IPO Note | Consultancy Services

March 28, 2019

Rail Vikas Nigam Ltd. (RVNL)

SUBSCRIBE

sue Open: March 29, 2019

Is

Issue Close: April 03, 2019

Rail Vikas Nigam Ltd. (RVNL) is a wholly owned Government Company, a

Miniratna (Category - I) Schedule ‘A’ Central Public Sector Enterprise. RVNL is a

project executing agency working for and on behalf of MoR (Ministry of Railways).

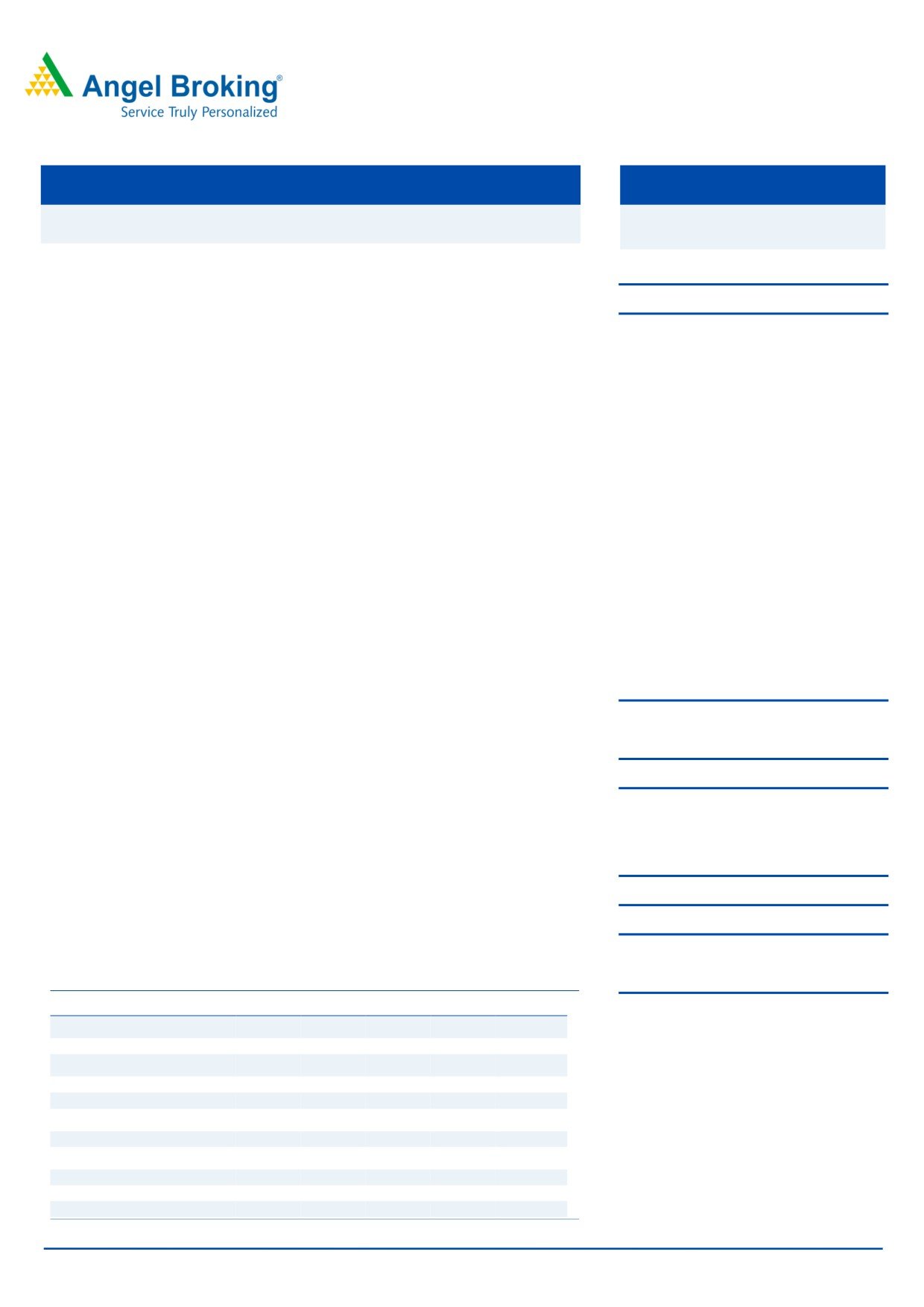

Issue Details

It undertakes rail project development, mobilization of financial resources and

Face Value: `10

implementation of rail projects pertaining to strengthening of golden quadrilateral

and port connectivity coupled with raising of extra-budgetary resources for project

Present Eq. Paid up Capital: `2,085cr

execution. The role of RVNL is to mobilize finances and is restricted to forming of

Offer for Sale: `477cr

project specific SPVs with private participation.

Retail & Employee Duscount:

Healthy order book with diversified revenue stream: RVNL’s order book stood at

`0.5/Share

~`77,500cr as of December 2018, out of which ~`43,000cr is expected to get

Post Eq. Paid up Capital: `2,085cr

executed over 2-3 years, and the remaining is with a longer gestation period. In

the light of future investment opportunity in railways, we believe RVNL is in a

Issue size (amount): *`426cr -**477 cr

sweet spot to tap the opportunities going forward. Moreover, RVNL has been

successfully able to corner 20-30% of work from MoR (in railway electrification

Price Band: `17 - `19

and doubling of line), which formed roughly 40% of December 2018 order book.

Lot Size: 780 shares and in multiple

Expertise in undertaking all stages of project development and execution from

thereafter

conceptualization to commissioning: Initially RVNL undertook the execution of new

Post-issue implied mkt. cap: *`3,545cr

- **`3,962cr

