2016

Radico Khaitan

BUY

CMP

`113

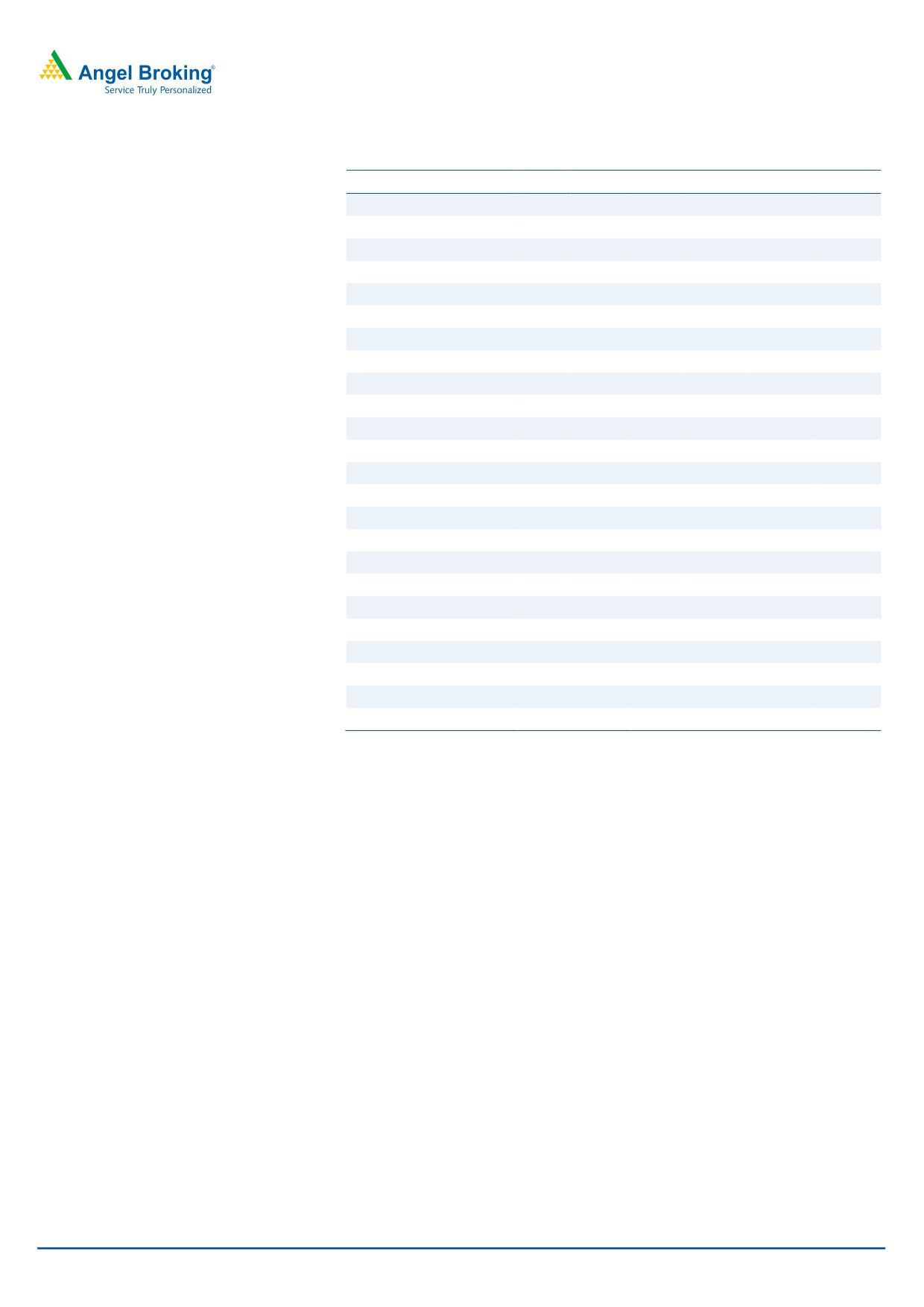

Performance Highlights

Target Price

`156

Quarterly Data

Investment Period

12 months

(` cr)

3QFY16 3QFY15

% yoy 2QFY16

% qoq

Revenue

401

413

(2.8)

370

8.3

EBITDA

58.5

46

27.1

50

16.6

Stock Info

Margin (%)

14.6

11.2

(344bp)

13.6

(103bp)

Sector

Breweries & Distilleries

Adj. PAT

25

21

19.3

19

36.1

Market Cap (` cr)

1,509

Source: Company, Angel Research

Net Debt (` cr)

741

For 3QFY2016, Radico Khaitan (RKL) outperformed our estimates on the earnings

Beta

0.8

front although the top-line came in flat yoy. On the operating front, the company

52 Week High / Low

131 / 78

reported margin expansion, primarily on account of lower raw material and selling

& distribution expenses. Further, on the bottom-line front, the company reported a

Avg. Daily Volume

1,69,862

healthy growth due to strong operating performance and lower interest cost.

Face Value (`)

2

BSE Sensex

24,617

Regular & others products segment de-grew which restricted overall top-line

growth but healthy volume growth in Prestige & above products segment: For the

Nifty

7,498

quarter, RKL’s top-line grew flat yoy to ~`401cr (our estimate was of ~ `432cr),

Reuters Code

RADC.BO

mainly due to the company’s shift in focus towards prestige and above products

Bloomberg Code

RDCK@IN

over higher volume mass market products. During the quarter, Prestige & above

brands’ volume grew ~10.7% yoy. Prestige and above brands’ contribution to

total Indian made foreign liquor (IMFL) volumes increased from 21.4% in

Shareholding Pattern (%)

3QFY2015 to 24.6% in 3QFY2016. However, de-growth in Regular & others

Promoters

40.5

products segment which contribute more than 75% of total sales volume, restricted the

overall top-line growth of the company. The company is continuously focusing on the

MF / Banks / Indian Fls

13.3

high-margin Premium products segment to increase revenue.

FII / NRIs / OCBs

21.1

PAT grew ~19% yoy: The reported net profit for the quarter grew by 19% yoy to

Indian Public / Others

25.1

`25.4cr (our estimate was of

`23.4cr) on account of strong operating

performance and lower interest cost (in FY2015 the company has repaid a

Abs. (%)

3m 1yr 3yr

significant amount of its debt; further debt reduction is also on the cards).

Sensex

(6.4)

(14.7)

25.2

Outlook and valuation: RKL has not performed well in the last two years due to

RKL

8.0

19.9

(21.6)

increasing material costs (ENA is a key raw material) and with it not receiving

significant price hikes from various states. We expect the company to perform well

going forward in anticipation of easing material costs and on expectation of

3-year price chart

better price hikes. This would result in an overall improvement in the operating

180

margin of the company. Also, with the company having reduced significant debt

160

140

from its balance sheet, it would be able to report an improvement in its

120

profitability. We expect the company to report strong earnings CAGR of ~18% to

100

~`95cr over FY2015-17E. Hence, we recommend a Buy rating on the stock with

80

60

a target price of `156.

