Q4FY2019 Result Update | Banking

Apr 20, 2019

RBL Bank

BUY

CMP

`676

Overall healthy Q4; NIM at all time high

Target Price

`775

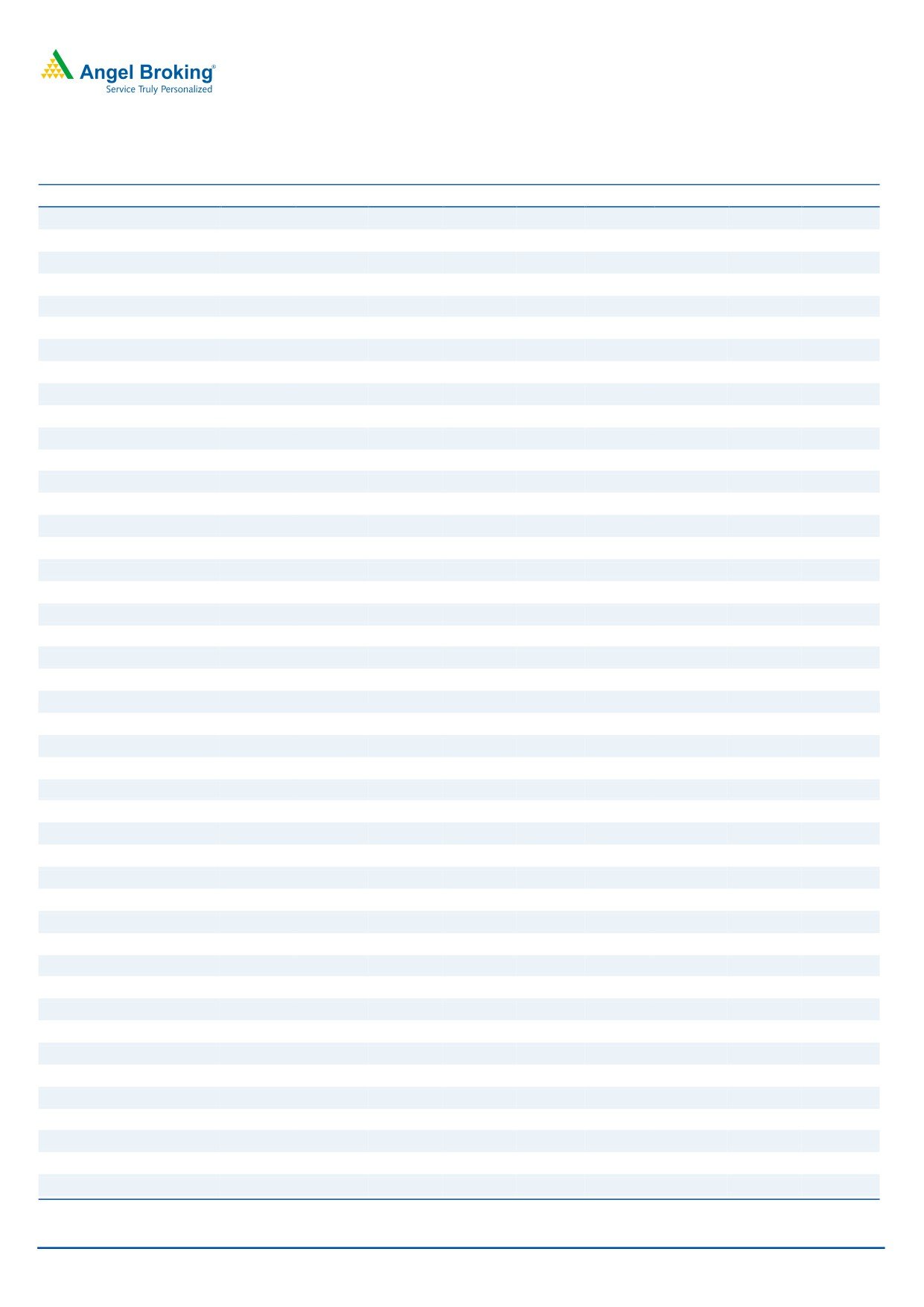

Particulars (` cr)