lines, doubling, gauge conversion, and railway electrification projects. Further,

upon establishing a good track record in the area of execution of these

Promoters holding Pre-Issue: 100%

conventional type of projects, it has diversified and is now executing various types

Promoters holding Post-Issue: 87.8%

of projects including construction of new railway lines in hilly regions, metro lines,

*Calculated on lower price band

workshops and institutional buildings.

Outlook & valuation: In terms of valuations, PE works out to 6.9x FY18 EPS of

** Calculated on upper price band

`2.77 and annualized 6MFY19 PE works out to 7.8X (at the upper end of the

Book Building

issue price band) which is reasonably priced considering (a) healthy order book

QIBs

50% of issue

with near and long term execution visibility, (b) highly capable and experienced

management coupled with asset light business model, (c) healthy dividend payout

Non-Institutional

15% of issue

ratio around 30% in last three years, (d) diversified revenue segment, and (e)

Retail

35% of issue

increasing revenue opportunity from railways due to new investment in

electrification and infrastructure. Given that RVNL is an executing agency of MoR,

we believe it is in a sweet spot to tap the upcoming opportunities in Indian

Post Issue Shareholding Patter

Railways. On the basis of the above arguments, we recommend SUBSCRIBE to

Promoters

88%

issue.

Key Financials

Others

12%

Y/E March (` Cr.)

FY15

FY16

FY17

FY18

FY19*

Net Sales

3,147

4,540

5,915

7,597

7,246

% chg

-

44

30

28

(5)

Net Profit

337

429

443

570

507

% chg

-

27

3

29

(11)

EBITDA (%)

146

217

282

389

323

EPS (Rs)

1.62

2.06

2.13

2.73

2.43

P/E (x)

11.76

9.23

8.93

6.95

7.81

P/BV (x)

1.29

1.16

1.11

1.01

0.98

Kripashankar Maurya

RoE (%)

11.0

12.5

12.5

14.5

12.5

+022 39357600, Extn: 6004

RoCE (%)