40

20

Key financials

0

Y/E March (` cr)

FY2014

FY2015

FY2016E

FY2017E

Net sales

1,452

1,488

1,517

1,635

% chg

15.4

2.5

1.9

7.8

Source: Company, Angel Research

Net profit

71

68

78

95

% chg

(7.8)

(5.1)

14.6

22.1

EBITDA margin (%)

13.3

11.4

12.7

13.4

EPS (`)

5.4

5.1

5.8

7.1

P/E (x)

21.1

22.2

19.4

15.9

P/BV (x)

1.9

1.8

1.7

1.5

RoE (%)

9.1

8.1

8.6

9.6

RoCE (%)

9.2

7.8

8.7

9.8

Amarjeet S Maurya

EV/Sales (x)

1.6

1.5

1.5

1.3

022-39357800 Ext: 6831

EV/EBITDA (x)

11.8

13.2

11.5

10.0

Source: Company, Angel Research, Note: CMP as of February 5, 2016

Please refer to important disclosures at the end of this report

1

Radico Khaitan | 3QFY2016 Result Update

Exhibit 1: Quarterly performance

Y/E March (` cr)

3QFY16

3QFY15

% yoy

2QFY16

% qoq

9MFY16

9MFY15

% chg

Net Sales

401

413

(2.8)

370.03

8.3

1,165

1,145

1.8

Consumption of RM

179

221

(19.2)

178

0.6

535

562

(4.9)

(% of Sales)

44.6

53.6

48.0

45.9

49.1

Staff Costs

29

30

(2.3)

29

0.5

85

80

6.6

(% of Sales)

7.2

7.2

7.8

7.3

6.9

Selling & Administrative Exps.

71.4

77

(6.9)

64.4

10.8

208

217

(3.9)

(% of Sales)

17.8

18.6

17.4

17.8

18.9

Operating Expense

63

39

62.8

49

29.3

182

149

21.9

(% of Sales)

15.8

9.4

13.2

15.6

13.1

Total Expenditure

342

367

(6.6)

320

7.0

1,010

1,008

0.2

Operating Profit

58

46

27.1

50

16.6

156

137

13.5

OPM (%)

14.6

11.2

13.6

13.4

12.0

Interest

20

23

(14.4)

21

(5.3)

62

68

(9.6)

Depreciation

10

9

11.1

10

-

30

30

0.0

Other Income

6.82

10.27

(33.6)

7.01

(2.6)

23

30

(22.2)

PBT

36

24

46.8

26

35.0

87

69

26.7

(% of Sales)

8.9

5.9

7.1

7.5

6.0

Provision for Taxation

10

3

241.7

8

32.3

25

16

55.7

(% of PBT)