Q 4FY19

Q 3FY19

% chg (qoq)

Q 4FY18

% chg (yoy)

Investment Period

12 Months

NII

739

655

13%

500

48%

Pre-prov. profit

560

498

12%

383

46%

Stock Info

PAT

247

225

10%

178

39%

Source: Company, Angel Research

Sector

Banking

RBL Bank delivered healthy set of numbers for Q4FY2019, with PAT growth of 39%

Market Cap (` cr)

28,822

yoy. On the operating front, the bank reported 48% yoy growth in NII. The NIM

Beta

1.1

qoq/yoy increased by 11/25 bps, respectively, driven by a higher yield on

52 Week High / Low

692/483

advances. The bank managed to reduce its expenses and brought down the

Avg. Daily Volume

1,17,971

cost/income ratio from 52.8% in Q4FY2018 to 51.2% in Q4FY2019.

Face Value (`)

10

BSE Sensex

39,140

Robust growth in advances; NIM register improvement: During Q4FY2019, the

Nifty

11,035

bank’s advances grew by 36.2% yoy, of which retail loan book increased 57.8%

Reuters Code

RATB BO

yoy to constitute 30% of the total advances. The corporate loans inched up by

Bloomberg Code

RBK IN

27.3% yoy. The net interest income during this period grew by 48%, which is

higher than the growth in advances. During the quarter, NIM increased by 11bps

qoq and 25bps yoy to 4.23%, aided by higher yield on advances (up 140bps yoy)

Shareholding Pattern (%)

as against cost of funds (up 83bps yoy). Rise in yield was on account of increasing

Promoters

0.0

MCLR rates as well as higher proportion of high-yielding non-wholesale book.

Moreover, a slower rise in Opex aided lower cost/income by 167bps yoy to 51.2%

MF / Banks / Indian Fls

24.8

in Q4FY2019.

FII / NRIs / OCBs

18.8

Strong asset quality: Total deposits surged by

33% yoy and 12% qoq in

Indian Public / Others

56.4

Q4FY2019. CASA deposits accounted for 25% of the total deposits. On the asset

quality front, the bank continued to maintain strong asset quality with a

GNPA/NPA ratio of 1.38%/0.69% of loans. Total slippages for the quarter were at

Abs. (%)

3m 1yr 3yr

`206cr, which declined 2.2% qoq, whereas increased 79% yoy.

Sensex

7.6

13.7

56.8

Outlook & Valuation: We expect RBL Bank to grow its advances at CAGR of 35%

RBL Bank

18.6

33.1

191.0

over FY2018-20E. Improvement in CASA, higher share of retail book and in-

house priority sector lending will support NIM going forward. At CMP, RBL trades

at 2.9x FY21E P/ABV, which we believe is attractive considering growth prospects,

3-year price chart

hence, we recommend BUY with a target price of `775 over the next 12 months.