2.5

3.5

4.6

5.9

5.0

EV/EBITDA

41.6

30.0

23.5

20.6

26.0

Source: RHP, *Annualized calculated number, Note: Valuation ratios based on post outstanding shares and at upper end of the price ban

Please refer to important disclosures at the end of this report

1

RVNL | IPO Note

Company background

RVNL is a wholly owned Government Company, a Miniratna (Category - I) Schedule

‘A’ Central Public Sector Enterprise. RVNL is project executing agency working for and

on behalf of MoR. It undertakes rail project development, mobilization of financial

resources and implementation of rail projects pertaining to strengthening of golden

quadrilateral and port connectivity coupled with raising of extra-budgetary resources for

project execution. The role of RVNL is to mobilize finances and is restricted to forming

of project specific SPVs with private participation.

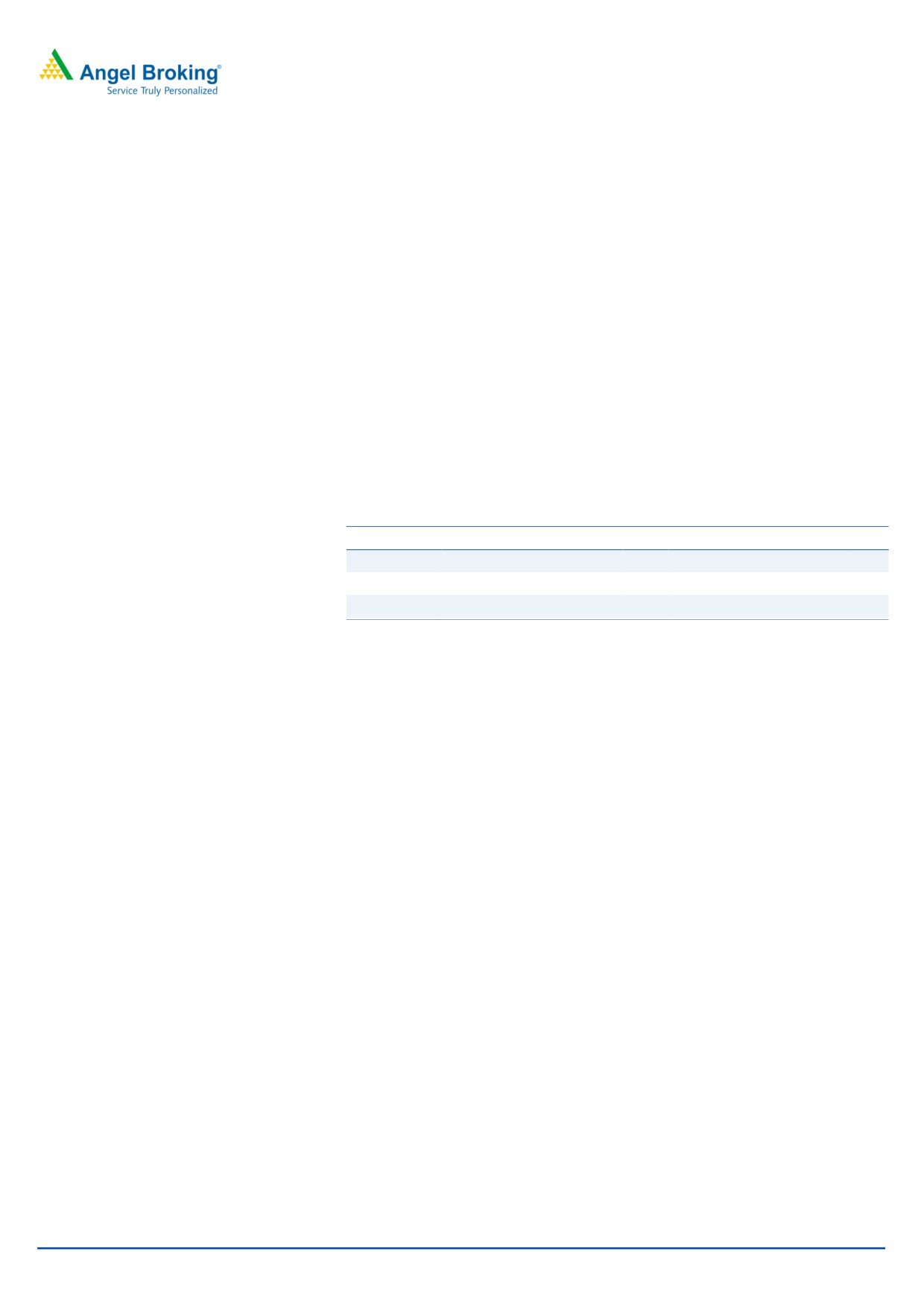

Issue Details

The company is raising ~`477cr through an offer for sale in the price band of `17-19

with retail and employee discount of Rs0.5/share. The offer will constitute ~12.15% of

the post-issue paid-up equity share capital of the company, assuming the issue is

subscribed at the upper end of the price band. The company is offering 25.34cr shares

that are being sold by Government of India (GOI).

Exhibit 1: Pre and Post-IPO shareholding pattern