28.8

12.4

29.4

28.9

23.6

Minority Interest

Reported PAT

25

21

19.3

19

36.1

62

53

17.8

PATM

6.3

5.2

5.0

5.3

4.6

Source: Company, Angel Research

February 6, 2016

2

Radico Khaitan | 3QFY2016 Result Update

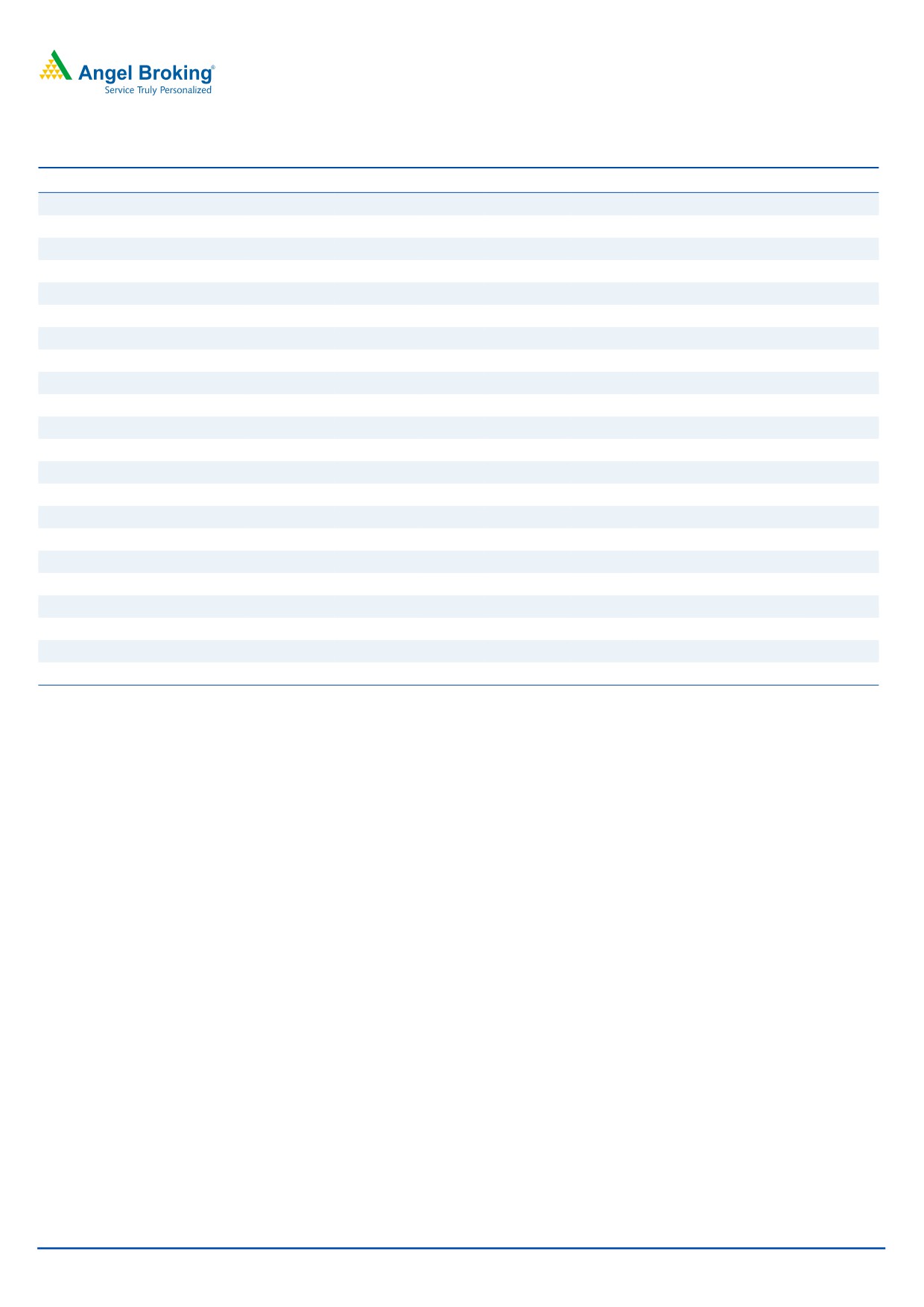

Regular & other products segment’s volume de-grew which

restricted overall top-line growth but healthy volume growth in

Prestige & above products segment

For the quarter, RKL’s top-line grew flat yoy to ~`401cr (our estimate was of

~ `432cr), mainly due to the company’s shift in focus towards prestige and above

products over higher volume mass market products. During the quarter, Prestige &

above brands’ volume grew ~10.7% yoy. Prestige and above brands’ contribution

to total Indian made foreign liquor (IMFL) volumes increased from 21.4% in

3QFY2015 to 24.6% in 3QFY2016. However, de-growth in Regular & others products

segment which contribute more than 75% of total sales volume, restricted the overall

top-line growth of the company. The company is continuously focusing on the high-

margin Premium products segment to increase revenue.

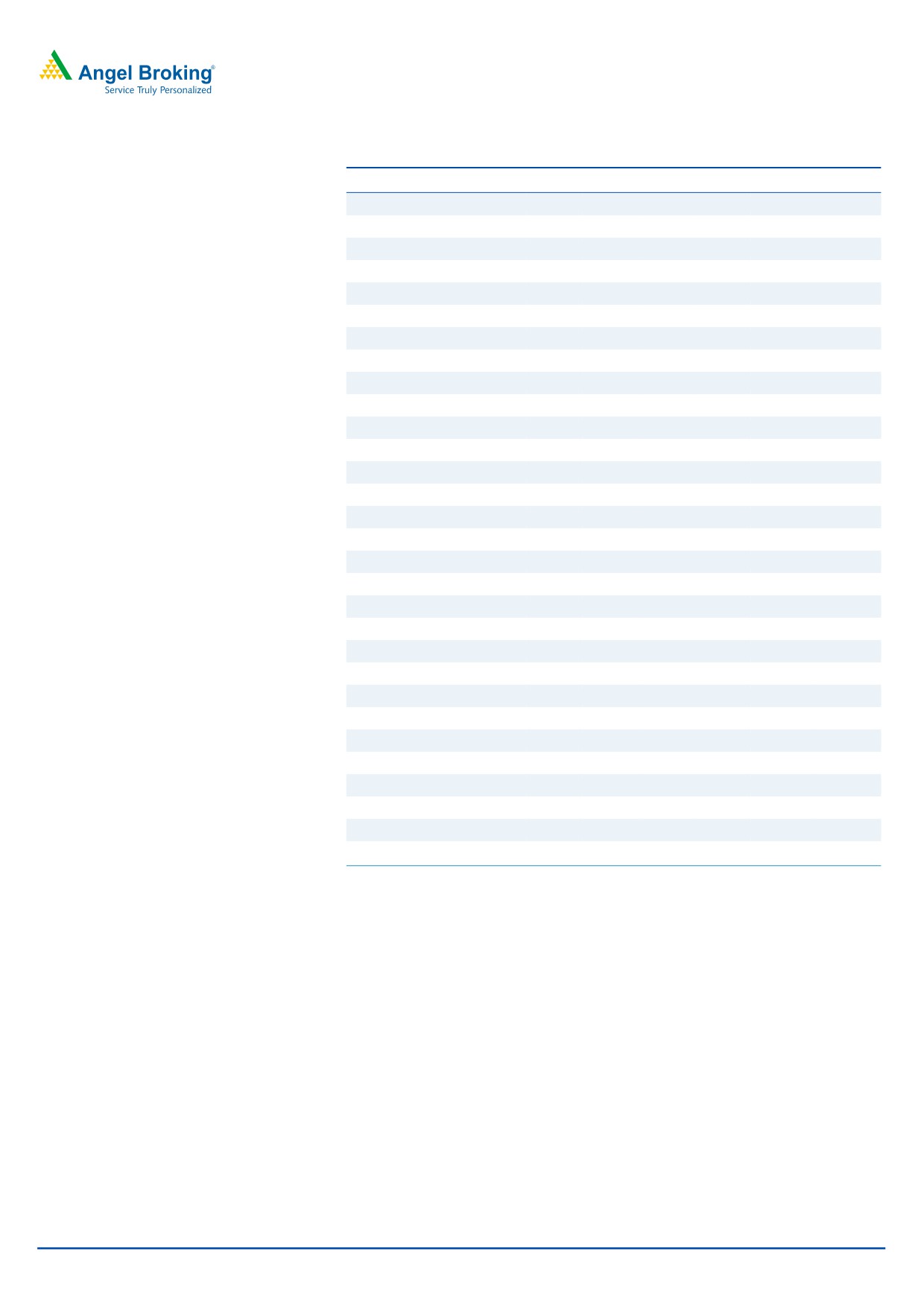

Exhibit 2: Top-line growth trend

450

20

400

15

350

10

300

5

250

-

200

(5)

150

(10)

100

50

(15)

0

(20)

Net sales

QoQ growth (%)