900

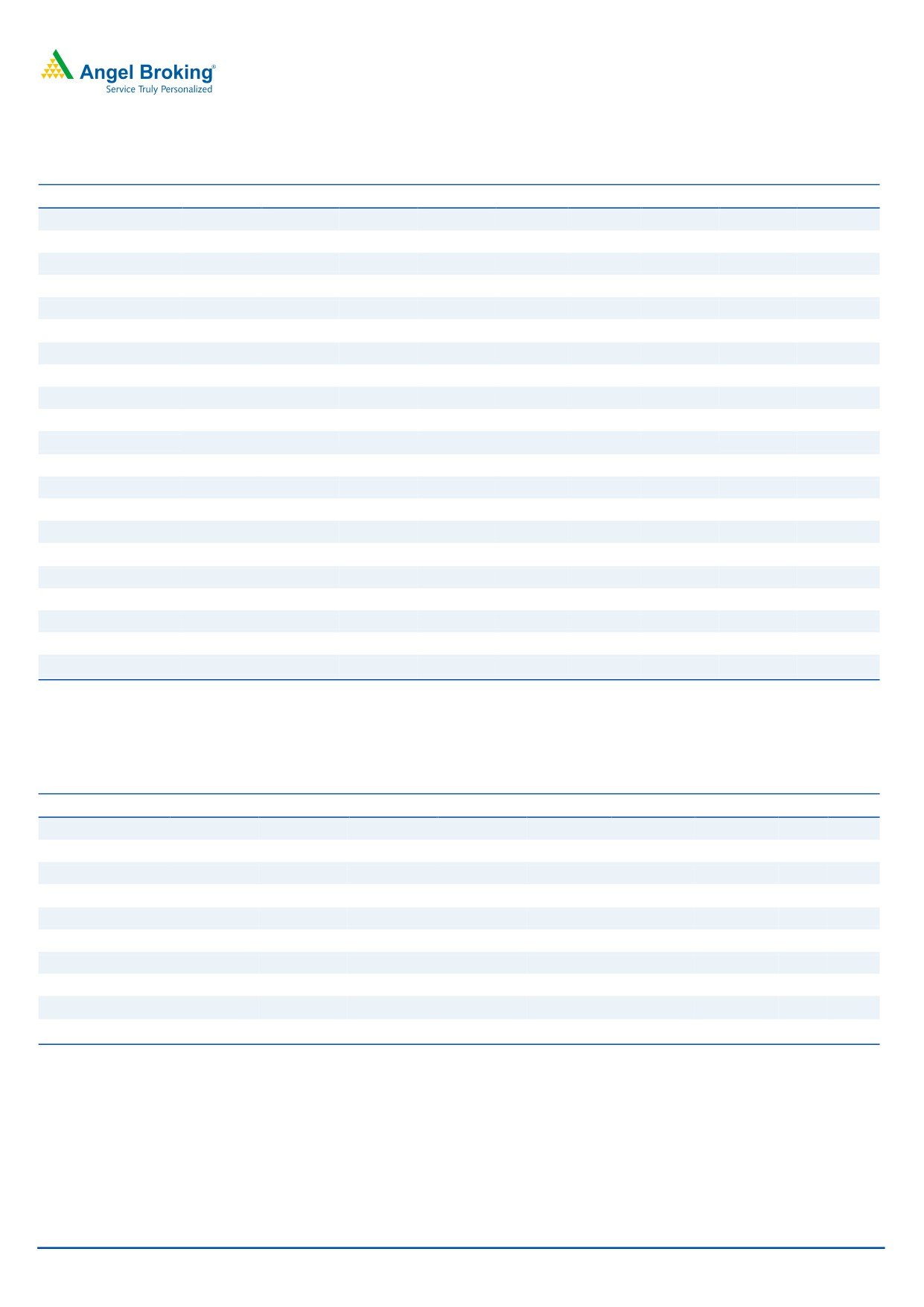

Key financials (Standalone)

700

Y/E March (` cr)

F Y17

F Y18

F Y19

F Y20E

F Y21E

500

NII

1,221

1,766

2,539

3,500

4,804

300

% chg

42

27

33

34

34

100

Net profit

446

635

867

1,291

1,861

% chg

52.5

42.3

36.6

48.9

44.2

NIM (%)

2.9

3.4

3.7

3.9

4.0

Source: Company, Angel Research

EPS ( Rs)

10.6

15.1

20.7

30.8

44.4

P/E (x)

64

45

33

22

15

P/ABV (x)

6.7

4.3

3.9

3.4

2.9

Jaikishan Parmar

RoA (%)

1.0

1.1

1.2

1.4

1.5

Research Analyst

R oE (%)

12.2

11.5

12.2

15.9

19.7

022 - 39357600 Ext: 6810

Source: Company, Angel Research, Note: CMP as of 19/04/19

Please refer to important disclosures at the end of this report

1