No of shares (Pre-issue)

% No of shares (Post-issue)

%

Promoter (GOI)

2,08,50,20,100

100%

1,83,15,62,820

88%

Other

0

0%

25,34,57,280

12%

Total

2,08,50,20,100

100%

2,08,50,20,100 100%

Source: RHP, Angel Research; Note: Calculated on upper price band

Objects of the offer

As the issue is an offer for sale, RVNL will not receive any proceeds from the offer.

Outlook & valuation:

In terms of valuations, PE works out to 6.9x FY18 EPS of `2.77 and annualized

6MFY19 PE works out to 7.8X (at the upper end of the issue price band), which is

reasonably priced considering (a) healthy order book with near and long term

execution visibility, (b) highly capable and experienced management coupled

with asset light business model, (c) healthy dividend payout ratio around 30% in

last three years, (d) diversified revenue segment, and (e) increasing revenue

opportunity from railways due to new investment in electrification and

infrastructure. Given that RVNL is an executing agency of MoR, we believe it is in

a sweet spot to tap the upcoming opportunities in Indian Railways. On the basis

of the above arguments, we recommend SUBSCRIBE to issue.

Key Risks

High dependence on railway orders

RVNL receives most of the orders from the Railways, hence any slowdown in railway

spending may adversely impact the financial performance of the company.