Source: Company, Angel Research

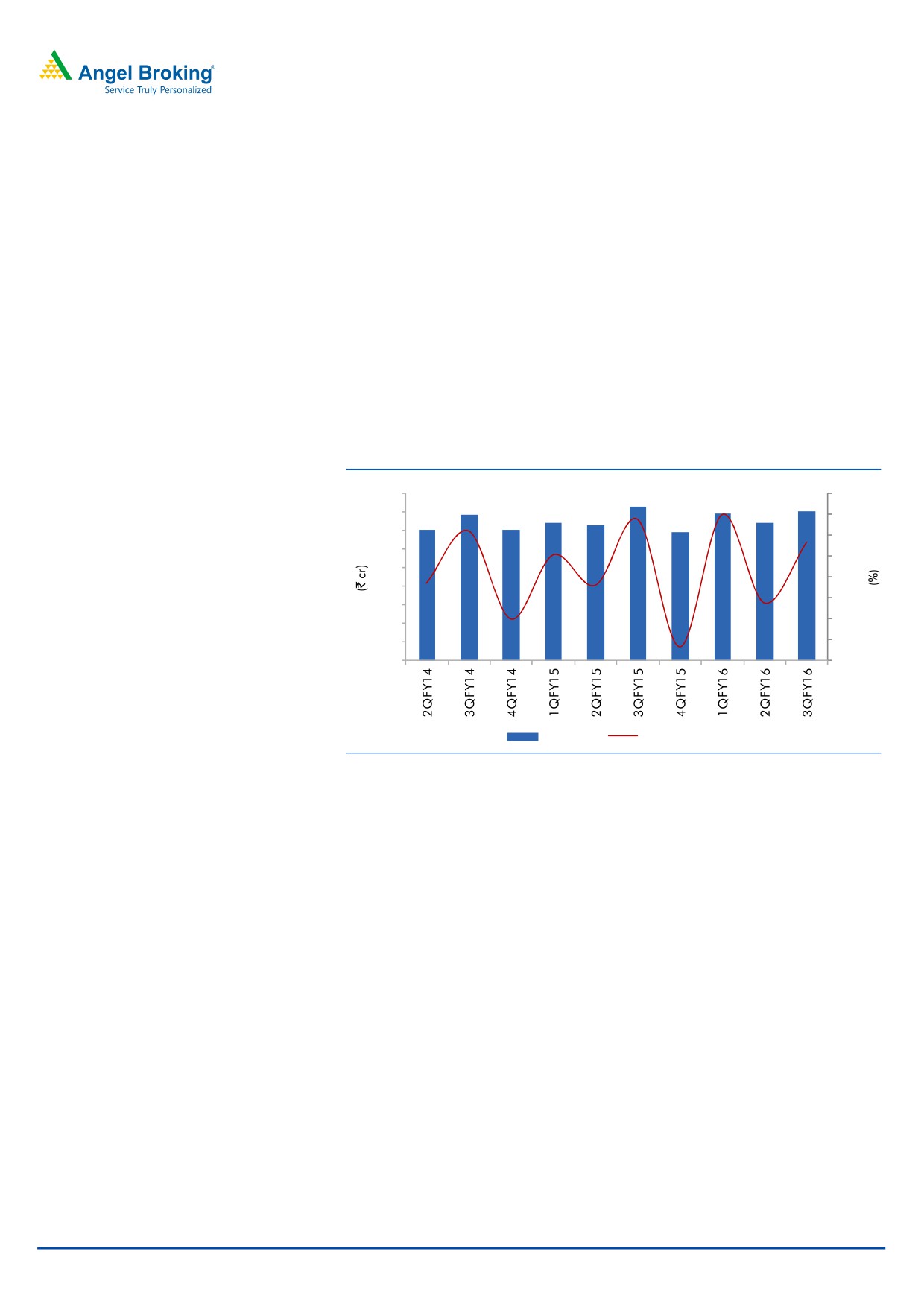

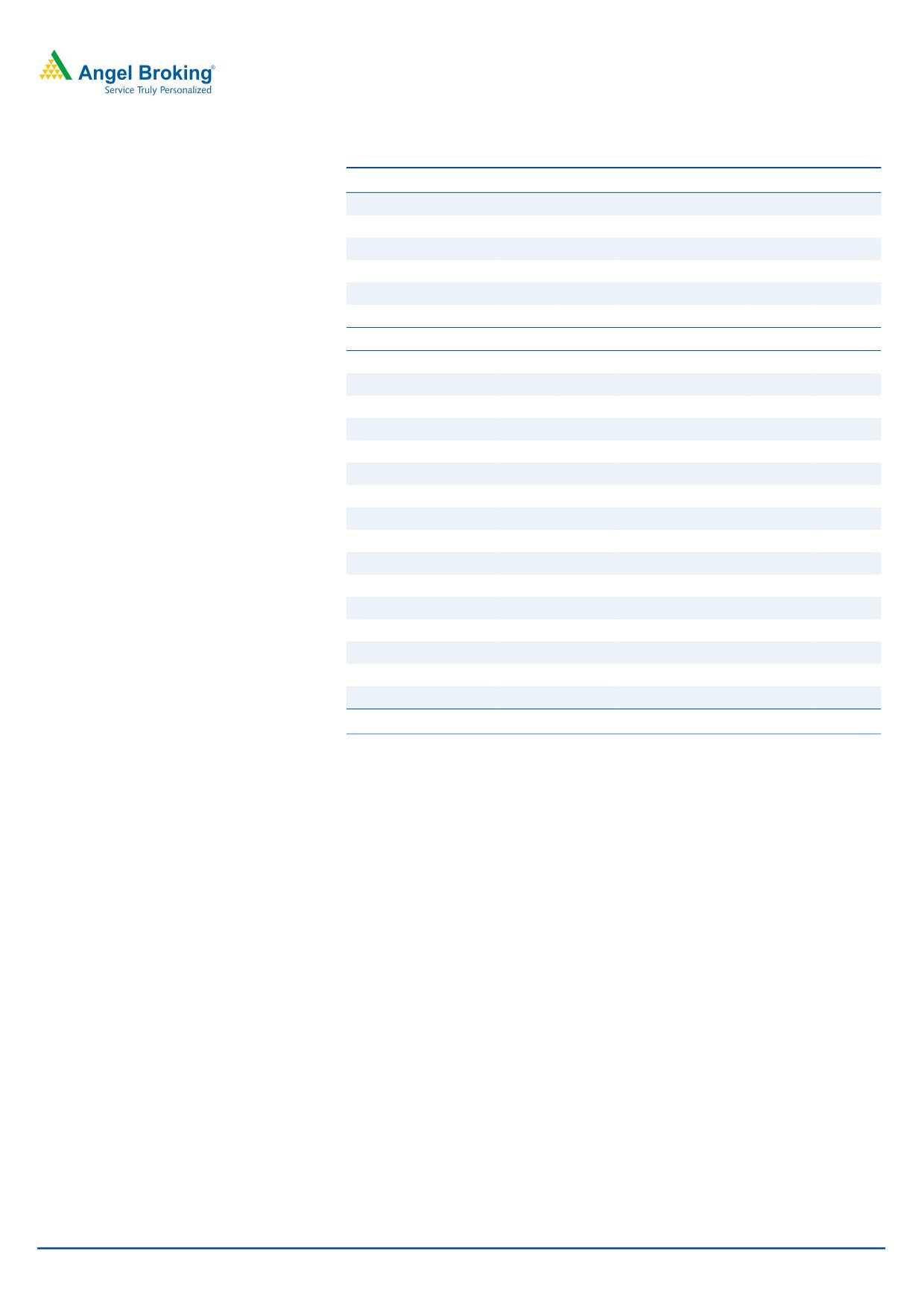

Operating margin expansion due to lower raw material and

selling & distribution expenses

On the operating front, the company’s margin improved by 344bp yoy to 14.6%,

primarily on account of lower raw material and selling & distribution expenses. The

operating profit resultantly grew by ~27% yoy to `58cr. During the quarter, foreign

exchange fluctuation loss was of `1.8cr in 3QFY2016 compared to a loss of

`5.3cr in 3QFY2015.