March 28, 2019

2

RVNL | IPO Note

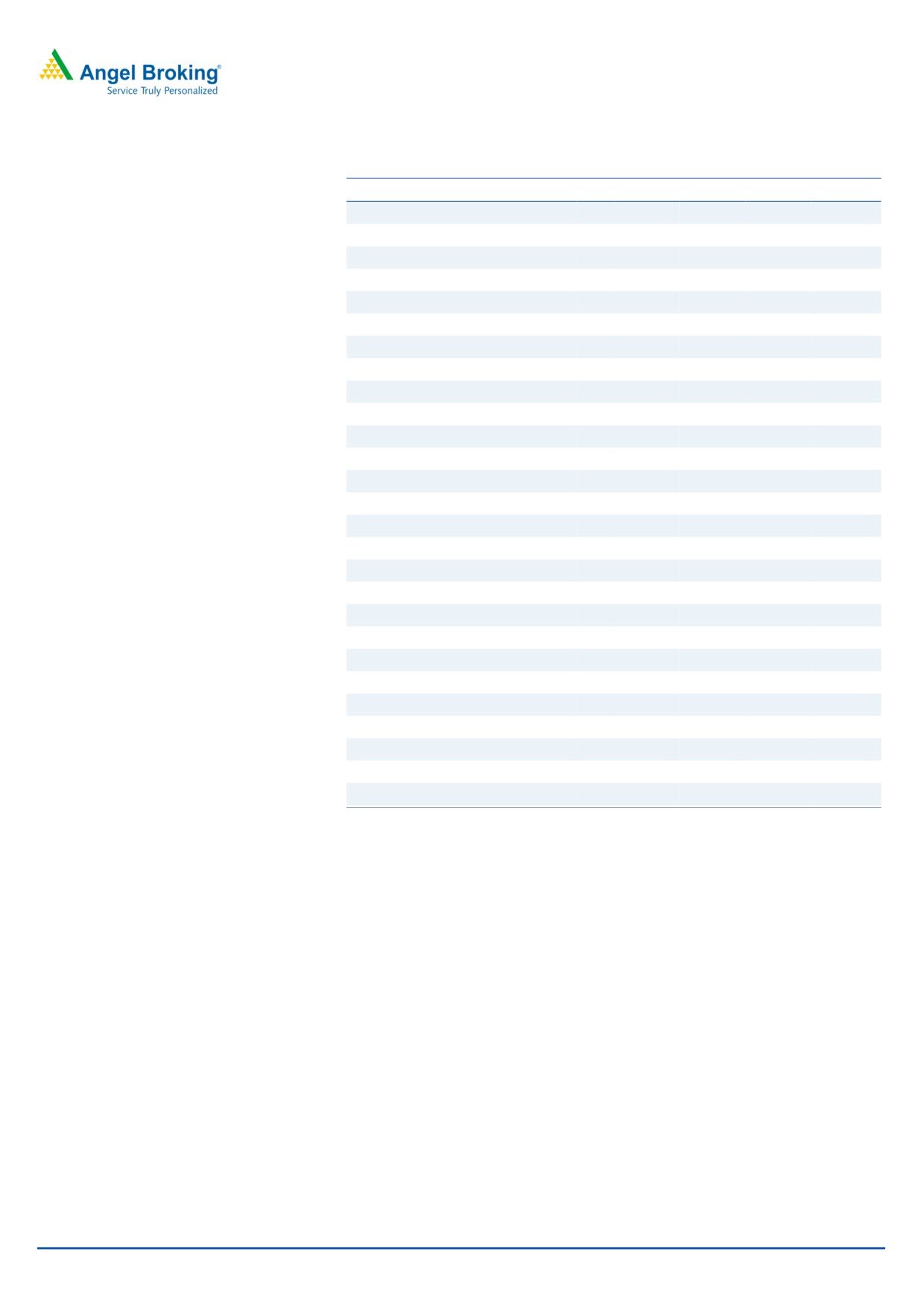

Income Statement

Y/E March (` Cr.)

FY15

FY16

FY17

FY18

FY19*

Total operating income

3,147

4,540

5,915

7,597

7,246

% chg

-

44

30

28

(5)

Total Expenditure

3,001

4,322

5,633

7,209

6,923

Raw Material

2,896

4,189

5,468

7,024

6,702

Personnel

77

97

117

134

155

Others Expenses

28

37

48

51

65

EBITDA

146

217

282

389

323

% chg

-

49

30

38

(17)

(% of Net Sales)

5

5

5

5

4

Depreciation& Amortisation

5

5

5

5

5

EBIT

140

213

277

384

318

% chg

-

51

30

39

(17)

(% of Net Sales)

4

5

5

5

4

Interest & other Charges

15

23

35

45

41

Other Income

123

180

248

225

295

(% of PBT)

50

49

51

40

52

Extraordinary Items

0

0

0

1

2

Share in profit of Associates

-

-

-

-

-

Recurring PBT

248

370

489

563

570

Share in Profit/(Loss) of Joint Ventures

128

129

54

100

49

% chg

-

49

32

15

1

Tax

0

0

0

0

0

PAT (reported)

376

499

543

663

618

% chg

-

33

9

22

(7)

(% of Net Sales)

12

11

9

9

9

Basic & Fully Diluted EPS (Rs)

1.62

2.06

2.13

2.73

2.43

% chg

-

27

3

29

(11)

Source: RHP, Angel Research

Note *Annualized number

March 28, 2019

3

RVNL | IPO Note

Balance sheet

Y/E March (`Cr.)

FY15

FY16

FY17

FY18

6MFY19

SOURCES OF FUNDS

Equity Share Capital

2,085

2,085

2,085

2,085

2,085

Reserves& Surplus

975

1,337

1,472

1,840

1,977

Shareholders Funds

3,061

3,422

3,557

3,925

4,062

Total Loans

2,514

2,624

2,437

2,634

2,286

Other Liab & Prov

5

8

9

49

37

Total Liabilities

5,580

6,054

6,003

6,608

6,385

APPLICATION OF FUNDS

Net Block

6

6

8

249

249

Other Investments

897

1,020

1,255

1,244

1,274

Investments

498

10

10

10

10

Current Assets

13,517

18,118

3,998

3,282

3,697

Inventories

11,565

14,824

766

2

6

Sundry Debtors

262

590

479

1,177

1,439

Cash & Bank

808

1,378

1,255

343

51

Bank

882

1,327

1,498

1,761

2,201

Loans & Advances

722

1,885

1,903

1,529

1,559

Other Assets

495

1,177

1,686

2,255

1,945

Current liabilities

10,556

16,162

2,857

1,960

2,348

Net Current Assets

2,961

1,957

1,141

1,322

1,349

Other Non Current Asset

-

-

-

-

-

Total Assets

5,580

6,054

6,003

6,609

6,385

Source: RHP, Angel Research

March 28, 2019

4

RVNL | IPO Note

Cash Flow

Y/E March (` Cr)

FY15

FY16

FY17

FY18

6MFY19

Profit before tax

3,766

4,990

5,433

6,640

3,101

Share in (Profit)/Loss

(1,281)

(1,289)

(542)

(998)

(244)

of JV

Depreciation

51

47

50

48

27

Others

(876)

(1,321)

(1,645)

(1,235)

(1,281)

Change in Working

1,660

2,426

3,296

4,456

1,604

Capital

Adjustments for

(Increase)/

(25,162)

(46,734)

138,933

(1,256)

(2,920)

Decrease in Operating

Assets:

Adjustments for

(Increase)/

25,132

56,113

(133,771)

(5,234)

3,986

Decrease in Operating

Liabilities:

Direct Taxes Paid/

495

5,285

2,759

1,087

550

Received

Cash Flow from

1,134

6,519

5,698

(3,122)

2,119

Operations

(Inc.)/ Dec. in Fixed

(84)

(104)

(1,798)

(974)

(95)

Assets

(Inc.)/ Dec. in

(208)

1,101

1,544

790

914

Investments

Cash Flow from

(292)

997

(254)

(184)

819

Investing

Issue of Equity

-

-

-

-

-

Inc./(Dec.) in loans

(1,523)

(1,823)

(6,684)

(5,812)

(5,860)

Others

-

-

-

-

-

Cash Flow from

(1,523)

(1,823)

(6,684)

(5,812)

(5,860)

Financing

Inc./(Dec.) in Cash

(680)

5,693

(1,240)

(9,117)

(2,921)