February 6, 2016

3

Radico Khaitan | 3QFY2016 Result Update

Exhibit 3: Operating profit and margin trend

70

16

60

14

12

50

10

40

8

30

6

20

4

10

2

0

0

Operating Profit

Margin (%)

Source: Company, Angel Research

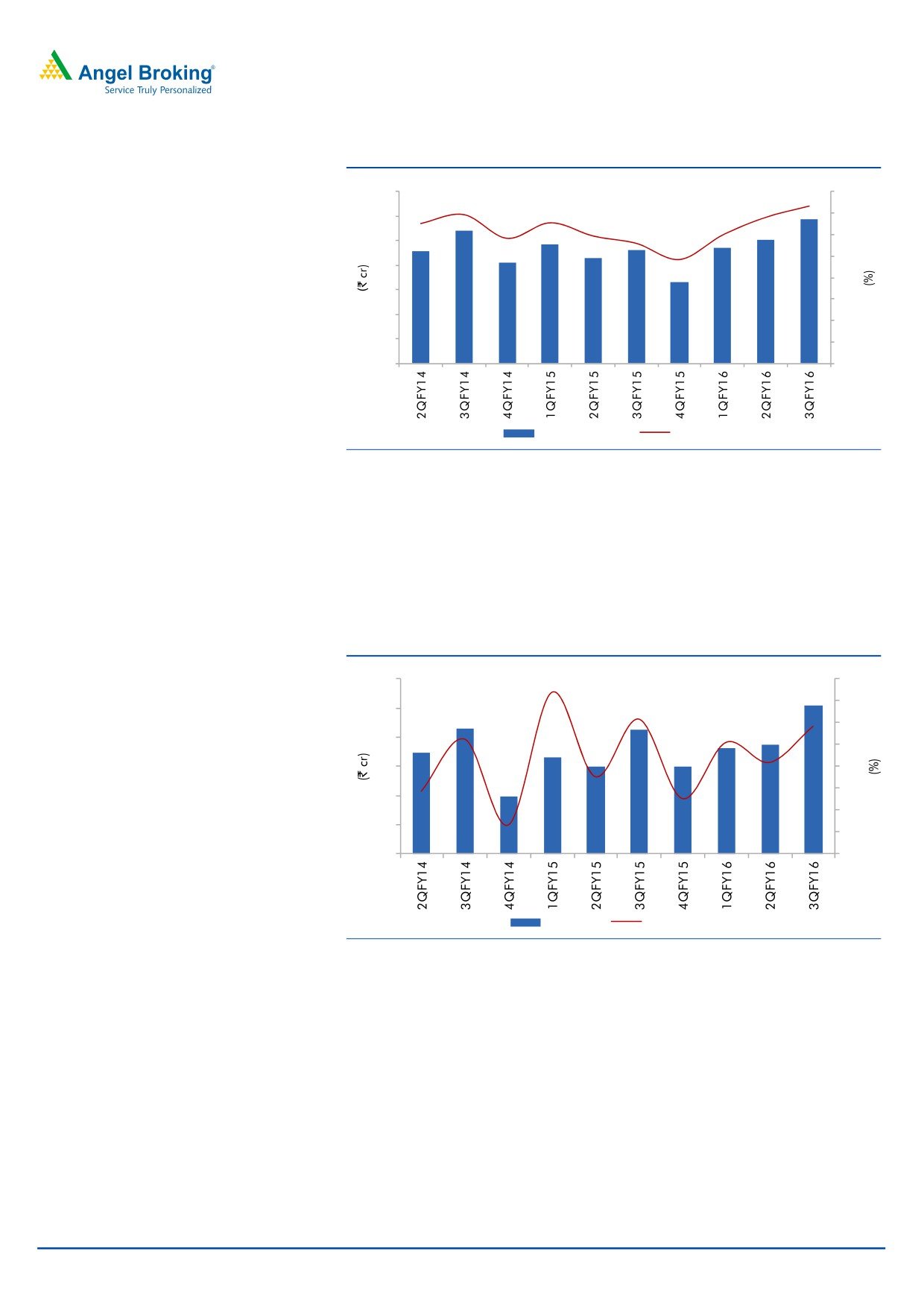

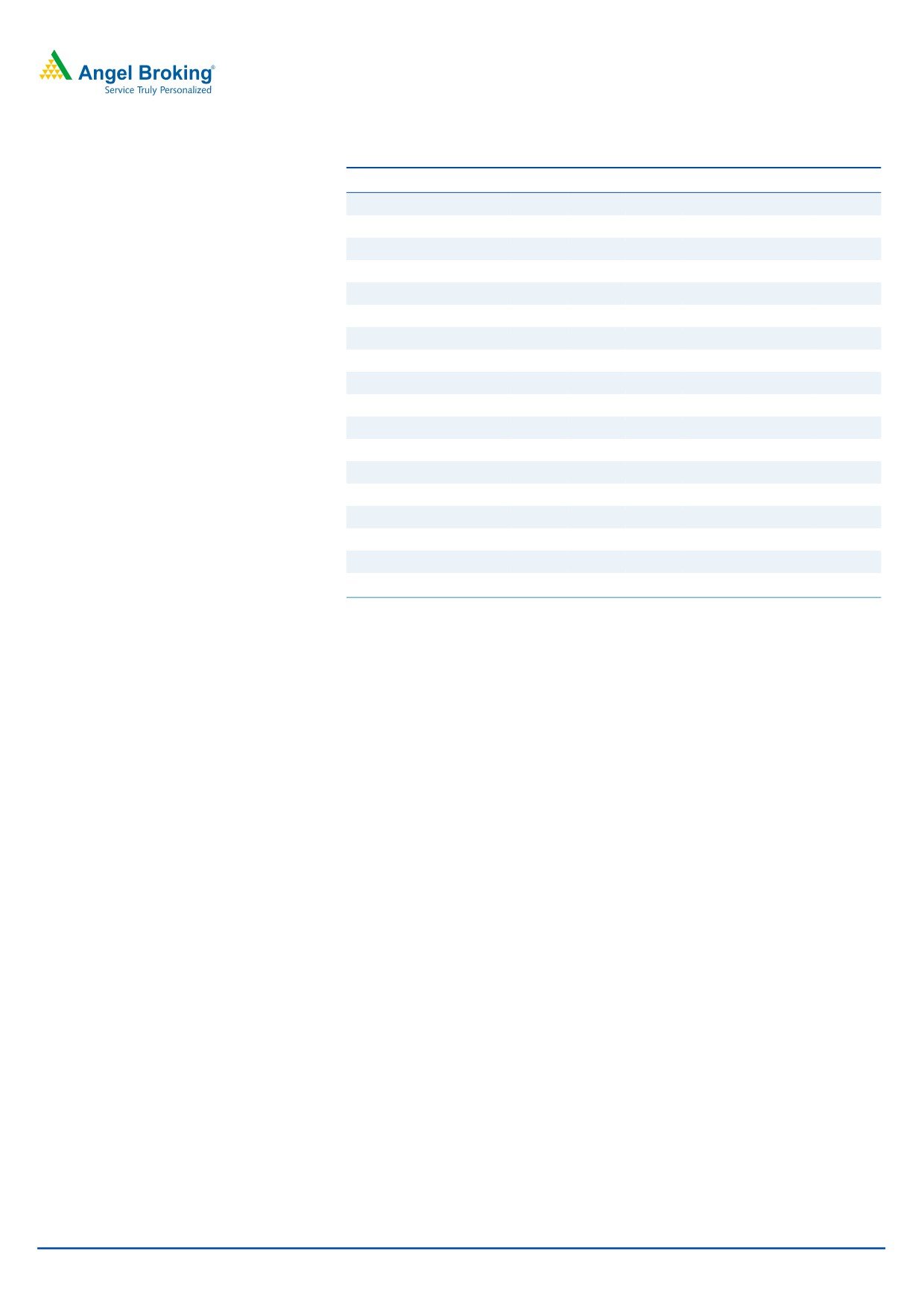

PAT grew ~19% yoy

The reported net profit grew by 19% yoy to `25.4cr (above our estimate of

`23.4cr) on account of the strong operating performance and lower interest costs

(in FY2015 the company repaid a significant amount of its debt; further debt

reduction is also on the cards).

Exhibit 4: Net Profit and growth trend

30

80

60

25

40

20

20

15

-

(20)

10

(40)

5

(60)

0

(80)

Net Profit

QoQ growth (%)

Source: Company, Angel Research

February 6, 2016

4

Radico Khaitan | 3QFY2016 Result Update

Investment rationale

Raw material prices expected to ease

We expect the price of extra neutral alcohol (ENA), a key raw material for the

company, to remain stable and potentially even decline going forward. This is

because sugar production during the October 2014 to May 2015 period has risen

by ~16% yoy to 27.9mn tonne, which is an 8-year high production level. As a

result ENA (a by-product of sugarcane) production too would be higher this year.

Pricing environment expected to be favorable for IMFL industry

Our interaction with liquor companies suggests that the industry has now bottomed

out. We expect the industry’s pricing environment to likely get better going ahead

mainly because there has not been any significant price hike in products in recent

times due to delay in approval by various state governments. Hence, the industry is

now expecting a significant price hike in the coming financial year. Also, the

industry leader - United Spirits - has been facing pressure at the operating level

and the company has a huge debt on its balance sheet. Hence we believe that the

company’s new Management would shift focus on profitability over volume growth,

which in turn, would lead to increased scope for other liquor companies to hike

prices.

Higher proportion of Premium products in volume mix to drive

profitability

In the IMFL segment, more than 20% of the company’s volumes come from

Prestige and above products, which is a high margin business, and the balance

volumes come from regular and others brands. Since the last seven years, the

company’s prestige and above brands’ volume has reported a CAGR of ~26%

and their share in the product mix has increased from 7.9% in FY2009 to 20.7% in

FY2015. We expect volume contribution of prestige and above products in the

IMFL segment to increase further on back of higher ad spend. The company has

roped in celebrity Hrithik Roshan as its brand ambassador. Also, RKL’s presence in

the prestige Vodka segment is under penetrated which leaves scope for growth.

Thus, this would improve the overall margin for the company and result in higher

profitability.

Wide distribution network with strong brands

RKL has a strong sales and distribution network with a presence in retail and off-

trade outlets in the relevant segments in different parts of India. Currently, the

company is selling its products through over 45,000 retail outlets and over 5,000

on-premise outlets. Apart from wholesalers, a total of around 300 employees

divided into four zones, each headed by regional profit centre head, ensure an

adequate on-the-ground sales and distribution presence across the country.

Apart from this, the company has strong brands likes Magic Moments Vodka,

Morpheus Brandy, Verve Vodka, Florence Brandy, After Dark Whisky etc.

February 6, 2016

5

Radico Khaitan | 3QFY2016 Result Update

Outlook and valuation

RKL has not performed well in the last two years due to increasing material costs

(ENA is a key raw material) and with it not receiving significant price hikes from

various states. We expect the company to perform well going forward in

anticipation of easing material costs and on expectation of better price hikes. This

would result in an overall improvement in the operating margin of the company.

Also, with the company having reduced significant debt from its balance sheet, it

would be able to report an improvement in its profitability. We expect the company

to report strong earnings CAGR of ~18% to ~`95cr over FY2015-17E. Hence, we

recommend a Buy rating on the stock with a target price of `156.