Opening Cash

8,761

8,081

13,776

12,546

3,429

balances

Closing Cash

8,081

13,774

12,537

3,428

507

balances

Source: RHP, Angel Research

March 28, 2019

5

RVNL | IPO Note

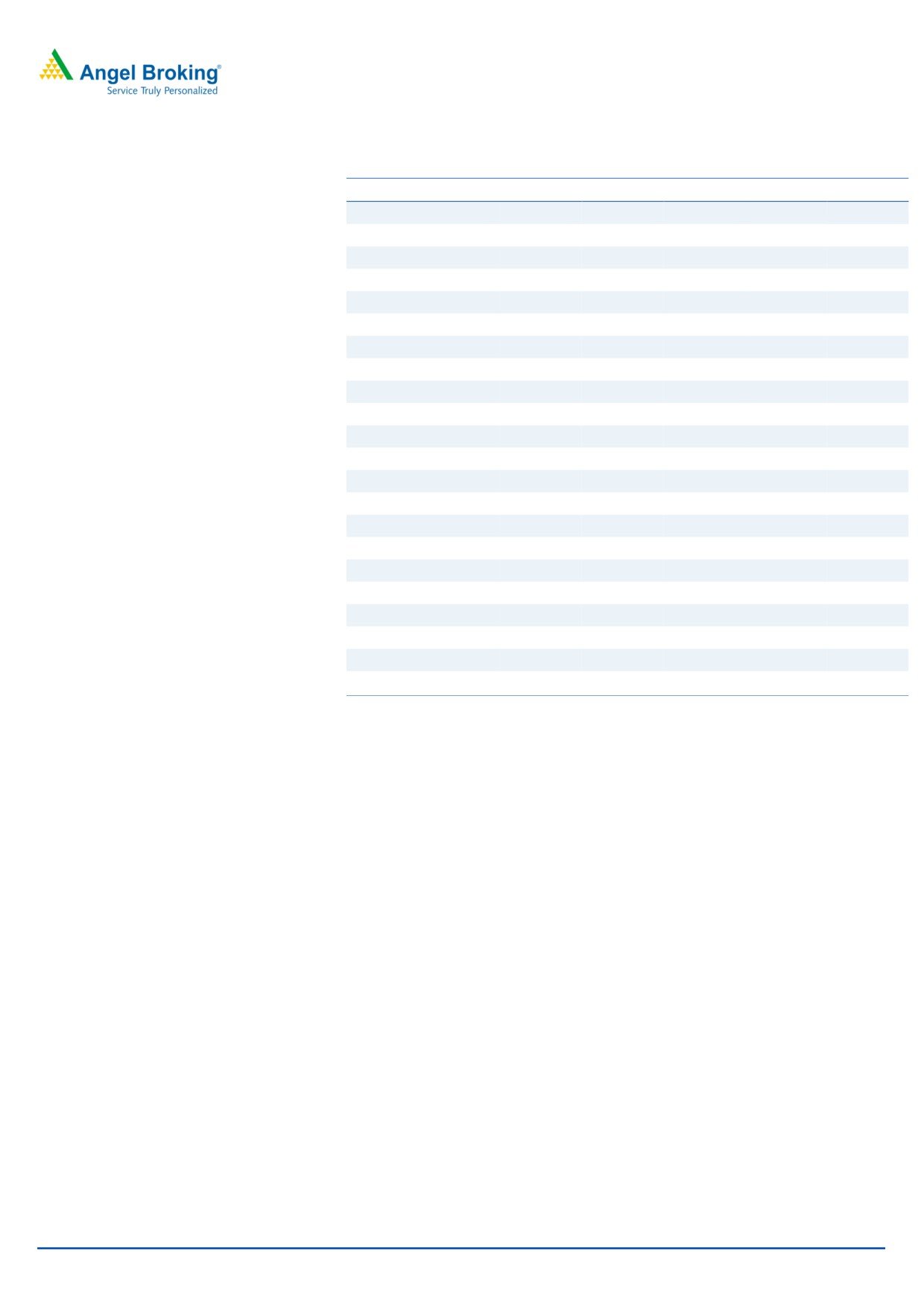

Valuation ratio

Y/E March

FY2015

FY2016

FY2017

FY2018

FY19*

Valuation Ratio (x)

P/E (on FDEPS)

11.8

9.2

8.9

7.0

7.8

P/CEPS

11.6

9.1

8.8

6.9

7.7

P/BV

1.29

1.16

1.11

1.01

0.98

EV/Sales

1.92

1.44

1.12

1.05

1.16

EV / Total Assets

1.08

1.08

1.10

1.21

1.31

Per Share Data (Rs)

EPS (Basic)