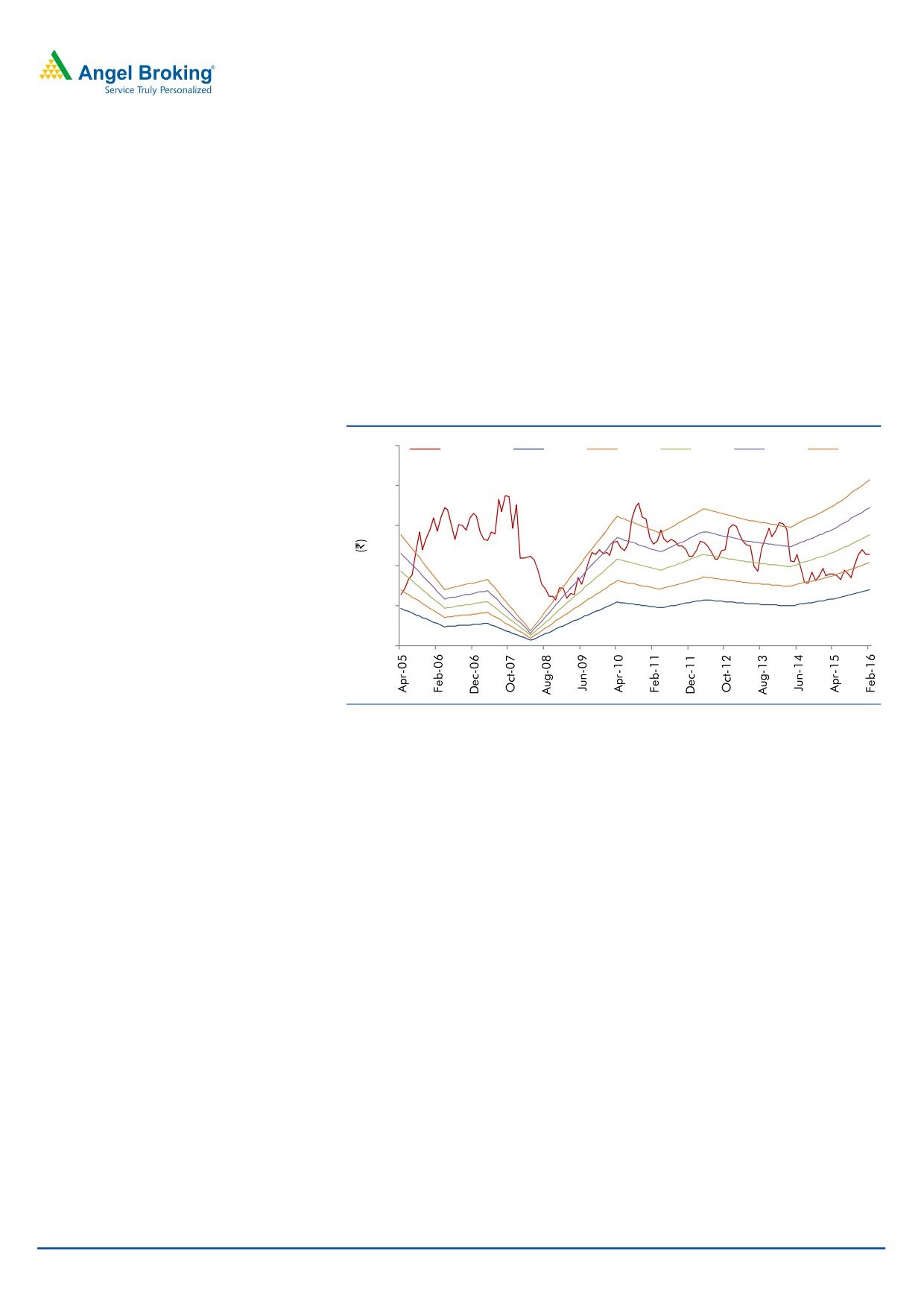

Exhibit 5: One-year forward P/E band

250

Share Prices

10.0 X

15.0 X

20.0 X

25.0 X

30.0 X

200

150

100

50

0

Source: Company, Angel Research

Company Background

Radico Khaitan Ltd is an India-based spirits company engaged in the manufacture

of liquor. The company has three distilleries and one JV with total capacity of

150mn litres and 33 bottling units spread across the country. The company is one

of the largest providers of branded IMFL to the Canteen Stores Department (CSD),

which has significant entry barriers. RKL's brands include After Dark Whisky, Magic

Moments Vodka, Morpheus Brandy, Contessa Rum, Old Admiral Brandy and 8

PM. Its liquor business also includes rectified spirit, country liquor and IMFL. Its

alcohol products include rectified spirit, silent spirit, cane juice spirit, malt spirit,

grain spirit and ethanol. The company’s PET division produces a range of PET

bottles and jars for industries, such as pharmaceutical, cosmetics, home and

personal care, edible oil and confectionery.

February 6, 2016

6

Radico Khaitan | 3QFY2016 Result Update

Profit & Loss Statement

Y/E March (` cr)

FY2012

FY2013

FY2014

FY2015

FY2016E

FY2017E

Total operating income

1,144

1,258

1,452

1,488

1,517

1,635

% chg

20.9

10.0

15.4

2.5

1.9

7.8

Total Expenditure

987

1,074

1,258

1,318

1,324

1,416

Raw Material Cost

546

585

653

717

699

744

Personnel Expenses

71

79

93

107

114

128

Selling & Administrative Exp.

205

235

286

284

276

286

Others Expenses

166

176

226

210

235

258

EBITDA

157

184

193

170

193

219

% chg

3.9

17.7

5.0

(11.9)

13.1

13.9

(% of Net Sales)

13.7

14.6

13.3

11.4

12.7

13.4

Depreciation& Amortisation

33

35

39

38

41

42

EBIT

124

149

155

132

152

178

% chg

0.1

20.4

3.9

(14.6)

14.9

17.0

(% of Net Sales)

10.8

11.8

10.7

8.9

10.0

10.9

Interest & other Charges

58

70

85

90

84

84

Other Income

21

30

36

45

45

45

(% of PBT)

24.6

27.8

34.3

51.6

40.0

32.3

Share in profit of Associates

-

-

-

-

-

-

Recurring PBT

87

109

106

87

112

139

% chg

(12.6)

25.7

(2.6)

(18.1)

28.9

23.9

Prior Period & Extra. Exp./(Inc.)

-

-

-

-

-

-

PBT (reported)

87

109

106

87

112

139

Tax

23

32

35

19

35

45

(% of PBT)

26.8

29.3

33.0

22.4

31.0

32.0

PAT (reported)

64

77

71

68

78

95

% chg

(12.6)

21.4

(7.8)

(5.1)

14.6

22.1

(% of Net Sales)

5.6

6.1

4.9

4.5

5.1

5.8

Basic EPS (`)

4.8

5.8

5.4

5.1

5.8

7.1

Fully Diluted EPS (`)

4.8

5.8

5.4

5.1

5.8

7.1

% chg

(12.7)

21.2

(7.9)

(5.1)

14.6

22.1

February 6, 2016

7

Radico Khaitan | 3QFY2016 Result Update

Balance Sheet

Y/E March (` cr)

FY2012

FY2013

FY2014

FY2015

FY2016E FY2017E

SOURCES OF FUNDS

Equity Share Capital

27

27

27

27

27

27

Reserves& Surplus

642

702

754

812

878

958

Shareholders Funds

668

728

781

839

904

985

Total Loans

650

768

904

849

840

830

Deferred Tax Liability

65

70

85

85

85

85

Total Liabilities

1,384

1,566

1,770

1,773

1,829

1,900

APPLICATION OF FUNDS

Gross Block

687

744

821

831

851

871

Less: Acc. Depreciation

185

214

250

288

329

371

Net Block

502

529

571

542

521

500

Capital Work-in-Progress

5

5

8

8

8

8

Investments

111

109

108

98

98

98

Current Assets

1,016

1,161

1,330

1,379

1,458

1,570

Inventories

179

186

211

212

216

228

Sundry Debtors

348

435

523

538

553

596

Cash

21

16

15

10

25

35

Loans & Advances

382

314

441

470

482

515

Other Assets

86

209

139

149

182

196

Current liabilities

259

249

262

270

272

292

Net Current Assets

757

912

1,067

1,109

1,186

1,279

Deferred Tax Asset

9

11

15

15

15

15

Mis. Exp. not written off

-

-

-

-

-

-

Total Assets

1,384

1,566

1,770

1,773

1,829

1,900

February 6, 2016

8

Radico Khaitan | 3QFY2016 Result Update

Cashflow Statement

Y/E March (` cr)

FY2012

FY2013

FY2014

FY2015

FY2016E FY2017E

Profit before tax

87

109

106

87

112

139

Depreciation

33

35

39

38

41

42

Change in Working Capital

(15)

(242)

(53)

(47)

(63)

(83)

Interest / Dividend (Net)

37

42

50

90

84

84

Direct taxes paid

(18)

(23)

(26)

(19)

(35)

(45)

Others

18

13

22

-

-

-

Cash Flow from Operations

142

(66)

137

149

140

137

(Inc.)/ Dec. in Fixed Assets

(118)

48

(141)

11

(20)

(20)

(Inc.)/ Dec. in Investments

(9)

(3)

(0)

(10)

-

-

Cash Flow from Investing

(128)

46

(141)

0.2

(20)

(20)

Issue of Equity

1

1

1

-

-

-

Inc./(Dec.) in loans

109

97

99

(55)

(9)

(10)

Dividend Paid (Incl. Tax)

(11)

(12)

(12)

(10)

(12)

(14)

Interest / Dividend (Net)

(101)

(71)

(84)

(90)

(84)

(84)

Cash Flow from Financing

(2)

15

3

(154)

(105)

(108)

Inc./(Dec.) in Cash

12

(5)

(1)

(5)

15

10

Opening Cash balances

9

21

16

15

10

25

Closing Cash balances

21

16

15

10

25

35

February 6, 2016

9

Radico Khaitan | 3QFY2016 Result Update

Key Ratios

Y/E March

FY2012

FY2013

FY2014

FY2015

FY2016E FY2017E

Valuation Ratio (x)

P/E (on FDEPS)

23.6

19.4

21.1

22.2

19.4

15.9

P/CEPS

15.5

13.3

13.7

14.2

12.7

11.0

P/BV

2.2

2.1

1.9

1.8

1.7

1.5

Dividend yield (%)

0.7

0.7

0.7

0.7

0.8

0.9

EV/Sales

1.8

1.7

1.6

1.5

1.4

1.3

EV/EBITDA

12.9

11.6

11.8

13.2

11.3

9.8

EV / Total Assets

1.2

1.2

1.1

1.1

1.0

1.0

Per Share Data (`)

EPS (Basic)

4.8

5.8

5.4

5.1

5.8

7.1

EPS (fully diluted)

4.8

5.8

5.4

5.1

5.8

7.1

Cash EPS

7.3

8.5

8.3

8.0

8.9

10.3

DPS

0.8

0.8

0.8

0.8

0.9

1.1

Book Value

50.4

54.8

58.7

63.0

68.0

74.0

Returns (%)

ROCE

9.4

10.0

9.2

7.8

8.7

9.8

Angel ROIC (Pre-tax)

10.4

10.9

9.9

8.4

9.6

10.9

ROE

9.5

10.6

9.1

8.1

8.6

9.6

Turnover ratios (x)

Asset Turnover (Gross Block)

2.3

2.4

2.5

2.7

2.9

3.3

Inventory / Sales (days)

57

54

53

52

52

51

Receivables (days)

111

126

132

132

133

133

Payables (days)

38

36

33

33

32

31

WC cycle (ex-cash) (days)

130

144

152

151

153

153

February 6, 2016

10

Radico Khaitan | 3QFY2016 Result Update

Research Team Tel: 022 - 39357800

DISCLAIMER

Angel Broking Private Limited (hereinafter referred to as “Angel”) is a registered Member of National Stock Exchange of India Limited,

Bombay Stock Exchange Limited and Metropolitan Stock Exchange of India Limited. It is also registered as a Depository Participant with

CDSL and Portfolio Manager with SEBI. It also has registration with AMFI as a Mutual Fund Distributor. Angel Broking Private Limited is

a registered entity with SEBI for Research Analyst in terms of SEBI (Research Analyst) Regulations, 2014 vide registration number

INH000000164. Angel or its associates has not been debarred/ suspended by SEBI or any other regulatory authority for accessing

/dealing in securities Market. Angel or its associates including its relatives/analyst do not hold any financial interest/beneficial

ownership of more than 1% in the company covered by Analyst. Angel or its associates/analyst has not received any compensation /

managed or co-managed public offering of securities of the company covered by Analyst during the past twelve months. Angel/analyst

has not served as an officer, director or employee of company covered by Analyst and has not been engaged in market making activity

of the company covered by Analyst.

This document is solely for the personal information of the recipient, and must not be singularly used as the basis of any investment

decision. Nothing in this document should be construed as investment or financial advice. Each recipient of this document should

make such investigations as they deem necessary to arrive at an independent evaluation of an investment in the securities of the

companies referred to in this document (including the merits and risks involved), and should consult their own advisors to determine

the merits and risks of such an investment.

Reports based on technical and derivative analysis center on studying charts of a stock's price movement, outstanding positions and

trading volume, as opposed to focusing on a company's fundamentals and, as such, may not match with a report on a company's

fundamentals.

The information in this document has been printed on the basis of publicly available information, internal data and other reliable

sources believed to be true, but we do not represent that it is accurate or complete and it should not be relied on as such, as this

document is for general guidance only. Angel Broking Pvt. Limited or any of its affiliates/ group companies shall not be in any way

responsible for any loss or damage that may arise to any person from any inadvertent error in the information contained in this report.

Angel Broking Pvt. Limited has not independently verified all the information contained within this document. Accordingly, we cannot

testify, nor make any representation or warranty, express or implied, to the accuracy, contents or data contained within this document.

While Angel Broking Pvt. Limited endeavors to update on a reasonable basis the information discussed in this material, there may be

regulatory, compliance, or other reasons that prevent us from doing so.

This document is being supplied to you solely for your information, and its contents, information or data may not be reproduced,

redistributed or passed on, directly or indirectly.

Neither Angel Broking Pvt. Limited, nor its directors, employees or affiliates shall be liable for any loss or damage that may arise from

or in connection with the use of this information.

Note: Please refer to the important ‘Stock Holding Disclosure' report on the Angel website (Research Section). Also, please refer to the

latest update on respective stocks for the disclosure status in respect of those stocks. Angel Broking Pvt. Limited and its affiliates may

have investment positions in the stocks recommended in this report.

Disclosure of Interest Statement

Radico Khaitan

1. Analyst ownership of the stock

No

2. Angel and its Group companies ownership of the stock

No

3. Angel and its Group companies' Directors ownership of the stock

No

4. Broking relationship with company covered

No

Note: We have not considered any Exposure below ` 1 lakh for Angel, its Group companies and Directors

Ratings (Based on expected returns

Buy (> 15%)

Accumulate (5% to 15%)

Neutral (-5 to 5%)

over 12 months investment period):

Reduce (-5% to -15%)

Sell (< -15%)

February 6, 2016

11