1.6

2.1

2.1

2.7

2.4

EPS (fully diluted)

1.6

2.1

2.1

2.7

2.4

Cash EPS

1.6

2.1

2.2

2.8

2.5

DPS

0.2

0.2

1.2

0.8

0.5

Book Value

14.7

16.4

17.1

18.8

19.5

Returns (%)

ROCE

2.5%

3.5%

4.6%

5.9%

5.0%

Angel ROIC (Pre-tax)

4.1%

6.4%

8.5%

8.5%

7.7%

ROE

11.0%

12.5%

12.5%

14.5%

12.5%

Turnover ratios (x)

Inventory / Sales (days)

1,342

1,192

47

0.1

0.3

Receivables (days)

21.7

38.7

17.2

44.9

59.3

Payables (days)

5.2

7.3

6.8

3.3

7.5

Working capital cycle (ex-cash) (days)

1,358

1,223

58

42

52

Source: RHP, Angel Research

Note *Annualized number

March 28, 2019

6

RVNL | IPO Note

Research Team Tel: 022 - 39357800

DISCLAIMER:

Angel Broking Limited (hereinafter referred to as “Angel”) is a registered Member of National Stock Exchange of India Limited, Bombay

Stock Exchange Limited, Metropolitan Stock Exchange Limited, Multi Commodity Exchange of India Ltd and National Commodity &

Derivatives Exchange Ltd It is also registered as a Depository Participant with CDSL and Portfolio Manager and Investment Adviser with

SEBI. It also has registration with AMFI as a Mutual Fund Distributor. Angel Broking Limited is a registered entity with SEBI for Research

Analyst in terms of SEBI (Research Analyst) Regulations, 2014 vide registration number INH000000164. Angel or its associates has not

been debarred/ suspended by SEBI or any other regulatory authority for accessing /dealing in securities Market. Angel or its

associates/analyst has not received any compensation / managed or co-managed public offering of securities of the company covered

by Analyst during the past twelve months.

This document is solely for the personal information of the recipient, and must not be singularly used as the basis of any investment

decision. Nothing in this document should be construed as investment or financial advice. Each recipient of this document should make

such investigations as they deem necessary to arrive at an independent evaluation of an investment in the securities of the companies

referred to in this document (including the merits and risks involved), and should consult their own advisors to determine the merits and

risks of such an investment.

Reports based on technical and derivative analysis center on studying charts of a stock's price movement, outstanding positions and

trading volume, as opposed to focusing on a company's fundamentals and, as such, may not match with a report on a company's

fundamentals. Investors are advised to refer the Fundamental and Technical Research Reports available on our website to evaluate the

contrary view, if any

The information in this document has been printed on the basis of publicly available information, internal data and other reliable

sources believed to be true, but we do not represent that it is accurate or complete and it should not be relied on as such, as this

document is for general guidance only. Angel Broking Limited or any of its affiliates/ group companies shall not be in any way

responsible for any loss or damage that may arise to any person from any inadvertent error in the information contained in this report.

Angel Broking Limited has not independently verified all the information contained within this document. Accordingly, we cannot testify,

nor make any representation or warranty, express or implied, to the accuracy, contents or data contained within this document. While

Angel Broking Limited endeavors to update on a reasonable basis the information discussed in this material, there may be regulatory,

compliance, or other reasons that prevent us from doing so.

This document is being supplied to you solely for your information, and its contents, information or data may not be reproduced,

redistributed or passed on, directly or indirectly.

Neither Angel Broking Limited, nor its directors, employees or affiliates shall be liable for any loss or damage that may arise from or in

connection with the use of this information.

Disclosure of Interest Statement

RVNL

1. Financial interest of research analyst or Angel or his Associate or his relative

No

2. Ownership of 1% or more of the stock by research analyst or Angel or associates or

No

relatives

3. Served as an officer, director or employee of the company covered under Research

No

4. Broking relationship with company covered under Research

No

March 28, 2019

7